Please wait

ANNUAL INFORMATION FORM

FOR HYDRO ONE LIMITED

FOR THE YEAR ENDED DECEMBER 31, 2025

February 13, 2026

TABLE OF CONTENTS

GLOSSARY

When used in this annual information form, the following terms have the meanings set forth below unless expressly indicated otherwise:

“$” or “dollar” means Canadian dollars, unless otherwise indicated.

“1.41% Notes” means the October 2020 offering of $425 principal amount of 1.41% notes due October 15, 2027.

“2017 Long-Term Energy Plan” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario 2017 Long-Term Energy Plan”.

“2020 Ontario Budget” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – OEB Actions on Electricity Pricing”.

“2023 Framework” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2023 – 2023 Sustainable Financing Framework”.

“2024 Framework” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2024 – 2024 Sustainable Financing Framework”.

“2024 HOI MTN Shelf Prospectus” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2024 – 2024 MTN Shelf Prospectus”.

“2024 HOL Shelf Prospectus” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2024 – 2024 HOL Universal Base Shelf Prospectus”.

“2024 HOHL U.S. Debt Prospectus” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2024 – 2024 U.S. Debt Shelf Prospectus”.

“2025-2036 Framework” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Recent Distribution Rate Applications – Conservation and Demand Management”.

“Addendum” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario Integrated Energy Plan”.

“Affordable Energy Act” means the Affordable Energy Act, 2024, S.O. 2024, c. 26 - Bill 214.

“Annual MD&A” means the management’s discussion and analysis for Hydro One Limited for the years ended December 31, 2025 and 2024 filed on SEDAR+ under Hydro One Limited’s profile at www.sedarplus.com.

“Auditor General Act” means the Auditor General Act, RSO 1990, c A-35.

“B2M LP” means B2M Limited Partnership.

“Board” means the Board of Directors of Hydro One Limited.

“Building Broadband Faster Act” means the Building Broadband Faster Act, 2021, S.O. 2021, c. 2, Schedule 1.

“Canadian Energy Regulator Act” means the Canadian Energy Regulator Act, SC 2019, c 28, s 10.

“CDM” means conservation and demand management.

“CEO” means Chief Executive Officer.

“CFO” means Chief Financial Officer.

“Clean Electricity Regulations” means the Clean Electricity Regulations made under the Canadian Environmental Protection Act, 1999, S.C. 1999, c.33.

“CLLP” means Chatham x Lakeshore Limited Partnership.

“common shares” means the common shares in the capital of Hydro One Limited.

“control person” has the meaning given to it under applicable Canadian securities laws.

“CSO” has the meaning given to it under “Business of Hydro One – Employees”.

“Custom IR Method” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

“CUSW” has the meaning given to it under “Business of Hydro One – Employees”.

“DBRS” has the meaning given to it under “Credit Ratings”.

“DERs” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board”.

“Dividend Reinvestment Plan” has the meaning given to it under “Dividends – Dividend Reinvestment Plan”.

“DMS” has the meaning given to it under “Business of Hydro One – Distribution Business Segment –Capital Expenditures”.

“eDSM” means electricity demand side management.

“Electricity Act” means the Electricity Act, 1998, SO 1998, c 15, Schedule A.

“Electricity Council” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Federal Initiatives”.

“Electrification and Energy Transition Panel” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario 2017 Long-Term Energy Plan”.

“Energy Statute Law Amendment Act” means the Energy Statute Law Amendment Act, 2016, SO 2016,

c 10.

“Environmental Assessment Act” means the Environmental Assessment Act, RSO 1990, c E-18.

“EPSCA” has the meaning given to it under “Business of Hydro One – Employees”.

“ESG” means environmental, social and governance.

“Exemptive Relief” has the meaning given to it under “The Electricity Industry in Ontario – Exemptive Relief – U.S. GAAP”.

“Exposure Draft” has the meaning given to it under “The Electricity Industry in Ontario – Exemptive Relief – U.S. GAAP”.

“FCPA” means Fellow of the Institute of Chartered Professional Accountants.

“Financial Administration Act” means the Financial Administration Act, RSO 1990, c F-12.

“GHG” means greenhouse gas.

“Governance Agreement” means the governance agreement dated November 5, 2015 between Hydro One Limited and the Province, as amended and modified from time to time, including by the Waiver.

“GTA” means the Greater Toronto Area.

“HOHL” means Hydro One Holdings Limited, an indirect wholly-owned subsidiary of Hydro One Limited.

“HOHL Senior Debt Indenture” has the meaning given to it under “Material Contracts”.

“HOL Indenture” has the meaning given to it under “Material Contracts”.

“HOSSM” means Hydro One Sault Ste. Marie LP.

“Hydro One” or the “Company” have the meanings given to such terms set out under “Presentation of Information”.

“Hydro One Inc.” has the meaning given to it under “Presentation of Information”.

“Hydro One Limited” has the meaning given to it under “Presentation of Information”.

“Hydro One Networks” means Hydro One Networks Inc.

“Hydro One Remote Communities” means Hydro One Remote Communities Inc.

“IASB” means the International Accounting Standards Board.

“ICMA” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2023 – 2023 Sustainable Financing Framework”.

“ICD.D” means the “Institute of Corporate Directors, Director” designation.

“IEP” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board”.

“IESO” means the Independent Electricity System Operator.

“ITC” means Investment Tax Credit.

“JRAP” has the meaning given to it under “Business of Hydro One – Transmission Business Segment –Regulation – Recent Transmission Rate Applications – Hydro One Networks”.

“kV” means kilovolt.

“kW” means kilowatt.

“Letter Agreement” means the agreement dated July 11, 2018 between Hydro One Limited and the Province.

“LSTA” has the meaning given to it under “General Development of the Business – Chronological Development of the Business – 2023 – 2023 Sustainable Financing Framework”.

“MAAD Application” means an application for a Merger, Amalgamation, Acquisition and Divestiture filed with the OEB.

“management” has the meaning given to it under “Presentation of Information”.

“Mandatory Rate-regulated Standard” has the meaning given to it under “The Electricity Industry in Ontario – Exemptive Relief – U.S. GAAP”.

“Market Rules” means the rules made under section 32 of the Electricity Act that are administered by the IESO.

“Minister of Energy” means the Minister of Energy, Northern Development and Mines for the Province, the Minister of Energy for the Province, the Minister of Energy and Electrification for the Province, or the Minister of Energy and Mines for the Province, as applicable at the relevant time.

“Ministry of Energy” means the Ministry of Energy and Electrification for the Province, or the Ministry of Energy and Mines for the Province, as applicable at the relevant time.

“National Energy Board Act” means the National Energy Board Act, RSC 1985, c N-7.

“NERC” means the North American Electric Reliability Corporation.

“Niagara Line” means the 230 kV transmission line in the Niagara region owned by NRLP.

“Non-Aggregated Holders” has the meaning given to it under “The Electricity Industry in Ontario –Exemptive Relief – Disclosure of Ownership by the Province”.

“NPCC” means the Northeast Power Coordinating Council, Inc.

“NRLP” means Niagara Reinforcement Limited Partnership.

“Nuclear Fuel Waste Act” means the Nuclear Fuel Waste Act, SC 2002, c 23.

“OBCA” means the Business Corporations Act, RSO 1990, c B-16.

“OEB” means the Ontario Energy Board.

“OEFC” means Ontario Electricity Financial Corporation.

“Ontario” or the “province” has the meaning given to it under “Presentation of Information”.

“Ontario Energy Board Act” means the Ontario Energy Board Act, 1998, SO 1998, c 15, Schedule B.

“Ontario’s Affordable Energy Future” has the meaning given to it under “The Electricity Industry in Ontario – Regulation of Transmission and Distribution – Ontario Energy Board ”.

“PCBs” means polychlorinated biphenyls.

“Price Cap IR” has the meaning given to it under “Business of Hydro One – Distribution Business Segment – Regulation – Distribution Rates”.

“Protect Ontario by Securing Affordable Energy for Generations Act” means Protect Ontario by Securing Affordable Energy for Generations Act, 2025, S.O. 2025, c. 22 - Bill 40.

“Protect Ontario by Unleashing our Economy Act” means the Protect Ontario by Unleashing our Economy Act, 2025, S.O. 2025, c. 4 - Bill 5.

“Province” has the meaning given to it under “Presentation of Information”.

“PULSE” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario Integrated Energy Plan”.

“PWU” has the meaning given to it under “Business of Hydro One – Employees”.

“rate base” has the meaning given to it under “Presentation of Information”.

“rate-regulated” has the meaning given to it under “Rate-Regulated Utilities – Rate Applications in Ontario – Framework”.

“RBPPAG” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Regional Planning”.

“Registration Rights Agreement” means the registration rights agreement dated November 5, 2015 between Hydro One Limited and the Province.

“Reliability Standards” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Reliability Standards and Regulations for Transmission”.

“Removal Notice” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Election and Replacement of Directors – Province’s Right to Replace the Board”.

“Reserve” means a “reserve” as that term is defined in the Indian Act, RSC 1985, c I-5.

“return on equity” has the meaning given to it under “Presentation of Information”.

“revenue cap escalator factor” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Recent Transmission Rate Applications – HOSSM”.

“Revenue Cap Index” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

“ROE” has the meaning given to it under “Rate-Regulated Utilities – Rate Applications in Ontario – Framework”.

“RPP” has the meaning given to it under “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – OEB Actions on Electricity Pricing”.

“RPPAG” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Regional Planning”.

“RRF” means the performance-based model set out in the OEB’s Renewed Regulatory Framework for Electricity Distributors.

“RRRP” has the meaning given to it under “Business of Hydro One – Distribution Business Segment – Regulation – Recent Distribution Rate Applications – Hydro One Remote Communities”.

“S&P” has the meaning given to it under “Credit Ratings”.

“Series 1 preferred shares” means the Series 1 preferred shares in the capital of Hydro One Limited.

“Series 2 preferred shares” means the Series 2 preferred shares in the capital of Hydro One Limited.

“Share Ownership Restrictions” has the meaning given to it under “The Electricity Industry in Ontario – Legislative Provisions Specific to Hydro One – 10% Ownership Restriction”.

“Shares” has the meaning given to it under “Agreements with Principal Shareholder – Registration Rights Agreement – Demand Registration”.

“Society” has the meaning given to it under “Business of Hydro One – Employees”.

“Special Board Resolution” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Board Approvals Requiring a Special Resolution of the Directors”.

“Specified Provincial Entity” has the meaning given to it under “Agreements with Principal Shareholder – Governance Agreement – Governance Matters – Nomination of Directors – Independence”.

“Transmission System Code” means the OEB’s Transmission System Code.

“trust assets” has the meaning given to it under “Interest of Management and Others in Material

Transactions – Relationships with the Province and Other Parties – Transfer Orders”.

“TSF” means Transmitter Selection Framework.

“TS” means transformer station.

“TSX” means the Toronto Stock Exchange.

“TWh” means terawatt-hours.

“U.S.” means the United States of America.

“U.S. GAAP” means United States Generally Accepted Accounting Principles.

“uniform transmission rates” has the meaning given to it under “Business of Hydro One – Transmission Business Segment – Regulation – Transmission Rate Setting”.

“Voting Securities” means a security of Hydro One Limited carrying a voting right either under all circumstances or under some circumstances that have occurred and are continuing.

“Waiver” means the waiver and acknowledgement dated June 18, 2025 between Hydro One Limited and the Province.

PRESENTATION OF INFORMATION

Unless otherwise specified, all information in this annual information form is presented as at December 31, 2025.

Capitalized terms used in this annual information form are defined under “Glossary”. Words importing the singular number include the plural, and vice versa, and words importing any gender include all genders. The Annual MD&A is specifically incorporated by reference into and forms an integral part of this annual information form. A copy of this document has been filed with the Canadian securities regulatory authorities and is available on SEDAR+ under Hydro One Limited’s profile at www.sedarplus.com.

Unless otherwise noted or the context otherwise requires, references to “Hydro One” or the “Company” refer to Hydro One Limited and its subsidiaries taken together as a whole. References to “Hydro One Inc.” refer only to Hydro One Inc. and references to “Hydro One Limited” refer only to Hydro One Limited.

In addition, “Province” refers to the Province of Ontario as a provincial government entity, and “Ontario” or the “province” in lower case type refers to the Province of Ontario as a geographical area. References to “management” in this annual information form mean the persons who are identified as executive officers of Hydro One Limited and its subsidiaries, as applicable, in this annual information form. Any statements made by or on behalf of management are made in such persons’ respective capacities as executive officers of Hydro One Limited and its subsidiaries, as applicable, and not in their personal capacities. See “Directors and Officers” for more information.

This annual information form refers to certain terms commonly used in the electricity industry, such as “rate-regulated”, “rate base” and “return on equity”. Rate base is an amount that a utility is required to calculate for regulatory purposes, and refers to the net book value of the utility’s assets for regulatory purposes plus an allowance for working capital. Return on equity is a percentage that is set or approved by a utility’s regulator and represents the rate of return that a regulator allows the utility to earn on the equity component of the utility’s rate base. See also “Rate-Regulated Utilities”.

In this annual information form, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Hydro One Limited and Hydro One Inc. prepare and present their financial statements in accordance with U.S. GAAP.

FORWARD-LOOKING INFORMATION

Certain information in this annual information form contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information in this annual information form is based on current expectations, estimates, forecasts and projections about Hydro One’s business and the industry, and the regulatory and economic environments, in which Hydro One operates and includes beliefs of and assumptions made by management. Such statements include, but are not limited to, statements related to: the Company’s transmission and distribution rate applications, and resulting decisions, rates and impacts; expectations regarding future corporate strategies; expected impacts and timing of changes to the electricity industry; expected impacts of recent changes to legislation in Ontario impacting transmitters and distributors, including the Protect Ontario by Securing Affordable Energy for Generations Act on Hydro One and its operations; the Company’s expected engagement with IESO and industry and the government decision on potential competitive procurement projects; the expected advancement and construction of various transmission stations and transmission lines in connection with the Province’s first integrated energy plan and the target in-service dates; the Company’s maturing debt; expectations regarding the Company’s financing activities; credit ratings; ongoing and planned projects and/or initiatives; expected future capital investments and expenditures, the nature and timing of these investments and expenditures, including the Company’s plans for sustaining and development capital expenditures for its distribution and transmission systems; the Company’s expected capital expenditures relating to its distribution business from 2026 to 2027; expectations related to the TSF, including consultations, reports, requirements, and implementation; expectations regarding allowed return on equity; expectations regarding the ability of the Company to recover expenditures in future rates; expectations regarding the timing and outcome of the Z-Factor application filed with the OEB; expectations regarding the ability to negotiate collective agreements consistent with rate orders; expectations related to work force demographics; the Company’s focus on health, safety and environmental management; expectations regarding taxes; expectations regarding load growth; the regional planning process; expectations related to Hydro One’s CDM requirements and targets; new legislation and regulatory initiatives relating to the electricity industry and the expected impacts of such; expectations regarding the Company’s DMS; the Company’s customer focus and related initiatives; the potential impacts of the Exposure Draft; the Company’s status as an SEC issuer; statements related to the Company’s relationships with Indigenous communities; statements related to environmental matters, and the Company’s expected future environmental, expected land assessment and remediation expenditures and the Company’s ability to recover such costs; statements related to the Company’s commitment to releasing an annual sustainability report and to improve the quality of its ESG disclosures; statements relating to the Company’s plans to issue sustainable financing instruments, such as sustainable and green bonds, and to allocate the net proceeds to investments in eligible green and social project categories; statements relating to the Company’s intention to provide annual updates regarding the use of net proceeds of any green and/or sustainable financing; cyber and data security; the Company’s relationship with the Province; future sales of shares of Hydro One Limited; expectations regarding the Company’s capital program to modernize the smart metering infrastructure and implementation through 2029; acquisitions and consolidation opportunities and other strategic initiatives; expectations regarding the Governance Agreement and other agreements with the Province; the status of litigation; expectations

regarding the manner in which Hydro One will operate and the Company’s strategy; expectations regarding Hydro One’s dividend policy and the Company’s intention to declare and pay dividends, including the target payout ratio of 60% to 70% of net earnings; potential conflicts of interest; and legal proceedings in which Hydro One is currently involved.

Words such as “aim”, “could”, “would”, “expect”, “anticipate”, “intend”, “attempt”, “may”, “plan”, “will”, “believe”, “seek”, “estimate”, “goal”, “target”, and variations of such words and similar expressions are intended to identify such forward-looking information. These statements are not guarantees of future performance and involve assumptions and risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed, implied or forecasted in such forward-looking information. Hydro One does not intend, and it disclaims any obligation to update any forward-looking information, except as required by law.

The forward-looking information in this annual information form is based on a variety of factors and assumptions including, but not limited to: no unforeseen changes in the legislative and operating framework for Ontario’s electricity market; favourable decisions from the OEB and other regulatory bodies concerning outstanding and future rate and other applications; no unexpected delays in obtaining required regulatory approvals; no unforeseen changes in rate orders or rate setting methodologies for Hydro One’s distribution and transmission businesses; no unfavourable changes in environmental regulation; continued use of U.S. GAAP; a stable regulatory environment; no significant changes to the Company’s current credit ratings; no unforeseen impacts of new accounting pronouncements; no changes to expectations regarding electricity consumption; no unforeseen changes to economic and market conditions; completion of operating and capital projects that have been deferred; and no significant event occurring outside the ordinary course of business. These assumptions are based on information currently available to Hydro One, including information obtained from third-party sources. Actual results may differ materially from those predicted by such forward-looking information. While Hydro One does not know what impact any of these differences may have, Hydro One’s business, results of operations, financial condition and credit stability may be materially adversely affected if any such differences occur. Factors that could cause actual results or outcomes to differ materially from the results expressed or implied by forward-looking information include, among other things:

•regulatory risks and risks relating to Hydro One’s revenues, including risks relating to actual performance against forecasts, competition with other transmitters and other applications to the OEB, the rate-setting models for transmission and distribution, the recoverability of capital expenditures, obtaining rate orders or recoverability of total compensation costs;

•risks associated with the Province’s share ownership of Hydro One and other relationships with the Province, including potential conflicts of interest that may arise between Hydro One, the Province and related parties, risks associated with the Province’s exercise of further legislative and regulatory powers, risks relating to the ability of the Company to attract and retain qualified executive talent or the risk of a credit rating

downgrade for the Company and its impact on the Company’s funding and liquidity;

•risks relating to the location of the Company’s assets on Reserve lands, that the Company’s operations and activities may give rise to the Crown’s duty to consult and potentially accommodate Indigenous communities, and the risk that Hydro One may incur significant costs associated with transferring assets located on Reserves;

•the risk that the Company may be unable to comply with regulatory and legislative requirements or that the Company may incur additional costs for compliance that are not recoverable through rates;

•the risk of exposure of the Company’s facilities to the effects of severe weather conditions, natural disasters, man-made events or other unexpected occurrences for which the Company is uninsured or for which the Company could be subject to claims for damage;

•risks associated with information system security and maintaining complex information technology and operational technology system infrastructure, including system failures or risks of cyber-attacks or unauthorized access to corporate information technology and operational technology systems;

•the risk of non-compliance with environmental regulations and inability to recover environmental expenditures in rate applications and the risk that assumptions that form the basis of the Company’s recorded environmental liabilities and related regulatory assets may change;

•the risk of labour disputes and inability to negotiate or renew appropriate collective agreements on acceptable terms consistent with the Company’s rate orders;

•the risk that the Company may not be able to execute plans for capital projects necessary to maintain the performance of the Company’s assets or to carry out projects in a timely manner or the risk of increased competition for the development of large transmission projects or legislative changes affecting the selection of transmitters;

•risks associated with asset condition, capital projects and innovation, including public opposition to or delays or denials of the requisite approvals and accommodations for the Company’s planned projects;

•risks related to the Company’s work force demographic and its potential inability to attract and retain qualified personnel;

•the risk that the Company is not able to arrange sufficient cost-effective financing to

repay maturing debt and to fund capital expenditures, the risk of a downgrade in the Company’s credit ratings or risks associated with investor interest in ESG performance and reporting;

•risks associated with fluctuations in interest rates and failure to manage exposure to credit and financial instrument risk;

•risks associated with economic uncertainty and financial market volatility;

•the risk of failure to mitigate significant health and safety risks;

•the risk of not being able to recover the Company’s pension expenditures in future rates and uncertainty regarding the future regulatory treatment of pension, other post-employment benefits and post-retirement benefits costs;

•the impact of the ownership by the Province of lands underlying the Company’s transmission system;

•the risk associated with legal proceedings that could be costly, time-consuming or divert the attention of management and key personnel from the Company’s business operations;

•the impact if the Company does not have valid occupational rights on third-party owned or controlled lands and the risks associated with occupational rights of the Company that may be subject to expiry;

•risks relating to adverse reputational events or political actions relating to Hydro One and the electricity industry;

•the potential that Hydro One may incur significant expenses to replace functions currently outsourced if agreements are terminated or expire before a new service provider is selected;

•risks relating to acquisitions, including the failure to realize the anticipated benefits of such transactions at all, or within the time periods anticipated, and unexpected costs incurred in relation thereto;

•the inability to continue to prepare financial statements using U.S. GAAP; and

•the risk related to the impact of any new accounting pronouncements.

Hydro One cautions the reader that the above list of factors is not exhaustive. Some of these and other factors are discussed in more detail under the heading “Risk Management and Risk Factors” in the

Annual MD&A. You should review such section in detail, including the matters referenced therein.

In addition, Hydro One cautions the reader that information provided in this annual information form regarding Hydro One’s outlook on certain matters, including potential future expenditures, is provided in order to give context to the nature of some of Hydro One’s future plans and may not be appropriate for other purposes.

ELECTRICITY INDUSTRY OVERVIEW

General Overview

The electricity industry is made up of businesses that generate, transmit, distribute and sell electricity. While traditionally a mature and stable industry, the electricity industry is facing rapid and dramatic technological change and increasing innovation. Hydro One’s business is focused on the transmission and distribution of electricity.

•Transmission refers to the delivery of electricity over high voltage lines, typically over long distances, from generating stations to local areas and large industrial customers.

•Distribution refers to the delivery of electricity over low voltage lines to end users such as homes, businesses and institutions.

Overview of an Electricity System

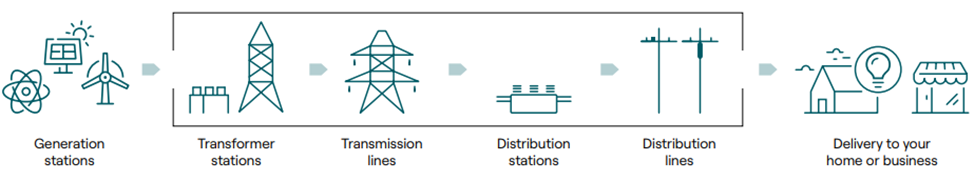

The basic configuration of a typical electricity system, showing electricity generation, transmission and distribution, is illustrated in the following diagram:

Note:

The above image shows a typical electricity system with transmission-connected generation.

Transmission and distribution networks are sometimes referred to as the “electricity grid” or simply “the grid”.

THE ELECTRICITY INDUSTRY IN ONTARIO

Regulation of Transmission and Distribution

General

The Electricity Act and the Ontario Energy Board Act establish the general legislative framework for Ontario’s electricity market. The activities of transmitters and distributors in Ontario are overseen by three main regulatory authorities: (i) the OEB, (ii) the IESO, and (iii) the Canada Energy Regulator. The Minister of Energy is responsible for developing integrated energy plans and has the power to issue directives to the IESO and the OEB regarding implementation of such plans.

Ontario Energy Board

The OEB is an independent regulatory agency. The Ontario Energy Board Act provides the OEB with the authority to regulate Ontario’s electricity market, including the activities of transmitters and distributors.

The OEB has the following legislated objectives in relation to the electricity industry:

•to inform consumers and protect their interests with respect to prices and the adequacy, reliability and quality of electricity service,

•to promote economic efficiency and cost effectiveness in the generation, transmission, distribution, sale and demand management of electricity and to facilitate the maintenance of a financially viable electricity industry,

•to regulate the electricity sector in a manner that supports economic growth, consistent with the policies of the Province,

•to promote electricity conservation and demand management in a manner consistent with the policies of the Province, including having regard to the consumer’s economic circumstances, and

•to facilitate innovation in the electricity sector.

The OEB is responsible for, among other things, approving transmission and distribution rates in Ontario. It also approves the construction, expansion, or reinforcement of transmission lines greater than two kilometres in length, as well as mergers, acquisitions, amalgamations and divestitures involving distributors, transmitters and other entities which it licenses. The activities of transmitters and distributors are subject to the conditions of their licences and a number of industry codes issued by the OEB. These codes and other requirements prescribe minimum standards of conduct and service for licensed participants in the electricity market.

In January 2023, the OEB released its Framework for Energy Innovation: Setting a Path Forward for DER Integration report. This report is the culmination of the OEB’s Framework for Energy Innovation: Distributed Resources and Utility Incentives consultation and sets out the OEB’s policies and next steps with respect to the integration of distributed energy resources (“DERs”) into distribution system planning and operations, as well as the use of DERs by electricity distributors as non-wires alternatives. In April 2023, the OEB released an Energy Transition Roadmap as part of its 2023-26 Business Plan that provides a schedule of initiatives the OEB is taking or plans to undertake with respect to the energy transition. The Energy Transition Roadmap is intended to provide clarity on the OEB’s priorities, support the coordination of interrelated initiatives within the OEB and across the sector and support effective stakeholder engagement.

In June 2025, the Ministry of Energy issued a letter of direction to the OEB regarding the implementation of the Province’s Integrated Energy Plan (“IEP”), including in support of planning for growth and electrification, streamlining transmission connections and advancing the Province’s objectives relating to DERs. The OEB has since initiated a number of policy consultations in response to the letter of direction, including: Distribution Customer Connections Review, Streamlining Transmission Connections, Regional and Bulk Electricity System Planning Process Review, Review of the Valuation of Distributed Energy Resources, and Gas-Electric Co-ordination and Information Sharing. In December 2025, the OEB submitted to the Minister a Distribution System Operator roadmap for the potential development and implementation of Distribution System Operator capabilities, which is expected to inform further OEB-led Distribution System Operator consultations and working groups in 2026.

In December 2025, the Minister of Energy issued a letter of direction to the OEB, which included the Minister of Energy’s priorities and expectations for the OEB over the next three years. The initiatives identified include continuing to implement the IEP, supporting the work of the PULSE, advancing work to review the utility remuneration framework, investing in growth to improve last mile connections, and supporting distribution sector reliability, security, and resilience.

See also “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario 2017 Long-Term Energy Plan” and “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario Integrated Energy Plan”.

IESO

The IESO delivers key services across the electricity sector, including managing the power system in real time, planning for Ontario’s future energy needs, enabling conservation and designing a more efficient electricity marketplace to support sector evolution. Transmitters and other wholesale market participants must comply with the Market Rules issued by the IESO. The Market Rules require transmitters to comply with mandatory North American reliability standards for transmission issued by the NERC and the NPCC. The IESO enforces these reliability standards and coordinates with system operators and reliability agencies in other jurisdictions to ensure energy adequacy and security across the interconnected bulk electricity system in North America.

In December 2022, the IESO released its Pathways to Decarbonization report in response to the Minister of Energy’s request to evaluate a moratorium on new natural gas generation in Ontario, and to develop an achievable pathway to decarbonization in the electricity system.

In November 2023, the IESO launched an engagement initiative on the development of a TSF. The TSF is consistent with the IESO’s Pathways to Decarbonization report that recommends building on existing actions to ensure Ontario is positioned to build the electricity generation, storage and transmission necessary to maintain a reliable, affordable and clean electricity system and power the province’s growth beyond 2030. In October 2024, following the release of the Powering Ontario’s Growth report and in response to a July 2023 letter of direction from the Minister of Energy, the IESO released updates on its engagement initiative for the TSF. The industry engagement continued in 2025 and the IESO launched the TSF registry on July 31, 2025. Hydro One continues to engage with IESO and industry and is awaiting the Province’s decision on potential projects that may be considered for competitive procurement. In January 2026, the Province announced that they are proposing the IESO launch a competitive transmission selection process to select a transmitter to build a new electricity transmission line from the Darlington Nuclear Generating Station to downtown Toronto, to help address capacity constraints in Toronto. See “Business of Hydro One – Transmission Business Segment – Competitive Conditions” for more information.

In October 2024, the IESO released a new demand forecast showing that Ontario’s electricity demand is anticipated to grow by 75% by 2050, driven by a series of factors, including growth in the industrial sector, ongoing electrification and data centres looking to connect to the grid. See also “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario 2017 Long-Term Energy Plan” and “The Electricity Industry in Ontario – Ontario Integrated Energy Plan” for more information.

In June 2025, the Ministry of Energy issued a letter of direction to the IESO regarding the implementation of the Province’s Integrated Energy Plan, including in support of planning for growth and electrification, streamlining transmission connections and advancing the Province’s objectives relating to DERs.

Canada Energy Regulator

In August 2019, the Canadian Energy Regulator Act came into force, replacing the National Energy Board Act. As a result of the new statute, the National Energy Board became the Canada Energy Regulator. Any decision or order made by the National Energy Board is considered to have been made under the Canadian Energy Regulator Act and may be enforced as such.

The Canada Energy Regulator has jurisdiction over the construction and operation of international power lines, as well as interprovincial lines that are designated as being under federal jurisdiction (of which there are currently none). As Hydro One owns and operates 11 active international power lines connecting Ontario’s transmission system with transmission systems in Michigan, Minnesota and New York, Hydro

One holds several certificates and permits with the Canada Energy Regulator.

Transmission

Transmission companies own and operate transmission systems that deliver electricity over high voltage lines. Hydro One owns and operates a transmission system that accounts for approximately 91% of Ontario’s transmission capacity, based on the network component of the revenue requirement1 approved by the OEB.2 The Company’s transmission system is interconnected to systems in Manitoba, Michigan, Minnesota, New York and Quebec and is part of the North American electricity grid’s Eastern Interconnection. The Eastern Interconnection is a contiguous electricity transmission system that extends from Manitoba to Florida and from east of the Rocky Mountains to the North American east coast. Being part of the Eastern Interconnection provides benefits to Ontario, such as greater security and stability for Ontario’s transmission system, emergency support when there are generation constraints or shortages in Ontario, and the ability to exchange electricity with other jurisdictions.

Distribution

Distributors own and operate distribution systems that deliver electricity over power lines at voltages of 50 kV or less to end users. A local distribution company is responsible for distributing electricity to customers in its OEB-licensed service territory, and in some cases to other distributors. A service territory may cover large portions or all of a particular municipality, or an otherwise defined geographic area. Distribution customers include homes, commercial and industrial businesses and institutions such as governments, schools and hospitals.

In Ontario, as per the OEB’s annual data on electricity distributors, as at December 31, 2024, 53 local distribution companies provided electricity to approximately 5.5 million customers. The distribution industry in Ontario is fragmented, with the 10 largest local distribution companies accounting for approximately 82% of the province’s customers.

Through its wholly-owned subsidiary, Hydro One Inc., Hydro One owns the largest local distribution business in Ontario, which serves approximately 1.5 million predominantly rural customers, or approximately 27% of the total number of customers in Ontario.

1 The network component of the revenue requirement is Hydro One’s portion of the transmission revenue requirement attributed to assets that are used for the common benefit of all Hydro One and non-Hydro One customers in the province.

2 Hydro One owns and operates approximately 94% of the transmission system in Ontario based on the total OEB approved revenue requirement.

Issues Affecting the Electricity Industry Generally

Tax Incentives

Tax incentives introduced in the 2015 Ontario budget to promote consolidation in the electricity distribution sector, reduced the tax rate for transfers of electricity assets from 33% to 22% and to nil for municipal electricity utilities with fewer than 30,000 customers. In addition, the budget introduced a capital gains exemption where capital gains arise as a result of exiting the payments in lieu of corporate taxes regime. These incentives are in place until December 31, 2028, with an additional temporary reduction of the tax rate for transfers from 22% to nil for municipal electricity utilities with 30,000 customers or more, effective from January 1, 2025 to December 31, 2028.

Ontario 2017 Long-Term Energy Plan

In October 2017, the Province released its 2017 Long-Term Energy Plan (the “2017 Long-Term Energy Plan”), which set out a number of initiatives for Ontario’s energy system. The IESO and the OEB developed implementation plans in support of the objectives of the 2017 Long-Term Energy Plan, and each implementation plan was approved by the Minister of Energy in February 2018.

In 2022, the Province established the Electrification and Energy Transition Panel (the “Electrification and Energy Transition Panel”). This panel was responsible for advising the Province on the highest value short, medium, and long-term opportunities for the energy sector to help Ontario’s economy prepare for electrification and the energy transition. The Electrification and Energy Transition Panel also identified opportunities to strengthen Ontario’s long-term energy planning process by better coordinating the fuels and the electricity sector. In 2023, the Electrification and Energy Transition Panel invited stakeholders, Indigenous partners and the public to provide written advice on five themes related to energy transition and electrification. These engagements assisted the Electrification and Energy Transition Panel in preparing its report, which was released in January 2024.

In December 2024, the Affordable Energy Act amended various statutes, providing a legislative framework to replace the Province’s long-term energy plans with integrated energy plans. See “The Electricity Industry in Ontario – Issues Affecting the Electricity Industry Generally – Ontario Integrated Energy Plan” for more information.

Ontario Integrated Energy Plan

In January 2024, the Electrification and Energy Transition Panel, an advisory body to the Province, released its report outlining a roadmap for Ontario’s transition to a clean energy economy. In October 2024, the Province released its vision for Ontario’s energy sector, Ontario’s Affordable Energy Future, outlining key objectives to meet growing electricity demand in Ontario. This vision was intended to help guide the Province’s first integrated energy plan, among other initiatives. In December 2024, the Affordable Energy Act amended various statutes, including the Electricity Act and the Ontario Energy

Board Act, providing a legislative framework to replace the Province’s long-term energy plans (including the 2017 Long-Term Energy Plan), with integrated energy plans. Integrated energy plans are expected to detail actions and policy steps to build an affordable, reliable and clean energy system over the long term. Whereas the focus of the long-term energy plan had been primarily on the electricity system, the integrated energy plan is intended to address all sources of energy. The amendments effected by the Affordable Energy Act also allow the Minister, subject to the approval of the Lieutenant Governor in Council, to issue directives to the IESO and OEB setting out implementation requirements relating to the integrated energy plan. From October to December 2024, the Ministry of Energy ran a consultation requesting feedback to assist the Province in developing its first plan.

The changes made by the Affordable Energy Act to the Ontario Energy Board Act, among other things, also provide the Province with the ability to make regulations specifying amendments to the Distribution System Code and the Transmission System Code in relation to certain cost allocation and cost recovery matters relating to the construction, expansion or reinforcement of distribution systems or transmission systems, or of connections to those systems. The changes made by the Affordable Energy Act also allow regulations to be made exempting persons or things from provisions of the Distribution System Code and the Transmission System Code relating to cost allocation or cost recovery, as well as alternative provisions that apply instead.

In June 2025, the Province released its first integrated energy plan, Energy for Generations (“IEP”), which aims to leverage electricity, natural gas, hydrogen, storage and other energy sources to provide Ontario with affordable, secure, reliable and clean energy to power growth and jobs across the province. The IEP establishes a planning horizon out to 2050, including the acceleration of the development of transmission infrastructure and the modernization of the distribution grid. As part of the IEP, the Province announced the advancement of several transmission projects. See “Business of Hydro One – Transmission Business Segment – Business – Hydro One Transmission Projects Under the Integrated Energy Plan” for more information.

In July 2025, the IESO announced the launch of the TSF registry. Registration enables transmitters to participate in future competitive IESO transmission procurements.

In October 2025, the Province announced the launch of the Panel for Utility Leadership and Service Excellence (“PULSE”), a strategic advisory group that will support the objectives of the IEP and provide recommendations to the Province on how to best fund and deliver the next generation of electricity infrastructure. The Panel will provide strategic advice and recommendations to the Province on how to ensure local distribution companies are positioned to meet increasing electricity demand while maintaining high standards of safety, reliability, and cost-effectiveness.

OEB Actions on Electricity Pricing

Since March 2020, the Province has taken a number of actions related to the pricing of electricity to support regulated price plan (“RPP”) customers, following the COVID-19 pandemic. These government-

mandated actions include providing different fixed electricity prices for various periods of time. In response to direction provided by the Province, in September 2020 the OEB announced that, as of October 13, 2020, all utilities were required to give RPP customers the choice to opt out of time-of-use pricing and to elect instead to be charged on the basis of tiered (or fixed) electricity pricing.

In November 2020, the Province released its 2020 Ontario Budget: Ontario’s Action Plan: Protect, Support, Recover (the “2020 Ontario Budget”), which included a rate mitigation plan to help certain business and industrial customers. As of January 1, 2021, a portion of non-hydro renewable energy contracts (including wind, solar, bioenergy) is funded by the Province and not ratepayers. According to the 2020 Ontario Budget, this represented an approximately 25% reduction in Global Adjustment. The Global Adjustment is the difference between the guaranteed price and the money the generators earn in the wholesale marketplace. The OEB reset the RPP prices effective January 1, 2021, to reflect a decrease in the RPP supply cost as a result of the reduction in the Global Adjustment as set out in the 2020 Ontario Budget. The OEB has since reset the RPP prices in accordance with the OEB’s usual practice.

Resulting from established regulatory requirements by the Province in 2022, the OEB required distributors to implement a new voluntary ultra-low overnight price plan for RPP customers effective November 1, 2023. This represents a third pricing option for RPP customers in addition to time-of-use and tiered pricing plans. The ultra-low overnight price plan supports electrification and decarbonization by incentivizing customers to shift electricity loads to overnight periods when demand is lower and more electricity from non-emitting sources is available. In April 2023, the OEB released an addendum to their RPP Price Report that established the electricity prices under the ultra-low overnight price plan for May 1, 2023 to October 31, 2023. In September 2023, Hydro One launched the new ultra-low overnight price plan and began offering the new ultra-low overnight price plan to eligible customers. In October 2023, the OEB updated the RPP prices (including the new ultra-low overnight prices) for households and small businesses effective November 1, 2023. In October 2024, the OEB updated the RPP prices (including the new ultra-low overnight prices) for households and small businesses effective November 1, 2024. In October 2025, the OEB updated the RPP prices (including the new ultra-low overnight prices) for households and small businesses effective November 1, 2025. Going forward, it is anticipated that the OEB will periodically review the RPP prices and will reset them if required, in accordance with the OEB’s usual practice.

Building Broadband Faster Act, 2021

In March 2021, the Province introduced Bill 257, Supporting Broadband and Infrastructure Expansion Act, 2021, to create a new act entitled the Building Broadband Faster Act, 2021 that is aimed at supporting the timely deployment of broadband infrastructure within unserved and underserved rural Ontario communities. Bill 257, which received Royal Assent in 2021, amended the Ontario Energy Board Act to provide the Province with regulation-making authority regarding the development of, access to, or use of electricity infrastructure for non-electricity purposes. The Building Broadband Faster Act Guideline and three regulations informing the legislative changes were published in 2021. In March 2022, the Province introduced Bill 93, Getting Ontario Connected Act, 2022. Bill 93, which received Royal

Assent in 2022, amended the Building Broadband Faster Act to ensure that organizations that own underground utility infrastructure near a designated high-speed internet project provide timely access to their infrastructure data, which would allow internet service providers to quickly start work on laying down underground high-speed internet infrastructure. A regulation regarding electricity infrastructure and designated broadband projects under the Ontario Energy Board Act came into force in April 2022. This regulation substantially adopted Hydro One’s proposed approach to allocation of the costs of broadband-related work on utility assets. It also directed the OEB to establish a deferral account for rate-regulated distributors to record incremental costs associated with carrying out activities pertaining to designated broadband projects, which the OEB completed in July 2022. This regulation was amended in March 2023 with respect to performance timelines associated with designated broadband projects. In September 2022, the Company launched its choice-based operating model to provide internet service providers with choices on how to access the Company’s infrastructure in order to effectively execute designated broadband projects.

In August 2023, the Building Broadband Faster Act Guideline was further amended to provide additional guidance to support the implementation of legislative and regulatory requirements, including a framework to support cost sharing for pole attachments and make-ready work.

The Company has developed and adapted an appropriate management framework that meets the government’s objectives, including arrangements to sustain the Company’s revenues and recovery of reasonable associated costs.

In October 2024, the Province announced that it had developed a program to deliver up to $400 million in subsidies to internet service providers for work associated with designated broadband projects. The program is intended to enable internet service providers to successfully and safely attach their material and equipment to the Company’s poles to bring connectivity to rural communities as part of a designated broadband project. A portion of the subsidies is expected to be used to reimburse Hydro One Networks on behalf of internet service providers for their share of enablement costs incurred to facilitate the program to date.

In November 2025, the Province amended a regulation made under the Ontario Energy Board Act, implementing a monthly capacity target of poles ready for deployment and extending the performance timelines associated with the designated broadband projects. Hydro One Networks must complete its share of the work before July 1, 2028.

Protect Ontario by Unleashing our Economy Act, 2025 and Protect Ontario by Securing Affordable Energy for Generations Act, 2025

In April 2025, the Province introduced Bill 5, the Protect Ontario by Unleashing our Economy Act, 2025, which received Royal Assent on June 5, 2025. The Protect Ontario by Unleashing our Economy Act amended various statutes to streamline the permitting and authorization process for certain projects, including major infrastructure, including through changes to the environmental permitting process in

Ontario. The Company is assessing the potential impact on Hydro One.

In June 2025, the Province introduced Bill 40, the Protect Ontario by Securing Affordable Energy for Generations Act, 2025, which received Royal Assent on December 11, 2025. The Protect Ontario by Securing Affordable Energy for Generations Act amended various statutes, making economic development part of the mandate of the OEB, enabling the establishment of variance accounts for foreign equipment restrictions, and introducing regulation-making authority with regards to data centre connections for the provincial government. The Company is assessing the potential impact on Hydro One.

Legislative Provisions Specific to Hydro One

In addition to legislation in Ontario that impacts all transmitters and distributors, there is legislation that is specific to Hydro One. Specifically, the Electricity Act requires Hydro One’s head office and principal grid control centre to be maintained in Ontario, restricts the disposition of substantially all of its OEB-regulated transmission or distribution business, prohibits any change to its jurisdiction of incorporation, requires the Company to have an ombudsman, contains a 10% ownership restriction with respect to Voting Securities and restricts the Province from selling Voting Securities if it would own less than 40% of the Voting Securities of any class or series as a result of the sale.

Ombudsman

The Electricity Act requires the Company to have an ombudsman to act as a liaison with customers and to establish procedures for the ombudsman to inquire into and report to the Board on matters raised with the ombudsman by or on behalf of customers. See “Business of Hydro One – Ombudsman” for more information.

10% Ownership Restriction

The Electricity Act imposes share ownership restrictions on the Voting Securities. These restrictions provide that no person or company (or combination of persons or companies acting jointly or in concert) may beneficially own or exercise control or direction over more than 10% of any class or series of Voting Securities, including common shares of the Company (the “Share Ownership Restrictions”). The Share Ownership Restrictions do not apply to Voting Securities held by the Province, nor to an underwriter who holds Voting Securities solely for the purpose of distributing those securities to purchasers who comply with the Share Ownership Restrictions. The articles of Hydro One Limited provide for comprehensive enforcement mechanisms that are applicable in the event of a contravention of the Share Ownership Restrictions.

Maintenance of 40% Ownership

As of December 31, 2025, the Province owned approximately 47.1% of Hydro One Limited’s common shares. See the Annual MD&A under the heading “Risk Management and Risk Factors” for more

information.

The Electricity Act restricts the Province from selling Voting Securities (including common shares of Hydro One Limited) if it would own less than 40% of the outstanding number of Voting Securities of that class or series after the sale. If as a result of the issuance of additional Voting Securities by Hydro One Limited, the Province owns less than 40% of the outstanding number of Voting Securities of any class or series, the Province must, subject to the approval of the Lieutenant Governor in Council and the necessary appropriations from the Legislature, take steps to acquire as many Voting Securities of that class or series as are necessary to increase the Province’s ownership to not less than 40% of the outstanding number of Voting Securities of that class or series. The manner in which, and the time by which, the Province must acquire these additional Voting Securities will be determined by the Lieutenant Governor in Council.

The Province has been granted pre-emptive rights by Hydro One Limited to assist it in meeting its ownership requirements under the Electricity Act as described under “Agreements with Principal Shareholder – Governance Agreement – Other Matters – Pre-emptive Rights”.

Elimination of Certain Legislation With Respect to Hydro One

In 2015 and 2016, Hydro One Inc. and its subsidiaries ceased to be subject to a number of Ontario statutes that apply to entities owned by the Province. Hydro One Limited is similarly not subject to those statutes. Notwithstanding the elimination of certain legislation with respect to Hydro One, the Company is required under the Financial Administration Act and the Auditor General Act to provide financial information to the Province for the Province’s public reporting purposes.

Cybersecurity

The Company is exposed to potential risks related to cyberattacks, supply chain compromises and unauthorized access to our systems. As the Company continues to make investments in and rely on additional, more complex and interconnected digital technology to enable efficient operations, the likelihood of a cyber-breach impacting our business increases. In addition, the critical nature of our business further increases the likelihood of a sophisticated cyber attacker taking advantage of our people, processes and technology. The Company takes a risk-aligned approach to cyber related investments to reduce the likelihood of an impactful cyber related breach. Despite having strong security measures in place, a breach could occur. A breach has the ability to corrupt our information technology systems, compromise our sensitive information, effect the integrity of our financial controls, disrupt operations or have impacts to the safety of our work environment. The Company manages these risks by establishing a common set of cybersecurity standards, periodic security testing, program maturity objectives, security partnerships and a unified security strategy built on a set of cybersecurity standards driven by the OEB. This Ontario specific set of standards is in alignment with the National Institute of Standards and Technology’s Cyber Security Framework. In addition to provincial regulatory requirements of the OEB, critical systems that support the North American Bulk Electric System are regulated by the North American Electric Reliability Critical Infrastructure Protection Standards. These two foundational

frameworks establish strong security measures across all aspects of our operations.

Exemptive Relief

Disclosure of Ownership by the Province

In July 2022, the Canadian securities regulatory authorities granted (i) the Minister of Energy; (ii) Ontario Power Generation Inc. (on behalf of itself and the segregated funds established as required by the Nuclear Fuel Waste Act); and (iii) agencies of the Crown, provincial Crown corporations and other provincial entities (collectively, the “Non-Aggregated Holders”) exemptive relief, subject to certain conditions, to enable each Non-Aggregated Holder to treat securities of Hydro One Limited and debt securities of Hydro One Inc. and HOHL that it owns or controls separately from securities of Hydro One Limited and debt securities of Hydro One Inc. and HOHL owned or controlled by the other Non-Aggregated Holders for purposes of certain take-over bid, early warning reporting, insider reporting and control person distribution rules and certain distribution restrictions under Canadian securities laws. Hydro One Limited was also granted relief permitting it to rely solely on insider reports and early warning reports filed by Non-Aggregated Holders when reporting beneficial ownership or control or direction over securities of Hydro One Limited and debt securities of Hydro One Inc. and HOHL in any information circular or annual information form in respect of such securities beneficially owned or controlled by any Non-Aggregated Holder, subject to certain conditions. This exemptive relief will remain in effect until the earliest to occur of the following: (i) July 28, 2027, and (ii) the date that the Non-Aggregated Holders becomes subject to disclosure requirements that are substantially similar to the disclosure requirements regarding beneficial ownership or control over securities of Hydro One Limited or debt securities of Hydro One Inc. or HOHL for which such exemption was granted and such disclosure requirements require the aggregation of holdings by the Minister of Energy with other Non-Aggregated Holders. Substantially similar relief had previously been granted in June 2017, which terminated in 2022.

U.S. GAAP

In October 2022, Hydro One Limited was granted exemptive relief by the securities regulators in each province and territory of Canada that allows Hydro One Limited to continue to report its financial results in accordance with U.S. GAAP (the “Exemptive Relief”). The Exemptive Relief will remain in effect until the earliest to occur of the following: (i) January 1, 2027; (ii) if Hydro One Limited ceases to have rate-regulated activities, the first day of Hydro One Limited’s financial year that commences after it ceases to have such rate-regulated activities; and (iii) the first day of Hydro One Limited’s financial year that commences on or following the later of: (a) the effective date prescribed by the IASB for the mandatory application of a standard within International Financial Reporting Standards specific to entities with rate-regulated activities (the “Mandatory Rate-regulated Standard”); and (b) two years after the IASB publishes the final version of a Mandatory Rate-regulated Standard. In January 2021, the IASB published Exposure Draft – Regulatory Assets and Liabilities (the “Exposure Draft”). In July 2024, following completion of the re-deliberations of the proposals in the Exposure Draft, the IASB indicated that it expects to publish the new standard in the second half of 2025. The IASB tentatively decided to

require an entity to apply the prospective Mandatory Rate-regulated Standard for annual periods beginning on or after January 1, 2029, with earlier application permitted. In October 2025, the IASB updated its timing expectation for the issuance of the new standard to the second quarter of 2026. The Company continues to monitor the developments related to the anticipated new standard and determine the potential impacts to the Company’s financial statements.

Hydro One Limited is also permitted to report its financial results in accordance with U.S. GAAP by virtue of being, and for so long as it remains, an “SEC issuer” (within the meaning of National Instrument 52-107 – Acceptable Accounting Principles and Auditing Standards). There can be no assurance that Hydro One Limited will remain an SEC issuer indefinitely.

RECENT DEVELOPMENTS AT HYDRO ONE

Collective Bargaining

On January 13, 2026, Hydro One Inc. and the Society announced that a tentative agreement had been reached. On January 30, 2026, the agreement was ratified by the Society-represented employees, covering the period from October 1, 2025, to March 31, 2028.

RATE-REGULATED UTILITIES

Rate Applications in Ontario

Framework

The term “rate-regulated” is used to refer to an electricity business whose rates for transmission, distribution and other services are subject to approval by a regulator. The rate base of a rate-regulated utility means the net book value of the regulated assets of the utility, plus an allowance for working capital. The OEB is the regulator that approves electricity transmission and distribution rates in Ontario. Transmission and distribution rates have historically been determined using either a cost-of-service model or a performance-based model, which typically includes a cost-of-service base year. The OEB’s rate-setting models and cost of capital policy are reviewed and modified by the OEB from time to time. The OEB recently launched a consultation to update the rate-setting framework, in response to a changing energy and policy landscape.

In a cost-of-service model, a utility charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. A utility’s return on equity, or “ROE”, is the rate of return that a regulator allows the utility to earn on the equity portion of the utility’s rate base. The utility’s costs of providing its services must be prudently incurred. Cost savings are typically passed on to customers in the form of lower rates reflected in future rate decisions.

| | | | | | | | | | | | | | |

Cost of Service ($) | + | Return on Equity ($) | = | Revenue Requirement ($) |

In a performance-based model, a utility also charges rates for its services that allow it to recover the costs of providing its services and earn an allowed return on equity. However, rates are adjusted formulaically in years subsequent to the initial rebasing of costs. The formulaic adjustments in a performance-based model consider inflation and expectations regarding productivity. They assume that the utility becomes increasingly efficient over time. If a utility achieves cost savings in excess of those established by the regulator, the utility may retain some or all of the benefits of those cost savings, which may permit the utility to earn more than its allowed return on equity. In Ontario, transmission and distribution rates, including those of Hydro One, are now generally determined using a performance-based model.

In 2024, the OEB commenced a generic proceeding to review and potentially revise the methodology for determining the cost of capital parameters and deemed capital structure for rate-regulated utilities in Ontario. In March 2025, the OEB issued a decision, revising the methodology for determining the values of the cost of capital parameters. These parameters are updated annually and are expected to be applied at a utility’s next rebasing application. The OEB’s approach for deemed capital structure remained unchanged at 40% equity and 60% debt, and provided utilities with the option to file evidence to support changes due to their specific circumstances in future rate applications.

CORPORATE STRUCTURE

Incorporation and Office

Hydro One Limited was incorporated on August 31, 2015, under the OBCA. Its registered office and head office is located at 483 Bay Street, 8th Floor, South Tower, Toronto, Ontario M5G 2P5.

On October 30, 2015, the articles of Hydro One Limited were amended to authorize the creation of an unlimited number of Series 1 preferred shares and an unlimited number of Series 2 preferred shares, with the Series 1 preferred shares to be issued to the Province.

On October 31, 2015, all of the issued and outstanding shares of Hydro One Inc. were acquired by Hydro One Limited from the Province in exchange for the issuance to the Province of common shares and Series 1 preferred shares of Hydro One Limited. All of the Series 1 preferred shares were subsequently redeemed by Hydro One Limited on November 20, 2020, such that there are currently no Series 1 preferred shares issued and outstanding.

On November 4, 2015, the articles of Hydro One Limited were amended to authorize the consolidation of its outstanding common shares such that 595,000,000 common shares of Hydro One Limited were issued and outstanding.

On June 24, 2025, the articles of Hydro One Limited were amended to change the minimum and

maximum number of directors, providing for a minimum of eight directors and a maximum of 15 directors.

Corporate Structure and Subsidiaries

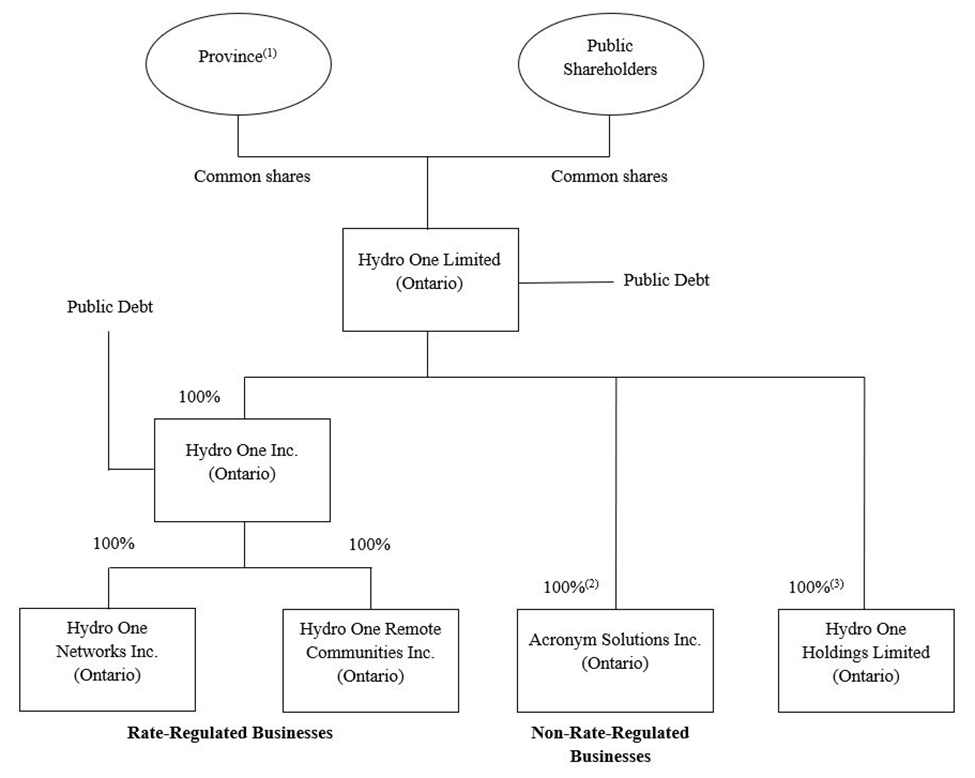

The following is a simplified chart showing the organizational structure of Hydro One and the name and jurisdiction of incorporation of certain of its subsidiaries. This chart does not include all legal entities within Hydro One’s organizational structure. Hydro One Limited owns, directly or indirectly, 100% of the voting securities of all of the subsidiaries listed below.

Notes:

(1)As of December 31, 2025, the Province directly owned approximately 47.1% of Hydro One Limited’s outstanding common shares.

(2)Indirectly held through a wholly-owned subsidiary of Hydro One Limited that acts as a holding company for Hydro One’s non-rate-regulated businesses.

(3)Indirectly held through a wholly-owned subsidiary of Hydro One Limited.

Certain of Hydro One’s subsidiaries are described below:

•Hydro One Inc. – acts as a holding company for Hydro One’s rate-regulated businesses. Its publicly-issued debt continues to be outstanding.

•Hydro One Networks – the principal operating subsidiary that carries on Hydro One’s rate-regulated transmission and distribution businesses.

•Hydro One Remote Communities – generates and supplies electricity to remote communities in northern Ontario.

•Acronym Solutions Inc. – carries on Hydro One’s non-rate-regulated telecommunications business.

•Hydro One Holdings Limited – a finance subsidiary with no operational activities.

GENERAL DEVELOPMENT OF THE BUSINESS

Chronological Development of the Business

Background

In August 2015, Hydro One Limited was incorporated by the Province as its sole shareholder. In November 2015, Hydro One Limited completed its initial public offering on the TSX by way of a secondary offering of common shares by the Province. Hydro One Limited did not receive any proceeds from the initial public offering. Prior to the closing of the initial public offering, all of the issued and outstanding common shares of Hydro One Inc. were acquired by Hydro One Limited.

2023

Directors

Effective June 2, 2023, Mitch Panciuk, Helga Reidel, and Brian Vaasjo were elected directors of Hydro One Limited and Hydro One Inc. at Hydro One Limited’s annual meeting of shareholders. The new directors replaced William Sheffield, Blair Cowper-Smith, and Russel Robertson who did not stand for re-election.

Executive Officers

Effective February 1, 2023, William Sheffield resigned as Interim President and Chief Executive Officer of Hydro One Limited and Hydro One Inc.

Effective February 1, 2023, David Lebeter was appointed as President and Chief Executive Officer of Hydro One Limited and Hydro One Inc.

Effective April 13, 2023, David Lebeter resigned as Chief Operating Officer.

Effective April 13, 2023, Teri French was appointed as Executive Vice President, Operations and Customer Experience. Teri French’s current title is Executive Vice President, Safety, Operations and Customer Experience.

Effective April 13, 2023, Andrew Spencer was appointed as Executive Vice President, Capital Portfolio Delivery.

Effective April 13, 2023, Paul Harricks resigned as Executive Vice President, Chief Legal Officer.

Effective April 13, 2023, Megan Telford’s title was expanded to Executive Vice President, Strategy, Energy Transition and Human Resources.

Effective April 13, 2023, Chris Lopez’s title was expanded to Executive Vice President, Chief Financial and Regulatory Officer.

2023 Sustainable Financing Framework

In January 2023, Hydro One Limited announced the publication of its Sustainable Financing Framework dated January 23, 2023 (the “2023 Framework”), a first for a utility in Canada. The 2023 Framework allows Hydro One Limited and its subsidiaries (including Hydro One Inc.) to issue sustainable financing instruments, such as sustainable and green bonds, and allocate the net proceeds to investments in eligible green and social project categories. Under the 2023 Framework, Hydro One Limited committed to providing an annual verification regarding the allocation of net proceeds of any green and/or sustainable financing, until the net proceeds of any such financing are fully allocated to eligible projects identified under the 2023 Framework. The 2023 Framework has been reviewed by Sustainalytics, which issued a second party opinion confirming that the 2023 Framework aligns with the International Capital Markets Association (“ICMA”) Sustainability Bond Guidelines 2021, Green Bond Principles 2021, the Social Bond Principles 2021 and the Loan Syndications and Trading Association (“LSTA”) Green and Social Loan Principles 2021. The 2023 Framework continues to apply in respect of certain sustainable financing instruments that were issued by Hydro One Limited or its subsidiaries prior to August 13, 2024.

See also “General Development of the Business – Chronological Development of the Business – 2024 – 2024 Sustainable Financing Framework”.

COVID-19

In 2023, the World Health Organization declared the end to COVID-19 as a public health emergency, which was originally declared a global pandemic in 2020. During the pandemic, the Company had continued to operate in-line with evolving safety procedures and practices.

2024

Executive Officers

Effective March 25, 2024, Renée McKenzie became Executive Vice President, Digital and Technology Solutions.

Effective June 9, 2024, Chris Lopez resigned as Executive Vice President and Chief Financial and Regulatory Officer.

Effective June 10, 2024, Harry Taylor was appointed as Executive Vice President and Chief Financial and Regulatory Officer.

Effective December 12, 2024, Andrew Spencer resigned as Executive Vice President, Capital Portfolio Delivery.

On December 12, 2024, Ryan Docherty, Vice President, Engineering and Construction Services, assumed responsibility on an interim basis for overseeing Capital Portfolio Delivery. Effective January 30, 2025, Mr. Docherty became Acting Head, Capital Portfolio Delivery.

2024 Sustainable Financing Framework

Hydro One Inc. has published allocation reports dated January 24, 2024, August 13, 2024, and May 16, 2025.

In August 2024, Hydro One Limited updated and published a new Sustainable Financing Framework (the “2024 Framework”). The 2024 Framework has been reviewed by Sustainalytics, which issued a second party opinion confirming that the 2024 Framework aligns with the ICMA Sustainability Bond Guidelines 2021, Green Bond Principles 2021, the Social Bond Principles 2023 and the LSTA Green and Social Loan Principles 2023.

The 2024 Framework allows Hydro One Limited and its subsidiaries (including Hydro One Inc.) to issue sustainable financing instruments, such as sustainability and green bonds, and allocate the net proceeds to investments in eligible green and social project categories. The project categories include: clean energy, energy efficiency, clean transportation, biodiversity conservation, climate change adaptation, socio-economic advancement of Indigenous peoples and access to essential services (such as the electrical grid

and enablement of high-speed broadband internet). Under the 2024 Framework, Hydro One Limited has committed to providing an annual verification regarding the allocation of net proceeds of any green and/or sustainable financing, until the net proceeds of any such financing are fully allocated to eligible projects identified under the 2024 Framework.

See also “General Development of the Business – Chronological Development of the Business – 2023 – 2023 Sustainable Financing Framework”.

2024 HOI MTN Shelf Prospectus