| Skadden, Arps, Slate, Meagher & Flom llp | ||

One

Manhattan West

TEL: (212) 735-3000 |

FIRM/AFFILIATE BOSTON BEIJING |

September 30, 2024

VIA EDGAR

Mr. Scott Stringer

Mr. Joel

Parker

Ms. Taylor Beech

Ms. Mara Ransom

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | PDD Holdings Inc. | ||

| Form 20-F for the Fiscal Year Ended December 31, 2023 | |||

| File No. 001-38591 |

Dear Mr. Stringer, Mr. Parker, Ms. Beech and Ms. Ransom,

On behalf of our client, PDD Holdings Inc. (the “Company”), we set forth below the Company’s responses to the comments contained in the letter dated August 27, 2024 from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) regarding the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2023 filed with the Commission on April 25, 2024 (the “2023 Form 20-F”). The Staff’s comments are repeated below in bold and are followed by the Company’s responses thereto. All capitalized terms used but not defined in this letter shall have the meaning ascribed to such terms in the 2023 Form 20-F.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 2

Form 20-F for the Fiscal Year Ended December 31, 2023

Our Company, page 3

| 1. | Please revise to discuss in more detail the founding of Temu, including where the majority of its current operations and customers are located and how its business and operations are differentiated from those of Pinduoduo. In this regard, your description of the platforms is nearly identical, making it unclear how you choose to manage them and how they contribute to your overall financial performance. In addition, identify through which entities you operate your Temu and Pinduoduo businesses in your organizational chart on page 4. |

In response to the Staff’s comment regarding the location of Temu’s operations, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Our Company” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed. As more fully elaborated in the Company’s response to Comments 16 and 17 below, despite its differentiated geographical coverage, Pinduoduo and Temu have the same value propositions and operational model. Both platforms serve merchants in China, assisting them in reaching consumers and growing their sales. Many of these Chinese merchants operate on both platforms and offer their products to consumers all over the world. Therefore, Temu is considered an integral part of the Company’s e-commerce business rather than a distinct business segment that is separately monitored and reported. This integration has led to the Company’s holistic approach in evaluating the operational and financial results of both platforms, making separate disclosures about each platform’s financial performance unnecessary.

“Our Company

[…]

Temu

was founded in September 2022 in Boston, Massachusetts, the United States. Following its initial launch in North America in September 2022,

Temu expanded to Oceania and Europe in April 2023 and then to other countries and regions worldwide. As of the end of 2023, Temu

was serving consumers in various countries and regions, including the United States, Germany, Japan, the United Kingdom,

France, Italy and Canada. As a new initiative at an early stage of development, Temu aspires to become a global online platform

dedicated to providing quality products to consumers at attractive prices. In partnership with a global network of logistics vendors

and fulfillment partners, Temu empowers merchants with value-added services that enables a broader market reach.

Both Pinduoduo and Temu enable merchants to provide product listings for buyers to conveniently browse and order on the platforms. We help merchants streamline their manufacturing and operations, leading to more competitive prices and reduced waste, and use fun, interactive shopping experiences and competitive pricing to attract, engage and retain buyers and merchants.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 3

Our revenues primarily consist of (i) transaction services and (ii) online marketing services and others provided to third-party merchants who sell their products on our platforms. For the fiscal year ended December 31, 2023, substantially all of our revenues were derived from third-party merchants in China.”

In response to the Staff’s comment regarding the operating entities of Temu and Pinduoduo, the Company respectfully proposes to include the following underlined disclosure under “Item 3. Key Information—Our Holding Company Structure and Contractual Arrangements with the VIE” and “Item 4. Information on the Company—C. Organizational Structure” in its future Form 20-F filings, subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

“[…]

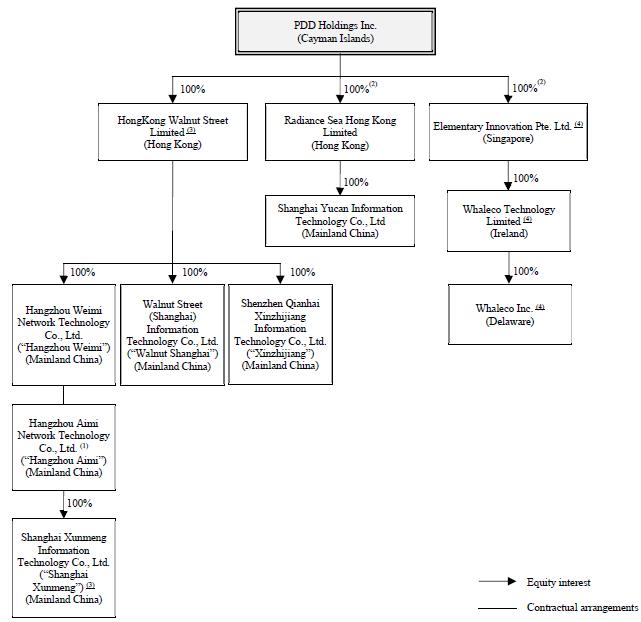

We conduct our businesses through a number of operating entities incorporated in jurisdictions across the globe. The following diagram illustrates our corporate structure, including our principal subsidiaries and the VIE and its principal subsidiary, as of the date of this annual report:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 4

[…]

| (3) | These entities provide services to users of Pinduoduo. |

| (4) | These entities provide services to users of Temu.” |

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 5

Our Holding Company Structure and Contractual Arrangements with the VIE, page 4

| 2. | Describe the contractual arrangements with the VIE, including the shareholders’ voting rights proxy agreement, equity pledge agreement, spousal consent letter, exclusive consulting and services agreement and exclusive option agreement that you reference on page 5. |

In response to the Staff’s comment, the Company undertakes to include the following disclosure under “Item 3. Key Information—Our Holding Company Structure and Contractual Arrangements with the VIE” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

“Our Holding Company Structure and Contractual Arrangements with the VIE

[…]

The VIE structure

consists of a series of contractual arrangements, including a shareholders’ voting rights proxy agreement, equity pledge agreement,

spousal consent letter, exclusive consulting and services agreement and exclusive option agreement, that have been entered into by and

among Hangzhou Weimi, the VIE, the VIE’s shareholders and, as applicable, their spouses. As a result of the contractual arrangements,

we are able to direct the activities of and derive economic benefits from the VIE. We are considered the primary beneficiary of the VIE

and its subsidiaries for accounting purposes, and we have consolidated their financial results in our consolidated financial statements.

Revenues contributed by the VIE and its subsidiaries accounted for 59.3%, 56.2% and 45.7% of our total revenues for 2021, 2022 and 2023,

respectively. […] For more details of these contractual arrangements, see “Item 4. Information on the Company—C.

Organizational Structure—Contractual Arrangements with the VIE and Its Shareholders.”

The following is a summary of the currently effective contractual arrangements by and among our wholly owned subsidiary, Hangzhou Weimi, the VIE and its shareholders.

Arrangements that enable us to direct the activities of the VIE and its subsidiaries

Shareholders’ Voting Rights Proxy Agreement. Pursuant to the amended and restated shareholders’ voting rights proxy agreement dated July 15, 2020, by and among Hangzhou Weimi, Hangzhou Aimi and the shareholders of Hangzhou Aimi, each shareholder of Hangzhou Aimi irrevocably authorized Hangzhou Weimi or any person(s) designated by Hangzhou Weimi to exercise such shareholder’s rights in Hangzhou Aimi, including without limitation, the power to participate in and vote at shareholder’s meetings, the power to nominate and appoint the directors, senior management, the power to sell or transfer such shareholder’s equity interest in Hangzhou Aimi, the power to propose to convene an extraordinary shareholders meeting, and other shareholders’ voting rights permitted by the Articles of Association of Hangzhou Aimi. The shareholders’ voting rights proxy agreement remains irrevocable and continuously valid from the date of execution so long as each shareholder remains as a shareholder of Hangzhou Aimi.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 6

Equity Pledge Agreement. Pursuant to the amended and restated equity pledge agreement dated July 15, 2020, by and among Hangzhou Weimi, Hangzhou Aimi and the shareholders of Hangzhou Aimi, the shareholders of Hangzhou Aimi pledged all of their equity interests in Hangzhou Aimi to Hangzhou Weimi to guarantee their and Hangzhou Aimi’s obligations under the contractual arrangements including the exclusive consulting and services agreement, the exclusive option agreement and the shareholders’ voting rights proxy agreement and this equity pledge agreement, as well as any loss incurred due to events of default defined therein and all expenses incurred by Hangzhou Weimi in enforcing such obligations of Hangzhou Aimi or its shareholders. In the event of default defined therein, upon written notice to the shareholders of Hangzhou Aimi, Hangzhou Weimi, as pledgee, will have the right to dispose of the pledged equity interests in Hangzhou Aimi and priority in receiving the proceeds from such disposition. The shareholders of Hangzhou Aimi agree that, without Hangzhou Weimi’s prior written approval, during the term of the equity pledge agreement, they will not dispose of the pledged equity interests or create or allow any other encumbrance on the pledged equity interests. We have completed the registration of the equity pledges with the relevant office of the SAIC in accordance with the PRC Property Rights Law.

Spousal Consent Letter. Pursuant to each spousal consent letter, the spouse of the signing shareholder of the VIE unconditionally and irrevocably agreed that the equity interest in Hangzhou Aimi held by such shareholder and registered in his name will be disposed of pursuant to the equity interest pledge agreement, the exclusive option agreement and the shareholders’ voting rights proxy agreement. The spouse of the signing shareholder of the VIE agreed not to assert any rights over the equity interest in Hangzhou Aimi held by the signing shareholder. In addition, in the event that the spouse of the signing shareholder of the VIE obtains any equity interest in Hangzhou Aimi held by the signing shareholder for any reason, the spouse agreed to be bound by the contractual arrangements.

Agreements that allow us to receive economic benefits from the VIE

Exclusive Consulting and Services Agreement. Under the exclusive consulting and services agreement between Hangzhou Weimi and Hangzhou Aimi, dated June 5, 2015, Hangzhou Weimi has the exclusive right to provide to Hangzhou Aimi consulting and services related to, among other things, design and development, operation maintenance, product consulting, and management and marketing consulting. Hangzhou Weimi has the exclusive ownership of intellectual property rights created as a result of the performance of this agreement. Hangzhou Aimi agrees to pay Hangzhou Weimi service fees at an amount as determined by Hangzhou Weimi. This agreement will remain effective for a ten-year term and then be automatically renewed, unless Hangzhou Weimi gives Hangzhou Aimi a termination notice 90 days before the term ends.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 7

Agreements that provide us with the option to purchase the equity interests in the VIE

Exclusive Option Agreement. Pursuant to the amended and restated exclusive option agreement dated July 15, 2020, by and among Hangzhou Weimi, Hangzhou Aimi and each of the shareholders of Hangzhou Aimi, each of the shareholders of Hangzhou Aimi irrevocably granted Hangzhou Weimi an exclusive call option to purchase, or have its designated person(s) to purchase, at its discretion, all or part of their equity interests in Hangzhou Aimi, and the purchase price shall be the lowest price permitted by applicable PRC law. In addition, Hangzhou Aimi has granted Hangzhou Weimi an exclusive call option to purchase, or have its designated person(s) to purchase, at its discretion, to the extent permitted under PRC law, all or part of Hangzhou Aimi’s assets at the book value of such assets, or at the lowest price permitted by applicable PRC law, whichever is higher. Each of the shareholders of Hangzhou Aimi undertakes that, without the prior written consent of Hangzhou Weimi or us, they may not increase or decrease the registered capital, dispose of its assets, incur any debts or guarantee liabilities, enter into any material purchase agreements, enter into any merger, acquisition or investments, amend its articles of association or provide any loans to third parties. Unless terminated by Hangzhou Weimi at its sole discretion, the exclusive option agreement will remain effective until all equity interests in Hangzhou Aimi held by the shareholders of Hangzhou Aimi and all assets of Hangzhou Aimi are transferred or assigned to Hangzhou Weimi or its designated representatives.

However, the use

of these contractual arrangements involves unique risks to investors. The contractual arrangements do not, and may never, provide holders

of our ADSs with direct or indirect equity ownership in the VIE and its subsidiaries. Although the contractual arrangements enable us

to direct the activities of and derive economic benefits from the VIE, any control that we have over our ability

to direct the activities of, as well as any economic benefits that we may derive from, the VIE depend on the enforceability of the

contractual arrangements that we have entered into with the VIE and its shareholders. Although King & Wood Mallesons, our PRC

legal counsel, has advised us that these contractual arrangements are legal, valid, binding and enforceable in accordance with their

terms and applicable PRC laws and regulations, they have also advised us that there are uncertainties regarding the interpretation and

application of the current and future PRC laws and regulations over the validity of our contractual arrangements with the VIE. As of

the date of this annual report, the legality and enforceability of these contractual arrangements, as a whole, have not been tested in

any PRC court. There is no guarantee that these contractual arrangements, as a whole, would be enforceable if they were tested in a PRC

court, and we may incur substantial costs to enforce the terms of the arrangements. See “Item 3. Key Information—D. Risk

Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with the VIE and its shareholders for

a large portion of our business operations, which may not be as effective as direct ownership in providing operational control”

and “—The shareholders of the VIE may have potential conflicts of interest with us, which may materially and adversely affect

our business and financial condition.”

[…]”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 8

| 3. | We note your disclosure in footnote (1) to the organizational chart that Mr. Lei Chen and Mr. Jianchong Zhu “have entered into a series of contractual arrangements with Hangzhou Weimi, pursuant to which the Company has control over and is the primary beneficiary of Hangzhou Aimi.” Please revise any references to control or benefits that accrue to you because of the VIE so they are limited to a clear description of the conditions you have satisfied for consolidation of the VIE under U.S. GAAP, and your disclosure should clarify that you are the primary beneficiary of the VIE for accounting purposes. |

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Our Holding Company Structure and Contractual Arrangements with the VIE,” “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure,” “Item 4. Information on the Company—A. History and Development of the Company” and “Item 4. Information on the Company—C. Organizational Structure” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

“Item 3. Key Information

[…]

Our Holding Company Structure and Contractual Arrangements with the VIE

We conduct our businesses through a number of operating entities incorporated in jurisdictions across the globe. The following diagram illustrates our corporate structure, including our principal subsidiaries and the VIE and its principal subsidiary, as of the date of this annual report:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 9

| (1) | Mr. Lei Chen and Mr. Jianchong

Zhu hold 86.6% and 13.4% equity interests in Hangzhou Aimi, respectively. They are employees

of our company and have entered into a series of contractual arrangements with Hangzhou Weimi,

pursuant to which the Company |

[…]

However, the use

of these contractual arrangements involves unique risks to investors. The contractual arrangements do not, and may never, provide holders

of our ADSs with direct or indirect equity ownership in the VIE and its subsidiaries. Although the contractual arrangements enable us

to direct the activities of and derive economic benefits from the VIE, any control that we have over our ability

to direct the activities of, as well as any economic benefits that we may derive from, the VIE depend on the enforceability of the

contractual arrangements that we have entered into with the VIE and its shareholders. […]”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 10

“Item 3. Key Information

D. Risk Factors

[…]

Risks Related to Our Corporate Structure

If the PRC government determines that the contractual arrangements that establish part of the VIE structure do not comply with the PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in our operations in China, and our ADSs may decline in value or become worthless.

[…]

[…] We, through

Hangzhou Weimi, entered into a series of contractual arrangements, including a shareholders’ voting rights proxy agreement, equity

pledge agreement, spousal consent letter, exclusive consulting and services agreement and exclusive option agreement, with Hangzhou Aimi,

its shareholders and, as applicable, their spouses, which enable us to (i) direct the activities of the VIE, (ii) receive substantially

all of the economic benefits of the VIE and its subsidiaries, and (iii) have an exclusive option to purchase all or part of the

equity interests and assets in the VIE when and to the extent permitted by PRC law. As a result of these contractual arrangements, we

have control over and are considered the primary beneficiary of the VIE and its subsidiaries for accounting purposes

and hence consolidate their financial results into our consolidated financial statements under U.S. GAAP. The VIE and its subsidiaries

contributed 45.7% of our revenues in 2023. See “Item 4. Information on the Company—C. Organizational Structure” for

further details.

[…]

The shareholders of the VIE may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

Mr. Lei Chen

and Mr. Jianchong Zhu hold 86.6% and 13.4% equity interests in the VIE, respectively. They are employees of our company and have

entered into a series of contractual arrangements with Hangzhou Weimi, pursuant to which we have control over are

able to (i) direct the activities of the VIE and its subsidiaries; (ii) receive substantially all of the economic benefits

of the VIE and its subsidiaries; and (iii) have an exclusive option to purchase all or part of the equity interests in and assets

of the VIE when and to the extent permitted by PRC law. and We are considered the primary beneficiary of

the VIE and its subsidiaries for accounting purposes and hence consolidate their financial results into our consolidated financial

statements under U.S. GAAP. These shareholders of the VIE may have potential conflicts of interest with us. See “Item 4. Information

on the Company—C. Organizational Structure.” These shareholders may breach, or cause the VIE to breach, or refuse to renew,

the existing contractual arrangements we have with them and the VIE, which would have a material and adverse effect on our ability to

direct the activities of the VIE and its subsidiaries and receive economic benefits from it. For example, the shareholders may be able

to cause our arrangements with the VIE to be performed in a manner adverse to us by, among other things, failing to remit payments due

under the contractual arrangements to us on a timely basis. We cannot assure you that when conflicts of interest arise any or all of

these shareholders will act in the best interests of our company or such conflicts will be resolved in our favor.”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 11

“Item 4. Information on the Company

A. History and Development of the Company

[…]

As a result of our direct ownership in Hangzhou Weimi and the VIE contractual arrangements, we are regarded as the primary beneficiary of the VIE and its subsidiaries for accounting purposes. We treat it and its subsidiaries as our consolidated affiliated entities under U.S. GAAP, and have consolidated the financial results of these entities in our consolidated financial statements in accordance with U.S. GAAP.”

The changes to be made to “Item 4. Information on the Company—C. Organizational Structure” will conform to the changes made to “Item 3. Key Information—Our Holding Company Structure and Contractual Arrangements with the VIE” shown above.

| 4. | We note your disclosure on page 5 that “revenues contributed by the VIE and its subsidiaries accounted for 59.3%, 56.2% and 45.7% of our total revenues for 2021, 2022 and 2023, respectively.” Please revise to include a follow up statement that to the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of you, your subsidiaries, or the consolidated VIEs by the PRC government to transfer cash. On page 10 where you state that “PDD Holdings Inc.’s ability to pay dividends to the shareholders and to service any debt it may incur may depend partially upon dividends paid by our mainland China subsidiaries and license and service fees paid by the VIE,” revise to note, as you do on page 5, that revenues contributed by the VIE and its subsidiaries accounted for 59.3%, 56.2% and 45.7% of our total revenues for 2021, 2022 and 2023, respectively. |

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 12

The Company respectfully clarifies that the PRC government currently does not impose restrictions or limitations on overseas cash transfers by our Hong Kong entity or our business in Hong Kong.

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Our Holding Company Structure and Contractual Arrangements with the VIE” and “Item 3. Key Information—Cash and Asset Flows Through Our Organization” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

“Our Holding Company Structure and Contractual Arrangements with the VIE

The VIE structure

consists of a series of contractual arrangements, including a shareholders’ voting rights proxy agreement, equity pledge agreement,

spousal consent letter, exclusive consulting and services agreement and exclusive option agreement, that have been entered into by and

among Hangzhou Weimi, the VIE, the VIE’s shareholders and, as applicable, their spouses. As a result of the contractual arrangements,

we are able to direct the activities of and derive economic benefits from the VIE. We are considered the primary beneficiary of the VIE

and its subsidiaries for accounting purposes, and we have consolidated their financial results in our consolidated financial statements.

Revenues contributed by the VIE and its subsidiaries accounted for 59.3%, 56.2% and 45.7% of our total revenues for 2021, 2022 and 2023,

respectively. Cash held by the VIE and its subsidiaries, as well as our mainland China subsidiaries, may not be available to fund

operations or for other use outside of mainland China due to regulatory restrictions and limitations on currency conversion, cross-border

transactions and cross-border capital flows. Shortages in the availability of foreign currency may temporarily delay the ability of the

VIE and its subsidiaries, as well as our mainland China subsidiaries, to pay us or satisfy their foreign currency denominated obligations.

For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations—We

may rely on distributions and advances paid by our mainland China subsidiaries to fund any cash and financing requirements we may have,

and any limitation on the ability of our mainland China subsidiaries to make payments to us could have a material and adverse effect

on our ability to conduct our business” and “—Governmental control of currency conversion may limit our ability to

utilize our revenues effectively and affect the value of your investment.” For more details of these contractual arrangements,

see “Item 4. Information on the Company—C. Organizational Structure—Contractual Arrangements with the VIE and Its Shareholders.”

[…]

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 13

Cash and Asset Flows Through Our Organization

PDD Holdings Inc. is a holding company incorporated in the Cayman Islands with no operations of its own. While we carry out our business in the rest of the world primarily through our subsidiaries, we conduct our operations in mainland China primarily through our mainland China subsidiaries, the VIE and its subsidiaries. Revenues contributed by the VIE and its subsidiaries accounted for 59.3%, 56.2% and 45.7% of our total revenues for 2021, 2022 and 2023, respectively. As a result, although other means are available for us to obtain financing at the holding company level, PDD Holdings Inc.’s ability to pay dividends to the shareholders and to service any debt it may incur may depend partially upon dividends paid by our mainland China subsidiaries and license and service fees paid by the VIE. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to our Cayman Islands holding company. In addition, our mainland China subsidiaries are permitted to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our mainland China subsidiaries, the VIE and its subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. For more details, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Holding Company Structure.””

Our Operations in China Are Subject to PRC Laws and Regulations, page 5

| 5. | We note your disclosure that “based on the advice of King & Wood Mallesons, our PRC legal counsel, we are of the view that none of us, our mainland China subsidiaries, the VIE or its subsidiaries is required under the M&A Rules to obtain any permission from the CSRC for our previous securities offerings.” Revise to clarify whether you, your mainland China subsidiaries, and the VIE or its subsidiaries are covered by any permissions requirements by the CSRC for future offerings. In this regard, your current disclosure states only that you “may” be subject to CSRC approval, but does not take a position on its applicability to you. If you did not consult counsel on this issue, then explain why, as well as the basis for your conclusions regarding whether approval is required. |

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Our Operations in China Are Subject to PRC Laws and Regulations” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 14

“Our Operations in China Are Subject to PRC Laws and Regulations

[…]

The PRC governmental

authorities have promulgated PRC laws and regulations relating to cybersecurity review and listings outside of mainland

China. Pursuant to the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, effective

as of the date of this annual report, a special purpose vehicle incorporated outside of mainland China that (i) was formed for listing

purposes through the acquisition of mainland China companies and (ii) is controlled by mainland China persons or entities must obtain

the approval of the China Securities Regulatory Commission, or the CSRC, before it can list its securities on a stock exchange outside

of mainland China. Based on the advice of King & Wood Mallesons, our PRC legal counsel, we are of the view that none of us,

our mainland China subsidiaries, the VIE or its subsidiaries is required under the M&A Rules to obtain any permission from the

CSRC for our previous securities offerings because (a) our mainland China subsidiaries were incorporated through direct investment,

rather than by the acquisition, through merger or otherwise, of the equity interests or assets of a mainland China company owned by mainland

China entities or individuals that are the Company’s beneficial owners, and (b) the Company does not constitute a “special

purpose vehicle” to which the relevant provisions of the M&A Rules would apply. In addition, on February 17, 2023,

the CSRC released a set of regulations, including the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic

Companies and five supporting guidelines, or, collectively, the Filing Measures, which took effect on March 31, 2023. According

to the Filing Measures, an issuer that is a mainland China company, or whose main operating entities are located in mainland China, must

make a filing with the CSRC in connection with any indirect initial public offering and listing conducted in jurisdictions outside of

mainland China. This filing with the CSRC must be made by the issuer within three working days of the date on which the issuer submits

the application documents for the offering and listing outside of mainland China. Companies that completed listings or offerings before

the Filing Measures took effect (i.e., March 31, 2023) are not required to immediately complete the filing procedures. However,

they are required to file with the CSRC within three business days following the completion of any follow-on offering in the same market

where their securities are listed. For more details, see “Item 4. Information on the Company—B. Business Overview—Regulations

in the PRC—Regulations Relating to Listings and M&A Outside of Mainland China.” Based on the advice of King &

Wood Mallesons, our PRC legal counsel, we believe that we will be required to file with the CSRC for any follow-on offering on Nasdaq

within three business days following its completion, in accordance with the Filing Measures. However, as the interpretation and application

of these regulations may change, we will reassess the need for CSRC approval or CSRC filing at the time of any future offering.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 15

[…]

However,

in connection with any future capital markets activities, we may need to obtain permission from the CSRC, undergo a cybersecurity review

conducted by the CAC or meet other regulatory requirements that may be adopted in the future by the PRC authorities.

To the extent such these requirements are or become applicable, we cannot assure you that we would be able to

comply with them. Any failure to obtain or delay in obtaining such permission, clearing such review process or meeting such requirements

would subject us to restrictions and penalties imposed by the CSRC, the CAC or other PRC regulatory authorities, which could include

fines and penalties on our operations in mainland China, delays of or restrictions on the repatriation of the proceeds from our offerings

into mainland China, restrictions on our ability to remain listed on a U.S. exchange, or other actions that could materially and adversely

affect our business, financial condition, results of operations, and prospects, as well as significantly limit or completely hinder our

ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or

be worthless. For more information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and

Industry—Our business generates and processes a large amount of data, and we are required to comply with laws relating to privacy

and cybersecurity. The improper use or disclosure of data could have a material and adverse effect on our business and prospects”

and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations—Under PRC laws,

the approval of or filing with the CSRC or other PRC government authorities may be required in connection with our previous or future

offerings, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.””

| 6. | We note your disclosure that you have not “received any request from the Cyberspace Administration of China, or the CAC, to undergo a cybersecurity review pursuant to the Cybersecurity Laws.” Please revise to explicitly state whether you believe that you, your mainland China subsidiaries, and the VIE or its subsidiaries are covered by permissions requirements from the CAC. If you did not consult counsel, then explain why, as well as the basis for your conclusions regarding whether approval is required. |

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Our Operations in China Are Subject to PRC Laws and Regulations” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 16

“Our Operations in China Are Subject to PRC Laws and Regulations

[…]

The

PRC governmental authorities have also promulgated laws and regulations relating to cybersecurity review. The Data Security

Law, the Regulations on the Protection of Critical Information Infrastructure, and the Cybersecurity Review Measures promulgated by the

PRC authorities (collectively, the “Cybersecurity Laws”) impose cybersecurity review obligations on: (i) critical

information infrastructure operators and network platform operators. Critical information infrastructure operators,

as determined and notified by the applicable governing authorities, who are required to undergo cybersecurity reviews if they

procure network products and services which that could affect the security of their information infrastructure,

network or data.; (ii) network platform operators that hold the personal data of more than one million users,

who must apply for a cybersecurity review before making any public offering on a stock exchange outside of the PRC; and (iii) persons

identified by certain governmental authorities to be operators engaged in offering network products and services or data processing activities

that affect or may affect national security, against whom the Cybersecurity Review Office may initiate cybersecurity reviews. Based on

the advice of King & Wood Mallesons, our PRC legal counsel, we believe that we are currently not subject to the cybersecurity

review obligations for critical information infrastructure operators and network platform operators because (i) As as

of the date of this annual report, we have not received any notice from any governmental authority designating us, our mainland

China subsidiaries or the VIE or its subsidiaries as a critical information infrastructure operator from any government authority,

(ii) we completed our public offerings on the Nasdaq Global Select Market before the promulgation of the Cybersecurity Laws, and

(iii) . Nor have we received any request from the Cyberspace Administration of China, or the CAC, to undergo a cybersecurity

review pursuant to the Cybersecurity Laws. Moreover, none of us, our PRC subsidiaries, the VIE or its subsidiaries has received

any notice from any PRC authority requiring us to obtain any permissions, in each case in connection with our previous issuance of securities

to investors outside the PRC. However, we may nonetheless be subject to cybersecurity review obligations if the Cybersecurity Review

Office decides to initiate a review against us on the grounds that we are deemed to be an operator engaged in offering network products

and services or data processing activities that affect or may affect national security, though our ability to control and assess the

likelihood of whether this happens is limited. As of the date of this annual report, we have not received any request from the CAC to

undergo a cybersecurity review pursuant to the Cybersecurity Laws.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 17

However,

in connection with any future capital markets activities, we may need to obtain permission from the CSRC, undergo a cybersecurity review

conducted by the CAC or meet other regulatory requirements that may be adopted in the future by the PRC authorities.

To the extent such these requirements are or become applicable, we cannot assure you that we would be able to

comply with them. Any failure to obtain or delay in obtaining such permission, clearing such review process or meeting such requirements

would subject us to restrictions and penalties imposed by the CSRC, the CAC or other PRC regulatory authorities, which could include

fines and penalties on our operations in mainland China, delays of or restrictions on the repatriation of the proceeds from our offerings

into mainland China, restrictions on our ability to remain listed on a U.S. exchange, or other actions that could materially and adversely

affect our business, financial condition, results of operations, and prospects, as well as significantly limit or completely hinder our

ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or

be worthless. For more information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and

Industry—Our business generates and processes a large amount of data, and we are required to comply with laws relating to privacy

and cybersecurity. The improper use or disclosure of data could have a material and adverse effect on our business and prospects”

and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations—Under PRC laws,

the approval of or filing with the CSRC or other PRC government authorities may be required in connection with our previous or future

offerings, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.””

Summary of Risk Factors, page 7

| 7. | In your summary of risk factors, revise your acknowledgement that “[c]hanges in China’s economic, political or social conditions or government policies could have a material adverse effect on [y]our business and operations” to specifically discuss risks arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice; and the risk that the Chinese government may intervene or influence your operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in your operations and/or the value of the securities you may register for sale. Acknowledge any risks that any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Cross-reference to more detail on this risk in your Risk Factors discussion. |

In response to the Staff’s comment, the Company respectfully proposes to revise the summary of risk factors in “Item 3. Key Information” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 18

“Summary of Risk Factors

[…]

Risks Related to Our Multi-jurisdictional Operations

We are also subject to risks and uncertainties associated with having a business presence in multiple jurisdictions, including the PRC and the United States. These risks and uncertainties include, but are not limited to, the following:

| · | […] |

| · | Changes in U.S. and international trade policies, escalations of tensions in international relations, and increased scrutiny from customs and other authorities, may adversely impact our business and operating results. In addition, any factors that reduce cross-border e-commerce or make such trade activities more difficult could harm our business. |

| · | A significant portion of our assets and operations is located in China. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic and social conditions in China generally. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations—Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.” |

| · | There

are uncertainties regarding the interpretation and enforcement of PRC laws, rules, and regulations,

and rules and regulations in China may evolve quickly with little advance notice. In

particular, |

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 19

| · | The

PRC government’s authority in regulating our operations, our offerings of securities

and investment in us could limit our ability or prevent us from conducting future offerings

of securities to investors |

The Holding Foreign Companies Accountable Act, page 7

| 8. | Revise to explicitly disclose the location of your auditor’s headquarters. |

In response to the Staff’s comment, the Company respectfully proposes to include the following underlined disclosure under “Item 3. Key Information—The Holding Foreign Companies Accountable Act” in its future Form 20-F filings, subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

“The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCA Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong Kong, including our auditor, which is headquartered in mainland China.”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 20

Risks Related to Our Multi-jurisdictional Operations, page 9

| 9. | Here and on page 43, we note the inclusion of references to “multiple jurisdictions” with respect to disclosure that was previously focused on risks related to the PRC government in your 20-F for the fiscal year ended December 31, 2022. It is unclear to us that there have been changes in the regulatory environment in the PRC since your prior annual report on Form 20-F was filed warranting revised disclosure to mitigate the challenges you face in the PRC and related disclosures. Please remove the mitigating language and discuss plainly and directly the risks relating to doing business in China, separate from the risks you may face in other jurisdictions. Additionally, please revise any other China-Based Companies risk factors with mitigating language in a similar fashion, such as the deletion of language on pages 9 and 46-47. |

The Company respectfully advises the Staff that, since the filing of its prior annual report, there have been no significant changes in the regulatory environment within the PRC that affect the Company’s operations. The latest developments in PRC laws and regulations applicable to the Company have been adequately disclosed in the 2023 Form 20-F. However, since the prior annual report, the Company has further advanced its global expansion in other jurisdictions beyond mainland China and Hong Kong. As the Company expands globally, it encounters operational challenges similar to those faced in the PRC, but now on a broader scale. As currently disclosed, these challenges include international trade restrictions, investment barriers, product liability, employment and labor laws, taxation, consumer protection, marketing and advertising standards, online payment systems, data privacy, intellectual property protection, safety concerns, and supply chain management across the various regions where the Company operates. Therefore, references to “multiple jurisdictions” provide a more accurate description of the risks that the Company is facing, acknowledging that regulatory actions in one region may have repercussions in others. This broader framing allows the Company to better inform investors about the complex, multifaceted risks it faces, rather than narrowly focusing on one jurisdiction, which could be misleading.

In response to the Staff’s comment, the Company respectfully proposes to revise the summary of risk factors in “Item 3. Key Information” in its future Form 20-F filings, as shown in the response to Comment 7 in this letter, to more prominently disclose the risks associated with doing business in China.

In addition, the Company respectfully proposes to revise the following risk factors under “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations” in its future Form 20-F filings, as shown in the blackline below (with deletions in strikethrough and additions underlined), subject to updates and adjustments based on any material developments in the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 21

“Risks Related to Our Multi-jurisdictional Operations

[…]

Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.

[…]

While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy, and the rate of growth has been slowing since 2010. According to the National Bureau of Statistics of China, China’s real GDP growth rate was 8.1%, 3.0% and 5.2% in 2021, 2022 and 2023, respectively. There have also been concerns about geopolitical conditions in certain regions or around the world, which may result in or intensify potential conflicts in relation to territorial, regional security and trade disputes. Changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China may have a material effect on the overall economic growth of China, which could adversely affect our business and operating results, lead to reduction in demand for our services and adversely affect our competitive position. Any disruptions or continuing or worsening slowdown could significantly reduce commerce activities in China, which could lead to significant reduction in merchants’ demand for and spending on the various services we offer. An economic downturn, whether actual or perceived, a further decrease in economic growth rates or an otherwise uncertain economic outlook in China could have a material adverse effect on business and consumer spending and, as a result, adversely affect our business, financial condition and results of operations. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations.

[…]

The regulatory environment in China is complex and evolving, which could adversely affect us.

We conduct our business in China primarily through our PRC subsidiaries, the VIE and its subsidiaries. Our operations in China are governed by PRC laws and regulations. Our PRC subsidiaries are subject to laws and regulations applicable to foreign investment in China. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under a civil law system may be cited for reference but have limited precedential value. In addition, any new or changes in PRC laws and regulations related to foreign investment in China could affect the business environment and our ability to operate our business in China.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 22

From time to time, we may have to resort to administrative and court proceedings to enforce our legal rights. Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management’s attention. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. These uncertainties may impede our ability to enforce the contracts we have entered into and could materially and adversely affect our business and results of operations.

Furthermore, the PRC legal system is based in part on government policies and internal rules, some of which may have retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. Such unpredictability could adversely affect our business and impede our ability to continue our operations.

We may be adversely affected by the complexity, uncertainties and changes in the PRC’s regulation of internet-related businesses and companies, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations.

[…]

The landscape of PRC laws, regulations and policies relating to the internet industry is complex and developing. There are uncertainties regarding the interpretation and enforcement of PRC laws, rules, and regulations. Existing laws, regulations and policies are relatively new and have been applied and interpreted for only a short period of time. New laws, regulations or policies may also be adopted in the future or evolve quickly with little advance notice. Determining the legality of existing and future foreign investments in, and the businesses and activities of, internet businesses in China, including the Pinduoduo platform, is therefore a complex and evolving process. We cannot assure you that the Pinduoduo platform has obtained all the permits or licenses required for conducting its business or will be able to maintain its existing licenses or obtain new ones. If the PRC government determines that the Pinduoduo platform was operating without the proper approvals, licenses or permits or promulgates new laws and regulations that require additional approvals or licenses or imposes additional restrictions on any part of the operations of the Pinduoduo platform, the PRC government has the power to, among other things, levy fines, confiscate income, revoke business licenses, and require the Pinduoduo platform to discontinue the relevant part of its business or impose restrictions on the affected portion of the Pinduoduo platform. Any of these actions by the PRC government may have a material adverse effect on our business and results of operations.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 23

The PRC government’s significant oversight and discretion over our business operations could result in a material change in our operations and the value of our ADSs.

Our operations in

China are governed by PRC laws and regulations. The PRC government has significant oversight and discretion over the conduct of our business.

The PRC government has released regulations and policies that have impacted various industries in general and specific operators within

such industries, and may in the future release new regulations or policies that could intervene in or influence our operations or the

industry sectors in which we operate. The PRC government may also require us to obtain new permits or approvals to continue our operations.

If we fail to comply with these regulations, policies or requirements, the enforcement actions taken by the PRC government may intervene

or influence our operations at any time and it could result in a material adverse change in our operations

and the value of our ADSs. In addition, the PRC government has indicated an intent to exert more oversight and control over offerings

conducted outside of mainland China and foreign investment in mainland China-based companies. Any such actions could significantly

limit or completely hinder our ability to offer or continue to offer our ADSs to investors and cause the value of our ADSs to significantly

decline or become worthless. Therefore, investors of our company and our business face uncertainty from potential actions taken by regulators

that may affect our business and the value of our ADSs.”

| 10. | Your disclosure about cash transfers from your mainland China subsidiaries to entities outside of mainland China acknowledges limitations upon transfers, “to the extent cash in [y]our business is in mainland China.” However, your disclosure elsewhere acknowledges the paid-in capital and the statutory reserve funds of your subsidiaries and the net assets of the VIE that are held in China. Revise to remove language “to the extent” of cash held in mainland China to specifically acknowledge such funds and assets. |

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure under “Item 3. Key Information—Summary of Risk Factors,” “Item 3. Key Information—Cash and Asset Flows Through Our Organization” and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 24

“Summary of Risk Factors

[…]

Risks Related to Our Multi-jurisdictional Operations

[…]

| · | Cash

transfers from our mainland China subsidiaries to entities outside of mainland China are

subject to PRC laws and regulations related to currency conversion. |

Cash and Asset Flows Through Our Organization, page 10

| 11. | Revise to disclose your intentions to settle amounts owed under the VIE agreements. Also disclose whether any dividends or distributions have been made to date by your subsidiaries and the VIE. In this regard, your disclosure only states that PDD Holdings Inc. has not declared or paid any cash dividends. |

In response to the Staff’s comment, the Company respectfully proposes to revise the following disclosure in “Item 3. Key Information—Cash and Asset Flows Through Our Organization” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed:

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 25

“Cash and Asset Flows Through Our Organization

[…]

Under PRC law, PDD Holdings Inc. may provide funding to our mainland China subsidiaries only through capital contributions or loans, and to the VIE only through loans, subject to satisfaction of applicable government registration and approval requirements. For the years ended December 31, 2021, 2022 and 2023, (i) PDD Holdings Inc. provided loans to our subsidiaries in an aggregate principal amount of RMB15,520.1 million, RMB21,991.6 million, and RMB1,754.5 million (US$247.1 million), respectively, (ii) our subsidiaries repaid loans to PDD Holdings Inc. in an aggregate principal amount of RMB9,664.8 million, RMB22,057.3 million and RMB10,570.6 million (US$1,488.8 million), respectively, and none of our subsidiaries paid dividends or made other distributions to PDD Holdings Inc., (iii) the VIE and its subsidiaries provided loans to our subsidiaries in an aggregate principal amount of RMB47,711.8 million, RMB5,443.7 million and RMB206,353.0 million (US$29,064.2 million), respectively, (iv) our subsidiaries repaid loans to the VIE and its subsidiaries in an aggregate principal amount of RMB29,999.3, RMB16.0 million and RMB171,391.6 million (US$24,140.0 million), respectively, (v) our subsidiaries provided loans to the VIE and its subsidiaries in an aggregate principal amount of RMB7,729.5 million, RMB62,753.7 million and RMB5,193.0 million (US$731.4 million), respectively, and (vi) the VIE and its subsidiaries repaid loans to our subsidiaries in an aggregate principal amount of RMB7,300.0 million, RMB46,043.4 million and RMB1,802.6 million (US$253.9 million), respectively. We have settled and will continue to settle fees under the contractual arrangements with the VIE.”

Risk Factors

The PRC government’s significant oversight and discretion..., page 47

| 12. | Describe the risk that the Chinese government may intervene or influence your operations at any time, which could result in a material change in your operations and/or the value of your securities. Also, given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, acknowledge the risk that any such action could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. |

In response to the Staff’s comment, the Company respectfully proposes to revise the following risk factor under “Item 3. Key Information—D. Risk Factors—Risks Related to Our Multi-jurisdictional Operations” in its future Form 20-F filings, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 26

“The PRC government’s significant oversight and discretion over our business operations could result in a material change in our operations and the value of our ADSs.

Our operations in

China are governed by PRC laws and regulations. The PRC government has significant oversight and discretion over the conduct of our business.

The PRC government has released regulations and policies that have impacted various industries in general and specific operators within

such industries, and may in the future release new regulations or policies that could intervene in or influence our operations or the

industry sectors in which we operate. The PRC government may also require us to obtain new permits or approvals to continue our operations.

If we fail to comply with these regulations, policies or requirements, enforcement actions taken by the PRC government may intervene

or influence our operations at any time and it could result in a material adverse change in our operations

and the value of our ADSs. In addition, the PRC government has indicated an intent to exert more oversight and control over offerings

conducted outside of mainland China and foreign investment in mainland China-based companies. Any such actions could significantly

limit or completely hinder our ability to offer or continue to offer our ADSs to investors and cause the value of our ADSs to significantly

decline or become worthless. Therefore, investors of our company and our business face uncertainty from potential actions taken by regulators

that may affect our business and the value of our ADSs.”

Information on the Company, page 62

| 13. | Revise to provide a description of the principal markets in which the company competes, including a breakdown of total revenues by category of activity and geographic market for each of the last three financial years. Refer to Item 4.B. of Form 20-F. |

In response to the Staff’s comment, the Company respectfully advises the Staff that the 2023 Form 20-F includes a breakdown of total revenues by category of activity for each of the last three financial years. The Company disaggregates its revenue by type of service into two categories: (i) transaction services and (ii) online marketing services and others, in view of the differences in the nature of these services. For transaction services, the Company earns fees from merchants for sales of their products completed on its online platforms. For online marketing services and others, the Company earns service fees from merchants for various types of online marketing services. Please refer to Page 89 under “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Key Line Items and Specific Factors Affecting Our Results of Operations.”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 27

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced business overview disclosure under “Item 4. Information of the Company” in its future Form 20-F filings, as shown in the blackline below (with additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed.

“PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. We aim to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from increased productivity and new opportunities.

Our customers are third-party merchants who sell their products on our platforms. Our revenues primarily consist of (i) transaction services and (ii) online marketing services and others.

For transaction services, we earn fees from merchants for sales of their products completed on its platforms.

For online marketing services and others, we earn service fees from merchants for various types of online marketing services. These include matching product listings appearing in search or browsing results on our platforms, charging merchants based on impressions or clicks, and providing display marketing services where merchants place advertisements on our platforms primarily at fixed prices.

Our revenues grew from RMB93,949.9 million in 2021 to RMB130,557.6 million in 2022 and further to RMB247,639.2 million (US$34,879.3 million) in 2023. We generated net income of RMB7,768.7 million, RMB31,538.1 million and RMB60,026.5 million (US$8,454.6 million) in 2021, 2022 and 2023, respectively. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results— Key Line Items and Specific Factors Affecting Our Results of Operations—Revenues” for a breakdown of our total revenues by category of activity for each of the last three financial years.”

In response to the Staff’s comment in relation to a breakdown of total revenues by geographic market, the Company respectfully advises the Staff that substantially all of the Company’s revenues are derived from third-party merchants in China. As such, the Company has determined that no further disaggregation by geographic region or market is necessary, as noted in Note 2(x) of the 2023 consolidated financial statements. Furthermore, for reasons more fully elaborated in the Company’s response to Comments 16 and 17 below, the Company has determined that a breakdown based on geographic regions or markets where the merchants’ products are sold does not align with how the Company’s management views its operations and hence is not applicable to the Company or meaningful to the Company’s investors.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 28

Directors and Senior Management, page 99

| 14. | Disclose the number of limited partners of your PDD Partnership and whether there is any particular requirement to maintain a certain number of limited partners of the Partnership. Elaborate upon how the PDD Partnership helps you “better manage [y]our business and to carry our [y]our vision, mission and value continuously.” Also, clarify whether the PDD Partnership currently has the ability to appoint executive directors. Your disclosure on page 100, and elsewhere in the annual report, says that such right has yet to come into effect and yet you identify Mr. Lei Chen as an executive director and your disclosure seems to indicate that the current size of the Board would allow for 3 executive directors to be nominated by the Partnership. |

In response to the Staff’s comment, the Company respectfully advises the Staff that the number of limited partners in PDD Partnership has not yet reached five and the rights and functions elaborated on page 100 of the 2023 Form 20-F have yet come into effect, and there is no specific requirement to maintain a certain number of limited partners.

All partners of PDD Partnership are required to meet specific quality standards, including (i) a high standard of personal character and integrity, and (ii) continued service with our company for no less than five years. The Company respectfully advises the Staff that the rights and functions of PDD Partnership, as exercised by its partners who share the same core values, when coming into effect, will enable the Company to ensure the sustainability and governance of the Company and maintain its vision, mission and values continuously.

As disclosed in the 2023 Form 20-F, the major rights and functions of the PDD Partnership, such as the right to appoint an executive director to the Company’s board, will not take effect until the PDD Partnership consists of no less than five limited partners. As the number of limited partners in the PDD Partnership has not yet reached five, the Company confirms that these rights and functions have not yet come into effect. The PDD Partnership currently cannot appoint executive directors.

The appointment of Mr. Lei Chen as an executive director is unrelated to the PDD Partnership’s rights and functions; it resulted from his appointment by the board of directors and the approval of his re-election by the shareholders at the general meetings.

Note 2. Summary of Significant Accounting Policies

(n) Advertising expenditures, page F-20

| 15. | Please revise to disclose advertising expenditures and incentive programs, separately for each period presented. Refer to ASC 720-35-50-1. |

In response to the Staff’s comment, the Company respectfully proposes to revise the referenced disclosure in its future Form 20-F filings to separately disclose advertising expenditures and incentive programs in accordance with ASC 720-35-50-1, as shown in the blackline below (with deletions shown in strikethrough and additions in underline), subject to such updates and adjustments to be made in connection with any material developments of the subject matter being disclosed.

“Advertising expenditures are expensed

when incurred and are included in sales and marketing expenses. Total amount of For the years ended December 31,

2021, 2022 and 2023, the advertising expenditures were RMB19,204,371, RMB18,921,293, and RMB56,415,274 (US$7,945,925), and

incentive programs recognized in sales and marketing expenses were RMB41,456,838, RMB49,971,418 and RMB76,428,811 (US$10,764,773)

for the years ended December 31, 2021, 2022 and 2023, RMB22,252,467, RMB31,050,125, and RMB20,013,537 (US$2,818,848),

respectively.”

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 29

(x) Segment Reporting, page F-23

| 16. | Please provide us with a detailed analysis of how you determined you have one reportable segment and revise your disclosure as applicable. In doing so, clarify why the Pinduoduo and Temu platforms do not qualify as separate reportable segments. Refer to ASC 280-10-50-1 through 50-9. If you are aggregating operating segments tell us how you evaluated all the criteria in ASC 280-10-50-11 and 12, including how they have similar economic characteristics. |

The Company acknowledges the Staff’s comments and respectfully advises the Staff that, when forming the conclusion that the Company has one operating segment and one reportable segment (i.e., the provision of e-commerce services) in connection with the 2023 Form 20-F, it performed a thorough analysis of its business and operations in accordance with ASC 280-10-50. Below please find a summary of the key considerations:

Business

The Company operates a business that assists merchants in reaching consumers and growing their sales through two major e-commerce platforms, Pinduoduo and Temu. Both platforms serve merchants in China, many of whom operate on both platforms and offer their products to consumers all over the world. The Company successfully connected merchants in China with consumers in various countries and regions within less than two years, which is attributable to the universal consumer demand for quality products at attractive prices, regardless of regional, cultural, or linguistic differences. This rapid growth is driven by the Company’s strong supply chain capabilities, which include a large number of merchants in China operating on the platforms and offering a diverse range of products, thereby enhancing the overall quality and affordability of the product offerings.

With a broader selection of products, the Company’s platforms can attract more consumers. This influx of consumers encourages even more merchants to participate, creating a virtuous cycle that leads to higher transaction volumes and increased transaction service fees.

Moreover, as the number of merchants and the variety of products grows, there is a natural incentive for them to invest more in marketing efforts. Merchants are increasingly motivated to distinguish themselves and reach a wider audience through marketing activities, ultimately boosting the Company’s online marketing service revenue.

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

September 30, 2024

Page 30

The Company’s growth outside of China is built on eight years of supporting merchants in China since the launch of Pinduoduo. By leveraging its supply chain capabilities, the Company has expanded globally over the past year. The Company aspires to continue growing its merchant base and strengthening partnerships with merchants to meet global consumers’ universal demand for value-for-money products. The Company’s business will continue to be driven by the number of merchants operating on its platforms and their demand for the Company’s various services.

Please find below a summary of the key considerations in accordance with ASC 280-10-50-1 through 50-9:

The Company’s Organizational Structure and Its Chief Operating Decision Makers

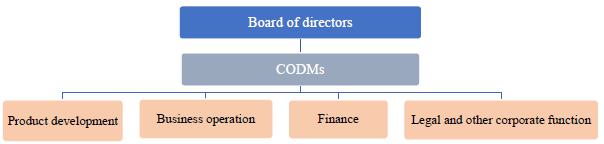

The Company, founded in 2015, is a multinational commerce group. Since its inception, the Company has maintained a singular focus on its sole operational segment: e-commerce. The Company’s organizational structure is broadly depicted as follows:

The Company’s Co-Chief Executive Officers (“Co-CEOs”) are Mr. Lei Chen and Mr. Jiazhen Zhao. Business function leaders report to the Co-CEOs. All of these functional areas operate on a company-wide scale and support all products across platforms. The Co-CEOs regularly report to the board of directors to keep board members informed about the Company’s latest business developments and to seek guidance and approvals from the board on significant matters.