Q4 2025PRESENTATION February 19, 2026

Disclaimer Forward-Looking Statements These presentational materials and related

discussions include forward-looking statements made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements do not reflect historical facts and may be identified by words such

as "anticipate", "believe", "continue", "estimate", "expect", "intends", "may", "should", "will", "likely", "aim", "plan", "guidance", the negative of such terms, and similar expressions and include statements regarding industry trends and

market outlook, supply/demand expectations, statements about expected activity and state of the market, expected activity levels in the jack-up rig and oil industry, the expectation of improving market conditions, improved fundamentals and

earnings visibility, Dayrate Equivalent Backlog, expected contract coverage gains, new contract commitments and potential Dayrate Equivalent Backlog from such commitments, tender activity and expected contracting, rig tendering pipeline,

customer activity and contracting opportunities, expected payment visibility, operating outlook in Mexico, including Pemex announcements, expectations on market conditions, pricing and earnings visibility, contract coverage, dayrates, market

conditions, the expectation that the market bottom is behind us, statements about the global jack-up fleet, including the number of rigs contracted and available and expected to be available and expected trends in the global fleet, including

expected new deliveries and the number of rigs under construction and expectations as to when such rigs will join the global fleet, expectations about the benefits of the recent five-rig acquisition from Noble Corporation (the “Five-Rig

Acquisition”), including integration thereof, our expectation to complete a full up-listing to Oslo Stock Exchange in the first half of 2026, and statements made under “Market” and "Risk and uncertainties" in our latest earnings release, and

other non-historical statements. These forward-looking statements are based upon current expectations and various assumptions, which are, by their nature, uncertain and are subject to significant known and unknown risks, contingencies and other

important factors which are difficult or impossible to predict and are beyond our control. Such risks, uncertainties, contingencies and other factors could cause our actual financial results, level of activity, performance, financial position,

liquidity or achievements to differ materially from those expressed or implied by these forward-looking statements, including risks relating to our industry and industry conditions, business, the risk that our actual results of operations in

current or future periods differ materially from expected results or guidance discussed herein, the actual timing of payments to us and the risk of delays in payments or receivables to our JVs and payments from our JVs to us, the risk that our

customers do not comply with their contractual obligations, including the risk that we may not be able to recover all amounts due from our customers, including Lime Petroleum Holding AS, or that customers may not be able to continue to comply

with contracts with us, the risk of customers becoming subject to sanctions, risks relating to geopolitical events and inflation, risks relating to global economic uncertainty and energy commodity prices, risks relating to contracting,

including our ability to convert commitments, LOIs and LOAs into contracts, the risk of contract suspension or termination, the risk that options will not be exercised, the risk that backlog will not materialize as expected, risks relating to

the operations of our rigs, risks relating to dayrates and duration of contracts and the terms of contracts and the risk that we may not enter into contracts or that contracts are not performed as expected, risks relating to contracting our

most recently delivered rigs and other available rigs and the five rigs acquired in the Five-Rig Acquisition and other risks related to such acquisition, risks relating to market trends, including tender activity, risks relating to customer

demand and contracting activity and suspension or termination of operations, including as a result of customers becoming subject to sanctions, risks relating to our liquidity and cash flows, risks relating to our indebtedness including risks

relating to our ability to repay or refinance our debt at maturity, including our secured notes maturing in 2028 and 2030, our Convertible Bonds due 2028, our seller’s credit with Noble Corporation due 2032 and debt under our revolving credit

facilities and risks relating to our other payment obligations on these debt instruments including interest, amortization and cash sweeps, risks relating to our ability to comply with covenants under our revolving credit facilities and other

debt instruments and obtain any necessary waivers and the risk of cross defaults, risks relating to our ability to pay cash distributions and repurchase shares including the risk that we may not have available liquidity or distributable

reserves or the ability under our debt instruments to pay such cash distributions or repurchase shares and the risk that we may not complete our share repurchase program in full, and risks relating to the amount and timing of any cash

distributions we declare, risks relating to future financings including the risk that future financings may not be completed when required and risks relating to the terms of any refinancing, including risks related to dilution from any future

offering of shares or convertible bonds, risks related to climate change, including climate-change or greenhouse gas related legislation or regulations and the impact on our business from physical climate-change related to changes in weather

patterns, and the potential impact of new regulations relating to climate change and the potential impact on the demand for oil and gas, risks relating to military actions and their impact on our business and industry, and other risks factors

set forth under “Risk Factors” in our most recent annual report on Form 20-F and other filings with and submissions to the U.S. Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document.

We undertake no (and expressly disclaim any) obligation to update any forward-looking statements after the date of this report or to conform such statements to actual results or revised expectations, except as required by law. Non-GAAP

Financial Measures The Company uses certain financial information calculated on a basis other than in accordance with accounting principles generally accepted in the United States (US GAAP) including Adjusted EBITDA. Adjusted EBITDA as

presented above represents our periodic net income/(loss) adjusted for: depreciation of non-current assets, (loss)/income) from equity method investments, total financial expense net and income tax expense. Adjusted EBITDA is presented here

because the Company believes that the measure provides useful information regarding the Company’s operational performance. For a reconciliation of Adjusted EBITDA to Net income/(loss), please see the last page of this report. The Company

provides guidance on expected Adjusted EBITDA, which is a non-GAAP financial measure. Management evaluates the Company's financial performance in part based on the basis of actual and expected Adjusted EBITDA, which management believes enhances

investors' understanding of the Company's overall financial performance by providing them with an additional meaningful relevant comparison of current and anticipated future results across periods. Due to the forward-looking nature of Adjusted

EBITDA, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the Company is unable to present a quantitative reconciliation of such forward looking

non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. The Company disclaims any current intention to update such guidance, except as required by law

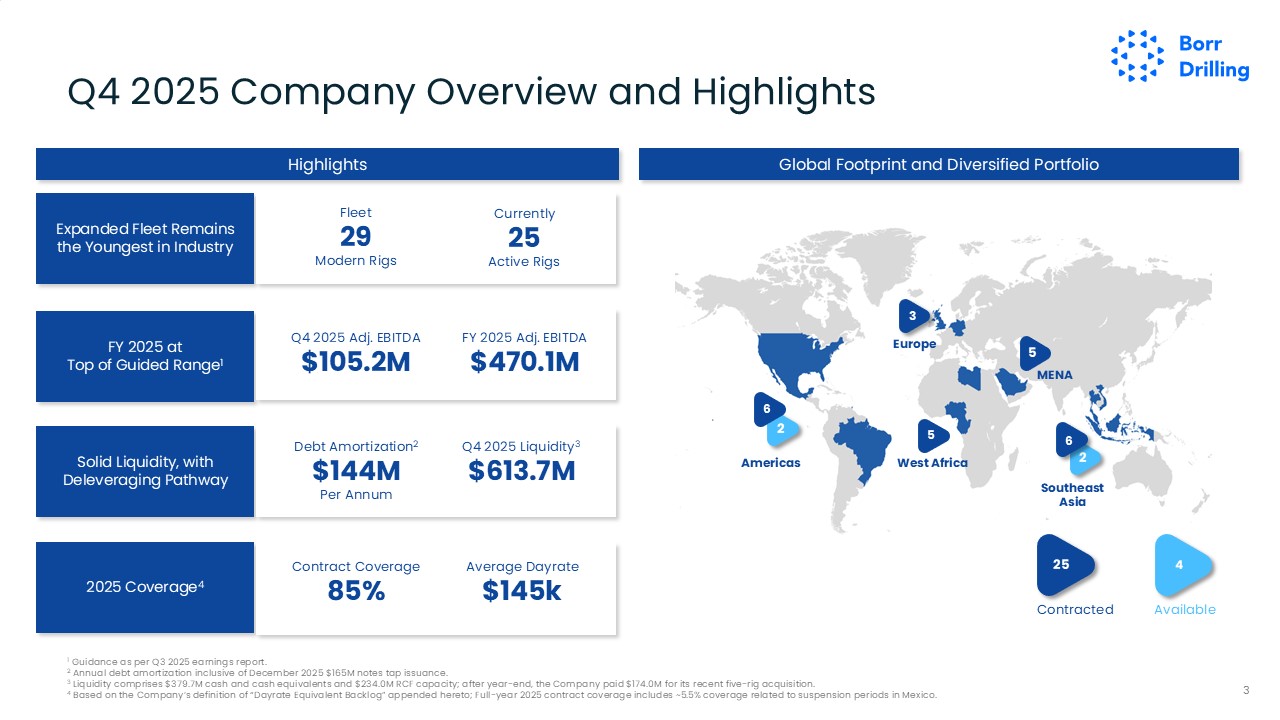

Q4 2025 Company Overview and Highlights 1 Guidance as per Q3 2025 earnings report. 2

Annual debt amortization inclusive of December 2025 $165M notes tap issuance. 3 Liquidity comprises $379.7M cash and cash equivalents and $234.0M RCF capacity; after year-end, the Company paid $174.0M for its recent five-rig acquisition. 4

Based on the Company’s definition of “Dayrate Equivalent Backlog” appended hereto; Full-year 2025 contract coverage includes ~5.5% coverage related to suspension periods in Mexico. 3 Global Footprint and Diversified Portfolio FY 2025 at

Top of Guided Range1 Q4 2025 Adj. EBITDA $105.2M FY 2025 Adj. EBITDA $470.1M 2025 Coverage4 Contract Coverage85% Average Dayrate $145k Solid Liquidity, with Deleveraging Pathway Q4 2025 Liquidity3 $613.7M Debt Amortization2 $144M

Per Annum Expanded Fleet Remains the Youngest in Industry Currently 25 Active Rigs Fleet 29 Modern Rigs Highlights Contracted 25 Available 4 2 Americas 2 1 6 Southeast Asia MENA 5 West Africa 5 1 3 Europe 2 6

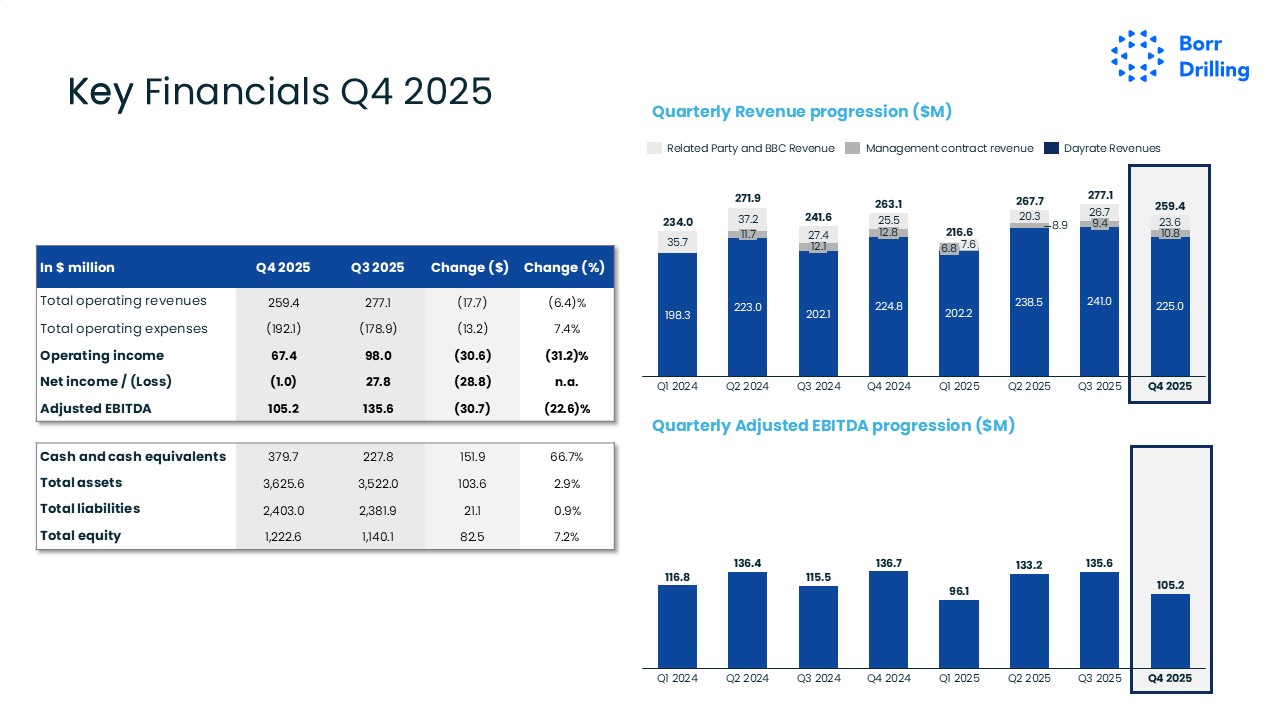

In $ million Q4 2025 Q3 2025 Change ($) Change (%) Total operating

revenues 259.4 277.1 (17.7) (6.4)% Total operating expenses (192.1) (178.9) (13.2) 7.4% Operating income 67.4 98.0 (30.6) (31.2)% Net income / (Loss) (1.0) 27.8 (28.8) n.a. Adjusted

EBITDA 105.2 135.6 (30.7) (22.6)% Cash and cash equivalents 379.7 227.8 151.9 66.7% Total assets 3,625.6 3,522.0 103.6 2.9% Total liabilities 2,403.0 2,381.9 21.1 0.9% Total equity 1,222.6 1,140.1 82.5 7.2% Quarterly

Revenue progression ($M) Quarterly Adjusted EBITDA progression ($M) Q1 2024 11.7 Q2 2024 12.1 Q3 2024 12.8 Q4 2024 7.6 6.8 Q1 2025 Q2 2025 9.4 Q3 2025 10.8 Q4 2025 234.0 271.9 241.6 263.1 216.6 267.7 277.1 259.4 Related

Party and BBC Revenue Management contract revenue Dayrate Revenues Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Key Financials Q4 2025 Key

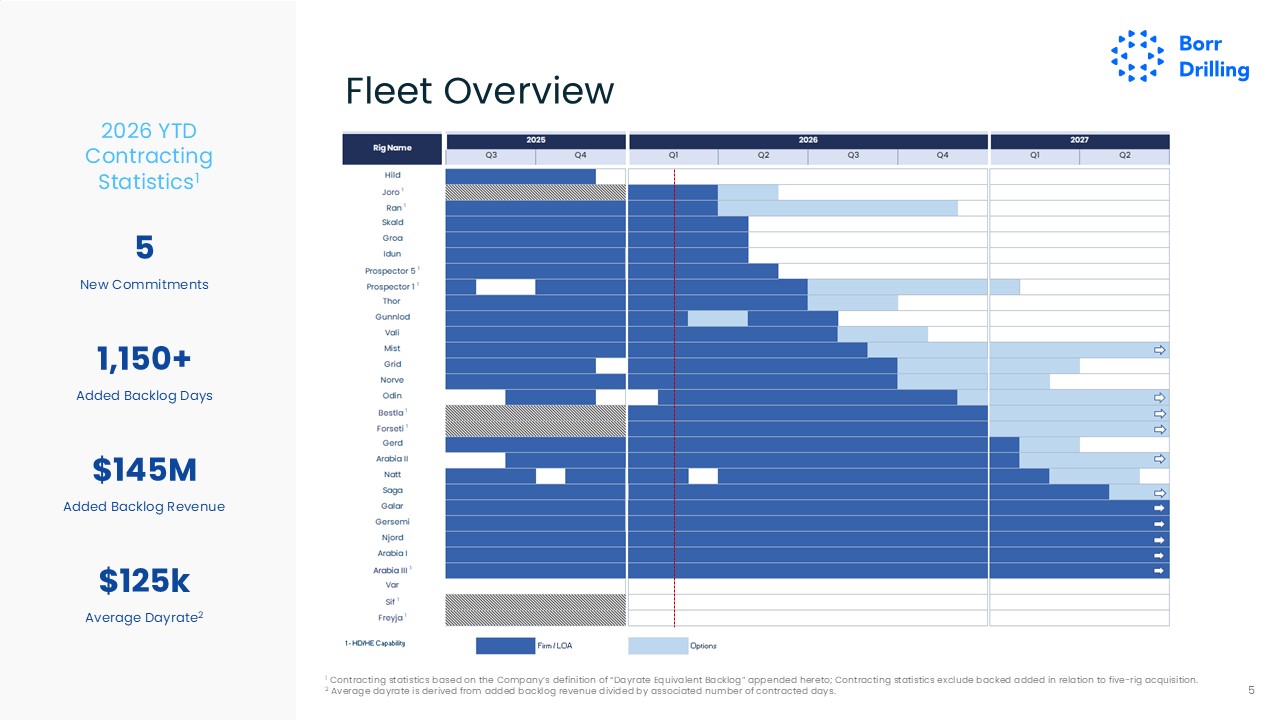

1 Contracting statistics based on the Company’s definition of “Dayrate Equivalent Backlog”

appended hereto; Contracting statistics exclude backed added in relation to five-rig acquisition. 2 Average dayrate is derived from added backlog revenue divided by associated number of contracted days. 5 Fleet Overview 5 New

Commitments $145M Added Backlog Revenue $125k Average Dayrate2 1,150+ Added Backlog Days 2026 YTD Contracting Statistics1

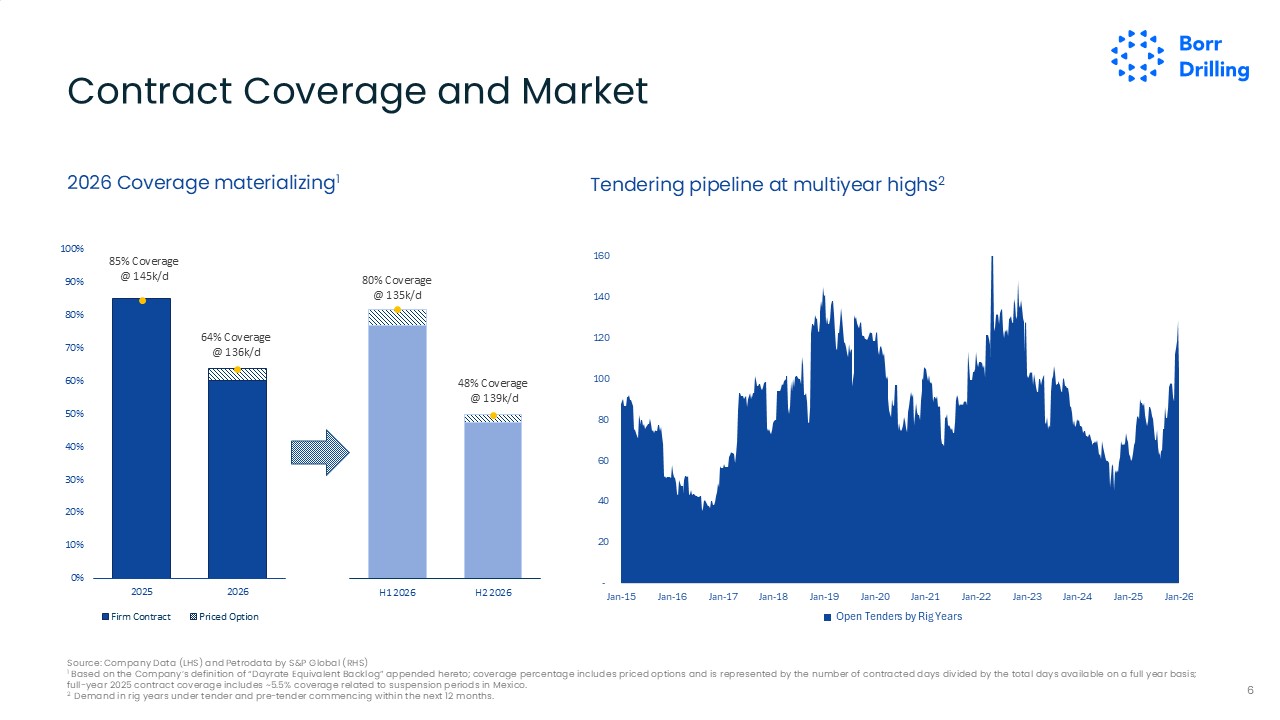

Contract Coverage and Market 2026 Coverage materializing1 Source: Company Data (LHS) and

Petrodata by S&P Global (RHS) 1 Based on the Company’s definition of “Dayrate Equivalent Backlog” appended hereto; coverage percentage includes priced options and is represented by the number of contracted days divided by the total days

available on a full year basis; full-year 2025 contract coverage includes ~5.5% coverage related to suspension periods in Mexico. 2 Demand in rig years under tender and pre-tender commencing within the next 12 months. 6 Tendering pipeline at

multiyear highs2

7 In Conclusion Resilient execution in 2025 despite headwinds $470.1M Adj. EBITDA for

FY 2025 – top end of guidance range Successful capital market transactions – solidified balance sheet, providing strategic flexibility 1 Completed acquisition of five premium assets Attractive pricing and immediately accretive to Adj.

EBITDA Strengthened Borr Drilling platform at opportune point in cycle 2 Constructive market outlook expected to support utilization and dayrates into 2027 3

Appendix

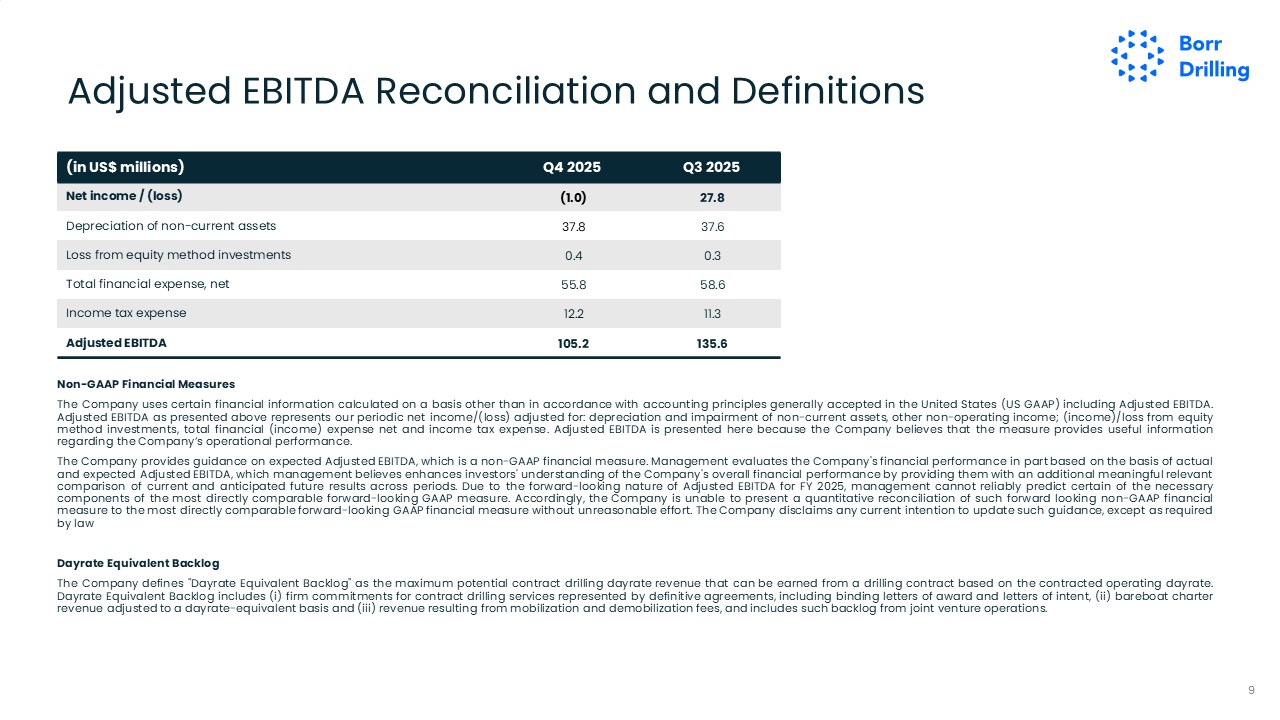

9 (in US$ millions) Q4 2025 Q3 2025 Net income / (loss) (1.0) 27.8 Depreciation of

non-current assets 37.8 37.6 Loss from equity method investments 0.4 0.3 Total financial expense, net 55.8 58.6 Income tax expense 12.2 11.3 Adjusted EBITDA 105.2 135.6 Non-GAAP Financial Measures The Company uses certain

financial information calculated on a basis other than in accordance with accounting principles generally accepted in the United States (US GAAP) including Adjusted EBITDA. Adjusted EBITDA as presented above represents our periodic net

income/(loss) adjusted for: depreciation and impairment of non-current assets, other non-operating income; (income)/loss from equity method investments, total financial (income) expense net and income tax expense. Adjusted EBITDA is presented

here because the Company believes that the measure provides useful information regarding the Company’s operational performance. The Company provides guidance on expected Adjusted EBITDA, which is a non-GAAP financial measure. Management

evaluates the Company's financial performance in part based on the basis of actual and expected Adjusted EBITDA, which management believes enhances investors' understanding of the Company's overall financial performance by providing them with

an additional meaningful relevant comparison of current and anticipated future results across periods. Due to the forward-looking nature of Adjusted EBITDA for FY 2025, management cannot reliably predict certain of the necessary components of

the most directly comparable forward-looking GAAP measure. Accordingly, the Company is unable to present a quantitative reconciliation of such forward looking non-GAAP financial measure to the most directly comparable forward-looking GAAP

financial measure without unreasonable effort. The Company disclaims any current intention to update such guidance, except as required by law Dayrate Equivalent Backlog The Company defines "Dayrate Equivalent Backlog" as the maximum potential

contract drilling dayrate revenue that can be earned from a drilling contract based on the contracted operating dayrate. Dayrate Equivalent Backlog includes (i) firm commitments for contract drilling services represented by definitive

agreements, including binding letters of award and letters of intent, (ii) bareboat charter revenue adjusted to a dayrate-equivalent basis and (iii) revenue resulting from mobilization and demobilization fees, and includes such backlog from

joint venture operations. Adjusted EBITDA Reconciliation and Definitions

10