UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☒ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material under §240.14a-12

|

Dayforce, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

High-Premium Deal Delivers Full Value of the Long-Range Business Plan October

22, 2025

Cautionary Statement Regarding Forward-Looking Statements This presentation

may include “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian

Securities laws (collectively, “forward-looking statements”). Forward-looking statements may be identified by the use of words such as “continue,” “guidance,” “expect,” “outlook,” “project,” “believe” or other similar expressions that

predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the benefits of and timeline for closing the merger. These

statements are based on various assumptions, whether or not identified in these communications, and on current expectations and are not predictions of actual performance. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or

impossible to predict and may differ from assumptions. Many actual events and circumstances are beyond the control of Dayforce. These forward-looking statements are subject to a number of risks and uncertainties, including the timing,

receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could delay the consummation of the proposed transaction or cause the parties to abandon the proposed transaction; the

occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement entered into in connection with the proposed transaction; the possibility that Dayforce stockholders may not approve the

proposed transaction; the risk that the parties to the merger agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business

operations due to the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Dayforce’s common stock; the risk of any unexpected costs or expenses

resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Dayforce to retain and

hire key personnel and to maintain relationships with customers, vendors, partners, employees, stockholders and other business relationships and on its operating results and business generally. Further information on factors that could

cause actual results to differ materially from the results anticipated by the forward-looking statements is included in the Dayforce Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed with the Securities and

Exchange Commission (the “SEC”) and Canadian securities regulators on February 28, 2025, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings made by Dayforce from time to time with the SEC and Canadian securities

regulators. These filings, when available, are available on the investor relations section of the Dayforce website at https://investors.dayforce.com or on the SEC’s website at https://www.sec.gov. If any of these risks materialize or any of

these assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Dayforce presently does not know of or that Dayforce currently

believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The forward-looking statements included in these communications are made only as of the date hereof. Dayforce

assumes no obligation and does not intend to update these forward-looking statements, except as required by law. Additional Information and Where to Find It In connection with the proposed transaction between Dayforce and Thoma Bravo,

Dayforce has filed and will file relevant materials with the SEC and Canadian securities regulators, including the definitive Proxy Statement of Dayforce (the “Proxy Statement”), which was filed on September 29, 2025. Dayforce has mailed

the Proxy Statement to its stockholders and holders of exchangeable shares. DAYFORCE URGES YOU TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT DAYFORCE, THOMA BRAVO, THE PROPOSED TRANSACTION AND RELATED MATTERS. You are able to obtain a free copy of the Proxy Statement and other related documents (when available) filed by Dayforce with the SEC at the

website maintained by the SEC at www.sec.gov. You are also able to obtain a free copy of the Proxy Statement and other documents (when available) filed by Dayforce with the SEC by accessing the investor relations section of Dayforce’s

website at https://investors.dayforce.com or by contacting Dayforce investor relations at investors@dayforce.com or calling (844) 829-9499. Participants in the Solicitation Dayforce and its directors and executive officers may be

deemed to be participants in the solicitation of proxies from Dayforce stockholders in connection with the merger. Information regarding the directors and executive officers of Dayforce, including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth (i) in Dayforce’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings “Proposal One: Election of Directors,” “Executive Team,”

“Compensation Discussion and Analysis,” “Executive Compensation Tables,” and “Certain Relationships and Related Party Transactions,” which was filed with the SEC on March 13, 2025 and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1725057/000172505725000064/day-20250313.htm, (ii) in the Proxy Statement, including under the headings “The Merger - Interests of the Company’s Directors and Executive Officers in the Merger”

and “Security Ownership of Certain Beneficial Owners and Management” which was filed with the SEC on September 29, 2025 and is available at https://www.sec.gov/Archives/edgar/data/1725057/000114036125036413/ny20054883x2_defm14a.htm and

(iii) to the extent holdings of Dayforce’s securities by its directors or executive officers have changed since the amounts set forth in Proxy Statement, such changes have been or will be reflected on Initial Statement of Beneficial

Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results

https://www.sec.gov/edgar/browse/?CIK=0001725057&owner=only. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are or

will be contained in the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of these documents through the website maintained by the SEC at

https://www.sec.gov. Disclaimers 1

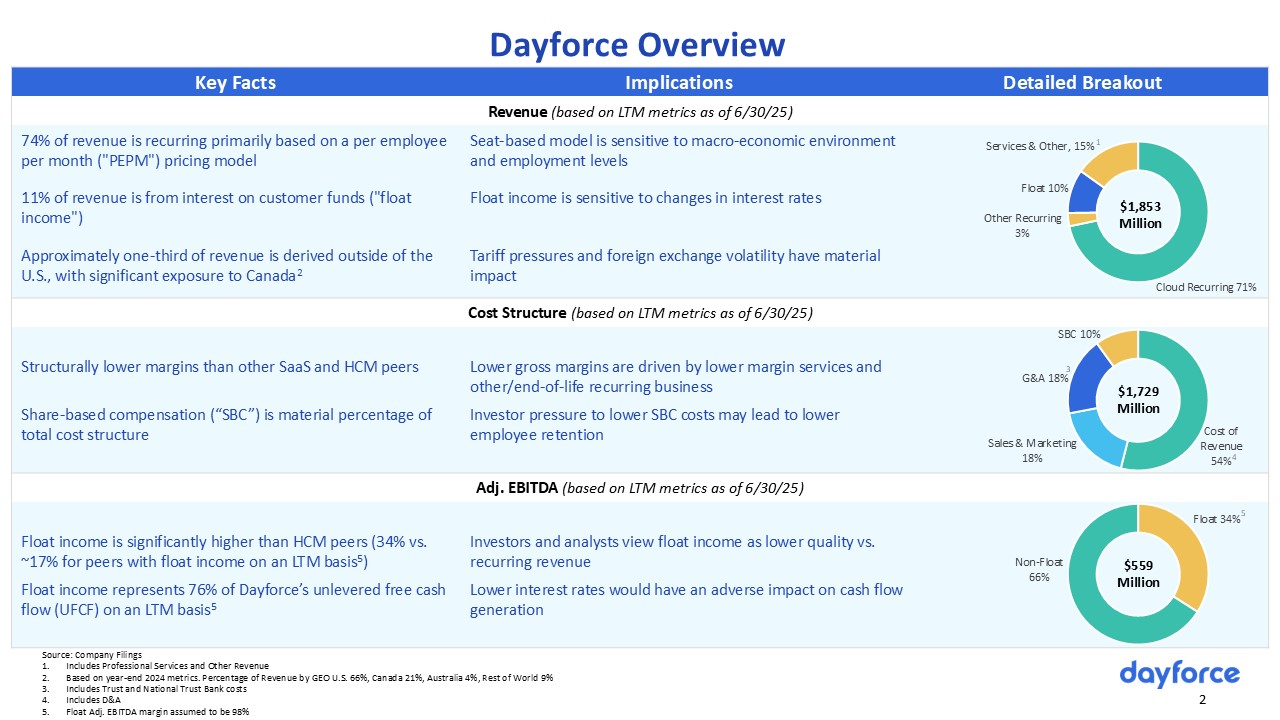

Key Facts Implications Detailed Breakout Detailed Breakout Revenue (based

on LTM metrics as of 6/30/25) 74% of revenue is recurring primarily based on a per employee per month ("PEPM") pricing model Seat-based model is sensitive to macro-economic environment and employment levels 11% of revenue is from

interest on customer funds ("float income") Float income is sensitive to changes in interest rates Approximately one-third of revenue is derived outside of the U.S., with significant exposure to Canada2 Tariff pressures and foreign

exchange volatility have material impact Cost Structure (based on LTM metrics as of 6/30/25) Structurally lower margins than other SaaS and HCM peers Share-based compensation (“SBC”) is material percentage of total cost structure Lower

gross margins are driven by lower margin services and other/end-of-life recurring business Investor pressure to lower SBC costs may lead to lower employee retention Adj. EBITDA (based on LTM metrics as of 6/30/25) Float income is

significantly higher than HCM peers (34% vs. ~17% for peers with float income on an LTM basis5) Float income represents 76% of Dayforce’s unlevered free cash flow (UFCF) on an LTM basis5 Investors and analysts view float income as lower

quality vs. recurring revenue Lower interest rates would have an adverse impact on cash flow generation Dayforce Overview 2 Source: Company Filings Includes Professional Services and Other Revenue Based on year-end 2024 metrics.

Percentage of Revenue by GEO U.S. 66%, Canada 21%, Australia 4%, Rest of World 9% Includes Trust and National Trust Bank costs Includes D&A Float Adj. EBITDA margin assumed to be 98% $1,853 Million $1,729 Million $559

Million 5 1 4 3

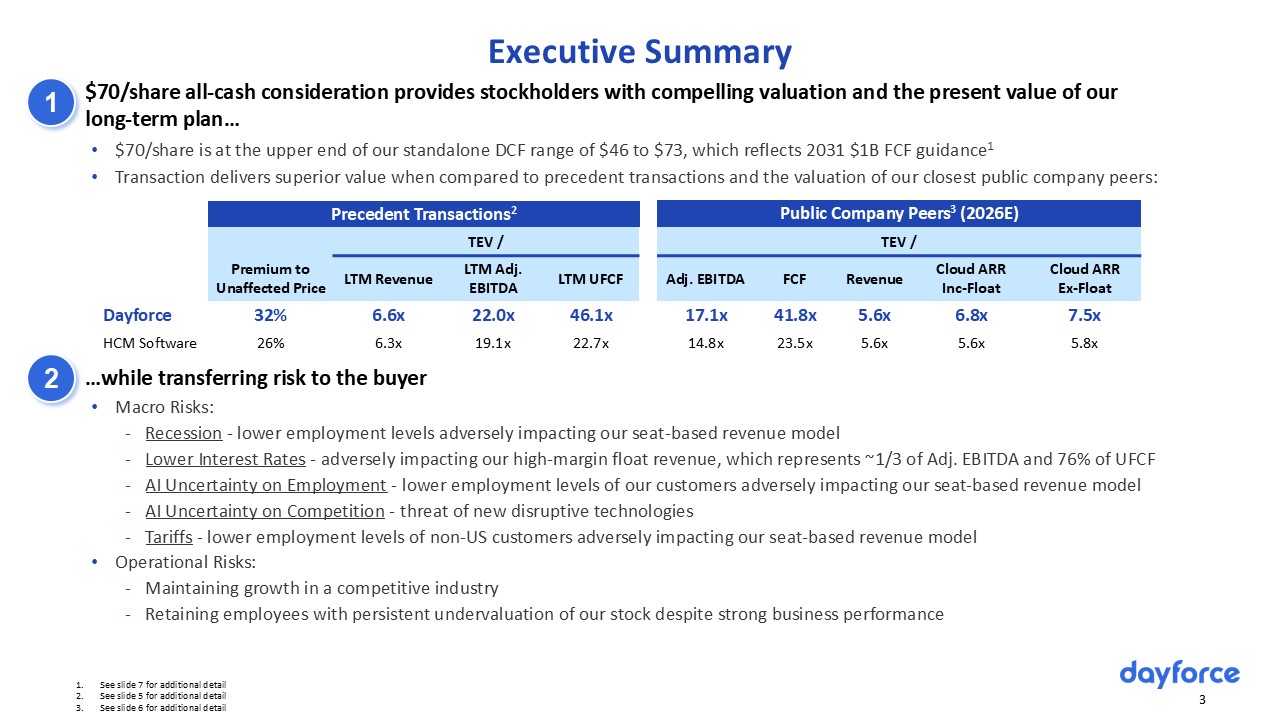

$70/share all-cash consideration provides stockholders with compelling

valuation and the present value of our long-term plan… $70/share is at the upper end of our standalone DCF range of $46 to $73, which reflects 2031 $1B FCF guidance1 Transaction delivers superior value when compared to precedent

transactions and the valuation of our closest public company peers: 1 See slide 7 for additional detail See slide 5 for additional detail See slide 6 for additional detail 2 TEV / TEV / Premium to Unaffected Price LTM Revenue LTM

Adj. EBITDA LTM UFCF Adj. EBITDA FCF Revenue Cloud ARR Inc-Float Cloud ARR Ex-Float Dayforce 32% 6.6x 22.0x 46.1x 17.1x 41.8x 5.6x 6.8x 7.5x HCM Software 26% 6.3x 19.1x 22.7x 14.8x 23.5x 5.6x 5.6x 5.8x …while

transferring risk to the buyer Macro Risks: Recession - lower employment levels adversely impacting our seat-based revenue model Lower Interest Rates - adversely impacting our high-margin float revenue, which represents ~1/3 of Adj.

EBITDA and 76% of UFCF AI Uncertainty on Employment - lower employment levels of our customers adversely impacting our seat-based revenue model AI Uncertainty on Competition - threat of new disruptive technologies Tariffs - lower

employment levels of non-US customers adversely impacting our seat-based revenue model Operational Risks: Maintaining growth in a competitive industry Retaining employees with persistent undervaluation of our stock despite strong

business performance Precedent Transactions2 Public Company Peers3 (2026E) 3 Executive Summary

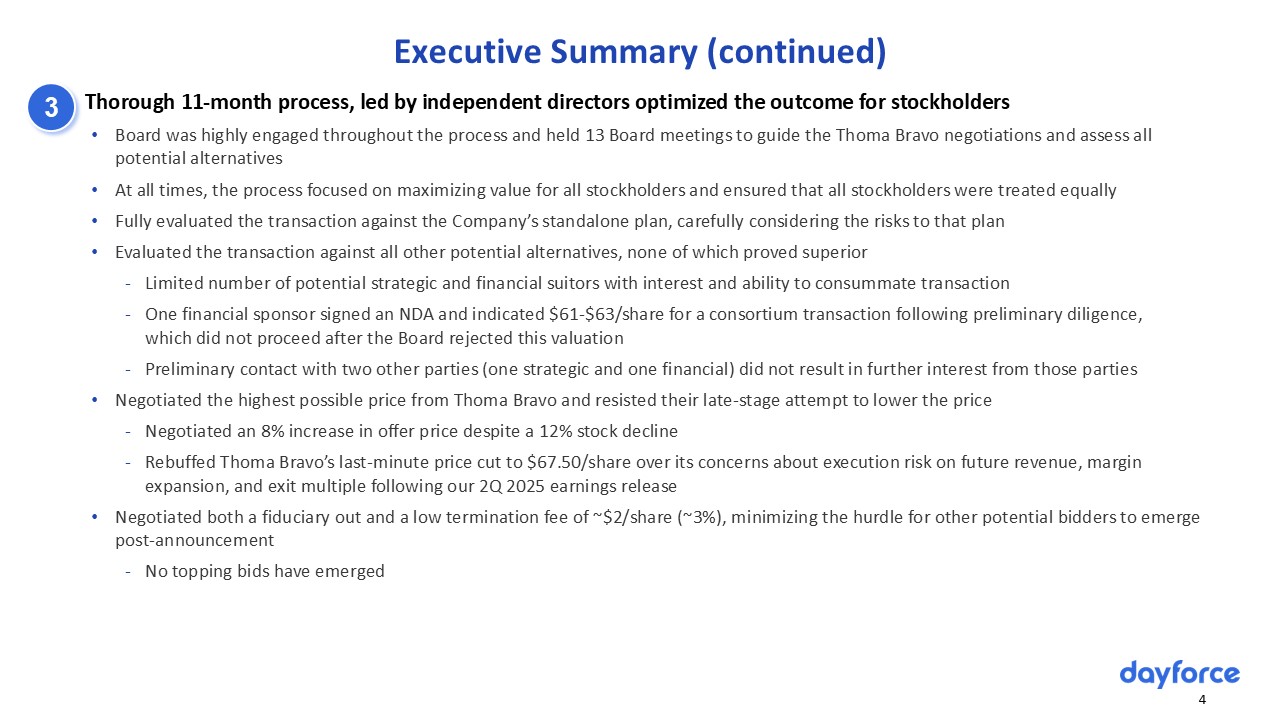

Thorough 11-month process, led by independent directors optimized the outcome

for stockholders Board was highly engaged throughout the process and held 13 Board meetings to guide the Thoma Bravo negotiations and assess all potential alternatives At all times, the process focused on maximizing value for all

stockholders and ensured that all stockholders were treated equally Fully evaluated the transaction against the Company’s standalone plan, carefully considering the risks to that plan Evaluated the transaction against all other potential

alternatives, none of which proved superior Limited number of potential strategic and financial suitors with interest and ability to consummate transaction One financial sponsor signed an NDA and indicated $61-$63/share for a consortium

transaction following preliminary diligence, which did not proceed after the Board rejected this valuation Preliminary contact with two other parties (one strategic and one financial) did not result in further interest from those

parties Negotiated the highest possible price from Thoma Bravo and resisted their late-stage attempt to lower the price Negotiated an 8% increase in offer price despite a 12% stock decline Rebuffed Thoma Bravo’s last-minute price cut to

$67.50/share over its concerns about execution risk on future revenue, margin expansion, and exit multiple following our 2Q 2025 earnings release Negotiated both a fiduciary out and a low termination fee of ~$2/share (~3%), minimizing the

hurdle for other potential bidders to emerge post-announcement No topping bids have emerged 4 Executive Summary (continued) 3

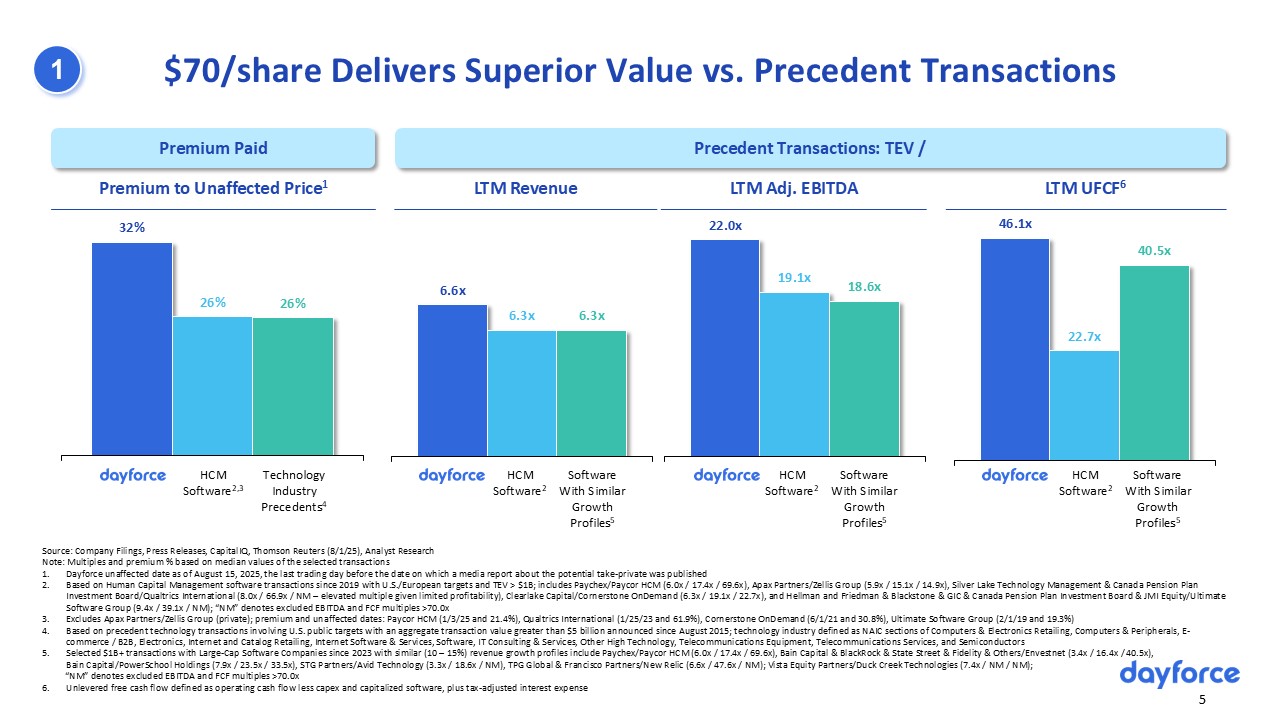

LTM Adj. EBITDA Premium to Unaffected Price1 Precedent Transactions: TEV

/ Premium Paid Source: Company Filings, Press Releases, CapitalIQ, Thomson Reuters (8/1/25), Analyst Research Note: Multiples and premium % based on median values of the selected transactions Dayforce unaffected date as of August 15,

2025, the last trading day before the date on which a media report about the potential take-private was published Based on Human Capital Management software transactions since 2019 with U.S./European targets and TEV > $1B; includes

Paychex/Paycor HCM (6.0x / 17.4x / 69.6x), Apax Partners/Zellis Group (5.9x / 15.1x / 14.9x), Silver Lake Technology Management & Canada Pension Plan Investment Board/Qualtrics International (8.0x / 66.9x / NM – elevated multiple given

limited profitability), Clearlake Capital/Cornerstone OnDemand (6.3x / 19.1x / 22.7x), and Hellman and Friedman & Blackstone & GIC & Canada Pension Plan Investment Board & JMI Equity/Ultimate Software Group (9.4x / 39.1x /

NM); “NM” denotes excluded EBITDA and FCF multiples >70.0x Excludes Apax Partners/Zellis Group (private); premium and unaffected dates: Paycor HCM (1/3/25 and 21.4%), Qualtrics International (1/25/23 and 61.9%), Cornerstone OnDemand

(6/1/21 and 30.8%), Ultimate Software Group (2/1/19 and 19.3%) Based on precedent technology transactions involving U.S. public targets with an aggregate transaction value greater than $5 billion announced since August 2015; technology

industry defined as NAIC sections of Computers & Electronics Retailing, Computers & Peripherals, E-commerce / B2B, Electronics, Internet and Catalog Retailing, Internet Software & Services, Software, IT Consulting &

Services, Other High Technology, Telecommunications Equipment, Telecommunications Services, and Semiconductors Selected $1B+ transactions with Large-Cap Software Companies since 2023 with similar (10 – 15%) revenue growth profiles include

Paychex/Paycor HCM (6.0x / 17.4x / 69.6x), Bain Capital & BlackRock & State Street & Fidelity & Others/Envestnet (3.4x / 16.4x / 40.5x), Bain Capital/PowerSchool Holdings (7.9x / 23.5x / 33.5x), STG Partners/Avid Technology

(3.3x / 18.6x / NM), TPG Global & Francisco Partners/New Relic (6.6x / 47.6x / NM); Vista Equity Partners/Duck Creek Technologies (7.4x / NM / NM); “NM” denotes excluded EBITDA and FCF multiples >70.0x Unlevered free cash flow

defined as operating cash flow less capex and capitalized software, plus tax-adjusted interest expense Technology Industry Precedents4 5 LTM UFCF6 HCM Software2 Software With Similar Growth Profiles5 $70/share Delivers Superior

Value vs. Precedent Transactions HCM Software2 Software With Similar Growth Profiles5 HCM Software2,3 LTM Revenue HCM Software2 Software With Similar Growth Profiles5 1

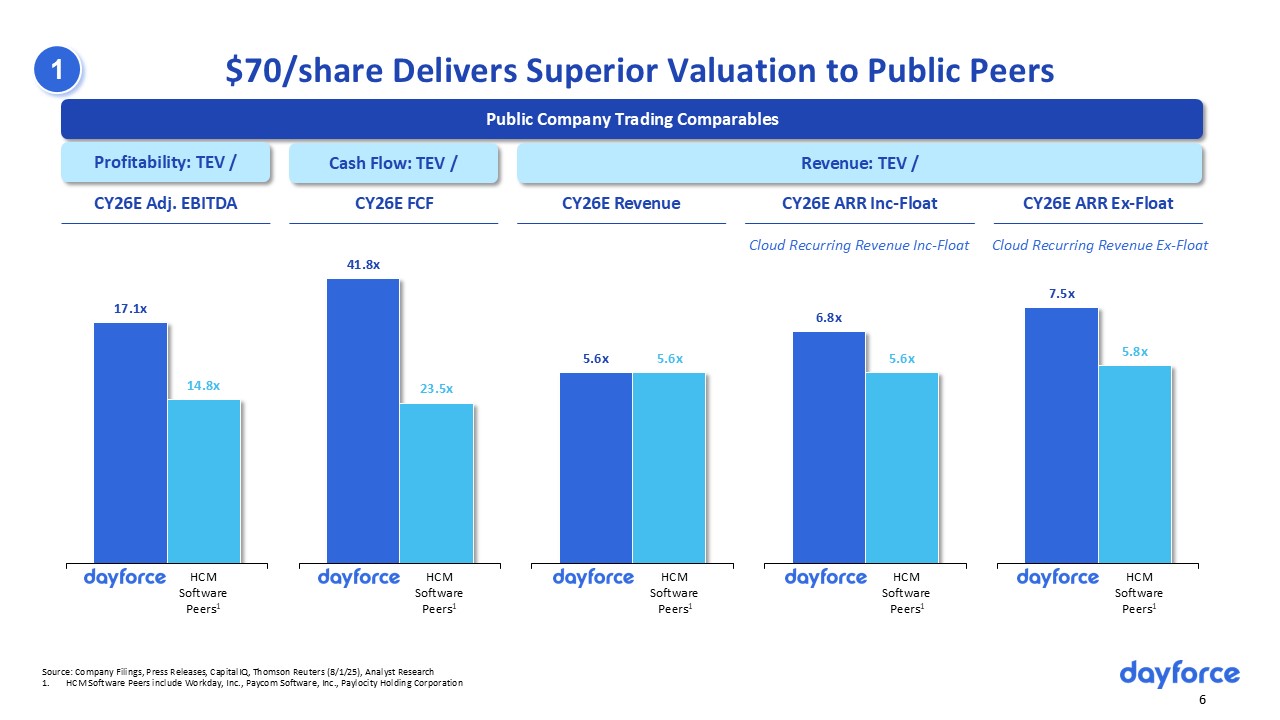

$70/share Delivers Superior Valuation to Public Peers CY26E ARR

Inc-Float Source: Company Filings, Press Releases, CapitalIQ, Thomson Reuters (8/1/25), Analyst Research HCM Software Peers include Workday, Inc., Paycom Software, Inc., Paylocity Holding Corporation Public Company Trading

Comparables HCM Software Peers1 CY26E Revenue CY26E Adj. EBITDA CY26E FCF HCM Software Peers1 HCM Software Peers1 HCM Software Peers1 6 CY26E ARR Ex-Float HCM Software Peers1 Cloud Recurring Revenue Inc-Float Cloud

Recurring Revenue Ex-Float Public Peers TEV/CY26E Adj. EBITDA TEV/CY26E Free Cash Flow TEV/CY26E Revenue TEV/CY26E ARR Inc-Float TEV/CY26E ARR Ex-Float Dayforce 17.1x 41.8x 5.6x 6.8x 7.5x HCM

Software 14.8x 23.5x 5.6x 5.6x 5.8x Revenue: TEV / Profitability: TEV / Cash Flow: TEV / 1

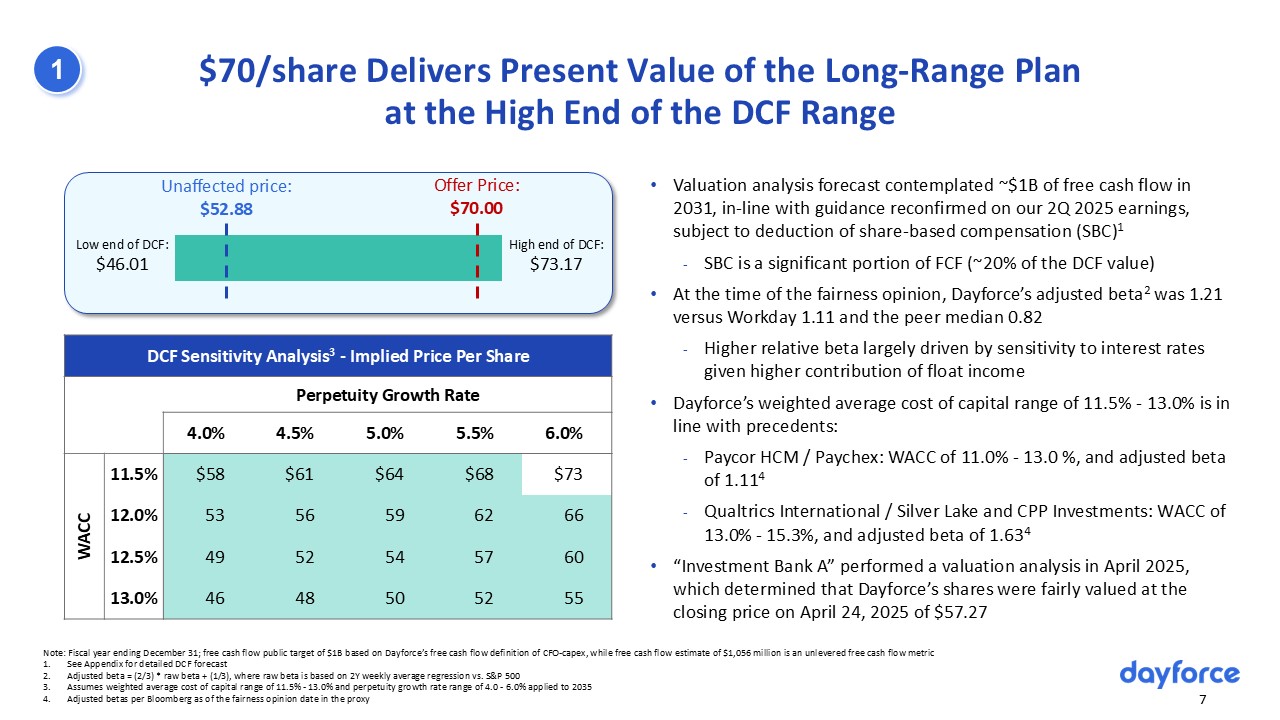

7 $70/share Delivers Present Value of the Long-Range Plan at the High End of

the DCF Range Valuation analysis forecast contemplated ~$1B of free cash flow in 2031, in-line with guidance reconfirmed on our 2Q 2025 earnings, subject to deduction of share-based compensation (SBC)1 SBC is a significant portion of FCF

(~20% of the DCF value) At the time of the fairness opinion, Dayforce’s adjusted beta2 was 1.21 versus Workday 1.11 and the peer median 0.82 Higher relative beta largely driven by sensitivity to interest rates given higher contribution

of float income Dayforce’s weighted average cost of capital range of 11.5% - 13.0% is in line with precedents: Paycor HCM / Paychex: WACC of 11.0% - 13.0 %, and adjusted beta of 1.114 Qualtrics International / Silver Lake and CPP

Investments: WACC of 13.0% - 15.3%, and adjusted beta of 1.634 “Investment Bank A” performed a valuation analysis in April 2025, which determined that Dayforce’s shares were fairly valued at the closing price on April 24, 2025 of

$57.27 Low end of DCF: $46.01 High end of DCF:$73.17 Offer Price: $70.00 Unaffected price: $52.88 1 DCF Sensitivity Analysis3 - Implied Price Per Share Perpetuity Growth Rate 4.0% 4.5% 5.0% 5.5% 6.0% WACC 11.5% $58

$61 $64 $68 $73 12.0% 53 56 59 62 66 12.5% 49 52 54 57 60 13.0% 46 48 50 52 55 Note: Fiscal year ending December 31; free cash flow public target of $1B based on Dayforce’s free cash flow

definition of CFO-capex, while free cash flow estimate of $1,056 million is an unlevered free cash flow metric See Appendix for detailed DCF forecast Adjusted beta = (2/3) * raw beta + (1/3), where raw beta is based on 2Y weekly average

regression vs. S&P 500 Assumes weighted average cost of capital range of 11.5% - 13.0% and perpetuity growth rate range of 4.0 - 6.0% applied to 2035 Adjusted betas per Bloomberg as of the fairness opinion date in the proxy

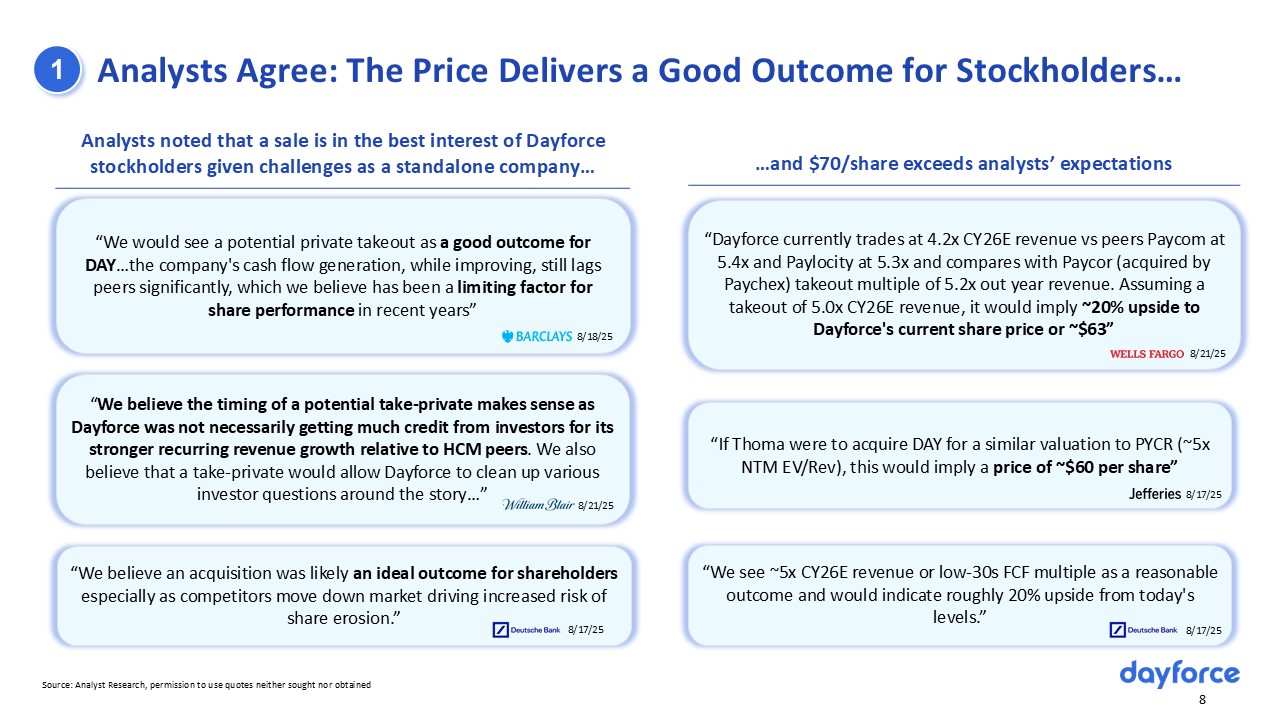

Analysts Agree: The Price Delivers a Good Outcome for Stockholders… Source:

Analyst Research, permission to use quotes neither sought nor obtained Analysts noted that a sale is in the best interest of Dayforce stockholders given challenges as a standalone company… …and $70/share exceeds analysts’

expectations 8 1 “Dayforce currently trades at 4.2x CY26E revenue vs peers Paycom at 5.4x and Paylocity at 5.3x and compares with Paycor (acquired by Paychex) takeout multiple of 5.2x out year revenue. Assuming a takeout of 5.0x CY26E

revenue, it would imply ~20% upside to Dayforce's current share price or ~$63” “If Thoma were to acquire DAY for a similar valuation to PYCR (~5x NTM EV/Rev), this would imply a price of ~$60 per share” “We believe the timing of a

potential take-private makes sense as Dayforce was not necessarily getting much credit from investors for its stronger recurring revenue growth relative to HCM peers. We also believe that a take-private would allow Dayforce to clean up

various investor questions around the story…” “We would see a potential private takeout as a good outcome for DAY…the company's cash flow generation, while improving, still lags peers significantly, which we believe has been a limiting

factor for share performance in recent years” “We believe an acquisition was likely an ideal outcome for shareholders especially as competitors move down market driving increased risk of share

erosion.” 8/18/25 8/21/25 8/21/25 8/17/25 8/17/25 “We see ~5x CY26E revenue or low-30s FCF multiple as a reasonable outcome and would indicate roughly 20% upside from today's levels.” 8/17/25

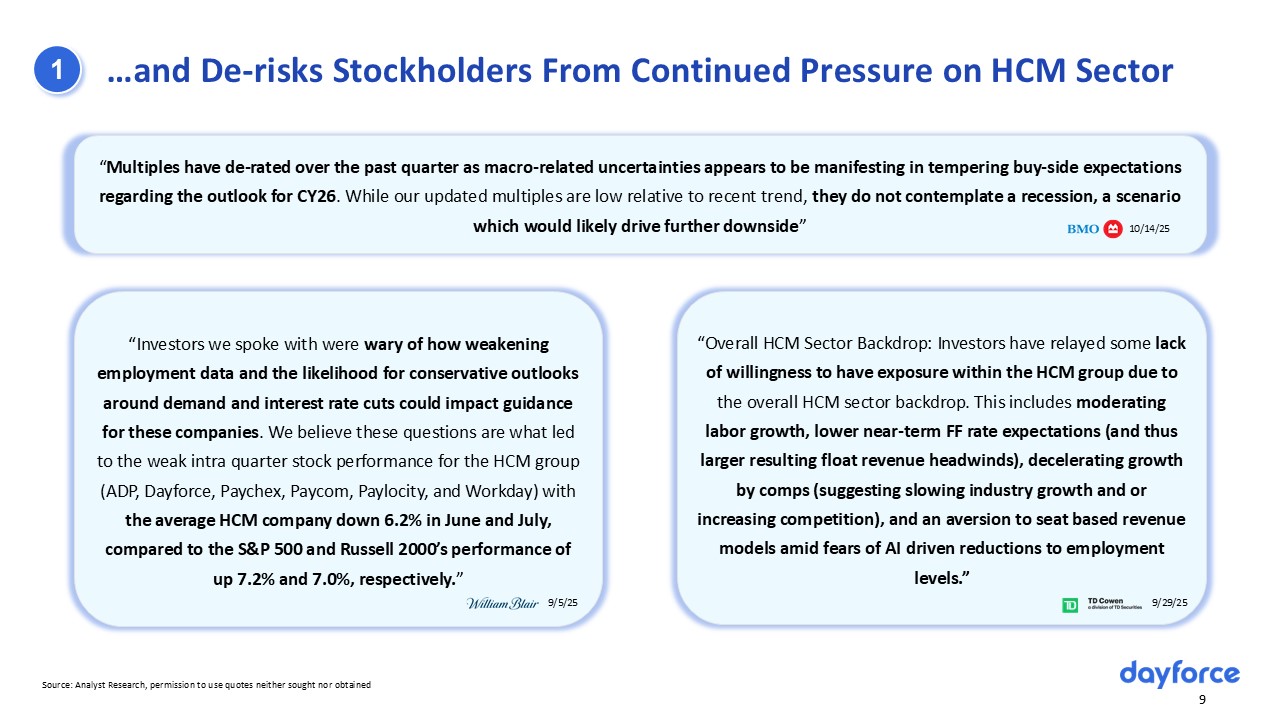

…and De-risks Stockholders From Continued Pressure on HCM

Sector 9 “Investors we spoke with were wary of how weakening employment data and the likelihood for conservative outlooks around demand and interest rate cuts could impact guidance for these companies. We believe these questions are what

led to the weak intra quarter stock performance for the HCM group (ADP, Dayforce, Paychex, Paycom, Paylocity, and Workday) with the average HCM company down 6.2% in June and July, compared to the S&P 500 and Russell 2000’s performance

of up 7.2% and 7.0%, respectively.” 9/5/25 “Overall HCM Sector Backdrop: Investors have relayed some lack of willingness to have exposure within the HCM group due to the overall HCM sector backdrop. This includes moderating labor growth,

lower near-term FF rate expectations (and thus larger resulting float revenue headwinds), decelerating growth by comps (suggesting slowing industry growth and or increasing competition), and an aversion to seat based revenue models amid

fears of AI driven reductions to employment levels.” 9/29/25 Source: Analyst Research, permission to use quotes neither sought nor obtained 1 “Multiples have de-rated over the past quarter as macro-related uncertainties appears to be

manifesting in tempering buy-side expectations regarding the outlook for CY26. While our updated multiples are low relative to recent trend, they do not contemplate a recession, a scenario which would likely drive further

downside” 10/14/25

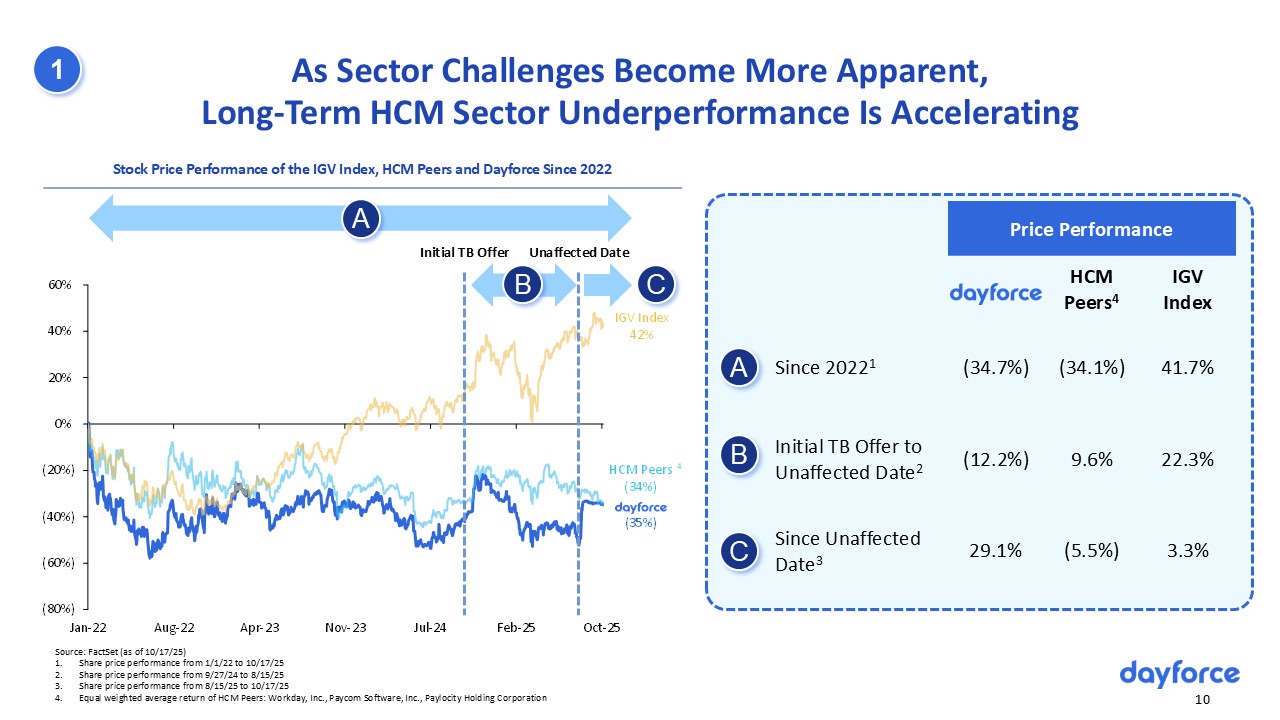

As Sector Challenges Become More Apparent,Long-Term HCM Sector

Underperformance Is Accelerating 10 Stock Price Performance of the IGV Index, HCM Peers and Dayforce Since 2022 Unaffected Date 4 Price Performance HCM Peers4 IGV Index Since 20221 (34.7%) (34.1%) 41.7% Initial TB Offer to

Unaffected Date2 (12.2%) 9.6% 22.3% Since Unaffected Date3 29.1% (5.5%) 3.3% Initial TB Offer B C A A B C 1 Source: FactSet (as of 10/17/25) Share price performance from 1/1/22 to 10/17/25 Share price performance from

9/27/24 to 8/15/25 Share price performance from 8/15/25 to 10/17/25 Equal weighted average return of HCM Peers: Workday, Inc., Paycom Software, Inc., Paylocity Holding Corporation

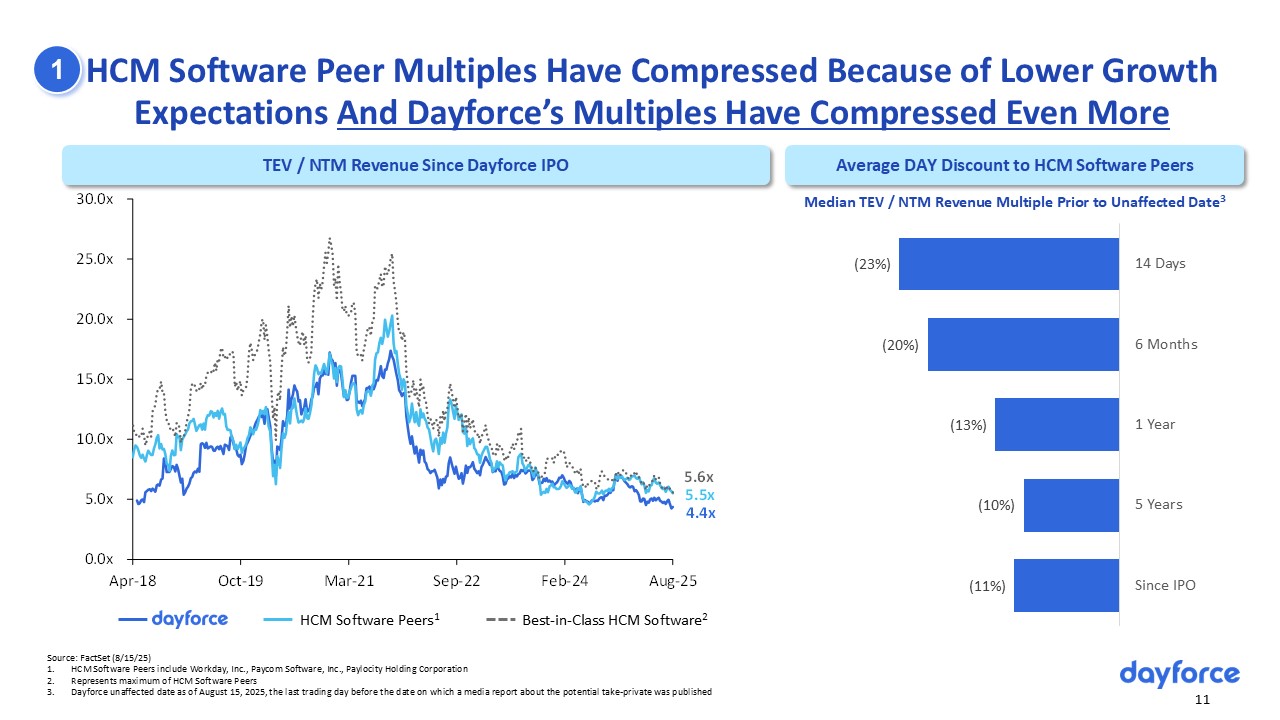

HCM Software Peer Multiples Have Compressed Because of Lower Growth

Expectations And Dayforce’s Multiples Have Compressed Even More 11 HCM Software Peers1 TEV / NTM Revenue Since Dayforce IPO Best-in-Class HCM Software2 Average DAY Discount to HCM Software Peers Median TEV / NTM Revenue Multiple Prior

to Unaffected Date3 1 Source: FactSet (8/15/25) HCM Software Peers include Workday, Inc., Paycom Software, Inc., Paylocity Holding Corporation Represents maximum of HCM Software Peers Dayforce unaffected date as of August 15, 2025, the

last trading day before the date on which a media report about the potential take-private was published

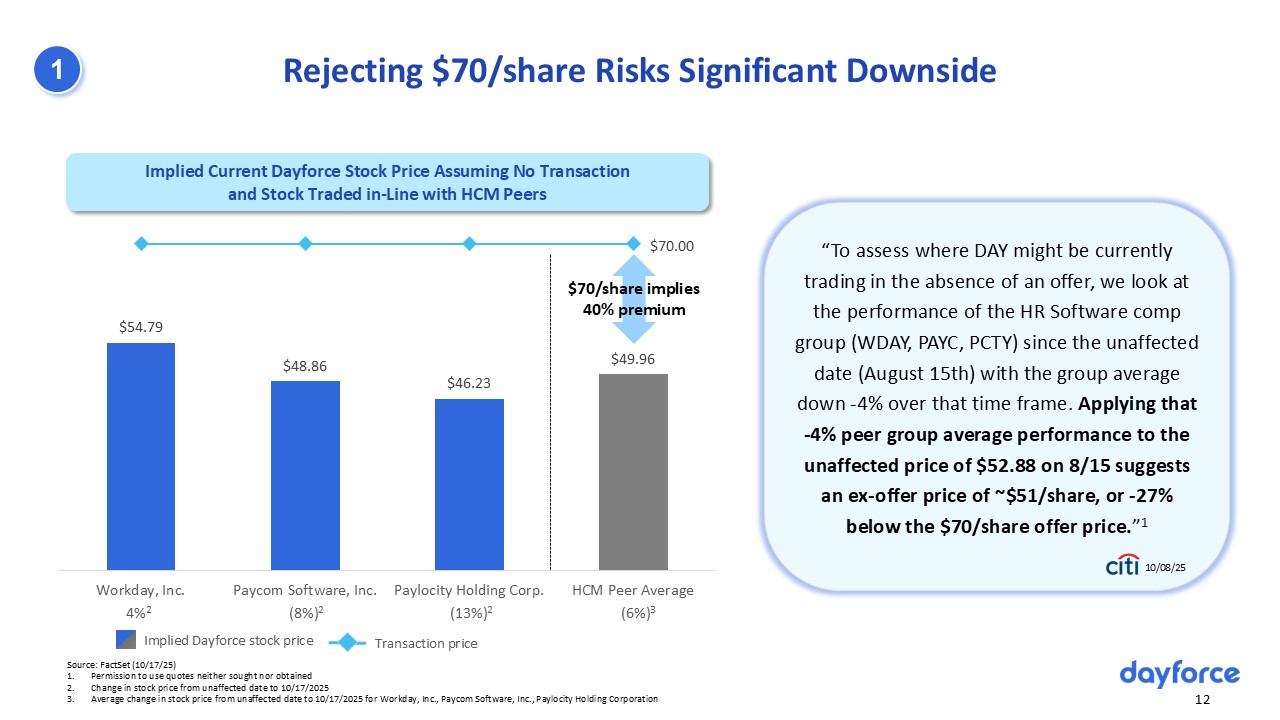

Rejecting $70/share Risks Significant Downside 12 Implied Current Dayforce

Stock Price Assuming No Transaction and Stock Traded in-Line with HCM Peers “To assess where DAY might be currently trading in the absence of an offer, we look at the performance of the HR Software comp group (WDAY, PAYC, PCTY) since the

unaffected date (August 15th) with the group average down -4% over that time frame. Applying that -4% peer group average performance to the unaffected price of $52.88 on 8/15 suggests an ex-offer price of ~$51/share, or -27% below the

$70/share offer price.”1 10/08/25 4%2 (8%)2 (13%)2 1 (6%)3 $70/share implies 40% premium Implied Dayforce stock price Transaction price Source: FactSet (10/17/25) Permission to use quotes neither sought nor obtained Change in

stock price from unaffected date to 10/17/2025 Average change in stock price from unaffected date to 10/17/2025 for Workday, Inc., Paycom Software, Inc., Paylocity Holding Corporation

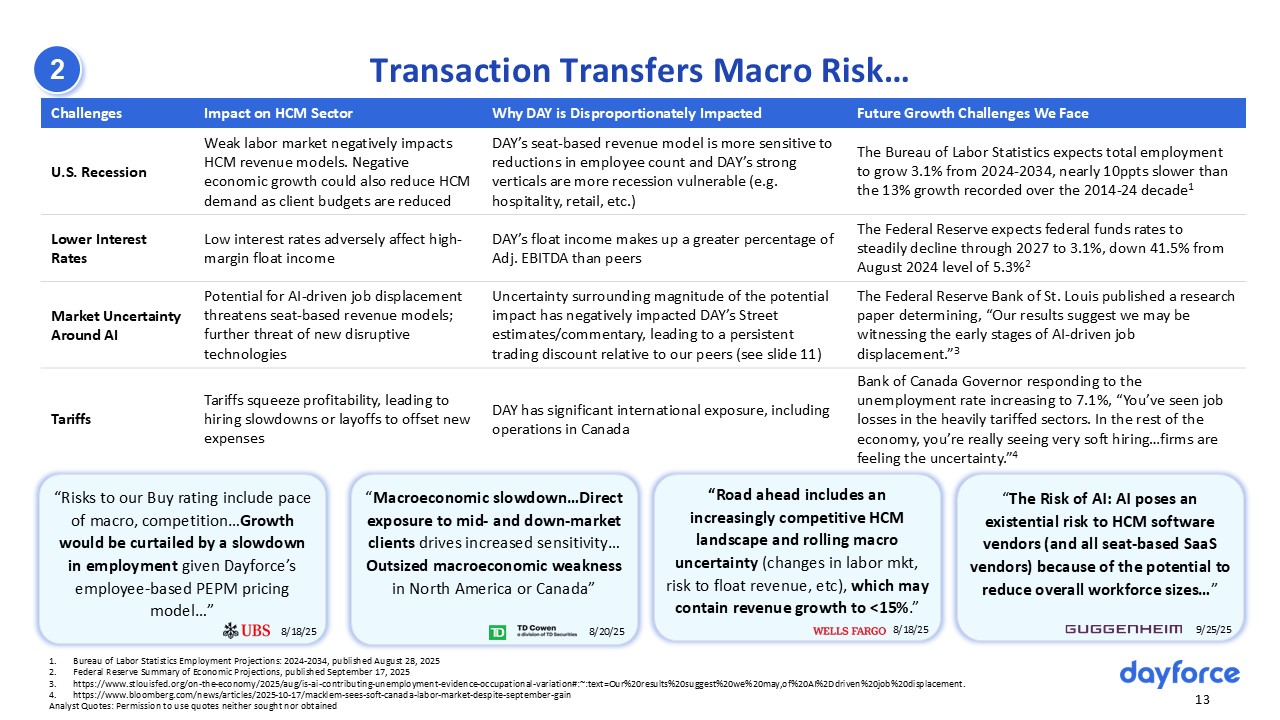

Transaction Transfers Macro Risk… 13 Challenges Impact on HCM Sector Why

DAY is Disproportionately Impacted Future Growth Challenges We Face U.S. Recession Weak labor market negatively impacts HCM revenue models. Negative economic growth could also reduce HCM demand as client budgets are reduced DAY’s

seat-based revenue model is more sensitive to reductions in employee count and DAY’s strong verticals are more recession vulnerable (e.g. hospitality, retail, etc.) The Bureau of Labor Statistics expects total employment to grow 3.1% from

2024-2034, nearly 10ppts slower than the 13% growth recorded over the 2014-24 decade1 Lower Interest Rates Low interest rates adversely affect high-margin float income DAY’s float income makes up a greater percentage of Adj. EBITDA than

peers The Federal Reserve expects federal funds rates to steadily decline through 2027 to 3.1%, down 41.5% from August 2024 level of 5.3%2 Market Uncertainty Around AI Potential for AI-driven job displacement threatens seat-based revenue

models; further threat of new disruptive technologies Uncertainty surrounding magnitude of the potential impact has negatively impacted DAY’s Street estimates/commentary, leading to a persistent trading discount relative to our peers (see

slide 11) The Federal Reserve Bank of St. Louis published a research paper determining, “Our results suggest we may be witnessing the early stages of AI-driven job displacement.”3 Tariffs Tariffs squeeze profitability, leading to hiring

slowdowns or layoffs to offset new expenses DAY has significant international exposure, including operations in Canada Bank of Canada Governor responding to the unemployment rate increasing to 7.1%, “You’ve seen job losses in the heavily

tariffed sectors. In the rest of the economy, you’re really seeing very soft hiring…firms are feeling the uncertainty.”4 Bureau of Labor Statistics Employment Projections: 2024-2034, published August 28, 2025 Federal Reserve Summary of

Economic Projections, published September 17,

2025 https://www.stlouisfed.org/on-the-economy/2025/aug/is-ai-contributing-unemployment-evidence-occupational-variation#:~:text=Our%20results%20suggest%20we%20may,of%20AI%2Ddriven%20job%20displacement. https://www.bloomberg.com/news/articles/2025-10-17/macklem-sees-soft-canada-labor-market-despite-september-gain Analyst

Quotes: Permission to use quotes neither sought nor obtained 2 “Risks to our Buy rating include pace of macro, competition…Growth would be curtailed by a slowdown in employment given Dayforce’s employee-based PEPM pricing

model…” 8/18/25 “Macroeconomic slowdown…Direct exposure to mid- and down-market clients drives increased sensitivity… Outsized macroeconomic weakness in North America or Canada” 8/20/25 “Road ahead includes an increasingly competitive

HCM landscape and rolling macro uncertainty (changes in labor mkt, risk to float revenue, etc), which may contain revenue growth to <15%.” 8/18/25 “The Risk of AI: AI poses an existential risk to HCM software vendors (and all

seat-based SaaS vendors) because of the potential to reduce overall workforce sizes…” 9/25/25

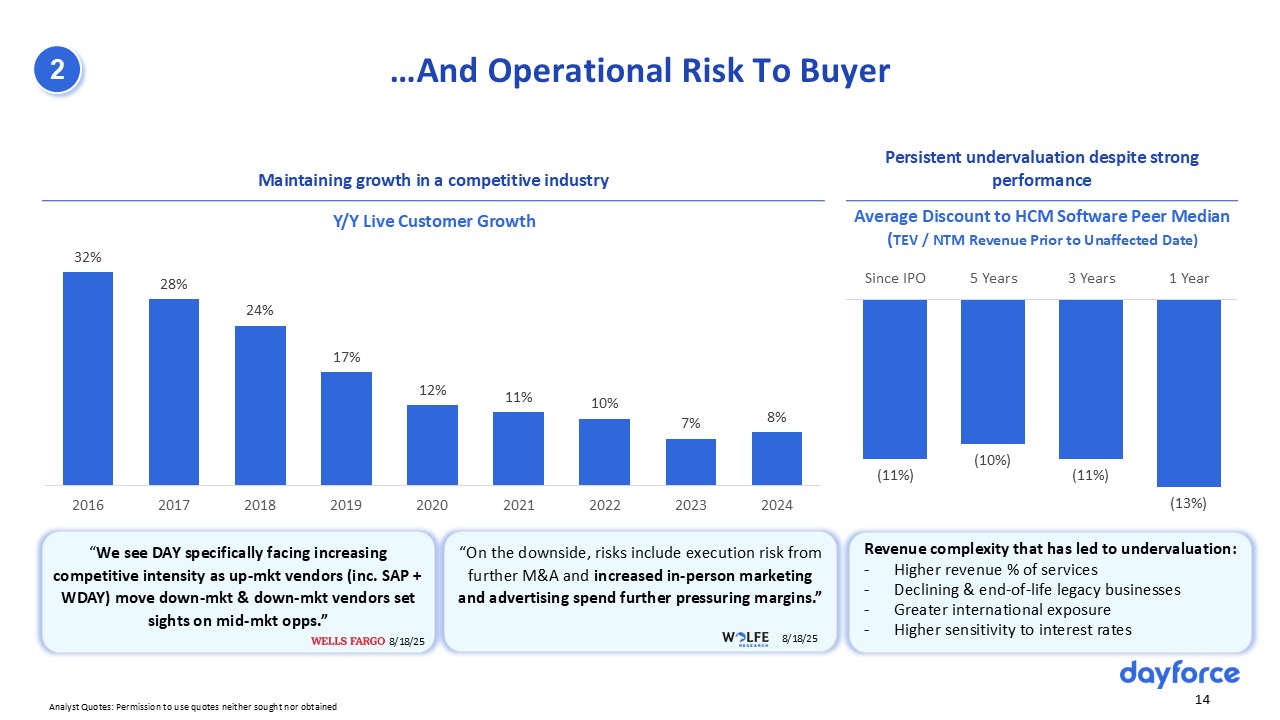

…And Operational Risk To Buyer 14 Maintaining growth in a competitive

industry Persistent undervaluation despite strong performance “We see DAY specifically facing increasing competitive intensity as up-mkt vendors (inc. SAP + WDAY) move down-mkt & down-mkt vendors set sights on mid-mkt

opps.” 8/18/25 Average Discount to HCM Software Peer Median (TEV / NTM Revenue Prior to Unaffected Date) 8/6/25 “On the downside, risks include execution risk from further M&A and increased in-person marketing and advertising spend

further pressuring margins.” 8/18/25 2 Analyst Quotes: Permission to use quotes neither sought nor obtained Revenue complexity that has led to undervaluation: Higher revenue % of services Declining & end-of-life legacy

businesses Greater international exposure Higher sensitivity to interest rates

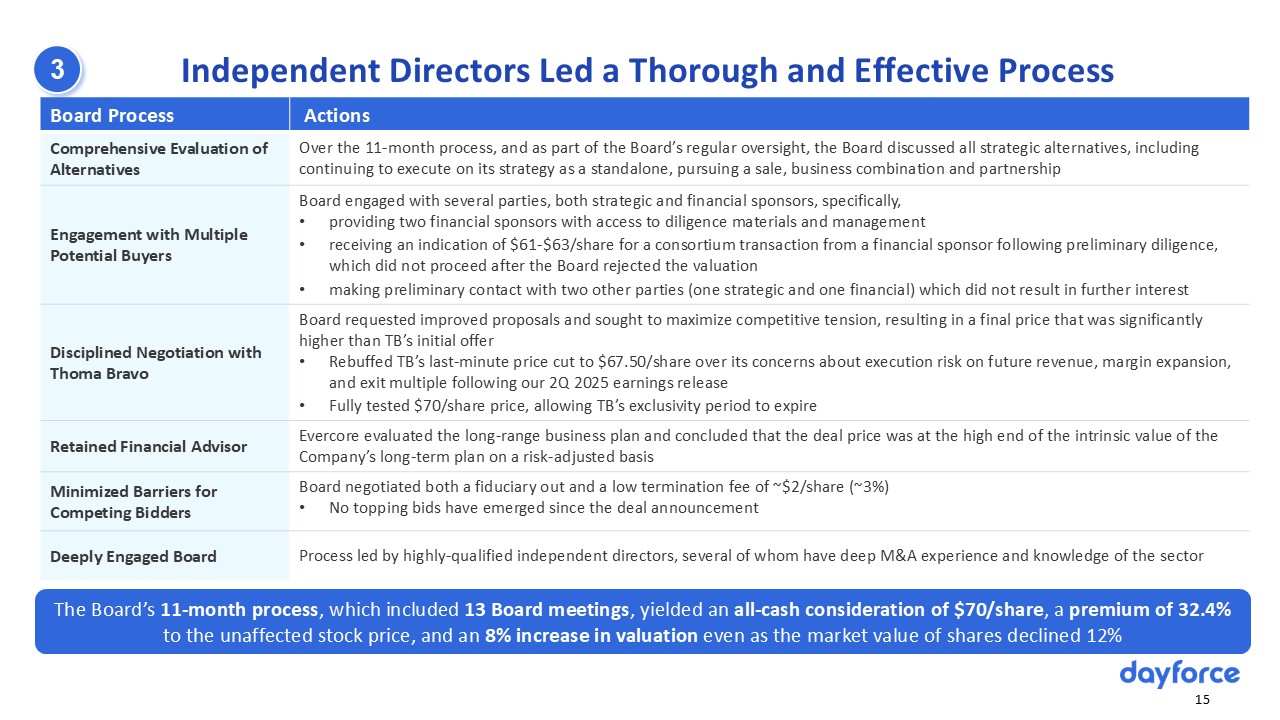

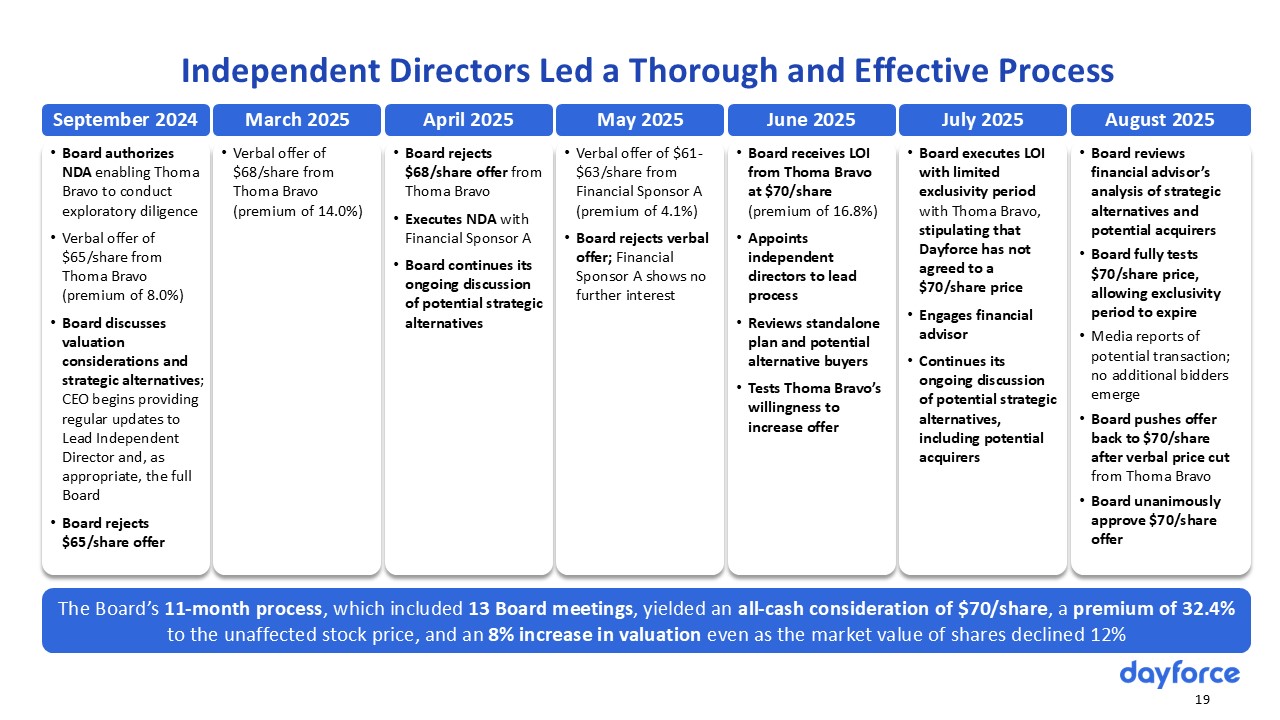

The Board’s 11-month process, which included 13 Board meetings, yielded an

all-cash consideration of $70/share, a premium of 32.4% to the unaffected stock price, and an 8% increase in valuation even as the market value of shares declined 12% Independent Directors Led a Thorough and Effective Process 15 Board

Process Actions Comprehensive Evaluation of Alternatives Over the 11-month process, and as part of the Board’s regular oversight, the Board discussed all strategic alternatives, including continuing to execute on its strategy as a

standalone, pursuing a sale, business combination and partnership Engagement with Multiple Potential Buyers Board engaged with several parties, both strategic and financial sponsors, specifically, providing two financial sponsors with

access to diligence materials and management receiving an indication of $61-$63/share for a consortium transaction from a financial sponsor following preliminary diligence, which did not proceed after the Board rejected the

valuation making preliminary contact with two other parties (one strategic and one financial) which did not result in further interest Disciplined Negotiation with Thoma Bravo Board requested improved proposals and sought to maximize

competitive tension, resulting in a final price that was significantly higher than TB’s initial offer Rebuffed TB’s last-minute price cut to $67.50/share over its concerns about execution risk on future revenue, margin expansion, and exit

multiple following our 2Q 2025 earnings release Fully tested $70/share price, allowing TB’s exclusivity period to expire Retained Financial Advisor Evercore evaluated the long-range business plan and concluded that the deal price was at

the high end of the intrinsic value of the Company’s long-term plan on a risk-adjusted basis Minimized Barriers for Competing Bidders Board negotiated both a fiduciary out and a low termination fee of ~$2/share (~3%) No topping bids have

emerged since the deal announcement Deeply Engaged Board Process led by highly-qualified independent directors, several of whom have deep M&A experience and knowledge of the sector 3

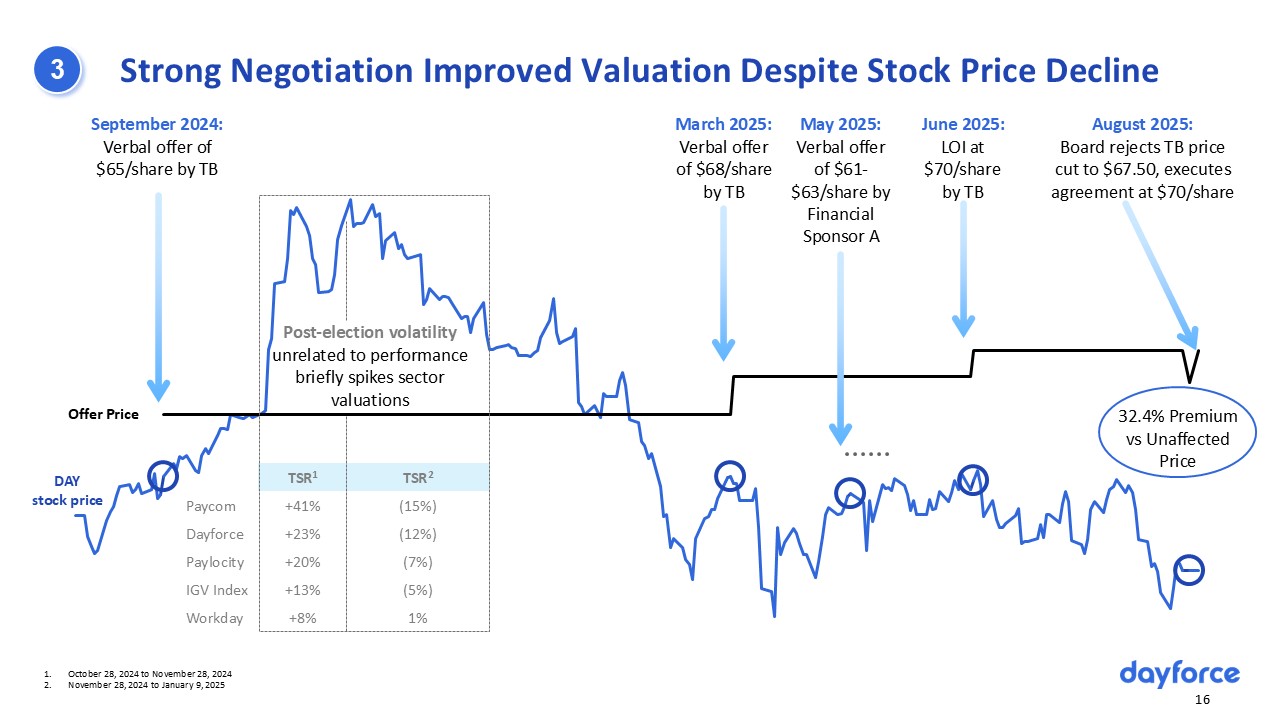

TSR1 TSR2 Paycom +41% (15%) Dayforce +23% (12%) Paylocity +20% (7%) IGV

Index +13% (5%) Workday +8% 1% September 2024: Verbal offer of $65/share by TB March 2025: Verbal offer of $68/share by TB May 2025: Verbal offer of $61-$63/share by Financial Sponsor A June 2025: LOI at $70/share by

TB August 2025: Board rejects TB price cut to $67.50, executes agreement at $70/share Offer Price October 28, 2024 to November 28, 2024 November 28, 2024 to January 9, 2025 32.4% Premium vs Unaffected Price Strong Negotiation

Improved Valuation Despite Stock Price Decline 16 DAY stock price Post-election volatility unrelated to performance briefly spikes sector valuations 3

Dayforce’s Board of Directors Recommends that Stockholders Vote FOR the

Transaction Vote “FOR” the Transaction If you have any questions about how to vote your shares, please call the firm assisting us with the solicitation of proxies: (877) 456-3422 (toll-free from the U.S. and Canada); +1 (412) 232-3651

from other countries 17 ✔ $70/share includes full present value of Company’s risk-adjusted standalone plan ✔ All-cash consideration at a premium valuation provides immediate value to stockholders for potential future growth while

transferring all execution, macro and market risk to buyer ✔ Highly-qualified independent directors led a thorough 11-month process which optimized the outcome for stockholders ✔ No topping bids have emerged, a testament to the Board’s

thorough process and disciplined negotiations

Appendix

The Board’s 11-month process, which included 13 Board meetings, yielded an

all-cash consideration of $70/share, a premium of 32.4% to the unaffected stock price, and an 8% increase in valuation even as the market value of shares declined 12% September 2024 March 2025 April 2025 May 2025 June 2025 July

2025 August 2025 Board authorizes NDA enabling Thoma Bravo to conduct exploratory diligence Verbal offer of $65/share from Thoma Bravo (premium of 8.0%) Board discusses valuation considerations and strategic alternatives; CEO begins

providing regular updates to Lead Independent Director and, as appropriate, the full Board Board rejects $65/share offer Verbal offer of $68/share from Thoma Bravo (premium of 14.0%) Board rejects $68/share offer from Thoma

Bravo Executes NDA with Financial Sponsor A Board continues its ongoing discussion of potential strategic alternatives Verbal offer of $61-$63/share from Financial Sponsor A (premium of 4.1%) Board rejects verbal offer; Financial

Sponsor A shows no further interest Board receives LOI from Thoma Bravo at $70/share (premium of 16.8%) Appoints independent directors to lead process Reviews standalone plan and potential alternative buyers Tests Thoma Bravo’s

willingness to increase offer Board executes LOI with limited exclusivity period with Thoma Bravo, stipulating that Dayforce has not agreed to a $70/share price Engages financial advisor Continues its ongoing discussion of potential

strategic alternatives, including potential acquirers Board reviews financial advisor’s analysis of strategic alternatives and potential acquirers Board fully tests $70/share price, allowing exclusivity period to expire Media reports

of potential transaction; no additional bidders emerge Board pushes offer back to $70/share after verbal price cut from Thoma Bravo Board unanimously approve $70/share offer Independent Directors Led a Thorough and Effective Process 19

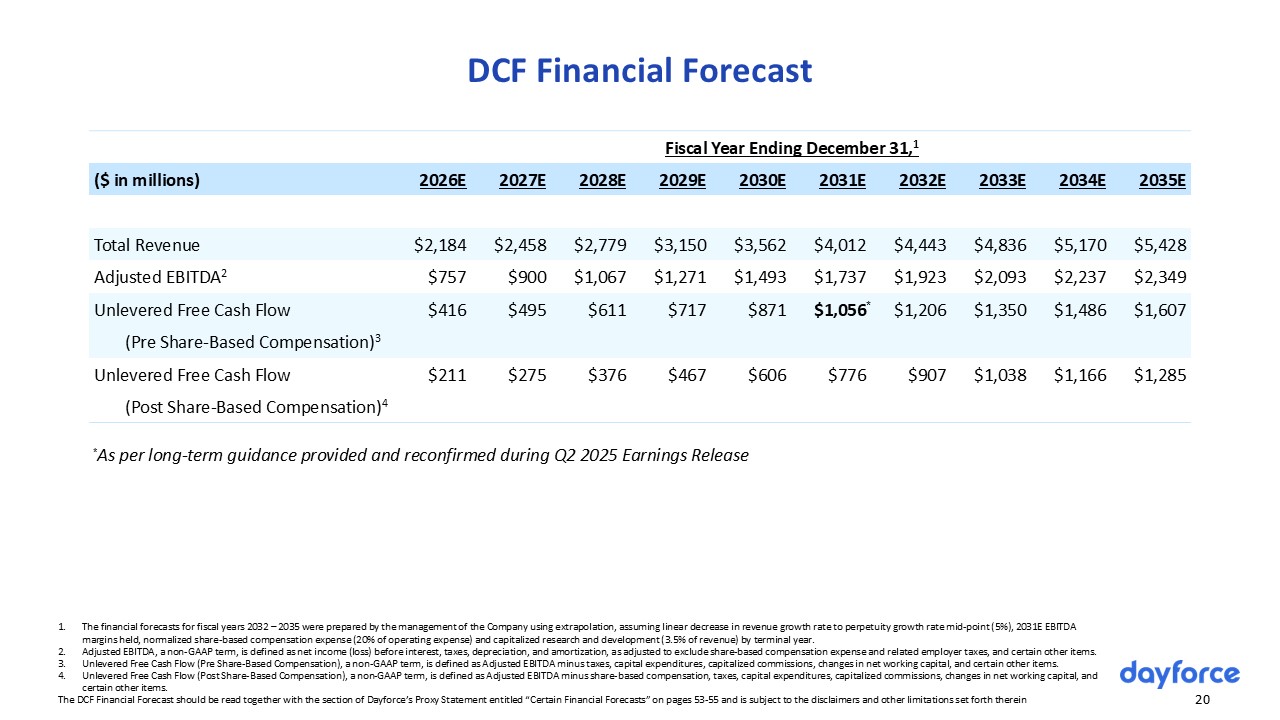

DCF Financial Forecast 20 The financial forecasts for fiscal years 2032 –

2035 were prepared by the management of the Company using extrapolation, assuming linear decrease in revenue growth rate to perpetuity growth rate mid-point (5%), 2031E EBITDA margins held, normalized share-based compensation expense (20%

of operating expense) and capitalized research and development (3.5% of revenue) by terminal year. Adjusted EBITDA, a non-GAAP term, is defined as net income (loss) before interest, taxes, depreciation, and amortization, as adjusted to

exclude share-based compensation expense and related employer taxes, and certain other items. Unlevered Free Cash Flow (Pre Share-Based Compensation), a non-GAAP term, is defined as Adjusted EBITDA minus taxes, capital expenditures,

capitalized commissions, changes in net working capital, and certain other items. Unlevered Free Cash Flow (Post Share-Based Compensation), a non-GAAP term, is defined as Adjusted EBITDA minus share-based compensation, taxes, capital

expenditures, capitalized commissions, changes in net working capital, and certain other items. The DCF Financial Forecast should be read together with the section of Dayforce’s Proxy Statement entitled “Certain Financial Forecasts” on

pages 53-55 and is subject to the disclaimers and other limitations set forth therein Fiscal Year Ending December 31,1 ($ in millions) 2026E 2027E 2028E 2029E 2030E 2031E 2032E 2033E 2034E 2035E Total

Revenue $2,184 $2,458 $2,779 $3,150 $3,562 $4,012 $4,443 $4,836 $5,170 $5,428 Adjusted EBITDA2 $757 $900 $1,067 $1,271 $1,493 $1,737 $1,923 $2,093 $2,237 $2,349 Unlevered Free Cash Flow $416 $495 $611 $717 $871

$1,056 $1,206 $1,350 $1,486 $1,607 (Pre Share-Based Compensation)3 Unlevered Free Cash Flow $211 $275 $376 $467 $606 $776 $907 $1,038 $1,166 $1,285 (Post Share-Based Compensation)4 *As per

long-term guidance provided and reconfirmed during Q2 2025 Earnings Release *

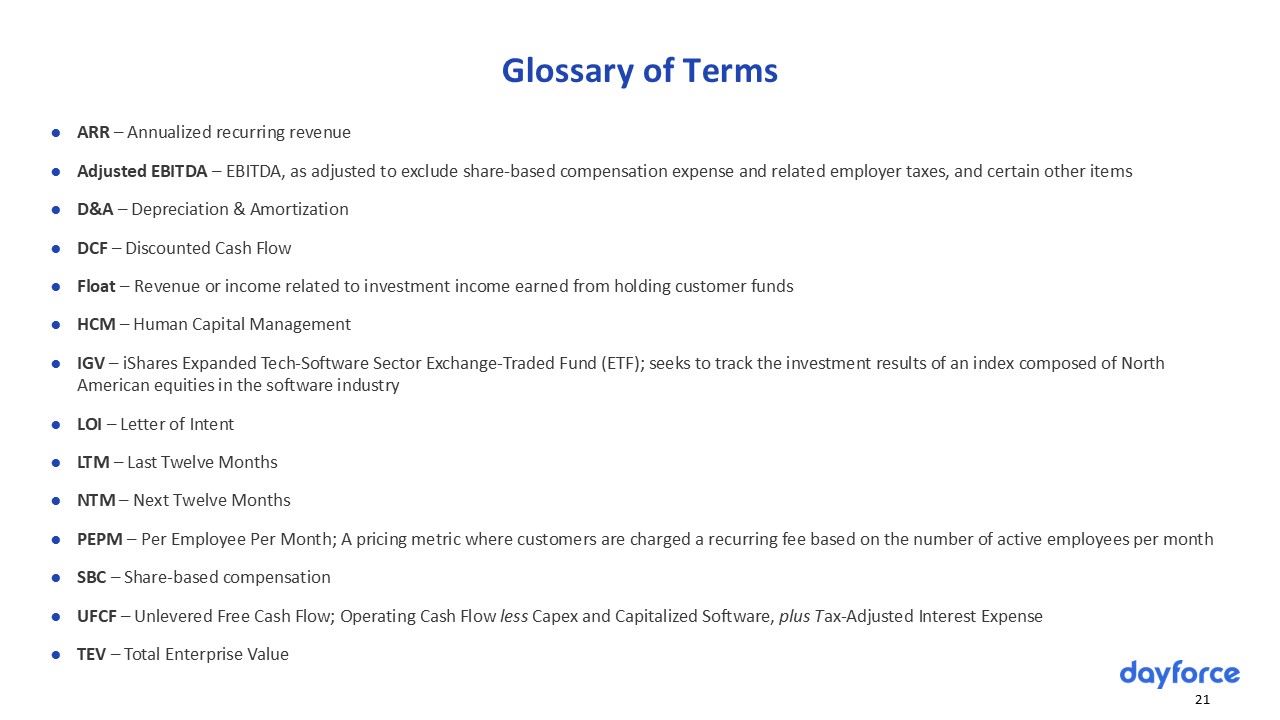

Glossary of Terms 21 ARR – Annualized recurring revenue Adjusted EBITDA –

EBITDA, as adjusted to exclude share-based compensation expense and related employer taxes, and certain other items D&A – Depreciation & Amortization DCF – Discounted Cash Flow Float – Revenue or income related to investment

income earned from holding customer funds HCM – Human Capital Management IGV – iShares Expanded Tech-Software Sector Exchange-Traded Fund (ETF); seeks to track the investment results of an index composed of North American equities in the

software industry LOI – Letter of Intent LTM – Last Twelve Months NTM – Next Twelve Months PEPM – Per Employee Per Month; A pricing metric where customers are charged a recurring fee based on the number of active employees per

month SBC – Share-based compensation UFCF – Unlevered Free Cash Flow; Operating Cash Flow less Capex and Capitalized Software, plus Tax-Adjusted Interest Expense TEV – Total Enterprise Value