Investor Presentation November 2022 May 5, 2025 Second Quarter Fiscal Year 2025 Supplemental Presentation

2 Certain matters discussed in this presentation and the accompanying oral presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made based on known events and circumstances at the time of presentation, and as such, are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding BellRing Brands, Inc.’s (“BellRing”) net sales, Adjusted EBITDA and capital expenditure outlook ranges and BellRing’s prospective financial and operating performance and opportunities. These forward- looking statements are sometimes identified from the use of forward-looking words such as “believe,” “should,” “could,” “potential,” “continue,” “expect,” “project,” “estimate,” “predict,” “anticipate,” “aim,” “intend,” “plan,” “forecast,” “target,” “is likely,” “will,” “can,” “may” or “would” or the negative of these terms or similar expressions, and include all statements regarding future performance, events or developments. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, THE FOLLOWING: • BellRing's dependence on sales from its ready-to-drink (“RTD”) protein shakes; • BellRing’s ability to continue to compete in its product categories and its ability to retain its market position and favorable perceptions of its brands; • disruptions or inefficiencies in BellRing’s supply chain, including as a result of BellRing’s reliance on third-party suppliers or manufacturers for the manufacturing of many of its products, pandemics and other outbreaks of contagious diseases, labor shortages, fires and evacuations related thereto, changes in weather conditions, natural disasters, agricultural diseases and pests and other events beyond BellRing’s control; • BellRing’s dependence on third-party contract manufacturers for the manufacture of most of its products, including one manufacturer for nearly half of its RTD protein shakes; • the ability of BellRing’s third-party contract manufacturers to produce an amount of BellRing’s products that enables BellRing to meet customer and consumer demand for the products; • BellRing’s reliance on a limited number of third-party suppliers to provide certain ingredients and packaging; • significant volatility in the cost or availability of inputs to BellRing’s business (including freight, raw materials, packaging, energy, labor and other supplies); • BellRing’s ability to anticipate and respond to changes in consumer and customer preferences and behaviors and introduce new products; • consolidation in BellRing’s distribution channels; • BellRing’s ability to expand existing market penetration and enter into new markets; • the loss of, a significant reduction of purchases by or the bankruptcy of a major customer; • legal and regulatory factors, such as compliance with existing laws and regulations, as well as new laws and regulations and changes to existing laws and regulations and interpretations thereof, affecting BellRing’s business, including current and future laws and regulations regarding food safety, advertising, labeling, tax matters and environmental matters; • fluctuations in BellRing’s business due to changes in its promotional activities and seasonality; • BellRing’s ability to maintain the net selling prices of its products and manage promotional activities with respect to its products; • BellRing’s ability to obtain additional financing (including both secured and unsecured debt) and its ability to service its outstanding debt (including covenants that restrict the operation of its business); • the accuracy of BellRing’s market data and attributes and related information; • changes in critical accounting estimates; • uncertain or unfavorable economic conditions that limit customer and consumer demand for BellRing’s products or increase its costs; Cautionary Statement Regarding Forward-Looking Statements

Cautionary Statement Regarding Forward-Looking Statements (Cont’d) 3 (CONTINUED FROM PRIOR PAGE): • risks related to BellRing’s ongoing relationship with Post Holdings, Inc. (“Post”) following BellRing’s separation from Post and Post’s distribution of BellRing stock to Post’s shareholders (the “Spin-off”), including BellRing’s obligations under various agreements with Post; • conflicting interests or the appearance of conflicting interests resulting from certain of BellRing’s directors also serving as officers and/or directors of Post; • risks related to the previously completed Spin-off; • the ultimate impact litigation or other regulatory matters may have on BellRing; • risks associated with BellRing’s international business; • BellRing’s ability to protect its intellectual property and other assets and to continue to use third-party intellectual property subject to intellectual property licenses; • costs, business disruptions and reputational damage associated with technology failures, cybersecurity incidents and corruption of BellRing’s data privacy protections; • impairment in the carrying value of goodwill or other intangible assets; • BellRing’s ability to identify, complete and integrate or otherwise effectively execute acquisitions or other strategic transactions and effectively manage its growth; • BellRing’s ability to hire and retain talented personnel, employee absenteeism, labor strikes, work stoppages or unionization efforts; • BellRing’s ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002; • significant differences in BellRing’s actual operating results from any guidance BellRing may give regarding its performance; and • other risks and uncertainties described in BellRing’s filings with the Securities and Exchange Commission. You should not rely upon forward-looking statements as predictions of future events. Although BellRing believes that the expectations reflected in the forward-looking statements are reasonable, BellRing cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, BellRing undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in its expectations.

Additional Information 4 Prospective Information Any prospective information provided in this presentation regarding BellRing’s future performance, including BellRing’s plans, expectations, estimates and similar statements, represents BellRing management’s estimates as of May 5, 2025 only and are qualified by, and subject to, the assumptions and the other information set forth on the slide captioned “Cautionary Statement Regarding Forward-Looking Statements.” Prospective information provided in this presentation regarding BellRing’s plans, expectations, estimates and similar statements contained in this presentation are based upon a number of assumptions and estimates that, while they may be presented with numerical specificity, are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond BellRing’s control, are based upon specific assumptions with respect to future business decisions, some of which will change, and are necessarily speculative in nature. It can be expected that some or all of the assumptions of the estimates will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate as of May 5, 2025, and actual results will vary from the estimates set forth herein. It should be recognized that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors should put all prospective information in context and not rely on it. Any failure to successfully implement BellRing’s operating strategy or the occurrence of the events or circumstances set forth under “Cautionary Statement Regarding Forward- Looking Statements” could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material. Market and Industry Data This presentation includes industry and trade association data, forecasts and information that were prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to BellRing. Some data also is based on BellRing management’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. BellRing has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. Similarly, BellRing believes its internal research is reliable, even though such research has not been verified by any independent sources and BellRing cannot guarantee its accuracy or completeness. Trademarks and Service Marks Logos, trademarks, trade names and service marks mentioned in this presentation, including BellRing®, BellRing Brands®, Premier Protein®, Dymatize®, PowerBar®, Premier Protein Clear®, ISO.100®, Elite Mass®, Elite Whey Protein®, Elite 100% Whey®, Super Mass Gainer®, All9 Amino®, Pebbles®, Dunkin®, PREW.O®, Athlete’s BCAA®, PowerBar Clean WheyTM, PowerBar Protein PlusTM, Protein Nut2TM and PowerBar EnergizeTM, are currently the property of, or are under license by, BellRing or one of its subsidiaries. BellRing or one of its subsidiaries owns or has rights to use the trademarks, service marks and trade names that are used in conjunction with the operation of BellRing or its subsidiaries’ businesses. Some of the more important trademarks that BellRing or one of its subsidiaries owns or has rights to use that appear in this presentation may be registered in the United States (“U.S.”) and other jurisdictions. Each logo, trademark, trade name or service mark of any other company appearing in this presentation is owned or used under license by such company.

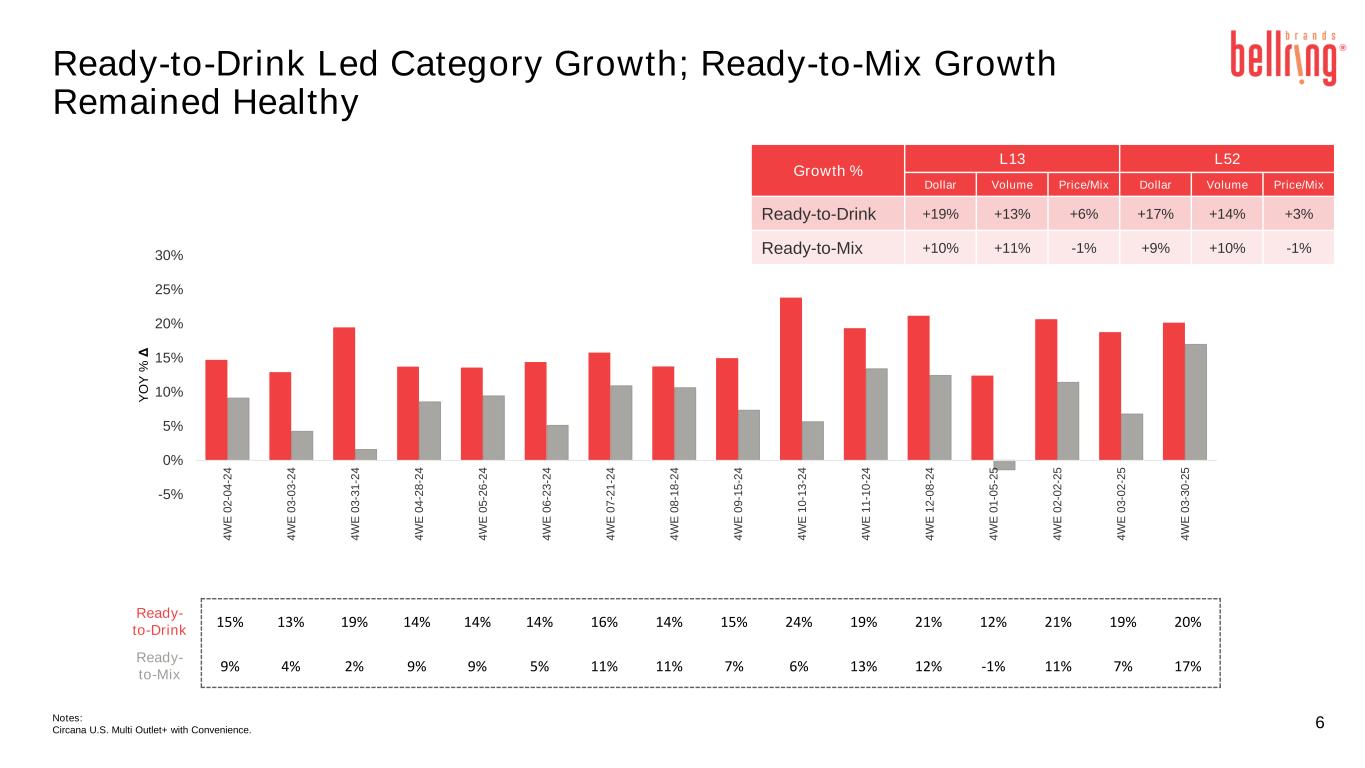

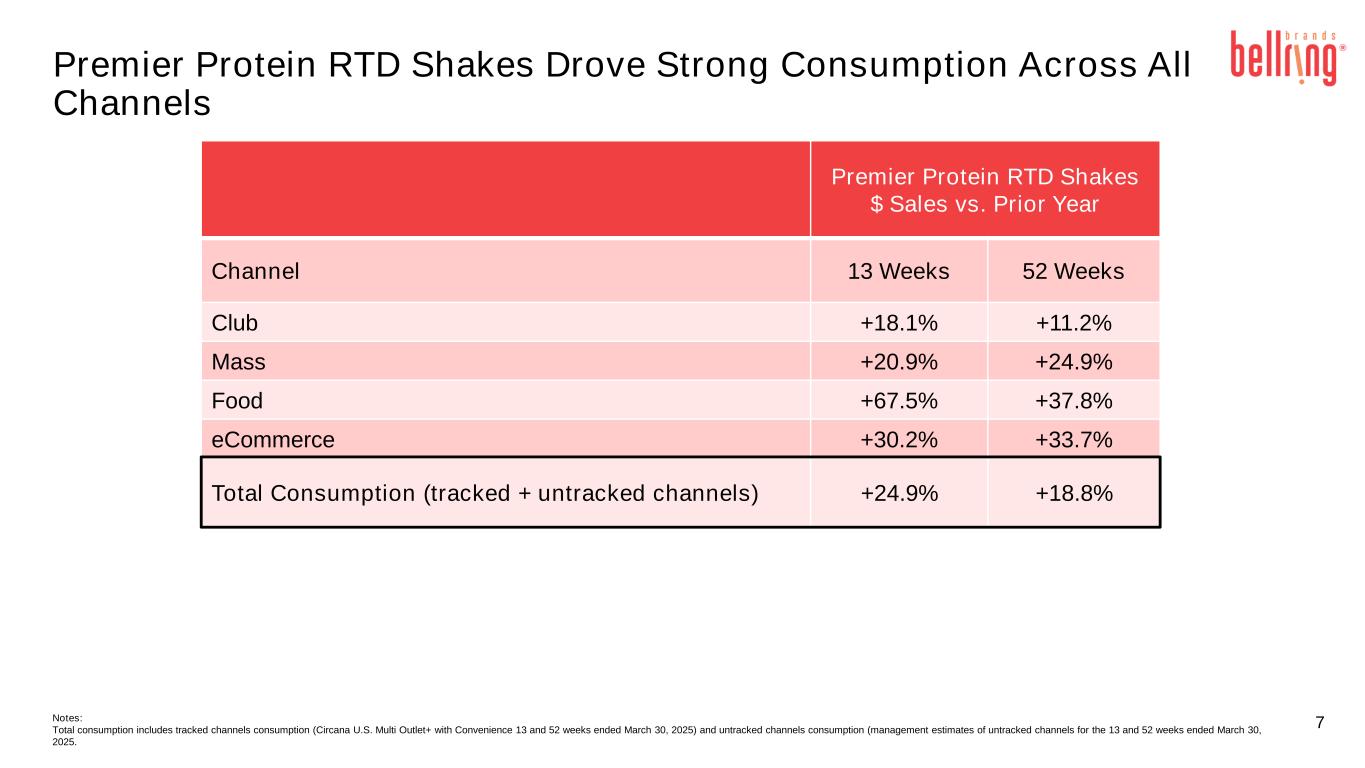

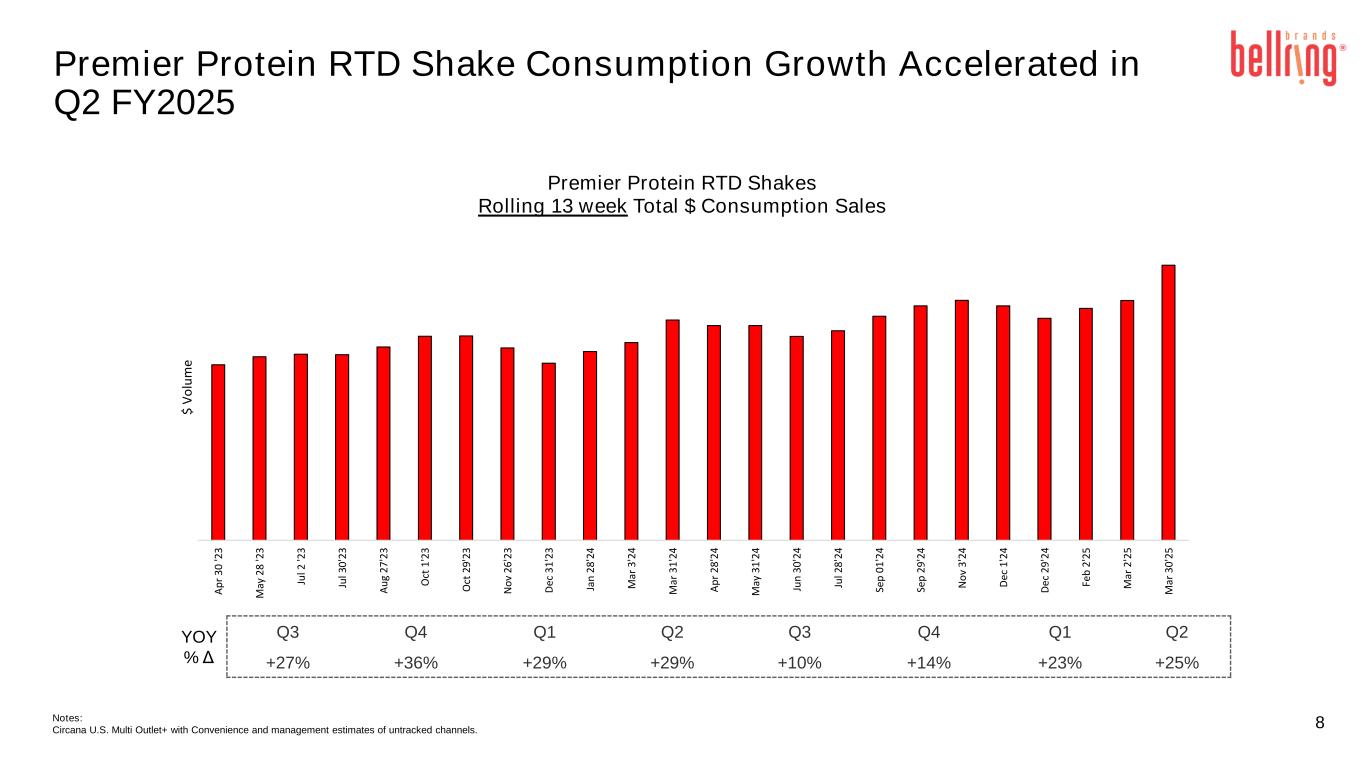

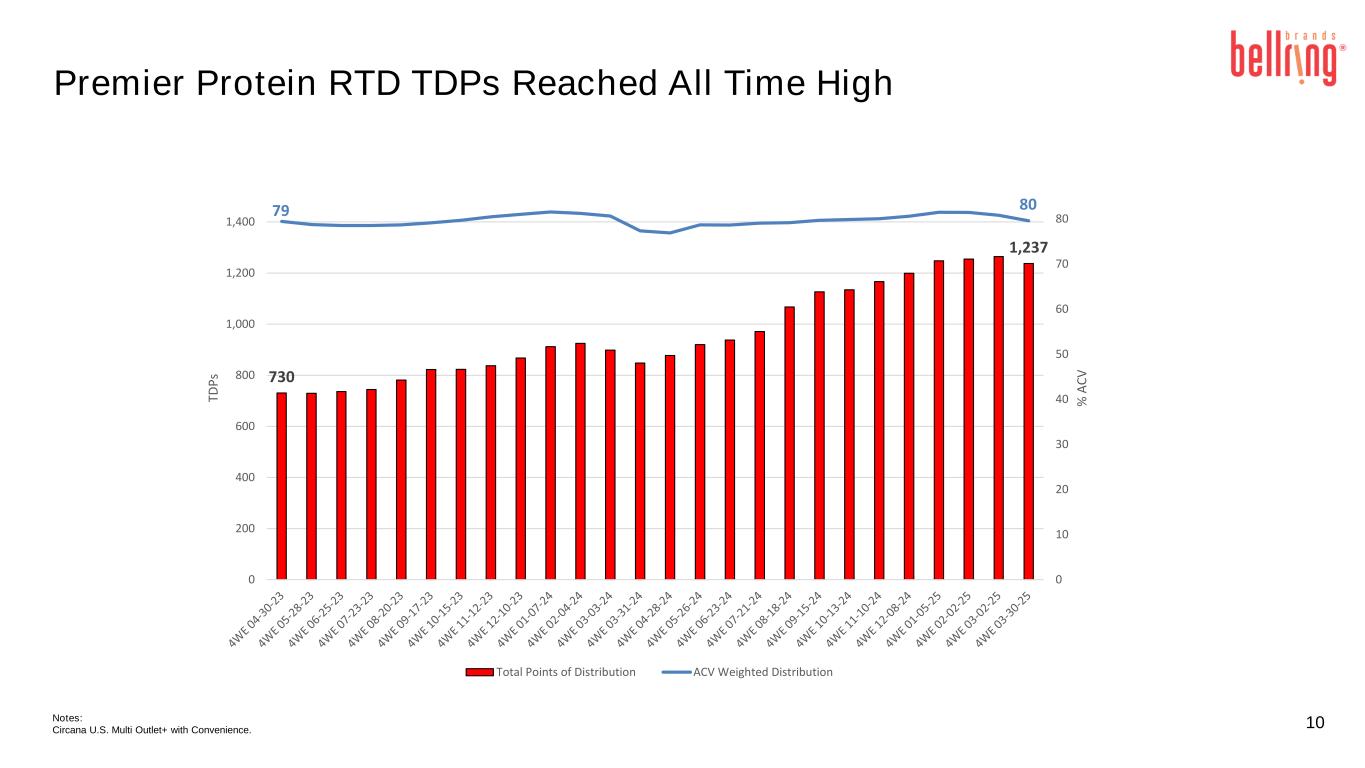

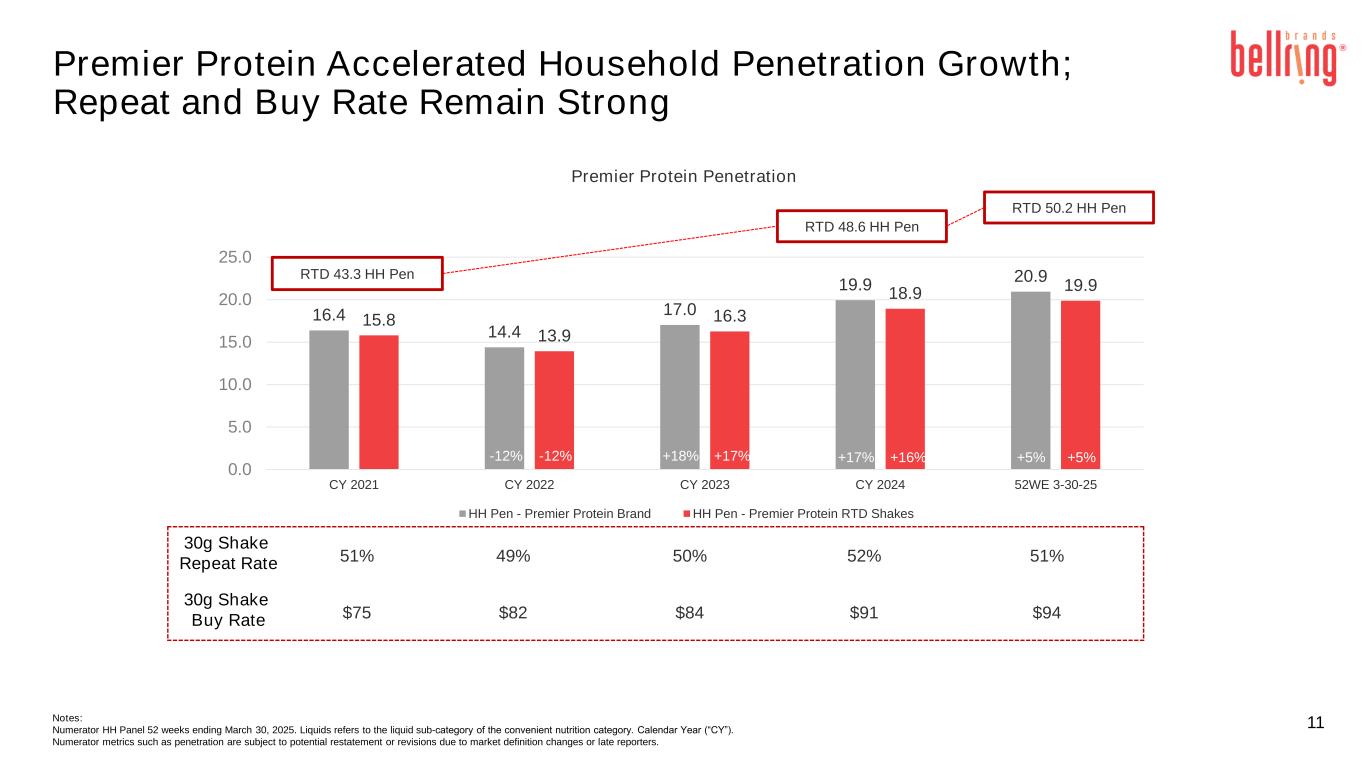

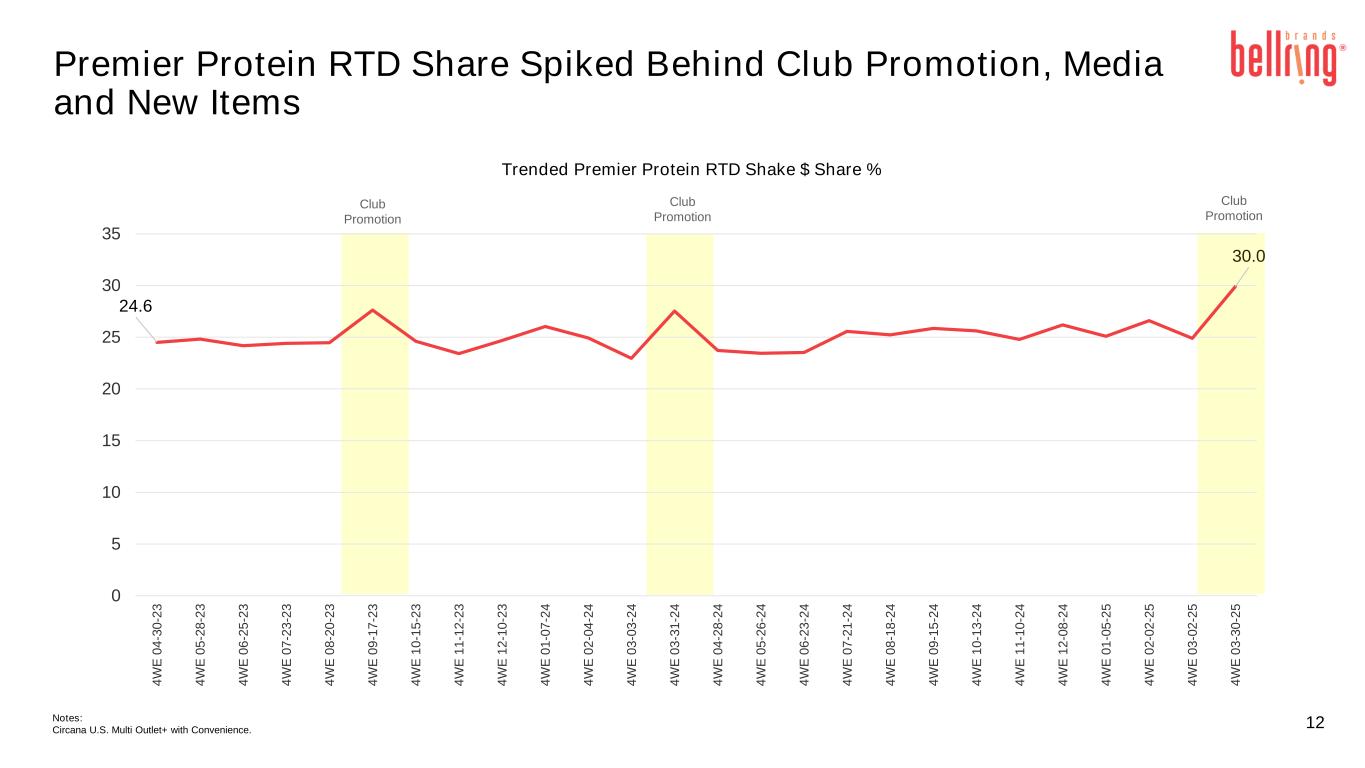

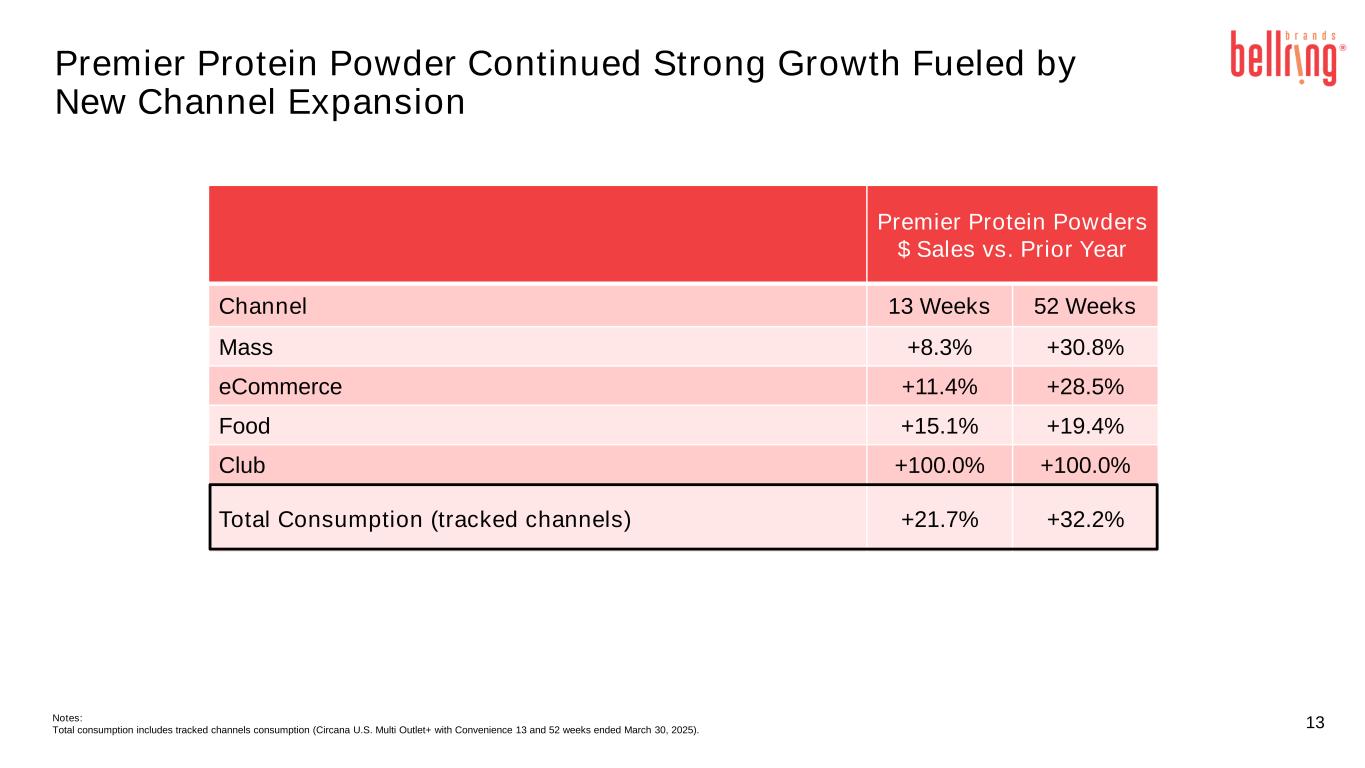

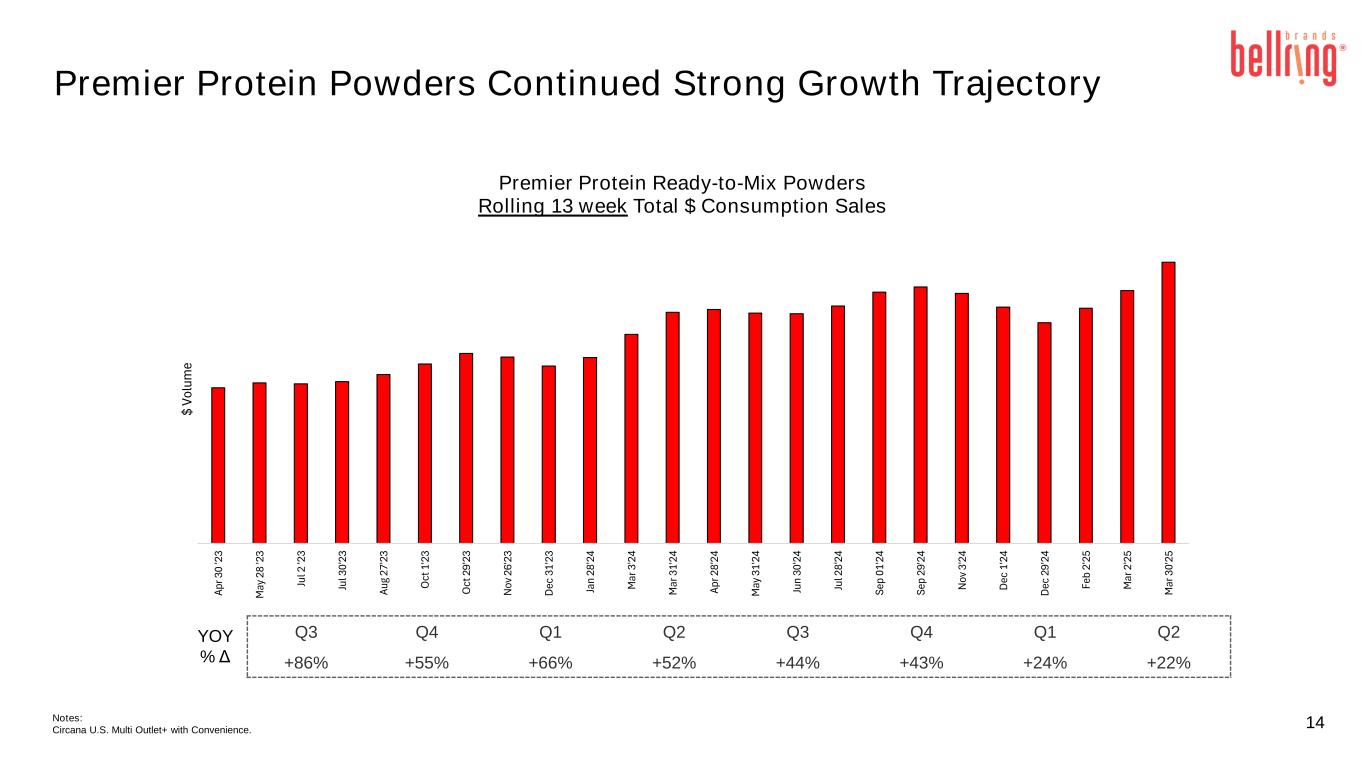

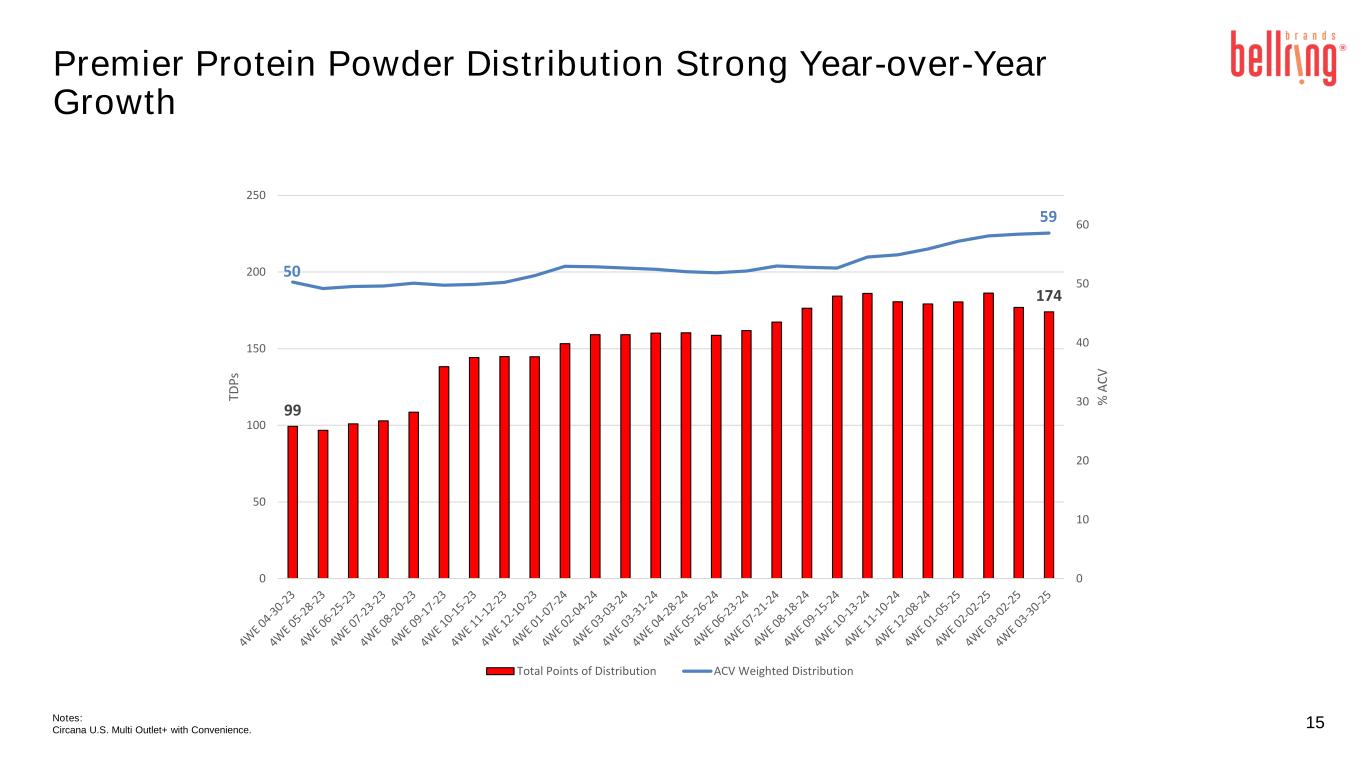

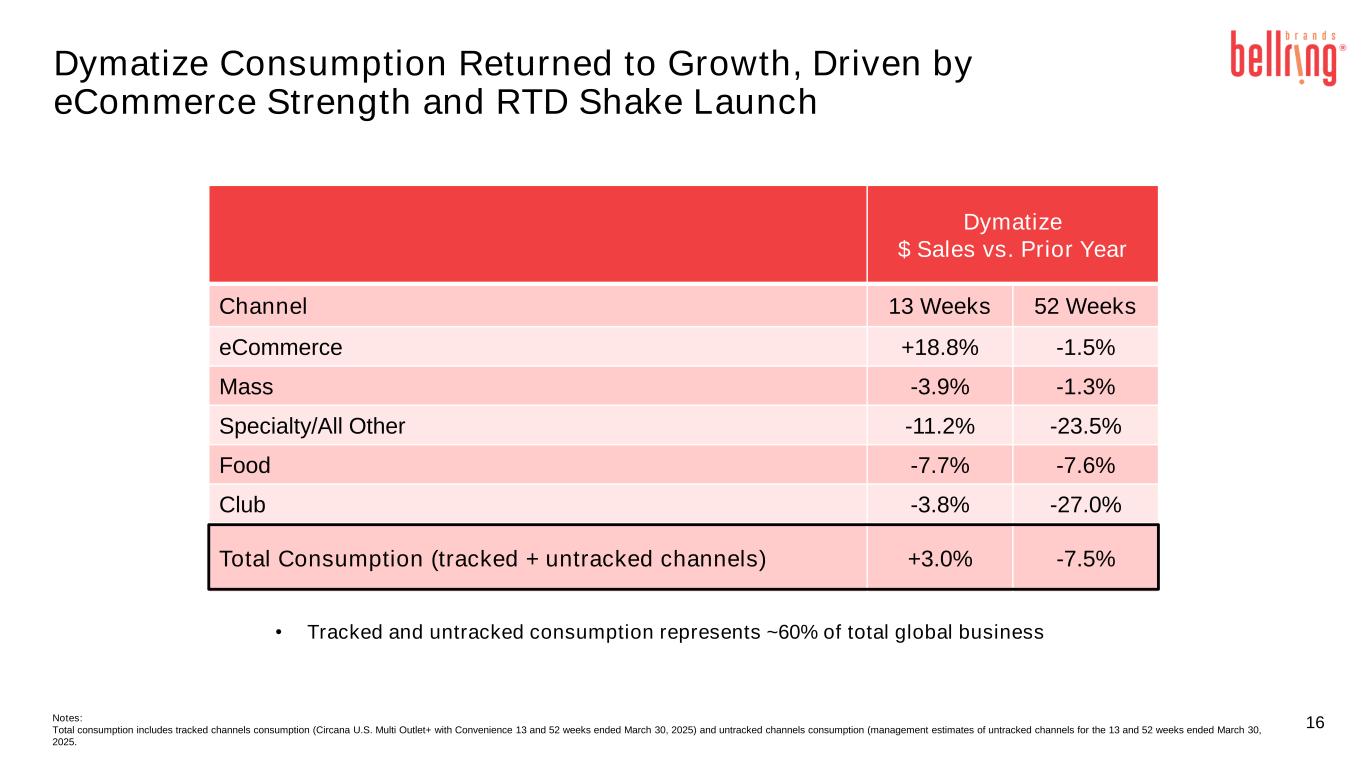

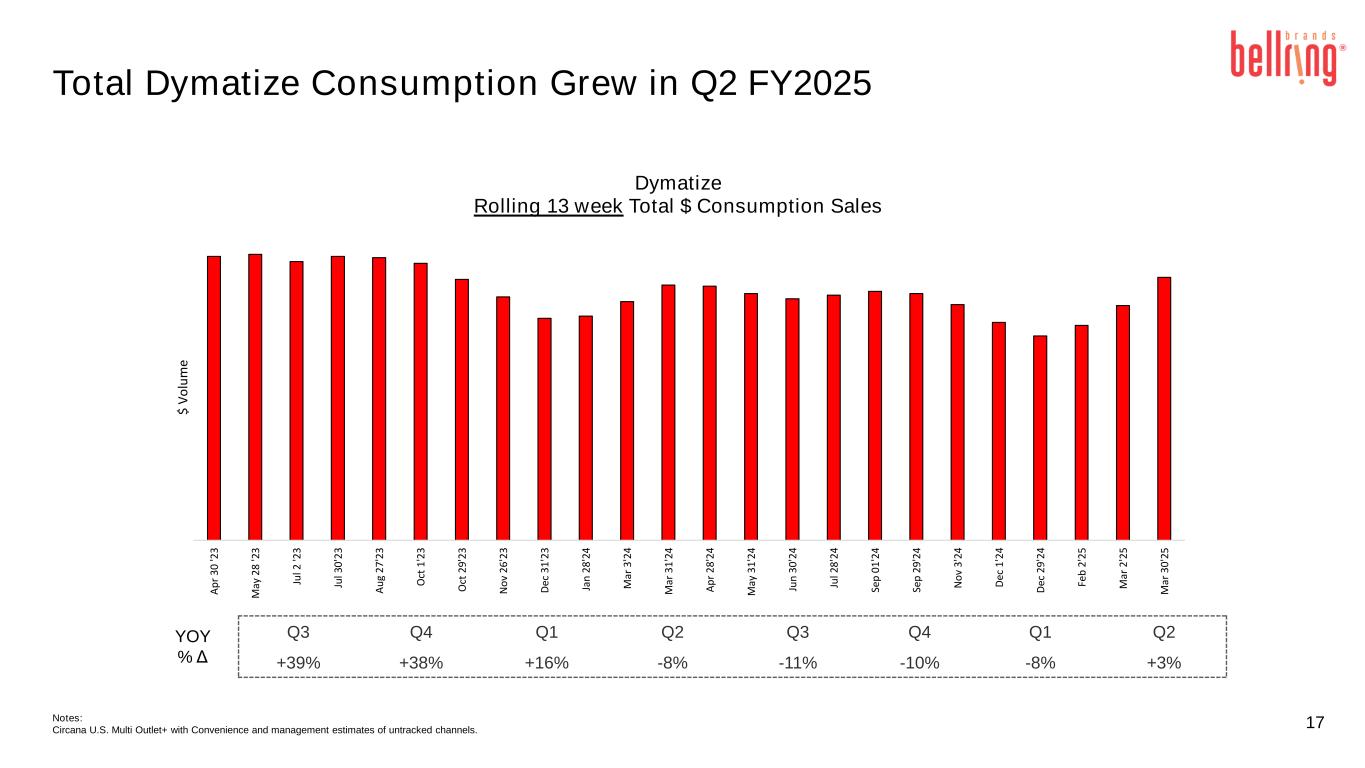

5 Q2 FY2025 Consumption and Key Metrics Executive Summary ● The convenient nutrition category showed continued momentum (+12%)1, with the ready-to-drink (“RTD”) category driving outsized growth (+19%); ready-to-mix (“RTM”) growth remained healthy. ● Premier Protein RTD shake brand metrics and consumption were strong, with dollar growth +25%2 vs Q2 FY2024. o Consumption remained strong across channels, accelerating to reach a new quarterly dollar sales high and benefited from increased promotions, media and improved year-over-year retailer in stocks. o Distribution and household penetration (20.9% 3) both reached an all-time high; household penetration continued to lead the RTD category while velocities, buy rate and repeat rate remained strong. o Premier Protein reached a new RTD category market share high in March (30%) and continued to lead the convenient nutrition and RTD categories in tracked market share1. ● Premier Protein powders drove strong consumption growth (+22%)1 behind velocity strength and expanded distribution in key channels. ● Dymatize remained one of the strongest brands in the sports nutrition category with velocities in the top tertile of key customers, reaching the #4 powder share position. o Consumption grew +3%2 vs Q2 FY2024 driven by incremental promotion and new RTD shake launch. Notes: 1. U.S. Circana Multi Outlet+ with Convenience 13 weeks ended March 30, 2025. 2. U.S. Circana Multi Outlet+ with Convenience 13 weeks ended March 30, 2025 and management estimates of untracked channels for the 13 weeks ended March 30, 2025. 3. Numerator HH Panel 52 weeks ending March 30, 2025.

6 Ready-to-Drink Led Category Growth; Ready-to-Mix Growth Remained Healthy Notes: Circana U.S. Multi Outlet+ with Convenience. Ready- to-Drink 15% 13% 19% 14% 14% 14% 16% 14% 15% 24% 19% 21% 12% 21% 19% 20% Ready- to-Mix 9% 4% 2% 9% 9% 5% 11% 11% 7% 6% 13% 12% -1% 11% 7% 17% -5% 0% 5% 10% 15% 20% 25% 30% 4 W E 0 2 -0 4 -2 4 4 W E 0 3 -0 3 -2 4 4 W E 0 3 -3 1 -2 4 4 W E 0 4 -2 8 -2 4 4 W E 0 5 -2 6 -2 4 4 W E 0 6 -2 3 -2 4 4 W E 0 7 -2 1 -2 4 4 W E 0 8 -1 8 -2 4 4 W E 0 9 -1 5 -2 4 4 W E 1 0 -1 3 -2 4 4 W E 1 1 -1 0 -2 4 4 W E 1 2 -0 8 -2 4 4 W E 0 1 -0 5 -2 5 4 W E 0 2 -0 2 -2 5 4 W E 0 3 -0 2 -2 5 4 W E 0 3 -3 0 -2 5 Y O Y % Δ Growth % L13 L52 Dollar Volume Price/Mix Dollar Volume Price/Mix Ready-to-Drink +19% +13% +6% +17% +14% +3% Ready-to-Mix +10% +11% -1% +9% +10% -1%

7 Premier Protein RTD Shakes $ Sales vs. Prior Year Channel 13 Weeks 52 Weeks Club +18.1% +11.2% Mass +20.9% +24.9% Food +67.5% +37.8% eCommerce +30.2% +33.7% Total Consumption (tracked + untracked channels) +24.9% +18.8% Notes: Total consumption includes tracked channels consumption (Circana U.S. Multi Outlet+ with Convenience 13 and 52 weeks ended March 30, 2025) and untracked channels consumption (management estimates of untracked channels for the 13 and 52 weeks ended March 30, 2025. Premier Protein RTD Shakes Drove Strong Consumption Across All Channels

8Notes: Circana U.S. Multi Outlet+ with Convenience and management estimates of untracked channels. Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 +27% +36% +29% +29% +10% +14% +23% +25% YOY % Δ A p r 3 0 '2 3 M ay 2 8 '2 3 Ju l 2 '2 3 Ju l 3 0 '2 3 A u g 2 7 '2 3 O ct 1 '2 3 O ct 2 9' 2 3 N o v 2 6 '2 3 D ec 3 1 '2 3 Ja n 2 8 '2 4 M ar 3 '2 4 M ar 3 1 '2 4 A p r 2 8 '2 4 M ay 3 1 '2 4 Ju n 3 0 '2 4 Ju l 2 8 '2 4 Se p 0 1 '2 4 Se p 2 9 '2 4 N o v 3 '2 4 D ec 1 '2 4 D ec 2 9 '2 4 Fe b 2 '2 5 M ar 2 '2 5 M ar 3 0 '2 5 $ V o lu m e Premier Protein RTD Shakes Rolling 13 week Total $ Consumption Sales Premier Protein RTD Shake Consumption Growth Accelerated in Q2 FY2025

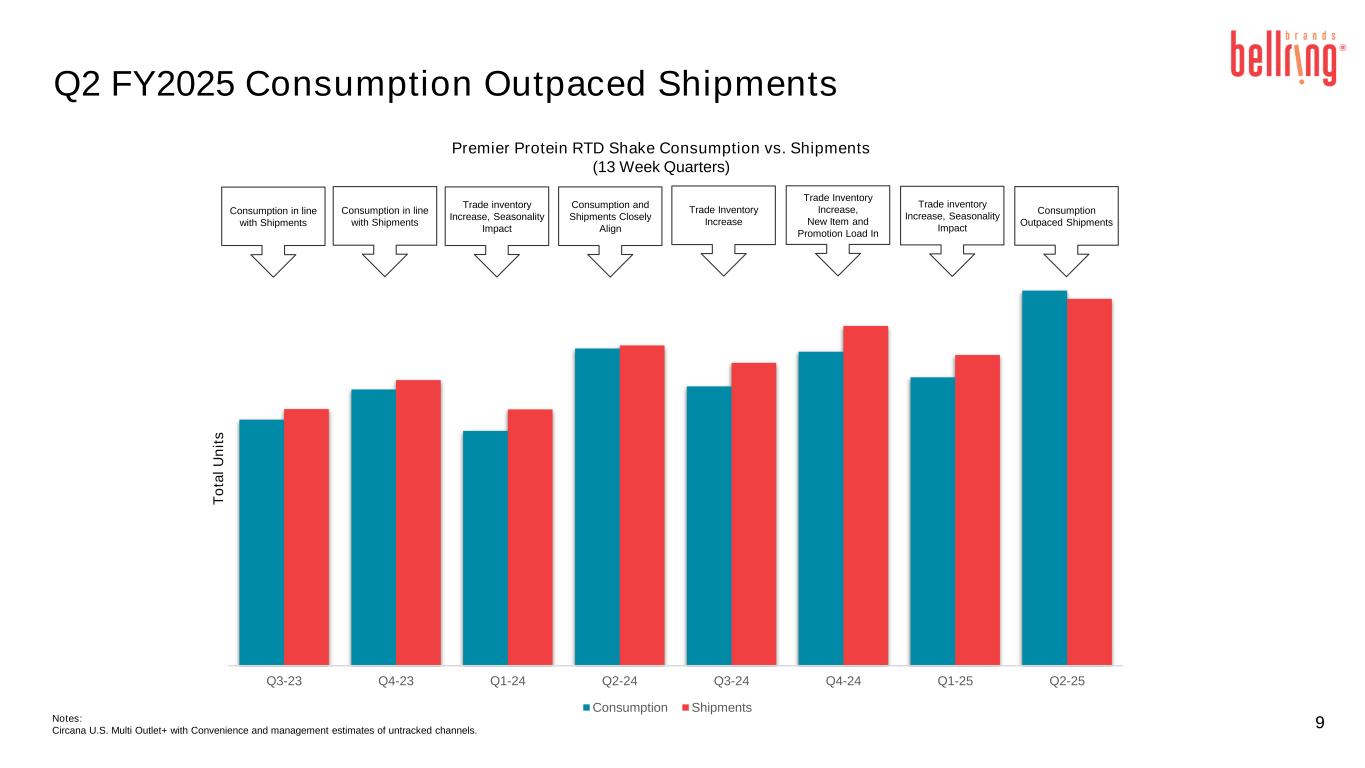

9 Q2 FY2025 Consumption Outpaced Shipments Premier Protein RTD Shake Consumption vs. Shipments (13 Week Quarters) Notes: Circana U.S. Multi Outlet+ with Convenience and management estimates of untracked channels. Consumption and Shipments Closely Align Trade Inventory Increase Trade Inventory Increase, New Item and Promotion Load In Consumption Outpaced Shipments Consumption in line with Shipments Trade inventory Increase, Seasonality Impact Consumption in line with Shipments Trade inventory Increase, Seasonality Impact Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Q2-25 T o ta l U n it s Consumption Shipments

10 Premier Protein RTD TDPs Reached All Time High Notes: Circana U.S. Multi Outlet+ with Convenience. 730 1,237 79 80 0 10 20 30 40 50 60 70 80 0 200 400 600 800 1,000 1,200 1,400 % A C V TD P s Total Points of Distribution ACV Weighted Distribution

16.4 14.4 17.0 19.9 20.9 15.8 13.9 16.3 18.9 19.9 0.0 5.0 10.0 15.0 20.0 25.0 CY 2021 CY 2022 CY 2023 CY 2024 52WE 3-30-25 Premier Protein Penetration HH Pen - Premier Protein Brand HH Pen - Premier Protein RTD Shakes Premier Protein Accelerated Household Penetration Growth; Repeat and Buy Rate Remain Strong 30g Shake Repeat Rate 51% 49% 50% 52% 51% 30g Shake Buy Rate $75 $82 $84 $91 $94 RTD 43.3 HH Pen RTD 50.2 HH Pen RTD 48.6 HH Pen +16%+17%-12% +17%+18%-12% +5%+5% 11Notes: Numerator HH Panel 52 weeks ending March 30, 2025. Liquids refers to the liquid sub-category of the convenient nutrition category. Calendar Year (“CY”). Numerator metrics such as penetration are subject to potential restatement or revisions due to market definition changes or late reporters.

Club Promotion Club Promotion 24.6 30.0 0 5 10 15 20 25 30 35 4 W E 0 4 -3 0 -2 3 4 W E 0 5 -2 8 -2 3 4 W E 0 6 -2 5 -2 3 4 W E 0 7 -2 3 -2 3 4 W E 0 8 -2 0 -2 3 4 W E 0 9 -1 7 -2 3 4 W E 1 0 -1 5 -2 3 4 W E 1 1 -1 2 -2 3 4 W E 1 2 -1 0 -2 3 4 W E 0 1 -0 7 -2 4 4 W E 0 2 -0 4 -2 4 4 W E 0 3 -0 3 -2 4 4 W E 0 3 -3 1 -2 4 4 W E 0 4 -2 8 -2 4 4 W E 0 5 -2 6 -2 4 4 W E 0 6 -2 3 -2 4 4 W E 0 7 -2 1 -2 4 4 W E 0 8 -1 8 -2 4 4 W E 0 9 -1 5 -2 4 4 W E 1 0 -1 3 -2 4 4 W E 1 1 -1 0 -2 4 4 W E 1 2 -0 8 -2 4 4 W E 0 1 -0 5 -2 5 4 W E 0 2 -0 2 -2 5 4 W E 0 3 -0 2 -2 5 4 W E 0 3 -3 0 -2 5 Premier Protein RTD Share Spiked Behind Club Promotion, Media and New Items 12 Trended Premier Protein RTD Shake $ Share % Club Promotion Notes: Circana U.S. Multi Outlet+ with Convenience.

Premier Protein Powder Continued Strong Growth Fueled by New Channel Expansion 13 Premier Protein Powders $ Sales vs. Prior Year Channel 13 Weeks 52 Weeks Mass +8.3% +30.8% eCommerce +11.4% +28.5% Food +15.1% +19.4% Club +100.0% +100.0% Total Consumption (tracked channels) +21.7% +32.2% Notes: Total consumption includes tracked channels consumption (Circana U.S. Multi Outlet+ with Convenience 13 and 52 weeks ended March 30, 2025).

Premier Protein Powders Continued Strong Growth Trajectory 14Notes: Circana U.S. Multi Outlet+ with Convenience. Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 +86% +55% +66% +52% +44% +43% +24% +22% YOY % Δ Ap r 3 0 '2 3 M ay 2 8 '2 3 Ju l 2 '2 3 Ju l 3 0' 23 Au g 27 '2 3 O ct 1 '2 3 O ct 2 9' 23 N ov 2 6' 23 D ec 3 1' 23 Ja n 28 '2 4 M ar 3 '2 4 M ar 3 1' 24 Ap r 2 8' 24 M ay 3 1' 24 Ju n 30 '2 4 Ju l 2 8' 24 Se p 01 '2 4 Se p 29 '2 4 N ov 3 '2 4 D ec 1 '2 4 D ec 2 9' 24 Fe b 2' 25 M ar 2 '2 5 M ar 3 0' 25 $ Vo lu m e Premier Protein Ready-to-Mix Powders Rolling 13 week Total $ Consumption Sales

15 Premier Protein Powder Distribution Strong Year-over-Year Growth Notes: Circana U.S. Multi Outlet+ with Convenience. 99 174 50 59 0 10 20 30 40 50 60 0 50 100 150 200 250 % A C V TD P s Total Points of Distribution ACV Weighted Distribution

16 Dymatize Consumption Returned to Growth, Driven by eCommerce Strength and RTD Shake Launch • Tracked and untracked consumption represents ~60% of total global business Dymatize $ Sales vs. Prior Year Channel 13 Weeks 52 Weeks eCommerce +18.8% -1.5% Mass -3.9% -1.3% Specialty/All Other -11.2% -23.5% Food -7.7% -7.6% Club -3.8% -27.0% Total Consumption (tracked + untracked channels) +3.0% -7.5% Notes: Total consumption includes tracked channels consumption (Circana U.S. Multi Outlet+ with Convenience 13 and 52 weeks ended March 30, 2025) and untracked channels consumption (management estimates of untracked channels for the 13 and 52 weeks ended March 30, 2025.

17 Total Dymatize Consumption Grew in Q2 FY2025 Notes: Circana U.S. Multi Outlet+ with Convenience and management estimates of untracked channels. Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 +39% +38% +16% -8% -11% -10% -8% +3% YOY % Δ A p r 3 0 '2 3 M ay 2 8 '2 3 Ju l 2 '2 3 Ju l 3 0 '2 3 A u g 2 7 '2 3 O ct 1 '2 3 O ct 2 9' 2 3 N o v 2 6 '2 3 D ec 3 1 '2 3 Ja n 2 8 '2 4 M ar 3 '2 4 M ar 3 1 '2 4 A p r 2 8 '2 4 M ay 3 1 '2 4 Ju n 3 0 '2 4 Ju l 2 8 '2 4 Se p 0 1 '2 4 Se p 2 9 '2 4 N o v 3 '2 4 D ec 1 '2 4 D ec 2 9 '2 4 Fe b 2 '2 5 M ar 2 '2 5 M ar 3 0 '2 5 $ V o lu m e Dymatize Rolling 13 week Total $ Consumption Sales

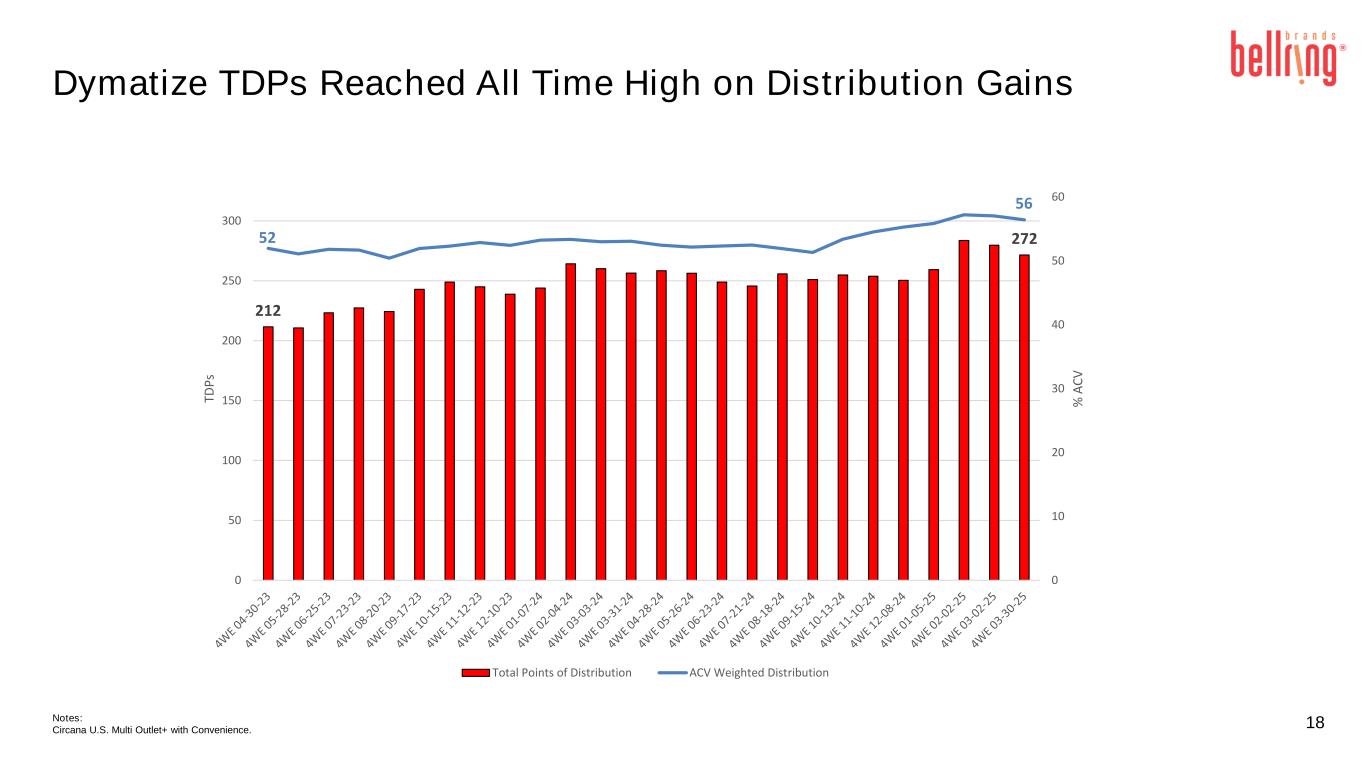

18 Dymatize TDPs Reached All Time High on Distribution Gains Notes: Circana U.S. Multi Outlet+ with Convenience. 212 27252 56 0 10 20 30 40 50 60 0 50 100 150 200 250 300 % A C V TD P s Total Points of Distribution ACV Weighted Distribution

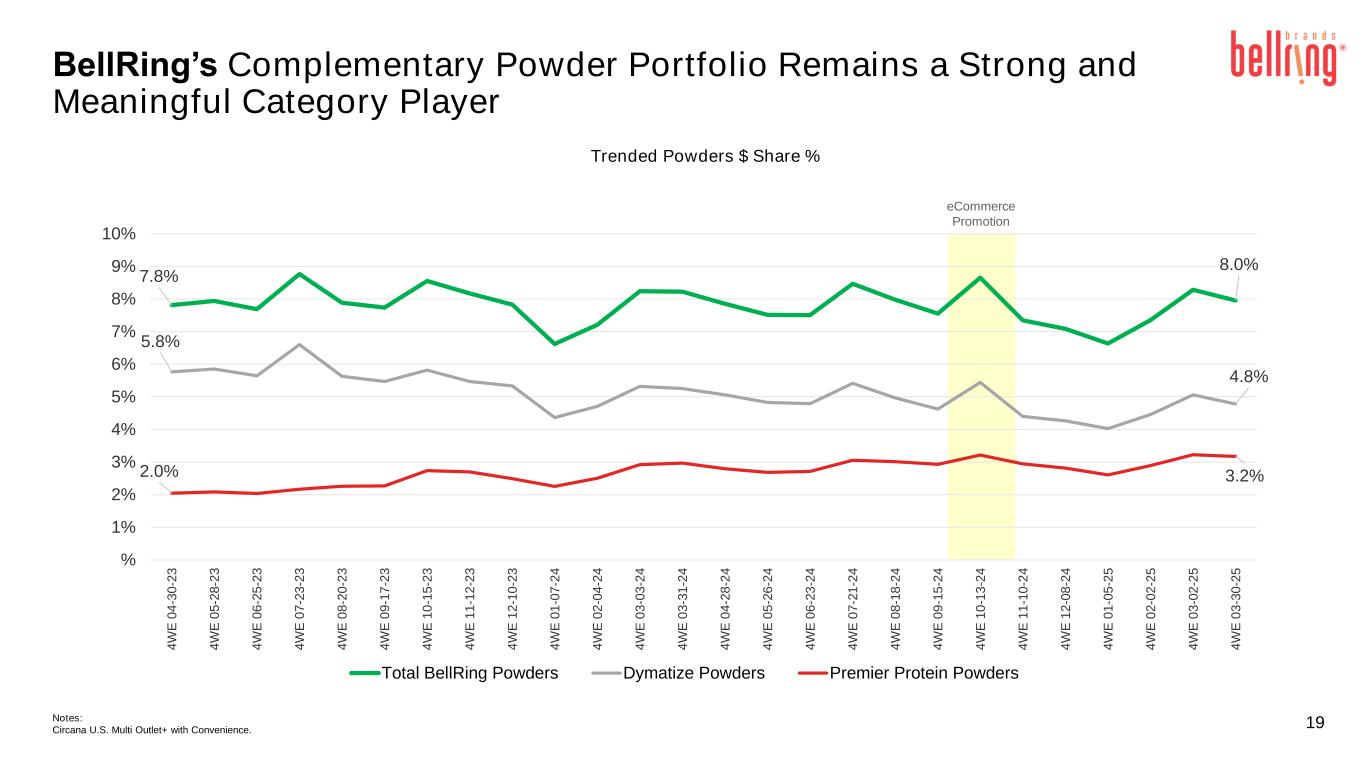

19 BellRing’s Complementary Powder Portfolio Remains a Strong and Meaningful Category Player Trended Powders $ Share % Notes: Circana U.S. Multi Outlet+ with Convenience. eCommerce Promotion 7.8% 8.0% 5.8% 4.8% 2.0% 3.2% % 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 4 W E 0 4 -3 0 -2 3 4 W E 0 5 -2 8 -2 3 4 W E 0 6 -2 5 -2 3 4 W E 0 7 -2 3 -2 3 4 W E 0 8 -2 0 -2 3 4 W E 0 9 -1 7 -2 3 4 W E 1 0 -1 5 -2 3 4 W E 1 1 -1 2 -2 3 4 W E 1 2 -1 0 -2 3 4 W E 0 1 -0 7 -2 4 4 W E 0 2 -0 4 -2 4 4 W E 0 3 -0 3 -2 4 4 W E 0 3 -3 1 -2 4 4 W E 0 4 -2 8 -2 4 4 W E 0 5 -2 6 -2 4 4 W E 0 6 -2 3 -2 4 4 W E 0 7 -2 1 -2 4 4 W E 0 8 -1 8 -2 4 4 W E 0 9 -1 5 -2 4 4 W E 1 0 -1 3 -2 4 4 W E 1 1 -1 0 -2 4 4 W E 1 2 -0 8 -2 4 4 W E 0 1 -0 5 -2 5 4 W E 0 2 -0 2 -2 5 4 W E 0 3 -0 2 -2 5 4 W E 0 3 -3 0 -2 5 Total BellRing Powders Dymatize Powders Premier Protein Powders