.2

.2

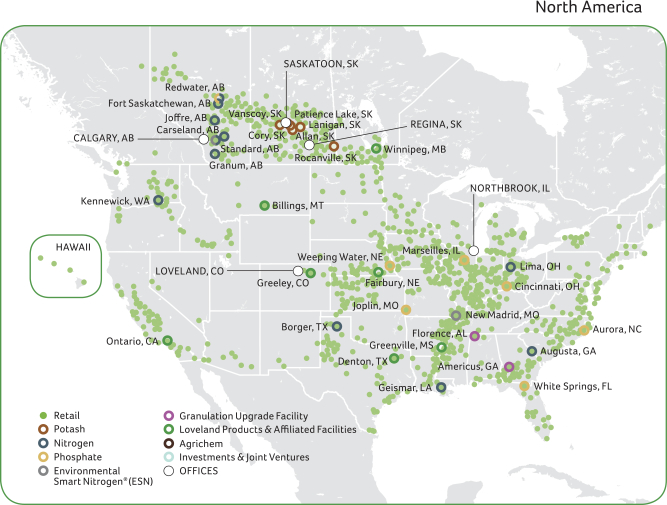

Nutrien’s Global Footprint

This is Nutrien. A global agriculture company with operations and investments in 14 countries. Our integrated platform combines the world’s premier Ag Retail network with some of the highest quality, lowest cost production assets. With this position, we are able to efficiently supply crop inputs and services to major growing regions of the world.

| NUTRIEN 2018 | 10 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| NUTRIEN 2018 | 11 | ANNUAL REPORT |

Delivering Value

It begins with our people and our portfolio of assets. We have more than 20,000 employees worldwide helping grow our world from the ground up. To enable the global achievement of Nutrien’s strategy, we must attract, develop and engage employees who live our values and principles.

Strategic Road Map

| Basic Beliefs | Strategy and Risk | Governance |

|

Key external and internal factors that inform our strategic choices |

___ > |

Integrated approach that considers risk throughout our strategic planning activities |

___ > |

Process and oversight to ensure we deliver sustained value to all stakeholders | ||||

| Learn more on page 13 | Learn more on pages 14-28 | Learn more on page 29 | ||

| NUTRIEN 2018 | 12 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Basic Beliefs Provide Foundation

for Our Strategic Choices

Our strategic process starts with a view of the core drivers for our business: how these factors will shape the future of our industry and how we are positioned to create value for our stakeholders today and in the future.

Basic Beliefs

|

|

|

|

| ||||||||||||

| Ag markets will remain cyclical with favorable long-term demand drivers. | Innovation and technology development must focus on adding value for the grower. | Integrating production and distribution provides efficiencies and market access. | Leading sustainability practices will create competitive advantages and make a global difference. | Talent acquisition and people development are critical to sustaining long- term success. | ||||||||||||

|

|

|

| ||||||||||||||

| We have a unique opportunity to benefit from recovering agriculture and fertilizer markets and generate superior returns through the cycle. |

We have the resources and relationship with the grower to best develop innovative products and solutions. |

The scale of our production and distribution footprint is unmatched in the ag space, providing the opportunity to generate significant cost savings across our supply chain. |

Sustainability is integrated across our value chain to reduce our environmental footprint and make a meaningful contribution to society and the economy. |

Fostering our purpose driven culture will create a long-term competitive advantage. | ||||||||||||

| NUTRIEN 2018 | 13 | ANNUAL REPORT |

Our Strategic Approach

Our vision is to be the leading global integrated Ag solutions provider

Our Strategy

How We Compete

|

Build a Unique Relationship with the Grower |

Create the Best Channel to the Customer |

Own Leading Production Assets & Proprietary Offerings |

Our Key Actions

|

Focus on Sustainability & Safety

|

Drive Integration & Optimization |

Strategically Allocate Capital |

Invest in Growth & Innovation |

Engage Employees |

| NUTRIEN 2018 | 14 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Our Strategy = Channel + Content

Our relationship with the grower, channel to the customer, and extensive product and service offering provide Nutrien with very distinct and valuable competitive advantages—this is how we and our customers succeed on a daily basis.

How We Compete

| NUTRIEN 2018 | 15 | ANNUAL REPORT |

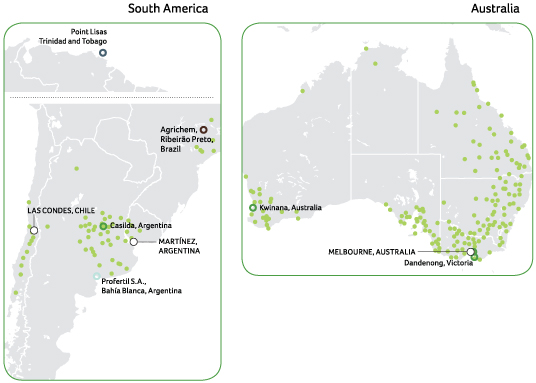

Our Integrated Platform Provides Advantages

We leverage our extensive distribution system to efficiently move our crop nutrients and proprietary products to our world-class retail network. Providing products

and solutions direct to the grower strengthens our partnership with our customer.

| NUTRIEN 2018 | 16 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Creating Value through Our Key Actions

Nutrien’s key actions drive each and every employee’s deliverables on a daily basis. We set priorities for each of these areas to ensure we can define and measure our performance. Our strategy and performance are supported by governance oversight and risk management by our leaders and Board of Directors.

is foundational to everything we do

18-19

Drive Integration & Optimization

to unlock potential and improve existing asset base

20-21

Strategically Allocate Capital

to maximize long-term shareholder returns

22-23

to identify and pursue long-term value-enhancing opportunities

24-25

to ensure we can deliver on our priorities

26-27

| NUTRIEN 2018 | 17 | ANNUAL REPORT |

Feeding a growing population is one of the world’s greatest opportunities and one of its greatest challenges. Nutrien is well positioned to make meaningful contributions to many of the United Nations Sustainable Development Goals (SDGs), most notably Goal 2: “End hunger, achieve food security and improved nutrition and promote sustainable agriculture”.

In 2018, we began the development of a new Nutrien sustainability strategy to advance resilient agricultural practices and strengthen sustainable food production. Through innovative solutions, we aim to balance environmental, social and economic factors in our business and across our value chain.

In 2018, we built on the following core foundations:

| NUTRIEN 2018 | 18 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| Sustainability Priorities

|

||||

| • Sustainable Agriculture: Lead the next wave of innovation and sustainability in agriculture. |

• Environmental Footprint: Protect the planet and minimize our environmental impact. |

• Diversity and Inclusion: Champion diversity and inclusive growth in the agriculture industry. |

2018 was a year of stakeholder engagement, process alignment and strategic planning. We are working on targets and initiatives to improve our social, economic and environmental impact. Details, including more about our priorities, will be available in Nutrien’s first sustainability report in 2019.

|

Find out more at nutrien.com/sustainability |

2018 Performance

|

$17M |

0.07 |

0.34 |

>600K | |||

| Invested in Communities |

Total Environmental Incidents Frequency* |

Lost-Time Injury Frequency* |

Students Reached Through Ag Education | |||

* Frequency based for every 200,000 hours worked.

| NUTRIEN 2018 | 19 | ANNUAL REPORT |

Drive Integration & Optimization

Delivering sustained value to all our stakeholders requires a constant focus on being a low-cost supplier to the markets we serve. Integrating and optimizing our extensive production and distribution channel ensures that our customers receive top quality products and services in a reliable and timely manner.

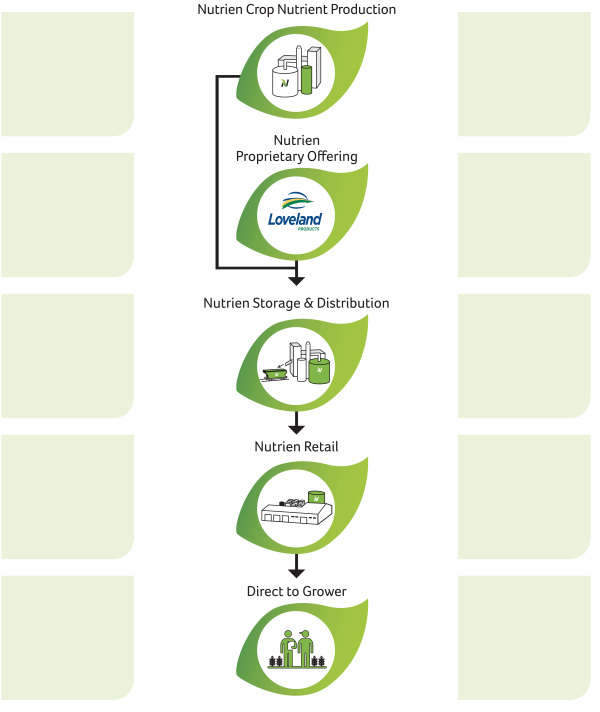

Drive Integration

At the onset of the Merger, we committed to delivering $500 million in annual run-rate synergies by the end of 2019. We were able to accelerate the rate of synergy capture and achieve this target within the first 12 months after the Merger. We also raised our target to $600 million by the end of 2019. The increased synergy target is indicative of the tremendous value that has been created by combining the two legacy companies.

| NUTRIEN 2018 | 20 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| Integration and Optimization Priorities | ||||

| • Realize $600 million run-rate synergy target by the end of 2019 and drive further integration opportunities across the organization in the near and long term. |

• Continue to improve capacity utilization and reduce cash costs across our nutrient production assets. |

• Deliver higher year-over-year normalized comparable store sales and EBITDA margin in our Retail operations. | ||

Optimization

Our focus extends beyond the synergies realized through the Merger. Optimizing our organizational cost structure is also about operational excellence and defining what matters to our bottom line and what we can control. By focusing on these and other factors, Nutrien expects to reduce the cost to produce and sell our products and services, and thereby deliver industry leading results.

2018 Performance

|

$60 |

$72 |

92% |

10% | |||

| Potash Cash Cost per Tonne |

Urea Controllable per Tonne |

Ammonia Operating Rate (excludes Trinidad and Joffre) |

Retail | |||

| NUTRIEN 2018 | 21 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| Capital Allocation Priorities | ||||

| • Continue to invest in Nutrien earnings growth, predominantly in Retail. |

• Provide a stable and growing dividend in a targeted range of 40-60 percent of free cash flow after sustaining capital through the cycle. |

• Maintain investment-grade credit rating. | ||

2018 Performance

|

58% |

$2.8B |

1.6x |

$1.1B | |||

| of Capital Deployment to Dividends and Share Repurchases |

in Dividends and Share Repurchases |

Adjusted Net Debt / Adjusted EBITDA Ratio |

in Sustaining Capital | |||

| NUTRIEN 2018 | 23 | ANNUAL REPORT |

Growth and Innovation Priorities

| • Continue to grow US and Australian Retail footprint and develop Retail network in Brazil. |

• Enhance our digital omni-channel offering and our proprietary crop input product technologies.

|

• Evaluate nitrogen brownfield projects in North America. |

Investing in growth and innovation is intended to support not only continual earnings progression, but the long-term viability of our company and benefit all our stakeholders. We remain committed to prudently identifying and pursuing long-term, value-enhancing opportunities while executing on them in a timely manner.

Growth

| NUTRIEN 2018 | 24 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Innovation

2018 Performance

|

~$400M |

AGRICHEM |

120 |

>50% | |||||||||

| of Expected Annual Revenue Acquired

(related to purchased retail locations) |

Crop Protection Acquisition in Brazil |

New Product Launches and Registrations | of Customer Sales Linked to | |||||||||

| NUTRIEN 2018 | 25 | ANNUAL REPORT |

Nutrien’s People Strategy is to attract, develop and engage skilled employees who live our values and principles. In 2018, we focused on establishing our foundational people program to enable the continued growth of the business and infuse Nutrien’s purpose driven culture into the organization.

| NUTRIEN 2018 | 26 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Employee Engagement Priorities

| • Achieve progress toward our diversity priority of increasing the representation of women in senior leadership to 20 percent or more by 2022.

|

• Become more representative of our local markets in our employment of protected groups and visible minorities. |

• Maintain at least 92 percent acceptance rate of all Nutrien employment offers, increasing to 95 percent acceptance by 2023. |

• Maintain an annual voluntary resignation rate, globally, below 9.5 percent. |

• By 2023, achieve an employee engagement survey score of no less than 75 percent. |

Our Purpose

2018 Performance

|

17%

of Senior Leaders are Women |

92%

Acceptance Rate of all Nutrien Employment Offers |

<1.5%

Voluntary Resignation Rate of Senior Leaders |

85%

of North American Senior Leaders Trained in Leading | |||

| NUTRIEN 2018 | 27 | ANNUAL REPORT |

Our Integrated Approach to Strategy & Risk

Enterprise Risk Management at Nutrien is integrated into our strategic and business planning activities, with a focus on managing our key business risks and facilitating informed risk taking. By fostering a risk-aware culture in decision making at all levels of the Company, Nutrien is positioned to better manage risk and identify opportunities to enhance value.

| NUTRIEN 2018 | 28 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Corporate governance at Nutrien is key to long-term success and ensuring that our basic beliefs, strategy and enterprise risk management, are aligned and carried out with a view to acting in the best interests of all our stakeholders and are consistent with our core values. Our Board of Directors is comprised of directors with a vast array of relevant experience and education, skills and leadership that is applied in the strategic decision-making process.

| NUTRIEN 2018 | 29 | ANNUAL REPORT |

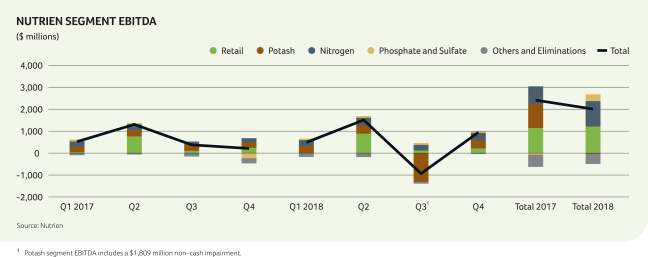

Operating Segment Performance & Outlook

We report our results in four operating segments:

Retail, Potash, Nitrogen and Phosphate and Sulfate.

| • | Our reporting structure reflects how we manage our business. |

| • | EBITDA is the primary profit measure used to evaluate performance and allocate resources in all operating segments. |

| • | Net sales (sales revenues less freight, transportation and distribution expenses) is the primary revenue measure used in planning and forecasting in the Potash, Nitrogen and Phosphate and Sulfate operating segments. |

| 31-37 | Retail | |

| 38-43 | Potash | |

| 44-49 | Nitrogen | |

| 50-55 | Phosphate & Sulfate | |

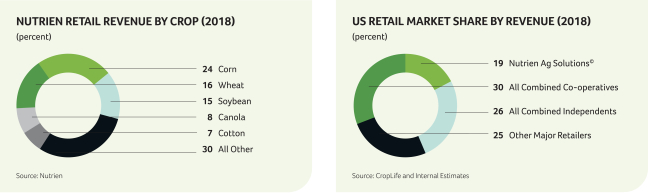

Retail Operating Environment

Overview

Competitive Landscape

Key Success Factors

| NUTRIEN 2018 | 32 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

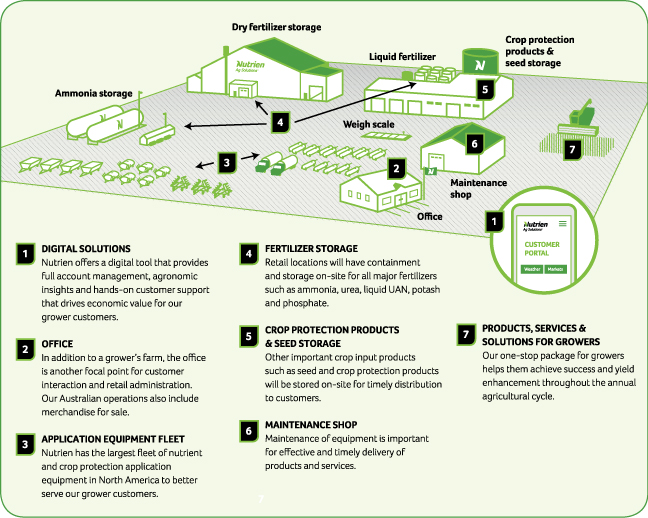

Our Business

| Products & Services | Purpose for the Grower | |||||

| Crop Nutrients | Crop nutrients are the essential fertilizers of potash, nitrogen, phosphate, sulfates and micronutrients that allow plants to grow and provide meaningful nutrition to our planet. | |||||

| Crop Protection Products | Crop protection products are a broad spectrum of herbicides, fungicides, insecticides and adjuvants products that help growers minimize yield losses from weeds, diseases and insects. | |||||

| Seed | We provide the seed and seed-related information and analysis our customers require. We sell seed brands from top global suppliers as well as our proprietary seed products that include licensed traits best suited for the grower’s specific geography. |

|||||

| Merchandise | Merchandise includes a variety of products in Australia and Canada, including most notably fencing, feed supplements, livestock-related animal health products, storage and irrigation equipment. It also includes the fuel and equipment businesses in Canada. | |||||

| Service and Other |

This includes services, such as product application, soil and leaf testing, crop scouting and precision agriculture services under our ECHELON® platform and financial services. We maintain a large fleet of application equipment and other rolling stock to ensure timely and optimal applications of both nutrients and crop protection products in a safe and effective manner for our growers.

|

|||||

| NUTRIEN 2018 | 33 | ANNUAL REPORT |

Standard Retail Facility Operations

| NUTRIEN 2018 | 34 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| NUTRIEN 2018 | 35 | ANNUAL REPORT |

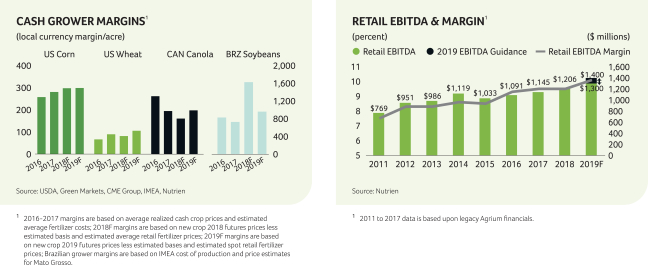

Retail Financial Performance

| Dollars (millions) | Gross Margin Dollars (millions) | Gross Margin (percentage) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nutrien | Nutrien | % | PCS | % | Nutrien | Nutrien | % | PCS | % | Nutrien | Nutrien | PCS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | Change | 2017 | Change | 2018 | 2017 | Change | 2017 | Change | 2018 | 2017 | 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crop nutrients 1,2 |

$ | 4,577 | $ | 4,121 | 11 | $ | – | n/m | $ | 923 | $ | 848 | 9 | $ | – | n/m | 20 | 21 | – | |||||||||||||||||||||||||||||||||||||||||||||||||

| Crop protection products |

4,862 | 4,937 | (2 | ) | – | n/m | 1,155 | 1,185 | (3 | ) | – | n/m | 24 | 24 | – | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seed |

1,687 | 1,628 | 4 | – | n/m | 333 | 325 | 2 | – | n/m | 20 | 20 | – | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Merchandise |

734 | 683 | 7 | – | n/m | 103 | 106 | (3 | ) | – | n/m | 14 | 16 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Services and other |

810 | 734 | 10 | – | n/m | 521 | 482 | 8 | – | n/m | 64 | 66 | – | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12,670 | 12,103 | 5 | – | n/m | $ | 3,035 | $ | 2,946 | 3 | $ | – | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of goods sold |

(9,635 | ) | (9,157 | ) | 5 | – | n/m |

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross margin |

3,035 | 2,946 | 3 | – | n/m | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses 3 |

(2,328 | ) | (2,090 | ) | 11 | – | n/m | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBIT |

707 | 856 | (17 | ) | – | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

499 | 289 | 73 | – | n/m | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA |

$ | 1,206 | $ | 1,145 | 5 | $ | – | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

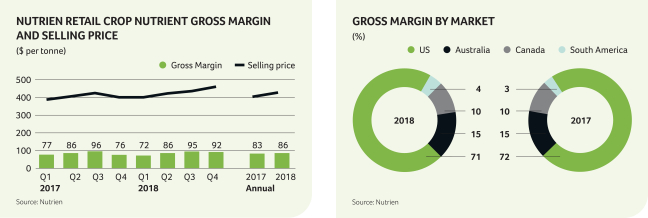

1 Sales tonnes were 10,689,000 tonnes (2017 (Nutrien) – 10,202,000 tonnes), average per tonne prices were $428 (2017 (Nutrien) – $404) and average margin per tonne was $86 (2017 (Nutrien) – $83). 2 Includes intersegment sales. See note 4 to the financial statements. 3 Includes selling expenses of $2,303 million (2017 (Nutrien) – $2,007 million). |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The most significant contributors to the change in EBITDA were as follows (direction of arrows refers to impact on EBITDA and ● means no impact):

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||

|

Sales volumes |

|

Crop nutrient volumes were up across all geographic locations with much of the increase coming from Australia and North America acquisitions. | PotashCorp did not have Retail operations prior to the Merger. | |||

|

|

Crop protection volumes decreased mainly due to adverse weather in North America and Australia. | |||||

|

|

Strong cotton seed volumes in the US more than offset lower seed volumes in Australia caused by dry weather. |

|||||

|

|

Merchandise sales increased in Canada primarily due to higher fuel sales and in Australia primarily due to increased animal health volumes. |

|||||

|

|

Services and other sales increased primarily due to higher livestock sales and wool commissions in Australia.

|

|||||

| Sales prices |

|

Crop nutrients prices were higher in all geographic locations consistent with higher global benchmark prices. | ||||

| Gross margin |

|

Crop nutrient gross margin was higher primarily due to increased volumes in all geographic locations. Gross margin percentage was flat due to the increase in selling prices being offset by rising costs. | ||||

| Selling expenses |

|

Expenses were up due to higher depreciation and amortization discussed below and increased payroll from acquisitions. | ||||

| Depreciation and amortization |

● |

Expense was higher primarily due to the PPA adjustments as a result of the Merger and from recently acquired businesses. |

| NUTRIEN 2018 | 36 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

SELECTED RETAIL FINANCIAL PERFORMANCE MEASURES

| Nutrien 2018 |

Nutrien 2017 1 |

% Change |

PCS 2017 | |||||||||||||||||||

| Comparable store sales |

1 | % | 0 | % | n/m | n/a | ||||||||||||||||

| Normalized comparable store sales |

(1 | %) | 2 | % | n/m | n/a | ||||||||||||||||

| Average working capital to sales |

21 | % | 17 | % | 26 | n/a | ||||||||||||||||

| Cash operating coverage ratio |

59 | % | 60 | % | (2 | ) | n/a | |||||||||||||||

| 1 | 2017 average working capital to sales and cash operating coverage ratio are from Agrium’s 2017 Annual Report. |

n/a = not available

Normalized comparable store sales decreased due primarily to US and Australia weather-related impacts to fertilizer and crop protection sales volumes more than offsetting sales volume growth in Canada and South America.

| NUTRIEN 2018 | 37 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

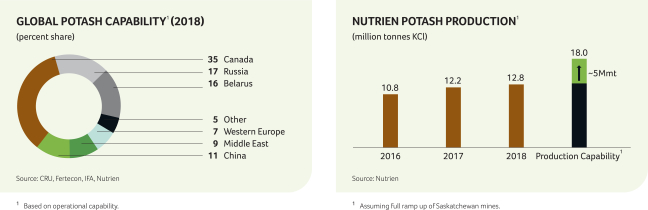

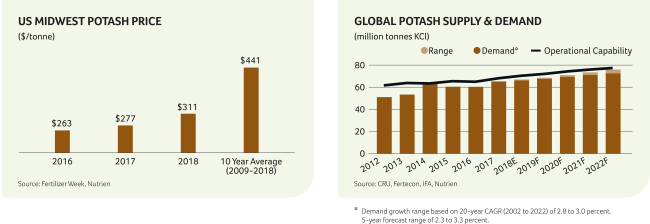

Potash Operating Environment

Overview

Competitive Landscape

Key Success Factors

| NUTRIEN 2018 | 39 | ANNUAL REPORT |

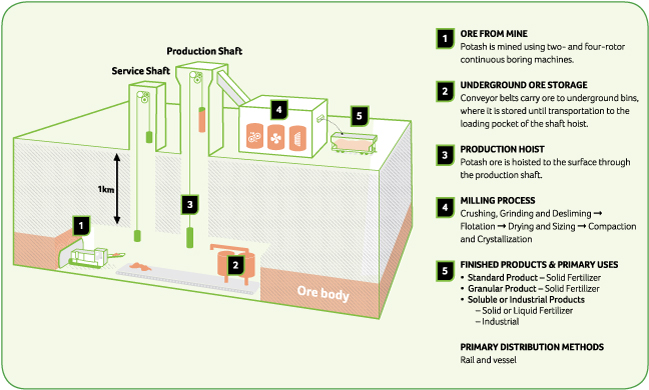

Our Business

Potash Production Process

| NUTRIEN 2018 | 40 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| NUTRIEN 2018 | 41 | ANNUAL REPORT |

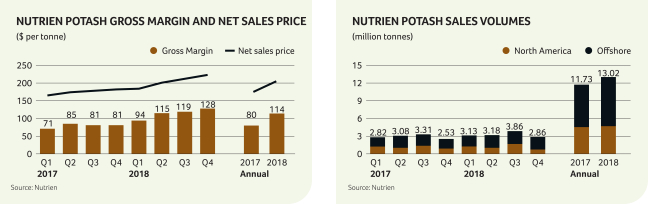

Potash Financial Performance

The most significant contributors to the change in EBITDA were as follows (direction of arrows refers to impact on EBITDA and ● means no impact):

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||

| Volumes |

|

Offshore volumes were higher due to increased demand and a higher Canpotex allocation.

|

|

Offshore volumes were higher due to increased demand and a higher Canpotex allocation.

| ||||

|

|

North America volumes were up primarily due to increased intercompany sales to Retail and lower imports. |

|

North America volumes were up primarily due to lower imports. | |||||

|

|

Volumes were also higher as a result of the Merger, specifically the addition of the Vanscoy Potash mine and intercompany sales to Retail. | |||||||

| Net sales prices

|

|

Selling prices were higher due to increased prices in all major spot markets due to strong demand. |

|

Selling prices were higher due to increased prices in all major spot markets due to strong demand.

| ||||

| Cost per tonne |

|

Costs decreased due to our portfolio optimization and results from our cost reduction strategy more than offsetting increased depreciation related to PPA adjustments as a result of the Merger. |

|

Costs increased due to the addition of Agrium’s operations and higher depreciation on the related PPA adjustments as a result of the Merger. |

| NUTRIEN 2018 | 42 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||

| Impairment of property, plant and equipment |

|

A non-cash impairment of property, plant and equipment was recorded as a result of the decision to safely shut down our New Brunswick operations due to the operations no longer being part of our medium or long-term strategic plans. See note 16 to the financial statements. |

|

A non-cash impairment of property, plant and equipment was recorded as a result of the decision to safely shut down our New Brunswick operations due to the operations no longer being part of our medium or long-term strategic plans. See note 16 to the financial statements. | ||||

| Provincial mining and other taxes |

|

Under Saskatchewan provincial legislation, we are subject to resource taxes, including the potash production tax and the resource surcharge. Provincial mining and other taxes increased primarily due to stronger potash prices. |

|

Provincial mining and other taxes increased primarily due to stronger potash prices. | ||||

| Depreciation and amortization |

● |

Expenses were higher due to PPA adjustments as a result of the Merger and increased sales volumes. |

● |

Expenses were higher due to the addition of the Vanscoy Potash mine, increased sales volumes and PPA adjustments as a result of the Merger. |

CANPOTEX SALES BY MARKET

| (percentage of sales volumes) | Nutrien 2018 |

Nutrien 2017 |

% Change |

|||||||||||||||||

| Latin America |

33 | 30 | 10 | |||||||||||||||||

| Other Asian markets 1 |

31 | 33 | (6 | ) | ||||||||||||||||

| China |

18 | 18 | – | |||||||||||||||||

| India |

10 | 12 | (17 | ) | ||||||||||||||||

| Other markets |

8 | 7 | 14 | |||||||||||||||||

| 1 | All Asian markets except China and India. |

POTASH PRODUCTION

| NUTRIEN 2018 | 43 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

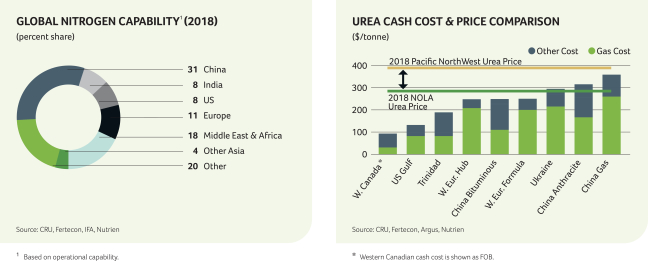

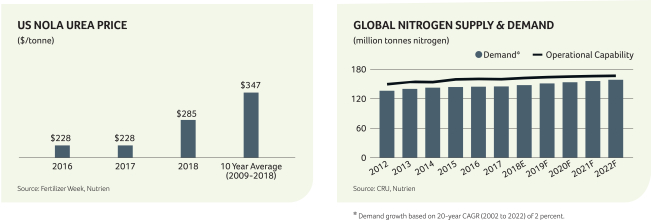

Nitrogen Operating Environment

Overview

Competitive Landscape

Key Success Factors

| NUTRIEN 2018 | 45 | ANNUAL REPORT |

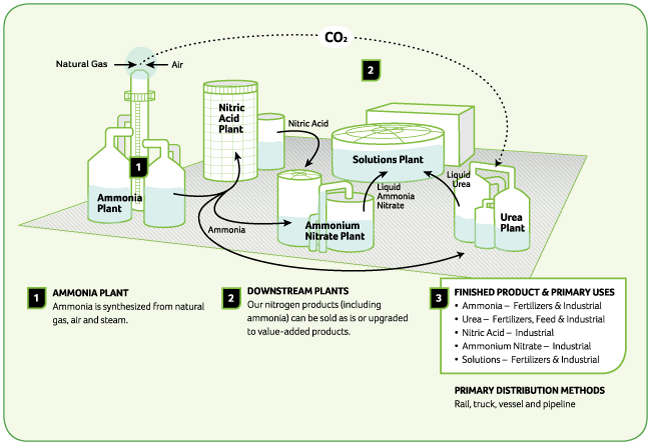

Our Business

Nitrogen Production Process

| NUTRIEN 2018 | 46 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| NUTRIEN 2018 | 47 | ANNUAL REPORT |

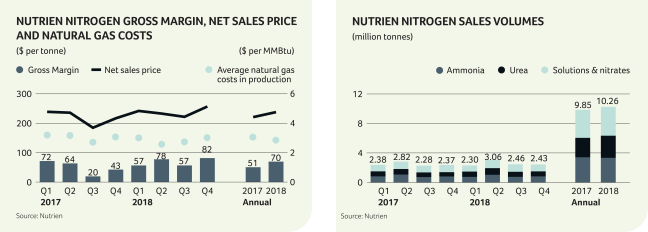

Nitrogen Financial Performance

| Dollars (millions) | Tonnes (thousands) | Average per Tonne | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Manufactured product 1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ammonia |

$ | 903 | $ | 911 | (1 | ) | $ | 584 | 55 | 3,330 | 3,404 | (2 | ) | 2,205 | 51 | $ | 271 | $ | 267 | 1 | $ | 265 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Urea |

895 | 672 | 33 | 302 | 196 | 3,003 | 2,641 | 14 | 1,166 | 158 | $ | 298 | $ | 254 | 17 | $ | 259 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Solutions and nitrates |

644 | 594 | 8 | 421 | 53 | 3,925 | 3,808 | 3 | 2,946 | 33 | $ | 164 | $ | 156 | 5 | $ | 143 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,442 | 2,177 | 12 | 1,307 | 87 | 10,258 | 9,853 | 4 | 6,317 | 62 | $ | 238 | $ | 221 | 8 | $ | 207 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of goods sold |

(1,729 | ) | (1,670 | ) | 4 | (1,066 | ) | 62 | $ | (168 | ) | $ | (170 | ) | (1 | ) | $ | (169 | ) | (1 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross margin |

713 | 507 | 41 | 241 | 196 | $ | 70 | $ | 51 | 37 | $ | 38 | 84 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other 2 |

67 | 48 | 40 | 15 | 347 | Depreciation and amortization |

|

$ | 42 | $ | 30 | 40 | $ | 32 | 31 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross margin |

780 | 555 | 41 | 256 | 205 | Gross margin excluding depreciation and amortization |

|

$ | 112 | $ | 81 | 38 | $ | 70 | 60 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses |

(47 | ) | (34 | ) | 38 | (21 | ) | 124 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBIT |

733 | 521 | 41 | 235 | 212 |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

429 | 291 | 47 | 203 | 111 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA |

$ | 1,162 | $ | 812 | 43 | $ | 438 | 165 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Includes intersegment sales. See note 4 to the financial statements. 2 Includes other nitrogen and purchased products and is comprised of net sales of $417 million (2017 (Nutrien) – $462 million, 2017 (PotashCorp) – $33 million) less cost of goods sold of $350 million (2017 (Nutrien) – $414 million, 2017 (PotashCorp) – $18 million). |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The most significant contributors to the change in EBITDA were as follows (direction of arrows refers to impact on EBITDA and ● means no impact):

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||

|

Volumes |

|

Total sales volumes were up in 2018 due to higher reliability/utilization rates at our facilities, and higher production of upgraded products such as urea and UAN solutions, partly due to the continued ramp up at our Borger urea facility. |

|

Volumes increased primarily as a result of the Merger. | ||||

|

|

Ammonia sales volumes were lower due primarily to increased production of upgraded nitrogen products, limiting excess ammonia available for sale. | |||||||

|

Net sales prices |

|

Our average price increased for all manufactured product categories, reflecting the impact of higher fertilizer benchmarks supported by tight supply and continued demand growth. |

|

Our average price for all manufactured product categories was higher, reflecting the impact of higher fertilizer benchmarks supported by tight supply and continued demand growth. | ||||

|

|

Realized prices in parts of our industrial portfolio (mainly ammonia and nitrates) were lower given lower natural gas prices in Canada. |

| NUTRIEN 2018 | 48 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||

|

Cost per tonne |

|

Costs decreased due to lower natural gas costs, higher utilization and from realized synergies, which more than offset higher depreciation and amortization related to PPA adjustments as a result of the Merger. |

|

Costs decreased due to lower natural gas costs (discussed below) and higher operating rates more than offsetting higher depreciation and amortization related to PPA adjustments as a result of the Merger. | ||||

|

|

Average natural gas costs, including our hedge position, decreased 7 percent, principally as a result of lower AECO index prices and a reduced realized impact from gas derivatives, partly offset by higher gas costs in Trinidad (contract prices indexed primarily to Tampa ammonia prices). |

|

Average natural gas costs, including our hedge position, decreased 17 percent due to the relatively lower-cost gas available at our Alberta facilities acquired in the Merger, partially offset by higher gas costs in Trinidad (contract prices indexed primarily to Tampa ammonia prices). | |||||

| Expenses | ● | There were no significant changes between 2017 and 2018. |

|

Expenses were higher in 2018 due to the addition of Agrium’s operations in the Merger. | ||||

|

Depreciation and amortization |

● |

Expense was higher in 2018 due to higher volumes and the PPA adjustments as a result of the Merger. |

● |

Expense was higher in 2018 due to higher volumes and the PPA adjustments as a result of the Merger. |

| Sales Tonnes (thousands) | Average Net Sales Price per Tonne | |||||||||||||||||||||||||||||||

| Nutrien 2018 |

Nutrien 2017 |

PCS 2017 |

Nutrien 2018 |

Nutrien 2017 |

PCS 2017 |

|||||||||||||||||||||||||||

| Fertilizer |

5,340 | 5,093 | 2,564 | $ | 254 | $ | 226 | $ | 215 | |||||||||||||||||||||||

| Industrial and feed |

4,918 | 4,760 | 3,753 | $ | 220 | $ | 215 | $ | 201 | |||||||||||||||||||||||

| 10,258 | 9,853 | 6,317 | $ | 238 | $ | 221 | $ | 207 | ||||||||||||||||||||||||

NITROGEN PRODUCTION

| Ammonia 1 | Urea 2 | |||||||||||||||||||||||||||||||

| Annual Capacity 3 |

Production | Annual Capacity 3 |

Production | |||||||||||||||||||||||||||||

| (million tonnes product) | Nutrien 2018 | Nutrien 2017 | Nutrien 2018 | Nutrien 2017 | ||||||||||||||||||||||||||||

| Trinidad Nitrogen |

2.2 | 1.88 | 1.94 | 0.7 | 0.58 | 0.55 | ||||||||||||||||||||||||||

| Redwater Nitrogen |

0.9 | 0.88 | 0.80 | 0.7 | 0.73 | 0.53 | ||||||||||||||||||||||||||

| Augusta Nitrogen |

0.8 | 0.72 | 0.60 | 0.5 | 0.52 | 0.45 | ||||||||||||||||||||||||||

| Lima Nitrogen |

0.8 | 0.67 | 0.65 | 0.4 | 0.46 | 0.44 | ||||||||||||||||||||||||||

| Carseland Nitrogen |

0.5 | 0.52 | 0.46 | 0.7 | 0.68 | 0.51 | ||||||||||||||||||||||||||

| Joffre Nitrogen |

0.5 | 0.47 | 0.31 | – | – | – | ||||||||||||||||||||||||||

| Geismar Nitrogen |

0.5 | 0.44 | 0.47 | 0.4 | 0.26 | 0.23 | ||||||||||||||||||||||||||

| Fort Saskatchewan Nitrogen |

0.4 | 0.40 | 0.46 | 0.4 | 0.37 | 0.43 | ||||||||||||||||||||||||||

| Borger Nitrogen |

0.5 | 0.39 | 0.31 | 0.6 | 0.42 | 0.23 | ||||||||||||||||||||||||||

| Total |

7.1 | 6.37 | 6.00 | 4.4 | 4.02 | 3.37 | ||||||||||||||||||||||||||

| 1 | All figures are shown on a gross production basis. |

| 2 | Reflects capacity and production of urea liquor prior to final product upgrade. Urea liquor is used in the production of solid urea, UAN and DEF. |

| 3 | Annual capacity estimates include allowances for normal outages and planned maintenance shutdowns. |

| NUTRIEN 2018 | 49 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

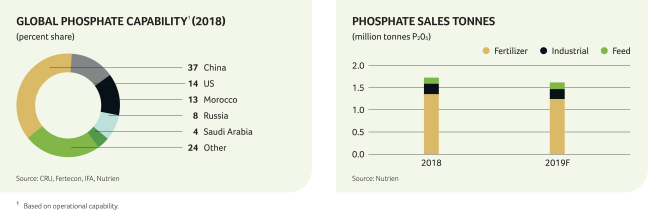

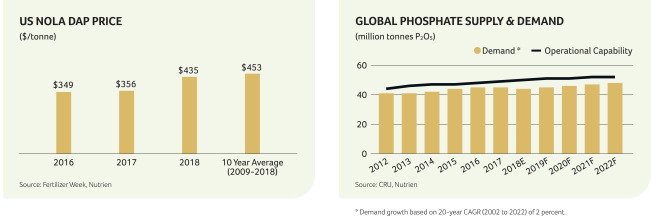

Phosphate Operating Environment

Overview

Competitive Landscape

Key Success Factors

| NUTRIEN 2018 | 51 | ANNUAL REPORT |

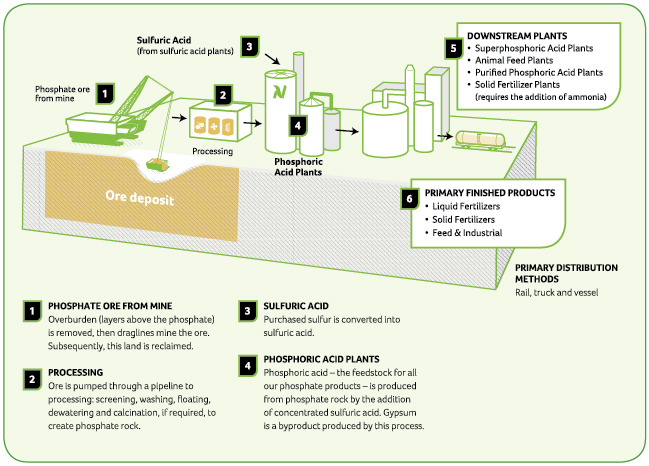

Our Business

Phosphate Production Process

| NUTRIEN 2018 | 52 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| NUTRIEN 2018 | 53 | ANNUAL REPORT |

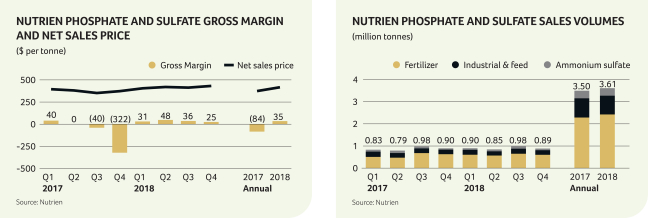

Phosphate & Sulfate Financial Performance

| Dollars (millions) | Tonnes (thousands) | Average per Tonne | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Manufactured product 1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net sales |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fertilizer |

$ | 995 | $ | 800 | 24 | $ | 609 | 63 | 2,425 | 2,285 | 6 | 1,809 | 34 | $ | 410 | $ | 350 | 17 | $ | 337 | 22 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industrial and feed |

424 | 423 | – | 494 | (14 | ) | 847 | 868 | (2 | ) | 1,002 | (15 | ) | $ | 500 | $ | 487 | 3 | $ | 493 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ammonium sulfate |

85 | 81 | 5 | – | n/m | 340 | 345 | (1 | ) | – | n/m | $ | 250 | $ | 235 | 6 | – | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1,504 | 1,304 | 15 | 1,103 | 36 | 3,612 | 3,498 | 3 | 2,811 | 28 | $ | 416 | $ | 373 | 12 | $ | 393 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of goods sold |

(1,377 | ) | (1,601 | ) 2 | (14 | ) | (1,471 | ) | (6 | ) | $ | (381 | ) | $ | (457 | ) | (17 | ) | $ | (523 | ) | (27 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross margin |

127 | (297 | ) | n/m | (368 | ) | n/m | $ | 35 | $ | (84 | ) | n/m | $ | (130 | ) | n/m | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other 3 |

1 | 5 | (80 | ) | 2 | (50 | ) | Depreciation and amortization |

$ | 57 | $ | 68 | (16 | ) | $ | 78 | (27 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross margin |

128 | (292 | ) | n/m | (366 | ) | n/m |

|

Gross margin excluding

|

|

|

|

|

|

|

|

$ | 92 | $ | (16 | ) | n/m | $ | (52 | ) | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Expenses |

(26 | ) | (23 | ) | 13 | (14 | ) | 86 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBIT |

102 | (315 | ) | n/m | (380 | ) | n/m |

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization |

206 | 240 | (14 | ) | 220 | (6 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EBITDA |

$ | 308 | $ | (75 | ) | n/m | $ | (160 | ) | n/m | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Includes intersegment sales. See note 4 to the financial statements. 2 Includes a non-cash impairment of property, plant and equipment of $305 million. 3 Includes other phosphate and purchased products and is comprised of net sales of $163 million (2017 (Nutrien) – $53 million, 2017 (PotashCorp) – $8 million) less cost of goods sold of $162 million (2017 (Nutrien) – $48 million, 2017 (PotashCorp) – $6 million). n/m = not meaningful |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The most significant contributors to the change in EBITDA were as follows (direction of arrows refers to impact on EBITDA and ● means no impact):

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||||

| Volumes

|

|

Volumes were up due to strong fertilizer demand and increased production levels at our phosphate facilities. |

|

|

|

Volumes increased primarily as a result of the Merger. | ||||

|

|

|

|

Industrial volumes decreased primarily due to the decision to close our small phosphate facility at Geismar. | |||||||

| Net sales prices |

|

Our average realized fertilizer price was up due to strong demand and higher global sulfur benchmark prices. |

|

|

|

Our average realized fertilizer price was up due to strong demand and higher global sulfur benchmark prices. | ||||

| Cost per tonne |

|

Industrial and feed costs were lower in 2018 than in 2017 due to the non-cash impairment of feed assets at Aurora in 2017. |

|

|

|

Industrial and feed costs were lower in 2018 than in 2017 due to the non-cash impairment of feed assets at Aurora in 2017. | ||||

|

|

Fertilizer costs were lower in 2018 than in 2017 due to the non-cash impairment of White Springs assets due to sustained negative performance and the write-off of other assets that were no longer used in 2017, more than offsetting higher sulfur costs in 2018. |

|

|

|

Fertilizer costs were lower in 2018 than in 2017 due to the non-cash impairment of White Springs assets due to sustained negative performance and the write-off of other assets that were no longer used in 2017, more than offsetting higher sulfur costs in 2018. | |||||

| NUTRIEN 2018 | 54 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||||||

| Depreciation and amortization |

● |

Expense was lower in 2018 primarily due to lower depreciable asset balances at our US facilities as a result of the non-cash impairments recorded in the latter half of 2017 and the impact of the PPA adjustments as a result of the Merger. The decrease was partially offset by an increase in depreciation at our Redwater facility due to a change in the assets’ estimated useful lives. |

● |

Expense was lower in 2018 primarily due to lower depreciable asset balances at our US facilities as a result of the non-cash impairments recorded in the latter half of 2017 and the impact of the PPA adjustments as a result of the Merger. The decrease was partially offset by an increase in depreciation at our Redwater facility due to a change in the assets’ estimated useful lives. |

PHOSPHATE PRODUCTION

| Phosphate Rock | Phosphoric Acid (P2O5) | Liquid Products | Solid Fertilizer Products | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual

|

Nutrien Production |

Annual

|

Nutrien Production |

Annual

|

Nutrien Production |

Annual

|

Nutrien Production |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (million tonnes) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aurora Phosphate |

5.4 | 4.03 | 4.78 | 1.2 | 1.08 | 1.03 | 2.7 | 2 | 2.10 | 2.04 | 0.8 | 0.82 | 0.79 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| White Springs Phosphate |

2.0 | 1 | 1.85 | 1.55 | 0.5 | 0.47 | 0.42 | 0.7 | 3 | 0.62 | 0.57 | 0.8 | 4 | 0.17 | 0.13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Redwater Phosphate |

– | – | – | 0.3 | 0.30 | 0.25 | – | – | – | 0.7 | 0.57 | 0.46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total |

7.4 | 5.88 | 6.33 | 2.0 | 1.85 | 1.70 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Revised capacity estimates based on review of mining operations completed in 2017. Prior capacity was 3.6 million tonnes. |

| 2 | A substantial portion is consumed internally in the production of downstream products. The balance is exported to phosphate fertilizer producers or sold domestically to dealers who custom-mix liquid fertilizer. Capacity comprised of 2.0 million tonnes merchant grade acid and 0.7 million tonnes superphosphoric acid. |

| 3 | Represents annual superphosphoric acid capacity. A substantial portion is consumed internally in the production of downstream products. The balance is exported to phosphate fertilizer producers and sold domestically to dealers who custom-mix liquid fertilizer. |

| 4 | The second MAP train was restarted at the end of 2018 which added 0.4 million tonnes of annual capacity. |

In addition to the production above, annual capacity (in millions of tonnes) for phosphate feed, ammonium sulfate and purified acid was 0.7, 0.4 and 0.3, respectively. 2018 production was 0.29, 0.36 and 0.23, respectively, and 2017 production was 0.28, 0.31 and 0.23, respectively.

| NUTRIEN 2018 | 55 | ANNUAL REPORT |

Key Risks

| 1. Long-Term Agriculture Changes

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Farm and industry consolidation, shifting grower demographics, agriculture productivity and development, changes in consumer food preferences, technological innovation and digital business models, and climate change, among other factors, could impact our strategy, demand for our products or financial performance. |

Our integrated platform and diversified earnings portfolio of crop inputs and services are designed to respond and adapt to changes in agriculture. We are proactive in the development and use of new agricultural products and practices and recently launched our integrated digital platform. We believe our teams have strong industry knowledge and direct customer relationships across the value chain, providing unique insights on trends and developments in the agriculture industry. | |

| 2. Shifting Global Dynamics

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Changes in global macro-economic conditions, including trade tariffs and/or other trade restrictions and increased price competition, or a significant change in agriculture production or consumption trends, could lead to a low crop price environment and reduced demand for our products, or increased prices for, or decreased availability of, raw materials necessary to produce our products. | Our diversified portfolio of agricultural products, services and solutions, combined with our global footprint, is designed to enable us to respond to changing economic conditions and dynamics.

We have a favorable cost-to-service position and flexibility to make operational changes across our portfolio to minimize the impact of changing market dynamics. In addition, we engage in market development, education, training and customer relations initiatives to support demand growth. | |

Sustainability & Safety

Sustainability & Safety |

Drive Integration & Optimization

Drive Integration & Optimization |

Strategically Allocate Capital

Strategically Allocate Capital |

Invest in Growth & Innovation

Invest in Growth & Innovation |

Engage Employees

Engage Employees |

| NUTRIEN 2018 | 56 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

| 3. Political, Economic and Social Instability

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Political, economic and social instability may affect our business in the jurisdictions in which we operate. Among other things, restrictions on monetary distributions, forced divestitures or changes to or nullification of existing agreements, mining permits or leases could result. Instability in political or regulatory regimes could also affect our ability to transact business and could impact our sales and operating results, our reputation or the value of our assets. | We have an active engagement strategy with governments, regulators and other stakeholders in the countries where we operate or plan to operate, and we assess our capital investments and project decisions against political, country and other related risk factors to ensure our exposure is controlled. Dedicated teams regularly monitor political, economic, and social developments and global trends that may impact us. | |

| 4. Changing Regulations

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Changing laws, regulations and government policies affecting our operations, including health and safety, environmental and climate change pressures, could affect our ability to produce or sell certain products, reduce efficiency, increase our raw material, energy, transportation or compliance costs, or require us to make capital improvements to our operations, all of which could impact our financial performance or reputation. | We have an active engagement strategy with governments and regulators to stay informed of emerging issues and participate in regulatory developments affecting our business. We are also active members in various industry associations that address proposed changes to laws and regulations impacting the agriculture industry. Where regulations are subject to change, we evaluate the potential implications and strive to adapt as necessary. | |

| 5. Cybersecurity Threats

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Cyberattacks or breaches of our systems, including our digital platform or exposure to potential computer viruses, could lead to disruptions to our operations, loss of data, or the unintended disclosure of confidential information or property damage resulting in business disruptions, reputational damage, personal injury, and third-party claims, which could impact our operations, financial performance or reputation. |

We maintain an enhanced focus on cybersecurity, including continuous monitoring of key systems for abnormal and elevated risk behavior in conjunction with our cybersecurity strategy, policy and framework.

Threat and risk assessments are completed for all new information technology systems, and our cybersecurity incident response processes are backstopped by external response capability. | |

| 6. Capital Allocation

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Our inability to deploy capital or to effectively execute on opportunities, whether due to market conditions, lack of options or otherwise, or our decisions to deploy capital in a manner that is inconsistent with strategic priorities, could impact our returns, operations, reputation or access to capital. |

We allocate capital in a disciplined manner that is consistent with our strategic priorities focused on creating the greatest long-term value while ensuring sufficient capital is allocated to safety and asset preservation. We employ a governance process for all capital allocation decisions and incorporate risk-related factors, including execution risk, in those decisions.

See page 23 of this report for more information on our capital allocation priorities. | |

Sustainability & Safety

Sustainability & Safety |

Drive Integration & Optimization

Drive Integration & Optimization |

Strategically Allocate Capital

Strategically Allocate Capital |

Invest in Growth & Innovation

Invest in Growth & Innovation |

Engage Employees

Engage Employees |

| NUTRIEN 2018 | 57 | ANNUAL REPORT |

| 7. Talent and Organizational Structure

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| An inability to attract, develop, or retain skilled employees, or establish the right organizational structure or culture, could impact productivity, reliability, safety performance, costs or our reputation. |

We strategically map critical talent in anticipation of future needs, seeking to hire talent at the right time and with the right fit for our culture and purpose. Our succession planning proactively identifies critical roles in the organization and links to internal top talent. Our incentive programs are competitive and support our purpose driven culture with performance expectations encouraging inclusion and a desire to add greater diversity to our workforce.

See page 26 of this report for Nutrien’s People Strategy. | |

| 8. Retail Business Model

|

Associated Key Actions

| |

| Description |

Risk Management Approach | |

| Digital innovations, increasing research and development activity and new technology in the agriculture market, among other factors, could alter the competitive environment, which could impact our Retail operations and financial performance. |

Our full-service offering and investment in technology, including our integrated digital platform, is intended to position our Retail business as a leader in agricultural solutions for growers. We are actively involved in the ag technology innovation space through external investments and partnerships, which supports access to early stage technology. Further, we seek to maintain strong relationships with industry partners, positioning Nutrien Ag Solutions as a key part of the ag value chain for both suppliers and growers.

Our dedicated in-house product innovation teams continue to invest in enhancing our digital platform and e-commerce capabilities through focused research and development and acquisition.

See page 25 of this report for more information on innovation. | |

Sustainability & Safety

Sustainability & Safety |

Drive Integration & Optimization

Drive Integration & Optimization |

Strategically Allocate Capital

Strategically Allocate Capital |

Invest in Growth & Innovation

Invest in Growth & Innovation |

Engage Employees

Engage Employees |

| NUTRIEN 2018 | 58 | ANNUAL REPORT |

| Dollars (millions) unless otherwise noted | Nutrien 2018 |

Nutrien 2017 |

PCS 2017 |

PCS 2016 |

||||||||||||||||||||

| Sales |

$ | 19,636 | $ | 18,169 | $ | 4,547 | $ | 4,456 | ||||||||||||||||

| Net (loss) earnings from continuing operations |

(31 | ) | 656 | 154 | 199 | |||||||||||||||||||

| Basic net (loss) earnings per share from continuing operations |

(0.05 | ) | n/a | 0.18 | 0.24 | |||||||||||||||||||

| Diluted net (loss) earnings per share from continuing operations |

(0.05 | ) | n/a | 0.18 | 0.24 | |||||||||||||||||||

| Net earnings from continuing and discontinued operations |

3,573 | n/a | 327 | 323 | ||||||||||||||||||||

| Basic net earnings per share from continuing and discontinued operations |

5.72 | n/a | 0.39 | 0.39 | ||||||||||||||||||||

| Diluted net earnings per share from continuing and discontinued operations |

5.72 | n/a | 0.39 | 0.38 | ||||||||||||||||||||

| Total assets |

45,502 | 34,940 | 16,998 | 17,255 | ||||||||||||||||||||

| Total non-current financial liabilities |

7,616 | n/a | 3,746 | 3,763 | ||||||||||||||||||||

| Dividends declared per share |

2.06 | n/a | 0.40 | 0.70 | ||||||||||||||||||||

n/a = Information was not prepared on a combined historical basis.

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | 2017 vs 2016 (PotashCorp) | ||||

| Sales |

Sales increased due to higher potash, urea and phosphate fertilizer prices, as well as higher potash sales volumes and increased retail sales due to recent acquisitions. | Sales increased primarily due to the addition of Agrium’s operations in the Merger. Sales also increased due to Retail acquisitions, higher potash sales volumes and increases in potash, urea and phosphate fertilizer prices. | Sales increased slightly due to increases in potash sales volumes and net sales prices being partially offset by decreases in nitrogen and phosphate net sales prices. | |||

| Earnings and earnings per share from continuing operations | There was a loss from continuing operations in 2018 compared to earnings in 2017 primarily due to a non-cash impairment of property, plant and equipment in the Potash segment of $1,809 million in 2018 more than offsetting the impact of higher gross margin in all operating segments. | There was a loss from continuing operations in 2018 compared to earnings in 2017 primarily due to a non-cash impairment of property, plant and equipment in the Potash segment of $1,809 million in 2018 more than offsetting the impact of the addition of Agrium’s operations in the Merger and higher gross margin in all operating segments. | Net earnings from continuing operations (and related per share amounts) decreased slightly due to increased non-cash impairments of property, plant and equipment and increased Merger and related costs, which were partially offset by an income tax recovery in 2017 compared to income tax expense in 2016. | |||

| Earnings and earnings per share from continuing and discontinued operations | 2017 information was not prepared on a combined historical basis. | Net earnings, and the related per share amounts, were higher in 2018 due to the gains on sale of our investments presented as discontinued operations, the addition of Agrium’s operations in the Merger and higher gross margin in all operating segments more than offsetting the non-cash impairment of property, plant and equipment in the Potash segment. | Net earnings (and related per share amounts) were flat due to the decrease in net earnings from continuing operations being offset by an increase in earnings from discontinued operations consisting primarily of the earnings of equity-accounted investees SQM and APC. | |||

| Assets and non-current financial liabilities | Assets increased primarily due to the fair value adjustments to legacy Agrium assets as a result of the PPA in the Merger. Combined historical non-current financial liability information was not prepared. | Assets and financial liabilities increased primarily due to the addition of Agrium’s assets and liabilities, including related PPA adjustments, acquired in the Merger. | There were no significant changes. |

| NUTRIEN 2018 | 60 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Nutrien 2018 EBITDA Compared to Nutrien 2017 EBITDA

| Dollars (millions) except per share amounts, excluding depreciation and amortization |

EBITDA | Changes in EBITDA |

Earnings per share impact |

|||||||||||||

| EBITDA December 31, 2017 |

$ | 2,412 | ||||||||||||||

| RETAIL |

||||||||||||||||

| Increases in Retail selling expenses |

|

|

|

$ | (86 | ) | $ | (0.10 | ) | |||||||

| Increase in Retail crop nutrient gross margin |

|

|

|

75 | 0.09 | |||||||||||

| POTASH |

||||||||||||||||

| Non-cash impairment of property, plant and equipment in Potash in 2018 |

|

|

|

(1,809 | ) | (2.11 | ) | |||||||||

| Increases in Potash prices |

|

|

|

389 | 0.45 | |||||||||||

| Increases in Potash sales volumes |

|

|

|

110 | 0.13 | |||||||||||

| Decreases in Potash cost of goods sold (COGS) |

|

|

|

109 | 0.13 | |||||||||||

| Increase in Potash provincial mining and other taxes |

|

|

|

(85 | ) | (0.10 | ) | |||||||||

| NITROGEN |

||||||||||||||||

| Increases in Nitrogen prices |

|

|

|

181 | 0.22 | |||||||||||

| Decreases in Nitrogen COGS |

|

|

|

143 | 0.18 | |||||||||||

| PHOSPHATE AND SULFATE |

||||||||||||||||

| Decreases in Phosphate and Sulfate COGS due primarily to the 2017 non-cash impairment 1 |

|

|

|

228 | 0.28 | |||||||||||

| Increases in Phosphate and Sulfate prices |

|

|

|

156 | 0.19 | |||||||||||

| OTHERS |

||||||||||||||||

| Decreases in Others segment other income due primarily to the defined benefit plans curtailment gain |

|

|

|

151 | 0.19 | |||||||||||

| ALL OTHER CHANGES |

||||||||||||||||

| Other changes |

|

|

|

32 | 0.04 | |||||||||||

| EBITDA December 31, 2018 |

$ 2,006 | |||||||||||||||

| 1 | Includes a non-cash impairment of property, plant and equipment of $305 million. See note 16 to the financial statements. |

| NUTRIEN 2018 | 61 | ANNUAL REPORT |

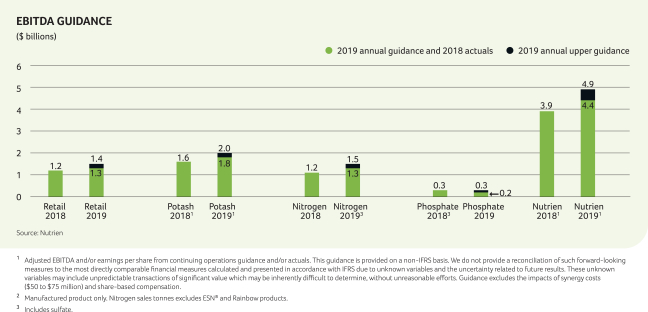

2019 Guidance

| 2019 Guidance Ranges | ||||||||

| Dollars (billions) unless otherwise noted | Low | High | ||||||

| Adjusted net earnings per share 1 |

$ | 2.80 | $ | 3.20 | ||||

| Adjusted EBITDA 1 |

$ | 4.4 | $ | 4.9 | ||||

| Retail EBITDA |

$ | 1.3 | $ | 1.4 | ||||

| Potash EBITDA |

$ | 1.8 | $ | 2.0 | ||||

| Nitrogen EBITDA |

$ | 1.3 | $ | 1.5 | ||||

| Phosphate EBITDA |

$ | 0.2 | $ | 0.3 | ||||

| Potash sales tonnes (millions) 2 |

13.0 | 13.4 | ||||||

| Nitrogen sales tonnes (millions) 2 |

10.6 | 11.0 | ||||||

| Depreciation and amortization |

$ | 1.8 | $ | 1.9 | ||||

| Integration and synergy costs (millions) |

$ | 50 | $ | 75 | ||||

| Effective tax rate on continuing operations |

24% | 26% | ||||||

| Sustaining capital expenditures |

$ | 1.0 | $ | 1.1 | ||||

2019 Sensitivities

| NUTRIEN 2018 | 62 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Others Segment Financial Performance

“Others” is a non-operating segment comprising corporate and administrative functions that provide support and governance to our operating business units. No sales are made in this segment.

| Nutrien | Nutrien | % | PCS 1 | % | ||||||||||||||||||||||||

| Dollars (millions), except percentage amounts | 2018 | 2017 | Change | 2017 | Change | |||||||||||||||||||||||

| Selling expenses |

$ | 22 | $ | 15 | 47 | $ | (2 | ) | n/m | |||||||||||||||||||

| General and administrative expenses |

(400 | ) | (377 | ) | 6 | (170 | ) | 135 | ||||||||||||||||||||

| Provincial mining and other taxes |

(2 | ) | – | n/m | – | n/m | ||||||||||||||||||||||

| Other expenses |

(106 | ) | (256 | ) | (59 | ) | (99 | ) | 7 | |||||||||||||||||||

| Loss before finance costs and income taxes |

(486 | ) | (618 | ) | (21 | ) | (271 | ) | 79 | |||||||||||||||||||

| Depreciation and amortization |

54 | 56 | (4 | ) | 37 | 46 | ||||||||||||||||||||||

| EBITDA |

$ | (432 | ) | $ | (562 | ) | (23 | ) | $ | (234 | ) | 85 | ||||||||||||||||

| 1 | Certain amounts have been reclassified to conform to the current period’s presentation as described in note 33 to the financial statements. |

| n/m | = not meaningful |

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||

| EBITDA |

EBITDA increased primarily due to the impact of the defined benefit plans curtailment gain included in other expenses (see note 28 to the financial statements). | EBITDA decreased primarily due to the addition of Agrium’s operations more than offsetting the impact of a defined benefit plans curtailment gain in other expenses (see note 28 to the financial statements). |

Expenses & Income Below Gross Margin

| Nutrien | Nutrien | % | PCS 1 | % | ||||||||||||||||||||||||

| Dollars (millions), except percentage amounts | 2018 | 2017 | Change | 2017 | Change | |||||||||||||||||||||||

| Selling expenses 2 |

$ | (2,337 | ) | $ | (2,043 | ) | 14 | $ | (29 | ) | n/m | |||||||||||||||||

| General and administrative expenses 3 |

(539 | ) | (503 | ) | 7 | (185 | ) | 191 | ||||||||||||||||||||

| Provincial mining and other taxes 4 |

(250 | ) | (159 | ) | 57 | (146 | ) | 71 | ||||||||||||||||||||

| Impairment of property, plant and equipment 5 |

(1,809 | ) | – | n/m | – | n/m | ||||||||||||||||||||||

| Other expenses |

(43 | ) | (255 | ) | (83 | ) | (125 | ) | (66 | ) | ||||||||||||||||||

| Finance costs |

(538 | ) | (515 | ) | 4 | (238 | ) | 126 | ||||||||||||||||||||

| Income tax recovery (expense) |

93 | (20 | ) | n/m | 183 | (49 | ) | |||||||||||||||||||||

| Net earnings from discontinued operations |

3,604 | n/a | n/m | 173 | n/m | |||||||||||||||||||||||

| 1 | Certain amounts have been reclassified to conform to the current period’s presentation as described in note 33 to the financial statements. |

| 2 | Expenses are primarily in the Retail segment. See page 36 for analysis. |

| 3 | Expenses are primarily in the Others segment. See above for analysis. |

| 4 | Expenses are primarily in the Potash segment. See page 43 for analysis. |

| 5 | Impairment was in the Potash segment. See page 43 for analysis. |

| n/m | = not meaningful |

| n/a | = not available |

| NUTRIEN 2018 | 63 | ANNUAL REPORT |

The most significant contributors to the change in expenses and income below gross margin results were as follows:

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||

|

Other (Expenses) Income |

Other expenses decreased primarily due to a defined benefit plans curtailment gain (see note 28 to the financial statements) in 2018 (none in 2017) and foreign exchange gains in 2018 (losses in 2017). | Other expenses decreased as a defined benefit plans curtailment gain (see note 28 to the financial statements) in 2018 (none in 2017) more than offset the increase in Merger and related costs. | ||

| There were no significant changes to finance costs. | Finance costs increased primarily as a result of the Merger. See note 8 to the financial statements for a breakdown of these costs. |

|

Finance Costs |

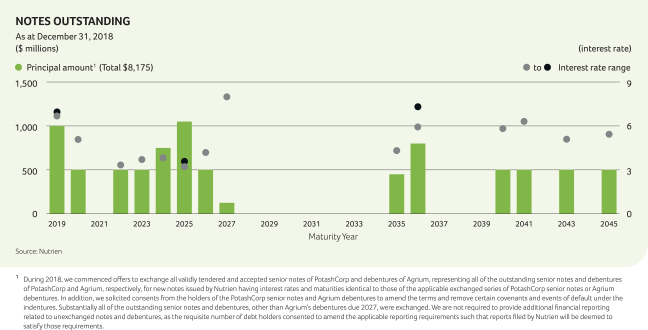

WEIGHTED AVERAGE DEBT BALANCES & RATES

|

|||||||||||||

| Dollars (millions), except percentage amounts | Nutrien 2018 | Nutrien 2017 | PCS 2017 | |||||||||||

| Short-term balance 1 |

$ | 2,933 | $ | 1,525 | $ | 381 | ||||||||

| Short-term rate 1,2 |

3.3% | 2.4% | 1.3% | |||||||||||

| Long-term balance |

$ | 8,175 | $ | 8,641 | $ | 4,229 | ||||||||

| Long-term rate |

4.8% | 4.7% | 4.7% | |||||||||||

| 1 | North American weighted average short-term debt balances were $2,719 (2017 (Nutrien) – $1,345, 2017 (PotashCorp) – $381) and rates were 2.5% (2017 (Nutrien) – 1.5%, 2017 (PotashCorp) – 1.3%). |

| 2 | Rates were higher in 2018 due to increases in benchmark interest rates. |

| Income Tax Recovery (Expense) | A loss from continuing operations was realized for accounting purposes in 2018 compared to earnings from continuing operations in 2017. As a result, a tax recovery was recorded in 2018 compared to a tax expense in 2017. The 2017 tax expense included a net discrete recovery of $178 as a result of a federal income tax rate decrease pursuant to US tax reform legislation.

See note 9 to the financial statements for further information on income tax recovery (expense). |

A loss from continuing operations was realized for accounting purposes in 2018 and 2017. The 2017 tax recovery included a discrete recovery of $187 as a result of a federal income tax rate decrease pursuant to US tax reform legislation.

See note 9 to the financial statements for further information on income tax recovery (expense). |

|

EFFECTIVE TAX RATES & DISCRETE ITEMS

|

| |||||||||||

| Dollars (millions), except percentage amounts | Nutrien 2018 | Nutrien 2017 1 | PCS 2017 1 | |||||||||

| Actual effective tax rate on ordinary earnings |

72% | 29% | (7)% | |||||||||

| Actual effective tax rate including discrete items |

75% | 3% | n/m | |||||||||

| Discrete tax adjustments that impacted the rate |

$ | 4 | $ 176 | $ | 185 | |||||||

| 1 | Rates have been adjusted as a result of our equity interests in SQM, APC and ICL being classified as discontinued in 2017. |

| n/m | = not meaningful |

|

Net Earnings From Discontinued Operations |

Combined historical Nutrien information was not prepared for discontinued operations. | Net earnings from discontinued operations were higher in 2018 primarily due to the gains on sale of our equity investments in SQM and APC, and dividends from SQM and APC, exceeding the equity earnings and dividend income from these investments in 2017 (equity accounting for these investments ceased when the investments were classified as held for sale). This was partially offset by an increase in income tax expense. |

Other Comprehensive (Loss) Income

Other comprehensive (loss) income in 2018 was a $302 million loss compared to $176 million income for 2017 Nutrien and $96 million income for 2017 PotashCorp due primarily to a loss on translation of our net operations in Canada and Australia (gain for 2017 Nutrien) and a fair value loss on our investment in Sinofert (Gain for 2017 Nutrien and 2017 PotashCorp).

| NUTRIEN 2018 | 64 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

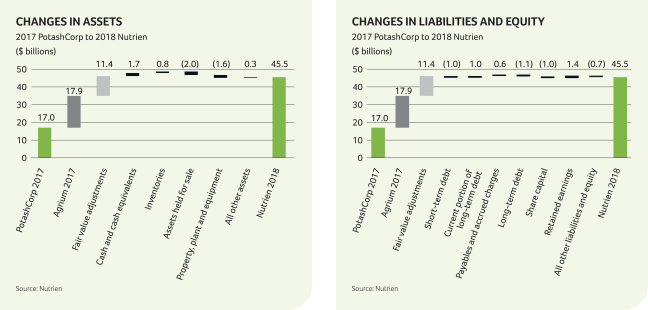

Balance Sheet Analysis

The most significant contributors to the changes in our balance sheet are analyzed below (direction of arrows refers to increase or decrease in financial condition and ● means no impact). All impacts for balance sheet line items are after the opening balance sheet impacts of the Merger, which includes fair value adjustments in relation to the Merger (if any).

Total assets and liabilities increased primarily as a result of the Merger and fair value adjustments described in note 3 to the financial statements. Total equity increased primarily as a result of the issuance of Nutrien shares in the Merger. The analysis below explains the further changes after these adjustments.

| Assets | Liabilities | |||||||||||||

|

|

For information regarding changes in cash and cash equivalents, refer to the “Sources and Uses of Cash” section on page 67 and the consolidated statements of cash flows in our financial statements. |

|

Short-term debt decreased due to repayments upon receipt of cash proceeds from the sale of our held for sale equity investments.

Current portion of long-term debt increased and long-term debt decreased due to the 6.75 percent notes due January 15, 2019 and 6.5 percent notes due May 15, 2019 becoming due within one year. | |||||||||||

|

|

Inventory increased primarily due to lower than expected Retail crop protection sales caused by adverse weather in North America and earlier than average seasonal inventory purchases in Retail. |

●

| ||||||||||||

|

|

Assets held for sale were lower due to the sale of our equity interests in SQM, APC and ICL as discussed in note 10 to the financial statements. |

|

Payables and accrued charges increased due to a higher dividend payable, accelerated seasonal Retail inventory purchases, higher customer prepayments and the timing of cash payments. | |||||||||||

|

|

Property, plant and equipment were primarily impacted by a non-cash impairment loss relating to our New Brunswick Potash operations as described in note 16 to the financial statements. |

|||||||||||||

| Equity | ||||||||||||||

|

|

Share capital was reduced by share repurchases.

| |||||||||||||

|

|

Retained earnings was higher primarily as a result of net earnings exceeding the impact of share repurchases and dividends declared. | |||||||||||||

As at December 31, 2018, $NIL (December 31, 2017 (Nutrien) – $104 million, (PotashCorp) – $104 million) of our cash and cash equivalents was held in certain foreign subsidiaries that could be subject to taxes upon repatriation.

| NUTRIEN 2018 | 65 | ANNUAL REPORT |

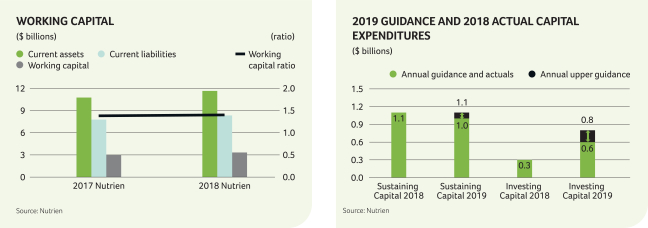

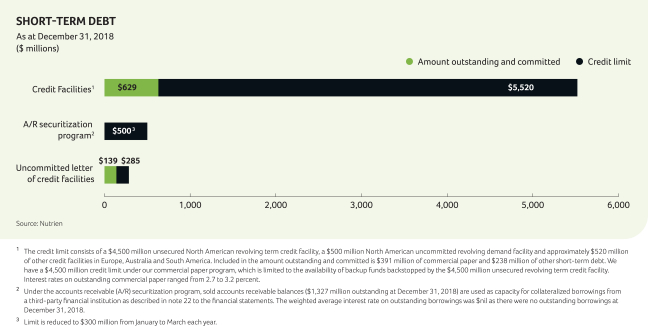

Sources & Uses of Liquidity

Liquidity risk arises from our general funding needs and in the management of our assets, liabilities and capital structure. We manage liquidity risk to maintain sufficient liquid financial resources to fund our financial position and meet our commitments and obligations in a cost-effective manner. Our 2018 significant liquidity sources are listed below along with our expected ongoing primary uses of liquidity. Proceeds from the sale of investments are not expected to be a significant liquidity source in 2019 now that the required Merger-related divestitures have been completed.

| Liquidity sources:

|

Primary uses:

| |

| • Cash from operations |

• Operational expenses | |

| • Investments sale proceeds 1 |

• Seasonal working capital requirements | |

| • Commercial paper issuances |

• Sustaining and investing capital 2 | |

| • Credit facility drawdowns |

• Business acquisitions and investments 3 | |

| • Accounts receivable securitization borrowings |

• Dividends 4 and interest | |

| • Debt capital markets |

• Debt securities principal payments | |

| • Share repurchases 5 |

| 1 | In 2018, we closed sales on our equity interests in SQM, ICL and APC for net proceeds of approximately $5.3 billion. |

| 2 | See graph below for forecast 2019 and actual 2018 capital expenditures to sustain operations and for investing (excluding business acquisitions and investments in equity-accounted investees). Amounts are based on a forecast exchange rate of 1.32 Canadian Dollars per US Dollar. |

| 3 | In 2018, we acquired 53 retail locations in North America and Australia, in addition to companies operating within the digital agriculture, proprietary products and agricultural services businesses (note 3 and note 21 to the financial statements). On February 5, 2019, we announced the planned acquisition of Actagro, LLC, a developer, manufacturer and marketer of environmentally sustainable soil and plant health products and technologies for approximately $340 million. Closing of the transaction is subject to US regulatory approval and is expected to be completed in the first half of 2019. |

| 4 | We target a stable and growing dividend that represents 40 to 60 percent of free cash flow after sustaining capital through the agricultural cycle. In November 2018, we increased our dividend from $0.40 per share to $0.43 per share. |

| 5 | During 2018, 36,332,197 common shares were repurchased for cancellation at a cost of $1,852 million with an average price per share of $50.97. In the fourth quarter of 2018, the Board of Directors approved an increase to the existing share repurchase program, raising the maximum number of shares that can be repurchased by February 22, 2019 to 50,363,686 common shares, representing approximately 8% of our outstanding common shares. On February 20, 2019, the Board of Directors approved the renewal of the share repurchase program of up to 5 percent of our outstanding common shares over a one-year period through a normal course issuer bid. As of February 20, 2019, an additional 5,933,135 common shares were repurchased at a cost of $297 million and an average price per share of $50.10. |

We believe that internally generated cash flow, supplemented by available borrowings under our existing financing sources, if necessary, will be sufficient to meet our anticipated capital expenditures and other cash requirements for at least the next 12 months. At this time, we do not reasonably expect any presently known trend or uncertainty to affect our ability to access our historical sources of liquidity. We had positive working capital of $3.33 billion and a working capital ratio of 1.40 at December 31, 2018 and an adjusted net debt to adjusted EBITDA ratio of 1.64.

| NUTRIEN 2018 | 66 | ANNUAL REPORT |

MANAGEMENT'S DISCUSSION AND ANALYSIS

Sources and Uses of Cash

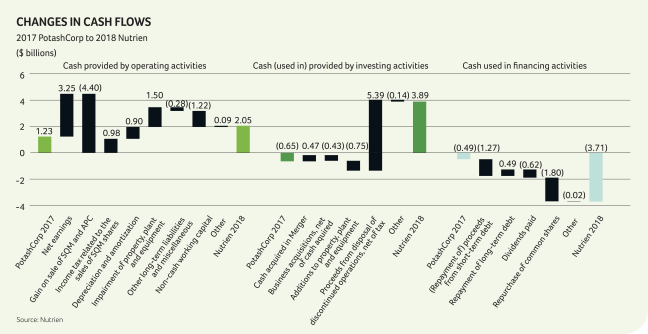

Our cash flows from operating, investing and financing activities are summarized in the following table:

| Dollars (millions), except percentage amounts | Nutrien 2018 |

Nutrien 2017 |

% Change |

PCS 2017 |

% Change |

|||||||||||||||||||||||

| Cash provided by operating activities |

$ | 2,052 | $ | 2,568 | (20 | ) | $ | 1,225 | 68 | |||||||||||||||||||

| Cash provided by (used in) investing activities |

3,887 | (1,594 | ) | n/m | (652 | ) | n/m | |||||||||||||||||||||

| Cash used in financing activities |

(3,705 | ) | (824 | ) | 350 | (489 | ) | 658 | ||||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents |

(36 | ) | (12 | ) | 200 | – | n/m | |||||||||||||||||||||

| Increase in cash and cash equivalents |

$ | 2,198 | $ | 138 | n/m | $ | 84 | n/m | ||||||||||||||||||||

n/m = not meaningful

The most significant contributors to the changes in cash flows were as follows:

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||

| Cash Provided by Operating Activities was impacted by: | • Higher net earnings in 2018 than in 2017.

• Significant changes in non-cash adjustments were due to the gain on disposal of SQM and APC net of tax in 2018 ($NIL – 2017), higher depreciation and amortization, and higher impairment of property, plant and equipment.

• Non-cash working capital was impacted primarily by cash outflows for payables and accrued charges (inflows in 2017) and inventories (lower outflows in 2017) more than offsetting inflows from prepaid expenses and other current assets (outflows in 2017). |

• Higher net earnings in 2018 than in 2017.

• Significant changes in non-cash adjustments were due to the gain on disposal of SQM and APC net of tax in 2018 ($NIL – 2017), higher depreciation and amortization, and higher impairment of property, plant and equipment.

• Non-cash working capital was impacted primarily by cash outflows for payables and accrued charges (inflows in 2017) and inventories (lower outflows in 2017) more than offsetting inflows from prepaid expenses and other current assets (outflows in 2017).

|

| NUTRIEN 2018 | 67 | ANNUAL REPORT |

| 2018 vs 2017 (Nutrien) | 2018 vs 2017 (PotashCorp) | |||

| Cash Provided by (Used in) Investing Activities was impacted by: | • Higher net cash outlays for business acquisitions (net of cash acquired) in 2018 compared to 2017.

• Cash proceeds received from the disposals of our discontinued operations in SQM, ICL and APC in 2018. |

• Cash acquired in the Merger in 2018.

• Higher net cash outlays for business combinations (net of cash acquired) in 2018 compared to 2017.

• Higher cash additions to property, plant and equipment in 2018 than in 2017 due primarily to the addition of Agrium’s Retail operations in the Merger.

• Cash proceeds received from the disposals of our discontinued operations in SQM, ICL and APC in 2018. | ||

| Cash Used in Financing Activities was impacted by: | • A net repayment of commercial paper in 2018 compared to net proceeds in 2017.

• Lower cash repayments of long-term debt in 2018.

• Cash outlays for share repurchases under the NCIB in 2018 (none in 2017). |

• A net repayment of commercial paper in 2018 compared to net proceeds in 2017.

• Lower cash repayments of long-term debt in 2018.

• Higher cash dividends paid in 2018 than in 2017.

• Cash outlays for share repurchases under the NCIB in 2018 (none in 2017). |

Cash Requirements

The following aggregated information about our contractual obligations and other commitments summarizes certain of our liquidity and capital resource requirements as at December 31, 2018. The information presented in the table below does not include planned (but not legally committed) capital expenditures or potential share repurchases.

| Payments Due by Period | ||||||||||||||||||||||||

| Dollars (millions) at December 31, 2018 | Total | Within 1 Year | 1 to 3 Years | 3 to 5 Years | Over 5 Years | |||||||||||||||||||

| Long-term debt obligations |

Notes 23, 26 | $ | 8,175 | $ | 1,000 | $ | 500 | $ 1,000 | $ | 5,675 | ||||||||||||||

| Estimated interest payments on long-term debt obligations |

Note 26 | 4,543 | 341 | 612 | 576 | 3,014 | ||||||||||||||||||

| Operating leases |

Note 26 | 1,087 | 216 | 316 | 212 | 343 | ||||||||||||||||||

| Purchase commitments1 |

Note 26 | 3,396 | 1,364 | 949 | 945 | 138 | ||||||||||||||||||