PRIVILEGED & CONFIDENTIAL DRAFT SUBJECT TO MATERIAL REVISION DRAFT PREPARED AT THE REQUEST OF COUNSEL

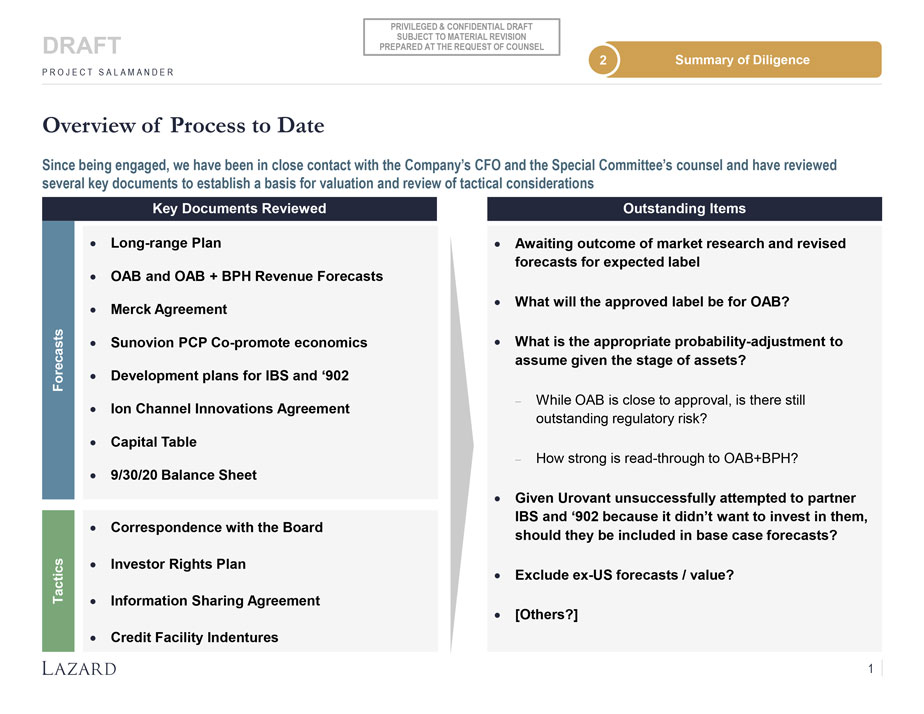

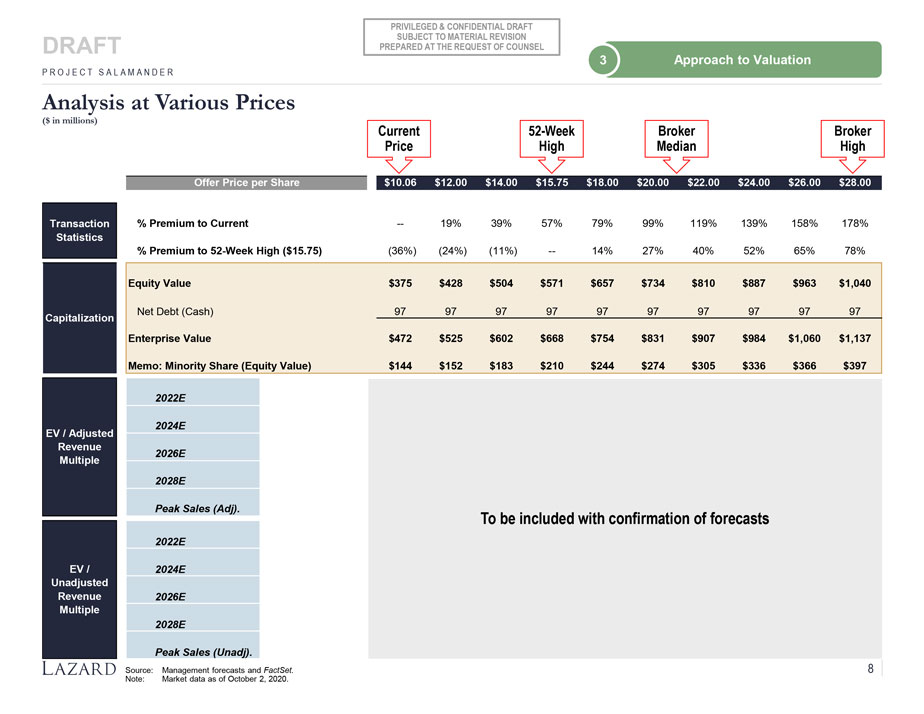

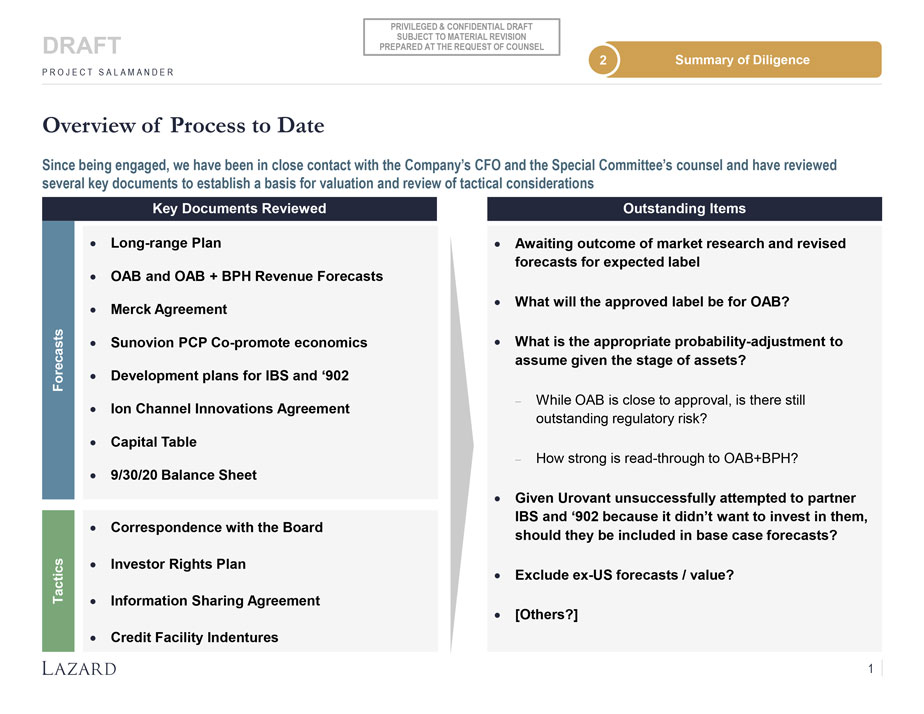

2 Summary of Diligence P R O J E C T S A L A M A N D E R Overview of Process to Date Since being engaged, we have been in close contact with the Company’s CFO and the Special Committee’s counsel and have reviewed several key documents to

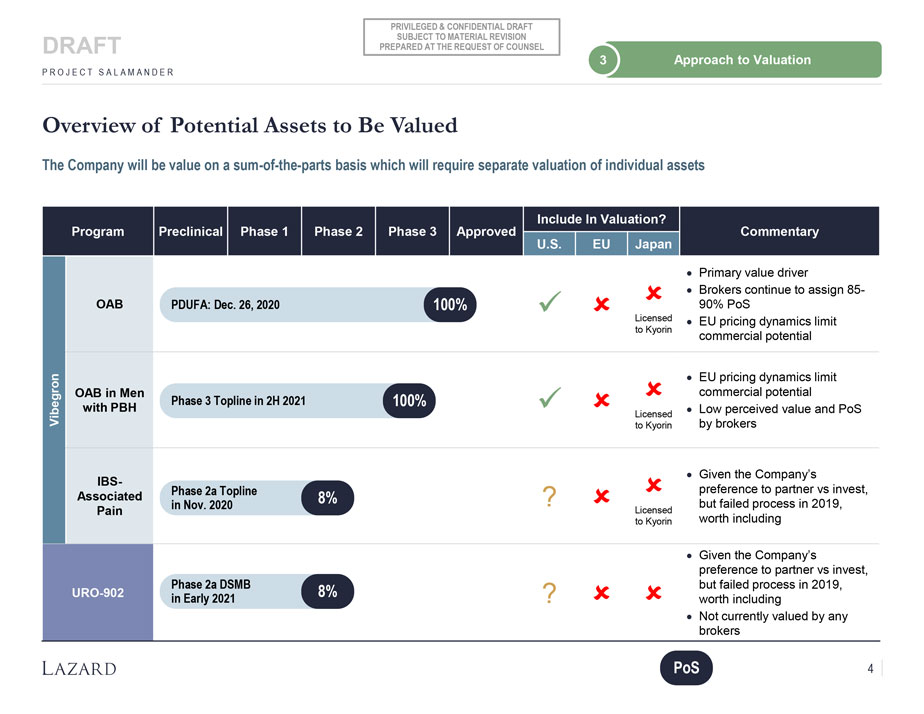

establish a basis for valuation and review of tactical considerations Key Documents Reviewed Outstanding Items ,· Long-range Plan ,· Awaiting outcome of market research and revised forecasts for expected label ,· OAB and OAB +

BPH Revenue Forecasts ,· What will the approved label be for OAB? ,· Merck Agreement ,· Sunovion PCP Co-promote economics ,· What is the appropriate probability-adjustment to assume

given the stage of assets? Forecasts ,· Development plans for IBS and ‘902 While OAB is close to approval, is there still ,· Ion Channel Innovations Agreement outstanding regulatory risk? ,· Capital Table How

strong is read-through to OAB+BPH? ,· 9/30/20 Balance Sheet ,· Given Urovant unsuccessfully attempted to partner IBS and ‘902 because it didn’t want to invest in them, ,· Correspondence with the Board should they be

included in base case forecasts? ,· Investor Rights Plan Tactics ,· Exclude ex-US forecasts / value? ,· Information Sharing Agreement ,· [Others?] ,· Credit Facility

Indentures 1