Q2 2025 1 Company Presentation

Forward-Looking Statements Cautionary Statement on Forward-looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. This presentation includes forward-looking statements that reflect our current expectations, projections and goals relating to our future results, performance and prospects. Forward-looking statements include all statements that are not historical in nature and are not current facts. When used in this presentation, the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could,” “will” or the negative of these terms or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events with respect to, among other things: our operating cash flows; the availability of capital and our liquidity; our ability to renew and refinance our debt; our future revenue, income and operating performance; our ability to sustain and improve our utilization, revenue and margins; our ability to maintain acceptable pricing for our services; future capital expenditures; our ability to finance equipment, working capital and capital expenditures; our ability to execute our long-term growth strategy and to integrate our acquisitions; our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements; and the timing and success of strategic initiatives and special projects. The Company’s actual experience and results may differ materially from the experience and results anticipated in such statements. Forward-looking statements are not assurances of future performance and actual results could differ materially from our historical experience and our present expectations or projections. Although we believe the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Our forward-looking statements involve significant risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risks associated with the following: a decline in demand for our services, declining commodity prices, overcapacity and other competitive factors affecting our industry; the cyclical nature and volatility of the oil and gas industry, which impacts the level of exploration, production and development activity and spending patterns by oil and natural gas exploration and production companies; a decline in, or substantial volatility of, crude oil and gas commodity prices, which generally leads to decreased spending by our customers and negatively impacts drilling, completion and production activity; inflation; increases in interest rates; the ongoing conflict in Ukraine and its continuing effects on global trade; the on-going conflict in Israel; supply chain issues; and other risks and uncertainties listed in our filings with the U.S. Securities and Exchange Commission, including our Current Reports on Form 8-K that we file from time to time, Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward- looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by law. Disclaimer on Non-GAAP Financial Measures This presentation includes Adjusted EBITDA, Adjusted EBITDA margin, levered free cash flow, unlevered free cash flow and net debt measures. Each of the metrics are “non-GAAP financial measures” as defined in Regulation G of the Securities Exchange Act of 1934. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA is not a measure of net earnings or cash flows as determined by GAAP. We define Adjusted EBITDA as net earnings (loss) before interest, taxes, depreciation and amortization, further adjusted for (i) goodwill and/or long-lived asset impairment charges, (ii) stock-based compensation expense, (iii) restructuring charges, (iv) transaction and integration costs related to acquisitions, and (v) other expenses or charges to exclude certain items that we believe are not reflective of the ongoing performance of our business. Adjusted EBITDA is used to calculate the Company’s leverage ratio, consistent with the terms of the Company’s ABL Facility. We believe Adjusted EBITDA is useful because it allows us to supplement the GAAP measures in order to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP, or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA margin is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA margin is not a measure of net earnings or cash flows as determined by GAAP. Adjusted EBITDA margin is defined as the quotient of Adjusted EBITDA and total revenue. We believe Adjusted EBITDA margin is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, as a percentage of revenues. We define unlevered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment plus cash interest expense. We define levered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment. Our management uses unlevered and levered free cash flow to assess the Company’s liquidity and ability to repay maturing debt, fund operations and make additional investments. We believe that each of unlevered and levered free cash flow provide useful information to investors because it is an important indicator of the Company’s liquidity, including its ability to reduce net debt and make strategic investments. We define net debt as total debt less cash and cash equivalents and restricted cash. We believe that net debt provides useful information to investors because it is an important indicator of the Company’s indebtedness. Results of KLX Energy Services Holdings, Inc. (the "Company", “KLXE”, "KLX", "KLX Energy Services", “we”, “us” or “our”) for Q1’20 are presented on a pre-merger combined basis, which is the sum of the Company and Quintana Energy Services, Inc. (“QES”) results as disclosed, without any pro forma adjustments. Note that legacy QES fiscal year ended on December 31 and legacy KLXE fiscal year ended on January 31, which continued for KLXE until the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. Additional information is available on our website, www.klx.com. KLX Energy Services 2

3 NEXT LEVEL READINESS KLX Energy Services is a leading U.S. onshore provider of value-added, technologically-differentiated oilfield services focused on completion, intervention and production activities for the most technically demanding wells. NASDAQ KLXE Headquartered in Houston, TX Employees ~1,640 LTM Revenue $667MM LTM Net Loss $71MM LTM Adjusted EBITDA $78MM Results reflect Q2 2025 LTM results and headcount is as of June 30,2025; LTM Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the comparable GAAP measure, see Appendix.

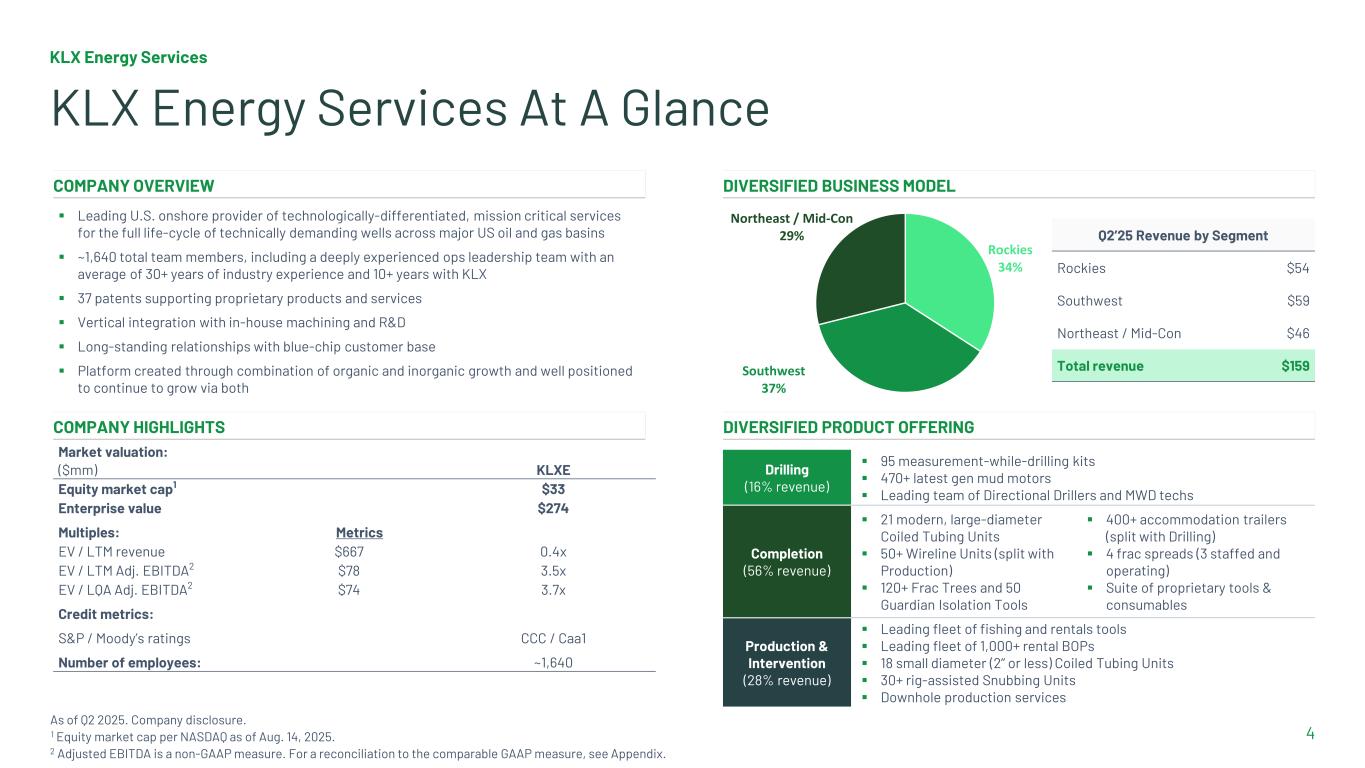

KLX Energy Services 4 KLX Energy Services At A Glance As of Q2 2025. Company disclosure. 1 Equity market cap per NASDAQ as of Aug. 14, 2025. 2 Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the comparable GAAP measure, see Appendix. COMPANY OVERVIEW DIVERSIFIED BUSINESS MODEL Leading U.S. onshore provider of technologically-differentiated, mission critical services for the full life-cycle of technically demanding wells across major US oil and gas basins ~1,640 total team members, including a deeply experienced ops leadership team with an average of 30+ years of industry experience and 10+ years with KLX 37 patents supporting proprietary products and services Vertical integration with in-house machining and R&D Long-standing relationships with blue-chip customer base Platform created through combination of organic and inorganic growth and well positioned to continue to grow via both Rockies 34% Southwest 37% Northeast / Mid-Con 29% Q2’25 Revenue by Segment Rockies $54 Southwest $59 Northeast / Mid-Con $46 Total revenue $159 COMPANY HIGHLIGHTS DIVERSIFIED PRODUCT OFFERING Market valuation: ($mm) KLXE Equity market cap1 $33 Enterprise value $274 Multiples: Metrics EV / LTM revenue $667 0.4x EV / LTM Adj. EBITDA2 $78 3.5x EV / LQA Adj. EBITDA2 $74 3.7x Credit metrics: S&P / Moody’s ratings CCC / Caa1 Number of employees: ~1,640 Drilling (16% revenue) 95 measurement-while-drilling kits 470+ latest gen mud motors Leading team of Directional Drillers and MWD techs Completion (56% revenue) 21 modern, large-diameter Coiled Tubing Units 50+ Wireline Units (split with Production) 120+ Frac Trees and 50 Guardian Isolation Tools 400+ accommodation trailers (split with Drilling) 4 frac spreads (3 staffed and operating) Suite of proprietary tools & consumables Production & Intervention (28% revenue) Leading fleet of fishing and rentals tools Leading fleet of 1,000+ rental BOPs 18 small diameter (2’’ or less) Coiled Tubing Units 30+ rig-assisted Snubbing Units Downhole production services

5 Provide market leading onsite job execution and safety Drive margin enhancing utilization Focus on pricing and cost structure to drive margins Expand share of wallet with top customers Continue to de-lever through a combination of EBITDA growth, free cash flow generation, debt reduction and consolidation Expand integrated suite of proprietary technology and products Expand certain product service lines ("PSLs") geographically Continue to redeploy and expand our asset base in certain PSLs as returns warrant Believe KLX is the partner of choice for consolidation Maximize long-term shareholder value via synergistic consolidation Greene’s acquisition is a blue- print by which KLX can structure win-win transactions, providing a conduit to liquidity for exceptional private oil service businesses Operational Excellence Augment Balance Sheet Strength Technology & Organic Growth Consolidation KLX Energy Services Strategic Focus

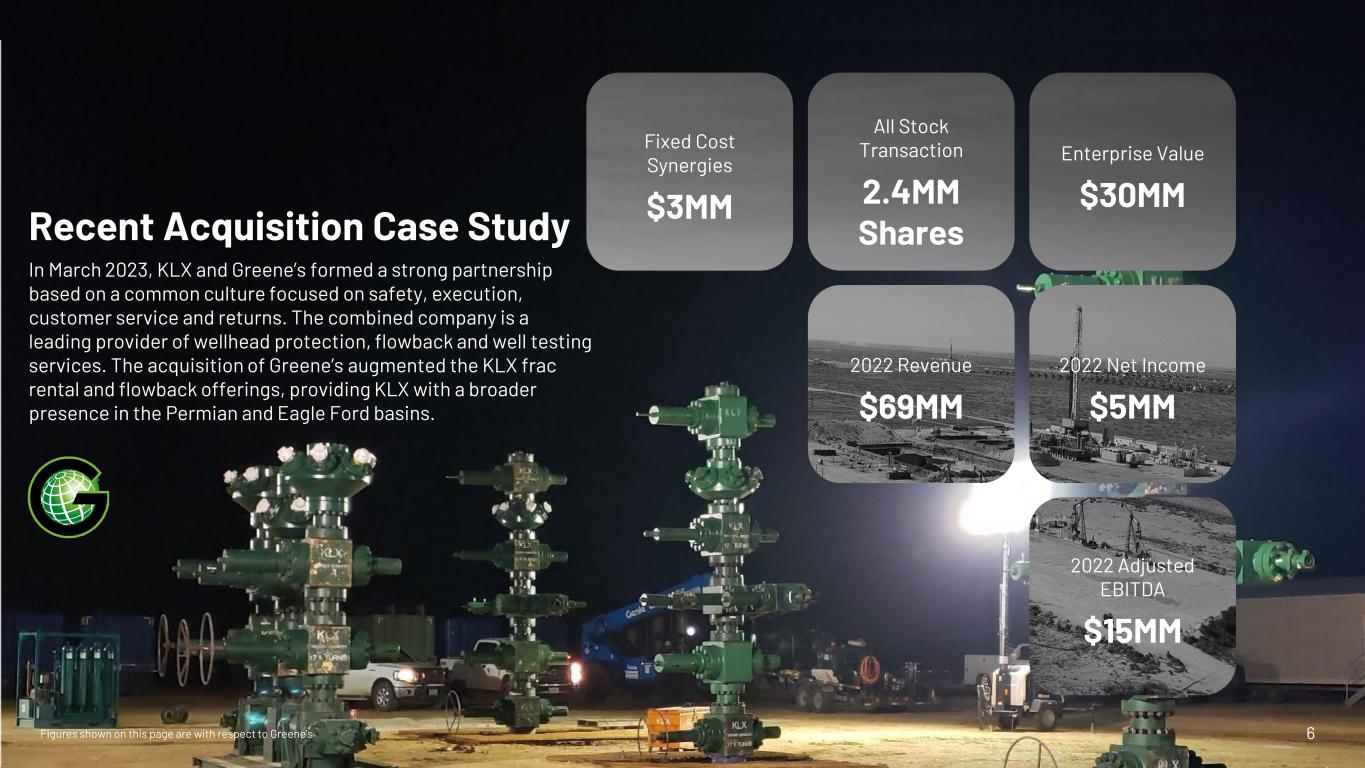

6 Recent Acquisition Case Study In March 2023, KLX and Greene’s formed a strong partnership based on a common culture focused on safety, execution, customer service and returns. The combined company is a leading provider of wellhead protection, flowback and well testing services. The acquisition of Greene’s augmented the KLX frac rental and flowback offerings, providing KLX with a broader presence in the Permian and Eagle Ford basins. 2022 Adjusted EBITDA $15MM 2022 Revenue $69MM All Stock Transaction 2.4MM Shares Enterprise Value $30MM 2022 Net Income $5MM Fixed Cost Synergies $3MM Figures shown on this page are with respect to Greene’s

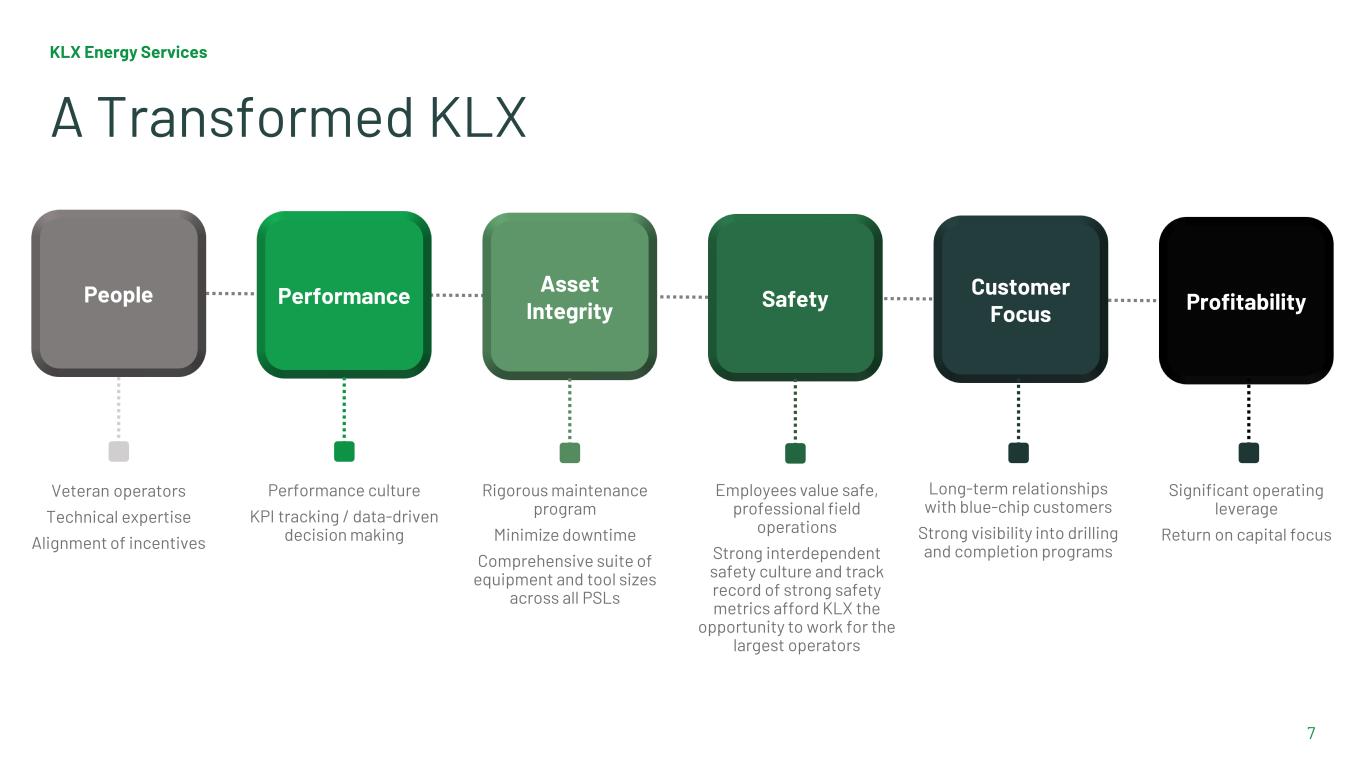

Performance culture KPI tracking / data-driven decision making Veteran operators Technical expertise Alignment of incentives KLX Energy Services 7 Rigorous maintenance program Minimize downtime Comprehensive suite of equipment and tool sizes across all PSLs Employees value safe, professional field operations Strong interdependent safety culture and track record of strong safety metrics afford KLX the opportunity to work for the largest operators A Transformed KLX Long-term relationships with blue-chip customers Strong visibility into drilling and completion programs Significant operating leverage Return on capital focus People Performance Asset Integrity Safety Customer Focus Profitability

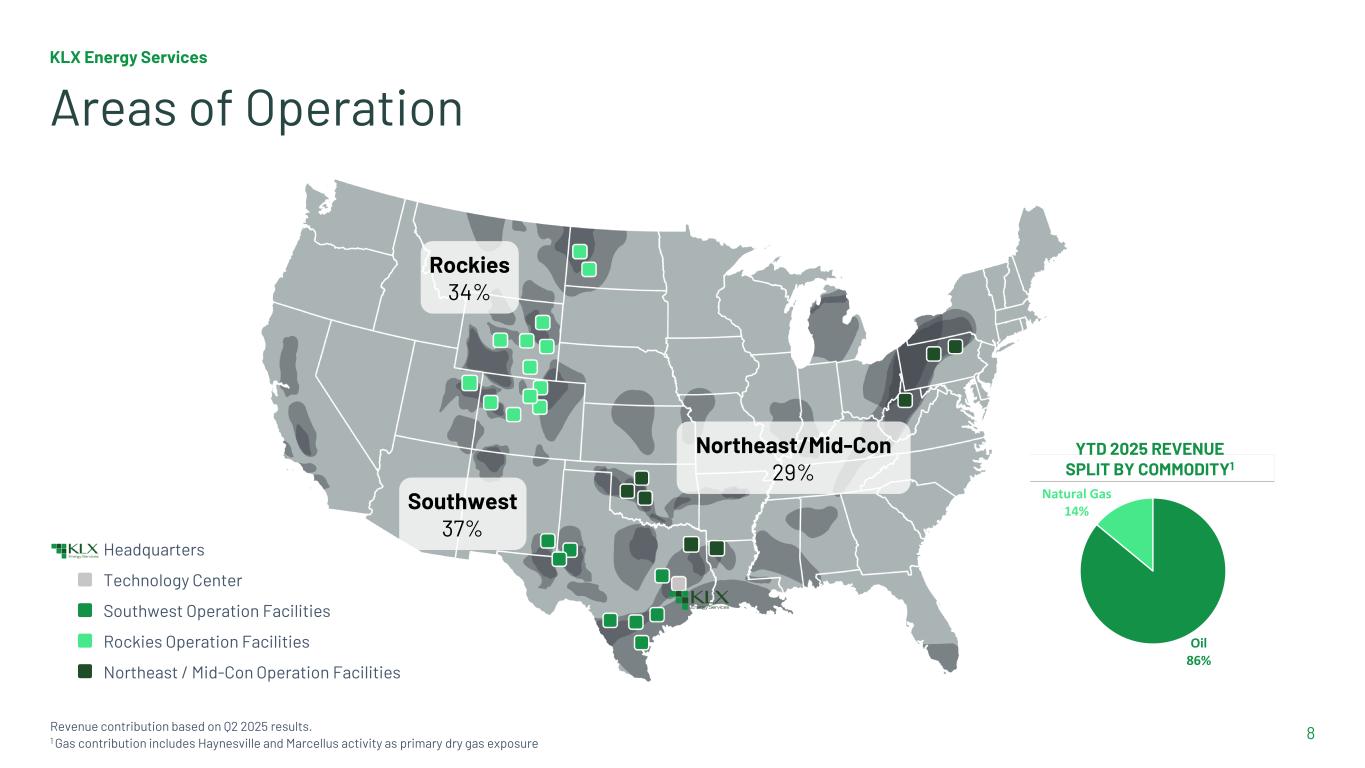

KLX Energy Services 8 Areas of Operation Revenue contribution based on Q2 2025 results. 1 Gas contribution includes Haynesville and Marcellus activity as primary dry gas exposure Headquarters Technology Center Southwest Operation Facilities Rockies Operation Facilities Northeast / Mid-Con Operation Facilities Rockies 34% Northeast/Mid-Con 29% Southwest 37% YTD 2025 REVENUE SPLIT BY COMMODITY1 Oil 86% Natural Gas 14%

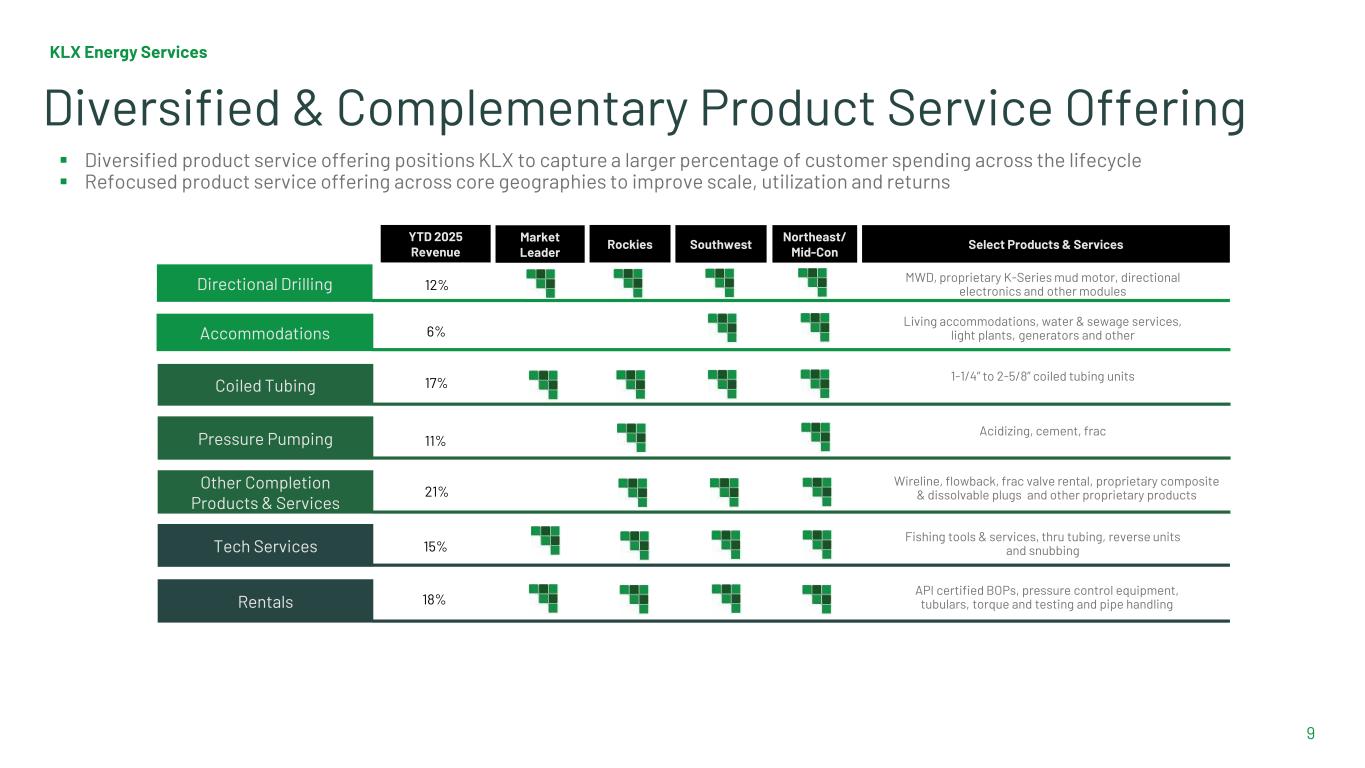

KLX Energy Services 9 Diversified & Complementary Product Service Offering Diversified product service offering positions KLX to capture a larger percentage of customer spending across the lifecycle Refocused product service offering across core geographies to improve scale, utilization and returns 1 MWD, proprietary K-Series mud motor, directional electronics and other modulesDirectional Drilling Pressure Pumping Accommodations Coiled Tubing Other Completion Products & Services Tech Services Rentals Living accommodations, water & sewage services, light plants, generators and other 1-1/4” to 2-5/8” coiled tubing units Acidizing, cement, frac Wireline, flowback, frac valve rental, proprietary composite & dissolvable plugs and other proprietary products Fishing tools & services, thru tubing, reverse units and snubbing API certified BOPs, pressure control equipment, tubulars, torque and testing and pipe handling YTD 2025 Revenue Market Leader Rockies Southwest Northeast/ Mid-Con Select Products & Services 12% 6% 17% 11% 21% 15% 18%

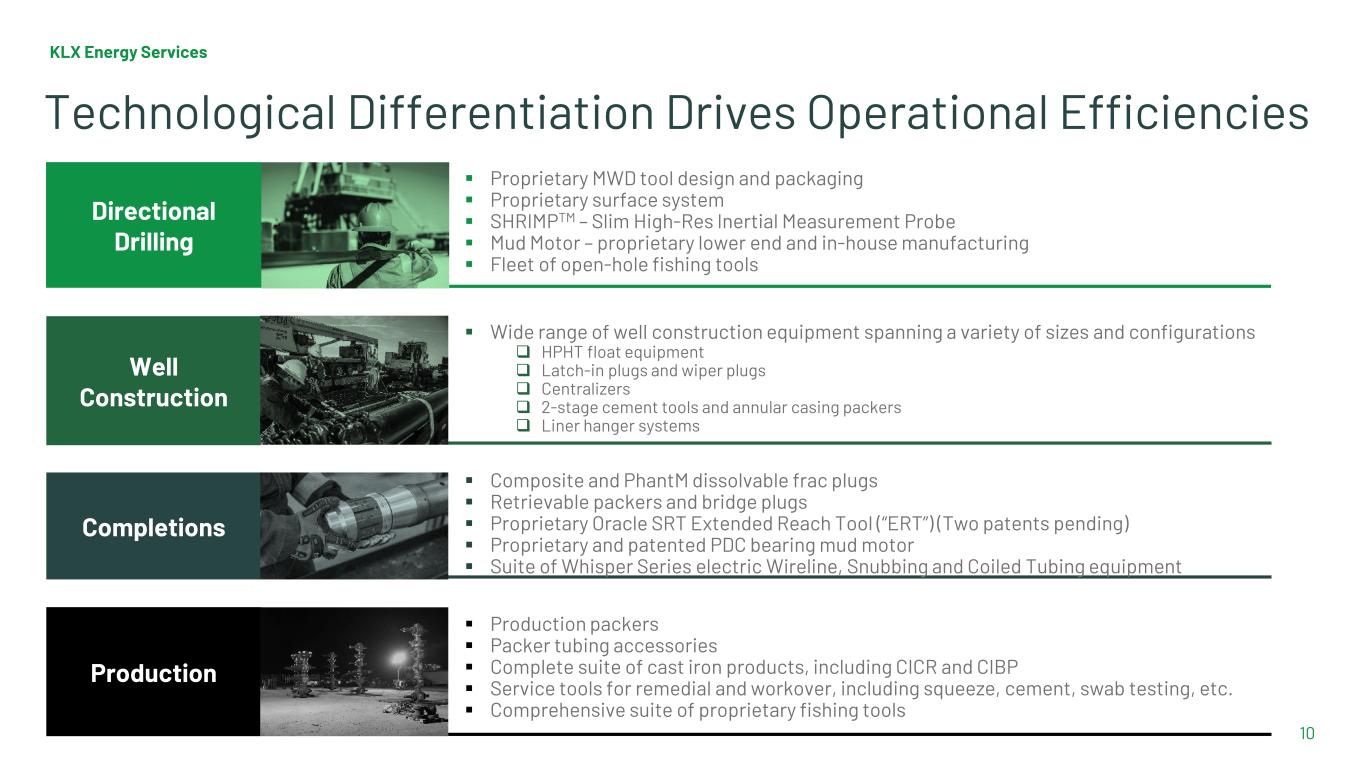

Wide range of well construction equipment spanning a variety of sizes and configurations HPHT float equipment Latch-in plugs and wiper plugs Centralizers 2-stage cement tools and annular casing packers Liner hanger systems Proprietary MWD tool design and packaging Proprietary surface system SHRIMPTM – Slim High-Res Inertial Measurement Probe Mud Motor – proprietary lower end and in-house manufacturing Fleet of open-hole fishing tools KLX Energy Services 10 Directional Drilling Well Construction Completions Production Composite and PhantM dissolvable frac plugs Retrievable packers and bridge plugs Proprietary Oracle SRT Extended Reach Tool (“ERT”) (Two patents pending) Proprietary and patented PDC bearing mud motor Suite of Whisper Series electric Wireline, Snubbing and Coiled Tubing equipment Production packers Packer tubing accessories Complete suite of cast iron products, including CICR and CIBP Service tools for remedial and workover, including squeeze, cement, swab testing, etc. Comprehensive suite of proprietary fishing tools Technological Differentiation Drives Operational Efficiencies

KLX Energy Services 11 In-House R&D Capability Supports Continuous Improvement KLX recently introduced its revolutionary VISION suite of Downhole Completion tools, delivering advanced engineering and customized solutions for downhole operators Engineering Breadth Two dedicated R&D facilities focusing primarily on: — Downhole production service enhancement — Technical services support — Frac valve innovation Product Design From new advanced downhole tools to the KLX Frac Relief Valve System, KLX engineers are continuously designing innovative, value-added products Collaborative Engineering Engineering team works closely with operators to fully understand operational challenges Experienced Engineers 8 dedicated engineers supporting the R&D effort across the organization Dedicated in-house R&D team of eight dedicated engineers work closely with operators to create, new value-added innovations that help minimize Non-Product Time (NPT) and streamline operations “KLX has a legacy in providing lasting results for the most challenging operations. By continually listening to our customers; investing in product innovation; and empowering our team of experts, KLX embodies its mantra of, “Next Level Readiness.” – John Horgan, VP Operations, KLX Improved Efficiency Converts fluid flow into bit rotation and allows KLX to drill/mill up plugs and debris Extended Reach Tool Offers unique way to resolve long lateral issues Setting the Standard Dissolvable frac plugs that are highly engineered to exceeds industry standards Pump at Faster Rates Mud lube bearings that allows KLX to meet operators’ desire to pump at increasing rates Optimum Efficiency Works in conjunction with KLX’s downhole thru tubing motor system as a smarter solution Reduce Lost Time Minimizes the need for interventions with highly engineered design Long Lateral Solution Offers the capability to handle long laterals Full Data Capabilities Captures important data to make quicker decisions Reduce Failures Dissolvable plugs lower NPT and failures due to higher quality fabrication

12 KLX Energy Services KLX – The Choice of Top Operators Revenue driven by top 10 customers in 2024 Significant leverage to and long-term relationships with the most active operators and industry consolidators ~610 50% Unique customers serviced in 2024 with no one customer accounting for more than 10% of 2024 revenue As of June 30, 2025, 70% of YTD 2025 Top 10 Customers were Top 20 operators by rig count.

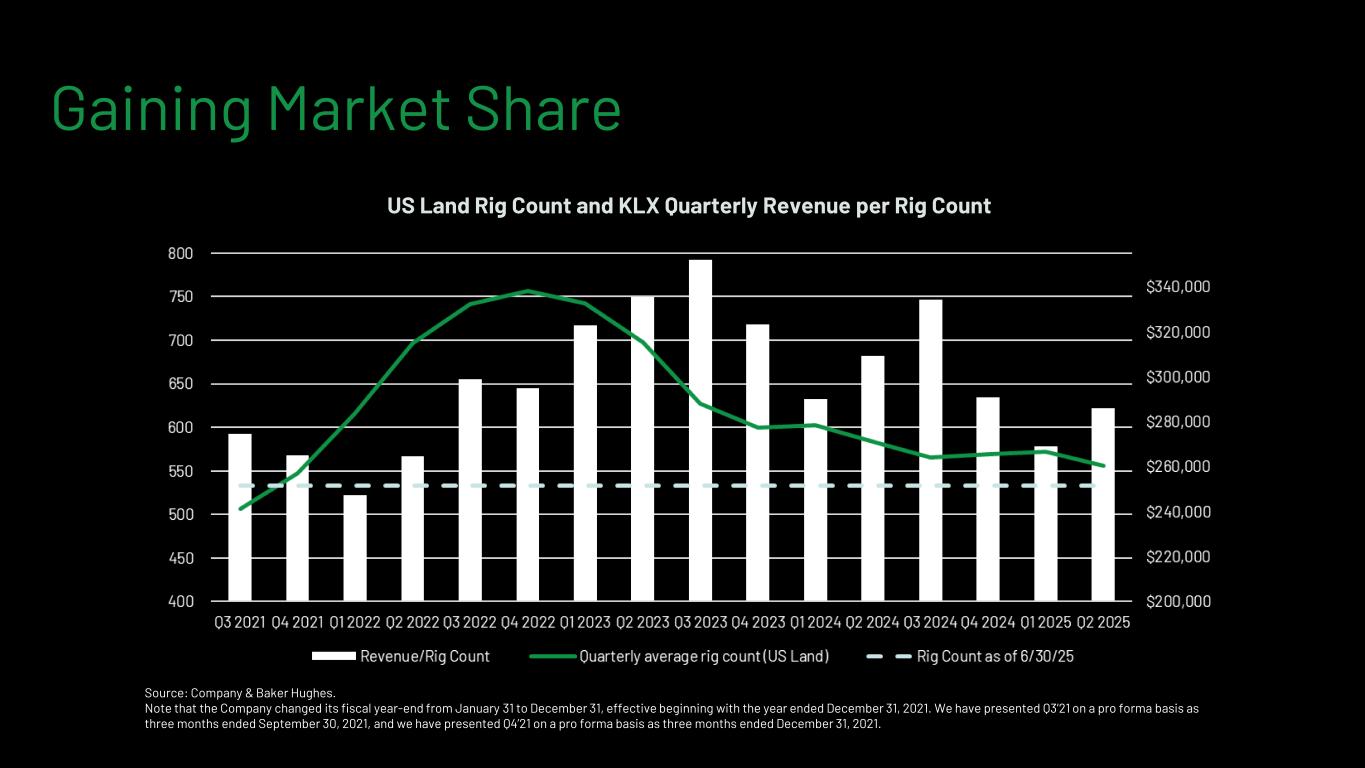

Source: Company & Baker Hughes. Note that the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. We have presented Q3’21 on a pro forma basis as three months ended September 30, 2021, and we have presented Q4’21 on a pro forma basis as three months ended December 31, 2021. Gaining Market Share US Land Rig Count and KLX Quarterly Revenue per Rig Count

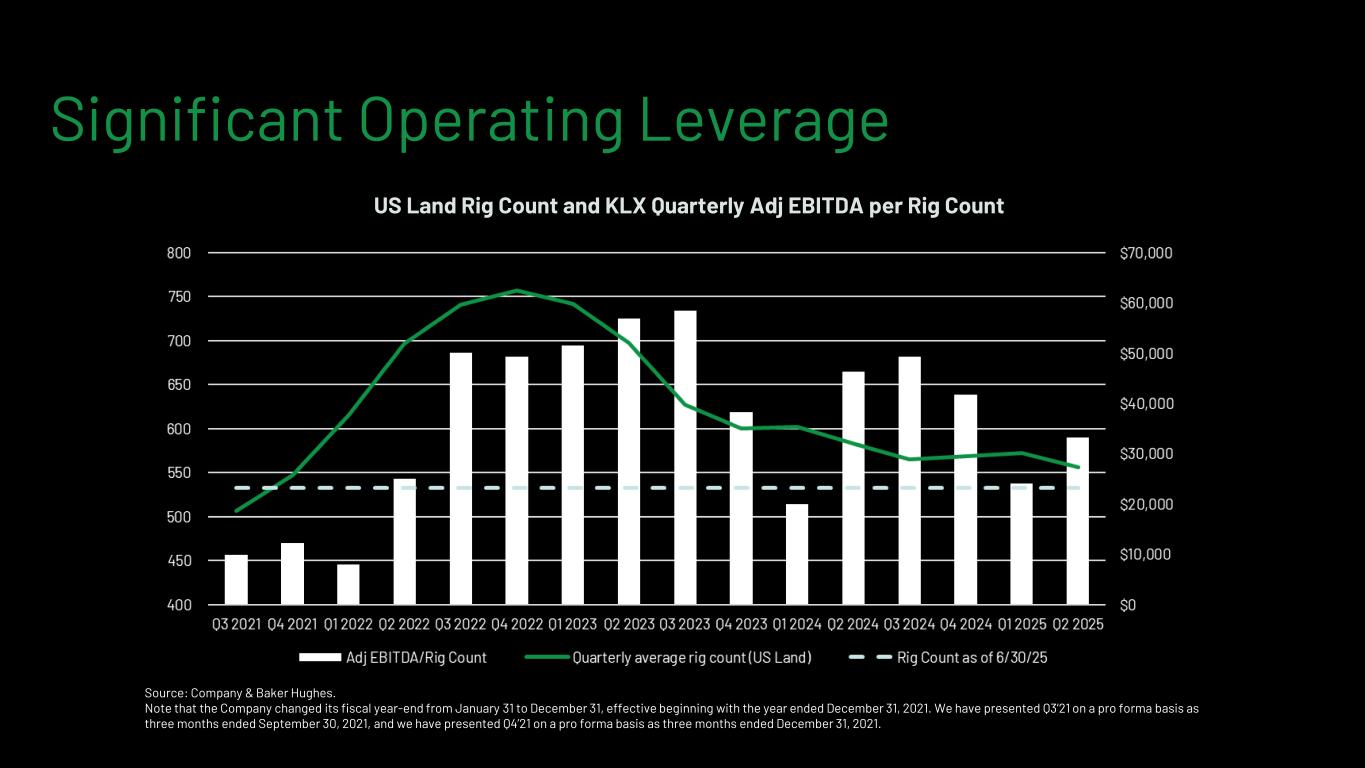

Source: Company & Baker Hughes. Note that the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. We have presented Q3’21 on a pro forma basis as three months ended September 30, 2021, and we have presented Q4’21 on a pro forma basis as three months ended December 31, 2021. Significant Operating Leverage US Land Rig Count and KLX Quarterly Adj EBITDA per Rig Count

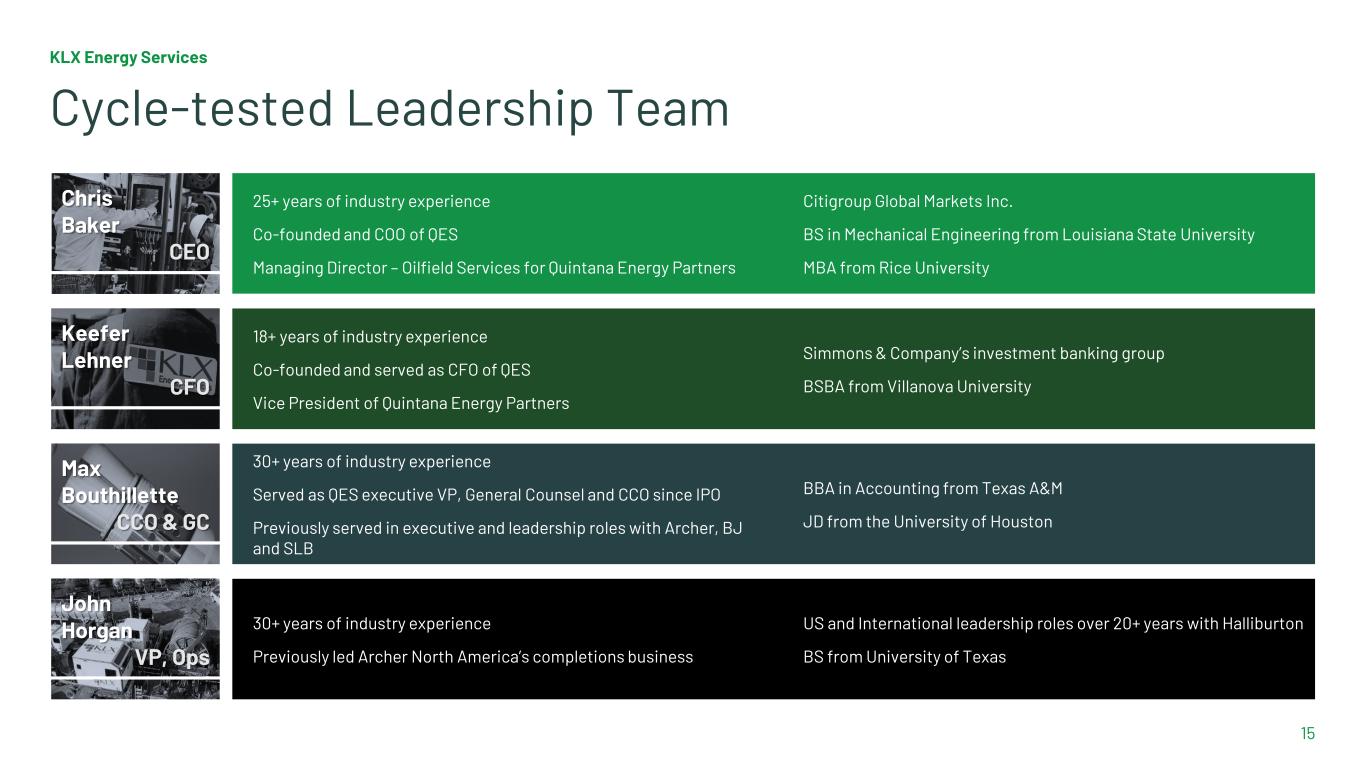

KLX Energy Services 15 Cycle-tested Leadership Team Chris Baker CEO 25+ years of industry experience Co-founded and COO of QES Managing Director – Oilfield Services for Quintana Energy Partners Citigroup Global Markets Inc. BS in Mechanical Engineering from Louisiana State University MBA from Rice University Keefer Lehner CFO 18+ years of industry experience Co-founded and served as CFO of QES Vice President of Quintana Energy Partners Simmons & Company’s investment banking group BSBA from Villanova University Max Bouthillette CCO & GC 30+ years of industry experience Served as QES executive VP, General Counsel and CCO since IPO Previously served in executive and leadership roles with Archer, BJ and SLB BBA in Accounting from Texas A&M JD from the University of Houston John Horgan VP, Ops 30+ years of industry experience Previously led Archer North America’s completions business US and International leadership roles over 20+ years with Halliburton BS from University of Texas

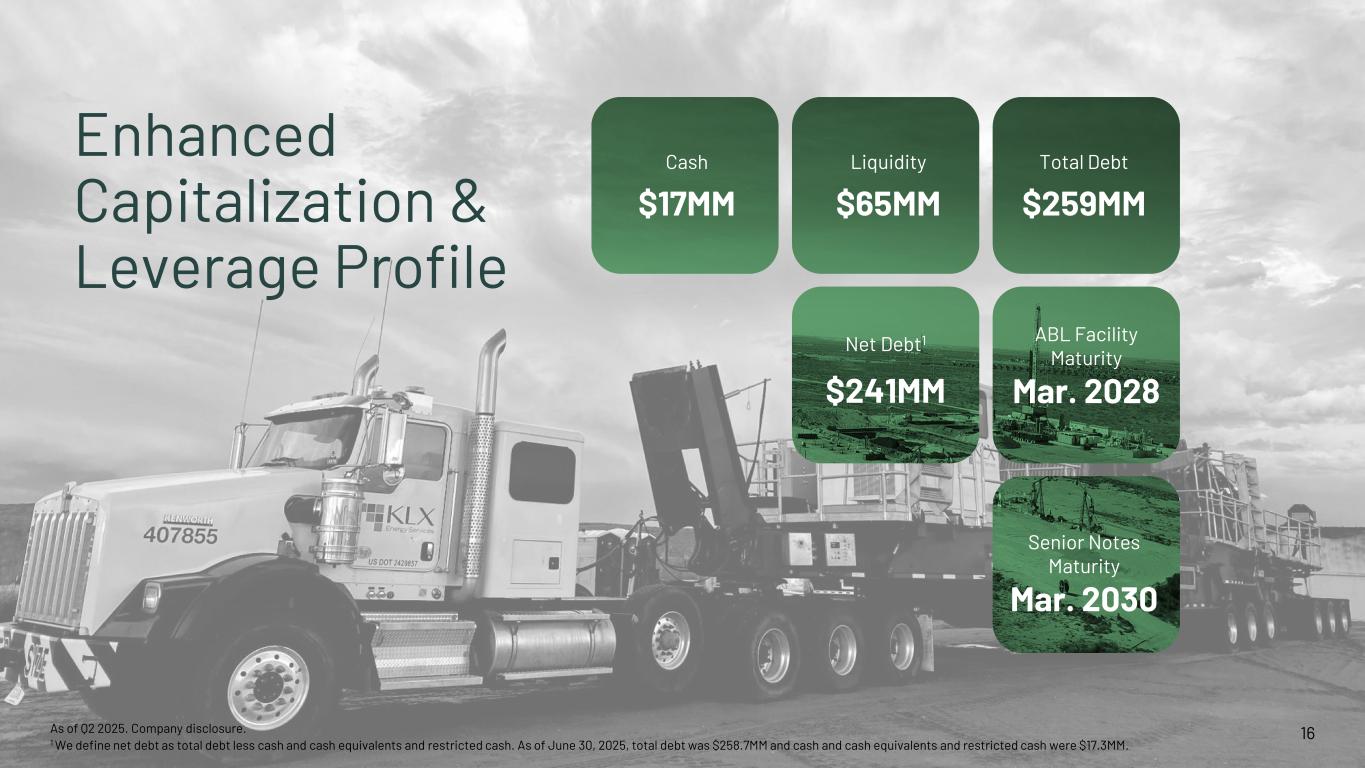

16 Enhanced Capitalization & Leverage Profile Maturity 2025 ABL Facility Maturity Mar. 2028 Cash $17MM Liquidity $65MM Total Debt $259MM Net Debt1 $241MM Senior Notes Maturity Mar. 2030 As of Q2 2025. Company disclosure. 1 We define net debt as total debt less cash and cash equivalents and restricted cash. As of June 30, 2025, total debt was $258.7MM and cash and cash equivalents and restricted cash were $17.3MM.

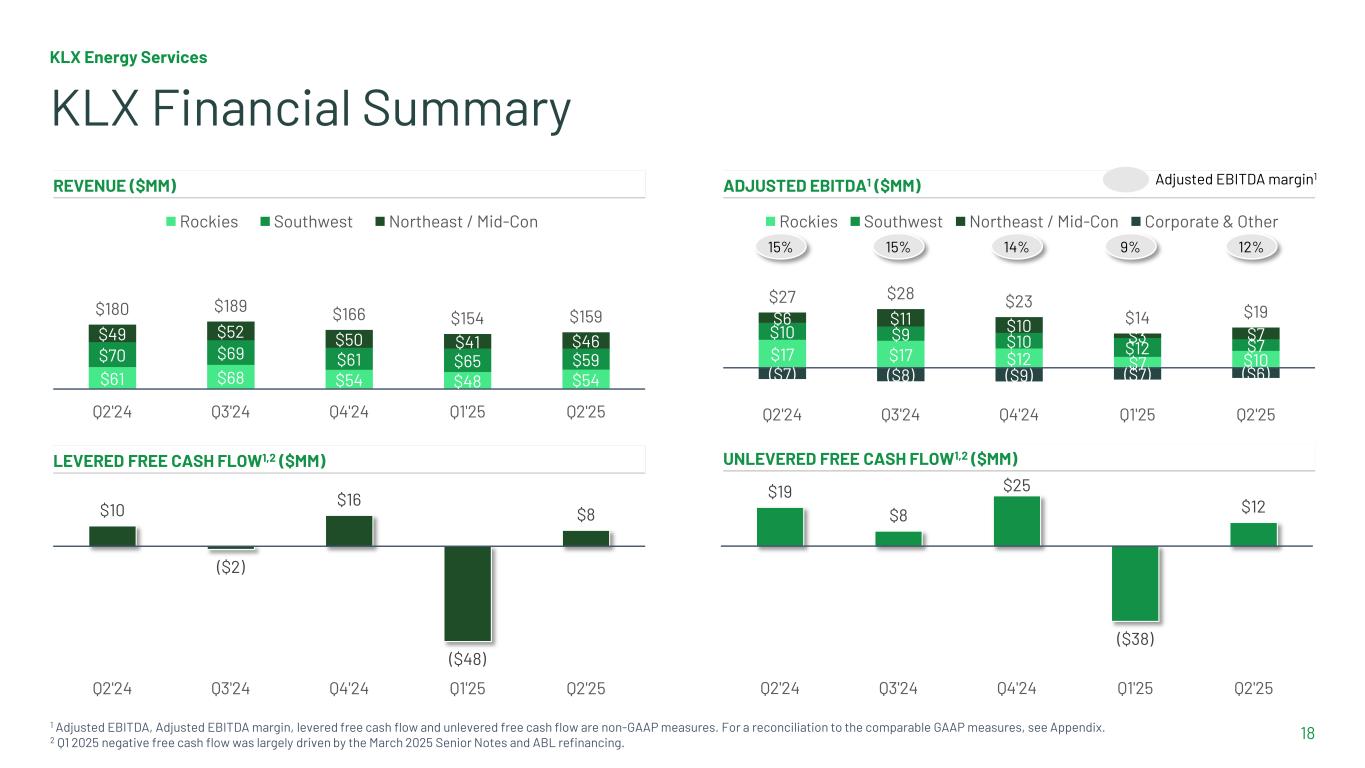

KLX Energy Services 17 Q2 2025 Summary & Q3 2025 Guidance Q3 revenue guidance of low to mid- single digit percentage increase Continued Adj EBITDA Margin expansion Q3 2025 GUIDANCE (AS DISCLOSED IN EARNINGS RELEASE ON AUGUST 6, 2025) Q2 2025 SUMMARY $159MM of Revenue increased 3% sequentially, despite 7% decline in US land rig count over the same period Adjusted EBITDA increased 34% sequentially to $19MM 12% Adjusted EBITDA Margin, an increase of 30% from 9% in Q1 2025 The sequential improvement in Adjusted EBITDA and Adjusted EBITDA Margin was driven by increased utilization and decreased white space in our Rockies and Northeast/Mid-Con segments, more than offsetting lower activity from the Permian due to that basin experiencing the largest sequential rig count decrease in close to two years Cash and liquidity of $17MM and $65MM, respectively Total Debt of $259MM, reduced 1% sequentially

$17 $17 $12 $7 $10 $10 $9 $10 $12 $7 $6 $11 $10 $3 $7 ($7) ($8) ($9) ($7) ($6) $27 $28 $23 $14 $19 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Rockies Southwest Northeast / Mid-Con Corporate & Other KLX Energy Services 18 KLX Financial Summary REVENUE ($MM) LEVERED FREE CASH FLOW1,2 ($MM) ADJUSTED EBITDA1 ($MM) UNLEVERED FREE CASH FLOW1,2 ($MM) 1 Adjusted EBITDA, Adjusted EBITDA margin, levered free cash flow and unlevered free cash flow are non-GAAP measures. For a reconciliation to the comparable GAAP measures, see Appendix. 2 Q1 2025 negative free cash flow was largely driven by the March 2025 Senior Notes and ABL refinancing. $10 ($2) $16 ($48) $8 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 15% 9%15% 14% $61 $68 $54 $48 $54 $70 $69 $61 $65 $59 $49 $52 $50 $41 $46 $180 $189 $166 $154 $159 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Rockies Southwest Northeast / Mid-Con Adjusted EBITDA margin1 12% $19 $8 $25 ($38) $12 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25

19 Corporate Headquarters 3040 POST OAK BLVD 15th Floor Houston, TX 77056 Investor Relations Keefer M. Lehner, EVP & CFO (832) 930-8066 IR@klxenergy.com

Appendix 20

KLX Energy Services 21 Reconciliation of Consolidated Net (Loss) Income to Adjusted EBITDA (Loss) *Previously announced quarterly numbers may not sum to the year-end total due to rounding. (1) Quarterly cost of sales includes lease expense associated with five coiled tubing unit leases of $2.1 million in Q1 ‘20 through Q3 ‘23 and $2.0 million in Q4 ‘23. (2) The Company’s results for Q1’20 are presented on a pre-merger combined basis, which is the sum of KLX Energy Services Holdings, Inc. (“KLXE”) and Quintana Energy Services, Inc. (“QES”) results as disclosed, without any pro forma adjustments. Note that legacy QES fiscal year ended on December 31 and legacy KLXE fiscal year ended on January 31, which continued for KLXE until the Company changed its fiscal year-end from January 31 to December 31, effective beginning with the year ended December 31, 2021. As a result, our pre-merger combined quarterly data for Q1’20 includes legacy KLXE for three months ended April 30, 2020 and legacy QES for three months ended March 31, 2020. Furthermore, note that we have presented Q2’20 on a pro forma basis as the results of legacy KLXE and legacy QES assuming the Merger had occurred on February 1, 2020. Pre-merger periods exclude the value of deal synergies. (3) We have presented Q3’21 on a pro forma basis as three months ended September 30, 2021, and we have presented Q4’21 on a pro forma basis as three months ended December 31, 2021. (4) The one-time costs during the second quarter of 2025 relate mainly to legal costs, operational costs and other. (dollar amounts in millions)

KLX Energy Services 22 Consolidated Net (Loss) Income Margin and Consolidated Adjusted EBITDA Margin Reconciliations (dollar amounts in millions)

KLX Energy Services 23 Reconciliation of Segment Operating (Loss) Income to Adjusted EBITDA (1) One-time costs are defined in the Reconciliation of Consolidated Net Loss to Adjusted EBITDA (loss) table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges. (dollar amounts in millions)

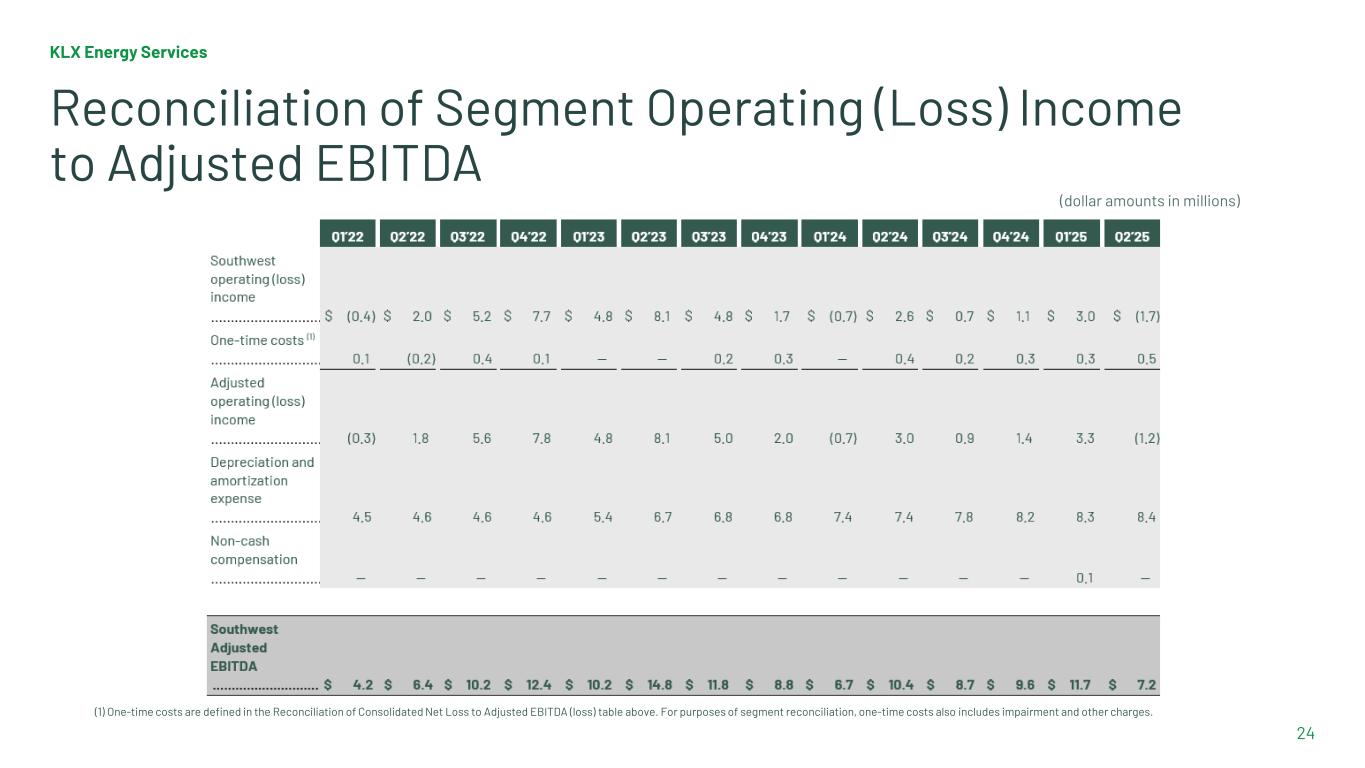

KLX Energy Services 24 Reconciliation of Segment Operating (Loss) Income to Adjusted EBITDA (1) One-time costs are defined in the Reconciliation of Consolidated Net Loss to Adjusted EBITDA (loss) table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges. (dollar amounts in millions)

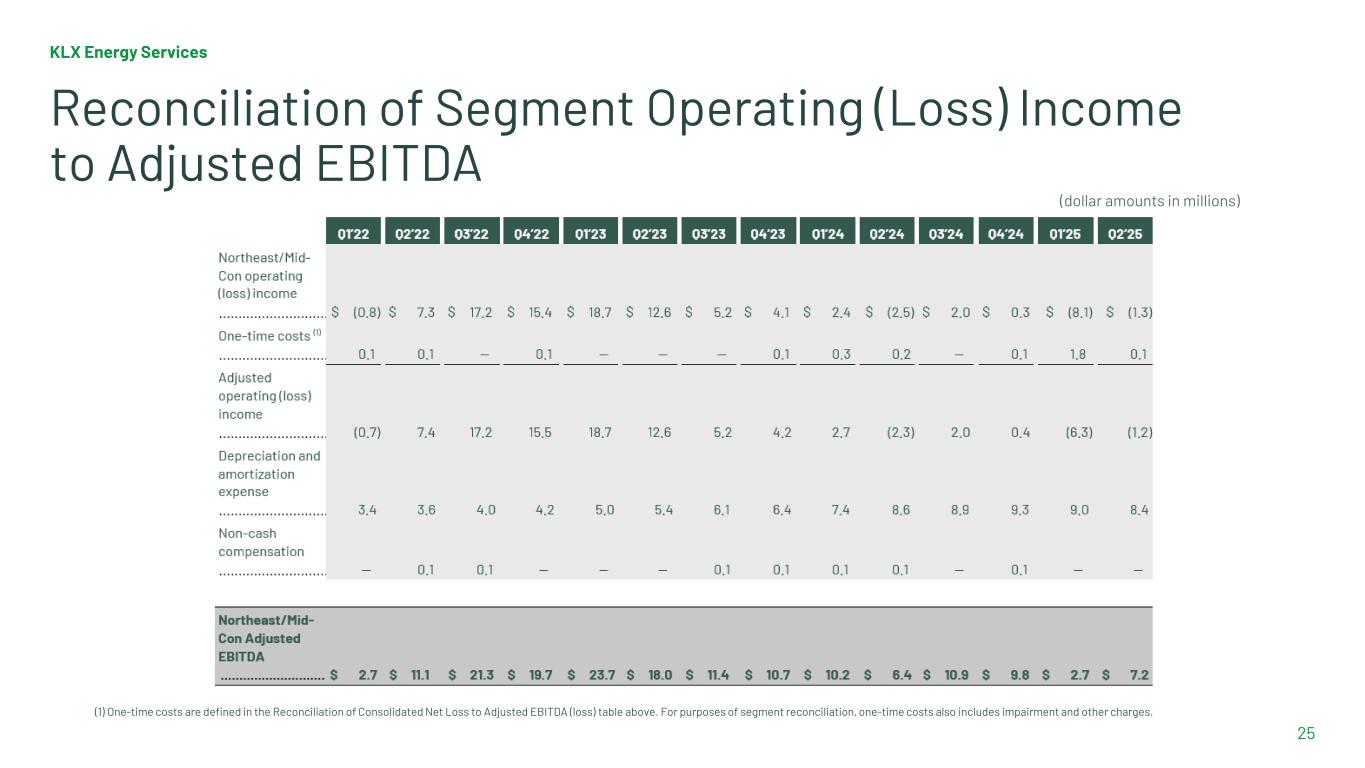

KLX Energy Services 25 Reconciliation of Segment Operating (Loss) Income to Adjusted EBITDA (1) One-time costs are defined in the Reconciliation of Consolidated Net Loss to Adjusted EBITDA (loss) table above. For purposes of segment reconciliation, one-time costs also includes impairment and other charges. (dollar amounts in millions)

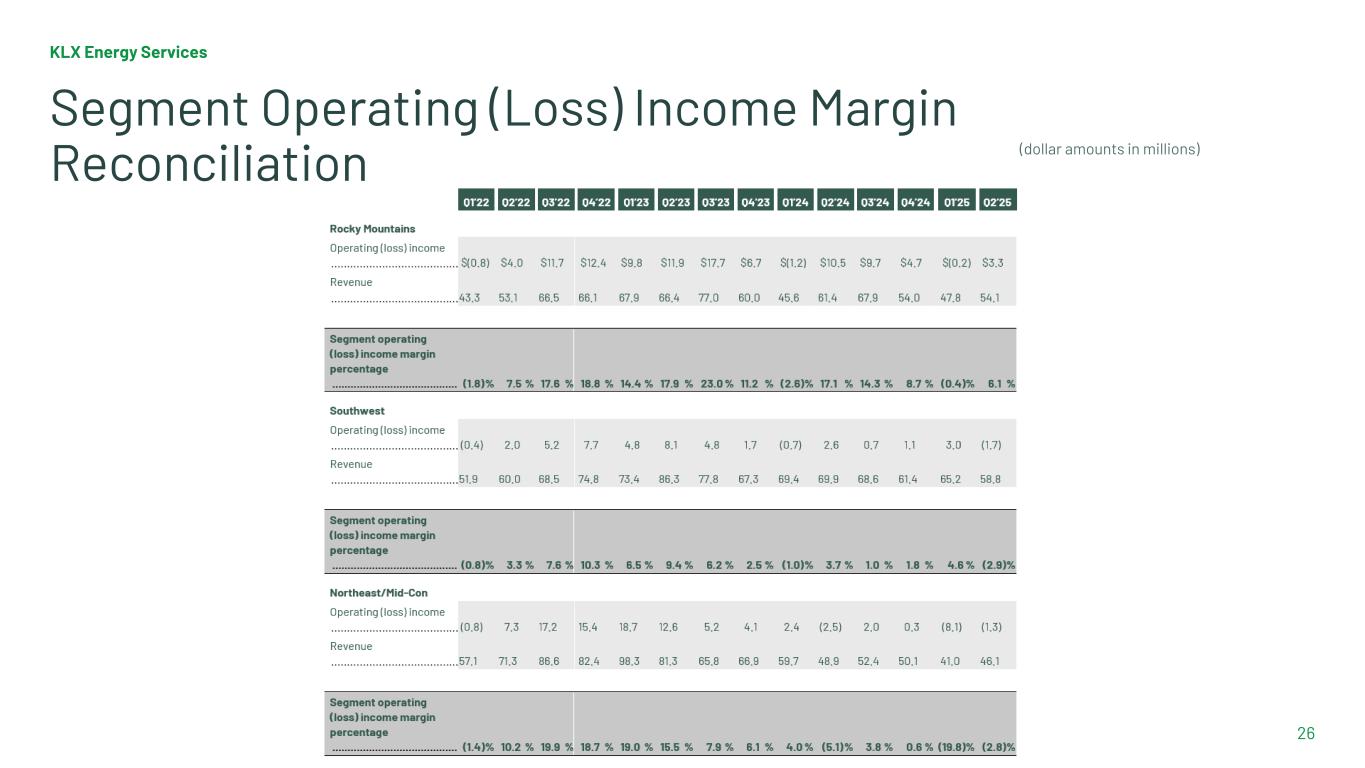

KLX Energy Services 26 Segment Operating (Loss) Income Margin Reconciliation (dollar amounts in millions)

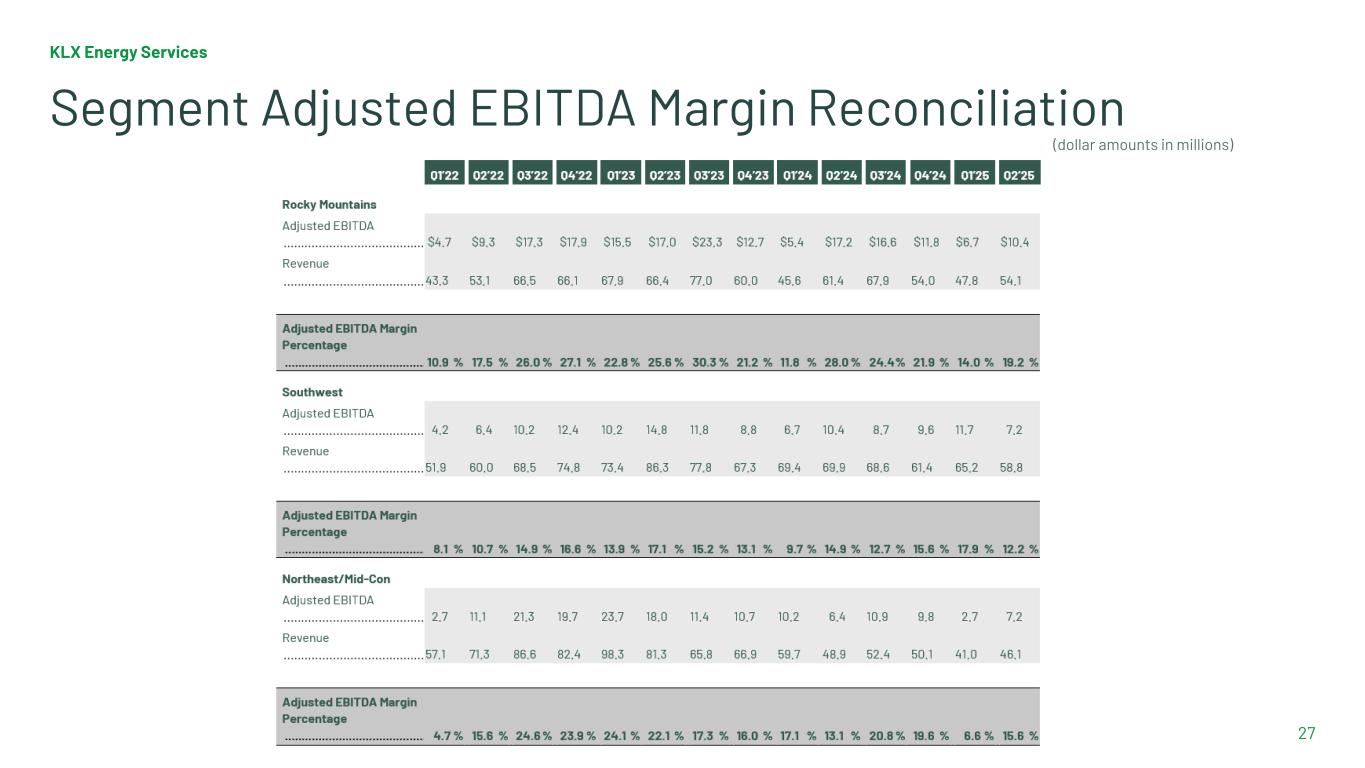

KLX Energy Services 27 Segment Adjusted EBITDA Margin Reconciliation (dollar amounts in millions)

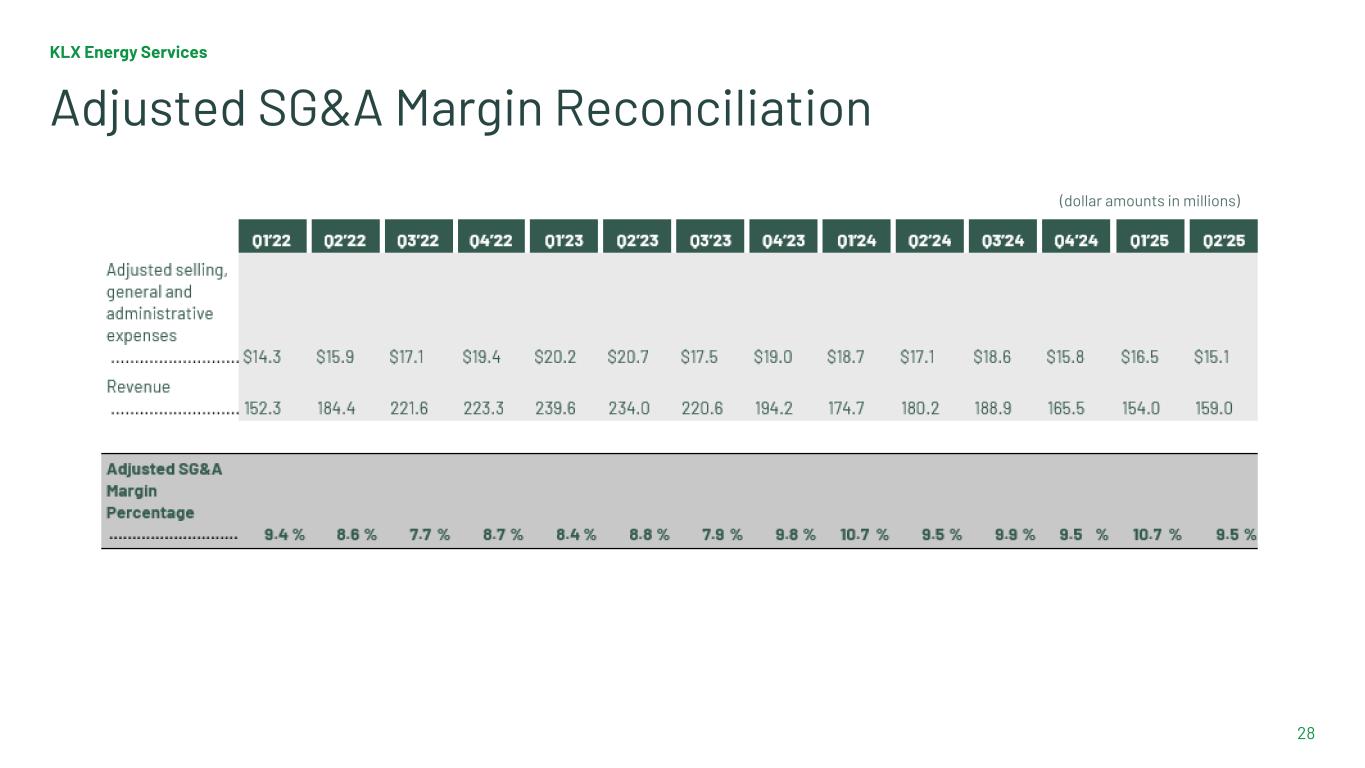

KLX Energy Services 28 Adjusted SG&A Margin Reconciliation (dollar amounts in millions)

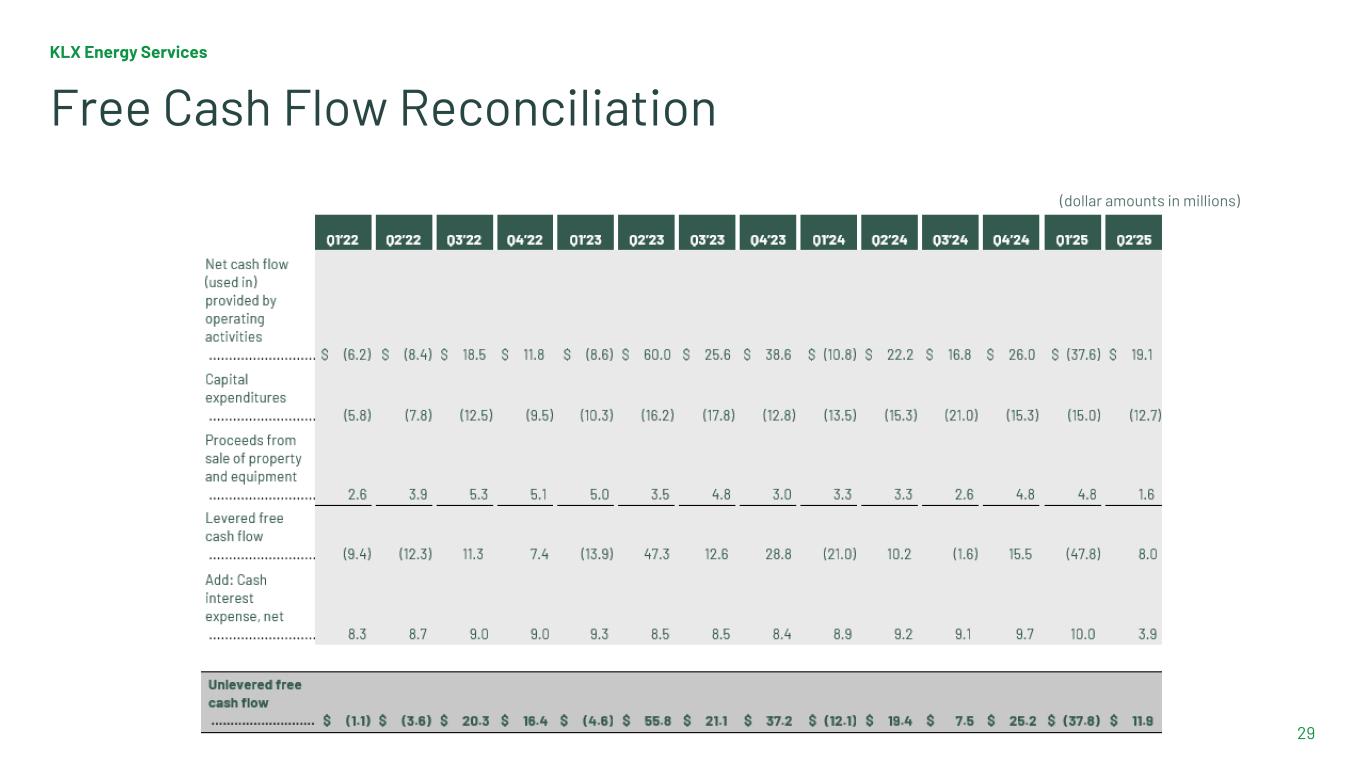

KLX Energy Services 29 Free Cash Flow Reconciliation (dollar amounts in millions)