| PennyMac Financial Services, Inc. INVESTOR UPDATE February 2026 |

| This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections, and assumptions with respect to the proposed transaction between Pennymac and Cenlar, future financial and operating results, benefits and synergies of the proposed transaction, future opportunities for the combined company, and the expected timing of the closing of the proposed transaction, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “project,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein and from past results discussed herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: the risk that the proposed transaction may not be completed on a timely basis or at all; the potential failure to receive the required approvals of the proposed transaction; the effect of the announcement or completion of the proposed transaction on each of Pennymac’s or Cenlar’s ability to attract, motivate, retain and hire key personnel and maintain relationships with key partners and others with whom Pennymac or Cenlar does business, or on Pennymac’s or Cenlar’s operating results and business generally; that the proposed transaction may divert management’s attention from each of Pennymac’s and Cenlar’s ongoing business operations; the risk of any legal proceedings related to the proposed transaction or otherwise; that Pennymac or Cenlar may be adversely affected by other economic, business and/or competitive factors; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreement; the risk that restrictions during the pendency of the proposed transaction may impact Pennymac’s or Cenlar’s ability to pursue certain business opportunities or strategic transactions; the risk that the anticipated benefits and synergies of the proposed transaction may not be fully realized or may take longer to realize than expected; and the risk that integration of the Pennymac and Cenlar businesses post-closing may not occur as anticipated or the combined company may not be able to achieve the growth prospects expected from the transaction. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. This presentation contains financial information calculated other than in accordance with U.S. generally accepted accounting principles (“GAAP”), such as pro forma servicing portfolio unpaid principal balances that provide a meaningful perspective on the Company’s expected business results from the proposed transaction since the Company utilizes this information to evaluate the transaction. Non-GAAP disclosures have limitations as an analytical tool and should not be viewed as a substitute for financial information determined in accordance with GAAP. 2 FORWARD-LOOKING STATEMENTS |

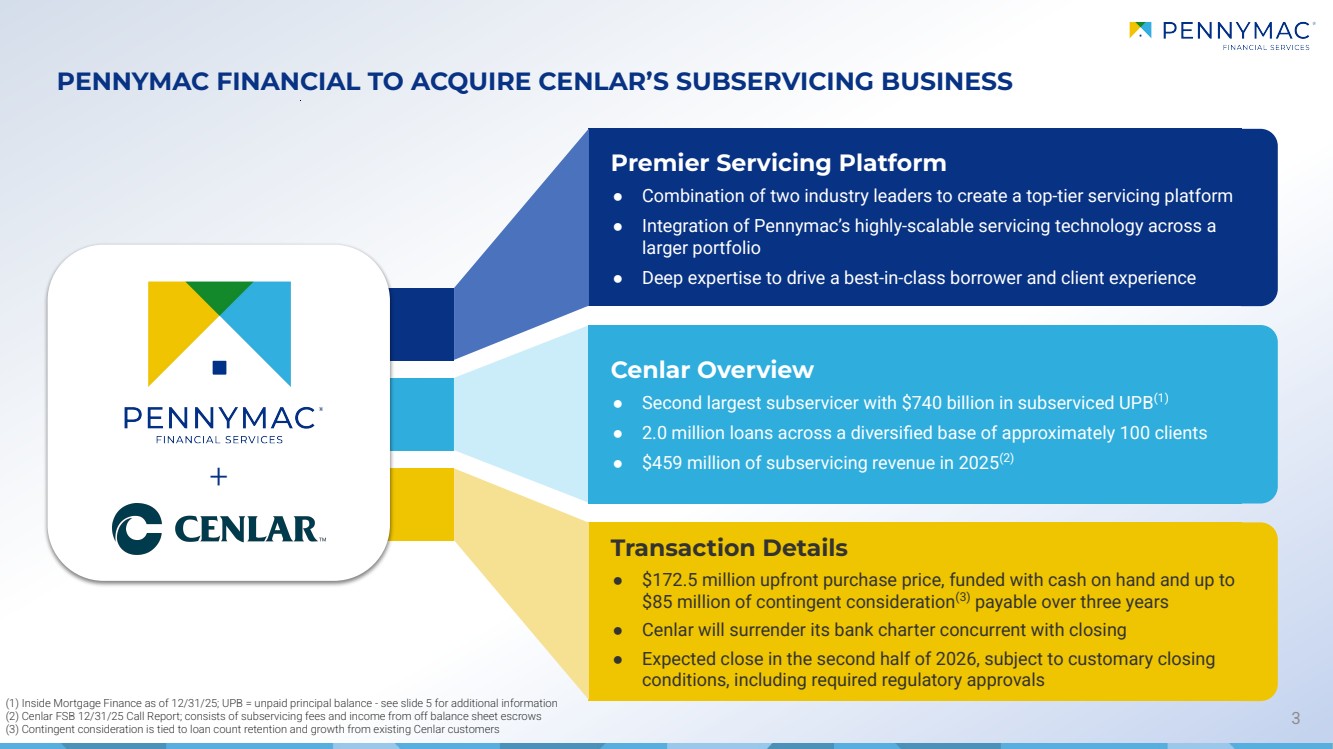

| 3 PENNYMAC FINANCIAL TO ACQUIRE CENLAR’S SUBSERVICING BUSINESS Cenlar Overview ● Second largest subservicer with $740 billion in subserviced UPB(1) ● 2.0 million loans across a diversified base of approximately 100 clients ● $459 million of subservicing revenue in 2025(2) Transaction Details ● $172.5 million upfront purchase price, funded with cash on hand and up to $85 million of contingent consideration(3) payable over three years ● Cenlar will surrender its bank charter concurrent with closing ● Expected close in the second half of 2026, subject to customary closing conditions, including required regulatory approvals + (1) Inside Mortgage Finance as of 12/31/25; UPB = unpaid principal balance - see slide 5 for additional information (2) Cenlar FSB 12/31/25 Call Report; consists of subservicing fees and income from off balance sheet escrows (3) Contingent consideration is tied to loan count retention and growth from existing Cenlar customers Premier Servicing Platform ● Combination of two industry leaders to create a top-tier servicing platform ● Integration of Pennymac’s highly-scalable servicing technology across a larger portfolio ● Deep expertise to drive a best-in-class borrower and client experience |

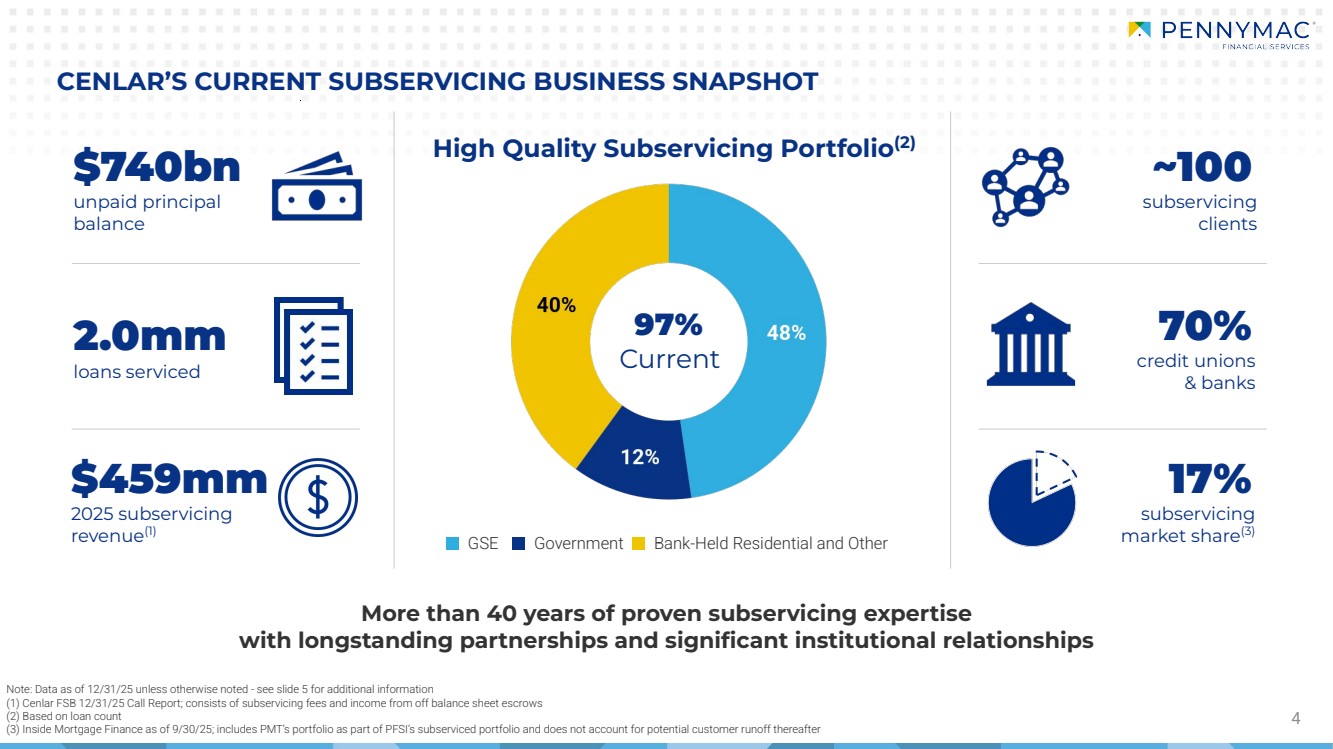

| 4 CENLAR’S CURRENT SUBSERVICING BUSINESS SNAPSHOT GSE Government Bank-Held Residential and Other $740bn unpaid principal balance 2.0mm loans serviced 17% subservicing market share(3) $459mm 2025 subservicing revenue(1) ~100 subservicing clients 70% credit unions & banks High Quality Subservicing Portfolio(2) Note: Data as of 12/31/25 unless otherwise noted - see slide 5 for additional information (1) Cenlar FSB 12/31/25 Call Report; consists of subservicing fees and income from off balance sheet escrows (2) Based on loan count (3) Inside Mortgage Finance as of 9/30/25; includes PMT’s portfolio as part of PFSI’s subserviced portfolio and does not account for potential customer runoff thereafter 97% Current More than 40 years of proven subservicing expertise with longstanding partnerships and significant institutional relationships |

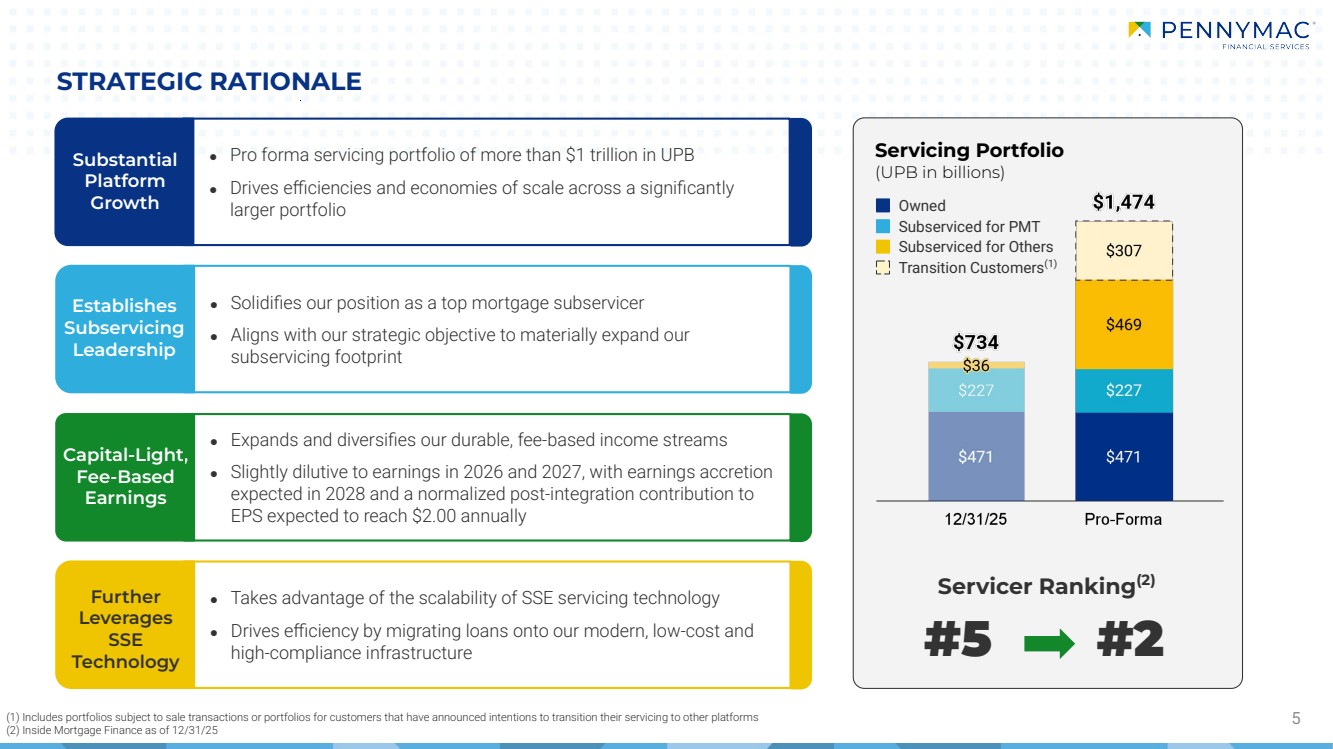

| (1) Includes portfolios subject to sale transactions or portfolios for customers that have announced intentions to transition their servicing to other platforms 5 (2) Inside Mortgage Finance as of 12/31/25 Servicing Portfolio (UPB in billions) Owned Subserviced for PMT Subserviced for Others Servicer Ranking(2) #5 #2 ● Pro forma servicing portfolio of more than $1 trillion in UPB ● Drives efficiencies and economies of scale across a significantly larger portfolio Substantial Platform Growth ● Solidifies our position as a top mortgage subservicer ● Aligns with our strategic objective to materially expand our subservicing footprint Establishes Subservicing Leadership Capital-Light, Fee-Based Earnings Further Leverages SSE Technology ● Expands and diversifies our durable, fee-based income streams ● Slightly dilutive to earnings in 2026 and 2027, with earnings accretion expected in 2028 and a normalized post-integration contribution to EPS expected to reach $2.00 annually Transition Customers(1) STRATEGIC RATIONALE ● Takes advantage of the scalability of SSE servicing technology ● Drives efficiency by migrating loans onto our modern, low-cost and high-compliance infrastructure |

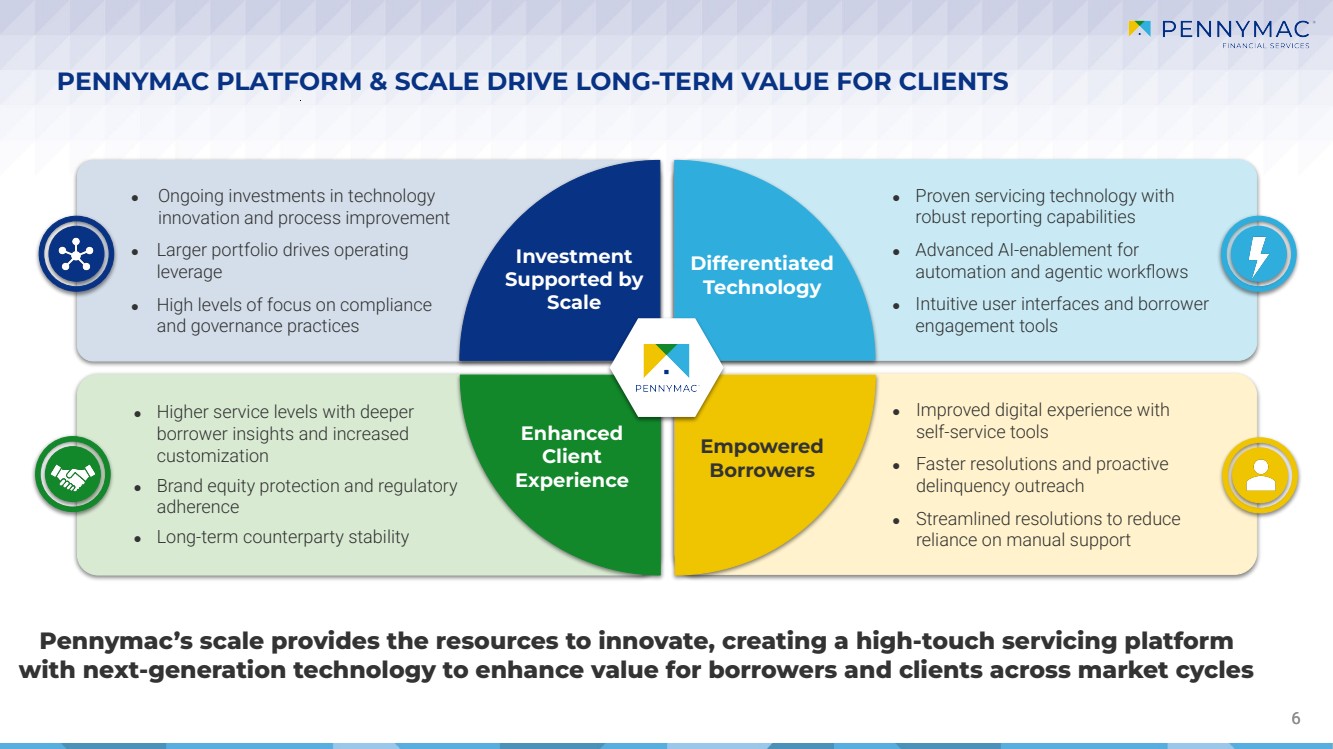

| 6 Investment Supported by Scale Differentiated Technology Enhanced Client Experience Empowered Borrowers Pennymac’s scale provides the resources to innovate, creating a high-touch servicing platform with next-generation technology to enhance value for borrowers and clients across market cycles ● Improved digital experience with self-service tools ● Faster resolutions and proactive delinquency outreach ● Streamlined resolutions to reduce reliance on manual support ● Ongoing investments in technology innovation and process improvement ● Larger portfolio drives operating leverage ● High levels of focus on compliance and governance practices ● Higher service levels with deeper borrower insights and increased customization ● Brand equity protection and regulatory adherence ● Long-term counterparty stability PENNYMAC PLATFORM & SCALE DRIVE LONG-TERM VALUE FOR CLIENTS ● Proven servicing technology with robust reporting capabilities ● Advanced AI-enablement for automation and agentic workflows ● Intuitive user interfaces and borrower engagement tools |

|