CO PY RI GH T © A BC EL LE RA November 6, 2025 Q3 2025 BUSINESS UPDATE

These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and other factors are described under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. We caution you that forward-looking statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a result, the forward-looking statements may not prove to be accurate. The forward-looking statements in this presentation represent our views as of the date hereof. We undertake no obligation to update any forward-looking statements for any reason, except as required by law. DISCLAIMER This presentation contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. All statements contained in this presentation other than statements of historical fact are forward-looking statements, including statements regarding our ability to develop, commercialize and achieve market acceptance of our current and planned products and services, our research and development efforts, and other matters regarding our business strategies, use of capital, results of operations and financial position, and plans and objectives for future operations. In some cases, you can identify forward-looking statements by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. 2 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e

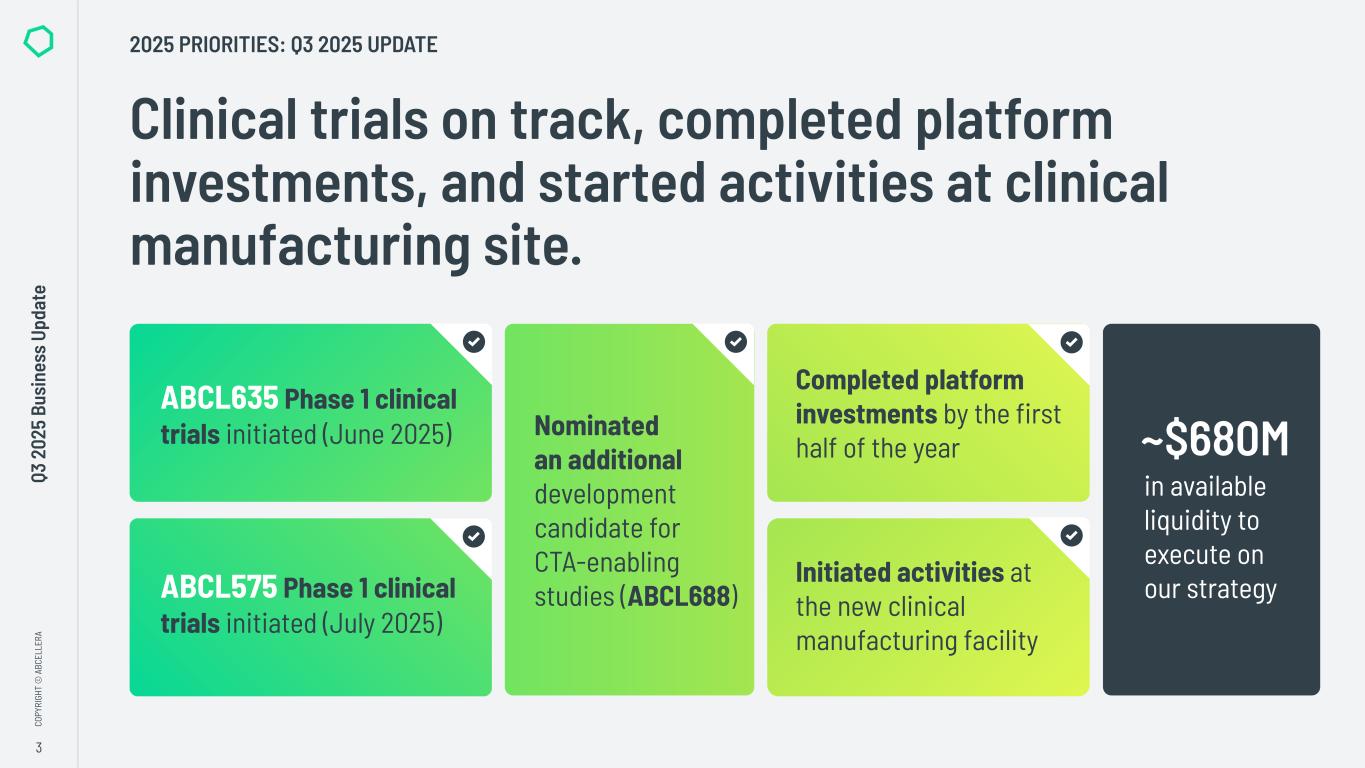

3 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e Clinical trials on track, completed platform investments, and started activities at clinical manufacturing site. ABCL635 Phase 1 clinical trials initiated (June 2025) ABCL575 Phase 1 clinical trials initiated (July 2025) Completed platform investments by the first half of the year Initiated activities at the new clinical manufacturing facility Nominated an additional development candidate for CTA-enabling studies (ABCL688) in available liquidity to execute on our strategy ~$680M 2025 PRIORITIES: Q3 2025 UPDATE

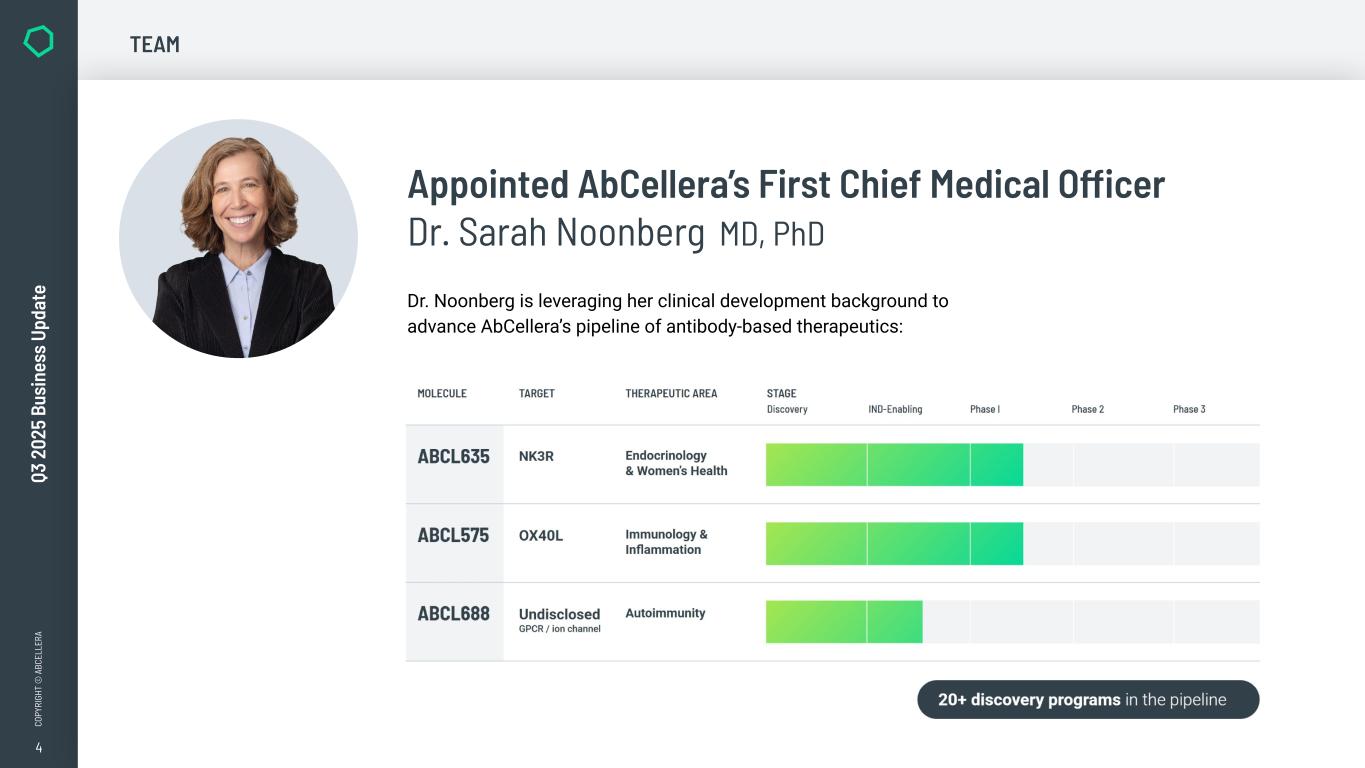

4 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e Appointed AbCellera’s First Chief Medical Officer Dr. Sarah Noonberg MD, PhD Dr. Noonberg is leveraging her clinical development background to advance AbCellera’s pipeline of antibody-based therapeutics: TEAM

5 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e Q3 2025 FINANCIALS UPDATE

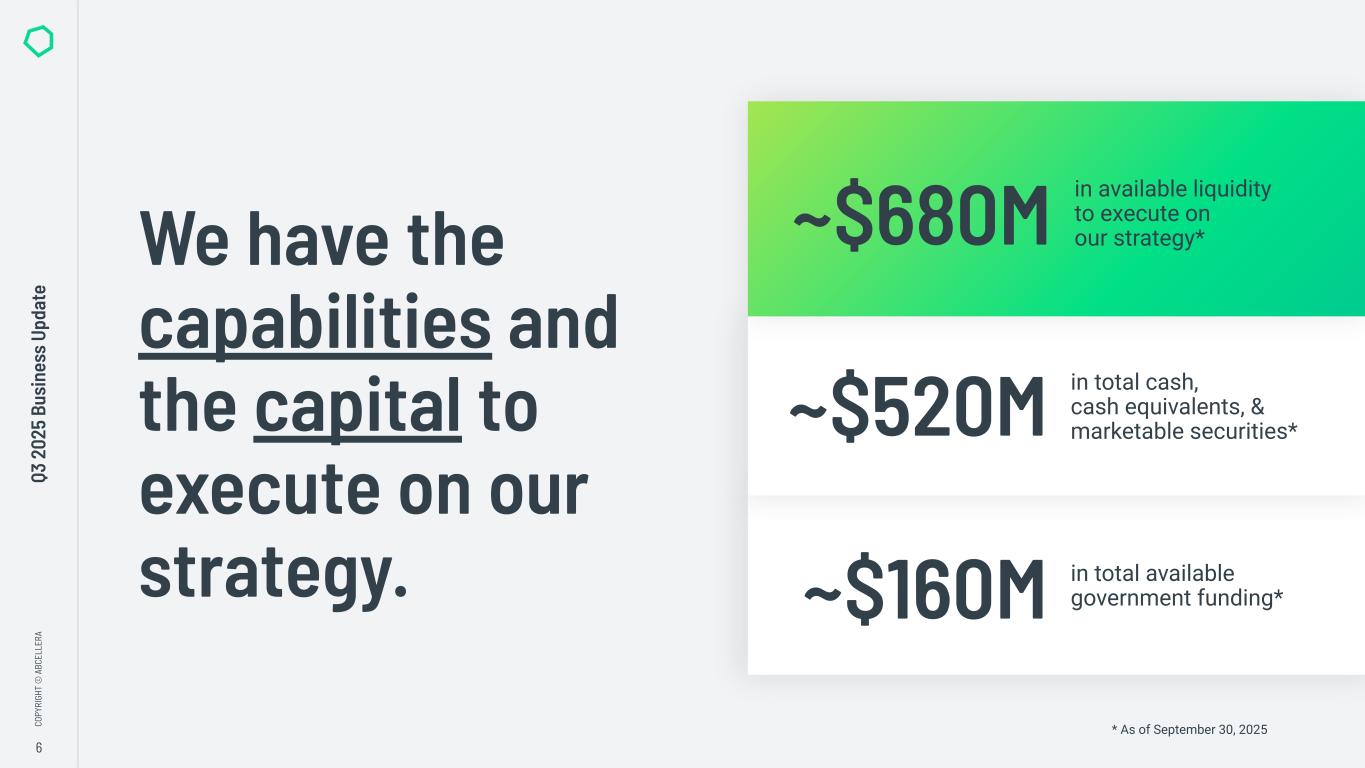

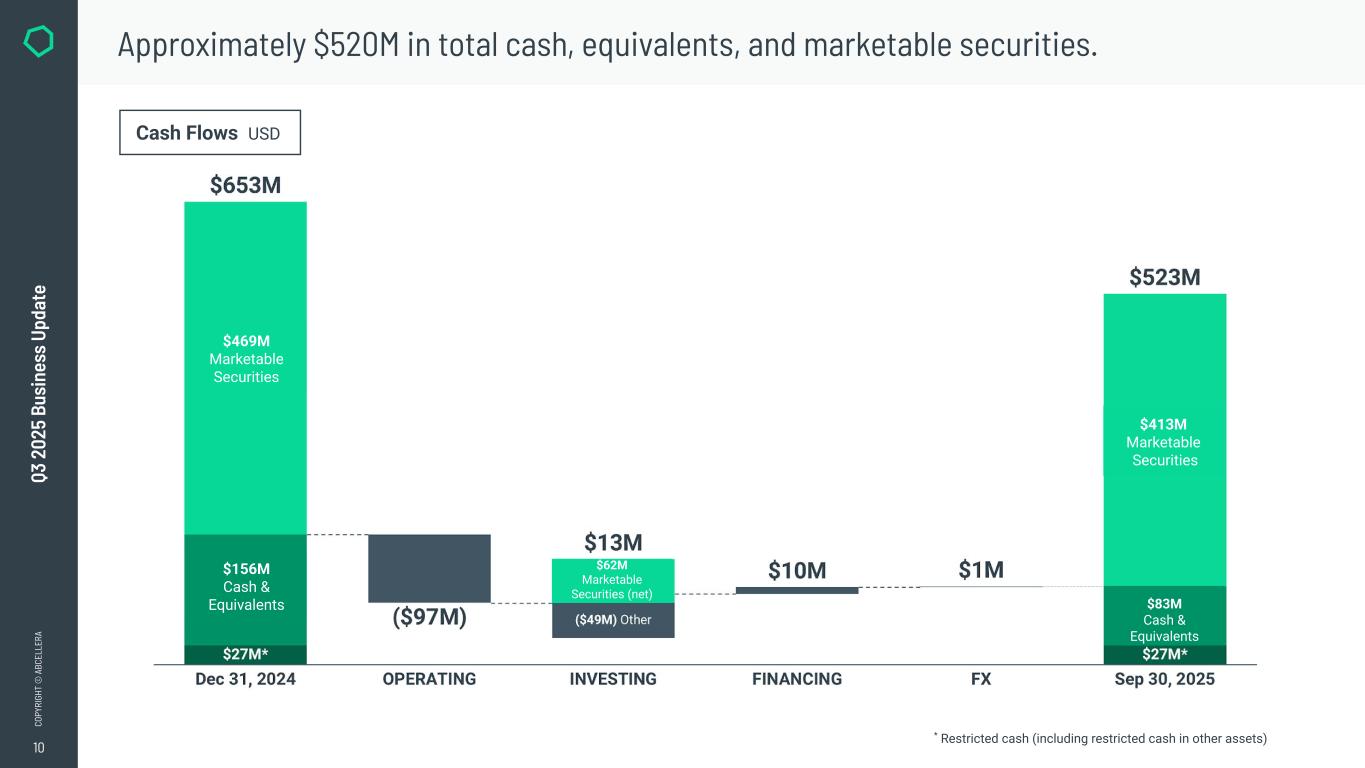

6 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e We have the capabilities and the capital to execute on our strategy. * As of September 30, 2025 in total available government funding*~$160M in total cash, cash equivalents, & marketable securities*~$520M in available liquidity to execute on our strategy*~$680M

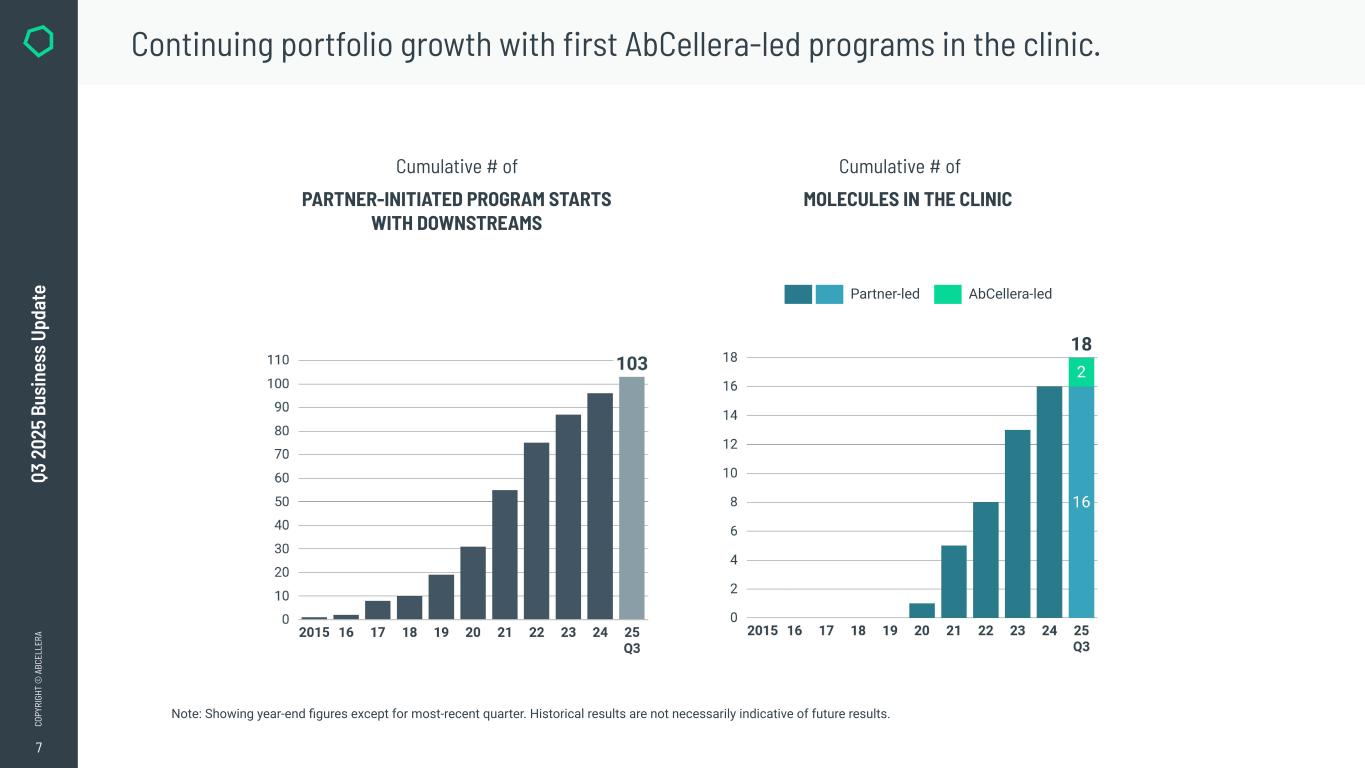

7 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e PARTNER-INITIATED PROGRAM STARTS WITH DOWNSTREAMS Cumulative # of MOLECULES IN THE CLINIC Cumulative # of Note: Showing year-end figures except for most-recent quarter. Historical results are not necessarily indicative of future results. Continuing portfolio growth with first AbCellera-led programs in the clinic. AbCellera-led Partner-led

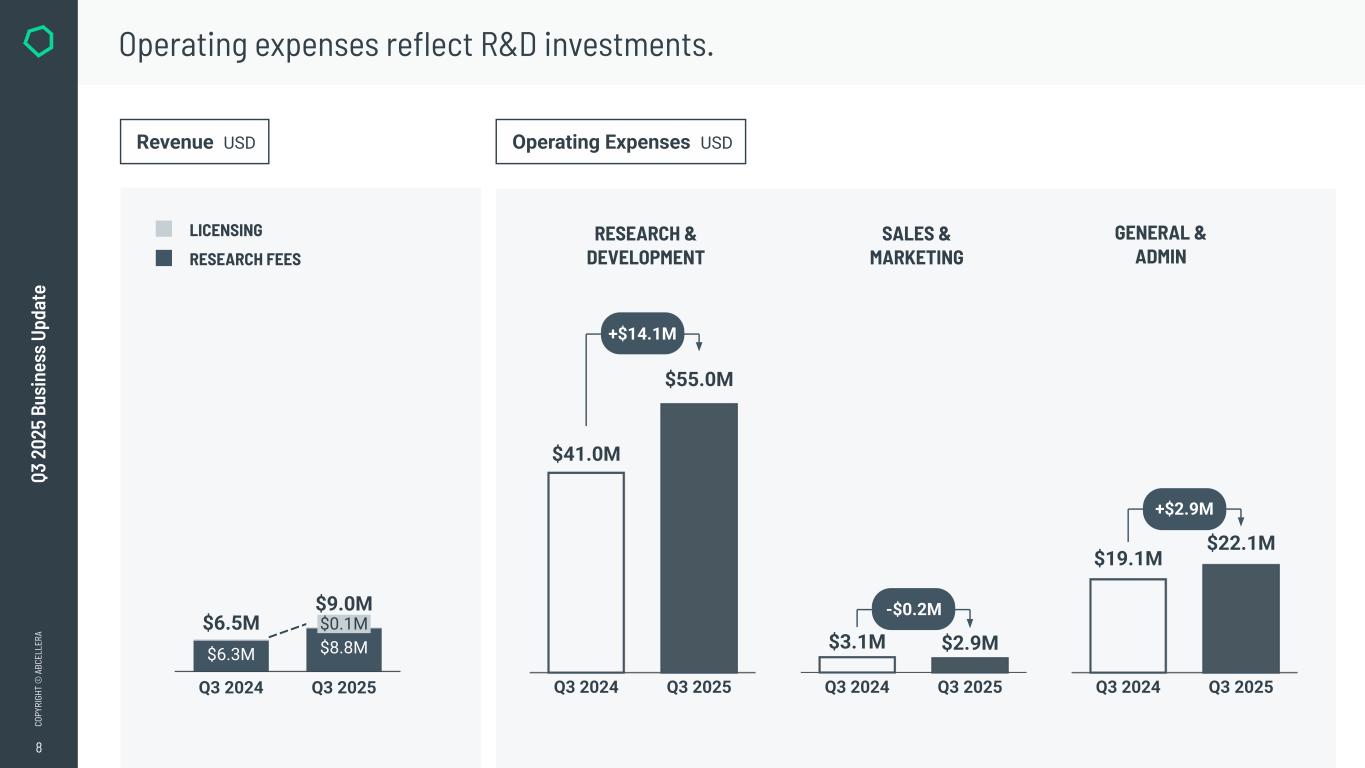

8 CO PY RI GH T © A BC EL LE RA RESEARCH & DEVELOPMENT SALES & MARKETING GENERAL & ADMIN Q3 2 02 5 Bu si ne ss U pd at e Operating expenses reflect R&D investments. Operating Expenses USDRevenue USD LICENSING RESEARCH FEES Q3 2025 $0.1M $8.8M $6.5M $9.0M Q3 2024 $6.3M Q3 2025Q3 2024 $41.0M $55.0M +$14.1M Q3 2025Q3 2024 $3.1M $2.9M -$0.2M Q3 2025Q3 2024 $19.1M $22.1M +$2.9M

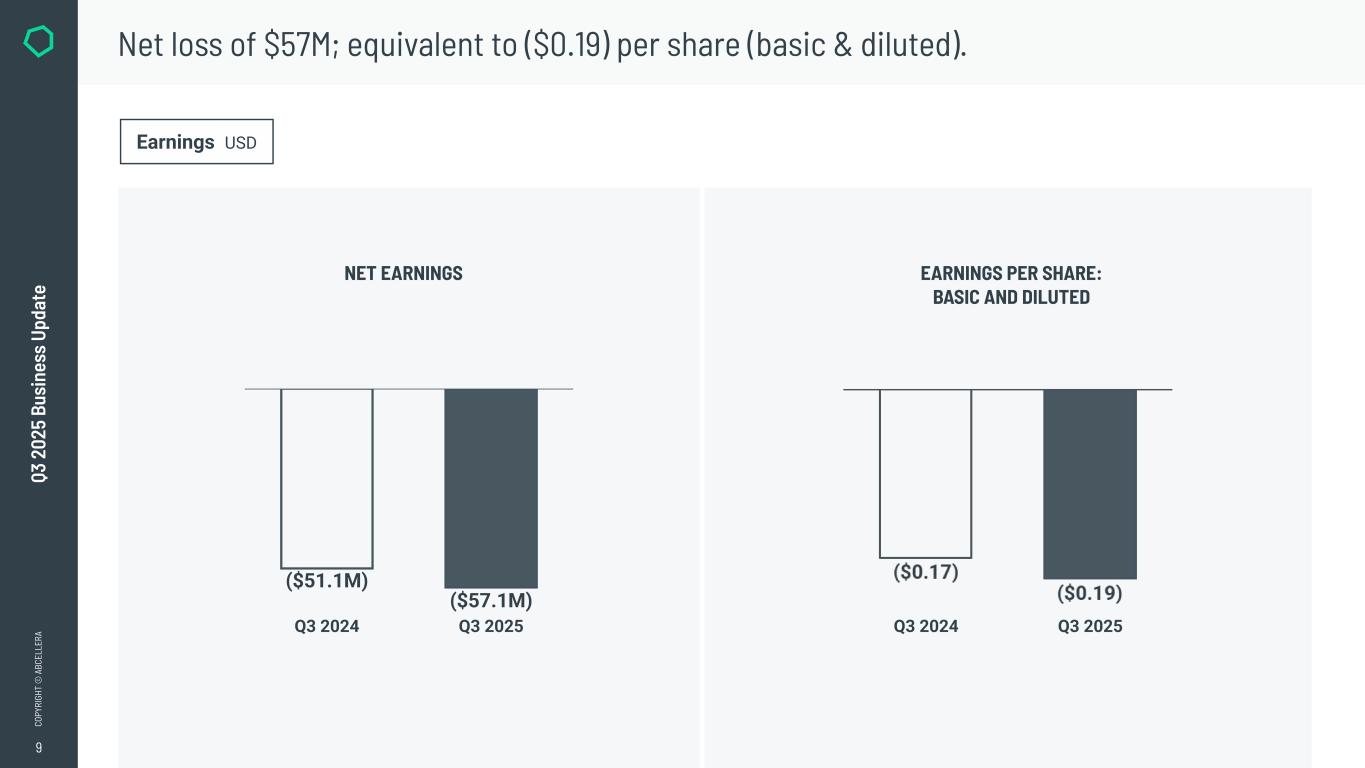

9 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e Net loss of $57M; equivalent to ($0.19) per share (basic & diluted). Earnings USD NET EARNINGS EARNINGS PER SHARE: BASIC AND DILUTED Q3 2024 Q3 2025 ($51.1M) ($57.1M) Q3 2024 Q3 2025

10 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e Approximately $520M in total cash, equivalents, and marketable securities. Cash Flows USD * Restricted cash (including restricted cash in other assets) INVESTING FINANCING ($49M) Other FX $413M Marketable Securities $83M Cash & Equivalents $469M Marketable Securities Sep 30, 2025 $62M Marketable Securities (net) OPERATINGDec 31, 2024 $27M* $156M Cash & Equivalents $653M ($97M) $13M $10M $1M $523M $27M* $469M Marketable Securities $156M Cash & Equivalents $413M Marketable Securities $83M Cash & Equivalents $62M Marketable Securities (net)

11 CO PY RI GH T © A BC EL LE RA Q3 2 02 5 Bu si ne ss U pd at e THANK YOU