Please wait

false0001739566DEF 14A0001739566ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-022023-12-310001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberutz:DylanLissetteMember2021-01-042022-01-020001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-01-012024-12-290001739566ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberutz:DylanLissetteMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-01-032023-01-010001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberutz:DylanLissetteMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-032023-01-010001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2024-01-012024-12-290001739566ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-01-042022-01-020001739566ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-042022-01-020001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberutz:DylanLissetteMemberecd:PeoMember2022-01-032023-01-010001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberutz:DylanLissetteMemberecd:PeoMember2022-01-032023-01-010001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2024-01-012024-12-290001739566ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-042022-01-020001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberutz:HowardFriedmanMemberecd:PeoMember2024-01-012024-12-290001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberutz:DylanLissetteMemberecd:PeoMember2020-01-012021-01-030001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:HowardFriedmanMemberecd:PeoMember2023-01-022023-12-310001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberutz:DylanLissetteMemberecd:PeoMember2021-01-042022-01-020001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:DylanLissetteMemberecd:PeoMember2021-01-042022-01-020001739566ecd:NonPeoNeoMemberutz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMember2023-01-022023-12-310001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2023-01-022023-12-31000173956632024-01-012024-12-290001739566ecd:NonPeoNeoMemberutz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMember2024-01-012024-12-290001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-042022-01-020001739566utz:HowardFriedmanMember2023-01-022023-12-310001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberutz:DylanLissetteMemberecd:PeoMember2020-01-012021-01-0300017395662022-01-032023-01-010001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberutz:DylanLissetteMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2024-01-012024-12-290001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberutz:DylanLissetteMember2020-01-012021-01-0300017395662023-01-022023-12-310001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:DylanLissetteMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-022023-12-3100017395662021-01-042022-01-020001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:DylanLissetteMemberecd:PeoMember2020-01-012021-01-030001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberutz:HowardFriedmanMemberecd:PeoMember2024-01-012024-12-290001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberecd:PeoMemberutz:DylanLissetteMember2021-01-042022-01-020001739566ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberutz:DylanLissetteMemberecd:PeoMember2021-01-042022-01-020001739566utz:DylanLissetteMember2021-01-042022-01-020001739566utz:HowardFriedmanMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-290001739566ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-022023-12-310001739566ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-032023-01-010001739566ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberutz:DylanLissetteMemberecd:PeoMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-022023-12-3100017395662024-01-012024-12-290001739566ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-01-012024-12-290001739566ecd:NonPeoNeoMemberutz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMember2020-01-012021-01-030001739566ecd:NonPeoNeoMemberutz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMember2022-01-032023-01-010001739566ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-01-012021-01-030001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2022-01-032023-01-010001739566utz:DylanLissetteMember2022-01-032023-01-010001739566utz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMemberutz:HowardFriedmanMemberecd:PeoMember2023-01-022023-12-310001739566ecd:NonPeoNeoMemberutz:YearOverYearChangeInFairValueOfAwardsGrantedDuringPriorFiscalYearVestingDuringCoveredFiscalYearMember2021-01-042022-01-020001739566ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2024-01-012024-12-290001739566utz:HowardFriedmanMember2020-01-012021-01-030001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberutz:DylanLissetteMember2021-01-042022-01-020001739566utz:HowardFriedmanMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-022023-12-310001739566ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-042022-01-0200017395662020-01-012021-01-030001739566utz:HowardFriedmanMember2024-01-012024-12-290001739566ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2024-01-012024-12-290001739566ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012021-01-030001739566ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberutz:HowardFriedmanMemberecd:PeoMember2024-01-012024-12-290001739566ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-032023-01-010001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberutz:HowardFriedmanMemberecd:PeoMember2023-01-022023-12-31000173956622024-01-012024-12-290001739566ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberutz:DylanLissetteMemberecd:PeoMember2022-01-032023-01-01000173956612024-01-012024-12-290001739566utz:DylanLissetteMember2020-01-012021-01-030001739566ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberutz:HowardFriedmanMemberecd:PeoMember2023-01-022023-12-310001739566ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-022023-12-310001739566utz:HowardFriedmanMember2022-01-032023-01-01iso4217:USD

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

☐ |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

|

Definitive Proxy Statement |

|

|

☐ |

|

Definitive Additional Materials |

|

|

☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

UTZ BRANDS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

☒ |

|

No fee required |

|

|

☐ |

|

Fee paid previously with preliminary materials. |

|

|

☐ |

|

Fee computed in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The Utz portfolio of brands offers a broad range of snacks that are loved for their flavors and crafted quality. From the namesake Utz® brand that has been beloved for its family-crafted flavors since 1921, to the restaurant-inspired On The Border® Tortilla Chips, Salsas and Dips, to the bold and unique flavors of Zapp’s® New Orleans Kettle Chips – Utz brands are made with the care and passion consumers love.

|

|

|

|

|

|

2025 Proxy Statement |

March 13, 2025

DEAR FELLOW

STOCKHOLDERS,

I invite you to attend our 2025 Annual Meeting of Stockholders to be held on Thursday, April 24, 2025, at 9:00 a.m. Eastern Time in a virtual meeting format.

A glance back at 2024:

2024 was a year of growth and strong performance. We executed well against our four fundamental strategies introduced a year ago, which we believe will drive shareholder value.

In fiscal year 2024, our total net sales decreased 2.0% to $1,409.3 million and Organic Net Sales increased 1.3%.(1) Our GAAP net income moved from $(40.0) million to $30.7 million, representing a 176.8% change, our Adjusted EBITDA increased approximately 6.9% to $200.2 million,(1) and we finished the year as the 3rd largest U.S. salty snack platform for the 13-week period ended December 29, 2024.(2)

For Utz, 2024 was the first year of a three-year journey to deliver against the 2026 targets we introduced at our investor day in December 2023. While sales growth was more challenged than we expected due to a difficult consumer demand environment, we are executing well on our distribution growth opportunities, and we believe our accelerated productivity cost savings will continue to give us the flexibility to expand our margins and increase investments in our brands to support our continued growth.

Our Utz associates made several notable accomplishments during the year including the following:

•Driving a retail sales share increase nationally for total Utz and gaining volume share in both our Core and Expansion Geographies.(2)

•Delivering productivity cost savings above our original expectation to fuel margin growth and investments in our brands and capabilities.

•Investing nearly $100 million in capital expenditures across our supply chain, in an effort to unlock future cost savings and operating efficiencies.

•Disposition of five manufacturing facilities and two brands, which we believe will accelerate our network optimization strategy, simplify execution, and enhance balance sheet flexibility.

Our mission at Utz is to become the fastest-growing pure-play U.S. salty snack company of scale by: building a portfolio of consumer-loved brands coast-to-coast; developing world-class people and capabilities; and delivering top-tier financial performance. I’m confident that our progress in 2024 has us well-positioned to deliver on our mission. On behalf of the Utz Board of Directors and leadership team, we thank you for being a stockholder of Utz. Your vote is important.

Sincerely,

Howard Friedman

Chief Executive Officer

Utz Brands, Inc.

(1)*See the description of the non-GAAP financial measures and reconciliation of the non-GAAP financial measures to the most comparable GAAP measures in the tables included in Annex A at Page A-1.

(2) Circana Total US MULO+ w/ convenience, custom Utz Brands hierarchy, 13-weeks and 52-weeks ended 12/29/2024.

THIS PROXY STATEMENT IS DATED MARCH 13, 2025

AND IS BEING MAILED WITH THE FORM OF PROXY ON OR SHORTLY AFTER MARCH 13, 2025.

|

|

|

|

|

|

|

2025 Proxy Statement |

1 |

|

|

|

|

UTZ BRANDS, INC. NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, APRIL 24, 2025 |

|

Hanover, Pennsylvania March 13, 2025 |

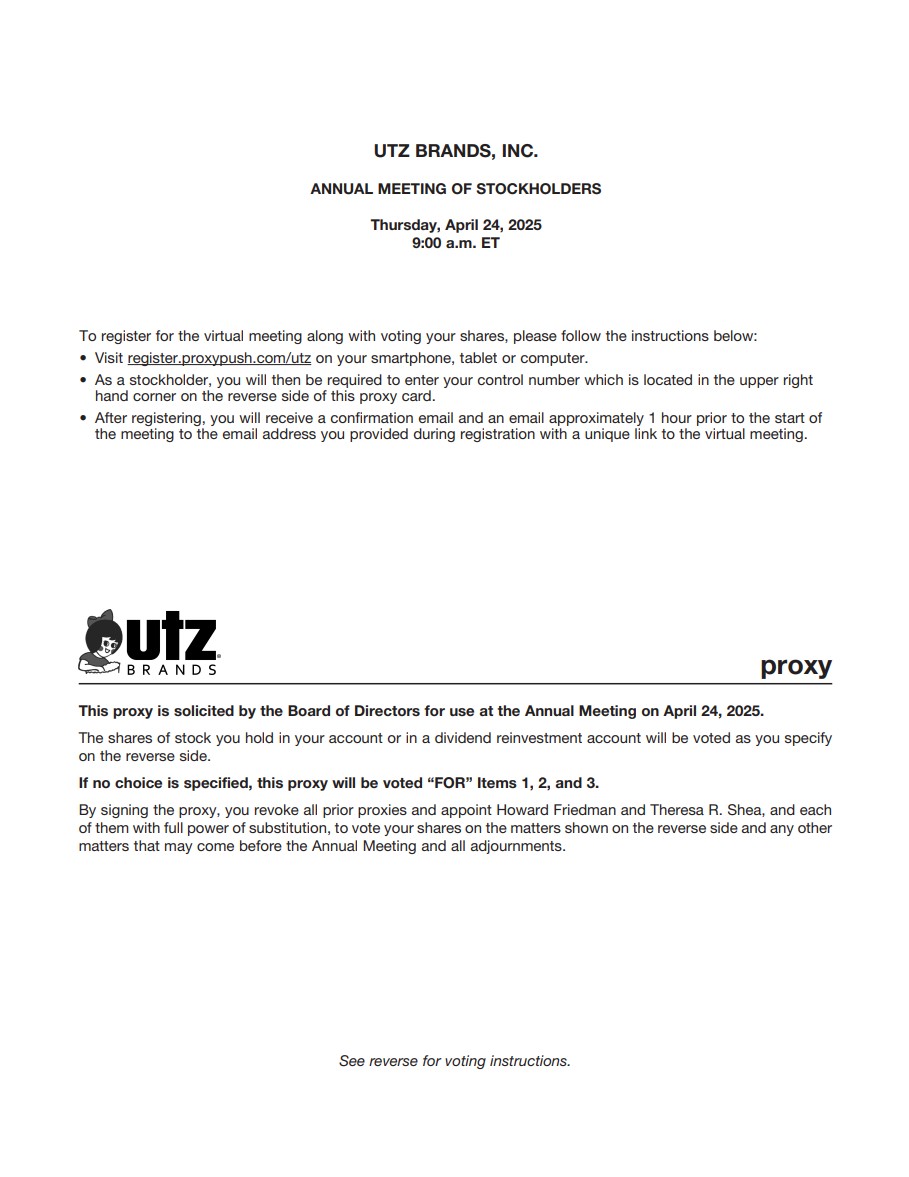

Notice is hereby given that the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Utz Brands, Inc., a Delaware corporation (the “Company”), will be held virtually on Thursday, April 24, 2025, at 9:00 a.m., Eastern Time. The meeting can be accessed by registering at http:\\register.proxypush.com/utz. Those who register will be provided a meeting link approximately one hour before the meeting start time. Through that link, you will be able to listen to the meeting live, submit questions and vote online. There will be no physical location for stockholders to attend the Annual Meeting in person. Stockholders may only participate by following the registration procedure outlined below. We believe that a virtual Annual Meeting provides greater access to those who want to attend, and therefore we have chosen this format over an in-person meeting.

At the Annual Meeting, stockholders will be asked to consider and vote upon the following proposals:

1.To elect four directors named herein to serve as the Class II directors on the Company’s Board of Directors (the “Board”) until the 2028 Annual Meeting of Stockholders or until such director's successor is elected and qualified;

2.To vote on a non-binding, advisory resolution to approve executive compensation;

3.To ratify the selection by our Audit Committee of Grant Thornton LLP to serve as our independent registered public accounting firm for the fiscal year ending December 28, 2025; and

4.Such other matters as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

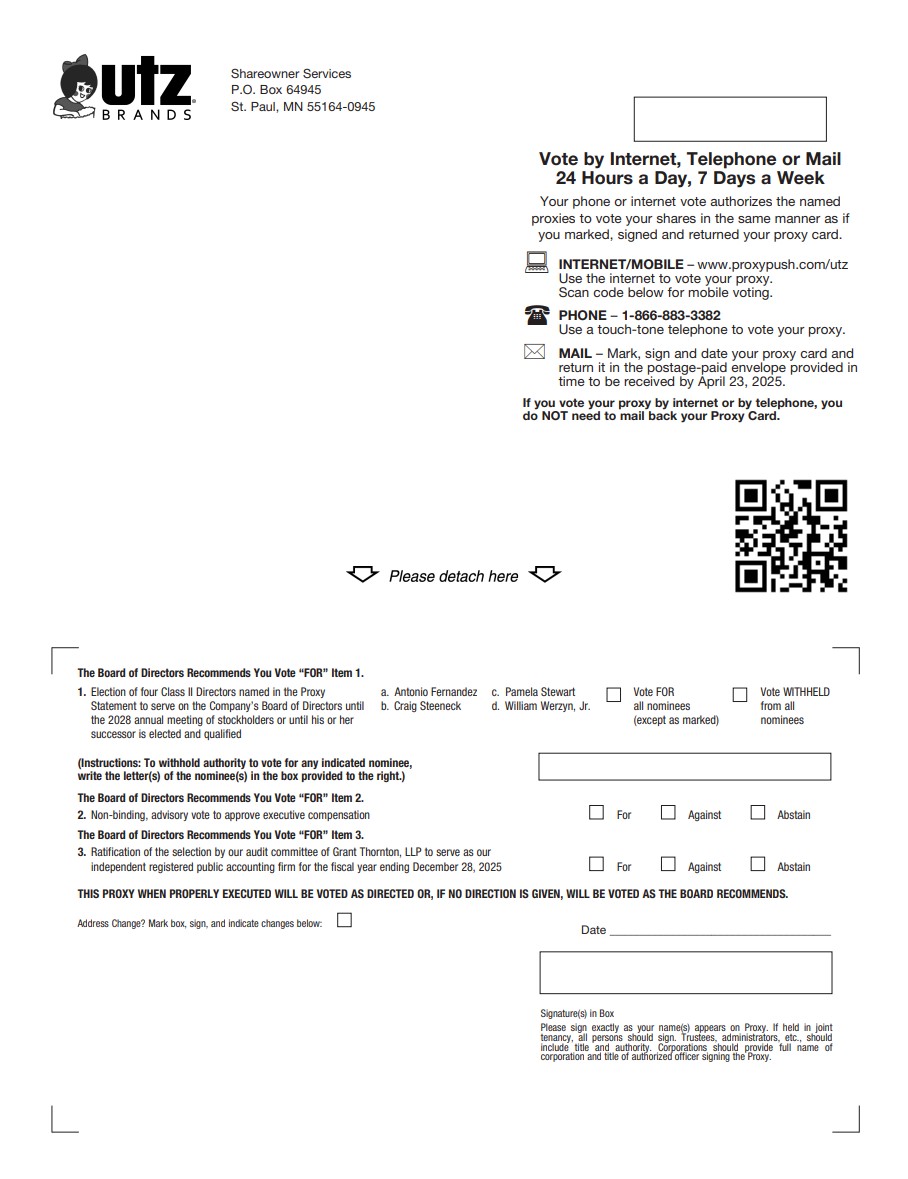

Our Board of Directors recommends that you vote “FOR” each of the nominees named herein for Class II directors (Proposal No. 1); “FOR” approval of the non-binding, advisory resolution to approve executive compensation (Proposal No. 2 ); and “FOR” ratification of the selection by our Audit Committee of Grant Thornton LLP to serve as our independent registered public accounting firm for the fiscal year ending December 28, 2025 (Proposal No. 3). Our Board of Directors has fixed the close of business on March 4, 2025 as the record date for determining the stockholders entitled to notice of the Annual Meeting.

Only stockholders of record as of such record date are entitled to vote at the Annual Meeting or any adjournments or postponements thereof. For 10 days prior to the Annual Meeting, a list of such stockholders will be available for inspection by any stockholder at our principal executive offices during normal business hours. Please request access by contacting me at tshea@utzsnacks.com or 312.933.9348.

We encourage you to access the Annual Meeting before the start time of 9:00 a.m., Eastern Time, on April 24, 2025. Stockholders will be able to join the meeting portal upon receipt of the meeting link, but the webcast will not open until 8:45 a.m., Eastern Time.

Whether or not you plan to attend the virtual Annual Meeting, our Board urges you to read the attached Proxy Statement and submit a proxy card or voting instructions for your shares via the internet or by telephone, or complete, date, sign and return your proxy card or voting instruction form in the pre-addressed, postage-paid envelope provided. We encourage you to submit your proxy card or voting instructions via the internet, which is convenient, helps reduce the environmental impact of our Annual Meeting and saves us significant postage and processing costs. For instructions on how to access the Annual Meeting, submit your proxy and/or voting instructions, please refer to “Questions and Answers About Our Annual Meeting — How Do I Vote?” beginning on page 73 of the attached Proxy Statement.

By Order of the Board of Directors,

Theresa R. Shea

Executive Vice President,

General Counsel and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 24, 2025: THE PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K ARE AVAILABLE FOR VIEWING AND DOWNLOADING AT eqproxyportal.com/eq/UTZ.

|

|

|

|

|

|

|

|

ITEM |

|

PROPOSALS |

|

BOARD’S VOTING

RECOMMENDATION |

|

PAGE REFERENCE

(FOR MORE DETAIL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

Election of four Class II Directors named herein |

|

FOR all

the nominees |

|

12-67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

Non-binding, advisory vote to approve executive compensation |

|

FOR |

|

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

Ratification of the selection by our Audit Committee of Grant Thornton LLP to serve as our independent registered public accounting firm for the fiscal year ending December 28, 2025 |

|

FOR |

|

69-70 |

|

|

|

|

|

|

|

PROXY SUMMARY § 2025 ANNUAL MEETING OF STOCKHOLDERS

PROXY SUMMARY

We are furnishing this Proxy Statement on behalf of the Board of Directors of Utz Brands, Inc., a Delaware corporation, for use at our Annual Meeting, for the purposes set forth below and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held virtually, at 9:00 a.m., Eastern Time, on Thursday, April 24, 2025.

2025 Annual Meeting of Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE AND TIME April 24, 2025, 9:00 a.m.,

Eastern Time |

|

PLACE Virtual Annual Meeting: Register in advance at

register.proxypush.com/utz Meeting details will be sent to you

one hour before the meeting begins |

|

RECORD DATE March 4, 2025 |

|

VOTING Holders of shares of our Class A

Common Stock and Class V

Common Stock are entitled to

vote together as a single class

on all matters. Each share is

entitled to one vote. |

Meeting Agenda and Voting Matters

|

|

|

|

|

|

|

2025 Proxy Statement |

3 |

PROXY SUMMARY § BOARD MEMBERS

Board Members

As of March 4, 2025, the record date for the Annual Meeting, our Board of Directors consisted of the following members:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME, AGE AND CLASS |

|

TERM

EXPIRATION |

|

DIRECTOR

SINCE1 |

|

PRIMARY OCCUPATION |

|

AUDIT

COMMITTEE |

|

COMPENSATION

COMMITTEE |

|

NOMINATING

AND CORPORATE

GOVERNANCE

COMMITTEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Altmeyer* 66 I |

|

2027 |

|

2020 |

|

Chief Executive Officer, GAF Materials LLC |

|

|

|

|

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timothy Brown* 62 III |

|

2026 |

|

2020 |

|

Founder and Chief Executive Officer, Sageworth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christina Choi* 47 III |

|

2026 |

|

2020 |

|

Chief Marketing Officer, North America, Ralph Lauren |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roger Deromedi* 71 III |

|

2026 |

|

2018 |

|

Lead Independent Director, Utz Brands, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Antonio Fernandez* 65 II |

|

2025 |

|

2018 |

|

President, AFF Advisors, LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Howard Friedman 55 I |

|

2027 |

|

2022 |

|

Chief Executive Officer, Utz Brands, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jason Giordano* 46 I |

|

2027 |

|

2018 |

|

Senior Managing Director, CC Capital |

|

|

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. John Lindeman* 55 I |

|

2027 |

|

2020 |

|

Chief Executive Officer, Hydrofarm Holdings Group, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dylan Lissette 53 III |

|

2026 |

|

2020 |

|

Chairperson, Utz Brands, Inc. Former Chief Executive Officer, Utz Brands, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Craig Steeneck* 67 II |

|

2025 |

|

2018 |

|

Former Chief Financial Officer, Pinnacle Foods |

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pamela Stewart* 49 II |

|

2025 |

|

2022 |

|

Chief Customer Officer, Retail North America, The Coca-Cola Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William Werzyn Jr.* 48 II |

|

2025 |

|

2024 |

|

Executive Chairman, Founder, and Chief Executive Officer of West Shore Home, LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Denotes Independent Directors pursuant to New York Stock Exchange listing rules.

(1) Date refers to appointment as a director of Collier Creek (as defined below) prior to the Business Combination (as defined below) and Utz Brands, Inc. following the Business Combination.

|

|

|

|

|

|

|

|

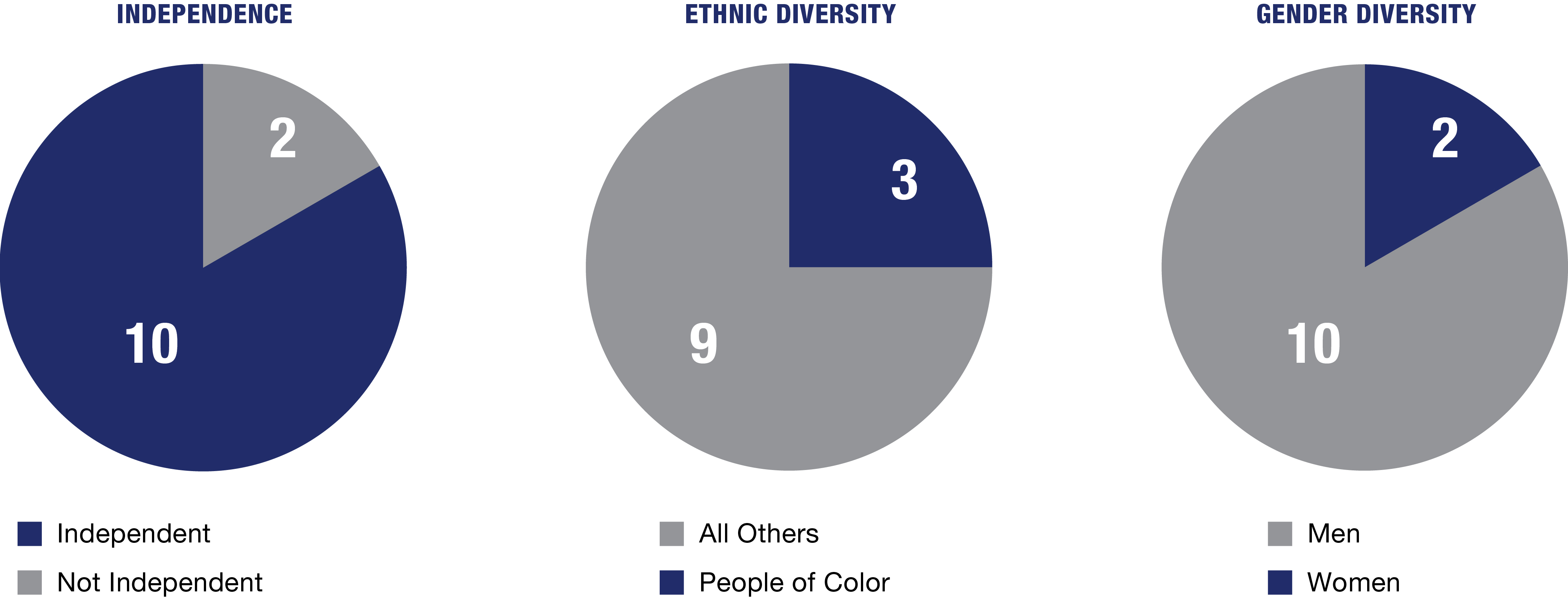

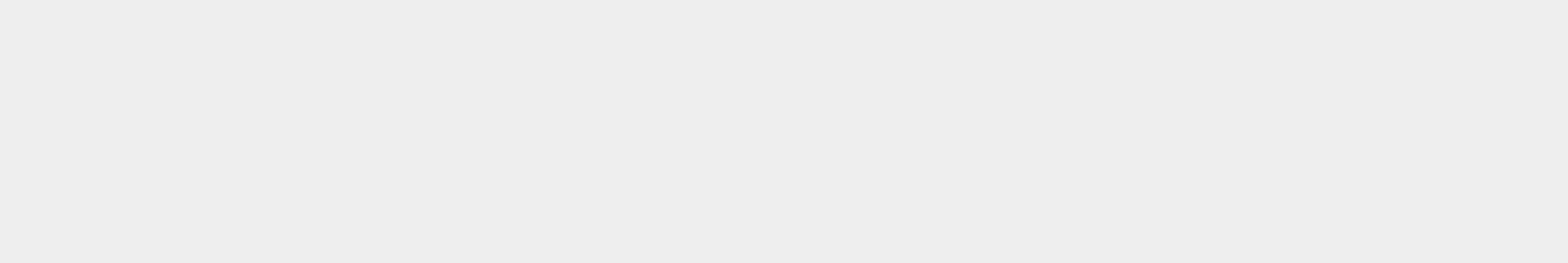

Governance Highlights The Board of Directors is committed to effective corporate governance practices. Some of the highlights include: |

|

§ |

Independent Lead Director of the Board |

|

§ |

10 of our 12 Board members are independent |

|

§ |

Stock ownership guidelines for our executive officers and directors |

|

§ |

Frequent executive sessions of our non-management directors |

|

§ |

Board oversight of risk management |

|

§ |

Annual Board and committee self-assessments |

PROXY SUMMARY § GOVERNANCE HIGHLIGHTS

2024 Financial Highlights*

|

|

|

|

|

Net Sales $1,409.3M down 2.0% YoY vs. 2023 |

|

|

Adjusted EBITDA $200.2M up 6.9% YoY vs. 2023 |

*See Annex A for reconciliations of certain non-GAAP measures.

|

|

|

|

|

|

|

2025 Proxy Statement |

5 |

PROXY SUMMARY § Our Directors' Skills and Experience

Our Directors' Skills and Experience

We believe it is important that our Board is composed of individuals reflecting the diversity represented by our employees, our customers, and our communities. In recent years, our Nominating and Governance Committee has taken this priority to heart in its nominations process and increased our focus on the diversity of our Board. In response to feedback from stockholders, we are providing the below enhanced disclosure regarding the diversity and skill set of our Board. The knowledge, skills, and experience reported below were reported to us by our directors through a self-assessment questionnaire, and are intended to identify specific knowledge, skills or experiences the director nominee will contribute or has contributed to the Board. The lack of a mark does not mean a director does not possess that specific knowledge, skill or experience. Each director nominee’s biography in “Proposal No. 1 Election of Directors” describes their qualifications and relevant experience in more detail.

PROXY SUMMARY § EXECUTIVE COMPENSATION PRINCIPLES

Executive Compensation Principles

The core principles of our executive compensation program are to align the compensation of our executive officers with the long-term interests of our stockholders and to provide a total compensation opportunity that allows us to attract and retain talented executive officers and motivate them to achieve exceptional business results. Our compensation program is designed to address certain core principles:

|

|

|

|

|

|

Pay is weighted more heavily toward incentive compensation |

|

We provide executive compensation through a total compensation program. This program consists of fixed and variable elements and performance-based pay designed to reward performance. Our total compensation is weighted more heavily toward incentive compensation in the form of short and long-term incentives. |

|

|

Executive officer goals are aligned with stockholder interests |

|

The Company’s compensation program and goals are designed to align the interests of our executive officers with the long-term interests of our stockholders. Rewarding executive officer performance creates value for our stockholders. |

|

|

Compensation is competitive with our peers in order to attract and retain talented associates |

|

The Compensation Committee, along with Frederic W. Cook and Co., Inc. (“F.W. Cook”), our independent compensation consultant, and members of senior management annually review our significant compensation elements to enable the Company to attract and retain talented executive officers. |

Key Features of our Executive Compensation Program

|

|

|

|

|

WHAT WE DO |

|

|

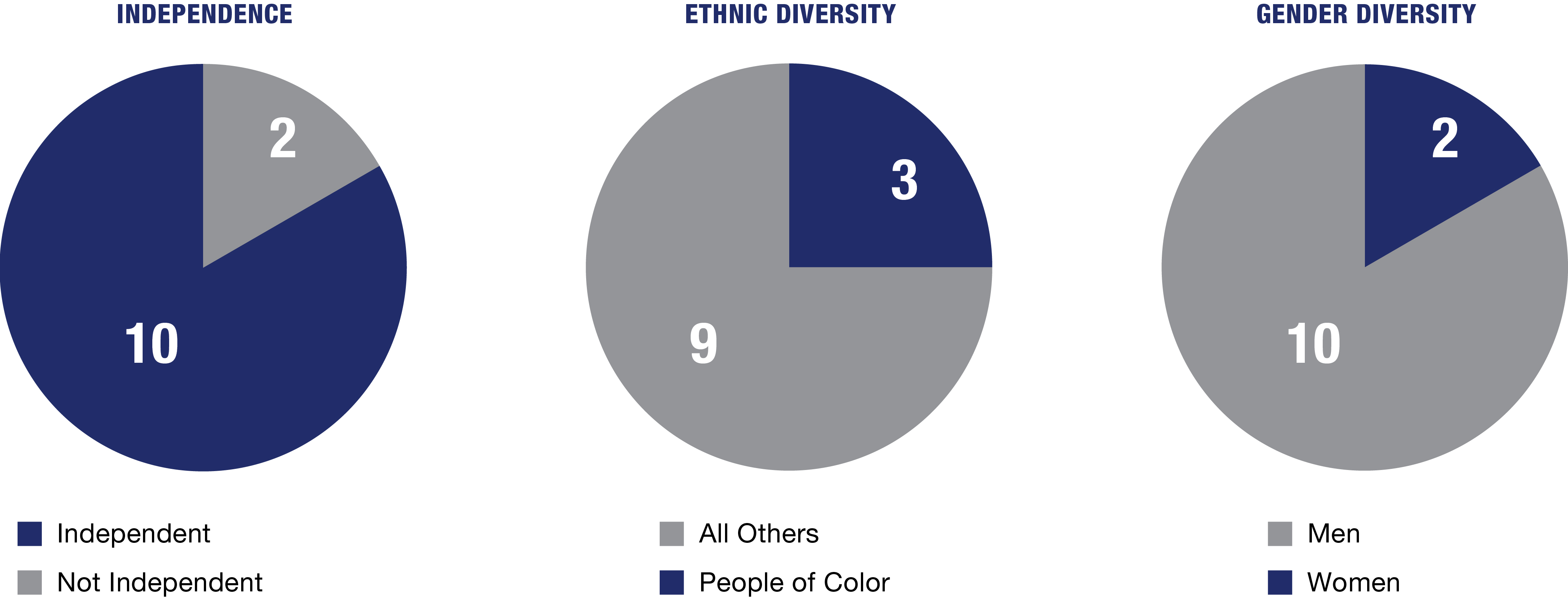

Align executive compensation with stockholders’ returns through long-term incentives (pages 39-41) |

|

|

Provide performance-based compensation for executives (pages 37-42) |

|

|

Balance short and long-term incentive awards (pages 35-41) |

|

|

Use an appropriate peer group when establishing total compensation for our executives (page 34) |

|

|

Have caps on individual payouts in our management incentive plan (page 37) |

|

|

Maintain stock ownership guidelines for executive officers and directors (page 46) |

|

|

Retain an independent compensation consultant (page 33) |

WHAT WE DON’T DO |

|

|

|

Incentivize participants to take excessive risk |

|

|

Guarantee payment of annual bonuses |

|

|

Allow repricing of stock options |

|

|

Offer tax “gross-ups” of annual compensation |

|

|

Pay dividends on stock options or on unvested restricted stock units or performance stock units |

|

|

Offer excessive perquisites |

|

|

Provide excise tax “gross-ups” upon termination upon a change-in-control |

We provide additional information regarding our executive compensation in our “Compensation Discussion and Analysis” beginning on page 32.

Our Board continues to believe that our executive compensation program and policies are effective in rewarding our executives for performance and for aligning their interests with the long-term interests of our stockholders.

|

|

|

|

|

|

|

2025 Proxy Statement |

7 |

PROXY SUMMARY § CORPORATE SUSTAINABILITY

Environmental, Social and Governance

In 2024, Utz continued to advance its commitment to transparency and accountability, guided by the principles outlined in the Sustainability Accounting Standards Board ("SASB") standards and the Task Force on Climate-related Financial Disclosures ("TCFD"). Insights from the 2023 Environmental, Social and Governance ("ESG") Report highlight significant progress in addressing critical ESG challenges and integrating sustainability into business operations. These efforts are anchored in Utz’s four pillars:

▪People: Emphasizing health and safety, our cultural values, training and communication, recruitment and hiring, and community engagement.

▪Planet: Focusing on environmental management, climate impact mitigation, and waste and water reduction.

▪Products: Advancing efforts in packaging innovation, sustainable agriculture, and maintaining excellence in product quality, safety, and transparency

▪Governance: Upholding ethical practices and transparency in decision-making and governance processes.

Sustainable Business Practices:

Utz has made significant strides in ESG integration, aligning business practices with stakeholder priorities and regulatory requirements. The Nominating and Governance Committee oversees the Company’s ESG initiatives, supported by cross-functional teams embedding sustainability into everyday operations. Utz’s cross-functional teams drove key initiatives, ensuring alignment with both stakeholder priorities and evolving regulatory landscapes.

Community:

Utz continues to prioritize its role as a valued member of the communities it serves, and recognizes the importance of an associate community where unique backgrounds and thoughts are shared to foster innovation and collaboration.

Ethical Governance:

Integrity remains central to Utz’s operations. The Company’s robust Code of Ethics is distributed to employees upon onboarding and annually thereafter. An anonymous hotline is available for reporting concerns, which are promptly investigated. The Board plays a crucial role in maintaining transparency and ensuring that corporate governance aligns with ESG priorities.

Employee Health, Safety, and Product Quality:

The health and safety of employees remain a top priority. In 2024, Utz enhanced workplace safety measures and training programs across its facilities. Rigorous product quality standards were upheld through the reassessment of food safety plans and certifications.

Environmental Stewardship:

Utz continues to advance its environmental stewardship efforts, evaluating and reducing water usage, greenhouse gas emissions, and energy consumption. In the 2023 ESG Report, alignment with TCFD standards provided a framework for evaluating climate-related risks and opportunities, further integrating climate considerations into corporate strategy. Another major milestone in 2024 was the opening of the Rice Distribution Center, a new large warehouse designed to enhance efficiency and sustainability. The facility is expected to reduce shipments across the Hanover campus, contributing to reduced greenhouse gas emissions, and improved logistics efficiency.

At Utz, these principles are deeply integrated into our operations, aligning with our core values and long-term strategic goals. These efforts ensure the continued success of the company while contributing positively to the planet and society.

PROXY SUMMARY § 2026 ANNUAL MEETING OF STOCKHOLDERS

Important Dates for 2026 Annual Meeting of Stockholders

In order to have a stockholder proposal included in the proxy statement for our 2026 Annual Meeting of Stockholders, in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such proposal must be received by our Corporate Secretary no later than November 13, 2025.

Notice of a stockholder nomination for candidates for the Board or any other business to be considered at our 2026 Annual Meeting of Stockholders outside of the Rule 14a-8 framework must be received by the Company between December 25, 2025 and January 26, 2026 and contain the information required by our Bylaws. Any notice of director nomination submitted to the Company must include the information required by Rule 14a-19(b) under the Exchange Act.

|

|

|

|

|

|

|

2025 Proxy Statement |

9 |

|

|

|

|

PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, APRIL 24, 2025 GENERAL INFORMATION |

|

UTZ BRANDS, INC. 900 High Street Hanover, Pennsylvania 17331 (717) 637-6644 |

We are furnishing this Proxy Statement on behalf of the Board of Directors (the “Board” or "Board of Directors") of Utz Brands, Inc., a Delaware corporation (the "Company"), for use at our virtual 2025 Annual Meeting of Stockholders at 9:00 a.m., Eastern Time, on Thursday, April 24, 2025, or at any adjournment or postponement of the meeting (the “Annual Meeting”), for the purposes set forth below and in the accompanying Notice of Annual Meeting of Stockholders.

Utz Brands, Inc. was formed upon the closing (the “Closing”) of the business combination (the “Business Combination”) of Utz Brands Holdings, LLC (“UBH”) with Collier Creek Holdings (“CCH”), a special purpose acquisition company, on August 28, 2020, at which time CCH changed its name to “Utz Brands, Inc.”

In connection with the Closing of the Business Combination, we entered into an Investor Rights Agreement dated August 28, 2020 (as amended in 2021 and in 2024, the “Investor Rights Agreement”) with certain counterparties including: (a) the “Continuing Members” of UBH, consisting of Series U of UM Partners, LLC and Series R of UM Partners, LLC and (b) the “Founder Holders” consisting of certain founder members of Collier Creek Partners LLC (the “Sponsor” of CCH), which was dissolved in October 2020, and their family members (together with the Sponsor, the “Sponsor Parties”).

We refer to the Investor Rights Agreement throughout this Proxy Statement. Please see “Related Party Transactions — Investor Rights Agreement” for additional details regarding the terms of the Investor Rights Agreement.

As used in this Proxy Statement, unless otherwise noted or unless the context otherwise requires, the terms “we,” “us,” “Utz,” and the “Company” and similar references refer to Utz Brands, Inc. and its consolidated subsidiaries. Unless otherwise noted or unless the context otherwise requires, “CCH” or “Collier Creek” refers to Collier Creek Holdings prior to the consummation of the Business Combination. The term “Board” refers to our Board of Directors.

On or about March 13, 2025, we will begin mailing to all stockholders entitled to vote at the Annual Meeting this Proxy Statement and the enclosed proxy materials. Although not part of this Proxy Statement, we will also mail with this Proxy Statement our Annual Report on Form 10-K for the fiscal year ended December 29, 2024, containing our financial statements for the fiscal year ended December 29, 2024.

|

|

|

|

|

|

|

2025 Proxy Statement |

11 |

Proposal No. 1:

ELECTION OF DIRECTORS

Our Board is divided into three classes, each serving staggered, three-year terms:

▪Our Class I directors are John Altmeyer, Howard Friedman, Jason Giordano, and B. John Lindeman, and their current terms expire at the 2027 Annual Meeting of Stockholders;

▪Our Class II directors are Antonio Fernandez, Craig Steeneck, Pamela Stewart, and William Werzyn Jr. and their current terms expire at the 2025 Annual Meeting of Stockholders; and

▪Our Class III directors are Timothy Brown, Christina Choi, Roger Deromedi, and Dylan Lissette, and their current terms expire at the 2026 Annual Meeting of Stockholders.

Action will be taken at the Annual Meeting for the election of four Class II directors, Antonio Fernandez, Craig Steeneck, Pamela Stewart, and William Werzyn, Jr. Each of the nominees is currently a director of the Company. Each director elected at the Annual Meeting will serve until the 2028 annual meeting of stockholders or until his/her successor is elected and qualified.

The Board has no reason to believe that any of the nominees for director will not be available to stand for election as director. However, if some unexpected occurrence should require the substitution by the Board of some other person or persons for any one or more of the nominees, then the proxies may be voted in accordance with the discretion of the named proxies “FOR” such substitute nominees.

Under the Investor Rights Agreement, subject to certain step-down provisions, the Company, the Founder Holders and the Continuing Members will take all necessary action (to the extent such actions are not prohibited by applicable law and within such party’s control, and in the case of any action that requires a vote or other action on the part of the Board to the extent such action is consistent with fiduciary duties that the Company’s directors may have in such capacity) (such actions, the “Necessary Action”) to include in the slate of nominees recommended by the Board for election as directors at each annual or special meeting of stockholders at which directors are to be elected a certain number of director nominees recommended by each of the Continuing Members (the “Continuing Member Nominees”) and following the dissolution of the Sponsor, the Sponsor Representative (the “Sponsor Nominees”) to be members of our Board of Directors. As of the date of this Proxy Statement, the Continuing Members are entitled to designate five Continuing Member Nominees and the Sponsor Representative is entitled to designate four Sponsor Nominees under the Investor Rights Agreement. Each of Mr. Fernandez and Mr. Steeneck is Sponsor Nominees, and Mr. Werzyn is a Continuing Member Nominee. For more information on the Investor Rights Agreement and other stockholders’ agreements, see “Related Party Transactions— Investor Rights Agreement” on page 65.

Vote Required

With regard to this Proposal No. 1 (Election of Directors), votes may be cast for the nominees or may be withheld. Each director nominee was recommended by the Nominating and Corporate Governance Committee of the Board, and all nominees are current directors. The election of directors requires a plurality of the votes cast and, therefore, the four nominees receiving the greatest number of votes will be elected. Proxies can be voted for only four nominees. Votes that are withheld and broker non-votes are not considered “votes cast” and, therefore, will have no effect on the outcome of Proposal No. 1.

Board Recommendation

|

|

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL CLASS II NOMINEES LISTED IN PROPOSAL NO. 1 FOR ELECTION TO SERVE A THREE-YEAR TERM ON THE BOARD. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

DIRECTORS OF UTZ BRANDS, INC.

The name, age as of the Record Date, principal occupation for the last five years, selected biographical information and period of service for each of the nominees for election as directors and for the continuing directors are set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME, AGE AND CLASS |

|

TERM

EXPIRATION |

|

INDEPENDENCE |

|

AUDIT

COMMITTEE |

|

COMPENSATION

COMMITTEE |

|

NOMINATING

AND CORPORATE

GOVERNANCE

COMMITTEE |

|

|

John Altmeyer 66 I |

|

2027 |

|

|

|

|

|

|

|

Chair |

|

|

Timothy Brown 62 III |

|

2026 |

|

|

|

|

|

|

|

|

|

|

Christina Choi 47 III |

|

2026 |

|

|

|

|

|

|

|

|

|

|

Roger Deromedi 71 III |

|

2026 |

|

|

|

|

|

|

|

|

|

|

Antonio Fernandez 65 II |

|

2025 |

|

|

|

|

|

|

|

|

|

|

Howard Friedman 55 I |

|

2027 |

|

|

|

|

|

|

|

|

|

|

Jason Giordano 46 I |

|

2027 |

|

|

|

|

|

Chair |

|

|

|

|

B. John Lindeman 55 I |

|

2027 |

|

|

|

|

|

|

|

|

|

|

Dylan Lissette 53 III |

|

2026 |

|

|

|

|

|

|

|

|

|

|

Craig Steeneck 67 II |

|

2025 |

|

|

|

Chair |

|

|

|

|

|

|

Pamela Stewart 49 II |

|

2025 |

|

|

|

|

|

|

|

|

|

|

William Werzyn, Jr. 48 II |

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 Proxy Statement |

13 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

Class I Directors for Election at the 2027 Annual Meeting of Stockholders |

|

|

|

|

John Altmeyer

Age: 66 |

|

Career Highlights Mr. Altmeyer has served as a member of the Board of Directors of the Company since August 2020. In January 2023, Mr. Altmeyer assumed the role of Chief Executive Officer of GAF Materials, LLC, a roofing and waterproofing manufacturer. Prior to that role, Mr. Altmeyer served as GAF’s Executive Chairperson, Commercial from January 2021 to January 2023. Mr. Altmeyer served as the President and Chief Executive Officer of Carlisle Construction Materials, a division of Carlisle Companies Incorporated (NYSE: CSL), from July 1997 to September 2018. Carlisle Construction Materials is principally engaged in the manufacture and sale of rubber and thermoplastic roofing systems and other products with roofing applications for commercial and residential buildings. Mr. Altmeyer also has served as a Member of the Board of Directors of EMCOR Group, Inc. (NYSE: EME), a mechanical and electrical construction, industrial and energy infrastructure and facilities services company, since 2014. As part of his service on the EMCOR Board of Directors, Mr. Altmeyer currently serves on the governance committee of EMCOR and has served as the Chair of the compensation committee of EMCOR since 2018. Mr. Altmeyer also served on the audit committee of EMCOR from 2014 through 2018. Additionally, Mr. Altmeyer served as a member of the Board of Directors of Berkshire Hills Bancorp (NYSE: BHLB), a bank holding company, from 2012 to 2014. Mr. Altmeyer also served on the Board of Directors of Tecta America, a roofing contracting and services business, from March 2019 until January 2021. Mr. Altmeyer earned his B.S. degree from Cornell University and his M.B.A. from Harvard Business School. Qualifications Mr. Altmeyer’s qualifications to serve on our Board of Directors include his substantial financial, operations, investment and acquisition experience, and his experience serving as a public company director. |

|

|

|

|

Howard Friedman

Age: 55 |

|

Career Highlights Mr. Friedman joined Utz in December 2022 and serves as the Company’s Chief Executive Officer and a member of the Board of Directors, having assumed that role upon his appointment to Chief Executive Officer in December 2022. Prior to his role at Utz, Mr. Friedman gained over 25 years of experience in the food and beverage industry, including serving as Chief Operating Officer of Post Holdings, an American consumer packaged goods holding company (NYSE: POST), from July 2021 to December 2022, and as President and Chief Executive Officer of Post Consumer Brands, Post Holdings’ flagship cereal business, from July 2018 to July 2021. Prior to serving in these positions, Mr. Friedman served as Executive Vice President, Refrigerated at The Kraft Heinz Company, an American multinational food company (Nasdaq: KHC), leading Kraft’s most prominent business unit from July 2016 to May 2018. Prior to serving as Executive Vice President, Refrigerated at The Kraft Heinz Company, Mr. Friedman served for over twenty years at the Kraft Heinz Company, serving in roles including general management, sales and marketing. Mr. Friedman began his career in the United States Army, serving in the United States and overseas, completing his service as a Captain. He holds a B.A. from Dickinson College and an M.B.A. in Marketing and Finance from New York University’s Stern School of Business. Qualifications Mr. Friedman’s qualifications to serve on our Board of Directors include his significant financial, marketing and operational experience in the food and beverage industry. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

|

|

Jason Giordano

Age: 46 |

|

Career Highlights Mr. Giordano has served as a member of the Board of Directors of the Company since August 2020. Mr. Giordano was the Co-Executive Chairperson, Principal Executive Officer and Principal Financial and Accounting Officer of Collier Creek from June 1, 2018 until August 2020. Mr. Giordano has over 20 years of investment and acquisition experience, with a focus in the consumer goods and related sectors. Mr. Giordano has been a Senior Managing Director at CC Capital (affiliates of whom are indirect owners of Utz securities through CC Collier Holdings LLC), a private investment firm, since November 2018. Mr. Giordano was EVP Corporate Development for CC Neuberger Principal Holdings II, a special purpose acquisition company, from July 2020 until July 2022, and was EVP Corporate Development for CC Neuberger Principal Holdings III, a special purpose acquisition company, from August 2020 to November 2023. Previously, Mr. Giordano was a Managing Director in the private equity group at Blackstone where he oversaw investments in the consumer, education, packaging and chemicals sectors. During his tenure at Blackstone from 2006 to October 2017, Mr. Giordano was involved in 12 initial and follow-on acquisitions representing over $10 billion of transaction value, including several investments in consumer, retail and related businesses. Prior to Blackstone, Mr. Giordano was a private equity investment professional at Bain Capital, LP, a leading multi-asset alternative investment firms, and an investment banker with Goldman, Sachs, & Co., a leading global investment banking, securities and investment management firm. Mr. Giordano previously served on the boards of directors of Pinnacle Foods, Inc., a U.S.-based manufacturer and marketer of branded food products, from 2007 to September 2015; Crocs, Inc. (Nasdaq: CROX), a global supplier of branded footwear, from January 2015 to October 2017; AVINTIV, a global supplier of specialty materials primarily sold to consumer goods manufacturers, from January 2011 to October 2015; and Ascend Learning, LLC, a provider of online professional training tools and educational software, from July 2017 to October 2017. Mr. Giordano currently serves on the Board of Visitors of the Nelson A. Rockefeller Center for Public Policy at Dartmouth College. Mr. Giordano earned an M.B.A. with high distinction from Harvard Business School, where he was a Baker Scholar, and earned an A.B. with high honors in Economics from Dartmouth College. Qualifications Mr. Giordano’s qualifications to serve on our Board of Directors include his substantial investment and acquisition experience at blue chip financial institutions, his in-depth knowledge and strong network of relationships in consumer and related sectors, and his experience serving as a director for various public and private companies. |

|

|

|

|

B. John Lindeman

Age: 55 |

|

Career Highlights Mr. Lindeman has served as a member of the Board of Directors of the Company since August 2020. Mr. Lindeman currently serves as the Chief Executive Officer of Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM), a wholesaler and manufacturer of hydroponics equipment and commercial horticultural products, having served in that role since January 2025. Prior to his current role, Mr. Lindeman served as Chief Financial Officer of Hydrofarm Holdings from March 2020 to December 2024. From August 2015 until March 2020 Mr. Lindeman served as Chief Financial Officer and Corporate Secretary at Calavo Growers, Inc. (Nasdaq-GS: CVGW), a global avocado-industry leader and expanding provider of valued-added fresh food, where he was responsible for the finance, accounting, IT and human resource functions.Mr. Lindeman has also served as a member of the board of directors and on the audit committee of Calavo Growers, Inc. since June 2024. Prior to joining Calavo, Mr. Lindeman held various leadership positions within the finance and investment banking industries, including serving as managing director at Sageworth Trust Company, a provider of investment management, fiduciary and planning services to highly successful individuals and families, from March 2015 to July 2015; Managing Director and co-head of the consumer and retail group at Janney Montgomery Scott, a financial advisory firm, from August 2009 to March 2015; Managing Director at Stifel Nicolaus, a full service brokerage and investment banking firm, from December 2005 to August 2009; and Principal at Legg Mason, a global asset management leader, from October 1999 to December 2005. Prior to joining Legg Mason, Mr. Lindeman was a Manager at PricewaterhouseCoopers LLP, a global network of firms delivering assurance, tax, and consulting services, from August 1996 to October 1999. Mr. Lindeman is a Chartered Financial Analyst and holds a B.S. in Business Administration from the University of Mary Washington. Qualifications Mr. Lindeman’s qualifications to serve on our Board of Directors include his significant financial and operational experience, including experience as chief financial officer of various public companies. |

|

|

|

|

|

|

|

2025 Proxy Statement |

15 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

Class II Directors Continuing in Office until the 2025 Annual Meeting of Stockholders |

|

|

|

|

Antonio Fernandez  Age: 65 |

|

Career Highlights Mr. Fernandez has served as a member of the Board of Directors of the Company since August 2020 and served as a member of the Board of Directors of Collier Creek from October 2018 to August 2020. Mr. Fernandez served as Executive Vice President and Chief Supply Chain Officer of Pinnacle Foods, a packaged foods company, from February 2011 to June 2016, where he was responsible for managing all aspects of the supply chain including procurement, manufacturing, distribution, product quality, innovation and sustainability. Mr. Fernandez also led Pinnacle Foods’ “maximizing value through productivity” continuous improvement initiatives, realizing gross savings of approximately 4% of cost of products sold annually. Mr. Fernandez was a key leader and closely involved in Pinnacle Foods’ acquisition, integration and synergy realization efforts. Prior to Pinnacle Foods, Mr. Fernandez was Senior Vice President, Operations Excellence at Kraft Foods, Inc., an American food manufacturing and processing conglomerate, from 2010 to 2011. Prior to Kraft, Mr. Fernandez was Chief Supply Chain Officer at Cadbury PLC, or Cadbury, a British multinational confectionery company, from 2008 to 2010, where he managed a supply chain with total costs of approximately $7 billion, 67 manufacturing facilities and over 20,000 employees. From 2000 to 2008, Mr. Fernandez held several senior supply chain roles within Cadbury. Prior to Cadbury, Mr. Fernandez held various supply chain and related roles at Dr. Pepper, an American multinational soft drink company, PepsiCo, Inc. (Nasdaq: PEP), an American multinational food, snack, and beverage corporation, and Procter & Gamble Co. (NYSE: PG), an American multinational consumer goods corporation. Mr. Fernandez is currently the President of AFF Advisors, LLC, an independent consulting firm focused on improving supply chain performance, supporting acquisition due diligence and merger integrations. Mr. Fernandez was also a Senior Advisor with McKinsey & Company, an American worldwide management consulting firm, from July 2017 to August 2019. Mr. Fernandez served on the board of directors of Liberty Property Trust (NYSE: LPT), a leading industrial real estate investment trust, from November 2014 until its merger with Prologis, Inc. (NYSE: PLD), a real estate investment trust headquartered in San Francisco, CA, in February 2020 and Green Rabbit, a privately held leading e-commerce cold chain logistics provider to the food industry, from February 2021 through August 2023. Mr. Fernandez has served on the Board of Directors with Americold Realty Trust (NYSE: COLD), the world’s largest publicly traded REIT, since May 2019; and as a Trustee of Lafayette College since May 2017. Mr. Fernandez received a Bachelor of Science in Chemical Engineering from Lafayette College. Qualifications Mr. Fernandez’s qualifications to serve on our Board of Directors include his substantial supply chain and operations experience at several publicly traded consumer companies, his record of realizing cost efficiencies and integrating acquisitions, and his experience serving as a director of a public company. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

|

|

Craig Steeneck

Age: 67 |

|

Career Highlights Mr. Steeneck has served as a member of the Board of Directors of Utz since August 2020 and served as a member of the Board of Directors of Collier Creek from November 2018 until August 2020. Mr. Steeneck served as the Executive Vice President and Chief Financial Officer of Pinnacle Foods, a packaged foods company, from July 2007 to January 2019, where he oversaw the company’s financial operations, treasury, tax, investor relations, corporate development and information technology functions and was an integral part of Pinnacle Foods’ integration team for several of its acquisitions. From 2005 to 2007, Mr. Steeneck served as Executive Vice President, Supply Chain Finance and IT of Pinnacle Foods, helping to redesign the supply chain to generate savings and improve financial performance. Pinnacle Foods was sold to ConAgra Brands (NYSE: CAG) in October 2018. From 2003 to 2005, Mr. Steeneck served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Resort Group (now Wyndham Hotels and Resorts Inc.), an American timeshare company, playing key roles in wide-scale organization of internal processes and staff management. From 2001 to 2003, he served as Chief Financial Officer of Resorts Condominiums International (now Wyndham Hotels and Resorts, Inc.), an American timeshare exchange company. From 1999 to 2001, Mr. Steeneck was the Chief Financial Officer of International Home Foods, Inc., a manufacturer of packaged food products acquired by ConAgra Foods in 2000. Mr. Steeneck has served on the Board of Directors and as chairperson of the audit committee of Freshpet, Inc. (Nasdaq: FRPT), an American pet food company, since November 2014; and as a director of KIND Inc., a snack food company, from May 2019 to June 2020. Mr. Steeneck served as member of the Board of Directors of Hostess Brands, Inc. (Nasdaq: TWNK) from November 2016 until November 2023, when it was sold to J.M. Smucker Company. Mr. Steeneck served as a member of the audit committee of Hostess from November 2016 to November 2023, as the lead independent director from January 2019 to December 2019 and chairperson of the audit committee from November 2016 to June 2022. Mr. Steeneck received his B.S. in Accounting from the University of Rhode Island. Qualifications Mr. Steeneck’s qualifications to serve on our Board of Directors include his substantial financial operations, investment and acquisition experience, and his experience serving as a director for public companies. |

|

|

|

|

Pamela Stewart

Age: 49 |

|

Career Highlights Ms. Stewart has served as a member of the Board of Directors of the Company since January 2022. Ms. Stewart currently serves as the Chief Customer Officer – Retail North America at The Coca-Cola Company (NYSE: KO), an American multinational beverage corporation, having assumed that role in January 2023. Prior to this role, Ms. Stewart served as President, West Zone Operations, North America Operating Unit for The Coca-Cola Company from January 2021 to December 2022. Prior to serving as President, West Zone Operations, North America Operating Unit, Ms. Stewart served as Senior Vice President, National Retail Sales from December 2018 to December 2020. From March 2015 to December 2018, Ms. Stewart served as Vice President, National Retail Sales – Publix at The Coca-Cola Company. During her 20-plus year tenure at Coca-Cola, Ms. Stewart has held leadership positions across finance, revenue growth management, sales, operations, and general management. Ms. Stewart brings a wide range of food and beverage experiences, particularly in working with major retailers and developing new business. Ms. Stewart formerly served as the Chair of the board of directors of GLAAD, having served in that role November 2016 to November 2022. Ms. Stewart also serves as a member of the board of directors of the Retail Industry Leaders Association, having served in this role since January 2023, serves as a member of the board of directors of National Restaurant Association, having served since January 2022, and as a member of the board of directors of 3DE by Junior Achievement, having served since November 2020. Ms. Stewart also currently serves as a member of the board of directors of the Coca-Cola Scholars Foundation, having served in this role since January 2021, and as a member of the Board of Directors of the Food Marketing Institute Foundation, having served in this role since January 2023. Ms. Stewart also serves on the Global Advisory Board of OUT Leadership having served in that role since January 2021. Ms. Stewart received a B.B.A. from Georgia State University and an M.B.A. from Oglethorpe University and holds a Harvard Business School executive education certification. She also is a graduate of the Golden Crown Literary Society Writing Academy and Leadership Atlanta. Qualifications Ms. Stewart’s qualifications to serve on our Board of Directors include her substantial experience in a leading consumer packaged goods company in the area of sales and sales operations. |

|

|

|

|

|

|

|

2025 Proxy Statement |

17 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

|

|

William Werzyn, Jr.

Age: 48 |

|

Career Highlights Mr. Werzyn has served as a member of the Board of Directors since August 2024, joining the Board following the retirement of Michael W. Rice. Mr. Werzyn currently serves as the Chief Executive Officer of West Shore Home, LLC, one of the largest direct-to-consumer home remodelers in the United States with over 41 locations in 21 states, having served in this role since June 2006, and has served as Executive Chairman of West Shore Home, LLC since October 2020. Mr. Werzyn received a B.S. from The Pennsylvania State University. Qualifications Mr. Werzyn’s qualifications to serve on our Board of Directors include his entrepreneurial background and his technology experience, combined with his business acumen. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

Class III Nominees Continuing in Officer Until the 2026 Annual Meeting of Stockholders |

|

|

|

|

Timothy Brown

Age: 62 |

|

Career Highlights Mr. Brown has served as a member of the Board of Directors of the Company since August 2020. Since 2001 Mr. Brown has served as the Founder and CEO of Sageworth, an entity comprised of Sageworth Holdings, LLC (“Sageworth Holdings”), Sageworth Trust Company and Sageworth Trust Company of South Dakota which collectively provide investment management, fiduciary, planning, and advisory services to highly successful individuals and families. As an attorney, accountant and the Founder and Chief Executive Officer of Sageworth, Mr. Brown brings extensive business, financial, legal, accounting, and investment knowledge to his position on the Board. Mr. Brown serves as Vice Chair of High Holdings Corporation, which owns the voting stock of a private, diversified steel, concrete, and real estate company, having served in that role since September 2021. Mr. Brown also serves on the Board of Directors of Penn State Health, a large hospital system, having served in that role since November 2018, and chaired the Penn State Health Finance Committee from November 2018 to September 2023, Investment Committee from February 2019 to September 2023, and was a member of its Executive Committee from July 2020 to September 2023. Mr. Brown has served on the Board of Directors of Chief Executives Organization, a 501(c)(6) organization, since November 2016, has served as a member of its Executive Committee since November 2018, and served as its International Chair from November 2023 to October 2024. Mr. Brown also serves on the Advisory Board of the Global Family Enterprise Program at Columbia Business School, having served in this role since May 2021. Mr. Brown has been a member of Young Presidents Organization since January 2005 and has previously served as its chair emeritus, chair, education officer, and finance officer of the Pennsylvania chapter. Mr. Brown helped found the S. Dale High Family Business Center at Elizabethtown College, is a founding director of Music for Everyone, former trustee of the Pennsylvania Academy of Music, past general counsel and secretary of The Lancaster Alliance, past president of the Lancaster Museum of Art, and past director of Harb-Adult, a homeless shelter. Mr. Brown received his Juris Doctor degree from the Georgetown University Law Center in Washington, D.C., and a B.S. in accounting from Penn State, graduating with the highest distinction. Qualifications Mr. Brown’s qualifications to serve on our Board of Directors include his historical understanding of our Company coupled with his extensive legal, financial, and investment experience. |

|

|

|

|

Christina Choi  Age: 47 |

|

Career Highlights Ms. Choi has served as a member of the Board of Directors of the Company since August 2020. Ms. Choi is currently Chief Marketing Officer, North America at Ralph Lauren, an American publicly traded luxury fashion company (NYSE: RL), having served in that role since October 2024. Prior to Ralph Lauren Ms. Choi served as Senior Vice President of Marketing and a member of the North America marketing leadership team for Diageo, a global leader in alcoholic beverages (NYSE: DEO) from July 2022 to October 2024. From July 2022 to October 2024, Ms. Choi led the Gin & Tequila categories across North America, in addition to the Breakout Growth Brand organization – a marketing and sales organization dedicated to accelerating high potential brands. Ms. Choi originally joined Diageo in January 2019 to lead the Gin, Rum & Tequila categories across North America, including consumer brands such as Tanqueray Gin, Captain Morgan Rum, and Don Julio Tequila. Ms. Choi is responsible for category strategy, brand marketing, and commercialization activities across this portfolio. Prior to Diageo, Ms. Choi served as Global Marketing Vice President for Anheuser- Busch InBev (NYSE: BUD), the world’s largest brewer, from March 2013 to January 2019. In this role, Ms. Choi developed the global launch strategy for Michelob Ultra, delivered double digit global sales growth for Stella Artois including leading two Super Bowl marketing campaigns, and oversaw the development and commercialization of several emerging brands. From 2006 to 2012, Ms. Choi held various marketing and innovation roles within the personal care business of Unilever PLC, based in the U.S. and Singapore. Ms. Choi led multiple brands and innovation launches globally, including across the U.S., Southeast Asia, Middle East, and Africa, among others. Ms. Choi began her career in financial services at Goldman Sachs in the Credit Risk Management and Advisory group and Goldman Sachs Asset Management. Ms. Choi holds an M.B.A. from Harvard Business School and a B.A. in Economics from Vassar College. Qualifications Ms. Choi’s qualifications to serve on our Board of Directors include her substantial marketing, commercialization and leadership experience, in each case as it applies to product campaigns and launches. |

|

|

|

|

|

|

|

2025 Proxy Statement |

19 |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

|

|

Roger Deromedi  Age: 71 |

|

Career Highlights Mr. Deromedi serves as Lead Independent Director of Utz, having served in this role since December 2022. Prior to this role, Mr. Deromedi served as Chairperson of the Company from August 2020 to December 2022, and was Co-Executive Chairperson of Collier Creek from June 2018 through August 2020. Mr. Deromedi has over 45 years of operational experience in the consumer goods sector, overseeing multiple businesses and iconic consumer brands. Mr. Deromedi was Independent Chairperson and Lead Independent Director of Pinnacle Foods from April 2016 to October 2018 and was Non-Executive Chairperson from July 2009 to April 2016 and Executive Chairperson from April 2007 to July 2009. Mr. Deromedi also was an advisor to Blackstone in relation to their acquisition of the company in April 2007. Pinnacle Foods was a manufacturer and marketer of consumer branded food products, whose key brands include Birds Eye (frozen vegetables, meals, and sides), Duncan Hines (desserts), Vlasic (pickles), Wishbone (salad dressings), Aunt Jemima (breakfast products), Mrs. Butterworth and Log Cabin (syrups), Udi’s and Glutino (gluten-free products), and Gardein (plant-based entrees and meat substitutes), among others. During Mr. Deromedi’s tenure, the company acquired and successfully integrated multiple businesses including Birds Eye Foods, Wishbone, Gardein, and Boulder Brands. From July 2013 to June 2015, Mr. Deromedi was an Executive Advisor for Blackstone in the consumer goods sector and was an independent advisor to Blackstone from 2007 to 2013. From 2003 to 2006, Mr. Deromedi was Chief Executive Officer of Kraft, which at the time was one of the world’s largest food companies, with iconic brands such as Kraft, Maxwell House, Nabisco, Oscar Mayer and Philadelphia. During this time, Mr. Deromedi integrated Kraft’s separate North American and International businesses. Prior to this, Mr. Deromedi was Co-CEO of Kraft from 2001 to 2003 during which time there was an initial public offering of the company, raising approximately $8.7 billion in gross proceeds. Mr. Deromedi was previously President of Kraft Foods International, President of the company’s Asia Pacific business, and President of Kraft’s Western European business, based in Zurich. Mr. Deromedi also served as Area Director of the company’s business in France, Iberia and Benelux, based in Paris, and was General Manager of Kraft’s cheese and specialty products businesses in the United States. Mr. Deromedi began his career with General Foods, Kraft’s predecessor company, in 1977 where he held various marketing positions. Mr. Deromedi previously served on the board of directors of Pinnacle Foods from 2007 to 2018, Kraft from 2001 to 2006 and The Gillette Company, Inc. from 2003 to 2005 (when the company was merged with The Procter & Gamble Company). Mr. Deromedi currently serves as a Director of The Joffrey Ballet and as a Life Trustee of the Field Museum. Mr. Deromedi earned an M.B.A. from the Stanford Graduate School of Business and a B.A. in Economics and Mathematics from Vanderbilt University. Qualifications Mr. Deromedi’s qualifications to serve on our Board of Directors include his experience as a senior executive officer and/or director of multiple businesses in the consumer sector, his track record of building significant stockholder value, his experience in evaluating, executing, and integrating acquisitions, and his history of serving as a director for several public and private companies. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS § DIRECTORS OF UTZ BRANDS, INC.

|

|

|

|

Dylan Lissette

Age: 53 |

|

Career Highlights Mr. Lissette is the Chairperson of the Board of Directors of Utz. Mr. Lissette served as the Executive Chairperson of Utz from December 2022 until May 4, 2023, immediately following the 2023 annual meeting of stockholders, at which point he assumed the role of Chairperson. Mr. Lissette has served as a member of the Board of Directors of the Company since August 2020. Prior to serving as the Executive Chairperson of Utz, Mr. Lissette served as the Chief Executive Officer of Utz from August 2020 until December 2022. Prior to that role, Mr. Lissette served as the Vice Chairperson, President and Chief Executive Officer of Utz and its predecessor companies since 2012. Mr. Lissette also served as the sole manager of UBH from September 2016 through August 2020. Prior to serving as Chief Executive Officer at Utz, Mr. Lissette served as the Company’s Chief Operating Officer from January 2011 to January 2013 and Executive Vice President of Sales and Marketing from January 2008 to January 2011. Prior to his service as an executive officer of the Utz companies, Mr. Lissette served the Utz companies in several capacities since joining in 1995, including serving as Retail Sales Manager, Key Account Director, and Director of Marketing. In 2007, Mr. Lissette was promoted to the position of Senior Vice President — Sales Operations where he had direct responsibility for route sales development in our Mid-Atlantic core markets and system-wide administration of the company’s DSD operations. Mr. Lissette represents the fourth generation of family leadership and involvement at Utz and is the son-in-law of Michael W. Rice, who previously served as our Chairman Emeritus and as a member of our Board of Directors until August 2024. Mr. Lissette currently serves as a member of the Board of Directors of Athletic Brewing Company, a private, craft non- alcoholic beer & hop-infused sparkling hop water company, having served in this role since March 2021, prior to which he served as a member of the Advisory Board from November 2019. Mr. Lissette also serves as a member of the Executive Committee of Sageworth Holdings, LLC, having served in that role since June 2023. Mr. Lissette holds a B.S. degree in Business Economics and Public Policy from The George Washington University. Qualifications Mr. Lissette’s extensive institutional knowledge and executive experience across a multitude of roles at Utz, including most recently as the Executive Chairperson of Utz, qualifies him to serve on our Board of Directors. |

|

|

|

|

|

|

|

2025 Proxy Statement |

21 |

EXECUTIVE OFFICERS OF UTZ BRANDS, INC.

EXECUTIVE OFFICERS OF UTZ BRANDS, INC.

Our executive officers are elected annually and serve at the pleasure of the Board. The following sets forth the name, age as of the Record Date, position(s) with us and selected biographical information for our executive officers as of the Record Date. The biography of Mr. Friedman is provided above under “Proposal No. 1: Election of Directors.”

|

|

|

|

|

|

NAME |

|

AGE |

|

POSITION |

Howard Friedman |

|

55 |

|

Chief Executive Officer |

Mitch Arends |

|

49 |

|

Executive Vice President, Chief Integrated Supply Chain Officer |

Jennifer Bentz |

|

54 |

|

Executive Vice President, Chief Marketing Officer |

Ajay Kataria |

|

48 |

|

Executive Vice President, Chief Financial and Accounting Officer |

Shannan Redcay |

|

44 |

|

Executive Vice President, Manufacturing |

Mark Schreiber |

|

61 |

|

Executive Vice President, Sales and Chief Customer Officer |

Theresa Shea |

|

52 |

|

Executive Vice President, General Counsel and Corporate Secretary |

James Sponaugle |

|

48 |

|

Executive Vice President, Chief People Officer |

Chad Whyte |

|

49 |

|

Executive Vice President, Supply Chain |

|

|

|

|

Mitch Arends Age: 49 |

|

Mr. Arends serves as Executive Vice President, Chief Integrated Supply Chain Officer at Utz, having served in that role since November 2023. As EVP, Chief Integrated Supply Chain Officer, he oversees all aspects of the supply chain, including operations, procurement, manufacturing, transportation, warehousing, planning, quality, and research & development. Mr. Arends joined Utz in November 2023, prior to which he served from September of 2021 to September of 2023 as the Chief Supply Chain Officer of North America at Kraft Heinz (Nasdaq: KHC), an American multinational food company. During Mr. Arends, 13 years at Kraft Heinz, in addition to serving as the Chief Supply Chain Officer of North America, Mr. Arends lead North America Operations & Manufacturing since 2018 until September 2021 as well several Business Unit operations roles in addition to roles in Procurement and Plant management. Prior to his time at Kraft, Mr. Arends served six years at Nestle & Gerber (OTCMKTS: NSRGY), a Swiss multinational food and drink processing conglomerate corporation, from 2004 to 2010, Prior to Mr. Arends’ roles at Nestle, Mr. Arends spent five years in several supply chain roles at Deere & Company (NYSE: DE), an American manufacturing corporation. Mr. Arends started his career in 1996 with Quality Farm and Fleet, a retail chain focusing on farm supplies and equipment, where he worked in Supply Chain and Merchandising. Mr. Arends holds a B.A. in Supply Chain Management / Operations Management from Michigan State University, as well as an M.B.A. from Arizona State University with an emphasis in Supply Chain Management. |

|

|

|

|

Jennifer Bentz Age: 54 |

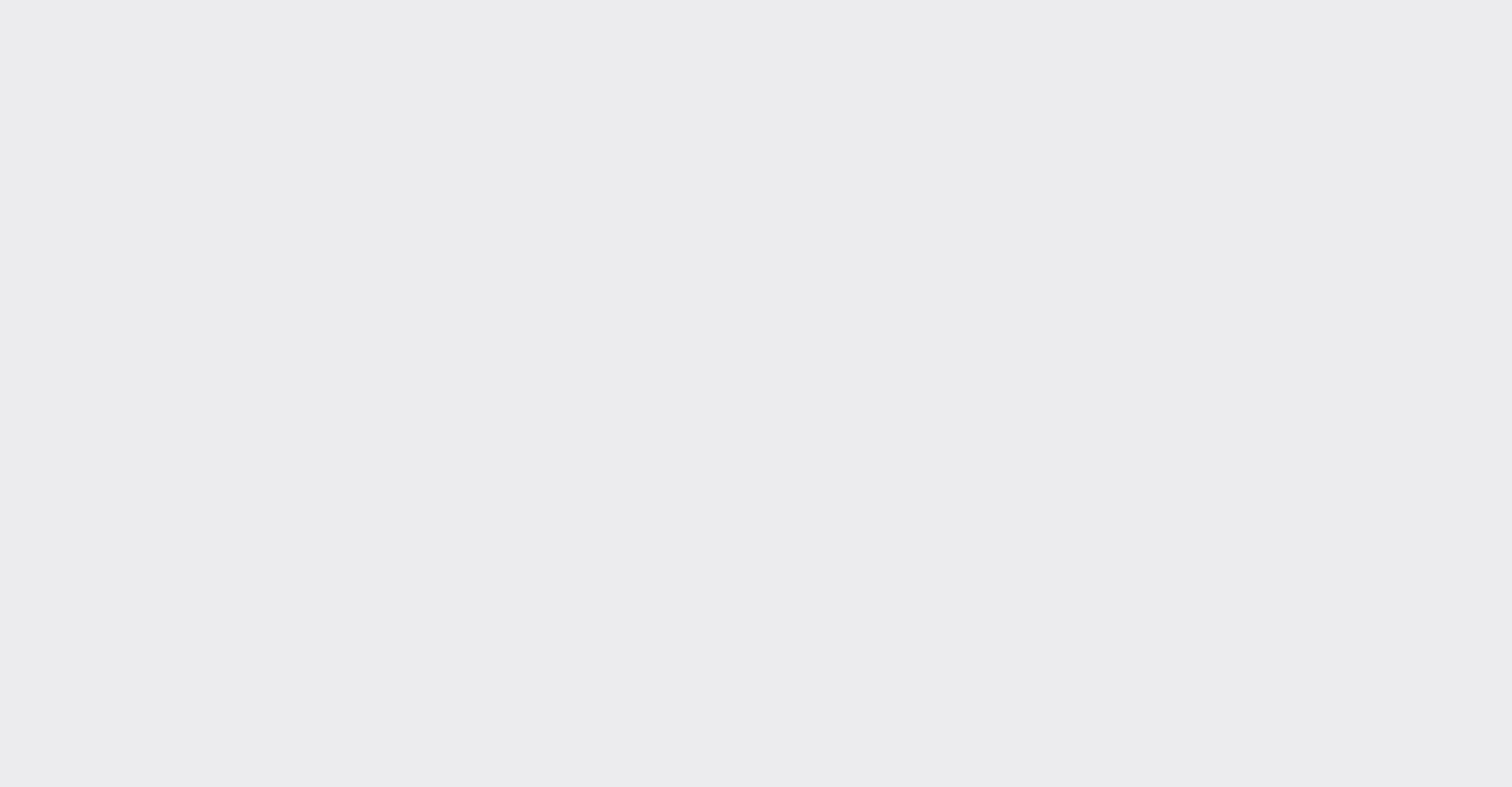

|