UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

GAMESQUARE HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

Name of Person(s) Filing Proxy Statement, if other than the Registrant

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

GAMESQUARE HOLDINGS INC.

6775 Cowboys Way, Ste. 1335

Frisco, Texas 75034

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 12:00 p.m. Central Time on December 4, 2025

EXPLANATORY NOTE

On November 4, 2025 at 12:00 p.m., Central Time, the Company convened its 2025 Annual Meeting of Stockholders (the “Annual Meeting”). At that time, there were not present or represented by proxy a sufficient number of shares of the Company’s common stock to constitute a quorum. Accordingly, pursuant to the Company’s bylaws, the Company adjourned the Annual Meeting without any business being conducted in order to allow for additional time for the Company to obtain the requisite number of shares by proxy or in person to constitute a quorum and approve the matters subject to stockholder vote. The adjourned Annual Meeting will reconvene virtually on Thursday, December 4, 2025 at 12:00 p.m., Central Time, or such other time as the chairman of the Annual Meeting may determine in accordance with the Company’s bylaws and applicable law, to vote upon the proposals set forth in the definitive proxy statement on Schedule 14A filed by the Company with the Securities and Exchange Commission (the “SEC”) on September 7, 2025, as supplemented from time to time (the “Initial Proxy Statement”). The close of business on September 5, 2025 (the “Record Date”) will continue to be the record date for the determination of stockholders of the Company entitled to vote at the reconvened Annual Meeting.

Stockholders may vote in person at the Annual Meeting or by submitting a proxy for the Annual Meeting. Stockholders of the Company who have previously submitted their proxy or otherwise voted and who do not want to change their vote do not need to take any action. During the period of the adjournment, the Company will continue to solicit votes from its stockholders with respect to the proposals for the Annual Meeting.

The Company encourages all stockholders of record as of the close of business on September 5, 2025, who have not yet voted, to do so by December 1, 2025 at 11:59 p.m., Central Time. Notwithstanding the foregoing, any votes properly received before the close of the adjourned Annual Meeting on November 4, 2025 will be accepted. Proxies previously submitted in respect of the Annual Meeting will be voted at the reconvened Annual Meeting unless properly revoked.

In connection with the change of the Annual Meeting’s adjournment date, and as required by the laws of Delaware, the federal securities law, and the Company’s bylaws, as applicable, the Company is filing these supplemental proxy materials (the “Supplement”) to provide notice to its stockholders of record as of the Record Date of the Reconvening Date. Copies of the Supplement are expected to be mailed to the stockholders of record as of the Record Date on or about November 7, 2025. The Supplement does not make any material changes to the matters set forth in the Initial Proxy Statement (as supplemented by the Supplement, the “Proxy Statement”). The Supplement sets forth a summary of the proposals to be voted upon at the adjourned Annual Meeting, which have not changed materially from the proposals set forth in the Initial Proxy Statement except for an immaterial, conforming change to Proposal 4 and the corresponding Appendix B, as set forth below. While there have been no material changes from the Initial Proxy Statement, the Initial Proxy Statement and this Supplement should be read together and in their entirety.

We have included the proxy card provided to stockholders as of the Record Date in connection with the Annual Meeting. There have been no changes to the proxy card that was previously provided to the stockholders entitled to vote at the Annual Meeting.

Stockholders may vote in person at the Annual Meeting or by submitting a proxy for the Annual Meeting. Stockholders of the Company who have previously submitted their proxy or otherwise voted and who do not want to change their vote do not need to take any action. Stockholders who previously voted and wish to change their vote may do so. During the period of the adjournment, the Company will continue to solicit votes from its stockholders with respect to the proposals for the Annual Meeting.

The Company encourages all stockholders of record as of the close of business on September 5, 2025, who have not yet voted. Notwithstanding the foregoing, any votes properly received before the close of the adjourned Annual Meeting on the Reconvening Date will be accepted. Proxies previously submitted in respect of the Annual Meeting will be voted at the reconvened Annual Meeting unless properly revoked.

Important Information

This document may be deemed to be solicitation material in respect of the Annual Meeting to be reconvened on December 4, 2025. The Company has filed the Proxy Statement with the SEC and has furnished to its stockholders the Proxy Statement in connection with the solicitation of proxies for the Annual Meeting. The Company advises its stockholders to read the Proxy Statement relating to the Annual Meeting because it contains important information. Stockholders may obtain a free copy of the Proxy Statement and other documents that the Company files with the SEC at the SEC’s website at www.sec.gov.

Participants in the Solicitation

The Company and its directors and executive officers and other employees may be deemed to be participants in the solicitation of proxies in respect of the adjourned Special Meeting. As previously disclosed, the Company has also engaged Laurel Hill Advisory Group, LLC, a proxy solicitation firm, to assist the Company in soliciting proxies in connection with the Annual Meeting.

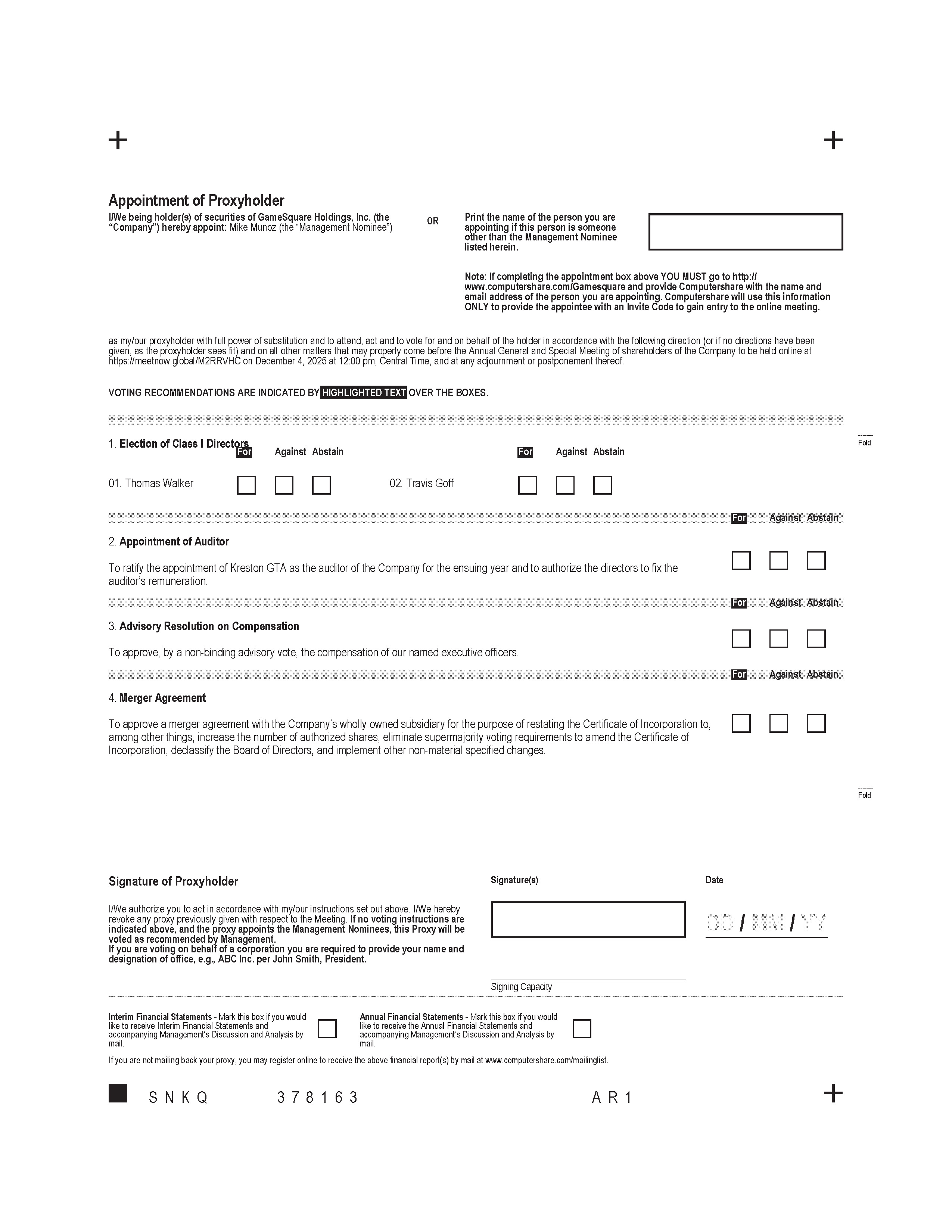

Proposal 1: Election of Directors

At the adjourned Annual Meeting, stockholders will be asked to elect two Class I members to our Board of Directors, Thomas Walker and Travis Goff, each to serve a three-year term and until their successors are duly elected and qualified, subject to earlier resignation or removal;

Proposal 2: Ratification of the Appointment of Independent Registered Public Accounting Firm

At the adjourned Annual Meeting, stockholders will be asked to ratify the appointment of Kreston GTA as our independent registered public accounting firm for the fiscal year ending December 31, 2025;.

Proposal 3: Advisory Vote to Approve the Compensation of Our Named Executive Officers

At the adjourned Annual Meeting, stockholders will be asked to approve, by a non-binding advisory vote, the compensation of our named executive officers.

Proposal 4: Vote to Approve a Merger Agreement with the Company’s Wholly Owned Subsidiary

At the adjourned Annual Meeting, stockholders will be asked to approve a merger agreement with the Company’s wholly owned subsidiary for the purpose of restating the Certificate of Incorporation to, among other things, increase the number of authorized shares, eliminate supermajority voting requirements to amend the Certificate of Incorporation, declassify the Board of Directors, and implement other non-material specified changes. The following is a summary of Proposal 4 which should be read in connection with the full disclosure contained in the Initial Proxy Statement.

Overview

The Board of Directors has approved and is recommending that the stockholders of the Company approve a merger agreement with the Company’s newly formed, wholly owned subsidiary, GameSquare Merger Sub 2, Inc. (the “Merger Agreement”) for the purpose of restating our Certificate of Incorporation (the “Certificate of Incorporation”) in order to increase the authorized shares, eliminate supermajority voting provisions to amend the Certificate of Incorporation of the Company, declassify the Board of Directors, and other non-material changes. This means that by voting in favor of the Merger, stockholders will also be voting in favor of all of the changes contained in the new Certificate of Incorporation, including an increase in authorized shares, the declassification of our Board of Directors, and other governance-related revisions.

Plan of Merger

The Company will be merged with and into GameSquare Merger Sub 2, Inc. pursuant to the Agreement and Plan of Merger by and between GameSquare Holdings, Inc. and GameSquare Merger Sub 2, Inc., dated August 26, 2025, which is attached as Appendix A to the Initial Proxy Statement. Upon the completion of the merger, the Company will be the surviving corporation. GameSquare Merger Sub 2, Inc.’s Certificate of Incorporation will be the Certificate of Incorporation of the surviving corporation (the “Restated Certificate of Incorporation”). The Certificate of Designation of Series A-1 Convertible Preferred Stock authorized by resolution of the Board of Directors of the Company providing for the authorization of 3,433.33 shares of Series A-1 Preferred Stock (the “Series A-1 Preferred Stock”) shall be the Certificate of Designation of Series A-1 Preferred Stock of the surviving corporation, until thereafter amended in accordance with the provisions provided therein or applicable law. The Company’s bylaws will remain the Company’s bylaws of the surviving corporation. GameSquare Merger Sub 2, Inc.’s Certificate of Incorporation is attached as Appendix B to this Proxy Statement. As part of this Supplement, Appendix B makes a conforming administrative change to the version filed with the Initial Proxy Statement. Such change removes a quorum requirement previously set forth in the certificate which was duplicative of Sec. 1.5 of the Company’s bylaws Removing the duplicative provision from the proposed amended and restated certificate of incorporation does not change or alter the Company’s quorum requirement for meetings of stockholders in any respect. The unchanged quorum requirement will continue to be governed by the Company’s Bylaws; accordingly, any future amendment to the quorum standard would be subject to the bylaw-amendment provisions of the Delaware General Corporation Law Sec. 109.

Delaware General Corporation Law generally does not provide appraisal rights for stockholders in the case of a merger where the shares of a company’s common stock are listed on a national securities exchange. The Company’s common stock is listed on the Nasdaq stock market, therefore the merger will not give rise to any appraisal rights for the Company’s stockholders.

Elimination of Supermajority Voting Provisions

Currently, the affirmative vote of the holders of at least two-thirds of the voting power of all the then-outstanding shares of stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class is required to amend or repeal the following sections of the Company’s Certificate of Incorporation:

| ● | Article IV (Capital Stock); |

| ● | Article V (Board of Directors); |

| ● | Article VII (Amendment of the Certificate of Incorporation and Bylaws); and |

| ● | Article VIII (Limitation of Director Liability and Indemnification); |

If the Merger Agreement is approved by stockholders, the Restated Certificate of Incorporation, which will become the Certificate of Incorporation of the Company upon completion of the merger, will not include the supermajority vote requirements set forth in Article VII to amend the Certificate of Incorporation. Under the Restated Certificate of Incorporation, the vote requirement for stockholders to amend the Company’s Certificate of Incorporation will revert to the default standard under Delaware General Corporation Law – a majority of the shares outstanding and entitled to vote on the matter.

Increase in Authorized Shares

The Company’s Certificate of Incorporation currently authorizes us to issue up to 100,000,000 shares of Common Stock and 50,000,000 shares of Preferred Stock, which we believe is inadequate to provide us with the flexibility necessary to respond to future needs and opportunities. As of the Record Date, we had a total of approximately 98,998,596 shares of Common Stock and 3,433 shares of Preferred Stock outstanding, and approximately 1,001,404 additional shares of Common Stock reserved for issuance.

If the Merger Agreement is approved by stockholders, the Restated Certificate of Incorporation, which will become the Certificate of Incorporation of the Company upon completion of the merger, will increase the number of authorized shares of Common Stock to 500,000,000. The authorized Preferred Stock will remain at 50,000,000.

Declassification of the Board of Directors

The Board has approved the Certificate of Incorporation of GameSquare Merger Sub 2, Inc., which will become the Certificate of Incorporation of the Company as the surviving company in the merger (the “Restated Certificate of Incorporation”). Paragraph A of ARTICLE SIXTH of the Restated Certificate of Incorporation eliminates the classified structure and provides for the annual election of all directors for one-year terms, beginning at the 2026 Annual Meeting of Stockholders.

In addition, Delaware law provides that directors serving on boards that are not classified may be removed with or without cause, whereas currently directors can be removed only for cause. Consistent with Delaware law, the Restated Certificate of Incorporation would permit stockholders to remove directors elected after the Board is declassified with or without cause. Directors elected while the Board was still classified, that is through the 2026 Annual Meeting, would continue to be removable only for cause.

If the Company’s stockholders do not approve the Merger Agreement (Proposal 4), the Board will remain classified, with each class of directors serving for three-year staggered terms.

Appendix B

GameSquare Merger Sub 2, Inc.

CERTIFICATE OF INCORPORATION

FIRST: The name of the Corporation is GameSquare Merger Sub 2, Inc. (hereinafter referred to as the “Corporation”).

SECOND: The address of the registered office of the Corporation in the State of Delaware is Corporation Trust Center 1209 Orange Street, in the City of Wilmington, County of New Castle. The name of the registered agent at that address is The Corporation Trust Company.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of Delaware.

FOURTH:

A. The total number of shares of all classes of stock which the Corporation shall have authority to issue is five hundred fifty million (550,000,000) consisting of:

1. Five hundred million (500,000,000) shares of Common Stock, par value $0.0001 per share (the “Common Stock”); and

2. Fifty Million (50,000,000) shares of Preferred Stock, par value $0.0001 per share (the “Preferred Stock”), of which Three Thousand Four Hundred Thirty Three and one/third (3,433.33) are designated as Series A-1 Preferred Stock.

B. The Board of Directors is authorized, subject to any limitations prescribed by law, to provide for the issuance of the shares of Preferred Stock in series, and by filing a certificate pursuant to the applicable law of the State of Delaware (such certificate being hereinafter referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences, and rights of the shares of each such series and any qualifications, limitations or restrictions thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the Common Stock, without a vote of the holders of the Preferred Stock, or of any series thereof, unless a vote of any such holders is required pursuant to the terms of any Preferred Stock Designation. Pursuant to the authority conferred by this Article FOURTH Section B, the terms, preferences, rights, privileges, and restrictions of the Series A-1 Preferred Stock, as set forth in the Certificate of Designation of Series A-1 Preferred Stock (“Certificate of Designation”), filed with the Secretary of State of Delaware on July 24, 2025, are hereby incorporated by reference and shall continue in full force and effect as part of this Certificate of Incorporation. A true and correct copy of the Certificate of Designation is attached hereto as Exhibit A and is incorporated herein for all purposes.

C. 1. Notwithstanding any other provision of this Certificate of Incorporation, in no event shall any record owner of any outstanding Common Stock which is beneficially owned, directly or indirectly, by a person who, as of any record date for the determination of stockholders entitled to vote on any matter, beneficially owns in excess of 10% of the then-outstanding shares of Common Stock (the “Limit”), be entitled to vote, or permitted to cast any vote in respect of the shares held in excess of the Limit, except that such restriction and all restrictions set forth in this subsection “C” shall not apply to any tax qualified employee stock benefit plan established by the Corporation, which shall be able to vote in respect to shares held in excess of the Limit. The number of votes which may be cast by any record owner by virtue of the provisions hereof in respect of Common Stock beneficially owned by such person owning shares in excess of the Limit shall be a number equal to the total number of votes which a single record owner of all Common Stock owned by such person would be entitled to cast, multiplied by a fraction, the numerator of which is the number of shares of such class or series which are both beneficially owned by such person and owned of record by such record owner and the denominator of which is the total number of shares of Common Stock beneficially owned by such person owning shares in excess of the Limit.

2. The following definitions shall apply to this Section C of this Article FOURTH:

| (a) | “Affiliate” shall have the meaning ascribed to it in Rule 12b-2 of the General Rules and Regulations under the Securities Exchange Act of 1934, as in effect on the date of filing of this Certificate of Incorporation. | |

| (b) | “Beneficial ownership” shall be determined pursuant to Rule 13d-3 of the General Rules and Regulations under the Securities Exchange Act of 1934 (or any successor rule or statutory provision), or, if said Rule 13d-3 shall be rescinded and there shall be no successor rule or statutory provision thereto, pursuant to said Rule 13d-3 as in effect on the date of filing of this Certificate of Incorporation; provided, however, that a person shall, in any event, also be deemed the “beneficial owner” of any Common Stock: |

| (1) | which such person or any of its affiliates beneficially owns, directly or indirectly; or | |

| (2) | which such person or any of its affiliates has (i) the right to acquire (whether such right is exercisable immediately or only after the passage of time), pursuant to any agreement, arrangement or understanding (but shall not be deemed to be the beneficial owner of any voting shares solely by reason of an agreement, contract, or other arrangement with this Corporation to effect any transaction which is described in any one or more of clauses of Article EIGHTH) or upon the exercise of conversion rights, exchange rights, warrants, options or otherwise, or (ii) sole or shared voting or investment power with respect thereto pursuant to any agreement, arrangement, understanding, relationship or otherwise (but shall not be deemed to be the beneficial owner of any voting shares solely by reason of a revocable proxy granted for a particular meeting of stockholders, pursuant to a public solicitation of proxies for such meeting, with respect to shares of which neither such person nor any such affiliate is otherwise deemed the beneficial owner); or | |

| (3) | which are beneficially owned, directly or indirectly, by any other person with which such first mentioned person or any of its affiliates acts as a partnership, limited partnership, syndicate or other group pursuant to any agreement, arrangement or understanding for the purpose of acquiring, holding, voting or disposing of any shares of capital stock of this Corporation; and provided further, however, that (1) no Director or Officer of this Corporation (or any affiliate of any such Director or Officer) shall, solely by reason of any or all of such Directors or Officers acting in their capacities as such, be deemed, for any purposes hereof, to beneficially own any Common Stock beneficially owned by another such Director or Officer (or any affiliate thereof), and (2) neither any employee stock ownership plan or similar plan of this Corporation or any subsidiary of this Corporation, nor any trustee with respect thereto or any affiliate of such trustee (solely by reason of such capacity as trustee), shall be deemed, for any purposes hereof, to beneficially own any Common Stock held under any such plan. For purposes of computing the percentage beneficial ownership of Common Stock of a person, the outstanding Common Stock shall include shares deemed owned by such person through application of this subsection but shall not include any other Common Stock which may be issuable by this Corporation pursuant to any agreement, or upon exercise of conversion rights, warrants, options, or otherwise. For all other purposes, the outstanding Common Stock shall include only Common Stock then outstanding and shall not include any Common Stock which may be issuable by this Corporation pursuant to any agreement, or upon the exercise of conversion rights, warrants, options, or otherwise. |

| (c) | A “person” shall include an individual, firm, a group acting in concert, a corporation, a partnership, an association, a joint venture, a pool, a joint stock company, a trust, an unincorporated organization or similar company, a syndicate or any other group formed for the purpose of acquiring, holding or disposing of securities or any other entity. |

3. The Board of Directors shall have the power to construe and apply the provisions of this section and to make all determinations necessary or desirable to implement such provisions, including but not limited to matters with respect to (i) the number of shares of Common Stock beneficially owned by any person, (ii) whether a person is an affiliate of another, (iii) whether a person has an agreement, arrangement, or understanding with another as to the matters referred to in the definition of beneficial ownership, (iv) the application of any other definition or operative provision of the section to the given facts, or (v) any other matter relating to the applicability or effect of this section.

4. The Board of Directors shall have the right to demand that any person who is reasonably believed to beneficially own Common Stock in excess of the Limit (or holds of record Common Stock beneficially owned by any person in excess of the Limit) supply the Corporation with complete information as to (i) the record owner(s) of all shares beneficially owned by such person who is reasonably believed to own shares in excess of the Limit, (ii) any other factual matter relating to the applicability or effect of this section as may reasonably be requested of such person.

5. Any constructions, applications, or determinations made by the Board of Directors pursuant to this section in good faith and on the basis of such information and assistance as was then reasonably available for such purpose shall be conclusive and binding upon the Corporation and its stockholders.

6. In the event any provision (or portion thereof) of this section shall be found to be invalid, prohibited or unenforceable for any reason, the remaining provisions (or portions thereof) of this section shall remain in full force and effect, and shall be construed as if such invalid, prohibited or unenforceable provision had been stricken herefrom or otherwise rendered inapplicable, it being the intent of this Corporation and its stockholders that such remaining provision (or portion thereof) of this section remain, to the fullest extent permitted by law, applicable and enforceable as to all stockholders, including stockholders owning an amount of stock in excess of the Limit, notwithstanding any such finding.

D. Subject to the provisions of law and the rights of the holders of the Preferred Stock and any other class or series of stock having a preference as to dividends over the Common Stock then outstanding, dividends may be paid on the Common Stock at such times and in such amounts as the Board of Directors may determine. Upon the dissolution, liquidation or winding up of the Corporation, the holders of the Common Stock shall be entitled to receive all the remaining assets of the Corporation available for distribution to its stockholders ratably in proportion to the number of shares held by them, respectively, after: (i) payment or provision for payment of the Corporation’s debts and liabilities; (ii) distributions or provision for distributions in settlement of the Liquidation Account established by the Corporation, as described in F below; and (iii) distributions or provisions for distributions to holders of any class or series of stock having a preference over the Common Stock in the liquidation, dissolution or winding up of the Corporation.

FIFTH: The following provisions are inserted for the management of the business and the conduct of the affairs of the Corporation, and for further definition, limitation and regulation of the powers of the Corporation and of its Directors and stockholders:

A. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. In addition to the powers and authority expressly conferred upon them by statute or by this Certificate of Incorporation or the Bylaws of the Corporation, the Directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

B. The Directors of the Corporation need not be elected by written ballot unless the Bylaws so provide. Stockholders may not cumulate their votes for election of directors.

C. Subject to the rights of any class or series of Preferred Stock of the Corporation, any action required or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders of the Corporation and may be effected by the unanimous consent in writing by such stockholders.

D. Special meetings of stockholders of the Corporation may be called only by the Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directorships (whether or not there exist any vacancies in previously authorized directorships at the time any such resolution is presented to the Board for adoption) (the “Whole Board”).

SIXTH:

A. The number of Directors shall be fixed from time to time exclusively by the Board of Directors pursuant to a resolution adopted by a majority of the Whole Board. At each annual meeting of stockholders, starting with the 2026 Annual Meeting, all directors shall be elected for terms expiring at the next annual meeting of stockholders and until such directors’ successors shall have been elected and qualified. Directors shall be elected by a plurality of the shares present in person or represented by proxy and entitled to vote in the elections of directors (unless otherwise required by law, regulation, the bylaws or by the listing standards of any stock exchange on which the Common Stock is then traded).

B. Subject to the rights of the holders of any series of Preferred Stock then outstanding, newly created directorships resulting from any increase in the authorized number of Directors or any vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification, removal from office or other cause may be filled by a majority vote of the Directors then in office, though less than a quorum, and Directors so chosen shall hold office for a term expiring at the annual meeting of stockholders at which the term of office of the class to which they have been chosen expires. No decrease in the number of Directors constituting the Board of Directors shall shorten the term of any incumbent Director.

C. Advance notice of stockholder nominations for the election of Directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner provided in the Bylaws of the Corporation.

D. Subject to the rights of the holders of any series of Preferred Stock then outstanding, any Director, or the entire Board of Directors, may be removed from office at any time, with or without cause by the affirmative vote of the holders of at least sixty six and two-thirds percent (66 2/3%) of the voting power of all then-outstanding shares of capital stock of the Corporation entitled to vote generally at an election of directors (after giving effect to the provisions of Article FOURTH of this Certificate of Incorporation (“Article FOURTH”)), voting together as a single class.

SEVENTH: The Board of Directors is expressly empowered to adopt, amend or repeal the Bylaws of the Corporation. Any adoption, amendment or repeal of the Bylaws of the Corporation by the Board of Directors shall require the approval of a majority of the Whole Board. The stockholders shall also have power to adopt, amend or repeal the Bylaws of the Corporation in the manner prescribed by the laws of the State of Delaware by a majority vote of the voting power of all of the then-outstanding shares of capital stock of the Corporation entitled to vote generally in the election of Directors (after giving effect to the provisions of Article FOURTH).

EIGHTH: The Board of Directors of the Corporation, when evaluating any offer of another Person (as defined in Article FOURTH hereof) to (A) make a tender or exchange offer for any equity security of the Corporation, (B) merge or consolidate the Corporation with another corporation or entity or (C) purchase or otherwise acquire all or substantially all of the properties and assets of the Corporation, may, in connection with the exercise of its judgment in determining what is in the best interest of the Corporation and its stockholders, give due consideration to all relevant factors, including, without limitation, the social and economic effect of acceptance of such offer on: the Corporation’s present and future customers and employees and those of its subsidiaries; the communities in which the Corporation and its Subsidiaries operate or are located; the ability of the Corporation to fulfill its corporate objectives as a bank holding company; and the ability of its subsidiary bank to fulfill the objectives under applicable statutes and regulations.

NINTH:

A. Each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter a “proceeding”), by reason of the fact that he or she is or was a Director or an Officer of the Corporation or is or was serving at the request of the Corporation as a Director, Officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (hereinafter an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a Director, Officer, employee or agent or in any other capacity while serving as a Director, Officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the Delaware General Corporation Law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than such law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such indemnitee in connection therewith; provided, however, that, except as provided in Section C hereof with respect to proceedings to enforce rights to indemnification, the Corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board of Directors of the Corporation.

B. The right to indemnification conferred in Section A of this Article NINTH shall include the right to be paid by the Corporation the expenses incurred in defending any such proceeding in advance of its final disposition (hereinafter an “advancement of expenses”); provided, however, that, if the Delaware General Corporation Law requires an advancement of expenses incurred by an indemnitee in his or her capacity as a Director of Officer (and not in any other capacity in which service was or is rendered by such indemnitee, including, without limitation, service to an employee benefit plan), indemnification shall be made only upon delivery to the Corporation of an undertaking (hereinafter an “undertaking”), by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal (hereinafter a “final adjudication”) that such indemnitee is not entitled to be indemnified for such expenses under this Section or otherwise. The rights to indemnification and to the advancement of expenses conferred in Sections A and B of this Article NINTH shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a Director, Officer, employee or agent and shall inure to the benefit of the indemnitee’s heirs, executors and administrators.

C. If a claim under Section A or B of this Article NINTH is not paid in full by the Corporation within sixty days after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty days, the indemnitee may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the indemnitee also shall be entitled to be paid the expense of prosecuting or defending such suit. In (i) any suit brought by the indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to enforce a right to an advancement of expenses) it shall be a defense that, and (ii) in any suit by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking the Corporation shall be entitled to recover such expenses upon a final adjudication that, the indemnitee has not met any applicable standard for indemnification set forth in the Delaware General Corporation Law. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such suit that indemnification of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set forth in the Delaware General Corporation Law, nor an actual determination by the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption that the indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the indemnitee, be a defense to such suit. In any suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder, or by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that the indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this Article NINTH or otherwise shall be on the Corporation.

D. The rights to indemnification and to the advancement of expenses conferred in this Article NINTH shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, the Corporation’s Certificate of Incorporation, Bylaws, agreement, vote of stockholders or disinterested Directors, or otherwise.

E. The Corporation may maintain insurance, at its expense, to protect itself and any Director, Officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the Delaware General Corporation Law.

F. The Corporation may, to the extent authorized from time to time by the Board of Directors, grant rights to indemnification and to the advancement of expenses to any employee or agent of the Corporation to the fullest extent of the provisions of this Article NINTH with respect to the indemnification and advancement of expenses of Directors and Officers of the Corporation.

TENTH: A Director of this Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a Director, except for liability (i) for any breach of the Director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law, or (iv) for any transaction from which the Director derived an improper personal benefit. If the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal liability of Directors, then the liability of a Director of the Corporation shall be eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law, as so amended.

Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a Director of the Corporation existing at the time of such repeal or modification.

ELEVENTH:

A. Unless the Corporation consents in writing to the selection of an alternative forum, the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, or (iv) any action asserting a claim governed by the internal affairs doctrine, shall be a state or federal court located within the state of Delaware, in all cases subject to the court’s having personal jurisdiction over the indispensable parties named as defendants. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article ELEVENTH.

B. Unless the Corporation consents in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article ELEVENTH.

TWELFTH: The Corporation reserves the right to amend or repeal any provision contained in this Certificate of Incorporation in the manner prescribed by the laws of the State of Delaware and all rights conferred upon stockholders are granted subject to this reservation.

THIRTEENTH: The name and mailing address of the sole incorporator is as follows:

| Name | Mailing Address | |

| John Wilk | c/o GameSquare Holdings, Inc., 6775 Cowboys Way, Suite 1335 Frisco, TX 75034 | |

I, THE UNDERSIGNED, being the incorporator, for the purpose of forming a corporation under the laws of the State of Delaware, do make, file and record this Certificate of Incorporation, do certify that the facts herein stated are true, and accordingly, have hereto set my hand this _____ day of __________, 2025.

| Name: | John Wilk | |

| Incorporator | ||