Invesco Real Estate Income Trust Inc.

Proxy

Statement

Notice of 2025 Annual Meeting of Stockholders

|

|

Your vote is important: Please vote by using the Internet, telephone or by signing, dating and returning a proxy card |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Invesco Real Estate Income Trust Inc.

Proxy

Statement

Notice of 2025 Annual Meeting of Stockholders

|

|

Your vote is important: Please vote by using the Internet, telephone or by signing, dating and returning a proxy card |

|

R. Scott Dennis has served as our Chief Executive Officer and as Chair of our Board of Directors since January 2019 |

A letter to our stockholders from the Chair of our Board of Directors

Dear Fellow Stockholder,

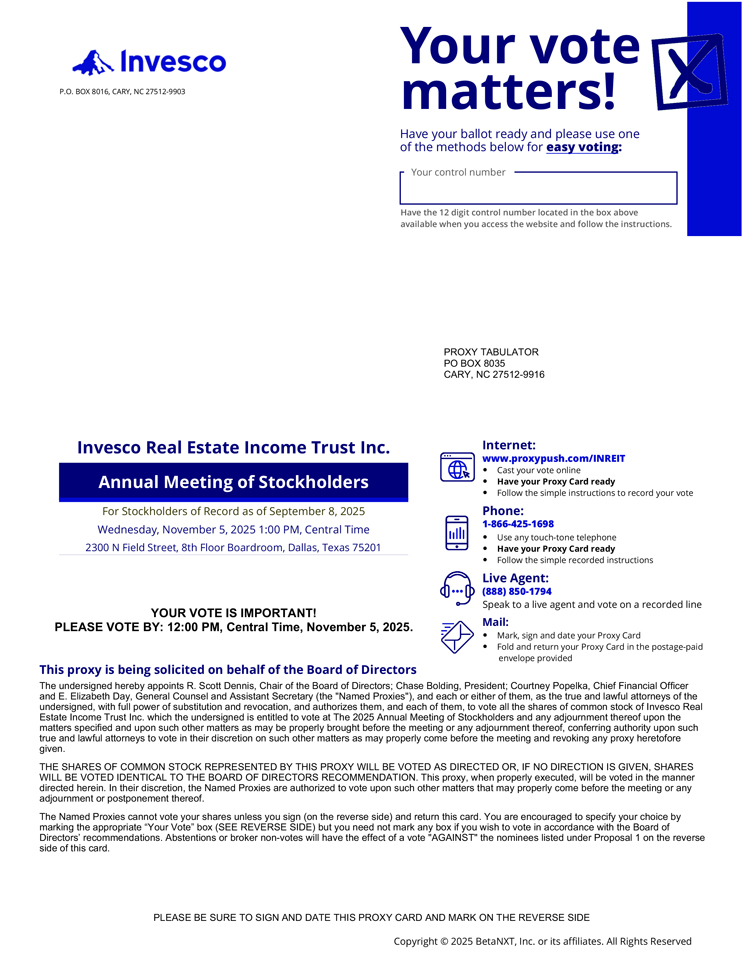

You are cordially invited to attend the Annual Meeting of Stockholders of Invesco Real Estate Income Trust Inc. to be held on November 5, 2025 at 1 p.m. Central Time, at The Union, 2300 N Field St., 8th Floor Boardroom, Dallas, Texas. The Notice of the Annual Meeting of Stockholders and proxy statement accompanying this letter provide an outline of the business to be conducted at the Annual Meeting. At the Annual Meeting, you will be asked to:

1. elect the seven members of the board of directors named in the enclosed proxy statement to serve as directors until the 2026 annual meeting of stockholders; and

2. ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

Our board of directors unanimously recommends that you vote for each of the proposals to be considered and voted on at the Annual Meeting.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, I urge you to authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares on the Internet or by telephone, or, if you received the proxy materials by mail, you may also authorize a proxy to vote your shares by mail. Your vote will ensure your representation at the Annual Meeting regardless of whether you attend.

On behalf of the Board of Directors and management, I thank you for your continuing support.

Regards,

R. Scott Dennis Chair |

2025 Proxy Statement i

Notice of 2025 Annual Meeting of Stockholders

| Date and time

| ||

|

Wednesday, November 5, 2025, at 1 p.m., | |

| Central Time | ||

| Place

| ||

|

The Union, 2300 N Field St., 8th Floor Boardroom Dallas, Texas 75201 | |

| Voting methods

| ||

|

Internet | |

| Visit the web site listed on your Notice | ||

|

Telephone | |

| Call the telephone number listed on your Notice | ||

|

||

| Sign, date and return a requested proxy card | ||

|

In person | |

| Attend the Annual | ||

| Meeting in Dallas, Texas | ||

| Items of business | Board voting recommendation | |||

| 1 |

To elect seven (7) directors to the board of directors to hold office until the annual meeting of stockholders in 2026 |

| ||

| 2 |

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 |

| ||

| 3 |

To consider and act upon such other business as may properly come before the meeting or any adjournment thereof | |||

Who can vote

Only holders of record of our common stock as of the close of business on September 8, 2025 are entitled to notice of and to attend and vote at the Annual Meeting and any adjournment or postponement thereof. On September 23, 2025, we mailed to eligible stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this Proxy Statement and our Annual Report via the Internet.

Stockholders, whether or not they expect to be present at the Annual Meeting, are requested to authorize a proxy to vote their shares electronically via the Internet, by telephone or by completing and returning a proxy card. Voting instructions are printed on your Notice. Any person giving a proxy has the power to revoke it at any time prior to the Annual Meeting and stockholders who are present at the Annual Meeting may withdraw their proxies and vote in person at the Annual Meeting.

By order of the Board of Directors,

Tina Carew,

Company Secretary

September 23, 2025

ii Invesco Real Estate Income Trust Inc.

Contents

| 1 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 8 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 11 | ||||||||

| 13 | ||||||||

| 13 | ||||||||

| Compensation committee interlocks and insider participation | 14 | |||||||

| 14 | ||||||||

| 14 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| Proposal No. 2 – Ratification of the appointment of independent registered public accounting firm | 26 | |||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| Questions and answers about voting your common stock | 29 | |||

| 32 | ||||

Proxy Statement

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of Invesco Real Estate Income Trust Inc. (“Board” or “Board of Directors”) for the Annual Meeting of Stockholders to be held on Wednesday, November 5, 2025, at 1 p.m., Central Time. In this Proxy Statement, except where the context suggests otherwise, the words “we,” “us,” “our” and the “Company” refer to Invesco Real Estate Income Trust Inc., a Maryland corporation, together with its consolidated subsidiaries, including Invesco REIT Operating Partnership LP (the “Operating Partnership”), a Delaware limited partnership, of which we are the general partner; “our adviser” refers to Invesco Advisers, Inc., our external adviser; and “Invesco” refers to Invesco Ltd., together with its consolidated subsidiaries, the indirect parent company of our adviser.

Proxy Statement summary

This summary highlights selected information in this Proxy Statement. Please review the entire Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 before voting.

Matters for stockholder voting

At this year’s Annual Meeting, we are asking our stockholders to vote on the following matters:

| Proposal | Board vote recommendation | |||

| 1 |

Election of seven directors |

| ||

| 2 |

Ratification of the appointment of PricewaterhouseCoopers LLP for 2025 |

| ||

1 Invesco Real Estate Income Trust Inc.

| Governance highlights |

|

Independence | |||||||

| • | 4 out of our 7 current directors are independent. | |||||||

|

• |

Our Audit Committee is comprised exclusively of independent directors. |

|||||||

|

Lead independent director |

| ||||||

| • | We have a lead independent director of our Board, selected by the independent directors. | |||||||

|

• |

Serves as liaison between the independent directors and the Chair of the Board. |

|||||||

|

Executive sessions | |||||||

| • | The independent directors regularly meet in private without management. | |||||||

|

• |

The Lead Independent Director presides at these executive sessions. |

|||||||

|

Board refreshment | |||||||

| • | Independent directors may not stand for election after age 75. | |||||||

|

Board practices | |||||||

| • | Our Board annually reviews its effectiveness as a group, with directors participating in one-on-one interviews coordinated by an independent external advisor that reports the results of the annual review to the Board in person. | |||||||

|

|

Accountability | |||||

| • | Directors must be elected annually by a majority of votes cast. | |||||

|

Insider trading restrictions | |||||

| • | Our insider trading policy prohibits short selling, dealing in publicly-traded options, pledging and hedging or monetization transactions in our equity securities. | |||||

|

Board oversight of risk management | |||||

| • | Our Board has principal responsibility for oversight of our risk management process and understanding of the overall risk profile of the company. | |||||

|

No overboarding | |||||

| • | All directors serve on the boards of two or fewer public companies. | |||||

| 2025 Proxy Statement 2 |

Proposal

1

Election of directors

Our Board of Directors currently has seven directors, each of whom is serving a term of office that continues until the Annual Meeting in 2025, or until such director’s successor has been duly elected and qualified, or such director is removed from office or such director’s office is otherwise earlier vacated.

The Board has nominated R. Scott Dennis, Julie Arrowsmith, Stephanie Holder, R. David Kelly, Paul S. Michaels, J. Ray Nixon, and Paul E. Rowsey for election as directors of the Company for a term ending at the 2026 Annual Meeting, or until such director’s successor has been duly elected and qualified, or such director is removed from office or such director’s office is otherwise earlier vacated. Further information regarding the director nominees is shown on the following pages. Each director nominee has indicated to the Company that the director nominee would serve if elected. We do not anticipate that any of our director nominees would be unable to stand for election, but if that were to happen, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate.

Under our Bylaws, at any meeting held for the purpose of electing directors at which a quorum is present, each director nominee receiving the affirmative vote of a majority of the total votes that are present, in person or by proxy at the Annual Meeting, will be elected as a director. Abstentions and broker non-votes will have the effect of votes against the director nominees. There is no cumulative voting in the election of directors.

|

|

Recommendation of the Board The Board unanimously recommends a vote “FOR” the election to the Board of each of the director nominees.

Vote required: This proposal requires the affirmative vote of a majority of the total votes that are present, in person or by proxy at the Annual Meeting. Abstentions votes and broker “non-votes”, if any, will have the effect of a vote against the director nominees.

|

3 Invesco Real Estate Income Trust Inc.

Information about director nominees

Director nominees to serve until the 2026 Annual Meeting of Stockholders

|

R. Scott Dennis Director and Chair of the Board, Chief Executive Officer

Age Tenure 66 6 Years

Qualifications: • Executive leadership • Industry expertise |

R. Scott Dennis Mr. Dennis has served as our Chief Executive Officer and as Chair of our Board of Directors since 2019. Mr. Dennis has been with Invesco Real Estate, the real estate investment center of Invesco, for more than 32 years. He has served as Chief Executive Officer of Invesco Real Estate since 2011, and was appointed Global Head of Invesco Private Markets in August 2025 after having served as Chief Executive Officer of Invesco Private Markets since 2019. He is responsible for the day-to-day strategy execution and management of Invesco Real Estate’s global real estate business. Mr. Dennis has served as Chair of the Board of Invesco Commercial Real Estate Finance Trust, Inc. since December 2022. Prior to becoming Chief Executive Officer of Invesco Real Estate, Mr. Dennis served as co-head of Invesco Real Estate’s North American group and head of its U.S. acquisitions team from 1992 to 2008. Prior to joining Invesco Real Estate, Mr. Dennis served in the investment banking group at Bankers Trust Company, where he was responsible for structuring equity and debt investments on behalf of Bankers Trust Company and its clients. Prior to that, Mr. Dennis was with Trammell Crow Company, where he was responsible for investments on behalf of the company’s opportunity funds. He has been directly involved in over $90 billion of real estate investments. Mr. Dennis earned a B.B.A. in Finance and Real Estate from The University of Texas at Austin. Mr. Dennis is a valuable member of our Board of Directors because of his experience overseeing the operations and growth of Invesco Real Estate and his significant investment experience. |

|

Julie Arrowsmith

Age Tenure 57 <1 year

Committees: • Audit

Qualifications: • Executive leadership • Finance and accounting expertise |

Julie Arrowsmith Ms. Arrowsmith was appointed as an independent director effective July 1, 2025. She is an accomplished executive and board member with over 25 years of leadership experience in accounting, finance and corporate strategy in the real estate and hospitality sectors. Ms. Arrowsmith served as the chief executive officer for two years at G6 Hospitality LLC, the owner, operator and franchisor of the Motel 6 and Studio 6 brands, until it was sold in December 2024. Prior to her CEO role, Ms. Arrowsmith served as the chief financial officer of G6 Hospitality LLC from October 2012 to January 2023, after having served in senior finance and accounting roles at Accor North America from 1995-2012. Prior to that, Ms. Arrowsmith held various audit roles with Deloitte from 1990 to 1995. Ms. Arrowsmith has served on the board of the University of North Texas College of Merchandising, Hospitality and Tourism since 2022. Ms. Arrowsmith earned a B.S. in Accounting from Texas A&M University, earned her certification in public accountancy in Texas, and is a member of the National Association of Corporate Directors. Ms. Arrowsmith brings an extensive background in accounting, financial reporting and corporate governance and qualifies as an audit committee financial expert, as such term is defined by applicable SEC rules and regulations. |

2025 Proxy Statement 4

|

Stephanie Holder Director

Age Tenure 41 < 1 Year

Qualifications: • Industry experience |

Stephanie Holder Ms. Holder was appointed as a director on August 6, 2025. She has served as Managing Director and Head of Dispositions and Financing at Invesco Real Estate (IRE) since 2021, after previously serving as Senior Director from 2018-2021. Ms. Holder is responsible for IRE’s sales and financing efforts nationwide and serves on the North American Management Committee for IRE. In addition, she is Committee Chair for IRE’s Equity Investment Committee, a member of the Credit Investment Committee and part of the CIO Council for North America. She began her investment career in 2006 and joined IRE in 2008 with the Acquisitions group and transitioned into the Dispositions group in 2009. Prior to joining Invesco, she was an analyst for Lincoln Property Company working on the Invesco account valuing assets within the portfolio. She has a background centered on commercial real estate and finance. Ms. Holder earned both a Master of Business Administration and a Bachelor of Business Administration with a major concentration in real estate finance from Southern Methodist University. Ms. Holder is a valuable member of our board of directors because of her investment and financing expertise and history with Invesco Real Estate. |

|

R. David Kelly Lead Independent Director

Age Tenure 61 6 Years

Committees: • Audit

Qualifications: • Executive leadership • Industry expertise • Public and private company board experience |

R. David Kelly Mr. Kelly has served as one of our independent directors since 2019 and as our lead independent director since 2020. Mr. Kelly has over 35 years of investment experience, including serving both public companies and private companies in the financial advisory and real estate development sectors. Mr. Kelly is the founder and managing partner of StraightLine Realty Partners, LLC, an alternative investment platform with investments in real estate, financial services and venture capital. Mr. Kelly has served as lead independent director of Invesco Commercial Real Estate Finance Trust, Inc. since March 2023. Mr. Kelly also serves as Chairman and CEO of Croesus and Company, an international real estate advisory firm; as lead director of TCW Direct Lending, focused on lending senior-secured loans primarily to US-based mid-market companies; as an independent director of Acadia Healthcare (NASDAQ: ACHC) and as an at-large director of Ashton Woods Homes. From 2007 to 2017, Mr. Kelly served as a trustee and Chairman of the Teacher’s Retirement System of Texas. From 2001 to 2006, Mr. Kelly was a gubernatorial appointee to the Texas Public Finance Authority (TPFA) and served as Chairman from 2002 to 2006. Mr. Kelly’s previous corporate directorships include Croesus Merchants International Singapore, Hong Kong-based Everglory Financial Holdings, and Dubai-based Al Masah Capital Limited. His civic and professional leadership experience includes service as director of the Children’s Medical Center Plano Governing Board, as member of Children’s Health Investment and Finance Committees, and on the Advisory Board of Sponsors for Educational Opportunity. Mr. Kelly earned a B.A. in Economics from Harvard University and an M.B.A. from Stanford University. Mr. Kelly is a valuable member of our board of directors because of his prior service as a director and his experience as an executive officer, including in the financial advisory and real estate investment fields. |

|

Paul S. Michaels Director

Age Tenure 64 6 Years

Qualifications: • Executive leadership • Industry experience |

Paul S. Michaels Mr. Michaels has served as one of our directors since 2019. Mr. Michaels has over 40 years of real estate experience including both debt and equity transactions in industrial, multifamily, retail and office properties. Mr. Michaels was employed by Invesco Real Estate from its inception in 1983 to his retirement in March 2020. Mr. Michaels served as Invesco Real Estate’s Director of North American Direct Real Estate from 2008 until his retirement. Mr. Michaels served as Chairperson of Invesco Real Estate’s Investment Committee from 2008 to 2019. Mr. Michaels also served as Director of U.S. Portfolio Management from 1991 to 2008. Mr. Michaels earned a B.B.A. in Finance and Real Estate from the University of Texas at Austin. Mr. Michaels is a valuable member of our board of directors because of his extensive real estate investment experience and history with Invesco Real Estate. |

5 Invesco Real Estate Income Trust Inc.

|

J. Ray Nixon Independent Director

Age Tenure 73 6 Years

Committees: • Audit

Qualifications: • Executive leadership • Industry expertise • Board experience |

J. Ray Nixon Mr. Nixon has served as one of our independent directors since 2019. Mr. Nixon has over 40 years of industry experience and is the current Chairman of Nixon Capital, a value oriented investment management firm. Previously, Mr. Nixon served as the Executive Director and Portfolio Manager at the $80 billion investment firm Barrow, Hanley, Mewhinney & Strauss, LLC from 1994 until his retirement in June 2019. Mr. Nixon served as a member of Smith Barney, Inc.’s Investment Policy Committee and as the firm’s lead institutional stockbroker for the Southwest from 1979 to 1994. Mr. Nixon chairs the Texas Health Resources Investment Committee, which oversees a $6.7 billion fund. Mr. Nixon has served as an independent director of Invesco Commercial Real Estate Finance Trust Inc. since March 2023. He is a Trustee of the UT Southwestern Foundation and a member of the investment committee and is also a member of the board of directors of the $70 billion endowment for the University of Texas and Texas A&M University. Mr. Nixon previously served as a research analyst for the Teacher Retirement System of Texas. Mr. Nixon earned a B.A. and an M.B.A. from the University of Texas at Austin. Mr. Nixon is a valuable member of our Board of Directors because of his extensive investment industry experience, prior service as a director and successful leadership through multiple economic cycles. |

|

Paul E. Rowsey Independent Director

Age Tenure 70 6 Years

Committees: • Audit (Chair)

Qualifications: • Executive leadership • Industry expertise • Legal expertise • Public and private company board experience |

Paul E. Rowsey Mr. Rowsey has served as one of our independent directors since 2019 and as chair of our Audit Committee since July 1, 2025. Since 2000, Mr. Rowsey has served as Chairman, managing partner, and co-founder of E2M Partners, LLC, a privately-held real estate investment management company. Previously, Mr. Rowsey served as the Executive Chairman of JLB Partners LLC, a privately-held real estate operating and development company, from 2018 to 2021. Before that, Mr. Rowsey held executive leadership roles at real estate companies Compatriot Capital, Rosewood Property Company, and Property Company of America. Mr. Rowsey was an attorney at Hewitt, Johnson, Swanson & Barbee from 1980 to 1984. Mr. Rowsey has served as an independent director of Invesco Commercial Real Estate Finance Trust Inc. since March 2023 and currently serves on the boards of Forum Energy Technologies, Inc. (NYSE: FET), a publicly-held, Houston-based energy service company, Powdr Corporation, a privately-held alpine skiing and outdoor adventure company, Snowbird Holdings LLC, a privately-held alpine skiing and hospitality company, and Teton Holdings Corporation, a Wyoming-based trust company. Mr. Rowsey served on the board of KDC Holdings LLC, a commercial real estate and development company, from 2008 until 2021, and the board of Valaris plc, a publicly-held, London-based, offshore drilling company, as its Chairman, from 2000 until 2021. Mr. Rowsey served as Lead Director of JLB Partners LLC, a multi-family development and investment company, from 2012 to 2018. Mr. Rowsey has also served on the boards of Crescent Real Estate Equities Company, Village Green Holdings LLC, and AMC, Inc. Mr. Rowsey’s board tenure includes audit committee, compensation committee, and nominating and governance committee service. Mr. Rowsey earned a B.A. in History and Management Science from Duke University and a J.D. from Southern Methodist School of Law, and is a citizen of the Cherokee Nation. Mr. Rowsey is a valuable member of our Board of Directors because of his experience as a director and executive officer for public and private companies and real estate investment and development companies, and his expertise in legal and governance matters. |

2025 Proxy Statement 6

Director Independence

Our Second Articles of Amendment and Restatement (our “Charter”) and our Corporate Governance Guidelines (“Guidelines”) require a majority of the members of our Board of Directors, and all members of our Audit Committee, to be “Independent Directors” in accordance with the criteria in our Charter, Bylaws, the applicable rules of the Securities and Exchange Commission (the “SEC”) and the listing standards of the New York Stock Exchange (“NYSE”), as further explained below. Our Audit Committee charter also requires that all members of our Audit Committee be “Independent Directors.”

Our Charter provides that a majority of our directors must be Independent Directors, except for a period of up to 60 days after the death, removal or resignation of an Independent Director pending the election of a successor Independent Director. Our Charter defines an “Independent Director” as a director who is not and has not for the last two years been associated, directly or indirectly, with Invesco or our adviser. A director is deemed to be associated with Invesco or our adviser if he or she owns any interest (other than an immaterial interest in an affiliate of Invesco) in, is employed by, is an officer or director of, or has any material business or professional relationship with Invesco, our adviser or any of their affiliates, performs services (other than as a director) for us, or serves as a director or trustee for more than three REITs organized by Invesco or advised by our adviser. A business or professional relationship will be deemed material if the gross income derived by the director from Invesco, our adviser or any of their affiliates exceeds 5% of (1) the director’s annual gross income derived from all sources during either of the last two years or (2) the director’s net worth on a fair market value basis. An indirect association is defined to include circumstances in which the director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law is or has been associated with Invesco, our adviser or any of their affiliates or us.

Based upon its review, our Board of Directors has affirmatively determined that each of Messrs. Kelly, Nixon, and Rowsey and Ms. Arrowsmith are “Independent Directors” under all applicable standards for independence, including as required for service on our Audit Committee.

Communications with the Lead Independent Director and non-executive directors

Any interested party may communicate with the Lead Independent Director or with our non-executive directors as a group at the following address:

Invesco Real Estate Income Trust Inc.

2300 N Field St.

Suite 1200

Dallas, TX 75201

Attn: Office of the Company Secretary

Communications will be distributed to the Board, or to any of the Board’s committees or individual directors as appropriate, depending on the facts and circumstances of the communication. In that regard, the Board does not receive certain communications which are unrelated to the duties and responsibilities of the Board.

In addition, our adviser maintains a Whistleblower Hotline for its employees or affiliates or individuals outside the Company to report complaints or concerns on an anonymous and confidential basis regarding questionable accounting, internal accounting controls or auditing matters and possible violations of the Company’s Code of Conduct or applicable law.

Persons may submit any complaint regarding accounting, internal accounting controls or auditing matters directly to the Audit Committee of the Board of Directors by sending a written communication appropriately addressed to:

Audit Committee

Invesco Real Estate Income Trust Inc.

2300 N Field St.

Suite 1200

Dallas, TX 75201

Attn: Office of the Company Secretary

7 Invesco Real Estate Income Trust Inc.

| Corporate governance | ||

| The Board has adopted Corporate Governance Guidelines. |

Corporate governance guidelines The Board has adopted Guidelines which are available in the corporate governance section of the Company’s website at www.inreit.com. The information on the Company’s website is not intended to form a part of, and is not incorporated by reference into, this Proxy Statement. The Guidelines set forth the practices the Board follows with respect to, among other matters, the composition of the Board, director responsibilities, Board committees, director access to officers and independent advisors, director compensation and the performance evaluation of the Board.

| |

| The Board is elected by stockholders to oversee our management team and to seek to assure that the long-term interests of the stockholders are being served. |

Board leadership structure R. Scott Dennis currently serves as Chair of the Board and Chief Executive Officer. In his capacity as Chair of the Board and Chief Executive Officer, Mr. Dennis leads our investment strategy and is responsible for managing our day-to-day operations.

The Board of Directors determined that combining the Chief Executive Officer and Chair positions is the appropriate leadership structure for the Company at this time. The Board of Directors is of the view that ‘‘one-size’’ does not fit all, the evidence does not demonstrate that any one leadership structure is more effective at creating long-term stockholder value and the decision of whether to combine or separate the positions of Chief Executive Officer and Chair will vary company-to-company and depend upon a company’s particular circumstances at a given point in time. Accordingly, the Board of Directors carefully considers from time to time whether the Chief Executive Officer and Chair positions should be combined based on what the Board of Directors believes is best for the Company and its stockholders. | |

| The Independent Directors have chosen to appoint a Lead Independent Director. |

As described in our Guidelines, our business is conducted day-to-day by our officers and our adviser, under the direction of the Chief Executive Officer and the oversight of the Board, to enhance the long-term value of the Company for its stockholders. The Board is elected by the stockholders to oversee our officers and our adviser and to seek to assure that the long-term interests of the stockholders are being served. In light of these differences in the fundamental roles of the Board and management, the Board of Directors has determined that since the Chair of our Board of Directors is not an Independent Director, as defined in our Bylaws, a Lead Independent Director should be appointed by a majority of our Independent Directors. Our Independent Directors have appointed Mr. Kelly to serve as our Lead Independent Director. Key responsibilities of our Lead Independent Director include, among others, presiding at executive sessions of Independent Directors, facilitating communications between the Independent Directors and the Chair of our Board of Directors, and calling meetings of the Independent Directors, as necessary.

| |

| Director nomination process | ||

| We do not have a standing nominating committee. Our Board of Directors has determined that it is appropriate not to have a nominating committee because our Board of Directors presently considers all matters for which a nominating committee would be responsible. Each member of our Board of Directors participates in the consideration of nominees. The Board is responsible for establishing a policy setting forth the specific, minimum qualifications that must be met by a nominee recommended for a position on the Board, and describing any specific qualities or skills that are necessary for one or more of the directors to possess. Such qualifications shall include the requirements under the Charter, any applicable corporate governance listing standards as well as consideration of the individual skills, experience and perspectives that will help create an effective Board. In recommending director nominees to our Board of Directors, our Board of Directors solicits candidate recommendations from its current members and management of our adviser. Our Board of Directors also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. The Board may engage the services of a search firm to assist in identifying potential director nominees. In evaluating the persons recommended as potential directors, our Board of | ||

2025 Proxy Statement 8

| Directors will consider each candidate without regard to the source of the recommendation and take into account those factors that our Board of Directors determines are relevant. Stockholders may directly nominate potential directors by satisfying the procedural requirements for such nomination as provided in our bylaws. | ||||

For so long as the Advisory Agreement (as defined below) is in effect, our adviser has the right to nominate, subject to the approval of such nomination by our Board of Directors, up to three affiliated directors to the slate of directors to be voted on by our stockholders at our annual meeting of stockholders; provided, however, that such number of director nominees shall be reduced as necessary by a number that will result in a majority of directors being independent of our adviser. | ||||

Our Board has approved a code of conduct and separate directors’ code of conduct. |

Codes of conduct Our Board has approved a code of conduct that applies to our officers, executive directors and employees, and to our adviser’s officers and employees who provide services to us (the “code of conduct”). Our Board has also approved a separate code of conduct that applies to all members of our board (the “directors’ code of conduct” and together with the code of conduct, our “codes of conduct”). Among other matters, our codes of conduct are designed to deter wrongdoing and to promote: • honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; • full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; • compliance with applicable governmental laws, rules and regulations; • prompt internal reporting of violations of the code of conduct to appropriate persons identified in the code of conduct; and • accountability for adherence to our codes of conduct. Any waiver of the codes of conduct for our executive officers or directors may be made only by our Board or one of our Board committees. The codes of conduct are posted on our website. We intend to satisfy the disclosure requirement regarding any amendment to, or a waiver of, a provision of the codes of conduct by posting such information on our website. Our insider trading policy contains our hedging policy, which is described below. | |||

Insider trading policy and procedure To promote compliance with applicable insider trading laws, rules and regulations, we have pre-clearance requirements and procedures for our directors and executive officers prior to effecting any transaction involving our securities and a pre-approval requirement for those individuals prior to entering into a Rule 10b5-1 trading plan, or any amendment, suspension or termination of a Rule 10b5-1 trading plan. In addition, our insider trading policy prohibits short selling, dealing in publicly-traded options, pledging, hedging (see below) or monetization transactions in our securities. | ||||

Hedging policy As part of our insider trading policy, we have a hedging policy in place for all of our directors, officers and employees, officers and employees of our adviser who provide services to us, and any of their respective (i) family members that reside in the same household as the individual (including a child away at college), (ii) anyone else who lives in the household, and (iii) family members outside of the household whose transactions in the company’s securities are directed by such individual or are subject to such individual’s influence or control and (iv) | ||||

| any entities, including any corporations, partnerships or trusts that the individual influences or controls. Our policy prohibits hedging or monetization transactions, such as zero-cost collars and forward sale contracts, involving our securities; however, limited exceptions are allowed. To date, no exceptions have been made.

| ||

Board’s role in risk oversight As with every business, we confront and must manage various risks including financial and economic risks related to the performance of our portfolio and how our investments have been financed. Pursuant to our Charter and Bylaws and the Maryland General Corporation Law, our business and affairs are managed under the direction of our Board. Our adviser is responsible for the day-to-day management of risks we face, while our Board has responsibility for establishing broad corporate policies for our overall operation and for the direction and oversight of our risk management. We have in place an enterprise risk management committee consisting of executive and senior management. The committee meets regularly and maintains dialogue with our Board regarding the top risks of the company and mitigating actions to address them. By receiving quarterly reports, the Board maintains a practical understanding of the risk management process and risk appetite of the company. In addition, members of our Board keep informed of our business by participating in meetings of our Board and the Audit Committee, by reviewing analyses, reports and other materials provided to them by and through discussions with our adviser and our executive officers.

In addition, since we are externally advised, we also rely upon the operational and investment risk oversight functions of our adviser and its affiliates. Invesco’s global risk management framework enables consistent and meaningful risk dialogue up, down and across Invesco. Its global investment risk and performance committee oversees the management of core investment risks and its enterprise risk management committee oversees the management of all other business and strategy related risks. A network of regional, business unit and specific risk management committees, with the oversight of Invesco’s enterprise risk management committee, provides ongoing identification, assessment, management and monitoring of risk that ensures both broad as well as in-depth, multi-layered coverage of the risks existing and emerging in the various domains of its business.

| ||

Oversight over cybersecurity risk Our Board oversees cybersecurity risk and receives updates, at a minimum, twice per year from our adviser’s Chief Information Security Officer (“CISO”) (or designee), which updates include a review of our adviser’s global security program and cybersecurity, including risks and protections for us and our adviser. The Global Operational Risk Management Committee, one of our adviser’s risk management committees, provides executive-level oversight and monitoring of the end-to-end programs dedicated to managing information security and cyber related risk. In addition, the CISO (or designee) provides quarterly updates to our Company’s enterprise risk management committee, which in turn provides quarterly updates to our Board, and members of our management team are included in our adviser’s incident response process in the event a cyber security incident occurs that could materially impact us.

Through this regular and consistent risk communication, the Board seeks to maintain reasonable assurance that all material risks of the company are being addressed and that the company is fostering a risk-aware culture in which effective risk management is embedded in the business. |

2025 Proxy Statement 10

Information about the Board and Audit Committee

Board of Directors and Audit Committee

We operate under the direction of our Board of Directors, the members of which are accountable to us and our stockholders as fiduciaries. Our Board has seven members, four of whom are Independent Directors, as defined by our Charter. Our Charter requires that each director have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets that we intend to acquire to serve as a director. Our Charter also requires that at all times at least one of our Independent Directors must have at least three years of relevant real estate experience. We have determined that our Board of Directors fulfills these criteria. Our Board of Directors has formed an Audit Committee and has adopted a charter for the Audit Committee, which is available on our website, www.inreit.com.

Board meetings and annual meeting of stockholders

During the calendar year ended December 31, 2024, the Board held seven meetings (not including committee meetings). Each director attended at least seventy-five percent (75%) of the aggregate of the total number of meetings held by the Board and the total number of Audit Committee meetings. The Board does not have a formal policy regarding Board member attendance at stockholder meetings. All directors attended the Annual Meeting of Stockholders in 2024.

Executive sessions

Our Corporate Governance Guidelines require that our Independent Directors hold executive sessions at which management is not present at least quarterly. Our Lead Independent Director chairs the regularly scheduled executive sessions of the Independent Directors.

| Members: Paul E. Rowsey (Chair) Julie Arrowsmith R. David Kelly Ray Nixon

Independence: Each member of the committee is independent under SEC and NYSE rules and financially literate

Audit Committee Financial Expert: Ms. Arrowsmith is qualified as an audit committee financial expert, as such term is defined by applicable SEC rules and regulations.

Meetings held in 2024: 4 |

The Audit Committee Under its charter, the committee:

• is comprised of at least three members of the Board and each is “independent” under the NYSE and SEC rules and is also “financially literate,” as defined under NYSE rules;

• members are appointed and removed by the Board;

• is required to meet at least quarterly;

• periodically meets with the internal auditor and the independent auditor in separate executive sessions without members of senior management present;

• has the authority to retain independent advisors, at the Company’s expense, whenever it deems appropriate to fulfill its duties; and

• reports to the Board regularly.

The committee’s charter is available on our website. The charter sets forth the committee’s responsibilities, which include assisting the Board in fulfilling its responsibility to oversee (i) the Company’s financial reporting, auditing and internal control activities, including the quality and integrity of the Company’s financial statements, (ii) the independent auditor’s qualifications, independence, appointment, compensation, and retention (iii) the performance of the Company’s internal audit function and independent auditor, and (iv) the Company’s compliance with applicable legal and regulatory requirements. |

Director compensation

Our directors who are affiliated with Invesco or the adviser, who we refer to as executive directors, do not receive additional compensation for serving on the Board or committees thereof. Our Board periodically reviews the level and form of the compensation of our non-executive directors, including how such compensation relates to director compensation of companies of comparable size, industry and complexity. As a part of its review, the Board received a report from the adviser on comparable non-executive director compensation practices and levels at companies of comparable size, industry and complexity.

11 Invesco Real Estate Income Trust Inc.

The Board approved non-executive director compensation for the 2024 service period as follows.

| Cash Fee | Annual cash fee in the amount of $56,250, payable in quarterly installments in arrears. | |

| Supplemental Audit Chair Fee | Additional annual cash fee in the amount of $15,000, payable in quarterly installments in arrears. | |

| Supplemental Fee for the Lead Independent Director | Additional annual cash fee in the amount of $5,000, payable in quarterly installments in arrears. | |

| Equity Award | Annual equity award in the amount of $18,750 in the form shares of Class E common stock. Equity awards are paid for service in advance and subject to a one-year vesting requirement. | |

Director compensation table

The following table sets forth the compensation paid to or earned by, as indicated, our non-executive directors during the year ended December 31, 2024:

| Name | Fees earned or paid in cash ($)1 | Share awards ($)2 | Total ($) | |||||||||||||

| James H. Forson |

71,250 | 62,500 | 133,750 | |||||||||||||

| R. David Kelly |

60,000 | 62,500 | 122,500 | |||||||||||||

| J. Ray Nixon |

56,250 | 62,500 | 118,750 | |||||||||||||

| Paul E. Rowsey |

56,250 | 62,500 | 118,750 | |||||||||||||

| 1. | Reflects fees earned during the year ended December 31, 2024. Fees earned during the year may be paid in a subsequent calendar year. |

| 2. | Reflects the grant as of December 1, 2024 of an annual equity award in the amount of 2,181 shares of Class E common stock for the service period November 2024 to November 2025. The equity awards vest on the anniversary of the date of grant. Reflects the full grant date fair value of such equity awards, determined in accordance with U.S. generally accepted accounting principles. |

The Board approved non-executive directors compensation for the 2025 service period as follows:

| Cash Fee | Annual cash fee in the amount of $62,500, payable in quarterly installments in arrears. | |

| Supplemental Audit Chair Fee | Additional annual cash fee in the amount of $15,000, payable in quarterly installments in arrears. | |

| Supplemental fee for the Lead Independent Director | Additional annual cash fee in the amount $5,000, payable in quarterly installments in arrears. | |

| Equity award | Annual equity award in the amount of $62,500 in the form shares of Class E common stock. Equity awards are paid for service in advance and subject to a one-year vesting requirement. | |

We do not pay our directors additional fees for attending Board of Director meetings, but we reimburse each of our directors for actual and reasonable out-of-pocket expenses incurred in attending Board of Director and committee meetings (including, but not limited to, the cost of airfare, hotel and food). The shares of stock granted to our non-executive directors are granted pursuant to the terms and conditions of our equity incentive plan, which has been adopted by our Board and approved by our stockholders.

2025 Proxy Statement 12

Information about the executive officers of the Company

Our executive officers include R. Scott Dennis, Courtney Popelka and Chase A. Bolding. Information regarding R. Scott Dennis is contained in “Information about Director Nominees.”

|

Courtney Popelka Chief Financial Officer

Age 49 |

Courtney Popelka Ms. Popelka has served as our Treasurer and Chief Financial Officer since October 7, 2024. Ms. Popelka was appointed as Chief Financial Officer (CFO) for Private Markets for Invesco Ltd. in October 2024. In that role, she provides strategic finance leadership and is responsible for the financial reporting teams supporting Invesco’s Private Markets products. Ms. Popelka previously served as Senior Director, then Managing Director, Head of US Fund Operations from 2015 to 2024, responsible for overseeing the day-to-day operations of the Invesco US real estate fund platform, including the core, core plus, high return, debt, and retail strategies. She began her investment career in 1999 and joined Invesco Real Estate in 2009, serving as senior controller of the real estate group. Ms. Popelka earned a Bachelor of Business Administration in Accounting and a master’s degree in finance from Texas A&M University. She is a certified public accountant (CPA). |

|

Chase A. Bolding President and Lead Portfolio Manager

Age 40 |

Chase A. Bolding Chase Bolding was appointed as our President on March 19, 2025 and has served as our Lead Portfolio Manager since March 2023, after previously serving as our Portfolio Manager from 2019 to March 2023. Mr. Bolding is a Managing Director and Chief Investment Officer at Invesco Real Estate (IRE). He has 15 years of real asset investment experience, and his investment capabilities include equity, debt, and joint ventures across the full risk-return spectrum. In addition to his role as President and Lead Portfolio Manager, Mr. Bolding co-chairs IRE’s CIO Council, serves on IRE’s Investment Committee and chairs IRE’s Screening (Equity) Committee and Platform Investments Committee. Prior to joining Invesco Real Estate, he worked for Greenfield Partners, a real estate private equity fund headquartered in Connecticut from 2007 to 2010. He earned a B.A. in Economics from The University of Texas at Austin and holds the Chartered Financial Analyst® (CFA) designation. |

Executive compensation

We are externally managed and do not have any employees. Our executive officers are employees of the adviser or one of its affiliates. Our Advisory Agreement provides that the adviser is responsible for managing our day-to-day operations and investment activities. As a result, our executive officers do not receive any cash compensation from us or any of our subsidiaries for serving as our executive officers but, instead, receive compensation from the adviser or its affiliates. In addition, we do not reimburse the adviser for compensation it pays to our executive officers. The Advisory Agreement does not require our executive officers to dedicate a specific amount of time to fulfilling the adviser’s obligations to us under the Advisory Agreement. Accordingly, the adviser cannot identify the portion of the compensation it awards to our executive officers that relates solely to such executives’ services to us, as the adviser does not compensate its employees specifically for such services. Furthermore, we do not have employment agreements with our executive officers; we do not provide pension or retirement benefits, perquisites or other personal benefits to our executive officers; our executive officers have not received any nonqualified deferred compensation; and we do not have arrangements to make payments to our executive officers upon their termination or in the event of a change in control of us.

Although we do not pay our executive officers any cash compensation, we pay the adviser the fees under the Advisory Agreement.

For additional information about our Advisory Agreement, see “Certain relationships and related transactions” below.

13 Invesco Real Estate Income Trust Inc.

Compensation committee interlocks and insider participation

We do not have a compensation committee of our Board of Directors because we do not directly compensate our executive officers or reimburse the adviser for their compensation. Accordingly, we have not included a Compensation Committee Report or a Compensation Discussion and Analysis in this Proxy Statement. Our Independent Directors participate in the consideration of Independent Director compensation.

As noted herein, we have no employees. During the fiscal year ended December 31, 2024, R. Scott Dennis, our Chairman and Chief Executive Officer, served as a director of Invesco Commercial Real Estate Finance Trust, Inc. Beth Zayicek, one of our directors and our Chief Operating Officer during 2024, also served as a director and as Chief Operating Officer of Invesco Commercial Real Estate Finance Trust, Inc. during 2024.

Policies and procedures for related person transactions

Our Charter contains policies on transactions with affiliated persons. Under the Charter, these transactions, if permitted, must be approved by a majority of our directors, including a majority of our Independent Directors, not otherwise interested in such transaction. In determining whether to approve or authorize a particular transaction with an affiliated person, the directors will consider whether the transaction between us and the related party is fair and reasonable to us and has terms and conditions no less favorable to us than those available from unaffiliated third parties.

Certain relationships and related transactions

The Advisory Agreement

The Board at all times has oversight and policy-making authority, including responsibility for governance, financial controls, compliance and disclosure with respect to our Company and our operating partnership. Under the Advisory Agreement, the Board has delegated to the adviser the day-to-day management of our business and the authority to source, evaluate and monitor our investments and make decisions related to the acquisition, management, financing and disposition of our assets, in accordance with our investment objectives, strategies, guidelines, policies and limitations. The adviser utilizes the personnel and global resources of Invesco Real Estate, the real estate investment center of Invesco, to provide investment management services to us under the Advisory Agreement. Set forth below is a summary of certain terms of the Advisory Agreement.

Services

Pursuant to the terms of the Advisory Agreement, the adviser is responsible for, among other things:

| • | serving as an adviser to us and our Operating Partnership with respect to the establishment and periodic review of our investment guidelines and our and the Operating Partnership’s investments, financing activities, and operations; |

| • | sourcing, evaluating and monitoring our and our Operating Partnership’s investment opportunities and executing the acquisition, management, financing and disposition of our and our Operating Partnership’s assets, in accordance with our investment objectives, strategies, guidelines, policies and limitations, subject to oversight by our Board of Directors; |

| • | with respect to prospective acquisitions, purchases, sales, exchanges or other dispositions of investments, conducting negotiations on our and our Operating Partnership’s behalf with sellers, purchasers, and other counterparties and, if applicable, their respective agents, advisors and representatives, and determining the structure and terms of such transactions; |

| • | providing us with portfolio management and other related services; |

2025 Proxy Statement 14

| • | serving as our adviser with respect to decisions regarding any of our financings, hedging activities or borrowings; |

| • | managing the DST Program whereby interests in DSTs are sold to third party investors and the DST Properties held by such DSTs are leased back to the Operating Partnership or its subsidiaries; and |

| • | engaging and supervising, on our and our Operating Partnership’s behalf and at our Operating Partnership’s expense, various service providers, including asset managers and loan servicers with respect to our assets. |

The above summary is provided to illustrate the material functions which the adviser will perform for us and it is not intended to include all of the services which may be provided to us by the adviser or third parties.

Term and Termination Rights

The current term of the Advisory Agreement expires on December 31, 2025. The Advisory Agreement is subject to automatic renewals for an unlimited number of successive one-year periods unless otherwise terminated by the Board or by the adviser for convenience. The Independent Directors will evaluate the performance of the adviser before renewing the Advisory Agreement (pursuant to the terms set forth in the Charter for such performance review).

The Advisory Agreement may be terminated:

| • | immediately by us (1) for “cause,” or (2) upon the bankruptcy of the adviser; |

| • | immediately by the adviser upon a change of control (as defined in the Advisory Agreement) of our Company or the Operating Partnership; |

| • | upon 60 days’ written notice by us without cause or penalty upon the vote of a majority of our Independent Directors; or |

| • | upon 60 days’ written notice by the adviser. |

“Cause” is defined in the Advisory Agreement to mean fraud, criminal conduct, willful misconduct or willful or negligent breach of fiduciary duty by the adviser under the Advisory Agreement.

In the event the Advisory Agreement is terminated, the adviser will be entitled to receive its prorated management fee owed through the date of termination. In addition, upon the termination or expiration of the Advisory Agreement, the adviser will cooperate with us and take all reasonable steps requested to assist the Board in making an orderly transition of the advisory function.

Management Fee, Performance Participation Interest and Expense Reimbursements

Management Fee

As compensation for its services provided under the Advisory Agreement, we pay the adviser a management fee equal to 1.0% of NAV for Class T shares, Class S shares, Class D shares, Class I shares, Class S-PR shares and Class K-PR shares per annum calculated and payable monthly. We will not pay a management fee on Class E shares. Commencing on January 16, 2030, ten years after the commencement of the Class N private offering, we will pay the adviser a management fee equal to 1.0% of NAV for Class N shares per annum payable monthly. In addition, we pay the adviser 1.0% per annum payable monthly of the total consideration received by us for selling interests in the DST Program (as defined below) to third-party investors, which will be allocated among all classes of common stock based on each class’s relative percentage of aggregate NAV.

In calculating the management fee, we will use our NAV before giving effect to accruals for the management fee, performance participation interest, stockholder servicing fees or distributions payable on our shares. Notwithstanding the foregoing, the value of our investments in real estate funds managed by the adviser or its affiliates will be excluded from our NAV for purposes of calculating the management fees.

The adviser may elect to receive its management fee in cash, shares of our Class I common stock, shares of our Class E common stock, Class I units of the Operating Partnership or Class E units of the Operating Partnership.

Special Limited Partner Interest

So long as the Advisory Agreement has not been terminated (including by means of non-renewal), Invesco REIT Special Limited Partner L.L.C. (the “Special Limited Partner”), a wholly owned indirect subsidiary of Invesco, will hold a performance participation interest in the Operating Partnership that entitles it to receive allocations from the Operating Partnership equal to (1) with respect to all classes of Operating Partnership units other than Class N units and Class E units, 12.5% of the Total Return, subject to a 6% Hurdle Amount and a High Water Mark, with a Catch-Up (each term as defined below) (the “Performance Participation”), and (2) with respect to Class N Operating Partnership units, 10% of the Class N Total Return, subject to a 7% Class N Hurdle Amount and a Class N High Water Mark, with a Catch-Up (each term as defined below) (the “Class N Performance Participation”).

15 Invesco Real Estate Income Trust Inc.

Performance Participation

With respect to Class T units, Class S units, Class D units, Class I units, Class S-PR units and Class K-PR units, the Special Limited Partner will be allocated a Performance Participation in an amount equal to:

| • | First, if the Total Return for the applicable period exceeds the sum of (1) the Hurdle Amount for that period and (2) the Loss Carryforward Amount (any such excess, “Excess Profits”), 100% of such Excess Profits until the total amount allocated to the Special Limited Partner equals 12.5% of the sum of (x) the Hurdle Amount for that period and (y) any amount allocated to the Special Limited Partner pursuant to this clause (this is commonly referred to as a “Catch-Up”); and |

| • | Second, to the extent there are remaining Excess Profits, 12.5% of such remaining Excess Profits. |

No Performance Participation is allocated with respect to Class E Units.

“Total Return” for any period since the end of the prior calendar year shall equal the sum of:

| 1. | All distributions accrued or paid (without duplication) on the Operating Partnership units outstanding at the end of such period since the beginning of the then-current calendar year, plus |

| 2. | The change in aggregate NAV of such units since the beginning of the year, before giving effect to (x) changes resulting solely from the proceeds of issuances of Operating Partnership units, (y) any allocation/accrual to the Performance Participation and (z) applicable stockholder servicing fee expenses (including any payments made to us for payment of such expenses). |

“Hurdle Amount” for any period during a calendar year means that amount that results in a 6% annualized internal rate of return on the NAV of the Operating Partnership units (other than Class N units and Class E units) outstanding at the beginning of the then-current calendar year and all Operating Partnership units (other than Class N units and Class E units) issued since the beginning of the then-current calendar year, taking into account the timing and amount of all distributions accrued or paid (without duplication) on all such units and all issuances of Operating Partnership units over the period and calculated in accordance with recognized industry practices. The ending NAV of the Operating Partnership units used in calculating the internal rate of return will be calculated before giving effect to any allocation/ accrual to the Performance Participation and applicable stockholder servicing fee expenses, provided that the calculation of the Hurdle Amount for any period will exclude any Operating Partnership units repurchased during such period, which units will be subject to the Performance Participation upon repurchase, as described below.

Except as described below in regards to Loss Carryforward Amounts, any amount by which Total Return falls below the Hurdle Amount will not be carried forward to subsequent periods.

“Loss Carryforward Amount” shall initially equal zero and shall cumulatively increase by the absolute value of any negative annual Total Return and decrease by any positive annual Total Return, provided that the Loss Carryforward Amount shall at no time be less than zero and provided further that the calculation of the Loss Carryforward Amount will exclude the Total Return related to any Operating Partnership units (other than Class N units and Class E units) repurchased during such year, which units will be subject to the Performance Participation upon repurchase as described below. The effect of the Loss Carryforward Amount is that the recoupment of past annual Total Return losses will offset the positive annual Total Return for purposes of the calculation of the Performance Participation. This is referred to as a “High Water Mark.”

Class N Performance Participation

With respect to Class N Operating Partnership units only, the Special Limited Partner will be allocated a Class N Performance Participation in an amount equal to:

| • | First, if the Class N Total Return for the applicable period exceeds the sum of (1) the Class N Hurdle Amount for that period and (2) the Class N Loss Carryforward Amount (any such excess, “Class N Excess Profits”), 50% of such Class N Excess Profits until the total amount allocated to the Special Limited Partner equals 10% of the sum of (x) the Class N Hurdle Amount for that period and (y) any amount allocated to the Special Limited Partner pursuant to this clause (this is commonly referred to as a “Catch-Up”); and |

| • | Second, to the extent there are remaining Class N Excess Profits, 10% of such remaining Class N Excess Profits. |

“Class N Total Return” for any period since the end of the prior calendar year shall equal the sum of:

| 1. | all distributions accrued or paid (without duplication) on the Class N Operating Partnership units outstanding at the end of such period since the beginning of the then-current calendar year, plus |

2025 Proxy Statement 16

| 2. | the change in aggregate NAV of such Class N units since the beginning of the year, before giving effect to (x) changes resulting solely from the proceeds of issuances of Class N Operating Partnership units, (y) any allocation/ accrual to the Class N Performance Participation and (z) applicable stockholder servicing fee expenses (including any payments made to us for payment of such expenses). |

For the avoidance of doubt, the calculation of Class N Total Return will (1) include any appreciation or depreciation in the NAV of units issued during the then-current calendar year but (2) exclude the proceeds from the initial issuance of such units.

“Class N Hurdle Amount” for any period during a calendar year means that amount that results in a 7% annualized internal rate of return on the NAV of the Class N Operating Partnership units outstanding at the beginning of the then-current calendar year and all Class N Operating Partnership units issued since the beginning of the then-current calendar year, taking into account the timing and amount of all distributions accrued or paid (without duplication) on all such units and all issuances of Class N Operating Partnership units over the period and calculated in accordance with recognized industry practices. The ending NAV of the Class N Operating Partnership units used in calculating the internal rate of return will be calculated before giving effect to any allocation/accrual to the Class N Performance Participation and applicable stockholder servicing fee expenses, provided that the calculation of the Class N Hurdle Amount for any period will exclude any Class N Operating Partnership units repurchased during such period, which units will be subject to the Class N Performance Participation upon repurchase as described below.

Except as described below in regards to Class N Loss Carryforward Amounts, any amount by which Class N Total Return falls below the Class N Hurdle Amount will not be carried forward to subsequent periods.

“Class N Loss Carryforward Amount” shall initially equal zero and shall cumulatively increase by the absolute value of any negative annual Class N Total Return and decrease by any positive annual Class N Total Return, provided that the Class N Loss Carryforward Amount shall at no time be less than zero and provided further that the calculation of the Class N Loss Carryforward Amount will exclude the Class N Total Return related to any Class N Operating Partnership units repurchased during such year, which units will be subject to the Class N Performance Participation upon repurchase as described below. The effect of the Class N Loss Carryforward Amount is that the recoupment of past annual Class N Total Return losses will offset the positive annual Class N Total Return for purposes of the calculation of the Class N Performance Participation. This is referred to as a “Class N High Water Mark.”

Such allocations are made annually and accrue monthly. Distributions on the Performance Participation and Class N Performance Participation may be payable in cash, Class I units of the Operating Partnership or Class E units of the Operating Partnership at the election of the Special Limited Partner. For the year ended December 31, 2024, the Special Limited Partner did not earn a performance participation interest.

Organization and Offering Expense Reimbursement

Our adviser advanced all of our organization and offering expenses (other than upfront selling commissions, dealer manager fees and stockholder servicing fees) on our behalf incurred through December 31, 2022. We will begin reimbursement of advanced organization and offering expenses on the earlier of (1) the date that our NAV reaches $1.0 billion and (2) December 31, 2027. Beginning January 1, 2023, we began reimbursing the adviser on a quarterly basis for organization and offering expense incurred subsequent to December 31, 2022.

Operating Expense Reimbursement

Our adviser advanced all of our operating expenses (excluding the organizational and offering expenses discussed above) on our behalf through December 31, 2021. From January 2022 to September 2022, we began ratably reimbursing the adviser over 60 months for the operating expenses incurred prior to December 31, 2021 and will recommence reimbursements to the adviser following the earlier of (1) the date that our NAV reaches $1.0 billion and (2) December 31, 2027. Beginning January 1, 2022, we began reimbursing the adviser on a quarterly basis for operating expenses incurred subsequent to December 31, 2021.

Our adviser provided the first $825,000 in costs related to the DST Program (as defined below) and we are not required to reimburse our adviser for these funds. We reimburse our adviser for any expenses that exceed $825,000 related to the DST Program as part of the quarterly reimbursement for operating expenses incurred subsequent to December 31, 2021.

Reimbursement of Expenses Incurred by Adviser

We will reimburse our adviser, subject to the limitations described below under “—Reimbursement by the adviser,” for all costs and expenses of the adviser and its affiliates incurred on our behalf (excluding the organizational and offering expenses discussed above), provided that the adviser will be solely responsible for any expenses related to any personnel of the adviser who provide investment advisory services to us under the Advisory Agreement (including each of our executive officers and any directors who are also directors, officers or employees of the adviser or any of its

17 Invesco Real Estate Income Trust Inc.

affiliates), including, without limitation, salaries, bonus and other wages, payroll taxes and the cost of employee benefit plans of such personnel, and costs of insurance with respect to such personnel. Without limiting the generality of the foregoing, such costs and expenses eligible for reimbursement include, without limitation, (1) the actual cost of goods and services used by us and obtained from third parties, including fees paid to administrators, consultants, attorneys, technology providers and other services providers, and brokerage fees paid in connection with the purchase and sale of investments and securities, (2) expenses of managing and operating our properties, whether payable to an affiliate or a non-affiliated person, (3) expenses in connection with the selection and acquisition of properties and real estate-related securities, whether or not such investments are acquired, (4) the compensation and expenses of our directors, (5) expenses relating to our compliance-related matters and regulatory filings relating to our activities, and (6) all fees, costs and expenses of non-investment advisory services rendered to us by the adviser or its affiliates in accordance with terms of the Advisory Agreement, including, without limitation, salaries and the cost of employee benefit plans and insurance with respect to personnel of the adviser.

During the year ended December 31, 2024, we recognized $1.0 million for total costs of support personnel, operational and travel expenses that were incurred by the Adviser.

Reimbursement by the Adviser

The adviser will reimburse us for any expenses that cause our Total Operating Expenses, including any distributions made to the Special Limited Partner with respect to its performance participation interest in the Operating Partnership, in any four consecutive fiscal quarters to exceed the greater of: (1) 2% of our Average Invested Assets and (2) 25% of our Net Income.

To the extent that our Total Operating Expenses exceed these limits and the Independent Directors determine that the excess expenses were justified based on unusual and nonrecurring factors that they deem sufficient, the adviser would not be required to reimburse us. Within 60 days after the end of any fiscal quarter for which our Total Operating Expenses for the four consecutive fiscal quarters then ended exceed these limits and our Independent Directors approve such excess amount, we will send our stockholders a written disclosure of such fact, or will include such information in our next quarterly report on Form 10-Q or in a current report on Form 8-K filed with the SEC, together with an explanation of the factors our Independent Directors considered in arriving at the conclusion that such excess expenses were justified. In addition, our Independent Directors will review at least annually the total fees and expense reimbursements for operating expenses paid to the adviser and the Special Limited Partner to determine if they are reasonable in light of our performance, our net assets and our net income and the fees and expenses of other comparable unaffiliated REITs.

For purposes of these limits:

| • | “Total Operating Expenses” are all costs and expenses paid or incurred by us, as determined under generally accepted accounting principles, including the management fee and the performance participation, but excluding: (i) the expenses of raising capital such as organization and offering expenses, legal, audit, accounting, underwriting, brokerage, listing, registration and other fees, printing and other such expenses and taxes incurred in connection with the issuance, distribution, transfer, registration and listing of shares of our common stock, (ii) property-level expenses incurred at each property, (iii) interest payments, (iv) taxes, (v) non-cash expenditures such as depreciation, amortization and bad debt reserves, (vi) incentive fees paid in compliance with our charter, (vii) acquisition fees and acquisition expenses related to the selection and acquisition of assets, whether or not a property is actually acquired, (viii) real estate commissions on the sale of property and (ix) other fees and expenses connected with the acquisition, disposition, management and ownership of real estate interests, mortgage loans or other property (including the costs of foreclosure, insurance premiums, legal services, maintenance, repair and improvement of property). |

| • | “Average Invested Assets” means, for any period, the average of the aggregate book value of our assets, invested, directly or indirectly, in equity interests in and loans secured by real estate, including all properties, real estate-related debt and real estate-related securities and consolidated and unconsolidated joint ventures or other partnerships, before deducting depreciation, amortization, impairments, bad debt reserves or other non-cash reserves, computed by taking the average of such values at the end of each month during such period. |

| • | “Net Income” means, for any period, total revenues applicable to such period, less the total expenses applicable to such period other than additions to, or allowances for, non-cash charges such as depreciation, amortization, impairments and reserves for bad debt or other similar non-cash reserves. |

For the year ended December 31, 2024, our Total Operating Expenses were 0.82% and 39.73% of each of our Average Invested Assets and our Net Income, respectively. Operating expenses for the four fiscal quarters ended December 31, 2024 did not exceed the Charter-imposed limitation. After the termination of each registered offering, the adviser has agreed to reimburse us to the extent that the organization and offering expenses that we incur with respect to such offering exceed 15% of our gross proceeds from the applicable offering.

2025 Proxy Statement 18

During the year ended December 31, 2024, we incurred management fees of $2.0 million. During the year ended December 31, 2024, the Special Limited Partner did not earn a performance participation interest. As of December 31, 2024, the Adviser advanced $5.4 million of operating expenses and $6.8 million of organization and offering expenses on our behalf.

Indemnification

To the extent permitted by law and our Charter, we will indemnify the adviser and its affiliates from all liabilities arising in connection with the performance of the adviser’s duties under the Advisory Agreement.

Dealer Manager Agreement

We entered into a Dealer Manager Agreement, pursuant to which Invesco Distributors, Inc., (the “Dealer Manager”) agreed to, among other things, manage our relationships with third-party broker-dealers engaged by the Dealer Manager to participate in the distribution of common stock, which we refer to as “participating broker-dealers,” and financial advisors. The Dealer Manager also coordinates our marketing and distribution efforts with participating broker-dealers and their registered representatives with respect to communications related to the terms of our offering, our investment strategies, material aspects of our operations and subscription procedures. We will not pay referral or similar fees to any accountants, attorneys or other persons in connection with the distribution of our common stock.

Upfront Selling Commissions and Dealer Manager Fees

Class S, Class T, and Class D Shares. The Dealer Manager is entitled to receive upfront selling commissions of up to 3.0%, and upfront dealer manager fees of up to 0.5%, of the transaction price of each Class T share sold in our offering, however such amounts may vary at certain participating broker-dealers, provided that the sum will not exceed 3.5% of the transaction price. The Dealer Manager is entitled to receive upfront selling commissions of up to 3.5% of the transaction price of each Class S Share sold. Subject to any discounts, the Dealer Manager may be entitled to receive upfront selling commissions of up to 1.5% of the transaction price of each Class D Share sold. The Dealer Manager anticipates that all or a portion of the upfront selling commissions will be retained by, or reallowed (paid) to, participating broker-dealers.

Class I Shares and Class E Shares. No upfront selling commissions or dealer manager fees will be paid with respect to purchases of Class I shares and Class E shares. No upfront selling commissions or dealer manager fees will be paid with respect to shares of any class sold pursuant to our distribution reinvestment plan.

Stockholder Servicing Fees — Class T, Class S and Class D Shares

Subject to any Financial Industry Regulatory Authority (“FINRA”) limitations on underwriting compensation and certain other limitations described below, we will pay the Dealer Manager selling commissions over time as a stockholder servicing fee