Q3 Supplemental Information NOVEMBER 2025 Funko, LLC © 2025

Funko, LLC © 2025 Cautionary Notes This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our future results of operations and financial position, industry dynamics, business strategy and plans and our objectives for future operations are forward-looking statements. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to execute our business strategy; our ability to manage our inventories and growth; risks relating to our indebtedness, including our ability to comply covenants under our Credit Agreement, as amended, and our ability to continue as a going concern; our ability to maintain and realize the full value of our license agreements; impacts from U.S. trade policy and tariffs; impacts from economic downturns; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; our ability to compete effectively; fluctuations in our gross margin; our dependence on content development and creation by third parties; the ongoing level of popularity of our products with consumers; our ability to develop and introduce products in a timely and cost effective manner; our ability to obtain, maintain and protect our intellectual property rights or those of our licensors; potential violations of the intellectual property rights of others; risks associated with counterfeit versions of our products; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third party manufacturing; risks associated with climate change; increased attention to sustainability and environment, social and governance initiatives; geographic concentration of our operations; risks associated with our international operations; changes in the effective tax rates or tax law; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation, including products liability claims and securities class action litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; future development and acceptance of blockchain networks; risks associated with receiving payments in digital assets; risk resulting from our e-commerce business and social media presence; our ability to successfully operate our information systems and implement new technology; risks relating to our indebtedness, including our ability to comply with financial and negative covenants under our Credit Agreement, as amended; our ability to secure additional financing on favorable terms or at all; the potential for our or our third-party providers' electronic data or the electronic data of our customers to be compromised; the influence of our significant shareholder, TCG, and the possibility that TCG's interests may conflict with the interests of our other stockholders; risks relating to our organizational structure, including the Tax Receivable Agreement ("TRA") which confers certain benefits upon the parties to the TRA ("TRA Parties") that will not benefit Class A common stockholders to the same extent as it will benefit the TRA Parties; volatility in the price of our Class A common stock; and the risks associated with our internal control over financial reporting. These and other important factors discussed under the caption “Risk Factors” in our Quarterly report on Form 10-Q for the quarter ended September 30, 2025, and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us.

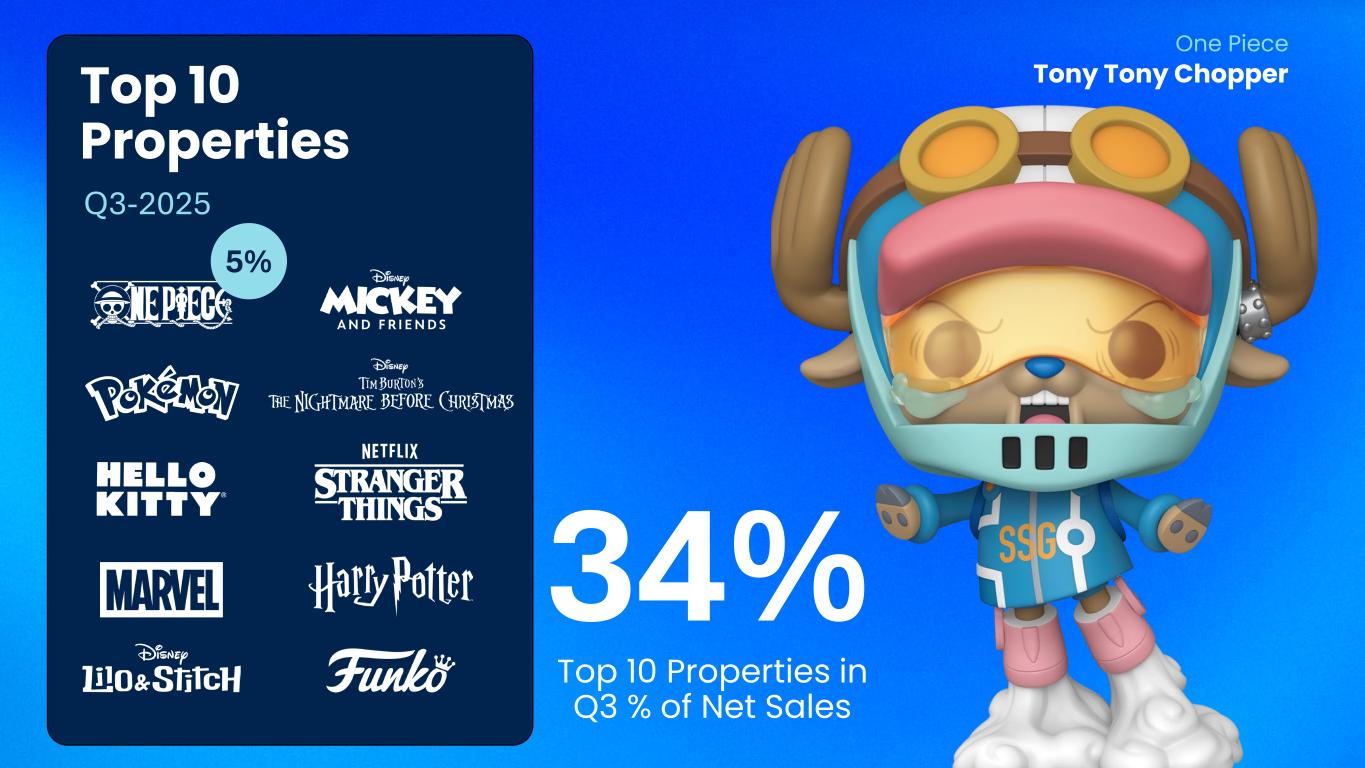

Q3-2025 Top 10 Properties 5% Top 10 Properties in Q3 % of Net Sales 34% One Piece Tony Tony Chopper

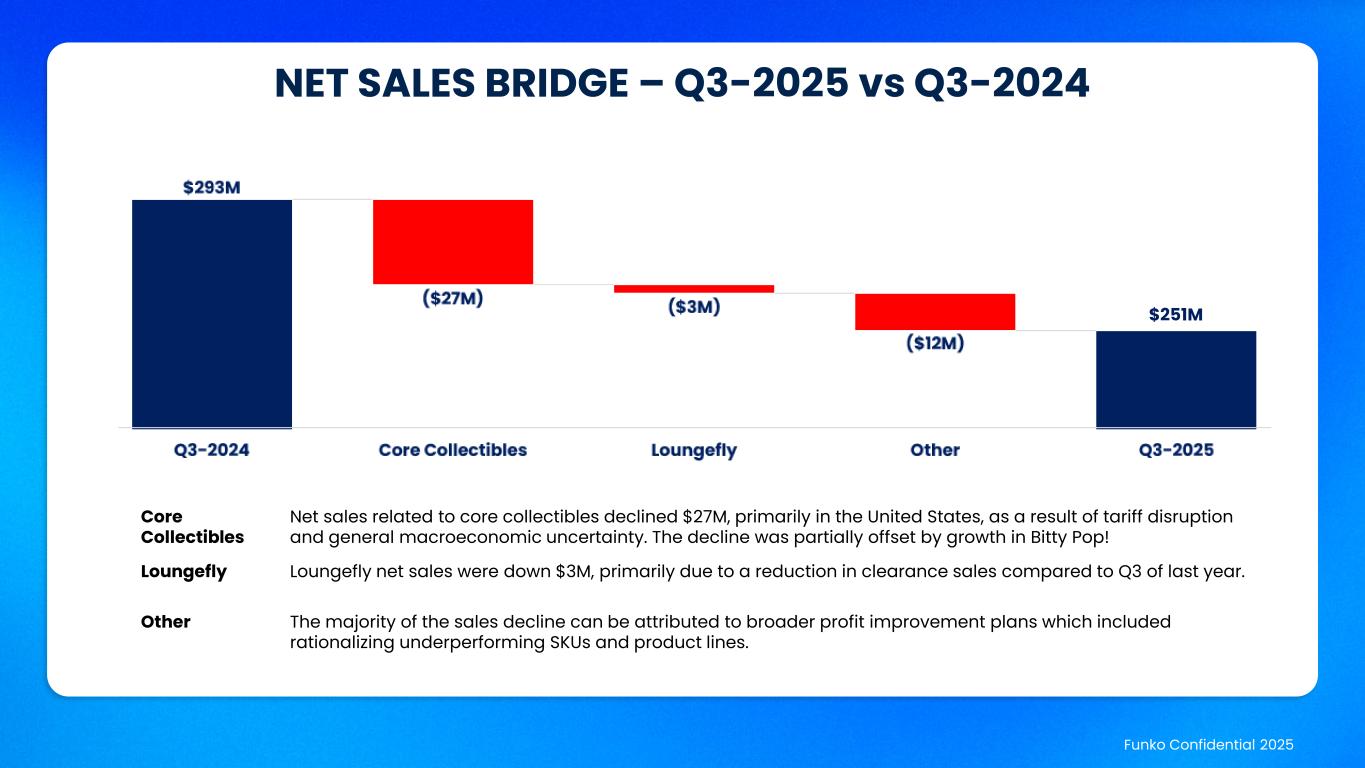

NET SALES BRIDGE – Q3-2025 vs Q3-2024 Funko Confidential 2025 $251M Core Collectibles Net sales related to core collectibles declined $27M, primarily in the United States, as a result of tariff disruption and general macroeconomic uncertainty. The decline was partially offset by growth in Bitty Pop! Loungefly Loungefly net sales were down $3M, primarily due to a reduction in clearance sales compared to Q3 of last year. Other The majority of the sales decline can be attributed to broader profit improvement plans which included rationalizing underperforming SKUs and product lines.

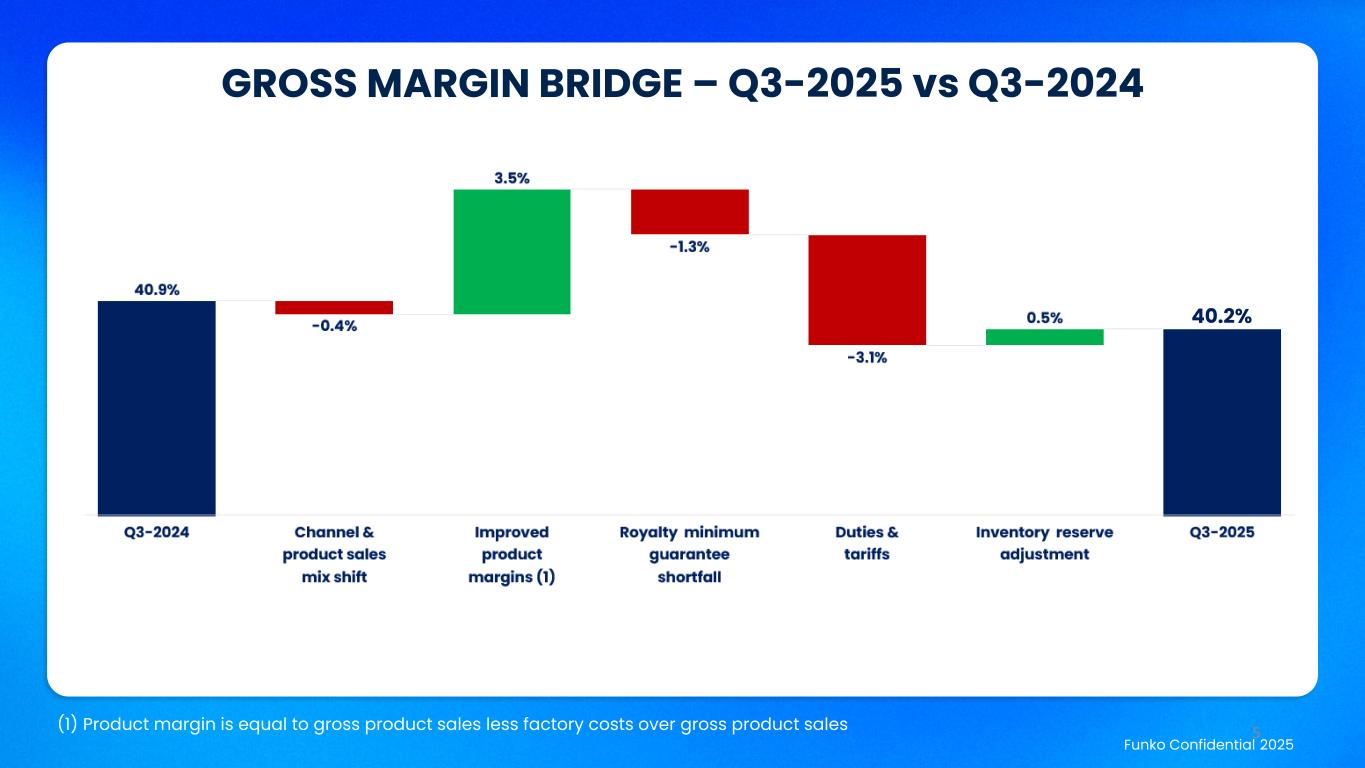

GROSS MARGIN BRIDGE – Q3-2025 vs Q3-2024 Funko Confidential 2025 40.2% 5(1) Product margin is equal to gross product sales less factory costs over gross product sales

3

7

8