|

|

CANNAE HOLDINGS, INC.

1701 VILLAGE CENTER CIRCLE

LAS VEGAS, NEVADA 89134

[●], 2025

Dear Shareholder:

On behalf of the Board of Directors, I cordially invite you to attend the annual meeting of the shareholders of Cannae Holdings, Inc. (Cannae). The meeting will be held virtually on December 12, 2025, at [●] Pacific Time. Instructions for accessing the virtual meeting platform online are included in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement for the 2025 Annual Meeting of Shareholders.

The Notice of Annual Meeting and Proxy Statement contain more information about the annual meeting, including:

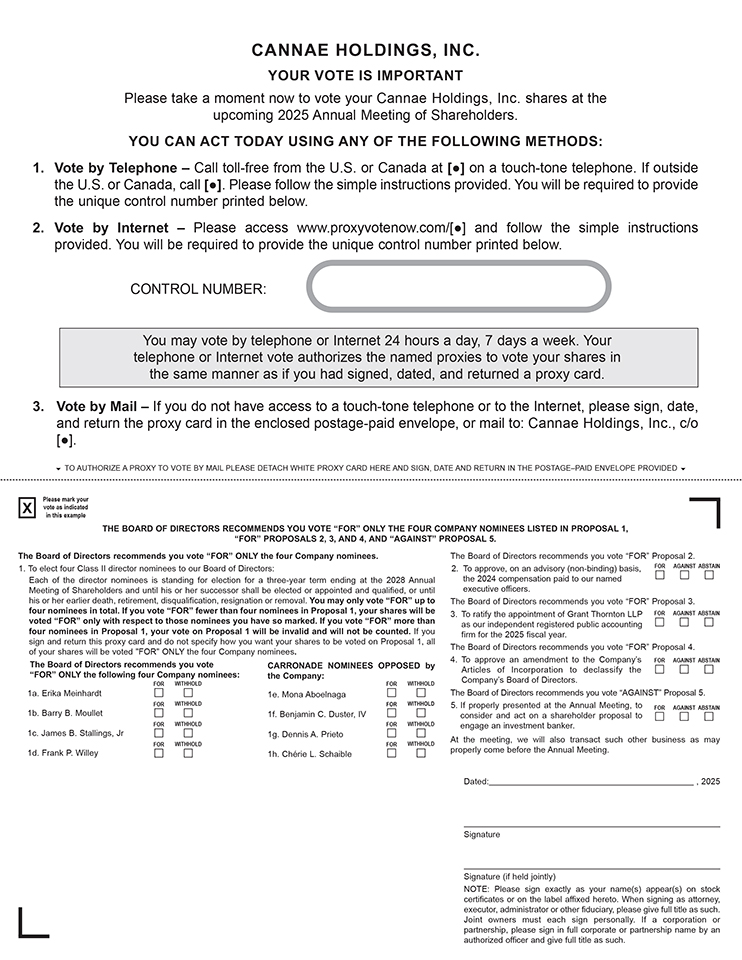

| • | who can vote; and |

| • | the different methods you can use to vote, including the telephone, Internet, and traditional paper proxy card. |

Whether or not you plan to attend the virtual annual meeting, please vote by one of the outlined methods to ensure that your shares are represented and voted in accordance with your wishes.

YOUR VOTE IS IMPORTANT

Your vote is especially important this year because an affiliate of Carronade Capital Management, LP (together with its affiliates and associates, Carronade), has notified us that it intends to nominate four candidates for election at the Annual Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” ONLY THE FOUR COMPANY NOMINEES, ERIKA MEINHARDT, BARRY B. MOULLET, JAMES B. STALLINGS, JR., AND FRANK P. WILLEY, BY USING THE ENCLOSED UNIVERSAL WHITE PROXY CARD AND DISREGARD ANY MATERIALS, AND DO NOT SIGN, RETURN, OR VOTE ON ANY GOLD PROXY CARD, SENT TO YOU BY OR ON BEHALF OF CARRONADE.

On behalf of the Board of Directors, I thank you for your support.

Sincerely,

Ryan R. Caswell

Chief Executive Officer