.3

2019 Annual Audited

Financial Statements

.3

2019 Annual Audited

Financial Statements

Statements

| 76 | ||||||||

| 77 | ||||||||

| 77 | ||||||||

| 78 | ||||||||

| 79 | ||||||||

| 80 | ||||||||

| 81 | Note 1 |

|||||||

| 81 | Note 2 |

|||||||

| P,E | 82 | Note 3 |

||||||

| P,E | 86 | Note 4 |

||||||

| 90 | Note 5 |

|||||||

| P,E | 90 | Note 6 |

||||||

| 92 | Note 7 |

|||||||

| 93 | Note 8 |

|||||||

| P,E | 93 | Note 9 |

||||||

| P | 97 | Note 10 |

||||||

| 97 | Note 11 |

|||||||

| P | 98 | Note 12 |

||||||

| P,E | 103 | Note 13 |

||||||

| P,E | 104 | Note 14 |

||||||

| P,E | 105 | Note 15 |

||||||

| P,E | 109 | Note 16 |

||||||

| P,E | 111 | Note 17 |

||||||

| 113 | Note 18 |

|||||||

| 113 | Note 19 |

|||||||

| 114 | Note 20 |

|||||||

| 115 | Note 21 |

|||||||

| 116 | Note 22 |

|||||||

| P,E | 116 | Note 23 |

||||||

| P,E |

121 | Note 24 |

Asset Retirement Obligations and Accrued Environmental Costs | |||||

| 123 | Note 25 |

|||||||

| 124 | Note 26 |

|||||||

| 125 | Note 27 |

|||||||

| P | 126 | Note 28 |

||||||

| 127 | Note 29 |

|||||||

| E | 127 | Note 30 |

||||||

| P,E | 129 | Note 31 |

||||||

| P | Includes Accounting Policies |

| E | Includes Accounting Estimates and Judgments |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Management’s

Responsibility

Management’s Responsibility for Financial Reporting

| 72 | Nutrien Annual Report 2019 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Report of Independent

Registered Public

Accounting Firm

To the Shareholders and Board of Directors of Nutrien Ltd.

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 73 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Report of Independent

Registered Public

Accounting Firm

To the Shareholders and Board of Directors of Nutrien Ltd.

| 74 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 75 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Consolidated Financial Statements

Consolidated Statements of Earnings

| For the years ended December 31 |

Note | 2019 | 2018 | |||||||||

| Note 2 | ||||||||||||

| Sales | 3 | 20,023 | 19,636 | |||||||||

| Freight, transportation and distribution | 5 | 768 | 864 | |||||||||

| Cost of goods sold | 5 | 13,814 | 13,380 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Gross Margin | 5,441 | 5,392 | ||||||||||

| Selling expenses | 5 | 2,505 | 2,337 | |||||||||

| General and administrative expenses | 5 | 404 | 423 | |||||||||

| Provincial mining and other taxes | 5 | 292 | 250 | |||||||||

| Share-based compensation | 6 | 104 | 116 | |||||||||

| Impairment of assets | 15, 16 | 120 | 1,809 | |||||||||

| Other expenses | 7 | 154 | 43 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Earnings Before Finance Costs and Income Taxes | 1,862 | 414 | ||||||||||

| Finance costs | 8 | 554 | 538 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Earnings (Loss) Before Income Taxes | 1,308 | (124) | ||||||||||

| Income tax expense (recovery) | 9 | 316 | (93) | |||||||||

|

|

|

|

|

|

|

|

||||||

| Net Earnings (Loss) from Continuing Operations | 992 | (31) | ||||||||||

| Net earnings from discontinued operations | 10 | – | 3,604 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Net Earnings | 992 | 3,573 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Net Earnings (Loss) per share from Continuing Operations | 11 | |||||||||||

| Basic | 1.70 | (0.05) | ||||||||||

| Diluted | 1.70 | (0.05) | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Net Earnings per share from Discontinued Operations | 11 | |||||||||||

| Basic | – | 5.77 | ||||||||||

| Diluted | – | 5.77 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Net Earnings per share (“EPS”) | 11 | |||||||||||

| Basic | 1.70 | 5.72 | ||||||||||

| Diluted | 1.70 | 5.72 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Weighted average shares outstanding for basic EPS | 11 | 582,269,000 | 624,900,000 | |||||||||

| Weighted average shares outstanding for diluted EPS | 11 | 583,102,000 | 624,900,000 | |||||||||

|

|

|

|

|

|

|

|

||||||

Consolidated Statements of Comprehensive Income

| For the years ended December 31 (net of related income taxes) |

2019 | 2018 | ||||||

| Net Earnings | 992 | 3,573 | ||||||

| Other comprehensive income (loss) | ||||||||

| Items that will not be reclassified to net earnings: |

||||||||

| Net actuarial gain on defined benefit plans |

7 | 54 | ||||||

| Net fair value loss on investments |

(25) | (99) | ||||||

| Items that have been or may be subsequently reclassified to net earnings: |

||||||||

| Gain (loss) on currency translation of foreign operations |

47 | (249) | ||||||

| Other |

7 | (8) | ||||||

|

|

|

|

|

|

||||

| Other Comprehensive Income (Loss) | 36 | (302) | ||||||

|

|

|

|

|

|

||||

| Comprehensive Income | 1,028 | 3,271 | ||||||

|

|

|

|

|

|

||||

(See Notes to the Consolidated Financial Statements)

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 77 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Consolidated Statements of Cash Flows

| For the years ended December 31 |

Note | 2019 | 2018 | |||||||||

| Note 2 | ||||||||||||

| Operating Activities | ||||||||||||

| Net earnings | 992 | 3,573 | ||||||||||

| Adjustments for: | ||||||||||||

| Depreciation and amortization |

1,799 | 1,592 | ||||||||||

| Share-based compensation |

6 | 104 | 116 | |||||||||

| Impairment of assets |

15, 16 | 120 | 1,809 | |||||||||

| Provision for (recovery of) deferred income tax |

177 | (290) | ||||||||||

| Gain on sale of investments in Sociedad Quimica y Minera de Chile S.A. (“SQM”) and Arab Potash Company (“APC”) |

– | (4,399) | ||||||||||

| Income tax related to the sale of the investment in SQM |

– | 977 | ||||||||||

| Other long-term liabilities and miscellaneous |

(17) | (188) | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Cash from operations before working capital changes | 3,175 | 3,190 | ||||||||||

| Changes in non-cash operating working capital: | ||||||||||||

| Receivables |

(64) | (153) | ||||||||||

| Inventories |

190 | (887) | ||||||||||

| Prepaid expenses and other current assets |

(238) | 561 | ||||||||||

| Payables and accrued charges |

602 | (659) | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Cash Provided by Operating Activities | 3,665 | 2,052 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Investing Activities | ||||||||||||

| Additions to property, plant and equipment | 15 | (1,728) | (1,405) | |||||||||

| Additions to intangible assets | 16 | (163) | (102) | |||||||||

| Business acquisitions, net of cash acquired | 4 | (911) | (433) | |||||||||

| Proceeds from disposal of discontinued operations, net of tax | 10 | 55 | 5,394 | |||||||||

| Purchase of investments | (198) | (135) | ||||||||||

| Cash acquired in Merger | 4 | – | 466 | |||||||||

| Other | 147 | 102 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Cash (Used in) Provided by Investing Activities | (2,798) | 3,887 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Financing Activities | ||||||||||||

| Transaction costs on long-term debt | (29) | (21) | ||||||||||

| Proceeds from (repayment of) short-term debt, net | 19 | 216 | (927) | |||||||||

| Proceeds from long-term debt | 20 | 1,510 | – | |||||||||

| Repayment of long-term debt | 20 | (1,010) | (12) | |||||||||

| Repayment of principal portion of lease liabilities | 20 | (234) | – | |||||||||

| Dividends paid | 25 | (1,022) | (952) | |||||||||

| Repurchase of common shares | 25 | (1,930) | (1,800) | |||||||||

| Issuance of common shares | 25 | 20 | 7 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Cash Used in Financing Activities | (2,479) | (3,705) | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (31) | (36) | ||||||||||

|

|

|

|

|

|

|

|

||||||

| (Decrease) Increase in Cash and Cash Equivalents | (1,643) | 2,198 | ||||||||||

| Cash and Cash Equivalents – Beginning of Year | 2,314 | 116 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Cash and Cash Equivalents – End of Year | 671 | 2,314 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Cash and cash equivalents 1 comprised of: | ||||||||||||

| Cash | 532 | 1,506 | ||||||||||

| Short-term investments | 139 | 808 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| 671 | 2,314 | |||||||||||

|

|

|

|

|

|

|

|

||||||

| Supplemental Cash Flows Information | ||||||||||||

| Interest paid | 505 | 507 | ||||||||||

| Income taxes paid | 29 | 1,155 | ||||||||||

| Total cash outflow for leases | 345 | – | ||||||||||

|

|

|

|

|

|

|

|

||||||

| 1 | Highly liquid investments with a maturity of three months or less from the date of purchase are considered to be cash equivalents. |

(See Notes to the Consolidated Financial Statements)

| 78 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Consolidated Statements of Changes in

Shareholders’ Equity

| Share Capital |

Contributed Surplus |

Accumulated Other Comprehensive (Loss) Income (“AOCI”) |

Retained Earnings |

Total Equity 2 |

||||||||||||||||||||||||||||||||

|

|

Net Fair Value Gain (Loss) on Investments |

Net Actuarial Gain on Defined Benefit Plans 1 |

Loss on Currency Translation of Foreign Operations |

Other | Total AOCI |

|||||||||||||||||||||||||||||||

| Balance – |

1,806 | 230 | 73 | – | (2) | (46) | 25 | 6,242 | 8,303 | |||||||||||||||||||||||||||

| Merger impact (Note 4) |

15,898 | 7 | – | – | – | – | – | (1) | 15,904 | |||||||||||||||||||||||||||

| Net earnings |

– | – | – | – | – | – | – | 3,573 | 3,573 | |||||||||||||||||||||||||||

| Other comprehensive (loss) income |

– | – | (99) | 54 | (249) | (8) | (302) | – | (302) | |||||||||||||||||||||||||||

| Shares repurchased (Note 25) |

(998) | (23) | – | – | – | – | – | (831) | (1,852) | |||||||||||||||||||||||||||

| Dividends declared |

– | – | – | – | – | – | – | (1,273) | (1,273) | |||||||||||||||||||||||||||

| Effect of share-based compensation including issuance of common shares |

34 | 17 | – | – | – | – | – | – | 51 | |||||||||||||||||||||||||||

| Transfer of net actuarial gain on defined benefit plans |

– | – | – | (54) | – | – | (54) | 54 | – | |||||||||||||||||||||||||||

| Transfer of net loss on sale of investment |

– | – | 19 | – | – | – | 19 | (19) | – | |||||||||||||||||||||||||||

| Transfer of net loss on cash flow hedges |

– | – | – | – | – | 21 | 21 | – | 21 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Balance – |

16,740 | 231 | (7) | – | (251) | (33) | (291) | 7,745 | 24,425 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Net earnings |

– | – | – | – | – | – | – | 992 | 992 | |||||||||||||||||||||||||||

| Other comprehensive (loss) income |

– | – | (25) | 7 | 47 | 7 | 36 | – | 36 | |||||||||||||||||||||||||||

| Shares repurchased (Note 25) |

(992) | – | – | – | – | – | – | (886) | (1,878) | |||||||||||||||||||||||||||

| Dividends declared |

– | – | – | – | – | – | – | (754) | (754) | |||||||||||||||||||||||||||

| Effect of share-based compensation including issuance of common shares |

23 | 17 | – | – | – | – | – | – | 40 | |||||||||||||||||||||||||||

| Transfer of net actuarial gain on defined benefit plans |

– | – | – | (7) | – | – | (7) | 7 | – | |||||||||||||||||||||||||||

| Transfer of net loss on sale of investment |

– | – | 3 | – | – | – | 3 | (3) | – | |||||||||||||||||||||||||||

| Transfer of net loss on cash flow hedges |

– | – | – | – | – | 8 | 8 | – | 8 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Balance – |

15,771 | 248 | (29) | – | (204) | (18) | (251) | 7,101 | 22,869 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| 1 | Any amounts incurred during a period were closed out to retained earnings at each period-end. Therefore, no balance exists at the beginning or end of period. |

| 2 | All equity transactions were attributable to common shareholders. |

(See Notes to the Consolidated Financial Statements)

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 79 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

| As at December 31 |

Note | 2019 | 2018 | |||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash and cash equivalents |

671 | 2,314 | ||||||||||

| Receivables |

13 | 3,542 | 3,342 | |||||||||

| Inventories |

14 | 4,975 | 4,917 | |||||||||

| Prepaid expenses and other current assets |

1,477 | 1,089 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| 10,665 | 11,662 | |||||||||||

| Non-current assets | ||||||||||||

| Property, plant and equipment |

15 | 20,335 | 18,796 | |||||||||

| Goodwill |

16 | 11,986 | 11,431 | |||||||||

| Other intangible assets |

16 | 2,428 | 2,210 | |||||||||

| Investments |

17 | 821 | 878 | |||||||||

| Other assets |

18 | 564 | 525 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Total Assets | 46,799 | 45,502 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Short-term debt |

19 | 976 | 629 | |||||||||

| Current portion of long-term debt |

20 | 502 | 995 | |||||||||

| Current portion of lease liabilities |

21 | 214 | 8 | |||||||||

| Payables and accrued charges |

22 | 7,437 | 6,703 | |||||||||

|

|

|

|

|

|

|

|

||||||

| 9,129 | 8,335 | |||||||||||

| Non-current liabilities | ||||||||||||

| Long-term debt |

20 | 8,553 | 7,579 | |||||||||

| Lease liabilities |

21 | 859 | 12 | |||||||||

| Deferred income tax liabilities |

9 | 3,145 | 2,907 | |||||||||

| Pension and other post-retirement benefit liabilities |

23 | 433 | 395 | |||||||||

| Asset retirement obligations and accrued environmental costs |

24 | 1,650 | 1,673 | |||||||||

| Other non-current liabilities |

161 | 176 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Total Liabilities | 23,930 | 21,077 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Shareholders’ Equity | ||||||||||||

| Share capital |

25 | 15,771 | 16,740 | |||||||||

| Contributed surplus |

248 | 231 | ||||||||||

| Accumulated other comprehensive loss |

(251) | (291) | ||||||||||

| Retained earnings |

7,101 | 7,745 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Total Shareholders’ Equity | 22,869 | 24,425 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| Total Liabilities and Shareholders’ Equity | 46,799 | 45,502 | ||||||||||

|

|

|

|

|

|

|

|

||||||

| (See Notes to the Consolidated Financial Statements) | ||||||||||||

| Approved by the Board of Directors,

|

||||||||||||

|

|

|||||

| Director | Director |

| 80 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 1 Description of Business

Nutrien Ltd. (collectively with its subsidiaries, “Nutrien”, “we”, “us”, “our” or “the Company”) is the world’s largest provider of crop inputs and services. Nutrien plays a critical role in helping growers around the globe increase food production in a sustainable manner.

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 81 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

The Company has four reportable operating segments: Retail, Potash, Nitrogen and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seed and merchandise, and provides services directly to growers through a network of farm centers in North and South America and Australia. The Potash, Nitrogen and Phosphate segments are differentiated by the chemical nutrient contained in the products that each produces.

Accounting Policies, Estimates and Judgments

Operating Segments

Revenue

We recognize revenue when we transfer control over a good or service to a customer.

| Transfer of Control for |

Retail |

Potash, Nitrogen and Phosphate | ||

| Sale of Goods |

At the point in time when the product is

• purchased at our Retail farm center or

• delivered and accepted by customers at their premises. |

At the point in time when the product is

• loaded for shipping or

• delivered to the customer. | ||

|

|

|

| ||

| Services |

Over time as the promised service is rendered. | Over time as the promised service is rendered. | ||

|

|

|

|

For transactions in which we act as an agent rather than the principal, revenue is recognized net of any commissions earned. The relating commissions are recognized as the sales occurred or as unconditional contracts are signed.

Retail

Retail revenue is generated primarily from sales of the following:

|

|

| |

| Crop nutrients |

Dry and liquid macronutrient products including potash, nitrogen and phosphate, proprietary liquid micronutrient products and nutrient application services. | |

|

|

| |

| Crop protection products |

Various third-party supplier and proprietary products designed to maintain crop quality and manage plant diseases, weeds, and other pests. | |

|

|

| |

| Seed |

Various third-party supplier seed brands and proprietary seed product lines. | |

|

|

| |

| Merchandise |

Fencing, feed supplements, livestock-related animal health products, storage and irrigation equipment, and other products. | |

|

|

| |

| Services and other revenues |

Product application, soil and leaf testing, crop scouting and precision agriculture services, water services, financial services and livestock marketing. | |

|

|

|

Provisions for returns, trade discounts and rebates are deducted from sales revenue.

| 82 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 3 Segment Information Continued

Potash, Nitrogen and Phosphate

|

|

Potash |

Nitrogen |

Phosphate | |||

| Products |

• North American – primarily granular

• Offshore (international) – primarily granular and standard |

• Ammonia, urea, urea ammonium nitrate, industrial grade ammonium nitrate and ammonium sulfate |

• Solid fertilizer, liquid fertilizer, industrial products and feed products | |||

|

|

|

|

| |||

| Sales prices impacted by |

• North American prices referenced at delivered prices (including transportation and distribution costs)

• International prices referenced at the mine site (excluding transportation and distribution costs) |

• Global energy costs and supply |

• Global prices and supplies of ammonia and sulfur | |||

|

|

|

|

|

Other

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 83 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 3 Segment Information Continued

Supporting Information

Financial information on each of these segments is summarized in the following tables:

| 2019 |

Retail | Potash | Nitrogen | Phosphate | Corporate and Others |

Eliminations | Consolidated | |||||||||||||||||||||||

| Sales | – third party |

13,183 | 2,702 | 2,608 | 1,397 | 133 | – | 20,023 | ||||||||||||||||||||||

| – intersegment |

38 | 207 | 612 | 203 | – | (1,060) | – | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Sales | – total |

13,221 | 2,909 | 3,220 | 1,600 | 133 | (1,060) | 20,023 | ||||||||||||||||||||||

| Freight, transportation and distribution | – | 305 | 372 | 232 | – | (141) | 768 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Net sales | 13,221 | 2,604 | 2,848 | 1,368 | 133 | (919) | 19,255 | |||||||||||||||||||||||

| Cost of goods sold | 9,981 | 1,103 | 2,148 | 1,373 | 133 | (924) | 13,814 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Gross margin | 3,240 | 1,501 | 700 | (5) | – | 5 | 5,441 | |||||||||||||||||||||||

| Selling expenses | 2,484 | 9 | 25 | 5 | (18) | – | 2,505 | |||||||||||||||||||||||

| General and administrative expenses | 112 | 6 | 15 | 7 | 264 | – | 404 | |||||||||||||||||||||||

| Provincial mining and other taxes | – | 287 | 2 | 1 | 2 | – | 292 | |||||||||||||||||||||||

| Share-based compensation expense | – | – | – | – | 104 | – | 104 | |||||||||||||||||||||||

| Impairment of assets (Note 15 and 16) | – | – | – | – | 120 | – | 120 | |||||||||||||||||||||||

| Other expenses (income) | 8 | (4 | ) | (46) | 25 | 171 | – | 154 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Earnings (loss) before finance costs |

636 | 1,203 | 704 | (43) | (643) | 5 | 1,862 | |||||||||||||||||||||||

| Depreciation and amortization | 595 | 390 | 535 | 237 | 42 | – | 1,799 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| EBITDA | 1,231 | 1,593 | 1,239 | 194 | (601) | 5 | 3,661 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Assets 1 | 19,990 | 11,696 | 10,991 | 2,198 | 2,129 | (205) | 46,799 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| 1 | Included in the Retail and Nitrogen segments are $126 and $482, respectively, relating to equity-accounted investees as described in Note 17. |

| 2018 |

Retail | Potash | Nitrogen 1 | Phosphate 1 | Corporate and Others |

Eliminations | Consolidated | |||||||||||||||||||||||

| Sales | – third party |

12,470 | 2,796 | 2,712 | 1,508 | 150 | – | 19,636 | ||||||||||||||||||||||

| – intersegment |

50 | 220 | 626 | 268 | – | (1,164) | – | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Sales | – total |

12,520 | 3,016 | 3,338 | 1,776 | 150 | (1,164) | 19,636 | ||||||||||||||||||||||

| Freight, transportation and distribution | – | 349 | 373 | 215 | – | (73) | 864 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Net sales | 12,520 | 2,667 | 2,965 | 1,561 | 150 | (1,091) | 18,772 | |||||||||||||||||||||||

| Cost of goods sold | 9,485 | 1,183 | 2,145 | 1,473 | 150 | (1,056) | 13,380 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Gross margin | 3,035 | 1,484 | 820 | 88 | – | (35) | 5,392 | |||||||||||||||||||||||

| Selling expenses | 2,303 | 14 | 32 | 10 | (22) | – | 2,337 | |||||||||||||||||||||||

| General and administrative expenses | 100 | 10 | 20 | 9 | 284 | – | 423 | |||||||||||||||||||||||

| Provincial mining and other taxes | – | 244 | 3 | 1 | 2 | – | 250 | |||||||||||||||||||||||

| Share-based compensation expense | – | – | – | – | 116 | – | 116 | |||||||||||||||||||||||

| Impairment of assets (Note 15) | – | 1,809 | – | – | – | – | 1,809 | |||||||||||||||||||||||

| Other (income) expenses | (75 | ) | 14 | (8) | 6 | 106 | – | 43 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Earnings (loss) before finance costs |

707 | (607 | ) | 773 | 62 | (486) | (35) | 414 | ||||||||||||||||||||||

| Depreciation and amortization | 499 | 404 | 442 | 193 | 54 | – | 1,592 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| EBITDA | 1,206 | (203 | ) | 1,215 | 255 | (432) | (35) | 2,006 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Assets 2 | 17,964 | 11,710 | 10,386 | 2,406 | 3,678 | (642) | 45,502 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

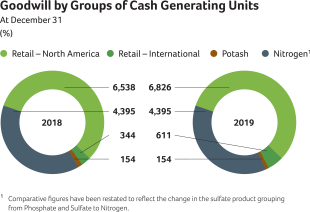

| 1 | Comparative figures have been restated to reflect the change in the sulfate product grouping from Phosphate and Sulfate to Nitrogen. |

| 2 | Included in the Retail and Nitrogen segments are $208 and $428, respectively, relating to equity-accounted investees as described in Note 17. |

| 84 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 3 Segment Information Continued

Financial information by geographic area is summarized in the following tables:

| Sales – Third Party |

2019 | 2018 | ||||||

| United States | 12,522 | 11,891 | ||||||

| Canada | 2,504 | 2,790 | ||||||

| Australia | 1,955 | 1,681 | ||||||

| Canpotex 1 | 1,625 | 1,657 | ||||||

| Trinidad | 113 | 190 | ||||||

| Argentina | 388 | 387 | ||||||

| Europe | 210 | 312 | ||||||

| Other | 706 | 728 | ||||||

|

|

|

|

|

|

||||

| 20,023 | 19,636 | |||||||

|

|

|

|

|

|

||||

| 1 | As described in Note 1, Canpotex executed offshore marketing, sales and distribution functions for certain of our products. Canpotex’s 2019 sales volumes were made to: Latin America 31 percent, China 22 percent, India 10 percent, Other Asian markets 27 percent, Other markets 10 percent (2018 – Latin America 33 percent, China 18 percent, India 10 percent, Other Asian markets 31 percent, Other markets 8 percent) (Note 29). |

| Non-Current Assets 1 |

2019 | 2018 | ||||||

| United States | 15,685 | 14,501 | ||||||

| Canada | 17,503 | 17,100 | ||||||

| Australia | 1,172 | 607 | ||||||

| Trinidad | 691 | 570 | ||||||

| Other | 639 | 621 | ||||||

|

|

|

|

|

|

||||

| 35,690 | 33,399 | |||||||

|

|

|

|

|

|

||||

| 1 | Excludes financial instruments (other than equity-accounted investees), deferred tax assets and post-employment benefit assets. |

We disaggregated revenue from contracts with customers by product line or geographic location for each reportable segment to show how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. Sales reported under our Corporate and Others segment primarily relates to our non-core Canadian business.

|

|

2019 | 2018 | ||||||

| Retail sales by product line | ||||||||

| Crop nutrients |

4,989 | 4,577 | ||||||

| Crop protection products |

4,983 | 4,862 | ||||||

| Seed |

1,712 | 1,687 | ||||||

| Merchandise |

598 | 584 | ||||||

| Services and other |

939 | 810 | ||||||

|

|

|

|

|

|

||||

| 13,221 | 12,520 | |||||||

|

|

|

|

|

|

||||

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 85 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 3 Segment Information Continued

|

|

2019 | 2018 | ||||||

| Potash sales by geography | ||||||||

| Manufactured product |

||||||||

| North America |

1,283 | 1,356 | ||||||

| Offshore 1 |

1,625 | 1,657 | ||||||

| Other potash and purchased products |

1 | 3 | ||||||

|

|

|

|

|

|

||||

| 2,909 | 3,016 | |||||||

|

|

|

|

|

|

||||

| Nitrogen sales by product line 2 | ||||||||

| Manufactured product |

||||||||

| Ammonia |

884 | 1,061 | ||||||

| Urea |

1,019 | 979 | ||||||

| Solutions, nitrates and sulfates |

812 | 825 | ||||||

| Other nitrogen and purchased products |

505 | 473 | ||||||

|

|

|

|

|

|

||||

| 3,220 | 3,338 | |||||||

|

|

|

|

|

|

||||

| Phosphate sales by product line 2 | ||||||||

| Manufactured product |

||||||||

| Fertilizer |

944 | 1,141 | ||||||

| Industrial and feed |

475 | 469 | ||||||

| Other phosphate and purchased products |

181 | 166 | ||||||

|

|

|

|

|

|

||||

| 1,600 | 1,776 | |||||||

|

|

|

|

|

|

||||

| 1 | Relates to Canpotex. |

| 2 | Comparative figures have been restated to reflect the change in the sulfate product grouping from Phosphate and Sulfate to Nitrogen. |

The Company’s business combinations include the merger between Potash Corporation of Saskatchewan Inc. (“PotashCorp”) and Agrium Inc. (“Agrium”) (the “Merger”), the acquisition of Retail businesses, including Ruralco Holdings Limited (“Ruralco”), and various digital agriculture, proprietary products and agricultural services.

Accounting Policies, Estimates and Judgments

| 86 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 4 Business Combinations Continued

| Asset |

Ruralco |

Merger |

Other |

Valuation Technique and Judgments Applied | ||||

| Property, plant and equipment |

X | X | X | Market approach for land and certain types of personal property: sales comparison that measures the value of an asset through an analysis of sales and offerings of comparable assets.

Replacement costs for all other depreciable property, plant and equipment: measures the value of an asset by estimating the costs to acquire or construct comparable assets and adjusts for age and condition of the asset. | ||||

|

|

|

|

|

| ||||

| Other intangible assets |

X | X | X | Income approach – multi-period excess earnings method: measures the value of an asset based on the present value of the incremental after-tax cash flows attributable to the asset after deducting contributory asset charges (“CACs”). Allocation of CACs is a matter of judgment and based on the nature of the acquired businesses’ operations and historical trends.

We considered several factors in determining the fair value of customer relationships, such as customers’ relationships with the acquired company and its employees, the segmentation of customers, historical customer attrition rates and revenue growth. Segmenting customers is a matter of judgment and includes factors such as the size of the customer and customer behavior patterns. | ||||

|

|

|

|

|

| ||||

| Long-term debt |

X | Comparable debt instruments with similar maturities, adjusted where necessary to the acquired company’s credit spread, based on information published by financial institutions. | ||||||

|

|

|

|

|

| ||||

| Asset retirement obligations and accrued environmental costs |

X | Decision-tree approach of future costs and a risk premium to capture the compensation sought by risk-averse market participants for bearing the uncertainty inherent in the cash flows of the liability. We expect asset retirement obligations for phosphate sites to be paid over the next 68 years, while we expect asset retirement obligations for potash and nitrogen sites to be paid subsequently.

We expect accrued environmental costs – discounted using a credit adjusted risk-free rate – to be paid over the next 30 years. | ||||||

|

|

|

|

|

|

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 87 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 4 Business Combinations Continued

Supporting Information

|

|

Ruralco |

Merger |

Other Acquisitions | |||

| Acquisition date |

September 30, 2019 | January 1, 2018 | Various | |||

|

|

|

|

| |||

| Purchase price, net of cash and cash equivalents acquired |

$330

On the acquisition date, we acquired 100% of the Ruralco stock that was issued and outstanding.

Also included in the total consideration, net of cash and cash equivalents acquired, is the impact of $18 relating to a foreign exchange hedge loss which we designated a cash flow hedge.

Transaction costs are recorded in acquisition and integration related costs in other expenses. |

$16,010

We determined the purchase price based on the number of Agrium shares outstanding

On the acquisition date, shareholders of PotashCorp received 0.400 common shares of Nutrien for each PotashCorp share held, and shareholders of Agrium received 2.230 common shares of Nutrien for each Agrium share held.

Merger and related costs are included in other expenses. |

2019 – $581, net of $100 previously held equity-accounted interest in Agrichem. We acquired the remaining 20 percent interest in Agrichem in the first nine months of 2019, making Agrichem a wholly owned consolidated subsidiary of the Company.

(2018 – $433) | |||

|

|

|

|

| |||

| Goodwill and expected benefits of the acquisition |

$202 |

$11,185, none of which is deductible for income tax purposes. |

$341 (2018 – $197) | |||

|

|

|

| ||||

| The expected benefits of the acquisitions resulting in goodwill include:

• synergies from expected reduction in operating costs;

• wider distribution channel for selling products of acquired businesses;

• a larger assembled workforce;

• potential increase in customer base;

• enhanced ability to innovate;

• production and expense optimization, including procurement savings (specific to Merger); and

• closer proximity of nitrogen operations to sources of low-cost natural gas (specific to Merger). | ||||||

|

|

|

|

| |||

| Description |

An agriservices business in Australia with approximately 250 operating locations. |

A major global producer and distributor of agricultural products, services and solutions. |

68 Retail locations in North and South America and Australia, including companies operating in the proprietary products business, such as Actagro, LLC, a developer, manufacturer and marketer of environmentally sustainable soil and plant health products and technologies (2018 – 53 Retail locations in North America and Australia and companies operating within the digital agriculture, proprietary products and agricultural services businesses). | |||

|

|

|

|

| |||

| 88 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 4 Business Combinations Continued

We allocated the following values to the acquired assets and assumed liabilities based upon fair values at their respective acquisition date:

| 2019 | 2018 | |||||||||||||||||||||||

| Ruralco (Estimate) | ||||||||||||||||||||||||

|

|

Preliminary 1 | Adjustments 2 | Revised Fair Value |

Other Acquisitions 3 |

Merger (Final) |

Other Acquisitions 3 |

||||||||||||||||||

| Cash and cash equivalents |

– | – | – | – | 466 | – | ||||||||||||||||||

| Receivables |

250 | 39 | 289 | 4 | 68 | 2,600 | 4 | 20 | ||||||||||||||||

| Inventories |

116 | 1 | 117 | 145 | 3,303 | 146 | ||||||||||||||||||

| Prepaid expenses and other current assets |

11 | (3 | ) | 8 | 38 | 1,124 | 2 | |||||||||||||||||

| Property, plant and equipment |

70 | 66 | 136 | 115 | 7,459 | 107 | ||||||||||||||||||

| Goodwill |

272 | (70 | ) | 202 | 341 | 11,185 | 197 | |||||||||||||||||

| Other intangible assets |

55 | 110 | 165 | 179 | 2,348 | 8 | ||||||||||||||||||

| Investments |

15 | – | 15 | – | 528 | 11 | ||||||||||||||||||

| Other assets |

16 | – | 16 | 5 | 2 | 293 | 5 | 3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Total assets |

805 | 143 | 948 | 888 | 29,306 | 494 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Short-term debt |

112 | – | 112 | 25 | 867 | – | ||||||||||||||||||

| Payables and accrued charges |

299 | 46 | 345 | 156 | 5,239 | 52 | ||||||||||||||||||

| Long-term debt, including current portion |

– | – | – | 11 | 4,941 | – | ||||||||||||||||||

| Lease liabilities, including current portion |

44 | 66 | 110 | 1 | – | – | ||||||||||||||||||

| Deferred income tax liabilities |

7 | 31 | 38 | 7 | 934 | – | ||||||||||||||||||

| Pension and other post-retirement benefit liabilities |

– | – | – | – | 142 | – | ||||||||||||||||||

| Asset retirement obligations and accrued environmental costs |

– | – | – | – | 1,094 | – | ||||||||||||||||||

| Other non-current liabilities |

13 | – | 13 | 7 | 79 | 9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Total liabilities |

475 | 143 | 618 | 207 | 13,296 | 61 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Total consideration |

330 | – | 330 | 681 | 16,010 | 433 | ||||||||||||||||||

| Previously held equity-accounted interest in Agrichem |

– | – | – | 100 | – | – | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Total consideration, net of cash and cash equivalents acquired |

330 | – | 330 | 581 | 16,010 | 433 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| 1 | Preliminary value as previously reported in our third quarter 2019 unaudited financial statements. The purchase price allocation is not final as we continue to obtain and verify information required to determine the fair value of certain assets and liabilities and the amount of deferred income taxes arising on their recognition. We estimated the preliminary purchase price allocation as of the date of the acquisition based on information that was available and continue to adjust those estimates as new information that existed at the date of acquisition becomes available. We expect to finalize the amounts recognized when we obtain the information necessary to complete the analysis, and in any event, not later than September 30, 2020. |

| 2 | We recorded adjustments to the preliminary fair value to reflect facts and circumstances in existence as of the date of acquisition. These adjustments primarily related to changes in the preliminary valuation assumptions, including refinement of intangible assets. All measurement period adjustments were offset against goodwill. |

| 3 | This represents preliminary fair values. For certain acquisitions, we finalized the purchase price with no material change to the fair values disclosed in prior periods. |

| 4 | Includes receivables from customers with gross contractual amounts of $247, of which $5 are considered to be uncollectible relating to Ruralco (2018 – $2,247 and $80 respectively relating to the Merger). |

| 5 | Includes deferred income tax assets of $14 relating to Ruralco (2018 – $158 relating to the Merger). |

Financial Information Related to the Acquired Operations

| 2019 Proforma 1 | Ruralco | Other Acquisitions | ||||||

| Sales |

1,090 | 480 | ||||||

| EBITDA |

50 | 40 | ||||||

|

|

|

|

|

|

||||

| 1 Estimated annual sales and EBITDA if acquisitions occurred at the beginning of the year. Net earnings before income taxes is not available. |

| |||||||

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 89 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 4 Business Combinations Continued

| 2019 Actuals | 2018 Actuals | |||||||||||||||

| From date of acquisition |

Ruralco | Other Acquisitions | Merger | Other Acquisitions | ||||||||||||

| Sales | 249 | 312 | 14,551 | 213 | ||||||||||||

| Net earnings (loss) before income taxes | (2 | ) | (1 | ) | 546 | 10 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

2019 | 2018 | ||||||

| Purchased and produced raw materials and product for resale 1 | 11,335 | 10,881 | ||||||

| Depreciation and amortization | 1,799 | 1,592 | ||||||

| Employee costs 2 | 2,268 | 1,949 | ||||||

| Freight | 845 | 934 | ||||||

| Impairment of assets (Note 15 and 16) | 120 | 1,809 | ||||||

| Provincial mining and other taxes 3 | 292 | 250 | ||||||

| Offsite warehouse costs 4 | 51 | 68 | ||||||

| Railcar and vessel costs 4 | 5 | 128 | ||||||

| Merger and related costs | 82 | 170 | ||||||

| Acquisition and integration related costs | 16 | – | ||||||

| Contract services | 504 | 469 | ||||||

| Lease expense 5 | 66 | 148 | ||||||

| Fleet fuel, repairs and maintenance | 202 | 183 | ||||||

| Other | 576 | 641 | ||||||

|

|

|

|

|

|

||||

| Total cost of goods sold and expenses | 18,161 | 19,222 | ||||||

|

|

|

|

|

|

||||

| 1 | Significant expenses include: supplies, energy, fuel, purchases of raw material (natural gas – feedstock, sulfur, ammonia and reagents) and product for resale (crop nutrients and protection products, and seed). |

| 2 | Includes employee benefits and share–based compensation. In 2018, employee costs also include a $157 gain on curtailment of defined benefit pension and other post-retirement benefit plans (“Defined Benefit Plans Curtailment Gain”) as described in Note 23. |

| 3 | Includes $190 and $102 (2018 – $160 and $90) relating to Saskatchewan potash production tax and Saskatchewan resource surcharge and other, respectively, as required under Saskatchewan provincial legislation. |

| 4 | Includes expenses relating to operating leases in 2018. |

| 5 | In 2019, includes lease expense relating to short-term leases, leases of low-value and variable lease payments. |

Note 6 Share-Based Compensation

We have share-based compensation plans (including those assumed from PotashCorp and Agrium) for eligible employees and directors as part of their remuneration package, including Stock Options, Performance Share Units (“PSUs”), Restricted Share Units (“RSUs”) and Deferred Share Units (“DSUs”).

Accounting Policies, Estimates and Judgments

| 90 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 6 Share-Based Compensation Continued

Supporting Information

The following summarizes the Nutrien share-based compensation plans, under which we have awards available to be granted, and the assumed legacy plans of PotashCorp and Agrium, under which no awards will be granted.

| Plan Features |

Stock Options |

PSUs |

RSUs |

DSUs |

SARs/TSARs 4 | |||||

| Eligibility |

Officers and eligible employees |

Officers and eligible employees |

Eligible employees |

Non-executive directors |

Awards no longer granted; legacy awards only | |||||

|

|

|

|

|

|

| |||||

| Granted |

Annually |

Annually |

Annually |

At the discretion of the Board of Directors |

Awards no longer granted; legacy awards only | |||||

|

|

|

|

|

|

| |||||

| Vesting Period |

25% per year over four years 1 |

On third anniversary of grant date based on total shareholder return over a three-year performance cycle, compared to average total shareholder return of a peer group of companies over the same period |

On third anniversary of grant date and are not subject to performance conditions |

Fully vest upon grant |

25% per year over four years | |||||

|

|

|

|

|

|

| |||||

| Maximum Term |

10 years |

Not applicable |

Not applicable |

Not applicable |

10 years | |||||

|

|

|

|

|

|

| |||||

| Settlement |

Shares |

Cash / Shares 2 |

Cash |

Cash 3 |

Cash | |||||

|

|

|

|

|

|

|

| 1 | Under the assumed legacy PotashCorp long-term incentive and performance option plan, stock options vest on the third anniversary of the grant date. |

| 2 | Under the assumed legacy PotashCorp long-term incentive plan, PSUs will be settled in shares for grantees who are subject to our share ownership guidelines and in cash for all other grantees. |

| 3 | Based on the common share price at the time of the director’s departure from the Board of Directors. |

| 4 | Under the assumed legacy Agrium stock appreciation rights (“SARs”) plan, holders of tandem stock appreciation rights (“TSARs”) have the ability to choose between (a) receiving in cash the price of our shares on the date of exercise in excess of the exercise price of the right or (b) receiving common shares by paying the exercise price of the right. Our past experience and future expectation is that substantially all TSAR holders will elect to choose the first option. |

The weighted average fair value of stock options granted was estimated as of the date of the grant using the Black-Scholes-Merton option-pricing model. The weighted average grant date fair value of stock options per unit granted in 2019 was $11.27 (2018 – $9.71). The weighted average assumptions by year of grant that impacted current year results are as follows:

| Year of Grant | ||||||||||

| Assumptions |

Based On |

2019 | 2018 | |||||||

| Exercise price per option | Quoted market closing price 1 |

53.54 | 44.50 | |||||||

| Expected annual dividend yield (%) | Annualized dividend rate 2 |

3.22 | 3.58 | |||||||

| Expected volatility (%) | Historical volatility 3 |

27 | 29 | |||||||

| Risk-free interest rate (%) | Zero-coupon government issues 4 |

2.55 | 2.79 | |||||||

| Average expected life of options (years) | Historical experience |

7.5 | 7.5 | |||||||

|

|

|

|

|

|

|

|||||

| 1 | Of common shares on the last trading day immediately preceding the date of the grant. |

| 2 | As of the date of grant. |

| 3 | Of the Company’s share over a period commensurate with the expected life of the option. |

| 4 | Implied yield available on equivalent remaining term at the time of the grant. |

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 91 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 6 Share-Based Compensation Continued

A summary of the status of our stock option plans as at December 31, 2019 and 2018 and changes during the years ending on those dates is as follows:

| Number of Shares Subject to Option | Weighted Average Exercise Price | |||||||||||||||

|

|

2019 | 2018 | 2019 | 2018 | ||||||||||||

| Balance – beginning of year | 9,044,237 | 9,947,583 | 58.41 | 69.54 | ||||||||||||

| Granted | 1,376,533 | 1,875,162 | 53.54 | 44.50 | ||||||||||||

| Exercised | (451,574 | ) | (647,331 | ) | 42.73 | 42.86 | ||||||||||

| Forfeited or cancelled | (502,016 | ) | (1,793,077 | ) | 86.53 | 82.84 | ||||||||||

| Expired | (275,700 | ) | (338,100 | ) | 76.59 | 154.94 | ||||||||||

|

|

|

|

|

|

||||||||||||

| Outstanding – end of year | 9,191,480 | 9,044,237 | 56.88 | 58.41 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

The aggregate grant-date fair value of all stock options granted during 2019 was $16. The average share price during 2019 was $50.91 per share.

The following table summarizes information about our stock options outstanding as at December 31, 2019 with expiry dates ranging from May 2020 to February 2029:

| Options Outstanding | Options Exercisable | |||||||||||||||||||

| Range of Exercise Prices |

Number | Weighted Average Remaining Life in Years |

Weighted Average Exercise Price |

Number | Weighted Average Exercise Price |

|||||||||||||||

| $37.84 to $40.23 | 1,345,235 | 6 | 38.21 | 1,170,022 | 38.26 | |||||||||||||||

| $40.24 to $45.40 | 1,934,844 | 7 | 43.61 | 1,067,346 | 42.88 | |||||||||||||||

| $45.41 to $49.51 | 1,371,872 | 7 | 46.46 | 788,169 | 46.38 | |||||||||||||||

| $49.52 to $52.75 | 912,183 | 5 | 51.96 | 912,183 | 51.96 | |||||||||||||||

| $52.76 to $77.62 | 1,814,520 | 8 | 58.58 | 574,542 | 69.47 | |||||||||||||||

| $77.63 to $130.78 | 1,812,826 | 3 | 93.56 | 1,812,826 | 93.56 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| 9,191,480 | 6 | 56.88 | 6,325,088 | 60.71 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Information for all employee and Director share-based compensation plans is summarized below:

| Compensation Expense (Recovery) | ||||||||||||||||

|

|

Units Granted in 2019 |

Units Outstanding as at December 31, 2019 |

2019 | 2018 | ||||||||||||

| Stock Options | 1,376,533 | 9,191,480 | 19 | 23 | ||||||||||||

| PSUs | 719,330 | 1,834,984 | 65 | 83 | ||||||||||||

| RSUs | 425,082 | 986,756 | 18 | 14 | ||||||||||||

| DSUs | 50,958 | 434,093 | 2 | – | ||||||||||||

| SARs | – | 1,750,169 | – | (4 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| 104 | 116 | |||||||||||||||

|

|

|

|

|

|

||||||||||||

|

|

2019 | 2018 | ||||||

| Merger and related costs | 82 | 170 | ||||||

| Acquisition and integration related costs | 16 | – | ||||||

| Foreign exchange loss (gain), net of related derivatives | 42 | (10 | ) | |||||

| Earnings of equity-accounted investees | (66 | ) | (40 | ) | ||||

| Bad debts | 24 | 26 | ||||||

| Defined Benefit Plans Curtailment Gain (Note 23) | – | (157 | ) | |||||

| Other expenses | 56 | 54 | ||||||

|

|

|

|

|

|

||||

| 154 | 43 | |||||||

|

|

|

|

|

|

||||

| 92 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

|

|

2019 | 2018 | ||||||

| Interest expense | ||||||||

| Short-term debt |

87 | 129 | ||||||

| Long-term debt |

387 | 372 | ||||||

| Lease liabilities (Note 21) |

34 | – | ||||||

| Unwinding of discount on asset retirement obligations (Note 24) | 54 | 51 | ||||||

| Interest on net defined benefit pension and other post-retirement plan obligations (Note 23) | 15 | 15 | ||||||

| Borrowing costs capitalized to property, plant and equipment | (18 | ) | (12 | ) | ||||

| Interest income | (5 | ) | (17 | ) | ||||

|

|

|

|

|

|

||||

| 554 | 538 | |||||||

|

|

|

|

|

|

||||

Borrowing costs capitalized to property, plant and equipment in 2019 were calculated by applying an average capitalization rate of 4.6 percent (2018 – 4.4 percent) to expenditures on qualifying assets.

Accounting Policies, Estimates and Judgments

We operate in a specialized industry and in several tax jurisdictions. As a result, our earnings are subject to various rates of taxation. Taxation on items recognized in the consolidated statements of earnings, other comprehensive income (“OCI”) or contributed surplus is recognized in the same location as those items.

Taxation on earnings (loss) is comprised of current and deferred income tax.

| Current income tax is |

Deferred income tax is | |

| • the expected tax payable on the taxable earnings for the year,

• calculated using rates enacted or substantively enacted at the dates of the consolidated balance sheets in the countries where our subsidiaries and equity-accounted investees operate and generate taxable earnings, and

• inclusive of any adjustment to income tax payable or recoverable in respect of previous years.

|

• recognized using the liability method,

• based on temporary differences between carrying amounts of assets and liabilities and their respective income tax bases, and

• determined using tax rates that have been enacted or substantively enacted by the dates of the consolidated balance sheets and are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled.

| |

|

|

|

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 93 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 9 Income Taxes Continued

Income tax assets and liabilities are offset when

| Current income taxes |

Deferred income taxes | |

| • we have a legally enforceable right to offset the recognized amounts 1, and

• the intention to settle on a net basis or realize the asset and settle the liability simultaneously. |

• we have a legally enforceable right to set off current tax assets against current tax liabilities, and

• they relate to income taxes levied by the same taxation authority on either: 1) the same taxable entity; or 2) different taxable entities intending to settle current tax liabilities and assets on a net basis, or realize assets and settle liabilities simultaneously in each future period. 2 | |

|

|

|

| 1 | For income taxes levied by the same taxation authority and the authority permits us to make or receive a single net payment or receipt. |

| 2 | In which significant amounts of deferred tax liabilities or assets expected are to be settled or recovered. |

Supporting Information

Income Taxes included in Net Earnings (Loss) from Continuing Operations

The provision for income taxes differs from the amount that would have resulted from applying the Canadian statutory income tax rates to earnings (loss) before income taxes as follows:

|

|

2019 | 2018 | ||||||

| Earnings (loss) before income taxes | ||||||||

| Canada |

765 | (1,195 | ) | |||||

| United States |

315 | 619 | ||||||

| Australia |

27 | 96 | ||||||

| Trinidad |

(28 | ) | 98 | |||||

| Other |

229 | 258 | ||||||

|

|

|

|

|

|

||||

| 1,308 | (124 | ) | ||||||

|

|

|

|

|

|

||||

| Canadian federal and provincial statutory income tax rate (%) | 27 | 27 | ||||||

|

|

|

|

|

|

||||

| Income tax at statutory rates | 353 | (33 | ) | |||||

| Adjusted for the effect of: | ||||||||

| Impact of foreign tax rates |

(45 | ) | (58 | ) | ||||

| Non-taxable income |

(19 | ) | (10 | ) | ||||

| Production-related deductions |

(17 | ) | (15 | ) | ||||

| Foreign accrual property income |

18 | 15 | ||||||

| Impact of tax rate changes |

16 | – | ||||||

| Other |

10 | 8 | ||||||

|

|

|

|

|

|

||||

| Income tax expense (recovery) included in net earnings (loss) from continuing operations | 316 | (93 | ) | |||||

|

|

|

|

|

|

||||

| 94 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 9 Income Taxes Continued

Total income tax expense (recovery), included in net earnings (loss) from continuing operations, was comprised of the following:

| 2019 | 2018 | |||||||

|

|

|

|

|

|

||||

| Current income tax | ||||||||

| Tax expense for current year |

161 | 195 | ||||||

| Adjustments in respect of prior years |

(22 | ) | (15 | ) | ||||

|

|

|

|

|

|

||||

| Total current income tax expense | 139 | 180 | ||||||

|

|

|

|

|

|

||||

| Deferred income tax | ||||||||

| Origination and reversal of temporary differences |

152 | (283 | ) | |||||

| Adjustments in respect of prior years |

9 | 12 | ||||||

| Impact of tax rate changes |

16 | – | ||||||

| Other |

– | (2 | ) | |||||

|

|

|

|

|

|

||||

| Total deferred income tax expense (recovery) | 177 | (273 | ) | |||||

|

|

|

|

|

|

||||

| Income tax expense (recovery) included in net earnings (loss) from continuing operations | 316 | (93 | ) | |||||

|

|

|

|

|

|

||||

Income Tax Balances

Income tax balances within the consolidated balance sheets as at December 31 were comprised of the following:

| Income Tax Assets and Liabilities |

Balance Sheet Location |

2019 | 2018 | |||||||

| Current income tax assets | ||||||||||

| Current |

Receivables (Note 13) |

104 | 248 | |||||||

| Long-term |

Other assets (Note 18) |

36 | 36 | |||||||

| Deferred income tax assets | Other assets (Note 18) |

249 | 216 | |||||||

|

|

|

|

|

|

|

|||||

| Total income tax assets | 389 | 500 | ||||||||

|

|

|

|

|

|

|

|||||

| Current income tax liabilities | ||||||||||

| Current |

Payables and accrued charges (Note 22) |

43 | 47 | |||||||

| Non-current |

Other non-current liabilities |

44 | 64 | |||||||

| Deferred income tax liabilities | Deferred income tax liabilities |

3,145 | 2,907 | |||||||

|

|

|

|

|

|

|

|||||

| Total income tax liabilities | 3,232 | 3,018 | ||||||||

|

|

|

|

|

|

|

|||||

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 95 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 9 Income Taxes Continued

Deferred Income Taxes

In respect of each type of temporary difference, unused tax loss and unused tax credit, the amounts of deferred tax assets and liabilities recognized in the consolidated balance sheets as at December 31 and the amount of the deferred tax expense (recovery) recognized in net earnings (loss) from continuing operations were:

| Deferred Income Tax (Assets) Liabilities |

Deferred Income Tax Expense (Recovery) Recognized in Net Earnings (Loss) |

|||||||||||||||

|

|

2019 | 2018 | 2019 | 2018 | ||||||||||||

| Deferred income tax assets | ||||||||||||||||

| Asset retirement obligations and accrued environmental costs |

(387 | ) | (412 | ) | 25 | 11 | ||||||||||

| Tax loss and other carryforwards |

(270 | ) | (261 | ) | (9 | ) | (198 | ) | ||||||||

| Pension and other post-retirement benefit liabilities |

(145 | ) | (130 | ) | (13 | ) | 44 | |||||||||

| Long-term debt |

(107 | ) | (110 | ) | 3 | 10 | ||||||||||

| Lease liabilities |

(227 | ) | – | 55 | – | |||||||||||

| Receivables |

(51 | ) | (58 | ) | 7 | (3 | ) | |||||||||

| Inventories |

(59 | ) | (54 | ) | (5 | ) | (13 | ) | ||||||||

| Derivatives |

(9 | ) | (17 | ) | 5 | 15 | ||||||||||

| Other assets |

(61 | ) | (57 | ) | 4 | 18 | ||||||||||

| Deferred income tax liabilities | ||||||||||||||||

| Property, plant and equipment |

3,647 | 3,218 | 147 | (132 | ) | |||||||||||

| Goodwill and other intangible assets |

523 | 546 | (58 | ) | (31 | ) | ||||||||||

| Other liabilities |

42 | 26 | 16 | 6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

| 2,896 | 2,691 | 177 | (273 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Reconciliation of net deferred income tax liabilities:

|

|

2019 | 2018 | ||||||

| Balance – beginning of year | 2,691 | 2,187 | ||||||

| Merger and acquisitions (Note 4) | 29 | 776 | ||||||

| Income tax expense (recovery) recognized in net earnings (loss) from continuing operations | 177 | (273 | ) | |||||

| Income tax expense (recovery) recognized in net earnings (loss) from discontinued operations | – | (17 | ) | |||||

| Income tax charge recognized in OCI | 2 | 22 | ||||||

| Other | (3 | ) | (4 | ) | ||||

|

|

|

|

|

|

||||

| Balance – end of year | 2,896 | 2,691 | ||||||

|

|

|

|

|

|

||||

Amounts and expiry dates of unused tax losses and unused tax credits as at December 31, 2019 were:

|

|

Amount | Expiry Date | ||||||

| Unused operating losses | 1,027 | 2020 - Indefinite | ||||||

| Unused capital losses | 829 | Indefinite | ||||||

| Unused investment tax credits | 38 | 2020 - 2038 | ||||||

|

|

|

|

|

|

||||

| 96 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 10 Discontinued Operations

Accounting Policies

Supporting Information

In 2018, our investments in SQM, Israel Chemicals Ltd. (“ICL”) and APC were presented as discontinued operations due to regulatory requirements to dispose of these investments in connection with the Merger.

As of December 31, 2018, we completed all required divestitures and retained no residual interests as outlined below:

| For the year ended December 31, 2018 |

Proceeds 1 | Gain (Loss) on Sale |

Gain (Loss) on Sale Net of Income Taxes |

AOCI | Net Earnings and Retained Earnings |

|||||||||||||||

| Shares in SQM | 5,126 | 4,278 | 3,366 | – | 3,366 | |||||||||||||||

| Shares in ICL | 685 | (19 | ) | (19 | ) | (19 | ) | – | ||||||||||||

| Shares in APC | 501 | 121 | 126 | – | 126 | |||||||||||||||

| Conda Phosphate operations | 98 | – | – | – | – | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Total sale | 6,410 | 2 | 4,380 | 3,473 | (19 | ) | 3,492 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| 1 | Proceeds are net of commissions. |

| 2 | Proceeds of $39 were collected in 2019. |

Net earnings from discontinued operations for the year ended December 31 were as follows:

|

|

2018 | |||

| Gain on disposal of investments in SQM and APC | 4,399 | |||

| Dividend income of SQM, APC and ICL 1 | 156 | |||

| Income tax expense 2 | (951 | ) | ||

|

|

|

|

||

| Net earnings from discontinued operations | 3,604 | |||

|

|

|

|

||

| 1 | Dividend income is included in cash provided by operating activities on the consolidated statements of cash flows, net of tax of $26. |

| 2 | For 2018, income tax expense is comprised of $(912) relating to the disposals of SQM shares, including the repatriation of the net proceeds, and $(39) relating to earnings from discontinued operations ($(18) for the planned repatriation of the remaining excess cash available in Chile, $(26) for the repatriation of dividend income received from SQM and $5 relating to APC). |

Note 11 Net Earnings Per share

|

|

2019 | 2018 | ||||||

| Weighted average number of common shares | 582,269,000 | 624,900,000 | ||||||

| Dilutive effect of stock options | 777,000 | – | 1 | |||||

| Dilutive effect of share-settled PSUs | 56,000 | – | 1 | |||||

|

|

|

|

|

|

||||

| Weighted average number of diluted common shares | 583,102,000 | 624,900,000 | ||||||

|

|

|

|

|

|

||||

| 1 | The diluted weighted average share calculations excluded an additional 658,000 stock options and 137,000 equity-settled PSUs due to their anti-dilutive effect. |

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 97 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 11 Net Earnings Per share Continued

Options excluded from the calculation of diluted net earnings per share due to the option exercise prices being greater than the average market price of common shares were as follows:

|

|

2019 | 2018 | ||||||

| Number of options excluded | 4,539,529 | 5,721,656 | ||||||

| Performance option plan years fully excluded | 2010 – 2015 | 2009 – 2015 | ||||||

| Stock option plan years fully excluded | 2015, 2019 | 2015, 2018 | ||||||

|

|

|

|

|

|

||||

Note 12 Financial Instruments and Related Risk Management

Accounting Policies

Financial instruments are classified and measured as follows:

|

|

Fair Value Through Profit

or Loss |

Fair Value Through Other |

Financial Assets and Liabilities

at | |||

| Instrument type |

Cash and cash equivalents and derivatives |

Equity investments not held for trading |

Receivables, short-term debt, payables and accrued charges, long-term debt, other long-term debt instruments | |||

|

|

|

|

| |||

| Measurement |

Fair value |

Fair value |

Amortized cost | |||

|

|

|

|

| |||

| Fair value gains and losses |

Profit or loss |

OCI 2 |

– | |||

|

|

|

|

| |||

| Interest and dividends |

Profit or loss |

Profit or loss |

Profit or loss: effective interest rate | |||

|

|

|

|

| |||

| Impairment of assets |

– |

– |

Profit or loss | |||

|

|

|

|

| |||

| Foreign exchange |

Profit or loss |

OCI |

Profit or loss | |||

|

|

|

|

| |||

| Transaction costs |

Profit or loss |

OCI |

Included in cost of instrument | |||

|

|

|

|

|

| 1 | Amortized cost is applied if the objective of the business model for the instrument or group of instruments is to hold the asset to collect the contractual cash flows and the contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest. |

| 2 | For equity investments not held for trading, we may make an irrevocable election at initial recognition to recognize changes in fair value through OCI rather than profit or loss. |

| 98 | Nutrien Annual Report 2019 | In millions of US dollars except as otherwise noted |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 12 Financial Instruments and Related Risk Management Continued

Supporting Information

Credit Risk

Our exposure to credit risk on our cash and cash equivalents, receivables (excluding taxes) and derivative instrument assets is the carrying amount of each instrument on the consolidated balance sheets.

Maximum exposure to credit risk as at December 31:

|

|

2019 | 2018 | ||||||

| Cash and cash equivalents |

671 | 2,314 | ||||||

| Receivables 1 |

3,438 | 3,094 | ||||||

| Other current assets – derivatives |

5 | 5 | ||||||

|

|

|

|

|

|

||||

| 4,114 | 5,413 | |||||||

|

|

|

|

|

|

||||

| 1 | Excluding income tax receivable. |

Credit risk is managed through policies applicable to the following assets:

|

|

Acceptable Minimum Counterparty Credit Ratings |

Exposure Thresholds by Counterparty |

Daily Counterparty Settlement Based on Prescribed Credit Thresholds |

Counterparties to Contracts are Investment-Grade Quality |

||||||

| Cash and Cash Equivalents |

X | X | ||||||||

| Natural Gas Derivatives |

X | X | X | |||||||

| Foreign Currency Derivatives |

X | |||||||||

|

|

|

|

|

|

|

|||||

| In millions of US dollars except as otherwise noted | Nutrien Annual Report 2019 | 99 |

| Overview | Management’s Discussion & Analysis | Two Year Highlights | Financial Statements |

Other Information |

Note 12 Financial Instruments and Related Risk Management Continued

The table below outlines our available credit facilities as at December 31, 2019:

|

|

Total Amount |

Amount Outstanding and Committed |

Amount Available |

|||||||||

| Unsecured revolving term credit facility 1 |

4,500 | 650 | 3,850 | |||||||||

| Uncommitted revolving demand facility |

500 | – | 500 | |||||||||

| Other credit facilities |