Q3 2025 Earnings Supplement November 2025 .2

Disclaimer Repay Holdings Corporation (“REPAY” or the “Company”) is required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”) Such filings, which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect REPAY’s business, results of operations and financial condition. Forward-Looking Statements This presentation (the “Presentation”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, REPAY’s plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, REPAY’s updated 2025 outlook and other financial guidance, expected demand on REPAY’s product offering, including further implementation of electronic payment options and statements regarding REPAY’s market and growth opportunities, and REPAY’s business strategy and the plans and objectives of management for future operations. Such forward-looking statements are based upon the current beliefs and expectations of REPAY’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond REPAY’s control. In addition to factors previously disclosed in REPAY’s reports filed with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2024 and subsequent Form 10-Qs, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: exposure to economic conditions and political risk affecting the consumer loan market, the receivables management industry and consumer and commercial spending, including bank failures or other adverse events affecting financial institutions, inflationary pressures, the U.S. government shutdown, general economic slowdown or recession; changes in the payment processing market in which REPAY competes, including with respect to its competitive landscape, technology evolution or regulatory changes; changes in the vertical markets that REPAY targets, including the regulatory environment applicable to REPAY’s clients; the ability to retain, develop and hire key personnel; risks relating to REPAY’s relationships within the payment ecosystem; risk that REPAY may not be able to execute its capital allocation and growth strategies, including identifying and executing acquisitions; risks relating to data security; changes in accounting policies applicable to REPAY; and the risk that REPAY may not be able to maintain effective internal controls. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance. All information set forth herein speaks only as of the date hereof in the case of information about REPAY or the date of such information in the case of information from persons other than REPAY, and REPAY disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this Presentation. Forecasts and estimates regarding our industry and end markets are based on sources REPAY believes to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms. Neither of REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information. Neither REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, are responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. Neither REPAY nor its affiliates give any express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein. Non-GAAP Financial Measures This Presentation includes certain non-GAAP financial measures that REPAY’s management uses to evaluate its operating business, measure its performance and make strategic decisions. Adjusted EBITDA is a non-GAAP financial measure that represents net income prior to interest expense, tax expense, depreciation and amortization, as adjusted to add back certain charges deemed to not be part of normal operating expenses, non-cash and/or non-recurring charges, such as non-cash impairment loss, loss on business disposition, loss on extinguishment of debt, loss on termination of interest rate hedge, non-cash change in fair value of contingent consideration, non-cash change in fair value of assets and liabilities, share-based compensation charges, transaction expenses, restructuring and other strategic initiative costs and other non-recurring charges. Adjusted EBITDA margin is a non-GAAP financial measure that represents Adjusted EBITDA divided by GAAP revenue. Adjusted Net Income is a non-GAAP financial measure that represents net income prior to amortization of acquisition-related intangibles, as adjusted to add back certain charges deemed to not be part of normal operating expenses, non-cash and/or non-recurring charges, such as non-cash impairment loss, loss on business disposition, loss on extinguishment of debt, loss on termination of interest rate hedge, non-cash change in fair value of contingent consideration, non-cash change in fair value of assets and liabilities, share-based compensation expense, transaction expenses, restructuring and strategic initiative costs and other non-recurring charges, non-cash interest expense, net of tax effect associated with these adjustments. Adjusted Net Income is adjusted to exclude amortization of all acquisition-related intangibles as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Management believes that the adjustment of acquisition-related intangible amortization supplements GAAP financial measures because it allows for greater comparability of operating performance. Although management excludes amortization from acquisition-related intangibles from REPAY’s non-GAAP expenses, management believes that it is important for investors to understand that such intangibles were recorded as part of purchase accounting and contribute to revenue generation. Each of “organic revenue growth,” and “organic gross profit (GP) growth” is a non-GAAP financial measure that represents the percentage change in the applicable metric for a fiscal period over the comparable prior fiscal period, exclusive of any incremental amount attributable to acquisitions or divestitures made in the comparable prior fiscal period or any subsequent fiscal period through the applicable current fiscal period. Any financial measure (whether GAAP or non-GAAP) that is modified by “excl. political media” is a non-GAAP financial measure that measures a defined growth rate exclusive of the estimated contribution from political media clients in the prior corresponding period. Free Cash Flow is a non-GAAP financial measure that represents net cash flow provided by operating activities less total capital expenditures. Free Cash Flow Conversion represents Free Cash Flow divided by Adjusted EBITDA. REPAY believes that each of the non-GAAP financial measures referenced in this paragraph provide useful information to investors and others in understanding and evaluating its operating results in the same manner as management. However, these non-GAAP financial measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income, operating profit, or any other operating performance measure calculated in accordance with GAAP. Using these non-GAAP financial measures to analyze REPAY’s business has material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies in REPAY’s industry may report measures titled with the same or similar description, such non-GAAP financial measures may be calculated differently from how REPAY calculates its non-GAAP financial measures, which reduces their overall usefulness as comparative measures. Because of these limitations, you should consider each of the non-GAAP financial measures referenced in this paragraph alongside other financial performance measures, including net income and REPAY’s other financial results presented in accordance with GAAP.

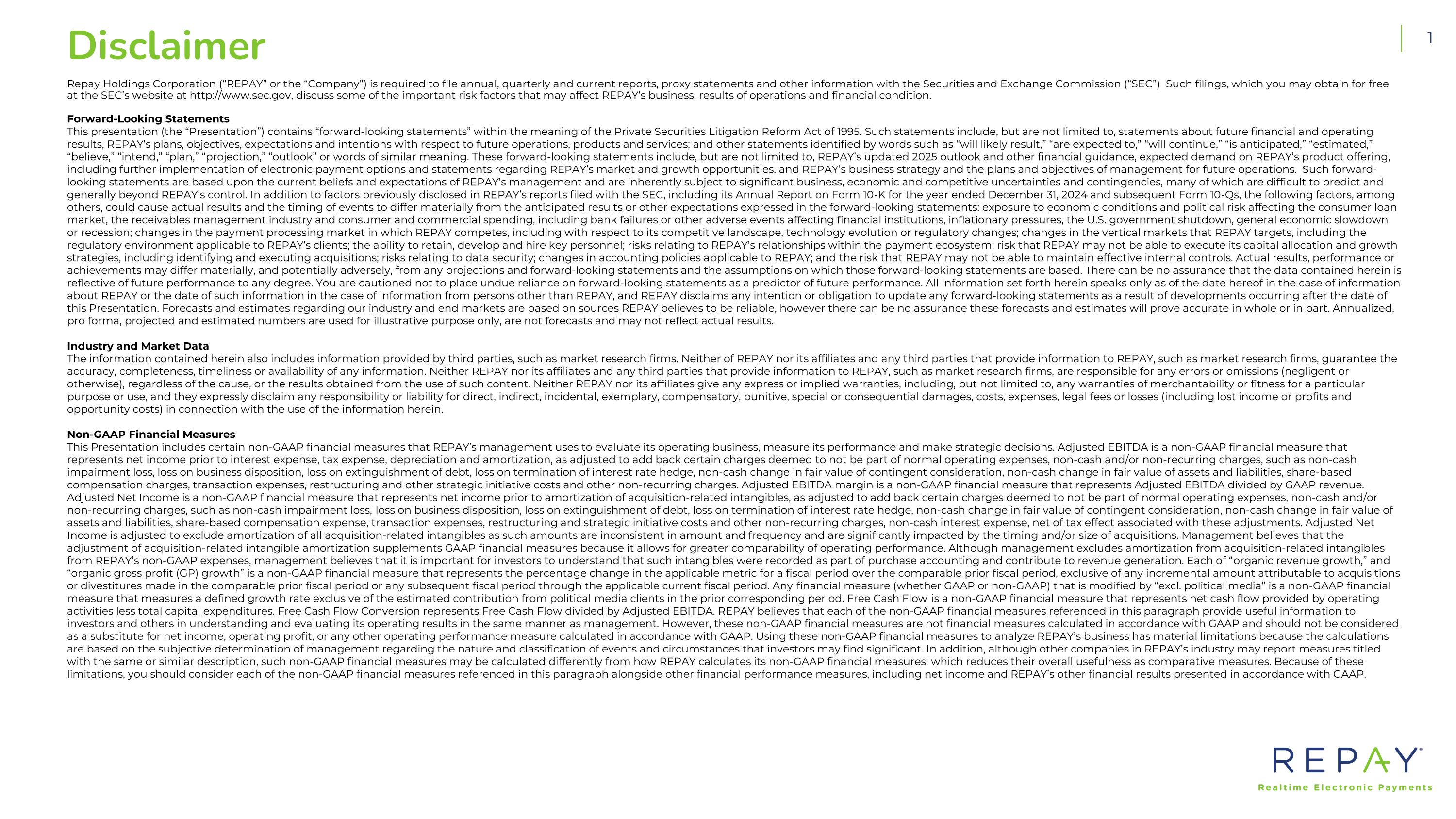

Financial Update – Q3 2025 ($MM) Revenue Gross Profit Adjusted EBITDA (2) Revenue growth excl. political media and Gross profit growth excl. political are non-GAAP financial measures. See slide 1 under “Non-GAAP Financial Measures” and slide 16 for reconciliation Gross profit margin represents gross profit / revenue Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See slide 1 under “Non-GAAP Financial Measures” and slide 12 for reconciliation. Adjusted EBITDA margin represents adjusted EBITDA / revenue Free Cash Flow and Free Cash Flow conversion are non-GAAP financial measures. See slide 1 under “Non-GAAP Financial Measures” and slide 14 for reconciliation. Free Cash Flow conversion represents Free Cash Flow / Adjusted EBITDA 78% 74% % Margin (2) 44% 40% % Margin (3) 1% y/y growth, excl. political media(1) 5% y/y growth, excl. political media(1) Free Cash Flow (3) 139% 67% FCF conversion (4)

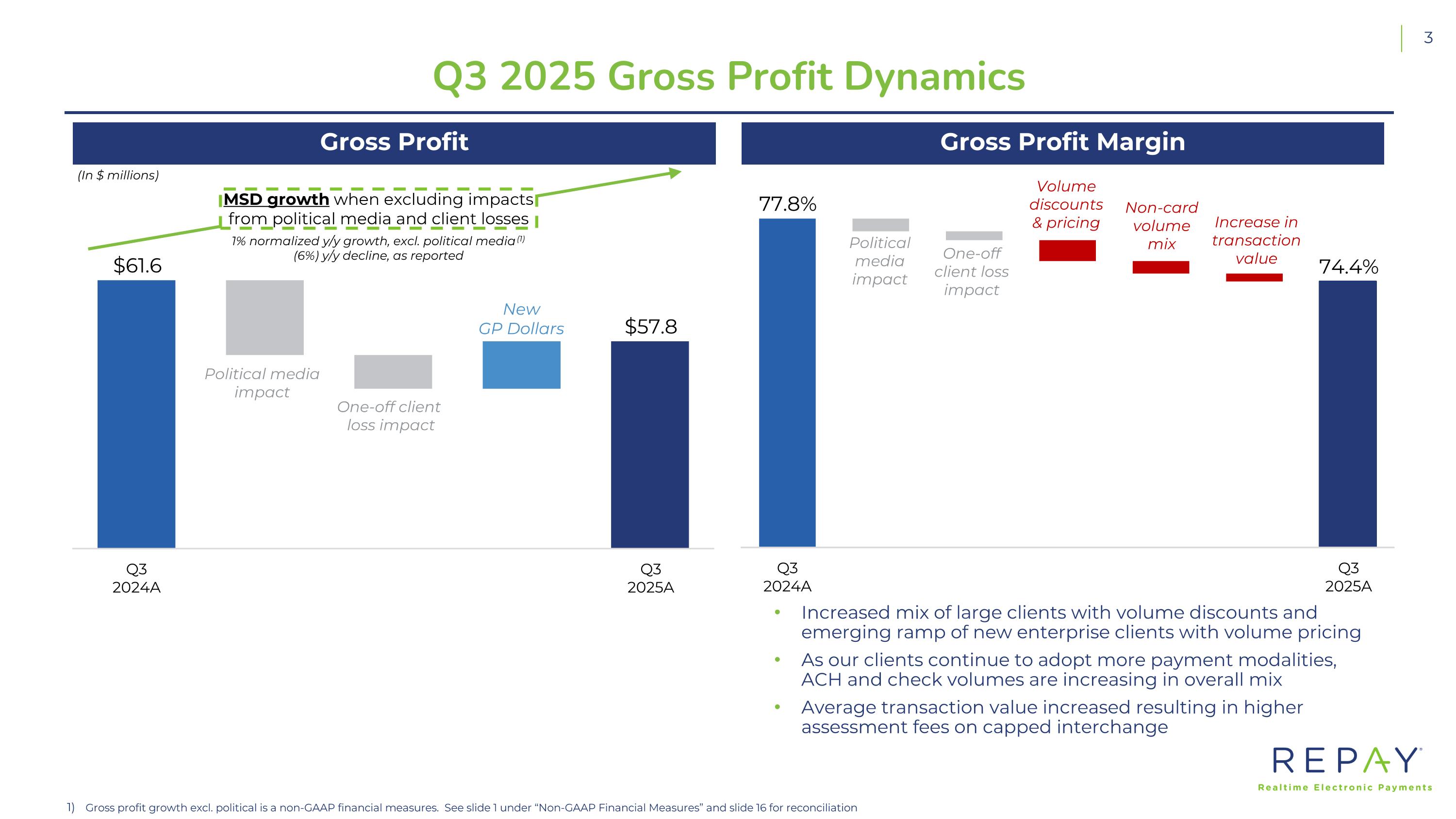

Q3 2025 Gross Profit Dynamics New GP Dollars Political media impact One-off client loss impact MSD growth when excluding impacts from political media and client losses 1% normalized y/y growth, excl. political media (1) (6%) y/y decline, as reported (In $ millions) One-off client loss impact Volume discounts & pricing Non-card volume mix Increase in transaction value Political media impact Gross Profit Margin Gross Profit Increased mix of large clients with volume discounts and emerging ramp of new enterprise clients with volume pricing As our clients continue to adopt more payment modalities, ACH and check volumes are increasing in overall mix Average transaction value increased resulting in higher assessment fees on capped interchange Gross profit growth excl. political is a non-GAAP financial measures. See slide 1 under “Non-GAAP Financial Measures” and slide 16 for reconciliation

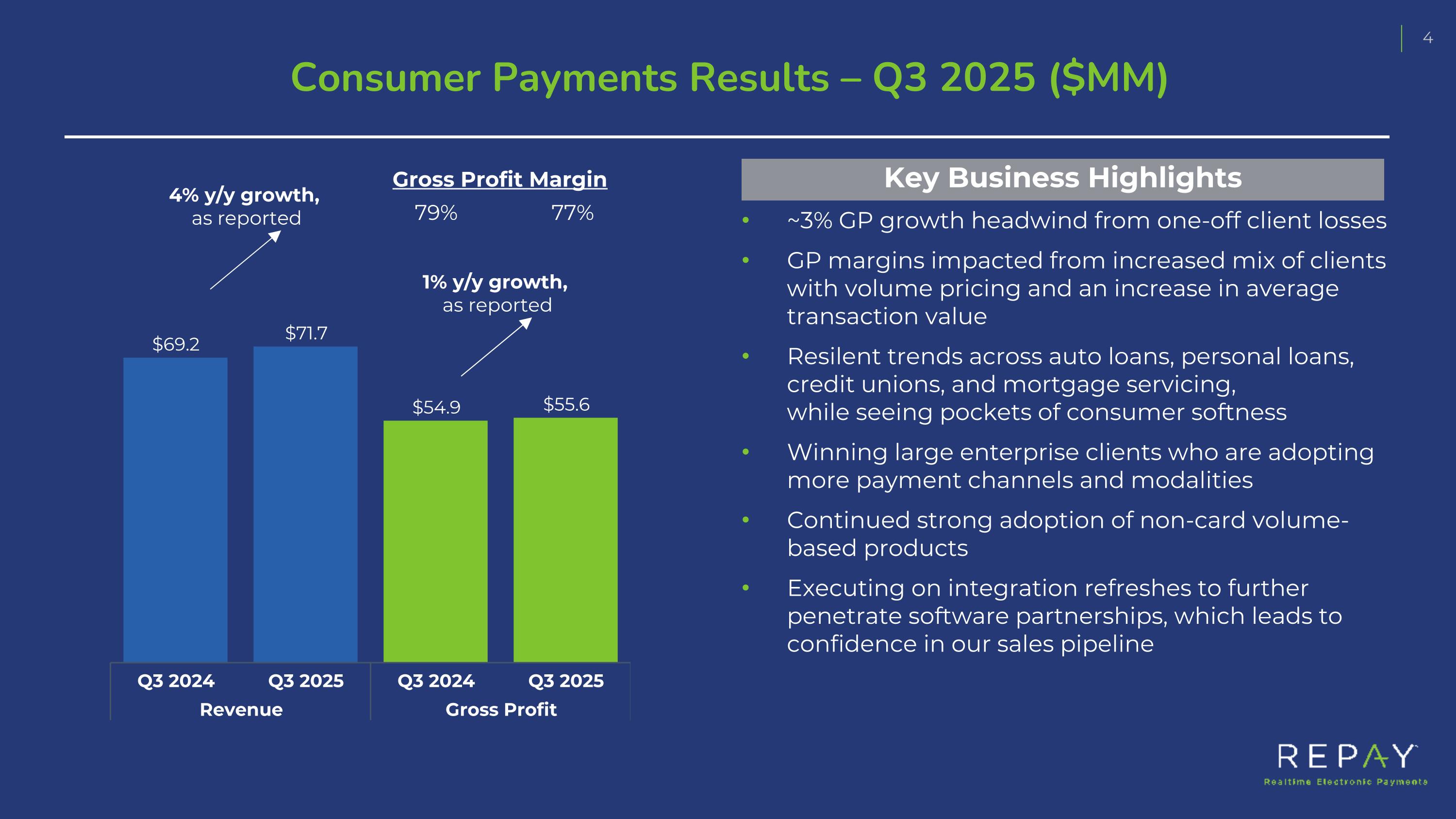

Consumer Payments Results – Q3 2025 ($MM) Key Business Highlights ~3% GP growth headwind from one-off client losses GP margins impacted from increased mix of clients with volume pricing and an increase in average transaction value Resilent trends across auto loans, personal loans, credit unions, and mortgage servicing, while seeing pockets of consumer softness Winning large enterprise clients who are adopting more payment channels and modalities Continued strong adoption of non-card volume-based products Executing on integration refreshes to further penetrate software partnerships, which leads to confidence in our sales pipeline Gross Profit Margin 79% 77% 4% y/y growth, as reported 1% y/y growth, as reported

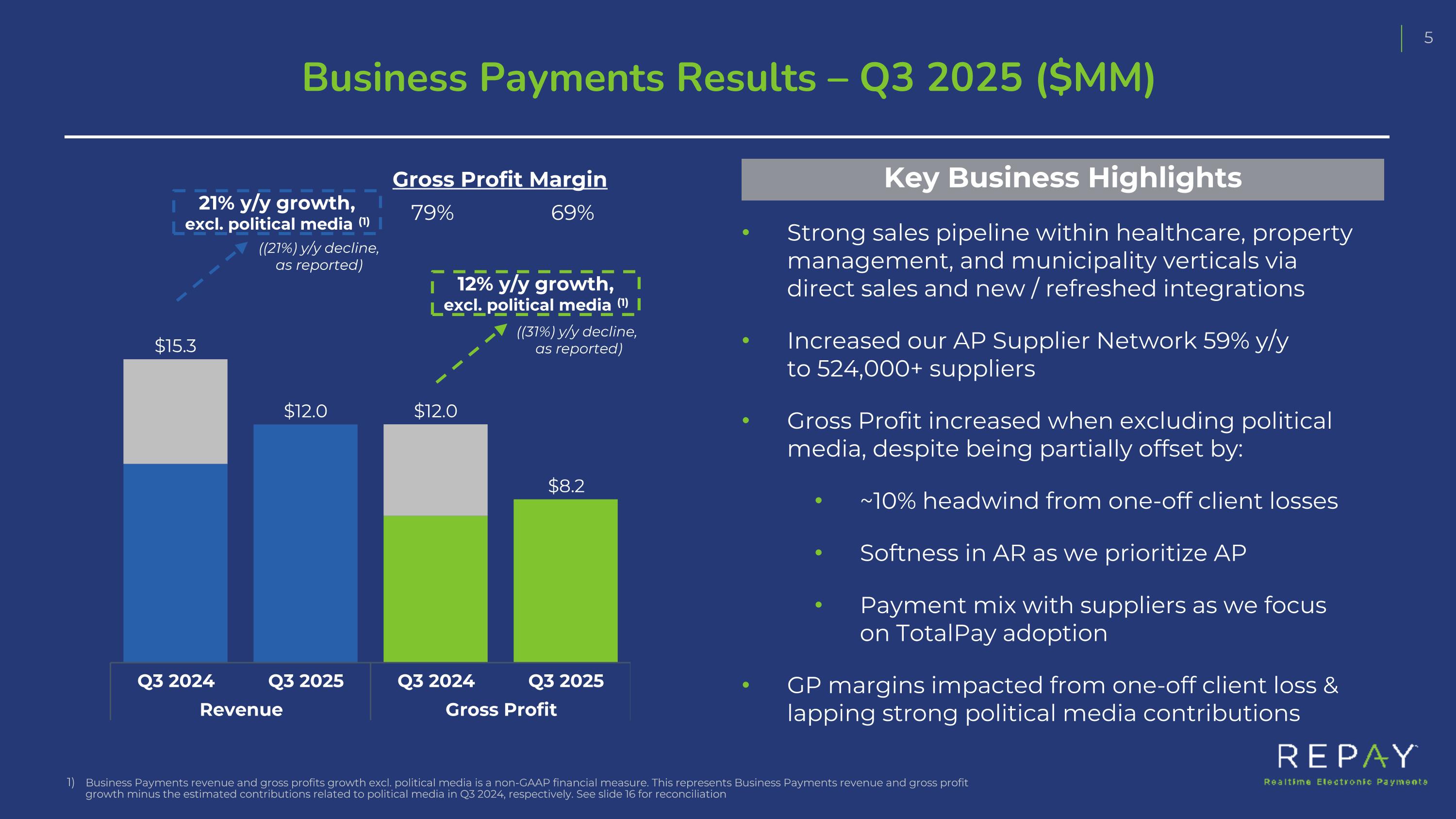

Strong sales pipeline within healthcare, property management, and municipality verticals via direct sales and new / refreshed integrations Increased our AP Supplier Network 59% y/y to 524,000+ suppliers Gross Profit increased when excluding political media, despite being partially offset by: ~10% headwind from one-off client losses Softness in AR as we prioritize AP Payment mix with suppliers as we focus on TotalPay adoption GP margins impacted from one-off client loss & lapping strong political media contributions Business Payments Results – Q3 2025 ($MM) Key Business Highlights Gross Profit Margin 79% 69% 21% y/y growth, excl. political media (1) 12% y/y growth, excl. political media (1) ((21%) y/y decline, as reported) ((31%) y/y decline, as reported) Business Payments revenue and gross profits growth excl. political media is a non-GAAP financial measure. This represents Business Payments revenue and gross profit growth minus the estimated contributions related to political media in Q3 2024, respectively. See slide 16 for reconciliation

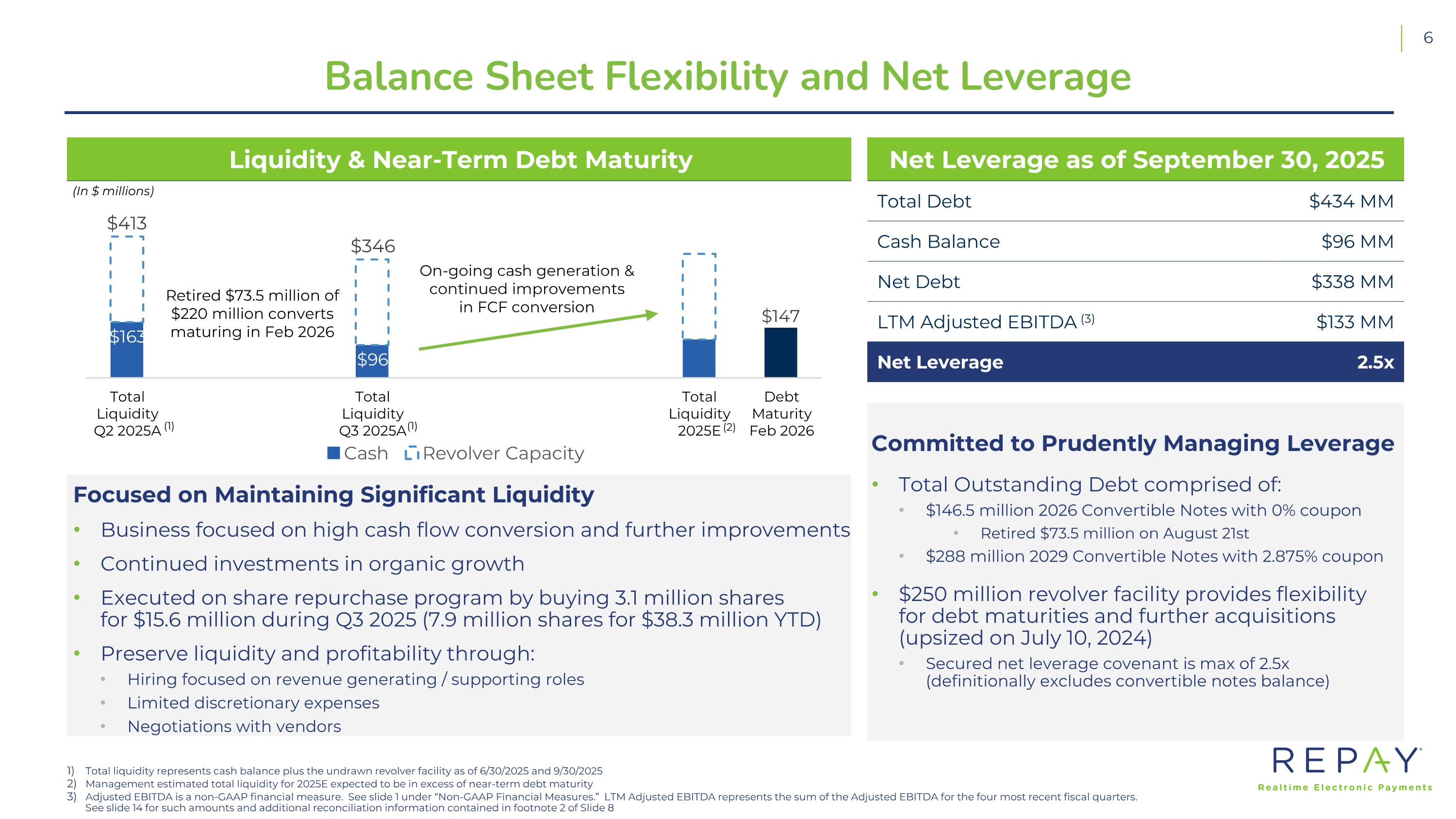

Balance Sheet Flexibility and Net Leverage Total liquidity represents cash balance plus the undrawn revolver facility as of 6/30/2025 and 9/30/2025 Management estimated total liquidity for 2025E expected to be in excess of near-term debt maturity Adjusted EBITDA is a non-GAAP financial measure. See slide 1 under “Non-GAAP Financial Measures.” LTM Adjusted EBITDA represents the sum of the Adjusted EBITDA for the four most recent fiscal quarters. See slide 14 for such amounts and additional reconciliation information contained in footnote 2 of Slide 8 Liquidity & Near-Term Debt Maturity Focused on Maintaining Significant Liquidity Business focused on high cash flow conversion and further improvements Continued investments in organic growth Executed on share repurchase program by buying 3.1 million shares for $15.6 million during Q3 2025 (7.9 million shares for $38.3 million YTD) Preserve liquidity and profitability through: Hiring focused on revenue generating / supporting roles Limited discretionary expenses Negotiations with vendors On-going cash generation & continued improvements in FCF conversion (1) (In $ millions) (2) Net Leverage as of September 30, 2025 Total Debt $434 MM Cash Balance $96 MM Net Debt $338 MM LTM Adjusted EBITDA (3) $133 MM Net Leverage 2.5x Committed to Prudently Managing Leverage Total Outstanding Debt comprised of: $146.5 million 2026 Convertible Notes with 0% coupon Retired $73.5 million on August 21st $288 million 2029 Convertible Notes with 2.875% coupon $250 million revolver facility provides flexibility for debt maturities and further acquisitions (upsized on July 10, 2024) Secured net leverage covenant is max of 2.5x (definitionally excludes convertible notes balance) (1) Retired $73.5 million of $220 million converts maturing in Feb 2026

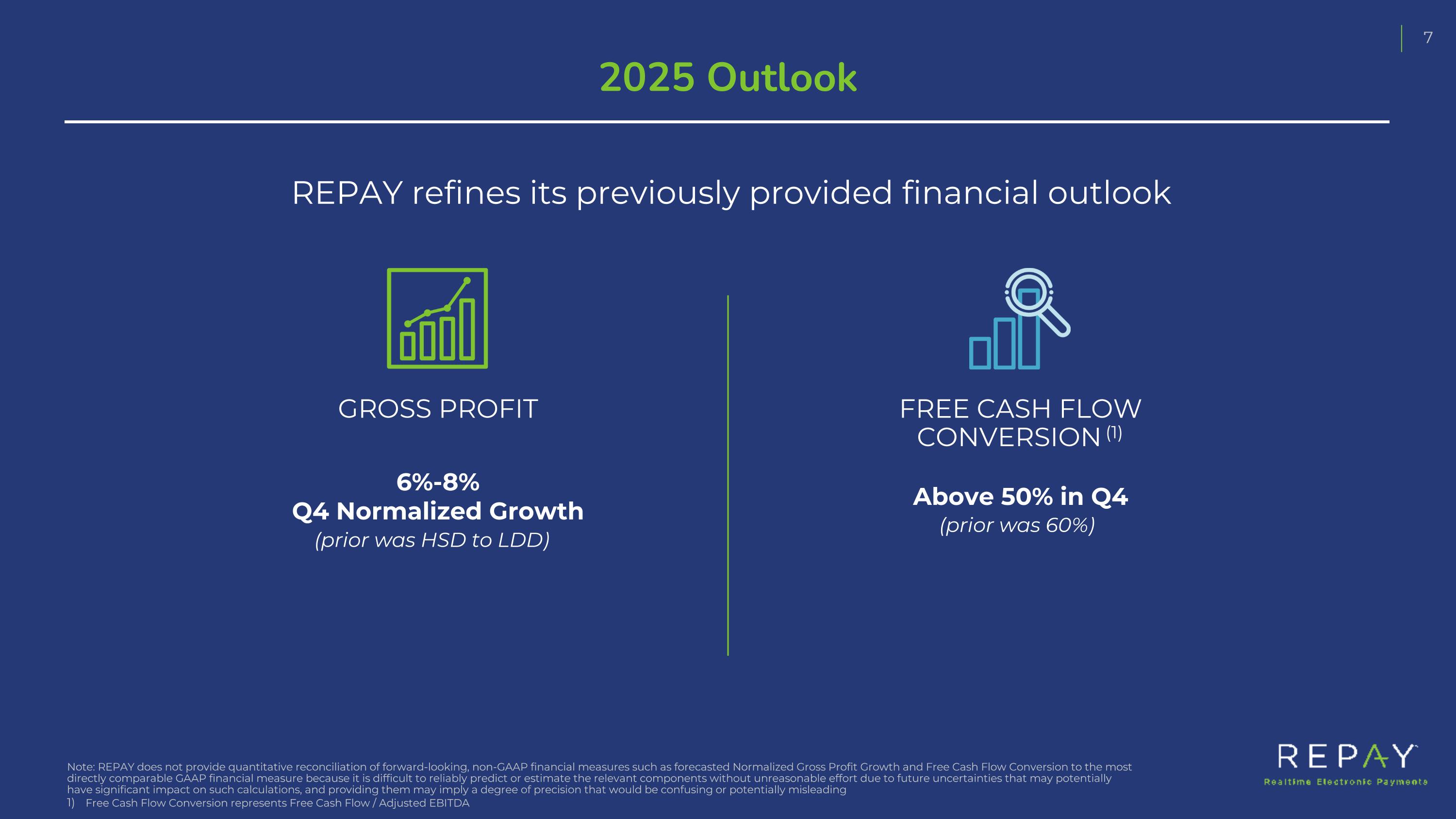

2025 Outlook GROSS PROFIT FREE CASH FLOW CONVERSION (1) Note: REPAY does not provide quantitative reconciliation of forward-looking, non-GAAP financial measures such as forecasted Normalized Gross Profit Growth and Free Cash Flow Conversion to the most directly comparable GAAP financial measure because it is difficult to reliably predict or estimate the relevant components without unreasonable effort due to future uncertainties that may potentially have significant impact on such calculations, and providing them may imply a degree of precision that would be confusing or potentially misleading Free Cash Flow Conversion represents Free Cash Flow / Adjusted EBITDA REPAY refines its previously provided financial outlook 6%-8% Q4 Normalized Growth Above 50% in Q4 (prior was HSD to LDD) (prior was 60%)

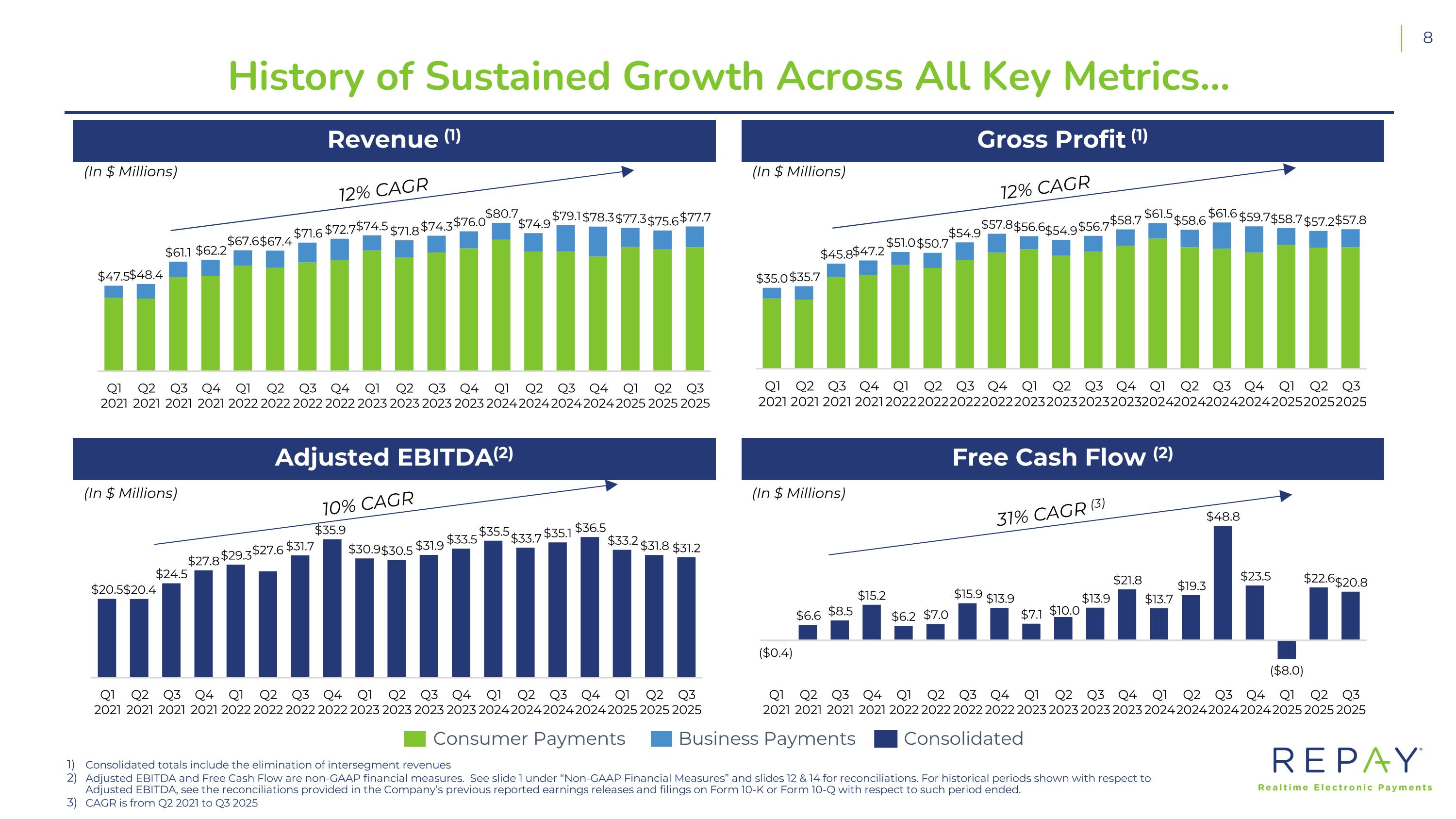

History of Sustained Growth Across All Key Metrics… Gross Profit (1) Revenue (1) Free Cash Flow (2) Adjusted EBITDA(2) (In $ Millions) (In $ Millions) (In $ Millions) (In $ Millions) 12% CAGR Consumer Payments Business Payments Consolidated Consolidated totals include the elimination of intersegment revenues Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. See slide 1 under “Non-GAAP Financial Measures” and slides 12 & 14 for reconciliations. For historical periods shown with respect to Adjusted EBITDA, see the reconciliations provided in the Company’s previous reported earnings releases and filings on Form 10-K or Form 10-Q with respect to such period ended. CAGR is from Q2 2021 to Q3 2025 12% CAGR 10% CAGR 31% CAGR (3)

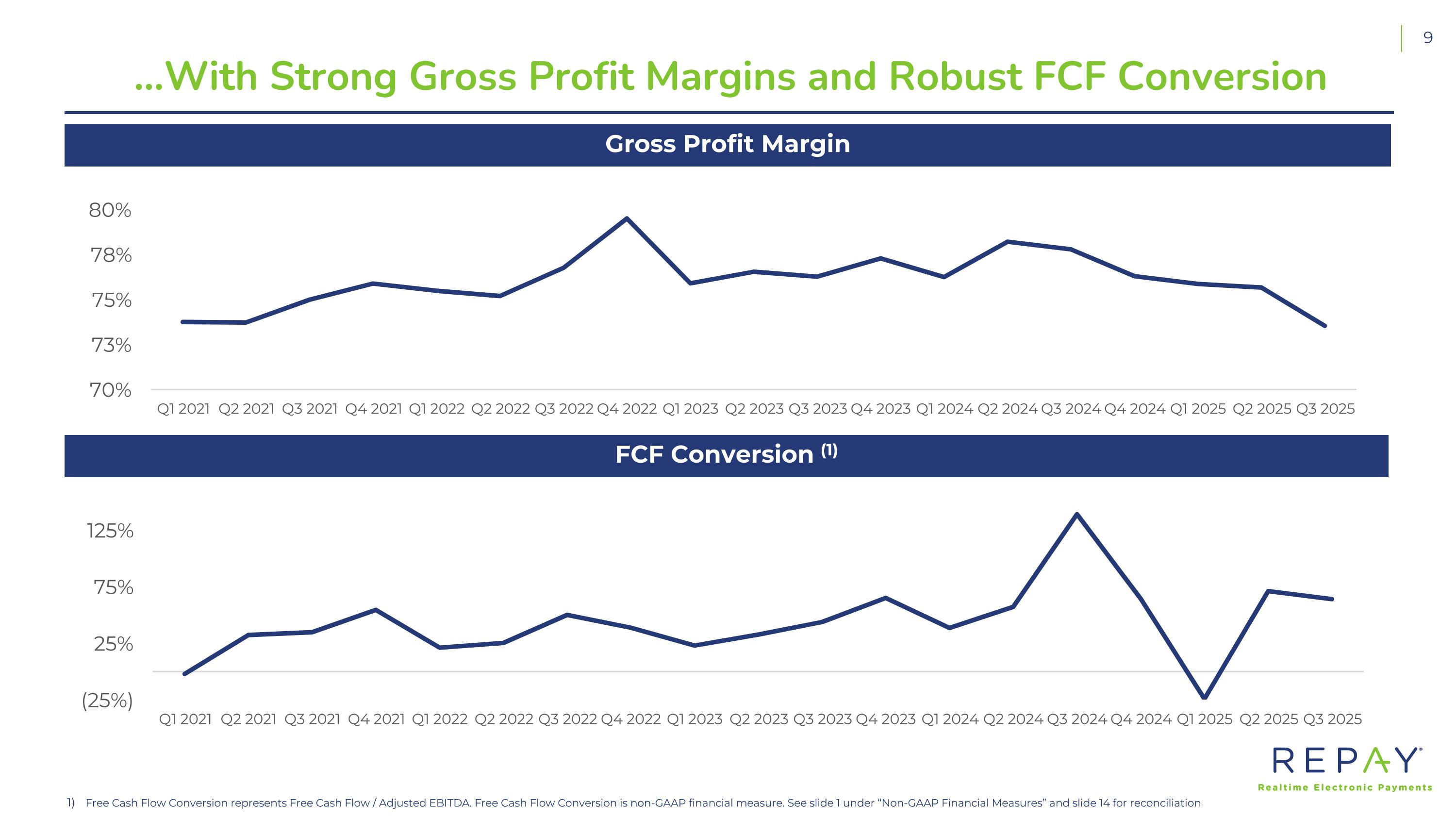

…With Strong Gross Profit Margins and Robust FCF Conversion FCF Conversion (1) Gross Profit Margin Free Cash Flow Conversion represents Free Cash Flow / Adjusted EBITDA. Free Cash Flow Conversion is non-GAAP financial measure. See slide 1 under “Non-GAAP Financial Measures” and slide 14 for reconciliation

Appendix

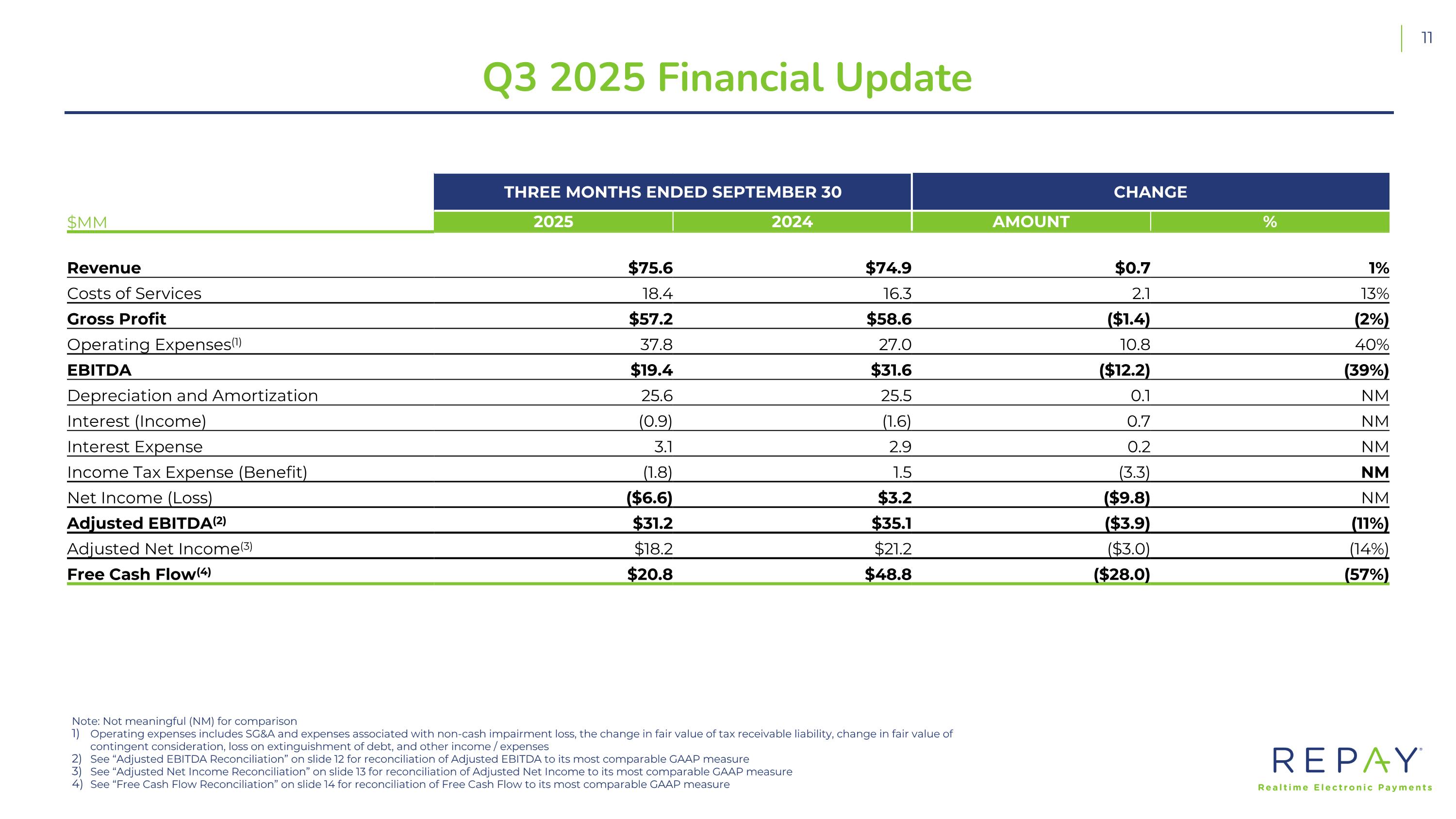

Q3 2025 Financial Update Note: Not meaningful (NM) for comparison Operating expenses includes SG&A and expenses associated with non-cash impairment loss, the change in fair value of tax receivable liability, change in fair value of contingent consideration, loss on extinguishment of debt, and other income / expenses See “Adjusted EBITDA Reconciliation” on slide 12 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure See “Adjusted Net Income Reconciliation” on slide 13 for reconciliation of Adjusted Net Income to its most comparable GAAP measure See “Free Cash Flow Reconciliation” on slide 14 for reconciliation of Free Cash Flow to its most comparable GAAP measure THREE MONTHS ENDED SEPTEMBER 30 CHANGE $MM 2025 2024 AMOUNT % Revenue $75.6 $74.9 $0.7 1% Costs of Services 18.4 16.3 2.1 13% Gross Profit $57.2 $58.6 ($1.4) (2%) Operating Expenses(1) 37.8 27.0 10.8 40% EBITDA $19.4 $31.6 ($12.2) (39%) Depreciation and Amortization 25.6 25.5 0.1 NM Interest (Income) (0.9) (1.6) 0.7 NM Interest Expense 3.1 2.9 0.2 NM Income Tax Expense (Benefit) (1.8) 1.5 (3.3) NM Net Income (Loss) ($6.6) $3.2 ($9.8) NM Adjusted EBITDA(2) $31.2 $35.1 ($3.9) (11%) Adjusted Net Income(3) $18.2 $21.2 ($3.0) (14%) Free Cash Flow(4) $20.8 $48.8 ($28.0) (57%)

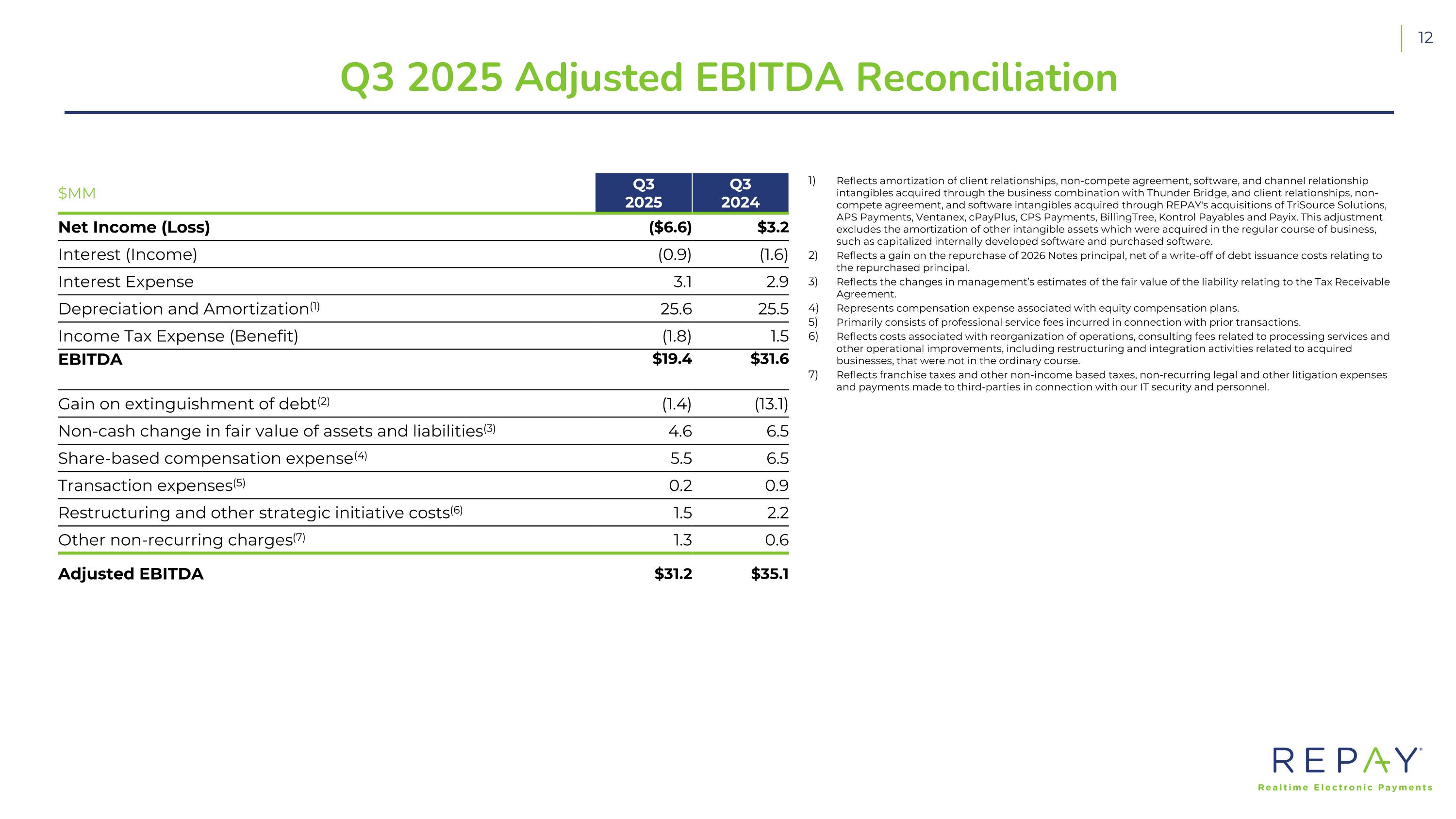

Q3 2025 Adjusted EBITDA Reconciliation Reflects amortization of client relationships, non-compete agreement, software, and channel relationship intangibles acquired through the business combination with Thunder Bridge, and client relationships, non-compete agreement, and software intangibles acquired through REPAY's acquisitions of TriSource Solutions, APS Payments, Ventanex, cPayPlus, CPS Payments, BillingTree, Kontrol Payables and Payix. This adjustment excludes the amortization of other intangible assets which were acquired in the regular course of business, such as capitalized internally developed software and purchased software. Reflects a gain on the repurchase of 2026 Notes principal, net of a write-off of debt issuance costs relating to the repurchased principal. Reflects the changes in management’s estimates of the fair value of the liability relating to the Tax Receivable Agreement. Represents compensation expense associated with equity compensation plans. Primarily consists of professional service fees incurred in connection with prior transactions. Reflects costs associated with reorganization of operations, consulting fees related to processing services and other operational improvements, including restructuring and integration activities related to acquired businesses, that were not in the ordinary course. Reflects franchise taxes and other non-income based taxes, non-recurring legal and other litigation expenses and payments made to third-parties in connection with our IT security and personnel. $MM Q3 2025 Q3 2024 Net Income (Loss) ($6.6) $3.2 Interest (Income) (0.9) (1.6) Interest Expense 3.1 2.9 Depreciation and Amortization(1) 25.6 25.5 Income Tax Expense (Benefit) (1.8) 1.5 EBITDA $19.4 $31.6 Gain on extinguishment of debt(2) (1.4) (13.1) Non-cash change in fair value of assets and liabilities(3) 4.6 6.5 Share-based compensation expense(4) 5.5 6.5 Transaction expenses(5) 0.2 0.9 Restructuring and other strategic initiative costs(6) 1.5 2.2 Other non-recurring charges(7) 1.3 0.6 Adjusted EBITDA $31.2 $35.1

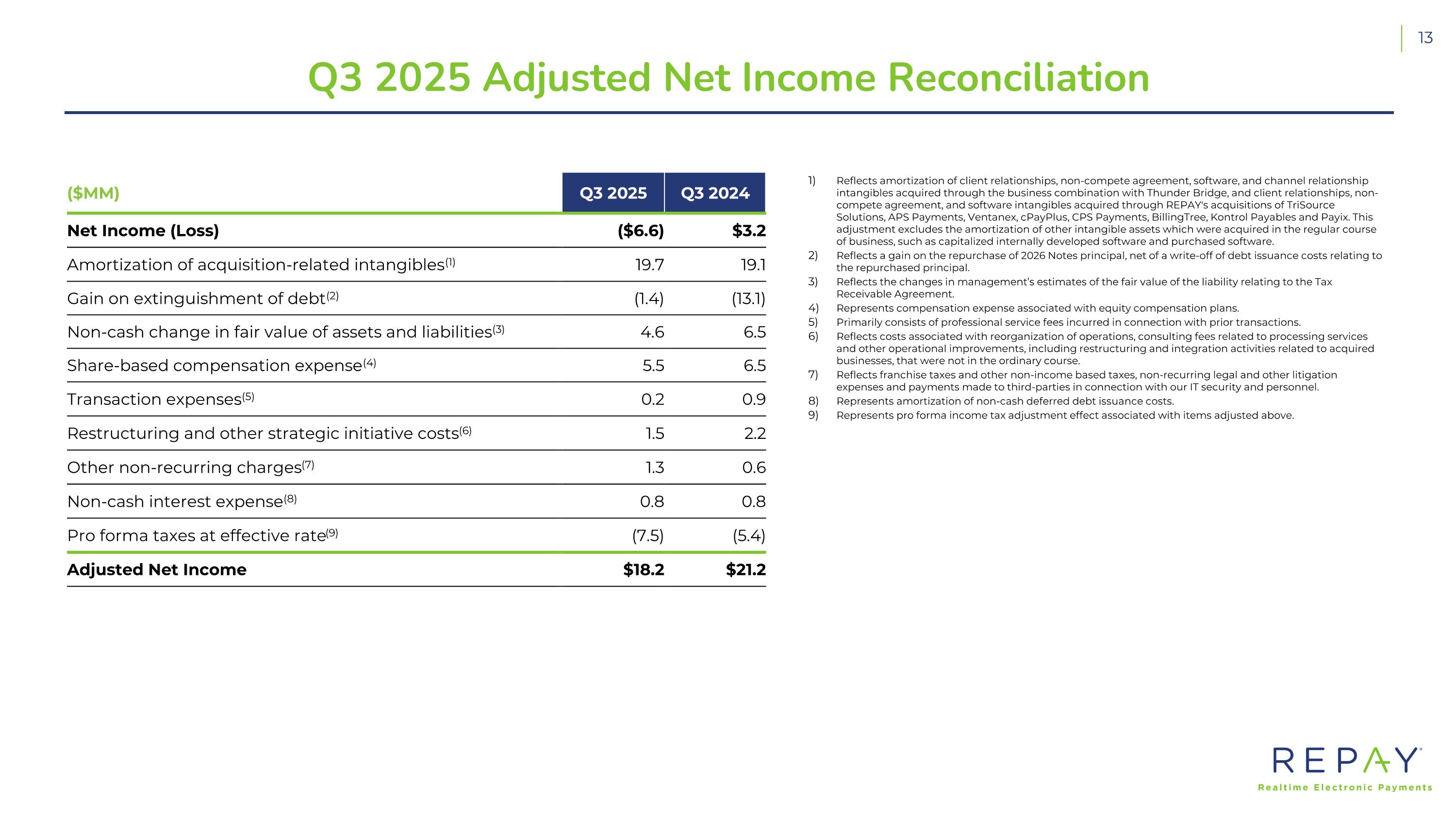

Q3 2025 Adjusted Net Income Reconciliation Reflects amortization of client relationships, non-compete agreement, software, and channel relationship intangibles acquired through the business combination with Thunder Bridge, and client relationships, non-compete agreement, and software intangibles acquired through REPAY's acquisitions of TriSource Solutions, APS Payments, Ventanex, cPayPlus, CPS Payments, BillingTree, Kontrol Payables and Payix. This adjustment excludes the amortization of other intangible assets which were acquired in the regular course of business, such as capitalized internally developed software and purchased software. Reflects a gain on the repurchase of 2026 Notes principal, net of a write-off of debt issuance costs relating to the repurchased principal. Reflects the changes in management’s estimates of the fair value of the liability relating to the Tax Receivable Agreement. Represents compensation expense associated with equity compensation plans. Primarily consists of professional service fees incurred in connection with prior transactions. Reflects costs associated with reorganization of operations, consulting fees related to processing services and other operational improvements, including restructuring and integration activities related to acquired businesses, that were not in the ordinary course. Reflects franchise taxes and other non-income based taxes, non-recurring legal and other litigation expenses and payments made to third-parties in connection with our IT security and personnel. Represents amortization of non-cash deferred debt issuance costs. Represents pro forma income tax adjustment effect associated with items adjusted above. ($MM) Q3 2025 Q3 2024 Net Income (Loss) ($6.6) $3.2 Amortization of acquisition-related intangibles(1) 19.7 19.1 Gain on extinguishment of debt(2) (1.4) (13.1) Non-cash change in fair value of assets and liabilities(3) 4.6 6.5 Share-based compensation expense(4) 5.5 6.5 Transaction expenses(5) 0.2 0.9 Restructuring and other strategic initiative costs(6) 1.5 2.2 Other non-recurring charges(7) 1.3 0.6 Non-cash interest expense(8) 0.8 0.8 Pro forma taxes at effective rate(9) (7.5) (5.4) Adjusted Net Income $18.2 $21.2

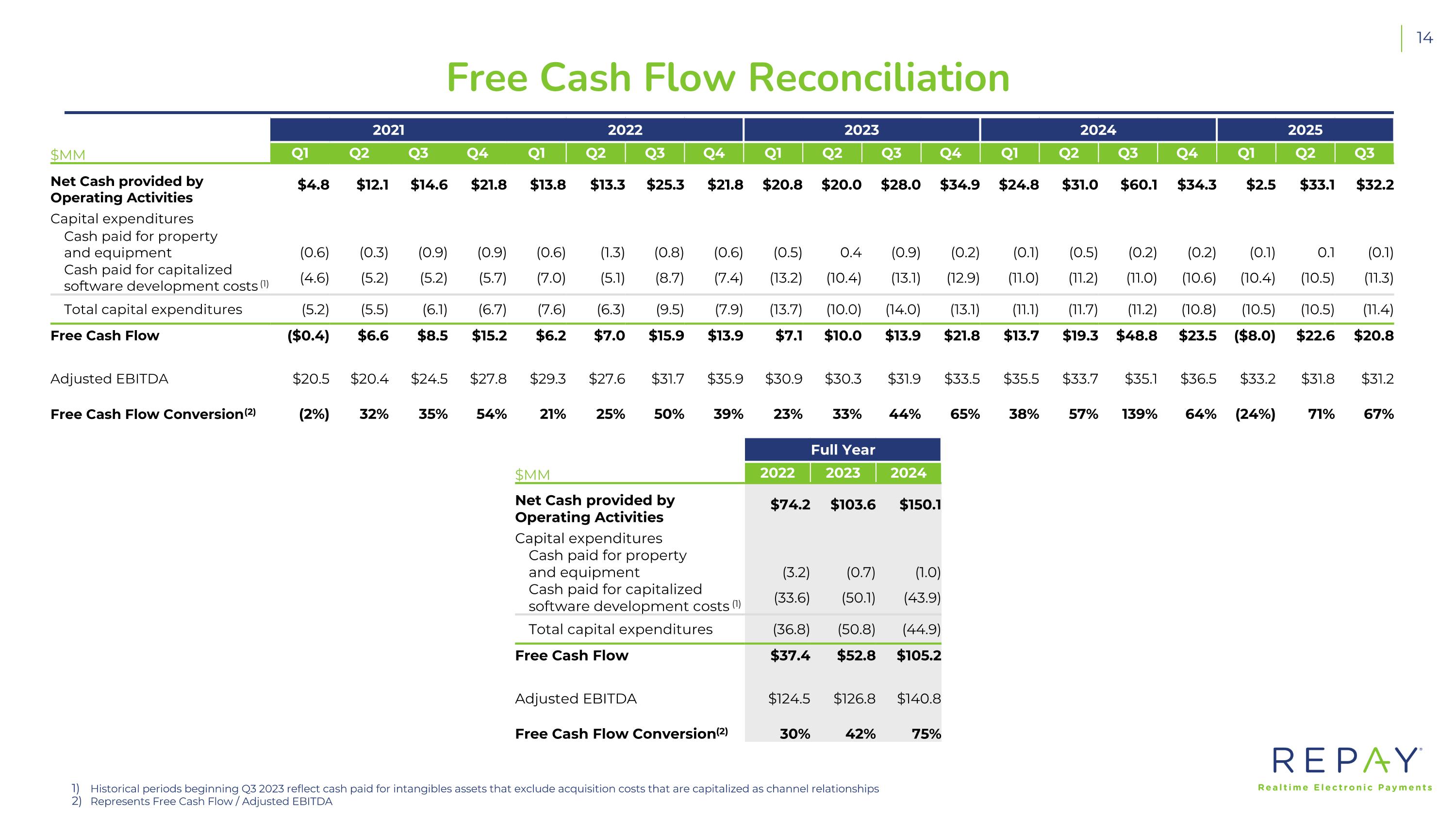

Free Cash Flow Reconciliation 2021 2022 2023 2024 2025 $MM Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net Cash provided by Operating Activities $4.8 $12.1 $14.6 $21.8 $13.8 $13.3 $25.3 $21.8 $20.8 $20.0 $28.0 $34.9 $24.8 $31.0 $60.1 $34.3 $2.5 $33.1 $32.2 Capital expenditures Cash paid for property and equipment (0.6) (0.3) (0.9) (0.9) (0.6) (1.3) (0.8) (0.6) (0.5) 0.4 (0.9) (0.2) (0.1) (0.5) (0.2) (0.2) (0.1) 0.1 (0.1) Cash paid for capitalized software development costs (1) (4.6) (5.2) (5.2) (5.7) (7.0) (5.1) (8.7) (7.4) (13.2) (10.4) (13.1) (12.9) (11.0) (11.2) (11.0) (10.6) (10.4) (10.5) (11.3) Total capital expenditures (5.2) (5.5) (6.1) (6.7) (7.6) (6.3) (9.5) (7.9) (13.7) (10.0) (14.0) (13.1) (11.1) (11.7) (11.2) (10.8) (10.5) (10.5) (11.4) Free Cash Flow ($0.4) $6.6 $8.5 $15.2 $6.2 $7.0 $15.9 $13.9 $7.1 $10.0 $13.9 $21.8 $13.7 $19.3 $48.8 $23.5 ($8.0) $22.6 $20.8 Adjusted EBITDA $20.5 $20.4 $24.5 $27.8 $29.3 $27.6 $31.7 $35.9 $30.9 $30.3 $31.9 $33.5 $35.5 $33.7 $35.1 $36.5 $33.2 $31.8 $31.2 Free Cash Flow Conversion(2) (2%) 32% 35% 54% 21% 25% 50% 39% 23% 33% 44% 65% 38% 57% 139% 64% (24%) 71% 67% Historical periods beginning Q3 2023 reflect cash paid for intangibles assets that exclude acquisition costs that are capitalized as channel relationships Represents Free Cash Flow / Adjusted EBITDA Full Year $MM 2022 2023 2024 Net Cash provided by Operating Activities $74.2 $103.6 $150.1 Capital expenditures Cash paid for property and equipment (3.2) (0.7) (1.0) Cash paid for capitalized software development costs (1) (33.6) (50.1) (43.9) Total capital expenditures (36.8) (50.8) (44.9) Free Cash Flow $37.4 $52.8 $105.2 Adjusted EBITDA $124.5 $126.8 $140.8 Free Cash Flow Conversion(2) 30% 42% 75%

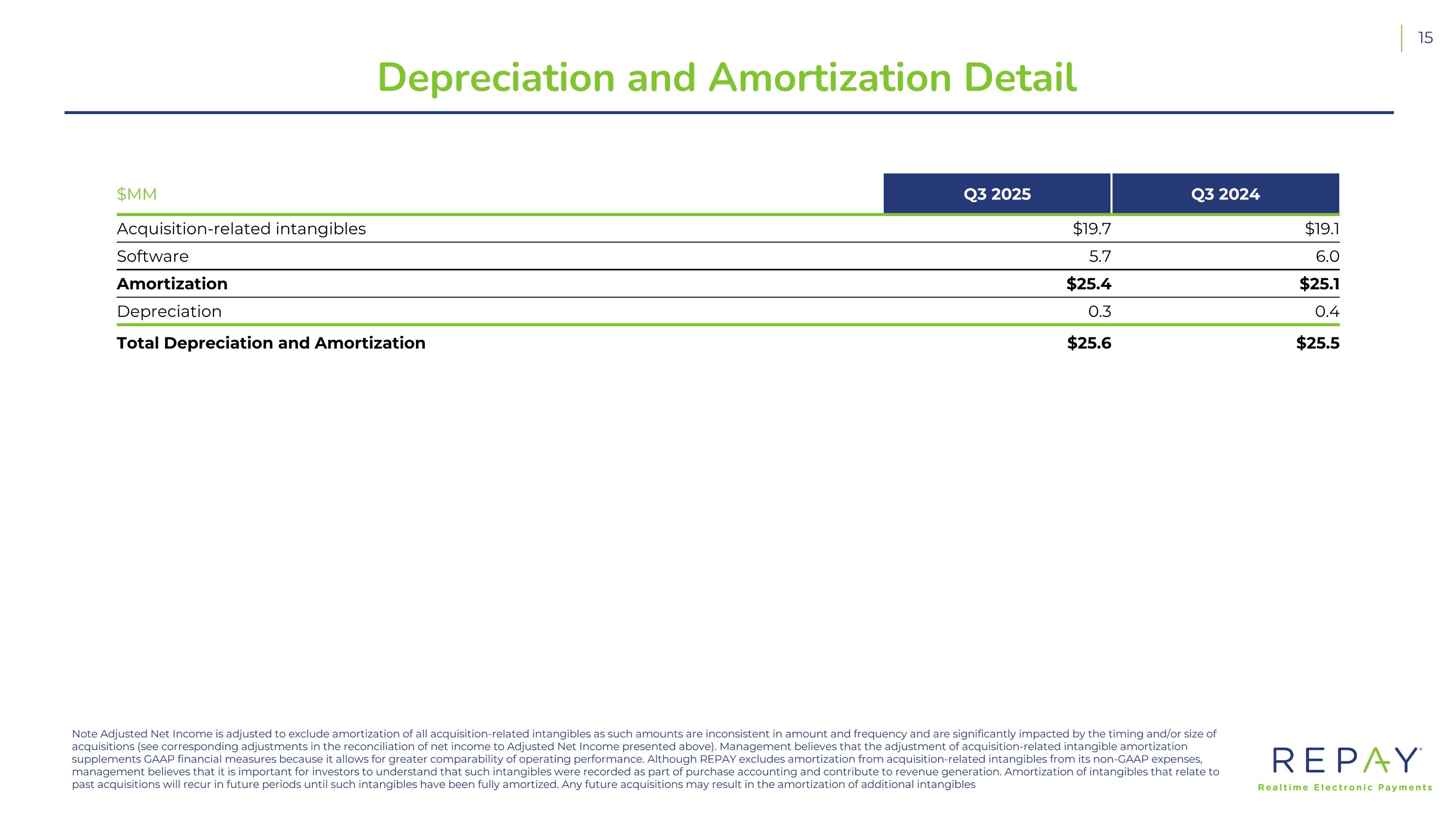

Depreciation and Amortization Detail Note Adjusted Net Income is adjusted to exclude amortization of all acquisition-related intangibles as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions (see corresponding adjustments in the reconciliation of net income to Adjusted Net Income presented above). Management believes that the adjustment of acquisition-related intangible amortization supplements GAAP financial measures because it allows for greater comparability of operating performance. Although REPAY excludes amortization from acquisition-related intangibles from its non-GAAP expenses, management believes that it is important for investors to understand that such intangibles were recorded as part of purchase accounting and contribute to revenue generation. Amortization of intangibles that relate to past acquisitions will recur in future periods until such intangibles have been fully amortized. Any future acquisitions may result in the amortization of additional intangibles $MM Q3 2025 Q3 2024 Acquisition-related intangibles $19.7 $19.1 Software 5.7 6.0 Amortization $25.4 $25.1 Depreciation 0.3 0.4 Total Depreciation and Amortization $25.6 $25.5

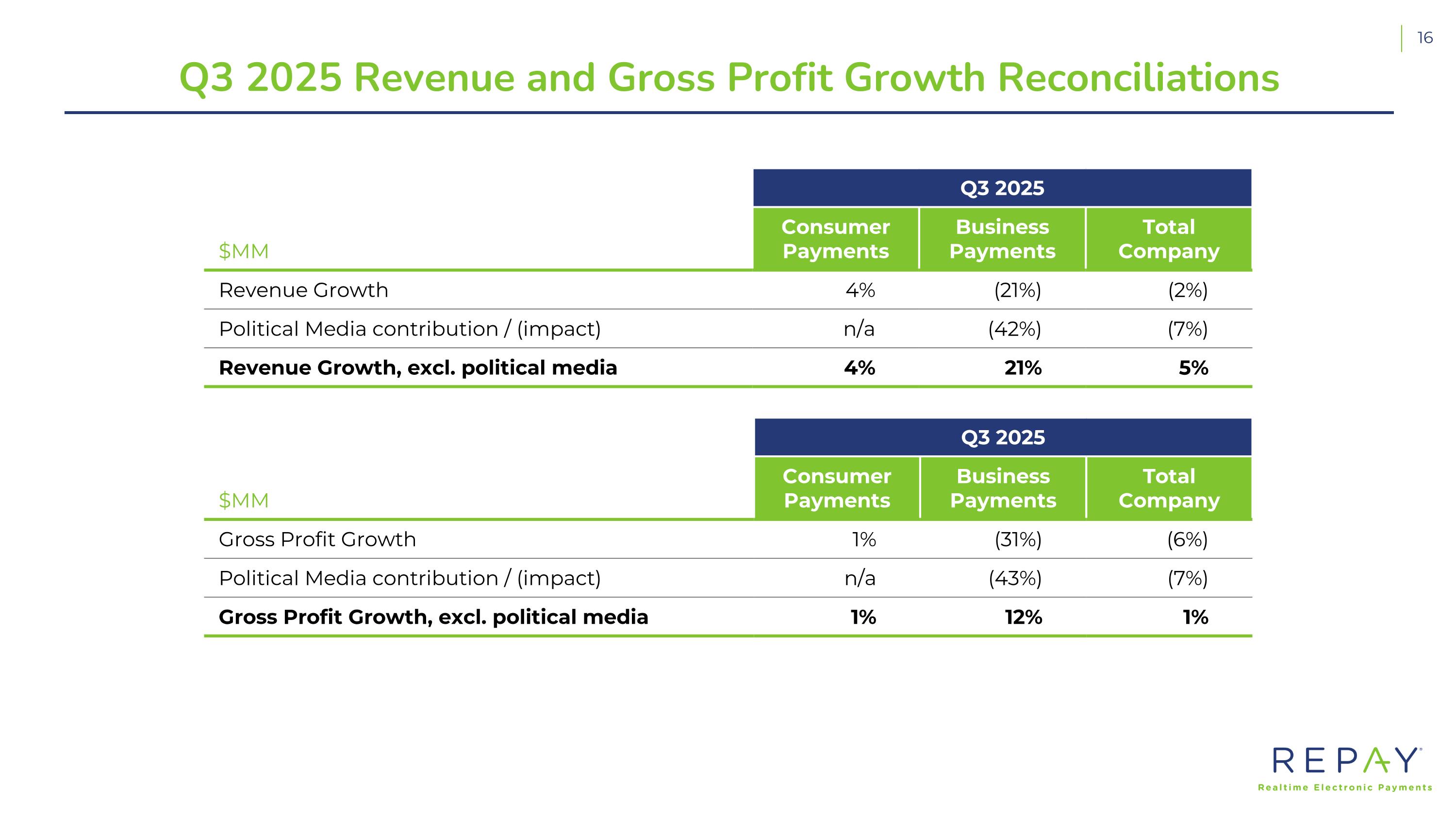

Q3 2025 Revenue and Gross Profit Growth Reconciliations Q3 2025 $MM Consumer Payments Business Payments Total Company Revenue Growth 4% (21%) (2%) Political Media contribution / (impact) n/a (42%) (7%) Revenue Growth, excl. political media 4% 21% 5% Q3 2025 $MM Consumer Payments Business Payments Total Company Gross Profit Growth 1% (31%) (6%) Political Media contribution / (impact) n/a (43%) (7%) Gross Profit Growth, excl. political media 1% 12% 1%

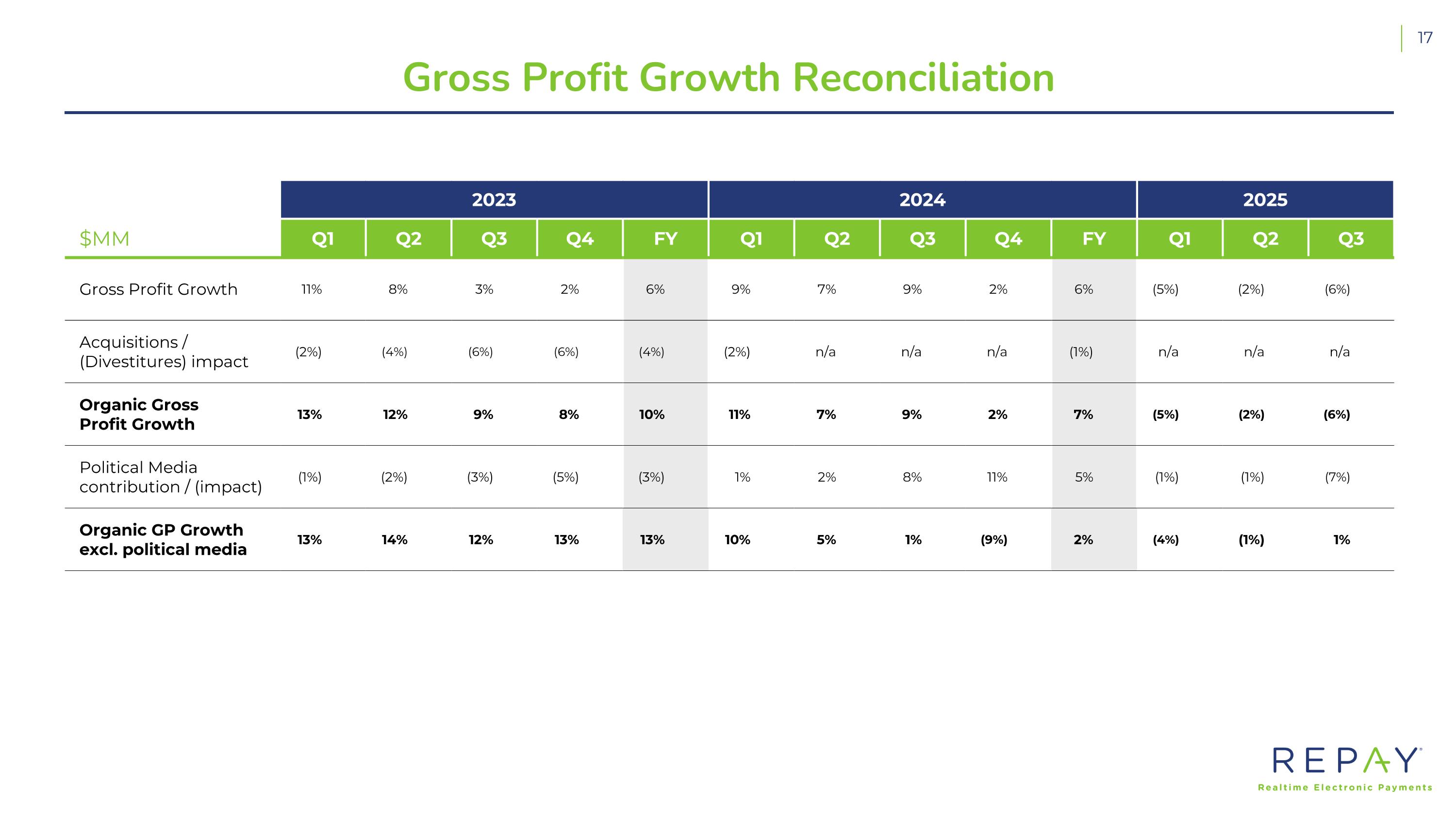

Gross Profit Growth Reconciliation 2023 2024 2025 $MM Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Gross Profit Growth 11% 8% 3% 2% 6% 9% 7% 9% 2% 6% (5%) (2%) (6%) Acquisitions / (Divestitures) impact (2%) (4%) (6%) (6%) (4%) (2%) n/a n/a n/a (1%) n/a n/a n/a Organic Gross Profit Growth 13% 12% 9% 8% 10% 11% 7% 9% 2% 7% (5%) (2%) (6%) Political Media contribution / (impact) (1%) (2%) (3%) (5%) (3%) 1% 2% 8% 11% 5% (1%) (1%) (7%) Organic GP Growth excl. political media 13% 14% 12% 13% 13% 10% 5% 1% (9%) 2% (4%) (1%) 1%

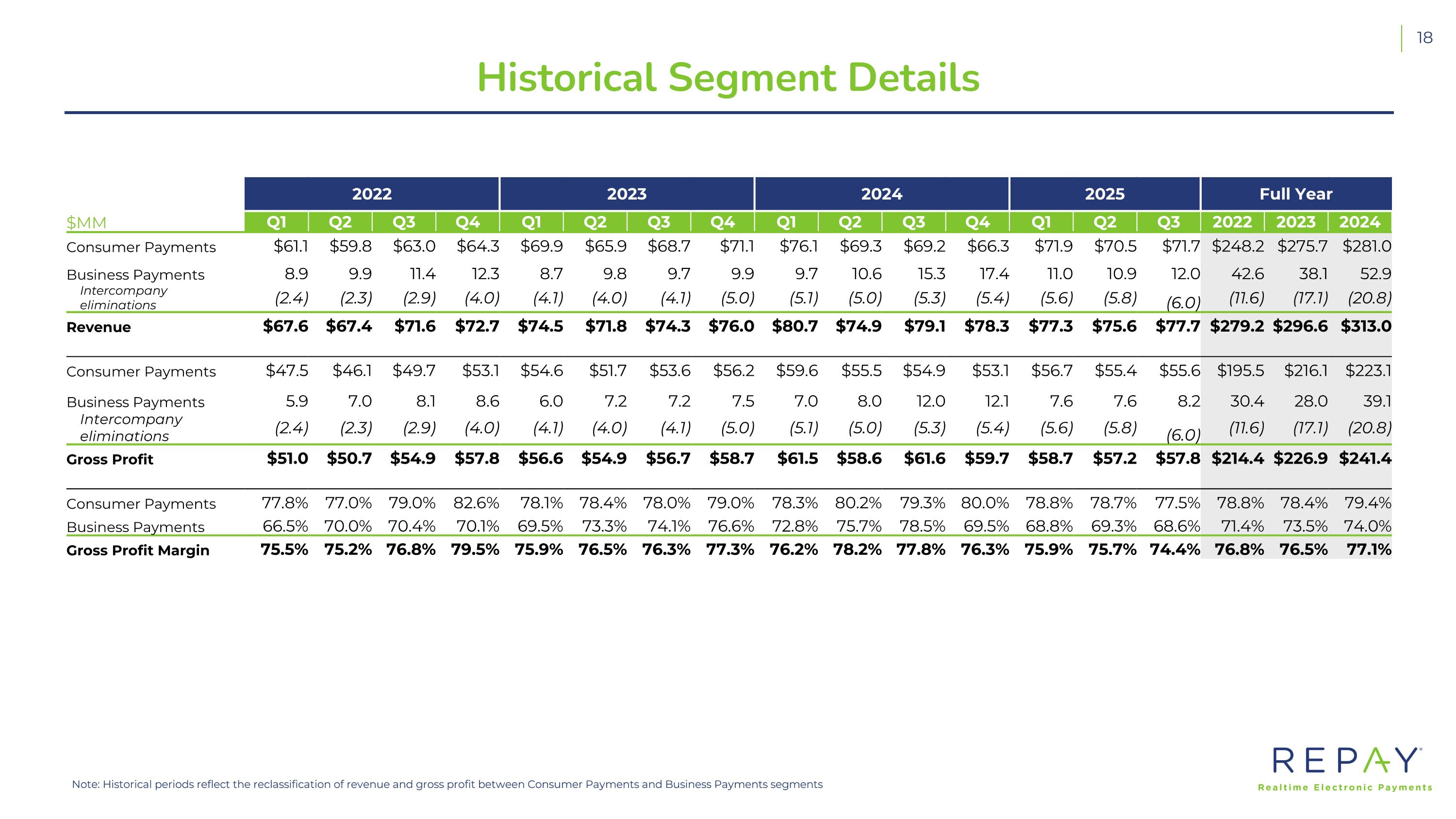

Historical Segment Details Note: Historical periods reflect the reclassification of revenue and gross profit between Consumer Payments and Business Payments segments 2022 2023 2024 2025 Full Year $MM Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2022 2023 2024 Consumer Payments $61.1 $59.8 $63.0 $64.3 $69.9 $65.9 $68.7 $71.1 $76.1 $69.3 $69.2 $66.3 $71.9 $70.5 $71.7 $248.2 $275.7 $281.0 Business Payments 8.9 9.9 11.4 12.3 8.7 9.8 9.7 9.9 9.7 10.6 15.3 17.4 11.0 10.9 12.0 42.6 38.1 52.9 Intercompany eliminations (2.4) (2.3) (2.9) (4.0) (4.1) (4.0) (4.1) (5.0) (5.1) (5.0) (5.3) (5.4) (5.6) (5.8) (6.0) (11.6) (17.1) (20.8) Revenue $67.6 $67.4 $71.6 $72.7 $74.5 $71.8 $74.3 $76.0 $80.7 $74.9 $79.1 $78.3 $77.3 $75.6 $77.7 $279.2 $296.6 $313.0 Consumer Payments $47.5 $46.1 $49.7 $53.1 $54.6 $51.7 $53.6 $56.2 $59.6 $55.5 $54.9 $53.1 $56.7 $55.4 $55.6 $195.5 $216.1 $223.1 Business Payments 5.9 7.0 8.1 8.6 6.0 7.2 7.2 7.5 7.0 8.0 12.0 12.1 7.6 7.6 8.2 30.4 28.0 39.1 Intercompany eliminations (2.4) (2.3) (2.9) (4.0) (4.1) (4.0) (4.1) (5.0) (5.1) (5.0) (5.3) (5.4) (5.6) (5.8) (6.0) (11.6) (17.1) (20.8) Gross Profit $51.0 $50.7 $54.9 $57.8 $56.6 $54.9 $56.7 $58.7 $61.5 $58.6 $61.6 $59.7 $58.7 $57.2 $57.8 $214.4 $226.9 $241.4 Consumer Payments 77.8% 77.0% 79.0% 82.6% 78.1% 78.4% 78.0% 79.0% 78.3% 80.2% 79.3% 80.0% 78.8% 78.7% 77.5% 78.8% 78.4% 79.4% Business Payments 66.5% 70.0% 70.4% 70.1% 69.5% 73.3% 74.1% 76.6% 72.8% 75.7% 78.5% 69.5% 68.8% 69.3% 68.6% 71.4% 73.5% 74.0% Gross Profit Margin 75.5% 75.2% 76.8% 79.5% 75.9% 76.5% 76.3% 77.3% 76.2% 78.2% 77.8% 76.3% 75.9% 75.7% 74.4% 76.8% 76.5% 77.1%