•making recommendations to our Board with respect to the adoption, amendment, termination or replacement of equity-based compensation or non-equity-based incentive compensation plans maintained by the Company and any material perquisites;

•determining, approving or making recommendations to our Board as to the appropriate compensation for other members of senior management, other employees as the Compensation Committee determines to be appropriate or directors;

•monitoring Alta’s compliance with SEC rules and regulations regarding stockholder approval of certain executive compensation; and

•assessing at least annually the independence of compensation consultants, legal and other advisers to the Compensation Committee.

The charter of the Compensation Committee is available on the Governance Documents portion of the Company’s website at https://investors.altg.com/governance/governance-documents/.

Nominating and Corporate Governance Committee. All members of the Nominating and Corporate Governance Committee are “independent” in accordance with the NYSE Rules. The Nominating and Corporate Governance Committee assists our Board in fulfilling its responsibilities by developing criteria and qualifications for Board membership, identifying and approving individuals who meet such criteria and are qualified to serve as members of our Board, selecting director nominees for our annual meetings of stockholders, developing and recommending to our Board Corporate Governance Guidelines and monitoring compliance with such guidelines.

The Nominating and Corporate Governance Committee develops guidelines that set forth the criteria and qualifications for Board membership, including, but not limited to, minimum individual qualifications, relevant career experience and technical skills, industry knowledge and experience, financial expertise, geographic ties, familiarity with the Company’s business, independence under applicable rules and regulations, gender, ethnic and racial background and ability to work collegially with others. The Nominating and Corporate Governance Committee uses these guidelines to identify, interview and evaluate potential director candidates to determine their qualifications to serve on our Board as well as their compatibility with the culture of the Company, its philosophy and its Board and management. When considering director candidates, the Nominating and Corporate Governance Committee and the Board seek individuals with backgrounds and qualities that, when combined with those of our incumbent directors, enhance the Board’s effectiveness and, as required by the Corporate Governance Guidelines, result in the Board having a broad range of skills, professional expertise, industry knowledge, diversity of opinion, geographic representation and contacts relevant to the Company’s business. In addition, although the Board considers diversity of backgrounds and qualities for director candidates, the Board does not have a formal diversity policy. We expect incumbent directors and director candidates to demonstrate business acumen and the ability to exercise sound judgment in decision-making processes to contribute positively to the Company, as well as our stockholders, employees, customers, and other significant stakeholders.

With respect to incumbent directors, the Nominating and Corporate Governance Committee annually evaluates their past participation in, and contributions to, activities of the Board, and, considering the qualities noted above, will determine whether those directors continue to satisfy the needs of the Board. The Nominating and Corporate Governance Committee considers the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers potential director candidates. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms, stockholders, or other persons. The Nominating and Corporate Governance Committee is responsible for conducting appropriate inquiries into the backgrounds and qualifications of potential director candidates and their suitability for service on our Board.

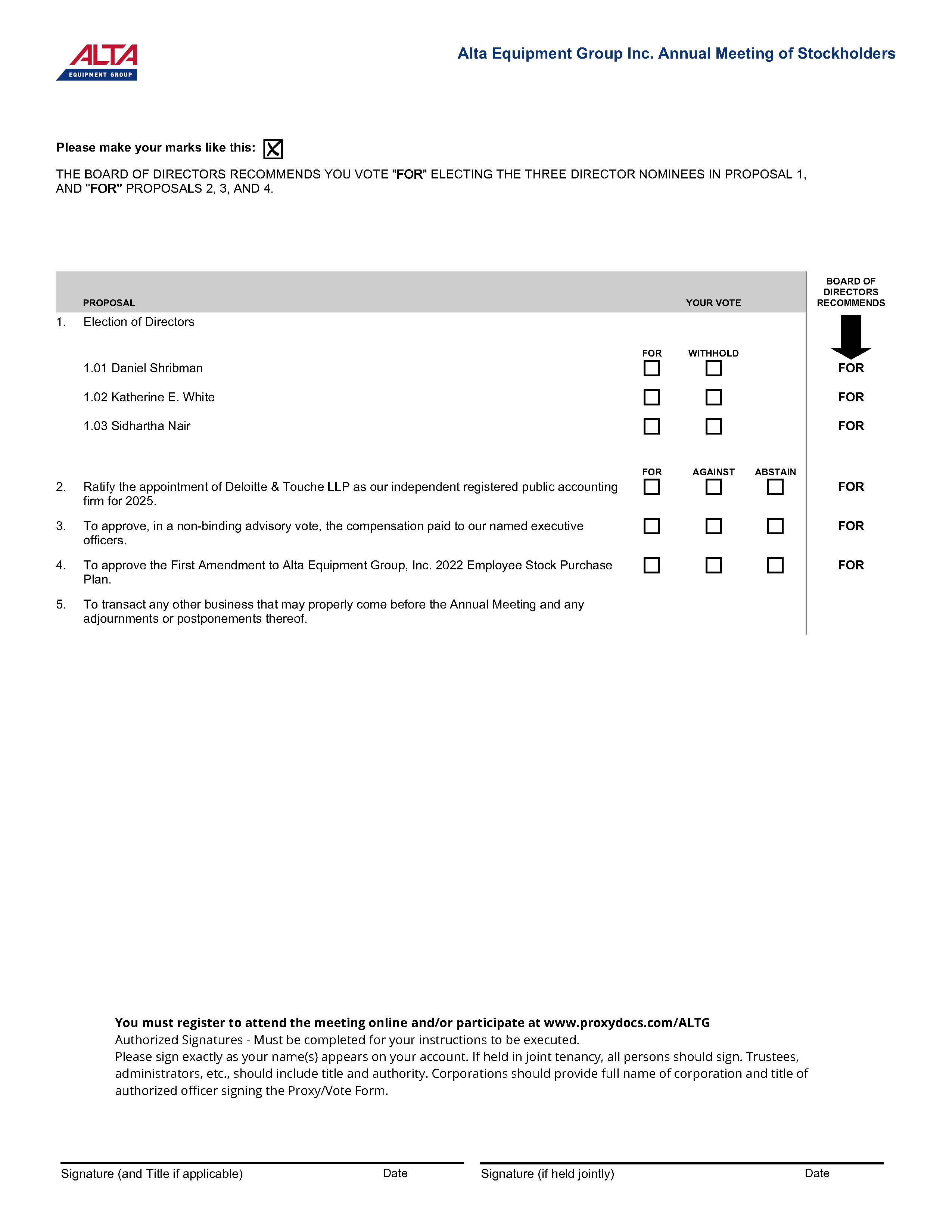

In the case of Mr. Shribman, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, approved him as a director nominee in recognition of his extensive experience in corporate finance and his strategic knowledge about investments in our industrials, transportation and automotive markets.

In the case of Ms. White, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, approved her as a director nominee in recognition of her legal background, long tenure in the U.S. government and military serving advisory and operational roles, as well as her previous experience as a member of several boards of directors and board committees.

In the case of Mr. Nair, the Board, upon the recommendation of the Nominating and Corporate Governance Committee, approved him as a director nominee in recognition of his extensive global experience in the digital and strategic transformation of business throughout their life cycle and his background in transportation, electrification and automotive markets.

The Nominating and Corporate Governance Committee will evaluate director candidates recommended by stockholders in the same way that the Nominating and Corporate Governance Committee evaluates any other director candidate.

Any recommendation submitted to the Secretary should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to recommend a candidate for consideration may do so by submitting the above information to the attention of the Secretary, 13211 Merriman Road, Livonia, Michigan 48150. All recommendations for nomination received by the Secretary that satisfy our Bylaw requirements relating to such director nominations will be presented to the Board for its consideration. Stockholders must also satisfy the notification, timeliness, consent, and information requirements set forth in