Q3 2025 Letter to shareholders .2

Q3 2025 highlights Revenue was $585 million, an increase of 68% year-over-year Gross margin was 91.0%, an improvement of 90 basis points from the prior year GAAP profitable with Net income of $163 million and net margin of 28%, an improvement of $133 million from the prior year Adjusted EBITDA was $236 million and Adjusted EBITDA margin was 40%, an improvement of $142 million from the prior year 1 Operating cash flow was $185 million, an improvement of $114 million from the prior year Free Cash Flow was $183 million, an improvement of $113 million from the prior year2 Basic and diluted earnings per share were $0.87 and $0.80, respectively Capital expenditures were $2.1 million, 0.4% of revenue Cash, cash equivalents, and marketable securities were $2.23 billion as of September 30, 2025 Total fully diluted shares outstanding were 206.1 million as of September 30, 2025, down 0.2% from the prior quarter and down 0.1% from the prior year Financial highlights 2 Q3 2025 • Letter to Shareholders Daily Active Uniques (“DAUq”) averaged 116.0 million, an increase of 19% year-over-year Weekly Active Uniques (“WAUq”) averaged 443.8 million, an increase of 21% year-over-year Logged-in users grew 14% and Logged-out users grew 24% year-over-year U.S. DAUq grew 7% year-over-year and International DAUq grew 31% year-over-year Total U.S. revenue grew 67% year-over-year and International revenue grew 74% year-over- year, driven by broad strength across objectives, verticals, geographies, and channels Advertising revenue of $549 million grew 74% year-over-year, and Other revenue was $36 million, up 7% year-over-year Advertising revenue growth was driven by year-over-year growth in impressions and pricing We saw strength across the full-funnel and with more than half of our top-15 industry verticals growing over 50% year-over-year Machine translation is available in 30 languages and a driver of top-of-funnel international user growth Business highlights

Dear fellow shareholders, Q3 was a strong quarter for Reddit, with differentiated results and solid execution across product, growth, and revenue. We ended the quarter with 116 million DAUq and 444 million WAUq, both growing around 20% year-over-year. We’re especially encouraged by the mix of growth, with organic product-led improvements and successful marketing both playing a role. This formula is working, and it’s one we’re focused on replicating across markets. Revenue came in at $585 million, up 68% year-over-year and our financial model is scaling very well. We continue to be GAAP profitable, with net income of $163 million and a net margin of 28%—an improvement of $133 million from last year. This quarter, we achieved a targeted Adjusted EBITDA margin of 40%, which was a profitability goal we set at our IPO just last year. Today, Reddit is the #3 most visited site in the U.S. (per Semrush, October 2025). That puts us in rare company— YouTube is #2 and Amazon is #4—and reflects how Reddit is where people start, not just where they end up. People come here to find trusted perspectives, to participate in communities that share their interests—no matter how niche or mainstream—and increasingly, to engage directly with brands, institutions, and publishers. In September, we launched new Reddit Pro tools tailored for publishers. Early adopters like The Associated Press can now sync their feeds, automatically import articles, track how their stories are shared, and use AI-powered tools to find the right communities. Our consumer product strategy continues to focus on making Reddit easier to use and more rewarding from day one, so casual users become daily users. They’re already coming to Reddit—now it’s on us to make the experience worth coming back for by being more relevant and intuitive. To that end, we’re making real progress across the three main focus areas we shared last quarter: core product, search, and globalization. Let’s start with the core product: We’re redesigning the Reddit experience with a more modern, search-forward interface and streamlining onboarding so it’s easier for new users to find what they're looking for with a dynamic, personalized home feed. We’re also helping more people contribute to their favorite communities by using AI to interpret subreddit rules and surface post insights. On the moderation side, we’re investing in tools that help mods grow and strengthen their communities. These tools are now live in over 3,000 communities, which are seeing 30% more active moderators on average. Moderators aren’t just enforcing rules—they’re shaping culture, building communities, and helping Reddit thrive. Our job is to give them the tools to do it more efficiently. 3 Q3 2025 • Letter to Shareholders

Next, search: Search is one of our biggest opportunities because Reddit conversations are uniquely authentic, contextual, and helpful. This is why we’re investing in making Reddit a true search destination. In Q3, over 75 million people searched on Reddit weekly, and that number continues to rise. Reddit Answers provides users with curated, community-powered insights that are often more helpful than traditional web results. We’ve started integrating Reddit Answers into core search, increasing its visibility across conversations, and rolling out to non-English languages. Our aim is to have a single, great search experience on Reddit. And third, internationalization: Our international growth continues to accelerate. Machine translation is available in 30 languages, and it’s a major driver of top-of-funnel user growth outside the U.S. We’ve built a local content framework to identify top interests in each country, which we use to guide partnerships, content, and marketing. This approach worked well in India, and we’re now applying it in Australia, Brazil, Germany, and France. We’re focused on finishing the year strong and putting our strategy for 2026 in motion. Looking ahead, our biggest priorities are: Growing app users by improving the experience and therefore retention. Broadening the types of users and communities that call Reddit home, both in the U.S. and globally. Increasing top-of-funnel growth by diversifying the sources of traffic, including organic, paid, and publisher- driven. And, of course, scaling ads and monetization formats for our users and partners. Reddit is in a unique position. We’re not trying to be the next anything—we’re focused on being the best version of ourselves and what the internet needs most: a place where people can connect on almost any topic and find genuinely useful information. Because no matter what you’re going through, someone on Reddit has already been there, done that—and shared the story. Thanks for being part of this journey. Steve Huffman Co-Founder & Chief Executive Officer 4 Q3 2025 • Letter to Shareholders

Starting 20 years ago as a web page of 25 links, Reddit has grown into a distinct network of communities unlike anywhere else online. Today, we believe it is the most human place on the internet, with over 440 million people visiting weekly to share, learn, and connect around their interests and passions. As the internet evolves, Reddit communities have continued to provide an essential space for people to find and engage in authentic, high-quality discussions, and for publishers, brands, and companies to connect with their audiences. We’re making it easier to contribute and discover discussions on Reddit, enriching our community ecosystem and building on the over 23 billion posts and comments that people come for every day. We’re achieving this by improving our search and contribution tools for users and building Reddit- unique products that publishers, brands, and organizations can use to share stories, reach audiences, and engage organically within Reddit communities. Empowering communities, connecting audiences, and elevating contribution +350k impressions +500 comments Reddit communities: bringing users, brands, 5 In communities like r/sonos and r/fidelityinvestments, companies are providing troubleshooting tips, investment advice, and customer service, and creators and publishers are using our new Ask Me Anything (“AMA ”) features to connect with their audience and fans on the platform. TM In September, we launched new Reddit Pro tools for publishers. Early adopters like The Associated Press, The Hill, The New York Times, and NBC News are able to sync their feeds and automatically import articles, track how their stories are being shared on Reddit (monitor views, upvotes, and clicks), and find the right communities for their content using our AI-powered suggestions and community recommendations. Publishers, brands, and companies are meeting their audiences on Reddit Q3 2025 • Letter to Shareholders and publishers together Reddit Pro Tools for publishers to monitor views, upvotes, and clicks Netflix AMA featuring the creators and acting voices behind KPop Demon Hunters TM Featuring new Video in Comments AMA responses

Core product year-over-year US DAUq INT’L DAUq 116.0M 19% Our unique community signals of human perspectives, authenticity, and trust are a core differentiating factor – for example, using user-powered voting as a signal in Reddit Answers improves the quality of search results. LLM-Powered Reddit Answers + Search Integration Search New Search-Forward UX Redesigning the Reddit experience with a more modern and search- forward interface – delivering immediate value to users by connecting them with relevant content quickly Streamlining onboarding, enabling users to engage with the app out of the box, with less friction and a dynamically personalized home feed Encouraging contribution and using AI to interpret subreddit rules, helping users post effectively and providing them with post insights and analytics Supporting moderators as community builders with new tools that empower moderators to contribute and create communities, now in use by over 3,000 communities, which have over 30% more active moderators on average (IN MILLIONS) Q2 '25Q3 '24 Q4 '24 Q1 '25 Q3 '25 64.449.0 53.7 58.0 60.1 Our product roadmap is focused on reducing friction and delivering value to convert casual users into habitual, daily users. 51.6 48.2 48.0 50.1 50.3 116.0 97.2 101.7 108.1 110.4 Q3 ‘25 DAUq 6 Q3 2025 • Letter to Shareholders A. Semrush, October 2025. We believe that searching directly on Reddit reveals a breadth of perspectives and knowledge not accessible anywhere else. In Q3’25, over 75 million WAUq searched on Reddit, and we’re integrating Reddit Answers into the core search experience and expanding its accessibility across conversations. Reddit Answers daily query volume is up over 20% since last quarter. We’re expanding Reddit Answers in non-English languages and focusing on product differentiators to make Reddit search distinctive. Reddit is the #3 most visited website in the U.S. , and one of the most visited sites in the world. With our growing corpus of authentic human content and perspectives, our strategy is to make Reddit a search destination and build a global, unified, and modern experience. A

Internationalization Advertising & monetization Alchemy Stream, an SMB AI-powered streaming service, utilized Reddit’s automated targeting capabilities to optimize for performance campaigns, driving 2x higher than average CTR In France, we ran a multi-channel brand awareness campaign, generating over 1 billion impressions, growing local communities such as r/AskFrance and r/VosSous, and boosting searches for “Reddit” across the country Growing engagment in local communities Machine translation now covers 30 languages, and is driving top-of-funnel international user growth – the first step in growing awareness outside the U.S Our local content framework identifies top interests in each country, guiding partnerships, content strategy, and marketing. This content-first approach, proven in India, is now expanding to Australia, Brazil, Germany, and France Local partnerships such as Sachin Tendulkar’s ambassadorship in India (~9M views on his AMA ) and SkySports in Great Britain drove content, discussion, and conversations TM Model and optimization improvements to our lower-funnel App Ads objective generated double digit percentage improvements to performance Lower-funnel conversion objective performance improved over 20% driven by optimized ML models We're investing in automation across our full ad-stack to help drive adoption of our ad tools and improve performance for advertisers Upper funnel: Launched beta of Automated Bidding for brand campaigns, simplifying budget management and improving efficiency for advertisers with +15% more impressions and lower pricing A Middle and Lower funnel: With ML improvements and enhanced reporting, Automated Targeting drives stronger campaign performance, and adoption is growing over 50% year-over-year We continue to invest in our ad models to enhance the efficiency and performance of Reddit ads. In Q3, we optimized our models for lower-funnel objectives, including conversions and app installs, improving performance and delivering value for advertisers. A. Reddit Internal, 2025. 7 AI and ML investments driving lower-funnel performance Automation is delivering results across the funnel Q3 2025 • Letter to Shareholders Our internationalization strategy is focused on driving top-of-funnel awareness with machine translation (“MT”) and marketing, while fostering local community and content creation through the machine-translated immersive app experience, our local content framework, and partnerships. +35% r/VosSous GROWTH IN COMMUNITY SUBSCRIBERS PRE / POST CAMPAIGN

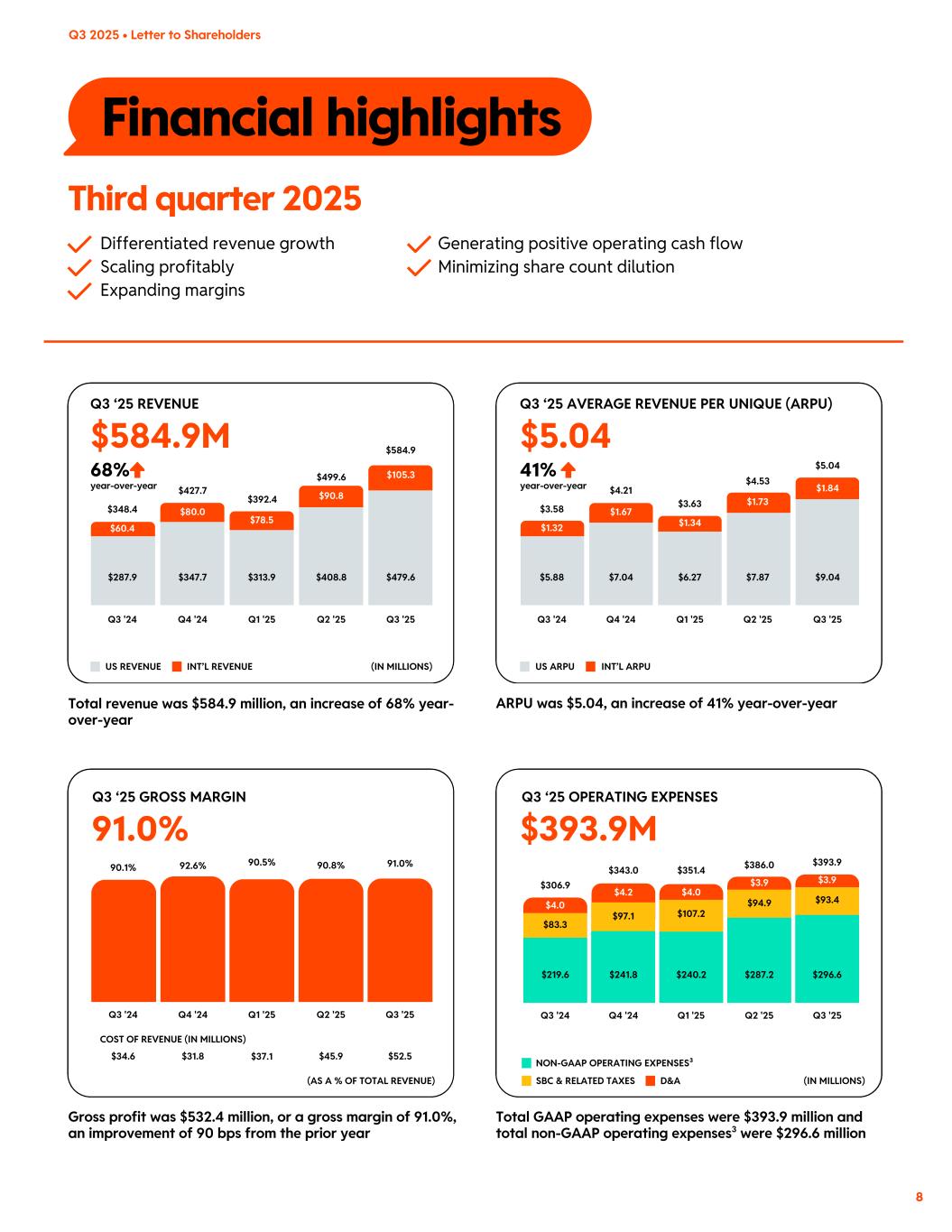

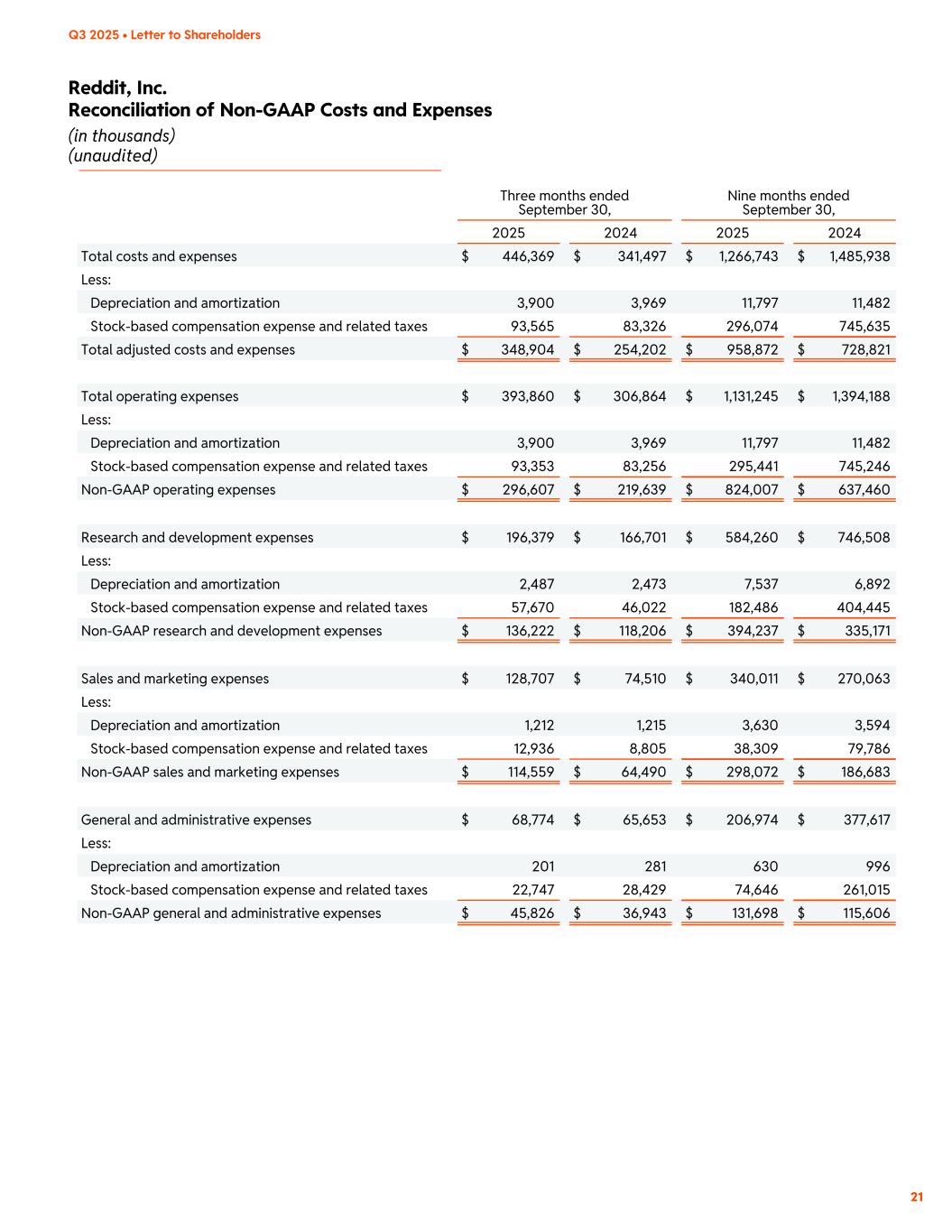

Financial highlights Differentiated revenue growth Scaling profitably Expanding margins 68% 41% SBC & RELATED TAXES NON-GAAP OPERATING EXPENSES³ D&A US REVENUE INT’L REVENUE $584.9M Q3 ‘25 REVENUE $5.04 Q3 ‘25 AVERAGE REVENUE PER UNIQUE (ARPU) Third quarter 2025 Generating positive operating cash flow Minimizing share count dilution (IN MILLIONS) $313.9 $78.5 $499.6 $408.8 $90.8 $584.9 $479.6 $105.3 $348.4 $287.9 $60.4 $427.7 $347.7 $80.0 Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 Total revenue was $584.9 million, an increase of 68% year- over-year US ARPU INT’L ARPU $3.63 $4.53 $5.04 $3.58 $4.21 Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 $6.27 $9.04$7.04$5.88 $7.87 $1.34 $1.84 $1.32 $1.67 $1.73 ARPU was $5.04, an increase of 41% year-over-year 91.0% Q3 ‘25 GROSS MARGIN 90.1% 92.6% 90.5% 90.8% 91.0% (AS A % OF TOTAL REVENUE) COST OF REVENUE (IN MILLIONS) Q4 '24 $31.8 Q1 '25 $37.1 Q2 '25 $45.9 Q3 '25 $52.5 Q3 '24 $34.6 Gross profit was $532.4 million, or a gross margin of 91.0%, an improvement of 90 bps from the prior year Total GAAP operating expenses were $393.9 million and total non-GAAP operating expenses were $296.6 million3 Q3 ‘25 OPERATING EXPENSES (IN MILLIONS) Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 $83.3 $306.9 $4.2 $4.0 $3.9$3.9 $4.0 $219.6 $241.8 $97.1 $343.0 $240.2 $287.2 $296.6 $93.4$94.9 $393.9$386.0$351.4 $107.2 $393.9M 8 year-over-year $392.4 year-over-year Q3 2025 • Letter to Shareholders

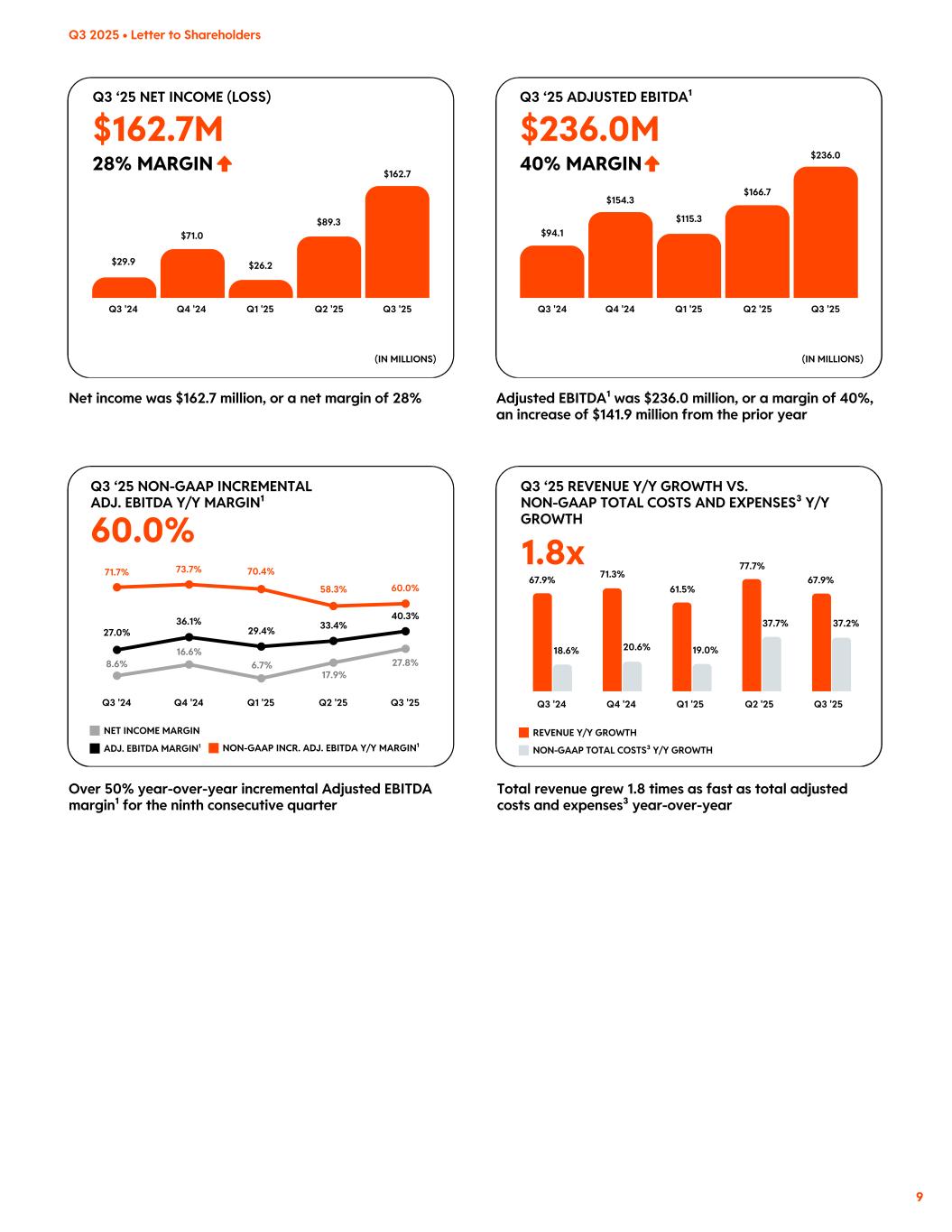

40% MARGIN28% MARGIN $236.0M 1.8x $162.7M 60.0% Q3 ‘25 NET INCOME (LOSS) Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 (IN MILLIONS) Net income was $162.7 million, or a net margin of 28% $26.2 $162.7 $29.9 $71.0 $89.3 NON-GAAP TOTAL COSTS³ Y/Y GROWTH REVENUE Y/Y GROWTH Total revenue grew 1.8 times as fast as total adjusted costs and expenses³ year-over-year 67.9% 18.6% 71.3% 20.6% 61.5% 19.0% 77.7% 37.7% 67.9% 37.2% Q3 ‘25 REVENUE Y/Y GROWTH VS. NON-GAAP TOTAL COSTS AND EXPENSES³ Y/Y GROWTH Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 Q3 ‘25 ADJUSTED EBITDA¹ Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 (IN MILLIONS) Adjusted EBITDA¹ was $236.0 million, or a margin of 40%, an increase of $141.9 million from the prior year $94.1 $236.0 $154.3 $115.3 $166.7 Over 50% year-over-year incremental Adjusted EBITDA margin¹ for the ninth consecutive quarter 71.7% 27.0% 73.7% 36.1% 8.6% 16.6% 29.4% 6.7% 58.3% 33.4% 17.9% 70.4% 60.0% 40.3% 27.8% Q3 ‘25 NON-GAAP INCREMENTAL ADJ. EBITDA Y/Y MARGIN¹ NON-GAAP INCR. ADJ. EBITDA Y/Y MARGIN¹ NET INCOME MARGIN Q3 '25 ADJ. EBITDA MARGIN1 Q2 '25Q1 '25Q4 '24Q3 '24 9 Q3 2025 • Letter to Shareholders

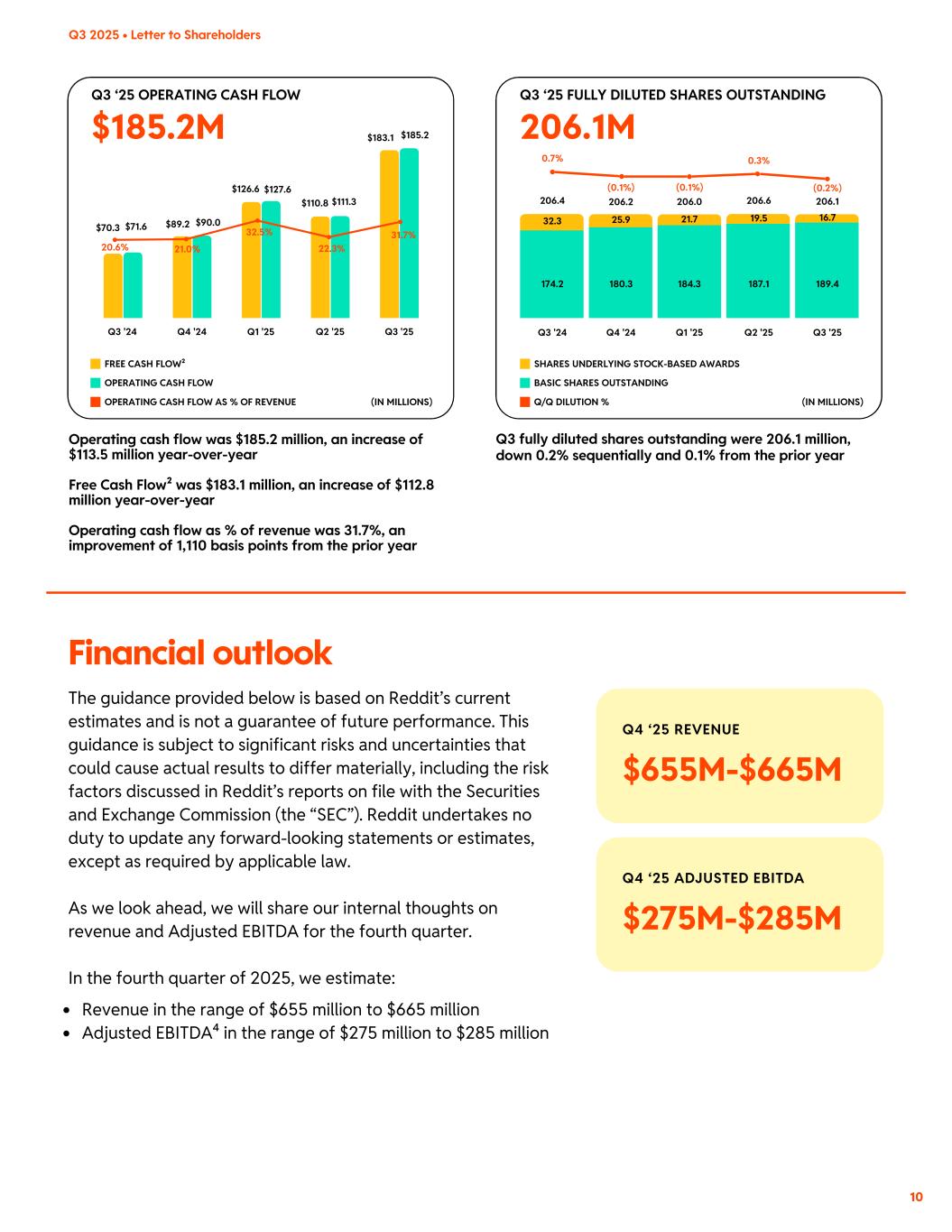

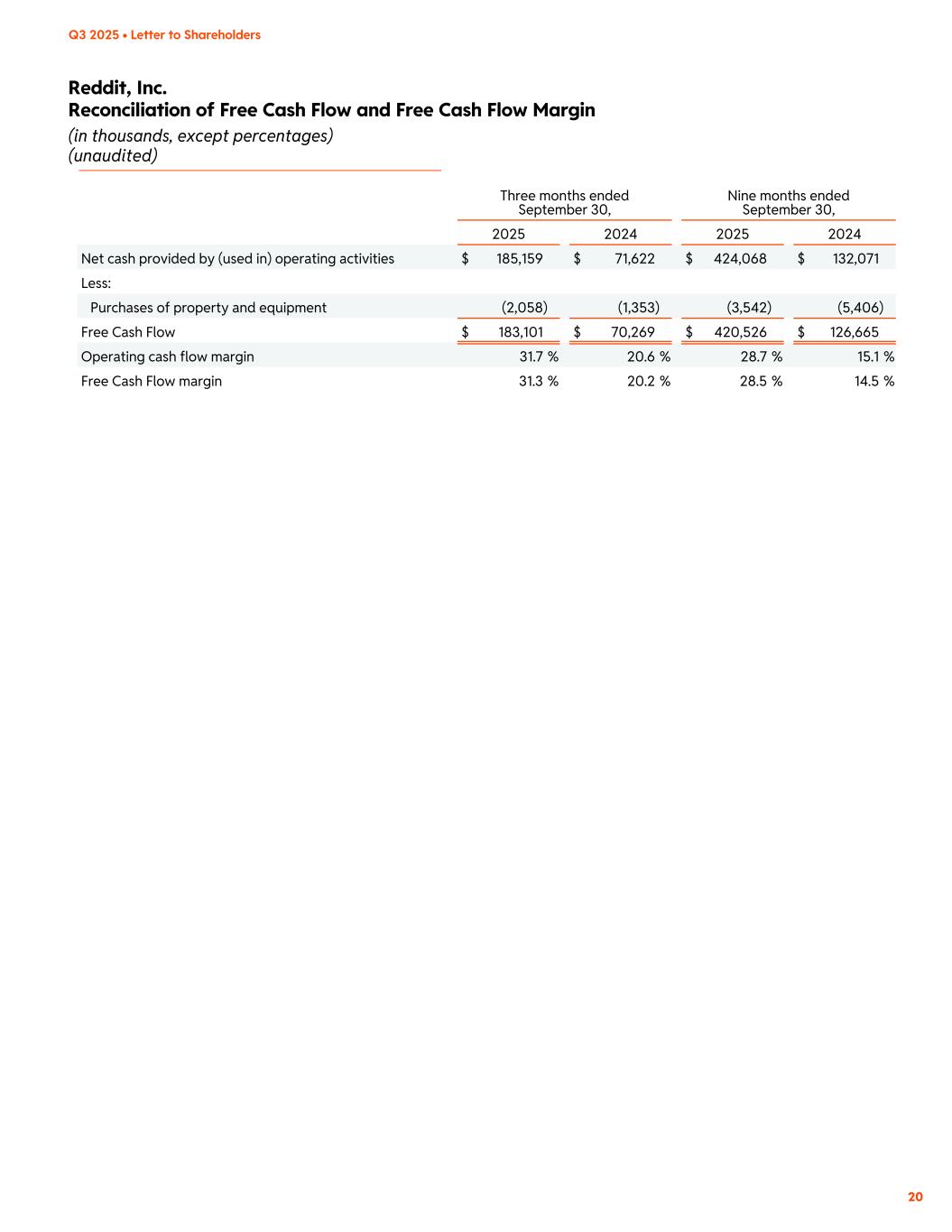

$185.2M Q4 ‘25 REVENUE $655M-$665M Q4 ‘25 ADJUSTED EBITDA $275M-$285M BASIC SHARES OUTSTANDING SHARES UNDERLYING STOCK-BASED AWARDS Q/Q DILUTION % $89.2 $126.6 20.6% 21.0% 32.5% 22.3% 31.7% $110.8 $183.1 $90.0$70.3 $71.6 $127.6 $111.3 $185.2 Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 Operating cash flow was $185.2 million, an increase of $113.5 million year-over-year Free Cash Flow² was $183.1 million, an increase of $112.8 million year-over-year Operating cash flow as % of revenue was 31.7%, an improvement of 1,110 basis points from the prior year Q3 ‘25 OPERATING CASH FLOW OPERATING CASH FLOW FREE CASH FLOW² (IN MILLIONS)OPERATING CASH FLOW AS % OF REVENUE 0.3% 206.1M Q3 ‘25 FULLY DILUTED SHARES OUTSTANDING 206.0 206.6 206.1206.4 206.2 Q4 '24 Q1 '25 Q2 '25 Q3 '25Q3 '24 184.3 189.4174.2 180.3 187.1 21.7 16.732.3 25.9 19.5 0.7% (0.1%) (0.1%) (0.2%) (IN MILLIONS) Q3 fully diluted shares outstanding were 206.1 million, down 0.2% sequentially and 0.1% from the prior year The guidance provided below is based on Reddit’s current estimates and is not a guarantee of future performance. This guidance is subject to significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in Reddit’s reports on file with the Securities and Exchange Commission (the “SEC”). Reddit undertakes no duty to update any forward-looking statements or estimates, except as required by applicable law. As we look ahead, we will share our internal thoughts on revenue and Adjusted EBITDA for the fourth quarter. In the fourth quarter of 2025, we estimate: Revenue in the range of $655 million to $665 million Adjusted EBITDA⁴ in the range of $275 million to $285 million Financial outlook 10 Q3 2025 • Letter to Shareholders

Reddit will host a conference call to discuss the results for the third quarter of 2025 on October 30, 2025, at 2:00 p.m. PT / 5:00 p.m. ET. A live webcast of the call can be accessed on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. A replay of the webcast and transcript will be available on the same websites following the conclusion of the conference call. Reddit will solicit questions from the community at r/RDDT on October 30, 2025, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. Steve Huffman Co-Founder & Chief Executive Officer Drew Vollero Chief Financial Officer Earnings conference call & community update 11 Q3 2025 • Letter to Shareholders

Appendix Notes 1.The definition of Adjusted EBITDA, Adjusted EBITDA margin, and incremental Adjusted EBITDA margin and a reconciliation of net income (loss) to Adjusted EBITDA and Adjusted EBITDA margin can be found on subsequent pages of this appendix 2.The definition of Free Cash Flow and a reconciliation of Free Cash Flow to net cash provided by (used in) operating activities can be found on subsequent pages of this appendix 3.The definition of total adjusted costs and expenses and non-GAAP operating expenses and a reconciliation of total adjusted costs and expenses and non-GAAP operating expenses to the comparable U.S. GAAP measures can be found on subsequent pages of this appendix 4.We have not provided a reconciliation to the forward-looking U.S. GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding U.S. GAAP guidance measures is not available without unreasonable effort About Reddit Reddit is a community of communities. It’s built on shared interests, passion, and trust, and is home to the most open and authentic conversations on the internet. Every day, Reddit users submit, vote, and comment on the topics they care most about. With 100,000+ active communities and 116 million daily active unique visitors, Reddit is one of the internet’s largest sources of information. For more information, visit www.redditinc.com. Forward Looking Statements This letter contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Reddit's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Reddit's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this letter include, but are not limited to, statements regarding Reddit’s priorities, future financial and operating performance, including evolution of machine translation, international growth strategies to increase content consumption and improve local user experience, consumer product strategy with respect to growth and engagement, GAAP and non- GAAP guidance, strategies, and expectations of growth. Reddit's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including those more fully described under the caption “Risk Factors” and elsewhere in documents that Reddit files with the SEC from time to time, including Reddit’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, which 12 Q3 2025 • Letter to Shareholders

is being filed with the SEC at or around the date hereof. The forward-looking statements in this letter are based on information available to Reddit as of the date hereof, and Reddit undertakes no obligation to update any forward-looking statements, except as required by law. A Note About Metrics We define a daily active unique (“DAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a 24-hour period. Average DAUq for a particular period is calculated by adding the number of DAUq on each day of that period and dividing that sum by the number of days in that period. We define a weekly active unique (“WAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a trailing seven-day period. Average quarterly WAUq for a particular period is calculated by adding the number of WAUq on each day of that period and dividing that sum by the number of days in that period. We define average revenue per unique (“ARPU”) as quarterly revenue in a given geography divided by the average DAUq in that geography. For the purposes of calculating ARPU, advertising revenue in a given geography is based on the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity, while other revenue in a given geography is based on the billing address of the customer. Use of Non-GAAP Financial Measures We use certain non-GAAP financial measures to supplement our consolidated financial statements, which are presented in accordance with U.S. GAAP, to evaluate our core operating performance. These non-GAAP financial measures include Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, Free Cash Flow margin, total adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense. We use these non-GAAP financial measures to facilitate reviews of our operational performance and as a basis for strategic planning. By excluding certain items that are non- recurring or not reflective of the performance of our normal course of business, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are a number of limitations related to the use of non-GAAP financial measures as they reflect the exercise of judgment by our management about which expenses are included or excluded in determining these non-GAAP measures. These non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. A reconciliation is provided below for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with U.S. GAAP. Reddit encourages investors to 13 Q3 2025 • Letter to Shareholders

review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures, and not to rely on any single financial measure to evaluate Reddit’s business. We have not provided a reconciliation to the forward- looking GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding GAAP guidance measures is not available without unreasonable effort. Adjusted EBITDA is defined as net income (loss) excluding interest (income) expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense and related taxes, other (income) expense, net, and certain other non-recurring or non-cash items impacting net income (loss) that we do not consider indicative of our ongoing business performance. Other (income) expense, net consists primarily of realized gains and losses on sales of marketable securities, foreign currency transaction gains and losses, and other income and expense that are not indicative of our core operating performance. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Incremental Adjusted EBITDA margin is defined as the change in Adjusted EBITDA divided by the change in revenue over the same period. We consider the exclusion of certain non-recurring or non- cash items in calculating Adjusted EBITDA and Adjusted EBITDA margin to provide a useful measure for investors and others to evaluate our operating results in the same manner as management. Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property and equipment. Free Cash Flow margin is defined as Free Cash Flow divided by revenue. We believe that Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Total adjusted costs and expenses represents cost of revenue and operating expenses excluding stock- based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting cost of revenue and operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP operating expenses represents operating expenses excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP research and development expense, non- GAAP sales and marketing expense, and non-GAAP general and administrative expense represent their respective operating expense line items excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items. We consider adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense to be useful measures as they exclude expenses that are not reflective of our operational performance and could mask underlying trends in our business. Investor Relations Jesse Rose ir@reddit.com Media Relations Gina Antonini press@reddit.com 14 Q3 2025 • Letter to Shareholders

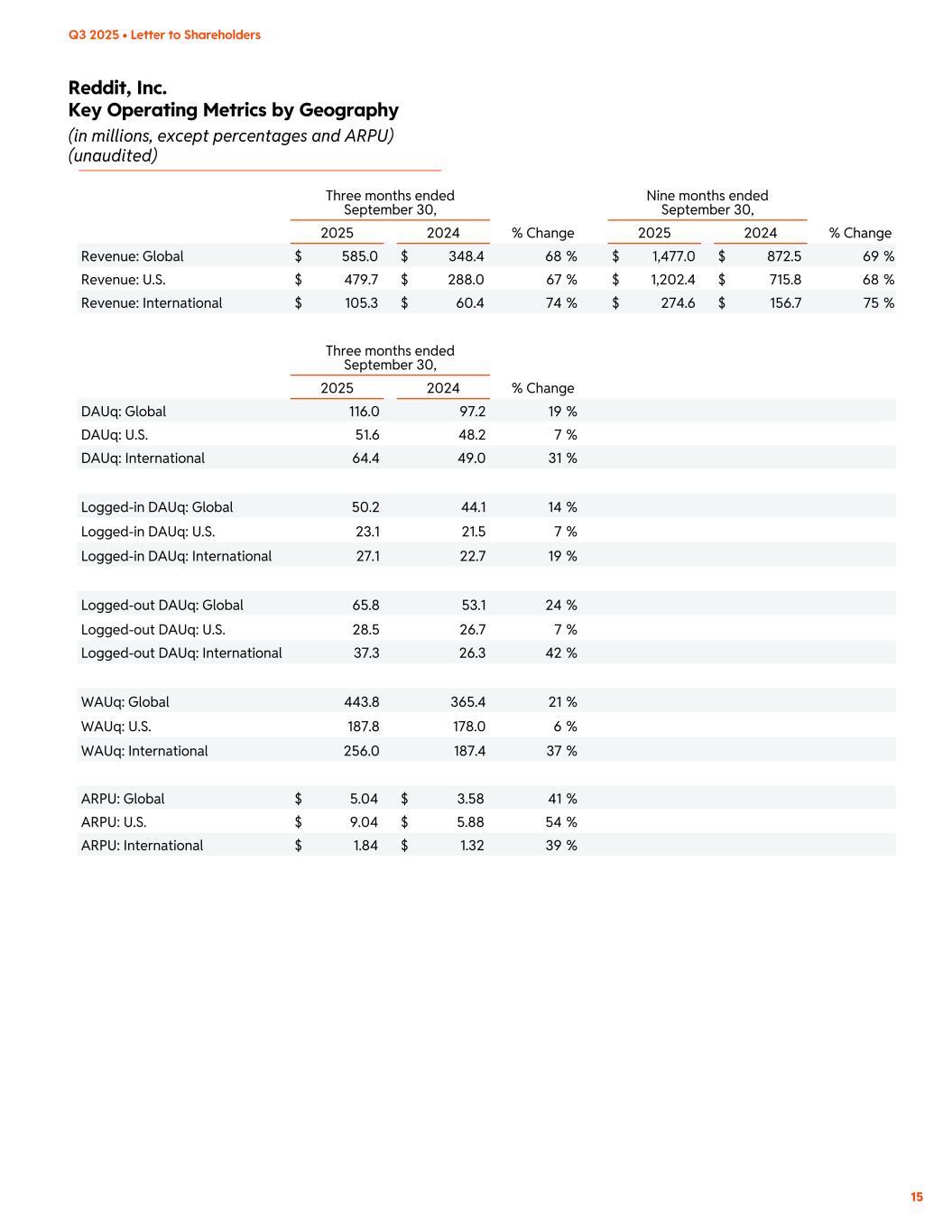

Reddit, Inc. Key Operating Metrics by Geography (in millions, except percentages and ARPU) (unaudited) 15 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 % Change 2025 2024 % Change Revenue: Global $ 585.0 $ 348.4 68 % $ 1,477.0 $ 872.5 69 % Revenue: U.S. $ 479.7 $ 288.0 67 % $ 1,202.4 $ 715.8 68 % Revenue: International $ 105.3 $ 60.4 74 % $ 274.6 $ 156.7 75 % Three months ended September 30, 2025 2024 % Change DAUq: Global 116.0 97.2 19 % DAUq: U.S. 51.6 48.2 7 % DAUq: International 64.4 49.0 31 % Logged-in DAUq: Global 50.2 44.1 14 % Logged-in DAUq: U.S. 23.1 21.5 7 % Logged-in DAUq: International 27.1 22.7 19 % Logged-out DAUq: Global 65.8 53.1 24 % Logged-out DAUq: U.S. 28.5 26.7 7 % Logged-out DAUq: International 37.3 26.3 42 % WAUq: Global 443.8 365.4 21 % WAUq: U.S. 187.8 178.0 6 % WAUq: International 256.0 187.4 37 % ARPU: Global $ 5.04 $ 3.58 41 % ARPU: U.S. $ 9.04 $ 5.88 54 % ARPU: International $ 1.84 $ 1.32 39 %

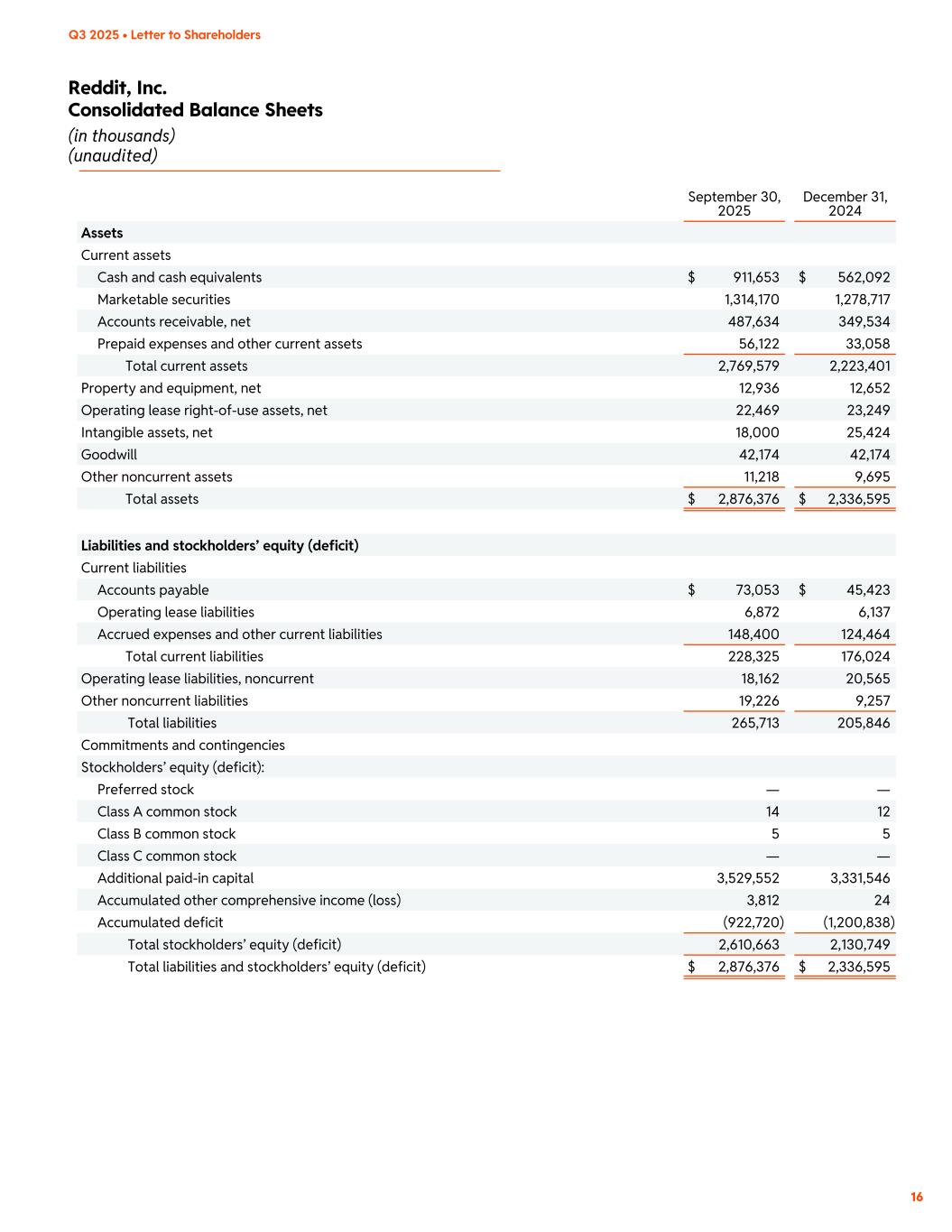

Reddit, Inc. Consolidated Balance Sheets (in thousands) (unaudited) 16 Q3 2025 • Letter to Shareholders September 30, 2025 December 31, 2024 Assets Current assets Cash and cash equivalents $ 911,653 $ 562,092 Marketable securities 1,314,170 1,278,717 Accounts receivable, net 487,634 349,534 Prepaid expenses and other current assets 56,122 33,058 Total current assets 2,769,579 2,223,401 Property and equipment, net 12,936 12,652 Operating lease right-of-use assets, net 22,469 23,249 Intangible assets, net 18,000 25,424 Goodwill 42,174 42,174 Other noncurrent assets 11,218 9,695 Total assets $ 2,876,376 $ 2,336,595 Liabilities and stockholders’ equity (deficit) Current liabilities Accounts payable $ 73,053 $ 45,423 Operating lease liabilities 6,872 6,137 Accrued expenses and other current liabilities 148,400 124,464 Total current liabilities 228,325 176,024 Operating lease liabilities, noncurrent 18,162 20,565 Other noncurrent liabilities 19,226 9,257 Total liabilities 265,713 205,846 Commitments and contingencies Stockholders’ equity (deficit): Preferred stock — — Class A common stock 14 12 Class B common stock 5 5 Class C common stock — — Additional paid-in capital 3,529,552 3,331,546 Accumulated other comprehensive income (loss) 3,812 24 Accumulated deficit (922,720) (1,200,838) Total stockholders’ equity (deficit) 2,610,663 2,130,749 Total liabilities and stockholders’ equity (deficit) $ 2,876,376 $ 2,336,595

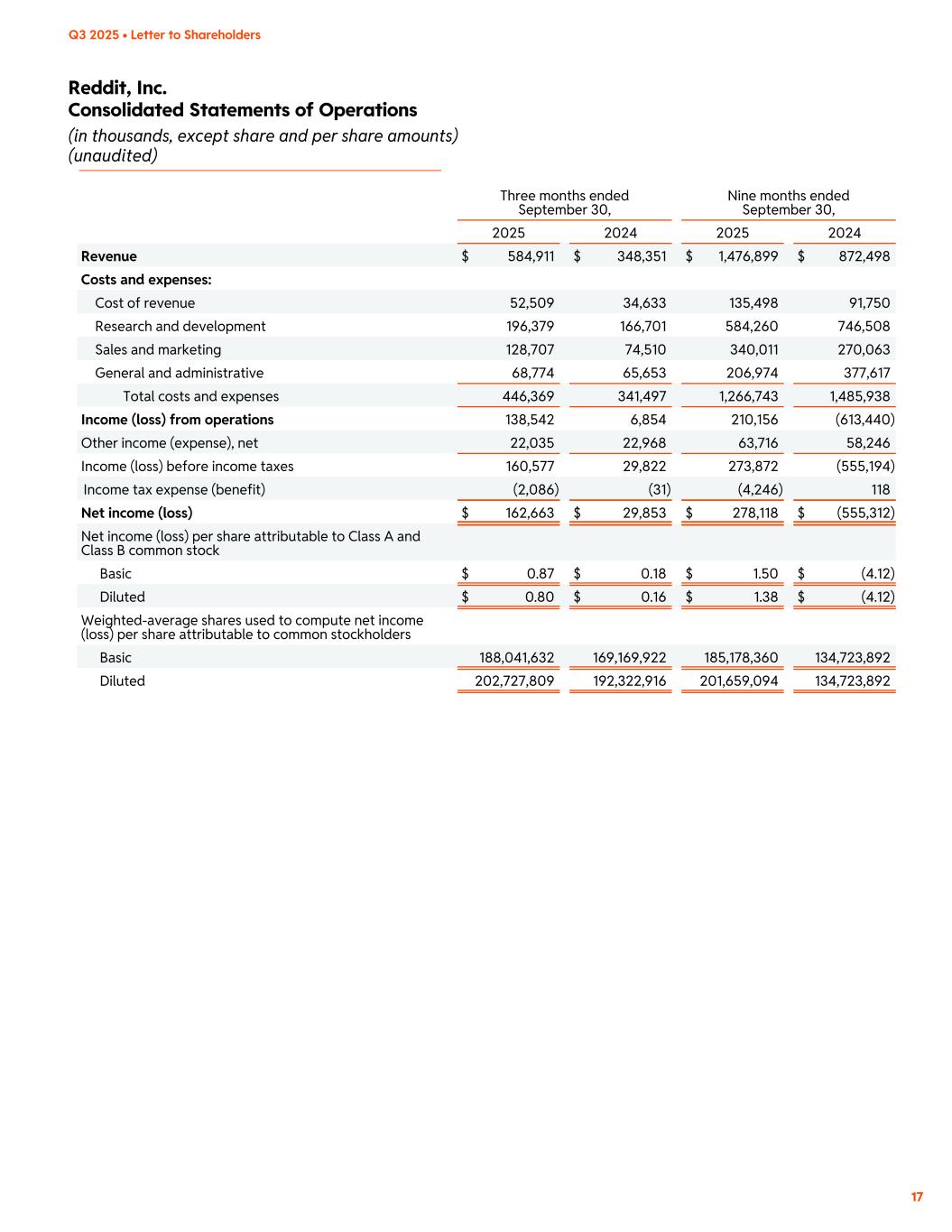

Reddit, Inc. Consolidated Statements of Operations (in thousands, except share and per share amounts) (unaudited) 17 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Revenue $ 584,911 $ 348,351 $ 1,476,899 $ 872,498 Costs and expenses: Cost of revenue 52,509 34,633 135,498 91,750 Research and development 196,379 166,701 584,260 746,508 Sales and marketing 128,707 74,510 340,011 270,063 General and administrative 68,774 65,653 206,974 377,617 Total costs and expenses 446,369 341,497 1,266,743 1,485,938 Income (loss) from operations 138,542 6,854 210,156 (613,440) Other income (expense), net 22,035 22,968 63,716 58,246 Income (loss) before income taxes 160,577 29,822 273,872 (555,194) Income tax expense (benefit) (2,086) (31) (4,246) 118 Net income (loss) $ 162,663 $ 29,853 $ 278,118 $ (555,312) Net income (loss) per share attributable to Class A and Class B common stock Basic $ 0.87 $ 0.18 $ 1.50 $ (4.12) Diluted $ 0.80 $ 0.16 $ 1.38 $ (4.12) Weighted-average shares used to compute net income (loss) per share attributable to common stockholders Basic 188,041,632 169,169,922 185,178,360 134,723,892 Diluted 202,727,809 192,322,916 201,659,094 134,723,892

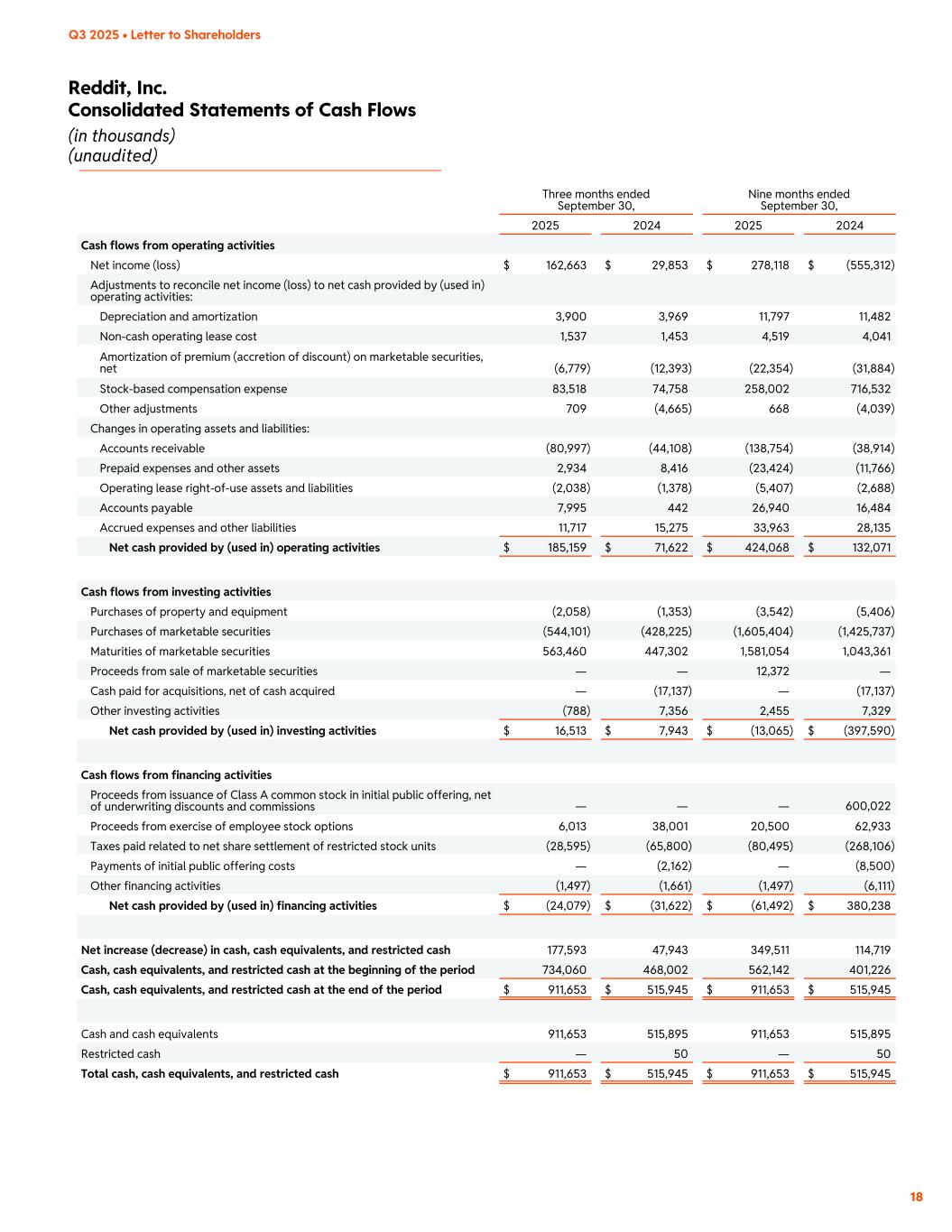

Reddit, Inc. Consolidated Statements of Cash Flows (in thousands) (unaudited) 18 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Cash flows from operating activities Net income (loss) $ 162,663 $ 29,853 $ 278,118 $ (555,312) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization 3,900 3,969 11,797 11,482 Non-cash operating lease cost 1,537 1,453 4,519 4,041 Amortization of premium (accretion of discount) on marketable securities, net (6,779) (12,393) (22,354) (31,884) Stock-based compensation expense 83,518 74,758 258,002 716,532 Other adjustments 709 (4,665) 668 (4,039) Changes in operating assets and liabilities: Accounts receivable (80,997) (44,108) (138,754) (38,914) Prepaid expenses and other assets 2,934 8,416 (23,424) (11,766) Operating lease right-of-use assets and liabilities (2,038) (1,378) (5,407) (2,688) Accounts payable 7,995 442 26,940 16,484 Accrued expenses and other liabilities 11,717 15,275 33,963 28,135 Net cash provided by (used in) operating activities $ 185,159 $ 71,622 $ 424,068 $ 132,071 Cash flows from investing activities Purchases of property and equipment (2,058) (1,353) (3,542) (5,406) Purchases of marketable securities (544,101) (428,225) (1,605,404) (1,425,737) Maturities of marketable securities 563,460 447,302 1,581,054 1,043,361 Proceeds from sale of marketable securities — — 12,372 — Cash paid for acquisitions, net of cash acquired — (17,137) — (17,137) Other investing activities (788) 7,356 2,455 7,329 Net cash provided by (used in) investing activities $ 16,513 $ 7,943 $ (13,065) $ (397,590) Cash flows from financing activities Proceeds from issuance of Class A common stock in initial public offering, net of underwriting discounts and commissions — — — 600,022 Proceeds from exercise of employee stock options 6,013 38,001 20,500 62,933 Taxes paid related to net share settlement of restricted stock units (28,595) (65,800) (80,495) (268,106) Payments of initial public offering costs — (2,162) — (8,500) Other financing activities (1,497) (1,661) (1,497) (6,111) Net cash provided by (used in) financing activities $ (24,079) $ (31,622) $ (61,492) $ 380,238 Net increase (decrease) in cash, cash equivalents, and restricted cash 177,593 47,943 349,511 114,719 Cash, cash equivalents, and restricted cash at the beginning of the period 734,060 468,002 562,142 401,226 Cash, cash equivalents, and restricted cash at the end of the period $ 911,653 $ 515,945 $ 911,653 $ 515,945 Cash and cash equivalents 911,653 515,895 911,653 515,895 Restricted cash — 50 — 50 Total cash, cash equivalents, and restricted cash $ 911,653 $ 515,945 $ 911,653 $ 515,945

Reddit, Inc. Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin (in thousands, except percentages) (unaudited) 19 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Net income (loss) $ 162,663 $ 29,853 $ 278,118 $ (555,312) Add (deduct): Interest (income) expense, net (22,305) (21,155) (63,775) (57,543) Income tax expense (benefit) (2,086) (31) (4,246) 118 Depreciation and amortization 3,900 3,969 11,797 11,482 Stock-based compensation expense and related taxes 93,565 83,326 296,074 745,635 Other (income) expense, net 270 (1,813) 59 (703) Adjusted EBITDA $ 236,007 $ 94,149 $ 518,027 $ 143,677 Net margin 27.8 % 8.6 % 18.8 % (63.6) % Adjusted EBITDA margin 40.3 % 27.0 % 35.1 % 16.5 %

Reddit, Inc. Reconciliation of Free Cash Flow and Free Cash Flow Margin (in thousands, except percentages) (unaudited) 20 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Net cash provided by (used in) operating activities $ 185,159 $ 71,622 $ 424,068 $ 132,071 Less: Purchases of property and equipment (2,058) (1,353) (3,542) (5,406) Free Cash Flow $ 183,101 $ 70,269 $ 420,526 $ 126,665 Operating cash flow margin 31.7 % 20.6 % 28.7 % 15.1 % Free Cash Flow margin 31.3 % 20.2 % 28.5 % 14.5 %

Reddit, Inc. Reconciliation of Non-GAAP Costs and Expenses (in thousands) (unaudited) 21 Q3 2025 • Letter to Shareholders Three months ended September 30, Nine months ended September 30, 2025 2024 2025 2024 Total costs and expenses $ 446,369 $ 341,497 $ 1,266,743 $ 1,485,938 Less: Depreciation and amortization 3,900 3,969 11,797 11,482 Stock-based compensation expense and related taxes 93,565 83,326 296,074 745,635 Total adjusted costs and expenses $ 348,904 $ 254,202 $ 958,872 $ 728,821 Total operating expenses $ 393,860 $ 306,864 $ 1,131,245 $ 1,394,188 Less: Depreciation and amortization 3,900 3,969 11,797 11,482 Stock-based compensation expense and related taxes 93,353 83,256 295,441 745,246 Non-GAAP operating expenses $ 296,607 $ 219,639 $ 824,007 $ 637,460 Research and development expenses $ 196,379 $ 166,701 $ 584,260 $ 746,508 Less: Depreciation and amortization 2,487 2,473 7,537 6,892 Stock-based compensation expense and related taxes 57,670 46,022 182,486 404,445 Non-GAAP research and development expenses $ 136,222 $ 118,206 $ 394,237 $ 335,171 Sales and marketing expenses $ 128,707 $ 74,510 $ 340,011 $ 270,063 Less: Depreciation and amortization 1,212 1,215 3,630 3,594 Stock-based compensation expense and related taxes 12,936 8,805 38,309 79,786 Non-GAAP sales and marketing expenses $ 114,559 $ 64,490 $ 298,072 $ 186,683 General and administrative expenses $ 68,774 $ 65,653 $ 206,974 $ 377,617 Less: Depreciation and amortization 201 281 630 996 Stock-based compensation expense and related taxes 22,747 28,429 74,646 261,015 Non-GAAP general and administrative expenses $ 45,826 $ 36,943 $ 131,698 $ 115,606