CORPORATE RESPONSIBILITY REPORT 20 24 ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

TABLE OF CONTENTS Introduction Letter from Our CEO and Our Chairman............................03 EPRT Overview EPRT Business Overview.................................................................05 Business History and Approach.................................................06 Tenant Industry Diversification..................................................07 Portfolio Geographic Exposure..................................................08 Top 10 Tenant Concentration......................................................09 Our Investment Strategy................................................................10 Stockholder Engagement...............................................................11 Our ESG Strategy..................................................................................13 2024 ESG Highlights...........................................................................14 Governance Board Composition.............................................................................16 Recognition & Awards.......................................................................17 ESG Oversight.........................................................................................18 Committees of the Board...............................................................19 Corporate Governance Policies..................................................20 Risk Management and Strategy................................................21 Cybersecurity..........................................................................................22 ESG Oversight Committees..........................................................23 About this Report and Indices About this Report.................................................................................40 SASB Indices............................................................................................41 TCFD Indices............................................................................................44 Social Our Employees......................................................................................33 Diversity and Inclusion.....................................................................34 Human Capital Management.....................................................35 Employee Development & Enhancement.........................36 Employee Benefits & Retention.................................................37 Community Impact............................................................................38 Environmental Environmental Stewardship.........................................................25 Reducing Our Operational Footprint.....................................26 Climate Preparedness.......................................................................27 Green Leasing.........................................................................................28 Tenant Spotlight: Super Star Car Wash................................29 Sustainability Partnership..............................................................30 2024 Partnership Progress.............................................................31 2024 Corporate Responsibility Report (1) (1) All financial and other data as of December 31, 2024

August Peter M. Mavoides President and CEO A LETTER FROM OUR CEO AND OUR CHAIRMAN Scott A. Estes Chairman of the Board of Directors 2024 Corporate Responsibility Report 03 To our fellow Stakeholders On behalf of our Board of Directors ( the “Board”) and our dedicated team at Essential Properties Realty Trust, Inc. (‘EPRT’ or ‘the Company’), we are pleased to present EPRT’s 2024 Corporate Responsibility Report for the year ended December 31, 2024 (the ‘2024 Report’). Our 2024 Report aims to provide our stakeholders with a thorough review of our positions and policies associated with Environmental, Social and Governance (‘ESG’) matters and present our progress to date on the key initiatives we are pursuing to execute our ESG strategy. Our Commitment: Rooted in Who We are as a Company We take our responsibilities to all of our stakeholders, including our stockholders, employees, tenants, and business relationships, very seriously. The foundation of our commitment to all of our stakeholders is conducting the Company’s business in accordance with the highest ethical standards. The character of our Company is rooted in our recognition that we are trusted stewards of our stockholder’s capital. We are also committed to providing our employees with a rewarding and dynamic work environment. We believe that responsible and effective corporate governance, a positive corporate culture, good corporate citizenship, and the promotion of sustainability initiatives are critical to our ability to create long-term stockholder value. Governance: Representing our Stockholder’s interests The cornerstone of our commitment to our stakeholders is strong corporate governance. We believe that commitment begins with our Board and is evidenced by the policies they adhere to and the practices they employ to promote transparency and accountability. Our Board is diverse and independent. As of December 31, 2024, we had 6 independent directors (out of 7 total) and over 40% of those directors are female. However, the value we place in diversity is not simply determined by gender representation, but by experience and professional qualifications. Strong corporate governance also mandates consistent and effective oversight. Our Nominating and Corporate Governance Committee (the ‘Nom Gov Committee’) of our Board, which is chaired by an independent director, leads the Board’s oversight of risk management matters and our ESG efforts. Our Nom Gov Committee exercises their oversight of our ESG efforts at their regular quarterly meetings. In addition, the Audit Committee of our Board assists the Nom Gov Committee in its oversight role through their oversight of our public reporting compliance. The Board is updated quarterly on our ESG efforts and progress. Environmental: Relationships Matter Our strategy for investing in single-tenant net lease commercial retail properties is differentiated from the majority of our peers in that we are focused on middle market operators in service and experience-based industries. A critical component of our strategy is to be the preferred provider of equity capital to our tenants, monetizing their real estate and helping them achieve their strategic goals. Our role as a capital provider is predicated on the establishment of a relationship with the operator and the development of trust in that relationship based on our reliability as a counterparty. We are pursuing initiatives that seek to expand the use of energy-efficient equipment at our properties, which promotes our tenant relationships, presents our tenants with potential operating cost efficiencies and, enhances their customer attraction opportunities. Our goal is to make a meaningful impact on the utilization of sustainability enhancements in our portfolio. Social: Our employees are EPRT Like our Board, our talented team of employees represent a diverse group of professionals. We capitalize on our diversity by encouraging innovative thinking, creating a work environment that encourages our employees to actively participate in executing our business and encouraging the contribution of their experience, knowledge, and ingenuity in all that we do. We believe an inclusive culture and providing equitable opportunities for our employees to reach their full potential are critical to achieving our goals and the mandate of our stockholders. We are committed to maximizing value for our stockholders and believe it is essential for all of our employees to be aligned in that commitment. For that reason, the annual compensation for all of our employee’s includes the opportunity to receive equity grants pursuant to our equity incentive program. The result is that all of our employees are stockholders in EPRT and therefore are well aligned with all of our other stockholders. Looking Ahead This 2024 Report continues our commitment to disclosure and transparency regarding our ESG efforts. We believe achieving our ESG goals will be a critical component of achieving meaningful AFFO growth and ultimately attractive risk adjusted returns for our stockholders. We are grateful to our fellow stockholders, for their investment in EPRT and the support they have shown us as the stewards of their capital. We are also appreciative of our Board of Directors, for their commitment to EPRT and their support and oversight of our ESG efforts, and to our employees, who are critical to the character and quality of our organization and to our ability to achieve our strategic goals. August 2025

2024 CORPORATE RESPONSIBILITY REPORT EPRT OVERVIEW

Essential Properties EPRT BUSINESS OVERVIEW Essential Properties Realty Trust, Inc. (‘EPRT’) is a triple- net lease REIT headquartered in Princeton, New Jersey with a team of approximatley 50 dedicated and diverse professionals. EPRT acquires, owns, and manages primarily single- tenant properties leased to middle-market companies operating primarily service-oriented and experience- based businesses largely through sale-leaseback transactions. EPRT’s objective is to maximize stockholder value by providing a growing stream of earnings and dividends generated by a portfolio of high-quality, diversified commercial real estate. 2024 Corporate Responsibility Report 05

BUSINESS HISTORY AND APPROACH As of December 31, 2024, 93.2% of our approximately $365 million of annualized base rent (“ABR”) was attributable to properties operated by tenants in service-oriented and experience-based businesses. In 2024, we completed $1.2 billion of gross investments in 297 properties in 145 transactions at a weighted average cash cap rate of 8.0%, the highest level of annual gross investments in the Company’s history. Our primary business objective is to maximize shareholder value by generating attractive, risk- adjusted returns through the acquisition, ownership, management, and growth of a diversified portfolio of commercially desirable properties that provides a growing stream of earnings and dividends. We have grown significantly since commencing our operations and investment activities in June 2016. As of December 31, 2024, our portfolio consisted of 2,104 properties. All properties in our portfolio were underwritten and invested in by our management team and demonstrate the following key investment characteristics: DIVERSIFIED PORTFOLIO Our portfolio includes 413 diverse tenants operating in 592 different concepts, across 16 industries and in 49 states. Our intent is that, over time, no more than 5% of our ABR will be derived from any single tenant or more than 1% of our ABR from any single property. LONG LEASE TERM Our properties generally are subject to long-term net leases, as evident by our 14.0 year weighted average lease term that we believe provides us with a stable base of revenue from which to grow our portfolio. SIGNIFICANT USE OF MASTER LEASES We use a master lease structure across a large percent of our annualized base rent. The master lease structure spreads our investment risk across multiple properties. We believe it reduces our exposure to operating and renewal risk at any one property and promotes efficient asset management. CONTRACTUAL BASE RENT ESCALATION Our rent escalation provisions provide contractually-specified incremental yield on our investments and provide a degree of protection from inflation or a rising interest rate environment. SMALLER, LOW BASIS SINGLE-TENANT PROPERTIES We believe investing in freestanding “small-box” single-tenant properties allows us to grow our portfolio without concentrating a large amount of capital in individual properties. HEALTHY RENT COVERAGE RATIO AND TENANT FINANCIAL REPORTING Our tenants are obligated to periodically provide us with specified unit-level financial reporting. 2024 Corporate Responsibility Report 06

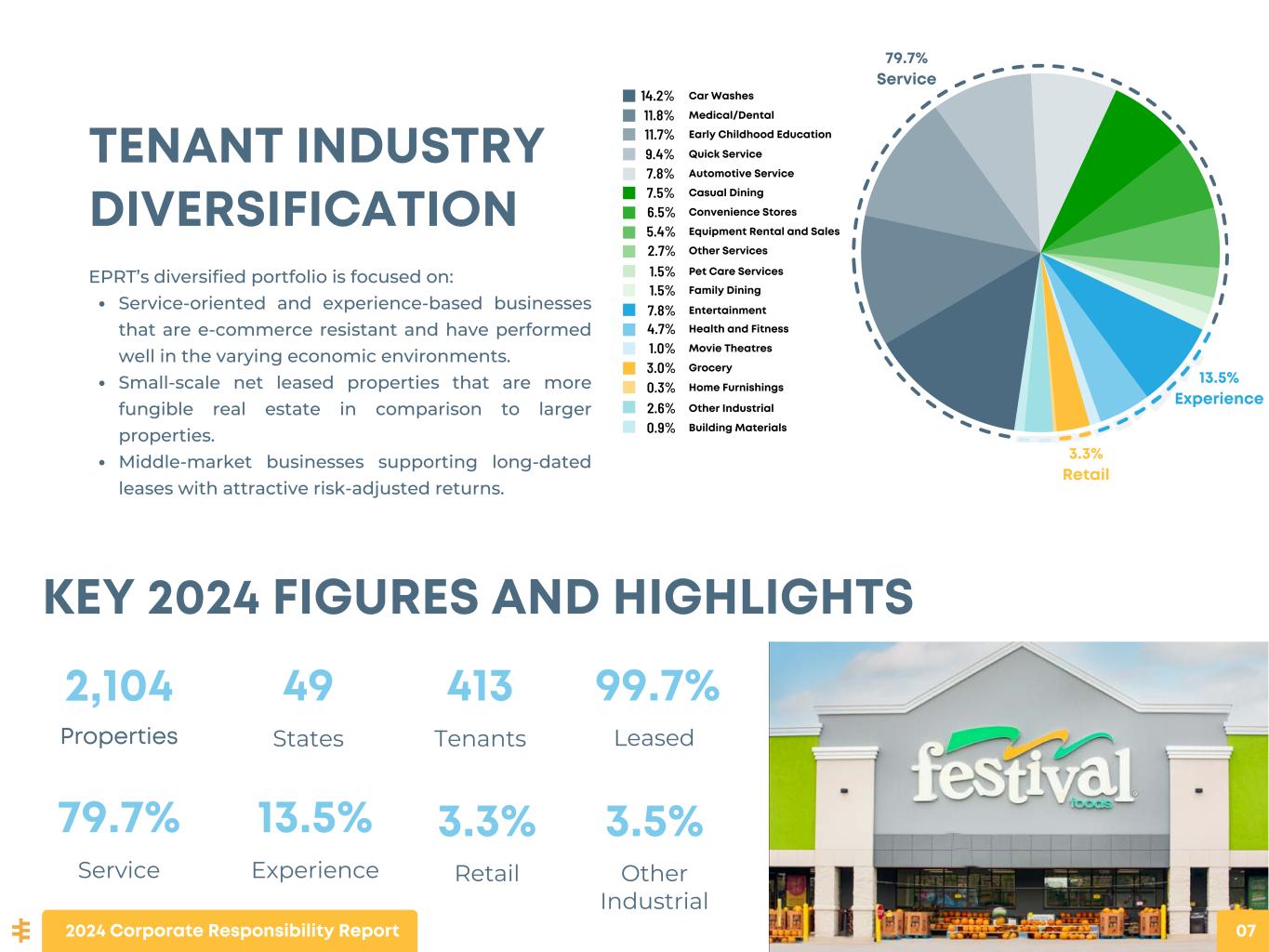

79.7% Service 13.5% Experience Medical/Dental Early Childhood Education Quick Service Automotive Service Casual Dining Convenience Stores Equipment Rental and Sales Other Services Pet Care Services Family Dining Entertainment Health and Fitness Movie Theatres Grocery Home Furnishings Other Industrial Building Materials 3.3% Retail 14.2% 11.8% 11.7% 9.4% 7.8% 7.5% 6.5% 5.4% 2.7% 1.5% 1.5% 7.8% 4.7% 1.0% 3.0% 0.3% 2.6% 0.9% Other Industrial 3.5% TENANT INDUSTRY DIVERSIFICATION EPRT’s diversified portfolio is focused on: Service-oriented and experience-based businesses that are e-commerce resistant and have performed well in the varying economic environments. Small-scale net leased properties that are more fungible real estate in comparison to larger properties. Middle-market businesses supporting long-dated leases with attractive risk-adjusted returns. KEY 2024 FIGURES AND HIGHLIGHTS *Metrics as of 12/31/2024 Properties 2,104 States 49 Tenants 413 Leased 99.7% Service 79.7% Experience 13.5% Retail 3.3% Car Washes 2024 Corporate Responsibility Report 07

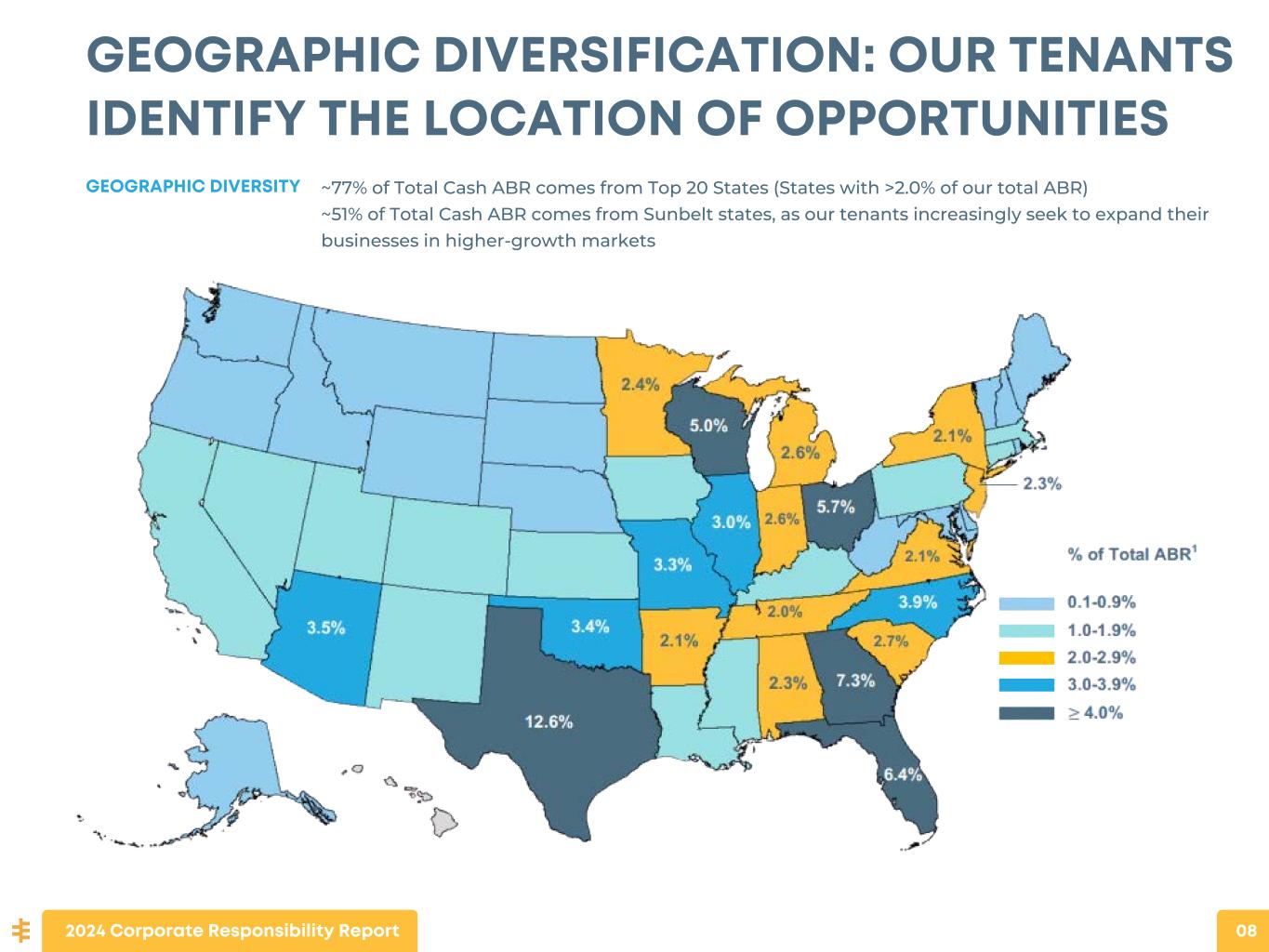

GEOGRAPHIC DIVERSIFICATION: OUR TENANTS IDENTIFY THE LOCATION OF OPPORTUNITIES ~77% of Total Cash ABR comes from Top 20 States (States with >2.0% of our total ABR) ~51% of Total Cash ABR comes from Sunbelt states, as our tenants increasingly seek to expand their businesses in higher-growth markets GEOGRAPHIC DIVERSITY 2024 Corporate Responsibility Report 08

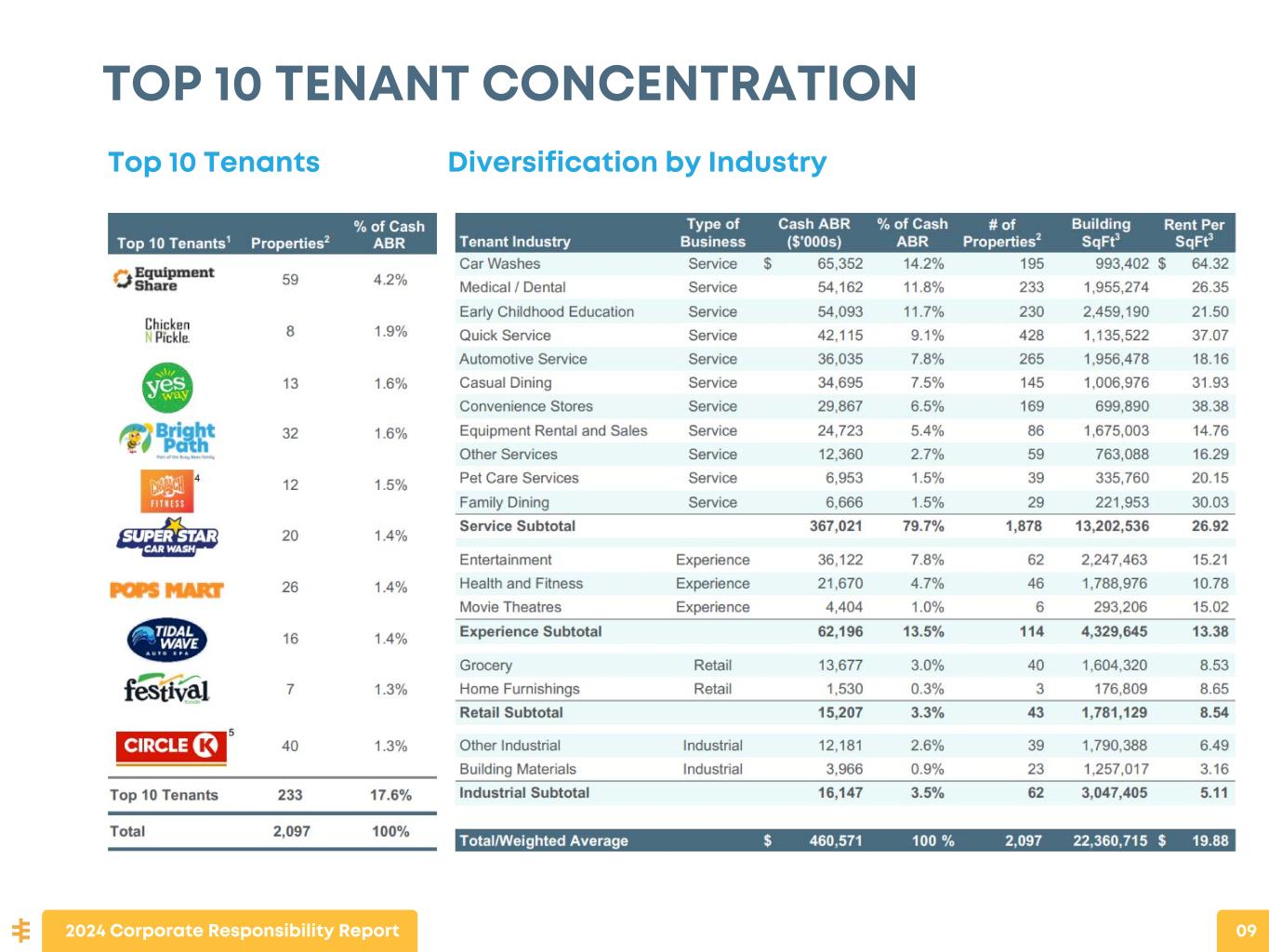

TOP 10 TENANT CONCENTRATION Top 10 Tenants Diversification by Industry 2024 Corporate Responsibility Report 09

We maintain direct relationships with our tenants. By establishing EPRT as the preferred capital partner, we actively seek to leverage our relationships to identify new investment opportunities. Repeat Business Through Existing Relationships Internally Originated Sale- Leaseback Transactions 97.2% 80.5% Tenant Relationships 41.5% OUR INVESTMENT STRATEGY We seek to acquire, own, and manage single-tenant properties that are net leased to middle-market companies operating primarily in service-oriented or experience-based businesses. It is our guiding principle that our properties, leased to tenants in these businesses, are essential to the generation of the tenants’ sales and profits, and that these businesses exhibit favorable growth characteristics and are generally insulated from e- commerce pressure. We have assembled a diversified portfolio using an investment strategy that focuses on properties leased to tenants in businesses such as car washes, medical and dental services, early childhood education, restaurants (including quick service, casual and family dining), automotive services, entertainment, convenience stores, equipment rental and sales, and other service industries. 2024 Corporate Responsibility Report 10

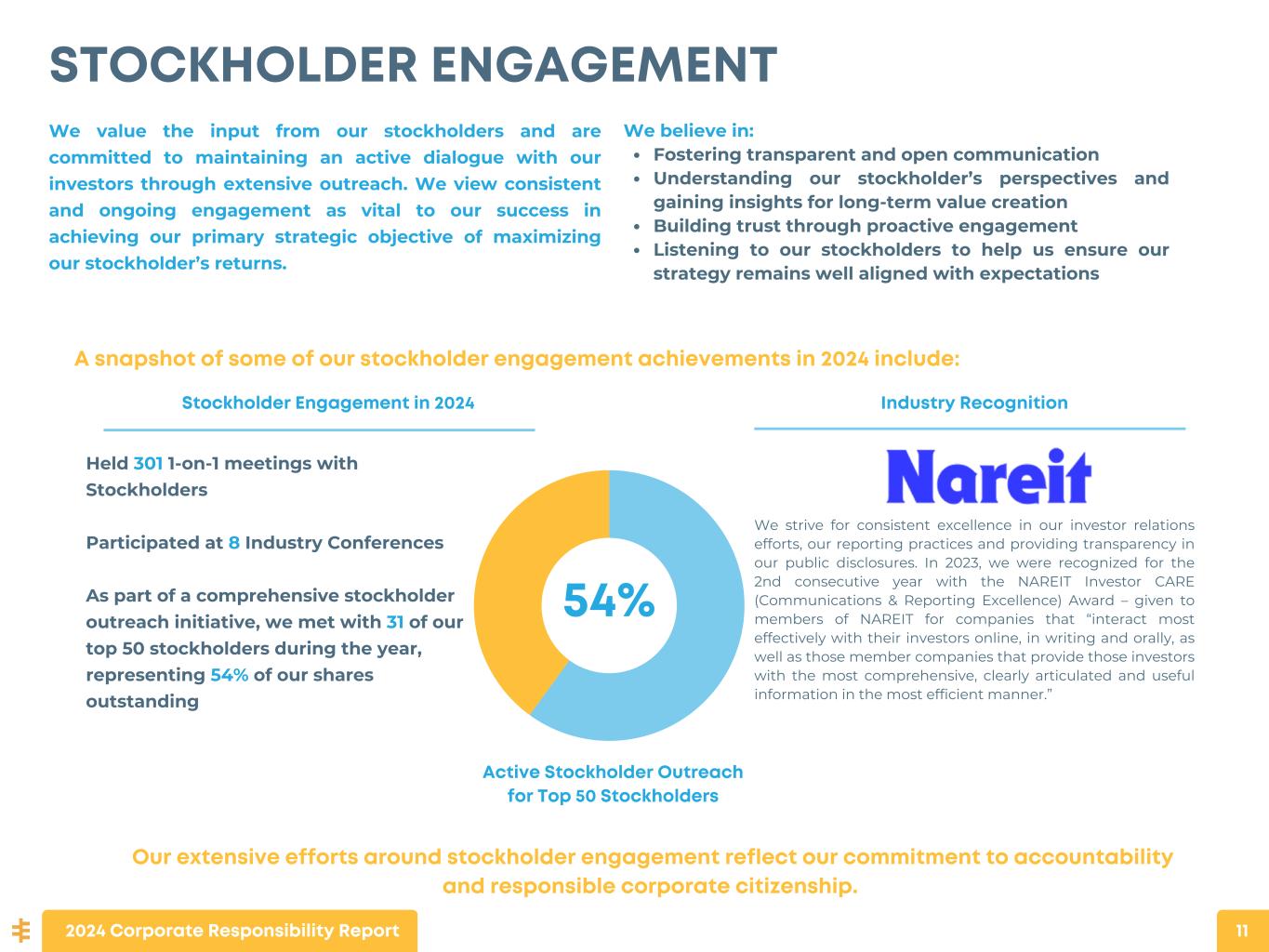

Held 301 1-on-1 meetings with Stockholders Participated at 8 Industry Conferences As part of a comprehensive stockholder outreach initiative, we met with 31 of our top 50 stockholders during the year, representing 54% of our shares outstanding Our extensive efforts around stockholder engagement reflect our commitment to accountability and responsible corporate citizenship. STOCKHOLDER ENGAGEMENT We value the input from our stockholders and are committed to maintaining an active dialogue with our investors through extensive outreach. We view consistent and ongoing engagement as vital to our success in achieving our primary strategic objective of maximizing our stockholder’s returns. 54% We believe in: Fostering transparent and open communication Understanding our stockholder’s perspectives and gaining insights for long-term value creation Building trust through proactive engagement Listening to our stockholders to help us ensure our strategy remains well aligned with expectations A snapshot of some of our stockholder engagement achievements in 2024 include: Stockholder Engagement in 2024 Industry Recognition Active Stockholder Outreach for Top 50 Stockholders We strive for consistent excellence in our investor relations efforts, our reporting practices and providing transparency in our public disclosures. In 2023, we were recognized for the 2nd consecutive year with the NAREIT Investor CARE (Communications & Reporting Excellence) Award – given to members of NAREIT for companies that “interact most effectively with their investors online, in writing and orally, as well as those member companies that provide those investors with the most comprehensive, clearly articulated and useful information in the most efficient manner.” 2024 Corporate Responsibility Report 11

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) We believe that responsible and effective corporate governance, a positive corporate culture, good corporate citizenship, and the promotion of sustainability initiatives are critical to our ability to create long-term stockholder value. Our approach to ESG begins with strong corporate governance. Our position on sustainability is that reducing our carbon footprint and that of our tenants is an important part of our corporate objective. A corporate culture that provides equitable opportunities for our employees is a critical ingredient for our future success. 2024 Corporate Responsibility Report 12

OUR ESG STRATEGY OUR COMMITMENT Reporting We seek to understand the carbon footprint of our portfolio, including our Scope 3 emissions. We have immaterial Scope 1 and 2 emissions. Measurement Perform tenant surveys to increase our engagement with our tenants and understanding of their sustainability goals Engagement Continue to enhance our robust cybersecurity program including using a third-party to facilitate strong risk management efforts Structure We will continue to implement energy efficiency upgrades throughout our portfolio Implementation Maintain strong oversight and visibility over our ESG strategy and initiatives led by our independent and experienced Board Oversight Invest in our employees through benefit programs and incentive structures and continue to promote aligning their interests with our stockholders Equity Continue to ensure that we promote and optomize the diversity of our employee base as a key input to our operations Diversity Maintain annual employee engagement to ensure consistent feedback from our team and understanding of our work environment and where we might improve Inclusion OUR GOALS Accountability and Transparency EPRT is committed to strong corporate governance. As stewards of our stockholder’s capital, we are committed to accountability and transparency with regard to our ESG efforts. Reducing our Carbon Footprint We are dedicated to reducing our carbon footprint by implementing sustainability upgrades and enhancing our portfolio's environmental responsibility and property value. Expanding our Relationship with our Tenants through Sustainability We will continue to implement sustainability upgrades at our properties to positively impact our tenants’ profitability and prospects for success. Our People are EPRT Our diversity is our strength, creating an inclusive work environment is our culture, and all of our employees are stockholders, thus 100% aligned with our fellow stockholders. Publish our Corporate Responsibility Report, aligned with SASB and TCFD indices annually 2024 Corporate Responsibility Report 13

We were named a ‘Champion of Board Diversity’ by the Forum of Executive Women for the fifth year in a row 2023 Silver Winner of Nareit’s Investor CARE Award Recognized with The Executive Women of New Jersey’s (EWNJ) 2023 Corporate Board Gender Diversity Award GOVERNANCE 98% of our new property investments in 2024 are subject to our EPRT Green Lease, consistent with 2023 As of year-end 2024, 63% of our properties and 44% of our portfolio’s ABR were subject to Green Lease clauses We continued to install energy efficiency equipment in 2024 for new tenants added to our Budderfly Sustainability Partnership in the Quick Service Restaurant and Casual Dining industries ENVIRONMENTAL 2024 ESG HIGHLIGHTS 2024 Corporate Responsibility Report 14 We implemented a Family Leave Policy that provides all expectant employees with 14- weeks of fully paid leave, along with full benefit retention and continued 401(k) match We had a 100% retention rate for employees who took Family Leave in 2024 SOCIAL

2024 CORPORATE RESPONSIBILITY REPORT GOVERNANCE

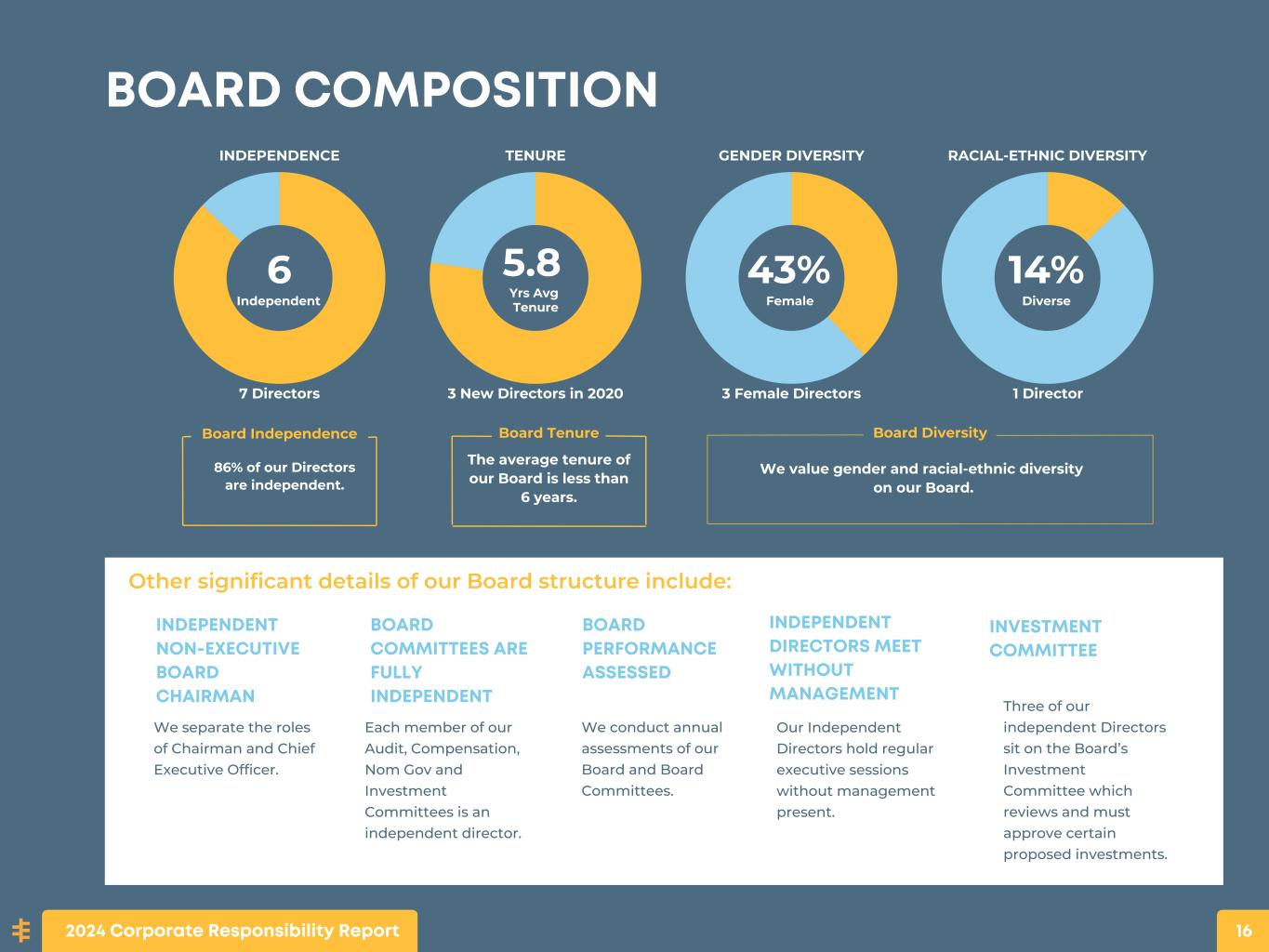

Board Tenure We value gender and racial-ethnic diversity on our Board. Board Diversity Three of our independent Directors sit on the Board’s Investment Committee which reviews and must approve certain proposed investments. 86% of our Directors are independent. Board Independence The average tenure of our Board is less than 6 years. Other significant details of our Board structure include: INDEPENDENT NON-EXECUTIVE BOARD CHAIRMAN We separate the roles of Chairman and Chief Executive Officer. BOARD COMPOSITION 6 Independent 5.8 Yrs Avg Tenure 43% Female 14% Diverse INDEPENDENCE TENURE GENDER DIVERSITY RACIAL-ETHNIC DIVERSITY 7 Directors 3 New Directors in 2020 3 Female Directors 1 Director We conduct annual assessments of our Board and Board Committees. Each member of our Audit, Compensation, Nom Gov and Investment Committees is an independent director. Our Independent Directors hold regular executive sessions without management present. BOARD COMMITTEES ARE FULLY INDEPENDENT BOARD PERFORMANCE ASSESSED INDEPENDENT DIRECTORS MEET WITHOUT MANAGEMENT INVESTMENT COMMITTEE 2024 Corporate Responsibility Report 16

RECOGNITION & AWARDS At EPRT, we believe we have leading governance practices, strong Board diversity, and industry recognized investor engagement and disclosure practices. Essential Properties was recognized with The Executive Women of New Jersey’s (EWNJ) 2023 Corporate Board Gender Diversity Award. The award honors those publicly traded companies in New Jersey that have achieved an impactful level of gender inclusion by appointing 35% or more women to their Board of Directors. We have been named a ‘Champion of Board Diversity’ by the Forum of Executive Women, for companies in the Philadelphia region that have 30% or more women on their respective boards. We have received this honor in 2020, 2021, 2022, 2023, and 2024. 2023 Silver Winner of Investor CARE Award--Nareit’s Investor CARE (Communications & Reporting Excellence) Awards honor those Nareit corporate members that interact most effectively with their investors online, in writing and orally, as well as those member companies that provide those investors with the most comprehensive, clearly articulated and useful information in the most efficient manner. 2024 Corporate Responsibility Report 17

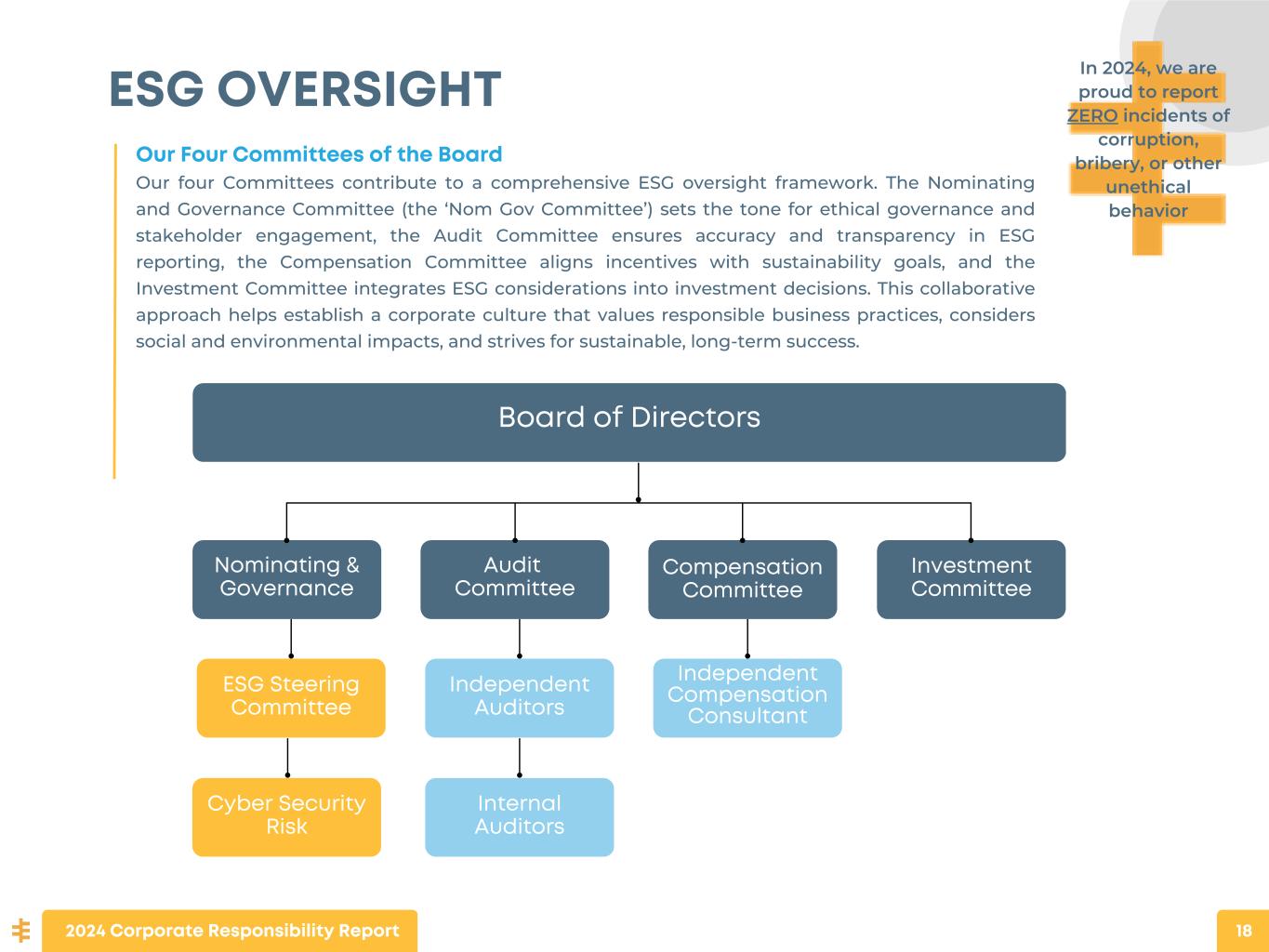

18 ESG OVERSIGHT Board of Directors Audit Committee Nominating & Governance Compensation Committee Investment Committee ESG Steering Committee Cyber Security Risk Independent Auditors Independent Compensation Consultant Our Four Committees of the Board Our four Committees contribute to a comprehensive ESG oversight framework. The Nominating and Governance Committee (the ‘Nom Gov Committee’) sets the tone for ethical governance and stakeholder engagement, the Audit Committee ensures accuracy and transparency in ESG reporting, the Compensation Committee aligns incentives with sustainability goals, and the Investment Committee integrates ESG considerations into investment decisions. This collaborative approach helps establish a corporate culture that values responsible business practices, considers social and environmental impacts, and strives for sustainable, long-term success. In 2024, we are proud to report ZERO incidents of corruption, bribery, or other unethical behavior Internal Auditors 2024 Corporate Responsibility Report 18

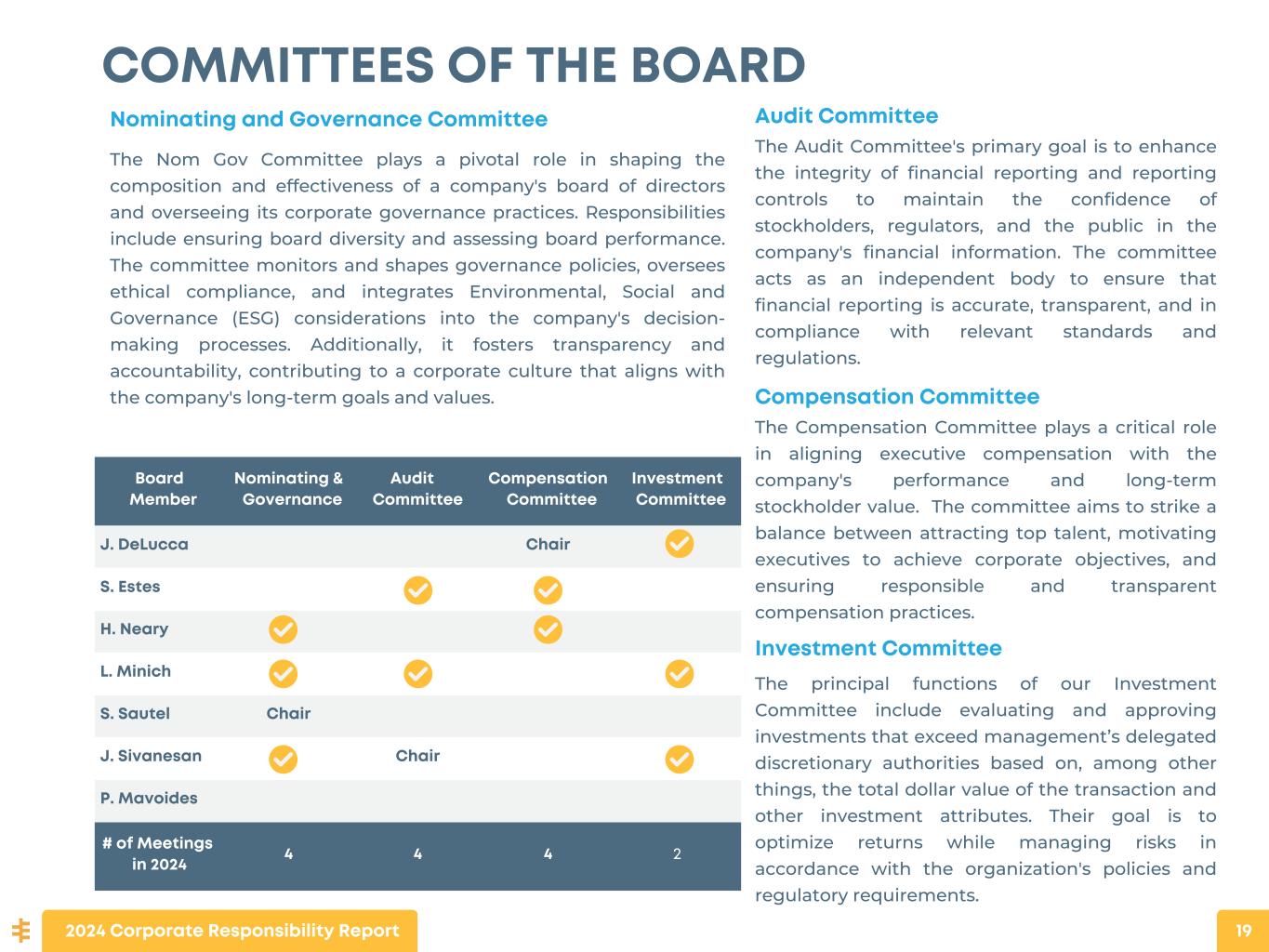

Board Member Nominating & Governance Audit Committee Compensation Committee Investment Committee J. DeLucca Chair S. Estes H. Neary L. Minich S. Sautel Chair J. Sivanesan Chair P. Mavoides # of Meetings in 2024 4 4 4 2 COMMITTEES OF THE BOARD Investment Committee The principal functions of our Investment Committee include evaluating and approving investments that exceed management’s delegated discretionary authorities based on, among other things, the total dollar value of the transaction and other investment attributes. Their goal is to optimize returns while managing risks in accordance with the organization's policies and regulatory requirements. Compensation Committee The Compensation Committee plays a critical role in aligning executive compensation with the company's performance and long-term stockholder value. The committee aims to strike a balance between attracting top talent, motivating executives to achieve corporate objectives, and ensuring responsible and transparent compensation practices. Audit Committee The Audit Committee's primary goal is to enhance the integrity of financial reporting and reporting controls to maintain the confidence of stockholders, regulators, and the public in the company's financial information. The committee acts as an independent body to ensure that financial reporting is accurate, transparent, and in compliance with relevant standards and regulations. Nominating and Governance Committee The Nom Gov Committee plays a pivotal role in shaping the composition and effectiveness of a company's board of directors and overseeing its corporate governance practices. Responsibilities include ensuring board diversity and assessing board performance. The committee monitors and shapes governance policies, oversees ethical compliance, and integrates Environmental, Social and Governance (ESG) considerations into the company's decision- making processes. Additionally, it fosters transparency and accountability, contributing to a corporate culture that aligns with the company's long-term goals and values. 2024 Corporate Responsibility Report 19

CORPORATE GOVERNANCE POLICIES CODE OF BUSINESS CONDUCT AND ETHICS We have adopted business and workplace policies that apply to all of our directors, officers, employees, vendors, and service providers that seek to create a culture that values high ethical standards, including integrity, honesty, transparency, and compliance with applicable laws, rules, and regulations. Each employee is required to renew acknowledgment annually. WHISTLEBLOWER PROTECTION Our “whistleblower” policy allows directors, officers, and employees to file reports on a confidential and anonymous basis regarding issues of impropriety, violations of law, violations of corporate or other policies, or unethical business practices. INSIDER TRADING AND CONFIDENTIALITY POLICY Our Insider Trading & Confidentiality Policy clearly states and confirms the requirements and procedures that employees, members of the Board of Directors, and our subsidiaries and affiliates must follow. Each employee hired by EPRT, as a condition of employment, is required to execute an acknowledgment indicating that they have read this policy, understand its provisions, and will comply with its provisions. HUMAN RIGHTS POLICY Our Human Rights Policy describes how we respect the human rights of all individuals impacted by our operations, including employees, contractors, and external stakeholders. Wherever we operate, we seek to avoid causing or contributing to human rights violations and to facilitate access to remedy. While governments have the primary responsibility to protect against human rights violations, we understand and accept our responsibility to respect human rights. VENDOR CODE OF CONDUCT Our Vendor Code of Conduct affirms our commitment to the highest ethical standards and full compliance with all applicable laws, regulations, and policies. We expect our vendors to uphold similar principles in their own operations. NO HEDGING OR PLEDGING We have policies that prohibit our officers and directors from hedging our stock, and prohibit our directors and executive officers from pledging or otherwise encumbering the shares they own in EPRT as collateral for indebtedness. EXECUTIVE COMPENSATION ‘CLAWBACK’ POLICY IOur policy provides our Board with the ability to recover or cancel incentive-based compensation paid or owed to one or more executive officers. 2024 Corporate Responsibility Report 20

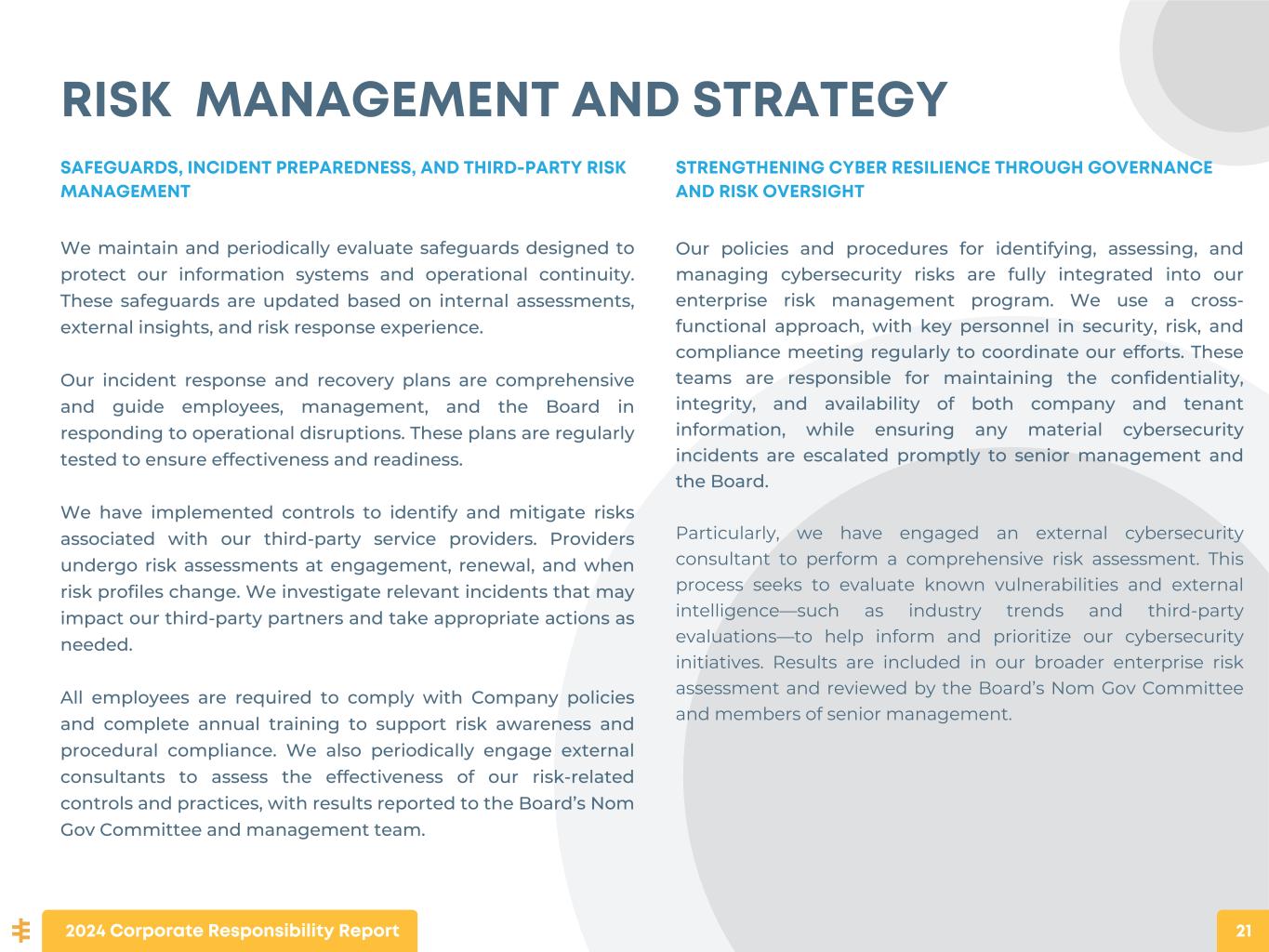

RISK MANAGEMENT AND STRATEGY STRENGTHENING CYBER RESILIENCE THROUGH GOVERNANCE AND RISK OVERSIGHT Our policies and procedures for identifying, assessing, and managing cybersecurity risks are fully integrated into our enterprise risk management program. We use a cross- functional approach, with key personnel in security, risk, and compliance meeting regularly to coordinate our efforts. These teams are responsible for maintaining the confidentiality, integrity, and availability of both company and tenant information, while ensuring any material cybersecurity incidents are escalated promptly to senior management and the Board. Particularly, we have engaged an external cybersecurity consultant to perform a comprehensive risk assessment. This process seeks to evaluate known vulnerabilities and external intelligence—such as industry trends and third-party evaluations—to help inform and prioritize our cybersecurity initiatives. Results are included in our broader enterprise risk assessment and reviewed by the Board’s Nom Gov Committee and members of senior management. 2024 Corporate Responsibility Report 21 SAFEGUARDS, INCIDENT PREPAREDNESS, AND THIRD-PARTY RISK MANAGEMENT We maintain and periodically evaluate safeguards designed to protect our information systems and operational continuity. These safeguards are updated based on internal assessments, external insights, and risk response experience. Our incident response and recovery plans are comprehensive and guide employees, management, and the Board in responding to operational disruptions. These plans are regularly tested to ensure effectiveness and readiness. We have implemented controls to identify and mitigate risks associated with our third-party service providers. Providers undergo risk assessments at engagement, renewal, and when risk profiles change. We investigate relevant incidents that may impact our third-party partners and take appropriate actions as needed. All employees are required to comply with Company policies and complete annual training to support risk awareness and procedural compliance. We also periodically engage external consultants to assess the effectiveness of our risk-related controls and practices, with results reported to the Board’s Nom Gov Committee and management team.

At EPRT, we have taken a proactive approach to managing the evolving landscape associated with cybersecurity and related risks to ensure the protection of our corporate data, our employees’ data, our clients’ data, and other stakeholders’ data. We consider the privacy and protection of our data, as well as our information systems, to be an integral part of our business strategy and planning. We have taken significant steps to improve EPRT’s cybersecurity risk, including: Pursuant to its Charter, our Nom Gov Committee exercises oversight on our cybersecurity risk management, including a quarterly review with management. Our Audit Committee supports the Nom Gov Committee through a quarterly review of cybersecurity disclosure matters. We utilize an outsourced Information Technology Management and Cybersecurity solutions provider. We conducted penetration testing on our IT infrastructure to assess its security and identify potential vulnerabilities. We have enhanced our email filtering software to help mitigate potential cyber attacks (e.g. phishing campaigns). Our IT Management and Cybersecurity solutions provider conducted education and training of our employee base on several cybersecurity risk issues (e.g. social engineering). As part of our overall risk-management framework, we maintain insurance policies designed to help protect the company against a range of potential risks, including those related to cybersecurity. These policies complement our ongoing investments in resources and technology to strengthen systems, processes, and controls, providing an added layer of protection for the company and its stakeholders. We maintain our commitment to investing in resources and capital to address cybersecurity risk management, fulfilling our responsibility as good stewards of the data entrusted to us. CYBERSECURITY In 2024, we are proud to report ZERO material cybersecurity incidents Our Board, our committees, and our management team are actively involved in our overall enterprise risk management program, including assessing, identifying, and managing material risks from cybersecurity threats. 2024 Corporate Responsibility Report 22

ESG OVERSIGHT COMMITTEES ESSENTIAL PROPERTIES HAS AN ACTIVE AND ENGAGED NOMINATING AND CORPORATE GOVERNANCE COMMITTEE The Nom Gov Committee of our Board, which is chaired by an independent director, oversees our efforts to promote environmental stewardship; our responsibilities relating to social issues, including our goals associated with promoting an employee base of diverse experience and backgrounds, incorporating equity in our compensation programs, creating an environment of inclusiveness in our organization, and our strong corporate governance. Our Nom Gov Committee meets at least quarterly and includes, as part of its regular agenda, an evaluation of our objectives associated with ESG matters and our progress in achieving those objectives. In addition, the Audit Committee of our Board assists the Nom Gov Committee through their oversight of our periodic SEC filings, including our Quarterly and Annual Report and our Proxy Statement. The Board is updated quarterly on our ESG efforts and achievements. Our Audit Committee plays an active role in our ESG oversight, monitoring our corporate policies, processes and procedures as a part of their oversight of our compliance with applicable rules and regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”). Our ESG efforts are led by our CEO and CFO, and includes all of our senior management team, as well as our Director of Sustainability. Our ESG efforts focus on: Review the development and implementation of our ESG strategy and action plan Evaluate and monitor progress in achieving our ESG initiatives Review disclosures regarding ESG matters Periodically monitor current and emerging ESG matters that may affect the business, operations, performance, or reputation of EPRT, or are otherwise pertinent to EPRT and its stakeholders 2024 Corporate Responsibility Report 23

2024 CORPORATE RESPONSIBILITY REPORT ENVIRONMENTAL

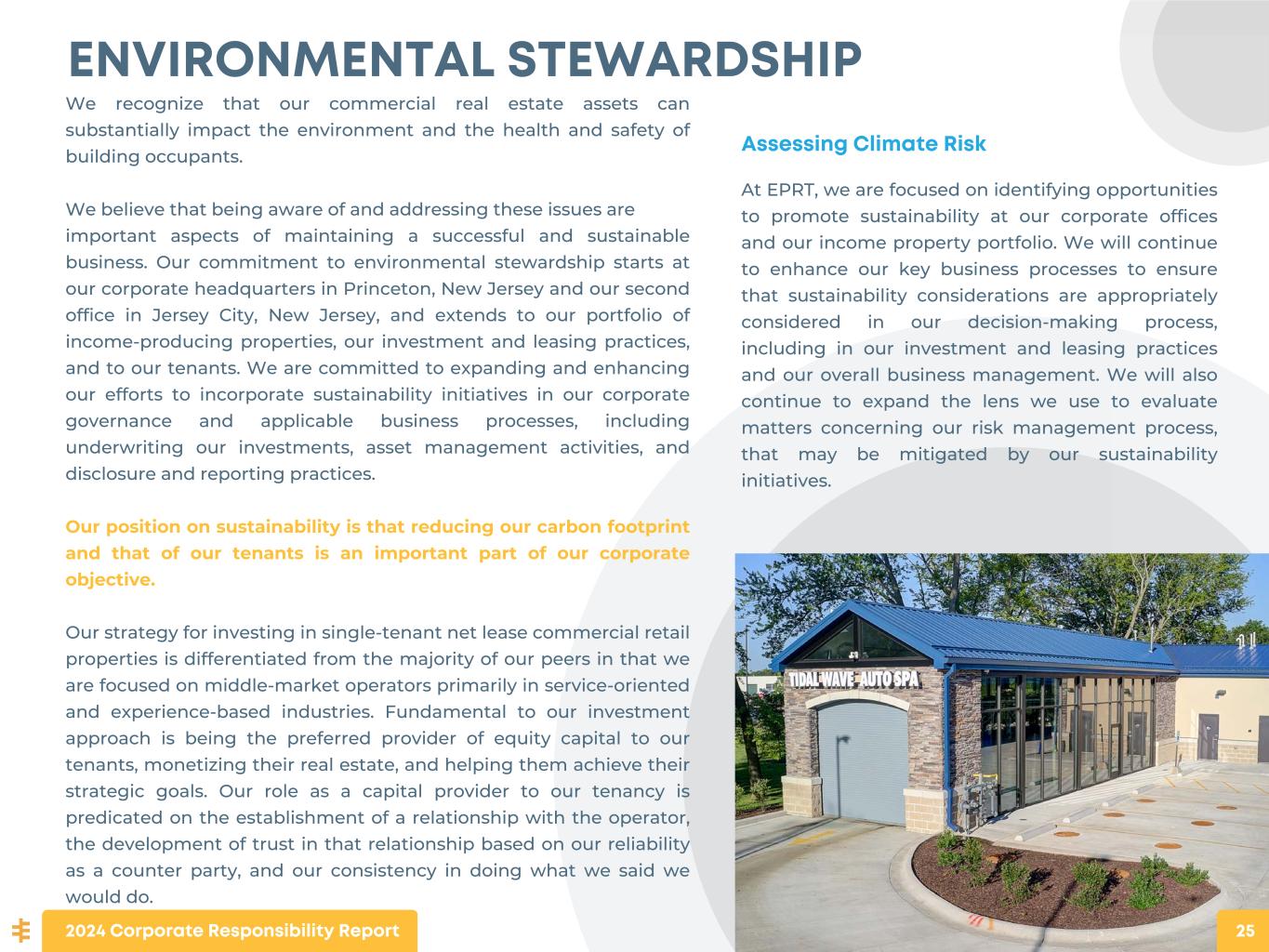

ENVIRONMENTAL STEWARDSHIP We recognize that our commercial real estate assets can substantially impact the environment and the health and safety of building occupants. We believe that being aware of and addressing these issues are important aspects of maintaining a successful and sustainable business. Our commitment to environmental stewardship starts at our corporate headquarters in Princeton, New Jersey and our second office in Jersey City, New Jersey, and extends to our portfolio of income-producing properties, our investment and leasing practices, and to our tenants. We are committed to expanding and enhancing our efforts to incorporate sustainability initiatives in our corporate governance and applicable business processes, including underwriting our investments, asset management activities, and disclosure and reporting practices. Our position on sustainability is that reducing our carbon footprint and that of our tenants is an important part of our corporate objective. Our strategy for investing in single-tenant net lease commercial retail properties is differentiated from the majority of our peers in that we are focused on middle-market operators primarily in service-oriented and experience-based industries. Fundamental to our investment approach is being the preferred provider of equity capital to our tenants, monetizing their real estate, and helping them achieve their strategic goals. Our role as a capital provider to our tenancy is predicated on the establishment of a relationship with the operator, the development of trust in that relationship based on our reliability as a counter party, and our consistency in doing what we said we would do. Assessing Climate Risk At EPRT, we are focused on identifying opportunities to promote sustainability at our corporate offices and our income property portfolio. We will continue to enhance our key business processes to ensure that sustainability considerations are appropriately considered in our decision-making process, including in our investment and leasing practices and our overall business management. We will also continue to expand the lens we use to evaluate matters concerning our risk management process, that may be mitigated by our sustainability initiatives. 2024 Corporate Responsibility Report 25

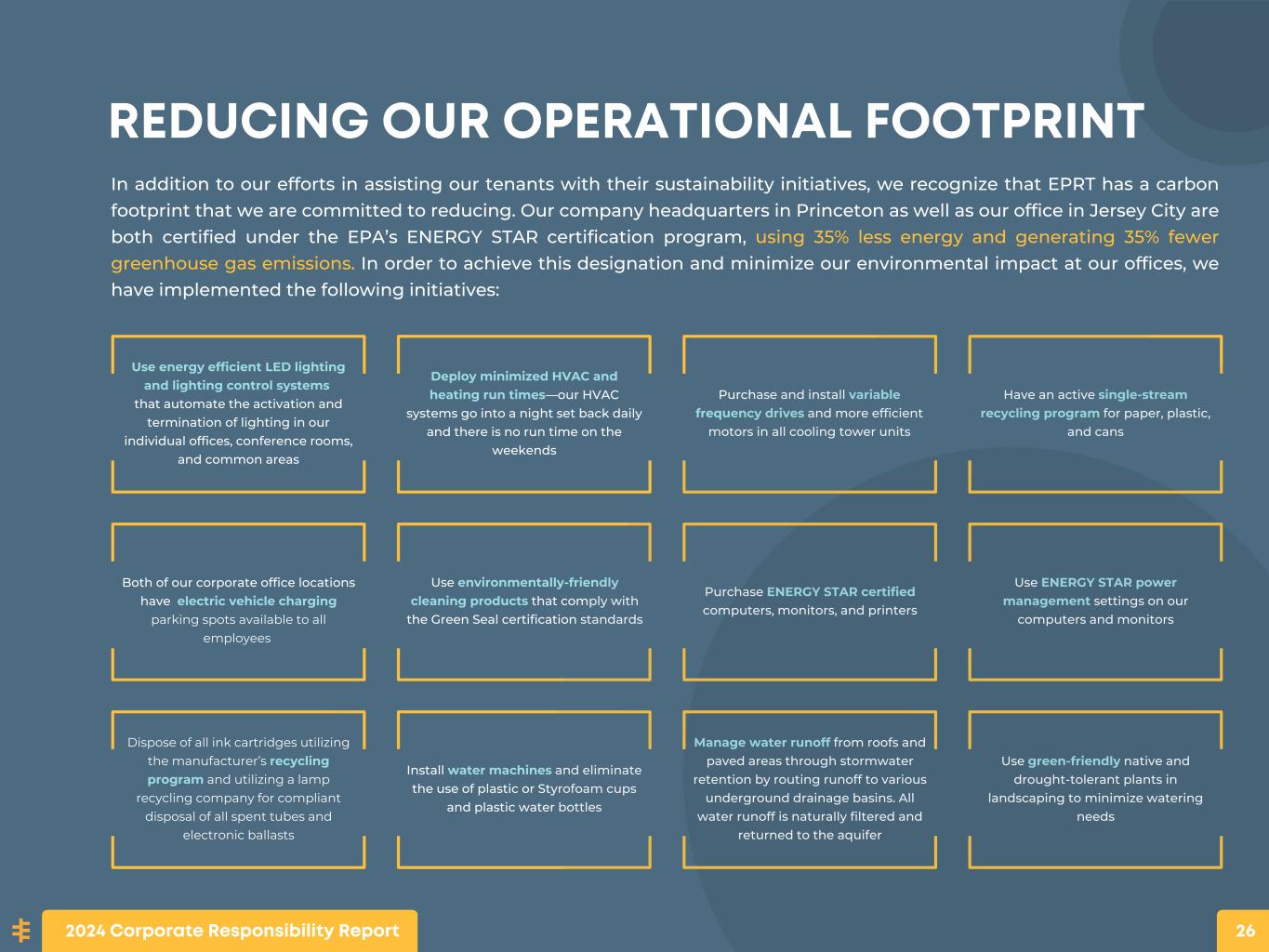

REDUCING OUR OPERATIONAL FOOTPRINT In addition to our efforts in assisting our tenants with their sustainability initiatives, we recognize that EPRT has a carbon footprint that we are committed to reducing. Our company headquarters in Princeton as well as our office in Jersey City are both certified under the EPA’s ENERGY STAR certification program, using 35% less energy and generating 35% fewer greenhouse gas emissions. In order to achieve this designation and minimize our environmental impact at our offices, we have implemented the following initiatives: Use energy efficient LED lighting and lighting control systems that automate the activation and termination of lighting in our individual offices, conference rooms, and common areas Deploy minimized HVAC and heating run times—our HVAC systems go into a night set back daily and there is no run time on the weekends Purchase and install variable frequency drives and more efficient motors in all cooling tower units Have an active single-stream recycling program for paper, plastic, and cans Both of our corporate office locations have electric vehicle charging parking spots available to all employees Use environmentally-friendly cleaning products that comply with the Green Seal certification standards Purchase ENERGY STAR certified computers, monitors, and printers Use ENERGY STAR power management settings on our computers and monitors Dispose of all ink cartridges utilizing the manufacturer’s recycling program and utilizing a lamp recycling company for compliant disposal of all spent tubes and electronic ballasts Install water machines and eliminate the use of plastic or Styrofoam cups and plastic water bottles Manage water runoff from roofs and paved areas through stormwater retention by routing runoff to various underground drainage basins. All water runoff is naturally filtered and returned to the aquifer Use green-friendly native and drought-tolerant plants in landscaping to minimize watering needs 2024 Corporate Responsibility Report 26

CLIMATE PREPAREDNESS At Essential Properties Realty Trust, climate preparedness is a core element of our risk management approach, designed to safeguard asset value and ensure long-term tenant performance. All tenants are required to carry business interruption insurance, providing a critical layer of financial protection against extreme weather or climate-related disruptions. Our acquisition process includes rigorous due diligence to assess location-specific risks such as flood zones, hurricane paths, and wildfire exposure. We maintain a geographically diverse portfolio across 49 states, paired with tailored hazard insurance coverage to help mitigate concentration risk and protect against property-level losses. 2024 Corporate Responsibility Report 27 We also invest in infrastructure upgrades that enhance asset resilience and operational reliability. Through our Sustainability partnership, we implement high-efficiency HVAC, lighting, and energy monitoring systems that improve performance and reduce exposure during extreme climate conditions. Our leases include provisions that require tenants to maintain emergency protocols, and we proactively support recovery efforts to minimize downtime. This practical, asset-focused approach to climate readiness strengthens tenant continuity and protects shareholder value by ensuring that our properties remain operational, insurable, and financially resilient in the face of a changing climate.

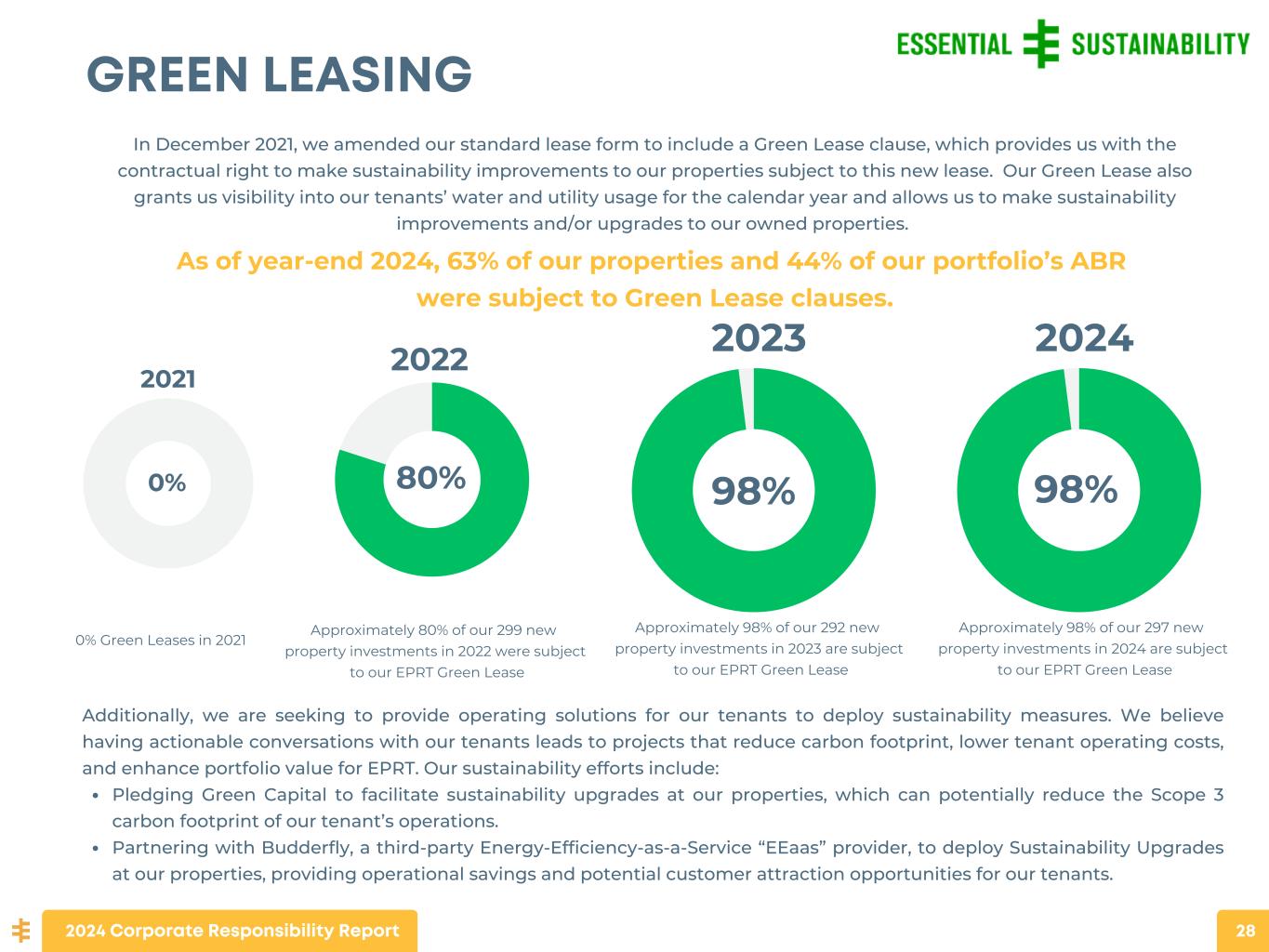

Additionally, we are seeking to provide operating solutions for our tenants to deploy sustainability measures. We believe having actionable conversations with our tenants leads to projects that reduce carbon footprint, lower tenant operating costs, and enhance portfolio value for EPRT. Our sustainability efforts include: Pledging Green Capital to facilitate sustainability upgrades at our properties, which can potentially reduce the Scope 3 carbon footprint of our tenant’s operations. Partnering with Budderfly, a third-party Energy-Efficiency-as-a-Service “EEaas” provider, to deploy Sustainability Upgrades at our properties, providing operational savings and potential customer attraction opportunities for our tenants. In December 2021, we amended our standard lease form to include a Green Lease clause, which provides us with the contractual right to make sustainability improvements to our properties subject to this new lease. Our Green Lease also grants us visibility into our tenants’ water and utility usage for the calendar year and allows us to make sustainability improvements and/or upgrades to our owned properties. As of year-end 2024, 63% of our properties and 44% of our portfolio’s ABR were subject to Green Lease clauses. 98% GREEN LEASING Approximately 98% of our 292 new property investments in 2023 are subject to our EPRT Green Lease 2023 0% 2021 80% Approximately 80% of our 299 new property investments in 2022 were subject to our EPRT Green Lease 2022 0% Green Leases in 2021 2024 Corporate Responsibility Report 28 98% Approximately 98% of our 297 new property investments in 2024 are subject to our EPRT Green Lease 2024

TENANT SUSTAINABILITY SPOTLIGHT: 2024 Corporate Responsibility Report 29 Super Star Car Wash: A High-Quality Service with a Sustainable Edge Super Star Car Wash is a fast-growing express car wash operator with locations across the Southwest and Southern California, offering quick, high-quality washes through a convenient membership model. With over 30 years in the business, they’ve built a strong following by combining customer-friendly service with a focus on operational efficiency. As a valued tenant in the Essential Properties portfolio, Super Star Car Wash reflects the kind of reliable, service- based businesses we’re proud to support—those that grow smart and prioritize sustainability along the way. Smart Water Use with Big Impact At the core of Super Star Car Wash’s operations is a closed-loop water system that captures, filters, and reuses water several times throughout the wash cycle. Instead of letting water go to waste, they reclaim it, run it through high-grade filters, and reuse it in the early stages of future washes. This helps dramatically cut down on freshwater use, saving tens of thousands of gallons each month at a single location, and reduces runoff, which helps keep local water systems clean too. Sustainable and Spot-Free Beyond reclaiming water, they also get smart about how and where they use different types of water. For example, softened water helps make soaps more effective with less chemical use, and reverse osmosis water is used at the end of the wash to give cars that spot-free shine. By blending water efficiency with quality service, Super Star Car Wash shows how sustainability can be practical, effective, and good for business—all while keeping cars (and communities) clean.

EARLY ADOPTERS In September 2022, we entered into a partnership with Budderfly Inc., a leading Energy-Efficiency-as-a-Service ("EEaaS") provider in the United States. This Sustainability Partnership intends to deploy meaningful sustainability options at EPRT properties aimed at maximizing the energy efficiency and delivering operating savings to our tenants through a guaranteed reduction in monthly utility usage. Through the Essential Sustainability Partnership, EPRT will invest capital in energy-efficient technologies and equipment upgrades that Budderfly will install and manage, at no cost to our tenants. A key element is a guaranteed reduction in energy usage thus cost savings per month that is passed through to the tenant. The sustainability upgrades will include, but are not limited to: Installation of LED lighting and lighting controls. Higher efficiency HVAC units and HVAC control monitoring. Refrigeration controls and monitoring. Net metering and controls through Budderfly’s Facility Smart Grid System. We believe enhancing the sustainability of our properties deepens tenant relationships, enhances tenant profitability, increases renewal probabilities, and increases the overall value of our portfolio. SUSTAINABILITY PARTNERSHIP 2024 Corporate Responsibility Report 30

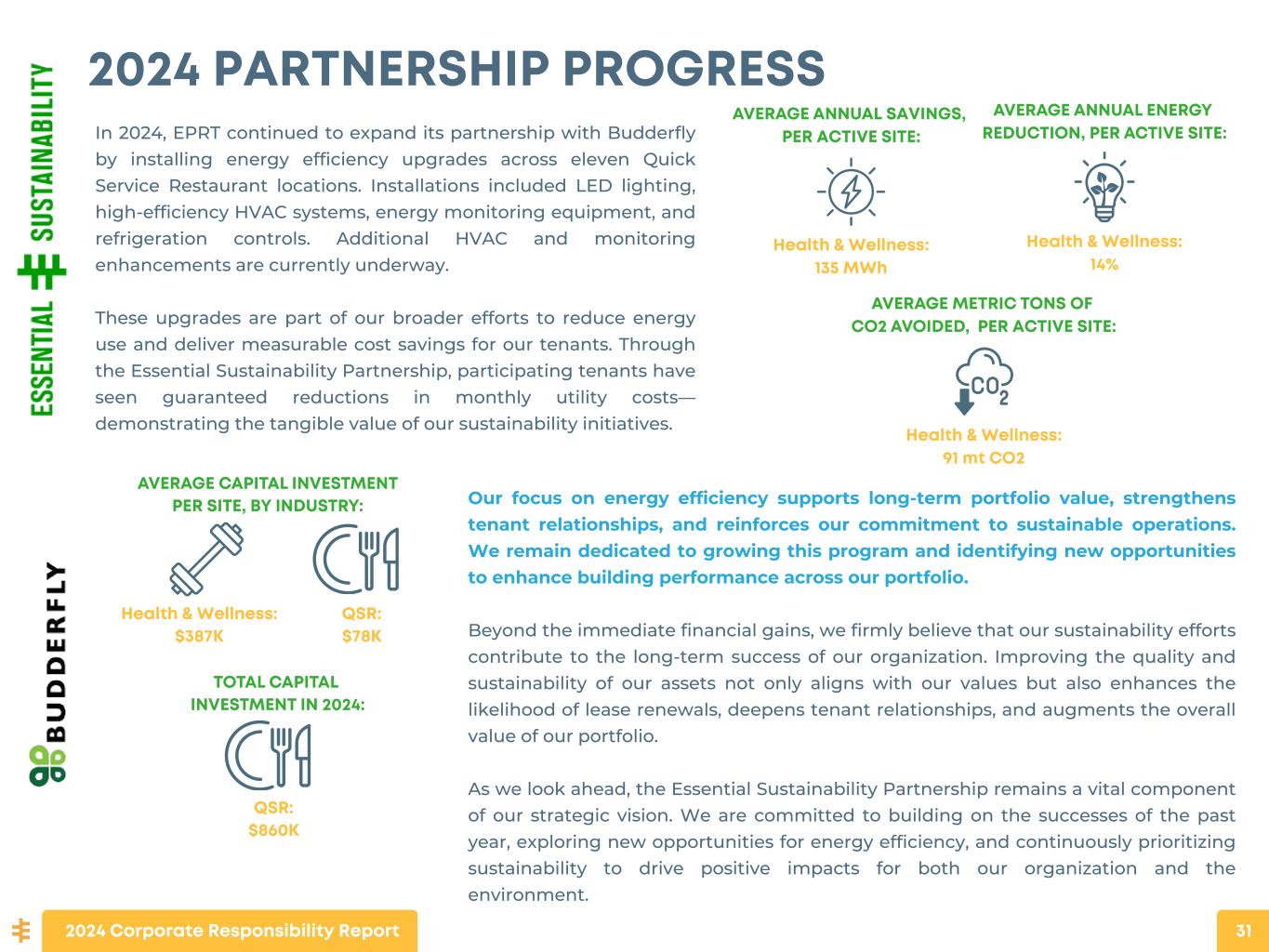

In 2024, EPRT continued to expand its partnership with Budderfly by installing energy efficiency upgrades across eleven Quick Service Restaurant locations. Installations included LED lighting, high-efficiency HVAC systems, energy monitoring equipment, and refrigeration controls. Additional HVAC and monitoring enhancements are currently underway. These upgrades are part of our broader efforts to reduce energy use and deliver measurable cost savings for our tenants. Through the Essential Sustainability Partnership, participating tenants have seen guaranteed reductions in monthly utility costs— demonstrating the tangible value of our sustainability initiatives. 2024 PARTNERSHIP PROGRESS 2024 Corporate Responsibility Report 31 AVERAGE CAPITAL INVESTMENT PER SITE, BY INDUSTRY: QSR: $78K Health & Wellness: $387K TOTAL CAPITAL INVESTMENT IN 2024: QSR: $860K Our focus on energy efficiency supports long-term portfolio value, strengthens tenant relationships, and reinforces our commitment to sustainable operations. We remain dedicated to growing this program and identifying new opportunities to enhance building performance across our portfolio. Beyond the immediate financial gains, we firmly believe that our sustainability efforts contribute to the long-term success of our organization. Improving the quality and sustainability of our assets not only aligns with our values but also enhances the likelihood of lease renewals, deepens tenant relationships, and augments the overall value of our portfolio. As we look ahead, the Essential Sustainability Partnership remains a vital component of our strategic vision. We are committed to building on the successes of the past year, exploring new opportunities for energy efficiency, and continuously prioritizing sustainability to drive positive impacts for both our organization and the environment. AVERAGE ANNUAL SAVINGS, PER ACTIVE SITE: Health & Wellness: 135 MWh AVERAGE ANNUAL ENERGY REDUCTION, PER ACTIVE SITE: Health & Wellness: 14% AVERAGE METRIC TONS OF CO2 AVOIDED, PER ACTIVE SITE: Health & Wellness: 91 mt CO2

2024 CORPORATE RESPONSIBILITY REPORT SOCIAL

OUR EMPLOYEES OUR PEOPLE ARE EPRT At Essential Properties we seek to provide a dynamic, rewarding work environment that promotes the retention and career development of our employees and is a differentiating factor in our ability to attract new talent. We strive to offer our employees attractive and equitable compensation, regular opportunities to participate in professional development activities, outlets for civic engagement, and reasonable flexibility to allow a healthy work-life balance. Our employees further our commitment to social responsibility through their efforts to become involved in outside organizations that promote education, environmental, and social well-being. We are committed to maximizing value for our stockholders and believe it is essential for all of our employees to be aligned in that commitment. This commitment includes providing all employees with the opportunity to participate in our equity incentive program. Today, all of our employees are stockholders.2024 Corporate Responsibility Report 33

DIVERSITY & INCLUSION 40% FEMALE GENDER DIVERSITY 23% DIVERSE RACIAL/ETHNIC DIVERSITY 75% FEMALE GENDER DIVERSITY 13% DIVERSE RACIAL/ETHNIC DIVERSITY TOTAL COMPANY TOTAL COMPANY NON-EXECUTIVE MANAGEMENT NON-EXECUTIVE MANAGEMENT At Essential Properties, we value diversity and inclusion. We have built a diverse and inclusive culture that encourages, supports, and celebrates our employees’ diverse voices and experiences. We believe a diverse employee base enhances our execution as a company, encourages innovative thinking, and increases alignment with our tenants, our stockholders, and the community around us. The following charts highlight our diverse workforce as of December 31, 2024. Additionally, we have a consistent and strong record of hiring veterans of the U.S. military, including our Chief Executive Officer and our Executive Vice President of Investments, who are both veterans and graduates of The United States Military Academy at West Point. 2024 Corporate Responsibility Report 34

HUMAN CAPITAL MANAGEMENT The following highlights certain key aspects of our commitment to our employees: ATTRACTIVE COMPENSATION Our approach to compensation includes an attractive market-based base salary and annual incentive compensation with the following additional elements: Equity incentive compensation available to all employees annually Health benefits (medical, dental, and vision) for all employees and their families A 401(k) plan A minimum of 20 days of PTO 14-week family leave policy Our compensation program is designed to attract and retain talent while aligning our employees’ efforts with the interests of our stakeholders. Factors we evaluate in connection with hiring, developing, training, and compensating individuals include, but are not limited to, qualification, performance, skill, and experience. Our employees are compensated based on merit, without regard to race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression, or any other status protected by applicable law. 100% INCLUSION IN OUR EQUITY INCENTIVE PROGRAM All of our employees participate in EPRT’s equity incentive program. As a result, all employees are owners in EPRT and therefore have significant alignment with the interests of our stockholders. INVESTING IN OUR EMPLOYEES’ RETIREMENT We provide a market leading matching investment in our employees who participate in our 401(k) program, matching 100% of the first 6% of our employee’s investment in their individual 401(k) plan. PROFESSIONAL DEVELOPMENT We offer our employees various continuing educational opportunities and reimbursement for certain educational expenses. We also offer reimbursement for certain costs associated with an employee’s professional certifications. We encourage all employees to grow within our organization, and we provide opportunities for employees to develop expertise in various aspects of our business, including acquisitions and dispositions, leasing, credit analysis, asset management, finance, and reporting and compliance. Employees are given regular feedback through formal annual performance reviews and an “open door” culture that encourages less formal guidance in “real time.” We support employees as they develop within our industry with memberships to industry organizations, such as the National Association of Real Estate Investment Trusts and the International Council of Shopping Centers. We periodically arrange “promotion dinners” to acknowledge and celebrate members of our team who have been promoted to positions of increasing responsibility. 2024 Corporate Responsibility Report 35

EMPLOYEE DEVELOPMENT AND ENHANCEMENT INTERNSHIP PROGRAM We are committed to developing talented individuals through our paid college internship program by providing career learning opportunities and an introduction to our business to students at the outset of their careers. In 2024, we had four individuals work as interns at the Company. EMPLOYEE ENGAGEMENT Each quarter, we hold a company-wide meeting, where we summarize overall corporate achievements and acknowledge significant employee contributions. We also celebrate the employees who celebrated their birthday during that quarter. At our weekly and quarterly meetings, all employees are encouraged to provide input into the development of our business and voice any suggestions or concerns that they may have. 2024 Corporate Responsibility Report 36 TEAM BUILDING We believe that fostering a collegial work environment is an important element of driving our long-term success. We strive to develop a supportive work environment through various events, such as company- sponsored sports teams, an annual summer outing, and a holiday celebration near year-end, which are designed to foster an increased level of collegiality among our employees and develop a shared sense of mission. FIRESIDE CHATS We host internal lunch and learn ‘fireside chats’ that provide the full team with the opportunity to learn more about the careers and job functions of various team leaders to promote a more interconnected and informed team.

EMPLOYEE BENEFITS AND RETENTION FAMILY LEAVE POLICY In 2024, we implemented a Family Leave Policy providing all expectant employees with 14 weeks of fully paid leave, full benefit retention, and continued 401(k) contributions. To further support working parents, we added private lactation rooms in our Princeton and Jersey City offices. Since implementation, the policy has been utilized by one Director and one Vice President, both of whom returned to their roles—reflecting a 100% retention rate. As our team grows, we remain committed to fostering an inclusive, supportive workplace that promotes employee well-being and work- life balance. These initiatives are designed to strengthen retention, boost morale, and drive long-term organizational success. JERSEY CITY OFFICE In the fall of 2023, we opened our second corporate office in Jersey City. This expansion has played a pivotal role in enhancing employee well-being, streamlining company operations, and strengthening our connections with stakeholders and potential investors. The proximity of the new office to New York City has significantly benefited local employees, offering increased convenience through reduced commute times and expanded transit options. The improved office layout and amenities contribute to a dynamic and productive work environment, elevating overall employee satisfaction. Additionally, this office location has proven advantageous in recruitment efforts, attracting top-tier talent from the diverse metropolitan talent pool. Overall, our second office in Jersey City stands as a testament to our commitment to operational excellence, employee satisfaction, and strategic growth. 2024 Corporate Responsibility Report 37 HEALTH, FAMILY, AND WELLNESS We strive to promote a healthy work-life balance for our employees. We have an onsite gym that is accessible and free of charge for all employees, and ensure our health benefits and coverages are attractive and supportive of the needs of individual employees and employees’ families. Furthermore, we cover nearly 100% of the cost of health benefits for each employee. We have maintained our work-from-home policy on Fridays and also utilize a “personal time off” (or PTO) program for our employees, which allows for at least four weeks of paid time off per year per employee.

COMMUNITY IMPACT We are committed to improving the community around us, and we believe that giving back is an important part of being a responsible corporate citizen. We actively support many organizations in the greater Princeton, New Jersey area surrounding our corporate headquarters, and we encourage our employees to volunteer with organizations that are meaningful to them. We are proud to have supported the following organizations: The Capital Area YMCA The Victor Green Foundation Better Beginnings Child Development Center (an organization that provides affordable childcare for working parents) Alex’s Lemonade Stand Foundation (an organization that seeks to cure childhood cancer and support families with children battling cancer) A Woman’s Place (an organization that seeks to end domestic violence and supports and shelters victims of domestic violence in Bucks County, Pennsylvania) During 2025, we look forward to continuing to support the organizations that we have been involved with previously, and we plan to identify new organizations to support which are contributors to the betterment of our local community and charitable causes in which our employees participate. 2024 Corporate Responsibility Report 38

ABOUT THIS REPORT AND INDICES

ABOUT THIS REPORT This is Essential Properties' second Corporate Responsibility Report and contains indices aligned with ESG reporting frameworks and standards, including the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). The information and metrics included in this report cover EPRT's operations as of December 31st, 2024 or for the 2024 calendar year, unless otherwise stated. FORWARD LOOKING STATEMENTS This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expect,” “plan,” "will," “estimate,” “project,” “intend,” “believe,” “guidance,” and other similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, our continued ability to source new investments, risks associated with using debt and equity financing to fund our business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads, changes in the price of our common shares, and conditions of the equity and debt capital markets, generally), unknown liabilities acquired in connection with acquired properties or interests in real-estate related entities, general risks affecting the real estate industry and local real estate markets (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), the financial performance of our retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers, potential fluctuations in the consumer price index, risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and other additional risks discussed in our filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 2024 Corporate Responsibility Report 40

SUSTAINABILITY ACCOUNTING STANDARDS BOARD (SASB) FRAMEWORK The Sustainability Accounting Standards Board (SASB) enables businesses around the world to identify, manage, and communicate financially-material sustainability information to their investors. SASB provides a complete set of globally applicable industry-specific standards which identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry. The following table aligns with the Real Estate Standard, the Standard most relevant to our business strategy. 2024 Corporate Responsibility Report 41

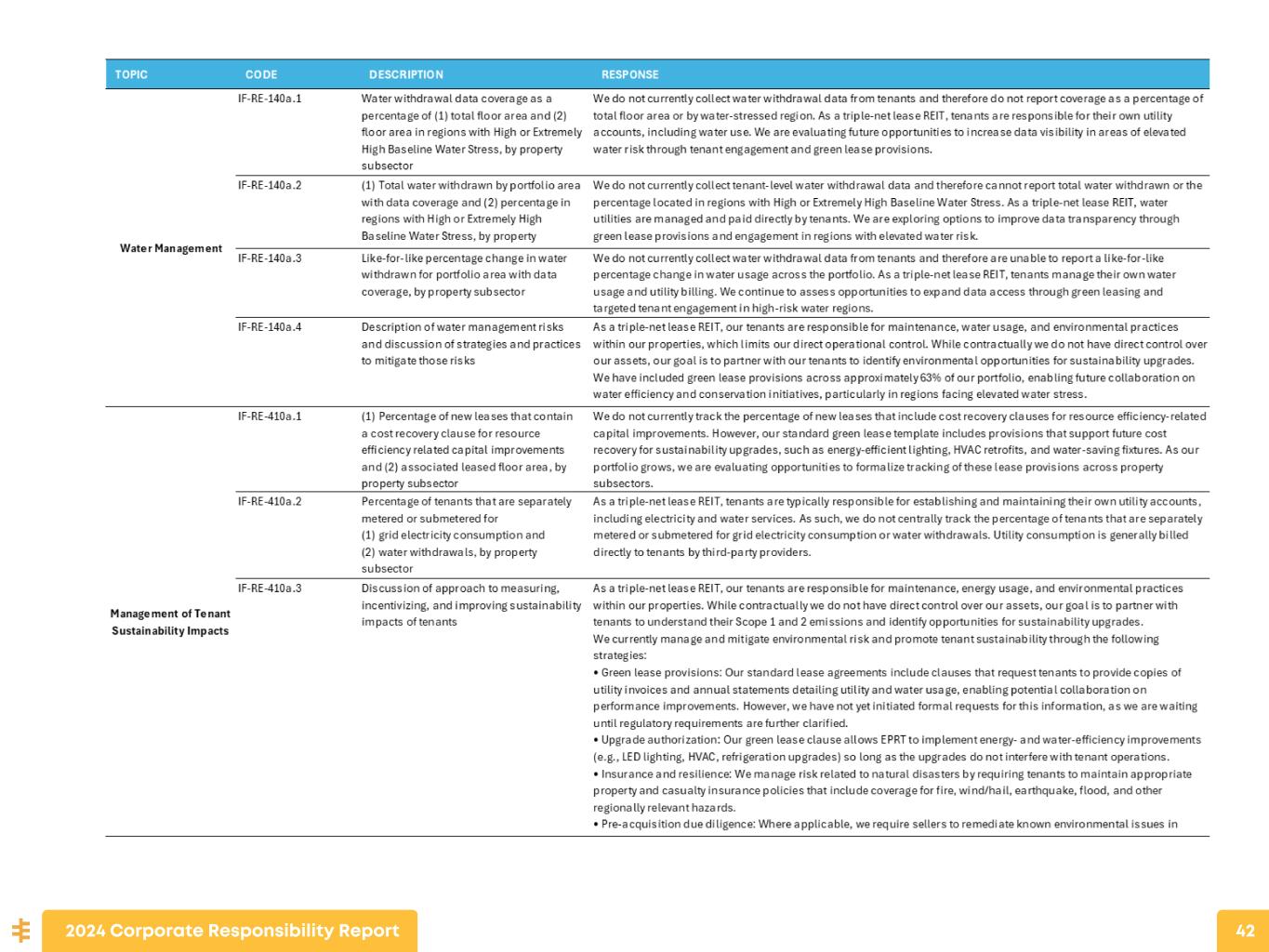

2024 Corporate Responsibility Report 42

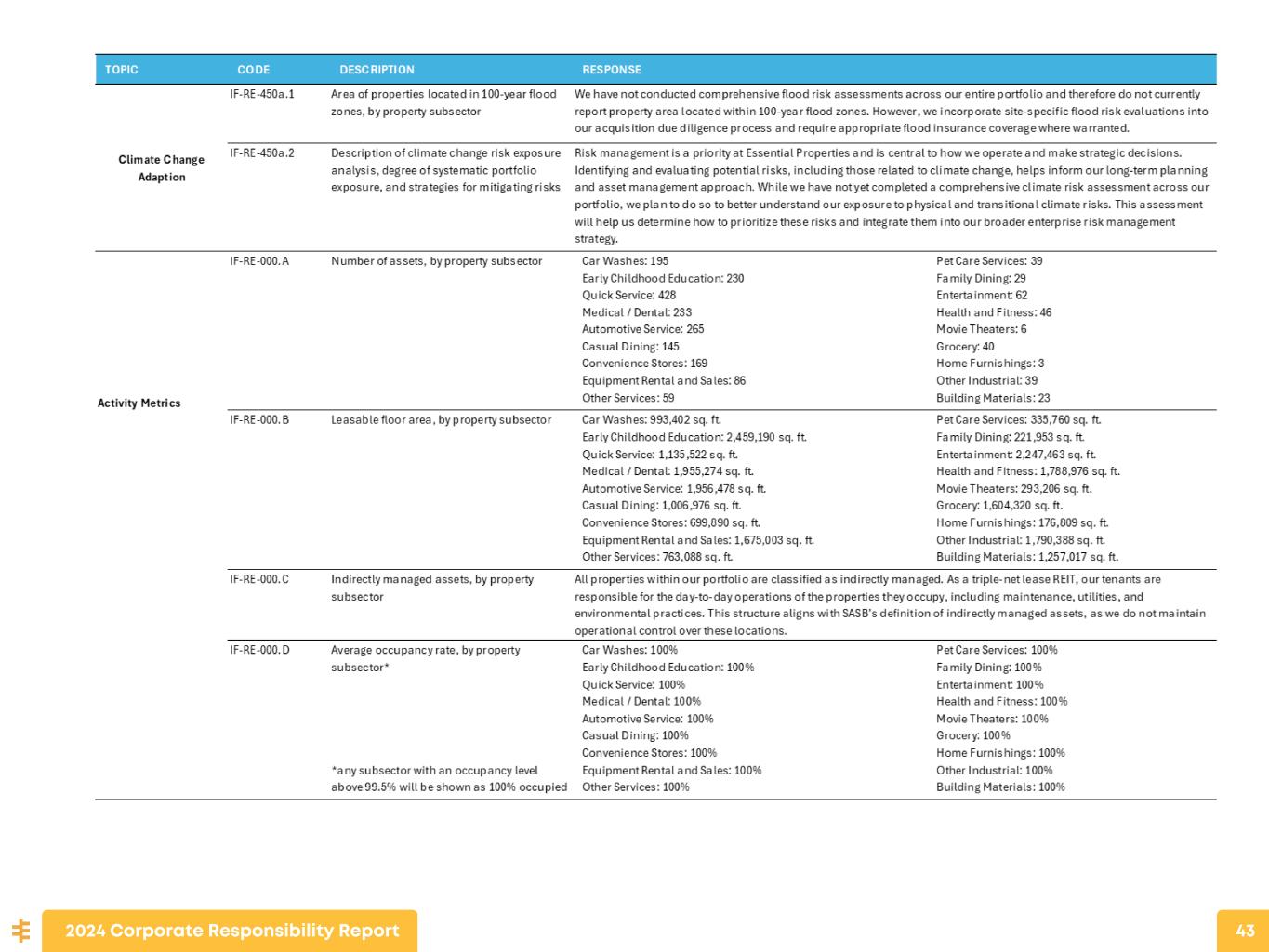

2024 Corporate Responsibility Report 43

The Financial Stability Board Task Force on Climate-related Financial Disclosures is a market-driven initiative, set up to develop a set of recommendations for voluntary and consistent climate-related financial risk disclosures in mainstream filings. The work and recommendations of the Task Force help firms understand what financial markets want from disclosure in order to measure and respond to climate change risks, and encourages firms to align their disclosures with investors’ needs. TASK FORCE ON CLIMATE- RELATED FINANCIAL DISCLOSURES (TCFD) 2024 Corporate Responsibility Report 44

2024 Corporate Responsibility Report 45

2024 Corporate Responsibility Report 46

2024 Corporate Responsibility Report 47

Headquarters 902 Carnegie Center Boulevard, Suite 520 Princeton, New Jersey 08540 Jersey City Office 15 Exchange Place, Suite 301 Jersey City, New Jersey 07302 info@essentialproperties.com 609-436-0619 www.essentialproperties.com 2024 Corporate Responsibility Report 48