Utz Brands, Inc. Third Quarter 2025 Earnings Presentation October 30, 2025

Disclaimer 2 Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as "may," "can," "should," "will," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "target," "goal," "on track," or other similar words, phrases or expressions. These forward-looking statements include future plans for Utz Brands, Inc. (“the Company”), including updated outlook for fiscal 2025, plans related to the transformation of the Company’s supply chain, the Company’s product mix, the Company's expectations regarding its level of indebtedness and associated interest expense impacts; the Company’s cost savings plans and the Company’s logistics optimization efforts; the estimated or anticipated future results and benefits of the Company’s plans and operations; the Company’s future capital structure; future opportunities for the Company; the effects of tariffs, inflation or supply chain disruptions on the Company or its business; statements regarding the Company’s project balance sheet and liabilities, including net leverage; and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties, and the Company’s business and actual results may differ materially. Some factors that could cause actual results to differ include, without limitation: our operation in an industry with high levels of competition and consolidation; our reliance on key customers and ability to obtain favorable contractual terms and protections with customers; changes in demand for our products driven by changes in consumer preferences and tastes or our ability to innovate or market our products effectively; changes in consumers’ loyalty to our brands due to factors beyond our control; impacts on our reputation caused by concerns relating to the quality and safety of our products, ingredients, packaging, or processing techniques; the potential that our products might need to be recalled if they become adulterated or are mislabeled; the loss of retail shelf space and disruption to sales of food products due to changes in retail distribution arrangements; our reliance on third parties to effectively operate both our direct-to-warehouse delivery system and our direct- store-delivery network system; the evolution of e-commerce retailers and sales channels; disruption to our manufacturing operations, supply chain, or distribution channels; the effects of inflation, including rising labor costs; shortages of raw materials, energy, water, and other supplies; changes in the legal and regulatory environments in which we operate, including with respect to tax legislation such as the One Big Beautiful Bill Act; potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries, or investigations into our business; potential adverse effects or unintended consequences related to the implementation of our growth strategy; our ability to successfully identify and execute acquisitions or dispositions and to manage integration or carve out issues following such transactions; the geographic concentration of our markets; our ability to attract and retain highly skilled personnel (including risks associated with our recently announced executive leadership transition); impairment in the carrying value of goodwill or other intangible assets; our ability to protect our intellectual property rights; disruptions, failures, or security breaches of our information technology infrastructure; climate change or legal, regulatory or market measures to address climate change; our exposure to liabilities, claims or new laws or regulations with respect to environmental matters; the increasing focus and opposing views, legislation and expectations with respect to ESG initiatives; restrictions on our operations imposed by covenants in our debt instruments; our exposure to changes in interest rates; adverse impacts from disruptions in the worldwide financial markets, including on our ability to obtain new credit; our exposure to any new or increased income or product taxes; pandemics, epidemics or other disease outbreaks; our exposure to changes to trade policies and tariff and import/export regulations by the United States and other jurisdictions; potential volatility in our Class A Common Stock caused by resales thereof; our dependence on distributions made by our subsidiaries; our payment obligations pursuant to a tax receivable agreement, which in certain cases may exceed the tax benefits we realize or be accelerated; provisions of Delaware law and our governing documents and other agreements that could limit the ability of stockholders to take certain actions or delay or discourage takeover attempts that stockholders may consider favorable; our exclusive forum provisions in our governing documents; the influence of certain significant stockholders and members of Utz Brands Holdings, LLC, whose interests may differ from those of our other stockholders; and other risks and uncertainties set forth in Part I, Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 29, 2024 and in the other reports we file with the U.S. Securities and Exchange Commission from time to time. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Industry Information Unless otherwise indicated, information contained in this presentation or made orally during this presentation concerning the Company’s industry, competitive position and the markets in which it operates is based on information from independent research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Company’s internal research, and are based on assumptions made by the Company upon reviewing such data, and the Company’s experience in, and knowledge of, such industry and markets, which the Company believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Company operates, and the Company’s future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by the Company.

Disclaimer (cont.) 3 Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but we will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Projected Financial Information This presentation contains financial forecasts, which were prepared in good faith by the Company on a basis believed to be reasonable. Such financial forecasts have not been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”). The Company’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purposes of their inclusion in this presentation, and accordingly, they have not expressed an opinion nor provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of the Company’s control, as discussed under Forward-Looking Statements above. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with GAAP including, but not limited to, Organic Net Sales, Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted SD&A, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Normalized Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per Share, Adjusted COGS, and Net Leverage Ratio, and certain ratios and other metrics derived therefrom. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations, earnings per share or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these historical non-GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. In addition, quantitative reconciliations are not available for the forward-looking GAAP financial measures used in this presentation without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Net Organic Sales, Adjusted EBITDA, Adjusted Earnings Per Share, and Net Leverage Ratio, respectively. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results.

Business Overview Howard Friedman Chief Executive Officer 4

3Q’25 Accelerating Growth, Confident in Full-Year Trajectory 5 o 3Q’25 Net Sales growth of 3.4% led by Branded Salty Snacks Organic Net Sales growth of 5.8%(1) o Dollar and Volume share gains in Salty Snacks category(2), posting our 9th consecutive quarter of volume share growth, outperforming the 0.2% decline for the Salty Snacks category o Productivity cost savings fueling Adj. Gross Profit Margin expansion o Adj. EBITDA growth of 11.7% y/y, driven by Adj. Gross Profit Margin and efficient SD&A investment o Supply chain transformation projects commenced in early 2024 on-track, largely complete by YE 2025 o Accelerating California market entry with acquisition of Insignia’s direct store delivery (DSD) assets o Updating FY25 guidance to reflect stronger top-line trends; reiterating Adj. EBITDA and Adj. EPS ranges Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. (1) Branded Salty Snacks sales as defined in 3Q’25 earnings press release dated Oct 30, 2025; excludes Independent Operator (“IO”) unreported sales. (2) Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25 compared to the 13-weeks ended 9/29/24 on a pro forma basis.

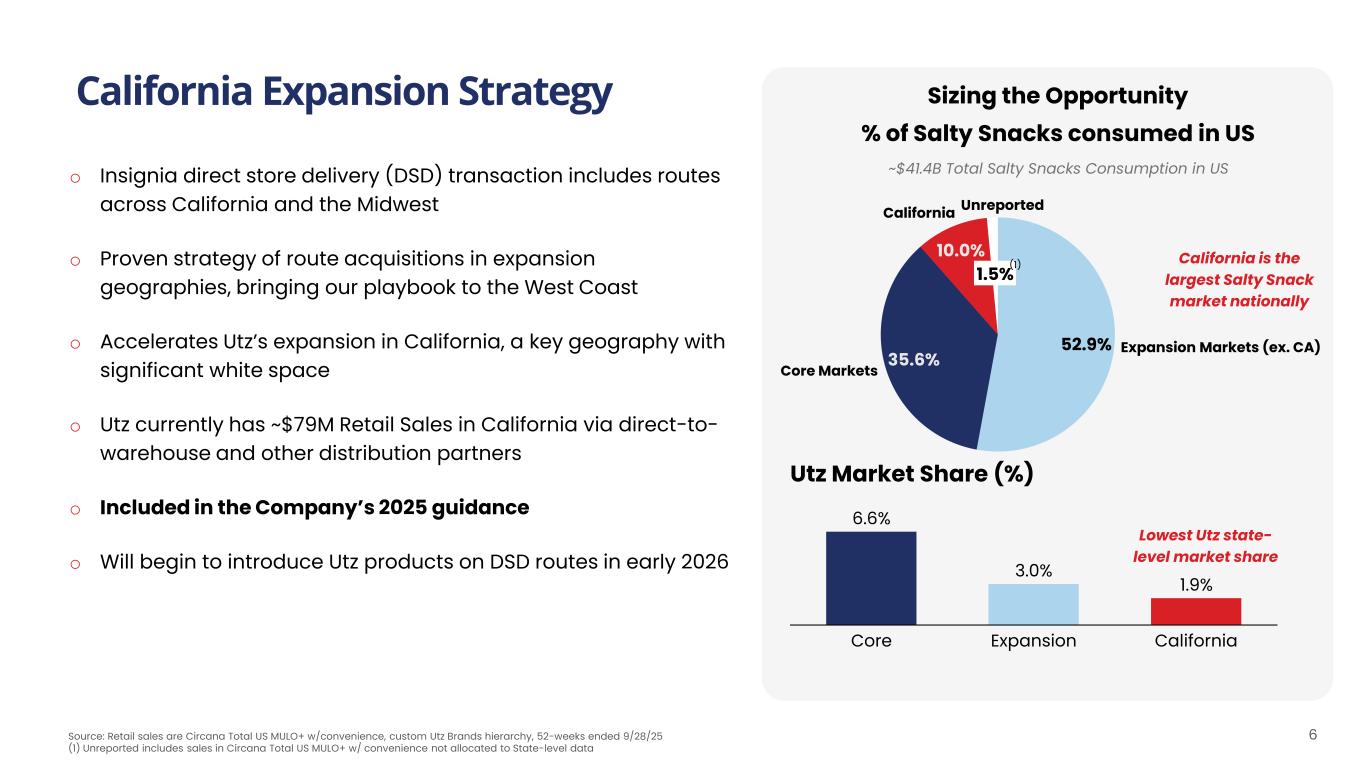

6 California Expansion Strategy o Insignia direct store delivery (DSD) transaction includes routes across California and the Midwest o Proven strategy of route acquisitions in expansion geographies, bringing our playbook to the West Coast o Accelerates Utz’s expansion in California, a key geography with significant white space o Utz currently has ~$79M Retail Sales in California via direct-to- warehouse and other distribution partners o Included in the Company’s 2025 guidance o Will begin to introduce Utz products on DSD routes in early 2026 Sizing the Opportunity % of Salty Snacks consumed in US Utz Market Share (%) Core Expansion California 6.6% 3.0% 1.9% Lowest Utz state- level market share ~$41.4B Total Salty Snacks Consumption in US Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 52-weeks ended 9/28/25 (1) Unreported includes sales in Circana Total US MULO+ w/ convenience not allocated to State-level data 52.9% 35.6% 10.0% Expansion Markets (ex. CA) Core Markets California 1.5% Unreported California is the largest Salty Snack market nationally (1)

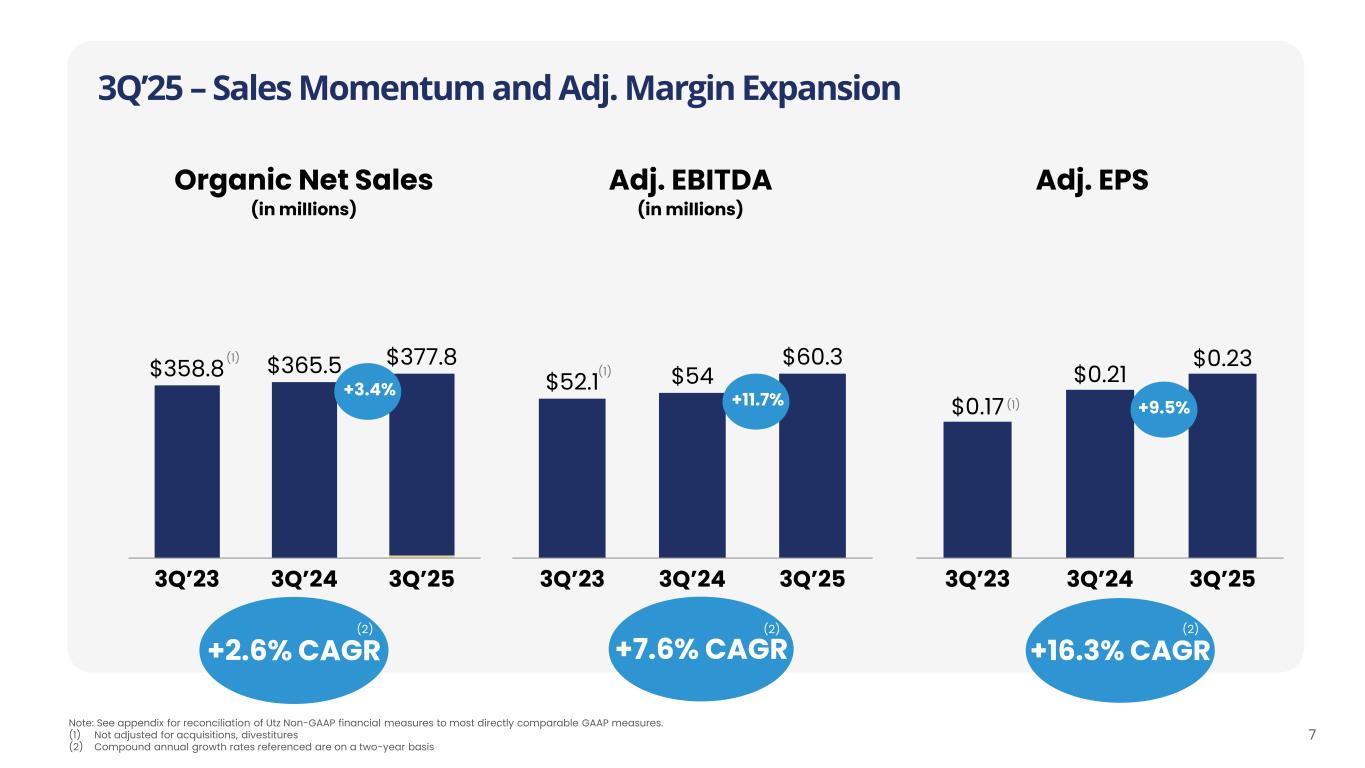

3Q’25 – Sales Momentum and Adj. Margin Expansion 7 Adj. EBITDA (in millions) 3Q’23 3Q’24 3Q’25 $52.1 $54 $60.3 Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. (1) Not adjusted for acquisitions, divestitures (2) Compound annual growth rates referenced are on a two-year basis Adj. EPS $0.17 $0.21 $0.23 3Q’23 3Q’24 3Q’25 Organic Net Sales (in millions) 3Q’23 3Q’24 3Q’25 $358.8 $365.5 $377.8 +16.3% CAGR+7.6% CAGR+2.6% CAGR (1) (1)+11.7%+3.4% +9.5% (1) (2) (2) (2)

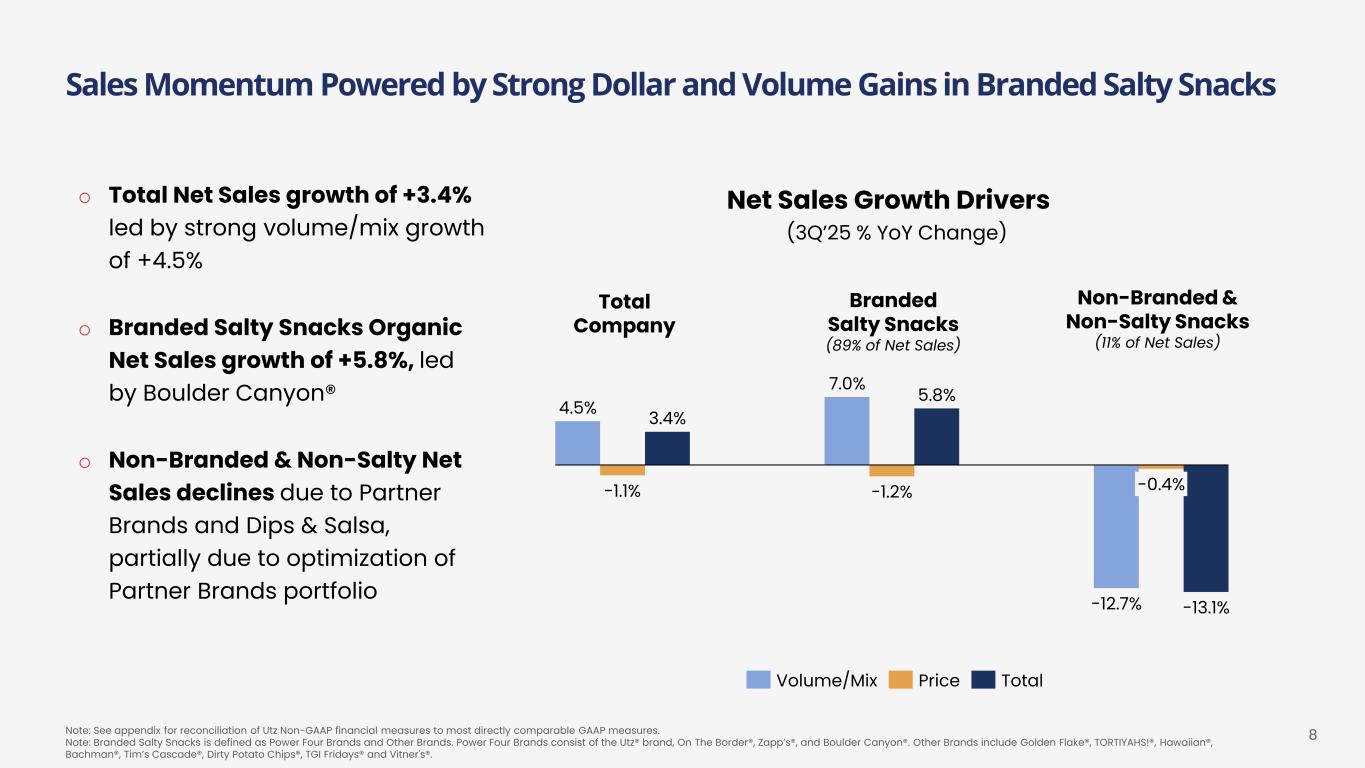

8Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. Note: Branded Salty Snacks is defined as Power Four Brands and Other Brands. Power Four Brands consist of the Utz® brand, On The Border®, Zapp’s®, and Boulder Canyon®. Other Brands include Golden Flake®, TORTIYAHS!®, Hawaiian®, Bachman®, Tim’s Cascade®, Dirty Potato Chips®, TGI Fridays® and Vitner's®. Sales Momentum Powered by Strong Dollar and Volume Gains in Branded Salty Snacks Non-Branded & Non-Salty Snacks (11% of Net Sales) Total Company 4.5% -1.1% 3.4% 7.0% -1.2% 5.8% -12.7% -0.4% -13.1% (3Q’25 % YoY Change) Volume/Mix Price Total Net Sales Growth Driverso Total Net Sales growth of +3.4% led by strong volume/mix growth of +4.5% o Branded Salty Snacks Organic Net Sales growth of +5.8%, led by Boulder Canyon® o Non-Branded & Non-Salty Net Sales declines due to Partner Brands and Dips & Salsa, partially due to optimization of Partner Brands portfolio Branded Salty Snacks (89% of Net Sales)

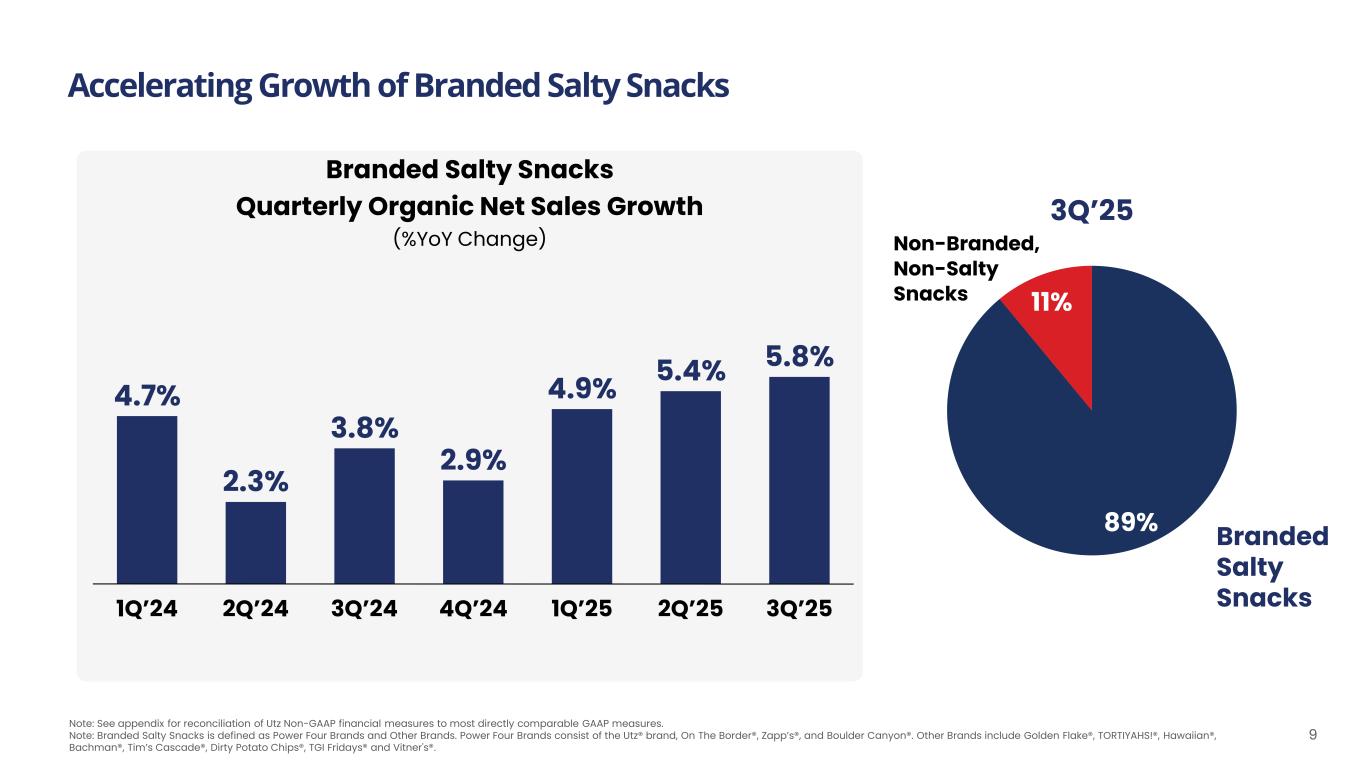

1Q’24 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 4.7% 2.3% 3.8% 2.9% 4.9% 5.4% 5.8% Accelerating Growth of Branded Salty Snacks 9 Branded Salty Snacks Quarterly Organic Net Sales Growth (%YoY Change) Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. Note: Branded Salty Snacks is defined as Power Four Brands and Other Brands. Power Four Brands consist of the Utz® brand, On The Border®, Zapp’s®, and Boulder Canyon®. Other Brands include Golden Flake®, TORTIYAHS!®, Hawaiian®, Bachman®, Tim’s Cascade®, Dirty Potato Chips®, TGI Fridays® and Vitner's®. 89% 11% 3Q’25 Branded Salty Snacks Non-Branded, Non-Salty Snacks

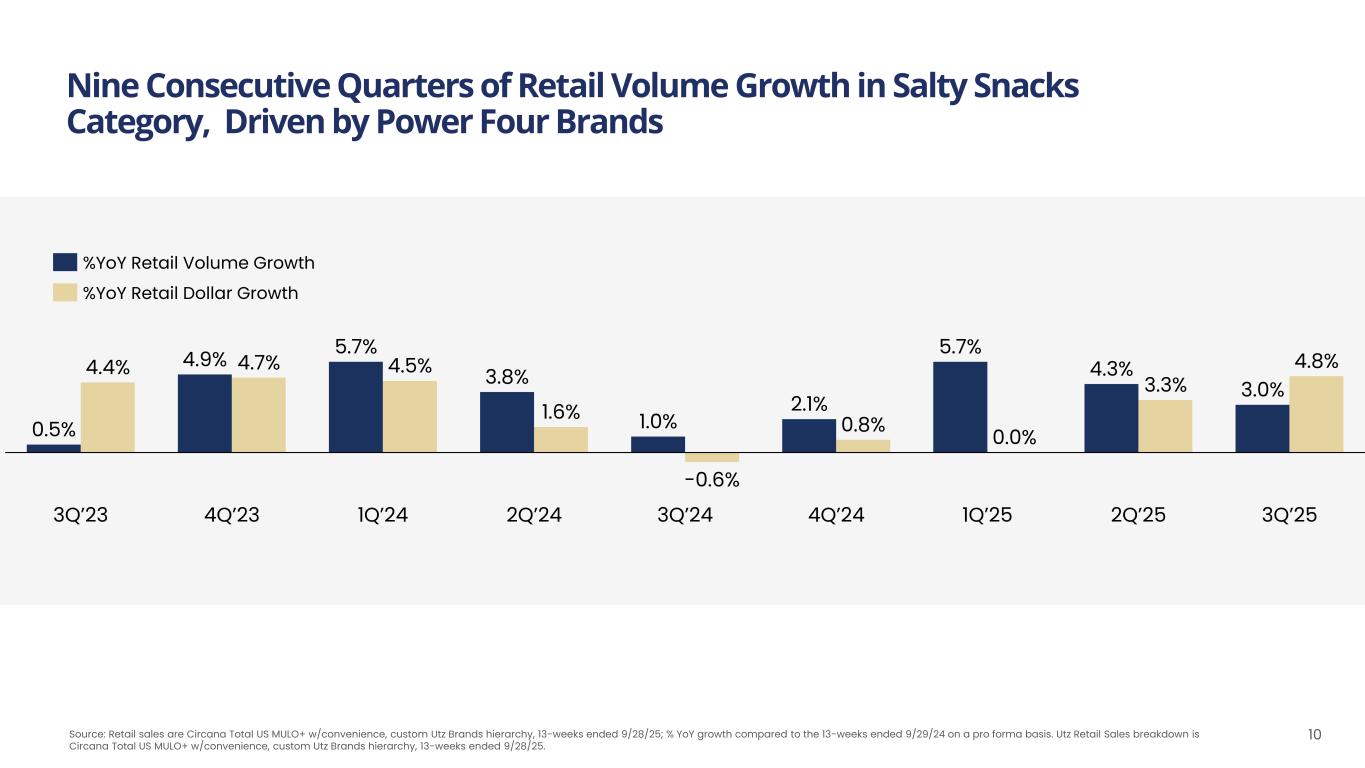

Nine Consecutive Quarters of Retail Volume Growth in Salty Snacks Category, Driven by Power Four Brands 10 3Q’23 4Q’23 1Q’24 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 0.5% 4.4% 4.9% 4.7% 5.7% 4.5% 3.8% 1.6% 1.0% -0.6% 2.1% 0.8% 5.7% 0.0% 4.3% 3.3% 3Q’25 3.0% 4.8% %YoY Retail Volume Growth %YoY Retail Dollar Growth Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25; % YoY growth compared to the 13-weeks ended 9/29/24 on a pro forma basis. Utz Retail Sales breakdown is Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25.

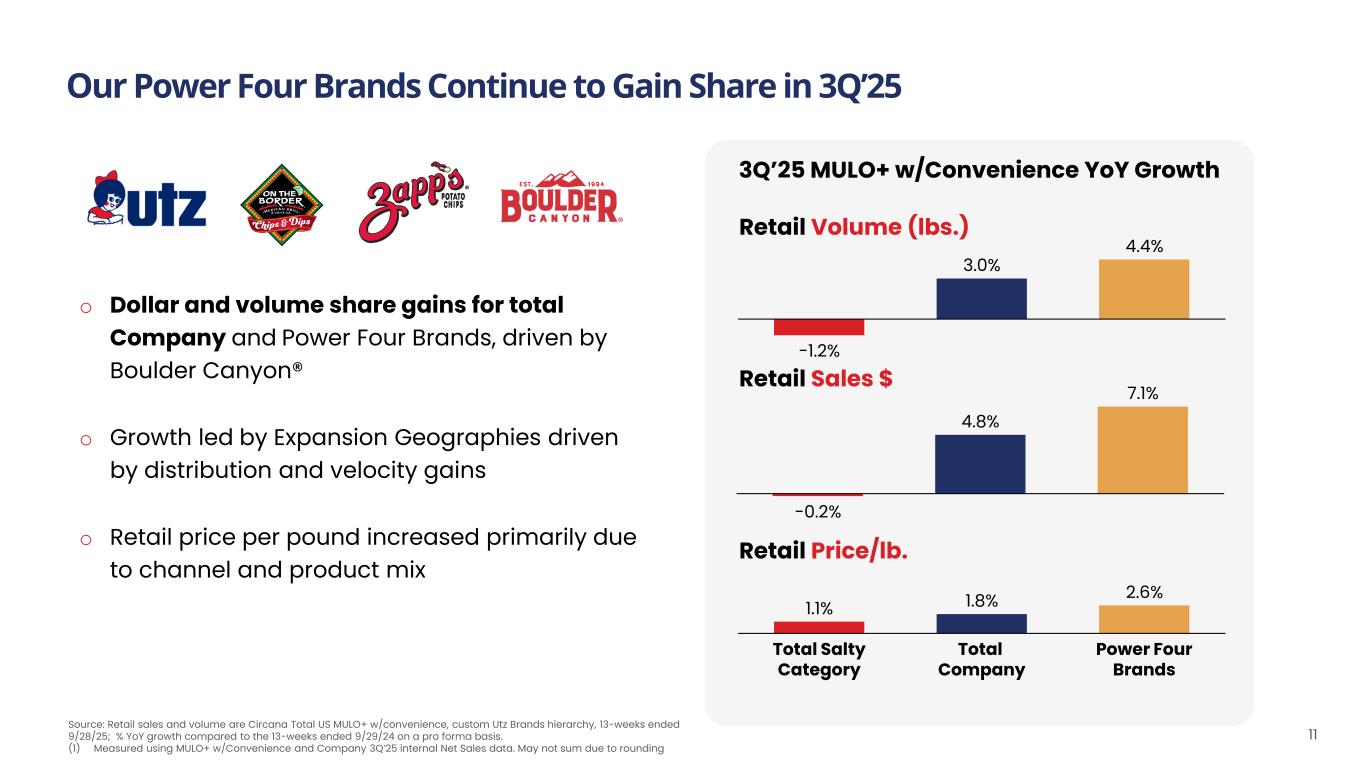

Our Power Four Brands Continue to Gain Share in 3Q’25 11 3Q’25 MULO+ w/Convenience YoY Growth -1.2% 3.0% 4.4% Retail Volume (lbs.) Total Salty Category Total Company Power Four Brands 1.1% 1.8% 2.6% Retail Price/lb. -0.2% 4.8% 7.1% Retail Sales $ Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25; % YoY growth compared to the 13-weeks ended 9/29/24 on a pro forma basis. (1) Measured using MULO+ w/Convenience and Company 3Q’25 internal Net Sales data. May not sum due to rounding o Dollar and volume share gains for total Company and Power Four Brands, driven by Boulder Canyon® o Growth led by Expansion Geographies driven by distribution and velocity gains o Retail price per pound increased primarily due to channel and product mix

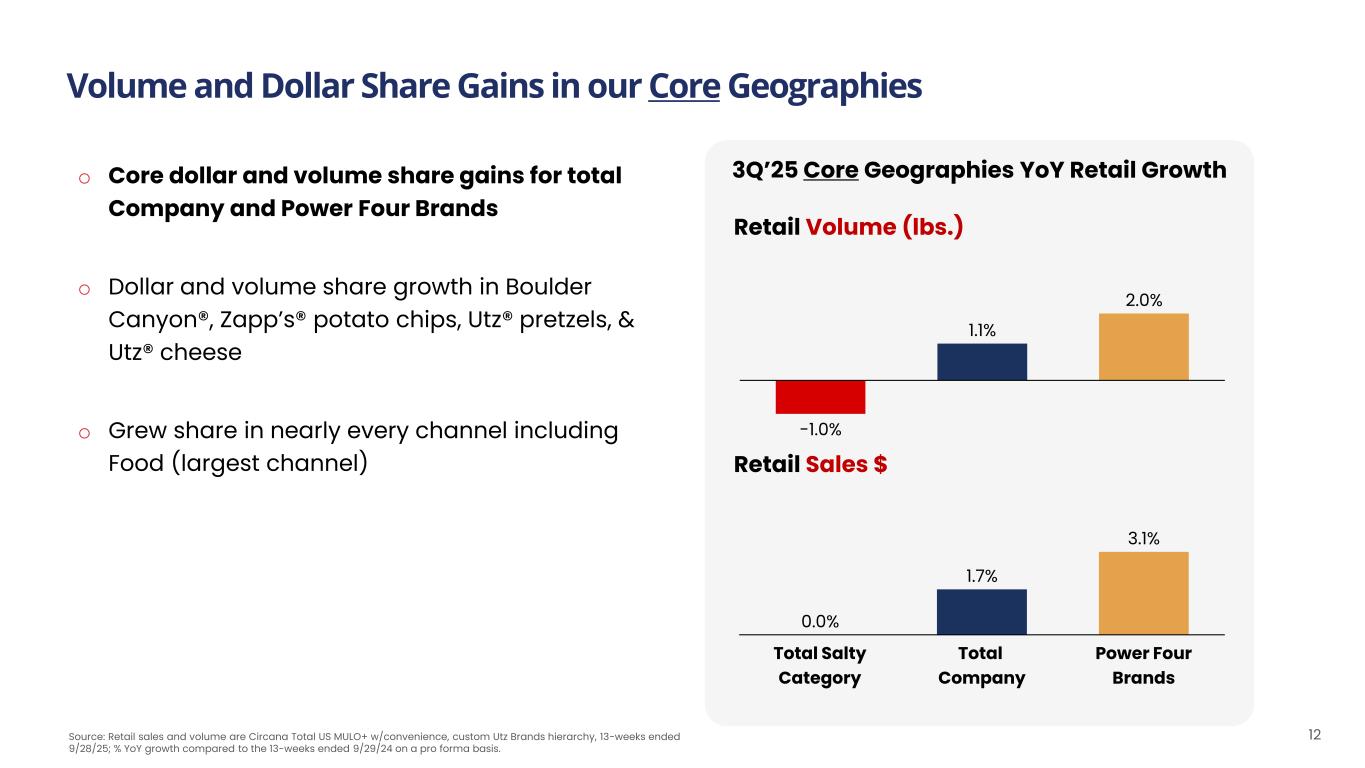

3Q’25 Core Geographies YoY Retail Growth Retail Volume (lbs.) Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25; % YoY growth compared to the 13-weeks ended 9/29/24 on a pro forma basis. Volume and Dollar Share Gains in our Core Geographies 12 Total Salty Category Total Company Power Four Brands 0.0% 1.7% 3.1% -1.0% 1.1% 2.0% Retail Sales $ o Core dollar and volume share gains for total Company and Power Four Brands o Dollar and volume share growth in Boulder Canyon®, Zapp’s® potato chips, Utz® pretzels, & Utz® cheese o Grew share in nearly every channel including Food (largest channel)

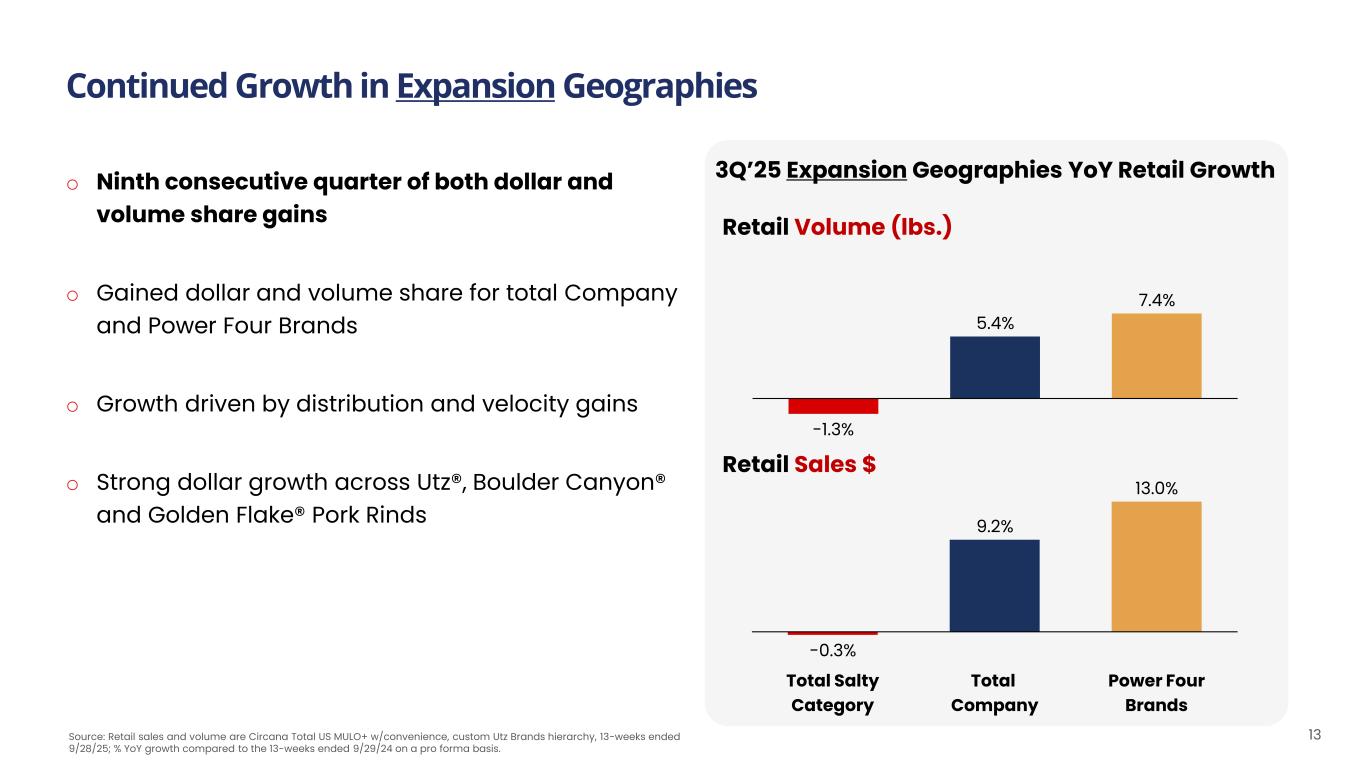

Continued Growth in Expansion Geographies 13 o Ninth consecutive quarter of both dollar and volume share gains o Gained dollar and volume share for total Company and Power Four Brands o Growth driven by distribution and velocity gains o Strong dollar growth across Utz®, Boulder Canyon® and Golden Flake® Pork Rinds 3Q’25 Expansion Geographies YoY Retail Growth Retail Volume (lbs.) Total Salty Category Total Company Power Four Brands -0.3% 9.2% 13.0% -1.3% 5.4% 7.4% Retail Sales $ Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25; % YoY growth compared to the 13-weeks ended 9/29/24 on a pro forma basis.

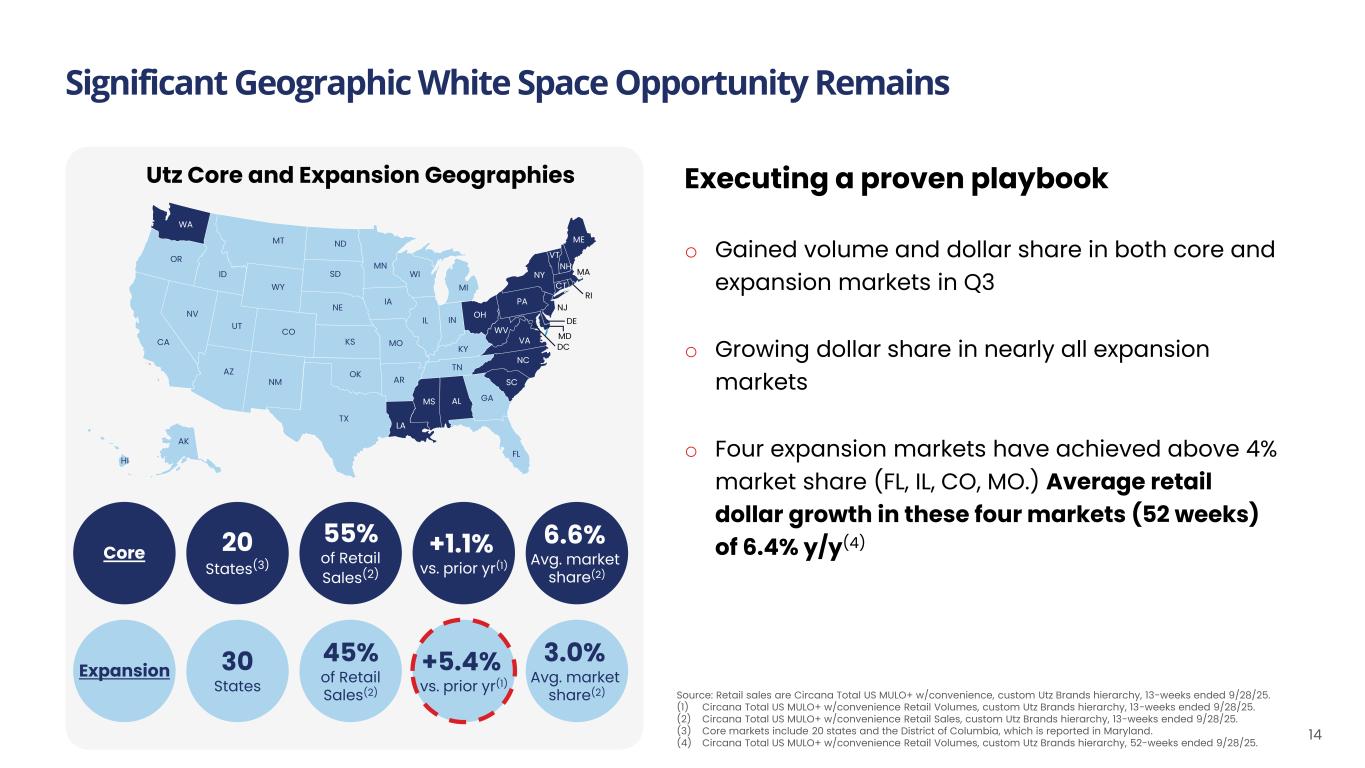

Significant Geographic White Space Opportunity Remains 14 Utz Core and Expansion Geographies FL NM DE MD TX OK KS NE SD NDMT WY COUT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DC VA OH MI HI AK Executing a proven playbook o Gained volume and dollar share in both core and expansion markets in Q3 o Growing dollar share in nearly all expansion markets o Four expansion markets have achieved above 4% market share (FL, IL, CO, MO.) Average retail dollar growth in these four markets (52 weeks) of 6.4% y/y(4)55% of Retail Sales(2) +1.1% vs. prior yr(1) 6.6% Avg. market share(2) Core 45% of Retail Sales(2) +5.4% vs. prior yr(1) 3.0% Avg. market share(2) Expansion 20 States(3) 30 States Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25. (1) Circana Total US MULO+ w/convenience Retail Volumes, custom Utz Brands hierarchy, 13-weeks ended 9/28/25. (2) Circana Total US MULO+ w/convenience Retail Sales, custom Utz Brands hierarchy, 13-weeks ended 9/28/25. (3) Core markets include 20 states and the District of Columbia, which is reported in Maryland. (4) Circana Total US MULO+ w/convenience Retail Volumes, custom Utz Brands hierarchy, 52-weeks ended 9/28/25.

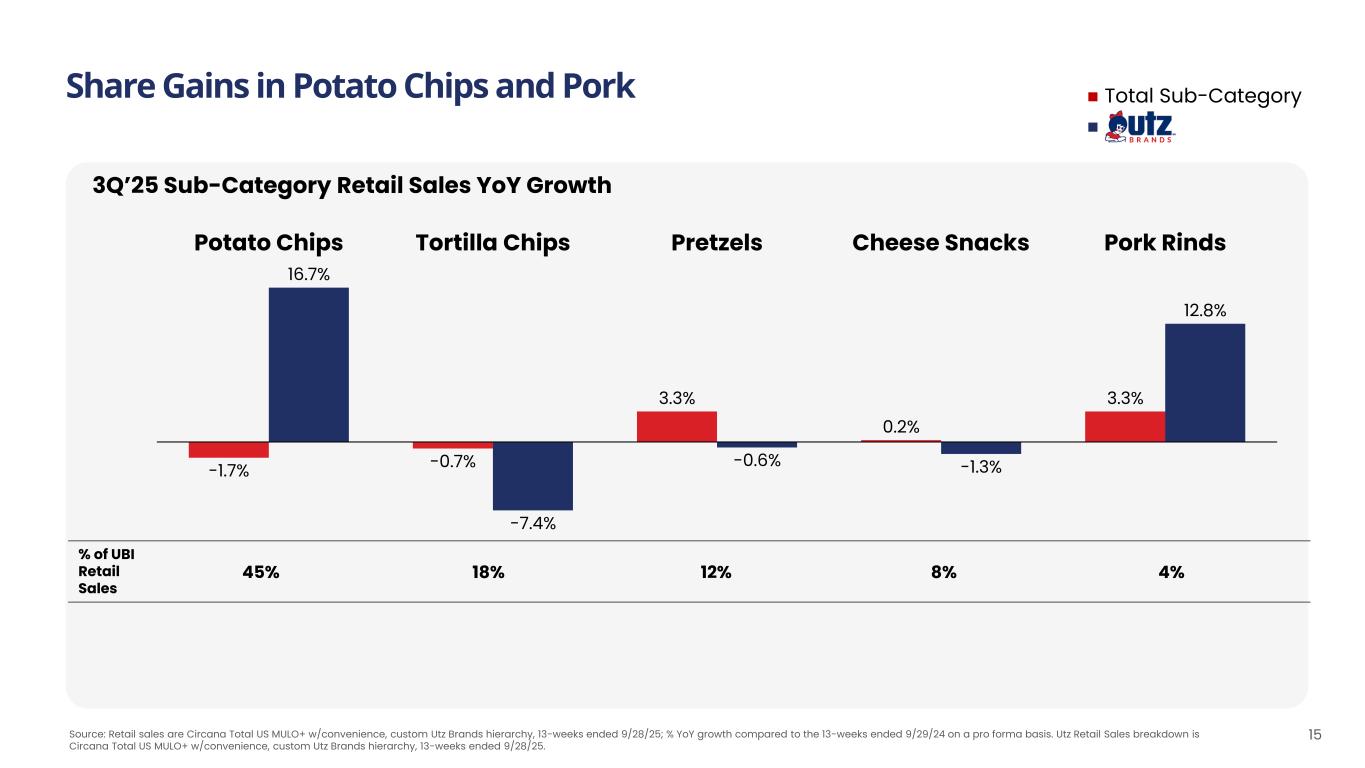

% of UBI Retail Sales 45% 18% 12% 8% 4% Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25; % YoY growth compared to the 13-weeks ended 9/29/24 on a pro forma basis. Utz Retail Sales breakdown is Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 9/28/25. 3Q’25 Sub-Category Retail Sales YoY Growth Potato Chips Tortilla Chips Pretzels Cheese Snacks Pork Rinds -1.7% 16.7% -0.7% -7.4% 3.3% -0.6% 0.2% -1.3% 3.3% 12.8% 15 Share Gains in Potato Chips and Pork Total Sub-Category

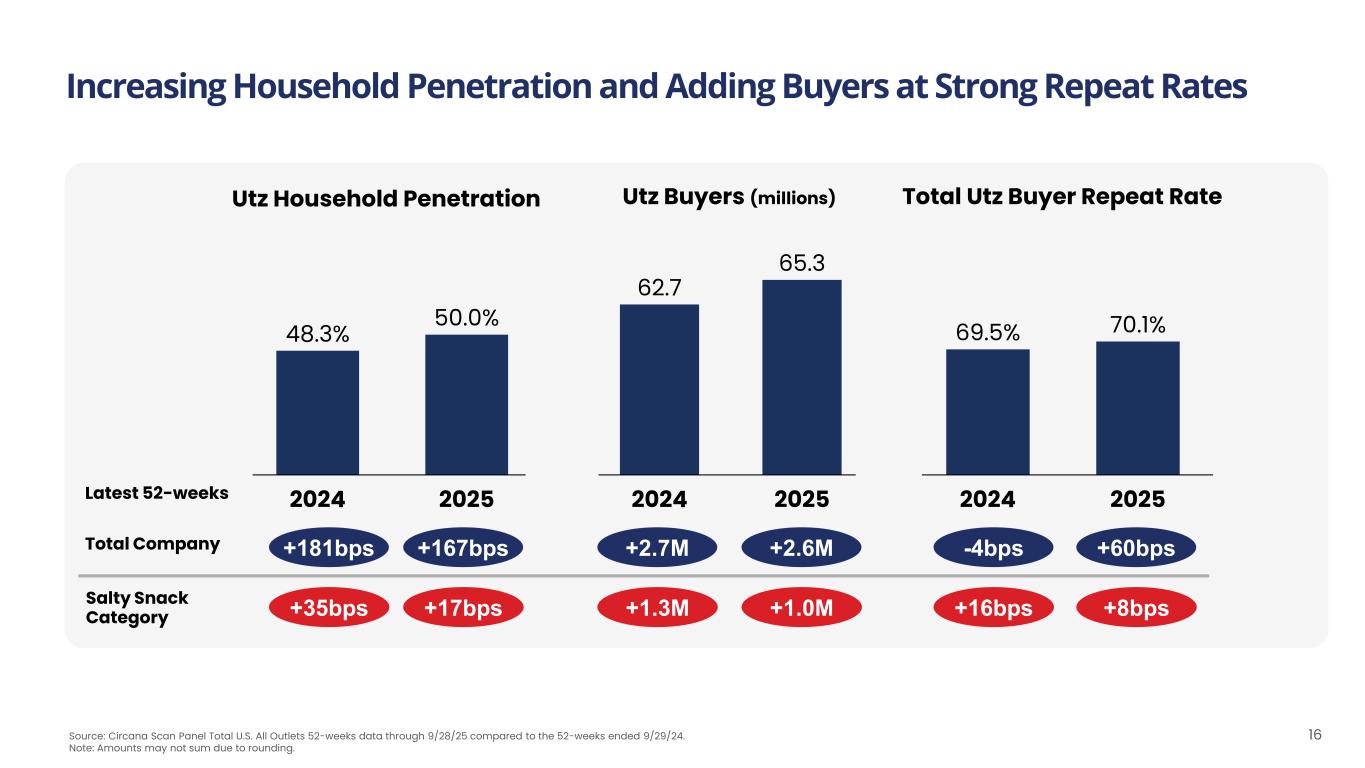

Increasing Household Penetration and Adding Buyers at Strong Repeat Rates 16 Utz Household Penetration Utz Buyers (millions) Total Utz Buyer Repeat Rate Source: Circana Scan Panel Total U.S. All Outlets 52-weeks data through 9/28/25 compared to the 52-weeks ended 9/29/24. Note: Amounts may not sum due to rounding. 35 40 45 50 55 2024 2025 48.3% 50.0% 60 65 70 75 2024 2025 69.5% 70.1% 62.7 65.3 45 50 55 60 65 70 2024 2025 Total Company Salty Snack Category +167bps +17bps +2.6M +1.0M +60bps +8bps +181bps +35bps +2.7M +1.3M -4bps +16bps Latest 52-weeks

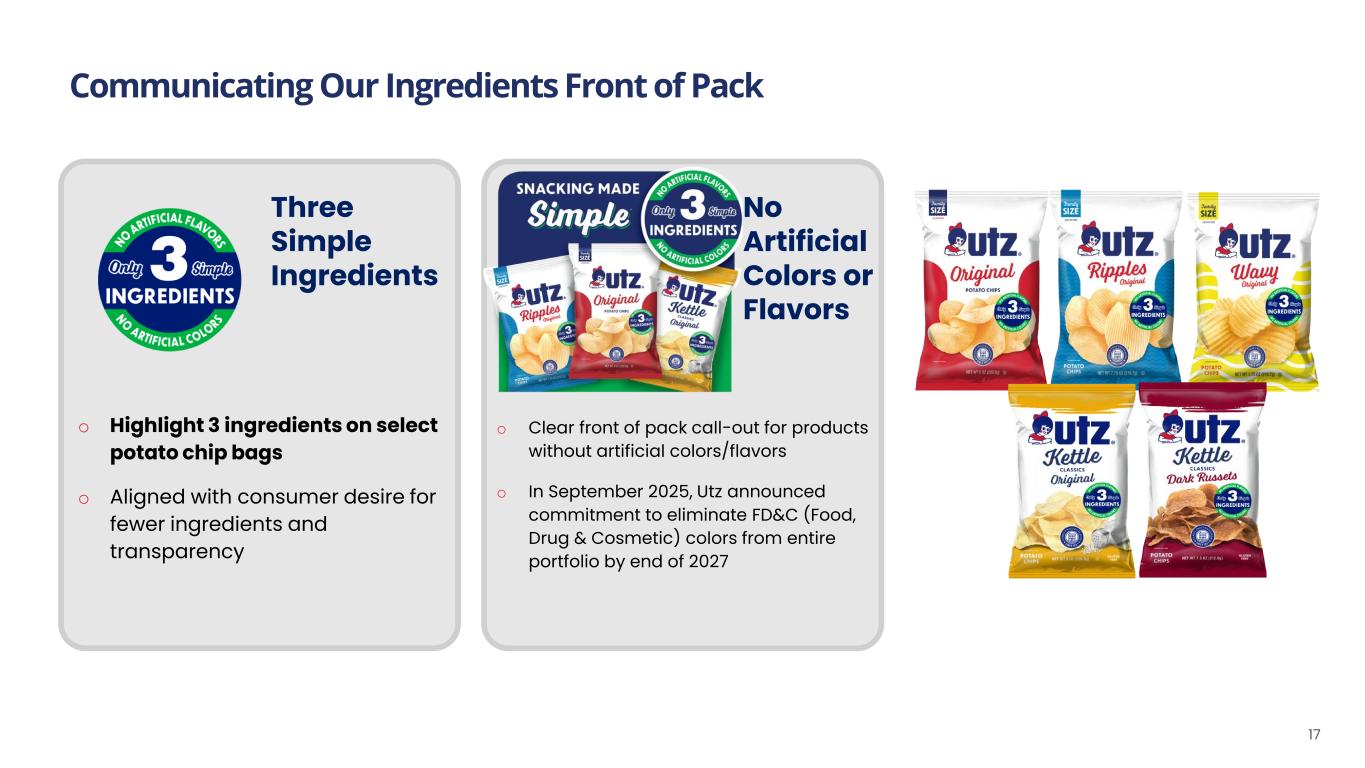

Communicating Our Ingredients Front of Pack o Clear front of pack call-out for products without artificial colors/flavors o In September 2025, Utz announced commitment to eliminate FD&C (Food, Drug & Cosmetic) colors from entire portfolio by end of 2027 No Artificial Colors or Flavors o Highlight 3 ingredients on select potato chip bags o Aligned with consumer desire for fewer ingredients and transparency Three Simple Ingredients 17

Financial Review BK Kelley Chief Financial Officer 18

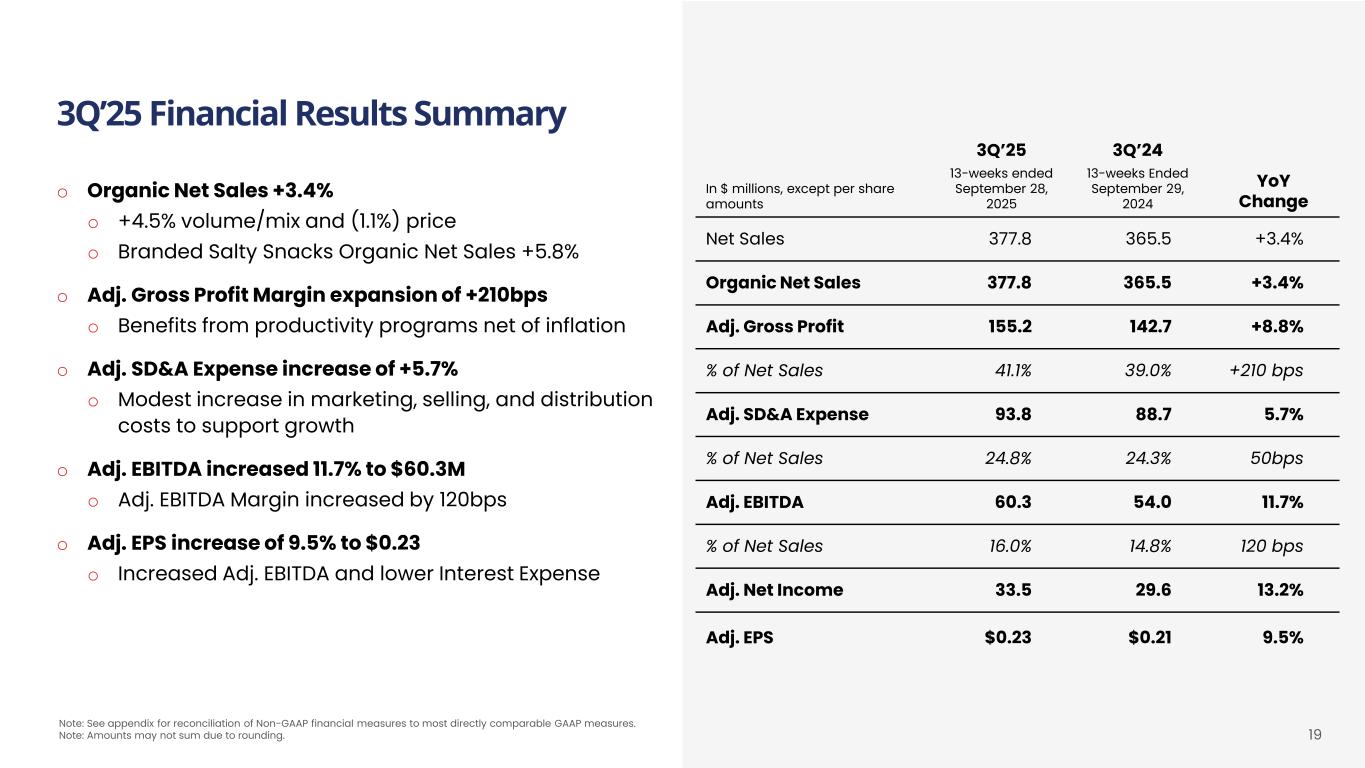

3Q’25 Financial Results Summary o Organic Net Sales +3.4% o +4.5% volume/mix and (1.1%) price o Branded Salty Snacks Organic Net Sales +5.8% o Adj. Gross Profit Margin expansion of +210bps o Benefits from productivity programs net of inflation o Adj. SD&A Expense increase of +5.7% o Modest increase in marketing, selling, and distribution costs to support growth o Adj. EBITDA increased 11.7% to $60.3M o Adj. EBITDA Margin increased by 120bps o Adj. EPS increase of 9.5% to $0.23 o Increased Adj. EBITDA and lower Interest Expense 3Q’25 3Q’24 YoY Change In $ millions, except per share amounts 13-weeks ended September 28, 2025 13-weeks Ended September 29, 2024 Net Sales 377.8 365.5 +3.4% Organic Net Sales 377.8 365.5 +3.4% Adj. Gross Profit 155.2 142.7 +8.8% % of Net Sales 41.1% 39.0% +210 bps Adj. SD&A Expense 93.8 88.7 5.7% % of Net Sales 24.8% 24.3% 50bps Adj. EBITDA 60.3 54.0 11.7% % of Net Sales 16.0% 14.8% 120 bps Adj. Net Income 33.5 29.6 13.2% Adj. EPS $0.23 $0.21 9.5% 19 Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Note: Amounts may not sum due to rounding.

20 3Q’25 Net Sales YoY Growth Decomposition Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Vol/Mix Net Price 3Q ’25 Total Net Sales Growth 4.5% (1.1%) 3.4% o Volume/Mix growth of 4.5% o Branded Salty Snacks volume/mix growth of +7.0%, led by Power Four Brands o Non-Branded & Non-Salty Snacks volume/mix decline of 12.7% primarily due to Partner Brands and Dips & Salsas o Pricing impact of (1.1%) o Focused trade promotions to address consumer value needs in a rational competitive environment, in-line with our expectations 3Q’25 Net Sales Bridge

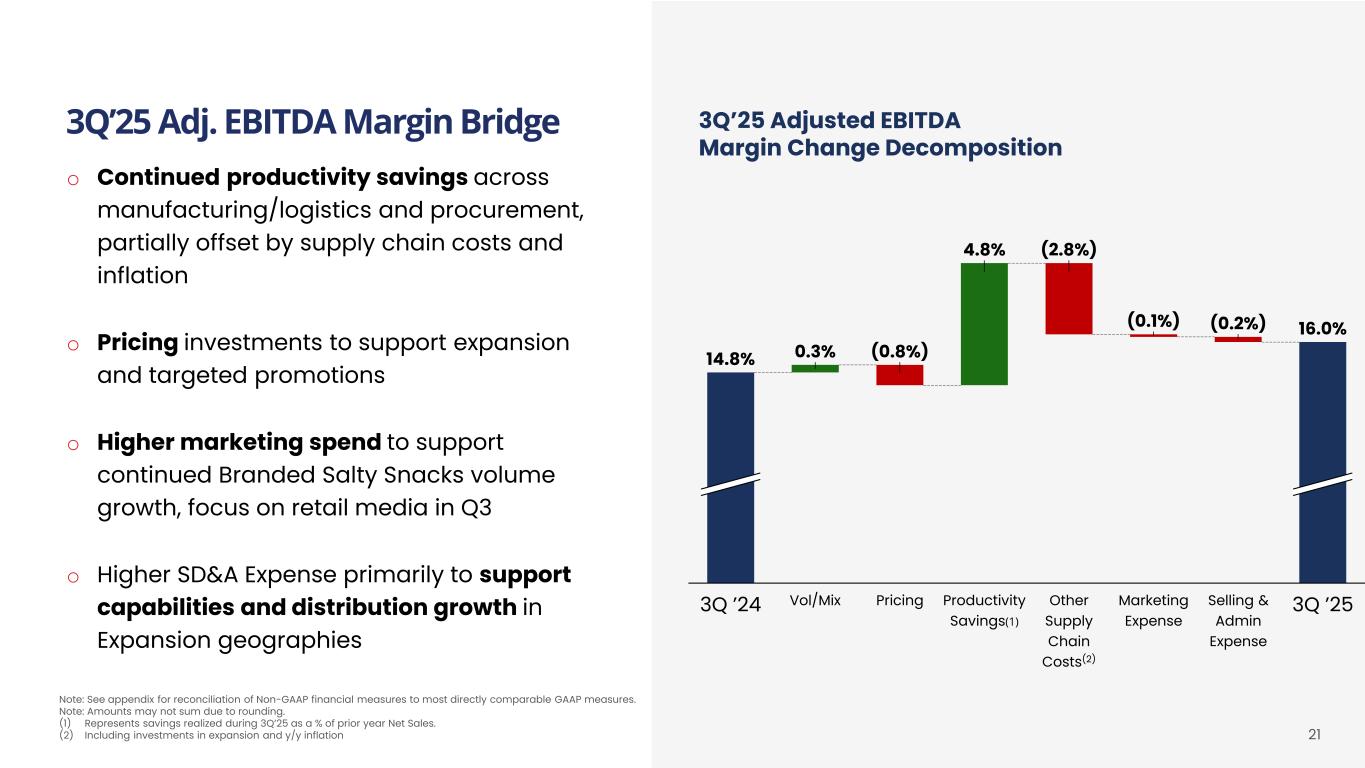

3Q’25 Adjusted EBITDA Margin Change Decomposition 3Q’25 Adj. EBITDA Margin Bridge 21 o Continued productivity savings across manufacturing/logistics and procurement, partially offset by supply chain costs and inflation o Pricing investments to support expansion and targeted promotions o Higher marketing spend to support continued Branded Salty Snacks volume growth, focus on retail media in Q3 o Higher SD&A Expense primarily to support capabilities and distribution growth in Expansion geographies Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Note: Amounts may not sum due to rounding. (1) Represents savings realized during 3Q’25 as a % of prior year Net Sales. (2) Including investments in expansion and y/y inflation 0.3% Vol/Mix (0.8%) Pricing 4.8% Productivity Savings(1) 14.8% 16.0% (2.8%) Other Supply Chain Costs(2) (0.1%) Marketing Expense (0.2%) 3Q ’24 3Q ’25Selling & Admin Expense

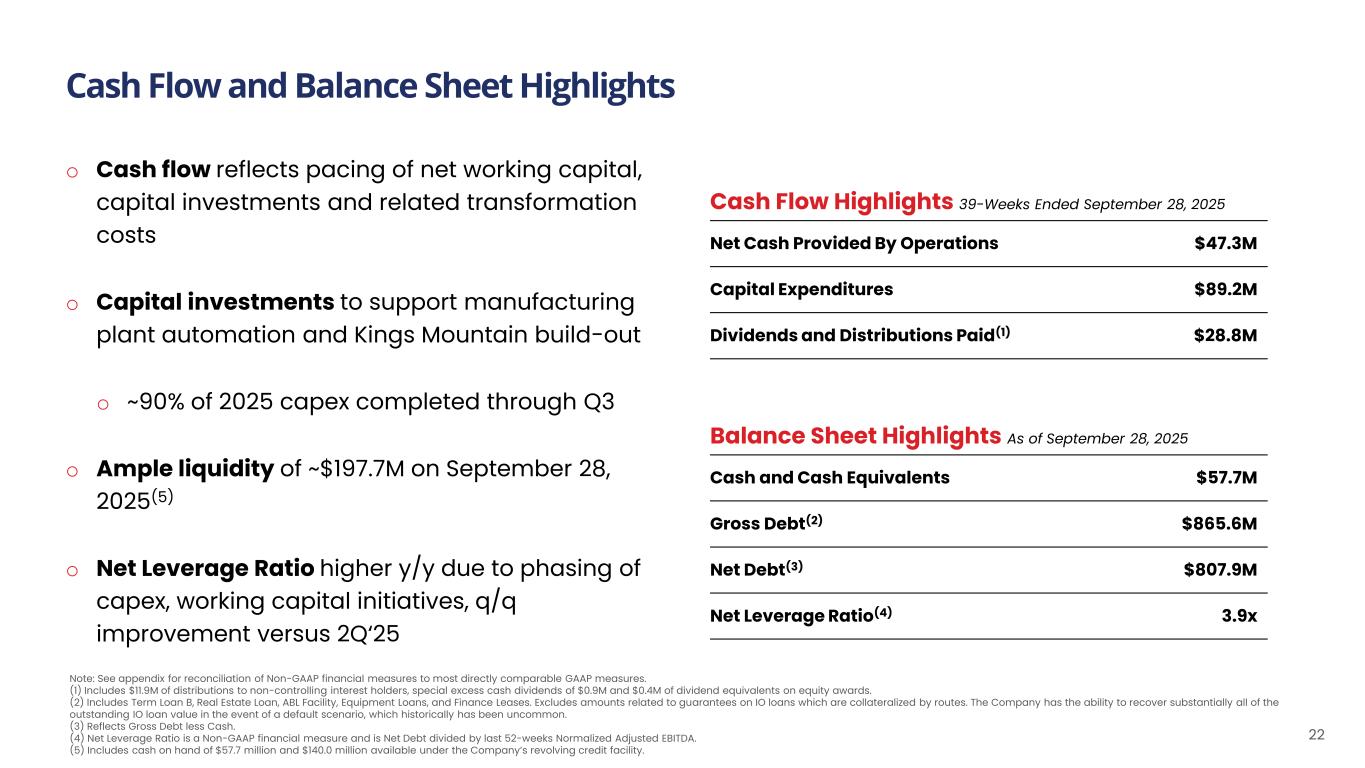

Cash Flow and Balance Sheet Highlights As of January 1, 2023 Cash Flow Highlights 39-Weeks Ended September 28, 2025 Net Cash Provided By Operations $47.3M Capital Expenditures $89.2M Dividends and Distributions Paid(1) $28.8M Balance Sheet Highlights As of September 28, 2025 Cash and Cash Equivalents $57.7M Gross Debt(2) $865.6M Net Debt(3) $807.9M Net Leverage Ratio(4) 3.9x 22 Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Includes $11.9M of distributions to non-controlling interest holders, special excess cash dividends of $0.9M and $0.4M of dividend equivalents on equity awards. (2) Includes Term Loan B, Real Estate Loan, ABL Facility, Equipment Loans, and Finance Leases. Excludes amounts related to guarantees on IO loans which are collateralized by routes. The Company has the ability to recover substantially all of the outstanding IO loan value in the event of a default scenario, which historically has been uncommon. (3) Reflects Gross Debt less Cash. (4) Net Leverage Ratio is a Non-GAAP financial measure and is Net Debt divided by last 52-weeks Normalized Adjusted EBITDA. (5) Includes cash on hand of $57.7 million and $140.0 million available under the Company’s revolving credit facility. o Cash flow reflects pacing of net working capital, capital investments and related transformation costs o Capital investments to support manufacturing plant automation and Kings Mountain build-out o ~90% of 2025 capex completed through Q3 o Ample liquidity of ~$197.7M on September 28, 2025(5) o Net Leverage Ratio higher y/y due to phasing of capex, working capital initiatives, q/q improvement versus 2Q‘25

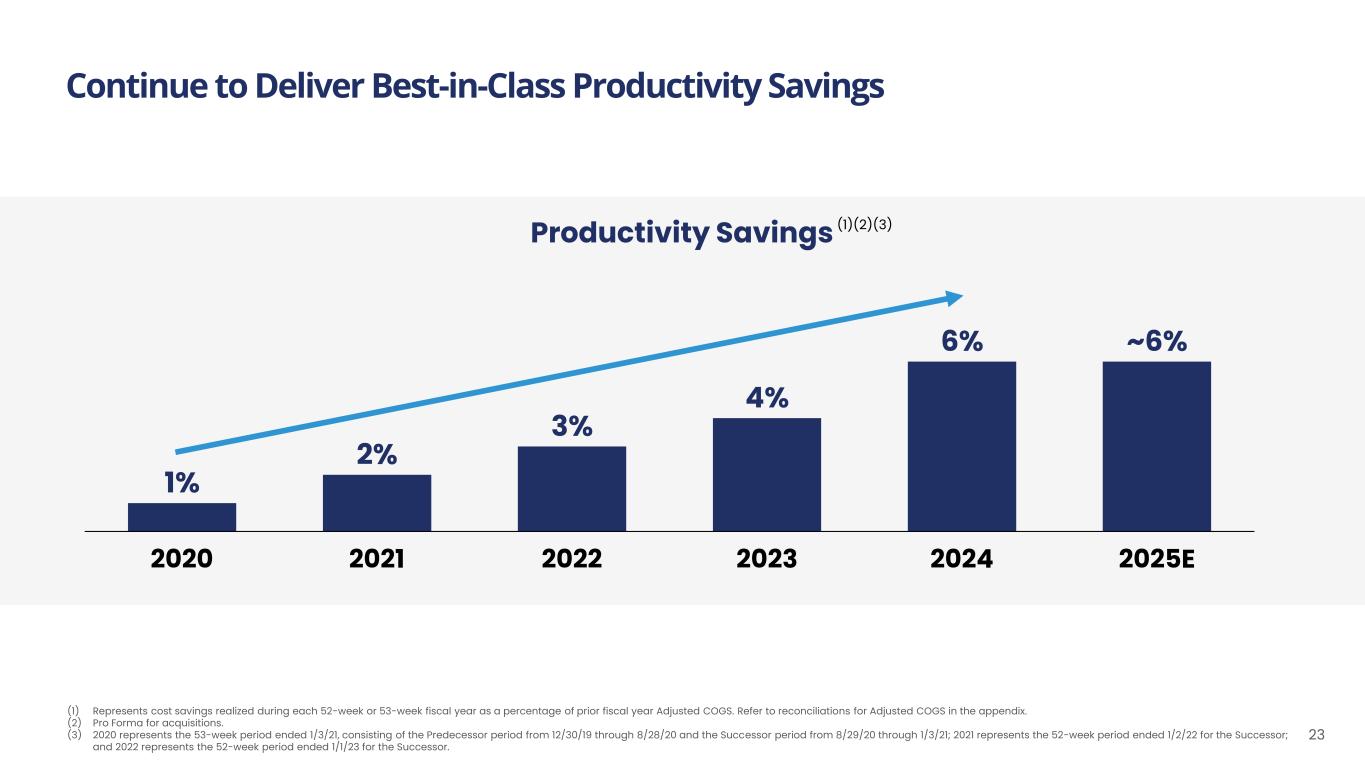

Continue to Deliver Best-in-Class Productivity Savings 23 Productivity Savings (1) Represents cost savings realized during each 52-week or 53-week fiscal year as a percentage of prior fiscal year Adjusted COGS. Refer to reconciliations for Adjusted COGS in the appendix. (2) Pro Forma for acquisitions. (3) 2020 represents the 53-week period ended 1/3/21, consisting of the Predecessor period from 12/30/19 through 8/28/20 and the Successor period from 8/29/20 through 1/3/21; 2021 represents the 52-week period ended 1/2/22 for the Successor; and 2022 represents the 52-week period ended 1/1/23 for the Successor. 2020 2021 2022 2023 2024 2025E 1% 2% 3% 4% 6% ~6% (1)(2)(3)

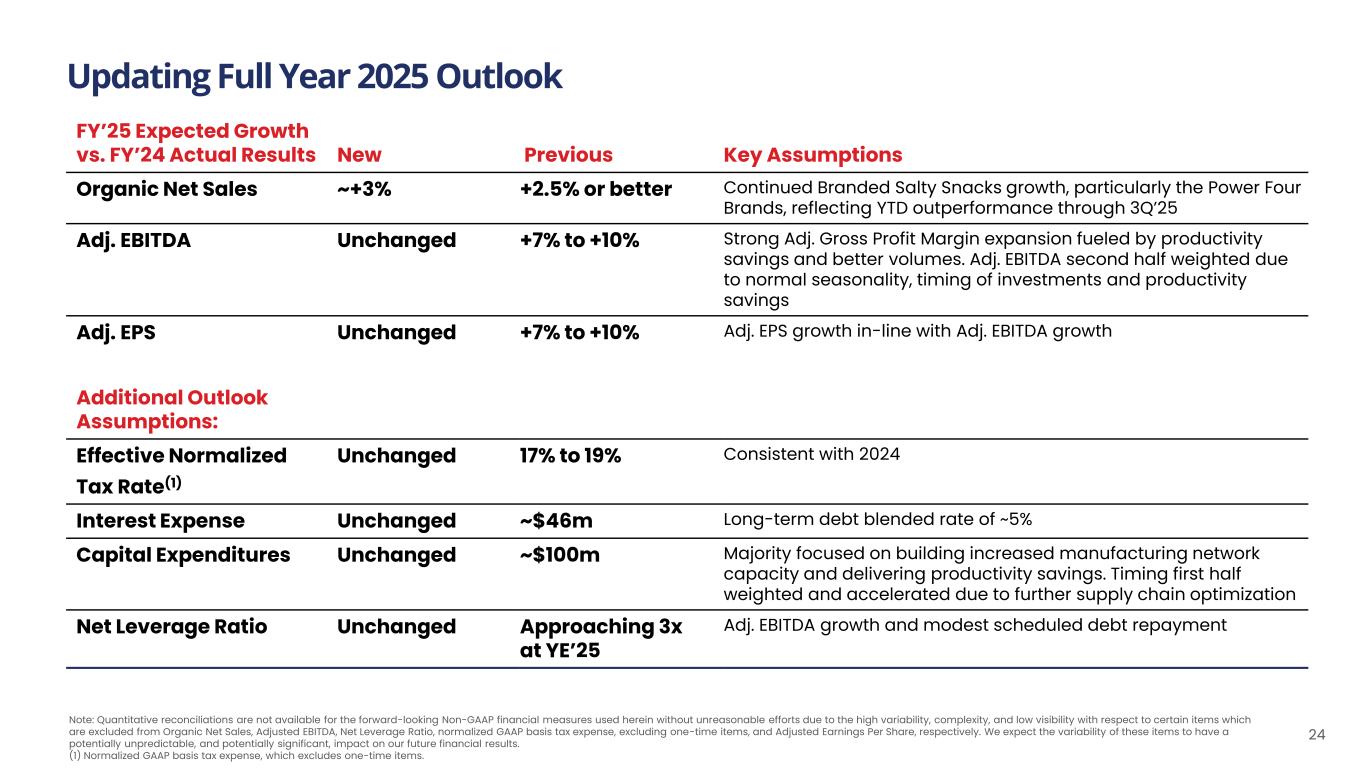

Note: Quantitative reconciliations are not available for the forward-looking Non-GAAP financial measures used herein without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Organic Net Sales, Adjusted EBITDA, Net Leverage Ratio, normalized GAAP basis tax expense, excluding one-time items, and Adjusted Earnings Per Share, respectively. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results. (1) Normalized GAAP basis tax expense, which excludes one-time items. FY’25 Expected Growth vs. FY’24 Actual Results New Previous Key Assumptions Organic Net Sales ~+3% +2.5% or better Continued Branded Salty Snacks growth, particularly the Power Four Brands, reflecting YTD outperformance through 3Q’25 Adj. EBITDA Unchanged +7% to +10% Strong Adj. Gross Profit Margin expansion fueled by productivity savings and better volumes. Adj. EBITDA second half weighted due to normal seasonality, timing of investments and productivity savings Adj. EPS Unchanged +7% to +10% Adj. EPS growth in-line with Adj. EBITDA growth Additional Outlook Assumptions: Effective Normalized Tax Rate(1) Unchanged 17% to 19% Consistent with 2024 Interest Expense Unchanged ~$46m Long-term debt blended rate of ~5% Capital Expenditures Unchanged ~$100m Majority focused on building increased manufacturing network capacity and delivering productivity savings. Timing first half weighted and accelerated due to further supply chain optimization Net Leverage Ratio Unchanged Approaching 3x at YE’25 Adj. EBITDA growth and modest scheduled debt repayment Updating Full Year 2025 Outlook 24

2026 – An Inflection Point in our Evolution 25 o Driving top-line growth ahead of category, driven by Expansion Markets (entering California, growing the remainder), Boulder Canyon space gains, and increased Marketing support o Winding down supply chain investment cycle; 2026 capital expenditures expected at ~$60M-$70M, cash transformation costs declining o Normalizing productivity savings (% of COGS) at or above best-in-class levels of ~3– 4% o Pursuing other productivity measures in SD&A, driven by technology, to continue to fund growth o Emphasizing accelerated free cash flow and debt pay down

Appendix 26

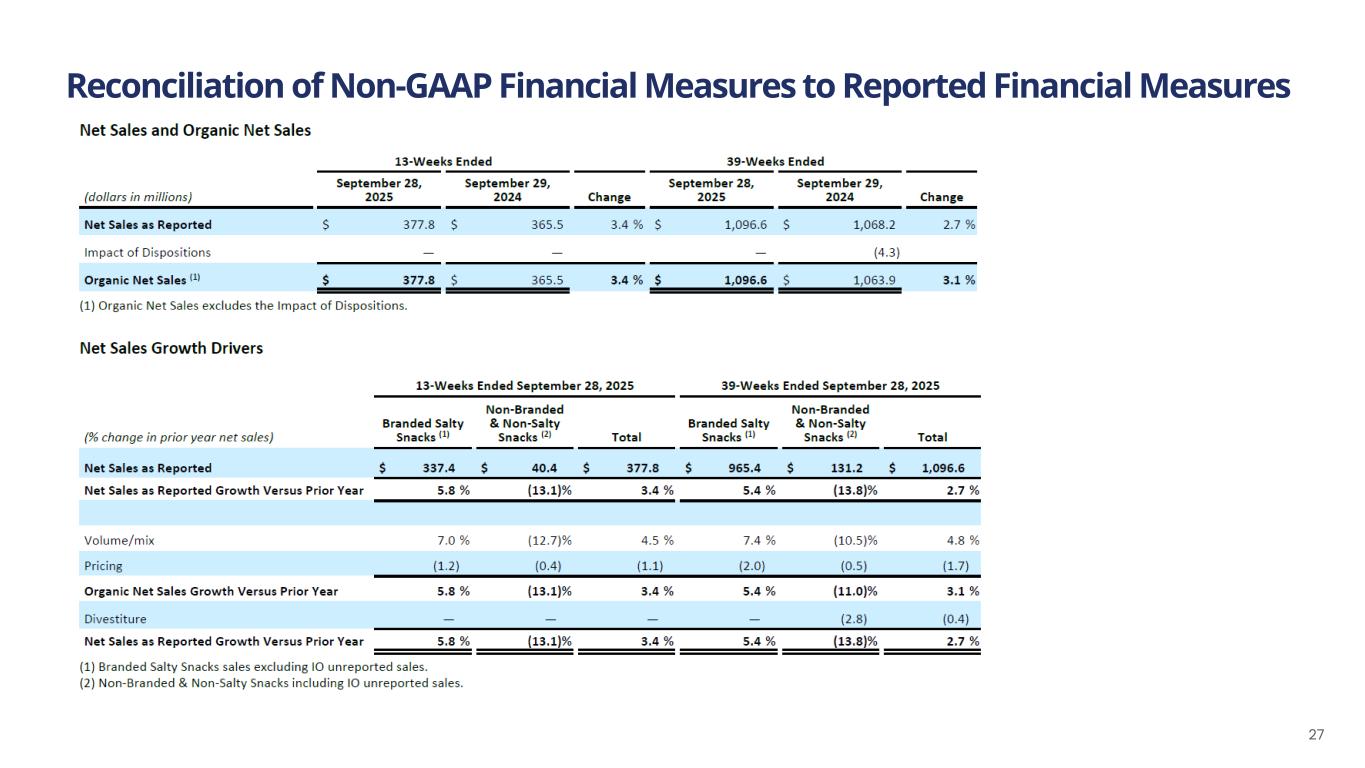

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 27

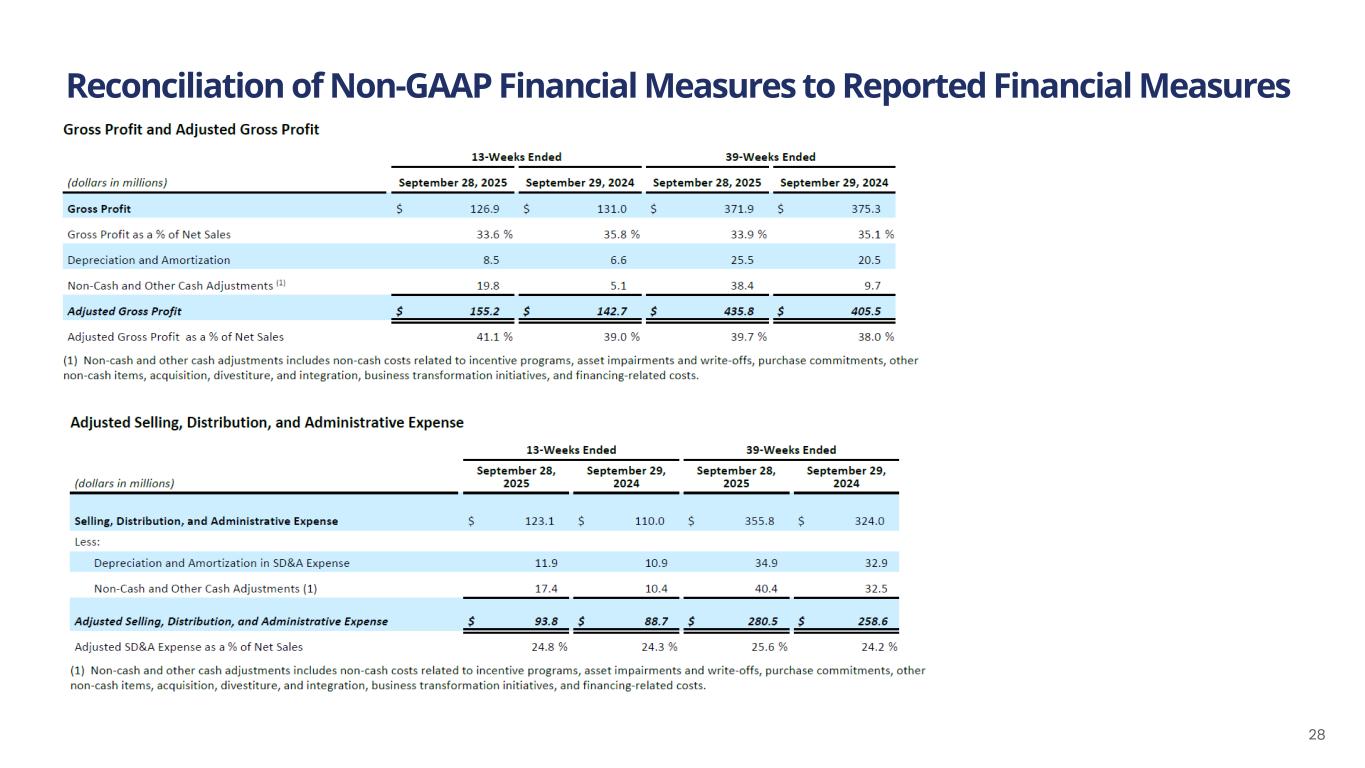

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 28

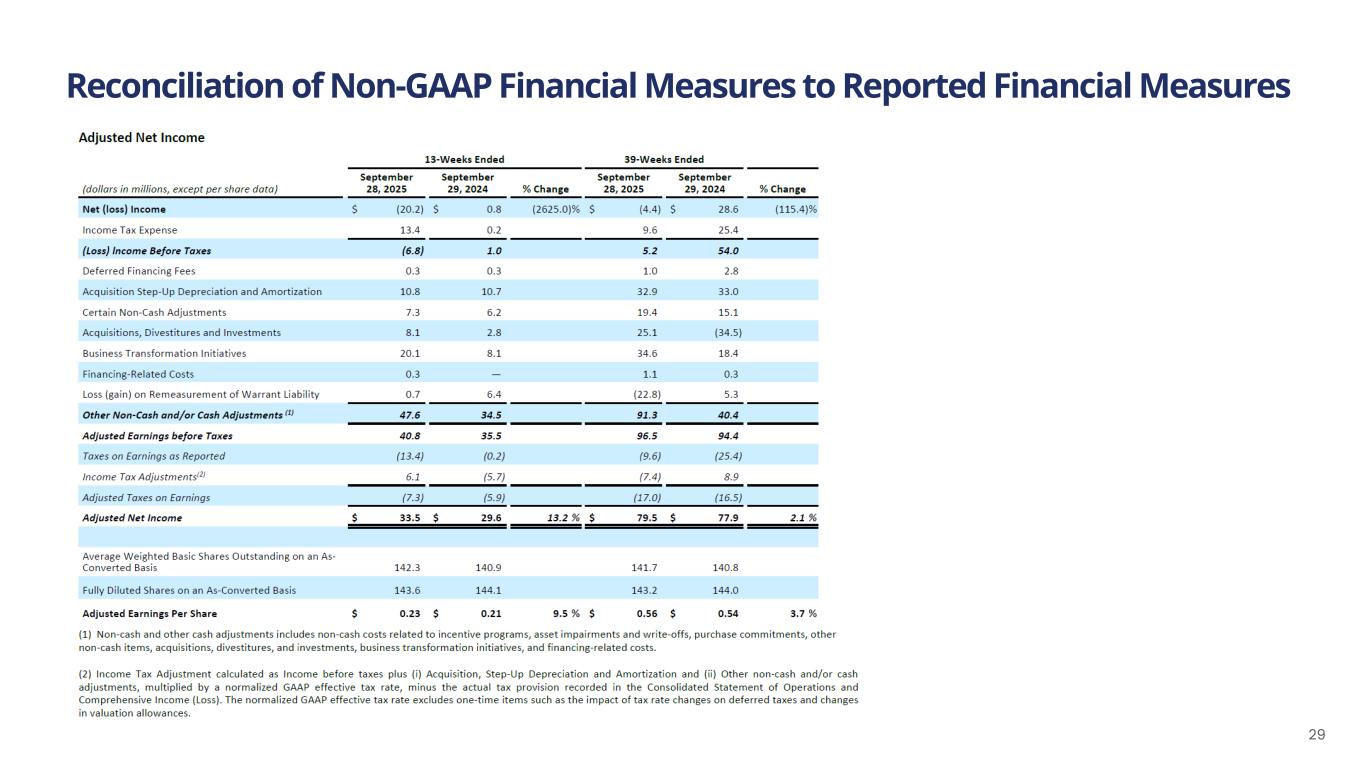

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 29

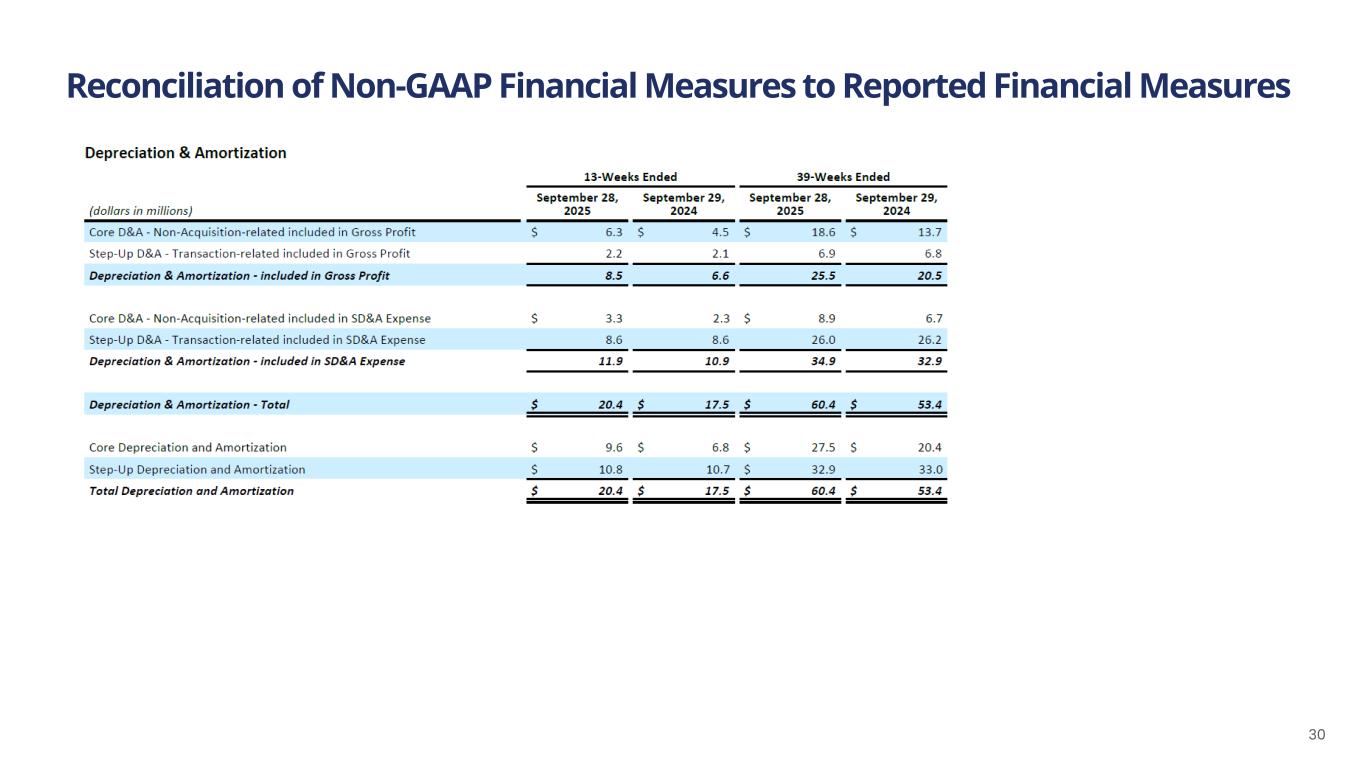

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 30

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 31 (1) Interest Income (IO loans) refers to interest income that we earn from IO notes receivable that has resulted from our initiatives to transition from RSP distribution to IO distribution ("Business Transformation Initiatives"). There is a notes payable recorded that mirrors most of the IO notes receivable, and the interest expense associated with the notes payable is part of the Interest Expense, Net adjustment. (2) Certain Non-Cash Adjustments are comprised primarily of the following: Incentive programs – The Company incurred $4.6 million and $4.7 million of share-based compensation expense for awards to employees and directors, and compensation expense associated with the Omnibus Equity Incentive Plan (the "OEIP") for the thirteen weeks ended September 28, 2025 and September 29, 2024, respectively. The Company incurred $10.8 million and $13.1 million of share-based compensation expense for awards to employees and directors, and compensation expense associated with the OEIP for the thirty-nine weeks ended September 28, 2025 and September 29, 2024, respectively. Loss on impairment - The Company recorded an impairment charge of $0.6 million during the thirty-nine weeks ended September 28, 2025. Purchase commitments and other adjustments – We have purchase commitments for specific quantities at fixed prices for certain of our products’ key ingredients. To facilitate comparisons of our underlying operating results, this adjustment was made to remove the volatility of purchase commitment related unrealized gains and losses. The adjustment related to purchase commitments and other adjustments, including cloud computing amortization, was expense of $2.7 million and $1.5 million for the thirteen weeks ended September 28, 2025 and September 29, 2024, respectively. The adjustment related to purchase commitments and other adjustments, including cloud computing amortization, was expense of $7.0 million and $2.0 million for the thirty-nine weeks ended September 28, 2025 and September 29, 2024, respectively. (3) Acquisitions, Divestitures and Investments – This is comprised of start-up costs, consulting, transaction services, and legal fees incurred for acquisitions and certain potential acquisitions, in addition to expenses associated with integrating recent acquisitions and costs related to divestitures. These acquisitions and divestitures include assets related to our supply chain consolidation and transformation. Such expenses were $10.0 million and $2.8 million for the thirteen weeks ended September 28, 2025 and September 29, 2024, respectively; and $26.0 million and $9.5 million for the thirty-nine weeks ended September 28, 2025 and September 29, 2024, respectively. Also included in the thirteen weeks ended and thirty-nine weeks ended September 28, 2025 was income of $1.9 million and $0.9 million, respectively, related to the change in the liability associated with the Tax Receivable Agreement. Also, included in the thirty-nine weeks ended September 29, 2024 was a gain of $44.0 million related to the Good Health and R.W. Garcia Sale. (4) Business Transformation Initiatives – This adjustment is related to start-up costs, consulting, professional and legal fees incurred for specific initiatives and structural changes to the business that do not reflect the cost of normal business operations. This adjustment also includes initiatives and structural changes related to our supply chain transformation. In addition, gains and losses realized from the sale of distribution rights to IOs and the subsequent disposal of trucks, severance costs associated with the elimination of RSP positions, and enterprise resource planning system transition costs fall into this category. The Company incurred such costs of $20.1 million and $8.1 million for the thirteen weeks ended September 28, 2025 and September 29, 2024, respectively; and $34.6 million and $18.4 million for the thirty-nine weeks ended September 28, 2025 and September 29, 2024, respectively. (5) Financing-Related Costs – These costs include adjustments for various items related to raising debt and equity capital or debt extinguishment costs. (6) Gains and Losses on Remeasurement of Warrant Liabilities - These liabilities are not expected to be settled in cash, and when exercised would result in a cash inflow to the Company with the warrants converting to Class A Common Stock with the liability being extinguished and the fair value of the warrants at the time of exercise being recorded as an increase to equity.

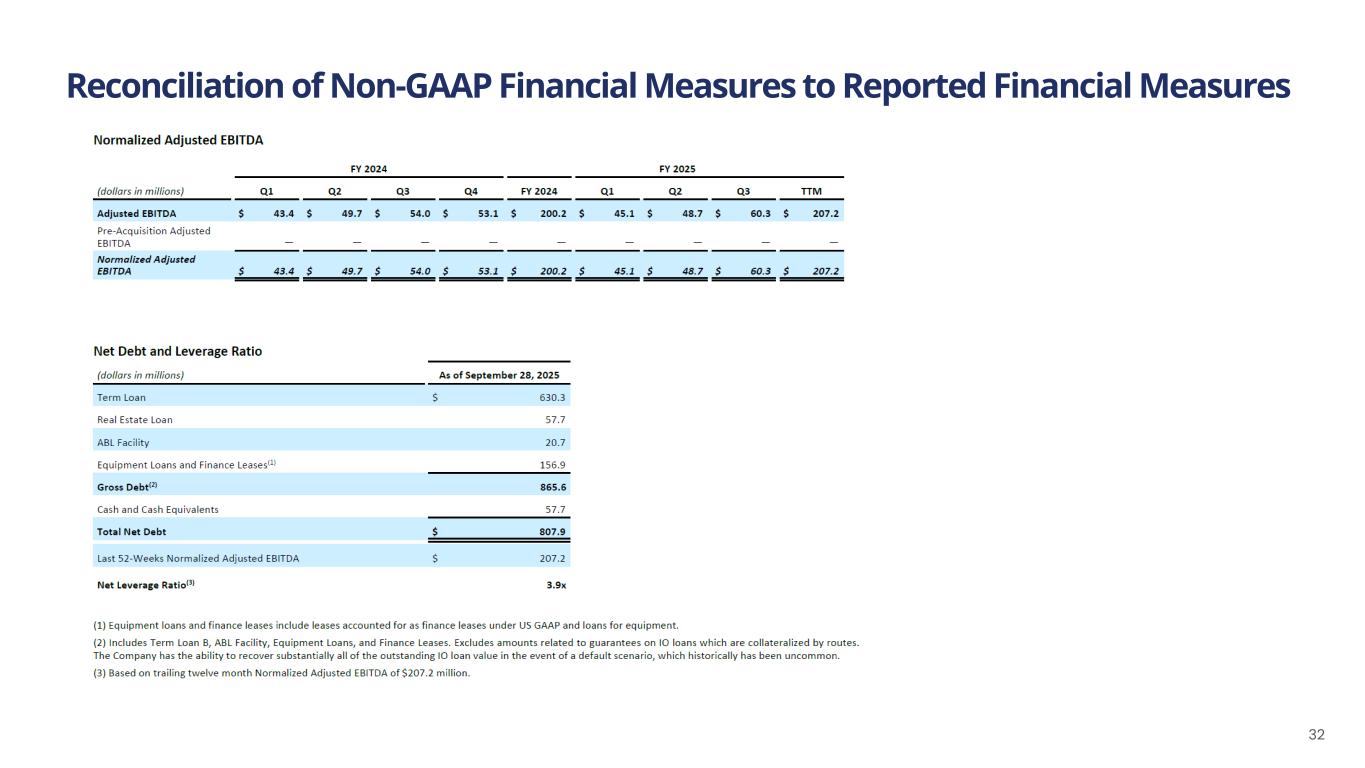

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 32

Appendix Additional Reconciliations as Previously Disclosed 33

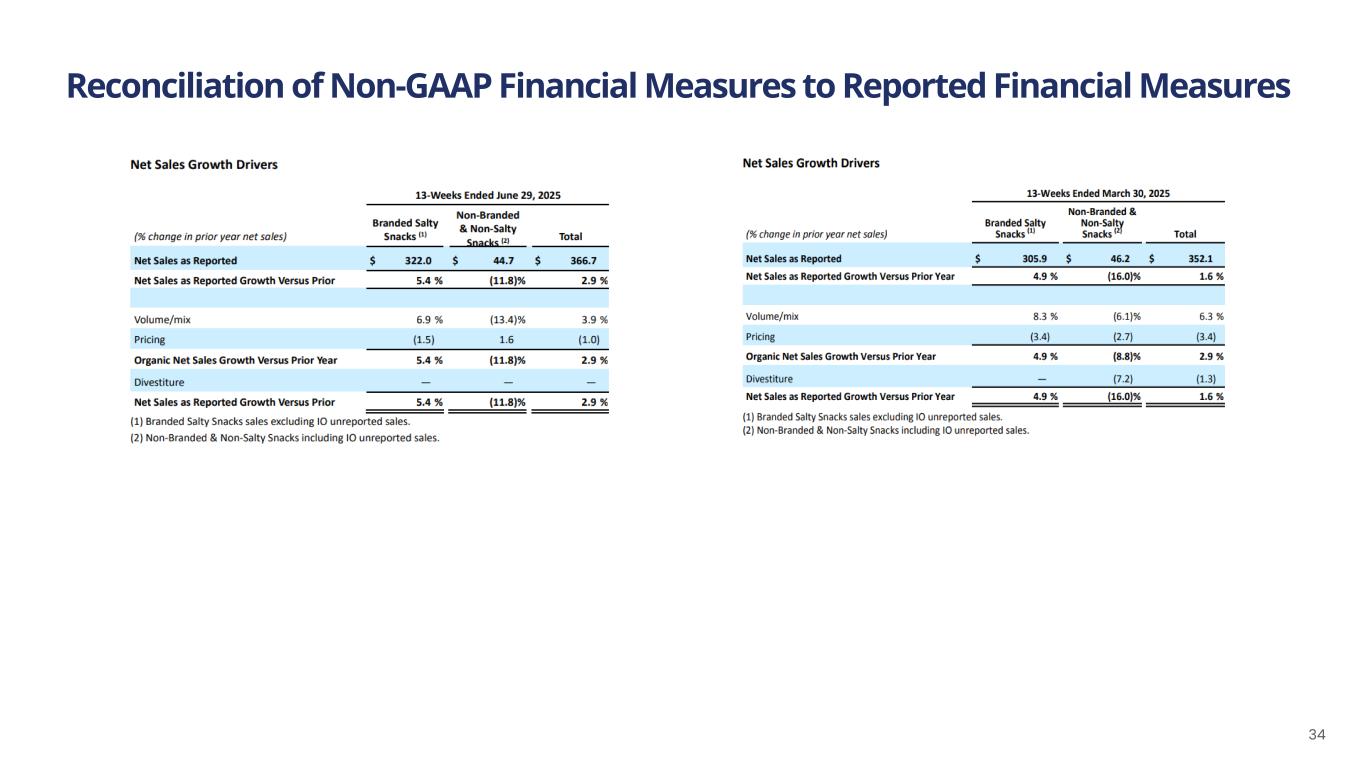

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 34

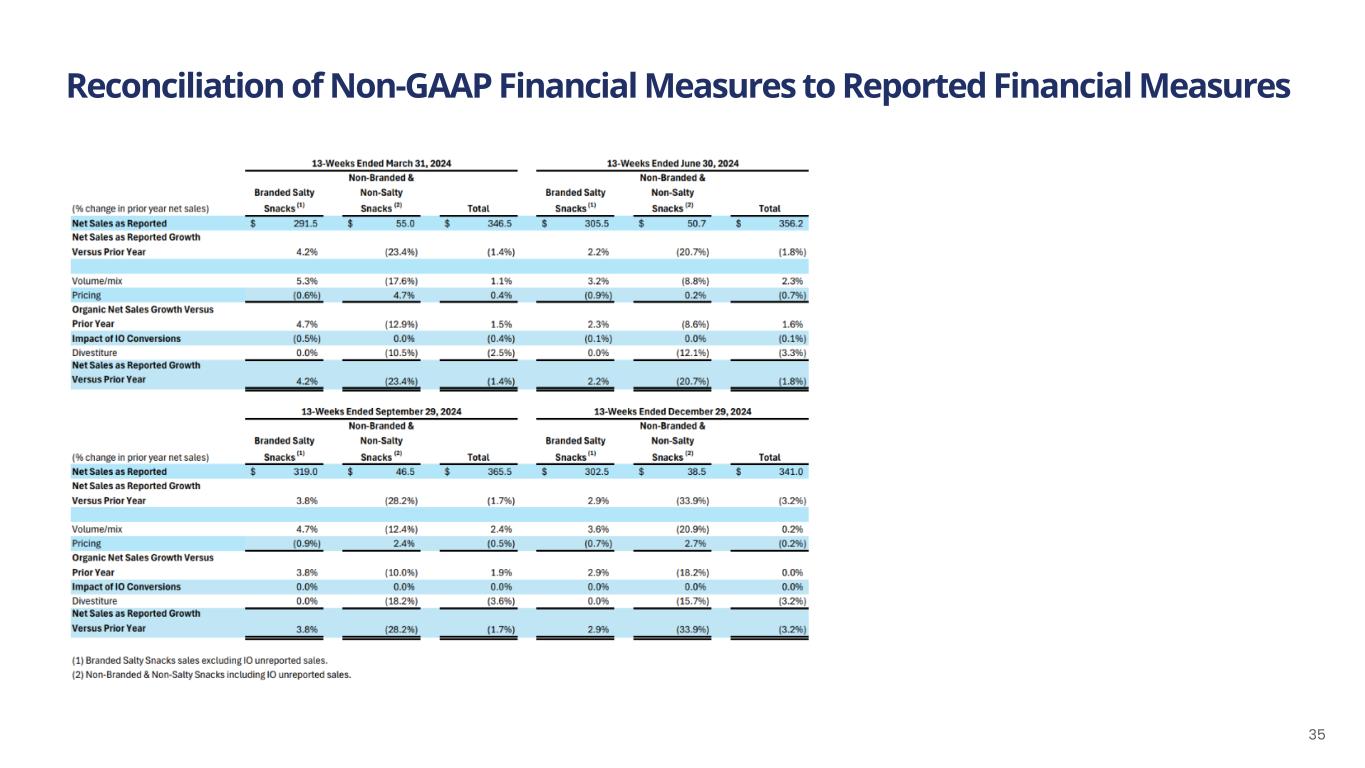

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 35

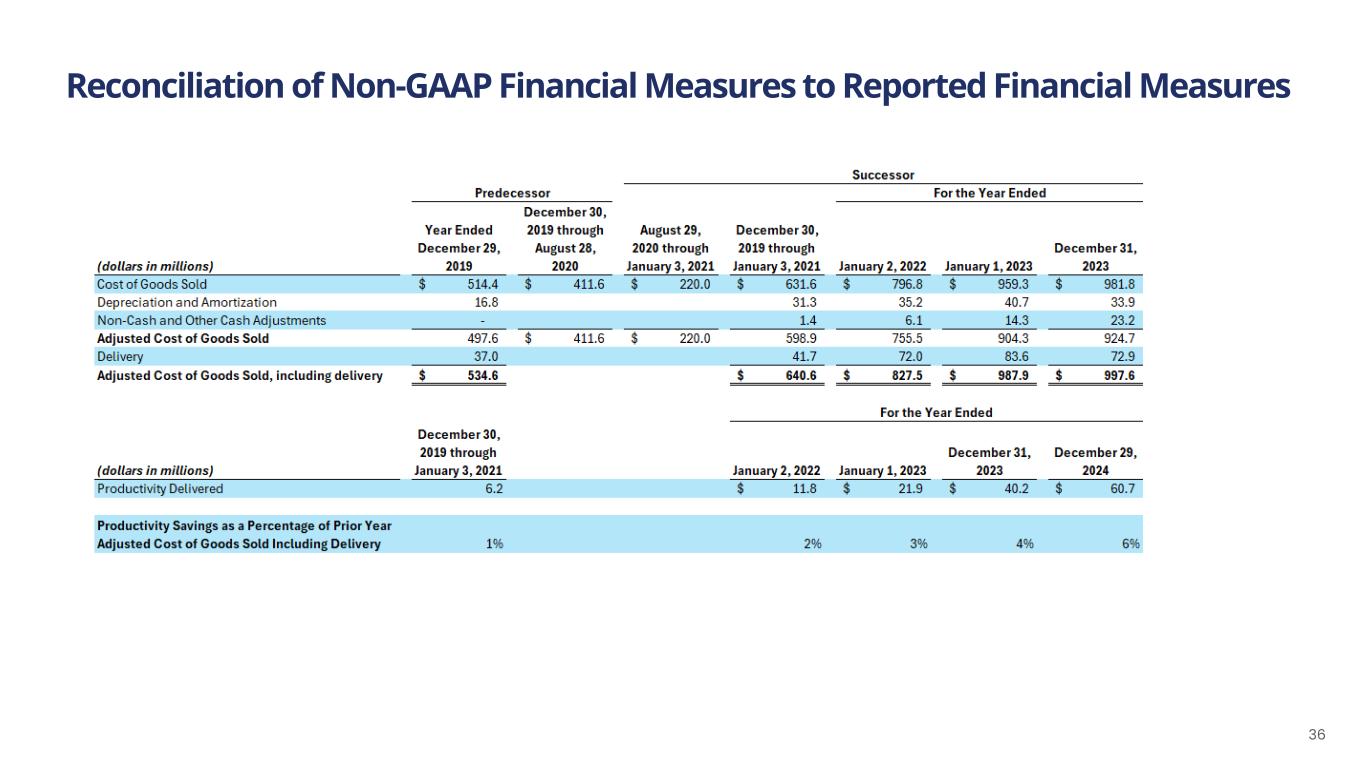

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 36

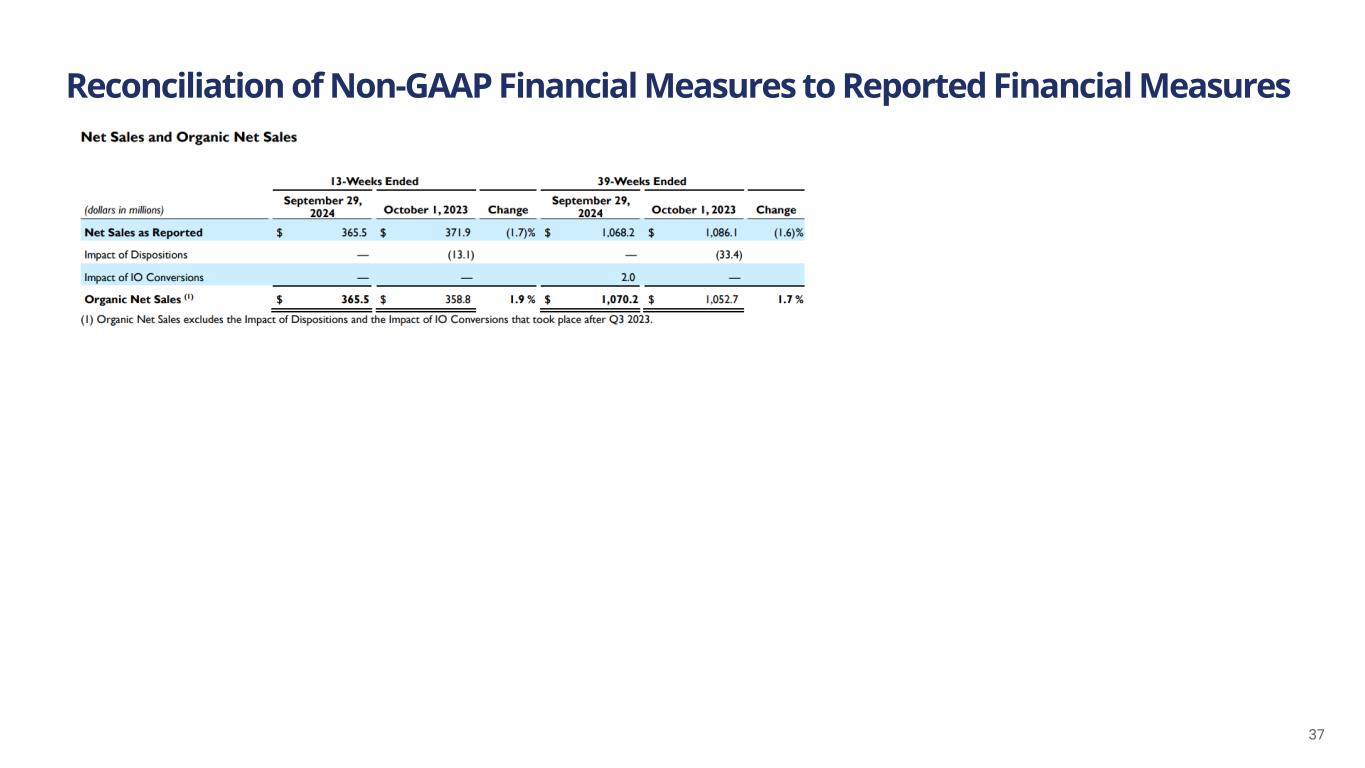

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 37

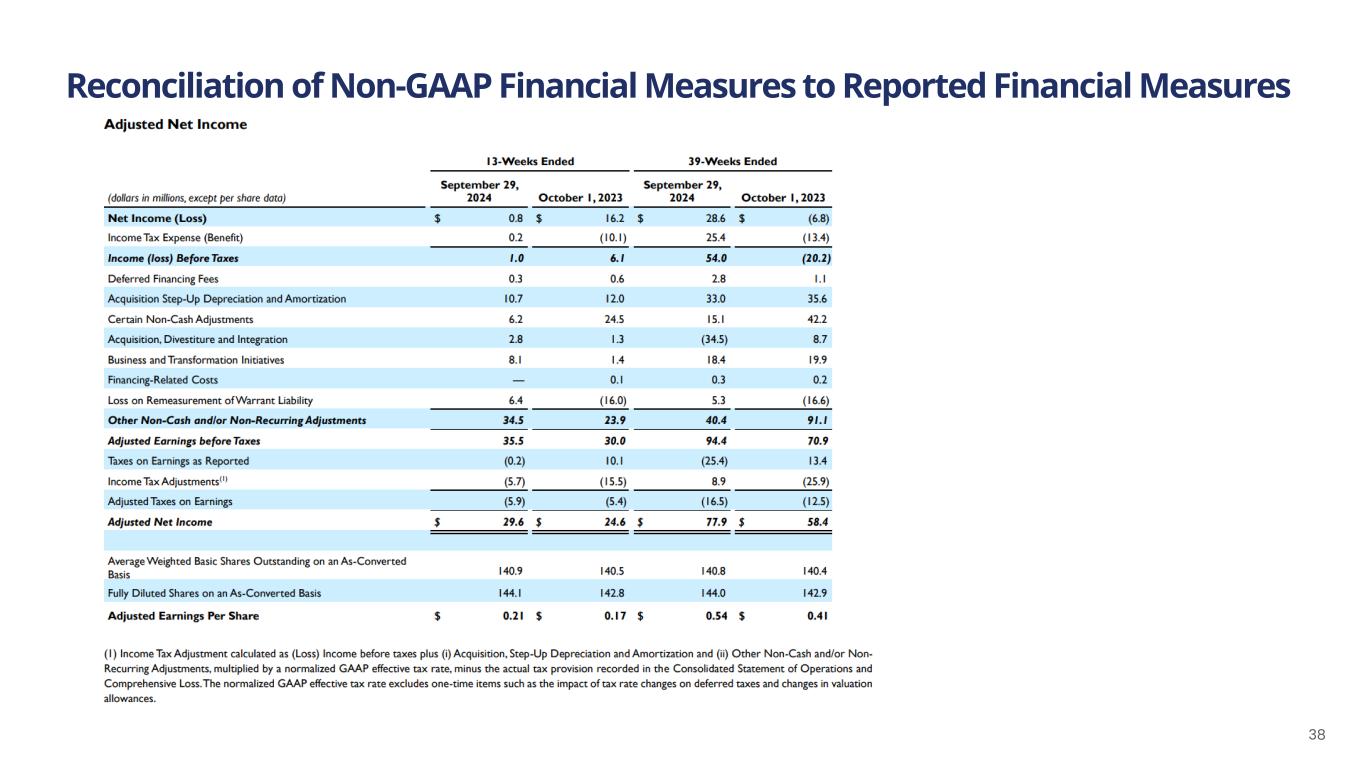

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 38

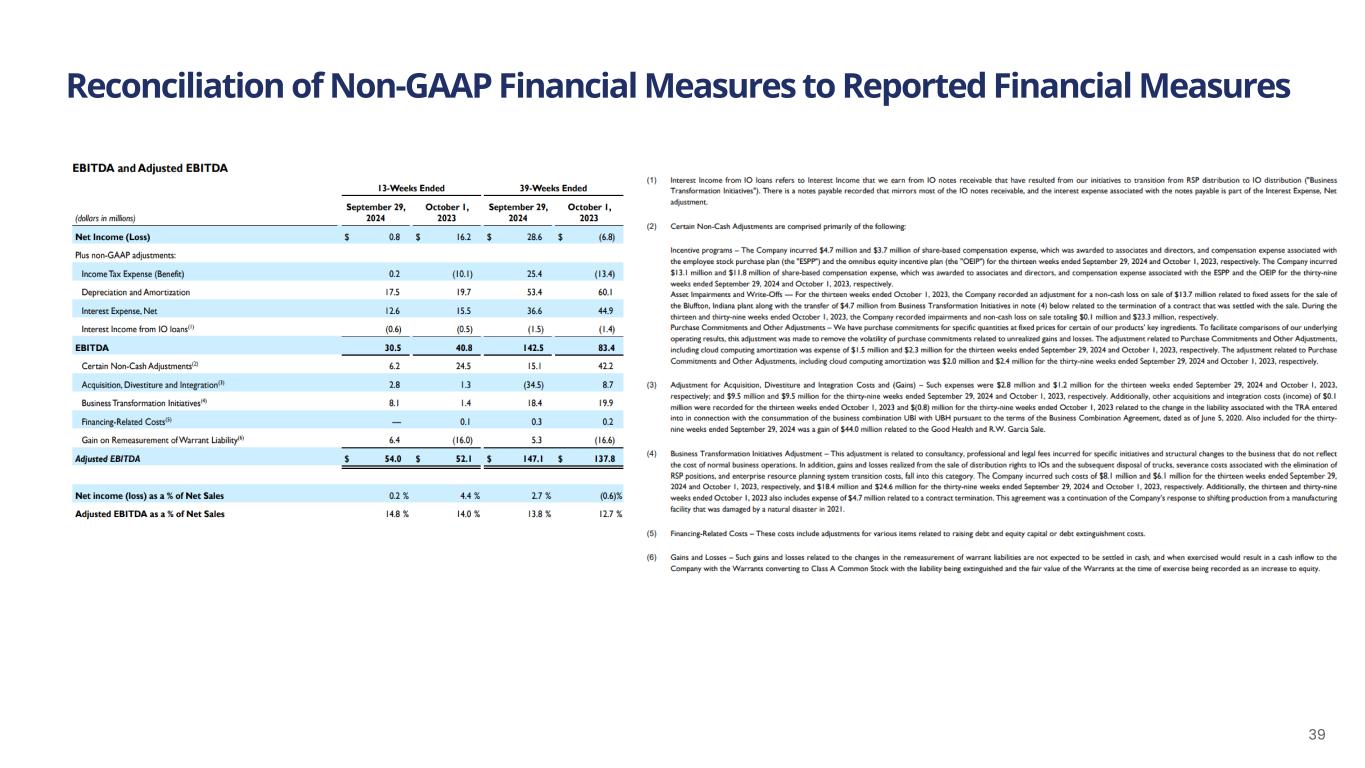

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 39