UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. | |||||

☐ | Fee paid previously with preliminary materials. | |||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||

National Vision Holdings, Inc.

2025 Proxy Statement and

Notice of Annual Meeting of Stockholders

Wednesday, June 18, 2025

1:00 p.m. Eastern Time

LETTER TO STOCKHOLDERS | ||

Dear Fellow Stockholders:

Year in Review

2024 was a pivotal year for National Vision as we undertook aggressive actions to accelerate our transformation, including bringing in new leaders and implementing strategic initiatives that delivered a strong finish to the year. We ended the year with our eighth consecutive quarter of positive adjusted comparable store sales as enhanced selling methods and targeted pricing actions supported increases in average ticket and customer engagement. Over the past two years, we have made great strides in improving our operational foundation.

• | We enhanced exam capacity through more flexible schedules that improved both recruitment and retention. |

• | We developed and expanded remote optometry, whereby Optometrists from home perform exams on patients in our stores (now enabled in 730+ locations). |

• | We launched a Hybrid Remote pilot to optimize doctor availability. |

• | We invested in new technology, including a new Finance ERP and an Adobe CRM platform set to launch in 2025. |

• | We completed a store fleet review to drive profitability and long-term growth. |

We are excited about the opportunities ahead and we are confident in our path forward. As we move into 2025, we are focused on executing and delivering on our transformation strategy, which we believe will position us to expand our customer base, enhance profitability, and create long-term value for shareholders.

CEO Succession Plan

We are excited to share our recent news that our Board of Directors has approved a succession plan, under which, effective August 1, 2025, Alex Wilkes will succeed Reade Fahs as the Company’s next Chief Executive Officer and will be appointed to the Company’s Board of Directors. In addition, Reade Fahs will assume the role of Executive Chairman, with Randy Peeler assuming the role of Lead Independent Director.

Mr. Wilkes was appointed President of National Vision in August 2024, and the fresh approaches and strong execution that he and the new leadership team have brought in this time demonstrate the value they will bring for years to come. As Executive Chairman, Reade will work closely with Alex to ensure a smooth and orderly transition and will remain active in the Company and with the executive management team.

This announcement represents the culmination of the Board’s long-term leadership succession strategy, and we have the utmost confidence that Mr. Wilkes’ proven track record, strategic mindset and passion for our mission make him the ideal leader for this next phase of growth.

Our 2025 Annual Meeting

We are pleased to invite you to attend the National Vision Holdings, Inc. 2025 Annual Meeting of Stockholders on Wednesday, June 18, 2025, at 1:00 p.m. Eastern Time. Detailed information concerning the Annual Meeting is set forth in this proxy statement.

Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting, your vote is important to us, and it is important that your shares be represented and voted during the meeting. We encourage you to review the proxy materials and submit your vote today.

2025 Proxy Statement |  | i | ||

LETTER TO STOCKHOLDERS | ||

On behalf of the Board of Directors and everyone at National Vision, we are grateful for your continued support. Thank you for being a stockholder of National Vision Holdings, Inc.

Sincerely,

|  | ||

D. Randolph Peeler Chairman of the Board of Directors | L. Reade Fahs Chief Executive Officer | ||

April 29, 2025

ii |  | 2025 Proxy Statement | ||

Notice of Annual Meeting of Stockholders

Date & Time | Wednesday, June 18, 2025, at 1:00 p.m. Eastern Time | ||||||

Place | The Westin Atlanta Gwinnett 6450 Sugarloaf Parkway Duluth, Georgia 30097 | ||||||

Items of Business | 1. | Election of the ten director nominees listed in this proxy statement. | |||||

2. | Advisory vote to approve the compensation of our named executive officers (“Say-on-Pay”). | ||||||

3. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025. | ||||||

4. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. | ||||||

Record Date | Stockholders of record of our common stock at the close of business on April 14, 2025, may vote at the Annual Meeting. | ||||||

How to Vote | You may vote your shares prior to June 18, 2025, on the Internet, by telephone or by completing, signing and promptly returning a proxy card, or you may vote in person at the Annual Meeting. | ||||||

By Order of the Board of Directors, | |||

| |||

Jared Brandman | |||

Chief Legal & Strategy Officer, Corporate Secretary | |||

April 29, 2025 | |||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on Wednesday, June 18, 2025: This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 28, 2024, are available free of charge at www.proxyvote.com. We made this proxy statement available to stockholders beginning on April 29, 2025. | ||

2025 Proxy Statement |  | iii | ||

PROXY STATEMENT SUMMARY | ||

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors,” or the “Board”) of National Vision Holdings, Inc. (the “Company” or “National Vision”) for the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) and for any adjournment or postponement of the Annual Meeting. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider and you should read the entire proxy statement carefully before voting.

Date & Time | Location | Record Date | ||||||

June 18, 2025 1:00 p.m. Eastern Time | The Westin Atlanta Gwinnett 6450 Sugarloaf Parkway Duluth, Georgia 30097 | April 14, 2025 | ||||||

Company Proposals | Board Vote Recommendation | For Further Details | |||||||||

Proposal 1: | Election of the ten director nominees listed in this proxy statement. | FOR all nominees | Page 8 | ||||||||

Proposal 2: | Advisory vote to approve the compensation of our named executive officers (“Say-on-Pay”). | FOR | Page 30 | ||||||||

Proposal 3: | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025. | FOR | Page 63 | ||||||||

By Internet | By Telephone | By Mail | In Person | ||||||||

Visit www.proxyvote.com | Dial 1-800-690-6903 | Sign, date and return your proxy card by mail | Attend our Annual Meeting and cast your vote during the meeting | ||||||||

Stockholders of record at the close of business on April 14, 2025, may vote at the Annual Meeting.

See full instructions under the heading “Important Information About Voting at the Annual Meeting.”

If you are a stockholder of record and you would like to vote in any manner other than in person during the Annual Meeting, your vote must be received by 11:59 p.m. Eastern Time, on June 17, 2025, to be counted. If you hold shares through a broker, bank or other nominee, please refer to information from your bank, broker or nominee for voting instructions.

2025 Proxy Statement |  | 1 | ||

PROXY STATEMENT SUMMARY | ||

2024 was an important year for National Vision, as we took numerous and decisive actions to transform the business and bring meaningful change throughout the organization. We added new members to our leadership team, who bring deep optical and retail expertise and new approaches that will help accelerate our transformation efforts, particularly across managed care, pricing and our field leadership organization, and implemented transformation initiatives intended to accelerate long-term growth and strengthen profitability, including continued expansion of exam capacity, new traffic-driving initiatives, and a review of our store fleet. Additionally, we continued to make progress against our growth initiatives, including the expansion of our remote medicine capabilities, focusing on the recruiting and retention of optometrists, increasing our marketing efficiency and omnichannel capabilities, increasing our participation in vision insurance programs; and the further digitization of our stores and corporate office.

In 2025, we will continue to strengthen our business as we progress our transformation and work to accelerate long-term growth. We will be focused on expanding our target demographic, implementing a new pricing architecture, enhancing the customer and patient experience, and optimizing our cost structure. These initiatives are designed to strengthen our core business, improve our results of operations and drive long-term shareholder value.

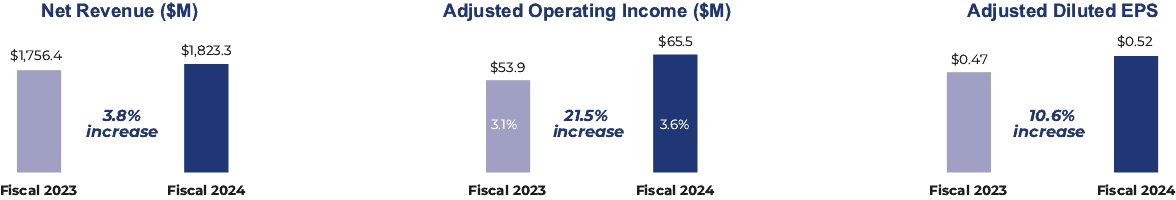

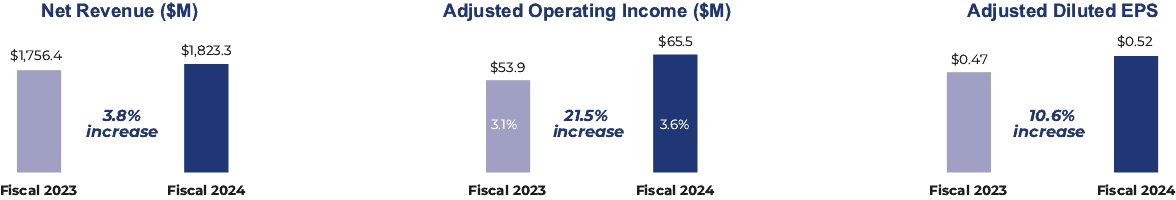

2024 Financial Highlights | ||

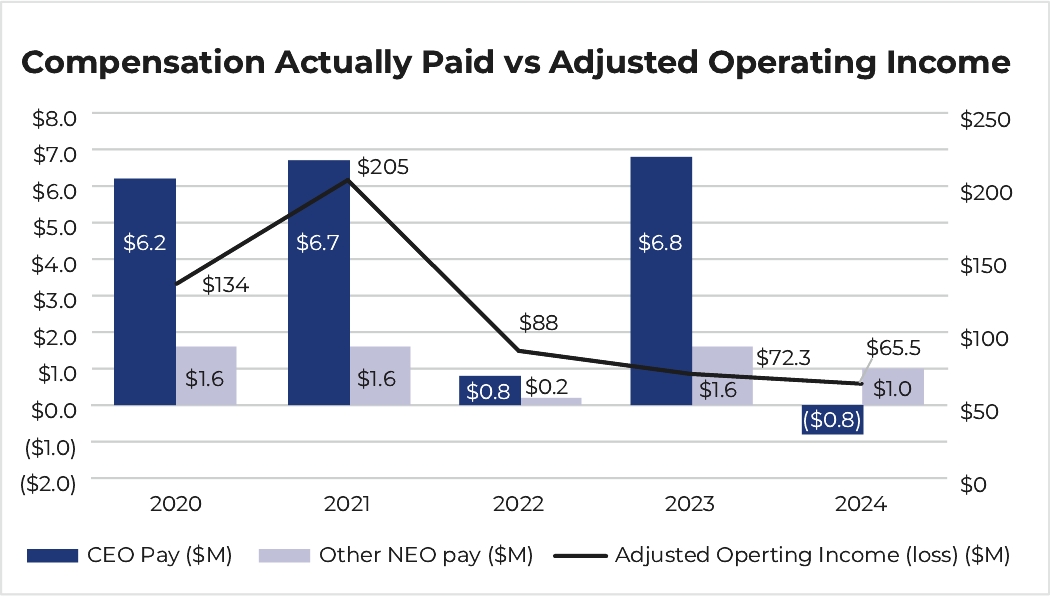

• Overall store count grew 4.4% to 1,240 stores • Comparable store sales growth was 1.9%, and Adjusted Comparable Store Sales Growth was 1.3% • Net revenue increased 3.8% over 2023 to $1,823.3 million • Net income (loss) from continuing operations of $(27.2) million and Diluted EPS from continuing operations of $(0.35) • Adjusted Operating Income from continuing operations increased 21.5% to $65.5 million compared with $53.9 million in fiscal year 2023 • Adjusted Diluted EPS from continuing operations of $0.52 compared with $0.47 in fiscal year 2023 | ||

| ||

In this proxy statement, we discuss financial measures that are referred to as non-GAAP financial measures, including adjusted comparable store sales growth, adjusted operating income, adjusted diluted EPS and annual incentive adjusted operating income. See Appendix A to this proxy statement for more information regarding these measures and reconciliations to the most directly comparable GAAP measures.

During fiscal 2024, the Company ceased its Walmart and AC Lens operations and, accordingly, financial results reflect the results of our former Legacy segment and the substantial majority of AC Lens operations as discontinued operations for all periods presented. Unless otherwise noted, amounts and disclosures in this proxy statement relate to the Company’s continuing operations.

These financial highlights are reproduced from our Annual Report on Form 10-K for the fiscal year ended December 28, 2024 (the “Annual Report on Form 10-K”), and speak as of February 26, 2025, the date we filed our Form 10-K with the SEC, unless clearly indicated otherwise.

2 |  | 2025 Proxy Statement | ||

PROXY STATEMENT SUMMARY | ||

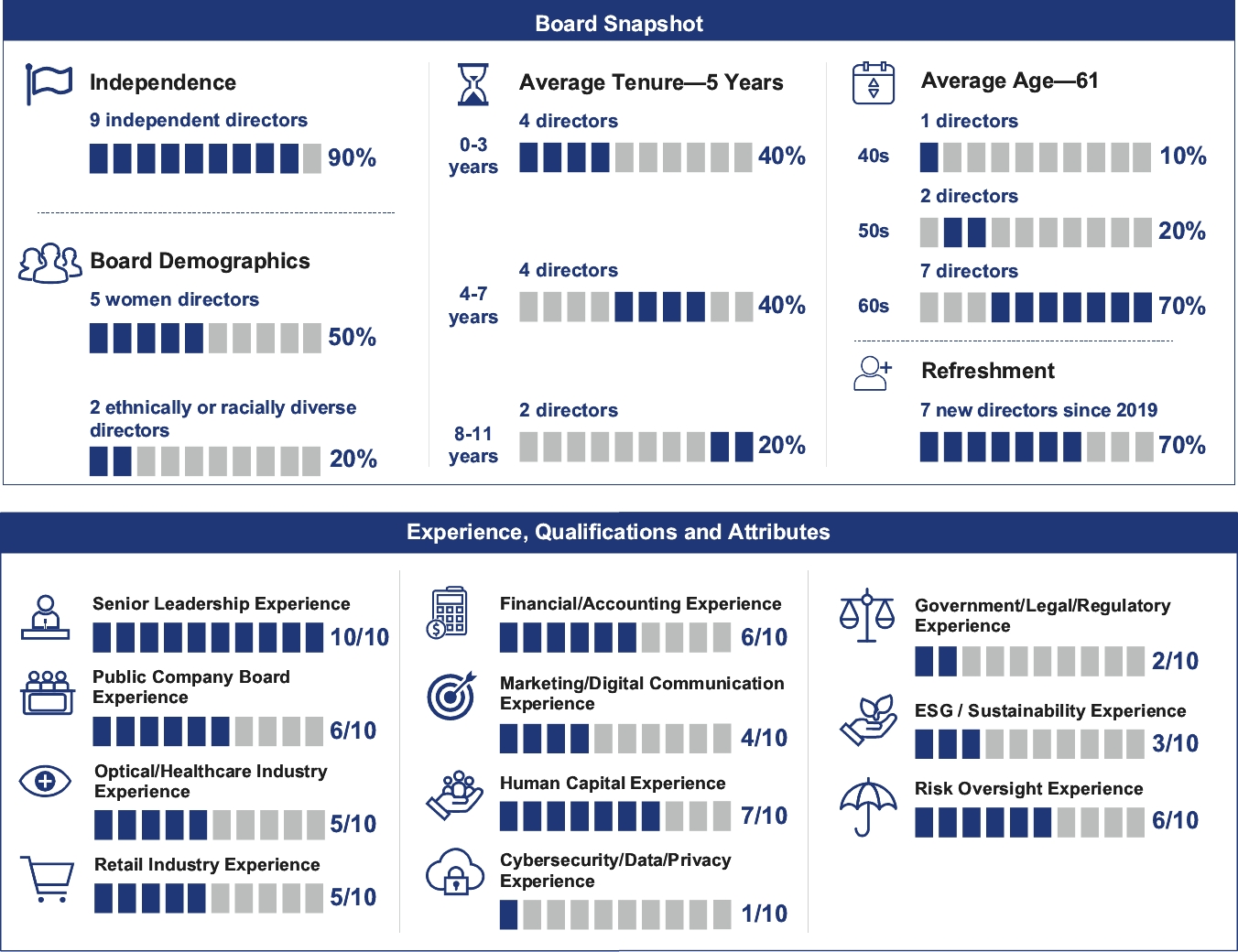

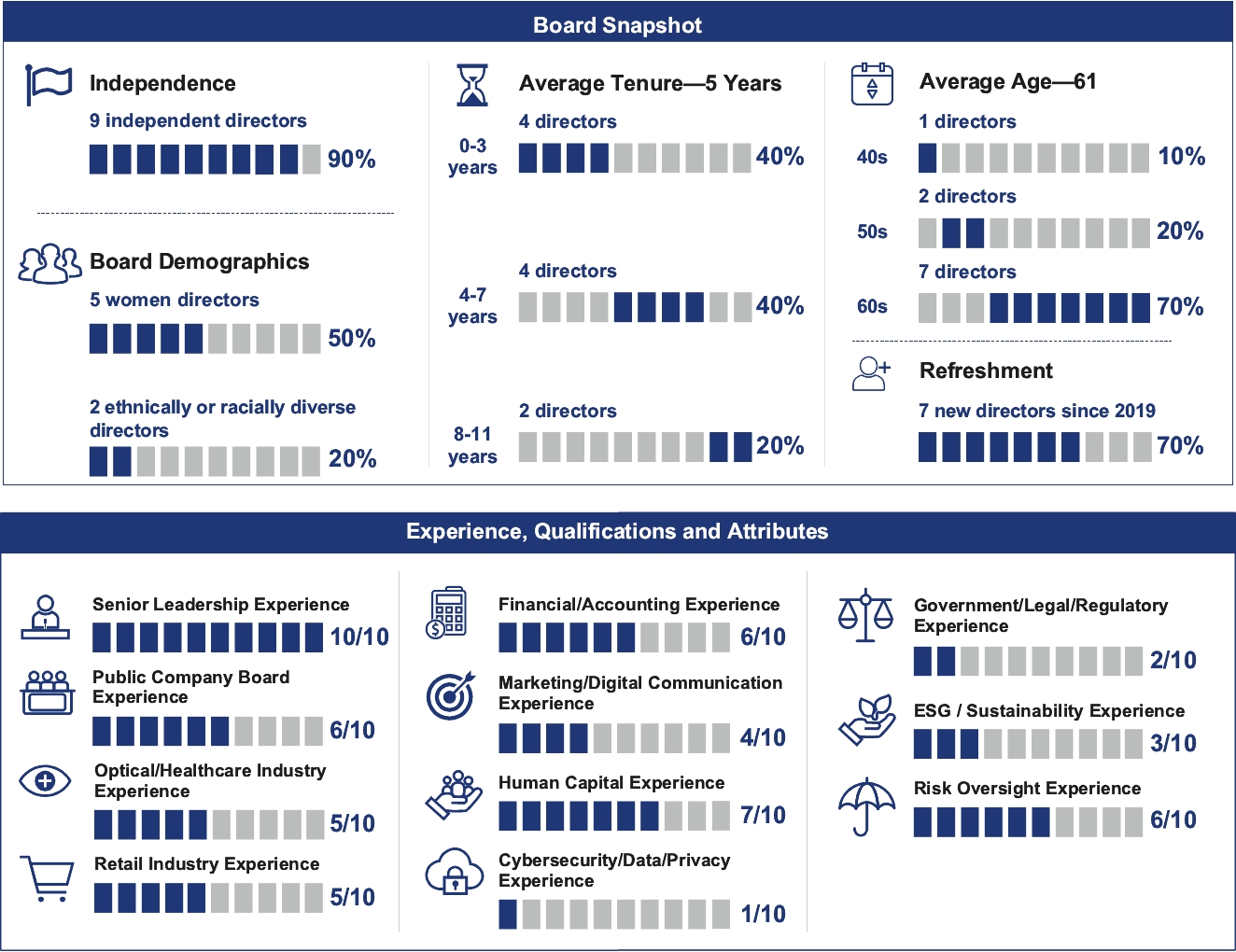

The fundamental duty of the Board is to oversee our strategy and the long-term interests of our stockholders. The following provides summary information about our current directors, individually, and our nominees for director in the aggregate. The table below sets forth the composition of the Board and its committees as of the date of this proxy statement. See “Proposal 1—Election of Directors” for more details on our director nominees’ qualifications, skills and experience.

Committee Membership | |||||||||||||||||||||||

Directors | Occupation | Age | Director Since | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||||||||||||||

L. Reade Fahs | Chief Executive Officer, National Vision Holdings, Inc. | 64 | 2014 | ||||||||||||||||||||

D. Randolph Peeler  | Managing Director, Berkshire Partners, LLC | 60 | 2014 |  |  | ||||||||||||||||||

Jose Armario | Chief Executive Officer, Bojangles’, Inc. | 66 | 2021 |  |  | ||||||||||||||||||

Virginia A. Hepner | Retired Chief Executive Officer, The Woodruff Arts Center | 67 | 2018 |  |  | ||||||||||||||||||

Susan S. Johnson | Retired Chief Marketing Officer, Prudential Financial, Inc. | 59 | 2020 |  |  | ||||||||||||||||||

Naomi Kelman | Retired President & Chief Executive Officer, Willow | 66 | 2020 |  |  |  | |||||||||||||||||

James M. McGrann | Chief Executive Officer, Advancing Eyecare | 63 | 2025 |  |  | ||||||||||||||||||

Michael J. Nicholson | President and Chief Operating Officer, J.Crew Group | 58 | 2025 |  |  |  | |||||||||||||||||

Susan O’Farrell | Retired Chief Financial Officer, Bluelinx Holdings, Inc. | 61 | 2024 |  |  | ||||||||||||||||||

Thomas V. Taylor, Jr. | Chief Executive Officer, Floor & Decor Holdings, Inc. | 59 | 2018 |  |  | ||||||||||||||||||

Caitlin Zulla | Chief Executive Officer, US Radiology Specialists | 47 | 2024 |  |  | ||||||||||||||||||

| Chair | ||

2025 Proxy Statement |  | 3 | ||

PROXY STATEMENT SUMMARY | ||

We maintain robust governance and Board practices that promote independence, accountability and effectiveness in the boardroom.

Key Governance Developments

Board Refreshment | In the last year, we added three new independent directors, while another longer-tenured director transitioned off the Board. | |||

Committee Composition | We refreshed our committee composition and chairs. | |||

Declassified Board | We have completed the phase out of the classified structure of the Board and all directors stand for election annually. | |||

Corporate Governance and Board Practices | |||||

All directors are elected annually  Majority voting in uncontested director elections  Recently updated bylaws to enhance corporate governance practices  Independent Chair of the Board  Nine of ten director nominees are independent  All committee members are independent  Seven new independent directors over the last five years  Nine experienced current and former CEOs/CFOs  Of our ten director nominees, five are female and two are racially or ethnically diverse  No restrictions on directors’ access to management |  Regular review of committee charters and Corporate Governance Guidelines incorporating evolving best practices  Strong, proactive stockholder engagement program  Annual Board and committee self-assessments  Regular Board executive sessions without management  Formal Board and committee oversight of our business strategy, enterprise risk management, cybersecurity, compensation strategy, and sustainability program and strategy  Robust director and executive stock ownership guidelines | ||||

2025 Proxy Statement |  | 5 | ||

PROXY STATEMENT SUMMARY | ||

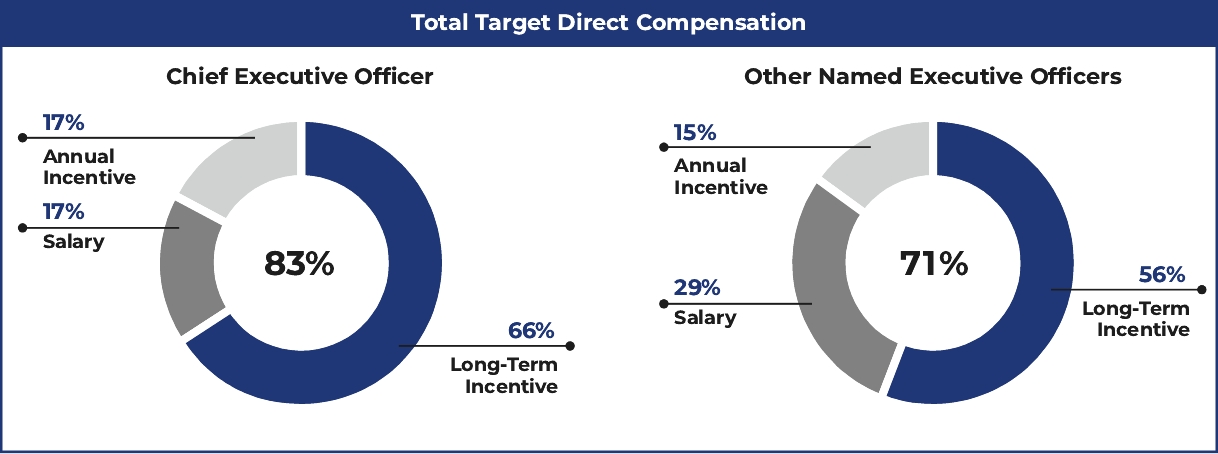

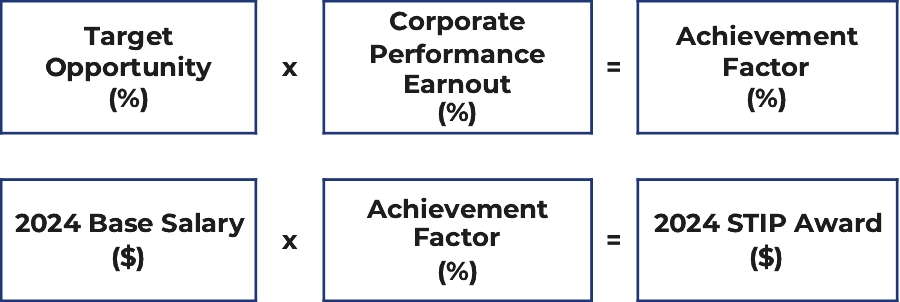

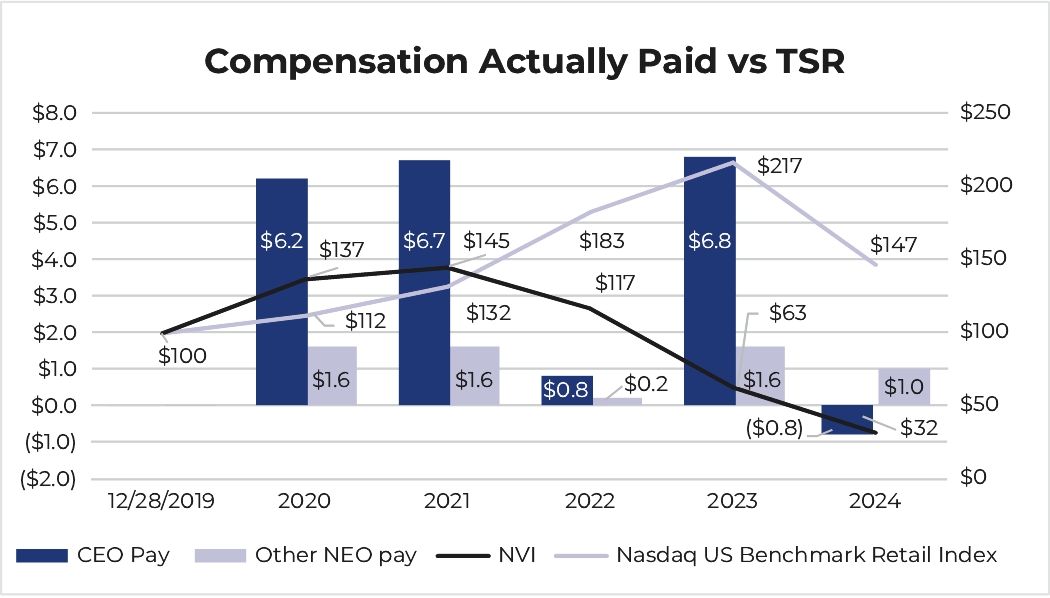

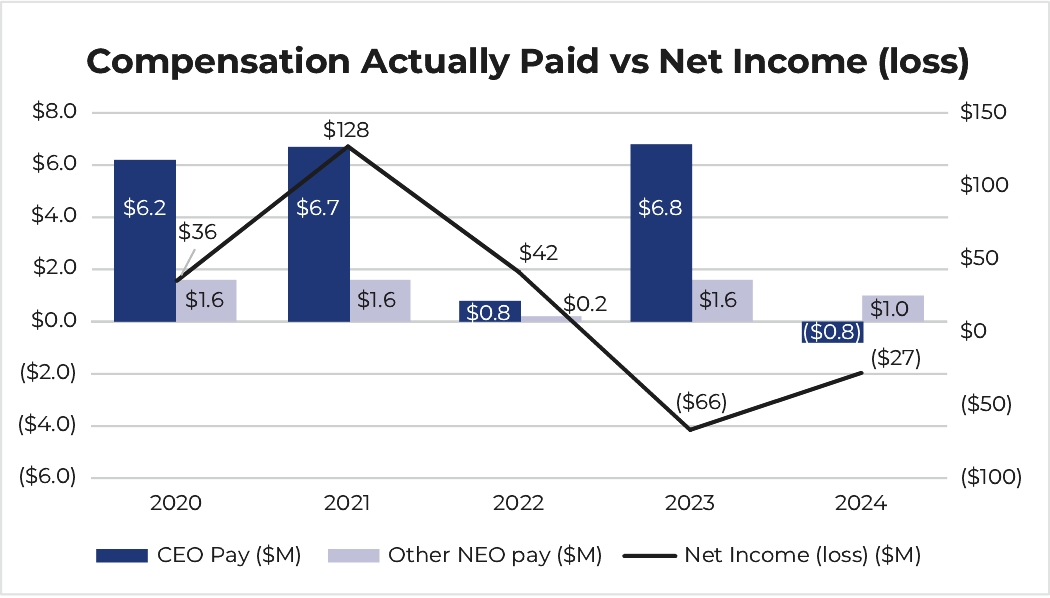

We strive to create an executive compensation program that strikes the right balance of pay for performance with an overarching goal to motivate our leaders to contribute to the achievement of our financial goals and focus on long-term value for our stockholders. Our executive compensation program has three main components: (1) base salary; (2) annual cash incentive compensation; and (3) long-term incentive awards. Each component is designed to be consistent with our compensation philosophy.

The compensation and governance practices that support these principles include the following:

What We Do: | What We Don’t Do: | ||||

Pay for performance, with high percentages of performance-based and long-term equity compensation  Grant performance stock units that vest based on achievement of performance goals over a three-year performance period and, beginning in 2025, include a relative shareholder return component  Award annual cash incentives based on performance against predefined performance metrics  Maintain robust stock ownership guidelines for our NEOs and directors • Chief Executive Officer—6x annual base salary • Other NEOs—3x annual base salary • Directors—5x annual cash retainer  Review our compensation programs and strategy annually with robust Board and committee oversight  Hold an annual Say-on-Pay vote supported by a strong stockholder engagement strategy  Require “Double-Trigger” vesting for change in control provisions  Maintain an incentive compensation recovery (“clawback”) policy  Retain an independent compensation consultant | ✗ No excise tax gross-ups ✗ No hedging of the Company’s stock by NEOs or directors ✗ No supplemental executive retirement plans ✗ No option repricing without stockholder approval ✗ No significant perquisites for executive officers | ||||

2025 Executive Compensation Updates

In February 2025, the compensation committee approved the design of our executive compensation program for 2025, which included the following changes.

• | Additional performance metric added to the annual cash incentive program. Beginning in 2025, our annual cash incentive program will include Adjusted Comparable Same Store Sales Growth as a second corporate performance metric, in addition to Annual Incentive Adjusted Operating Income. Adjusted Comparable Store Sales Growth is a key metric used by both management and shareholders to assess the operational health and overall performance of each brand and the Company as a whole. |

• | Enhanced PSU design, including relative total shareholder return component. To further align the interests of our shareholders with the interests of our executive officers and to further promote long-term value creation for shareholders, 25% of the PSUs granted in 2025 will vest based on attainment of relative total shareholder return. The remaining PSUs will vest based on achievement of financial performance goals related to growth in annual Adjusted Operating Income (50%) and Return on Invested Capital (25%). |

6 |  | 2025 Proxy Statement | ||

PROXY STATEMENT SUMMARY | ||

Additionally, the portion of the PSUs granted in 2025 that are subject to achievement of goals related to growth in annual Adjusted Operating Income will not vest if the Company’s Adjusted Operating Income growth is negative over the three-year performance period.

See “Executive Compensation” for a detailed discussion of the design and evolution of our executive compensation program.

2025 Proxy Statement |  | 7 | ||

CORPORATE GOVERNANCE MATTERS | ||

The Board recommends that you vote “FOR” all of the director nominees listed. | |||||

What Am I Voting on? | We are asking stockholders to elect the ten director nominees listed below for election at the Annual Meeting for a term of one year. If elected, each director will hold office until the 2026 annual meeting and until their respective successors are elected and qualified. | ||||

Vote Required | To be elected, a director must receive a majority of the votes cast in respect of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors (meaning the number of shares voted “FOR” a nominee must exceed the number of shares voted “AGAINST” such nominee). “Abstentions” and “broker non-votes” will not be counted as a vote cast either “FOR” or “AGAINST” a nominee’s election. | ||||

Presented on the following pages are the ten director nominees recommended by the Board of Directors for election at the Annual Meeting.

Upon the recommendation of the nominating and corporate governance committee, the Board has nominated D. Randolph Peeler, L. Reade Fahs, Jose Armario, Virginia A. Hepner, Susan S. Johnson, James M. McGrann, Michael J. Nicholson, Naomi Kelman, Susan O’Farrell, and Caitlin Zulla for re-election as directors for a one-year term expiring at the 2026 annual meeting. Mr. Taylor will not stand for re-election and his term will expire at the Annual Meeting.

All of the nominees listed in this proxy statement are incumbent directors, whose terms expire on the date of the Annual Meeting. With the exception of Mr. Fahs, our Chief Executive Officer, all are independent directors. The nominating and corporate governance committee evaluated and recommended each director nominee in accordance with its charter and our Corporate Governance Guidelines. We have no reason to believe that any of the director nominees will be unable or unwilling to serve if elected; however, in the unlikely event that any of them ceases to be a candidate for election by the time of the Annual Meeting, proxies may be voted for a substitute nominee recommended by the Board, or the Board may elect to reduce its size.

Board Refreshment

• | Caitlin Zulla was appointed to the Board in August 2024 and serves on the compensation committee. She brings expertise across the healthcare value chain as well as a strong finance background and brings direct experience in advancing and promoting value-based care. Ms. Zulla was identified through a director search process overseen by the nominating and corporate governance committee, and after evaluation by the nominating and governance committee, nominated for election at the 2025 annual meeting. |

• | In March 2025, the Board appointed James M. McGrann and Michael J. Nicholson as directors and agreed to nominate each of them for election at the 2025 annual meeting under an agreement between the Company and Engine Capital, L.P. (“Engine Capital”). A more detailed description of the agreement with Engine Capital is contained in our Current Report on Form 8-K filed with the SEC on March 17, 2025. |

• | Mr. McGrann brings deep experience across the optical space as an eye care industry veteran with nearly 30 years of experience across the industry, serving in Chief Executive Officer, Chief Technology Officer and Chief Information Officer roles throughout his career. Mr. McGrann was identified and evaluated through a director search process overseen by the |

8 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

nominating and corporate governance committee, and the Board appointed him as a director and agreed to nominate him for election at the 2025 annual meeting under an agreement between the Company and Engine Capital.

• | Mr. Nicholson is a seasoned retail executive with extensive expertise in business transformation, operations, and finance, with a proven track record of developing financial strategy and implementing operational excellence. The Board appointed Mr. Nicholson as a director and agreed to nominate him for election at the 2025 annual meeting under an agreement between the Company and Engine Capital. |

• | Thomas V. Taylor, Jr., who joined the Board in 2018, will not stand for reelection at the Annual Meeting and will be departing as a director immediately following the Annual Meeting. The Board thanks Mr. Taylor for his years of service and commitment to the Company and its stockholders. He has made meaningful contributions to the Board throughout his tenure, including as chair of the compensation committee. |

Mr. Taylor’s departure is in no way due to any disagreement with the Company, nor is it the result of a removal “for cause.” As a result, the size of the Board will be reduced from eleven to ten. Following the Annual Meeting, it is expected that the Company will have no open director seats.

2025 Proxy Statement |  | 9 | ||

CORPORATE GOVERNANCE MATTERS | ||

Biographical Information

The following pages set forth biographical information, including a description of their principal occupation, business experience, and the primary qualifications, attributes, and skills (represented by the icons below) that the nominating and corporate governance committee considered in recommending them as director nominees, as well as the Board committees on which each director nominee will serve as of the Annual Meeting.

Director since: 2014 Age: 60 Independent Committees: Nominating and Corporate Governance Committee | D. Randolph Peeler Board Chair | |||

Mr. Peeler has served as the Chair of our Board of Directors since 2020. Mr. Peeler is a Senior Advisor at Berkshire Partners LLC (“Berkshire”), a private equity firm. Mr. Peeler joined Berkshire in 1996 and became a Managing Director in 2000. Mr. Peeler brings to our Board of Directors acquisition and capital market transactions knowledge from years of experience in the private equity industry, along with board experience from serving as a director of several of Berkshire’s current or former portfolio companies, industry experience in the optical/healthcare and retail industries, senior leadership experience, financial/accounting experience, human capital experience and public company board and risk oversight experience. | ||||

Prior Experience • Co-founded a privately-owned healthcare services company • Special Assistant for the Assistant Secretary for Economic Policy in the U.S. Department of the Treasury • Consultant with Cannon Associates and Bain & Co. | ||||

Other Directorships • DVx Ventures, a venture studio with a unique approach to building companies from concept to scale (private) • CPK Media, LLC d/b/a Christopher Kimball’s Milk Street Kitchen, a multi-channel food media company (private) | ||||

Director since: 2014 Age: 64 | L. Reade Fahs | |||

Mr. Fahs has served as the Chief Executive Officer of the Company since 2014. Prior to our initial public offering, Mr. Fahs served as the President and Chief Executive officer of National Vision, Inc. (“NVI”) beginning in 2003, having joined NVI in 2002 as President and Chief Operating Officer. Mr. Fahs brings a unique perspective to our Board as our CEO and with his extensive knowledge of the Company, its operations, and business, along with senior leadership, public company board and risk oversight experience, in additional to his optical and retail industry knowledge, marketing and human capital experience. | ||||

Prior Experience • Chief Executive Officer of First Tuesday, a professional networking forum for established technology entrepreneurs and companies (1999-2001) • Managing Director of Vision Express U.K., a leading optical retailer (1997-1999) • Various positions at LensCrafters, a leading eyewear retailer (1986-1996) | ||||

Other Directorships • Board Observer and Roving Ambassador (February 2024-present) and Chairman (2006-2024) of VisionSpring, a social enterprise that works to ensure affordable access to eyewear • Restoring Vision, a nonprofit organization committed to ending the global vision crisis • PetVet Care Centers, a network of locally owned general practice, specialty, emergency and equine veterinary hospitals (private) | ||||

10 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

Director since: 2021 Age: 66 Independent Committees: Nominating and Corporate Governance Committee | Jose Armario | |||

Mr. Armario has served as the Chief Executive Officer and President and a member of the board of directors of Bojangles’, Inc. (“Bojangles”), a restaurant operator and franchisor, since 2019. Mr. Armario brings to our Board senior leadership, public company board, financial and accounting, risk oversight and retail industry experience from his role as Chief Executive Officer of Bojangles, prior executive positions and board work, along with optical and healthcare industry, marketing, ESG and sustainability, and human capital experience. | ||||

Prior Experience • Founder and Chief Executive Officer of consulting firms Armario Enterprises, LLC and PowerC,LLC, (2016-2019) • Corporate Executive Vice President, Supply Chain, Development and Franchising of McDonald’s Corporation (2011-2015) • Various leadership positions at McDonald’s Corporation (1996-2011) | ||||

Other Directorships • Bojangles, Inc. (private) • Golden State Foods, a global food services and logistics company specializing in quick-service restaurants (private) (2018-2024) | ||||

Director since: 2018 Age: 67 Independent Committees: Nominating and Corporate Governance Committee (Chair) | Virginia A. Hepner | |||

Ms. Hepner most recently served as the President and Chief Executive Officer, and is a Life Trustee, of The Woodruff Arts Center in Atlanta, Georgia, from 2012 to 2017. Ms. Hepner brings to our Board senior leadership experience, public company board knowledge and risk oversight experience from her time as CEO of The Woodruff Arts Center and other board positions, government/regulatory experience and corporate sustainability and human capital experience, along with over 25 years of financial and accounting experience. | ||||

Prior Experience • Investor in GHL, Inc., a real estate partnership for commercial properties in metro Atlanta (2005-2022) • Strategic Advisor at DMI Music & Media Solutions, a full-service entertainment and music company (2011-2019) • Executive Vice President and various other leadership positions at Wachovia Bank and its predecessors (1979-2005) | ||||

Other Directorships • Oxford Industries, a leader in the apparel industry (public) (nominating, compensation and governance committee chair) • Cadence Bancorporation, a commercial banking company (public) (audit committee chair) • State Bank & Trust Company, now a division of Cadence Bank (2010-2019) | ||||

2025 Proxy Statement |  | 11 | ||

CORPORATE GOVERNANCE MATTERS | ||

Director since: 2020 Age: 59 Independent Committees: Compensation Committee | Susan Somersille Johnson | |||

Ms. Johnson most recently served as the Chief Marketing Officer for Prudential Financial, Inc., a provider of financial products and services, from 2020 to 2024. Ms. Johnson brings to our Board of Directors extensive marketing and digital communication, retail, ESG and sustainability, and financial and accounting experience, along with senior leadership, public company board and risk oversight experience. | ||||

Prior Experience • Executive Vice President and Chief Marketing Officer of Truist Financial, a bank holding company, a full-service entertainment and music company (2014-2020) • Vice President, Global Marketing, of NCR Corporation, a software, consulting and technology company (2012-2014) • Global Head of Customer Marketing; Head of Software Marketing Programs, of Nokia Corporation, a telecommunications company (2007-2012) | ||||

Other Directorships • Constellation Brands, a leading international producer and marketer of beer, wine, and spirits (public) (2017-2024) | ||||

Director since: 2020 Age: 66 Independent Committees: Audit Committee Compensation Committee | Naomi Kelman | |||

Ms. Kelman most recently served as President and Chief Executive Officer of Willow Innovations, Inc., a revolutionary women’s health company, from 2014 to 2019. Ms. Kelman brings to our Board of Directors extensive knowledge of the healthcare industry and senior leadership, marketing and digital communication, government/regulatory and human capital knowledge from her time as CEO of Willow and prior leadership roles in the optical and healthcare industries. | ||||

Prior Experience • Global Division Head of Novartis OTC, a division of Novartis, a healthcare company (2011-2012) • Various executive roles at Johnson & Johnson, a focused healthcare company (2000-2011) • President, Lifescan North America, One Touch diabetes business (2009-2011) • President, Vistakon Americas (Acuvue Contact Lenses), a division of Johnson & Johnson Vision Care (2004-2009) | ||||

Other Directorships • Mirvie, a biotechnology company (private) • Blue River PetCare (Chair), a leading operator of veterinary hospitals (private) | ||||

12 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

Director since: 2025 Age: 63 Independent Committees: Compensation Committee | James M. McGrann | |||

Mr. McGrann has served as the Chief Executive Officer of Advancing Eyecare, a leading provider of ophthalmic instruments, since 2023. Mr. McGrann brings to the Board deep experience across the optical space as an eye care industry veteran with nearly 30 years of experience across the industry. | ||||

Prior Experience • President and Chief Operating Officer of Percept Corporation, a wearable technology company (2023) • Founder and Chief Executive Officer of HH&S Management Consulting, LLC, a business consulting firm (2017-2023) • Chairman and Chief Executive Officer of Professional Eye Care Associates of America (PECAA), a community of independent eye care professionals, (2017-2022) • President and Chief Executive Officer of VSP Global, a vision care health insurance company (2015-2017) • President (2011-2015) and Chief Technology Officer (2010-2012) of VSP Vision Care • President and Chief Executive Officer of Eyefinity, a VSP Vision company (2008-2012) • Senior Vice President and Chief Information Officer of Marchon Eyewear, Inc., one of the world’s largest manufacturers and distributors of eyewear (1999-2008) | ||||

Other Directorships • The Vision Council (Vice Chair), a non-profit organization serving as a global voice for eyewear and eyecare • Prevent Blindness (Chair), the nation's leading non-profit voluntary eye health organization dedicated to preventing blindness and preserving sight • Percept Corporation (private) • Ocuco, an optical software company (private) • Kepler Vision, a management services organization providing non-clinical administrative support services to Optometry practices nationwide (private) (2023-2025) (compensation committee chair) | ||||

Director since: 2025 Age: 58 Independent Committees: Audit Committee Nominating and Corporate Governance Committee | Michael J. Nicholson | |||

Mr. Nicholson has served as the President and Chief Operating Officer of J.Crew Group, an internationally recognized omnichannel retailer and family of legacy American brands; J.Crew, J.Crew Factory and Madewell, since 2020, having previously served as Interim Chief Executive officer from 2019 to 2020 and Chief Financial Officer from 2016 to 2017. Mr. Nicholson is a seasoned retail executive and brings to the Board extensive expertise in business transformation, operations, and finance. Mr. Nicholson is also a Certified Public Accountant. | ||||

Prior Experience • Executive Vice President, Chief Operating Officer and Chief Financial Officer of ANN, Inc., the parent Company of Ann Taylor and LOFT, two of the leading women's specialty retail fashion brands in North America (2007-2015) • Various executive positions at Limited Brands, Inc., a specialty retail company, including Executive Vice President, Chief Operating Officer and Chief Financial Officer for Victoria’s Secret Beauty, a subsidiary of Limited Brands, Inc., at the time. (2000-2007) • Senior leadership positions at Colgate-Palmolive, Altria, and PwC, where he played key roles in developing financial strategy and implementing operational excellence (1988-2000) | ||||

Other Directorships • The Container Store (Audit Committee Chair), a national, multi-channel retailer dedicated to helping people improve their lives through the power of organization (private) | ||||

2025 Proxy Statement |  | 13 | ||

CORPORATE GOVERNANCE MATTERS | ||

Director since: 2024 Age: 61 Independent Committees: Audit Committee (Chair) | Susan O’Farrell | |||

Ms. O’Farrell most recently served as Chief Financial Officer, Principal Accounting Officer and Treasurer at BlueLinx Holdings, Inc., a wholesale distributor of building and industrial products from 2014 to 2020. Ms. O’Farrell brings to the Board a wealth of financial and operational experience encompassing IT, procurement, supply chain and logistics in growth and transformational environments and is qualified financial expert and a holder of the CERT Certificate in Cybersecurity Oversight from Carnegie Mellon. | ||||

Prior Experience • Senior financial executive in various roles at The Home Depot, a leading home improvement omni-channel retailer (1999-2014) • Director of Southern Company Gas, formerly AGL Resources, an American Fortune 500 energy services holding company (1996-1999) | ||||

Other Directorships • Savers Value Village, Inc., the largest for-profit thrift operator in the U.S. and Canada (public) • Leslie’s Inc., a specialty retailer of pool supplies (public) (audit committee chair) | ||||

Director since: 2024 Age: 47 Independent Committees: Compensation Committee | Caitlin Zulla | |||

Ms. Zulla serves as Chief Executive Officer of US Radiology Specialists, one of the nation’s premier providers of diagnostic imaging services, where she leads teams committed to clinical and operational excellence and delivering the highest quality of imaging care. Ms. Zulla previously served as CEO of Optum Health East, where she oversaw health care delivery in 10 states from Maine to Delaware and was responsible for the experience of over 5.4 million patients and more than 15,000 team members. Prior to joining Optum Health East, Ms. Zulla served as Chief Executive Officer of SCA Health, a specialist alignment organization and leader in the ambulatory surgery center industry. Her tenure with SCA Health included serving as Chief Financial Officer, Chief Administrative Officer and Senior Vice President of Revenue Cycle. | ||||

Prior Experience • Chief Executive Officer, Optum Health East (2023-2025) • Chief Executive Officer, SCA Health (2018-2019) • Various roles at SCA Health including Chief Financial Officer, Chief Administrative Officer and Senior Vice President of Revenue Cycle (2015-2017) | ||||

Other Directorships • US Radiology Specialists (private) | ||||

14 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

Qualifications, Skills and Experience of our Directors

The nominating and corporate governance committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and recommends nominees for director to the Board for election by our stockholders in accordance with our Corporate Governance Guidelines. The application of these factors involves the exercise of judgment. The committee does not have a standard set of fixed qualifications applicable to all director candidates but at a minimum assesses each candidate’s integrity, accountability, skills, experience, independence, other outside commitments and ability to work collegially with the other members of the Board.

The Board regularly evaluates the experience, qualifications, attributes or skills, taken as a whole, of our current directors and nominees, to ensure that our Board is able satisfy its oversight responsibilities effectively in light of our business and structure. As part of this evaluation, the Board considers areas where additional expertise or skills may be needed. In recommending the director nominees listed in this proxy statement, the Board focused primarily on each person’s background and experience as reflected in the information discussed in the individual biographies set forth above. We believe that our director nominees provide an appropriate mix of experience and skills relevant to the size and nature of our business and are representative of diverse backgrounds. The following highlights some of the important characteristics, key qualifications, attributes or skills of our current directors that allow our Board to provide effective oversight of our business operations and strategy.

2025 Proxy Statement |  | 15 | ||

CORPORATE GOVERNANCE MATTERS | ||

Identifying Director Nominees

The nominating and corporate governance committee may identify, recommend and assist in recruiting candidates for election to the Board of Directors on its own, or by considering recommendations from stockholders, officers and employees of the Company and other sources that the committee deems appropriate. The nominating and corporate governance committee may also retain a third-party search firm to assist in the identification of possible candidates for election to the Board.

Stockholder Recommendations of Director Candidates

The committee will consider director candidates recommended by stockholders on a substantially similar basis as recommendations from other sources. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to recommend a candidate for consideration may do so by submitting the required information to the attention of the Secretary, National Vision Holdings, Inc., 2435 Commerce Ave, Building 2200, Duluth, Georgia 30096. All recommendations for nomination received by the Secretary that satisfy our bylaw requirements relating to director nominations will be presented to the nominating and corporate governance committee for its consideration. If stockholders want to formally nominate a director candidate for election, they must satisfy the notification, timeliness, consent and information requirements set forth in our bylaws. These requirements are also described under “Stockholder Proposals for the 2026 Annual Meeting.”

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe our Board’s views and policies on a wide range of governance topics. These Corporate Governance Guidelines are reviewed from time to time by our Board of Directors and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by our Board of Directors, and are available in the investors section of our website, www.nationalvision.com.

Corporate Governance and Board Practices | |||||

All directors are elected annually  Majority voting in uncontested director elections  Recently updated bylaws to enhance corporate governance practices  Independent Chair of the Board  Nine of ten director nominees are independent  All committee members are independent  Seven new independent directors over the last five years  Nine experienced current and former CEOs/CFOs  Of our ten director nominees, five are female and two are racially or ethnically diverse  No restrictions on directors’ access to management |  Regular review of committee charters and Corporate Governance Guidelines incorporating evolving best practices  Strong, proactive stockholder engagement program  Annual Board and committee self-assessments  Regular Board executive sessions without management  Formal Board and committee oversight of our business strategy, enterprise risk management, cybersecurity, compensation strategy, and sustainability program and strategy  Robust director and executive stock ownership guidelines | ||||

16 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

Key Governance Developments

In 2024, we took action to further our commitment to good governance, including the following:

Board Refreshment | In the last year, we added three new independent directors, while another longer-tenured director transitioned off the Board. | |||

Committee Composition | We refreshed our committee composition and chairs. | |||

Declassified Board | We have completed the phase out of the classified structure of the Board and all directors stand for election annually. | |||

Board Composition

The Board is currently comprised of eleven directors. Our certificate of incorporation provides that the authorized number of directors may be changed only by resolution of our Board of Directors. Because Mr. Taylor is not standing for reelection at the Annual Meeting, the size of the Board will be reduced from eleven to ten. Following the Annual Meeting, it is expected that the Company will have no open director seats.

Director Independence

We believe the Company benefits from having a Board that is independent from management. Under our Corporate Governance Guidelines and SEC and Nasdaq Listing Rules, a director is not independent unless the Board affirmatively determines that he or she does not have a relationship with management that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Corporate Governance Guidelines define independence in accordance with the independence standards in the current SEC and Nasdaq Listing Rules and require the Board to review the independence of all directors at least annually.

Our Board has determined that, other than Mr. Fahs, all of the director nominees listed in this proxy statement and all of the individuals who served during the fiscal year ended December 28, 2024, are independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and under all applicable Nasdaq guidelines. Mr. Fahs is not independent because of his current employment as our Chief Executive Officer. All members of the audit committee, compensation committee and nominating and corporate governance committee are independent.

In making its independence determinations, the Board considered and reviewed relevant information provided by the directors and the Company, including information identified through annual director questionnaires.

Executive Sessions

Executive sessions, or meetings of the independent directors of the Board, are scheduled regularly throughout the year, typically at the time of each regular Board meeting and as frequently as such independent directors deem appropriate.

Leadership Structure

While our Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chair of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company, the Board currently believes that having these positions separated, with Mr. Peeler serving as Chair of the Board and Mr. Fahs serving as our Chief Executive Officer and also as a director, is the appropriate leadership

2025 Proxy Statement |  | 17 | ||

CORPORATE GOVERNANCE MATTERS | ||

structure at this time and demonstrates our commitment to good corporate governance. Under our Corporate Governance Guidelines, if the Chair is not independent, the independent directors may annually elect from among themselves a Lead Independent Director.

On April 28, 2025, the Board approved the Company’s CEO succession plan (the “Succession Plan”). Under this plan, effective August 1, 2025, Mr. Wilkes will succeed Mr. Fahs as Chief Executive Officer and will be appointed to the Board, and Mr. Fahs will assume the role of Executive Chairman. Once Mr. Fahs becomes Executive Chairman, Mr. Peeler will become the Company’s Lead Independent Director. In connection with the Succession Plan, the Board expects to amend its Corporate Governance Guidelines to provide for an Executive Chairman of the Board when deemed appropriate by the Board, in addition to a Lead Independent Director. The Board believes that Mr. Fahs serving as Executive Chairman will provide support to the Company through the transition period and allow the Company to continue to leverage Mr. Fahs’ extensive knowledge of the Company and the industry.

The Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Meetings and Attendance

All directors are expected to make every effort to attend all meetings of the Board and of the committees of which they are members, as well as the annual meeting of stockholders. During the fiscal year ended December 28, 2024, the Board held seven meetings. During 2024, each of our directors attended 90% or more of the aggregate number of meetings of the Board and committees on which he or she served, in each case while they served on the Board or such committees, and all of our directors that were members of our Board at the time attended the 2024 annual meeting.

Our Board of Directors has three standing committees: the audit committee, the nominating and corporate governance committee, and the compensation committee. All members of our committees are independent directors. Each of these committees is governed by its written charter approved by our Board. We make copies of these charters available free of charge on the investors section of our website, www.nationalvision.com. Other than the text of the charters, we are not including the information contained on or available through our website as a part of, or incorporating such information by reference into, this proxy statement. The following further describes the membership, duties and responsibilities of each of the Board’s committees.

Audit Committee | |||||

Susan O’Farrell (Chair) Naomi Kelman Michael J. Nicholson 7 Meetings held in 2024 | The audit committee is responsible for, among other things, preparing the audit committee report required by the SEC to be included in our proxy statement and assisting the Board with respect to its oversight of: • our risk management policies and procedures • the audits and integrity of our financial statements, and the effectiveness of internal control over financial reporting • our compliance with legal and regulatory requirements, including SEC filings • the qualifications, engagement, performance and independence of the outside auditors, including approving all auditing and non-auditing services performed by our outside auditors • approving the annual audit plans and the performance of our internal audit function The Board has determined that each of Mses. Kelman and O’Farrell and Mr. Nicholson qualify as an independent director under Nasdaq corporate governance standards and the independence requirements of Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), and that Ms. O’Farrell and Mr. Nicholson each qualify as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. | ||||

18 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

Compensation Committee | |||||

Thomas V. Taylor, Jr. (Chair) Susan Somersille Johnson Naomi Kelman James M. McGrann Caitlin Zulla 4 Meetings held in 2024 | The primary purpose of the compensation committee is to assist our Board of Directors in discharging its responsibilities relating to: • setting our compensation philosophy and compensation of our executive officers and directors • monitoring our equity-based and certain incentive compensation plans • preparing the compensation committee report required to be included in our proxy statement or annual report under the rules and regulations of the SEC The Board has determined that each of Mr. Taylor, Ms. Johnson, Ms. Kelman, Mr. McGrann and Ms. Zulla are independent under the applicable listing standards of Nasdaq and our Corporate Governance Guidelines. | ||||

Nominating and Corporate Governance Committee | |||||

Virginia A. Hepner (Chair) Jose Armario Michael J. Nicholson D. Randolph Peeler 4 Meetings held in 2024 | The primary purpose of the nominating and corporate governance committee is to provide assistance to the Board by, among other things: • determining the size, structure, composition, processes and practices of the Board and its committees • assessing director independence and qualifications • identifying and recommending, and assisting the Board in recruiting, qualified director candidates • overseeing the Board’s director education practices • taking a leadership role in shaping the corporate governance of the Company through its review and development of our Corporate Governance Guidelines and practices and guidance of the annual Board evaluation • retaining, along with the Board, oversight responsibility for our sustainability strategy and providing oversight and guidance on environmental sustainability, social justice and corporate responsibility issues and opportunities The Board has determined that each of Ms. Hepner and Messrs. Nicholson, Peeler and Armario are independent under the applicable listing standards of Nasdaq and our Corporate Governance Guidelines. | ||||

The primary responsibility of our Board is to oversee the management of the business and the affairs of the Company for the benefit of our stockholders and other stakeholders, using its business judgment to act in the best interests of the Company and its stockholders. As part of its responsibility, the Board oversees critical matters such as strategy, management succession planning, financial and other internal controls, corporate governance, risk management and compliance, and selects and oversees the members of senior management who are charged by the Board with conducting the business of the Company.

Our Board of Directors oversees or directs our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board. To assist in fulfilling its duties, our Board has delegated certain authority to its three standing committees—the audit committee, the nominating and corporate governance committee and the compensation committee. The duties and responsibilities of these standing committees are described under the heading “Board Committees.”

2025 Proxy Statement |  | 19 | ||

CORPORATE GOVERNANCE MATTERS | ||

The Board’s role in oversight is further described below and in our Corporate Governance Guidelines.

Management Succession Planning

A primary responsibility of the Board is planning for CEO succession, overseeing the development and retention of senior talent, and monitoring management’s succession planning for other senior executives. Succession planning and management development are discussed regularly by the Board. As part of the succession planning review process, the Board reviews and discusses the capabilities of, as well as succession planning and potential successors for, both our CEO and other executive officers. The Board and compensation committee consider, among other things, organizational and operational needs, competitive challenges, leadership and management potential and development, and planning for emergency situations. Management also develops ideas and presents plans for identification, mentoring and continuing development of potential internal candidates for executive leadership positions and ensures that directors have substantial opportunities to engage with successor candidates, including emerging leaders. The Board also has access to external consultants, as needed.

Board Oversight of Risk Management

Management is responsible for the day-to-day management of risk, while the Board, as a whole and through its committees is responsible for oversight of the Company’s ongoing assessment and management of material risks impacting the business, including assessing whether management has an appropriate risk management framework to manage risks and whether that framework is operating effectively. The Board engages in risk oversight throughout the year as a matter of course in fulfilling its role overseeing management and business operations, including receiving regular reports from management on the strategic plans and related risks facing the Company which range from financial risks to operational, regulatory, legal, supply chain, sustainability, competitive and information technology risks. Significant operational risks that relate to ongoing business operations are the subject of regularly scheduled reports to either the full Board or one of its committees.

The Board has delegated to its committees certain elements of its risk oversight function to better coordinate with management and serve the long-term interests of our stockholders. The risks periodically reviewed by committees are also reviewed by the entire Board when deemed appropriate by the Board or its committees. The independent Chair of the Board promotes effective communication and consideration of matters presenting significant risk to the Company through his role in developing the Board’s meeting agendas, chairing meetings of the Board, and facilitating communications between independent directors of the Board and the Chief Executive Officer. We believe that the leadership structure of our Board, along with the allocation of risk management responsibilities described below by appropriate committee oversight, provides appropriate risk oversight of our activities.

Audit Committee

The audit committee oversees our risk management process with a specific focus on internal controls, financial statement integrity, compliance programs, fraud risk, legal matters and related risk mitigation. Along with the Board, the audit committee receives regular reports from management to help ensure effective and efficient oversight and to assist in proper risk management, including with respect to cybersecurity and data security risks, and the ongoing evaluation of management controls and procedures. Through its regular meetings with management, including the finance, legal, internal audit, and compliance functions, and discussions, as appropriate, with our independent registered public accounting firm and internal auditors, the audit committee reviews and discusses significant areas of our business, including areas of risk and appropriate mitigating factors. The internal audit function reports functionally and administratively to our Chief Financial Officer and directly to the audit committee. The audit committee receives reports on information technology risks, including data security and cybersecurity. The audit committee reviews cybersecurity and data security risks and

20 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

mitigation strategies, along with program assessments, planned improvements and the status of information technology initiatives, with the Chief Technology Officer quarterly. These risks and mitigation strategies are also periodically reviewed by the entire Board. See Item IC. Cybersecurity in our Annual Report on Form 10-K for additional details.

Compensation Committee

The compensation committee reviews the risk profile of our compensation policies and practices, including a review of a risk assessment of our compensation programs and managing risk associated with human capital management, including employee recruitment and retention.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee monitors risks relating to governance matters, including sustainability risks and the potential risks, impacts and opportunities posed by climate change, and reports to the Board on these risks and any recommended appropriate actions in response to those risks, as further described below under “Board Oversight of Corporate Sustainability.”

Board Oversight of Corporate Sustainability

Our Board is highly engaged in our corporate sustainability strategy, particularly given that societal impact is intricately linked to the mission of our business—making eye care and eyewear more affordable and accessible. Our nominating and corporate governance committee is responsible for overseeing the effectiveness of our sustainability strategies, policies, goals, initiatives and programs, including the review of our annual Corporate Sustainability Report, while our compensation committee is responsible for overseeing the development and implementation of human capital and succession plans and considering how best to incorporate human capital matters into our executive compensation plans. Our audit committee is responsible for overseeing our enterprise risk management program, which includes sustainability topics. See “Corporate Governance Matters—Sustainability” for a detailed discussion of our corporate sustainability strategy.

As a part of the Board’s commitment to corporate governance, the nominating and corporate governance committee coordinates an annual review and self-evaluation of the performance of the Board, its committees and individual directors. In addition, the nominating and corporate governance committee regularly reviews the Board’s composition and skillset and makes recommendations to the Board accordingly.

Process

The evaluation is typically conducted through a written questionnaire asking directors for feedback on a range of topics developed by the nominating and corporate governance committee with input and support from the Company’s General Counsel. Topics generally include:

• | The structure and leadership of the Board and its committees |

• | Overall Board and committee effectiveness, including meeting agendas and content, flow and organization of Board and committee meetings, allocations and priorities of Board and committee topics |

• | Board oversight, particularly of strategy and risk management |

• | CEO, senior leadership, and organizational talent and succession planning |

• | Board access to information and resources |

• | Management responsiveness to requests for information and updates |

In 2024, the chair of the nominating and corporate governance committee reviewed prior assessment processes and determined that this written questionnaire continues to be the best methodology to

2025 Proxy Statement |  | 21 | ||

CORPORATE GOVERNANCE MATTERS | ||

meet the Board’s desired goals for the evaluation process and the evaluation was conducted and completed with each director providing direct feedback. The questionnaire was anonymous and provided for both numerical ratings and narrative responses.

Review

The evaluations were reviewed, and the ratings and narrative comments were aggregated and summarized with results provided to the nominating and corporate governance committee as well as the full Board. The chair of the nominating and corporate governance committee led a discussion regarding the evaluations, and directors and followed up with individual directors as appropriate.

Feedback and Action

The annual evaluation process provides the Board with valuable insight regarding areas where the Board believes it functions effectively and areas where the Board believes it can continue to improve its effectiveness and oversight. As appropriate, these evaluations result in updates or changes to our practices as well as commitments to continue existing practices that our directors believe contribute positively to the effective functioning of our Board and its committees. For example, input by directors in recent years has informed the practices of the Board and its committees in areas such as meeting agendas and content, risk oversight, communication between the Board and management and director education focus areas.

We are committed to ensuring our business is conducted ethically and legally. We maintain a written code of conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions, which we call our Code of Conduct. Our Code of Conduct is a “code of ethics” as defined in Item 406(b) of Regulation S-K and is posted in the investors section of our website, www.nationalvision.com.

We intend to make any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Conduct on our website.

Our Securities Trading Policy requires executive officers and directors to consult the Company’s General Counsel prior to engaging in transactions involving Company securities. Directors and executive officers are prohibited from hedging or monetization transactions including, but not limited to, variable forward contracts, equity swaps, collars and exchange funds, or from trading in options, warrants, puts and calls or similar instruments on the Company’s securities or establishing a short position in Company securities. Our Securities Trading Policy discourages employees from purchasing Company securities on margin, or borrowing against any account in which Company securities are held, or pledging Company securities as collateral for a loan. For directors and officers, the pledging of Company securities is limited to those situations approved by the Company’s General Counsel.

The Board has adopted a written related person transaction policy that sets forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act, any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we were or are to be a participant, where the amount involved exceeds $120,000 and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material

22 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

interest, indebtedness, guarantees of indebtedness and employment by us of a related person. It is our policy that no related person transaction will be executed without the approval or ratification of the disinterested members of the Board or a committee of the Board.

There were no related persons transactions since the beginning of fiscal year 2024 required to be reported in this proxy statement under the applicable SEC rules.

Our director compensation program is designed to attract qualified, independent directors and align with our overall compensation philosophy. The compensation committee, with assistance from its independent compensation consultant, reviews our director compensation program regularly to ensure the program is structured consistent with best practices and current trends. As part of this review, the director compensation program is benchmarked against the same compensation peer group used for executive compensation benchmarking. Our employee directors do not receive payment for their service on the Board in addition to their regular employee compensation.

Elements of Director Compensation

In 2024, our director compensation program consisted of the following:

Annual Cash Retainer • Annual cash retainer paid quarterly, in arrears. • Non-employee directors are given the option to elect, prior to the end of the calendar year immediately preceding the calendar year in which such cash retainer fees would otherwise be paid, to receive all or any portion of their annual cash retainer in equity, in the form of restricted stock units, which vest in full on the first anniversary of the grant date, subject to continued service through the vesting date. | $80,000 | ||||

Annual Equity Grant Annual equity grant in the form of restricted stock units, which vest on the first anniversary of the grant date, subject to continued service through the applicable vesting date. | $170,000 | ||||

Additional Compensation for Committee Chairs Committee chairs receive an additional annual cash retainer paid quarterly, in arrears. | |||||

Audit Committee | $25,000 | ||||

Compensation Committee | $20,000 | ||||

Nominating and Corporate Governance Committee | $15,000 | ||||

Our directors are not paid any fees for attending meetings. However, our directors are reimbursed for reasonable travel and related expenses associated with attendance at Board or committee meetings.

Beginning August 1, 2025, the director compensation program will provide for an additional annual cash retainer in the amount of $30,000 for the Lead Independent Director role.

2025 Proxy Statement |  | 23 | ||

CORPORATE GOVERNANCE MATTERS | ||

2024 Director Compensation

The following table reflects all cash compensation paid and the aggregate market value of stock awards granted to our non-employee directors for service in fiscal 2024:

Name | Fees earned or paid in cash(1)(2) ($) | Stock awards(3) ($) | All other compensation ($) | Total ($) | ||||||||||

D. Randolph Peeler(1) | 80,000 | — | — | 80,000 | ||||||||||

Jose Armario | 80,000 | 170,010 | — | 250,010 | ||||||||||

Virginia A. Hepner | 95,000 | 170,010 | — | 265,010 | ||||||||||

Susan S. Johnson | 80,000 | 170,010 | — | 250,010 | ||||||||||

Naomi Kelman | 80,000 | 170,010 | — | 250,010 | ||||||||||

James M. McGrann(4) | — | — | — | — | ||||||||||

Micheal J. Nicholson(4) | — | — | — | — | ||||||||||

Susan O’Farrell | 93,791 | 170,010 | — | 263,801 | ||||||||||

Thomas V. Taylor, Jr. | 99,942 | 170,010 | — | 269,952 | ||||||||||

Caitlin Zulla(5) | 33,261 | 149,516 | — | 182,777 | ||||||||||

Former Directors | ||||||||||||||

David M. Tehle(6) | 46,181 | — | — | 46,181 | ||||||||||

(1) | At the request of Mr. Peeler, the compensation committee approved in February 2024 a program in which (i) in lieu of paying any cash retainer earned for Board or committee service directly to Mr. Peeler, the Company will instead make a quarterly donation of such retainer in Mr. Peeler’s name to our foundation or another charity of its choosing, and (ii) Mr. Peeler will not receive the restricted stock unit award to which non-employee directors are entitled under the director compensation program. |

(2) | Includes all annual retainer fees earned by the directors listed in 2024. Mr. Peeler donated his cash retainer to 20/20 Quest, a Company-sponsored charitable foundation. Mr. Armario elected to receive 100% of his cash retainer in equity, Ms. Johnson elected to receive 50% of her cash retainer in equity and Mr. Taylor elected to receive 67% of his cash retainer in equity, resulting in a grant of restricted stock units on June 14, 2024, as follows: Mr. Armario (5,957), Ms. Johnson (2,978) and Mr. Taylor (4,986). The grant date fair value of these awards, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“ASC Topic 718”) is as follows: Mr. Armario—$80,003, Ms. Johnson—$39,995, and Mr. Taylor—$66,962. Information about the assumptions used to value these awards is set forth in our Annual Report on Form 10-K in Note 7 to our Consolidated Financial Statements for the year ended December 28, 2024. |

(3) | On June 14, 2024, we granted each of our non-employee directors such number of restricted stock units determined by dividing $170,000 by $13.43, the closing price of our common stock on June 14, 2024, the date of grant, rounded up to the next whole restricted stock unit. Accordingly, each director received 12,659 restricted stock units, which will vest 100% on the first anniversary of the grant date. |

Amounts in this column reflect the grant date fair value of the award calculated in accordance with ASC Topic 718 on the date of the grant. Information about the assumptions used to value these awards is set forth in our Annual Report on Form 10-K in Note 7 to our Consolidated Financial Statements for the year ended December 28, 2024.

As of December 28, 2024, the non-employee directors as of that date held the following number of unvested restricted units: Mr. Armario (18,616), Ms. Hepner (12,659), Ms. Johnson (15,637), Ms. Kelman (12,659), Ms. O’Farrell (12,659), Mr. Taylor (17,645) and Ms. Zulla (11,010).

(4) | Mr. McGrann and Mr. Nicholson joined our Board in March 2025 and did not receive compensation in 2024. |

(5) | Ms. Zulla joined the board on August 1, 2024, and we granted her 11,010 restricted stock units, representing a pro rata number based on the number of days between the date of her appointment and June 18, 2025, the anticipated date of the next annual meeting of shareholders, and using the closing price of our common stock on August 1, 2024, of $13.58. |

(6) | Mr. Tehle’s term as a director ended at the 2024 annual meeting of shareholders. |

Director Stock Ownership Guidelines

Under our stock ownership guidelines (the “Guidelines”), non-employee directors are required to hold common stock and restricted stock units having a market value equal to at least five time (5x) the annual cash retainer. There is no required time frame within which a director must attain the applicable stock ownership level; however, the Guidelines provide that until the applicable ownership level is achieved, directors must retain 50% of vested shares net of stock option exercise and tax withholding,

24 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

as applicable. Shares that count toward these ownership requirements include shares owned outright, shares held in our 401(k) plan or other retirement plan and shares of time-based restricted stock and restricted stock units (whether vested or unvested). The retention requirement applies to all prior and future grants. As of December 28, 2024, Mses. O’Farrell and Zulla are subject to the restrictions in the Guidelines until their ownership requirements are met, and all other non-employee directors were in compliance with the Guidelines.

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of our Board, including the chairperson of our Board, the chairperson of any of the audit, compensation and nominating and corporate governance committees, or the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Secretary of the Company, 2435 Commerce Ave, Building 2200, Duluth, Georgia 30096, who will forward such communication to the appropriate party or parties.

We are committed to stockholder engagement and greatly value the input we receive from our stockholders. We believe strong corporate governance should include year-round engagement with our stockholders. Our investor relations team and members of our senior management are in frequent communication with stockholders on a variety of matters, including our operations and financial performance. Our Chief Executive Officer, Chief Financial Officer and Chief Operating Officer are engaged in meaningful dialogue with our stockholders through our quarterly earnings calls and investor-related outreach events. In addition, a cross-functional team conducts our off-season stockholder outreach and engagement program through which we solicit feedback focused on corporate governance, executive compensation, corporate social responsibility and other sustainability matters of interest to our stockholders. Stockholder engagement and feedback is regularly shared with our Board of Directors.

In 2024 and 2025, as part of our off-season stockholder engagement efforts, we engaged with our top institutional investors representing approximately 25% of our outstanding shares following outreach to stockholders representing 80% of our outstanding shares. Many of these stockholders expressed support for the continued progress of our Sustainability strategy and other topics covered included business operations, governance, human capital and our executive compensation program.

2025 Proxy Statement |  | 25 | ||

CORPORATE GOVERNANCE MATTERS | ||

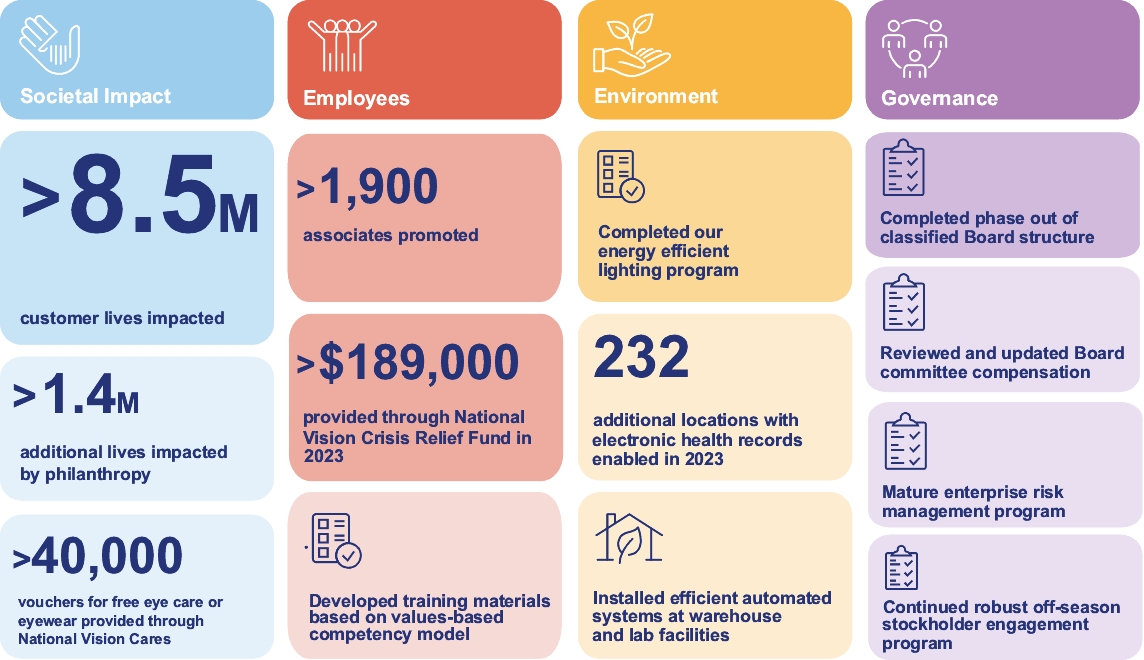

Our commitment to sustainability is a core part of who we are as a Company, as is evidenced by our mission —“We help people by making quality eye care and eyewear more affordable and accessible.” We understand the importance of acting responsibly as a business, employer and corporate citizen. Engagement on sustainability is important to us and our stakeholders, and we are committed to balancing the social, economic, human capital management and environmental aspects of our business with disclosure highlighting our aspirations and achievements in these areas. In 2024, we published our third Sustainability Report covering the 2023 fiscal year, in which we enhanced our disclosure on how our approach to sustainability links to both stakeholder impact and to business success.

SEE+G Framework

Our SEE+G framework guides our sustainability efforts. The framework aligns with our priority topics and is organized according to four pillars:

Societal Impact | We focus on making high-quality eye care and eyewear accessible and affordable for all. Our philanthropic giving and partnerships expand access to affordable eye care for those in need around the world. | |||

Employees | We invest in programs that support the well-being, development and quality of life of our people. We are committed to creating environments where team members at all levels are supported and empowered so that everyone can build happy, fulfilled and productive careers. | |||

Environment | We work to understand the impacts of our activities, increase the efficiency of our operations and minimize our environmental footprint. | |||

Governance | We strive to adhere to the highest standards and best practices for compliance, data privacy and cybersecurity, as well as product quality and safety. | |||

SEE+G Highlights

Below are just a few of the efforts we highlighted in our 2023 Sustainability Report.

26 |  | 2025 Proxy Statement | ||

CORPORATE GOVERNANCE MATTERS | ||

We focused our efforts in the last year on continuing to build a strong foundation for the success of our business and, by extension, our philanthropic impact.

• | We drove positive Societal Impact by continuing to expand our remote care offering and working with Americares to exceed our goal of helping 500,000 of the country’s most vulnerable see by 2023, serving an additional 270,000 people in the U.S. with Americares in 2023. In 2023, we provided more than 40,000 vouchers for free eye care or eyewear through National Vision Cares. A program that has proved effective both in engaging our associates and having real community impact. |