Please wait

DEF 14AfalseWALT DISNEY CO/0001744489iso4217:USD00017444892024-09-292025-09-270001744489dis:MrIgerMember2024-09-292025-09-270001744489dis:MrChapekMember2024-09-292025-09-270001744489dis:MrIgerMember2023-10-012024-09-280001744489dis:MrChapekMember2023-10-012024-09-2800017444892023-10-012024-09-280001744489dis:MrIgerMember2022-10-022023-09-300001744489dis:MrChapekMember2022-10-022023-09-3000017444892022-10-022023-09-300001744489dis:MrIgerMember2021-10-032022-10-010001744489dis:MrChapekMember2021-10-032022-10-0100017444892021-10-032022-10-010001744489dis:MrIgerMember2020-10-042021-10-020001744489dis:MrChapekMember2020-10-042021-10-0200017444892020-10-042021-10-020001744489dis:MrIgerMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMember2024-09-292025-09-270001744489dis:MrIgerMemberecd:AggtPnsnAdjsSvcCstMember2024-09-292025-09-270001744489ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-09-292025-09-270001744489ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-09-292025-09-27000174448912024-09-292025-09-27000174448922024-09-292025-09-27000174448932024-09-292025-09-27000174448942024-09-292025-09-27000174448952024-09-292025-09-27000174448962024-09-292025-09-27

F

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| | | | | | | | |

| | |

| | |

| 2026 | |

| | |

| | |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT | |

| | |

| | | | | |

Letter from Our Chairman | January 22, 2026 |

Dear Fellow Shareholders,

The Walt Disney Company delivered strong financial results for fiscal 2025, with meaningful accomplishments across each of the Company’s business segments, supported by our world-class brands and creative assets. Throughout the year, the Board continued its high priority work of management succession planning and oversight of strategy.

The Board and management team value ongoing dialogue with our shareholders to understand their priorities and perspectives. We continued our robust shareholder engagement during calendar year 2025, discussing a broad range of topics including management succession, Board composition and oversight and executive compensation. We intend to continue to engage with shareholders through formal outreach efforts in the year ahead.

Management succession planning remains a top priority for the Board, reflecting its importance to business continuity and long-term shareholder value. Oversight of the process is led by our dedicated Succession Planning Committee, and all directors have actively participated in a rigorous and ongoing evaluation of potential successor candidates, including direct engagement, performance assessment and consideration of leadership capabilities aligned with the Company’s long-term strategy. The appointment of the next CEO will be determined by the full Board, and we currently expect to announce the appointment of the Company’s next CEO in early 2026.

Our Board's representation of backgrounds and skill sets strongly aligns with Disney's long-term strategy, key risks and opportunities. To support the Board’s effective, independent oversight, we have evolved our Board’s membership and leadership to bring new perspectives to the table. This includes the appointment of a new Compensation Committee Chair and independent Chairman in fiscal 2025, and the nomination of a new director to stand for election at the annual meeting.

The Compensation Committee has remained focused on the thoughtful design and disciplined implementation of an executive compensation program that promotes sustained performance, reinforces executive accountability and supports the Company’s long-term strategic objectives. In fiscal 2025, the Committee introduced targeted enhancements to the program intended to further strengthen the link between compensation and performance and more directly align executive incentives with shareholder interests. These changes were designed to appropriately reward executives for delivering measurable results and advancing the Company’s strategic and financial goals.

On behalf of the full Board, I want to express our sincere appreciation for your continued trust in and support of The Walt Disney Company. We remain committed to delivering sustainable growth, strong governance and long-term value for all shareholders.

Sincerely,

James P. Gorman

Chairman of the Board

| | | | | |

Letter from Our CEO | January 22, 2026 |

Dear Fellow Shareholders,

Fiscal 2025 was a year of great progress for The Walt Disney Company as we advanced our strategic priorities and charted a path for the future. We continued our focus on delivering the very best in entertainment for consumers and creating value for shareholders. Throughout the year, our results reflected the strength and global appeal of our Entertainment, Sports and Experiences businesses, as well as the tremendous talent and dedication of our people across the company. During the fiscal year:

•We elevated our creative output, with content reflecting our commitment to quality and world-class storytelling. Over the past two years, the Company delivered six hit franchise films that each generated more than $1 billion at the global box office. Over this same period, no other Hollywood studio achieved even one release surpassing the $1 billion mark. For calendar 2025, this included our release of three films that each exceeded the $1 billion milestone and contributed to total global box office receipts for the Company of more than $6.5 billion — the biggest box office year for any studio since 2019. Our theatrical successes demonstrate the cross-generational appeal of Disney’s storytelling and IP worldwide, reinforcing our optimism in our creative direction. Looking ahead, we are excited about our upcoming film slate, including numerous highly anticipated titles such as The Devil Wears Prada 2, The Mandalorian and Grogu, Toy Story 5, live action Moana and Avengers: Doomsday.

•We increased the profitability of our streaming business. In fiscal 2025, our Entertainment DTC business generated $1.3 billion in operating income, representing a remarkable improvement of nearly $5 billion in just three years. Looking ahead, we are focused on delivering strong growth as we continue to enhance our product with an ongoing pipeline of high-quality content; integrating Disney+ and Hulu into a unified one-app experience—an offering no other company can match and one that enhances convenience, personalization and long-term subscriber value; expanding our international reach by strategically investing in local content; and improving the user experience through greater personalization, advanced recommendation engines and more intuitive navigation.

•We continued ESPN’s evolution as the preeminent digital sports platform. This past year, we ushered in a new era for sports fans with the launch of ESPN’s full direct-to-consumer service and enhanced ESPN app, making ESPN’s complete suite of networks and services available directly to consumers for the first time. This brings our deep portfolio of sports properties to an ever-broader array of audiences, reinforcing ESPN’s strong position as a leader in sports and fulfilling our mission to serve sports fans anytime, anywhere.

•We advanced our ambitious investment plans across our Experiences segment. We have more expansion projects underway at each of our theme parks globally than ever before, including the largest expansion ever of Magic Kingdom at Walt Disney World, as well as five additional cruise ships scheduled for launch beyond fiscal 2026 and a new theme park planned for development in Abu Dhabi. These strategic investments will strengthen our best-in-class experiential offerings and fuel our ability to continue appealing to new and global audiences.

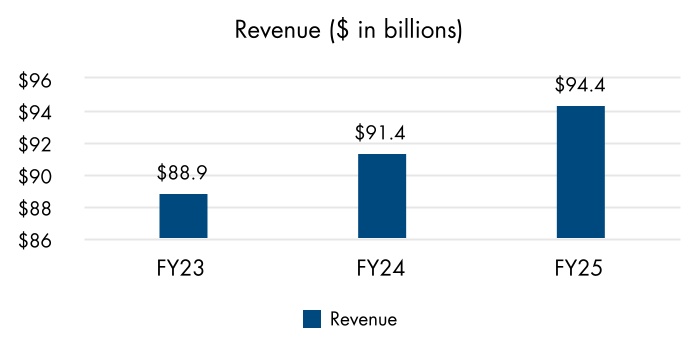

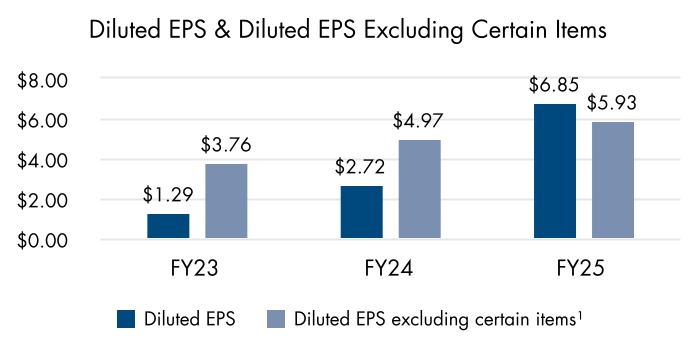

Our achievements reflect the work we have done to successfully navigate a period of intense industry disruption, further establish a strong foundation for growth and solidify our businesses for the future. Strategic success across these initiatives drove financial results in fiscal 2025, leading to Diluted EPS growth of 152% and Adjusted EPS growth of 19% compared to the prior year. We also delivered meaningful growth in shareholder returns, including a 50% increase in our dividend to $1.50 and a 100% increase in our target share repurchase in fiscal 2026. Looking forward, we are confident in our ability to leverage our unrivaled portfolio of beloved brands and franchises and deepen engagement with our global fan base.

As I reflect on all that we’ve accomplished, both in fiscal 2025 and since I returned to the company in 2022, I am inspired and energized by the opportunities before us. Through our strategic vision and unmatched collection of businesses, we continue to tell great stories that are reaching more people, in more places, in more ways than ever before. I am grateful to our leadership team for their dedication and vision during this transformative period, and I’m grateful to you, our shareholders, for your continued support of this remarkable company.

Sincerely,

Robert A. Iger

Chief Executive Officer

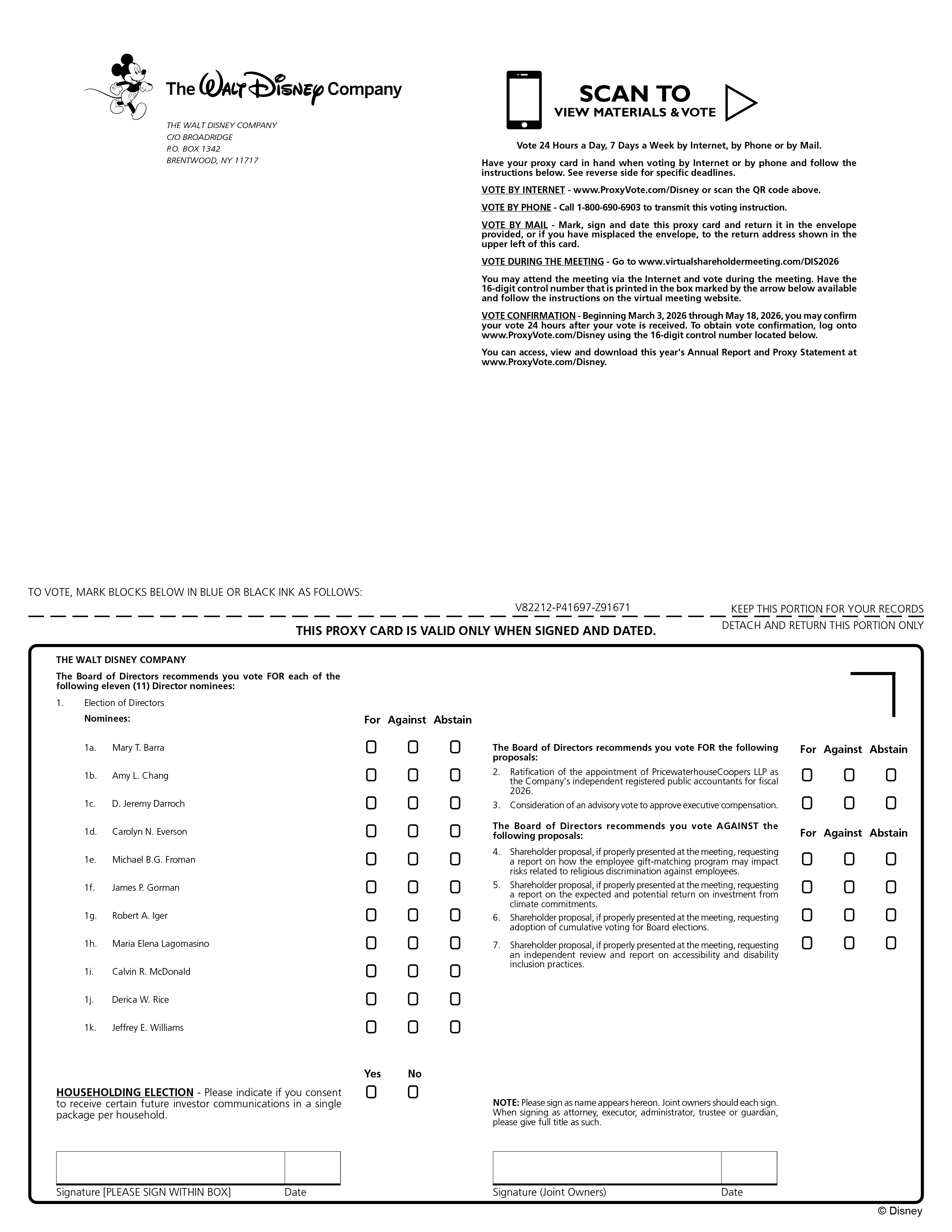

Notice of 2026 Annual Meeting

The 2026 Annual Meeting of Shareholders of The Walt Disney Company will be held virtually at

www.virtualshareholdermeeting.com/DIS2026 (please see “Attendance at the Meeting” below.)

Meeting Details

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| DATE | | | | TIME | | | | PLACE | | | | WHO CAN VOTE | |

| Wednesday, March 18, 2026 | | | | 10:00 AM PT | | | | Virtually at www.virtualshareholdermeeting.com/DIS2026 | | | | Shareholders of record at the close of business on January 20, 2026 | |

| | | | | | | | | | | | | | |

Items of Business

| | | | | | | | |

| Voting Items | Voting Recommendation |

| | |

| 1 | Election of the eleven (11) Director nominees named in the proxy statement, each for a term of one year. | FOR EACH NOMINEE |

| 2 | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants for fiscal 2026. | FOR |

| 3 | Consideration of an advisory vote to approve executive compensation. | FOR |

4-7 | Shareholder proposals, if properly presented at the meeting. | AGAINST EACH PROPOSAL |

Shareholders of record of The Walt Disney Company common stock (NYSE: DIS) at the close of business on January 20, 2026, are entitled to vote at the meeting and any postponements or adjournments of the meeting. A list of these shareholders is available during ordinary business hours at the offices of the Company in Burbank, California.

| | | | | | | | | | | |

Jolene E. Negre Deputy General Counsel – Securities Regulation, Governance & Secretary January 22, 2026 | Burbank, California | | | Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on March 18, 2026. The proxy statement and annual report to shareholders and the means to vote by Internet are available at www.ProxyVote.com/Disney. |

Attendance at the Meeting

To attend the virtual annual meeting, you must be a shareholder on the record date and have previously registered to attend the meeting. Register to attend the virtual meeting on or before 10:00 AM PT on March 17, 2026 by visiting www.ProxyVote.com/Disney and selecting ”Attend a Meeting” after you enter the 16-digit control number found on your proxy card, voting instruction form or notice. You will receive a confirmation email with information on how to attend the meeting. After you have registered, you will be able to participate in the annual meeting by visiting www.virtualshareholdermeeting.com/DIS2026 and entering the same 16-digit control number you used to pre-register. Beneficial shareholders should follow the instructions provided on the voting instruction form, email or Notice of Internet Availability provided by your broker, bank or other nominee.

Participation in the meeting is limited due to the capacity of the host platform and access to the meeting will be accepted on a first-come, first-served basis once electronic entry begins. Electronic entry to the meeting will begin at 9:00 AM PT and the meeting will begin promptly at 10:00 AM PT. If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/DIS2026. If you cannot attend the meeting or if you are not a shareholder of record, you can still listen to the meeting, which will be live-streamed on our Investor Relations website.

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding expectations, beliefs, business plans, changes to the Board of Directors, succession, governance and other statements that are not historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not undertake any obligation to update these statements unless required by applicable laws or regulations and you should not place undue reliance on forward-looking statements.

Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and IP we invest in, our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, as well as from developments beyond the Company’s control, including: the occurrence of subsequent events; deterioration in domestic and global economic conditions or failure of conditions to improve as anticipated; deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising revenue; consumer preferences and acceptance of our content, offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising sales on our direct-to-consumer (“DTC”) services and linear networks; health concerns and their impact on our businesses and productions; international, including tariffs and other trade policies, political or military developments; regulatory and legal developments; technological developments; labor markets and activities, including work stoppages; adverse weather conditions or natural disasters; and availability of content. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our operations, business plans or profitability, including DTC profitability; demand for our products and services; the performance of the Company’s content; our ability to create or obtain desirable content at or under the value we assign the content; the advertising market for programming; taxation; and performance of some or all Company businesses either directly or through their impact on those who distribute our products.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended September 27, 2025, under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” and subsequent filings with the Securities and Exchange Commission (the “SEC”), including, among others, Quarterly Reports on Form 10-Q.

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Changes to Employment Contracts | |

The Walt Disney Company (500 South Buena Vista Street, Burbank, California 91521) is providing you with this proxy statement relating to its 2026 Annual Meeting of Shareholders (the “Annual Meeting”). The Company expects to commence mailing of its proxy materials to shareholders on or about January 22, 2026. References to the “Company,” “Disney,” “we,” “us” or “our” in this proxy statement refer collectively to The Walt Disney Company and the subsidiaries through which our various businesses are actually conducted. The Company’s website and social media feeds and the information contained or linked therein or otherwise connected thereto are not part of or incorporated by reference into this proxy statement, regardless of any reference to such website or social media feeds in this proxy statement.

Proxy Summary

This summary highlights certain information in this proxy statement. As it is only a summary, please review the complete proxy statement and fiscal 2025 annual report before you vote.

Voting Items

| | | | | | | | | | | |

| Company Proposals | Board Recommendation | Page Reference |

| | | |

| Proposal 1 | Election of the eleven (11) Director nominees named in the proxy statement, each for a term of one year. | FOR EACH NOMINEE | |

| Proposal 2 | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants for fiscal 2026. | FOR | |

| Proposal 3 | Consideration of an advisory vote to approve executive compensation. | FOR | |

| | | | | | | | | | | |

| Shareholder Proposals | Board Recommendation | Page Reference |

| | | |

Proposals 4 – 7 | Shareholder proposals, if properly presented at the meeting. | AGAINST EACH PROPOSAL | |

Ways to Vote

YOUR VOTE IS IMPORTANT

Please vote as promptly as possible by using any of the following methods, as applicable:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| INTERNET | | | | SCAN | | | | PHONE | | | | MAIL | |

| Locate the 16-digit control number included in your proxy card, voting instruction form or notice in order to access the website indicated. | | | | Your proxy card, voting instruction form or notice may also include a QR code for voting by your mobile phone. | | | | You may submit your proxy by touch-tone telephone by dialing the number indicated on your proxy card or voting instruction form. You will need the 16-digit control number shown on your proxy card or voting instruction form. | | | | Mark, sign and date your proxy card or voting instruction form and return it in the postage-paid envelope provided. | |

| | | | | | | | | | | | | | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 1 |

Fiscal 2025 Overview

This past fiscal year was another year of great progress, as we strengthened the Company by leveraging the value of our creative and brand assets to deliver the very best in entertainment to consumers and continued to make meaningful progress across our strategic priorities to create value for our shareholders. Our efforts resulted in strong earnings growth for the Company, furthering the consistent growth our businesses have delivered over the past several fiscal years. And our portfolio of complementary businesses have each achieved significant operational milestones as we continue to execute against our key strategic pillars. Overall, this was another strong fiscal year for the Company, and we believe our efforts position us well for the future.

Financial Highlights

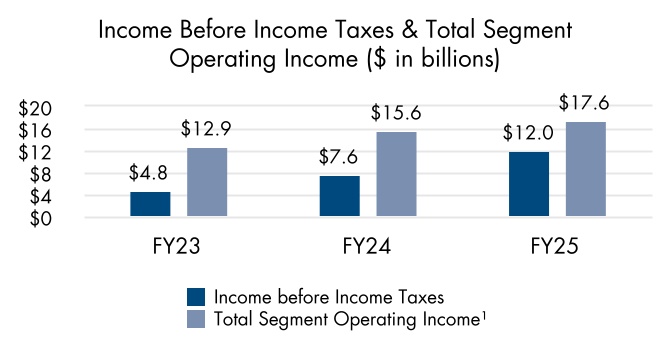

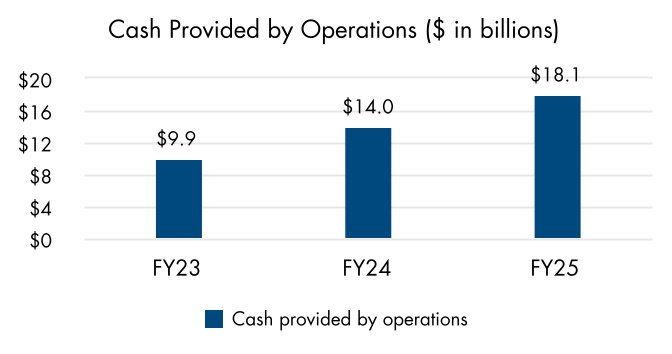

1Diluted earnings per share (“EPS”) excluding certain items (also referred to as adjusted EPS) and total segment operating income are non-GAAP financial measures. The most comparable GAAP measures are diluted EPS and income before income taxes, respectively. See Annex A beginning on page A-1 for how we define and calculate these measures and a quantitative reconciliation thereof to the most directly comparable GAAP measures. Business Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Entertainment | | | Sports | | | Experiences | |

| | | | | | | | |

| •Announced plans for Domestic Disney+ and Hulu unification, and completed rollout of Hulu as our global general entertainment brand in October 2025 •Second straight fiscal year with two films, Lilo & Stitch and Moana 2, delivering $1B+ in global box office | | | •Launched the ESPN tile on Disney+ in December 2024, further differentiating Disney’s comprehensive DTC offerings and laying the groundwork for ESPN Unlimited to be available within our DTC bundle •In August 2025, launched ESPN Unlimited, offering all networks and services direct-to-consumer for the first time, and a significantly enhanced ESPN app experience with new interactive and personalized features and functions | | | •Expansion at every Disney theme park globally, including the announcement of plans for an all-new Disney theme park coming to Abu Dhabi •Continued progress to double our cruise ship fleet by 2031 with the launch of the Disney Treasure in FY25 and two new ships expected to set sail in FY26 | |

| | | | | | | | |

| | | | | |

2 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

Board of Directors Highlights

Director Nominees

The Board of Directors of The Walt Disney Company (the ‘‘Board’’) has nominated a slate composed of eleven talented Director nominees with skill sets, experiences and professional backgrounds representing a range of perspectives and characteristics that are particularly relevant to Disney’s business and strategic objectives, as reflected in their biographies in the section titled “Corporate Governance and Board Matters — The Board of Directors — Director Nominees.”

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | BOARD STANDING COMMITTEES | |

| | | | | |

| | | | | | | |

| | | | | | | |

| NAME | PRIMARY OCCUPATION | AGE | DIRECTOR SINCE | AUDIT | GOVERNANCE & NOMINATING | COMPENSATION | EXECUTIVE |

| | | | | | | |

| Mary T. Barra | Chair and Chief Executive Officer, General Motors Company | 64 | 2017 | | | | |

| Amy L. Chang | Former Executive Vice President, Cisco Systems, Inc. | 49 | 2021 | | l | | |

D. Jeremy Darroch | Former Executive Chairman and Group Chief Executive Officer, Sky | 63 | 2024 | l | | | |

| Carolyn N. Everson | Former President, Instacart | 54 | 2022 | | | l | |

| Michael B.G. Froman | President, Council on Foreign Relations | 63 | 2018 | | | | |

James P. Gorman | Chairman Emeritus, Morgan Stanley | 67 | 2024 | | | | |

Robert A. Iger | Chief Executive Officer, The Walt Disney Company | 74 | 20001 | | | | l |

| Maria Elena Lagomasino | Chief Executive Officer and Managing Partner, WE Family Offices | 76 | 2015 | | l | l | |

| Calvin R. McDonald | Chief Executive Officer, lululemon athletica inc.2 | 54 | 2021 | l | | | |

| Derica W. Rice | Former Executive Vice President, CVS Health Corporation | 60 | 2019 | | | | |

Jeffrey E. Williams | Former Chief Operating Officer, Apple Inc. | 62 | —3 | | | | |

Chair l Member

Chair l Member1Departed Board in 2021 and rejoined in 2022

2Mr. McDonald has stepped down from his position as Chief Executive Officer of lululemon athletica inc., effective January 31, 2026.

3Mr. Williams is nominated for election to the Board at the Annual Meeting for the first time. If elected, Mr. Williams is anticipated to replace Ms. Lagomasino as a member of the Compensation Committee following the Annual Meeting.

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 3 |

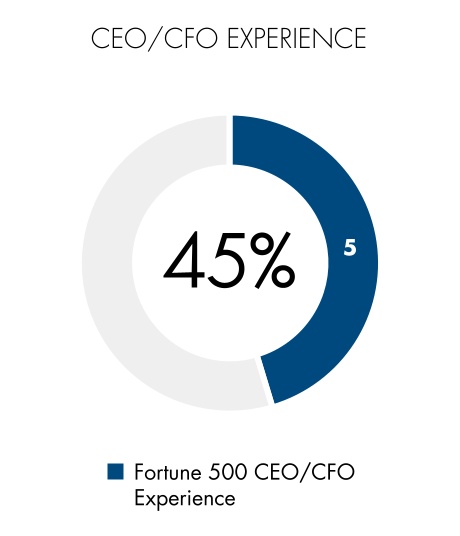

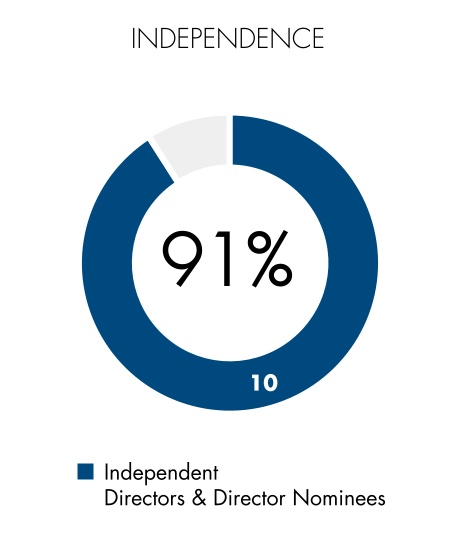

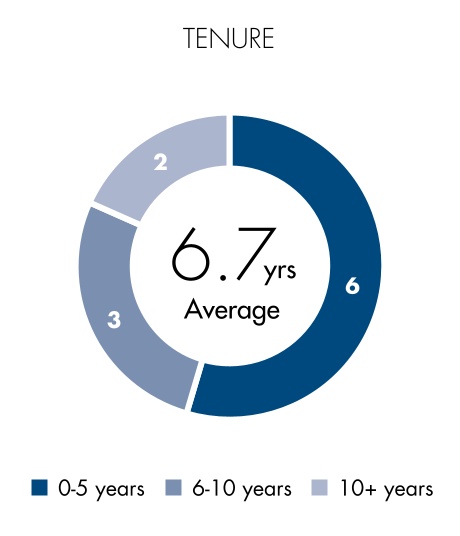

Board and Director Nominee Statistics

Out of our eleven Director nominees, four are women and three are from underrepresented racial/ethnic groups.

Four out of our ten non-management Director nominees have a tenure of less than 4 years, and the average tenure of our non-management Director nominees is 4.9 years.

Thoughtful Board Refreshment

The Board has nominated Jeffrey E. Williams for election to the Board as a new Director, effective at the Annual Meeting. This nomination reflects the Board’s commitment to refreshment and is the result of the diligent process led by the Governance and Nominating Committee as described below. Mr. Williams has extensive leadership experience overseeing worldwide operations for all products for Apple Inc., a preeminent technology company, and engineering for the Apple Watch and other health-related technologies, integrating hardware, software and services to deliver cohesive user experiences and drive innovation. The Board believes Mr. Williams’ experience in technology, consumer products and experiential design align closely with our entertainment, media and guest experience businesses and make him uniquely qualified to support the Board’s ongoing efforts to drive profitable growth and shareholder value creation. For additional information on the Board’s process for identifying and evaluating prospective Director nominees, see the section titled “Corporate Governance and Board Matters — Director Selection Process and Board Evaluation.”

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | JEFFREY E. WILLIAMS _______________ FORMER CHIEF OPERATING OFFICER, APPLE INC. | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •Brand stewardship •DTC expertise •Global business operations •Strategic transformation •Technology and innovation | |

| | | | | | | | |

| | | | | |

4 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

The Board’s thorough refreshment process is designed to identify and advance the best candidates that would be additive as individual directors and to supplement Disney’s collective Board composition. In addition to considering the experience and skill sets candidates would bring to the Board and the impact to overall composition, the Board also evaluates candidates’ personal qualities to assess ability to both engage constructively with and appropriately challenge management and other Board members. Below is a summary depiction of the key actions that support this iterative process.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Evaluate Board Composition The Governance and Nominating Committee develops criteria for Board positions, taking into account the needs of the Board and Company, as well as to maintain a regular refreshment of Board positions supporting value creation | | | | Governance Checks A final candidate completes the Company’s standard director questionnaire and the Company reviews with the Governance and Nominating Committee conflict of interest, related party transaction and independence considerations, as applicable | |

| | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Assess Potential Candidates In evaluating potential candidates, the Board seeks to encompass a broad range of talents, experiences, perspectives, skills and expertise sufficient to provide sound and prudent guidance with respect to all of the Company’s operations and interests and reflecting the Company’s shareholders, employees, customers, guests and communities | | | | Ongoing Governance and Nominating Committee Deliberation Throughout, the Committee stays closely coordinated on in-process candidates, including through ongoing conversations on the status and strength of candidates as potential new Board members. After completing final evaluations and any interviews, the Committee makes a recommendation to the full Board, which ultimately determines whether to nominate or appoint a new Director after considering the Committee’s report | |

| | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Meet with Qualified Candidates Members of the Governance and Nominating Committee, the Chairman of the Board and members of management meet with certain prospective candidates to assess the skills and perspectives the prospective director would bring to the Board, including both substantive experience and ability to provide meaningful oversight of management | | | | Director Orientation and Ongoing Development The Board provides new Directors with appropriate orientation programs, including multiple meetings with management, to familiarize them with the full scope of Disney’s businesses and key challenges and support ongoing development of key skills | |

| | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| RESULTS: SIGNIFICANT BOARD REFRESHMENT TO DATE 10 non-management Board and Director nominee changes since 2021 | |

| | | | | | | |

| 6 NEW NON-MANAGEMENT DIRECTORS AND DIRECTOR NOMINEES SINCE JUNE 2021 | | | | | 4 NON-MANAGEMENT DIRECTOR EXITS SINCE 2021 | |

| | | | | | | |

| | | | | | | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 5 |

Board Oversight

The Board, as a whole and through its committees, takes an active role in overseeing business strategy and risk management. In direct response to shareholder feedback, the Board has updated several aspects of its risk oversight. For more information regarding these matters, see the sections below titled “— Shareholder Engagement — Key Investor Engagement Themes and Overview of Recent Actions” and “Corporate Governance and Board Matters — The Board’s Role in Risk Oversight.” The Board specifically delegated oversight of certain risks to its committees:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| AUDIT COMMITTEE | | | | The Audit Committee Reviews the Company’s policies and practices with respect to risk assessment and risk management generally and oversees cybersecurity and data security risks and mitigation strategies. | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| GOVERNANCE AND NOMINATING COMMITTEE | | | | The Governance and Nominating Committee Oversees the Company’s lobbying and political strategy; human rights policies, including receiving an annual report on human rights-related risks, which has included risks associated with artificial intelligence; and sustainability and social impact programs and reporting, including with respect to environmental and sustainability policies and initiatives regarding climate change risks. | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| COMPENSATION COMMITTEE | | | | The Compensation Committee Oversees the Company’s strategies and programs related to senior leadership succession planning (other than those specifically delegated to the Succession Planning Committee); talent development and workforce equity matters; and risks associated with the Company’s compensation policies and practices. | |

| | | | | | |

| | | | | |

6 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

Shareholder Engagement

Below is an overview of the Company’s shareholder engagement program.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Commitment to Investor Engagement | | | Contacted 100+ firms INCLUDING OVER 95% OF OUR 25 LARGEST INSTITUTIONAL SHAREHOLDERS IN CALENDAR YEAR 2025 | | | | CONVERSATIONS LED, AS APPROPRIATE, BY INDEPENDENT MEMBERS OF THE BOARD, SECRETARY AND INVESTOR RELATIONS TEAM | |

| | | | | | |

| | | | | | | | | |

During fiscal 2025, including following the 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”), Board leadership continued their active engagement with shareholders. Our Investor Relations team and Secretary, together with members of the Board, held two formal rounds of engagement sessions in the winter and again in the fall with our largest shareholders to discuss the Company’s perspective on various topics important to our shareholders, including succession planning, compensation, governance and disclosure, and to provide an opportunity to respond to investor questions. These conversations help inform the Board’s thinking, and we intend to continue our robust and consistent approach to shareholder engagement in 2026.

In addition to these formal engagement conversations, members of our executive management team and our Investor Relations team interacted regularly throughout the 2025 calendar year with a broad subset of our investor base.

As part of our ongoing investor engagement, our Investor Relations team and Secretary engaged with certain shareholders that submitted a shareholder proposal for consideration at the Annual Meeting to discuss the related proposal, and the Governance and Nominating Committee evaluated each proposal. Topics relevant to shareholder proposals that we receive are also discussed as part of our outreach and engagement with a broad subset of our investor base. For more information regarding these matters, see “Items to Be Voted On — Shareholder Proposals.”

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 7 |

Key Investor Engagement Themes and Overview of Recent Actions

We have taken numerous actions to address matters important to our shareholders. Below we identify key themes recently addressed with our shareholders and highlight related actions the Company has taken. More detail on actions the Compensation Committee has taken regarding compensation can be found in the section titled “Executive Compensation — Compensation Discussion and Analysis.”

| | | | | | | | |

KEY THEMES | OVERVIEW | ACTIONS |

| | |

| | |

Board and Executive Oversight | Enhanced succession planning process and disclosure | •A special Succession Planning Committee formed in January 2023 •James Gorman appointed to the Succession Planning Committee in February 2024, and named Chair of the Succession Planning Committee in August 2024 •Enhanced disclosure of management succession in the 2024 proxy statement, including detailed update of the Succession Planning Committee’s progress in August 2024 •Included the expected announcement timeline of a new CEO — in early 2026 — and further expanded disclosure of succession planning in the 2025 proxy statement (see also the section titled “Corporate Governance and Board Matters — Management Succession Planning”) |

| |

| |

Increased Board experience in media and entertainment | •Since 2022, appointed two veteran media executives as independent Directors: Jeremy Darroch and Carolyn Everson |

| |

| |

Expanded Board oversight of certain focal areas | •The Compensation Committee’s oversight of risks associated with the Company’s compensation policies and practices memorialized in the Compensation Committee Charter, including expansion of the Compensation Committee’s oversight of workforce equity matters •Oversight of the Company’s strategies and programs related to senior leadership succession planning and talent development delegated to the Compensation Committee, except as specifically delegated to the Succession Planning Committee, with related reports to the Board at least annually •Oversight of lobbying and political strategy; human rights policies; and sustainability and social impact programs and reporting delegated to the Governance and Nominating Committee, with related reports to the Board at least annually |

| |

| |

Enhanced artificial intelligence oversight disclosure | •Enhanced Director Skills and Experience Matrix to include artificial intelligence oversight •Enhanced disclosure of artificial intelligence oversight by the Board and its Committees (see also the section titled “Corporate Governance and Board Matters — The Board’s Role in Risk Oversight”) |

| | |

| | |

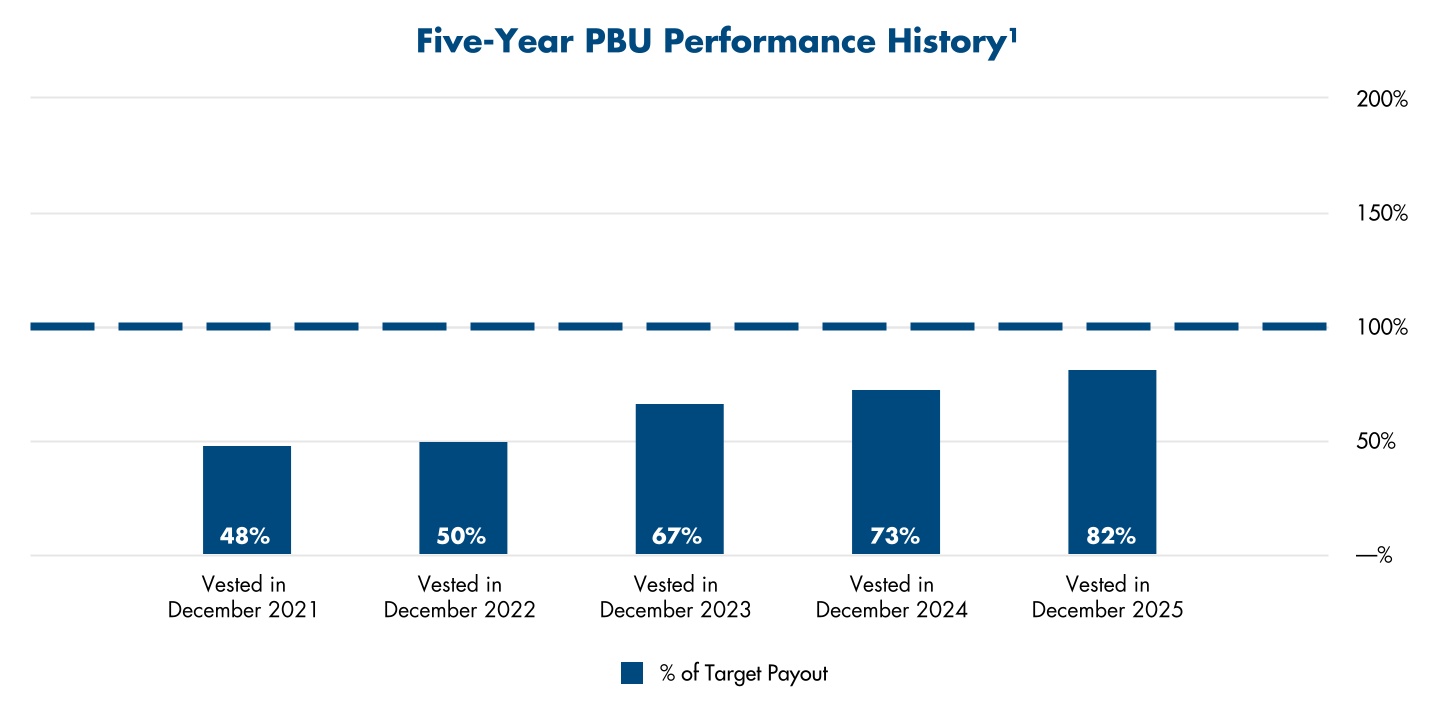

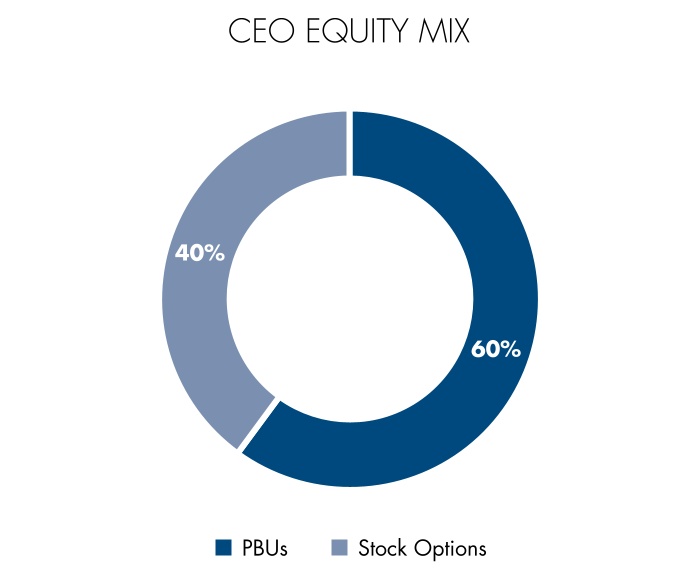

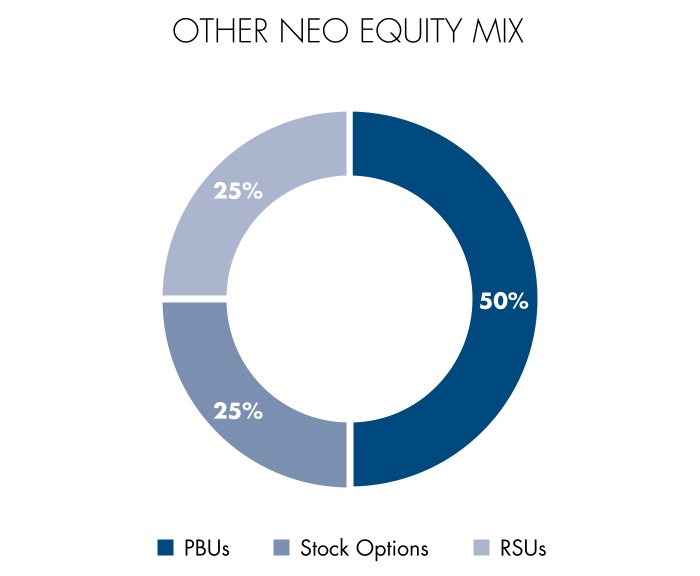

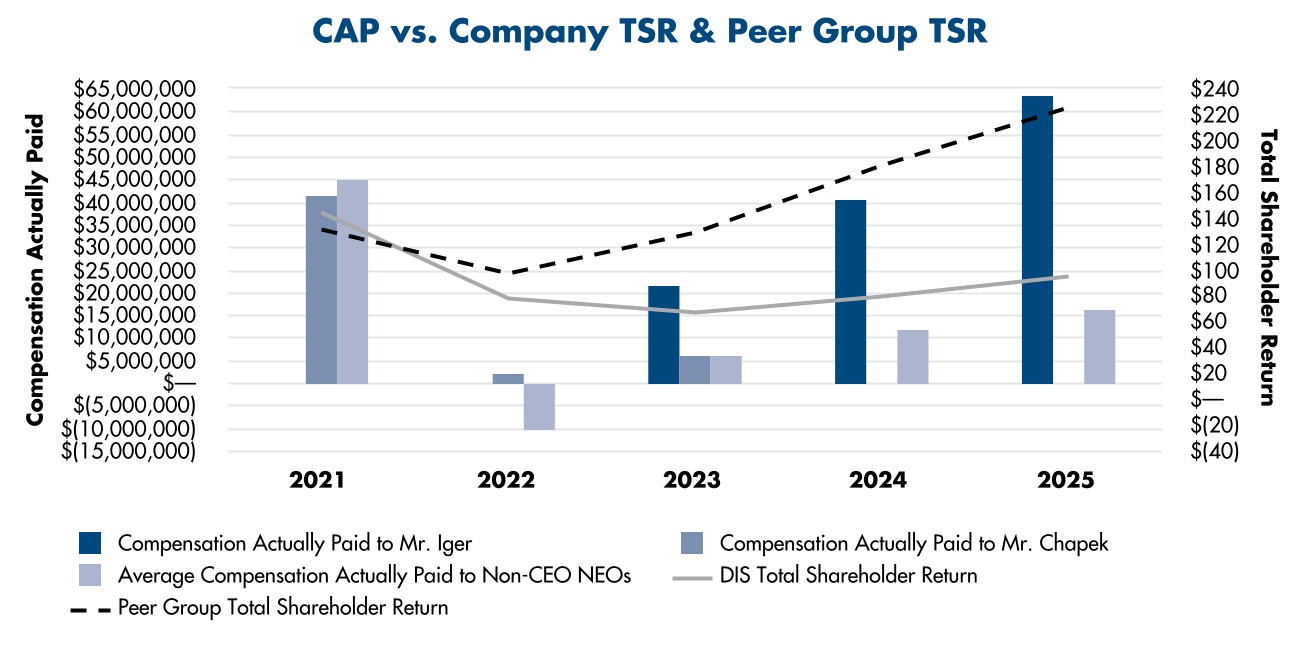

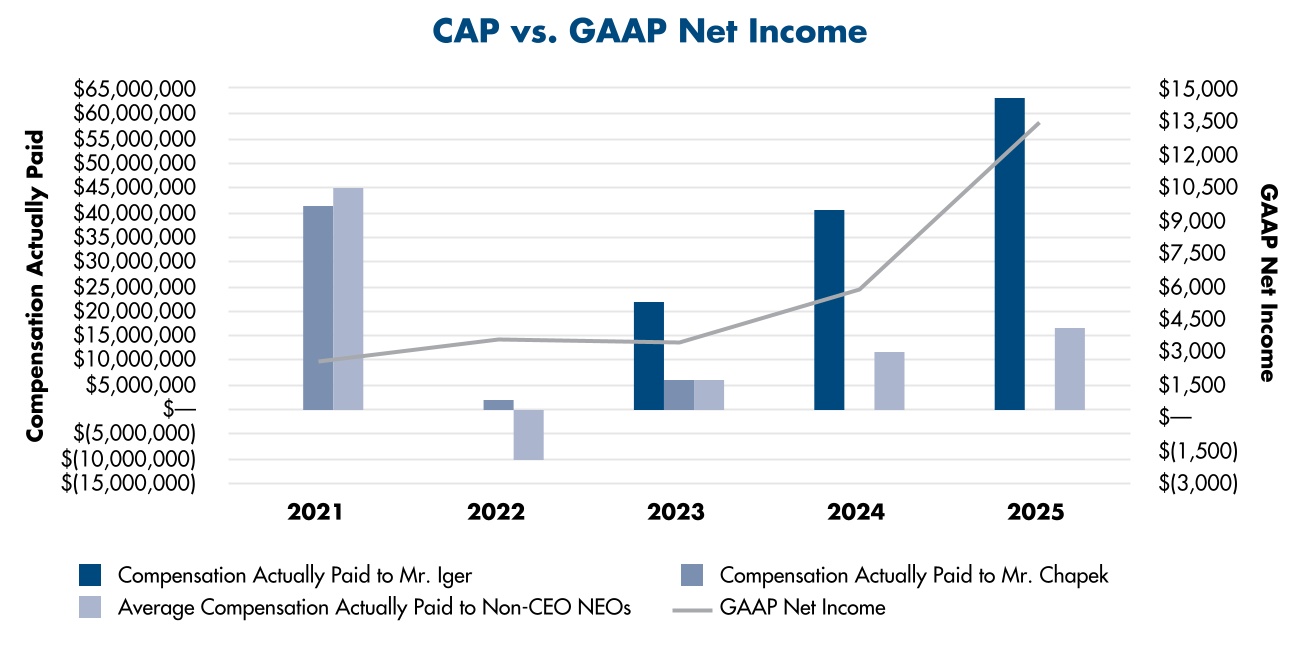

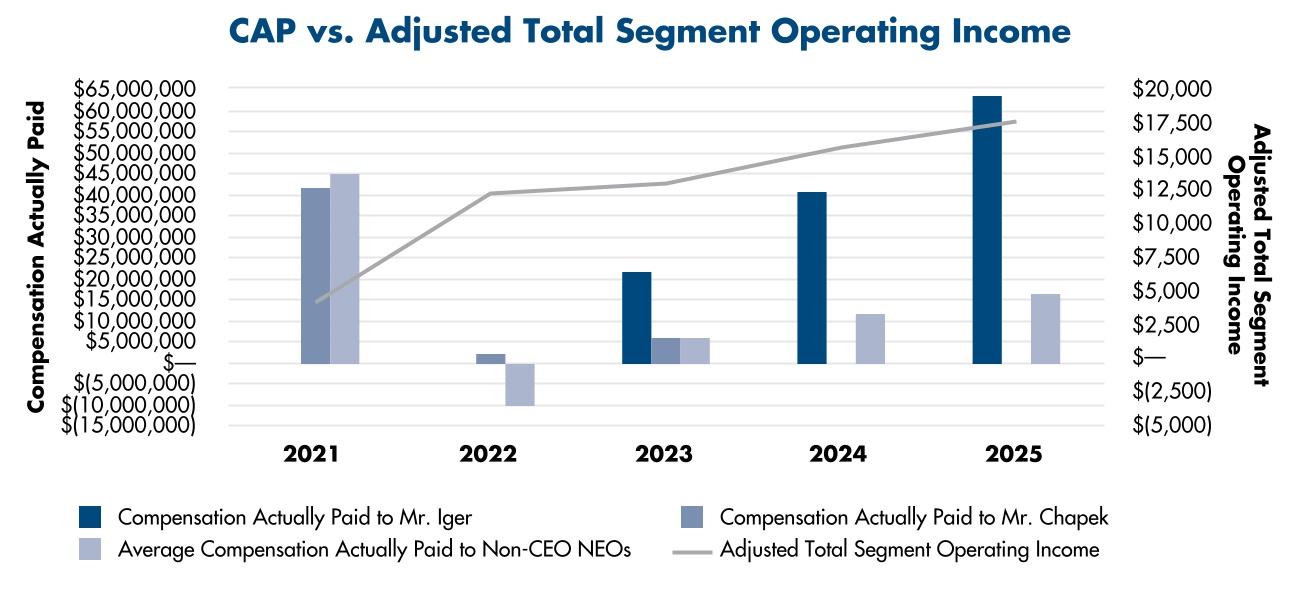

| Executive Compensation | Increased the impact of performance on executive officer pay outcomes | •For the CEO, performance-based restricted stock units (“PBUs”) comprise 60% of long-term incentive awards (increased from 50% in fiscal 2022), and for all other NEOs (as defined herein), PBUs comprise 50% of long-term incentive awards (increased from 30% in fiscal 2021) •The level of relative total shareholder return (“TSR”) performance required to earn PBU target payout for all NEOs increased to the 55th percentile of S&P 500 companies starting in fiscal 2022. For annual awards vested in fiscal 2023, 2024 and 2025, as well as Mr. Iger’s new hire award vested in fiscal 2025, NEOs forfeited 100% of PBUs that were subject to cumulative TSR performance measurement. For annual awards vested in fiscal 2026, TSR performance fell between minimum performance threshold and target levels. •Starting in fiscal 2025, TSR performance measured against the S&P 500 Media & Entertainment Index, a more focused comparator group with similar industry dynamics as the Company and a more appropriate representation of our relative performance than a more broad-based index |

| | |

| | | | | |

8 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

| | | | | | | | |

KEY THEMES | OVERVIEW | ACTIONS |

| | |

| | |

| Executive Compensation Cont. | Evaluated compensation metrics to encourage strategic alignment | •Continued alignment of annual incentive metrics with the Company’s overall growth and profitability goals by incorporating adjusted revenue, adjusted total segment operating income and adjusted after-tax free cash flow as financial metrics •While continuing to use return on invested capital (“ROIC”) as a PBU metric aligned to the Company’s focus on profitability and value creation in the long-term incentive program, returned to setting full 3-year goals in fiscal 2023 •Starting in fiscal 2025, introduced a new financial metric, Adjusted EPS Growth, into the PBU program to further align with the Company’s strategic focus on profitable growth. Adjusted EPS Growth, ROIC and relative TSR metrics determine 100% of our senior executives’ PBU payouts. |

| |

| |

Enhanced executive compensation disclosures | •In 2024 and 2025 proxy disclosures, provided rationale for adjustments to the fiscal 2025 PBU program •Starting in 2023, disclosure expanded for each of our annual bonus program metrics under the section titled “Executive Compensation — Compensation Discussion and Analysis” to include the performance target, and also included the disclosure of the performance leverage for the ROIC performance period for the PBUs |

| |

| |

Avoided excessive one-time special awards for NEOs | •No one-time special awards approved for NEOs in fiscal 2025 |

| |

| |

Limitations on certain executive payments | •In fiscal 2023, adopted a cash severance policy pursuant to which any cash severance payment will not exceed 2.99 times the sum of base salary plus target bonus for Section 16 officers without shareholder approval of such payment •In fiscal 2023, adopted The Walt Disney Company Clawback Policy, and current Section 16 officers of the Company have agreed in writing that employment agreements and other compensation agreements and plans are subject to the policy. In addition, under the Company’s 2011 Amended and Restated Stock Incentive Plan (the “2011 Stock Incentive Plan”), all equity awards granted under the plan, including time-based and performance-based awards, are subject to claw back where there is reputational or financial harm to the Company, which exceeds the Dodd-Frank Act clawback requirements |

| | |

| | |

Return of Capital to Shareholders | Increased shareholder value through cash dividend and share repurchase program | •In November 2025, declared a cash dividend of $1.50 per share, and in December 2024, declared a cash dividend of $1.00 per share •Approximately $3.5 billion in share repurchases in fiscal 2025; announced doubling of share repurchases target to $7 billion for fiscal 2026 compared to fiscal 2025 |

| | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 9 |

Compensation Structure and Philosophy

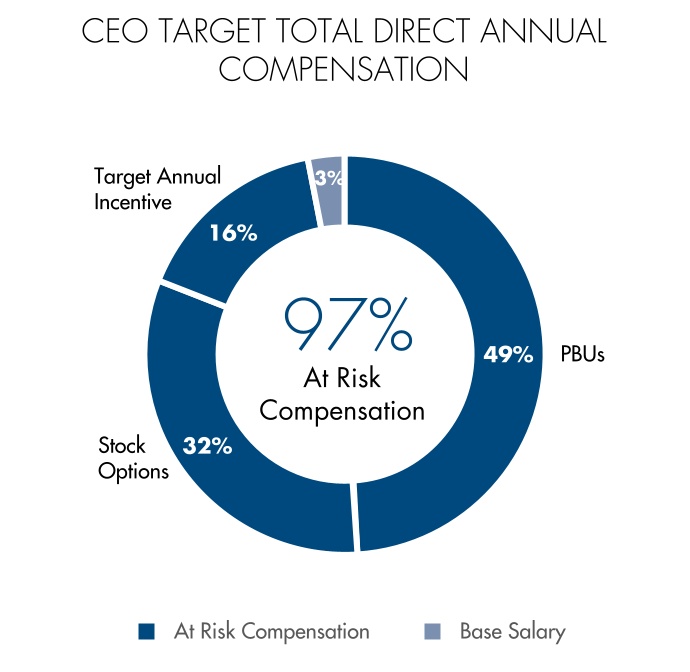

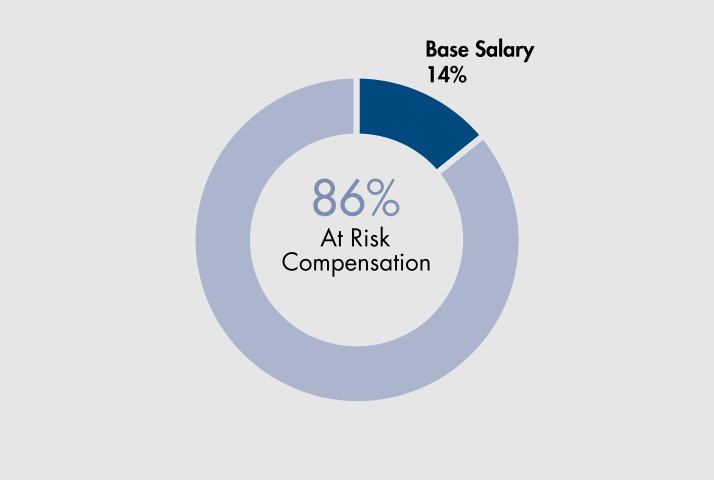

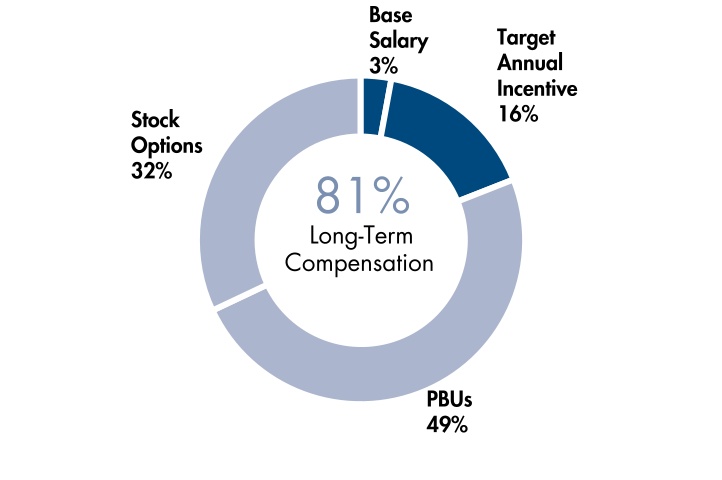

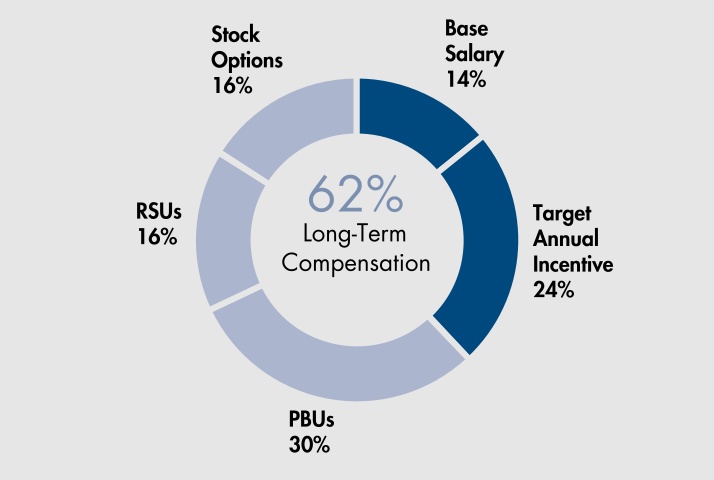

The Compensation Committee firmly believes in pay for performance. For fiscal 2025, the CEO’s compensation was delivered as detailed below.

In fiscal 2025, 97% of Mr. Iger’s target total direct annual compensation was variable or at risk based on Company and stock price performance. Mr. Iger’s target total direct annual compensation was comprised of 49% PBUs, 32% stock options, 16% target annual incentive and 3% base salary.

For fiscal 2025, Mr. lger’s target annual equity award was composed of 60% PBUs and 40% options; the potential realizable PBU value depends on the three-year achievement of relative TSR, Adjusted EPS Growth and ROIC performance, and the options will only have value to the extent that Disney stock price increases after the grant date.

Target payout for the relative TSR test of PBUs for all NEOs requires TSR performance at the 55th percentile of the S&P 500 Media & Entertainment Index companies. Additionally, PBUs represent at least 50% of the overall long-term incentive grant value for all NEOs.

More detail regarding our strategic priorities and our performance metrics can be found in the section titled “Executive Compensation — Compensation Discussion and Analysis.”

| | | | | |

10 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

Human Capital Management and Environmental Sustainability Highlights

The Company has a longstanding commitment to operating responsibly in our business activities, including investing in our people’s development, employee experience and well-being; fostering an inclusive workplace; undertaking meaningful and measurable environmental sustainability efforts and striving to have a positive impact in the communities in which we operate. The Governance and Nominating Committee oversees the Company’s sustainability and social impact programs and reporting. Below are some highlights of our activities in support of that commitment. Additional details of the Company’s efforts are available at our Impact website and in our Sustainability and Social Impact (“SSI”) Report.

| | | | | | | | |

Human Capital Management | |

| HEALTH, FINANCIAL, FAMILY RESOURCES, WELL-BEING AND OTHER BENEFITS | |

| | |

•Healthcare options aimed at improving quality of care while limiting out-of-pocket costs •Retirement and savings programs and paid time-off programs, including vacation and sick and family care leave •Family care resources such as childcare and senior care programs, long-term care coverage and a family-building benefit •Free mental health and well-being resources •Global well-being programs, including in-person offerings through campus health clubs and virtual and onsite events and activities focused on physical, emotional, financial and social well-being •Two Centers for Living Well in the Orlando area that offer on-demand access to board-certified physicians and counselors | |

| | |

| | |

| TALENT DEVELOPMENT AND EDUCATION | |

| | |

•Professional development programs designed to support the career aspirations of our employees, including new leadership development opportunities launched in fiscal 2025 •Our education investment program, Disney Aspire, which offers assistance for tuition, books and fees to eligible participating employees at a variety of in-network learning providers and universities at levels ranging from high school completion to undergraduate degrees | |

| | |

| | | | | | | | |

| Environmental Sustainability 2030 ENVIRONMENTAL GOALS1 |

| | |

| | •Reduce absolute emissions from direct operations (Scope 1 & 2) by 46.2%, against a fiscal 2019 baseline2 •Achieve net zero emissions for our direct operations •Purchase or produce 100% zero carbon electricity •Reduce Scope 3 emissions through absolute reduction and supplier and licensee engagement3 |

| | |

| | |

| | •Implement localized watershed stewardship strategies and source sustainable seafood |

| | |

| | |

| | •Pursue zero waste to landfill at wholly owned and operated parks and resorts, and cruise line •Reduce single-use plastics in our parks and resorts •Eliminate single-use plastics on cruise ships by 2025 |

| | |

| | |

| | •Reduce the environmental impacts of materials used in the creation and packaging of our products, while also working to increase the sustainability of our manufacturing network |

| | |

| | |

| | •Design new projects to achieve near net zero greenhouse gas emissions, maximize water efficiency and support zero waste operations |

| | |

1The complete set of our 2030 environmental goals is provided in our 2030 Environmental Goals White Paper (our “Environmental White Paper”), available on the Environmental Sustainability page of our Impact website. The Environmental White Paper also provides details around our goal coverage and approaches. Progress towards our goals is reported in our annual SSI Report. Disney’s 2025 SSI Report will be published in fiscal 2026.

2In fiscal 2023, this goal was validated by the Science Based Targets Initiative (“SBTi”).

3Our Scope 3 goal has additional sub-goals for absolute reduction and supplier and licensee engagement. This sub-goal language is in our Environmental White Paper, and has also been validated by SBTi.

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 11 |

Corporate Governance

and Board Matters

Corporate Governance Documents

The Board has adopted Corporate Governance Guidelines, which set forth a flexible framework within which the Board, assisted by its committees, directs the affairs of the Company. The Corporate Governance Guidelines address, among other things, the composition and functions of the Board, Director independence, stock ownership by and compensation of Directors, management succession and review, Board leadership, Board committees and selection of new Directors.

The Company has Standards of Business Conduct, which are applicable to all employees of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer. The Board has a separate Code of Business Conduct and Ethics for Directors, which contains provisions specifically applicable to Directors.

Each standing committee of the Board is governed by a charter adopted by the Board.

The Corporate Governance Guidelines, the Standards of Business Conduct, the Code of Business Conduct and Ethics for Directors and each of the Audit, Compensation and Governance and Nominating Committee charters, as well as other corporate governance documents, including the Company’s Restated Certificate of Incorporation, as amended, and Amended and Restated Bylaws, are available on the Company’s Investor Relations website under the “Governance” heading at www.disney.com/investors and in print to any shareholder who requests them from the Company’s Secretary. If the Company amends or waives the Code of Business Conduct and Ethics for Directors or the Standards of Business Conduct with respect to the principal executive officer, principal financial officer or principal accounting officer, we will post the amendment or waiver at the same location on our website.

Board Leadership

The Company’s Corporate Governance Guidelines provide that the Chairman of the Board shall in the normal course be an independent Director unless the Board concludes that, in light of the circumstances, the best interests of shareholders would be otherwise better served. In such event, the Company’s Corporate Governance Guidelines require that the Company explain the Board’s decision, designate an independent Director to serve as Lead Director and set out the duties of the Lead Director.

The current Chairman of the Board is James Gorman, who was appointed effective January 2025. Mr. Gorman is an independent Director. In determining to appoint Mr. Gorman as Chairman, the Board considered Mr. Gorman’s long-term strategic mentality; strong record in high-stakes succession planning, driving strategic transformation and delivering shareholder value; experience serving as executive chairman, chairman, chief executive officer and president of a global financial institution with a long-term sustainable business model; and leadership in the boardroom.

| | | | | |

12 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

The Board of Directors

The Board’s Director nominees are set forth below under the section titled “— Director Nominees.” All Directors serve for a term ending at the next annual meeting following the annual meeting at which the Director was elected or following the Director’s appointment, as applicable, and until the Director’s successors are elected and qualified, or until the Director’s earlier death, resignation, disqualification or removal. In fiscal 2025, the Board met 9 times and each then-serving Director attended at least 75% of the aggregate number of meetings of the Board and standing Board committees on which such Director served that occurred while such Director served on the Board or the committees. All then-serving Directors attended the Company’s 2025 Annual Meeting. Under the Company’s Corporate Governance Guidelines, each Director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of such Director’s duties, including by attending meetings of the shareholders of the Company and meetings of the Board and committees of which such Director is a member.

The Board believes that having a broad range of talents, experiences, perspectives, skills and expertise on the Board is important in order to provide sound and prudent guidance with respect to all of the Company’s operations and interests and to reflect its shareholders, employees, customers, guests and communities. Our Director nominees have a combined wealth of leadership experience derived from extensive service guiding large, complex organizations as executive leaders or board members and in government positions. Collectively, they possess substantive knowledge and skills applicable to our businesses. Each of the Board’s Director nominees possesses core competencies that contribute to the Director’s service on the Disney board. In addition to those qualifications, our Director nominees collectively possess skill sets that are directly relevant to the Company’s evolving business and strategic objectives.

Strategic Priorities

WE ARE BUILDING ON...

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | The creative success at our film studios | | | | | Our value proposition in streaming | | | | | ESPN’s evolution as the preeminent digital sports platform | | | | | Our best-in-class parks and experiences business | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | The skills that are central to our strategy are: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Brand Stewardship | | Direct-to-Consumer Expertise | | Global Business Operations | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Media and Entertainment | | Strategic Transformation | | Technology and Innovation | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 13 |

Director Skills and Experience Matrix

The following table summarizes the key skills and experiences of each Director nominee that our Board considered important in its decision to nominate or re-nominate that individual to our Board. Further details about each Director nominee’s qualifications are set forth in their individual biographies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills & Experience | | | | | | | | | | | |

| | | | | | | | | | | | |

Brand Stewardship | | l | l | l | l | l | | l | | l | |

| Denotes particular expertise in brand leadership and integration with consumer experience |

| Business Development, Mergers and Acquisitions and Growth | l | l | l | l | l | l | l | l | l | l | l |

Corporate Responsibility | | l | | l | | l | l | | l | l | l |

| Denotes formal service in a corporate responsibility thought leadership role |

| Cybersecurity | | l | | | l | | | | | l | |

DTC Expertise | l | l | l | l | | | l | | l | l | l |

Executive Management | | l | | l | l | | | l | | l | l |

| Denotes public company CEO experience |

Finance and Accounting | l | l | | l | l | l | l | l | l | | |

| Denotes public company CFO experience |

| Global Business Operations | l | l | l | l | l | l | l | l | l | l | l |

| Media and Entertainment | | | l | l | | | l | | | | |

| Risk Management | l | l | l | l | l | l | l | l | l | l | l |

| Strategic Transformation | l | | l | | | l | l | | l | | l |

Succession Planning | | l | l | | | | | l | | | |

| Denotes direct experience in CEO and senior leadership succession planning for Fortune 500 companies |

| Technology and Innovation | l | | l | | l | l | | | l | | l |

| Denotes experience in artificial intelligence oversight |

| | | | | |

14 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

| | | | | | | | |

| Skills & Experience | Application to the Company |

| | |

Brand Stewardship | Building brands that transcend entertainment and can be leveraged through multiple channels, utilizing consumer affinity that is created by delivering uniquely memorable experiences, is core to the Company’s ability to develop connections with audiences and guests | |

| Business Development, Mergers and Acquisitions and Growth | Implementation of both organic and inorganic growth strategies, identification of acquisition and business combination targets, analysis of cultural and strategic fit and the development of strategic partnerships are instrumental to the Company’s long-term success | |

Corporate Responsibility | The Company’s physical footprint and broad reach through its audience and guest base require consideration of a complex and evolving set of issues, including governance, human capital management, inclusion and sustainability | |

| Cybersecurity | The Company’s evolving and growing consumer base and increasing connectivity with customers through a wide range of offerings and services require deep experience in both understanding the cybersecurity threat landscape and managing cybersecurity and information security risks | |

DTC Expertise | As the Company continues to invest in and grow its DTC offerings and global distribution capabilities, oversight of and experience in managing and creating new DTC products and capabilities help the Company continue to meet evolving consumer preferences | |

Executive Management | The scale and complexity of our businesses require the successful alignment of various teams across functions and geographies to execute on strategic initiatives | |

Finance and Accounting | The Company’s businesses are multifaceted and require a range of financial and accounting skill sets for effective oversight, including experience as an operating executive with responsibility for all or a portion of a company’s financial reporting, experience in the financial sector or private equity or as an audit committee member for publicly traded companies, or educational background or training in accounting or finance | |

| Global Business Operations | The Company operates across many geographies with audiences and guests from different backgrounds, requiring an understanding of the nuances of the international business environments | |

| Media and Entertainment | As a premier entertainment company, the Company seeks to entertain, inform and inspire people around the globe through the power of storytelling and values a strong understanding of the risks and challenges specific to its industry and businesses | |

| Risk Management | The Company’s scale and complexity necessitate a thoughtful and coordinated approach to risk management, including clear understanding and oversight of the various risks facing the Company | |

| Strategic Transformation | The changing and competitive markets and landscapes in which the Company operates require experience in overseeing large-scale corporate reorganization and transformation | |

| Succession Planning | Finding the right successor to our current leadership to promote effective leadership and management are important to the Company’s success and the long-term outcome for the Company | |

| Technology and Innovation | The Company must leverage innovative technological strategies and maintain an understanding of emerging technology trends, including artificial intelligence, to continuously improve the guest experience and build strong connections with audiences | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 15 |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| MARY T. BARRA DIRECTOR SINCE 2017 _______________ CHAIR AND CHIEF EXECUTIVE OFFICER: GENERAL MOTORS COMPANY _______________ AGE: 64 _______________ COMMITTEES: Compensation (Chair) | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •Ms. Barra has deep experience in strategy, innovation and brand evolution through her role in leading the transformation of General Motors Company and prioritizing strategic investments in connectivity and electrified propulsion technologies, which provides an important perspective on the Board as the Company navigates its own strategic progression, embraces technological change and navigates shifts in consumer sentiment •As Chief Executive Officer of General Motors, she provides invaluable insights on large-scale cost rationalization, organizational restructuring, brand leadership and CEO and management succession planning •She brings meaningful experience in human capital management and executive compensation-related matters in her role on the Board’s Compensation Committee, where she focuses on aligning incentive structures that create shareholder value and execute the Company’s long-term strategic priorities | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •Overseeing and managing a broad range of executive teams and a sizeable global workforce, with an emphasis on development and marketing of technology-based consumer-facing products through her various executive roles at General Motors •Governance and public policy thought leadership, understanding of worldwide consumer markets and risks facing large public companies with complex retail operations through her role on the board of directors of the Business Roundtable | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2016–Present Chair and Chief Executive Officer, General Motors Company (an automotive manufacturing company) 2014–2016 Chief Executive Officer, General Motors Company 2013–2014 Executive Vice President, Global Product Development, Purchasing and Supply Chain, General Motors Company 2011–2013 Senior Vice President, Global Product Development, General Motors Company 2009–2011 Vice President, Global Human Resources, General Motors Company 2008–2009 Vice President, Global Manufacturing Engineering, General Motors Company Other Public Company Directorships General Motors Company (2014–Present) | |

| | | | | |

16 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

| | | | | | | | | | | | | | | | | | | | | | | |

| AMY L. CHANG DIRECTOR SINCE 2021 _______________ FORMER EXECUTIVE VICE PRESIDENT: CISCO SYSTEMS, INC. _______________ AGE: 49 _______________ COMMITTEES: Governance and Nominating | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •Ms. Chang has developed expertise across the technology sector from her time as an Executive Vice President at Cisco Systems, Inc., leading product development for Google Ads Measurement and Reporting and as a founder of a digital startup •She provides a unique viewpoint of emerging technology trends and their implications for consumer and retail businesses and the implementation of innovative technological business strategies that are particularly important as the Company evaluates the impact of, and opportunities presented by, new technologies in content production, our DTC businesses and our parks •Ms. Chang also provides valuable perspective on talent attraction and retention for key technical roles that are central to Disney’s content creation and digitally driven teams and an understanding of large-scale cost rationalization and analysis of organizational structure from her tenure as a public company director and an executive at Google and Cisco | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •Risk management oversight experience specific to digital and technology-forward companies, including cybersecurity and artificial intelligence, gained through her tenure at Cisco and Accompany and through her role on the board of directors of Salesforce •Deep understanding of strategic planning, corporate governance, social initiatives and executive management succession planning gained through public company board leadership | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2018–2020 Executive Vice President and General Manager, Collaboration, Cisco Systems, Inc. (a networking hardware company) 2013–2018 Founder and Chief Executive Officer, Accompany, Inc. (an artificial intelligence/machine learning-based relationship intelligence platform company) 2005–2012 Global Head of Product, Google Ads Measurement; various additional positions, Google LLC (a technology company) Other Public Company Directorships Salesforce, Inc. (2025–Present) Procter & Gamble (2017–Present) Former Public Company Directorships Marqeta, Inc. (2021–2022) Cisco Systems, Inc. (2016–2018) | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 17 |

| | | | | | | | | | | | | | | | | | | | | | | |

| D. JEREMY DARROCH DIRECTOR SINCE 2024 _______________ FORMER EXECUTIVE CHAIRMAN AND GROUP CHIEF EXECUTIVE OFFICER: SKY _______________ AGE: 63 _______________ COMMITTEES: Audit | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •As Group Chief Executive Officer of Sky, Mr. Darroch led the company’s tremendous growth and transformation from a linear satellite broadcaster into one of Europe’s largest multi-platform TV providers, providing valuable insights to the Board and management in navigating its strategic expansion of DTC offerings and changing media and entertainment landscapes •Mr. Darroch’s experience leading Sky’s executive teams and creative content investments and advising MultiChoice Group, provide key perspectives for the Company regarding its content creation, management of creative talent and brand evolution •As former Chief Financial Officer of Sky, Mr. Darroch’s financial executive experience and extensive finance, accounting and risk management expertise strengthen his role on the Company’s Audit Committee | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •Deep knowledge of management succession planning, global brands and risk management gained through his various executive roles at Sky and as a public company director •Strong experience in governance and sustainability and social impact thought leadership through his experience leading Sky’s corporate responsibility programs and as Chairman of the National Oceanography Centre | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2021 Executive Chairman, Sky (a media and entertainment company and a division of Comcast Corporation) 2007–2021 Group Chief Executive Officer, Sky 2004–2007 Chief Financial Officer, Sky PLC Other Public Company Directorships Reckitt Benckiser Group PLC (2022–Present) Former Public Company Directorships Ahren Acquisition Corp. (2021–2023) Burberry Group plc (2014–2019) Sky PLC (2004–2018) | |

| | | | | |

18 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

| | | | | | | | | | | | | | | | | | | | | | | |

| CAROLYN N. EVERSON DIRECTOR SINCE 2022 _______________ FORMER PRESIDENT: INSTACART _______________ AGE: 54 _______________ COMMITTEES: Compensation | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •From her experience leading marketing solutions and global sales teams at Instacart, Meta Platforms, Inc. and Microsoft Corporation and as a former board member of Creative Artists Agency, Ms. Everson offers strong insight to the Board and leadership team on navigating evolving media landscapes and advertising environments as well as branded, consumer-facing technology and its intersection with marketing, which has been important to the Board's oversight of the Company’s operations and strategy •From advising Permira, a private equity firm focused on technology and consumer brands, and Boston Consulting Group in the Technology, Media & Telecom and Marketing, Sales & Pricing practice areas, Ms. Everson brings experience evaluating internet and digital media businesses from an investor perspective •Ms. Everson further expands the Board’s collective skill sets and enhances its strategic oversight through her experience in the advertising technology space and understanding of large-scale cost rationalization and effective organizational structure | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •Understanding of business development and executive management processes gained through leadership of strategy teams at global technology companies •Risk management, corporate governance and artificial intelligence oversight through her expansive board experience | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2021 President, Instacart (a grocery retail company) 2011–2021 Vice President, Global Marketing Solutions, Meta Platforms, Inc. (a technology company) 2010–2011 Corporate Vice President, Global Advertising Sales, Strategy & Marketing, Microsoft Corporation (a technology corporation) 2004–2010 Various positions (most recently Chief Operating Officer and Executive Vice President, Advertising Sales), MTV Networks Company (a media entertainment company) 2000–2003 Various positions (including Vice President, Classifieds and Direct Response Advertising, and Vice President and General Manager, PriMedia Teen Digital Group), PriMedia, Inc. (an advertising company) Other Public Company Directorships Under Armour, Inc. (2023–Present) The Coca-Cola Company (2022–Present) Former Public Company Directorships Hertz Global Holdings, Inc. (2016–2018) | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 19 |

| | | | | | | | | | | | | | | | | | | | | | | |

| MICHAEL B.G. FROMAN DIRECTOR SINCE 2018 _______________ PRESIDENT: COUNCIL ON FOREIGN RELATIONS _______________ AGE: 63 _______________ COMMITTEES: Governance and Nominating (Chair) | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •Mr. Froman brings a deep, unique global perspective that is important to the Board given the nuances of the international business operations in which the Company operates and our strategic focus on innovation in changing markets and the global growth of our customer base •He delivers strategic insight to the Board and leadership team on complex international affairs, foreign relations and complex geopolitical issues gained from his experience as President of the Council on Foreign Relations, the Assistant to the President and Deputy National Security Advisor for International Economic Policy, and as the United States Trade Representative, all of which are important to the Company, particularly given its positioning and international growth opportunities •His roles as President of the Council on Foreign Relations and as former Vice Chairman and President, Strategic Growth, of Mastercard Incorporated, overseeing strategic growth and leveraging technology to expand digital inclusion at Mastercard, enable him to offer guidance to the Company on leveraging innovative technological strategies in international markets, factors affecting international trade and the balance of risks and opportunities in a dynamic marketplace •Mr. Froman applies a differentiated lens to corporate governance and risk management discussions, including through his deep experience in the complex digital governance and cyber issues facing global companies, including international regulation of digital platforms, cross border data flows and data usage, as well as concerns about privacy protection and cybersecurity | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •International trade, finance, executive and brand management and risk management gained through executive leadership roles •Meaningful experience with alternative investments business and environmental and social policy implementation | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2023–Present President, Council on Foreign Relations (an independent, non-partisan membership organization, think tank, publisher and educational institution that serves as a resource on foreign policy, national security issues and international economic affairs) 2018–2023 Vice Chairman and President, Strategic Growth, Mastercard Incorporated (a financial services company) 2013–2017 United States Trade Representative, Executive Office of the President 2009–2013 Assistant to the President and Deputy National Security Advisor for International Economic Policy, Executive Office of the President 1999–2009 Various positions (including Chief Executive Officer of CitiInsurance and Chief Operating Officer of alternative investments business), Citigroup (a financial services company) | |

| | | | | |

20 | The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement |

| | | | | | | | | | | | | | | | | | | | | | | |

| JAMES P. GORMAN DIRECTOR SINCE 2024 _______________ CHAIRMAN EMERITUS: MORGAN STANLEY _______________ AGE: 67 _______________ COMMITTEES: Executive (Chair) | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •As former Chairman and Chief Executive Officer of Morgan Stanley, Mr. Gorman has an established record driving strategic transformation of a global financial institution with a long-term sustainable business model, bringing important insight for the Company’s strategic progression •Mr. Gorman successfully executed innovative technological strategies leading Morgan Stanley’s acquisition and integration of online trading platform, E*Trade, providing key perspectives as the Company leverages technology to advance its strategy •Oversaw a multi-year CEO succession process and director succession planning •Through his roles at Morgan Stanley and Merrill Lynch and as former president of the Federal Advisory Council to the U.S. Federal Reserve Board, Mr. Gorman has deep finance management, investment and fiduciary experience evaluating businesses | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | Other Key Skill Sets •Managing a broad range of executive teams and a sizeable global workforce •Brand and risk management and governance and public policy thought leadership developed through his roles at The Business Council, Business Roundtable and the Council on Foreign Relations | |

| | | | | | |

| | | | | | |

| | | | | Employment Experience 2024 Executive Chairman, Morgan Stanley (a global financial services firm) 2012–2023 Chairman and Chief Executive Officer, Morgan Stanley 2010–2011 President and Chief Executive Officer, Morgan Stanley 2007–2009 Co-President, Morgan Stanley 2006–2007 Various positions, Morgan Stanley 1999–2005 Various positions, Merrill Lynch & Co., Inc. (a global financial services firm) Former Public Company Directorships Morgan Stanley (2010–2024) | |

| | | | | |

The Walt Disney Company | Notice of 2026 Annual Meeting and Proxy Statement | 21 |

| | | | | | | | | | | | | | | | | | | | | | | |

| ROBERT A. IGER DIRECTOR SINCE 2022; 2000-2021 _______________ CHIEF EXECUTIVE OFFICER: THE WALT DISNEY COMPANY _______________ AGE: 74 _______________ COMMITTEES: Executive | | | | | | |

| | | | | Notable Experience Aligned with Disney’s Strategy and Key Board Contributions •Gained through his experience serving as Chief Executive Officer of Disney for 18 years and former Executive Chairman, Mr. Iger has an unmatched knowledge of the Company and the creative content it produces, and an in-depth understanding of fostering innovation through technology and connecting to audiences in our markets around the world •Throughout Mr. Iger’s tenure at Disney, he has successfully expanded the Company’s geographic presence, identified new revenue streams and initiated the Company’s DTC efforts, expanding the scale and global reach of Disney’s storytelling and streaming services •Mr. Iger has also furthered Disney’s rich history of storytelling through the successful landmark acquisitions and integration of Pixar, Marvel, Lucasfilm and 21st Century Fox •His detailed understanding of all facets of the Company, and prior experience leading Disney through various market conditions and implementing successful strategic shifts throughout his career have uniquely positioned Mr. Iger to serve as Chief Executive Officer of Disney and a member of the Board at this time | |

| | | | | | |

| | | | | | |

| | | | | | |