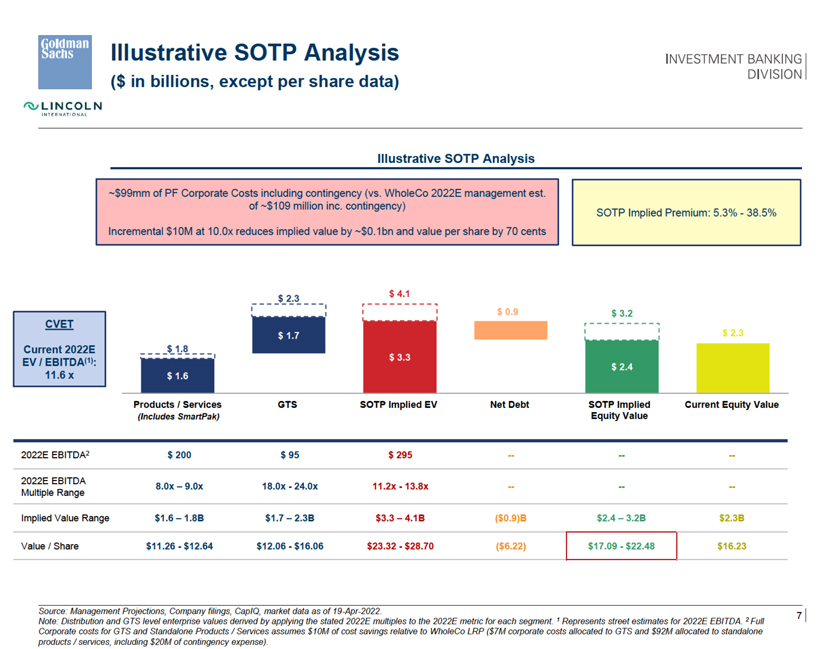

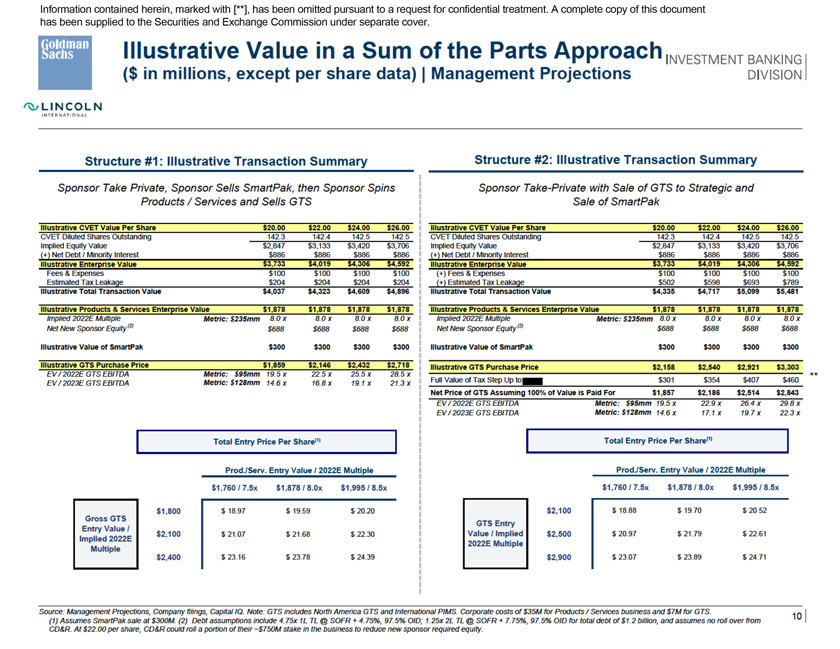

Illustrative Value in a Sum of the Parts Approach INvEsTMENT BANKING I ($ in millions, except per share data) 1

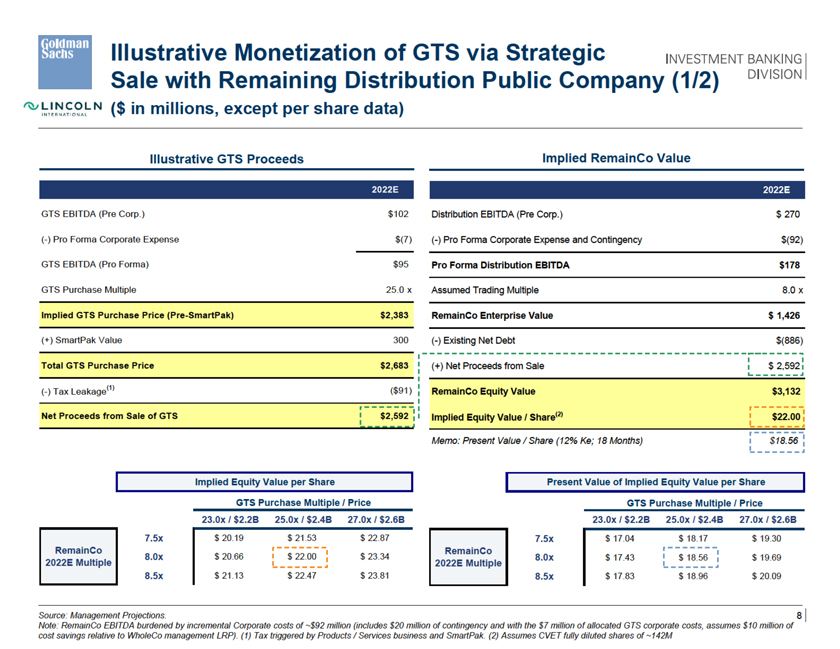

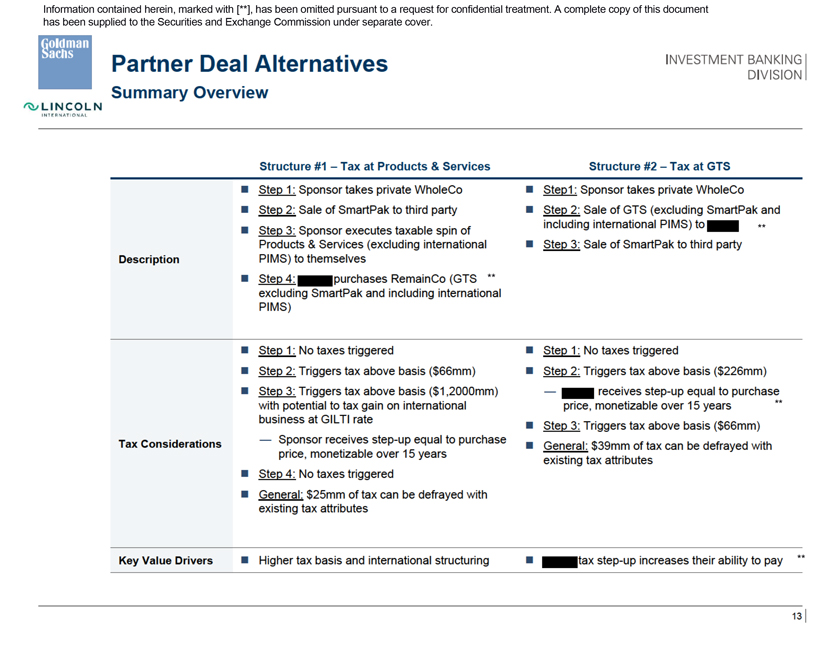

Management Projections DIVISION ‘WLINCOLN INTERNATIO NAL Structure #1: Illustrative Transaction Summary Structure #2: Illustrative Transaction Summary Sponsor Take Private, Sponsor Sells SmartPak, then Sponsor Spins Sponsor Take-Private with

Sale of GTS to Strategic and Products I Services and Sells GTS Sale of SmartPak Illustrative CVET Value Per Share $20.00 $22.00 $24.00 $26.00 Illustrative CVET Value Per Share $20.00 $22.00 $24.00 $26.00 CVET Diluted Shares Outstanding 142.3 142.4

142.5 142.5 CVET Diluted Shares Outstanding 142.3 142.4 142.5 142.5 Implied Equity Value $2,847 $3,133 $3,420 $3,706 Implied Equity Value $2,847 $3,133 $3,420 $3,706 ! +2Net Debt I Minori~ Interest $886 $886 $886 $886 !+2Net Debt I Minori~ Interest

$886 $886 $886 $886 Illustrative Entererise Value $3,733 $4,019 $4,306 $4,592 Illustrative Entererise Value $3,733 14,019 14,306 $4,592 Fees & Expenses $100 $100 $100 $100 (+)Fees & Expenses $100 $100 $100 $100 Estimated Tax

Leakage $204 $204 $204 $204 !+!Estimated Tax LeaKage $502 $598 $693 $789 Illustrative Total Transaction Value $4,037 $4,323 $4,609 $4,896 Illustrative Total Transaction Value $4,335 $4,717 $5,099 $5,481 Illustrative Products & Services

Ente!Erise Value $1,878 $1,878 $1,878 $1,878 Illustrative Products & Serv1ces Enterpnse Value $1,878 $1,878 $1,878 $1,878 Implied 2022E MUltiple Metric: $235mm 8.0 x 8.0x 8.0x 8.0 x Implied 2022E MUltiple Metric: $235mm 8.0x 8.0 x 8.0x 8.0x

Net New Sponsor Equity(2) $688 $688 $688 $688 Net New Sponsor Equity(2) $688 $688 $688 $688 Illustrative Value of SmartPak $300 $300 $300 $300 Illustrative Value of SmartPak $300 $300 $300 $300 Illustrative GTS Purchase Price $1,859 $2,146 $2,432

$2,718 Illustrative GTS Purchase Price $2,158 $2,540 $2,921 $3,303 EV 12022E GTS EBIIDA Metric: $95mm 19.5 x 22.5x 25.5x 28.5 x $301 $354 $407 $460 Full Value ofT ax Step Up to- EV 12023E GTS EBIIDA Metric:

$128mm 14.6 X 16.8 X 19.1 X 21.3 x Net Price of GTS Assuming 100% of Value is Paid For $1,857 $2,186 $2,514 $2,843 EV 12022E GTS EBIIDA Metric: $95mm 19.5x 22.9x 26.4 X 29.8x EV 12023E GTS EBIIDA Metric: $128mm 14.6 x 17.1 X 19.7 X 22.3x Total Entry

Price Per Sharel’l Total Entry Price Per Share~l ProdJServ. Entry Value / 2022E Multiple Prod./Serv. Entry Value / 2022E Multiple $1,760 / 7.5x $1,878 I 8.0x $1,995 / 8.5x $1,760 / 7.5x $1,878 I 8.0x $1,995 I 8.5x $1,800 $ 18.97 $ 19.59 $ 20.20

$2,100 $ 18.88 $ 19.70 $20 52 Gross GTS GTS Entry Entry Value I Implied 2022E $2,100 $ 21.07 $ 21.68 $ 22.30 Value / Implied $2,500 $ 20.97 $ 21.79 $22.61 Multiple 2022E Multiple $2,400 $ 23.16 $ 23.78 $ 24.39 $2,900 $ 23.07 $ 23.89 $24.71 Source:

Management Projections, Company filings, Capitai iQ. Note: GTS includes North America GTS and International PIMS. Corporate costs of $35M for Products I SeNices business and $7M for GTS. 10 1 (1) Assumes SmartPak sale at $300M. (2) Debt

assumptions include 4.75x 1L TL@ SOFR + 4.75%, 97.5% OlD; 1.25x 2L TL@ SOFR + 7.75%, 97.5% OlD for total debt of $1.2 billion, and assumes no rollover from CD&R. At $22.00 per share, CD&R could roll a portion of their -$750M stake in

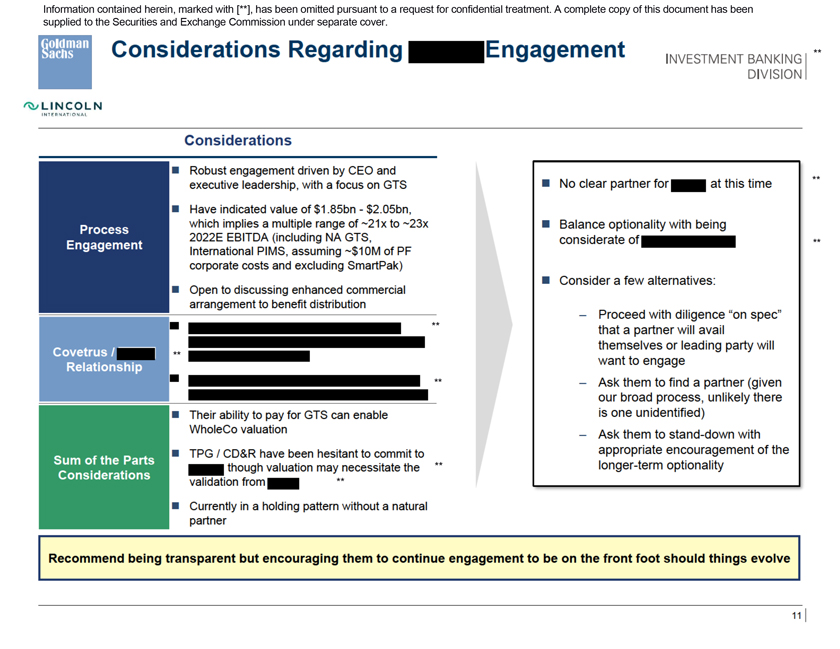

the business to reduce new sponsor required equity. Information contained herein, marked with [**], has been omitted pursuant to a request for confidential treatment. A complete copy of this document has been supplied to the Securities and Exchange

Commission under separate cover.