Utz Brands, Inc. Fourth Quarter and Full-Year 2025 Earnings Presentation February 12, 2026

Disclaimer 2 Forward-Looking Statements Certain statements made herein are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as "may," "can," "should," "will," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "target," "goal," "on track," or other similar words, phrases or expressions. These forward-looking statements include future plans for Utz Brands, Inc. (“the Company”), including updated outlook for fiscal 2026, plans with respect to future repurchases under the Company's stock buyback program, plans related to the transformation of the Company’s supply chain, the Company’s product mix, the Company's expectations regarding its level of indebtedness and associated interest expense impacts; the Company’s cost savings plans and the Company’s logistics optimization efforts; the estimated or anticipated future results and benefits of the Company’s plans and operations; the Company’s future capital structure; future opportunities for the Company; the effects of tariffs, inflation or supply chain disruptions on the Company or its business; statements regarding the Company’s project balance sheet and liabilities, including net leverage; and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties, and the Company’s business and actual results may differ materially. Some factors that could cause actual results to differ include, without limitation: our operation in an industry with high levels of competition and consolidation; our reliance on key customers and ability to obtain favorable contractual terms and protections with customers; changes in demand for our products driven by changes in consumer preferences and tastes or our ability to innovate or market our products effectively; changes in consumers’ loyalty to our brands due to factors beyond our control; impacts on our reputation caused by concerns relating to the quality and safety of our products, ingredients, packaging, or processing techniques; the potential that our products might need to be recalled if they become adulterated or are mislabeled; the loss of retail shelf space and disruption to sales of food products due to changes in retail distribution arrangements; our reliance on third parties to effectively operate both our direct-to-warehouse delivery system and our direct- store-delivery network system; the evolution of e-commerce retailers and sales channels; disruption to our manufacturing operations, supply chain, or distribution channels; the effects of inflation, including rising labor costs; shortages of raw materials, energy, water, and other supplies; changes in the legal and regulatory environments in which we operate, including with respect to tax legislation such as the One Big Beautiful Bill Act; potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries, or investigations into our business; potential adverse effects or unintended consequences related to the implementation of our growth strategy; our ability to successfully identify and execute acquisitions or dispositions and to manage integration or carve out issues following such transactions; the geographic concentration of our markets; our ability to attract and retain highly skilled personnel (including risks associated with our recently announced executive leadership transition); impairment in the carrying value of goodwill or other intangible assets; our ability to protect our intellectual property rights; disruptions, failures, or security breaches of our information technology infrastructure; climate change or legal, regulatory or market measures to address climate change; our exposure to liabilities, claims or new laws or regulations with respect to environmental matters; the increasing focus and opposing views, legislation and expectations with respect to ESG initiatives; restrictions on our operations imposed by covenants in our debt instruments; our exposure to changes in interest rates; adverse impacts from disruptions in the worldwide financial markets, including on our ability to obtain new credit; our exposure to any new or increased income or product taxes; pandemics, epidemics or other disease outbreaks; our exposure to changes to trade policies and tariff and import/export regulations by the United States and other jurisdictions; potential volatility in our Class A Common Stock caused by resales thereof; our dependence on distributions made by our subsidiaries; our payment obligations pursuant to a tax receivable agreement, which in certain cases may exceed the tax benefits we realize or be accelerated; provisions of Delaware law and our governing documents and other agreements that could limit the ability of stockholders to take certain actions or delay or discourage takeover attempts that stockholders may consider favorable; our exclusive forum provisions in our governing documents; the influence of certain significant stockholders and members of Utz Brands Holdings, LLC, whose interests may differ from those of our other stockholders; and other risks and uncertainties set forth in Part I, Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 29, 2024 and in the other reports we file with the U.S. Securities and Exchange Commission from time to time. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by law. Industry Information Unless otherwise indicated, information contained in this presentation or made orally during this presentation concerning the Company’s industry, competitive position and the markets in which it operates is based on information from independent research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Company’s internal research, and are based on assumptions made by the Company upon reviewing such data, and the Company’s experience in, and knowledge of, such industry and markets, which the Company believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Company operates, and the Company’s future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by the Company.

Disclaimer (cont.) 3 Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but we will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Projected Financial Information This presentation contains financial forecasts, which were prepared in good faith by the Company on a basis believed to be reasonable. Such financial forecasts have not been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”). The Company’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purposes of their inclusion in this presentation, and accordingly, they have not expressed an opinion nor provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of the Company’s control, as discussed under Forward-Looking Statements above. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with GAAP including, but not limited to, Organic Net Sales, Adjusted Gross Profit, Adjusted Gross Profit Margin, Adjusted SG&A, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Normalized Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per Share, Adjusted COGS, Modified Free Cash Flow, Adjusted Free Cash Flow and Net Leverage Ratio, and certain ratios and other metrics derived therefrom. These non-GAAP financial measures do not represent financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations, earnings per share or other measures of profitability, liquidity or performance under GAAP. You should be aware that the presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of these historical non-GAAP measures to the most directly comparable GAAP measures are set forth in the appendix to this presentation. We believe (i) these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the financial condition and results of operations of the Company to date; and (ii) the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in comparing financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. In addition, quantitative reconciliations are not available for the forward-looking GAAP financial measures used in this presentation without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Net Organic Sales, Adjusted EBITDA, Adjusted Earnings Per Share, and Net Leverage Ratio, respectively. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results.

Business Overview Howard Friedman Chief Executive Officer 4

4Q’25 Solid Retail Sales Growth, Substantial Adj. Margin Expansion 5 o 4Q’25 Net Sales growth of 0.4% led by Branded Salty Snacks Organic Net Sales growth of 2.5%(1) o Retail Sales growth of +3.5%, led by Power Four Brands +5.3%; reported sales impacted by inventory de-stocking o Salty Snacks category(2) returned to growth with 1.1% retail sales increase o Dollar and Volume share gains, posting our 10th consecutive quarter of volume share growth o Productivity cost savings fueling Adj. Gross Profit Margin expansion of 560bps y/y o Adj. EBITDA growth of 17.5% y/y, driven by Adj. Gross Profit Margin o Guidance reflects continued sales growth above category, solid margin expansion, and accelerating free cash flow Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. (1) Branded Salty Snacks sales as defined in 4Q’25 earnings press release dated Feb 12, 2026; excludes Independent Operator (“IO”) unreported sales. (2) Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25 compared to the 13-weeks ended 12/29/24 on a pro forma basis.

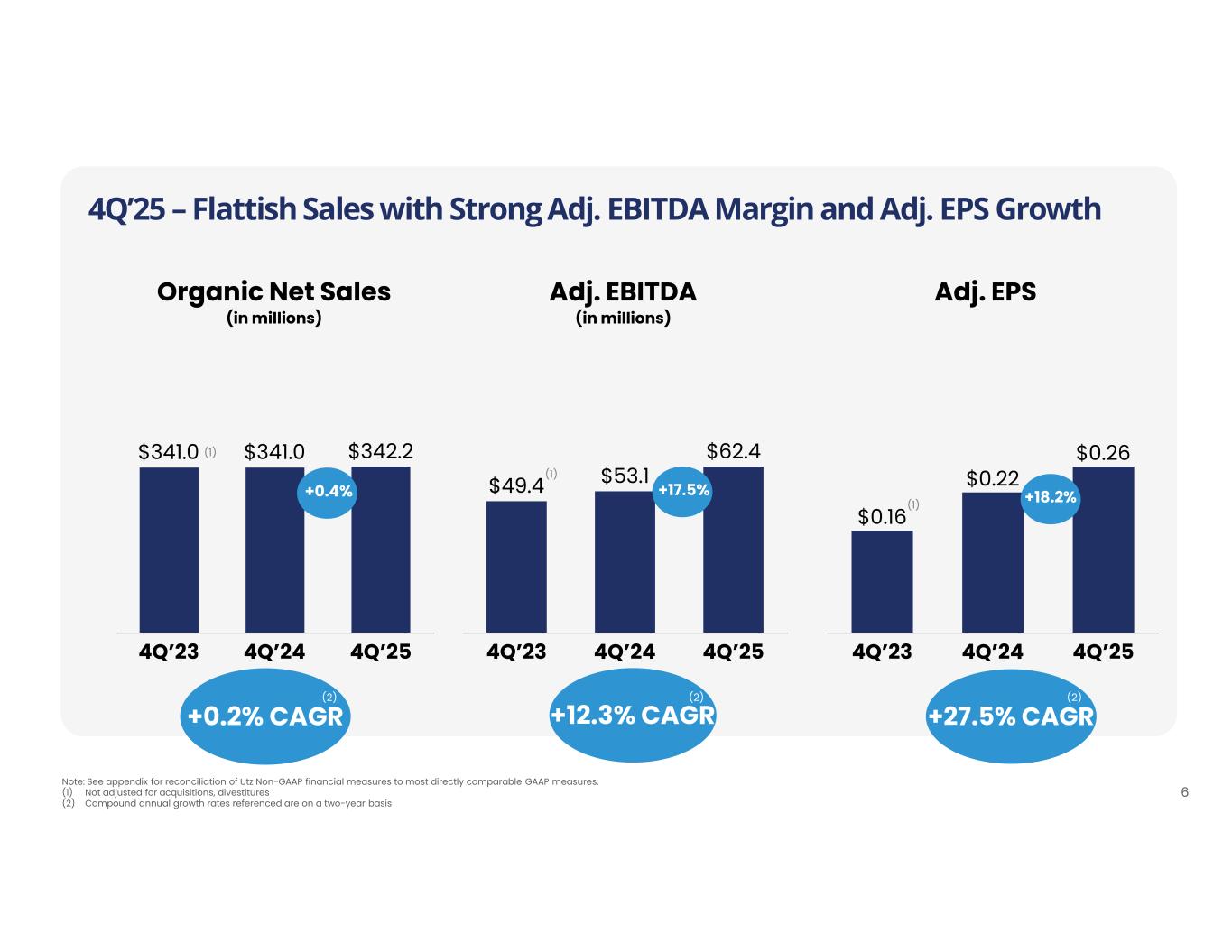

4Q’25 – Flattish Sales with Strong Adj. EBITDA Margin and Adj. EPS Growth 6 Adj. EBITDA (in millions) 4Q’23 4Q’24 4Q’25 $49.4 $53.1 $62.4 Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. (1) Not adjusted for acquisitions, divestitures (2) Compound annual growth rates referenced are on a two-year basis Adj. EPS $0.16 $0.22 $0.26 4Q’23 4Q’24 4Q’25 Organic Net Sales (in millions) 4Q’23 4Q’24 4Q’25 $341.0 $341.0 $342.2 +27.5% CAGR+12.3% CAGR+0.2% CAGR (1) (1) +17.5%+0.4% +18.2% (1) (2) (2) (2)

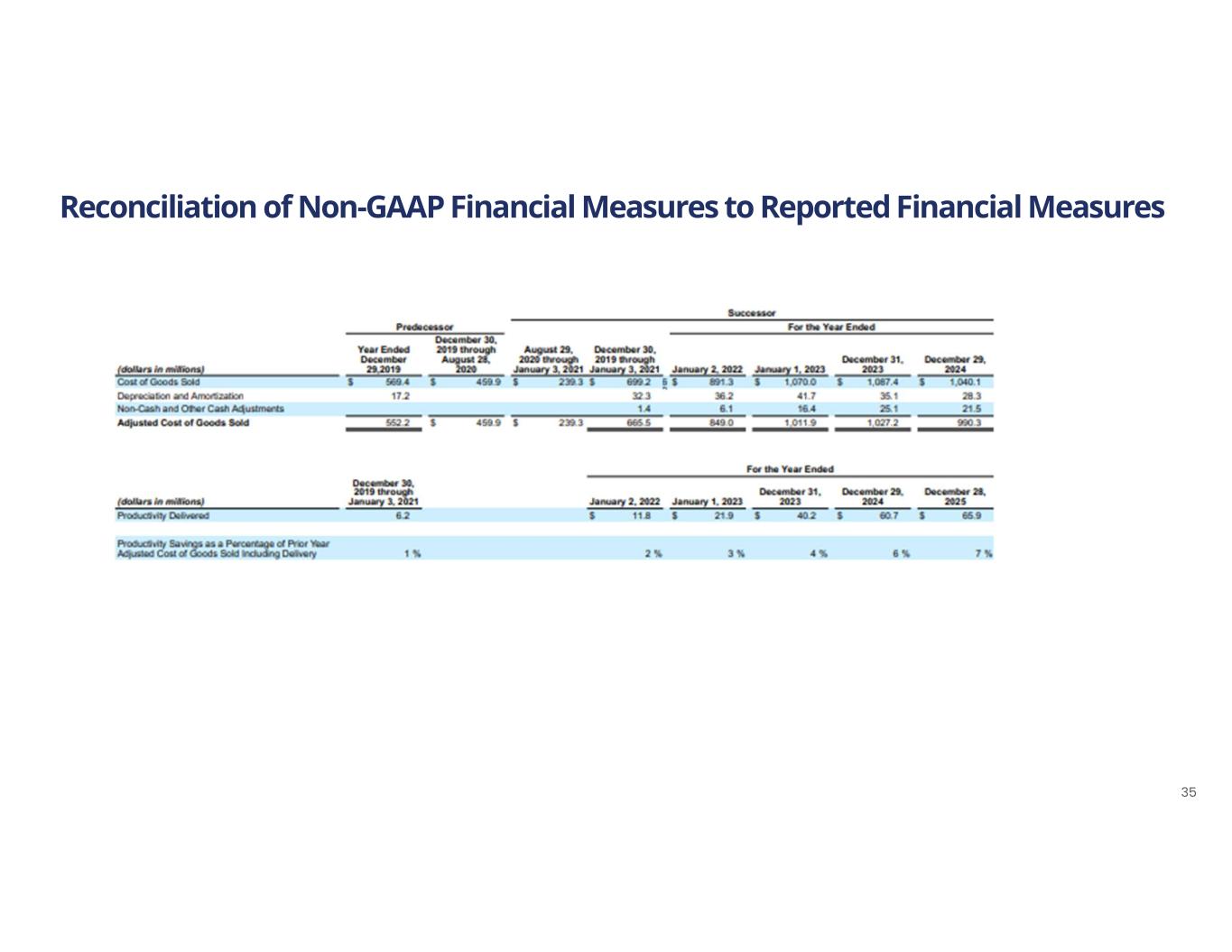

Continue to Deliver Best-in-Class Productivity Savings 7 Productivity Savings (1) Represents cost savings realized during each 52-week or 53-week fiscal year as a percentage of prior fiscal year Adjusted COGS. Refer to reconciliations for Adjusted COGS in the appendix. (2) Pro Forma for acquisitions. (3) 2020 represents the 53-week period ended 1/3/21, consisting of the Predecessor period from 12/30/19 through 8/28/20 and the Successor period from 8/29/20 through 1/3/21; 2021 represents the 52-week period ended 1/2/22 for the Successor; and 2022 represents the 52-week period ended 1/1/23 for the Successor. 2020 2021 2022 2023 2024 2025 1% 2% 3% 4% 6% 7% (1)(2)(3)

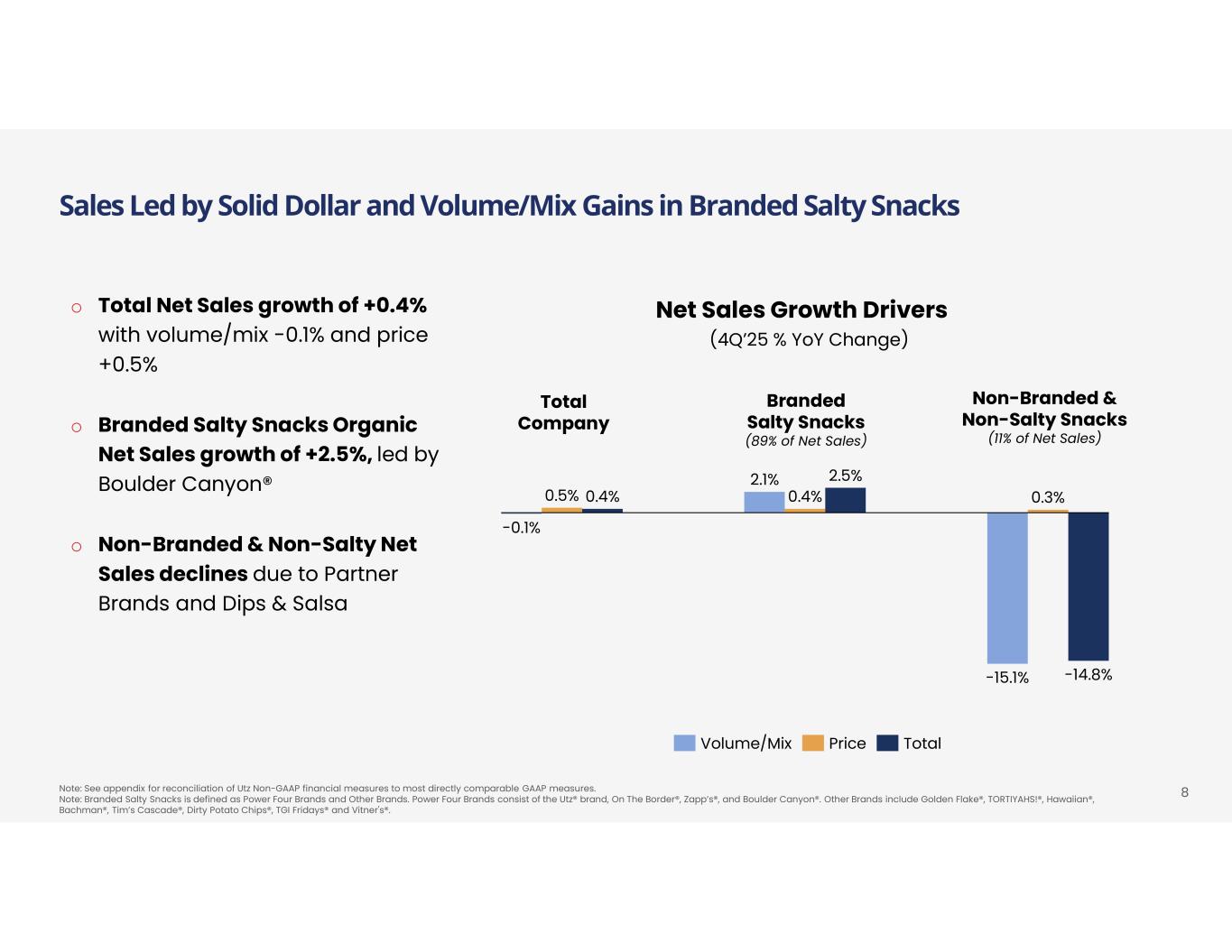

8Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. Note: Branded Salty Snacks is defined as Power Four Brands and Other Brands. Power Four Brands consist of the Utz® brand, On The Border®, Zapp’s®, and Boulder Canyon®. Other Brands include Golden Flake®, TORTIYAHS!®, Hawaiian®, Bachman®, Tim’s Cascade®, Dirty Potato Chips®, TGI Fridays® and Vitner's®. Sales Led by Solid Dollar and Volume/Mix Gains in Branded Salty Snacks Non-Branded & Non-Salty Snacks (11% of Net Sales) Total Company -0.1% 0.5% 0.4% 2.1% 0.4% 2.5% -15.1% 0.3% -14.8% (4Q’25 % YoY Change) Volume/Mix Price Total Net Sales Growth Driverso Total Net Sales growth of +0.4% with volume/mix -0.1% and price +0.5% o Branded Salty Snacks Organic Net Sales growth of +2.5%, led by Boulder Canyon® o Non-Branded & Non-Salty Net Sales declines due to Partner Brands and Dips & Salsa Branded Salty Snacks (89% of Net Sales)

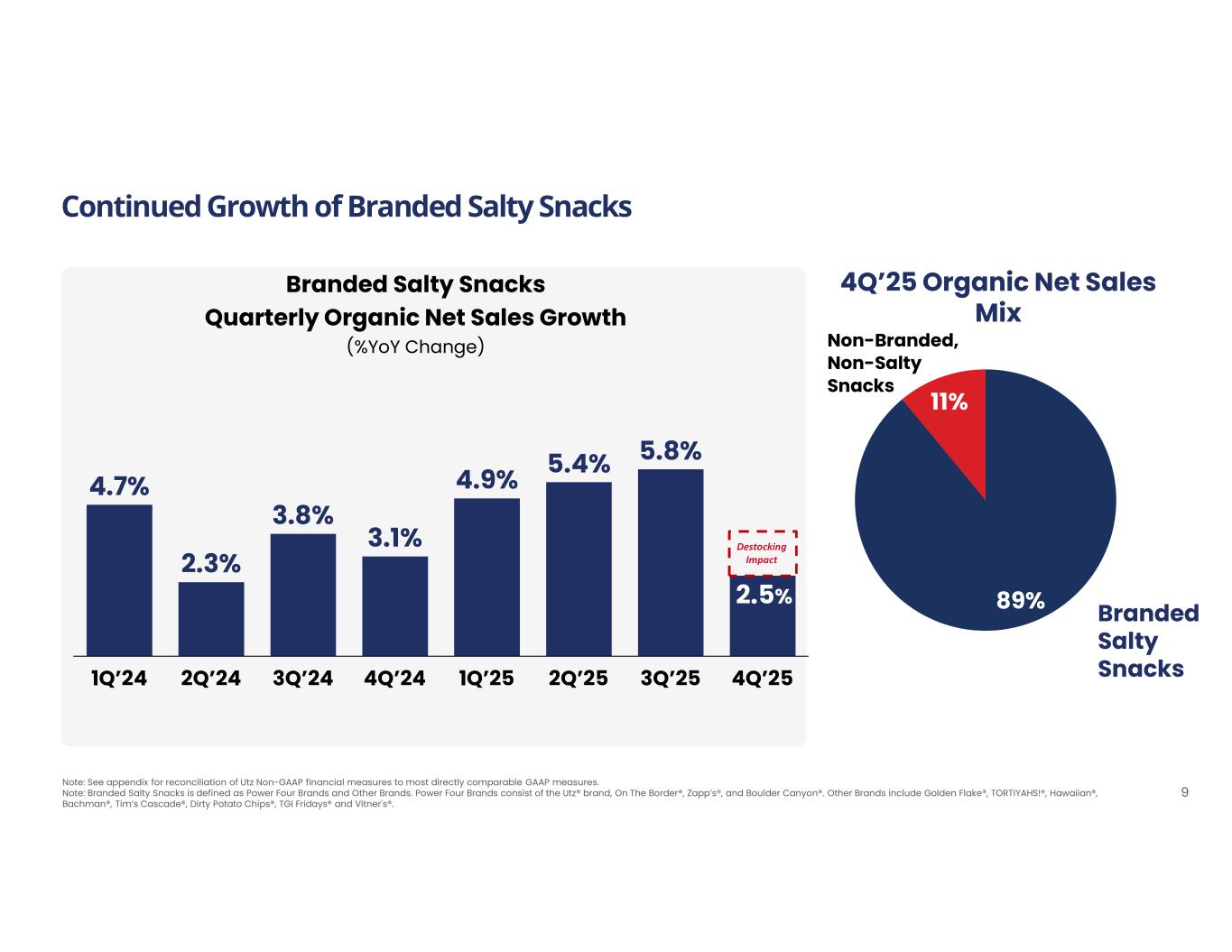

1Q’24 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 4.7% 2.3% 3.8% 3.1% 4.9% 5.4% 5.8% Continued Growth of Branded Salty Snacks 9 Branded Salty Snacks Quarterly Organic Net Sales Growth (%YoY Change) Note: See appendix for reconciliation of Utz Non-GAAP financial measures to most directly comparable GAAP measures. Note: Branded Salty Snacks is defined as Power Four Brands and Other Brands. Power Four Brands consist of the Utz® brand, On The Border®, Zapp’s®, and Boulder Canyon®. Other Brands include Golden Flake®, TORTIYAHS!®, Hawaiian®, Bachman®, Tim’s Cascade®, Dirty Potato Chips®, TGI Fridays® and Vitner's®. 89% 11% 4Q’25 Organic Net Sales Mix Branded Salty Snacks Non-Branded, Non-Salty Snacks Destocking Impact 2.5%

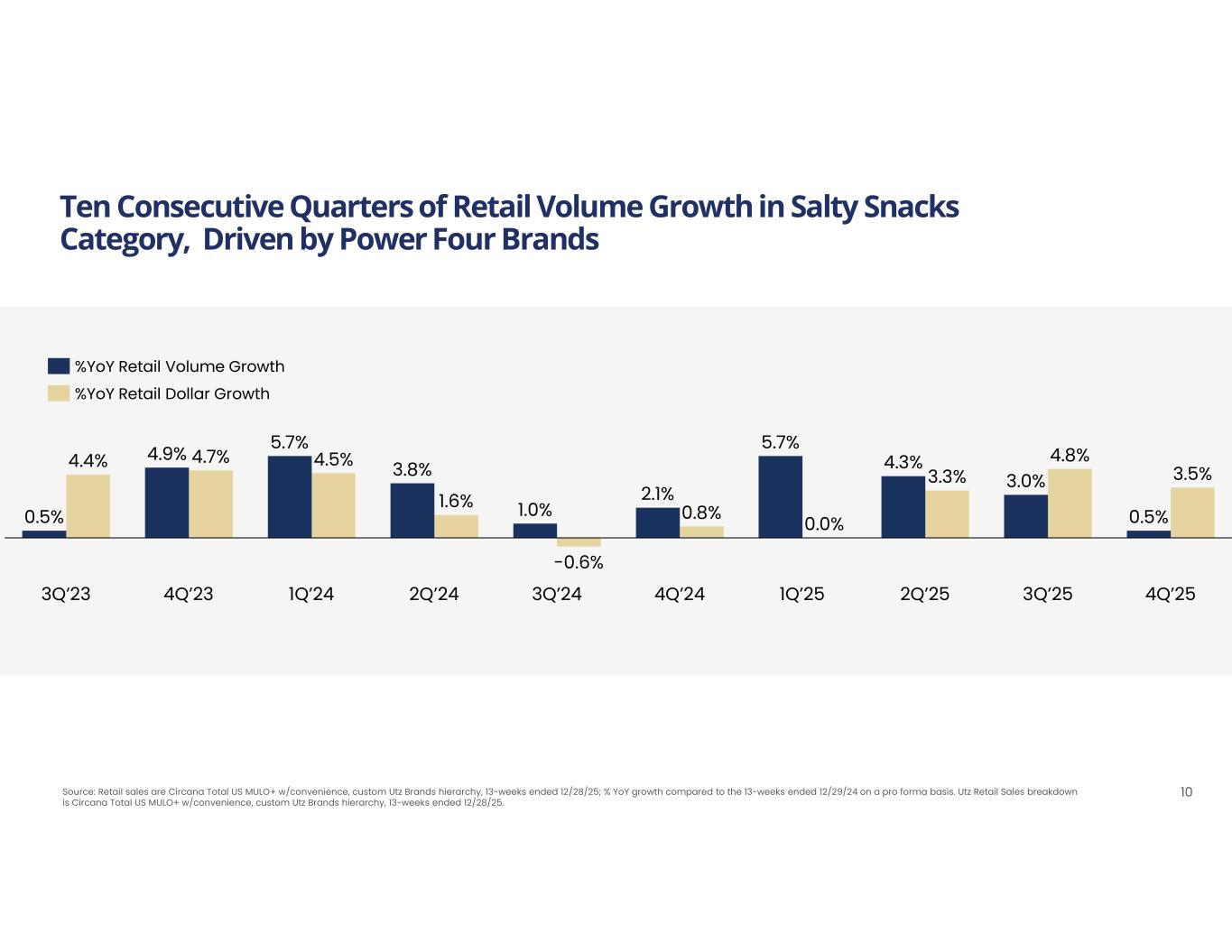

Ten Consecutive Quarters of Retail Volume Growth in Salty Snacks Category, Driven by Power Four Brands 10 3Q’23 4Q’23 1Q’24 2Q’24 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 0.5% 4.4% 4.9% 4.7% 5.7% 4.5% 3.8% 1.6% 1.0% -0.6% 2.1% 0.8% 5.7% 0.0% 4.3% 3.3% 3.0% 4.8% 0.5% 3.5% %YoY Retail Volume Growth %YoY Retail Dollar Growth Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25; % YoY growth compared to the 13-weeks ended 12/29/24 on a pro forma basis. Utz Retail Sales breakdown is Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25.

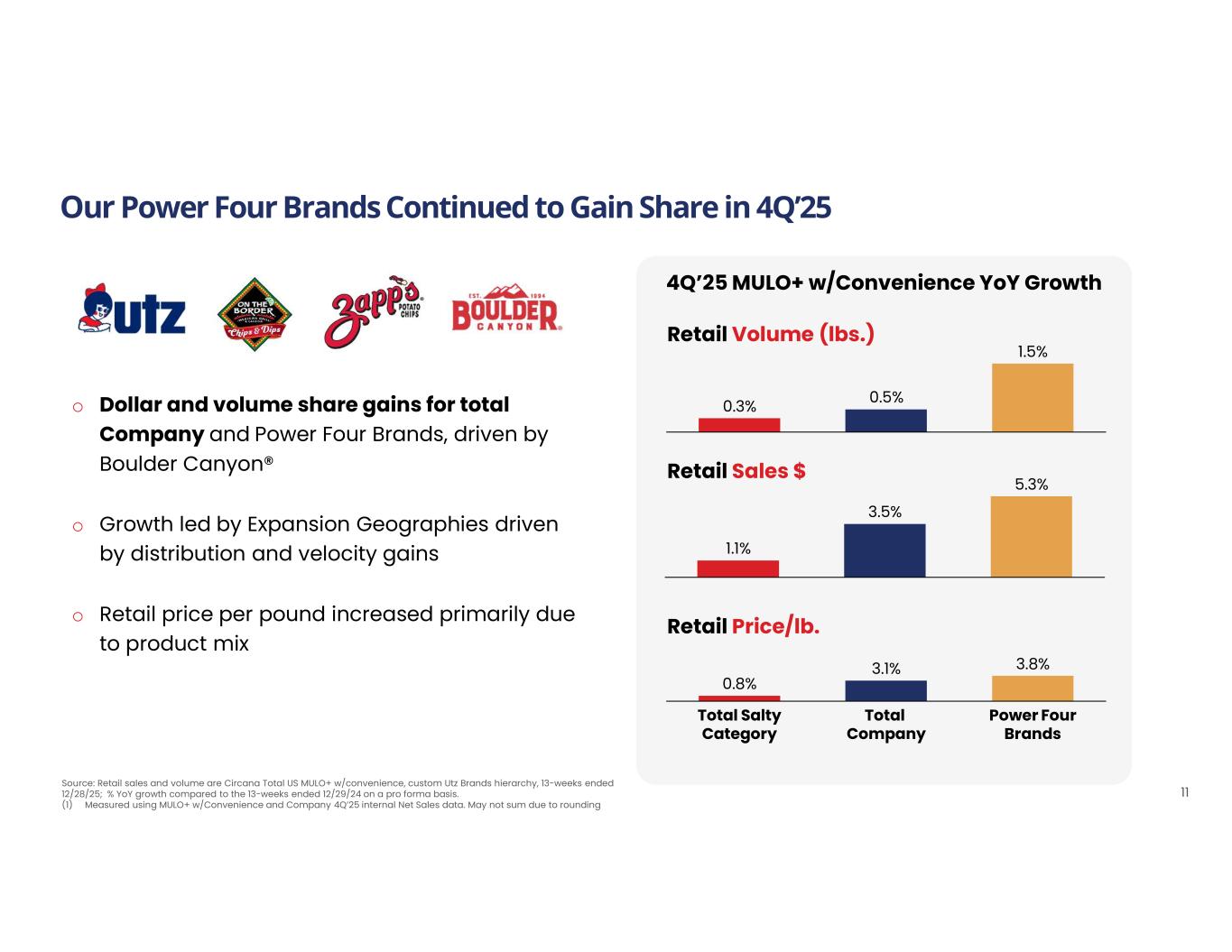

Our Power Four Brands Continued to Gain Share in 4Q’25 11 4Q’25 MULO+ w/Convenience YoY Growth 0.3% 0.5% 1.5% Retail Volume (lbs.) Total Salty Category Total Company Power Four Brands 0.8% 3.1% 3.8% Retail Price/lb. 1.1% 3.5% 5.3% Retail Sales $ Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25; % YoY growth compared to the 13-weeks ended 12/29/24 on a pro forma basis. (1) Measured using MULO+ w/Convenience and Company 4Q’25 internal Net Sales data. May not sum due to rounding o Dollar and volume share gains for total Company and Power Four Brands, driven by Boulder Canyon® o Growth led by Expansion Geographies driven by distribution and velocity gains o Retail price per pound increased primarily due to product mix

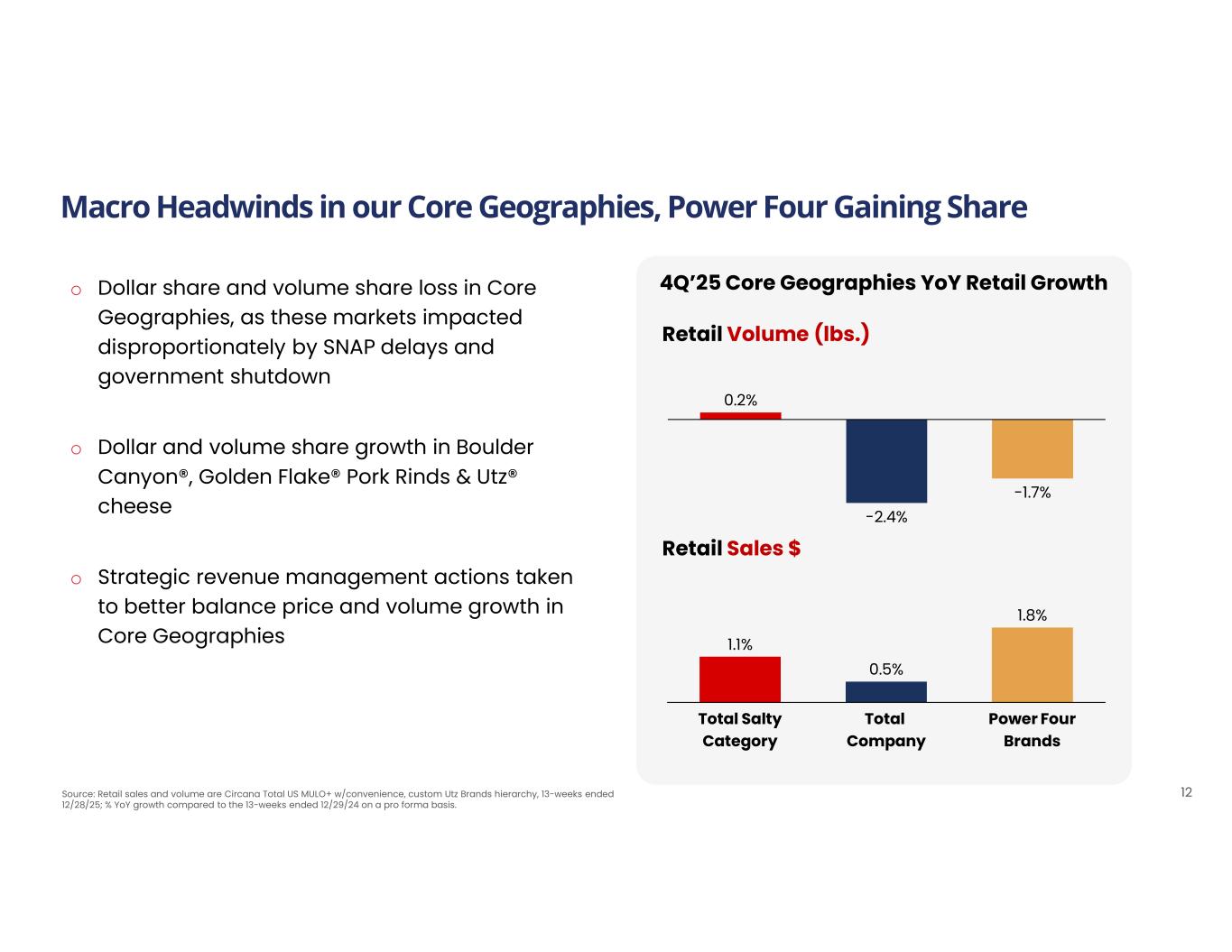

4Q’25 Core Geographies YoY Retail Growth Retail Volume (lbs.) Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25; % YoY growth compared to the 13-weeks ended 12/29/24 on a pro forma basis. Macro Headwinds in our Core Geographies, Power Four Gaining Share 12 Total Salty Category Total Company Power Four Brands 1.1% 0.5% 1.8% 0.2% -2.4% -1.7% Retail Sales $ o Dollar share and volume share loss in Core Geographies, as these markets impacted disproportionately by SNAP delays and government shutdown o Dollar and volume share growth in Boulder Canyon®, Golden Flake® Pork Rinds & Utz® cheese o Strategic revenue management actions taken to better balance price and volume growth in Core Geographies

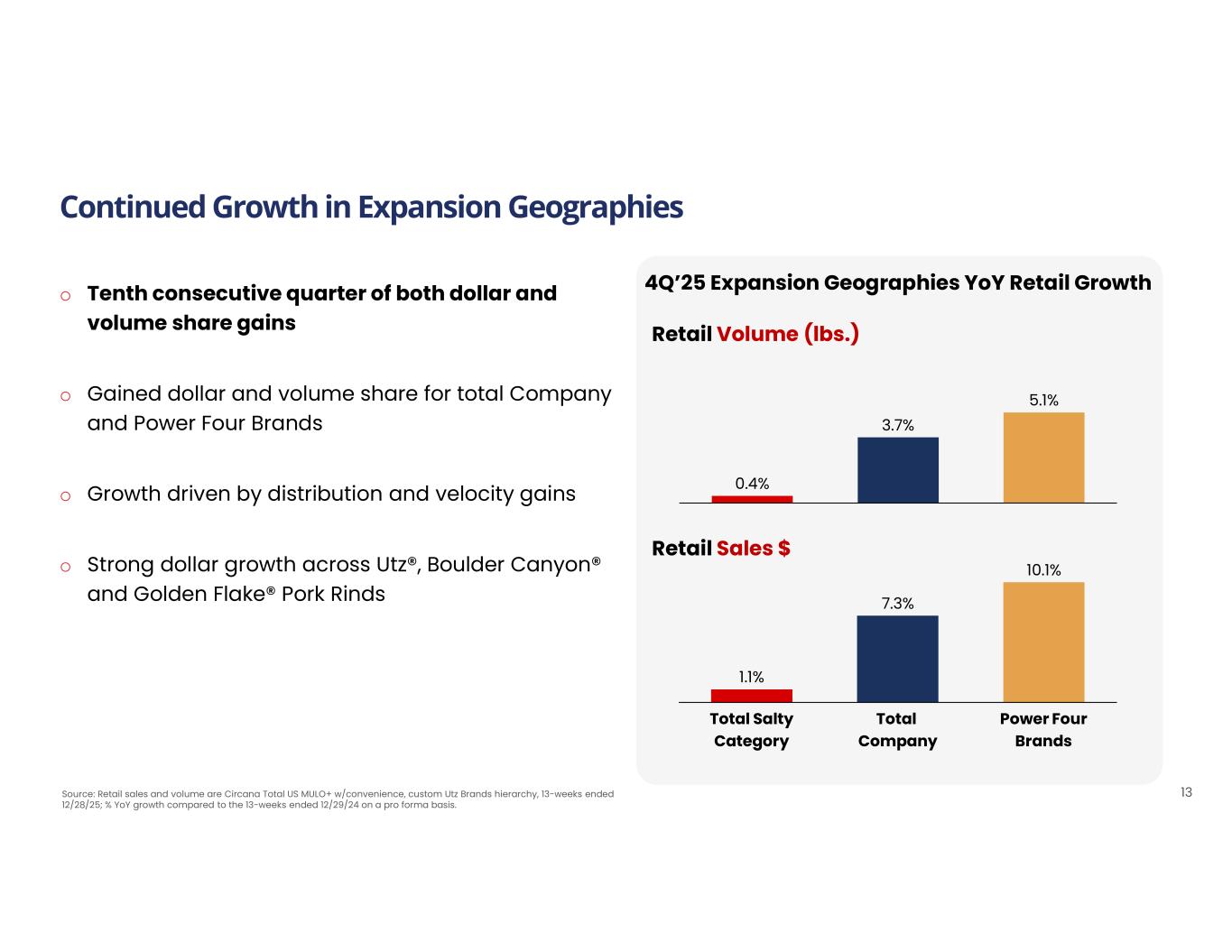

Continued Growth in Expansion Geographies 13 o Tenth consecutive quarter of both dollar and volume share gains o Gained dollar and volume share for total Company and Power Four Brands o Growth driven by distribution and velocity gains o Strong dollar growth across Utz®, Boulder Canyon® and Golden Flake® Pork Rinds 4Q’25 Expansion Geographies YoY Retail Growth Retail Volume (lbs.) Total Salty Category Total Company Power Four Brands 1.1% 7.3% 10.1% 0.4% 3.7% 5.1% Retail Sales $ Source: Retail sales and volume are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25; % YoY growth compared to the 13-weeks ended 12/29/24 on a pro forma basis.

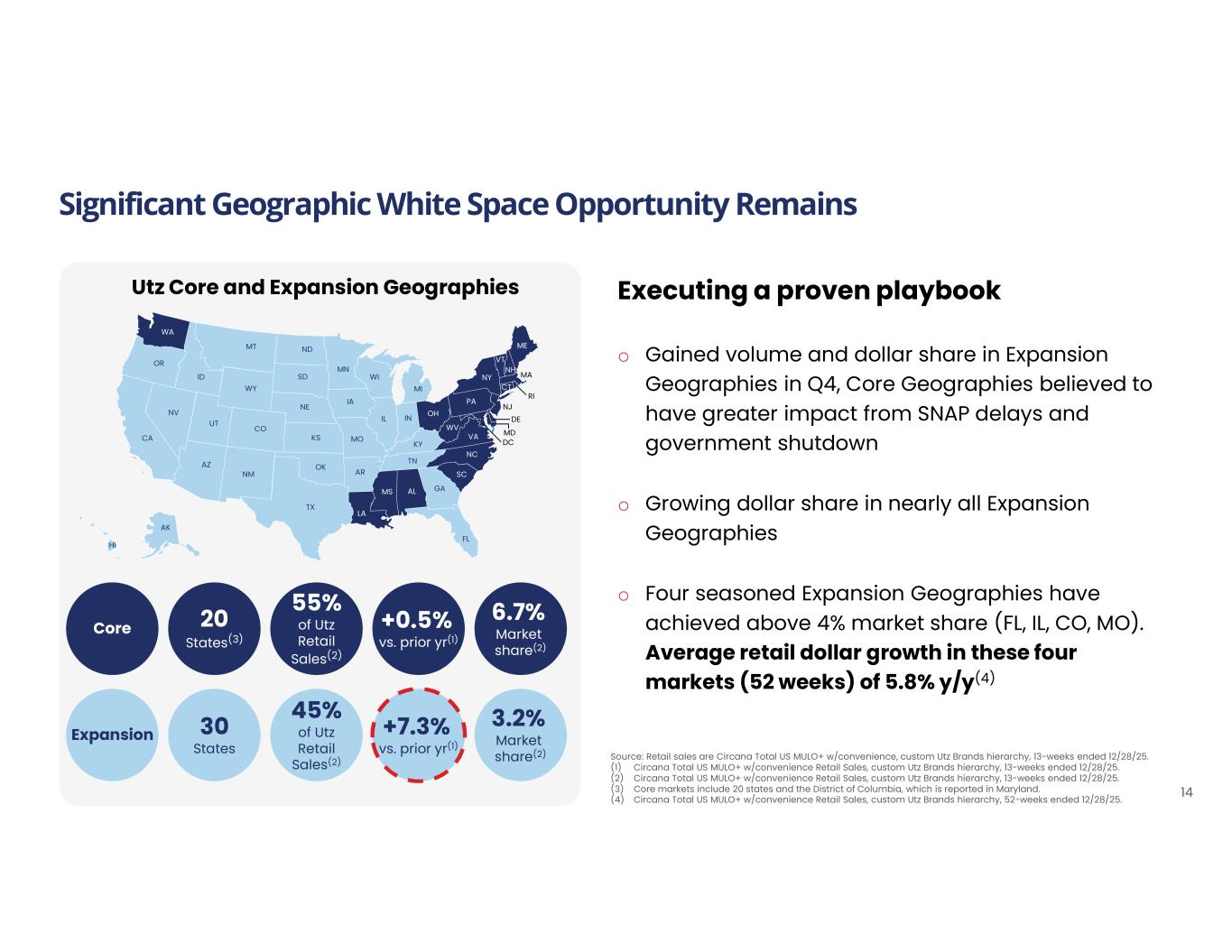

Significant Geographic White Space Opportunity Remains 14 Utz Core and Expansion Geographies FL NM DE MD TX OK KS NE SD NDMT WY COUT ID AZ NV WA CA OR KY ME NY PA VT NH MA RI CT WV INIL NC TN SC ALMS AR LA MO IA MN WI NJ GA DC VA OH MI HI AK Executing a proven playbook o Gained volume and dollar share in Expansion Geographies in Q4, Core Geographies believed to have greater impact from SNAP delays and government shutdown o Growing dollar share in nearly all Expansion Geographies o Four seasoned Expansion Geographies have achieved above 4% market share (FL, IL, CO, MO). Average retail dollar growth in these four markets (52 weeks) of 5.8% y/y(4) 55% of Utz Retail Sales(2) +0.5% vs. prior yr(1) 6.7% Market share(2) Core 45% of Utz Retail Sales(2) +7.3% vs. prior yr(1) 3.2% Market share(2) Expansion 20 States(3) 30 States Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25. (1) Circana Total US MULO+ w/convenience Retail Sales, custom Utz Brands hierarchy, 13-weeks ended 12/28/25. (2) Circana Total US MULO+ w/convenience Retail Sales, custom Utz Brands hierarchy, 13-weeks ended 12/28/25. (3) Core markets include 20 states and the District of Columbia, which is reported in Maryland. (4) Circana Total US MULO+ w/convenience Retail Sales, custom Utz Brands hierarchy, 52-weeks ended 12/28/25.

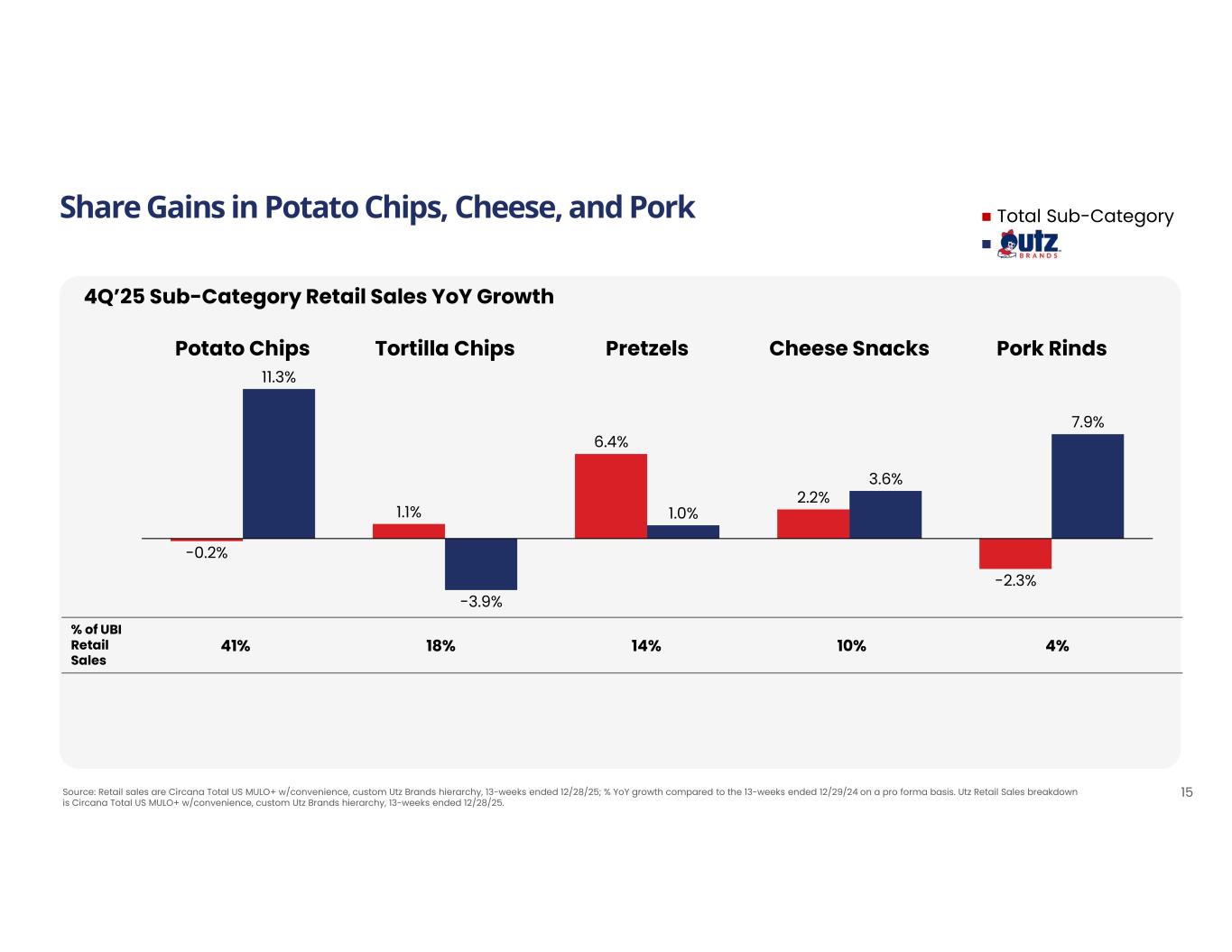

4%10%14%18%41% % of UBI Retail Sales Source: Retail sales are Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25; % YoY growth compared to the 13-weeks ended 12/29/24 on a pro forma basis. Utz Retail Sales breakdown is Circana Total US MULO+ w/convenience, custom Utz Brands hierarchy, 13-weeks ended 12/28/25. 4Q’25 Sub-Category Retail Sales YoY Growth Potato Chips Tortilla Chips Pretzels Cheese Snacks Pork Rinds -0.2% 11.3% 1.1% -3.9% 6.4% 1.0% 2.2% 3.6% -2.3% 7.9% 15 Share Gains in Potato Chips, Cheese, and Pork Total Sub-Category

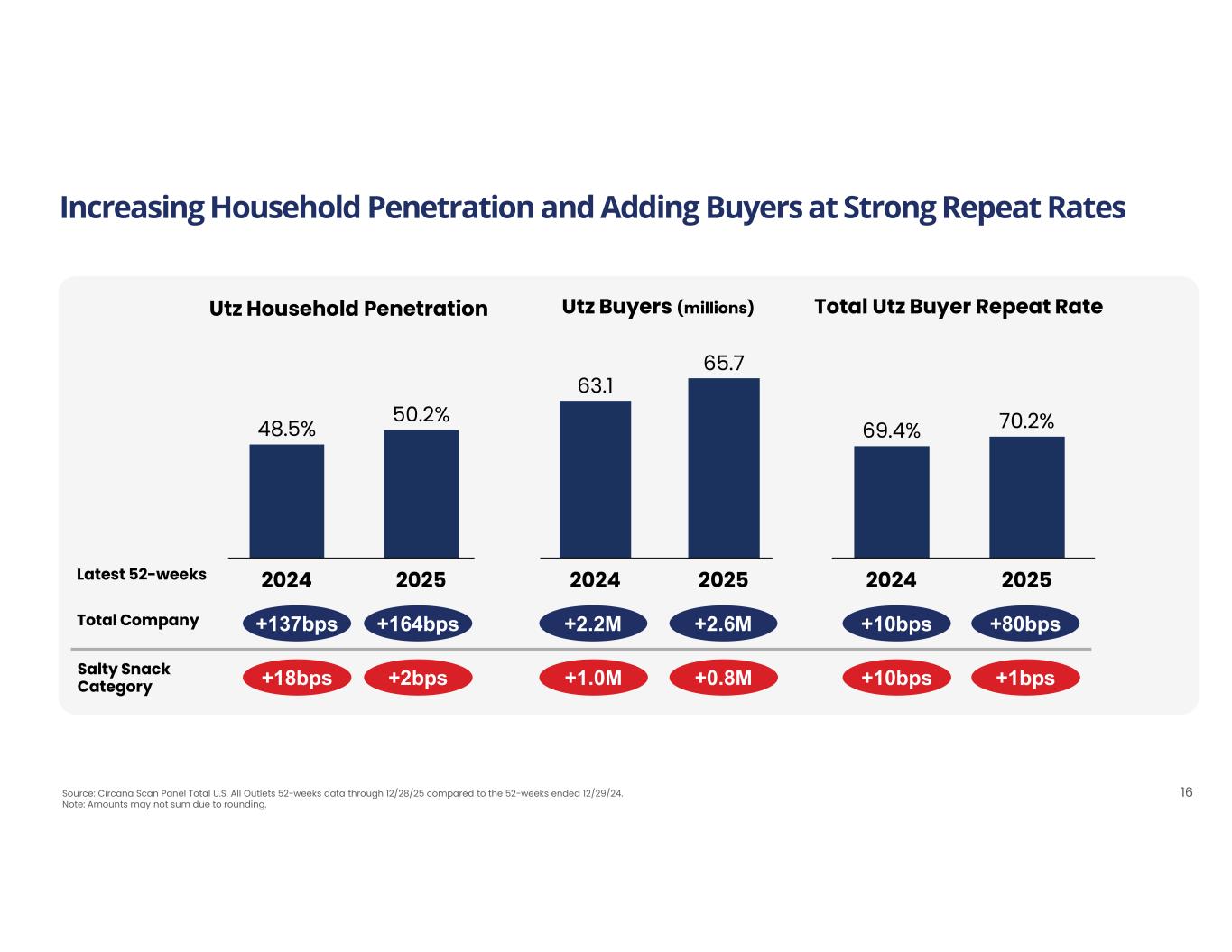

Increasing Household Penetration and Adding Buyers at Strong Repeat Rates 16 Utz Household Penetration Utz Buyers (millions) Total Utz Buyer Repeat Rate Source: Circana Scan Panel Total U.S. All Outlets 52-weeks data through 12/28/25 compared to the 52-weeks ended 12/29/24. Note: Amounts may not sum due to rounding. 35 40 45 50 55 2024 2025 48.5% 50.2% 60 65 70 75 2024 2025 69.4% 70.2% 63.1 65.7 45 50 55 60 65 70 2024 2025 Total Company Salty Snack Category +164bps +2bps +2.6M +0.8M +80bps +1bps +137bps +18bps +2.2M +1.0M +10bps +10bps Latest 52-weeks

Financial Review BK Kelley Chief Financial Officer 17

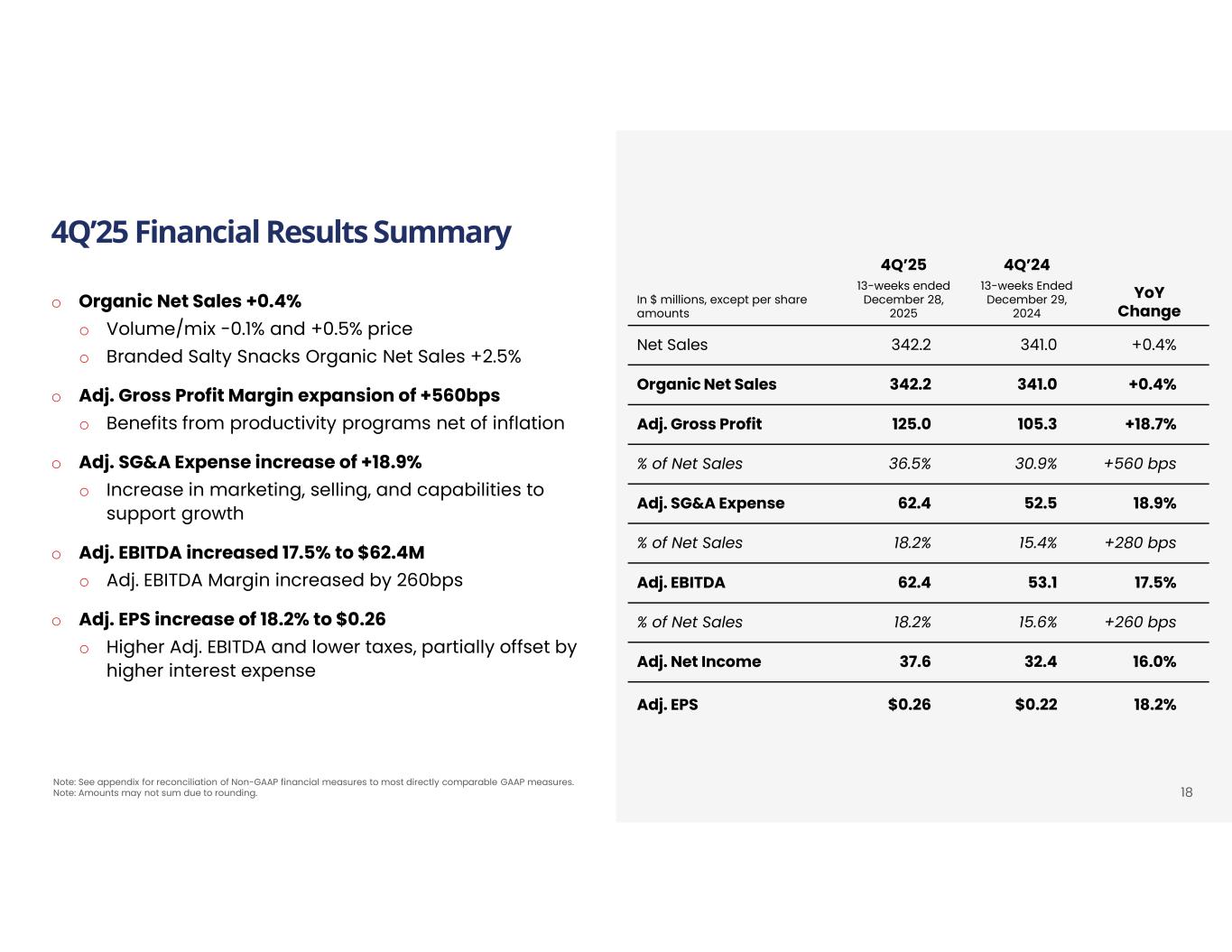

4Q’25 Financial Results Summary o Organic Net Sales +0.4% o Volume/mix -0.1% and +0.5% price o Branded Salty Snacks Organic Net Sales +2.5% o Adj. Gross Profit Margin expansion of +560bps o Benefits from productivity programs net of inflation o Adj. SG&A Expense increase of +18.9% o Increase in marketing, selling, and capabilities to support growth o Adj. EBITDA increased 17.5% to $62.4M o Adj. EBITDA Margin increased by 260bps o Adj. EPS increase of 18.2% to $0.26 o Higher Adj. EBITDA and lower taxes, partially offset by higher interest expense YoY Change 4Q’244Q’25 13-weeks Ended December 29, 2024 13-weeks ended December 28, 2025 In $ millions, except per share amounts +0.4%341.0342.2Net Sales +0.4%341.0342.2Organic Net Sales +18.7%105.3125.0Adj. Gross Profit +560 bps30.9%36.5%% of Net Sales 18.9%52.562.4Adj. SG&A Expense +280 bps15.4%18.2%% of Net Sales 17.5%53.162.4Adj. EBITDA +260 bps15.6%18.2%% of Net Sales 16.0%32.437.6Adj. Net Income 18.2%$0.22$0.26Adj. EPS 18 Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Note: Amounts may not sum due to rounding.

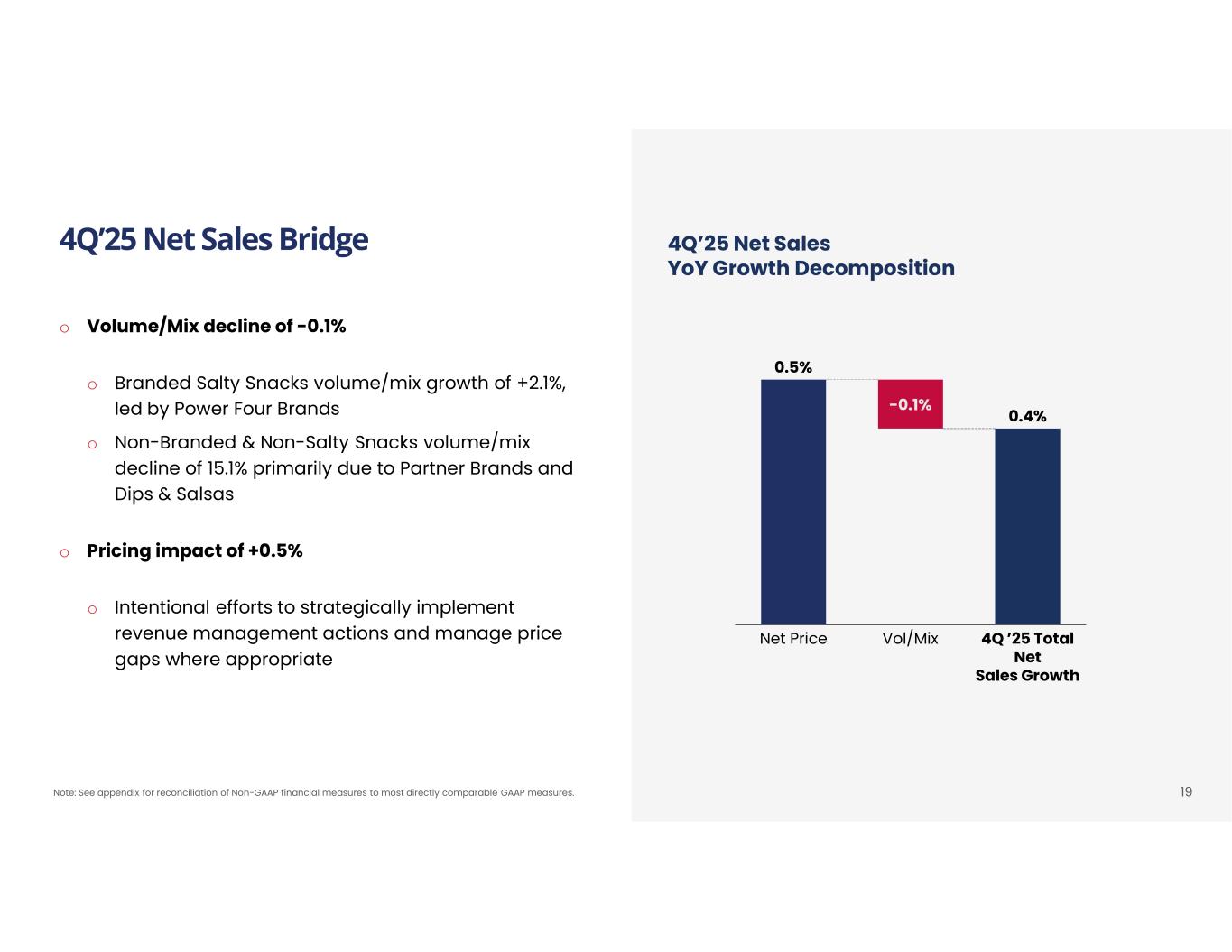

19 4Q’25 Net Sales YoY Growth Decomposition Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Net Price -0.1% Vol/Mix 4Q ’25 Total Net Sales Growth 0.5% 0.4% o Volume/Mix decline of -0.1% o Branded Salty Snacks volume/mix growth of +2.1%, led by Power Four Brands o Non-Branded & Non-Salty Snacks volume/mix decline of 15.1% primarily due to Partner Brands and Dips & Salsas o Pricing impact of +0.5% o Intentional efforts to strategically implement revenue management actions and manage price gaps where appropriate 4Q’25 Net Sales Bridge

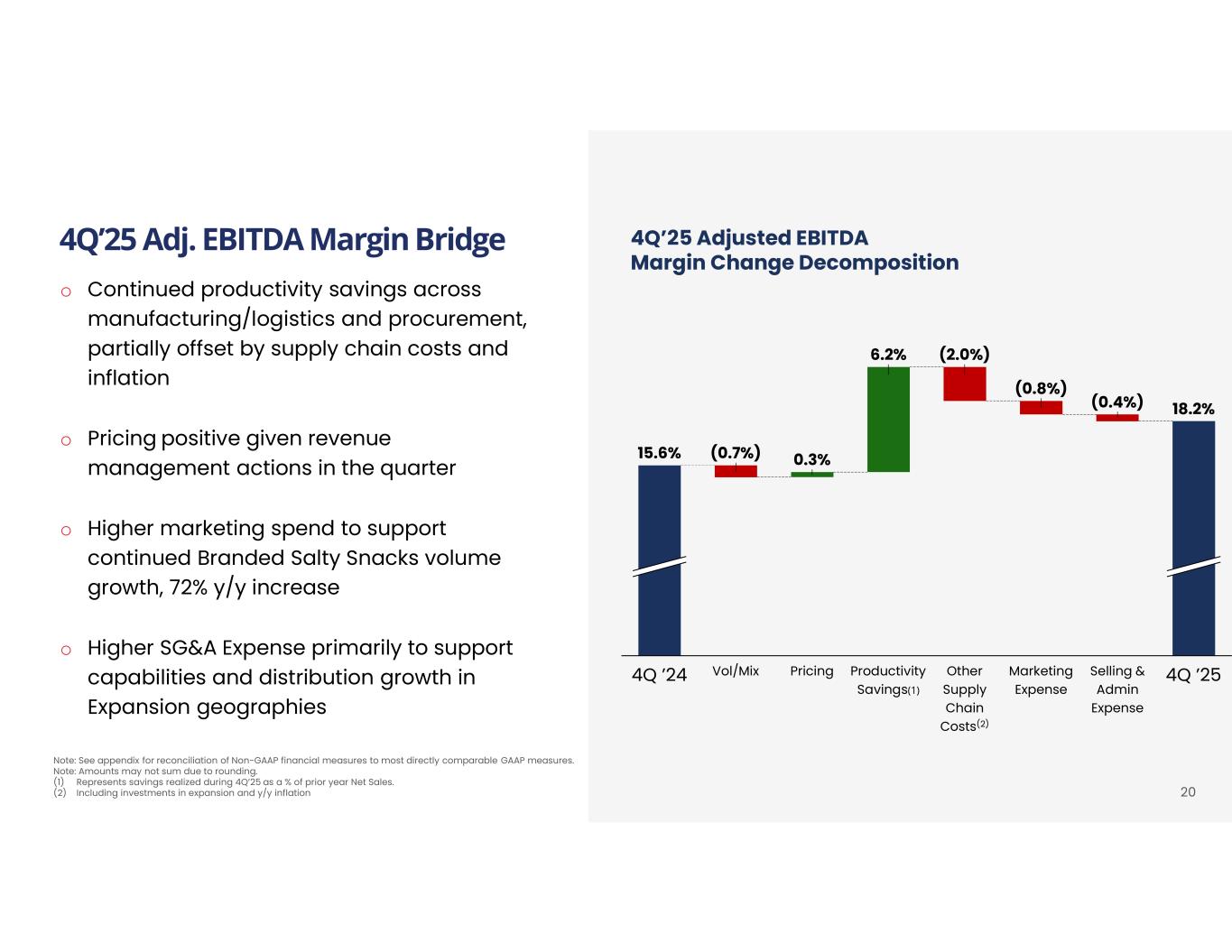

4Q’25 Adjusted EBITDA Margin Change Decomposition 4Q’25 Adj. EBITDA Margin Bridge 20 o Continued productivity savings across manufacturing/logistics and procurement, partially offset by supply chain costs and inflation o Pricing positive given revenue management actions in the quarter o Higher marketing spend to support continued Branded Salty Snacks volume growth, 72% y/y increase o Higher SG&A Expense primarily to support capabilities and distribution growth in Expansion geographies Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. Note: Amounts may not sum due to rounding. (1) Represents savings realized during 4Q’25 as a % of prior year Net Sales. (2) Including investments in expansion and y/y inflation (0.7%) Vol/Mix 0.3%15.6% 18.2% Pricing 6.2% Productivity Savings(1) (2.0%) Other Supply Chain Costs(2) (0.8%) Marketing Expense (0.4%) 4Q ’24 4Q ’25Selling & Admin Expense

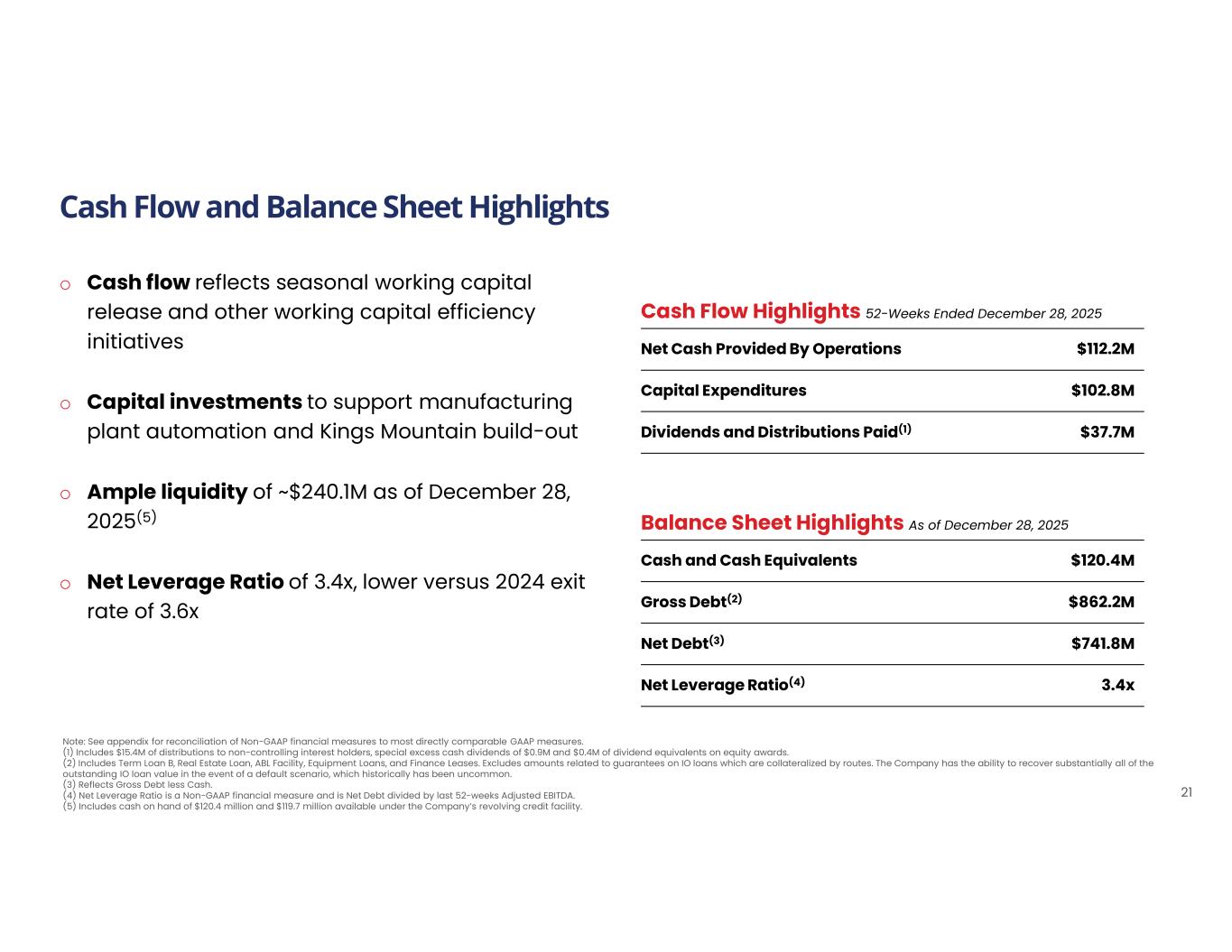

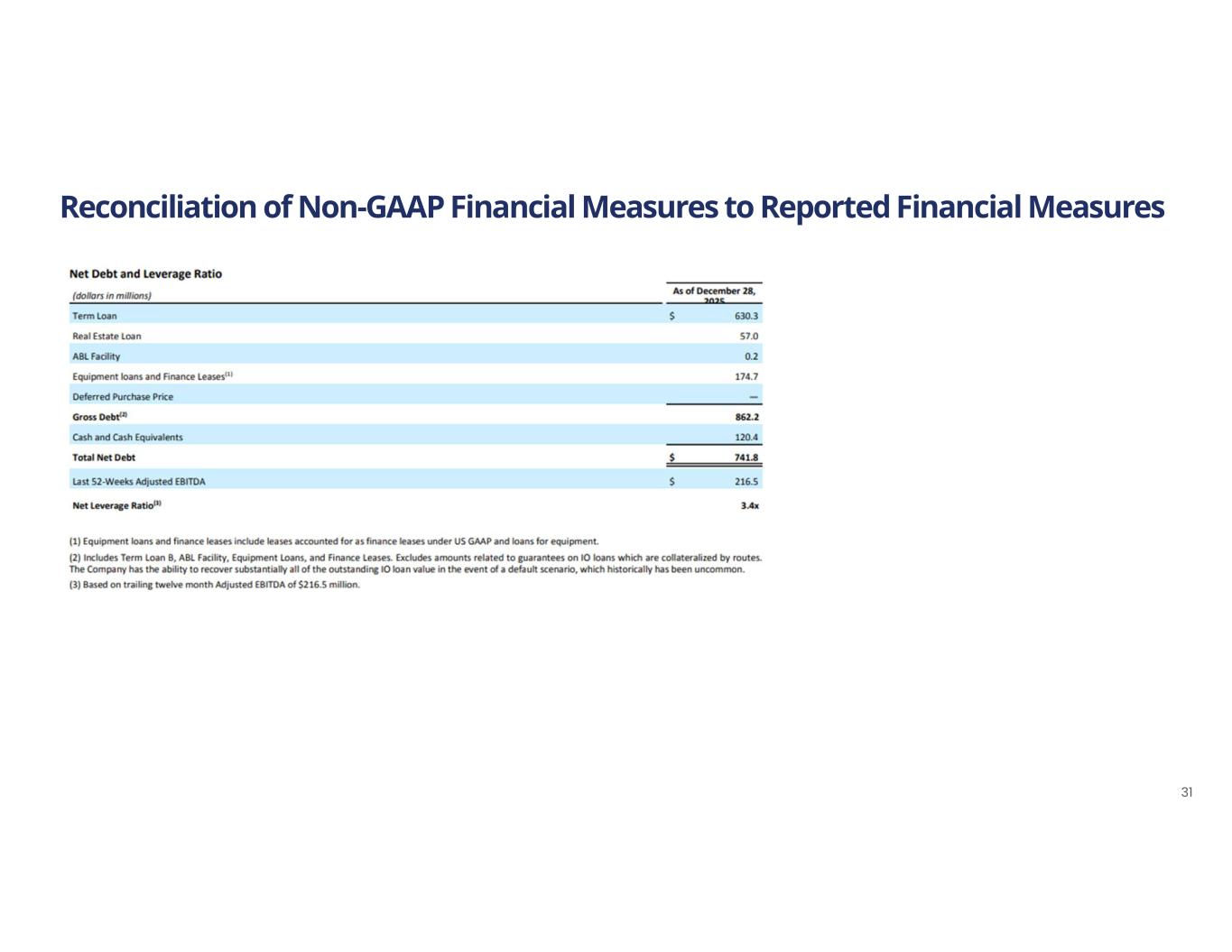

Cash Flow and Balance Sheet Highlights As of January 1, 2023 Cash Flow Highlights 52-Weeks Ended December 28, 2025 $112.2MNet Cash Provided By Operations $102.8MCapital Expenditures $37.7MDividends and Distributions Paid(1) Balance Sheet Highlights As of December 28, 2025 $120.4MCash and Cash Equivalents $862.2MGross Debt(2) $741.8MNet Debt(3) 3.4xNet Leverage Ratio(4) 21 Note: See appendix for reconciliation of Non-GAAP financial measures to most directly comparable GAAP measures. (1) Includes $15.4M of distributions to non-controlling interest holders, special excess cash dividends of $0.9M and $0.4M of dividend equivalents on equity awards. (2) Includes Term Loan B, Real Estate Loan, ABL Facility, Equipment Loans, and Finance Leases. Excludes amounts related to guarantees on IO loans which are collateralized by routes. The Company has the ability to recover substantially all of the outstanding IO loan value in the event of a default scenario, which historically has been uncommon. (3) Reflects Gross Debt less Cash. (4) Net Leverage Ratio is a Non-GAAP financial measure and is Net Debt divided by last 52-weeks Adjusted EBITDA. (5) Includes cash on hand of $120.4 million and $119.7 million available under the Company’s revolving credit facility. o Cash flow reflects seasonal working capital release and other working capital efficiency initiatives o Capital investments to support manufacturing plant automation and Kings Mountain build-out o Ample liquidity of ~$240.1M as of December 28, 2025(5) o Net Leverage Ratio of 3.4x, lower versus 2024 exit rate of 3.6x

2026 – An Inflection Point in our Evolution 22 o Planning for top-line growth profitably ahead of category, driven by Expansion Markets (entering California, growing the remainder), Boulder Canyon space gains and innovation, and increased marketing support o Completing supply chain investment cycle; 2026 capital expenditures expected at ~$60M-$65M o Normalizing productivity savings (% of Adjusted COGS) at best-in-class levels of ~4% o Accelerating Adjusted Free Cash Flow of $60M-$80M which will further support deleverage o Adjusted EPS growth impacted by D&A and tax; long-term expected to grow in-line with Adjusted EBITDA excluding capital allocation

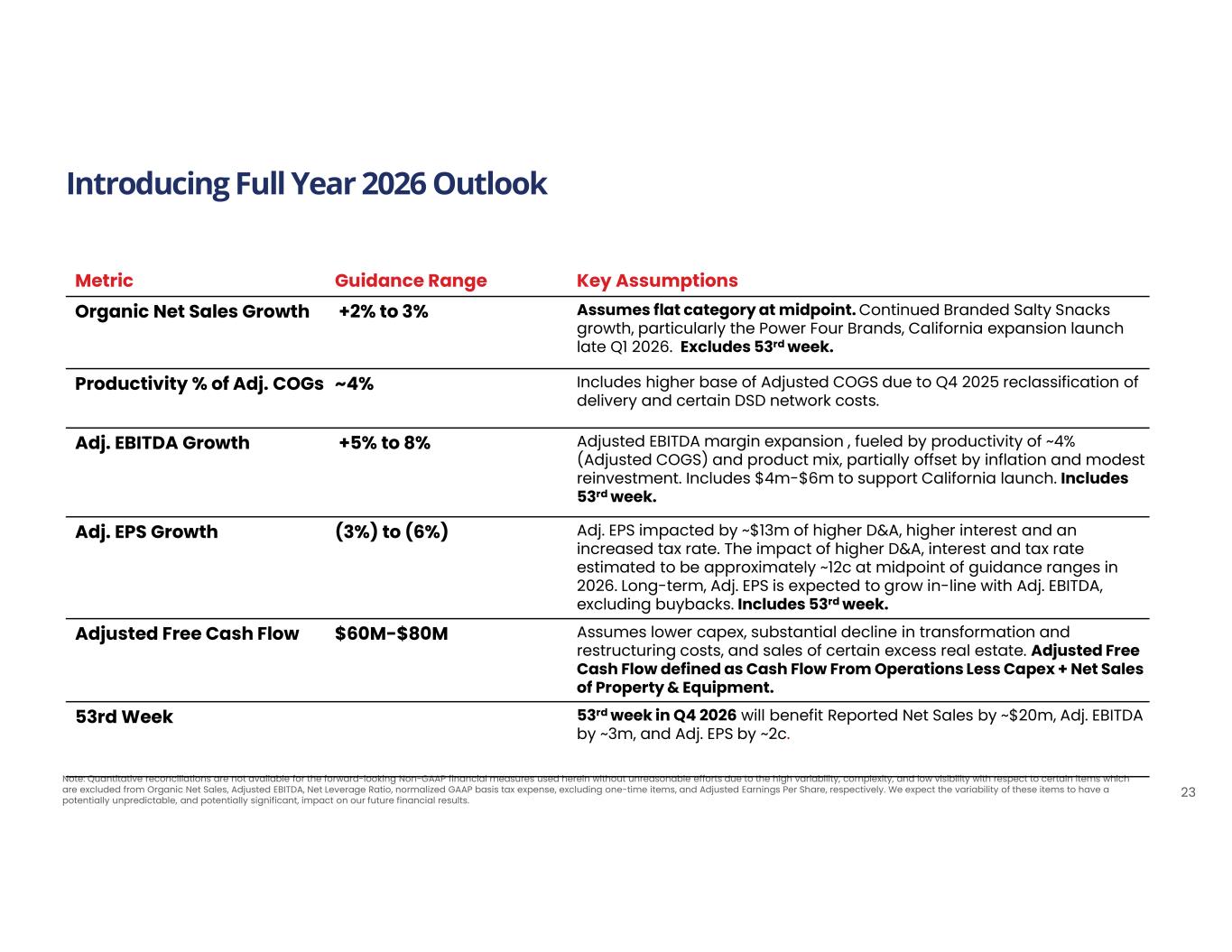

Note: Quantitative reconciliations are not available for the forward-looking Non-GAAP financial measures used herein without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Organic Net Sales, Adjusted EBITDA, Net Leverage Ratio, normalized GAAP basis tax expense, excluding one-time items, and Adjusted Earnings Per Share, respectively. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results. Key AssumptionsGuidance RangeMetric Assumes flat category at midpoint. Continued Branded Salty Snacks growth, particularly the Power Four Brands, California expansion launch late Q1 2026. Excludes 53rd week. +2% to 3% Organic Net Sales Growth Includes higher base of Adjusted COGS due to Q4 2025 reclassification of delivery and certain DSD network costs. ~4%Productivity % of Adj. COGs Adjusted EBITDA margin expansion , fueled by productivity of ~4% (Adjusted COGS) and product mix, partially offset by inflation and modest reinvestment. Includes $4m-$6m to support California launch. Includes 53rd week. +5% to 8%Adj. EBITDA Growth Adj. EPS impacted by ~$13m of higher D&A, higher interest and an increased tax rate. The impact of higher D&A, interest and tax rate estimated to be approximately ~12c at midpoint of guidance ranges in 2026. Long-term, Adj. EPS is expected to grow in-line with Adj. EBITDA, excluding buybacks. Includes 53rd week. (3%) to (6%)Adj. EPS Growth Assumes lower capex, substantial decline in transformation and restructuring costs, and sales of certain excess real estate. Adjusted Free Cash Flow defined as Cash Flow From Operations Less Capex + Net Sales of Property & Equipment. $60M-$80MAdjusted Free Cash Flow 53rd week in Q4 2026 will benefit Reported Net Sales by ~$20m, Adj. EBITDA by ~3m, and Adj. EPS by ~2c. 53rd Week Introducing Full Year 2026 Outlook 23

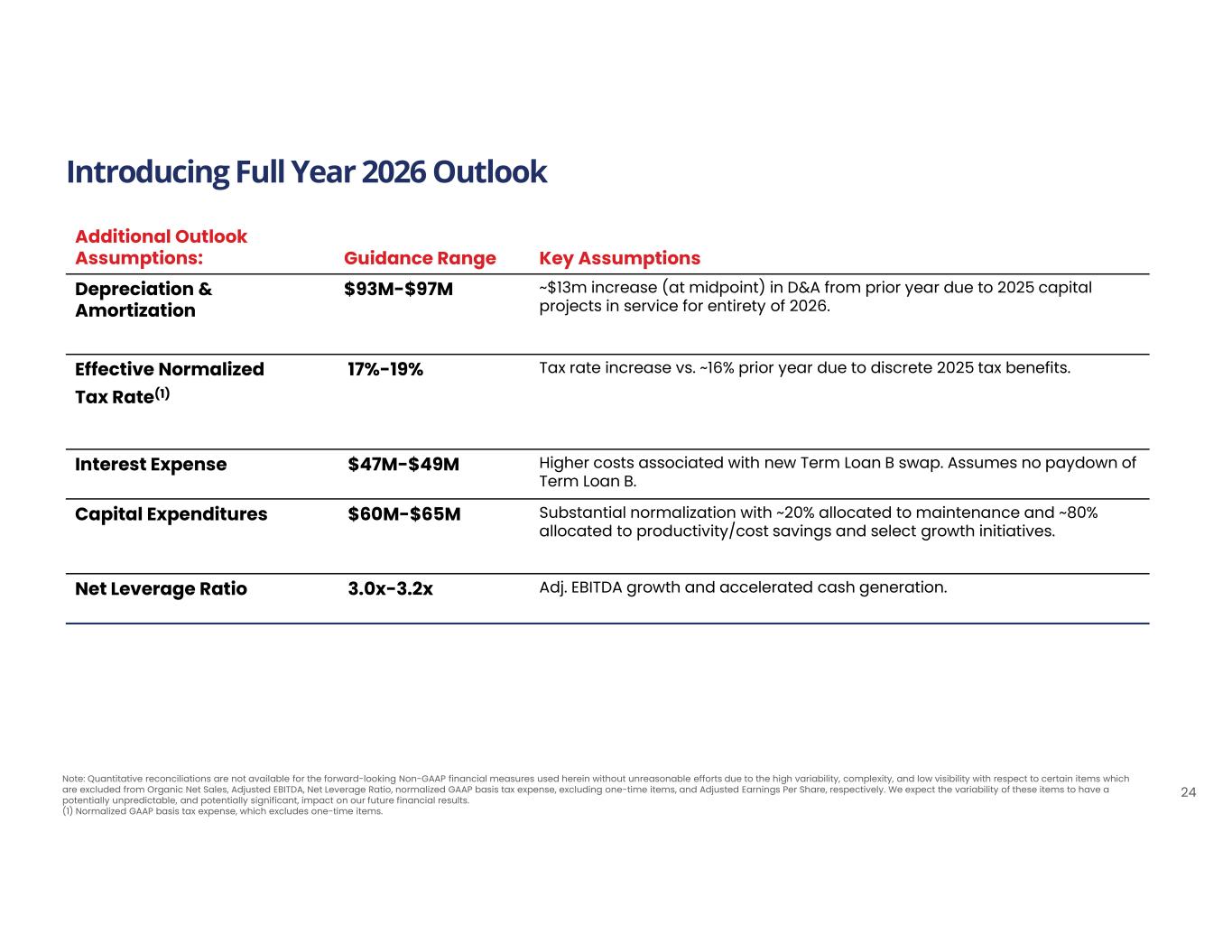

Note: Quantitative reconciliations are not available for the forward-looking Non-GAAP financial measures used herein without unreasonable efforts due to the high variability, complexity, and low visibility with respect to certain items which are excluded from Organic Net Sales, Adjusted EBITDA, Net Leverage Ratio, normalized GAAP basis tax expense, excluding one-time items, and Adjusted Earnings Per Share, respectively. We expect the variability of these items to have a potentially unpredictable, and potentially significant, impact on our future financial results. (1) Normalized GAAP basis tax expense, which excludes one-time items. Key AssumptionsGuidance Range Additional Outlook Assumptions: ~$13m increase (at midpoint) in D&A from prior year due to 2025 capital projects in service for entirety of 2026. $93M-$97MDepreciation & Amortization Tax rate increase vs. ~16% prior year due to discrete 2025 tax benefits.17%-19%Effective Normalized Tax Rate(1) Higher costs associated with new Term Loan B swap. Assumes no paydown of Term Loan B. $47M-$49MInterest Expense Substantial normalization with ~20% allocated to maintenance and ~80% allocated to productivity/cost savings and select growth initiatives. $60M-$65MCapital Expenditures Adj. EBITDA growth and accelerated cash generation.3.0x-3.2xNet Leverage Ratio Introducing Full Year 2026 Outlook 24

Appendix 25

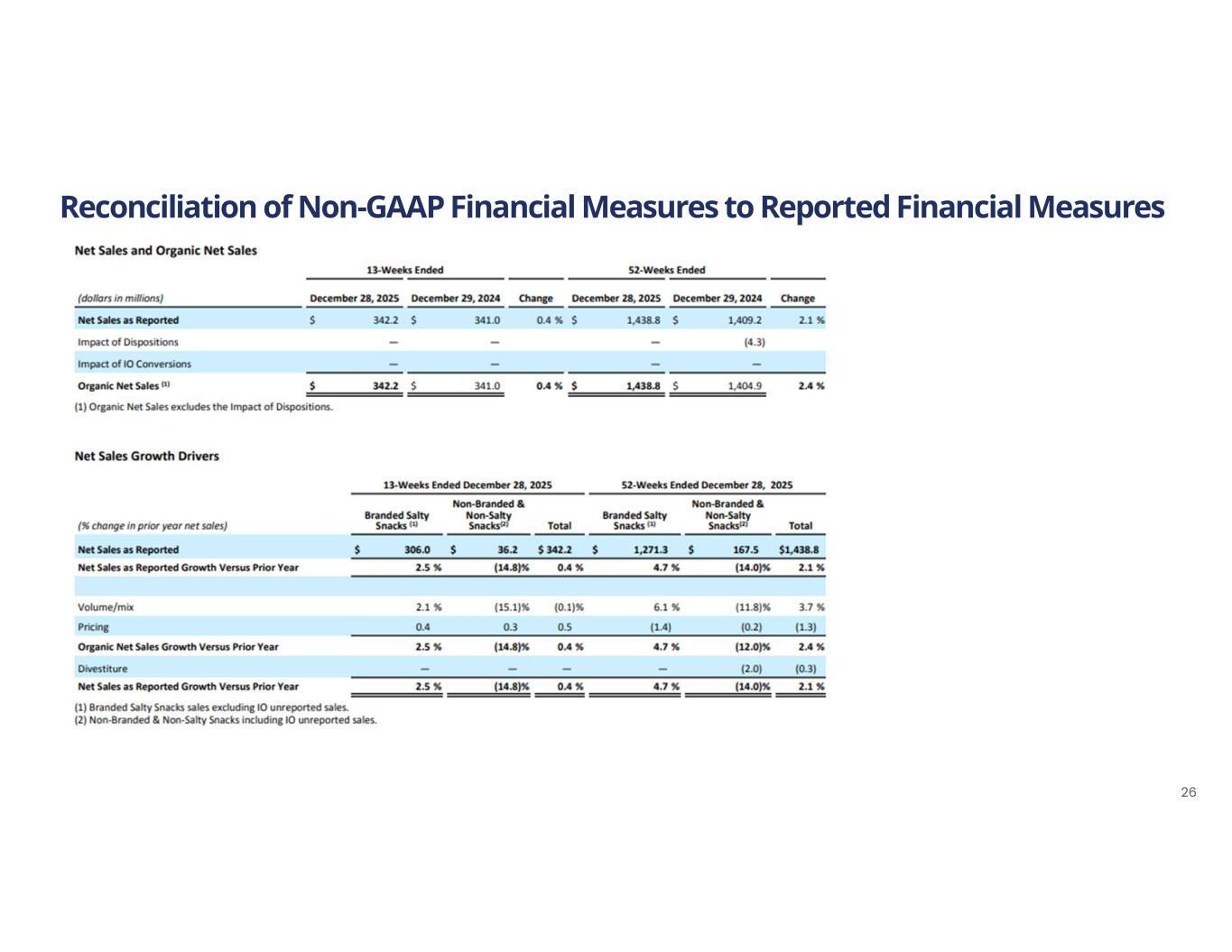

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 26

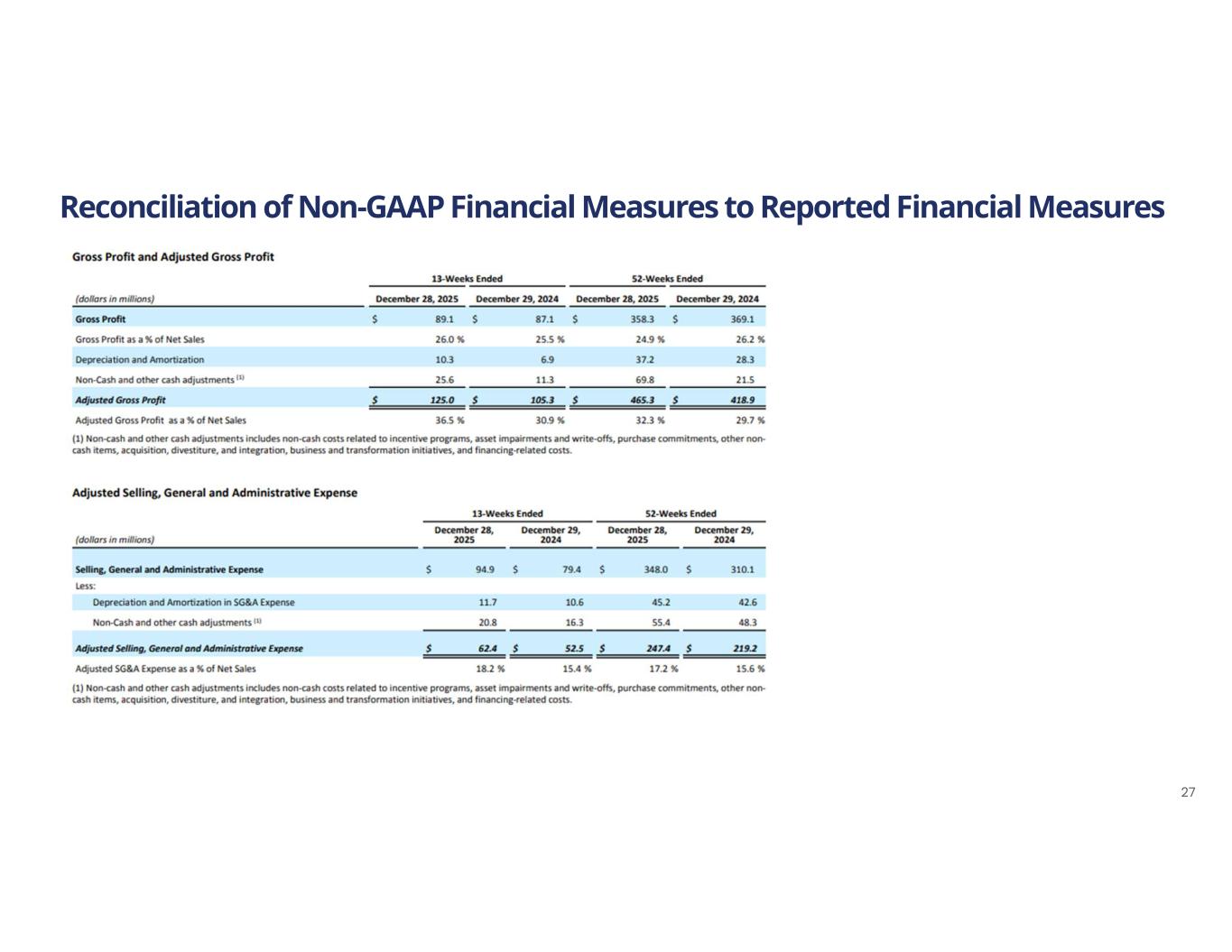

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 27

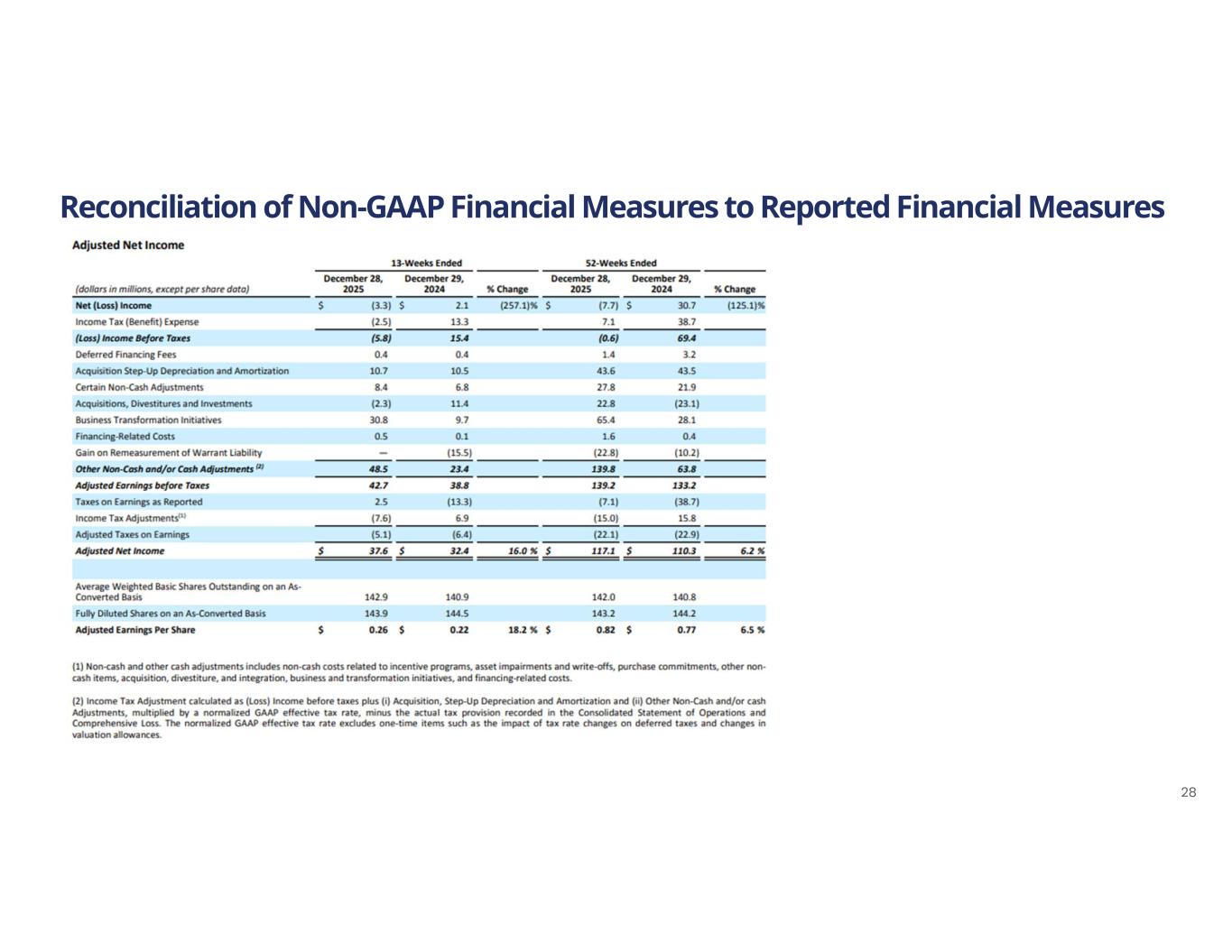

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 28

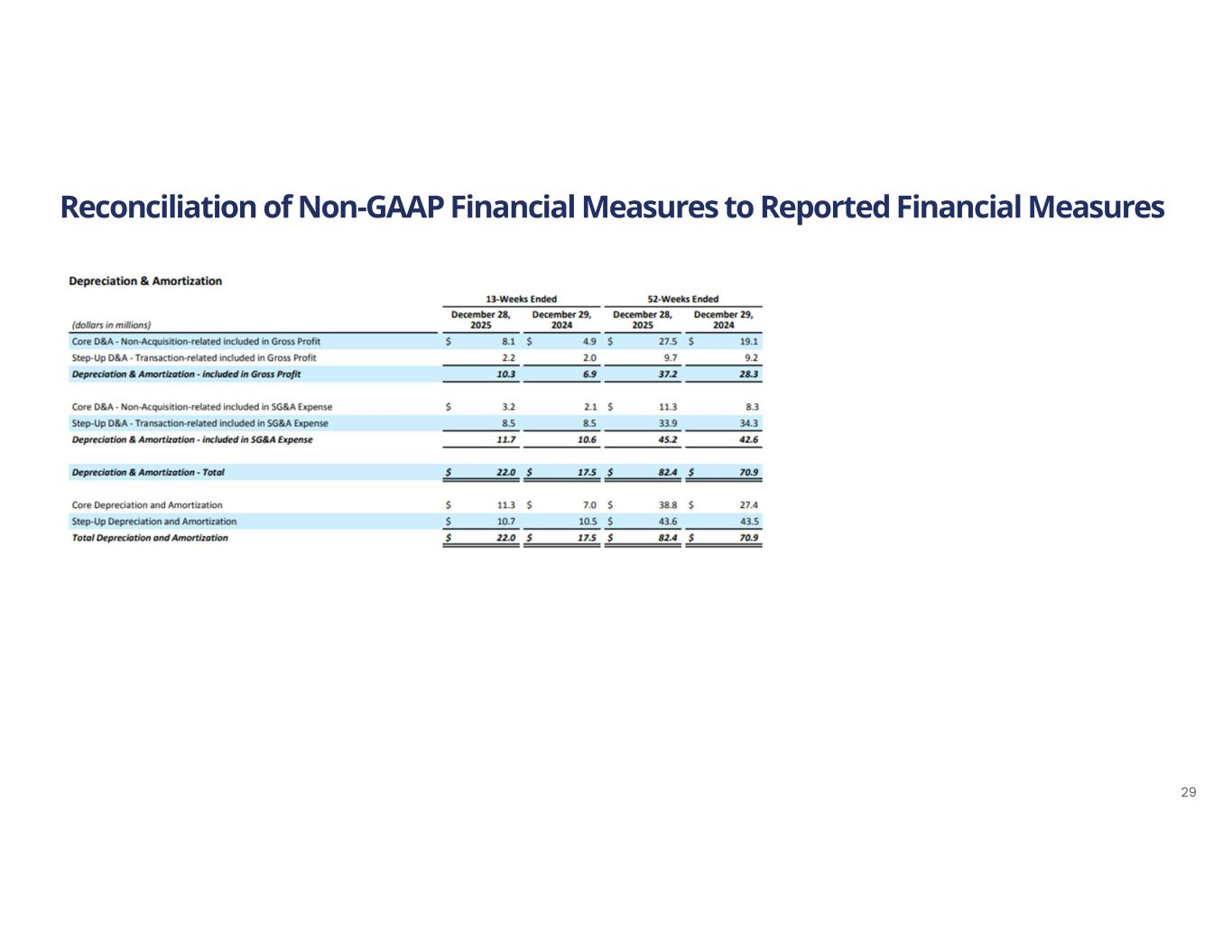

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 29

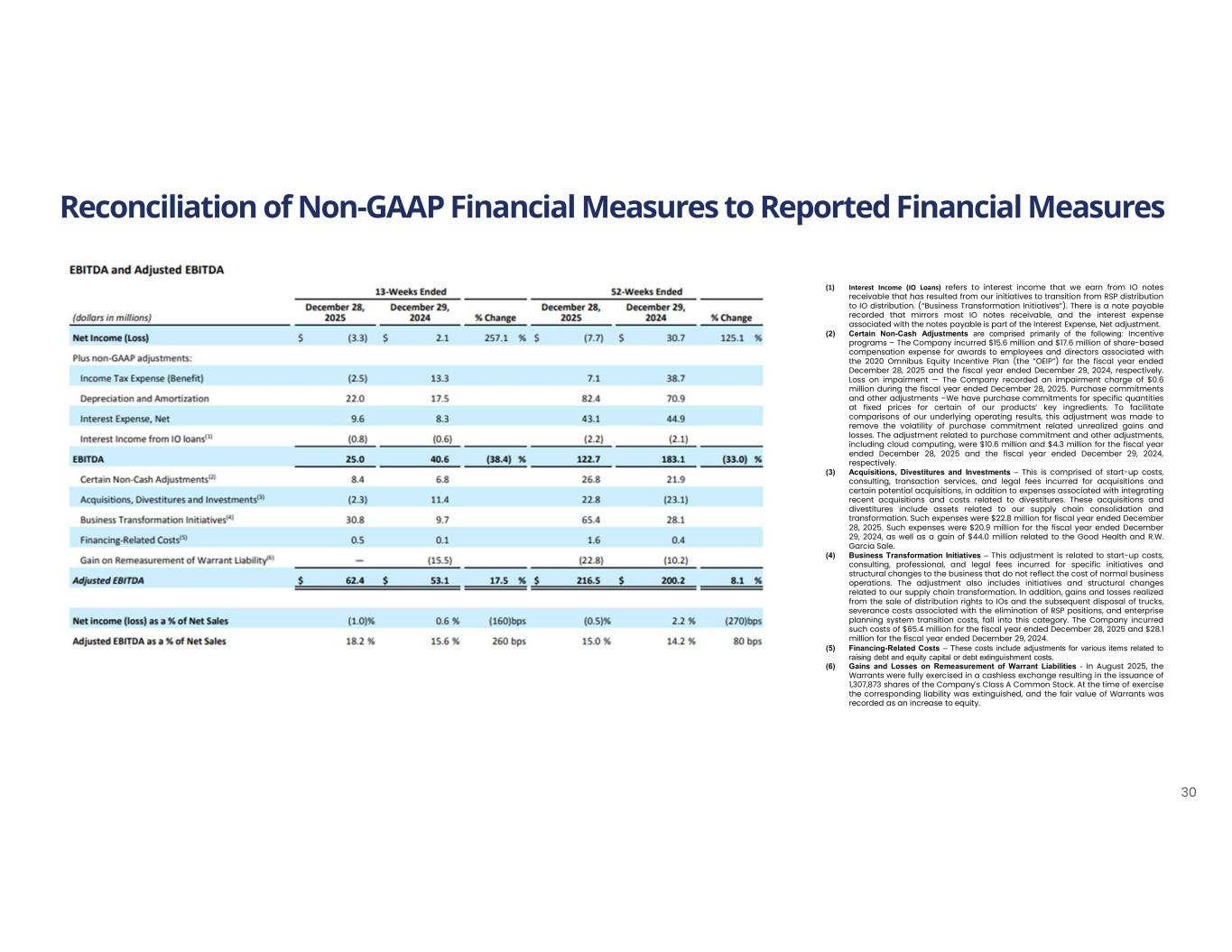

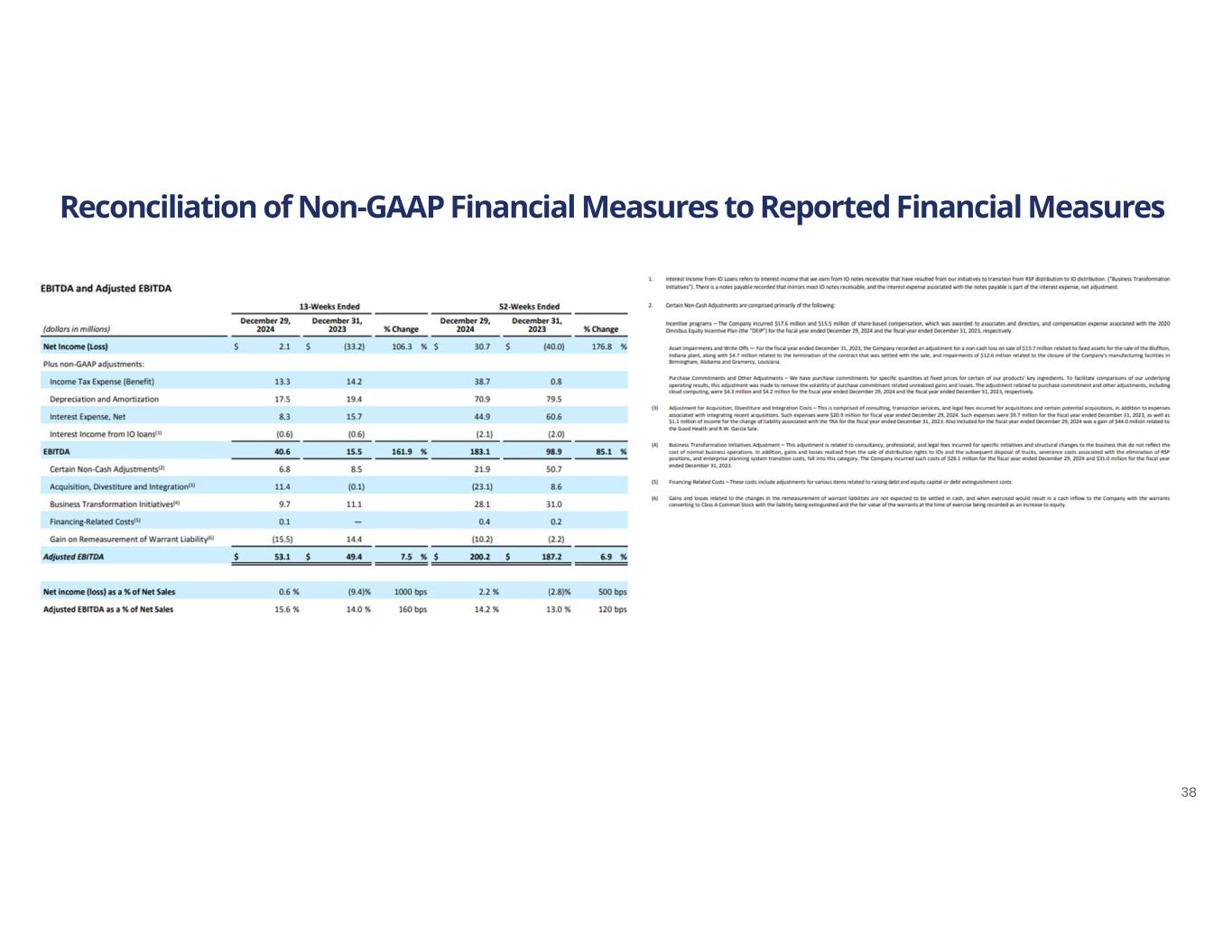

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 30 (1) Interest Income (IO Loans) refers to interest income that we earn from IO notes receivable that has resulted from our initiatives to transition from RSP distribution to IO distribution. (“Business Transformation Initiatives”). There is a note payable recorded that mirrors most IO notes receivable, and the interest expense associated with the notes payable is part of the Interest Expense, Net adjustment. (2) Certain Non-Cash Adjustments are comprised primarily of the following: Incentive programs – The Company incurred $15.6 million and $17.6 million of share-based compensation expense for awards to employees and directors associated with the 2020 Omnibus Equity Incentive Plan (the “OEIP”) for the fiscal year ended December 28, 2025 and the fiscal year ended December 29, 2024, respectively. Loss on impairment — The Company recorded an impairment charge of $0.6 million during the fiscal year ended December 28, 2025. Purchase commitments and other adjustments –We have purchase commitments for specific quantities at fixed prices for certain of our products’ key ingredients. To facilitate comparisons of our underlying operating results, this adjustment was made to remove the volatility of purchase commitment related unrealized gains and losses. The adjustment related to purchase commitment and other adjustments, including cloud computing, were $10.6 million and $4.3 million for the fiscal year ended December 28, 2025 and the fiscal year ended December 29, 2024, respectively. (3) Acquisitions, Divestitures and Investments – This is comprised of start-up costs, consulting, transaction services, and legal fees incurred for acquisitions and certain potential acquisitions, in addition to expenses associated with integrating recent acquisitions and costs related to divestitures. These acquisitions and divestitures include assets related to our supply chain consolidation and transformation. Such expenses were $22.8 million for fiscal year ended December 28, 2025. Such expenses were $20.9 million for the fiscal year ended December 29, 2024, as well as a gain of $44.0 million related to the Good Health and R.W. Garcia Sale. (4) Business Transformation Initiatives – This adjustment is related to start-up costs, consulting, professional, and legal fees incurred for specific initiatives and structural changes to the business that do not reflect the cost of normal business operations. The adjustment also includes initiatives and structural changes related to our supply chain transformation. In addition, gains and losses realized from the sale of distribution rights to IOs and the subsequent disposal of trucks, severance costs associated with the elimination of RSP positions, and enterprise planning system transition costs, fall into this category. The Company incurred such costs of $65.4 million for the fiscal year ended December 28, 2025 and $28.1 million for the fiscal year ended December 29, 2024. (5) Financing-Related Costs – These costs include adjustments for various items related to raising debt and equity capital or debt extinguishment costs. (6) Gains and Losses on Remeasurement of Warrant Liabilities - In August 2025, the Warrants were fully exercised in a cashless exchange resulting in the issuance of 1,307,873 shares of the Company's Class A Common Stock. At the time of exercise the corresponding liability was extinguished, and the fair value of Warrants was recorded as an increase to equity.

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 31

Appendix Additional Reconciliations as Previously Disclosed 32

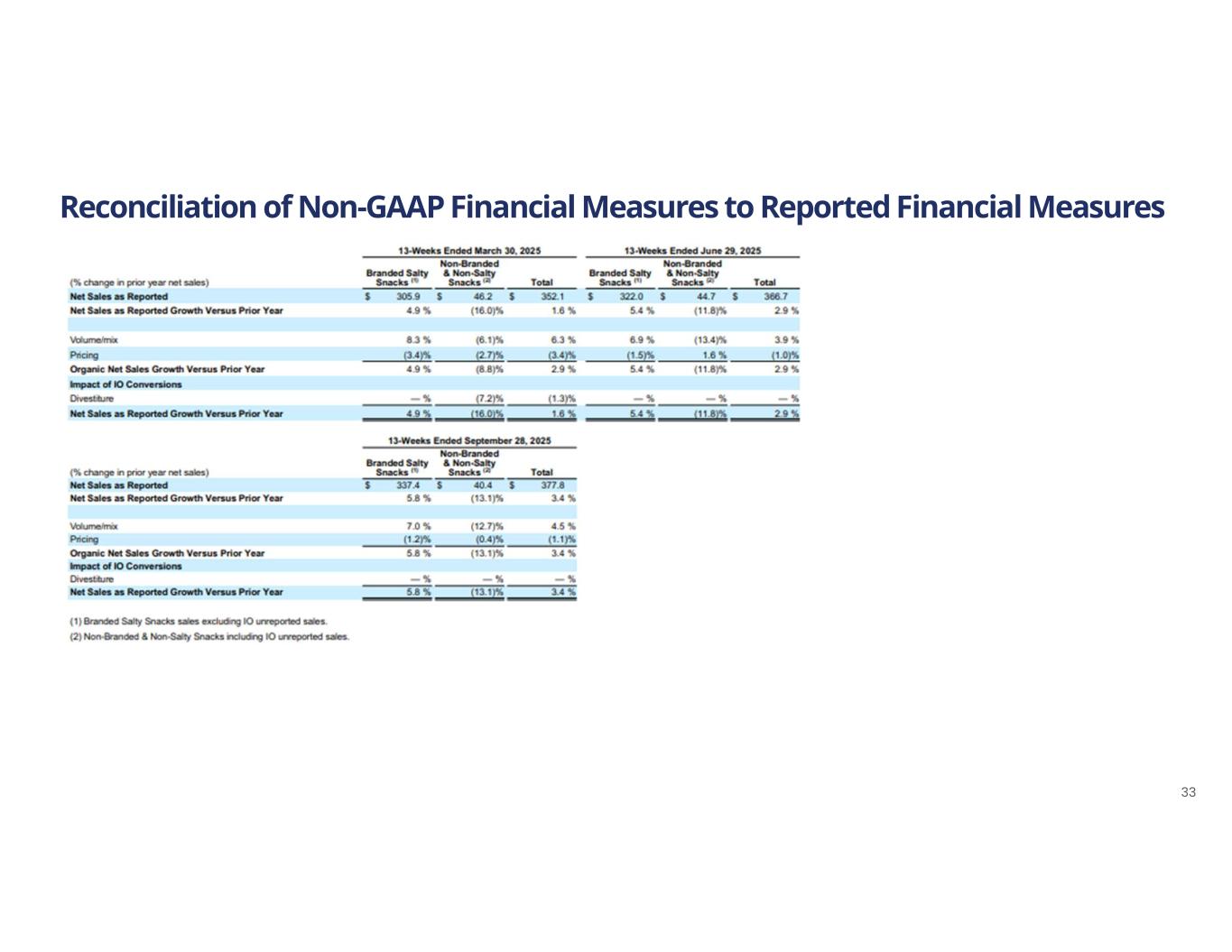

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 33

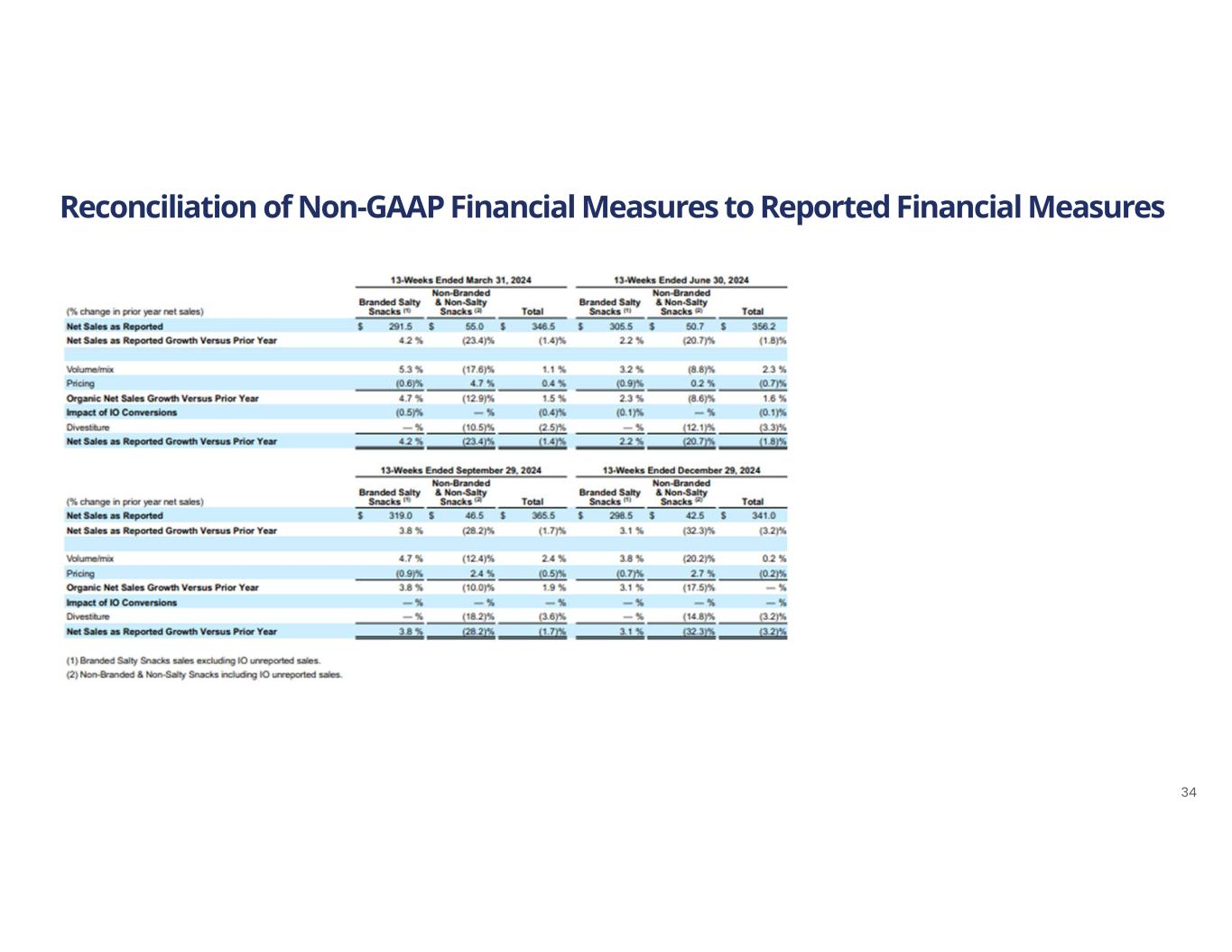

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 34

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 35

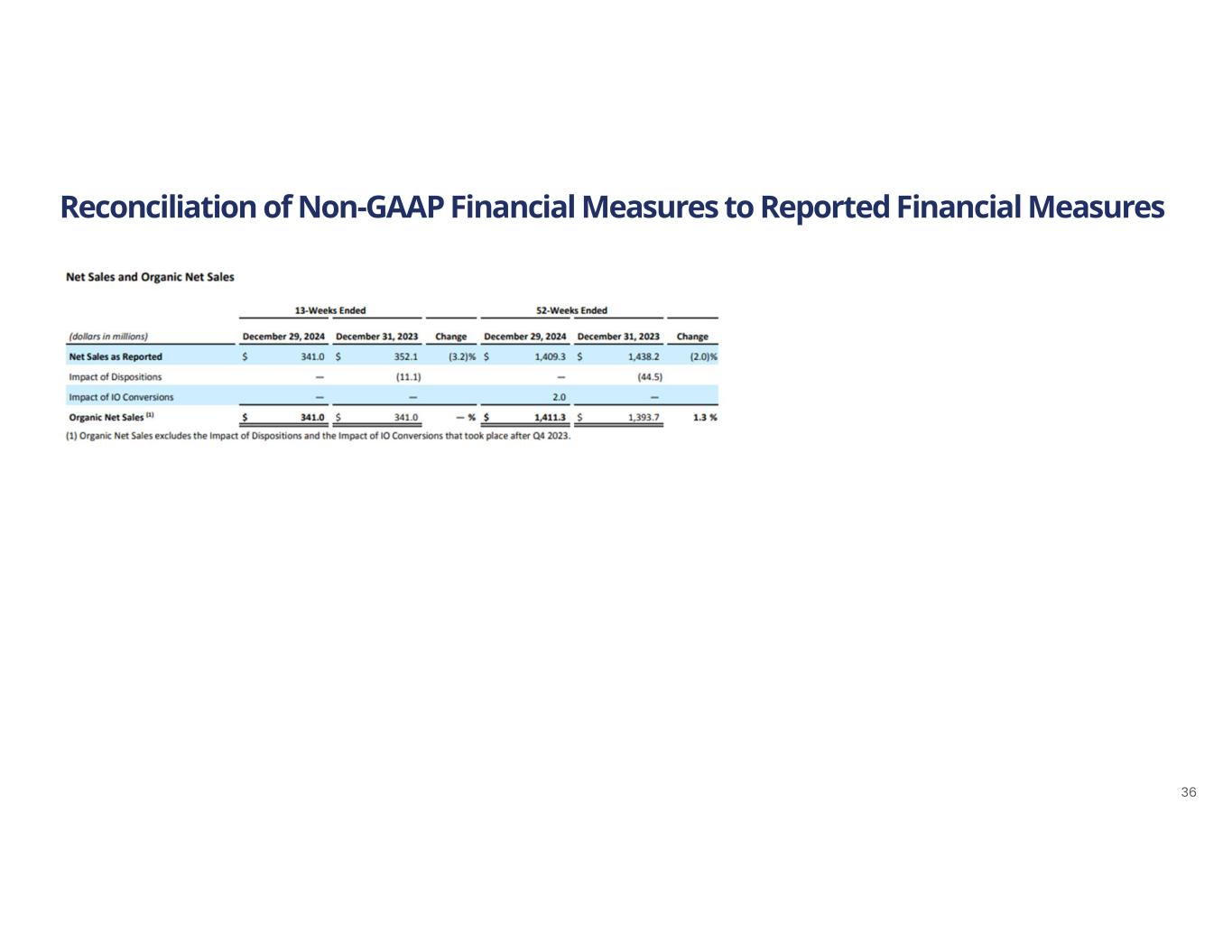

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 36

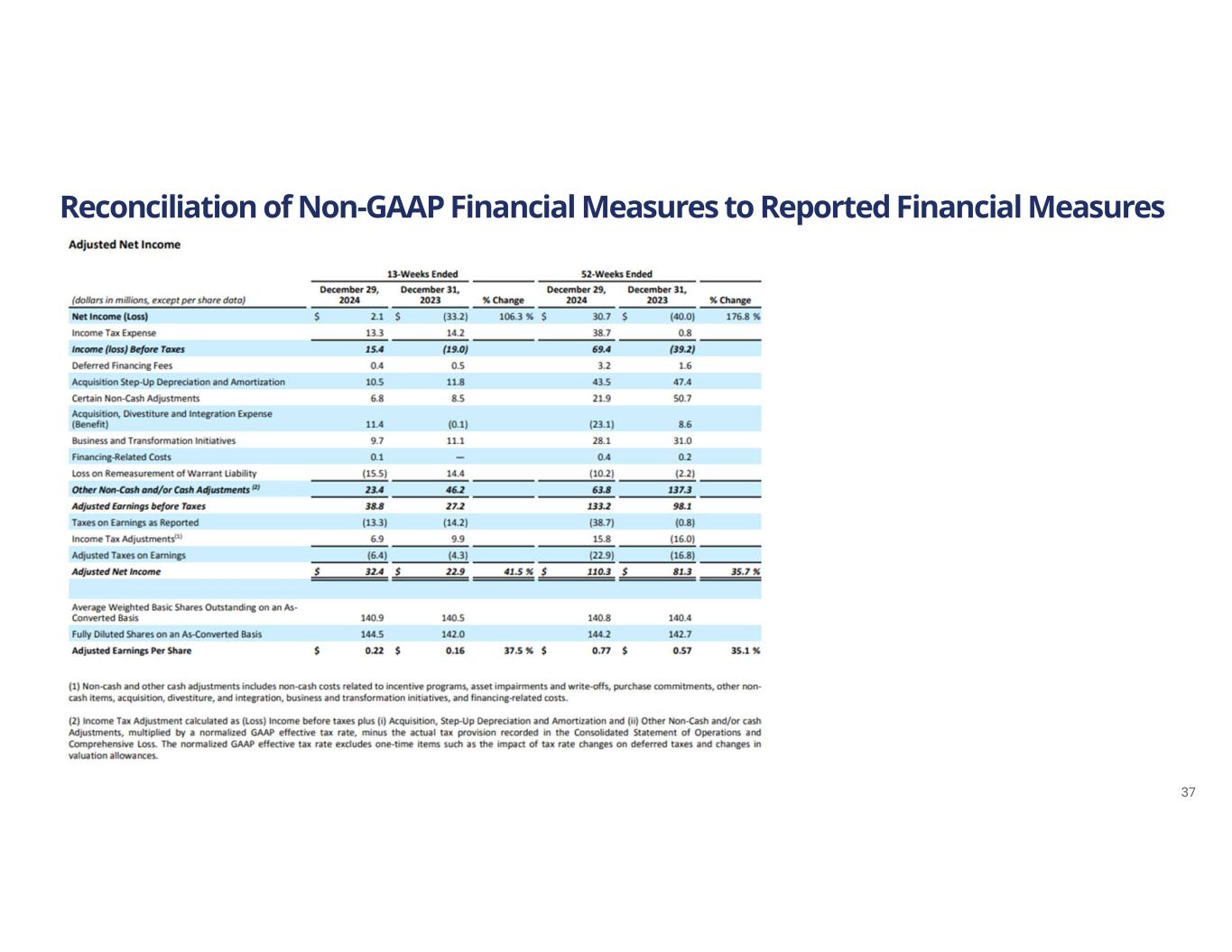

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 37

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures 38