Third Quarter 2025 Investor Presentation November 2025 CSE: TRUL OTCQX: TCNNF

www.trulieve.com 2 Forward-Looking Statements Unless the context otherwise requires, the terms “Company,” “Trulieve,” “we,” “us” and “our” in this presentation refer to Trulieve Cannabis Corp. and its subsidiaries. This presentation includes forward-looking information and statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”). These forward-looking statements relate to the Company’s expectations or forecasts of business, operations, financial performance, cash flows, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding the Company’s 2025 objectives, growth opportunities, and positioning for the future. Words such as “expects”, “continue”, “will”, “anticipates” and “intends” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the Company’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein, including, without limitation, the risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and in our periodic reports subsequently filed with the United States Securities and Exchange Commission and in the Company’s filings on https://www.sedarplus.ca/landingpage/. Although the Company believes that any forward-looking statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such statements, there can be no assurance that any such forward-looking statements will prove to be accurate, and accordingly, readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward- looking statements. Any forward-looking statements herein are made as of the date hereof and, except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking statements herein, whether as a result of new information, future events or results, or otherwise. PLEASE NOTE: MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, INCLUDING ITS CONSUMPTION, POSSESSION, CULTIVATION, DISTRIBUTION, MANUFACTURING, DISPENSING, AND POSSESSION WITH INTENT TO DISTRIBUTE. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold.

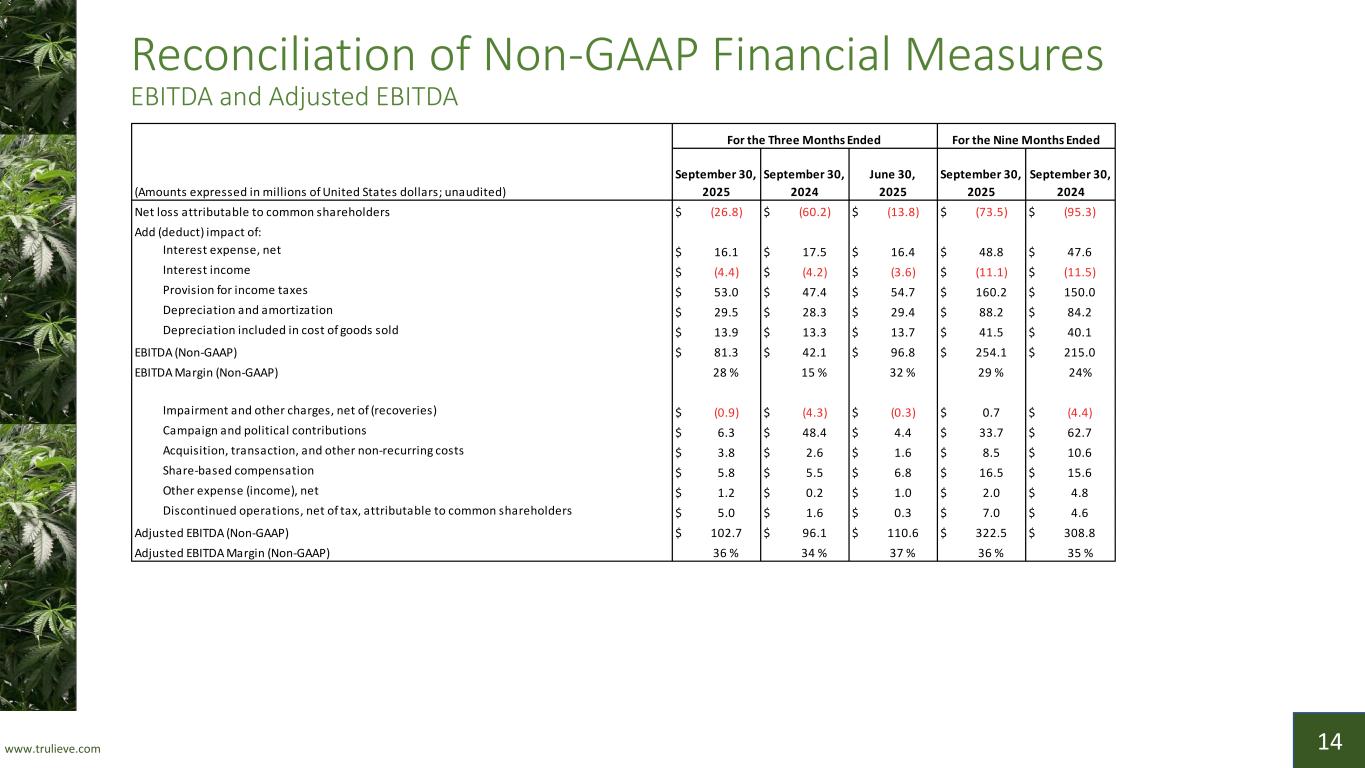

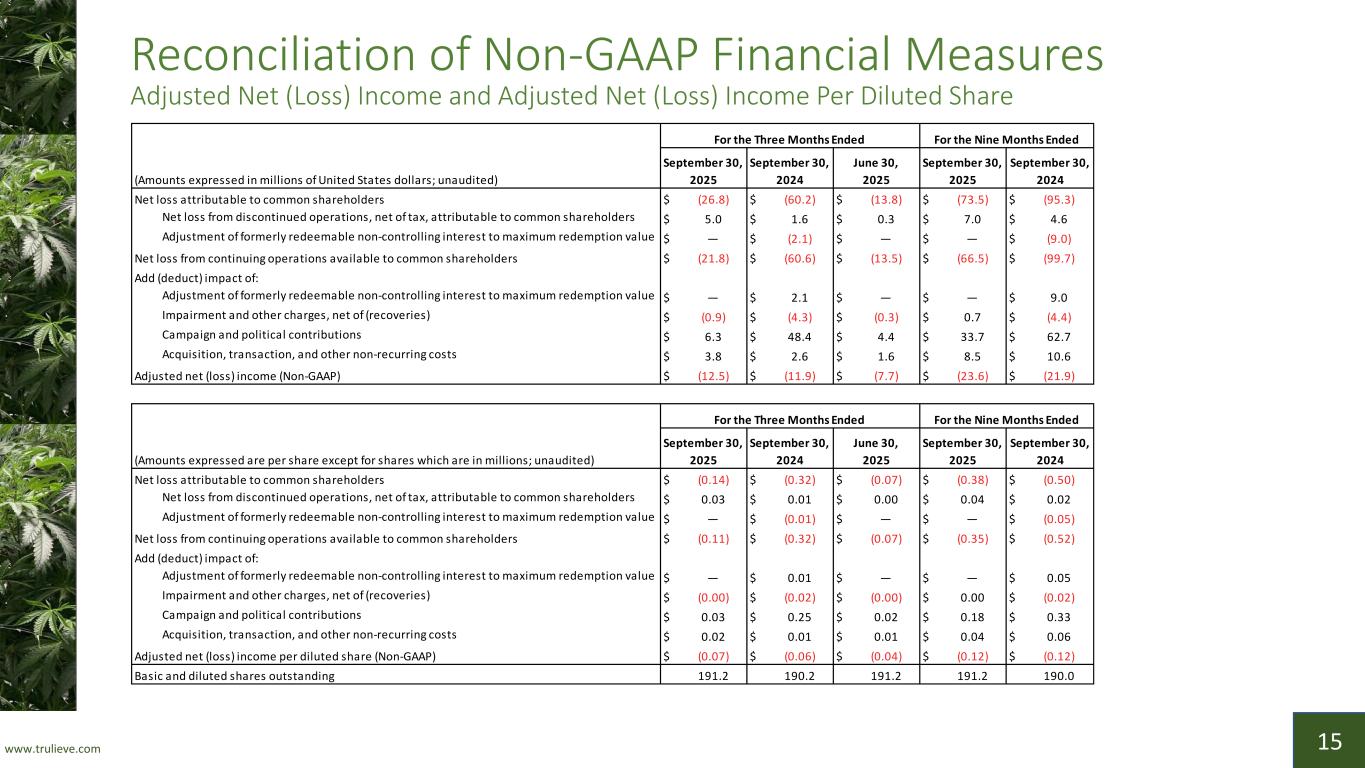

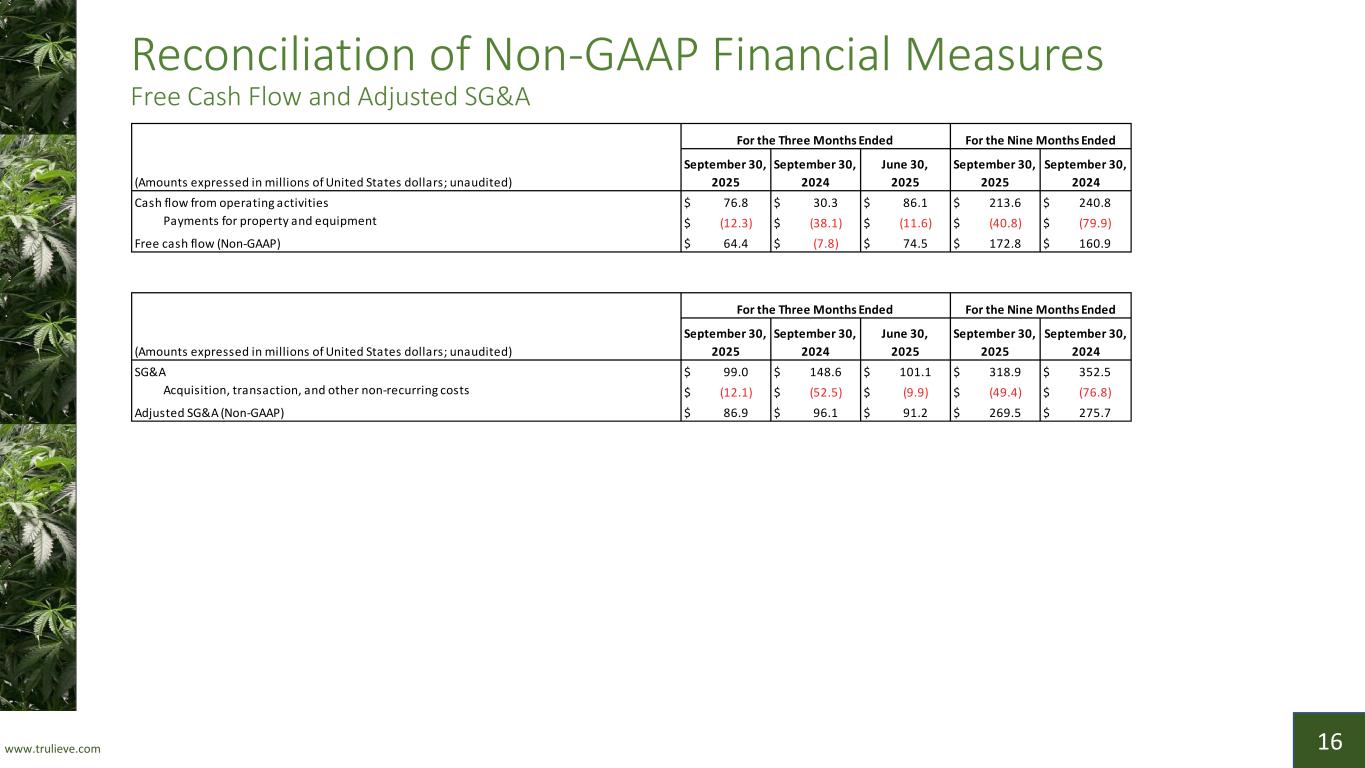

www.trulieve.com 3 Management’s Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including adjusted SG&A, adjusted SG&A as % revenue, adjusted net income (loss), adjusted net income (loss) per diluted share, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, and free cash flow. The Company calculates adjusted SG&A as SG&A less extraordinary expenses; adjusted SG&A margin as % of revenue; adjusted net income (loss) as net income (loss) less certain extraordinary items; adjusted net income (loss) per diluted share as adjusted net income (loss) divided by basic and diluted shares outstanding; EBITDA as net income (loss) before net interest expense, interest income, income tax expense, depreciation and amortization; EBITDA margin as EBITDA as % of revenue; adjusted EBITDA as net income (loss) before net interest expense, interest income, income tax expense, depreciation and amortization and also excludes certain extraordinary items; adjusted EBITDA margin as adjusted EBITDA as % of revenue; free cash flow as cash flow from operations less capital expenditures. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures are not and should not be considered as measures of liquidity. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found at the end of this presentation on the slides captioned “Reconciliation of Non-GAAP Financial Measures”. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.

www.trulieve.com 4 Agenda • Third Quarter 2025 Financial and Operational Highlights • Revenue Highlights • Recent Developments • Tax Position • 2025 Focus Areas • Financial Targets • Financial Highlights

www.trulieve.com 5 Third Quarter 2025 Financial and Operational Highlights* • Revenue $288 million, with 94% of revenue from retail sales • GAAP gross profit of $170 million and 59% gross margin • Net loss attributable to common shareholders of $27 million • Adjusted net loss of $12 million excludes non-recurring charges, asset impairments, disposals and discontinued operations • Adjusted EBITDA of $103 million, or 36% of revenue, up 7% year over year • Cash flow from operations of $77 million and free cash flow of $64 million • Added Chief Financial Officer Jan Reese to the leadership team and appointed Matthew Foulston to the Board of Directors • Rewards program members reached 820,000 members as of September 30, 2025 and accounted for 77% of transactions during the third quarter • Launched new Roll One Clutch All In One vapes in Florida, selling out in under two weeks • Expanded distribution of Onward premium THC beverages in Florida and Illinois, launched new Upward THC energy drinks, and introduced five new 10mg flavors • Opened one new dispensary in Cincinnati, Ohio and relocated one dispensary to Bisbee, Arizona * Adjusted net income, adjusted EBITDA and free cash flow are non-GAAP financial measures. See slides 14-16 for reconciliation to GAAP for all non-GAAP financial measures. Numbers may not sum perfectly due to rounding.

www.trulieve.com 6 Revenue Highlights • Retail revenue $271 million • Traffic up 6% versus last year • Consistent with historical seasonal patterns • Sold over 12.5 million branded products • Up 7% year over year • Customer retention 68% companywide and 76% medical only • Exited quarter with 30% of retail locations outside of the state of Florida and 86% of dispensaries serving only medical patients

www.trulieve.com 7 Recent Developments • Announced planned redemption of $368 million of senior secured notes due 2026 • Launched new mobile app serving Florida customers enabling patients to browse and reserve products, view promotions, and check rewards status through a seamless digital experience • Currently operate 232 retail dispensaries and over 4 million square feet of cultivation and processing capacity in the United States

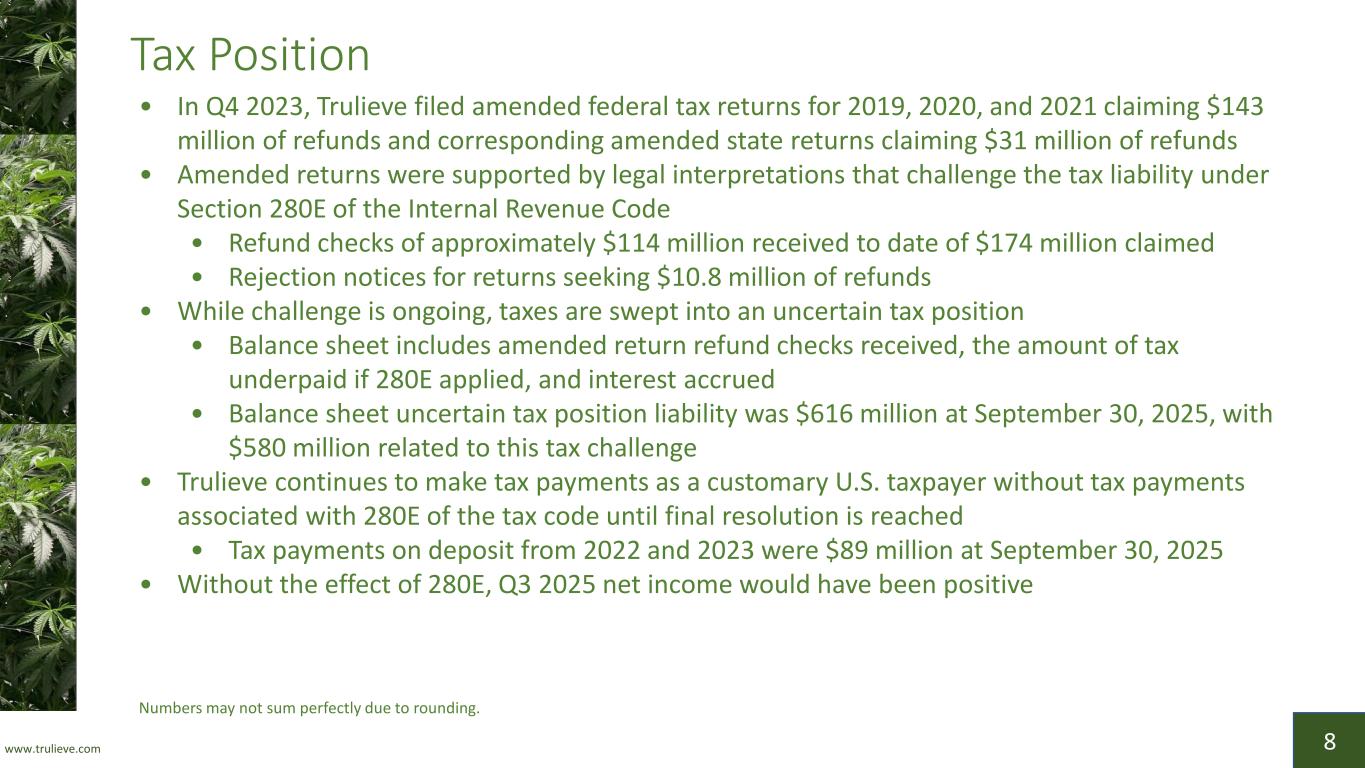

www.trulieve.com 8 Tax Position • In Q4 2023, Trulieve filed amended federal tax returns for 2019, 2020, and 2021 claiming $143 million of refunds and corresponding amended state returns claiming $31 million of refunds • Amended returns were supported by legal interpretations that challenge the tax liability under Section 280E of the Internal Revenue Code • Refund checks of approximately $114 million received to date of $174 million claimed • Rejection notices for returns seeking $10.8 million of refunds • While challenge is ongoing, taxes are swept into an uncertain tax position • Balance sheet includes amended return refund checks received, the amount of tax underpaid if 280E applied, and interest accrued • Balance sheet uncertain tax position liability was $616 million at September 30, 2025, with $580 million related to this tax challenge • Trulieve continues to make tax payments as a customary U.S. taxpayer without tax payments associated with 280E of the tax code until final resolution is reached • Tax payments on deposit from 2022 and 2023 were $89 million at September 30, 2025 • Without the effect of 280E, Q3 2025 net income would have been positive Numbers may not sum perfectly due to rounding.

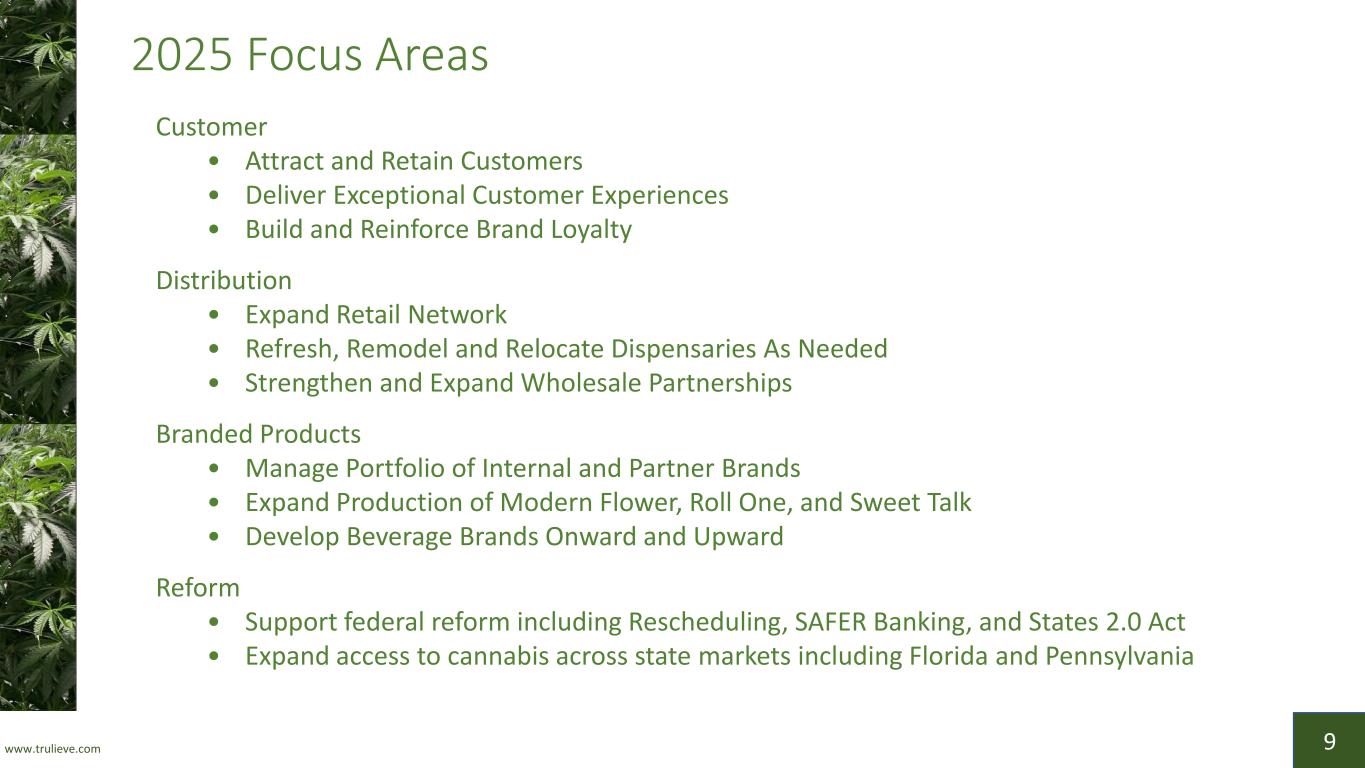

www.trulieve.com 9 2025 Focus Areas Customer • Attract and Retain Customers • Deliver Exceptional Customer Experiences • Build and Reinforce Brand Loyalty Distribution • Expand Retail Network • Refresh, Remodel and Relocate Dispensaries As Needed • Strengthen and Expand Wholesale Partnerships Branded Products • Manage Portfolio of Internal and Partner Brands • Expand Production of Modern Flower, Roll One, and Sweet Talk • Develop Beverage Brands Onward and Upward Reform • Support federal reform including Rescheduling, SAFER Banking, and States 2.0 Act • Expand access to cannabis across state markets including Florida and Pennsylvania

Financials

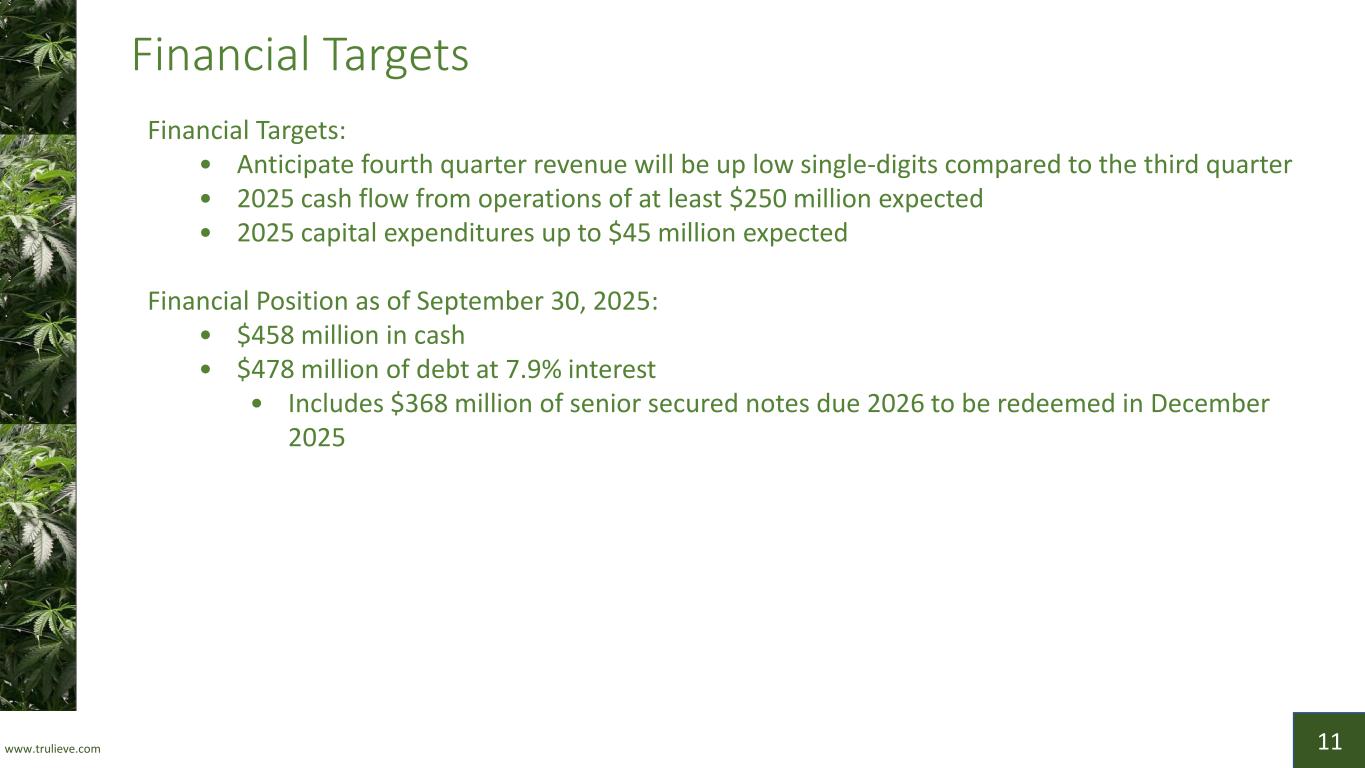

www.trulieve.com 11 Financial Targets Financial Targets: • Anticipate fourth quarter revenue will be up low single-digits compared to the third quarter • 2025 cash flow from operations of at least $250 million expected • 2025 capital expenditures up to $45 million expected Financial Position as of September 30, 2025: • $458 million in cash • $478 million of debt at 7.9% interest • Includes $368 million of senior secured notes due 2026 to be redeemed in December 2025

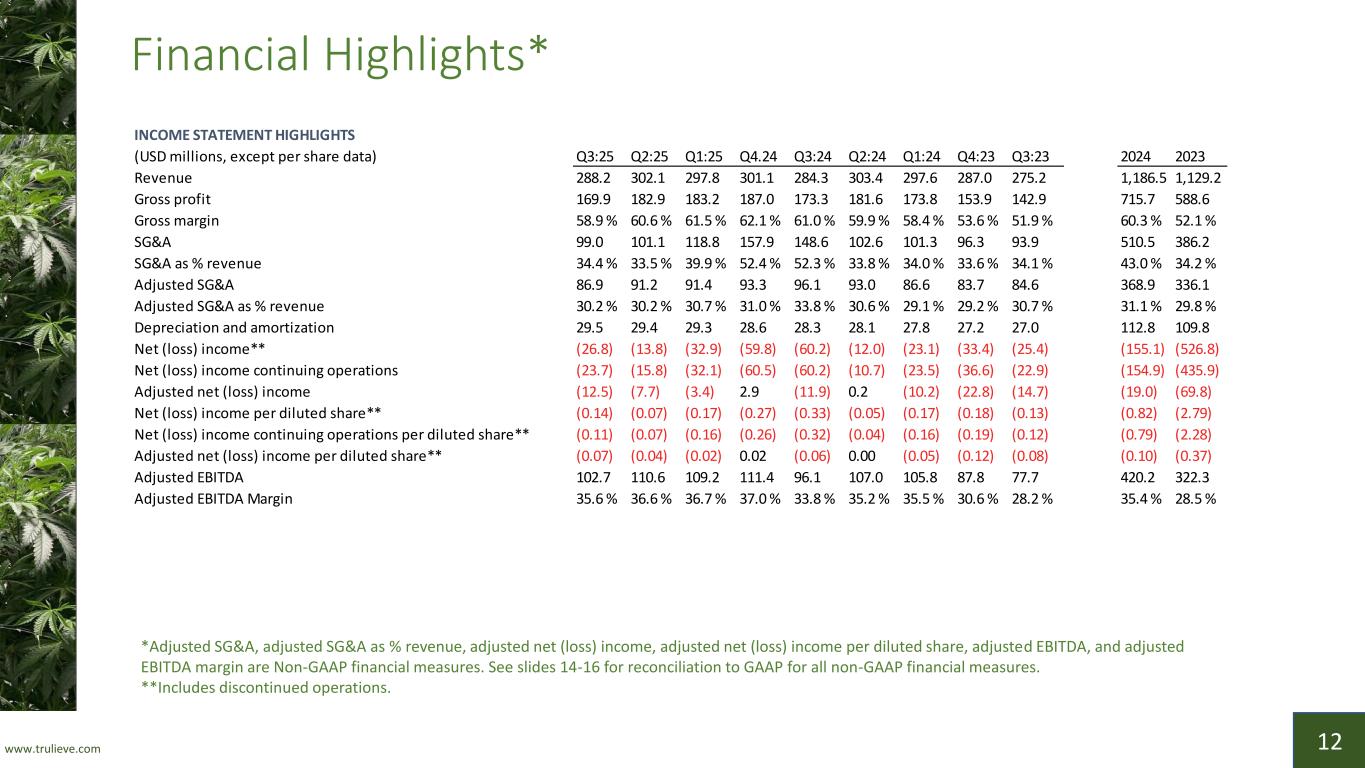

www.trulieve.com 12 Financial Highlights* *Adjusted SG&A, adjusted SG&A as % revenue, adjusted net (loss) income, adjusted net (loss) income per diluted share, adjusted EBITDA, and adjusted EBITDA margin are Non-GAAP financial measures. See slides 14-16 for reconciliation to GAAP for all non-GAAP financial measures. **Includes discontinued operations. INCOME STATEMENT HIGHLIGHTS (USD millions, except per share data) Q3:25 Q2:25 Q1:25 Q4.24 Q3:24 Q2:24 Q1:24 Q4:23 Q3:23 2024 2023 Revenue 288.2 302.1 297.8 301.1 284.3 303.4 297.6 287.0 275.2 1,186.5 1,129.2 Gross profit 169.9 182.9 183.2 187.0 173.3 181.6 173.8 153.9 142.9 715.7 588.6 Gross margin 58.9 % 60.6 % 61.5 % 62.1 % 61.0 % 59.9 % 58.4 % 53.6 % 51.9 % 60.3 % 52.1 % SG&A 99.0 101.1 118.8 157.9 148.6 102.6 101.3 96.3 93.9 510.5 386.2 SG&A as % revenue 34.4 % 33.5 % 39.9 % 52.4 % 52.3 % 33.8 % 34.0 % 33.6 % 34.1 % 43.0 % 34.2 % Adjusted SG&A 86.9 91.2 91.4 93.3 96.1 93.0 86.6 83.7 84.6 368.9 336.1 Adjusted SG&A as % revenue 30.2 % 30.2 % 30.7 % 31.0 % 33.8 % 30.6 % 29.1 % 29.2 % 30.7 % 31.1 % 29.8 % Depreciation and amortization 29.5 29.4 29.3 28.6 28.3 28.1 27.8 27.2 27.0 112.8 109.8 Net (loss) income** (26.8) (13.8) (32.9) (59.8) (60.2) (12.0) (23.1) (33.4) (25.4) (155.1) (526.8) Net (loss) income continuing operations (23.7) (15.8) (32.1) (60.5) (60.2) (10.7) (23.5) (36.6) (22.9) (154.9) (435.9) Adjusted net (loss) income (12.5) (7.7) (3.4) 2.9 (11.9) 0.2 (10.2) (22.8) (14.7) (19.0) (69.8) Net (loss) income per diluted share** (0.14) (0.07) (0.17) (0.27) (0.33) (0.05) (0.17) (0.18) (0.13) (0.82) (2.79) Net (loss) income continuing operations per diluted share** (0.11) (0.07) (0.16) (0.26) (0.32) (0.04) (0.16) (0.19) (0.12) (0.79) (2.28) Adjusted net (loss) income per diluted share** (0.07) (0.04) (0.02) 0.02 (0.06) 0.00 (0.05) (0.12) (0.08) (0.10) (0.37) Adjusted EBITDA 102.7 110.6 109.2 111.4 96.1 107.0 105.8 87.8 77.7 420.2 322.3 Adjusted EBITDA Margin 35.6 % 36.6 % 36.7 % 37.0 % 33.8 % 35.2 % 35.5 % 30.6 % 28.2 % 35.4 % 28.5 %

www.trulieve.com 13 Financial Highlights SHARE COUNT ESTIMATE Subordinate Voting Shares 167.9 Multiple Voting Shares* 0.2 Total Shares Outstanding 191.1 Employee Stock Options/RSUs 3.2 Pro Forma Estimated Shares 194.3 *converted at 100 subordinate shares per 1 multiple voting share (millions as of September 30, 2025 on as if converted basis) excludes 2.6 million unexercisable options excludes 8.3 million nonvested RSUs

www.trulieve.com 14 Reconciliation of Non-GAAP Financial Measures EBITDA and Adjusted EBITDA Net loss attributable to common shareholders $ (26.8) $ (60.2) $ (13.8) $ (73.5) $ (95.3) Add (deduct) impact of: Interest expense, net $ 16.1 $ 17.5 $ 16.4 $ 48.8 $ 47.6 Interest income $ (4.4) $ (4.2) $ (3.6) $ (11.1) $ (11.5) Provision for income taxes $ 53.0 $ 47.4 $ 54.7 $ 160.2 $ 150.0 Depreciation and amortization $ 29.5 $ 28.3 $ 29.4 $ 88.2 $ 84.2 Depreciation included in cost of goods sold $ 13.9 $ 13.3 $ 13.7 $ 41.5 $ 40.1 EBITDA (Non-GAAP) $ 81.3 $ 42.1 $ 96.8 $ 254.1 $ 215.0 EBITDA Margin (Non-GAAP) 28 % 15 % 32 % 29 % 24% Impairment and other charges, net of (recoveries) $ (0.9) $ (4.3) $ (0.3) $ 0.7 $ (4.4) Campaign and political contributions $ 6.3 $ 48.4 $ 4.4 $ 33.7 $ 62.7 Acquisition, transaction, and other non-recurring costs $ 3.8 $ 2.6 $ 1.6 $ 8.5 $ 10.6 Share-based compensation $ 5.8 $ 5.5 $ 6.8 $ 16.5 $ 15.6 Other expense (income), net $ 1.2 $ 0.2 $ 1.0 $ 2.0 $ 4.8 Discontinued operations, net of tax, attributable to common shareholders $ 5.0 $ 1.6 $ 0.3 $ 7.0 $ 4.6 Adjusted EBITDA (Non-GAAP) $ 102.7 $ 96.1 $ 110.6 $ 322.5 $ 308.8 Adjusted EBITDA Margin (Non-GAAP) 36 % 34 % 37 % 36 % 35 % For the Nine Months Ended September 30, 2024 September 30, 2025(Amounts expressed in millions of United States dollars; unaudited) September 30, 2025 September 30, 2024 June 30, 2025 For the Three Months Ended

www.trulieve.com 15 Reconciliation of Non-GAAP Financial Measures Adjusted Net (Loss) Income and Adjusted Net (Loss) Income Per Diluted Share Net loss attributable to common shareholders $ (26.8) $ (60.2) $ (13.8) $ (73.5) $ (95.3) Net loss from discontinued operations, net of tax, attributable to common shareholders $ 5.0 $ 1.6 $ 0.3 $ 7.0 $ 4.6 Adjustment of formerly redeemable non-controlling interest to maximum redemption value $ — $ (2.1) $ — $ — $ (9.0) Net loss from continuing operations available to common shareholders $ (21.8) $ (60.6) $ (13.5) $ (66.5) $ (99.7) Add (deduct) impact of: Adjustment of formerly redeemable non-controlling interest to maximum redemption value $ — $ 2.1 $ — $ — $ 9.0 Impairment and other charges, net of (recoveries) $ (0.9) $ (4.3) $ (0.3) $ 0.7 $ (4.4) Campaign and political contributions $ 6.3 $ 48.4 $ 4.4 $ 33.7 $ 62.7 Acquisition, transaction, and other non-recurring costs $ 3.8 $ 2.6 $ 1.6 $ 8.5 $ 10.6 Adjusted net (loss) income (Non-GAAP) $ (12.5) $ (11.9) $ (7.7) $ (23.6) $ (21.9) Net loss attributable to common shareholders $ (0.14) $ (0.32) $ (0.07) $ (0.38) $ (0.50) Net loss from discontinued operations, net of tax, attributable to common shareholders $ 0.03 $ 0.01 $ 0.00 $ 0.04 $ 0.02 Adjustment of formerly redeemable non-controlling interest to maximum redemption value $ — $ (0.01) $ — $ — $ (0.05) Net loss from continuing operations available to common shareholders $ (0.11) $ (0.32) $ (0.07) $ (0.35) $ (0.52) Add (deduct) impact of: Adjustment of formerly redeemable non-controlling interest to maximum redemption value $ — $ 0.01 $ — $ — $ 0.05 Impairment and other charges, net of (recoveries) $ (0.00) $ (0.02) $ (0.00) $ 0.00 $ (0.02) Campaign and political contributions $ 0.03 $ 0.25 $ 0.02 $ 0.18 $ 0.33 Acquisition, transaction, and other non-recurring costs $ 0.02 $ 0.01 $ 0.01 $ 0.04 $ 0.06 Adjusted net (loss) income per diluted share (Non-GAAP) $ (0.07) $ (0.06) $ (0.04) $ (0.12) $ (0.12) Basic and diluted shares outstanding 191.2 190.2 191.2 191.2 190.0 (Amounts expressed are per share except for shares which are in millions; unaudited) September 30, 2024 September 30, 2025 For the Nine Months EndedFor the Three Months Ended June 30, 2025 September 30, 2024 September 30, 2025 (Amounts expressed in millions of United States dollars; unaudited) September 30, 2025 For the Three Months Ended September 30, 2024 June 30, 2025 For the Nine Months Ended September 30, 2025 September 30, 2024

www.trulieve.com 16 Reconciliation of Non-GAAP Financial Measures Free Cash Flow and Adjusted SG&A Cash flow from operating activities $ 76.8 $ 30.3 $ 86.1 $ 213.6 $ 240.8 Payments for property and equipment $ (12.3) $ (38.1) $ (11.6) $ (40.8) $ (79.9) Free cash flow (Non-GAAP) $ 64.4 $ (7.8) $ 74.5 $ 172.8 $ 160.9 SG&A $ 99.0 $ 148.6 $ 101.1 $ 318.9 $ 352.5 Acquisition, transaction, and other non-recurring costs $ (12.1) $ (52.5) $ (9.9) $ (49.4) $ (76.8) Adjusted SG&A (Non-GAAP) $ 86.9 $ 96.1 $ 91.2 $ 269.5 $ 275.7 September 30, 2025 For the Nine Months Ended September 30, 2024 September 30, 2025 September 30, 2024 (Amounts expressed in millions of United States dollars; unaudited) September 30, 2025 September 30, 2024 For the Three Months Ended June 30, 2025 For the Nine Months EndedFor the Three Months Ended (Amounts expressed in millions of United States dollars; unaudited) September 30, 2025 September 30, 2024 June 30, 2025

www.trulieve.com 17 House of Brands Trulieve Brands V A LU E M ID P R EM IU M Partner Brands

THANK YOU CSE: TRUL OTCQX: TCNNF @Trulieve/@Trulieve_IR ir@trulieve.com