As filed with the Securities and Exchange Commission on January 3, 2025

Securities Act Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––––––

Form

REGISTRATION STATEMENT

–––––––––––––––––––––––––––––––––

☒ REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

and/or

☐ REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

–––––––––––––––––––––––––––––––––

Registrant Exact Name as Specified in Charter

–––––––––––––––––––––––––––––––––

Address of Principal Executive Offices (Number, Street, City, State, Zip Code)

Registrant’s Telephone Number, including Area Code

–––––––––––––––––––––––––––––––––

Name and Address (Number, Street, City, State, Zip Code) of Agent for Service

–––––––––––––––––––––––––––––––––

Copies of Communications to:

|

David A. Hearth |

R. William Burns |

–––––––––––––––––––––––––––––––––

Approximate Date of Commencement of Proposed Public Offering:

| | Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. | |||

| | Check box if any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. | |||

| | Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. | |||

| | Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. | |||

| | Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become effective (check appropriate box)

| | When declared effective pursuant to section 8(c) of the Securities Act. |

If appropriate, check the following box:

| | This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. | |||

| | This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ______. | |||

| | This Form is a post-effective amendment filed pursuant to Rule 462(c)under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ______. | |||

| | This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ______. |

Check each box that appropriately characterizes the Registrant:

| | Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). | |||

| | Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act). | |||

| | Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). | |||

| | A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). | |||

|

| Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). | |||

| | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934). | |||

| ☐ | If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. | |||

| | New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JANUARY 3, 2025

PRELIMINARY PROSPECTUS

KAYNE ANDERSON BDC, INC.

12,181,352 SHARES OF COMMON STOCK

–––––––––––––––––––––––––––––––––

We are a business development company (“BDC”) that invests primarily in first lien senior secured loans with a secondary focus on unitranche and split-lien loans to private middle market companies. We are managed by our investment adviser, KA Credit Advisors, LLC (the “Advisor”), an indirect controlled subsidiary of Kayne Anderson Capital Advisors, L.P. (“Kayne Anderson”), a prominent alternative investment management firm. Our investment objective is to generate current income and, to a lesser extent, capital appreciation. See “Prospectus Summary — Kayne Anderson, Kayne Anderson Private Credit and The Advisor” for a discussion of the Advisor’s and Kayne Anderson’s roles in achieving our investment objective.

Under normal market conditions, we expect at least 90% of our portfolio (including investments purchased with proceeds from borrowings under credit facilities and issuances of senior unsecured notes) to be invested in first lien senior secured, unitranche and split-lien loans. Our investment decisions are made on a case-by-case basis. We expect that a majority of these debt investments will be made in “core middle market companies” (as defined in “Prospectus Summary — Investment Objective, Principal Strategy and Investment Structures”) and will have stated maturities of three to six years. We expect that the loans in which we principally invest will be to companies that are located in the United States. We determine the location of a company as being in the United States by (i) such company being organized under the laws of one of the states in the United States; or (ii) during its most recent fiscal year, such company derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in the United States or has at least 50% of its assets in the United States.

We are an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (“1940 Act”).

We have elected to be treated, and intend to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) for U.S. federal income tax purposes. As a BDC and a RIC, we are required to comply with certain regulatory requirements.

This prospectus relates to the proposed resale, from time to time, in one or more offerings or series, by The Bank of New York Mellon, as Trustee for the Koch Companies Defined Benefit Master Trust or their permitted assigns (the “selling stockholder”) of up to 12,181,352 shares of our common stock, which represent approximately 17.2% of our issued and outstanding common stock as of December 30, 2024. The selling stockholder may sell some, all, or none of the shares being offered for resale in this offering. Given the substantial number of resale shares being registered for potential resale by the selling stockholder pursuant to the registration statement of which this prospectus forms a part, the sale of such resale shares by the selling stockholder, or the perception in the market that the selling stockholder may or intend to sell all or a significant portion of such resale shares, could increase the volatility of the market price of our shares of common stock or result in a significant decline in the public trading price of our common stock. See “Risk Factors — Risks Relating to this Offering — The number of shares being registered for sale is significant in relation to the number of our outstanding shares of common stock and the sale of the shares by the selling stockholder could depress the market price of our common stock.”

We are not selling any securities under this prospectus and will not receive any proceeds from the sale of the shares of our common stock by the selling stockholder. The common stock may be offered in an underwritten offering at prices and on terms to be described in one or more supplements to this prospectus, but may also be offered in ordinary market transactions from time to time. You should read this prospectus and any applicable prospectus supplement carefully before you invest in our securities. For additional information regarding the methods of possible sale of shares of our common stock by the selling stockholder, you should refer to the section of this prospectus entitled “Plan of Distribution.” For information regarding the selling stockholder, you should refer to the section of this prospectus entitled “Selling Stockholder.” The selling stockholder may not sell any of the common stock pursuant to this registration statement through agents, underwriters or dealers without delivery of this prospectus and a prospectus supplement describing the method and terms of the offering of such securities. We do not know how long the selling stockholder will hold the shares before selling them or how many shares they will sell, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares under this registration statement.

Our common stock is traded on The New York Stock Exchange (“NYSE”) under the symbol “KBDC”. The reported closing price of our common stock on the NYSE on December 30, 2024 was $16.91 per share. The net asset value per share of our common stock at September 30, 2024 (the last date prior to the date of this prospectus for which we reported net asset value) was $16.70.

Investing in shares of our common stock involves a high degree of risk, including credit risk and the risk of the use of leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes, and is highly speculative. We invest in debt that is typically not rated by any rating agency, but we believe that if such investments were rated, they would be below investment grade, which are sometimes referred to as “high yield bonds” or “junk bonds.” We also will further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. In addition, we have a maturity policy between three to six years for our debt investments. See the following risk factors in our most recent Annual Report on Form 10-K incorporated by reference herein:

• “— Risks Relating to Our Business and Structure — We finance our investments with borrowings under credit facilities and issuances of senior unsecured notes, which will magnify the potential for gain or loss on amounts invested and may increase the risk of investing in us”;

• “— Risks Relating to Our Investments — We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies”; and

• “— Risks Relating to Our Investments — Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity”.

In addition, shares of closed-end investment companies, including BDCs, frequently trade at a discount to their net asset values. If shares of our common stock trade at a discount to our net asset value, it will likely increase the risk of loss for purchasers in an offering made pursuant to this prospectus or any related prospectus supplement. Before investing in shares of our common stock, you should read the discussion of the material risks of investing in shares of our common stock, including the risk of leverage, in “Risk Factors” beginning on page 17 of this prospectus or otherwise incorporated by reference herein and included in, or incorporated by reference into, the applicable prospectus supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar headings in the other documents that are incorporated by reference into this prospectus.

This prospectus describes some of the general terms that may apply to an offering of our common stock. Any accompanying prospectus supplement and any related free writing prospectus may also add, update, or change information contained in this prospectus. You should carefully read this prospectus, any accompanying prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein before deciding whether to invest in shares of our common stock and retain it for future reference. We also file annual, quarterly, and current reports, proxy statements and other information about us with the United States Securities and Exchange Commission (the “SEC”), and such filings will be available upon written or oral request and without charge. You may request a free copy of this information about us or make stockholder inquiries, by calling us at (713) 493-2020 or by contacting us at 717 Texas Avenue, Suite 2200, Houston Texas, 77002. Such information about the Company also will be available for free on our website at www.kaynebdc.com. Information on our website is not incorporated into or a part of this prospectus, and you should not consider that information to be part of this prospectus. The SEC maintains a website (http://www.sec.gov) that contains material incorporated by reference and other information regarding the Company.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

1 |

||

|

13 |

||

|

14 |

||

|

16 |

||

|

17 |

||

|

24 |

||

|

26 |

||

|

28 |

||

|

29 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

30 |

|

|

31 |

||

|

32 |

||

|

34 |

||

|

50 |

||

|

51 |

||

|

RELATED PARTY TRANSACTIONS, CERTAIN RELATIONSHIPS AND CONFLICTS OF INTEREST |

52 |

|

|

53 |

||

|

55 |

||

|

56 |

||

|

57 |

||

|

65 |

||

|

70 |

||

|

71 |

||

|

72 |

||

|

SUB-ADMINISTRATOR, FUND ACCOUNTANT, CUSTODIAN, TRANSFER AND DIVIDEND PAYING AGENT AND REGISTRAR |

73 |

|

|

74 |

||

|

75 |

||

|

75 |

||

|

76 |

||

|

77 |

Statistical and market data used in this prospectus has been obtained from governmental and independent industry sources and publications. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus, for which the safe harbor provided in Section 27A of the Securities Act and Section 21E of the Exchange Act is not available. See “Cautionary Notice Regarding Forward-Looking Statements.”

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition and prospects may have changed since that date. To the extent required by applicable law, we will update this prospectus during the offering period to reflect material changes to the disclosure herein.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the SEC, using the “shelf” registration process. Under this shelf registration statement, the selling stockholder named in this prospectus may sell up to 12,181,352 shares of our common stock previously issued from time to time which represent approximately 17.2% of our issued and outstanding common stock as of December 30, 2024. See “Plan of Distribution” for more information.

Each time the selling stockholder sells shares of our common stock, the selling stockholder will provide a prospectus and may also provide a prospectus supplement containing specific information about the terms of the applicable offering, to the extent required by applicable law. A prospectus supplement may also add, update or change information in this prospectus or in documents incorporated by reference in this prospectus. To the extent that any statement that we or the selling stockholder makes in a prospectus supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, the statements made or incorporated by reference in this prospectus will be deemed modified or superseded by those made in the prospectus supplement. You should read this prospectus as well as the additional information described under the headings “Information Incorporated by Reference” and “Available Information” before making an investment decision.

No person has been authorized to give any information or make any representations in connection with this offering other than those contained or incorporated by reference in this prospectus in connection with the offering described in this prospectus, and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus shall not constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference in this prospectus is correct as of any date subsequent to the date of this prospectus or the date of the document incorporated by reference, as applicable. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus provides you with a general description of common stock that the selling stockholder is selling. The selling stockholder may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. In a prospectus supplement or free writing prospectus, the selling stockholder may also add, update, or change any of the information contained in this prospectus or in the documents we have incorporated by reference into this prospectus. This prospectus, together with any applicable prospectus supplement, any related free writing prospectus, and the documents incorporated by reference into this prospectus and the applicable prospectus supplement, will include all material information relating to the applicable offering. Before buying any of the shares of common stock being offered, please carefully read this prospectus, any accompanying prospectus supplement, any free writing prospectus and the documents incorporated by reference in this prospectus and any accompanying prospectus supplement.

This prospectus may contain estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and other third-party reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. However, we acknowledge our responsibility for all disclosures in this prospectus. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described or referenced in the section titled “Risk Factors,” that could cause results to differ materially from those expressed in these publications and reports.

Copies of some of the documents referred to herein have been filed or incorporated by reference, or will be filed or incorporated by reference, as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described in the section titled “Available Information.”

You should rely only on the information included or incorporated by reference in this prospectus, any prospectus supplement or in any free writing prospectus prepared by the selling stockholder or on its behalf or to which we have referred you. Neither We nor the selling stockholder have authorized any dealer, salesperson or other person to provide you with different information or to make representations as to matters not stated in this prospectus, in any accompanying prospectus supplement or in any free writing prospectus prepared by the selling stockholder or on its behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If anyone provides

ii

you with different or inconsistent information, you should not rely on it. This prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by the selling stockholder or on its behalf or to which we have referred you do not constitute an offer to sell, or a solicitation of an offer to buy, any securities by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. You should not assume that the information included or incorporated by reference in this prospectus, in any accompanying prospectus supplement or in any such free writing prospectus is accurate as of any date other than their respective dates. Our financial condition, results of operations and prospects may have changed since any such date. To the extent required by law, we will amend or supplement the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement to reflect any material changes to such information subsequent to the date of the prospectus and any accompanying prospectus supplement and prior to the completion of any offering pursuant to the prospectus and any accompanying prospectus supplement.

iii

PROSPECTUS SUMMARY

This summary highlights some of the information included elsewhere in this prospectus or incorporated by reference. It is not complete and may not contain all of the information that you may want to consider before investing in shares of our common stock. You should carefully read the entire prospectus, the applicable prospectus supplement, and any related free writing prospectus, including the risks of investing in shares of our common stock discussed in the section titled “Risk Factors” in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus and the applicable prospectus supplement. Before making your investment decision, you should also carefully read the information incorporated by reference into this prospectus, including our financial statements and related notes, and the exhibits to the registration statement of which this prospectus is a part. Throughout this prospectus we refer to Kayne Anderson BDC, Inc. as “we,” “us,” “our” or the “Company,” and to “KA Credit Advisors, LLC,” our investment advisor, as the “Advisor.”

Kayne Anderson BDC, Inc.

We are a business development company (“BDC”) that invests primarily in first lien senior secured loans, with a secondary focus on unitranche and split-lien loans to private middle market companies. We are managed by our investment advisor, KA Credit Advisors, LLC (the “Advisor”), an indirect controlled subsidiary of Kayne Anderson Capital Advisors, L.P. (“Kayne Anderson”), and the Advisor operates within Kayne Anderson’s private credit line of business (“KAPC”). Kayne Anderson is a prominent alternative investment management firm, focused on real estate, credit, infrastructure/energy and growth capital. Our Advisor is registered with the United States Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

We are a Delaware corporation that commenced operations on February 5, 2021. We are an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (the “1940 Act”). In addition, for U.S. federal income tax purposes, we intend to qualify, annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). On May 24, 2024, we completed our initial public offering (“IPO”) and our common stock is now traded on the NYSE under the symbol “KBDC.”

We generally intend to distribute, out of assets legally available for distribution, 90% to 100% of our available earnings, on a quarterly or annual basis, as determined by our Board of Directors (the “Board”) in its sole discretion. The distributions we pay to our stockholders in a year may exceed our taxable income for that year and, accordingly, a portion of such distributions equal to such excess of distributions over taxable income may constitute a return of invested capital for federal income tax purposes. Such a return of capital (i.e., a distribution that represents a return of an investor’s original investment) would be nontaxable to the stockholder and would reduce its basis in its shares. As a result, income tax related to the portion of such distributions treated as return of capital would be deferred until any subsequent sale of shares of common stock. The specific tax characteristics of our distributions will be reported to stockholders after the end of the calendar year. See “Certain U.S. Federal Income Tax Considerations.”

Investment Portfolio

Our portfolio is currently comprised of a broad mix of loans, with diversity among investment size and industry focus. The Advisor’s team of professionals conducts due diligence on prospective investments during the underwriting process and is involved in structuring the credit terms of our private middle market investments. Once an investment has been made, our Advisor closely monitors portfolio investments and takes a proactive approach to identify and address sector or company specific risks. The Advisor maintains a regular dialogue with portfolio company management teams (as well as their owners, the majority of whom are private equity firms, where applicable), reviews detailed operating and financial results on a regular basis (typically monthly or quarterly) and monitors current and projected liquidity needs, in addition to other portfolio management activities.

As of September 30, 2024, we had investments in 110 portfolio companies with an aggregate fair value of approximately $1,943 million, and unfunded commitments to these portfolio companies of $179 million, and our portfolio consisted of 98.0% first lien senior secured loans, 0.9% subordinated debt and 1.1% equity investments.

As of September 30, 2024, we held investments in broadly syndicated loans in 22 portfolio companies with an aggregate principal amount of $270 million. Our investments in broadly syndicated loans were made in anticipation of the receipt of proceeds from our final capital call and our IPO which closed during the second quarter of 2024. Prior

1

to these investments, we had not held broadly syndicated loans since 2022. Consistent with our strategy at that time, we expect to rotate out of these investments over coming quarters to invest in private middle market loans consistent with our principal strategy. We have presented certain portfolio-related information below for our private middle market loans and broadly syndicated loans separately and on a combined basis for ease of reference.

As of September 30, 2024, 100% of our debt investments had floating interest rates. Our weighted average yields for debt investments were as follows:

• private middle market loans at fair value and amortized cost weighted average yields were 11.9% and 12.0%, respectively;

• broadly syndicated loans at fair value and amortized cost weighted average yields were 7.8% and 7.7%, respectively; and

• total debt investments at fair value and amortized cost weighted average yields were 11.3% and 11.4%, respectively.

As of September 30, 2024, our portfolio was invested across 33 different industries (Global Industry Classification “GICS”, Level 3 — Industry). The largest industries in our portfolio as of September 30, 2024 were Trading Companies & Distributors, Food Products, Commercial Services & Supplies and Containers & Packaging, which represented, as a percentage of our portfolio of long-term investments, 14.6%, 9.7%, 7.8% and 7.7%, respectively, based on fair value. The mix of industries represented by our portfolio companies will vary over time.

As of September 30, 2024, our average position size based on commitment of private credit investments (at the portfolio company level) was $21.3 million.

As of September 30, 2024, the weighted average and median last twelve months (“LTM”) earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”) of our portfolio companies were as follows:

• private middle market loans were $59.6 million and $33.7 million, respectively, based on fair value1;

• broadly syndicated loans were $2,050.3 million and $1,210.8 million, respectively, based on fair value; and

• total investments were $349.5 million and $41.7 million, respectively, based on fair value1.

As of September 30, 2024, the weighted average loan-to-enterprise-value (“LTEV”) of our debt investments at the time of our initial investment was as follows:

• private middle market loans was 43.2%, based on par1;

• broadly syndicated loans was 34.6%, based on par; and

• total investments was 42.0%, based on par1.

LTEV represents the total par value of our debt investment relative to our estimate of the enterprise value of the underlying borrower.

As of September 30, 2024, we had two debt investments on non-accrual status, which represented 1.0% and 1.2% of total debt investments at fair value and cost, respectively.

As of September 30, 2024, our portfolio companies’ weighted average leverage ratios and weighted average interest coverage ratios (the calculations of which are based on the most recent quarter end or latest available information from the portfolio companies) were as follows:

• private middle market loans were 4.4x and 2.9x, respectively, based on fair value1;

• broadly syndicated loans were 3.3x and 4.0x, respectively, based on fair value; and

____________

1 Excludes investments on watch list, which represent 3.7% of the total fair value of debt investments as of September 30, 2024.

2

• Total investments were 4.2x and 3.1x, respectively, based on fair value1.

As of September 30, 2024, the percentage of our debt investments including at least one financial maintenance covenant was as follows:

• private middle market loans was 100.0% based on fair value1;

• broadly syndicated loans was 0%, based on fair value; and

• total investments was 85.7%, based on fair value1.

As a BDC, at least 70% of our assets must be the type of “qualifying” assets listed in Section 55(a) of the 1940 Act, as described herein, which are generally privately-offered securities issued by U.S. private or thinly-traded companies. We may also invest up to 30% of our portfolio opportunistically in “non-qualifying” portfolio investments. As of September 30, 2024, 9.1% of the Company’s total assets were in non-qualifying investments.

Investment Objective, Principal Strategy and Investment Structures

Our investment objective is to generate current income and, to a lesser extent, capital appreciation. We intend to have nearly all of our debt investments in private middle market companies. We use “private” to refer to companies that are not traded on a securities exchange and define “middle market companies” as companies that, in general, generate between $10 million and $150 million of annual EBITDA. Further, we refer to companies that generate between $10 million and $50 million of annual EBITDA as “core middle market companies” and companies that generate between $50 million and $150 million of annual EBITDA as “upper middle market companies.” We typically adjust EBITDA for non-recurring and/or normalizing items to assess the financial performance of our borrowers over time.

We achieve our investment objective by investing primarily in first lien senior secured loans, with a secondary focus on unitranche and split-lien loans to private middle market companies. Under normal market conditions, we expect at least 90% of our portfolio (including investments purchased with proceeds from borrowings under credit facilities and issuances of senior unsecured notes) to be invested in first lien senior secured, unitranche and split-lien loans. Our investment decisions are made on a case-by-case basis. We expect that a majority of these debt investments will be made in core middle market companies and will have stated maturities of three to six years. We expect that the loans in which we principally invest will be to companies that are located in the United States. We determine the location of a company as being in the United States by (i) such company being organized under the laws of one of the states in the United States; or (ii) during its most recent fiscal year, such company derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in the United States or has at least 50% of its assets in the United States.

See “Risk Factors — Risks Relating to Our Business and Structure — We depend upon our Advisor and Administrator for our success and upon their access to the investment professionals and partners of Kayne Anderson and its affiliates. Any inability of the Advisor or the Administrator to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business,” and “— Risks Relating to Our Investments — Limitations of investment due diligence in the private middle market companies in which we invest expose us to increased investment risk” in our most recent Annual Report on Form 10-K incorporated by reference herein.

We principally invest in the following types of debt securities:

• First lien debt: Typically senior on a lien basis to the other liabilities in the issuer’s capital structure with a first priority lien against substantially all assets of the borrower and often including a pledge of the capital stock of the business. The security interest ranks above the security interest of second lien lenders on those assets. These securities are typically floating rate investments priced with a spread to the reference rate (typically the Secured Overnight Financing Rate (“SOFR”));

____________

1 Excludes opportunistic deals, which represent 2.0% of the total fair value of debt investments as of September 30, 2024.

3

• Split-lien debt: Typically includes (i) a first lien on fixed and intangible assets of the borrower and often including a pledge of the capital stock of the business and (ii) a second lien on working capital assets. Used in conjunction with an asset based lender who has a first lien on the borrower’s working capital assets. These securities are typically floating rate investments priced with a spread to the reference rate (typically SOFR).

• Unitranche debt: Combines features of first lien, second lien and subordinated debt, generally in a first lien position. These securities can generally be thought of as first lien investments beyond what may otherwise be considered “typical” first lien leverage levels, effectively representing a greater portion of the overall capitalization of the underlying business. These securities are typically structured as floating rate investments priced with a spread to the reference rate (typically SOFR).

Senior secured debt often has restrictive covenants for the purpose of pursuing principal protection and repayment before junior creditors as covenants provide opportunities for lenders to take action following a covenant breach. The loans in which we principally invest will have financial maintenance covenants, which require borrowers to maintain certain financial performance criteria and financial ratios on a monthly or quarterly basis.

Currently, we partially finance our investments with leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes. We also will further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. As of September 30, 2024, we had $788.0 million of indebtedness outstanding under our credit facilities and senior unsecured notes. See “Risk Factors — Risks Relating to Our Business and Structure — Provisions in our credit facilities and our senior unsecured notes contain various covenants, which, if not complied with, could accelerate our repayment obligations under such facilities, thereby materially and adversely affecting our liquidity, financial condition, results of operations and ability to pay distributions” in our most recent Annual Report on Form 10-K incorporated by reference herein. In accordance with the 1940 Act, we are required to meet a coverage ratio of total assets (less total liabilities other than indebtedness) to total borrowings and other senior securities of at least 150%. If this ratio declines below 150%, we cannot incur additional leverage and could be required to sell a portion of our investments to repay some leverage when it is disadvantageous to do so. See “Regulation” for a discussion of BDC regulation and other regulatory considerations. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Contractual Obligations.”

We invest in debt that is typically not rated by any rating agency, but we believe that if such investments were rated, they would be below investment grade, which are sometimes referred to as “high yield bonds” or “junk bonds.” See “Risk Factors — Risks Relating to Our Investments — We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies” in our most recent Annual Report on Form 10-K incorporated by reference herein. In addition, we have a maturity policy between three to six years for our debt investments. See “Risk Factors — Risks Relating to Our Investments — Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity” in our most recent Annual Report on Form 10-K incorporated by reference herein.

Kayne Anderson, Kayne Anderson Private Credit and The Advisor

Kayne Anderson

Founded in 1984, Kayne Anderson is a prominent alternative investment management firm which is registered with the SEC under the Advisers Act, focused on real estate, credit, infrastructure/energy and growth capital. Kayne Anderson provides corporate and management services (such as information technology, human resources, compliance and legal services) to the Advisor.

As of September 30, 2024, investment vehicles managed or advised by Kayne Anderson had over $36 billion in assets under management (“AUM”) for institutional investors, family offices, high net worth and retail clients. Kayne Anderson has over 350 professionals located across five offices across the U.S. The firm has approximately 150 investment professionals, approximately 36 of which are dedicated to credit investing.

4

Kayne Anderson Private Credit

KAPC is Kayne Anderson’s line of business focused on private credit that operates various fund vehicles targeting middle market first lien senior secured, unitranche, and split-lien loans. KAPC was established in 2011 and manages (indirectly through affiliates) AUM of approximately $7.1 billion related to middle market private credit as of September 30, 2024.

KAPC’s integrated and scaled platform combines direct loan origination, strong fundamental credit analysis and relative-value perspective.

The Advisor — KA Credit Advisors, LLC

Our investment activities are managed by our Advisor, an indirect controlled subsidiary of Kayne Anderson, and the Advisor operates within KAPC’s line of business. The Advisor is an investment advisor registered with the SEC under the Advisers Act pursuant to an investment advisory agreement between us and the Advisor (the “Investment Advisory Agreement”). In accordance with the Advisers Act, our Advisor is responsible for originating prospective investments, conducting research and due diligence investigations on potential investments, analyzing investment opportunities, negotiating and structuring investment sand monitoring our investments and portfolio companies on an ongoing basis. The Advisor benefits from the scale and resources of Kayne Anderson and specifically KAPC.

The Advisor executes on our investment objective by (1) accessing the established loan sourcing channels developed by KAPC, which includes an extensive network of private equity firms, other middle market lenders, financial advisors, intermediaries and management teams, (2) selecting investments within our middle market company focus, (3) implementing KAPC’s underwriting process and (4) drawing upon its experience and resources and the broader Kayne Anderson network.

The principal executive offices of our Advisor are located at 717 Texas Avenue, Suite 2200, Houston, Texas 77002.

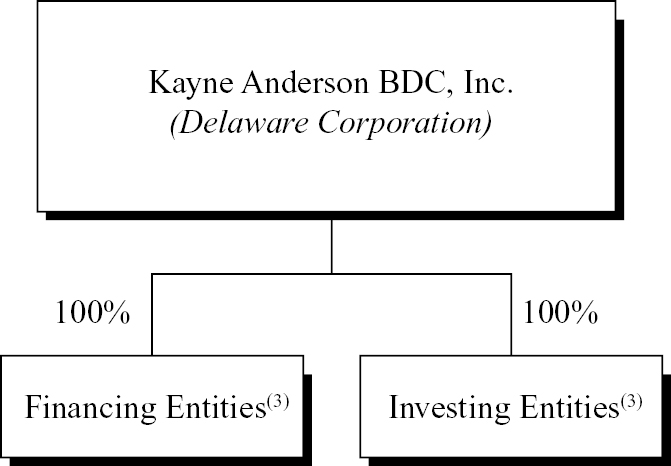

Corporate Structure

We are a Delaware corporation and commenced operations on February 5, 2021.

____________

(1) From time to time we may form wholly-owned subsidiaries to facilitate our normal course of business investing activities.

Investment Advisory Agreement

On March 6, 2024, the Company entered into an amended and restated investment advisory agreement with the Advisor (the “Amended Investment Advisory Agreement”), which became effective when we closed our initial public offering (“IPO”). Under the Amended Investment Advisory Agreement, the base management fee calculated at an annual rate of 1.00% and the incentive fee on income is subject to a twelve-quarter lookback quarterly hurdle rate of 1.50% and is subject to an Incentive Fee Cap (as defined below) based on the Company’s Cumulative Pre-Incentive Fee Net Return (as defined below).

The cost of both the management fee and the incentive fee under the Amended Investment Advisory Agreement are ultimately be borne by common stockholders. The Amended Investment Advisory Agreement was approved by the Board on March 6, 2024. Unless earlier terminated, the Amended Investment Advisory Agreement will renew automatically for successive annual periods, provided that such continuance is specifically approved at least annually by our Board including a majority of Independent Directors or the vote of a majority of our outstanding voting securities.

5

As discussed in more detail below, on March 6, 2024, the Advisor entered into the Amended Investment Advisory Agreement (effective upon the closing of the IPO) to include a three-year total return lookback feature on the income incentive fee. This lookback feature provides that the Advisor’s income incentive fee may be reduced if the Company’s portfolio experiences aggregate write-downs or net capital losses during the applicable Trailing Twelve Quarters (as defined below). On March 6, 2024 the Advisor also entered into a fee waiver agreement (the “Fee Waiver Agreement”) for the waivers of (i) the income incentive fee for three calendar quarters commencing in the calendar quarter the IPO was completed and (ii) a portion of the base management fee for one year following the completion of the IPO. The Fee Waiver Agreement became effective upon the closing of the IPO. Amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor. The waivers of the base management fee and incentive income fee pursuant to the Fee Waiver Agreement may only be terminated by the Board and may not be terminated by the Advisor. The Fee Waiver Agreement is contractual in nature.

Base Management Fee

Effective upon the closing of the IPO, the base management fee pursuant to the Amended Investment Advisory Agreement became calculated at an annual rate of 1.00% of the fair market value of the Company’s investments. Since the IPO occurred on a date other than the first day of a calendar quarter, the base management fee was calculated for such calendar quarter at a weighted rate based on the fee rates applicable before and after the closing of the IPO based on the number of days in such calendar quarter before and after the closing of the IPO. Pursuant to the Fee Waiver Agreement, effective upon the closing of the IPO, the Advisor entered into an agreement for the contractual waiver of the base management fee at an annual rate of 0.25% for one year following the completion of the IPO.

The base management fee under the Amended Investment Advisory Agreement is payable quarterly in arrears and calculated based on the average of the Company’s fair market value of investments, at the end of the two most recently completed calendar quarters, including, in each case, assets purchased with borrowings under credit facilities and issuances of senior unsecured notes, but excluding cash, U.S. government securities and commercial paper instruments maturing within one year of purchase. Base management fees for any partial quarter will be appropriately pro-rated.

Incentive Fee

The Company will also pay the Advisor an incentive fee. The incentive fee will consist of two parts — an incentive fee on income and an incentive fee on capital gains. Described in more detail below, these components of the incentive fee will be largely independent of each other with the result that one component may be payable even if the other is not.

Incentive Fee on Income

The incentive fee based on income (the “income incentive fee”) under the Amended Investment Advisory Agreement is determined and paid quarterly in arrears in cash (subject to the limitations described in “Payment of Incentive Fees” below).

Under the Amended Investment Advisory Agreement, the first part of the income incentive fee is calculated and payable quarterly in arrears based on the Company’s pre-incentive fee net investment income as defined in the Amended Investment Advisory Agreement. Pre-incentive fee net investment income means, as the context requires, either the dollar value of, or percentage rate of return on the value of, the Company’s net assets at the beginning of each applicable calendar quarter from interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s operating expenses accrued for the quarter (including the management fee, expenses payable under the Administration Agreement (as defined below), and any interest expense or fees on any credit facilities or senior unsecured notes and dividends paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind (“PIK”) interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-incentive fee net investment income excludes any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

6

Following the closing of the IPO, the Company is required to pay an income incentive fee of 15.0%, with a 1.50% quarterly hurdle and 100% catch-up. Pursuant to the Fee Waiver Agreement, the Advisor waived its right to receive an income incentive fee during the three calendar quarters commencing with the calendar quarter in which the IPO was completed and amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor.

Effective upon the closing of the IPO, the Company will pay the Advisor an income incentive fee based on its aggregate pre-incentive fee net investment income (as described above), with respect to (i) the calendar quarter ending June 30, 2024 (the “First Calendar Quarter”) and (ii) each subsequent calendar quarter, with the then, current calendar quarter and the eleven preceding calendar quarters beginning with the calendar quarter after the First Calendar Quarter (or the appropriate portion thereof in the case of any of the Company’s first eleven calendar quarters that commence after the First Calendar Quarter) (those calendar quarters after the First Calendar Quarter, the “Trailing Twelve Quarters”).

For the First Calendar Quarter, pre-incentive fee net investment income in respect of the First Calendar Quarter was compared to a hurdle rate of 1.50% (6.00% annualized). The income incentive fee for the First Calendar Quarter was determined as follows:

• no income incentive fee is payable to the Advisor if the aggregate pre-incentive fee net investment income for the First Calendar Quarter does not exceed that hurdle rate;

• 100% of the aggregate pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds that hurdle rate, but is less than a quarterly rate of 1.6667% for the portion of the First Calendar Quarter before the IPO and a quarterly rate of 1.7647% for the portion of the First Calendar Quarter after the IPO, referred to the “catch-up.” The “catch-up” is meant to provide the Advisor with approximately 10.0% of the Company’s pre-incentive fee net investment income for the portion of the First Calendar Quarter before the IPO and 15.0% for the balance of that First Calendar Quarter, as if the hurdle rate did not apply; and

• 10.0% of the aggregate pre-incentive fee net investment income, if any, that exceeds a quarterly rate of 1.6667% for the portion of the First Calendar Quarter before the IPO and 15.0% of the aggregate pre-incentive fee net investment income, if any, that exceeds a quarterly rate of 1.7647% for the balance of the First Calendar Quarter.

Commencing with the calendar quarter beginning immediately after the First Calendar Quarter, subject to the Incentive Fee Cap (described below), the pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters is compared to a “Hurdle Rate” equal to the product of (i) the hurdle rate of 1.50% per quarter (6.00% annualized) and (ii) the sum of our net assets at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The income incentive fee for each calendar quarter will be determined as follows:

• no income incentive fee is payable to the Advisor in any calendar quarter in which aggregate pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters does not exceed the Hurdle Rate;

• 100% of the aggregate pre-incentive fee net investment income in respect of the Trailing Twelve Quarters with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the Hurdle Rate, but is less than or equal to an amount, which we refer to as the “Catch-up Amount,” determined on a quarterly basis by multiplying 1.7647% by the Company’s net asset value at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters (after making appropriate adjustments to the Company’s net asset value at the beginning of each applicable calendar quarter for all issuances by the Company of shares of its common stock, including issuances pursuant to its dividend reinvestment plan, and distributions during the applicable calendar quarter); and

• 15.0% of the aggregate pre-incentive fee net investment income in respect of the Trailing Twelve Quarters that exceeds the Catch-up Amount.

Commencing with the quarter that begins immediately after the First Calendar Quarter, each income incentive fee became subject to an “Incentive Fee Cap” that in respect of any calendar quarter is an amount equal to 15.0% of the Cumulative Pre-Incentive Fee Net Return (as defined herein) during the Trailing Twelve Quarters less the aggregate income incentive fees that were paid to the Advisor in the preceding eleven calendar quarters (or portion thereof)

7

comprising the relevant Trailing Twelve Quarters. In the event the Incentive Fee Cap is zero or a negative value then no income incentive fee shall be payable and if the Incentive Fee Cap is less than the amount of income incentive fee that would otherwise be payable, the amount of income incentive fee shall be reduced to an amount equal to the Incentive Fee Cap.

“Cumulative Pre-Incentive Fee Net Return” means (x) with respect to the First Calendar Quarter, the sum of pre-incentive fee net investment income in respect of the First Calendar Quarter, (y) with respect to the relevant Trailing Twelve Quarters, the pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters minus any Net Capital Loss (as defined below), if any, in respect of the relevant Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, the Company will pay no income incentive fee to the Advisor for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is a positive value but is less than the income incentive fee that is payable to the Advisor for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, the Company will pay an income incentive fee to the Advisor equal to the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is equal to or greater than the income incentive fee that is payable to the Advisor for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, the Company will pay an income incentive fee to the Advisor equal to the incentive fee calculated as described above for such quarter without regard to the Incentive Fee Cap.

“Net Capital Loss” in respect of a particular period means the difference, if positive, between (i) aggregate capital losses, whether realized or unrealized, in such period and (ii) aggregate capital gains, whether realized or unrealized, in such period.

These calculations are prorated for any period of less than three months and adjusted for any share issuances or repurchases during the relevant quarter. In no event will the amendments to the income incentive fee to include the three year income and total return lookback features allow the Advisor to receive greater cumulative income incentive fees under the Amended Investment Advisory Agreement than it would have under the Investment Advisory Agreement. Amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor.

Incentive Fee on Capital Gains

The incentive fee on capital gains (the “capital gains incentive fee”) is calculated and payable in arrears in cash as follows:

• 15.0% of the Company’s realized capital gains, if any, on a cumulative basis from formation through the end of a given calendar year or upon termination of the Investment Advisory Agreement, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees.

Payment of Incentive Fees

Prior to the IPO, any incentive fees earned by the Advisor accrued as earned but only became payable in cash to the Advisor upon closing of the IPO. The Company incurred incentive fees of $16.8 million that became payable upon closing of the IPO.

The Administrator

On February 5, 2021, the Company entered into an administration agreement the (“Administration Agreement”) with its Advisor, which serves as its administrator (the “Administrator”) and will provide or oversee the performance of its required administrative services and professional services rendered by others, which will include (but are not limited to), accounting, payment of our expenses, legal, compliance, operations, technology and investor relations, preparation and filing of its tax returns, and preparation of financial reports provided to its stockholders and filed with the SEC. On March 6, 2024, the Board approved a one-year renewal term of the Administration Agreement through March 15, 2025.

The Company will reimburse the Administrator for its costs and expenses incurred in performing its obligations under the Administration Agreement, which may include, its allocable portion of office facilities, overhead, and compensation paid to or compensatory distributions received by its officers (including our Chief Compliance Officer

8

and Chief Financial Officer) and its respective staff who provide services to the Company. As the Company reimburses the Administrator for its expenses, such costs (including the costs of the sub-administrator) will be ultimately borne by common stockholders. The Administrator does not receive compensation from the Company other than reimbursement of its expenses. The Administration Agreement may be terminated by either party with 60 days’ written notice.

Since the inception of the Company, the Administrator has engaged a sub-administrator to assist the Administrator in performing certain of its administrative duties. Since the inception of the Company, the Administrator has not sought reimbursement of its expenses other than expenses incurred by the sub-administrator. However, the Administrator has a contractual right to seek reimbursement for its costs and expenses incurred in performing its obligations under the Administration Agreement and may do so in the future. On March 28, 2023, the Administrator engaged Ultimus Fund Solutions, LLC under a sub-administration agreement. Under the terms of the sub-administration agreement, Ultimus Fund Solutions, LLC will provide fund administration and fund accounting services. Since March 28, 2023, the Company has paid fees to Ultimus Fund Solutions, LLC, which constitute reimbursable expenses under the Administration Agreement. The Administrator may enter into additional sub-administration agreements with third-parties to perform other administrative and professional services on behalf of the Administrator.

Policies and Procedures for Managing Conflicts

The Advisor and the Administrator have a fiduciary duty to the Company under the 1940 Act, including with respect to the receipt of compensation. The Advisor and its affiliates have policies and procedures in place designed to manage the potential conflicts of interest between our Advisor’s fiduciary obligations to us and its similar fiduciary obligations to other clients. For example, such policies and procedures are designed to ensure that investment opportunities are generally allocated on a pro rata basis based on each account’s capital available for investment. An investment opportunity that is suitable for multiple clients of our Advisor and its affiliates may not be capable of being shared among some or all of such clients and affiliates due to the limited scale of the opportunity or other factors, including regulatory restrictions imposed by the 1940 Act. We can offer no assurance that the efforts of our Advisor and its affiliates to allocate any particular investment opportunity fairly among all clients for whom such opportunity is appropriate will result in an allocation of all or part of such opportunity to us. Our investors should not expect all conflicts of interest to be resolved in our favor.

Allocation of Investment Opportunities and Exemptive Relief

We make investments alongside certain entities and accounts advised by our Advisor and its affiliates. Under the 1940 Act, we are prohibited from knowingly participating in certain joint transactions with our affiliates without the prior approval of the independent directors and, in some cases, prior approval by the SEC. However, we generally make investments alongside affiliated entities and accounts pursuant to exemptive relief granted by the SEC to us, our Advisor, and certain affiliates of ours on February 4, 2020. Pursuant to such exemptive relief, and subject to certain conditions, we are permitted to co-invest in the same security with our affiliates in a manner that is consistent with our investment objective, investment strategy, regulatory consideration and other relevant factors. If opportunities arise that would otherwise be appropriate for us and an affiliate to purchase different securities in the same issuer, our Advisor will need to decide which account will proceed with such investment. Our Advisor’s investment allocation policy incorporates the conditions of exemptive relief to seek to ensure that investment opportunities are allocated in a manner that is fair and equitable.

Corporate Information

Our principal executive offices are located at 717 Texas Avenue, Suite 2200, Houston, Texas, 77002 and our telephone number is (713) 493-2020. Our corporate website is located at www.kaynebdc.com. Information on our website and the SEC’s website is not incorporated into or a part of this prospectus.

DGCL

The General Corporation Law of the State of Delaware, as amended (the “DGCL”), contains provisions that may discourage, delay or make more difficult a change in control of us or the removal of our directors. Our certificate of incorporation and bylaws contain provisions that limit liability and provide for indemnification of our directors and officers. These provisions and others which we may adopt also may have the effect of deterring hostile takeovers or

9

delaying changes in control or management. We are subject to Section 203 of the DGCL, the application of which is subject to any applicable requirements of the 1940 Act. See “Description of Our Capital Stock — Provisions of the DGCL and Our Certificate of Incorporation and Bylaws.”

Recent Developments

On October 15, 2024, we paid a regular dividend of $0.40 per share to each common stockholder of record as of September 30, 2024. The total dividend was $28.4 million and $4.5 million was reinvested into the Company through open market purchases of common stock.

On November 6, 2024, our Board of Directors declared a regular dividend to common stockholders in the amount of $0.40 per share. The regular dividend of $0.40 per share will be paid on January 15, 2025 to stockholders of record as of the close of business on December 31, 2024, payable in cash or shares of our common stock pursuant to our Dividend Reinvestment Plan, as amended.

From October 1, 2024 to November 7, 2024, our agent repurchased 21,668 shares of common stock at an average price of $16.09 per share for a total amount of $0.3 million. As of November 7, 2024, $98.5 million remains for repurchase under our stock repurchase plan.

Summary of Principal Risk Factors

Investing in our shares of common stock involves a number of significant risks. You should carefully consider information found in the section entitled “Risk Factors” and elsewhere in this prospectus. Some of the risks involved in investing in our shares of common stock include:

Principal Risks Relating to This Offering

• The number of shares being registered for sale is significant in relation to the number of our outstanding shares of common stock and the sale of the shares by the selling stockholder could depress the market price of our common stock.

• It is not possible to predict the actual number of shares the selling stockholder will sell under this offering, or the actual gross proceeds resulting from those sales. Further, we will not receive any of the proceeds from the sale of the shares offered hereby.

• Investors who buy shares at different times will likely pay different prices.

Principal Risks Relating to Our Business and Structure

• We have a limited operating history and our Advisor and its affiliates have limited experience advising BDCs and may not replicate the historical results achieved by other entities managed by members of the Advisor’s investment committee, the Advisor or its affiliates.

• We use leverage pursuant to borrowings under credit facilities and issuances of senior unsecured notes to finance our investments and changes in interest rates will affect our cost of capital and net investment income.

• We depend upon our Advisor and Administrator for our success and upon their access to the investment professionals and partners of Kayne Anderson and its affiliates. Any inability of the Advisor or the Administrator to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business.

• Our financial condition, results of operations and cash flows depend on our ability to manage our business and future growth effectively.

• There are significant potential conflicts of interest that could affect our investment returns, including conflicts related to obligations the Advisor’s investment committee, the Advisor or its affiliates have to other clients and conflicts related to fees and expenses of such other clients.

• We generally may make investments that could give rise to a conflict of interest and our ability to enter into transactions with our affiliates will be restricted.

10

• We operate in a highly competitive market for investment opportunities, which could reduce returns and result in losses.

• We will be subject to corporate-level income tax if we are unable to qualify as a RIC.

• We finance our investments with borrowings under credit facilities and issuances of senior unsecured notes, which will magnify the potential for gain or loss on amounts invested and may increase the risk of investing in us.

• Adverse developments in the credit markets may impair our ability to enter into new credit facilities or our ability to issue senior unsecured notes.

• The majority of our portfolio investments are recorded at fair value as determined in good faith by our Advisor and, as a result, there may be uncertainty as to the value of our portfolio investments.

• Our Board may change our investment objective, operating policies and strategies without prior notice or stockholder approval, and we may temporarily deviate from our regular investment strategy.

• Efforts to comply with the Exchange Act and the Sarbanes-Oxley Act will involve significant expenditures, and non-compliance would adversely affect us and the value of our shares of common stock.

• We are highly dependent on information systems, and cybersecurity risks and cyber incidents may adversely affect our business or the business of our portfolio companies, which may, in turn, negatively affect the value of our shares of common stock and our ability to pay distributions.

Principal Risks Relating to Our Investments

• Rising interest rates could affect the value of our investments and make it more difficult for portfolio companies to make periodic payments on their loans.

• Our business is dependent on bank relationships and recent strain on the banking system may adversely impact us.

• Limitations of investment due diligence in the private middle market companies in which we invest expose us to increased investment risk.

• We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies.

• We are subject to risks associated with our investments in unitranche secured loans and securities, including the potential loss of all or part of such investments.

• Our investments in securities that are rated below investment grade (i.e. “junk bonds”) may be risky and we could lose all or part of our investments.

• Defaults by our portfolio companies, including defaults relating to collateral, will harm our operating results.

• The lack of liquidity in our investments may adversely affect our business.

• Our prospective portfolio companies may prepay loans, which may reduce our yields if capital returned cannot be invested in transactions with equal or greater expected yields.

• Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity.

• Our portfolio may be concentrated in a limited number of portfolio companies and industries, which will subject us to a risk of significant loss if any of these companies defaults on its obligations under any of its debt instruments or if there is a downturn in a particular industry.

• There is no assurance that portfolio company management will be able to operate their companies in accordance with our expectations.

11

• Our investments in the Trading Companies & Distributors industry face considerable uncertainties including significant regulatory challenges.

• We are exposed to risks associated with changes in floating interest rates.

Risks Relating to Our Common Stock

• Prior to our IPO, there was no public market for our shares of common stock, and we cannot assure you that the market for our shares of common stock will be sustained or that the market price of our shares of common stock will not decline. Our common stock share price may be volatile and may fluctuate substantially.

• Sales of substantial amounts of our shares of common stock in the public market may have an adverse effect on the market price of our shares of common stock.

• Trading in our shares may be limited and our shares may trade below NAV.

• During extended periods of capital market disruption and instability, there is a risk that you may not receive distributions or that our distributions may not grow over time and a portion of our distributions may be a return of capital.

• Our stockholders may experience dilution in their ownership percentage.

12

THE OFFERING SUMMARY

|

Shares of Common Stock offered by the Selling Stockholder |

|

|

|

Use of Proceeds |

All of the securities offered by this prospectus are being registered for the account of the selling stockholder. We will not receive any of the proceeds from the sale of these securities. The selling stockholder will pay all costs, expenses and fees relating to the registration of the securities covered by this prospectus. The selling stockholder will bear all commissions and discounts, if any, attributable to the sale of the common stock under this shelf offering. |

|

|

Listing |

Our common stock is traded on the NYSE under the symbol “KBDC”. |

|

|

Leverage |

As a BDC, we are permitted under the 1940 Act to make borrowings under credit facilities and issue senior unsecured notes to finance a portion of our investments. As a result, we are exposed to the risks of leverage, which may be considered a speculative investment technique. We finance our investments with leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes. We also will further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. In accordance with the 1940 Act, we are required to meet a coverage ratio of total assets (less total liabilities other than indebtedness) to total borrowings and other senior securities of at least 150%. If this ratio declines below 150%, we cannot incur additional leverage and could be required to sell a portion of our investments to repay some leverage when it is disadvantageous to do so. Our common stockholders bear the burden of any increase in our expenses as a result of our use of leverage, including interest expenses and any increase in the base management fee payable to the Advisor. As of September 30, 2024, we had $788.0 million of indebtedness outstanding under our credit facilities and senior unsecured notes. As of September 30, 2024, our asset coverage ratio was 251%. |

|

|

Risk Factors |

Investing in our shares of common stock involves a number of significant risks. You should carefully consider information found in the section entitled “Risk Factors” and elsewhere in this prospectus before deciding to invest in our common stock. |

|

|

Available Information |

We file with or submit to the SEC periodic and current reports, proxy statements and other information meeting the informational requirements of the Exchange Act. We furnish our stockholders with annual reports containing audited financial statements, quarterly reports, and such other periodic reports as we determine to be appropriate or as may be required by law. We make available on our website (www.kaynebdc.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q and our current reports on Form 8-K. The SEC also maintains a website that contains such information. The reference to our website is an inactive textual reference only and the information contained on our website and in our reports filed with the SEC is not a part of this registration statement. See “Available Information”. |

13

FEES AND EXPENSES

The selling stockholder will pay any underwriting discounts and commissions and expenses incurred by it for brokerage, accounting, tax or legal services or any other expenses incurred by it in selling its shares of our common stock. We will not bear any expenses associated with any offering by the selling stockholder, other than expenses and fees relating to the registration of the securities covered by this prospectus. The following table is intended to assist you in understanding the costs and expenses associated with the offering. We caution you that some of the percentages indicated in the table below are estimates and may vary. The expenses shown in the table under “Annual Expenses” are based on estimated amounts for our current fiscal year assuming a debt-to-equity ratio of 1.00x (which equates to asset coverage of 200%). The following table should not be considered a representation of our future expenses. Actual expenses may be greater or less than shown.

| Selling Stockholder Transaction Expenses: |

| ||

| Sales Load (as a percentage of offering price)(1) |

|

| |

| Offering expenses (as a percentage of offering price)(2) |

|

| |

| Dividend Reinvestment Plan Fees(3) | $ | | |

| Total Stockholder Transaction Expenses ( |

|

|

| Annual Expenses ( |

| ||

| Management Fees(5) | | % | |

| Incentive Fees(6) | | % | |

| Interest Payments and fees paid on Borrowed Funds(7) | | % | |

| Other Expenses(8) | | % | |

| Total Annual Expenses | | % | |

| Management Fee Waiver(9) | ( | )% | |

| Total Net Annual Expenses | | % |

____________

(1)

(2)

(3)

The expenses of the dividend reinvestment plan are included in “other expenses” in the table above. Our common stockholders will ultimately bear indirectly the DRIP administrator’s fees. For additional information, see “Dividend Reinvestment Plan.”

(4)

(5)

The base management fee is calculated at an annual rate of 1.00% of the fair market value of our investments including, in each case, assets purchased with borrowings under credit facilities and issuances of senior unsecured notes, but excluding cash, U.S. government securities and commercial paper instruments maturing within one year of purchase.

(6)

(7)

14

(8)

(9)

Example

The following example demonstrates the projected dollar amount of total cumulative expenses over various periods with respect to a hypothetical investment in our shares of common stock. In calculating the following expense amounts, we have assumed that our annual operating expenses would remain at the levels set forth in the table above. Since the selling stockholder will pay any transaction expenses associated with selling of its shares, the transaction expenses are excluded from the table below.