1 Third Quarter 2025 Earnings Supplement November 6, 2025

2 FORWARD-LOOKING STATEMENTS This communication contains certain “forward-looking statements” within the meaning of federal securities laws. Forward-looking statements may be identified by words such as “years ahead,” “look forward” and similar expressions. Forward-looking statements are not statements of historical fact and reflect Core’s current views about future events. No assurances can be given that the forward-looking statements contained in this communication will occur as projected, and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, uncertainties regarding the ability of Core to mine, upgrade, process, and extract REEs and CMs from its existing mines, including uncertainties regarding the financial impacts of such activities; risks related to the recently announced CEO transition; risks related to the prior occurrence of combustion-related activity at Core’s Leer South mine and the risk of future occurrences; the increase in combustion-related gases at Core’s Leer South mine; Core’s ability to resume development work at Leer South with continuous miners and longwall development in accordance with its expected timing; the U.S. Government shutdown and our ability to resume operations at the Leer South mine; deterioration in economic conditions (including continued inflation) or changes in consumption patterns of our customers may decrease demand for our products, impair our ability to collect customer receivables and impair our ability to access capital; volatility and wide fluctuation in coal prices based upon a number of factors beyond our control; an extended decline in the prices we receive for our coal affecting our operating results and cash flows; significant downtime of our equipment or inability to obtain equipment, parts or raw materials; decreases in the availability of, or increases in the price of, commodities or capital equipment used in our coal mining operations; our reliance on major customers, our ability to collect payment from our customers and uncertainty in connection with our customer contracts; our inability to acquire additional coal reserves or resources that are economically recoverable; alternative steel production technologies that may reduce demand for our coal; the availability and reliability of transportation facilities and other systems that deliver our coal to market and fluctuations in transportation costs; a loss of our competitive position; foreign currency fluctuations that could adversely affect the competitiveness of our coal abroad; the risks related to the fact that a significant portion of our production is sold in international markets (and may grow) and our compliance with export control and anti-corruption laws; coal users switching to other fuels in order to comply with various environmental standards related to coal combustion emissions; the impact of current and future regulations to address climate change, the discharge, disposal and clean-up of hazardous substances and wastes and employee health and safety on our operating costs as well as on the market for coal; the risks inherent in coal operations, including being subject to unexpected disruptions caused by adverse geological conditions, equipment failure, delays in moving out longwall equipment, railroad derailments, security breaches or terroristic acts and other hazards, delays in the completion of significant construction or repair of equipment, fires, explosions, seismic activities, accidents and weather conditions; our inability to manage our operational footprint in response to changes in demand; failure to obtain or renew surety bonds or insurance coverages on acceptable terms; the effects of coordinating our operations with oil and natural gas drillers and distributors operating on our land; our inability to obtain financing for capital expenditures on satisfactory terms; the effects of our securities being excluded from certain investment funds as a result of environmental, social and governance practices; the effects of global conflicts on commodity prices and supply chains; the effect of new or existing laws, regulations, tariffs, executive orders or other trade measures; our inability to find suitable joint venture partners or acquisition targets or integrating the operations of future acquisitions into our operations; obtaining, maintaining and renewing governmental permits and approvals for our coal operations; the effects of asset retirement obligations, employee-related long-term liabilities and certain other liabilities; uncertainties in estimating our economically recoverable coal reserves; defects in our chain of title for our undeveloped reserves or failure to acquire additional property to perfect our title to coal rights; the outcomes of various legal proceedings; the risk of our debt agreements, our debt and changes in interest rates affecting our operating results and cash flows; information theft, data corruption, operational disruption and/or financial loss resulting from a terrorist attack or cyber incident; the potential failure to retain and attract qualified personnel of the company; failure to maintain effective internal control over financial reporting; uncertainty with respect to the company’s common stock, potential stock price volatility and future dilution; uncertainty regarding the timing and value of any dividends we may declare; uncertainty as to whether we will repurchase shares of our common stock; inability of stockholders to bring legal action against us in any forum other than the state courts of Delaware; the risk that the businesses of the company and Arch Resources, Inc. will not be integrated successfully; the risk that the anticipated benefits of the merger may not be realized or may take longer to realize than expected; the risks related to new or existing tariffs and other trade measures; and other unforeseen factors. All such factors are difficult to predict, are beyond Core’s control, and are subject to additional risks and uncertainties, including those detailed in Core’s annual report on Form 10-K for the year ended December 31, 2024, quarterly reports on Form 10-Q, and current reports on Form 8-K that are available on Core’s website at www.corenaturalresources.com and on the SEC’s website at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Core does not undertake any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

3 THIRD QUARTER 2025 HIGHLIGHTS • Delivers solid results and free cash flow despite a mixed market environment Reports net income of $31.6 million, or $0.61 per diluted share, and adjusted EBITDA1 of $141.2 million Both totals included fire extinguishment and idle mine cash costs of $18.4 million at Leer South and an initial recovery of insurance proceeds related to the Leer South combustion-related event of $19.4 million • Generates net cash provided by operating activities of $87.9 million and free cash flow1 of $38.9 million • Increases cash and cash equivalents by $31.5 million and overall liquidity by $47.5 million • Achieves another strong production and sales volume performance at the Pennsylvania Mining Complex • Transitions to a more advantageous reserve area at the West Elk mine • Raises PRB volume guidance once again, taking advantage of improving domestic coal generation • Signs commitments across all segments and all periods – at prices projected to provide attractive margins and healthy free cash flow – totaling nearly 26 million tons • Returns $24.6 million to stockholders via share repurchases and quarterly dividends, while increasing year-to-date capital return total to $218.3 million 1 Adjusted EBITDA and free cash flow are non-GAAP measures; see the Appendix for a reconciliation of these amounts to the most directly comparable GAAP measures.

4 THE PREMIER PURE-PLAY GLOBAL COAL PRODUCER, STRATEGICALLY POSITIONED TO SUPPLY THE WORLD’S GROWING STEEL, INDUSTRIAL, AND ENERGY NEEDS WHILE MANAGING BY OUR CORE VALUES OF SAFETY AND COMPLIANCE, CONTINUOUS IMPROVEMENT, AND FINANCIAL PERFORMANCE 4 Safety-Based Culture Highly skilled workforce with a deeply ingrained, safety-based culture and a goal of zero life-altering accidents, complemented by a deep commitment to environmental stewardship Innovation Leader in its core business and via its Innovations business unit, which is advancing new, coal-based applications in areas such as aerospace and defense Logistical Excellence Industry-leading logistical network anchored by ownership positions in two large-scale East Coast marine export terminals Unmatched Scale 2024 sales volume of 85 million tons and 2024 revenue1 of $4.6 billion Global Reach Supplies customers in ~25 countries located on five continents with one of the industry’s broadest arrays of coal products Strategic Diversification across multiple, high-potential market segments, with strong penetration in fast-growing seaborne markets as well as newly resurgent, AI-driven domestic power markets Longwall Powerhouse ~90% of projected seaborne export volumes from world-class longwall mines Low-Cost Advantage First quartile on cost curve among U.S. metallurgical and seaborne thermal coal suppliers Long-Lived Reserves Decades of high-quality reserves that will support low-cost mining at flagship longwall operations through 2050 Leading Supplier Among largest global suppliers of premium, High-Vol A coking coal Unrivaled Quality Highest calorific value thermal coal supplied to the seaborne marketplace Infrastructure Focus 75% of exports directed to steelmakers, cement manufacturers, and infrastructure providers, as well as other industrial users Compelling Cash Generation Highly cash-generative assets across a wide range of market environments, with a strategic mix of contracted and market- exposed volumes Financial Strength One of the industry’s strongest balance sheets and liquidity positions, with a net positive cash profile Leading Capital Return Program Industry-leading capital return program weighted towards share repurchases and capable of delivering robust returns across a wide range of market environments 1 2024 CONSOL Energy Inc. (“CONSOL”) revenue of $2,164 million, excluding miscellaneous other income not derived from customers and gain on sale of assets to conform historical financial information to current presentation; 2024 Arch Resources, Inc. (“Arch”) revenue of $2,433 million. Note: Units in short tons Source: Internal and Wood Mackenzie

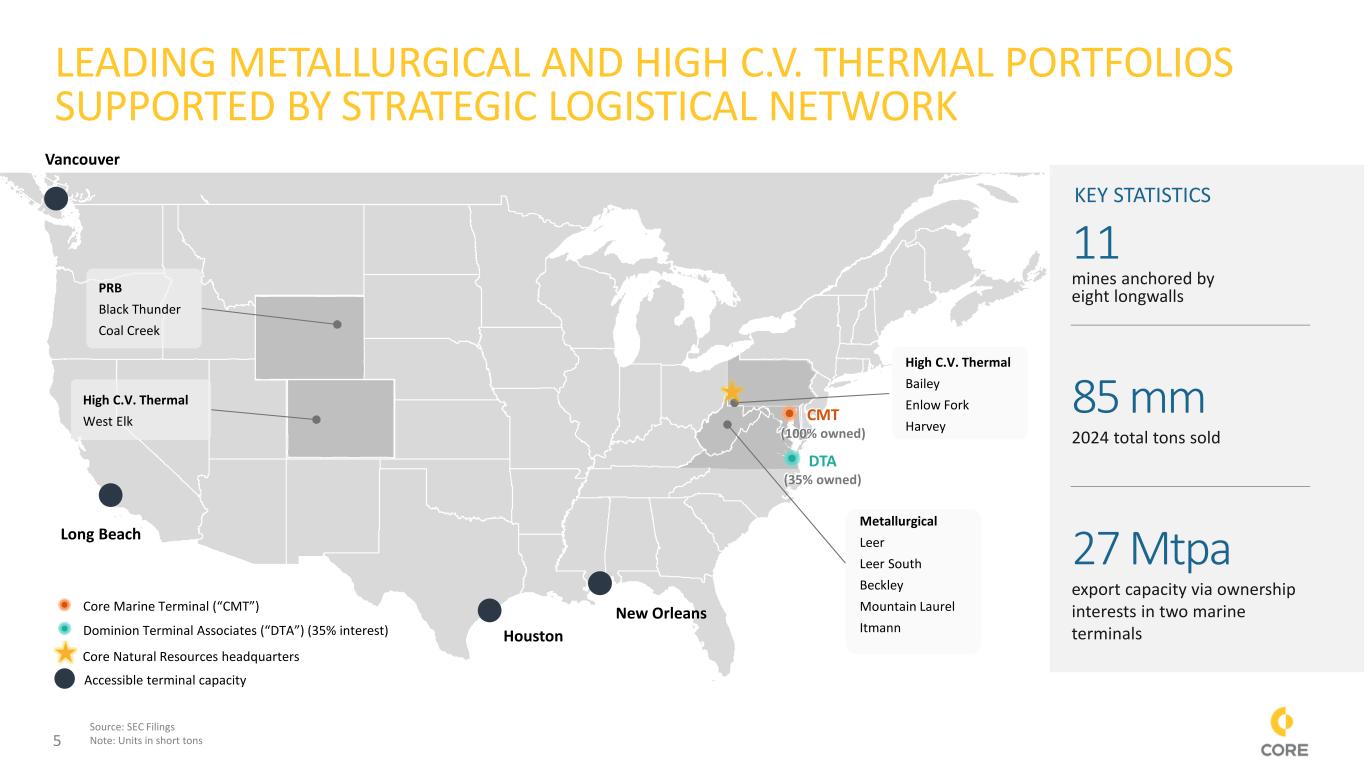

5 11 mines anchored by eight longwalls 85 mm 2024 total tons sold 27 Mtpa export capacity via ownership interests in two marine terminals KEY STATISTICS Core Marine Terminal (“CMT”) Accessible terminal capacity Core Natural Resources headquarters Vancouver Long Beach Houston New Orleans Dominion Terminal Associates (“DTA”) (35% interest) CMT (100% owned) High C.V. Thermal Bailey Enlow Fork Harvey PRB Black Thunder Coal Creek DTA (35% owned) LEADING METALLURGICAL AND HIGH C.V. THERMAL PORTFOLIOS SUPPORTED BY STRATEGIC LOGISTICAL NETWORK Metallurgical Leer Leer South Beckley Mountain Laurel Itmann High C.V. Thermal West Elk Source: SEC Filings Note: Units in short tons

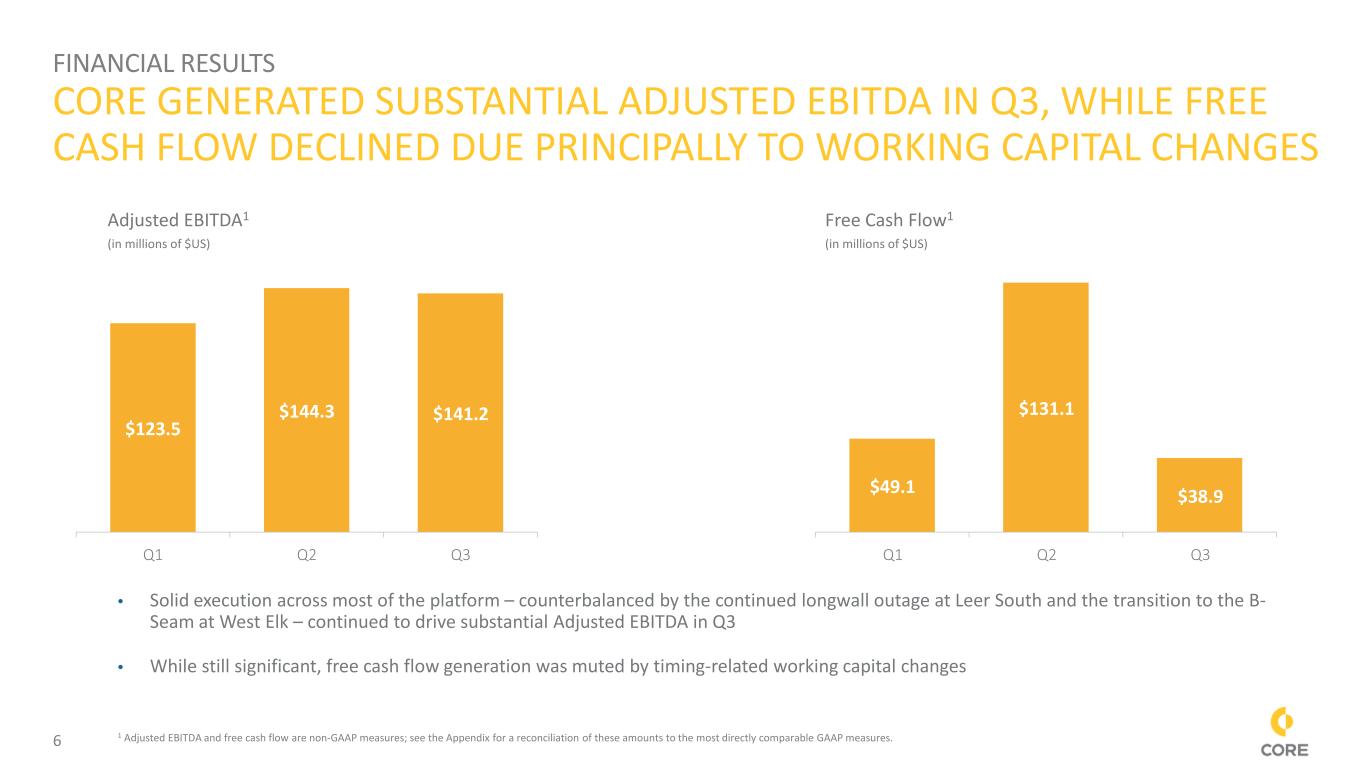

6 FINANCIAL RESULTS CORE GENERATED SUBSTANTIAL ADJUSTED EBITDA IN Q3, WHILE FREE CASH FLOW DECLINED DUE PRINCIPALLY TO WORKING CAPITAL CHANGES $123.5 $144.3 $141.2 Q1 Q2 Q3 Adjusted EBITDA1 (in millions of $US) • Solid execution across most of the platform – counterbalanced by the continued longwall outage at Leer South and the transition to the B- Seam at West Elk – continued to drive substantial Adjusted EBITDA in Q3 • While still significant, free cash flow generation was muted by timing-related working capital changes $49.1 $131.1 $38.9 Q1 Q2 Q3 Free Cash Flow1 (in millions of $US) 1 Adjusted EBITDA and free cash flow are non-GAAP measures; see the Appendix for a reconciliation of these amounts to the most directly comparable GAAP measures.

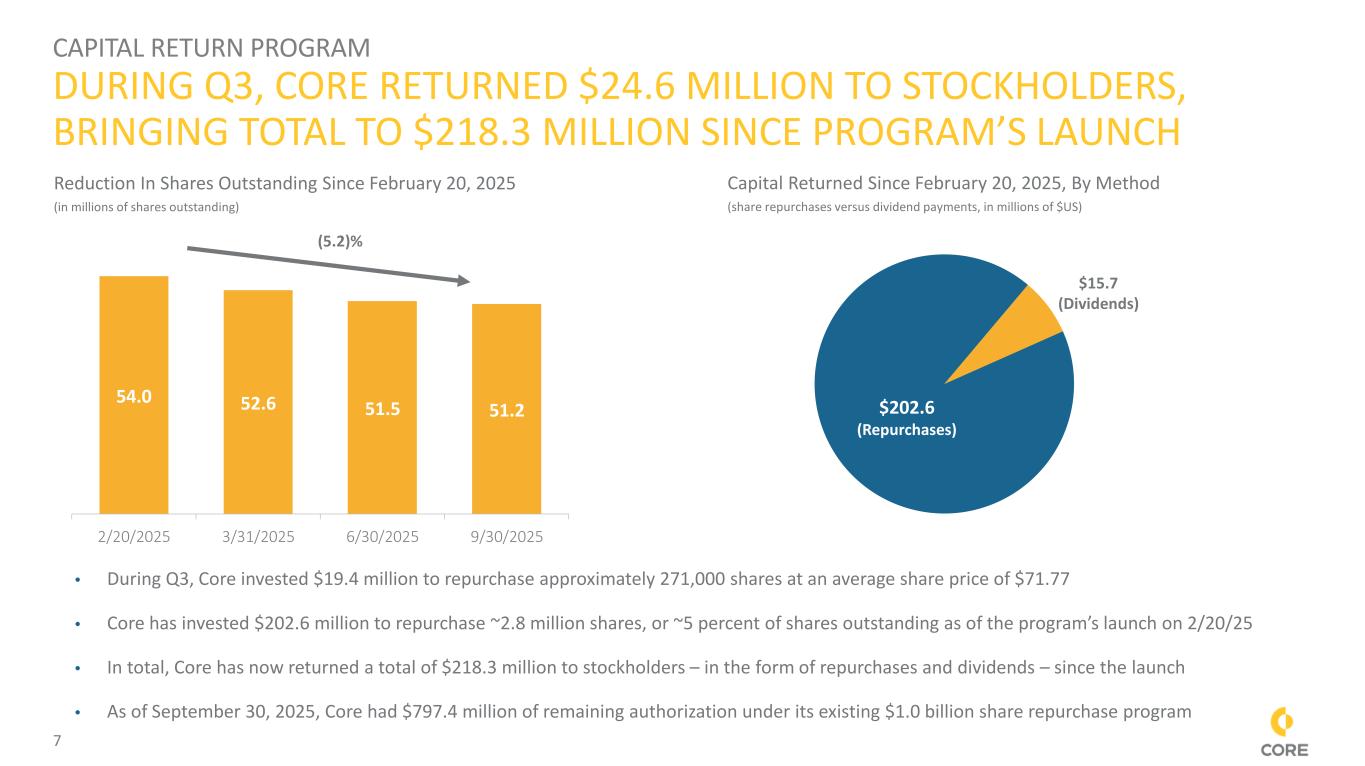

7 CAPITAL RETURN PROGRAM DURING Q3, CORE RETURNED $24.6 MILLION TO STOCKHOLDERS, BRINGING TOTAL TO $218.3 MILLION SINCE PROGRAM’S LAUNCH 54.0 52.6 51.5 51.2 2/20/2025 3/31/2025 6/30/2025 9/30/2025 Reduction In Shares Outstanding Since February 20, 2025 (in millions of shares outstanding) Capital Returned Since February 20, 2025, By Method (share repurchases versus dividend payments, in millions of $US) $202.6 (Repurchases) $15.7 (Dividends) (5.2)% • During Q3, Core invested $19.4 million to repurchase approximately 271,000 shares at an average share price of $71.77 • Core has invested $202.6 million to repurchase ~2.8 million shares, or ~5 percent of shares outstanding as of the program’s launch on 2/20/25 • In total, Core has now returned a total of $218.3 million to stockholders – in the form of repurchases and dividends – since the launch • As of September 30, 2025, Core had $797.4 million of remaining authorization under its existing $1.0 billion share repurchase program

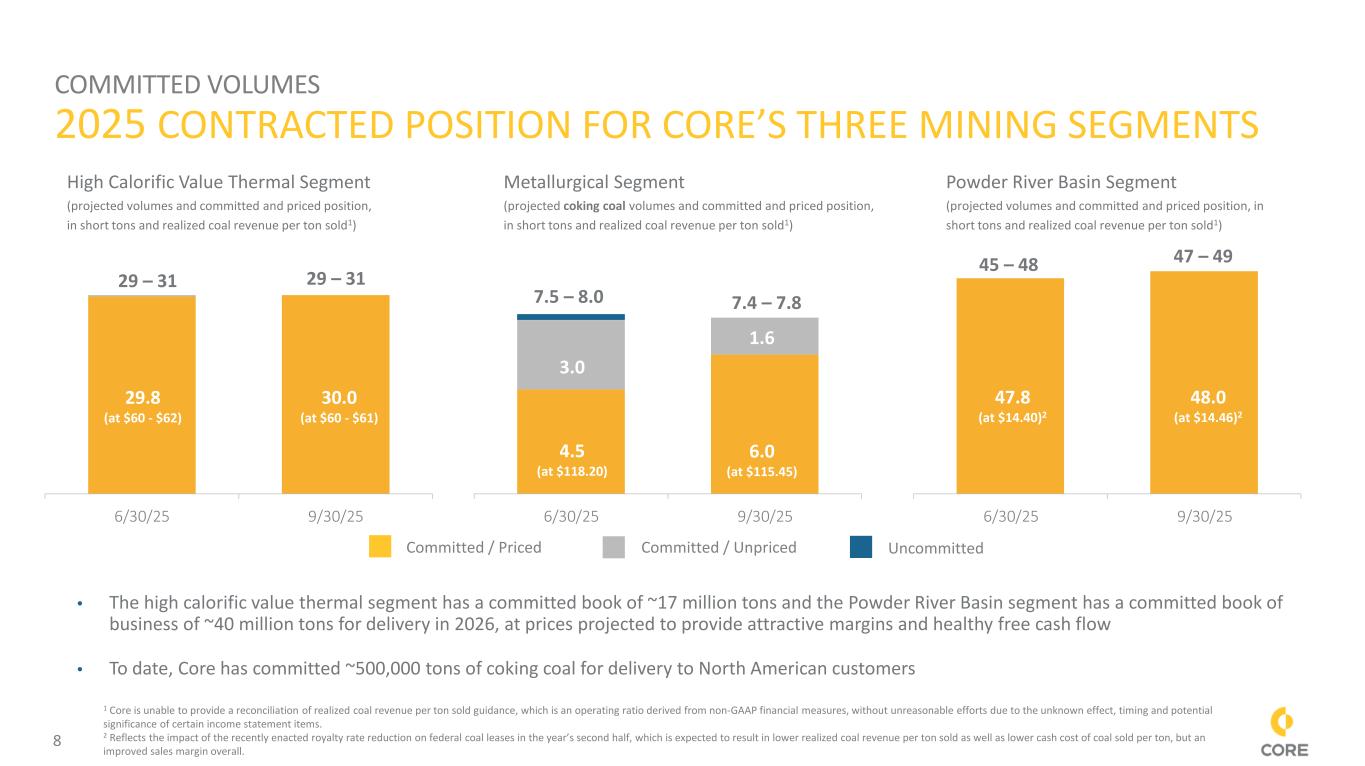

8 COMMITTED VOLUMES 2025 CONTRACTED POSITION FOR CORE’S THREE MINING SEGMENTS 6/30/25 9/30/25 High Calorific Value Thermal Segment (projected volumes and committed and priced position, in short tons and realized coal revenue per ton sold1) Metallurgical Segment (projected coking coal volumes and committed and priced position, in short tons and realized coal revenue per ton sold1) 29.8 (at $60 - $62) 30.0 (at $60 - $61) 29 – 31 29 – 31 Committed / Priced 6/30/25 9/30/25 3.5 6.0 (at $115.45) 7.5 – 8.0 7.4 – 7.8 3.0 4.5 (at $118.20) 3.0 1.6 Powder River Basin Segment (projected volumes and committed and priced position, in short tons and realized coal revenue per ton sold1) 6/30/25 9/30/25 47.8 (at $14.40)2 48.0 (at $14.46)2 45 – 48 47 – 49 • The high calorific value thermal segment has a committed book of ~17 million tons and the Powder River Basin segment has a committed book of business of ~40 million tons for delivery in 2026, at prices projected to provide attractive margins and healthy free cash flow • To date, Core has committed ~500,000 tons of coking coal for delivery to North American customers 1 Core is unable to provide a reconciliation of realized coal revenue per ton sold guidance, which is an operating ratio derived from non-GAAP financial measures, without unreasonable efforts due to the unknown effect, timing and potential significance of certain income statement items. 2 Reflects the impact of the recently enacted royalty rate reduction on federal coal leases in the year’s second half, which is expected to result in lower realized coal revenue per ton sold as well as lower cash cost of coal sold per ton, but an improved sales margin overall. Committed / Unpriced Uncommitted

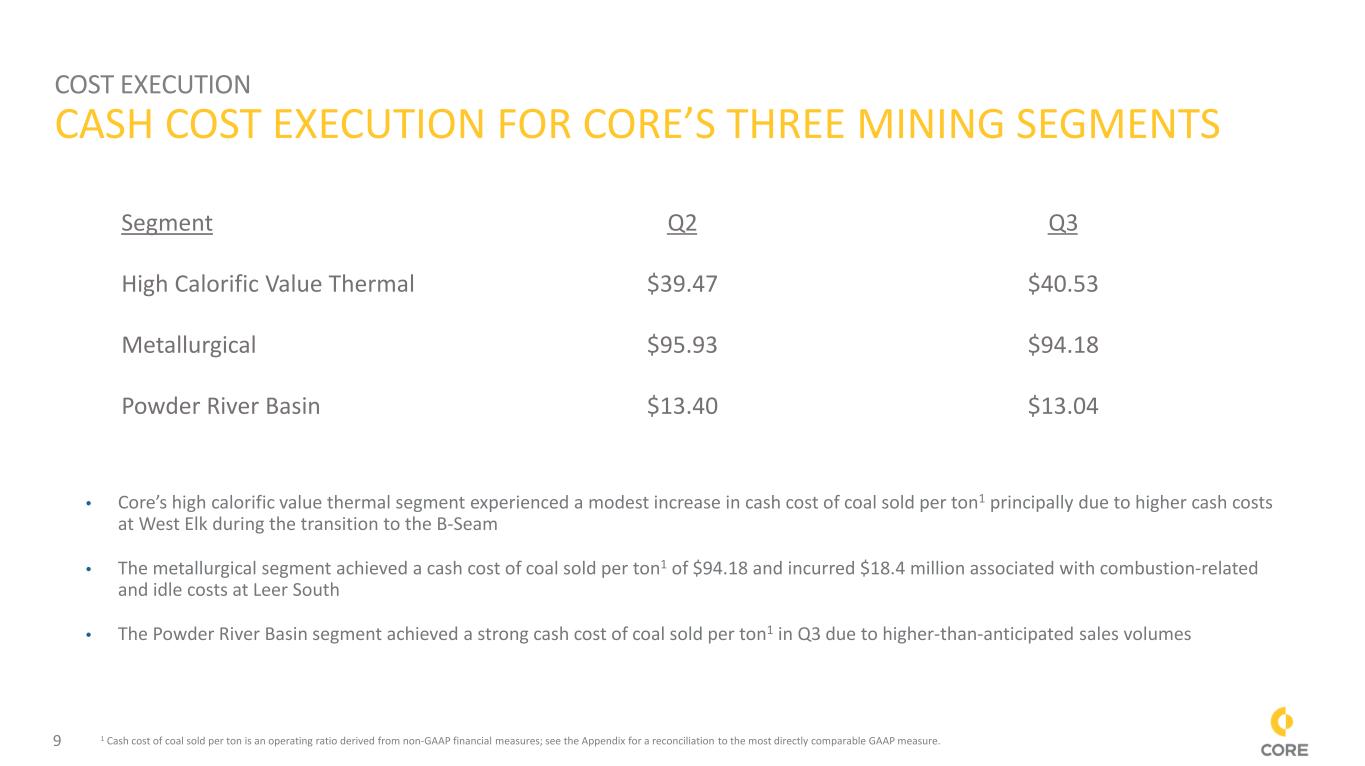

9 COST EXECUTION CASH COST EXECUTION FOR CORE’S THREE MINING SEGMENTS Segment Q2 Q3 High Calorific Value Thermal $39.47 $40.53 Metallurgical $95.93 $94.18 Powder River Basin $13.40 $13.04 • Core’s high calorific value thermal segment experienced a modest increase in cash cost of coal sold per ton1 principally due to higher cash costs at West Elk during the transition to the B-Seam • The metallurgical segment achieved a cash cost of coal sold per ton1 of $94.18 and incurred $18.4 million associated with combustion-related and idle costs at Leer South • The Powder River Basin segment achieved a strong cash cost of coal sold per ton1 in Q3 due to higher-than-anticipated sales volumes 1 Cash cost of coal sold per ton is an operating ratio derived from non-GAAP financial measures; see the Appendix for a reconciliation to the most directly comparable GAAP measure.

10 LEER SOUTH IS READY TO RECOVER, REPOSITION, AND RESTART THE LONGWALL SYSTEM ONCE MSHA PERSONNEL ARE AVAILABLE • The Leer South longwall has been idled since January 13, 2025, in the wake of a combustion-related event in a mined-out area of the operation • The Core team is prepared to reenter the Leer South mine to recover, reposition, and restart the longwall system as soon as the necessary governmental personnel are made available given the current government shutdown • The operating team remains confident that the longwall was largely unaffected by the combustion event • Core expects to incur fire extinguishment and idle costs of $15 to $25 million at Leer South in Q4 2025 • Leer South is a key asset in Core’s operating portfolio, and the company expects the restart of the longwall to drive substantially improved contributions from its metallurgical segment in future periods

11 • In April 2025, President Trump issued a series of executive orders intended to reduce the regulatory burden on America’s coal- based power plants and ensure the long-term preservation of the U.S. coal fleet • On July 4th, the President signed into law the “One Big Beautiful Bill Act,” which included provisions that stand to benefit Core • Designation of metallurgical coal as a “critical material” under the Advanced Manufacturing Tax Credit (45X) • Reduction in the royalty rate for federal coal leases • Significant cuts to federal subsidies for renewable energy • Other provisions that could prove beneficial over time, including language intended to facilitate investments in advanced power projects via Department of Energy loans as well as to facilitate an increase in the leasing of federal coal • On September 30th – at an event dubbed “Coal Day 2.0” – the Trump Administration and its National Energy Dominance Council announced additional energy and regulatory initiatives spanning the Department of Energy, the Department of the Interior, and the Environmental Protection Agency • Central to those initiatives was an overarching objective to ensure that America’s coal-based power generation fleet – which the Administration views as critical to a reliable, resilient and secure power grid – is preserved and maintained • Core applauds the President and his Administration for taking these historic steps to help ensure that coal remains a key element of America’s future energy supply as well as a stabilizing force in both domestic and international markets RECENT POLICY DEVELOPMENTS SHOULD ENHANCE COAL’S COMPETITIVENESS AND OUTLOOK IN BOTH THE U.S. AND OVERSEAS

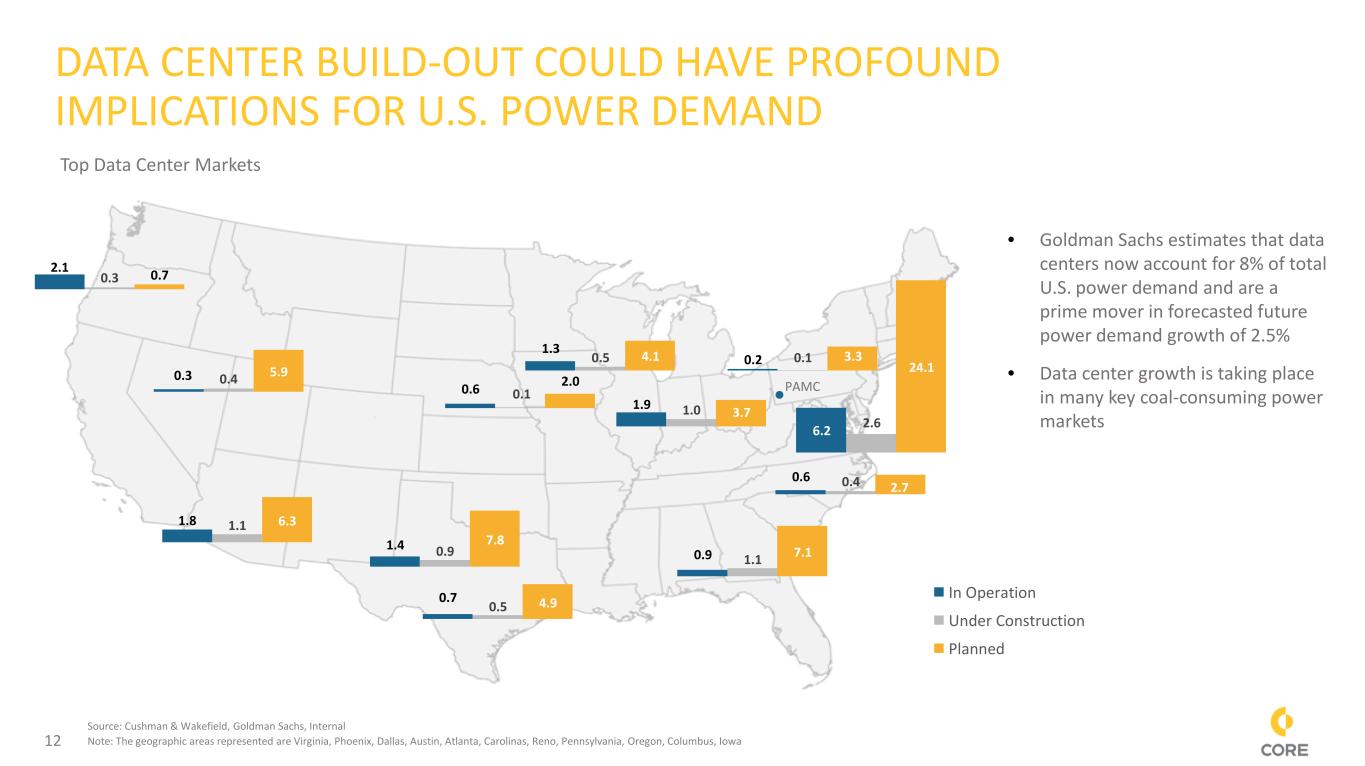

12 DATA CENTER BUILD-OUT COULD HAVE PROFOUND IMPLICATIONS FOR U.S. POWER DEMAND • Goldman Sachs estimates that data centers now account for 8% of total U.S. power demand and are a prime mover in forecasted future power demand growth of 2.5% • Data center growth is taking place in many key coal-consuming power markets Source: Cushman & Wakefield, Goldman Sachs, Internal Note: The geographic areas represented are Virginia, Phoenix, Dallas, Austin, Atlanta, Carolinas, Reno, Pennsylvania, Oregon, Columbus, Iowa Top Data Center Markets (GW of capacity) 6.2 2.6 24.1 0.0 0.0 In Operation Under Construction Planned 1.8 1.1 6.3 1.4 0.9 7.8 0.9 1.1 7.1 1.3 0.5 4.1 0.7 0.5 4.9 0.6 0.4 2.7 0.3 0.4 5.9 2.1 0.3 0.7 1.9 1.0 3.7 0.6 0.1 2.0 PAMC 0.2 0.1 3.3

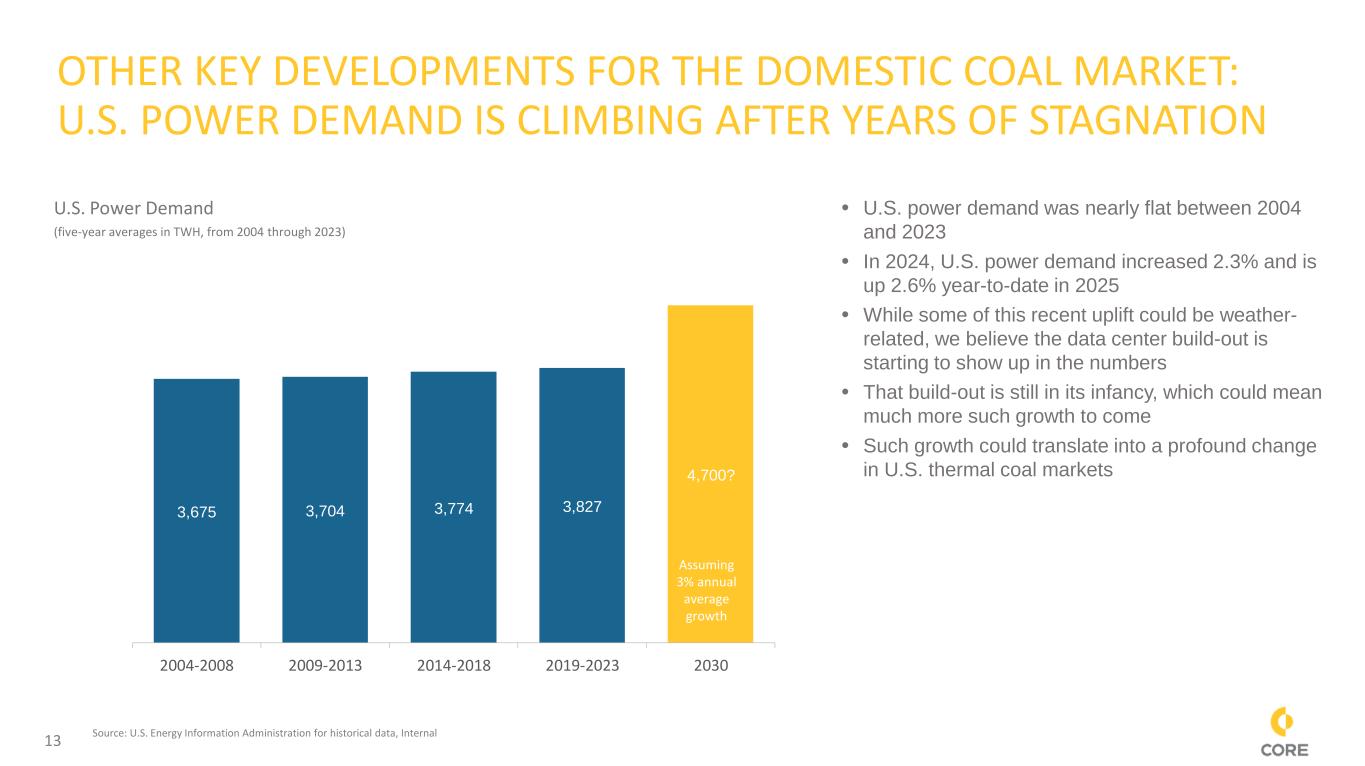

13 OTHER KEY DEVELOPMENTS FOR THE DOMESTIC COAL MARKET: U.S. POWER DEMAND IS CLIMBING AFTER YEARS OF STAGNATION • U.S. power demand was nearly flat between 2004 and 2023 • In 2024, U.S. power demand increased 2.3% and is up 2.6% year-to-date in 2025 • While some of this recent uplift could be weather- related, we believe the data center build-out is starting to show up in the numbers • That build-out is still in its infancy, which could mean much more such growth to come • Such growth could translate into a profound change in U.S. thermal coal markets Source: U.S. Energy Information Administration for historical data, Internal 3,675 3,704 3,774 3,827 4,700? 2004-2008 2009-2013 2014-2018 2019-2023 2030 Assuming 3% annual average growth U.S. Power Demand (five-year averages in TWH, from 2004 through 2023)

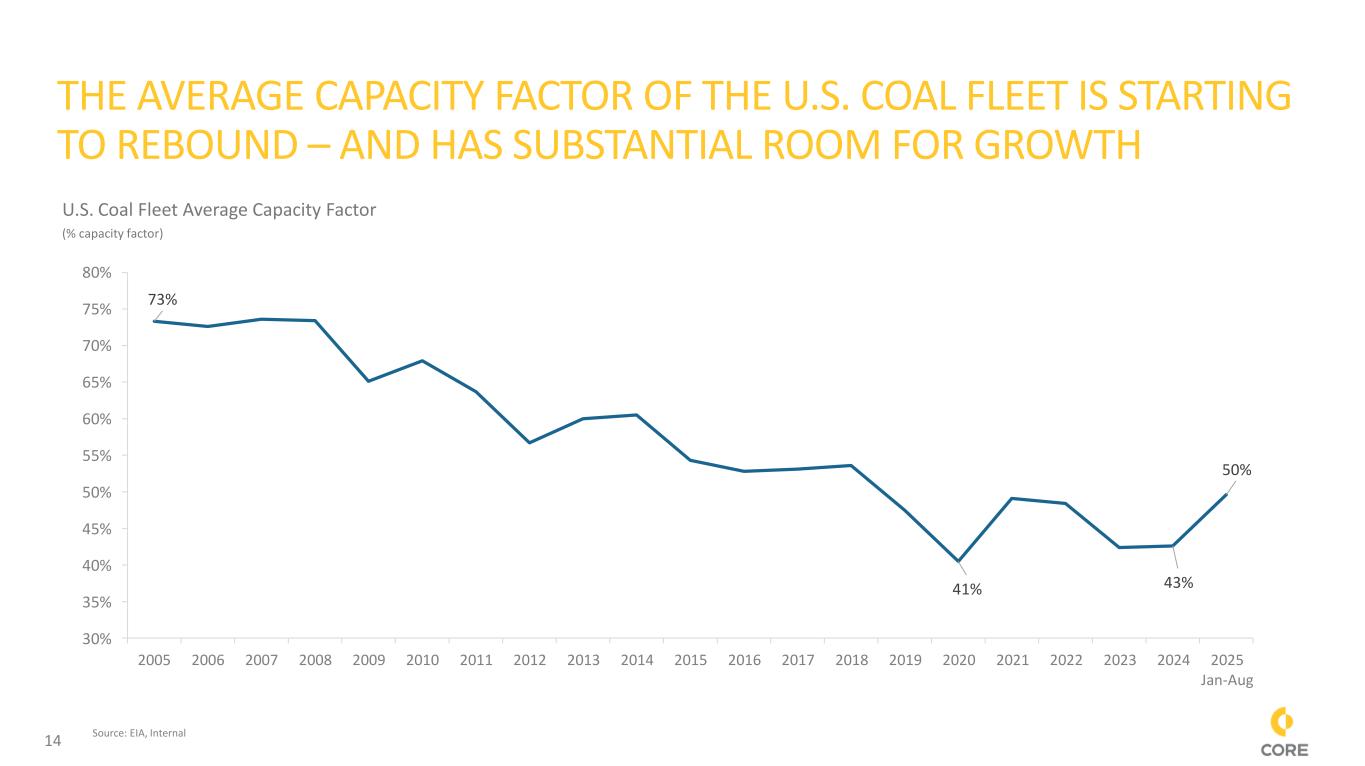

14 THE AVERAGE CAPACITY FACTOR OF THE U.S. COAL FLEET IS STARTING TO REBOUND – AND HAS SUBSTANTIAL ROOM FOR GROWTH Source: EIA, Internal 73% 41% 43% 50% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Jan-Aug U.S. Coal Fleet Average Capacity Factor (% capacity factor)

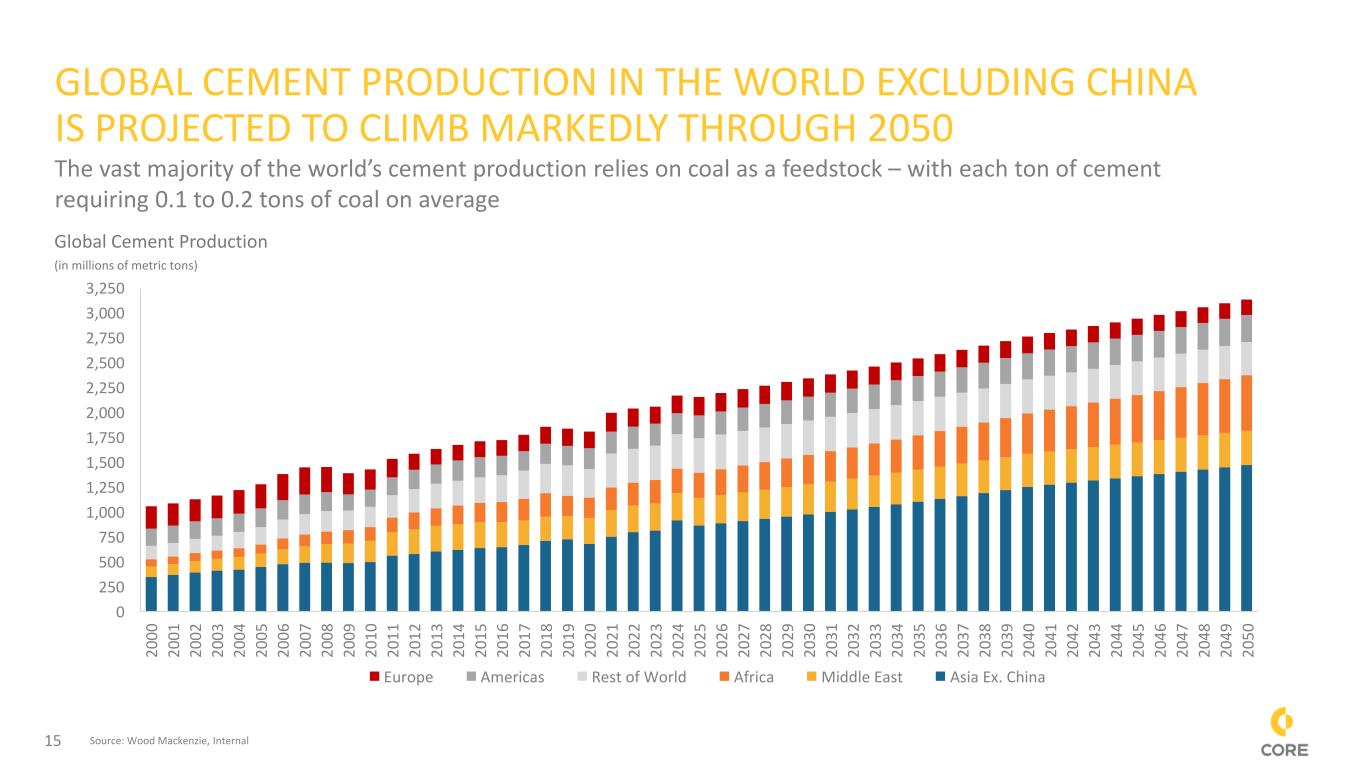

15 GLOBAL CEMENT PRODUCTION IN THE WORLD EXCLUDING CHINA IS PROJECTED TO CLIMB MARKEDLY THROUGH 2050 Global Cement Production (in millions of metric tons) Source: Wood Mackenzie, Internal 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2,750 3,000 3,250 2 00 0 2 00 1 2 00 2 2 00 3 2 00 4 2 00 5 2 00 6 2 00 7 2 00 8 2 00 9 2 01 0 2 01 1 2 01 2 2 01 3 2 01 4 2 01 5 2 01 6 2 01 7 2 01 8 2 01 9 2 02 0 2 02 1 2 02 2 2 02 3 2 02 4 2 02 5 2 02 6 2 02 7 2 02 8 2 02 9 2 03 0 2 03 1 2 03 2 2 03 3 2 03 4 2 03 5 2 03 6 2 03 7 2 03 8 2 03 9 2 04 0 2 04 1 2 04 2 2 04 3 2 04 4 2 04 5 2 04 6 2 04 7 2 04 8 2 04 9 2 05 0 Europe Americas Rest of World Africa Middle East Asia Ex. China The vast majority of the world’s cement production relies on coal as a feedstock – with each ton of cement requiring 0.1 to 0.2 tons of coal on average

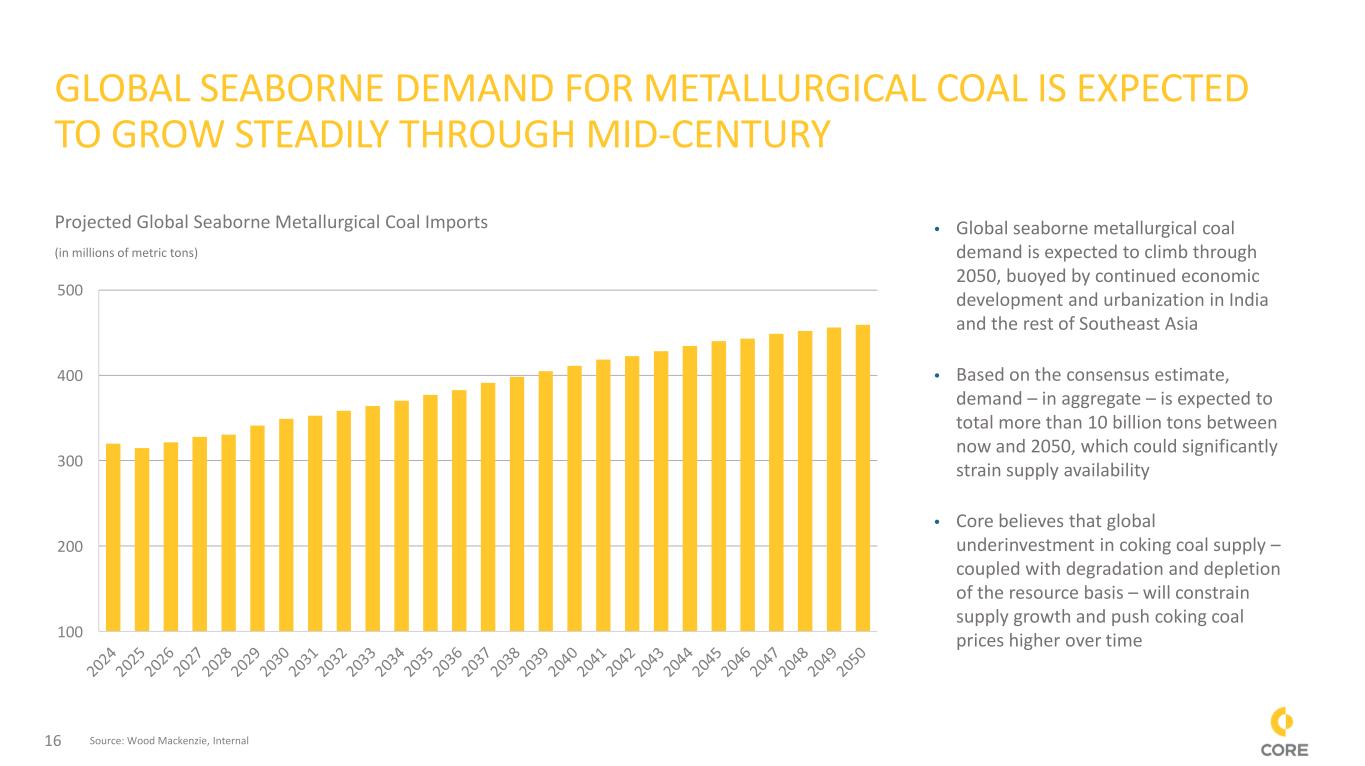

16 GLOBAL SEABORNE DEMAND FOR METALLURGICAL COAL IS EXPECTED TO GROW STEADILY THROUGH MID-CENTURY 100 200 300 400 500 • Global seaborne metallurgical coal demand is expected to climb through 2050, buoyed by continued economic development and urbanization in India and the rest of Southeast Asia • Based on the consensus estimate, demand – in aggregate – is expected to total more than 10 billion tons between now and 2050, which could significantly strain supply availability • Core believes that global underinvestment in coking coal supply – coupled with degradation and depletion of the resource basis – will constrain supply growth and push coking coal prices higher over time Projected Global Seaborne Metallurgical Coal Imports (in millions of metric tons) Source: Wood Mackenzie, Internal

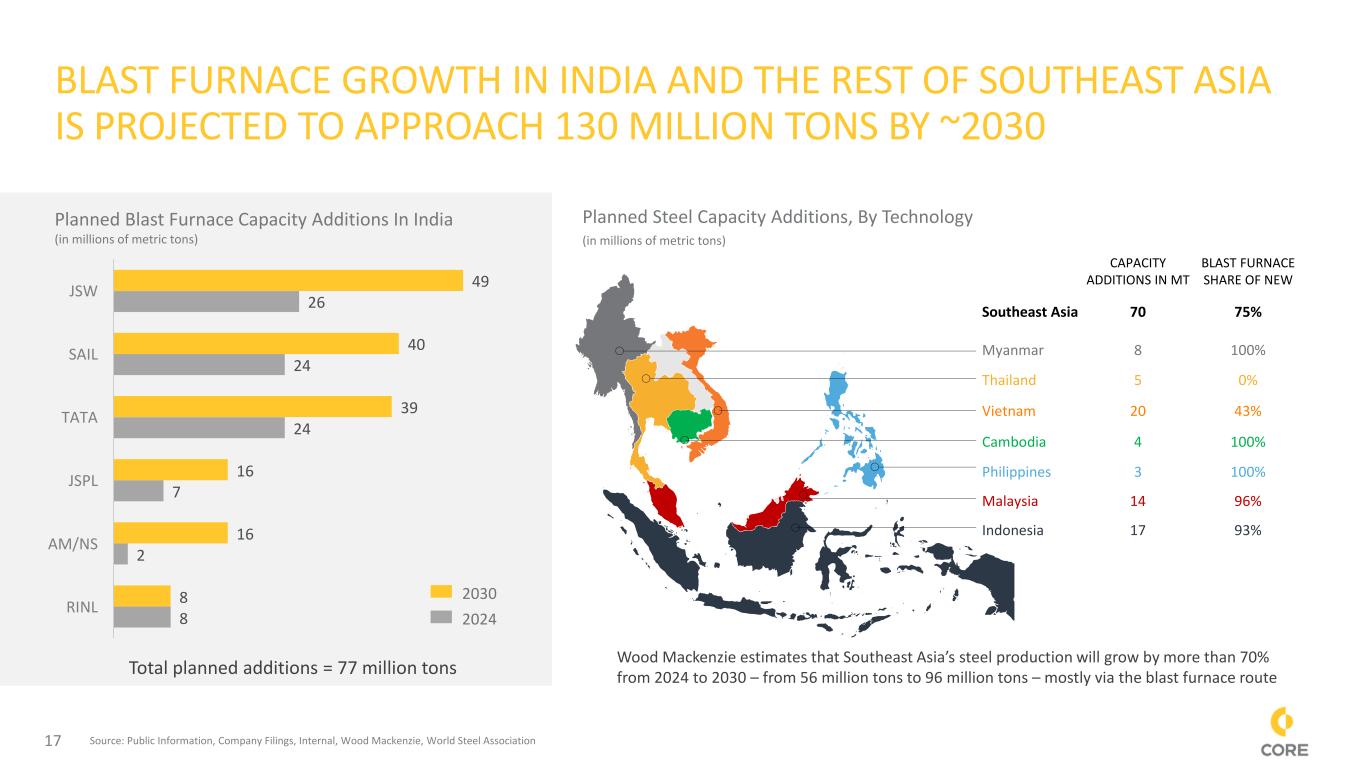

17 BLAST FURNACE GROWTH IN INDIA AND THE REST OF SOUTHEAST ASIA IS PROJECTED TO APPROACH 130 MILLION TONS BY ~2030 8 2 7 24 24 26 8 16 16 39 40 49 RINL AM/NS JSPL TATA SAIL JSW Wood Mackenzie estimates that Southeast Asia’s steel production will grow by more than 70% from 2024 to 2030 – from 56 million tons to 96 million tons – mostly via the blast furnace route Planned Blast Furnace Capacity Additions In India (in millions of metric tons) Planned Steel Capacity Additions, By Technology (in millions of metric tons) 2030 2024 CAPACITY ADDITIONS IN MT BLAST FURNACE SHARE OF NEW Southeast Asia 70 75% Myanmar 8 100% Thailand 5 0% Vietnam 20 43% Cambodia 4 100% Philippines 3 100% Malaysia 14 96% Indonesia 17 93% Source: Public Information, Company Filings, Internal, Wood Mackenzie, World Steel Association Total planned additions = 77 million tons

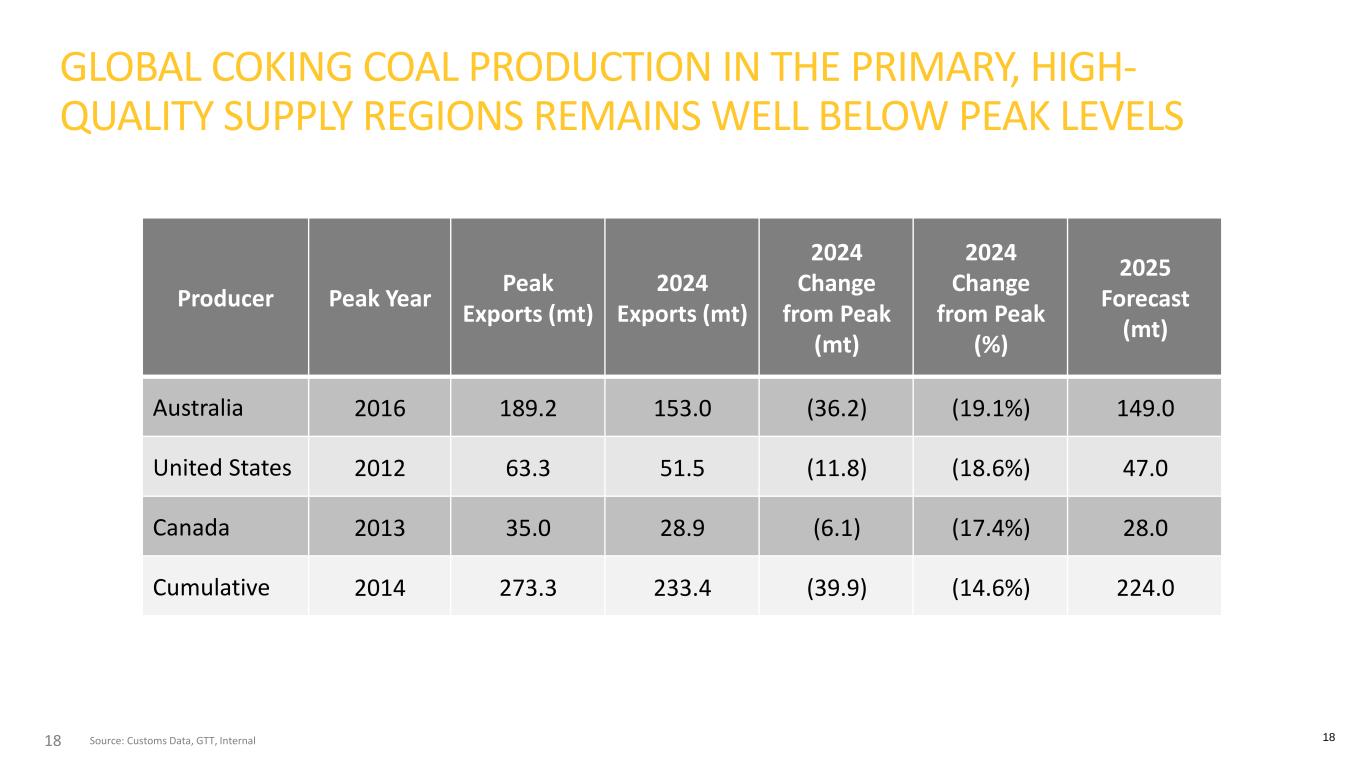

18 18 GLOBAL COKING COAL PRODUCTION IN THE PRIMARY, HIGH- QUALITY SUPPLY REGIONS REMAINS WELL BELOW PEAK LEVELS Producer Peak Year Peak Exports (mt) 2024 Exports (mt) 2024 Change from Peak (mt) 2024 Change from Peak (%) 2025 Forecast (mt) Australia 2016 189.2 153.0 (36.2) (19.1%) 149.0 United States 2012 63.3 51.5 (11.8) (18.6%) 47.0 Canada 2013 35.0 28.9 (6.1) (17.4%) 28.0 Cumulative 2014 273.3 233.4 (39.9) (14.6%) 224.0 Source: Customs Data, GTT, Internal

19 • REE and CM Opportunities at Core’s Large-Scale Western Operations • Core recently completed a sampling and analysis program at its PRB mines in collaboration with the University of Wyoming that demonstrated elevated ash-basis concentrations of certain rare earth elements (REEs) and critical minerals (CMs), particularly at the coal seam’s top and bottom • Among drill core and grab samples from coal seam margins at Black Thunder, dry ash-basis concentrations averaged in excess of 1,000 parts per million (ppm) for total REEs plus scandium, gallium, and germanium • When converted to a critical mineral oxide (CMO) reporting basis (which includes the 16 REEs plus scandium, gallium, and germanium, with the mass of each element converted to its oxide form), ash-basis concentrations at Black Thunder and Coal Creek varied between 284 and 3,047 ppm • This enrichment at the coal seam margins is consistent with what was observed during the U.S. Department of Energy-sponsored CORE-CM Project and reported by other operators in the Powder River Basin (PRB) • Primary magnetic rare earth element oxides (i.e., oxides of neodymium, praseodymium, dysprosium, and terbium) accounted for 20% of the total CMOs, and oxides of scandium, gallium, and germanium accounted for 17% of the total CMOs • Core is exploring a strategy to leverage the great scale of its PRB operations – which produced 46 million tons of coal in 2024 – in the areas of selective mining, upgrading, and extraction of REEs and CMs • REE and CM Opportunities at Core’s Large-Scale Eastern Operations • While concentrations at Core’s eastern operations were somewhat less elevated, the large flow rates and readily accessible nature of byproduct streams at the PAMC, Leer and Leer South operations could offer unique opportunities for further upgrading • Geochemical analysis of samples collected from the fine coal refuse streams at the PAMC and Leer operations showed an average dry ash-basis CMO concentration of 444 ppm, with a range of 344 to 568 ppm • Primary magnetic REE oxides accounted for 16% of total CMOs, and oxides of scandium, gallium, and germanium accounted for 29% • The scale of the PAMC’s preparation plant is unparalleled among U.S. coal mines and yields ~3 million tons per year of fine coal waste that is already very fine and can be readily diverted for further processing, and Leer and Leer South are proximal and could add to this economy of scale POTENTIAL FUTURE OPTIONALITY IN RARE EARTH ELEMENTS AND CRITICAL MINERALS ARENA

20 • The U.S. Department of Energy announced in August that it intends to issue nearly $1 billion of funding focused on securing the American critical minerals and materials supply chain, with some of this funding directed specifically toward critical minerals recovery from coal industry-based feedstocks • Core is now commencing the next phase of its REE and CM evaluation, which will include an expanded drilling program intended to facilitate additional characterization of the potential resource • Core is also engaging with technology and engineering providers and expects to launch an RFP process in coming months • The Core Innovations team also continues to advance its substantial raft of next generation coal applications and products in areas of strategic national interest, including aerospace, defense, and battery technology • In particular, Core’s C-BATT joint venture has the potential to reduce America’s heavy reliance on imported graphite, which is a key component in lithium-ion batteries • China is the primary source of U.S. battery-grade graphite imports POTENTIAL FUTURE OPTIONALITY IN RARE EARTH ELEMENTS AND CRITICAL MINERALS ARENA – NEXT STEPS

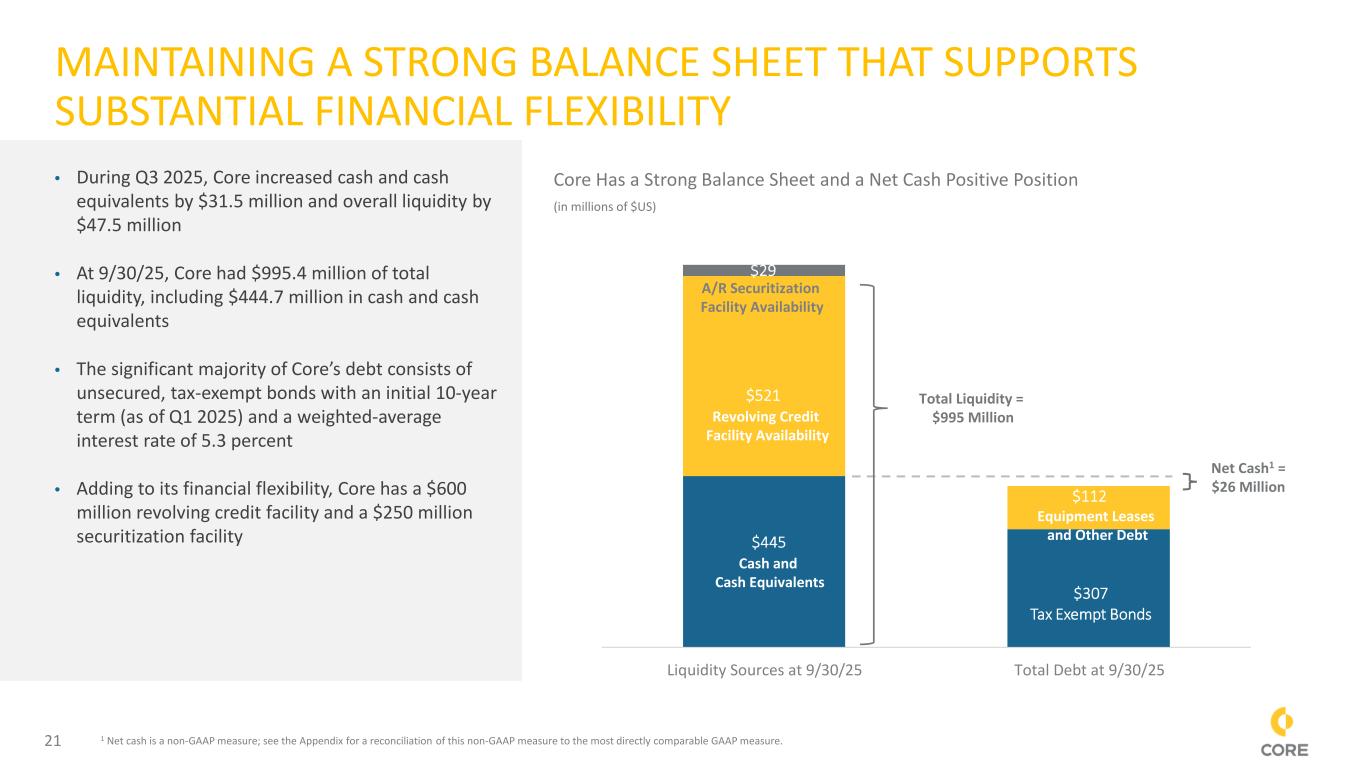

21 $445 $307 Tax Exempt Bonds $521 $112 $29 Liquidity Sources at 9/30/25 Total Debt at 9/30/25 Total Liquidity = $995 MillionRevolving Credit Facility Availability Cash and Cash Equivalents Equipment Leases and Other Debt MAINTAINING A STRONG BALANCE SHEET THAT SUPPORTS SUBSTANTIAL FINANCIAL FLEXIBILITY Equipment Leases• During Q3 2025, Cor increased cash and cash equivalents by $31.5 million and overall liquidity by $47.5 million • At 9/30/25, Core had $995.4 million of total liquidity, including $444.7 million in cash and cash equivalents • The significant majority of Core’s debt consists of unsecured, tax-exempt bonds with an initial 10-year term (as of Q1 2025) and a weighted-average interest rate of 5.3 percent • Adding to its financial flexibility, Core has a $600 million revolving credit facility and a $250 million securitization facility Core Has a Strong Balance Sheet and a Net Cash Positive Position (in millions of $US) Net Cash1 = $26 Million A/R Securitization Facility Availability 1 Net cash is a non-GAAP measure; see the Appendix for a reconciliation of this non-GAAP measure to the most directly comparable GAAP measure.

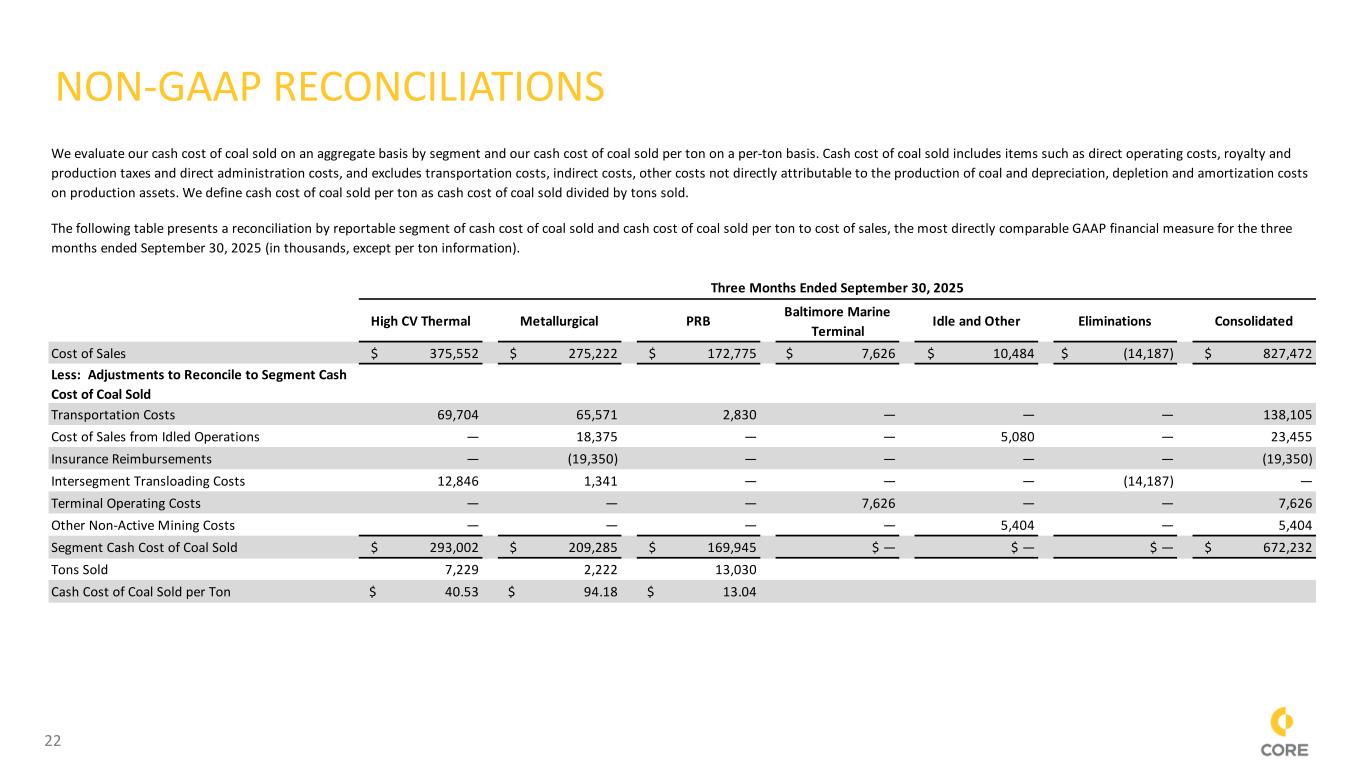

22 NON-GAAP RECONCILIATIONS High CV Thermal Metallurgical PRB Baltimore Marine Terminal Idle and Other Eliminations Consolidated Cost of Sales $ 375,552 $ 275,222 $ 172,775 $ 7,626 $ 10,484 $ (14,187) $ 827,472 Less: Adjustments to Reconcile to Segment Cash Cost of Coal Sold Transportation Costs 69,704 65,571 2,830 — — — 138,105 Cost of Sales from Idled Operations — 18,375 — — 5,080 — 23,455 Insurance Reimbursements — (19,350) — — — — (19,350) Intersegment Transloading Costs 12,846 1,341 — — — (14,187) — Terminal Operating Costs — — — 7,626 — — 7,626 Other Non-Active Mining Costs — — — — 5,404 — 5,404 Segment Cash Cost of Coal Sold $ 293,002 $ 209,285 $ 169,945 $ — $ — $ — $ 672,232 Tons Sold 7,229 2,222 13,030 Cash Cost of Coal Sold per Ton $ 40.53 $ 94.18 $ 13.04 Three Months Ended September 30, 2025 We evaluate our cash cost of coal sold on an aggregate basis by segment and our cash cost of coal sold per ton on a per-ton basis. Cash cost of coal sold includes items such as direct operating costs, royalty and production taxes and direct administration costs, and excludes transportation costs, indirect costs, other costs not directly attributable to the production of coal and depreciation, depletion and amortization costs on production assets. We define cash cost of coal sold per ton as cash cost of coal sold divided by tons sold. The following table presents a reconciliation by reportable segment of cash cost of coal sold and cash cost of coal sold per ton to cost of sales, the most directly comparable GAAP financial measure for the three months ended September 30, 2025 (in thousands, except per ton information).

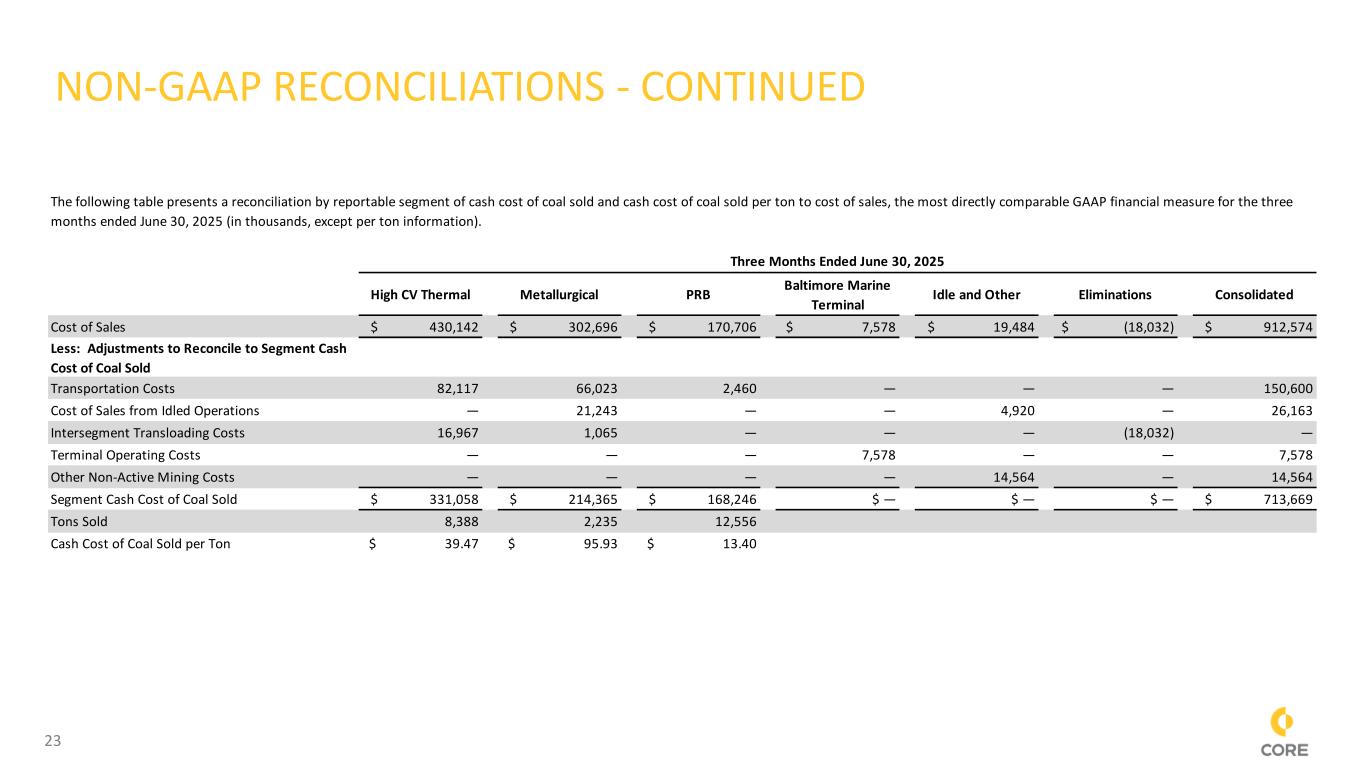

23 NON-GAAP RECONCILIATIONS - CONTINUED High CV Thermal Metallurgical PRB Baltimore Marine Terminal Idle and Other Eliminations Consolidated Cost of Sales $ 430,142 $ 302,696 $ 170,706 $ 7,578 $ 19,484 $ (18,032) $ 912,574 Less: Adjustments to Reconcile to Segment Cash Cost of Coal Sold Transportation Costs 82,117 66,023 2,460 — — — 150,600 Cost of Sales from Idled Operations — 21,243 — — 4,920 — 26,163 Intersegment Transloading Costs 16,967 1,065 — — — (18,032) — Terminal Operating Costs — — — 7,578 — — 7,578 Other Non-Active Mining Costs — — — — 14,564 — 14,564 Segment Cash Cost of Coal Sold $ 331,058 $ 214,365 $ 168,246 $ — $ — $ — $ 713,669 Tons Sold 8,388 2,235 12,556 Cash Cost of Coal Sold per Ton $ 39.47 $ 95.93 $ 13.40 The following table presents a reconciliation by reportable segment of cash cost of coal sold and cash cost of coal sold per ton to cost of sales, the most directly comparable GAAP financial measure for the three months ended June 30, 2025 (in thousands, except per ton information). Three Months Ended June 30, 2025

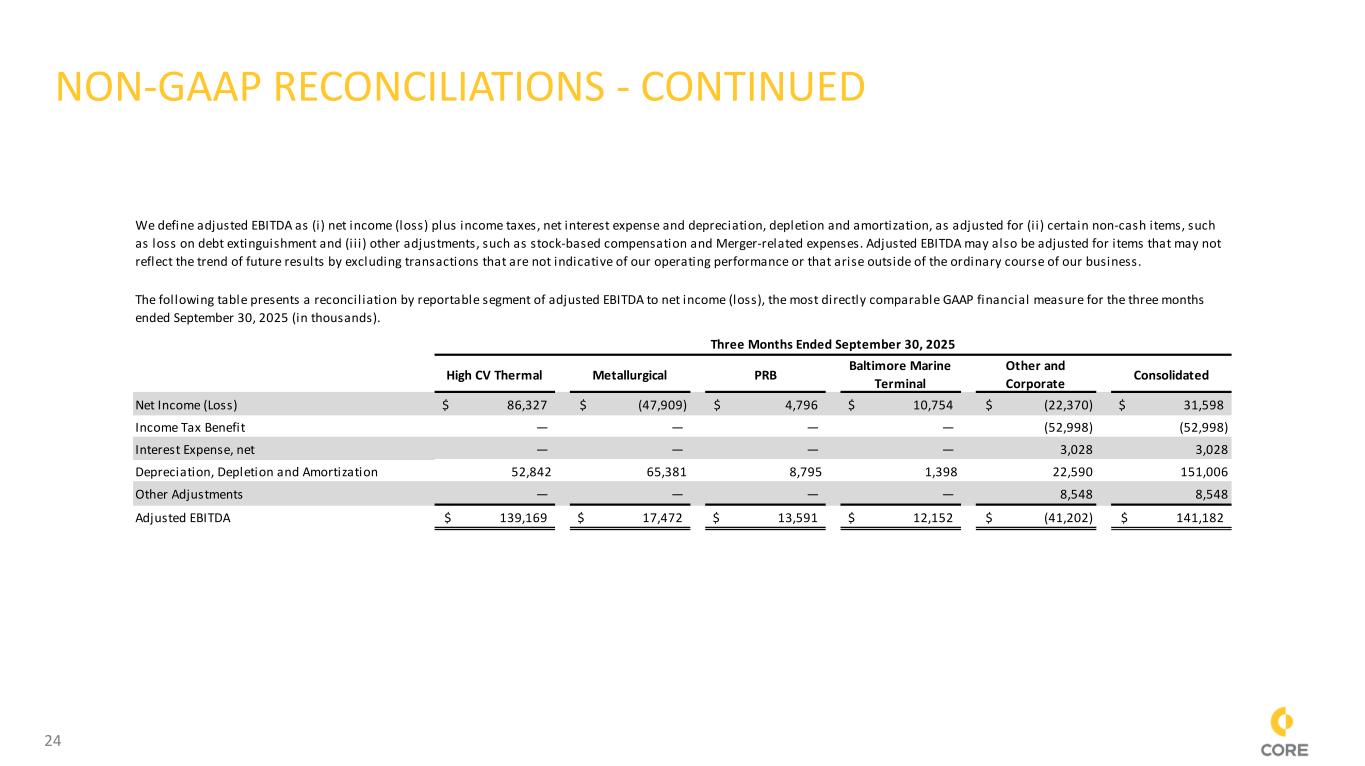

24 NON-GAAP RECONCILIATIONS - CONTINUED High CV Thermal Metallurgical PRB Baltimore Marine Terminal Other and Corporate Consolidated Net Income (Loss) 86,327$ (47,909)$ 4,796$ 10,754$ (22,370)$ 31,598$ Income Tax Benefit — — — — (52,998) (52,998) Interest Expense, net — — — — 3,028 3,028 Depreciation, Depletion and Amortization 52,842 65,381 8,795 1,398 22,590 151,006 Other Adjustments — — — — 8,548 8,548 Adjusted EBITDA 139,169$ 17,472$ 13,591$ 12,152$ (41,202)$ 141,182$ We define adjusted EBITDA as (i) net income (loss) plus income taxes, net interest expense and depreciation, depletion and amortization, as adjusted for (i i) certain non-cash items, such as loss on debt extinguishment and (i i i) other adjustments, such as stock-based compensation and Merger-related expenses. Adjusted EBITDA may also be adjusted for items that may not reflect the trend of future results by excluding transactions that are not indicative of our operating performance or that arise outside of the ordinary course of our business. The following table presents a reconcil iation by reportable segment of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure for the three months ended September 30, 2025 (in thousands). Three Months Ended September 30, 2025

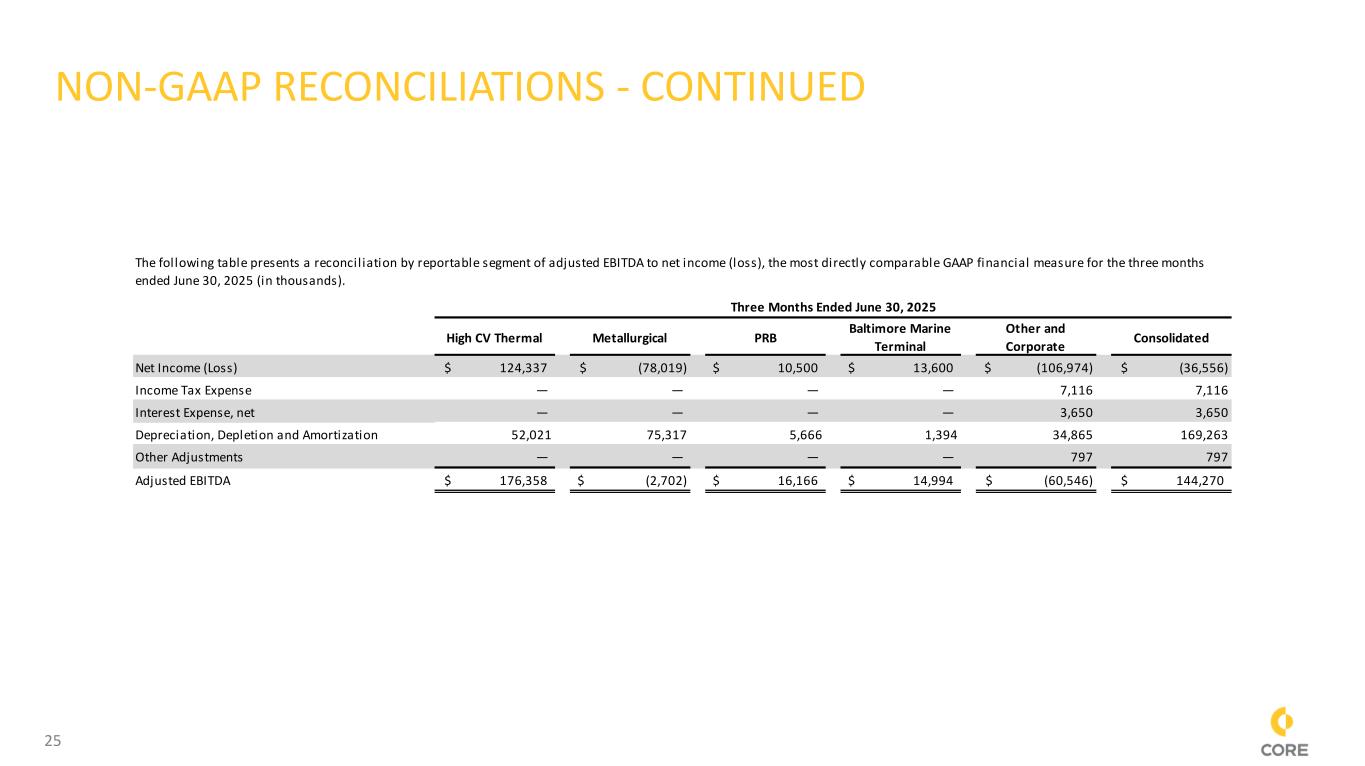

25 NON-GAAP RECONCILIATIONS - CONTINUED High CV Thermal Metallurgical PRB Baltimore Marine Terminal Other and Corporate Consolidated Net Income (Loss) 124,337$ (78,019)$ 10,500$ 13,600$ (106,974)$ (36,556)$ Income Tax Expense — — — — 7,116 7,116 Interest Expense, net — — — — 3,650 3,650 Depreciation, Depletion and Amortization 52,021 75,317 5,666 1,394 34,865 169,263 Other Adjustments — — — — 797 797 Adjusted EBITDA 176,358$ (2,702)$ 16,166$ 14,994$ (60,546)$ 144,270$ Three Months Ended June 30, 2025 The following table presents a reconcil iation by reportable segment of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure for the three months ended June 30, 2025 (in thousands).

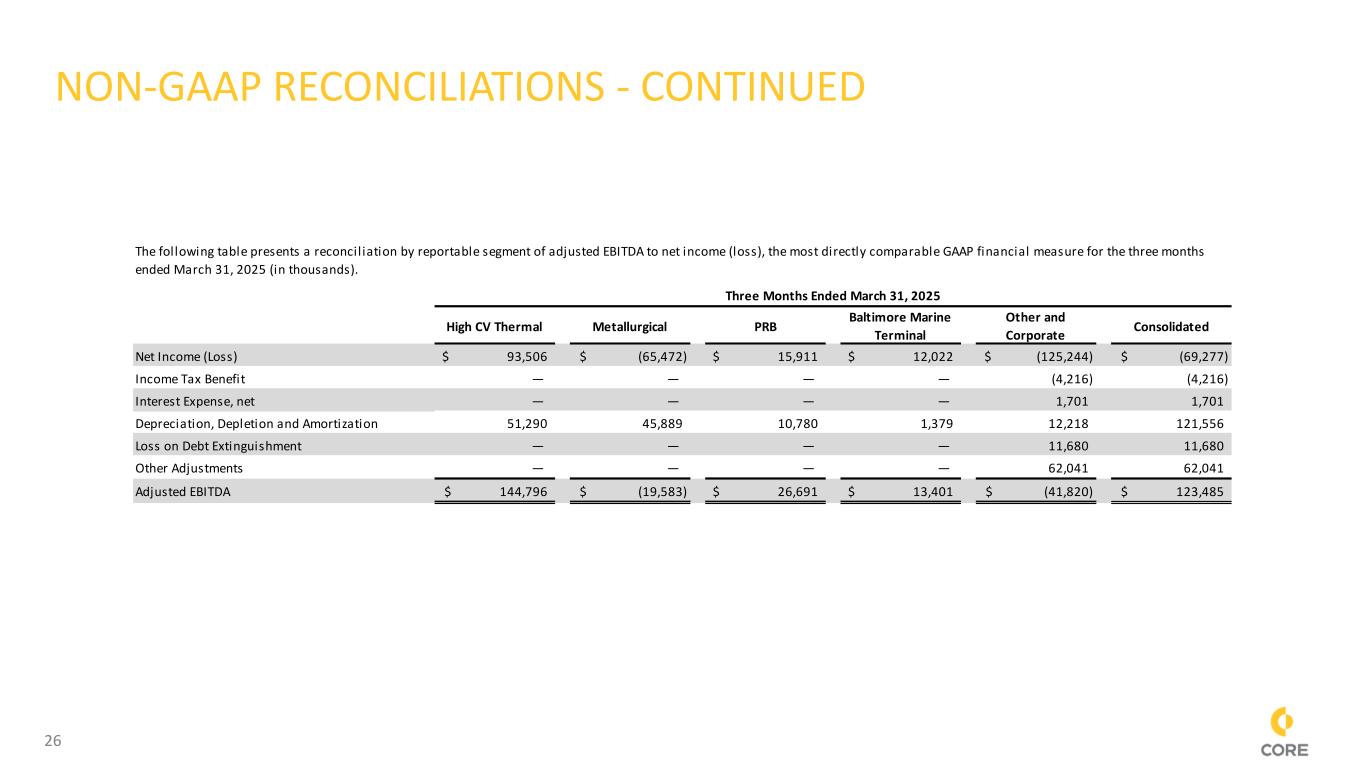

26 NON-GAAP RECONCILIATIONS - CONTINUED High CV Thermal Metallurgical PRB Baltimore Marine Terminal Other and Corporate Consolidated Net Income (Loss) 93,506$ (65,472)$ 15,911$ 12,022$ (125,244)$ (69,277)$ Income Tax Benefit — — — — (4,216) (4,216) Interest Expense, net — — — — 1,701 1,701 Depreciation, Depletion and Amortization 51,290 45,889 10,780 1,379 12,218 121,556 Loss on Debt Extinguishment — — — — 11,680 11,680 Other Adjustments — — — — 62,041 62,041 Adjusted EBITDA 144,796$ (19,583)$ 26,691$ 13,401$ (41,820)$ 123,485$ Three Months Ended March 31, 2025 The following table presents a reconcil iation by reportable segment of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure for the three months ended March 31, 2025 (in thousands).

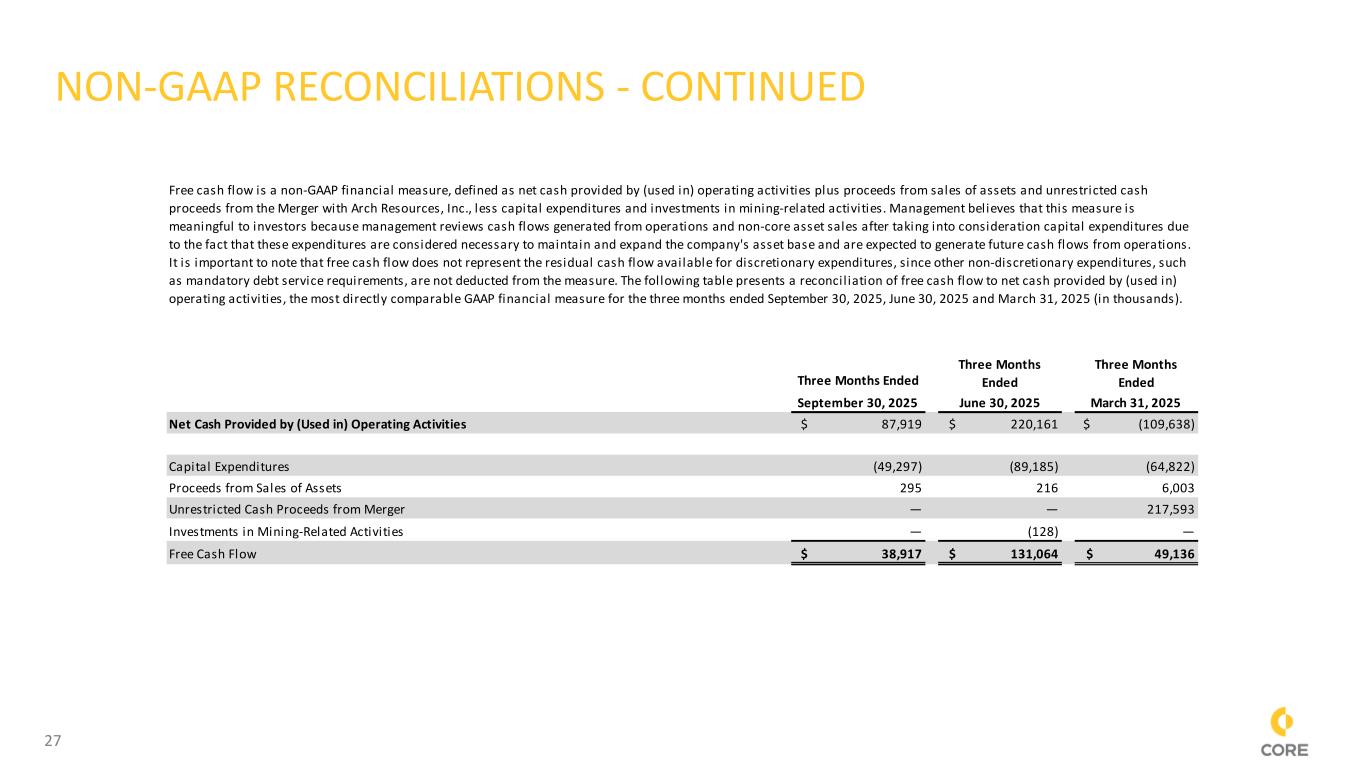

27 NON-GAAP RECONCILIATIONS - CONTINUED Three Months Ended Three Months Ended Three Months Ended September 30, 2025 June 30, 2025 March 31, 2025 Net Cash Provided by (Used in) Operating Activities $ 87,919 $ 220,161 $ (109,638) Capital Expenditures (49,297) (89,185) (64,822) Proceeds from Sales of Assets 295 216 6,003 Unrestricted Cash Proceeds from Merger — — 217,593 Investments in Mining-Related Activities — (128) — Free Cash Flow $ 38,917 $ 131,064 $ 49,136 Free cash flow is a non-GAAP financial measure, defined as net cash provided by (used in) operating activities plus proceeds from sales of assets and unrestricted cash proceeds from the Merger with Arch Resources, Inc., less capital expenditures and investments in mining-related activities. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations and non-core asset sales after taking into consideration capital expenditures due to the fact that these expenditures are considered necessary to maintain and expand the company's asset base and are expected to generate future cash flows from operations. It is important to note that free cash flow does not represent the residual cash flow available for discretionary expenditures, since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The following table presents a reconcil iation of free cash flow to net cash provided by (used in) operating activities, the most directly comparable GAAP financial measure for the three months ended September 30, 2025, June 30, 2025 and March 31, 2025 (in thousands).

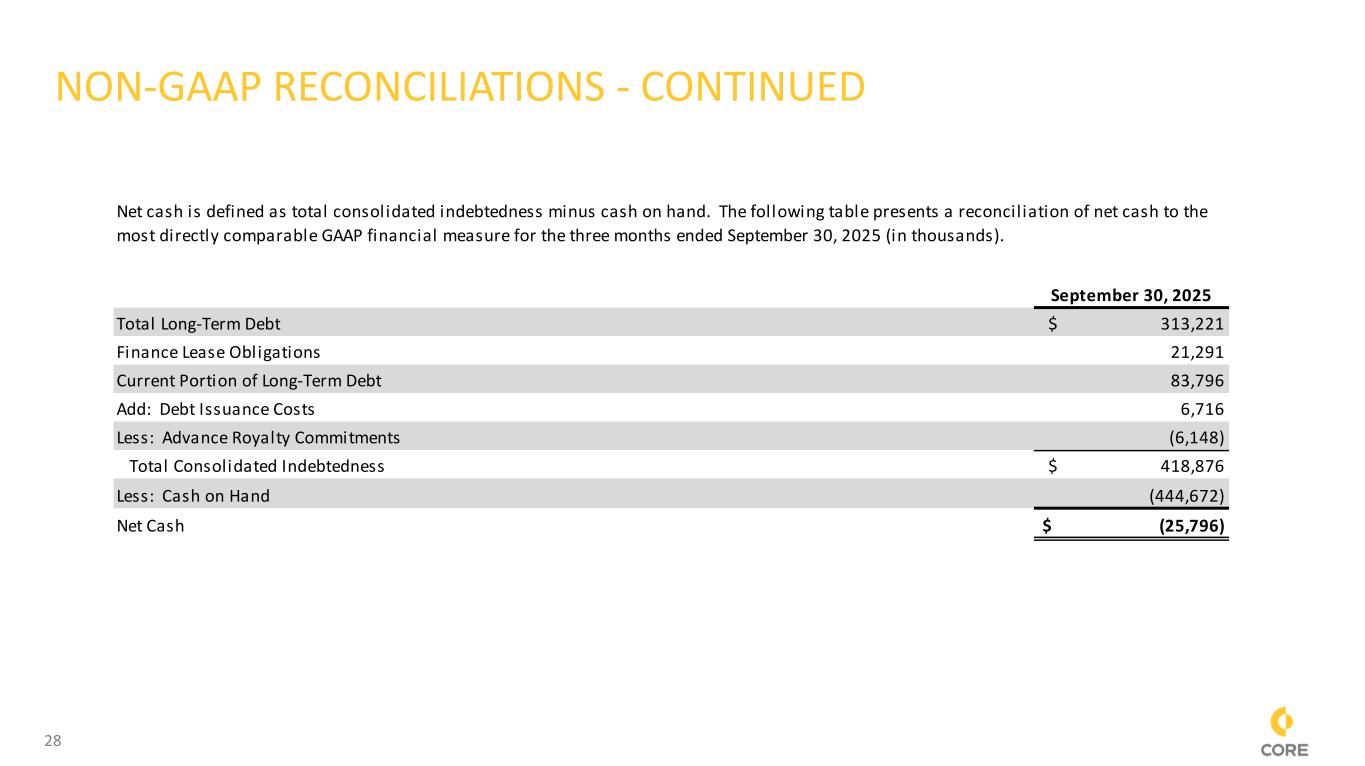

28 NON-GAAP RECONCILIATIONS - CONTINUED September 30, 2025 Total Long-Term Debt $ 313,221 Finance Lease Obligations 21,291 Current Portion of Long-Term Debt 83,796 Add: Debt Issuance Costs 6,716 Less: Advance Royalty Commitments (6,148) Total Consolidated Indebtedness $ 418,876 Less: Cash on Hand (444,672) Net Cash $ (25,796) Net cash is defined as total consolidated indebtedness minus cash on hand. The following table presents a reconciliation of net cash to the most directly comparable GAAP financial measure for the three months ended September 30, 2025 (in thousands).