Exhibit (c)(3)

Discussion Materials Strictly Private and Confidential September 7,2020 Citigroup Global Markets Japan | Investment Banking

Exhibit (c)(3)

Discussion Materials Strictly Private and Confidential September 7,2020 Citigroup Global Markets Japan | Investment Banking

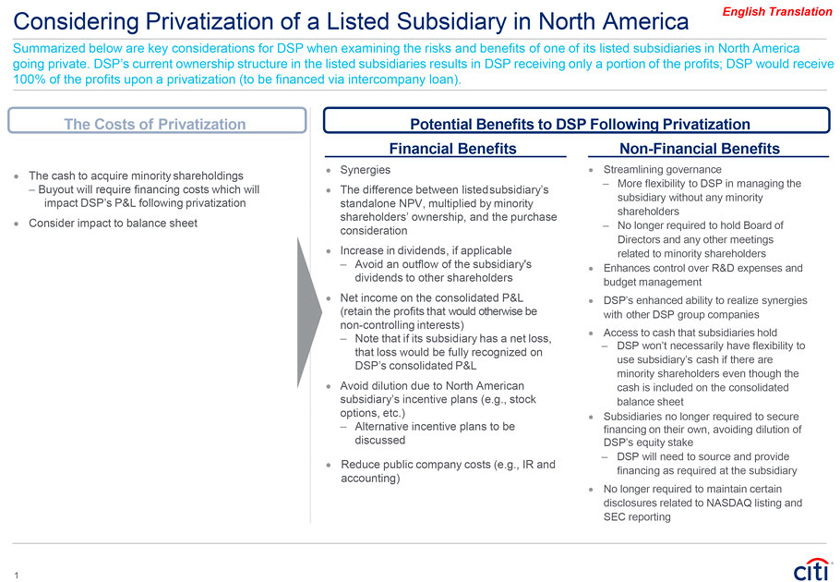

Considering Privatization of a Listed Subsidiary in North America English Translation Summarized below are key considerations for DSP when examining the risks and benefits of one of its listed subsidiaries in North America going private. DSP’s current ownership structure in the listed subsidiaries results in DSP receiving only a portion of the profits; DSP would receive 100% of the profits upon a privatization (to be financed via intercompany loan). The Costs of Privatization ï,· The cash to acquire minority shareholdings – Buyout will require financing costs which will impact DSP’s P&L following privatization ï,· Consider impact to balance sheet Potential Benefits to DSP Following Privatization Financial Benefits ï,· Synergies ï,· The difference between listed subsidiary’s standalone NPV, multiplied by minority shareholders’ ownership, and the purchase considerationï,· Increase in dividends, if applicable – Avoid an outflow of the subsidiary’s dividends to other shareholdersï,· Net income on the consolidated P&L (retain the profits that would otherwise be non-controlling interests) – Note that if its subsidiary has a net loss, that loss would be fully recognized on DSP’s consolidated P&L ï,· Avoid dilution due to North American subsidiary’s incentive plans (e.g., stock options, etc.) – Alternative incentive plans to be discussed ï,· Reduce public company costs (e.g., IR and accounting) Non-Financial Benefits ï,· Streamlining governance – More flexibility to DSP in managing the subsidiary without any minority shareholders – No longer required to hold Board of Directors and any other meetings related to minority shareholdersï,· Enhances control over R&D expenses and budget management ï,· DSP’s enhanced ability to realize synergies with other DSP group companiesï,· Access to cash that subsidiaries hold – DSP won’t necessarily have flexibility to use subsidiary’s cash if there are minority shareholders even though the cash is included on the consolidated balance sheetï,· Subsidiaries no longer required to secure financing on their own, avoiding dilution of DSP’s equity stake – DSP will need to source and provide financing as required at the subsidiaryï,· No longer required to maintain certain disclosures related to NASDAQ listing and SEC reporting

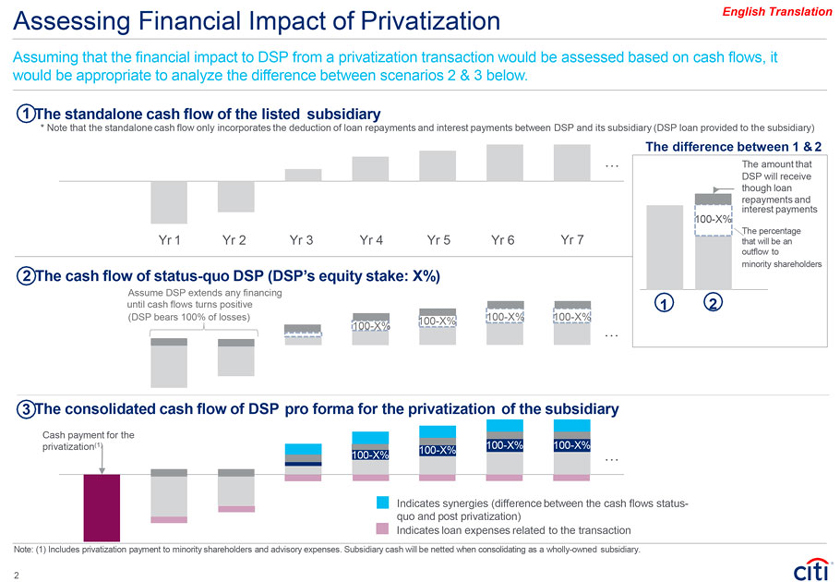

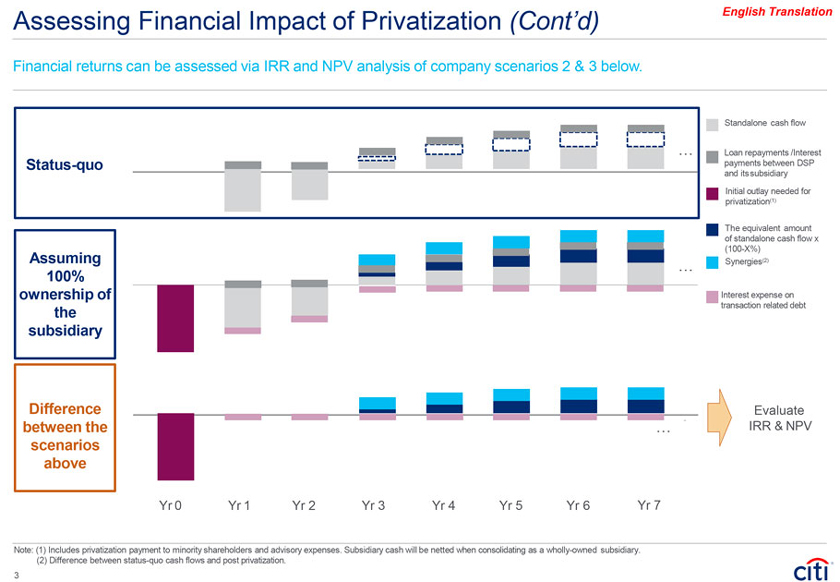

Assessing Financial Impact of Privatization English Translation Assuming that the financial impact to DSP from a privatization transaction would be assessed based on cash flows, it would be appropriate to analyze the difference between scenarios 2 & 3 below. 1 The standalone cash flow of the listed subsidiary * Note that the standalone cash flow only incorporates the deduction of loan repayments and interest payments between DSP and its subsidiary (DSP loan provided to the subsidiary) The difference between 1 & 2 … The amount that DSP will receive though loan repayments and interest payments 100-X% The percentage Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 that will be an outflow to minority shareholders 2 The cash flow of status-quo DSP (DSP’s equity stake: X%) Assume DSP extends any financing until cash flows turns positive 1 2 (DSP bears 100% of losses) 100-X% 100-X% 100-X% 100-X% … 3 The consolidated cash flow of DSP pro forma for the privatization of the subsidiary Cash payment for the privatization(1) 100-X% 100-X% 100-X% 100-X% … Indicates synergies (difference between the cash flows status-quo and post privatization) Indicates loan expenses related to the transaction Note: (1) Includes privatization payment to minority shareholders and advisory expenses. Subsidiary cash will be netted when consolidating as a wholly-owned subsidiary. 2

Assessing Financial Impact of Privatization (Cont’d) English Translation Financial returns can be assessed via IRR and NPV analysis of company scenarios 2 & 3 below. Standalone cash flow … Loan repayments /Interest Status-quo payments between DSP and its subsidiary Initial outlay needed for privatization(1) The equivalent amount of standalone cash flow x (100-X%) Assuming … Synergies(2) 100% ownership of Interest expense on transaction related debt the subsidiary Difference Evaluate between the … IRR & NPV scenarios above Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Note: (1) Includes privatization payment to minority shareholders and advisory expenses. Subsidiary cash will be netted when consolidating as a wholly-owned subsidiary. (2) Difference between status-quo cash flows and post privatization. 3

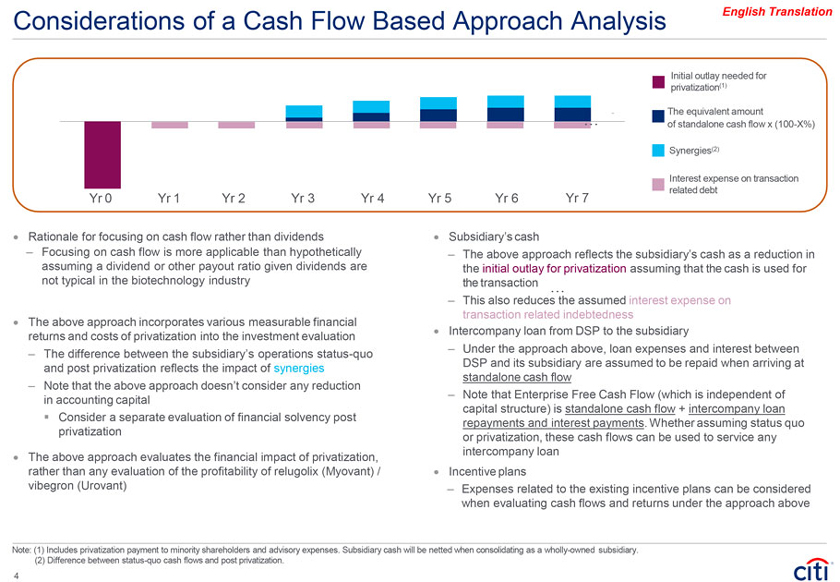

Considerations of a Cash Flow Based Approach Analysis English Translation Initial outlay needed for privatization(1) The equivalent amount … of standalone cash flow x (100-X%) Synergies(2) Interest expense on transaction related debt Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 ï,· Rationale for focusing on cash flow rather than dividends – Focusing on cash flow is more applicable than hypothetically assuming a dividend or other payout ratio given dividends are not typical in the biotechnology industry ï,· The above approach incorporates various measurable financial returns and costs of privatization into the investment evaluation – The difference between the subsidiary’s operations status-quo and post privatization reflects the impact of synergies – Note that the above approach doesn’t consider any reduction in accounting capitalï,§ Consider a separate evaluation of financial solvency post privatization ï,· The above approach evaluates the financial impact of privatization, rather than any evaluation of the profitability of relugolix (Myovant) / vibegron (Urovant) ï,· Subsidiary’s cash – The above approach reflects the subsidiary’s cash as a reduction in the initial outlay for privatization assuming that the cash is used for the transaction … – This also reduces the assumed interest expense on transaction related indebtednessï,· Intercompany loan from DSP to the subsidiary – Under the approach above, loan expenses and interest between DSP and its subsidiary are assumed to be repaid when arriving at standalone cash flow – Note that Enterprise Free Cash Flow (which is independent of capital structure) is standalone cash flow + intercompany loan repayments and interest payments. Whether assuming status quo or privatization, these cash flows can be used to service any intercompany loanï,· Incentive plans – Expenses related to the existing incentive plans can be considered when evaluating cash flows and returns under the approach above Note: (1) Includes privatization payment to minority shareholders and advisory expenses. Subsidiary cash will be netted when consolidating as a wholly-owned subsidiary. (2) Difference between status-quo cash flows and post privatization. 4

IRS Circular 230 Disclosure: Citigroup Inc. and its affiliates do not provide tax or legal advice. Any discussion of tax matters in these materials (i) is not intended or written to be used, and cannot be used or relied upon, by you for the purpose of avoiding any tax penalties and (ii) may have been written in connection with the “promotion or marketing” of any transaction contemplated hereby (“Transaction”). Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor. In any instance where distribution of this communication is subject to the rules of the US Commodity Futures Trading Commission (“CFTC”), this communication constitutes an invitation to consider entering into a derivatives transaction under U.S. CFTC Regulations §§ 1.71 and 23.605, where applicable, but is not a binding offer to buy/sell any financial instrument. Any terms set forth herein are intended for discussion purposes only and are subject to the final terms as set forth in separate definitive written agreements. This presentation is not a commitment to lend, syndicate a financing, underwrite or purchase securities, or commit capital nor does it obligate us to enter into such a commitment, nor are we acting as a fiduciary to you. By accepting this presentation, subject to applicable law or regulation, you agree to keep confidential the information contained herein and the existence of and proposed terms for any Transaction. Prior to entering into any Transaction, you should determine, without reliance upon us or our affiliates, the economic risks and merits (and independently determine that you are able to assume these risks) as well as the legal, tax and accounting characterizations and consequences of any such Transaction. In this regard, by accepting this presentation, you acknowledge that (a) we are not in the business of providing (and you are not relying on us for) legal, tax or accounting advice, (b) there may be legal, tax or accounting risks associated with any Transaction, (c) you should receive (and rely on) separate and qualified legal, tax and accounting advice and (d) you should apprise senior management in your organization as to such legal, tax and accounting advice (and any risks associated with any Transaction) and our disclaimer as to these matters. By acceptance of these materials, you and we hereby agree that from the commencement of discussions with respect to any Transaction, and notwithstanding any other provision in this presentation, we hereby confirm that no participant in any Transaction shall be limited from disclosing the U.S. tax treatment or U.S. tax structure of such Transaction. We are required to obtain, verify and record certain information that identifies each entity that enters into a formal business relationship with us. We will ask for your complete name, street address, and taxpayer ID number. We may also request corporate formation documents, or other forms of identification, to verify information provided. Any prices or levels contained herein are preliminary and indicative only and do not represent bids or offers. These indications are provided solely for your information and consideration, are subject to change at any time without notice and are not intended as a solicitation with respect to the purchase or sale of any instrument. The information contained in this presentation may include results of analyses from a quantitative model which represent potential future events that may or may not be realized, and is not a complete analysis of every material fact representing any product. Any estimates included herein constitute our judgment as of the date hereof and are subject to change without any notice. We and/or our affiliates may make a market in these instruments for our customers and for our own account. Accordingly, we may have a position in any such instrument at any time. Although this material may contain publicly available information about Citi corporate bond research, fixed income strategy or economic and market analysis, Citi policy (i) prohibits employees from offering, directly or indirectly, a favorable or negative research opinion or offering to change an opinion as consideration or inducement for the receipt of business or for compensation; and (ii) prohibits analysts from being compensated for specific recommendations or views contained in research reports. So as to reduce the potential for conflicts of interest, as well as to reduce any appearance of conflicts of interest, Citi has enacted policies and procedures designed to limit communications between its investment banking and research personnel to specifically prescribed circumstances. © 2020 Citigroup Global Markets Inc. Member SIPC. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world. Citi believes that sustainability is good business practice. We work closely with our clients, peer financial institutions, NGOs and other partners to finance solutions to climate change, develop industry standards, reduce our own environmental footprint, and engage with stakeholders to advance shared learning and solutions. Citi’s Sustainable Progress strategy focuses on sustainability performance across three pillars: Environmental Finance; Environmental and Social Risk Management; and Operations and Supply Chain. Our cornerstone initiative is our $100 Billion Environmental Finance Goal – to lend, invest and facilitate $100 billion over 10 years to activities focused on environmental and climate solutions.