As of December 31, 2024, $67,945,560 in aggregate principal amount was outstanding under the various tranches provided by the Credit Facility pursuant to the Credit Facility with Agent, and $10,000,000 was outstanding under the 2024 Convertibles Notes. These tranches accrue interest at varying rates as set forth in the Credit Facility including (i) a senior secured delayed draw term loan of up to $55,000,000 that accrues interest at the U.S. prime rate plus 10.375%, payable monthly in cash and 2.75% per annum paid in kind interest payable monthly, (ii) a loan for $4,200,000 that accrues interest at a cash interest rate of 15% per annum and 2.00% per annum paid in kind interest payable monthly, (iii) a $1,200,000 term loan which accrues interest a rate of 12.0%, and (iv) 2024 Convertible Notes that accrues interest at 12% per annum payable monthly. From January 1, 2023 to December 31, 2024, the Company paid a total of $84,000 in principal and $22,803,341 in interest under the various tranches of the Credit Facility and $177,534 in interest under the 2024 Convertible Notes. As of December 31, 2024, there were no amounts outstanding under the Convertible Notes as all of the outstanding Convertible Notes were converted into Subordinate Voting Shares on July 31, 2024. From January 1, 2023 to December 31, 2024, the Company paid an aggregate amount of $587,329 in interest on the Convertible Notes, which accrued interest at an annual interest rate of 12.0%, including 6.0% cash and 6.0% paid-in-kind.

On December 17, 2024, CA PIPE SPV, LLC entered into subscription agreements in connection with the sale by the Company of 129,536,875 Subordinate Voting Shares at a cash price of $0.625 per share for total proceeds to the Company of $80,960,547. CA PIPE SPV, LLC purchased $20,020,000 of Subordinate Voting Shares. As a partner of CAM, the manager of CA PIPE SPV, LLC, Mr. Mazarakis, has a direct material interest in the Equity Raise. The value of Mr. Mazarakis’ interest in the Equity Raise is approximately $5,800,000.

On December 27, 2024, the Company paid CAG $712,720 in consulting fees related to then-proposed business combinations of the Company with each of (i) Deep Roots Holdings, Inc., a Nevada corporation; (ii) Proper Holdings Management, Inc. and NGH Investments, Inc., both Missouri corporations; and (iii) WholesomeCo, Inc., a Delaware corporation.

Prior to his appointment as the Company’s Chief Executive Officer, Tyson Macdonald represented Deep Roots in the Deep Roots Merger as a Managing Partner for TrueRise Capital, which provided strategic financial advisory services to Deep Roots in connection with the Deep Roots Merger. Mr. Macdonald owns 60% of the equity interests of TrueRise Capital. As of the filing of the Annual Report, Deep Roots has $260,000 of fees outstanding to TrueRise Capital in connection with certain financial advisory services provided by TrueRise Capital to Deep Roots, including in connection with the Deep Roots Merger. TrueRise Capital is also entitled to a fee equal to 1.5% of the merger consideration to be paid in connection with the Deep Roots Merger, which may be adjusted to a cash fee of $1,500,000 at closing of the Deep Roots Merger.

On October 10, 2024, Vireo Health, Inc., the Company’s wholly-owned subsidiary, and Joshua Rosen entered into the Consulting Agreement pursuant to which Mr. Rosen will be paid consulting fees at a rate of $1,000 per hour for his advice and involvement with certain litigation between the Company and Verano. To date, the Company has paid Mr. Rosen $0 under the Consulting Agreement. The Consulting Agreement is attached to the Company’s Annual Report as Exhibit 10.76. See also “Item 3. Legal Proceedings – Verano” and “Item 1A. Risk Factors — We are involved in litigation with Verano, the outcome of which is uncertain.” in the Annual Report.

INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Other than as set forth herein, management of Vireo is not aware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of any person who has been a director or executive officer of Vireo at any time since the beginning of Vireo’s last financial year or of any associate or affiliate of any such persons, in any matter to be acted upon at the Meeting.

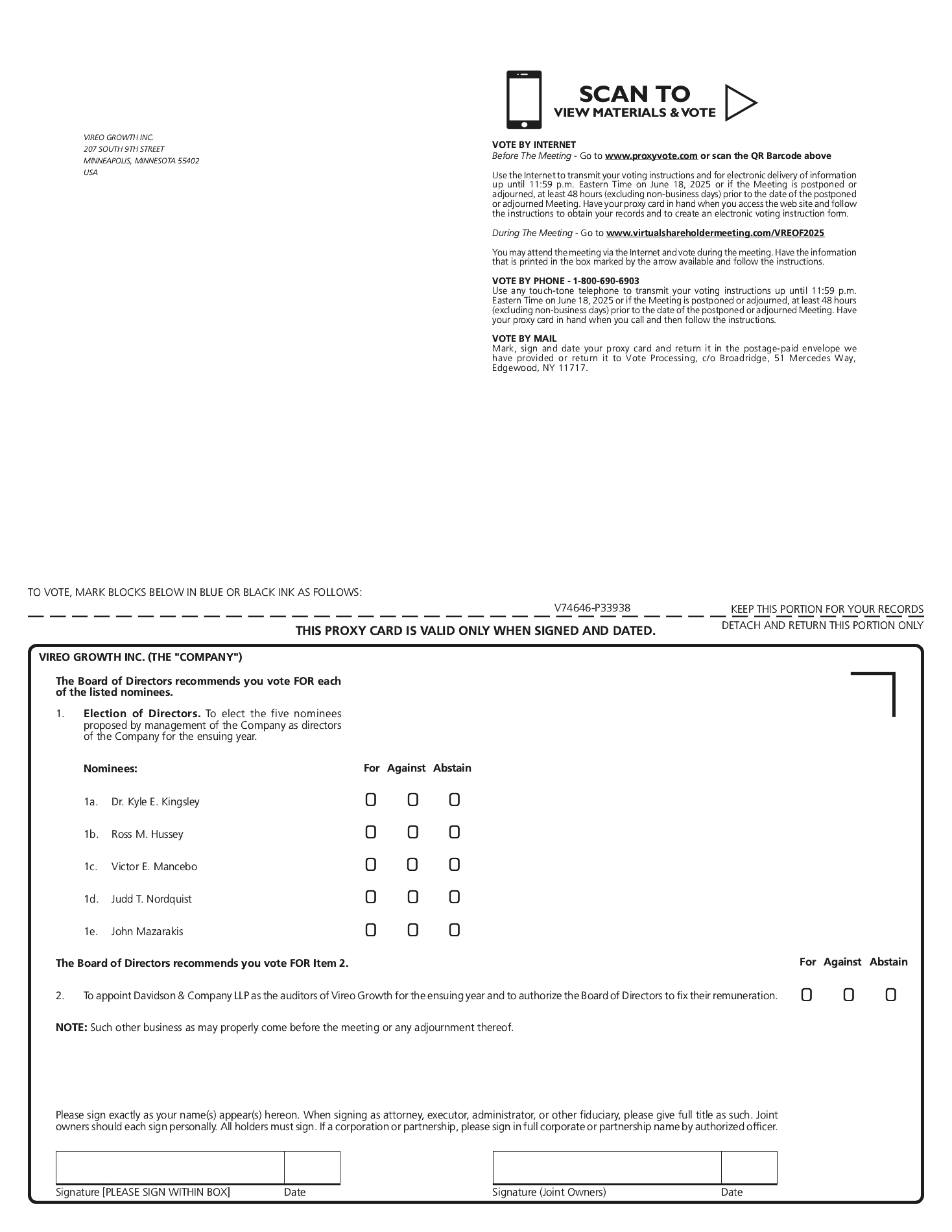

DISTRIBUTION OF CERTAIN DOCUMENTS

The Annual Report, including the 2024 Audited Financial Statements and related management’s discussion and analysis contained therein, for financial and other information about us, and this Circular, are available on the Internet as set forth in the Notice of Internet Availability. The Annual Report is not part of this Circular.

We are required to file annual, quarterly, and current reports; proxy statements; and other reports with the SEC. Copies of these filings are available through our website at investors.vireohealth.com/financials/regulatory-filings, on