4Q2025 Earnings Presentation January 26, 2026 FirstSun Capital Bancorp NASDAQ: FSUN

FirstSun Capital Bancorp | 2 Disclaimers Forward Looking Statements This presentation contains forward-looking information and statements by FirstSun Capital Bancorp (the “Company”) within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are generally identifiable by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “project”, “intend”, “estimate”, “may”, “will”, “would”, “could”, “should”, “assume”, “assumptions”, “view”, “continue”, “opportunity”, and “outlook” or other similar expressions, and in this presentation include our outlook regarding our loan portfolio, deposit mix, net interest income, noninterest income, noninterest expense, asset quality, capital and liquidity, as well as our 2026 Full Year Standalone Financial Outlook and related notes and assumptions. All statements in this presentation speak only as of the date they are made. Except as required by law, we do not intend or assume any obligation to update, revise or clarify any forward-looking statements that may be made from time to time by or on behalf of the Company, whether because of new information, future events or otherwise. Forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following: changes in interest rates (including anticipated Federal Reserve rate cuts that might not occur) and their related impact on macroeconomic conditions, customer behavior, our funding costs and our loan and securities portfolios; the quality or composition of our loan or investment portfolios and changes therein; failure to maintain our mortgage production flow to secondary markets; the sufficiency of liquidity and changes in our capital position; the inability of our infrastructure initiatives to reduce expenses; increased deposit volatility; potential regulatory developments; U.S. and global trade policies and tensions, including change in, or the imposition of, tariffs and/or trade barriers and the economic impacts, volatility and uncertainty resulting therefrom, and geopolitical instability; the possibility that our previously announced merger with First Foundation Inc. (“First Foundation) does not close when expected or at all because required regulatory, stockholder or other approvals and conditions to closing are not received or satisfied on a timely basis or at all; the possibility that the proposed First Foundation merger, including the re- positioning strategy, will not be completed as planned, or achieve the anticipated benefits; the diversion of management’s attention from ongoing business operations and opportunities due to the proposed First Foundation merger; the occurrence of any event, change or other circumstances that could give rise to the termination of the First Foundation merger agreement; the possibility that the anticipated benefits of the proposed First Foundation merger, including anticipated cost savings and synergies, are not realized when expected or at all, including because of the impact of, or problems arising from, the integration of the companies or as a result of the strength of the economy, competitive factors in the areas where we do business, or because of other unexpected factors or events; and other general competitive, economic, business, market and political conditions. We caution readers that the foregoing list of factors is not exclusive, is not necessarily in order of importance and readers should not place undue reliance on any forward-looking statements. Additional information concerning additional factors that could materially affect the forward-looking statements in this presentation can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and other documents subsequently filed by the Company with the SEC, including its Quarterly Reports on Form 10-Q. 2026 Outlook - Basis and Limitations Our 2026 Standalone Full Year Financial Outlook and 2026 Outlook (collectively, the “outlook”) reflects management’s current expectations regarding certain financial and operating metrics and related assumptions as of January 26, 2026. Unless otherwise noted, outlook metrics represent full-year expectations on a standalone basis (Company only) and exclude the financial impact of the pending First Foundation merger. The outlook is provided for convenience and should not be regarded as a guarantee of future results. Actual results, conditions or outcomes may differ materially. See “Forward-Looking Statements” in the above heading. We undertake no obligation to update or affirm the outlook, except as required by law. Forward-looking non-GAAP measures appearing in the outlook should be read together with “Use of Non-GAAP Measures.”

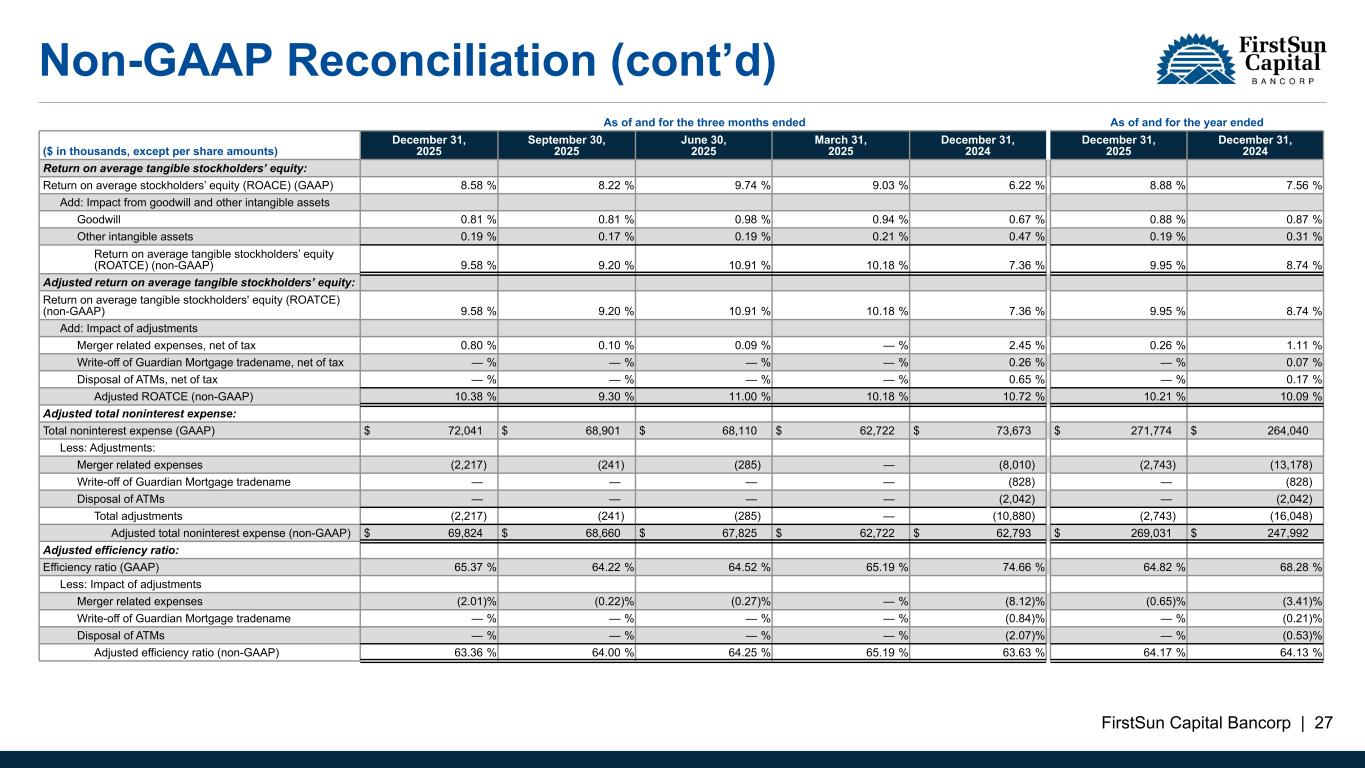

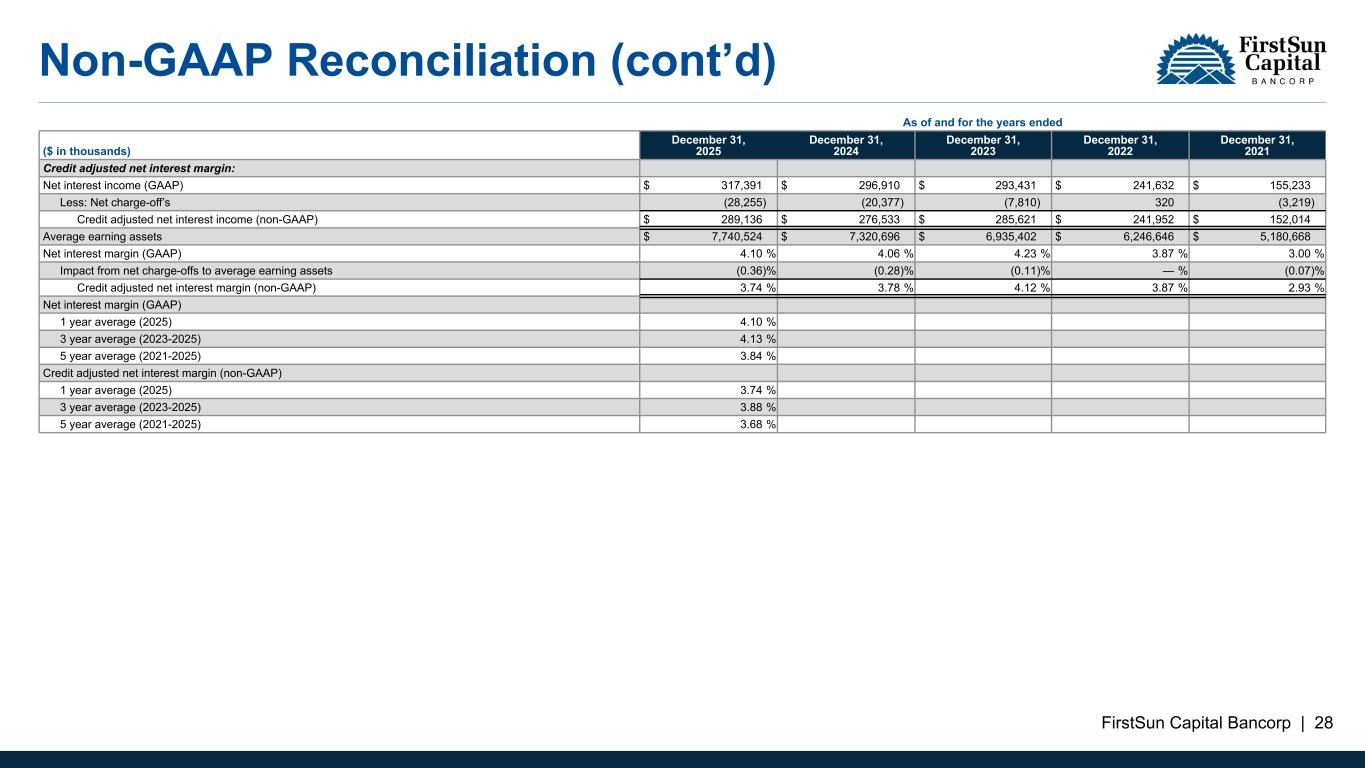

FirstSun Capital Bancorp | 3 Disclaimers (cont’d) Use of Non-GAAP Measures This presentation includes certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include certain operating performance measures that exclude merger-related and other charges that are not considered part of the Company’s recurring operations, such as “Adjusted Net Income”, “Adjusted Return on Average Total Assets”, “Return on Average Tangible Stockholders Equity”, “Adjusted Return on Average Tangible Stockholders’ Equity”, “Adjusted Diluted Earnings Per Share”, “Adjusted and Pre-tax Pre-provision Return on Average Assets”, “Adjusted Efficiency Ratio”, “TBV per Share”, “Price / TBV”, “Price / LTM Adjusted EPS”, and “Credit Adjusted NIM”. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of the Company’s ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The Company believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. The Company’s management believes investors may find these non-GAAP financial measures useful and that these non-GAAP financial measures provide useful supplemental information for evaluating the Company’s performance trends. Further, the Company’s management uses these measures in managing and evaluating the Company’s business and intends to refer to them in discussions about the Company’s operations and performance. These non-GAAP financial measures, however, should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies These measures should be viewed in addition to, and not as an alternative to substitute for measures that are determined in accordance with GAAP. To the extent applicable, reconciliations of these non-GAAP measures to the most directly comparable GAAP measure are included in the Appendix to this presentation. Day-Count Convention Annualized ratios are presented utilizing the Actual/Actual day-count convention. Annualized ratios have been recalculated to conform to the current presentation for periods prior to March 31, 2025. Market, Industry and Statistical Data Certain market and industry data used in this presentation are based on third-party sources, publicly available information and internal estimates. We believe such information to be reliable, but we have not independently verified it and make no representation as to its accuracy or completeness.

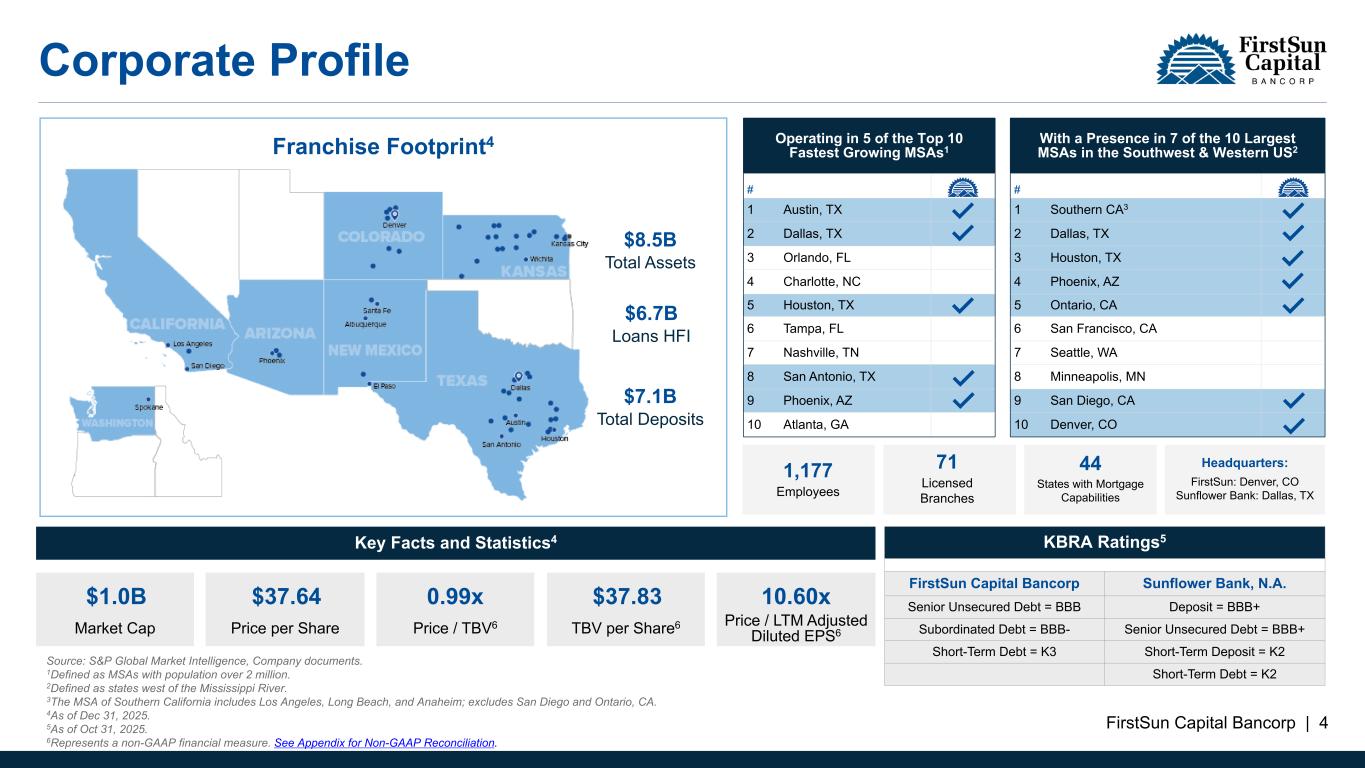

FirstSun Capital Bancorp | 4 Corporate Profile Operating in 5 of the Top 10 Fastest Growing MSAs1 # 1 Austin, TX 2 Dallas, TX 3 Orlando, FL 4 Charlotte, NC 5 Houston, TX 6 Tampa, FL 7 Nashville, TN 8 San Antonio, TX 9 Phoenix, AZ 10 Atlanta, GA With a Presence in 7 of the 10 Largest MSAs in the Southwest & Western US2 # 1 Southern CA3 2 Dallas, TX 3 Houston, TX 4 Phoenix, AZ 5 Ontario, CA 6 San Francisco, CA 7 Seattle, WA 8 Minneapolis, MN 9 San Diego, CA 10 Denver, CO 1,177 Employees 71 Licensed Branches 44 States with Mortgage Capabilities Headquarters: FirstSun: Denver, CO Sunflower Bank: Dallas, TX Key Facts and Statistics4 $1.0B $37.64 0.99x $37.83 10.60x Market Cap Price per Share Price / TBV6 TBV per Share6 Price / LTM Adjusted Diluted EPS6 KBRA Ratings5 FirstSun Capital Bancorp Sunflower Bank, N.A. Senior Unsecured Debt = BBB Deposit = BBB+ Subordinated Debt = BBB- Senior Unsecured Debt = BBB+ Short-Term Debt = K3 Short-Term Deposit = K2 Short-Term Debt = K2 Source: S&P Global Market Intelligence, Company documents. 1Defined as MSAs with population over 2 million. 2Defined as states west of the Mississippi River. 3The MSA of Southern California includes Los Angeles, Long Beach, and Anaheim; excludes San Diego and Ontario, CA. 4As of Dec 31, 2025. 5As of Oct 31, 2025. 6Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. $8.5B Total Assets $7.1B Total Deposits $6.7B Loans HFI Franchise Footprint4

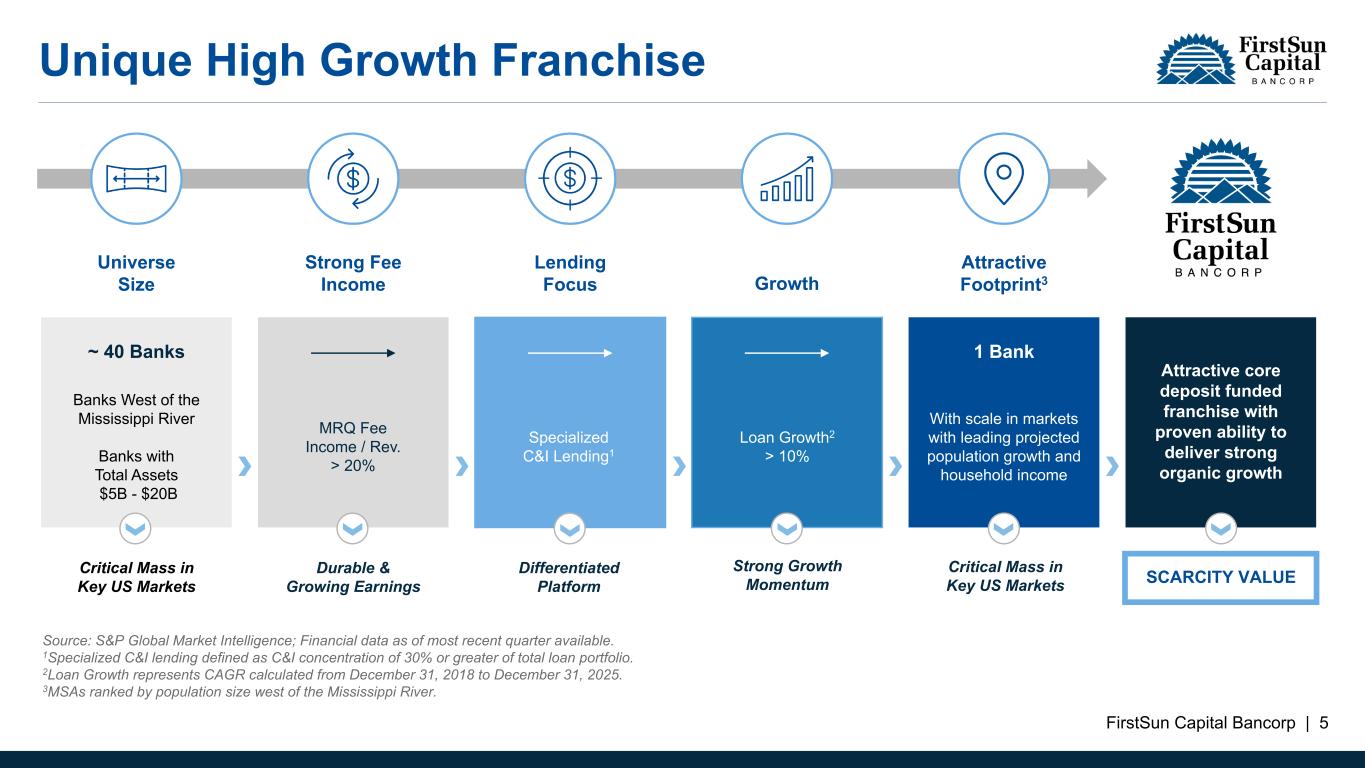

FirstSun Capital Bancorp | 5 Unique High Growth Franchise Universe Size Attractive Footprint3 Strong Fee Income Lending Focus Growth ~ 40 Banks 1 Bank Banks West of the Mississippi River Banks with Total Assets $5B - $20B MRQ Fee Income / Rev. > 20% Specialized C&I Lending1 Loan Growth2 > 10% With scale in markets with leading projected population growth and household income Critical Mass in Key US Markets Durable & Growing Earnings Differentiated Platform Strong Growth Momentum Critical Mass in Key US Markets Attractive core deposit funded franchise with proven ability to deliver strong organic growth SCARCITY VALUE Source: S&P Global Market Intelligence; Financial data as of most recent quarter available. 1Specialized C&I lending defined as C&I concentration of 30% or greater of total loan portfolio. 2Loan Growth represents CAGR calculated from December 31, 2018 to December 31, 2025. 3MSAs ranked by population size west of the Mississippi River.

FirstSun Capital Bancorp | 6 Investment Thesis — Focused Strategy Southwest & Western geography with a mix of metro and community markets C&I business focus with a disciplined and careful CRE exposure to core customers in our geography Vertical lending expertise provides true alternative to larger banks Core deposit funded franchise Financial service income at high end of peers Tenured management team

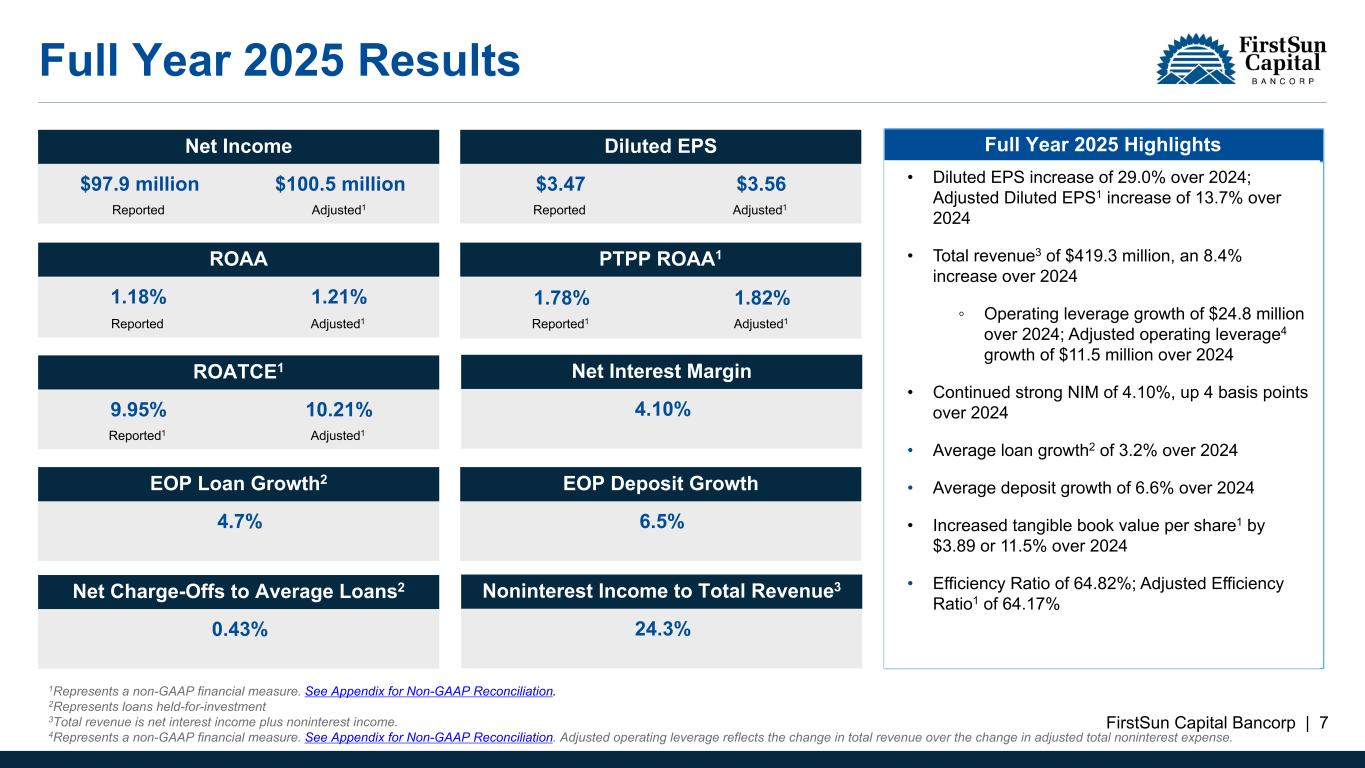

FirstSun Capital Bancorp | 7 Efficiency Ratio 64.82% 64.17% Reported Adjusted1 Full Year 2025 Results 2024 Highlights • Reported Net Income of $97.9 million, or diluted EPS of $3.47, on Revenue of $419.3 million • Strong adjusted PTPP ROAA of 1.78%, ROAA of 1.18%, ROTCE of 9.46% • Maintained a healthy full year NIM (FTE) of 4.16% • Increased tangible book value per share $3.89 or 11.46% • Maintained strong capital ratios with CET1 at 14.12% and TCE/ TA at 12.58% • Executed on organic growth opportunities across our franchise • Grew customers and deepened relationships • Plans for two new branch openings in southern California • KBRA Ratings Renewed • Confident positioning heading into 2025 Net Income $97.9 million $100.5 million Reported Adjusted1 Diluted EPS $3.47 $3.56 Reported Adjusted1 PTPP ROAA1 1.78% 1.82% Reported1 Adjusted1 Net Charge-Offs to Average Loans2 0.43% ROAA 1.18% 1.21% Reported Adjusted1 Noninterest Income to Total Revenue3 24.3% ROATCE1 9.95% 10.21% Reported1 Adjusted1 CET1 14.12% Net Interest Margin 4.10% Full Year 2025 Highlights 1Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. 2Represents loans held-for-investment 3Total revenue is net interest income plus noninterest income. 4Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. Adjusted operating leverage reflects the change in total revenue over the change in adjusted total noninterest expense. • Diluted EPS increase of 29.0% over 2024; Adjusted Diluted EPS1 increase of 13.7% over 2024 • Total revenue3 of $419.3 million, an 8.4% increase over 2024 ◦ Operating leverage growth of $24.8 million over 2024; Adjusted operating leverage4 growth of $11.5 million over 2024 • Continued strong NIM of 4.10%, up 4 basis points over 2024 • Average loan growth2 of 3.2% over 2024 • Average deposit growth of 6.6% over 2024 • Increased tangible book value per share1 by $3.89 or 11.5% over 2024 • Efficiency Ratio of 64.82%; Adjusted Efficiency Ratio1 of 64.17% EOP Deposit Growth 6.5% EOP Loan Growth2 4.7%

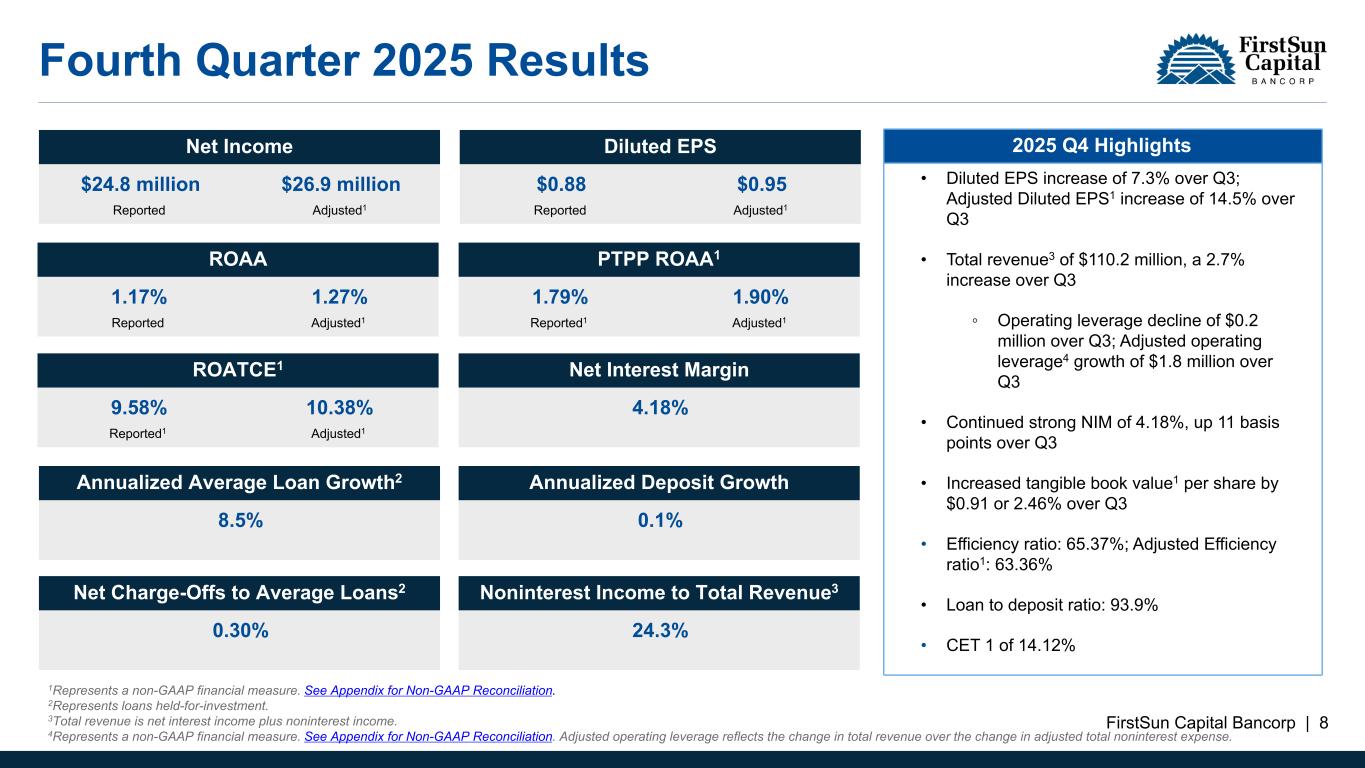

FirstSun Capital Bancorp | 8 Fourth Quarter 2025 Results 2025 Q4 HighlightsNet Income $24.8 million $26.9 million Reported Adjusted1 Diluted EPS $0.88 $0.95 Reported Adjusted1 PTPP ROAA1 1.79% 1.90% Reported1 Adjusted1 Noninterest Income to Total Revenue3 24.3% ROAA 1.17% 1.27% Reported Adjusted1 Net Interest Margin 4.18% ROATCE1 9.58% 10.38% Reported1 Adjusted1 Net Charge-Offs to Average Loans2 0.30% Annualized Average Loan Growth2 8.5% Annualized Deposit Growth 0.1% • Diluted EPS increase of 7.3% over Q3; Adjusted Diluted EPS1 increase of 14.5% over Q3 • Total revenue3 of $110.2 million, a 2.7% increase over Q3 ◦ Operating leverage decline of $0.2 million over Q3; Adjusted operating leverage4 growth of $1.8 million over Q3 • Continued strong NIM of 4.18%, up 11 basis points over Q3 • Increased tangible book value1 per share by $0.91 or 2.46% over Q3 • Efficiency ratio: 65.37%; Adjusted Efficiency ratio1: 63.36% • Loan to deposit ratio: 93.9% • CET 1 of 14.12% 1Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. 2Represents loans held-for-investment. 3Total revenue is net interest income plus noninterest income. 4Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. Adjusted operating leverage reflects the change in total revenue over the change in adjusted total noninterest expense.

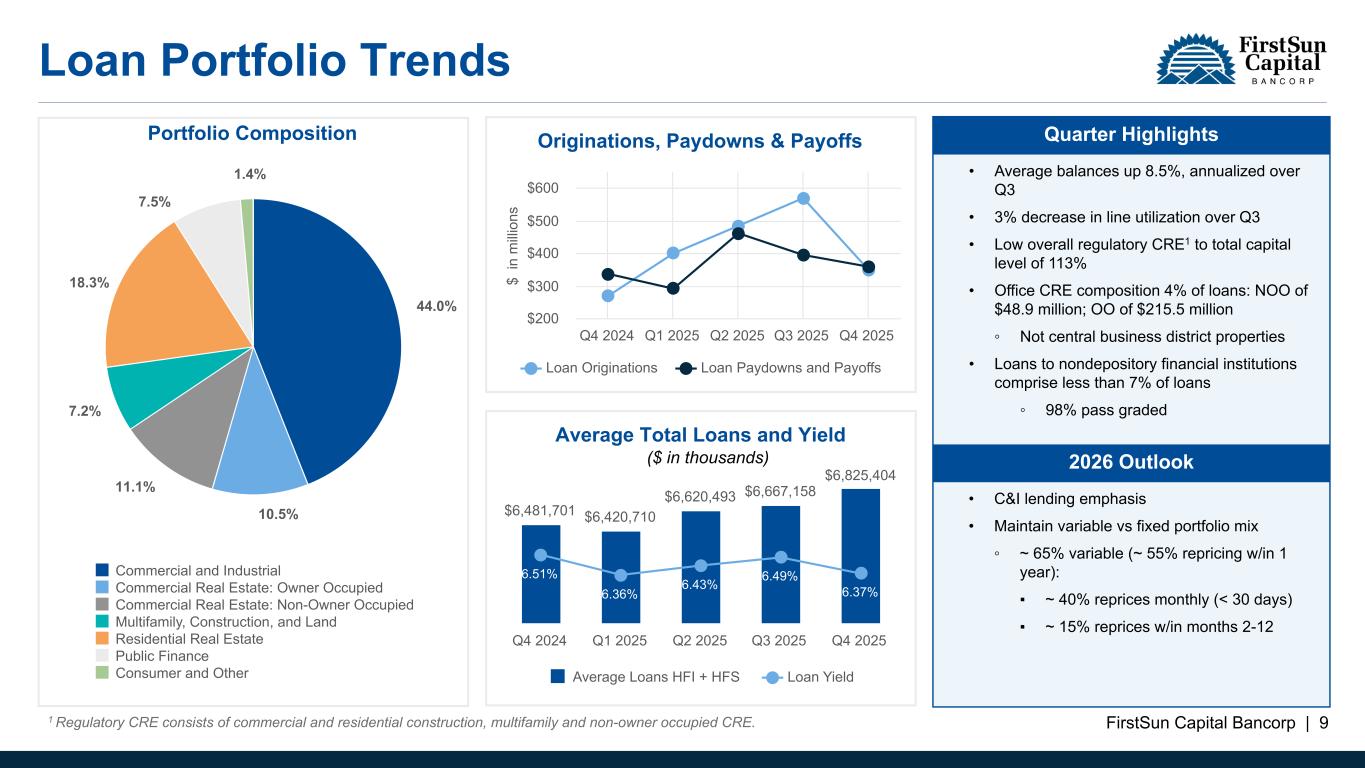

FirstSun Capital Bancorp | 9 Loan Portfolio Trends Portfolio Composition 44.0% 10.5% 11.1% 7.2% 18.3% 7.5% 1.4% Commercial and Industrial Commercial Real Estate: Owner Occupied Commercial Real Estate: Non-Owner Occupied Multifamily, Construction, and Land Residential Real Estate Public Finance Consumer and Other $ in m ill io ns Originations, Paydowns & Payoffs Loan Originations Loan Paydowns and Payoffs Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $200 $300 $400 $500 $600 Average Total Loans and Yield $6,481,701 $6,420,710 $6,620,493 $6,667,158 $6,825,404 6.51% 6.36% 6.43% 6.49% 6.37% Average Loans HFI + HFS Loan Yield Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 1 Regulatory CRE consists of commercial and residential construction, multifamily and non-owner occupied CRE. ($ in thousands) • Average balances up 8.5%, annualized over Q3 • 3% decrease in line utilization over Q3 • Low overall regulatory CRE1 to total capital level of 113% • Office CRE composition 4% of loans: NOO of $48.9 million; OO of $215.5 million ◦ Not central business district properties • Loans to nondepository financial institutions comprise less than 7% of loans ◦ 98% pass graded • C&I lending emphasis • Maintain variable vs fixed portfolio mix ◦ ~ 65% variable (~ 55% repricing w/in 1 year): ▪ ~ 40% reprices monthly (< 30 days) ▪ ~ 15% reprices w/in months 2-12 Quarter Highlights 2026 Outlook

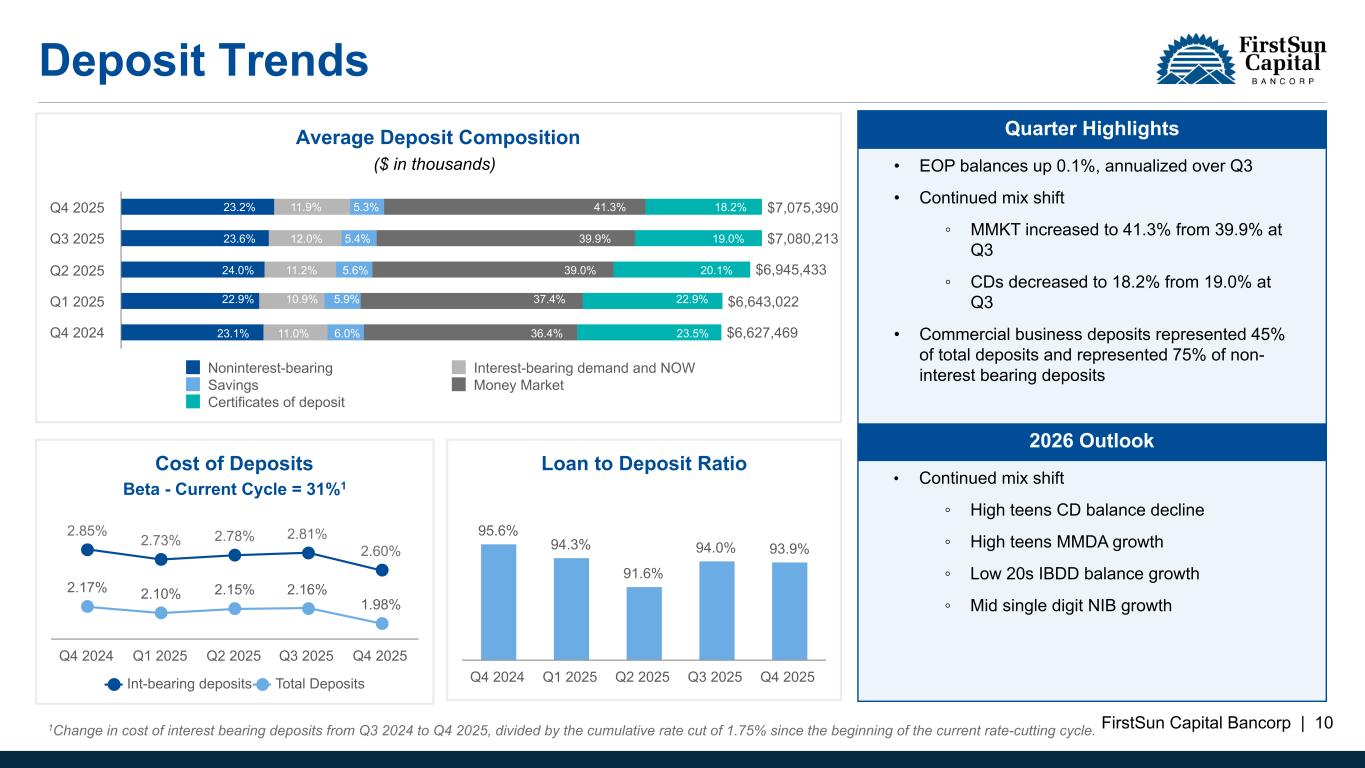

FirstSun Capital Bancorp | 10 Deposit Trends Average Deposit Composition $7,075,390 $7,080,213 $6,945,433 $6,643,022 $6,627,469 Noninterest-bearing Interest-bearing demand and NOW Savings Money Market Certificates of deposit Q4 2025 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Cost of Deposits 2.85% 2.73% 2.78% 2.81% 2.60% 2.17% 2.10% 2.15% 2.16% 1.98% Int-bearing deposits Total Deposits Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Loan to Deposit Ratio 95.6% 94.3% 91.6% 94.0% 93.9% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in thousands) • EOP balances up 0.1%, annualized over Q3 • Continued mix shift ◦ MMKT increased to 41.3% from 39.9% at Q3 ◦ CDs decreased to 18.2% from 19.0% at Q3 • Commercial business deposits represented 45% of total deposits and represented 75% of non- interest bearing deposits • Continued mix shift ◦ High teens CD balance decline ◦ High teens MMDA growth ◦ Low 20s IBDD balance growth ◦ Mid single digit NIB growth Quarter Highlights 2026 Outlook 23.6% 12.0% 5.4% 39.9% 19.0% 24.0% 11.2% 5.6% 39.0% 20.1% 22.9% 10.9% 5.9% 37.4% 22.9% 23.1% 11.0% 6.0% 36.4% 23.5% 23.2% 11.9% 5.3% 41.3% 18.2% Beta - Current Cycle = 31%1 1Change in cost of interest bearing deposits from Q3 2024 to Q4 2025, divided by the cumulative rate cut of 1.75% since the beginning of the current rate-cutting cycle.

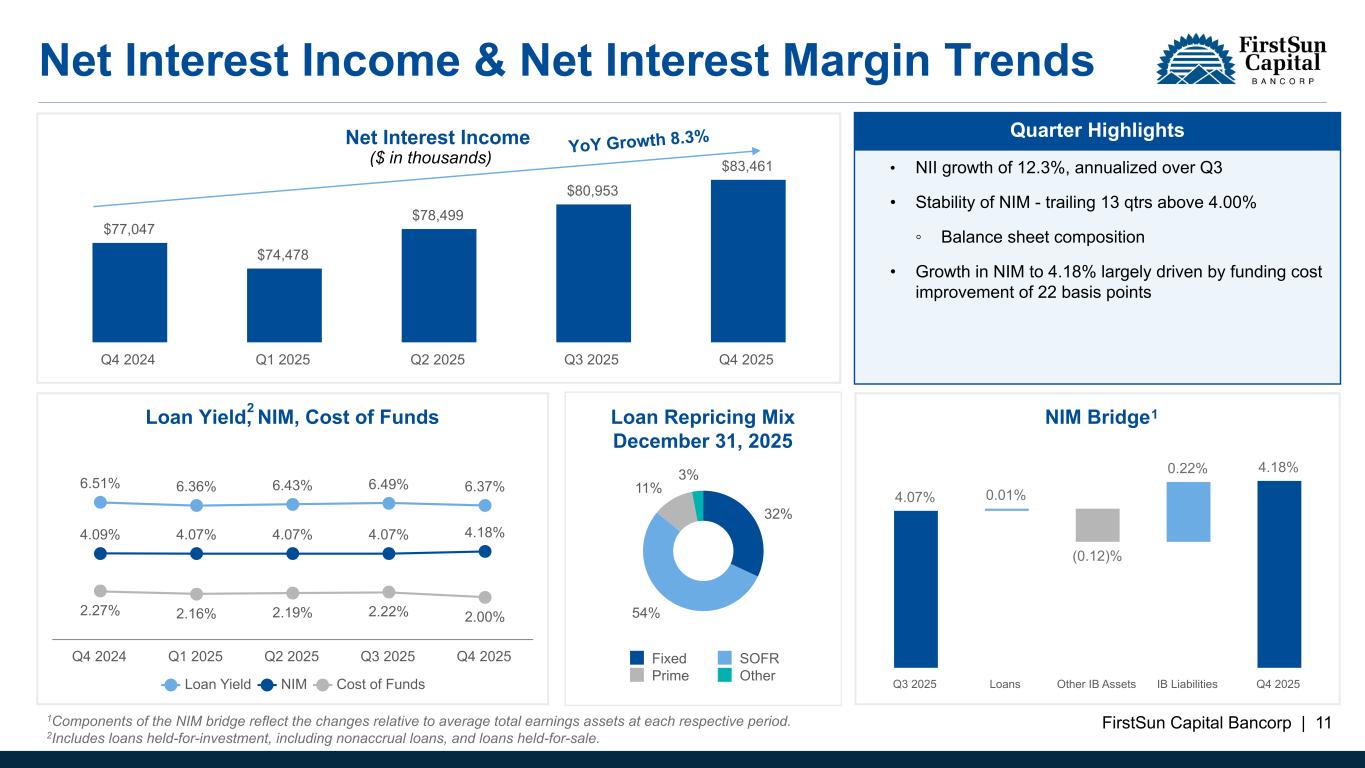

FirstSun Capital Bancorp | 11 NIM Bridge 4.07% 0.01% (0.12)% 0.22% 4.18% Q3 2025 Loans Other IB Assets IB Liabilities Q4 2025 Loan Yield, NIM, Cost of Funds 6.51% 6.36% 6.43% 6.49% 6.37% 4.09% 4.07% 4.07% 4.07% 4.18% 2.27% 2.16% 2.19% 2.22% 2.00% Loan Yield NIM Cost of Funds Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Net Interest Income $77,047 $74,478 $78,499 $80,953 $83,461 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Loan Repricing Mix December 31, 2025 32% 54% 11% 3% Fixed SOFR Prime Other Net Interest Income & Net Interest Margin Trends ($ in thousands) • NII growth of 12.3%, annualized over Q3 • Stability of NIM - trailing 13 qtrs above 4.00% ◦ Balance sheet composition • Growth in NIM to 4.18% largely driven by funding cost improvement of 22 basis points Quarter Highlights YoY Growth 8.3% 1Components of the NIM bridge reflect the changes relative to average total earnings assets at each respective period. 2Includes loans held-for-investment, including nonaccrual loans, and loans held-for-sale. 12

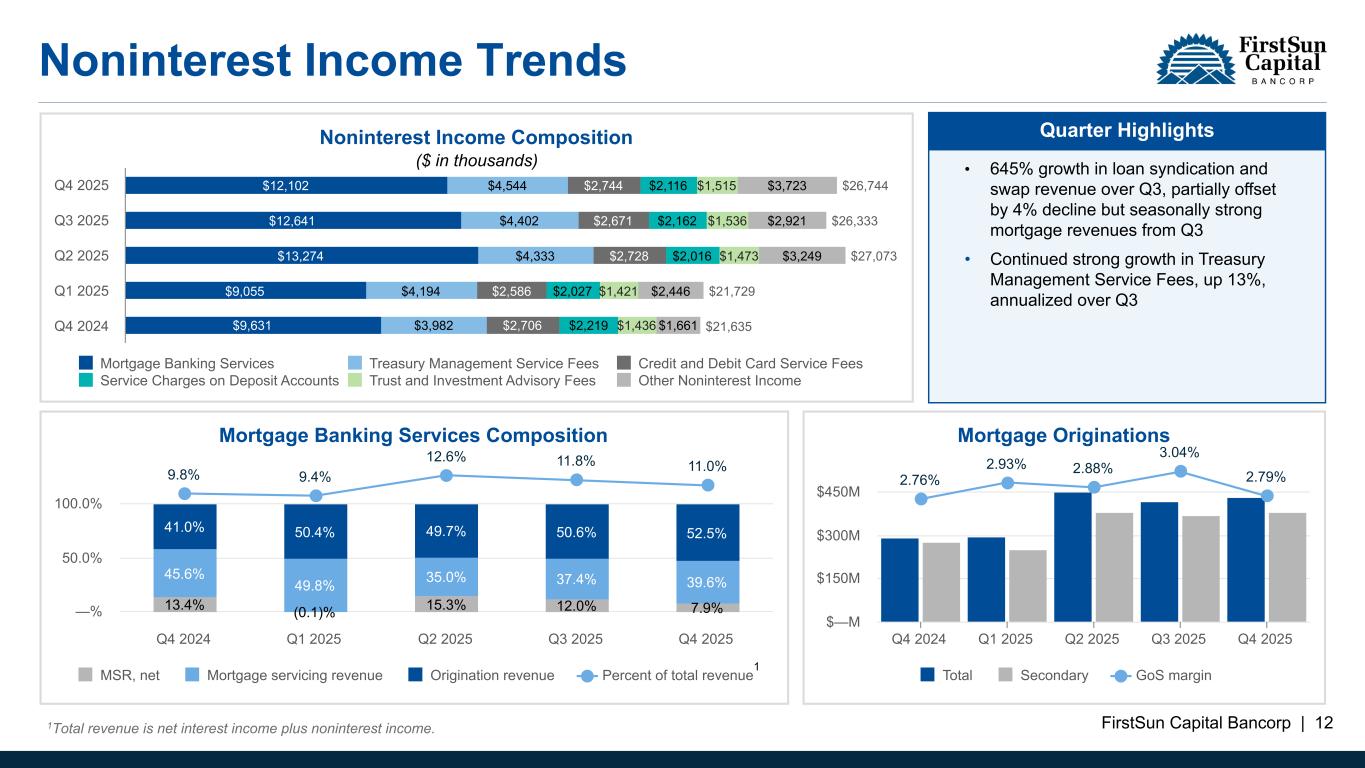

FirstSun Capital Bancorp | 12 Noninterest Income Trends Noninterest Income Composition $26,744 $26,333 $27,073 $21,729 $21,635 $12,102 $12,641 $13,274 $9,055 $9,631 $4,544 $4,402 $4,333 $4,194 $3,982 $2,744 $2,671 $2,728 $2,586 $2,706 $2,116 $2,162 $2,016 $2,027 $2,219 $1,515 $1,536 $1,473 $1,421 $1,436 $3,723 $2,921 $3,249 $2,446 $1,661 Mortgage Banking Services Treasury Management Service Fees Credit and Debit Card Service Fees Service Charges on Deposit Accounts Trust and Investment Advisory Fees Other Noninterest Income Q4 2025 Q3 2025 Q2 2025 Q1 2025 Q4 2024 ($ in thousands) Quarter Highlights 1Total revenue is net interest income plus noninterest income. • 645% growth in loan syndication and swap revenue over Q3, partially offset by 4% decline but seasonally strong mortgage revenues from Q3 • Continued strong growth in Treasury Management Service Fees, up 13%, annualized over Q3 Mortgage Banking Services Composition 13.4% (0.1)% 15.3% 12.0% 7.9% 45.6% 49.8% 35.0% 37.4% 39.6% 41.0% 50.4% 49.7% 50.6% 52.5% 9.8% 9.4% 12.6% 11.8% 11.0% MSR, net Mortgage servicing revenue Origination revenue Percent of total revenue Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 —% 50.0% 100.0% Mortgage Originations 2.76% 2.93% 2.88% 3.04% 2.79% Total Secondary GoS margin Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $—M $150M $300M $450M 1

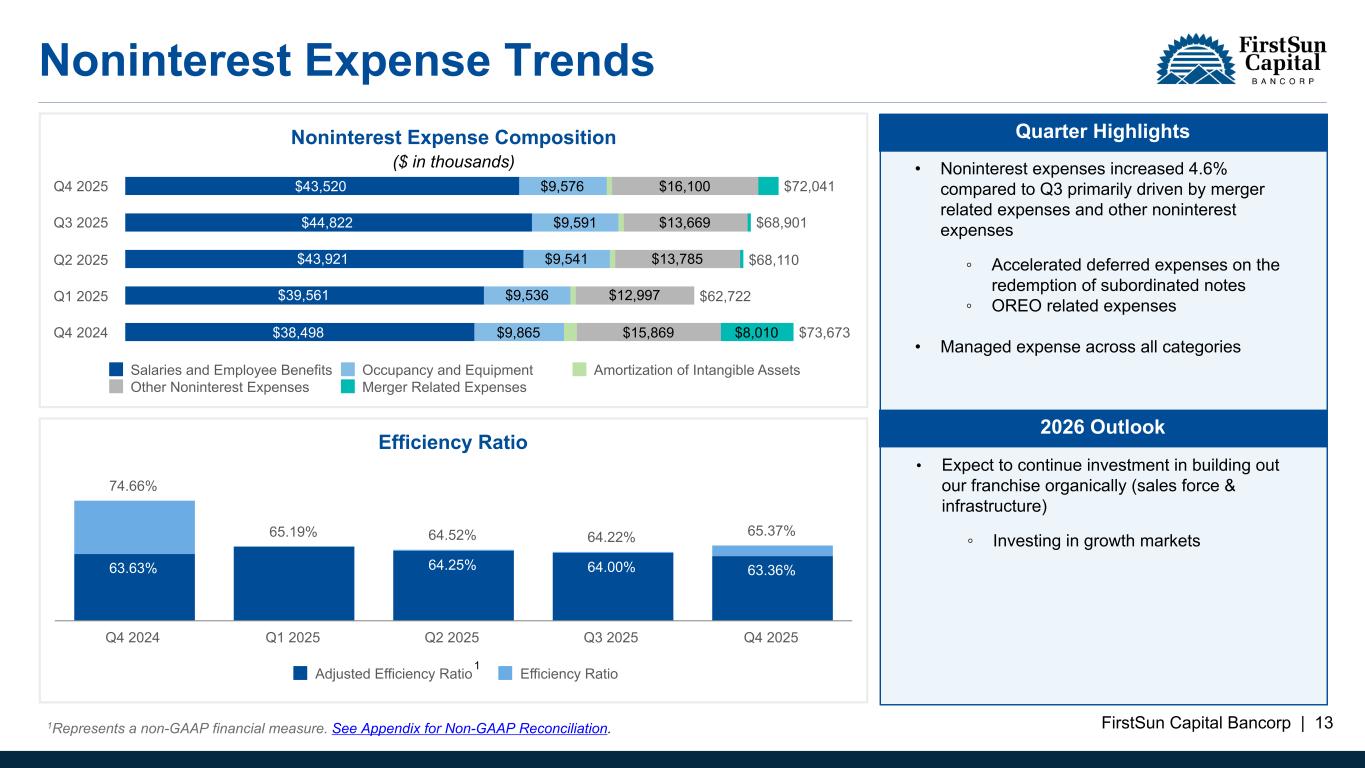

FirstSun Capital Bancorp | 13 Noninterest Expense Trends Noninterest Expense Composition $72,041 $68,901 $68,110 $62,722 $73,673 $43,520 $44,822 $43,921 $39,561 $38,498 $9,576 $9,591 $9,541 $9,536 $9,865 $16,100 $13,669 $13,785 $12,997 $15,869 $8,010 Salaries and Employee Benefits Occupancy and Equipment Amortization of Intangible Assets Other Noninterest Expenses Merger Related Expenses Q4 2025 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Efficiency Ratio 74.66% 65.19% 64.52% 64.22% 65.37% 63.63% 64.25% 64.00% 63.36% Adjusted Efficiency Ratio Efficiency Ratio Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in thousands) 1Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. • Noninterest expenses increased 4.6% compared to Q3 primarily driven by merger related expenses and other noninterest expenses ◦ Accelerated deferred expenses on the redemption of subordinated notes ◦ OREO related expenses • Managed expense across all categories • Expect to continue investment in building out our franchise organically (sales force & infrastructure) ◦ Investing in growth markets Quarter Highlights 2026 Outlook 1

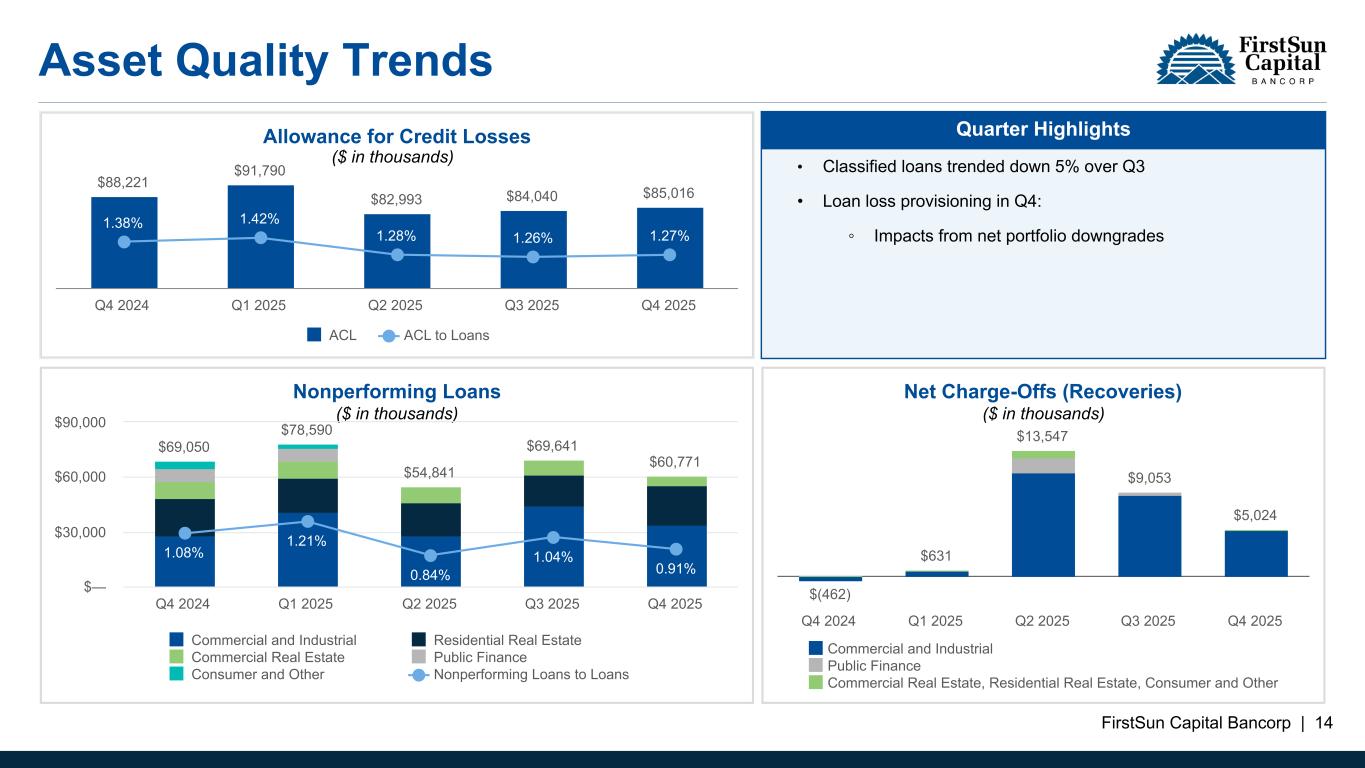

FirstSun Capital Bancorp | 14 Asset Quality Trends Net Charge-Offs (Recoveries) $(462) $631 $13,547 $9,053 $5,024 Commercial and Industrial Public Finance Commercial Real Estate, Residential Real Estate, Consumer and Other Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Allowance for Credit Losses $88,221 $91,790 $82,993 $84,040 $85,016 1.38% 1.42% 1.28% 1.26% 1.27% ACL ACL to Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Nonperforming Loans $69,050 $78,590 $54,841 $69,641 $60,771 1.08% 1.21% 0.84% $— $— Nonperforming Loans Nonperforming Loans to Total Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in thousands) ($ in thousands)($ in thousands) • Classified loans trended down 5% over Q3 • Loan loss provisioning in Q4: ◦ Impacts from net portfolio downgrades Quarter Highlights Outlook • Net charge-off ratio in high 30’s to Low 40’s in bps • ACL in mid 120’s in bps Nonperforming Loans $69,050 $78,590 $54,841 $69,641 $60,771 1.08% 1.21% 0.84% 1.04% 0.91% Commercial and Industrial Residential Real Estate Commercial Real Estate Public Finance Consumer and Other Nonperforming Loans to Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $— $30,000 $60,000 $90,000

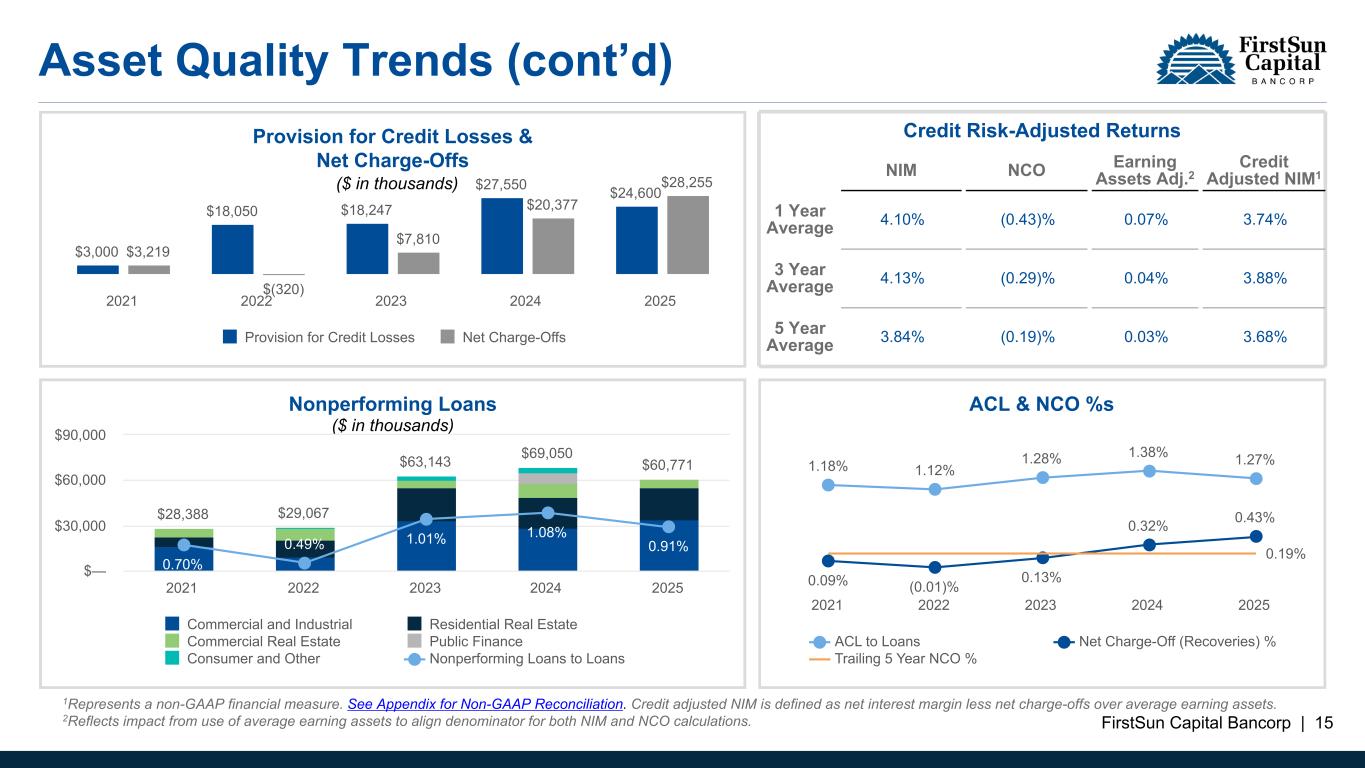

FirstSun Capital Bancorp | 15 Asset Quality Trends (cont’d) ($ in thousands) ($ in thousands) ACL & NCO %s 1.18% 1.12% 1.28% 1.38% 1.27% 0.09% (0.01)% 0.13% 0.32% 0.43% 0.19% ACL to Loans Net Charge-Off (Recoveries) % Trailing 5 Year NCO % 2021 2022 2023 2024 2025 Provision for Credit Losses & Net Charge-Offs $3,000 $18,050 $18,247 $27,550 $24,600 $3,219 $(320) $7,810 $20,377 $28,255 Provision for Credit Losses Net Charge-Offs 2021 2022 2023 2024 2025 Nonperforming Loans $28,388 $29,067 $63,143 $69,050 $60,771 0.70% 0.49% 1.01% 1.08% 0.91% Commercial and Industrial Residential Real Estate Commercial Real Estate Public Finance Consumer and Other Nonperforming Loans to Loans 2021 2022 2023 2024 2025 $— $30,000 $60,000 $90,000 Credit Risk-Adjusted Returns NIM NCO Earning Assets Adj.2 Credit Adjusted NIM1 1 Year Average 4.10% (0.43)% 0.07% 3.74% 3 Year Average 4.13% (0.29)% 0.04% 3.88% 5 Year Average 3.84% (0.19)% 0.03% 3.68% 1Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. Credit adjusted NIM is defined as net interest margin less net charge-offs over average earning assets. 2Reflects impact from use of average earning assets to align denominator for both NIM and NCO calculations.

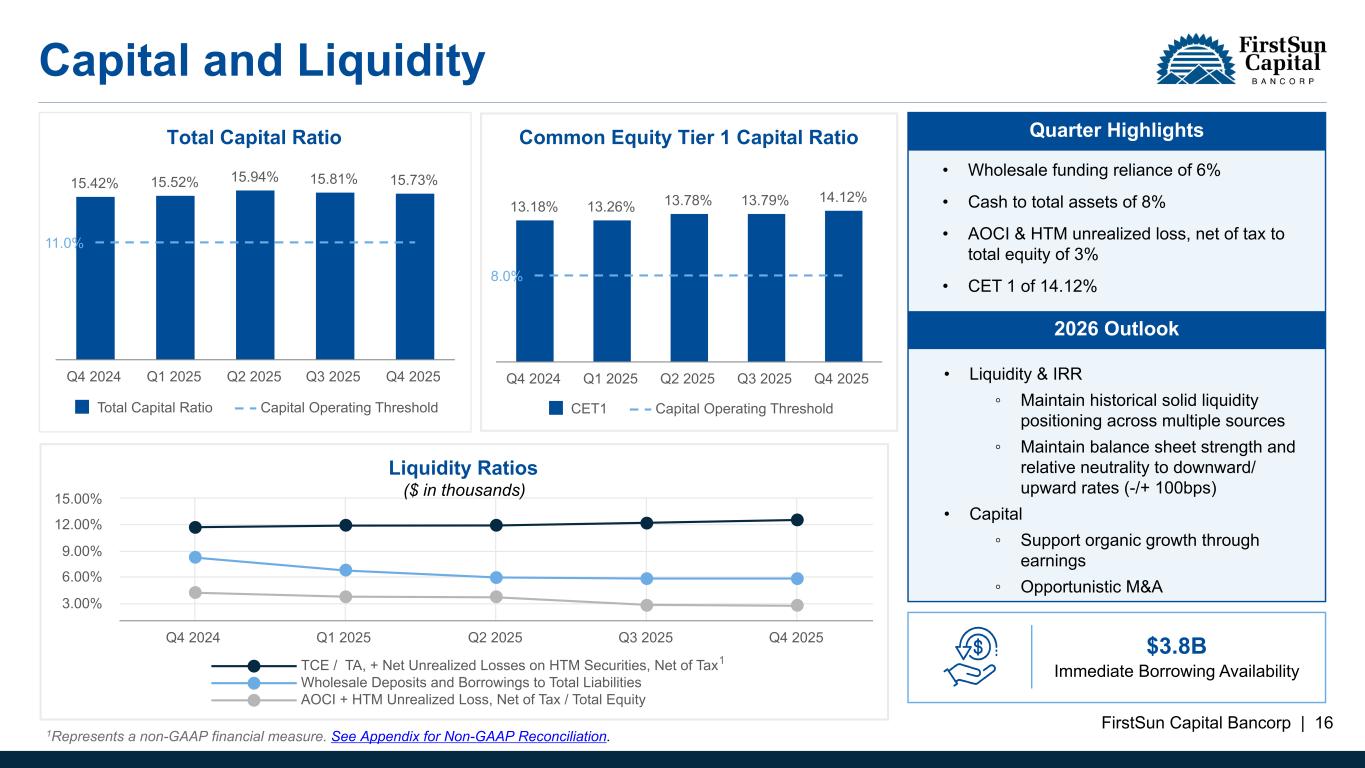

FirstSun Capital Bancorp | 16 Capital and Liquidity Total Capital Ratio 15.42% 15.52% 15.94% 15.81% 15.73% 11.0% Total Capital Ratio Capital Operating Threshold Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Common Equity Tier 1 Capital Ratio 13.18% 13.26% 13.78% 13.79% 14.12% 8.0% CET1 Capital Operating Threshold Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Liquidity Ratios TCE / TA, + Net Unrealized Losses on HTM Securities, Net of Tax Wholesale Deposits and Borrowings to Total Liabilities AOCI + HTM Unrealized Loss, Net of Tax / Total Equity Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 3.00% 6.00% 9.00% 12.00% 15.00% ($ in thousands) • Wholesale funding reliance of 6% • Cash to total assets of 8% • AOCI & HTM unrealized loss, net of tax to total equity of 3% • CET 1 of 14.12% Quarter Highlights 2026 Outlook • Liquidity & IRR ◦ Maintain historical solid liquidity positioning across multiple sources ◦ Maintain balance sheet strength and relative neutrality to downward/ upward rates (-/+ 100bps) • Capital ◦ Support organic growth through earnings ◦ Opportunistic M&A $3.8B Immediate Borrowing Availability 1Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. 1

FirstSun Capital Bancorp | 17 Consistent Long Term Strategy Key Southwest and Western Growth Markets C&I Focused Commercial Bank High Service Fee to Revenue Mix Core Deposit Franchise Operating Strategy Focused on Organic Loan and Deposit Growth in Targeted Markets Operating in 5 of 10 Fastest Growing MSAs1 in US Robust Mix of Customer Relationships across Urban and Rural Communities Relationship Driven C&I Banking with Attractive Specialty Verticals Expansive Treasury Management Services Low CRE Concentration Revenue Diversification Emphasis Multiple Profitable Service Fee Income Lines of Business Best in Class Revenue Mix High Quality, Attractive Long-Term Beta, Low Cost Deposits Balanced Distribution Across Deposit Rich Markets Advantageous Funding Solid Core Earnings Progression Sound Risk and Compliance Programs Opportunistic Acquisition Readiness 1 2 3 4 5 1Defined as MSAs with population over 2 million.

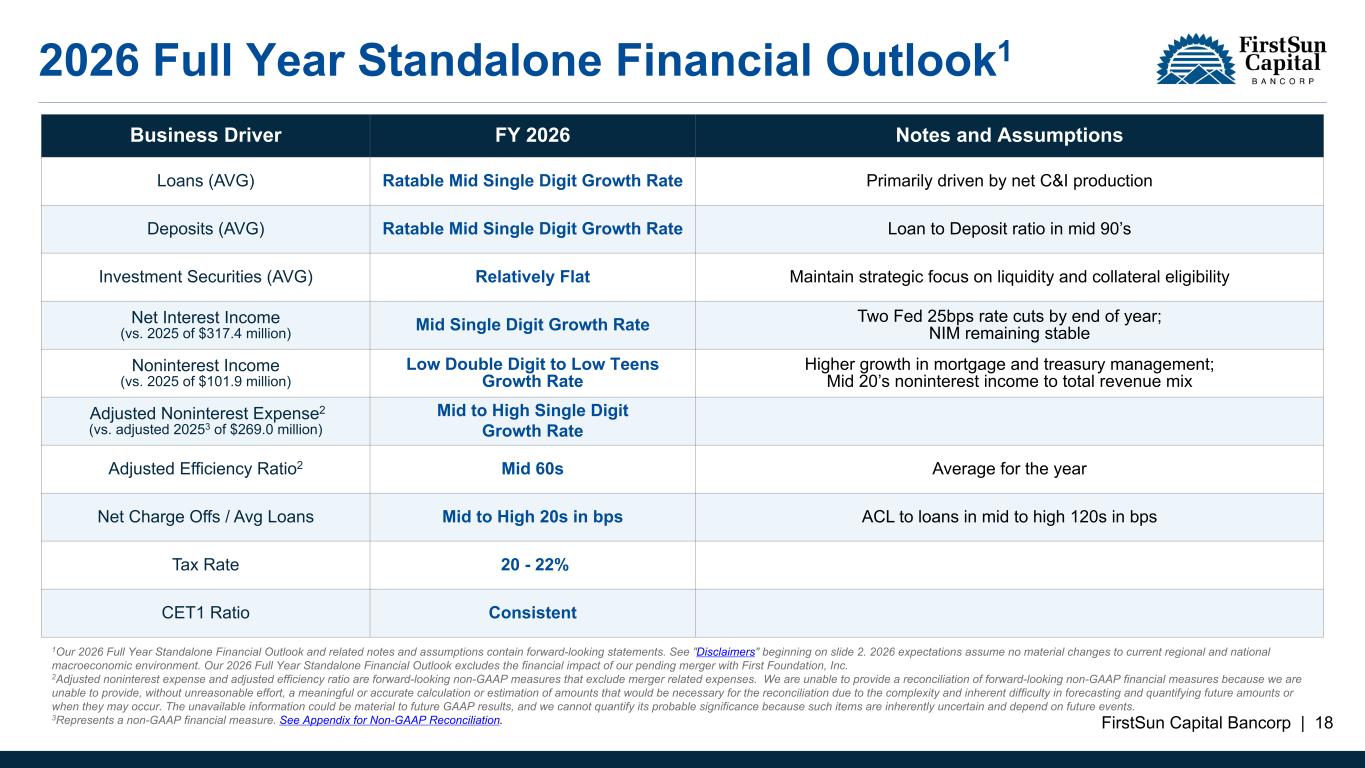

FirstSun Capital Bancorp | 18 2026 Full Year Standalone Financial Outlook1 Business Driver FY 2026 Notes and Assumptions Loans (AVG) Ratable Mid Single Digit Growth Rate Primarily driven by net C&I production Deposits (AVG) Ratable Mid Single Digit Growth Rate Loan to Deposit ratio in mid 90’s Investment Securities (AVG) Relatively Flat Maintain strategic focus on liquidity and collateral eligibility Net Interest Income (vs. 2025 of $317.4 million) Mid Single Digit Growth Rate Two Fed 25bps rate cuts by end of year; NIM remaining stable Noninterest Income (vs. 2025 of $101.9 million) Low Double Digit to Low Teens Growth Rate Higher growth in mortgage and treasury management; Mid 20’s noninterest income to total revenue mix Adjusted Noninterest Expense2 (vs. adjusted 20253 of $269.0 million) Mid to High Single Digit Growth Rate Adjusted Efficiency Ratio2 Mid 60s Average for the year Net Charge Offs / Avg Loans Mid to High 20s in bps ACL to loans in mid to high 120s in bps Tax Rate 20 - 22% CET1 Ratio Consistent 1Our 2026 Full Year Standalone Financial Outlook and related notes and assumptions contain forward-looking statements. See "Disclaimers" beginning on slide 2. 2026 expectations assume no material changes to current regional and national macroeconomic environment. Our 2026 Full Year Standalone Financial Outlook excludes the financial impact of our pending merger with First Foundation, Inc. 2Adjusted noninterest expense and adjusted efficiency ratio are forward-looking non-GAAP measures that exclude merger related expenses. We are unable to provide a reconciliation of forward-looking non-GAAP financial measures because we are unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts or when they may occur. The unavailable information could be material to future GAAP results, and we cannot quantify its probable significance because such items are inherently uncertain and depend on future events. 3Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation.

FirstSun Capital Bancorp | 19 Appendix

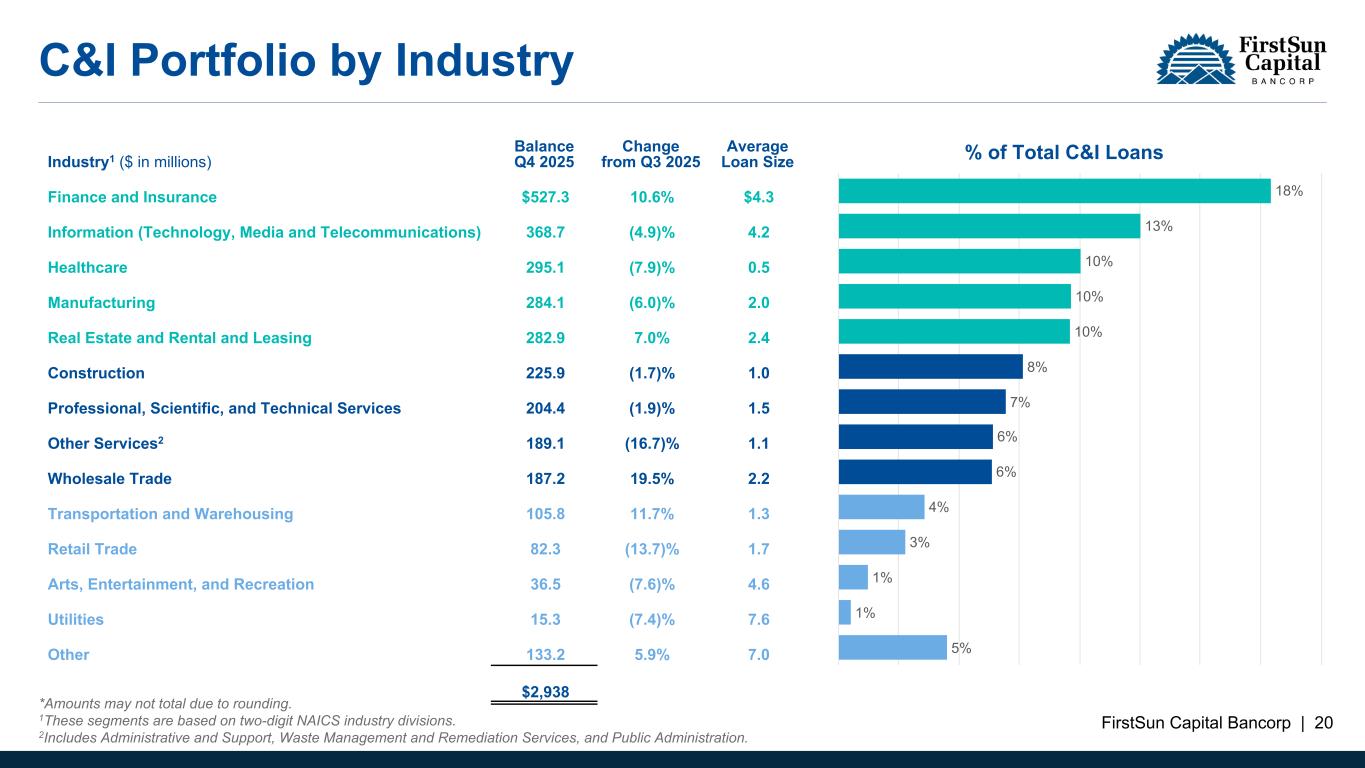

FirstSun Capital Bancorp | 20 C&I Portfolio by Industry Industry1 ($ in millions) Balance Q4 2025 Change from Q3 2025 Average Loan Size Finance and Insurance $527.3 10.6% $4.3 Information (Technology, Media and Telecommunications) 368.7 (4.9)% 4.2 Healthcare 295.1 (7.9)% 0.5 Manufacturing 284.1 (6.0)% 2.0 Real Estate and Rental and Leasing 282.9 7.0% 2.4 Construction 225.9 (1.7)% 1.0 Professional, Scientific, and Technical Services 204.4 (1.9)% 1.5 Other Services2 189.1 (16.7)% 1.1 Wholesale Trade 187.2 19.5% 2.2 Transportation and Warehousing 105.8 11.7% 1.3 Retail Trade 82.3 (13.7)% 1.7 Arts, Entertainment, and Recreation 36.5 (7.6)% 4.6 Utilities 15.3 (7.4)% 7.6 Other 133.2 5.9% 7.0 $2,938 18% 13% 10% 10% 10% 8% 7% 6% 6% 4% 3% 1% 1% 5% % of Total C&I Loans *Amounts may not total due to rounding. 1These segments are based on two-digit NAICS industry divisions. 2Includes Administrative and Support, Waste Management and Remediation Services, and Public Administration. Average Loan Size Change from Q3 2025 $4.3 10.6% 4.2 (4.9)% 0.5 (7.9)% 2.0 (6.0)% 2.4 7.0% 1.0 (1.7)% 1.1 (16.7)% 1.5 (1.9)% 2.2 19.5% 1.7 (13.7)% 1.3 11.7% 4.6 (7.6)% 7.6 (7.4)% 7.0 5.9%

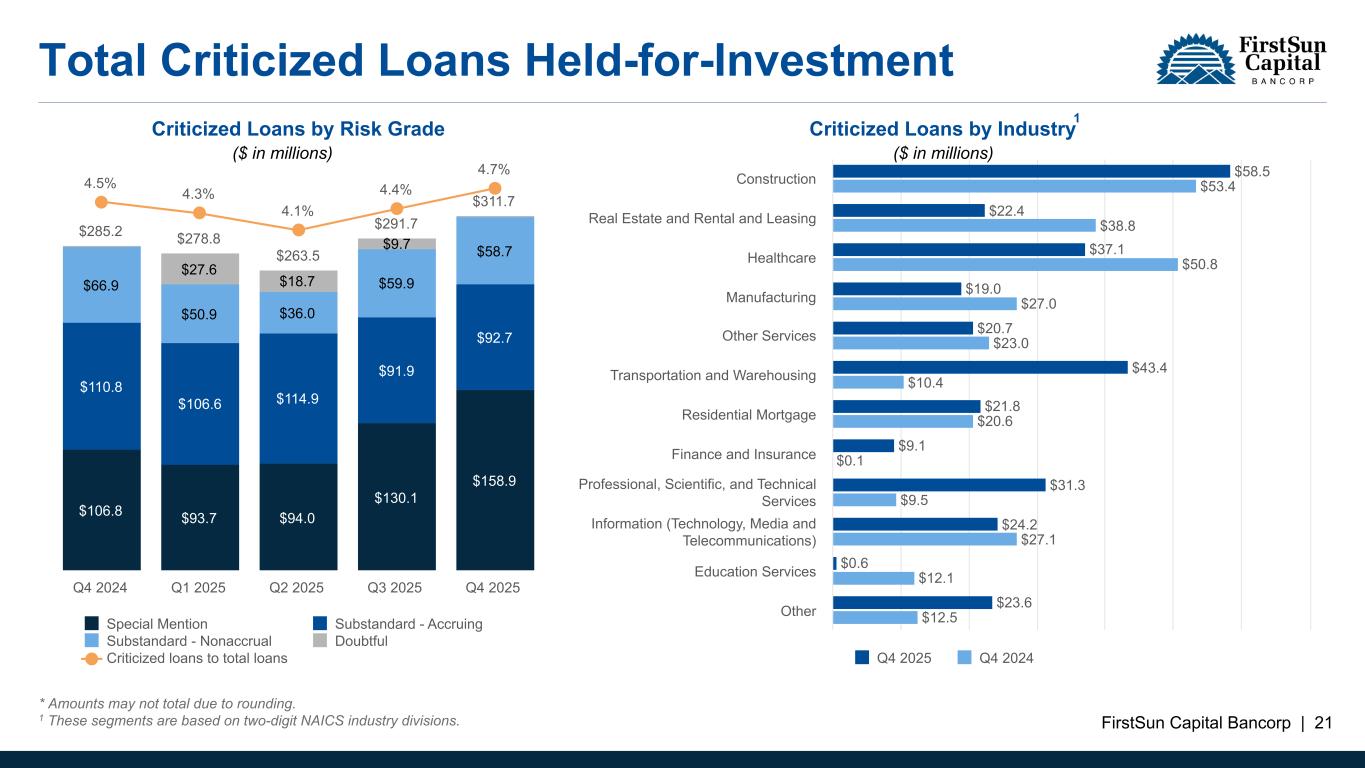

FirstSun Capital Bancorp | 21 Total Criticized Loans Held-for-Investment * Amounts may not total due to rounding. 1 These segments are based on two-digit NAICS industry divisions. Criticized Loans by Risk Grade $285.2 $278.8 $263.5 $291.7 $311.7 $106.8 $93.7 $94.0 $130.1 $158.9 $110.8 $106.6 $114.9 $91.9 $92.7 $66.9 $50.9 $36.0 $59.9 $58.7 $27.6 $18.7 $9.7 4.5% 4.3% 4.1% 4.4% 4.7% Special Mention Substandard - Accruing Substandard - Nonaccrual Doubtful Criticized loans to total loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Criticized Loans by Industry $58.5 $22.4 $37.1 $19.0 $20.7 $43.4 $21.8 $9.1 $31.3 $24.2 $0.6 $23.6 $53.4 $38.8 $50.8 $27.0 $23.0 $10.4 $20.6 $0.1 $9.5 $27.1 $12.1 $12.5 Q4 2025 Q4 2024 Construction Real Estate and Rental and Leasing Healthcare Manufacturing Other Services Transportation and Warehousing Residential Mortgage Finance and Insurance Professional, Scientific, and Technical Services Information (Technology, Media and Telecommunications) Education Services Other 1 Example Total Return Performance Special Mention Substandard - Accruing Substandard - Nonaccrual Loss Doubtful Criticized loans to total loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $—M $100.0M $200.0M $300.0M $400.0M $—M $8.0M $16.0M $24.0M $32.0M Example Total Return Perform nce ABC Company ABC Company NASDAQ Composite Widget Subcategory CEO Compensation 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 0 100 200 300 400 40 60 80 100 120 ($ in millions) ($ in millions)

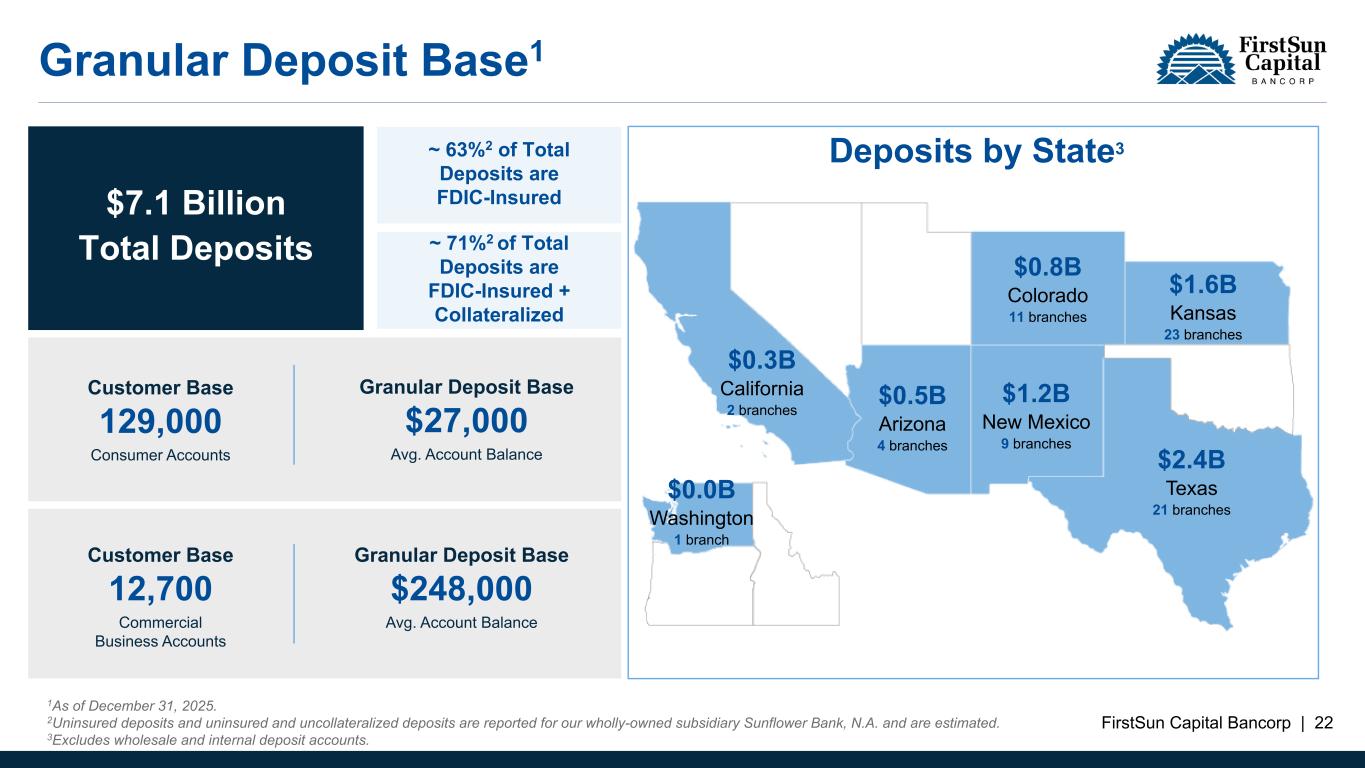

FirstSun Capital Bancorp | 22 ~ 63%2 of Total Deposits are FDIC-Insured Granular Deposit Base1 Customer Base 129,000 Consumer Accounts Granular Deposit Base $27,000 Avg. Account Balance Customer Base 12,700 Commercial Business Accounts Granular Deposit Base $248,000 Avg. Account Balance $7.1 Billion Total Deposits Deposits by State3 $2.4B Texas 21 branches $1.6B Kansas 23 branches $1.2B New Mexico 9 branches $0.8B Colorado 11 branches $0.5B Arizona 4 branches ~ 71%2 of Total Deposits are FDIC-Insured + Collateralized 1As of December 31, 2025. 2Uninsured deposits and uninsured and uncollateralized deposits are reported for our wholly-owned subsidiary Sunflower Bank, N.A. and are estimated. 3Excludes wholesale and internal deposit accounts. $0.3B California 2 branches $0.0B Washington 1 branch

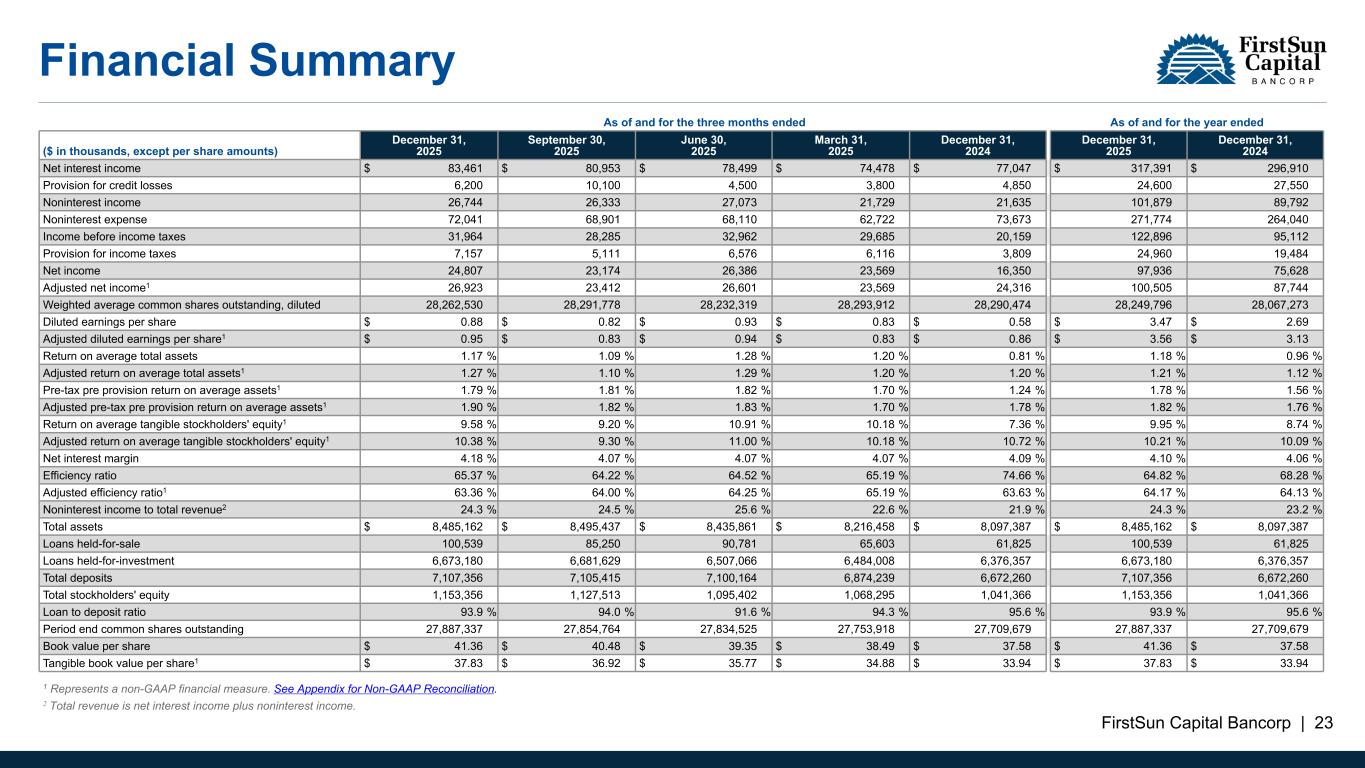

FirstSun Capital Bancorp | 23 Financial Summary As of and for the three months ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Net interest income $ 83,461 $ 80,953 $ 78,499 $ 74,478 $ 77,047 $ 317,391 $ 296,910 Provision for credit losses 6,200 10,100 4,500 3,800 4,850 24,600 27,550 Noninterest income 26,744 26,333 27,073 21,729 21,635 101,879 89,792 Noninterest expense 72,041 68,901 68,110 62,722 73,673 271,774 264,040 Income before income taxes 31,964 28,285 32,962 29,685 20,159 122,896 95,112 Provision for income taxes 7,157 5,111 6,576 6,116 3,809 24,960 19,484 Net income 24,807 23,174 26,386 23,569 16,350 97,936 75,628 Adjusted net income1 26,923 23,412 26,601 23,569 24,316 100,505 87,744 Weighted average common shares outstanding, diluted 28,262,530 28,291,778 28,232,319 28,293,912 28,290,474 28,249,796 28,067,273 Diluted earnings per share $ 0.88 $ 0.82 $ 0.93 $ 0.83 $ 0.58 $ 3.47 $ 2.69 Adjusted diluted earnings per share1 $ 0.95 $ 0.83 $ 0.94 $ 0.83 $ 0.86 $ 3.56 $ 3.13 Return on average total assets 1.17 % 1.09 % 1.28 % 1.20 % 0.81 % 1.18 % 0.96 % Adjusted return on average total assets1 1.27 % 1.10 % 1.29 % 1.20 % 1.20 % 1.21 % 1.12 % Pre-tax pre provision return on average assets1 1.79 % 1.81 % 1.82 % 1.70 % 1.24 % 1.78 % 1.56 % Adjusted pre-tax pre provision return on average assets1 1.90 % 1.82 % 1.83 % 1.70 % 1.78 % 1.82 % 1.76 % Return on average tangible stockholders' equity1 9.58 % 9.20 % 10.91 % 10.18 % 7.36 % 9.95 % 8.74 % Adjusted return on average tangible stockholders' equity1 10.38 % 9.30 % 11.00 % 10.18 % 10.72 % 10.21 % 10.09 % Net interest margin 4.18 % 4.07 % 4.07 % 4.07 % 4.09 % 4.10 % 4.06 % Efficiency ratio 65.37 % 64.22 % 64.52 % 65.19 % 74.66 % 64.82 % 68.28 % Adjusted efficiency ratio1 63.36 % 64.00 % 64.25 % 65.19 % 63.63 % 64.17 % 64.13 % Noninterest income to total revenue2 24.3 % 24.5 % 25.6 % 22.6 % 21.9 % 24.3 % 23.2 % Total assets $ 8,485,162 $ 8,495,437 $ 8,435,861 $ 8,216,458 $ 8,097,387 $ 8,485,162 $ 8,097,387 Loans held-for-sale 100,539 85,250 90,781 65,603 61,825 100,539 61,825 Loans held-for-investment 6,673,180 6,681,629 6,507,066 6,484,008 6,376,357 6,673,180 6,376,357 Total deposits 7,107,356 7,105,415 7,100,164 6,874,239 6,672,260 7,107,356 6,672,260 Total stockholders' equity 1,153,356 1,127,513 1,095,402 1,068,295 1,041,366 1,153,356 1,041,366 Loan to deposit ratio 93.9 % 94.0 % 91.6 % 94.3 % 95.6 % 93.9 % 95.6 % Period end common shares outstanding 27,887,337 27,854,764 27,834,525 27,753,918 27,709,679 27,887,337 27,709,679 Book value per share $ 41.36 $ 40.48 $ 39.35 $ 38.49 $ 37.58 $ 41.36 $ 37.58 Tangible book value per share1 $ 37.83 $ 36.92 $ 35.77 $ 34.88 $ 33.94 $ 37.83 $ 33.94 1 Represents a non-GAAP financial measure. See Appendix for Non-GAAP Reconciliation. 2 Total revenue is net interest income plus noninterest income.

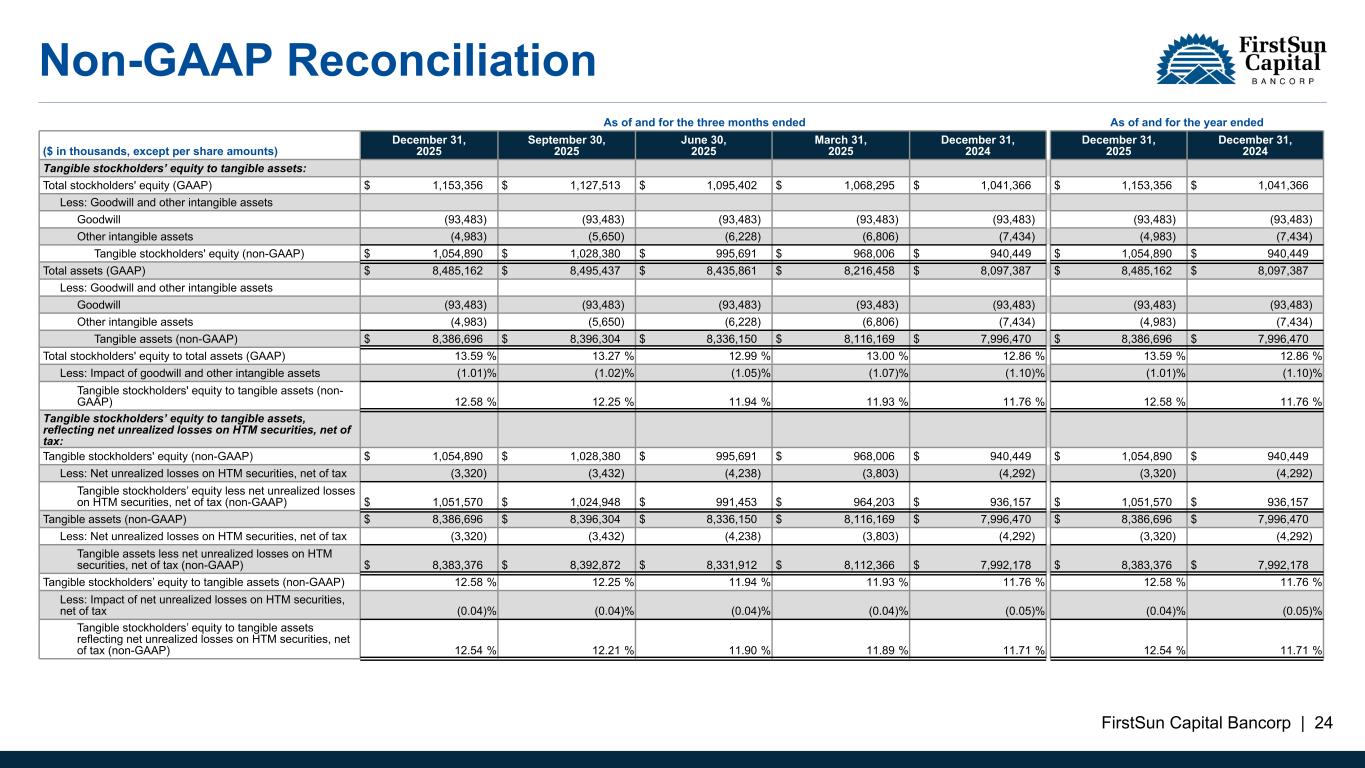

FirstSun Capital Bancorp | 24 Non-GAAP Reconciliation As of and for the three months ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Tangible stockholders’ equity to tangible assets: Total stockholders' equity (GAAP) $ 1,153,356 $ 1,127,513 $ 1,095,402 $ 1,068,295 $ 1,041,366 $ 1,153,356 $ 1,041,366 Less: Goodwill and other intangible assets Goodwill (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) Other intangible assets (4,983) (5,650) (6,228) (6,806) (7,434) (4,983) (7,434) Tangible stockholders' equity (non-GAAP) $ 1,054,890 $ 1,028,380 $ 995,691 $ 968,006 $ 940,449 $ 1,054,890 $ 940,449 Total assets (GAAP) $ 8,485,162 $ 8,495,437 $ 8,435,861 $ 8,216,458 $ 8,097,387 $ 8,485,162 $ 8,097,387 Less: Goodwill and other intangible assets Goodwill (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) (93,483) Other intangible assets (4,983) (5,650) (6,228) (6,806) (7,434) (4,983) (7,434) Tangible assets (non-GAAP) $ 8,386,696 $ 8,396,304 $ 8,336,150 $ 8,116,169 $ 7,996,470 $ 8,386,696 $ 7,996,470 Total stockholders' equity to total assets (GAAP) 13.59 % 13.27 % 12.99 % 13.00 % 12.86 % 13.59 % 12.86 % Less: Impact of goodwill and other intangible assets (1.01) % (1.02) % (1.05) % (1.07) % (1.10) % (1.01) % (1.10) % Tangible stockholders' equity to tangible assets (non- GAAP) 12.58 % 12.25 % 11.94 % 11.93 % 11.76 % 12.58 % 11.76 % Tangible stockholders’ equity to tangible assets, reflecting net unrealized losses on HTM securities, net of tax: Tangible stockholders' equity (non-GAAP) $ 1,054,890 $ 1,028,380 $ 995,691 $ 968,006 $ 940,449 $ 1,054,890 $ 940,449 Less: Net unrealized losses on HTM securities, net of tax (3,320) (3,432) (4,238) (3,803) (4,292) (3,320) (4,292) Tangible stockholders’ equity less net unrealized losses on HTM securities, net of tax (non-GAAP) $ 1,051,570 $ 1,024,948 $ 991,453 $ 964,203 $ 936,157 $ 1,051,570 $ 936,157 Tangible assets (non-GAAP) $ 8,386,696 $ 8,396,304 $ 8,336,150 $ 8,116,169 $ 7,996,470 $ 8,386,696 $ 7,996,470 Less: Net unrealized losses on HTM securities, net of tax (3,320) (3,432) (4,238) (3,803) (4,292) (3,320) (4,292) Tangible assets less net unrealized losses on HTM securities, net of tax (non-GAAP) $ 8,383,376 $ 8,392,872 $ 8,331,912 $ 8,112,366 $ 7,992,178 $ 8,383,376 $ 7,992,178 Tangible stockholders’ equity to tangible assets (non-GAAP) 12.58 % 12.25 % 11.94 % 11.93 % 11.76 % 12.58 % 11.76 % Less: Impact of net unrealized losses on HTM securities, net of tax (0.04) % (0.04) % (0.04) % (0.04) % (0.05) % (0.04) % (0.05) % Tangible stockholders’ equity to tangible assets reflecting net unrealized losses on HTM securities, net of tax (non-GAAP) 12.54 % 12.21 % 11.90 % 11.89 % 11.71 % 12.54 % 11.71 %

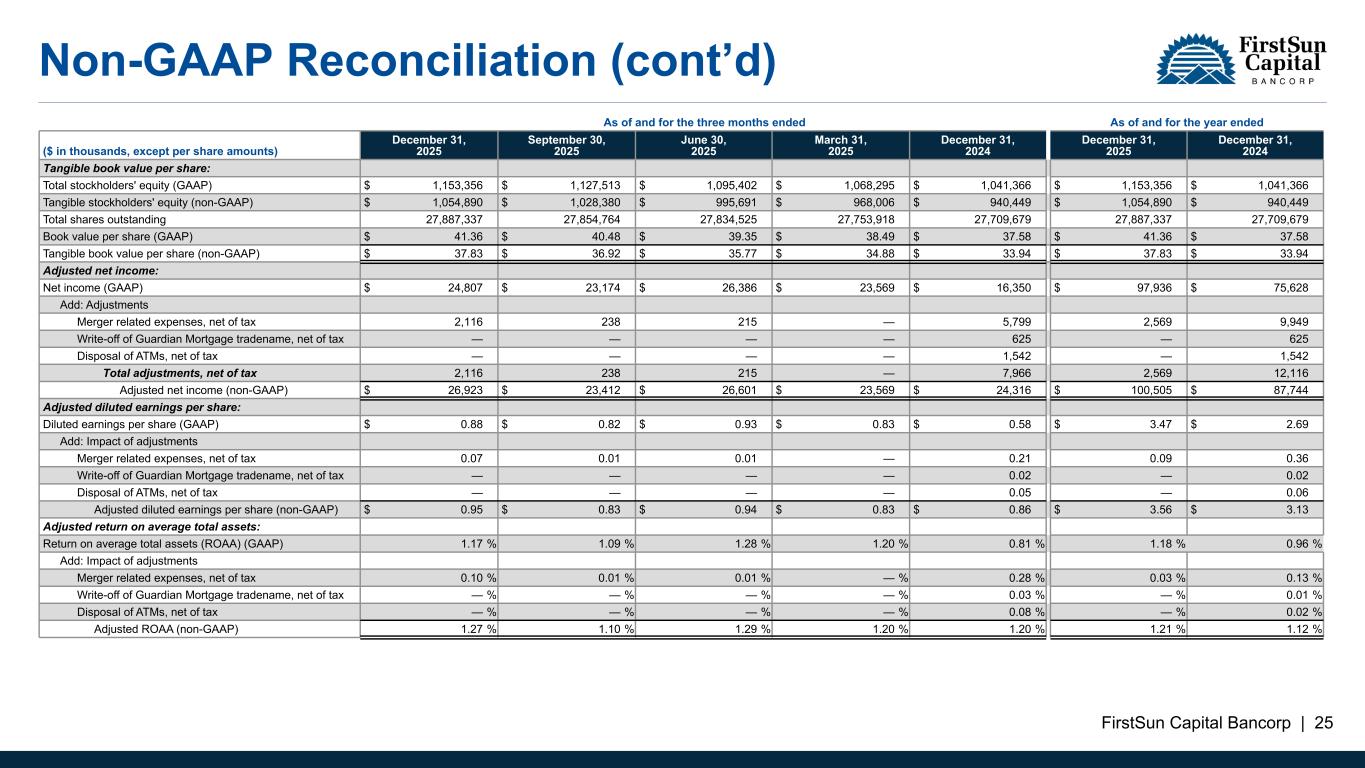

FirstSun Capital Bancorp | 25 Non-GAAP Reconciliation (cont’d) As of and for the three months ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Tangible book value per share: Total stockholders' equity (GAAP) $ 1,153,356 $ 1,127,513 $ 1,095,402 $ 1,068,295 $ 1,041,366 $ 1,153,356 $ 1,041,366 Tangible stockholders' equity (non-GAAP) $ 1,054,890 $ 1,028,380 $ 995,691 $ 968,006 $ 940,449 $ 1,054,890 $ 940,449 Total shares outstanding 27,887,337 27,854,764 27,834,525 27,753,918 27,709,679 27,887,337 27,709,679 Book value per share (GAAP) $ 41.36 $ 40.48 $ 39.35 $ 38.49 $ 37.58 $ 41.36 $ 37.58 Tangible book value per share (non-GAAP) $ 37.83 $ 36.92 $ 35.77 $ 34.88 $ 33.94 $ 37.83 $ 33.94 Adjusted net income: Net income (GAAP) $ 24,807 $ 23,174 $ 26,386 $ 23,569 $ 16,350 $ 97,936 $ 75,628 Add: Adjustments Merger related expenses, net of tax 2,116 238 215 — 5,799 2,569 9,949 Write-off of Guardian Mortgage tradename, net of tax — — — — 625 — 625 Disposal of ATMs, net of tax — — — — 1,542 — 1,542 Total adjustments, net of tax 2,116 238 215 — 7,966 2,569 12,116 Adjusted net income (non-GAAP) $ 26,923 $ 23,412 $ 26,601 $ 23,569 $ 24,316 $ 100,505 $ 87,744 Adjusted diluted earnings per share: Diluted earnings per share (GAAP) $ 0.88 $ 0.82 $ 0.93 $ 0.83 $ 0.58 $ 3.47 $ 2.69 Add: Impact of adjustments Merger related expenses, net of tax 0.07 0.01 0.01 — 0.21 0.09 0.36 Write-off of Guardian Mortgage tradename, net of tax — — — — 0.02 — 0.02 Disposal of ATMs, net of tax — — — — 0.05 — 0.06 Adjusted diluted earnings per share (non-GAAP) $ 0.95 $ 0.83 $ 0.94 $ 0.83 $ 0.86 $ 3.56 $ 3.13 Adjusted return on average total assets: Return on average total assets (ROAA) (GAAP) 1.17 % 1.09 % 1.28 % 1.20 % 0.81 % 1.18 % 0.96 % Add: Impact of adjustments Merger related expenses, net of tax 0.10 % 0.01 % 0.01 % — % 0.28 % 0.03 % 0.13 % Write-off of Guardian Mortgage tradename, net of tax — % — % — % — % 0.03 % — % 0.01 % Disposal of ATMs, net of tax — % — % — % — % 0.08 % — % 0.02 % Adjusted ROAA (non-GAAP) 1.27 % 1.10 % 1.29 % 1.20 % 1.20 % 1.21 % 1.12 %

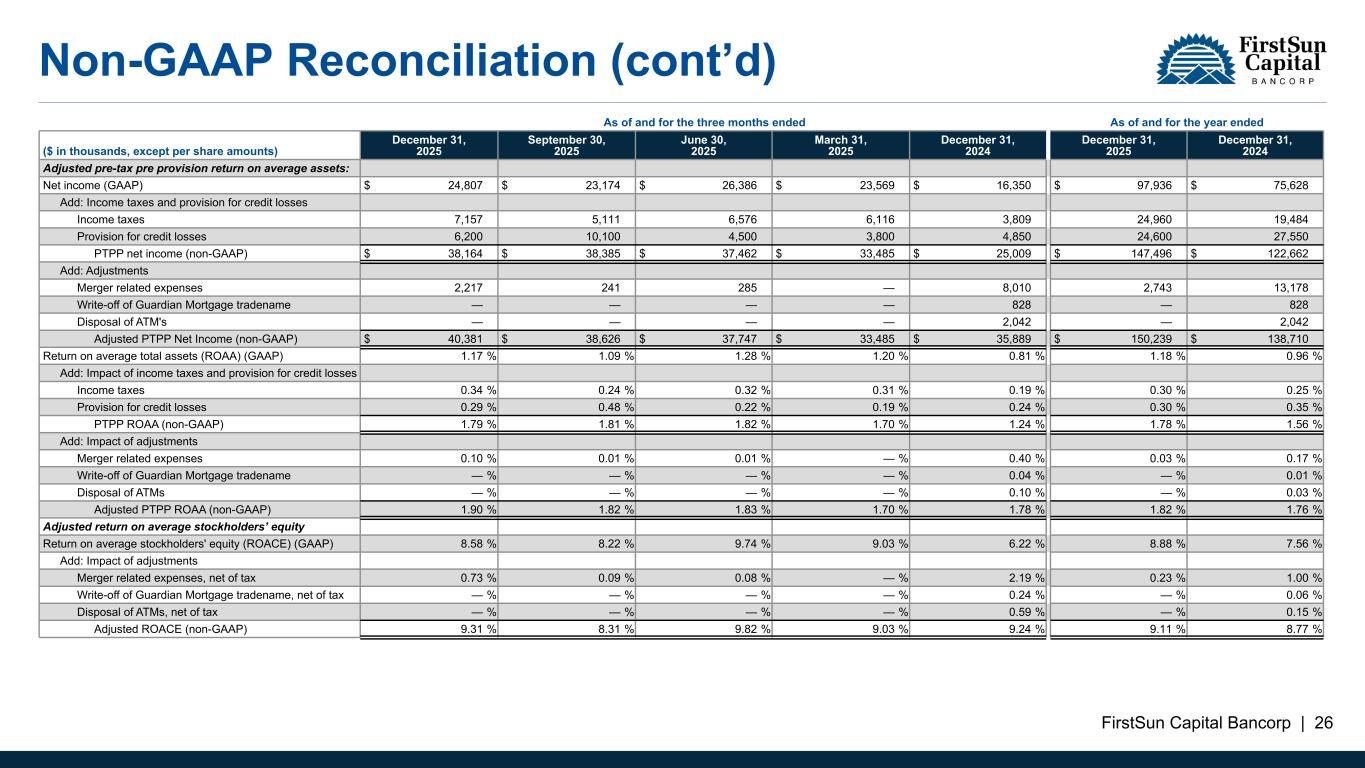

FirstSun Capital Bancorp | 26 Non-GAAP Reconciliation (cont’d) As of and for the three months ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Adjusted pre-tax pre provision return on average assets: Net income (GAAP) $ 24,807 $ 23,174 $ 26,386 $ 23,569 $ 16,350 $ 97,936 $ 75,628 Add: Income taxes and provision for credit losses Income taxes 7,157 5,111 6,576 6,116 3,809 24,960 19,484 Provision for credit losses 6,200 10,100 4,500 3,800 4,850 24,600 27,550 PTPP net income (non-GAAP) $ 38,164 $ 38,385 $ 37,462 $ 33,485 $ 25,009 $ 147,496 $ 122,662 Add: Adjustments Merger related expenses 2,217 241 285 — 8,010 2,743 13,178 Write-off of Guardian Mortgage tradename — — — — 828 — 828 Disposal of ATM's — — — — 2,042 — 2,042 Adjusted PTPP Net Income (non-GAAP) $ 40,381 $ 38,626 $ 37,747 $ 33,485 $ 35,889 $ 150,239 $ 138,710 Return on average total assets (ROAA) (GAAP) 1.17 % 1.09 % 1.28 % 1.20 % 0.81 % 1.18 % 0.96 % Add: Impact of income taxes and provision for credit losses Income taxes 0.34 % 0.24 % 0.32 % 0.31 % 0.19 % 0.30 % 0.25 % Provision for credit losses 0.29 % 0.48 % 0.22 % 0.19 % 0.24 % 0.30 % 0.35 % PTPP ROAA (non-GAAP) 1.79 % 1.81 % 1.82 % 1.70 % 1.24 % 1.78 % 1.56 % Add: Impact of adjustments Merger related expenses 0.10 % 0.01 % 0.01 % — % 0.40 % 0.03 % 0.17 % Write-off of Guardian Mortgage tradename — % — % — % — % 0.04 % — % 0.01 % Disposal of ATMs — % — % — % — % 0.10 % — % 0.03 % Adjusted PTPP ROAA (non-GAAP) 1.90 % 1.82 % 1.83 % 1.70 % 1.78 % 1.82 % 1.76 % Adjusted return on average stockholders’ equity Return on average stockholders' equity (ROACE) (GAAP) 8.58 % 8.22 % 9.74 % 9.03 % 6.22 % 8.88 % 7.56 % Add: Impact of adjustments Merger related expenses, net of tax 0.73 % 0.09 % 0.08 % — % 2.19 % 0.23 % 1.00 % Write-off of Guardian Mortgage tradename, net of tax — % — % — % — % 0.24 % — % 0.06 % Disposal of ATMs, net of tax — % — % — % — % 0.59 % — % 0.15 % Adjusted ROACE (non-GAAP) 9.31 % 8.31 % 9.82 % 9.03 % 9.24 % 9.11 % 8.77 %

FirstSun Capital Bancorp | 27 Non-GAAP Reconciliation (cont’d) As of and for the three months ended As of and for the year ended ($ in thousands, except per share amounts) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Return on average tangible stockholders’ equity: Return on average stockholders’ equity (ROACE) (GAAP) 8.58 % 8.22 % 9.74 % 9.03 % 6.22 % 8.88 % 7.56 % Add: Impact from goodwill and other intangible assets Goodwill 0.81 % 0.81 % 0.98 % 0.94 % 0.67 % 0.88 % 0.87 % Other intangible assets 0.19 % 0.17 % 0.19 % 0.21 % 0.47 % 0.19 % 0.31 % Return on average tangible stockholders’ equity (ROATCE) (non-GAAP) 9.58 % 9.20 % 10.91 % 10.18 % 7.36 % 9.95 % 8.74 % Adjusted return on average tangible stockholders’ equity: Return on average tangible stockholders' equity (ROATCE) (non-GAAP) 9.58 % 9.20 % 10.91 % 10.18 % 7.36 % 9.95 % 8.74 % Add: Impact of adjustments Merger related expenses, net of tax 0.80 % 0.10 % 0.09 % — % 2.45 % 0.26 % 1.11 % Write-off of Guardian Mortgage tradename, net of tax — % — % — % — % 0.26 % — % 0.07 % Disposal of ATMs, net of tax — % — % — % — % 0.65 % — % 0.17 % Adjusted ROATCE (non-GAAP) 10.38 % 9.30 % 11.00 % 10.18 % 10.72 % 10.21 % 10.09 % Adjusted total noninterest expense: Total noninterest expense (GAAP) $ 72,041 $ 68,901 $ 68,110 $ 62,722 $ 73,673 $ 271,774 $ 264,040 Less: Adjustments: Merger related expenses (2,217) (241) (285) — (8,010) (2,743) (13,178) Write-off of Guardian Mortgage tradename — — — — (828) — (828) Disposal of ATMs — — — — (2,042) — (2,042) Total adjustments (2,217) (241) (285) — (10,880) (2,743) (16,048) Adjusted total noninterest expense (non-GAAP) $ 69,824 $ 68,660 $ 67,825 $ 62,722 $ 62,793 $ 269,031 $ 247,992 Adjusted efficiency ratio: Efficiency ratio (GAAP) 65.37 % 64.22 % 64.52 % 65.19 % 74.66 % 64.82 % 68.28 % Less: Impact of adjustments Merger related expenses (2.01) % (0.22) % (0.27) % — % (8.12) % (0.65) % (3.41) % Write-off of Guardian Mortgage tradename — % — % — % — % (0.84) % — % (0.21) % Disposal of ATMs — % — % — % — % (2.07) % — % (0.53) % Adjusted efficiency ratio (non-GAAP) 63.36 % 64.00 % 64.25 % 65.19 % 63.63 % 64.17 % 64.13 %

FirstSun Capital Bancorp | 28 Non-GAAP Reconciliation (cont’d) As of and for the years ended ($ in thousands) December 31, 2025 December 31, 2024 December 31, 2023 December 31, 2022 December 31, 2021 Credit adjusted net interest margin: Net interest income (GAAP) $ 317,391 $ 296,910 $ 293,431 $ 241,632 $ 155,233 Less: Net charge-off’s (28,255) (20,377) (7,810) 320 (3,219) Credit adjusted net interest income (non-GAAP) $ 289,136 $ 276,533 $ 285,621 $ 241,952 $ 152,014 Average earning assets $ 7,740,524 $ 7,320,696 $ 6,935,402 $ 6,246,646 $ 5,180,668 Net interest margin (GAAP) 4.10 % 4.06 % 4.23 % 3.87 % 3.00 % Impact from net charge-offs to average earning assets (0.36) % (0.28) % (0.11) % — % (0.07) % Credit adjusted net interest margin (non-GAAP) 3.74 % 3.78 % 4.12 % 3.87 % 2.93 % Net interest margin (GAAP) 1 year average (2025) 4.10 % 3 year average (2023-2025) 4.13 % 5 year average (2021-2025) 3.84 % Credit adjusted net interest margin (non-GAAP) 1 year average (2025) 3.74 % 3 year average (2023-2025) 3.88 % 5 year average (2021-2025) 3.68 %