Investor Presentation D e c e m b e r 2 0 2 5

Cautionary Statement Concerning Forward-Looking Statements Information in this presentation of OneWater Marine Inc. (“OneWater,” “ONEW,” the “Company,” “we,” or “us”), and any oral statements made in connection therewith, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including regarding our strategy, future operations, financial position, prospects, plans and objectives of management, growth rate and its expectations regarding future revenue, operating income or loss or earnings or loss per share. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “will be,” “will likely result,” “should,” “expects,” “plans,” “anticipates,” “could,” “would,” “foresees,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “outlook” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. These forward-looking statements are not guarantees of future performance, but are based on management’s current expectations, assumptions and beliefs concerning future developments and their potential effect on us, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Our expectations expressed or implied in these forward-looking statements may not turn out to be correct. Important factors, some of which are beyond our control, that could cause actual results to differ materially from our historical results or those expressed or implied by these forward-looking statements include the following: changes in demand for our products and services, the seasonality and volatility of the boat industry, effects of industry wide supply chain challenges including a heightened inflationary environment and our ability to maintain adequate inventory, fluctuation in interest rates, adverse weather events, our acquisition and business strategies, the inability to comply with the financial and other covenants and metrics in our credit facilities, cash flow and access to capital, effects of a global health concern on the Company’s business, geopolitical risks, including the imposition of or changes in tariffs, duties, or other taxes affecting international trade, risks related to the ability to realize the anticipated benefits of any proposed acquisitions, including the risk that proposed acquisitions will not be integrated successfully, the timing of development expenditures, and other risks. More information on these risks and other potential factors that could affect our financial results is included in our filings with the Securities and Exchange Commission, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recently filed Annual Report on Form 10-K, or subsequently filed Quarterly Reports on Form 10-Q, and other filings we make with the SEC. Any forward-looking statement speaks only as of the date as of which such statement is made, and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise. Non-GAAP Financial Measures This presentation includes financial measures that are not presented in accordance with generally accepted accounting principles (“GAAP”), including Adjusted EBITDA, Adjusted Net Income Attributable to OneWater and Adjusted Diluted Earnings Per Share. While management believes Adjusted EBITDA, Adjusted Net Income Attributable to OneWater and Adjusted Diluted Earnings Per Share may be useful in performing meaningful comparisons of past and present operating results and in understanding the performance of ongoing operations and how management views the business, none are a measure of our financial performance under GAAP and none should be considered in isolation or as an alternative to any measure of such performance derived in accordance with GAAP. Adjusted EBITDA is calculated as net income (loss) before interest expense – other, income tax (benefit) expense, depreciation and amortization and other (income) expense, further adjusted to eliminate the effects of items such as the change in fair value contingent consideration, restructuring and impairment, gain (loss) on extinguishment of debt, transaction costs, and stock-based compensation. Adjusted Net Income Attributable to OneWater is calculated as net income (loss) attributable to OneWater before transaction costs, intangible amortization, change in fair value of contingent consideration, restructuring and impairment and other expense (income), all of which are then adjusted for an allocation to the non-controlling interest of OneWater Marine Holdings, LLC. Each of these adjustments are subsequently adjusted for income tax at an estimated effective tax rate. Management also reports Adjusted Diluted Earnings Per Share which presents all of the adjustments to net income attributable to OneWater noted above on a per share basis. Amounts excluded from these non-GAAP measures in future periods could be significant and our current presentation of these non-GAAP measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. These non-GAAP measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Because our non-GAAP financial measures may be defined differently by other companies, our definition of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. We have not reconciled non‐GAAP forward-looking measures to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable efforts. See the Appendix for a reconciliation to directly comparable GAAP financial measures. Industry and Market Data This presentation includes market data and other statistical information from third-party sources, including independent industry publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some of the data is also based on our good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. Trademarks and Trade Names OneWater owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. OneWater’s use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with OneWater (except as stated herein) or an endorsement or sponsorship by or of OneWater. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that OneWater will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks and trade names. Other Certain monetary amounts, percentages and other figures included in this presentation have been subject to rounding adjustments. Percentage amounts included in this presentation have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this presentation may vary from those obtained by performing the same calculations using the figures in our consolidated financial statements included elsewhere. Certain other amounts that appear in this presentation may not sum due to rounding. Disclaimer

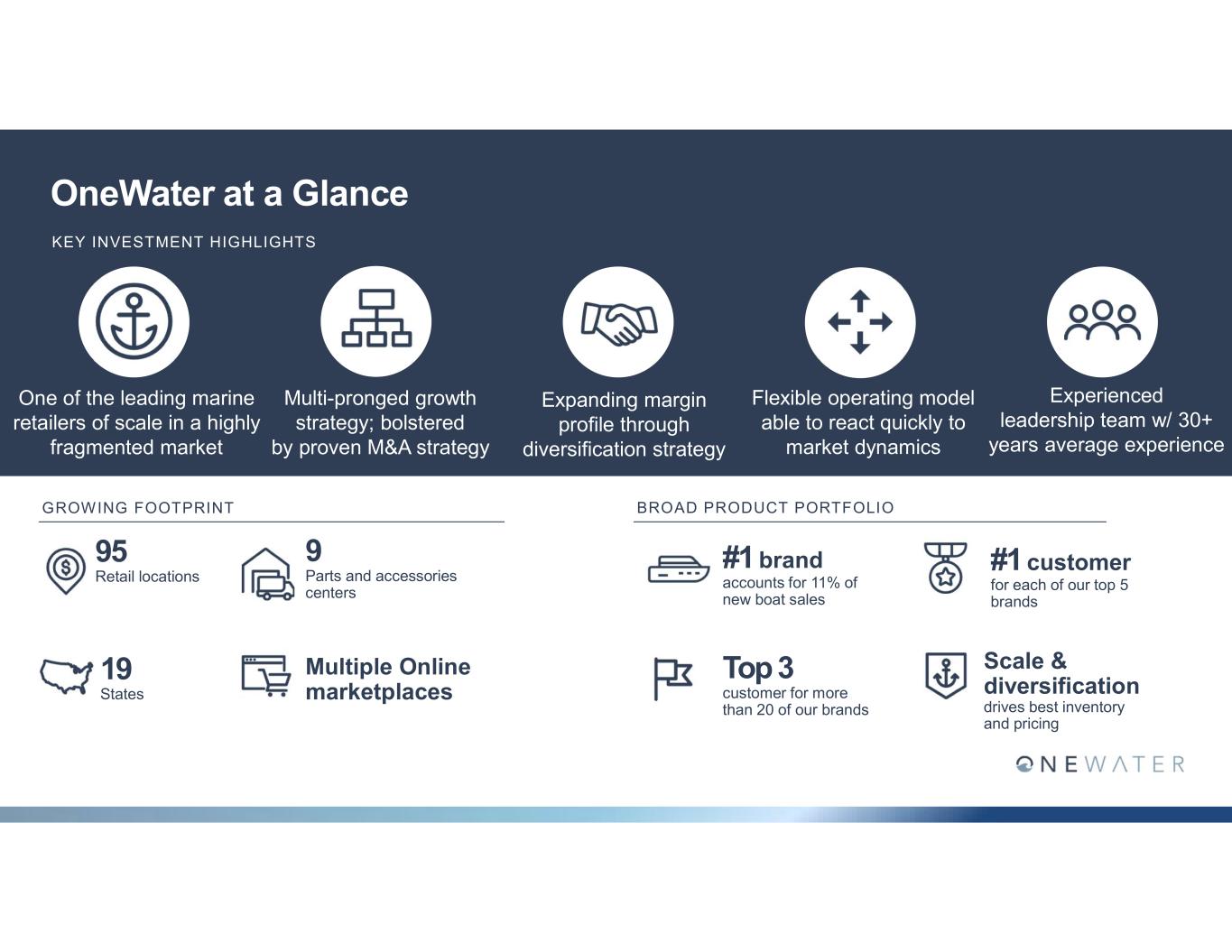

OneWater at a Glance One of the leading marine retailers of scale in a highly fragmented market Multi-pronged growth strategy; bolstered by proven M&A strategy Expanding margin profile through diversification strategy Flexible operating model able to react quickly to market dynamics Experienced leadership team w/ 30+ years average experience KEY INVESTMENT HIGHLIGHTS GROWING FOOTPRINT 95 Retail locations 9 Parts and accessories centers 19 States Multiple Online marketplaces BROAD PRODUCT PORTFOLIO #1brand accounts for 11% of new boat sales #1customer for each of our top 5 brands Top 3 customer for more than 20 of our brands Scale & diversification drives best inventory and pricing

OneWater’s Evolution into a Market Leader Note: retail location count as of November 2025. 1. Graphic excludes one retail international Denison Yachting location in Monaco <5 Locations 5 – 10 locations 10+ locations KEY ACQUISITIONS Private Ownership 1987 - 2014 Private Equity Backing 2015 - 2019 Public Company 2020 - Present 1 store in 1987 to 15 by 2014 Expanded to 63 stores by 2019 95 retail and 9 warehouse locations today1

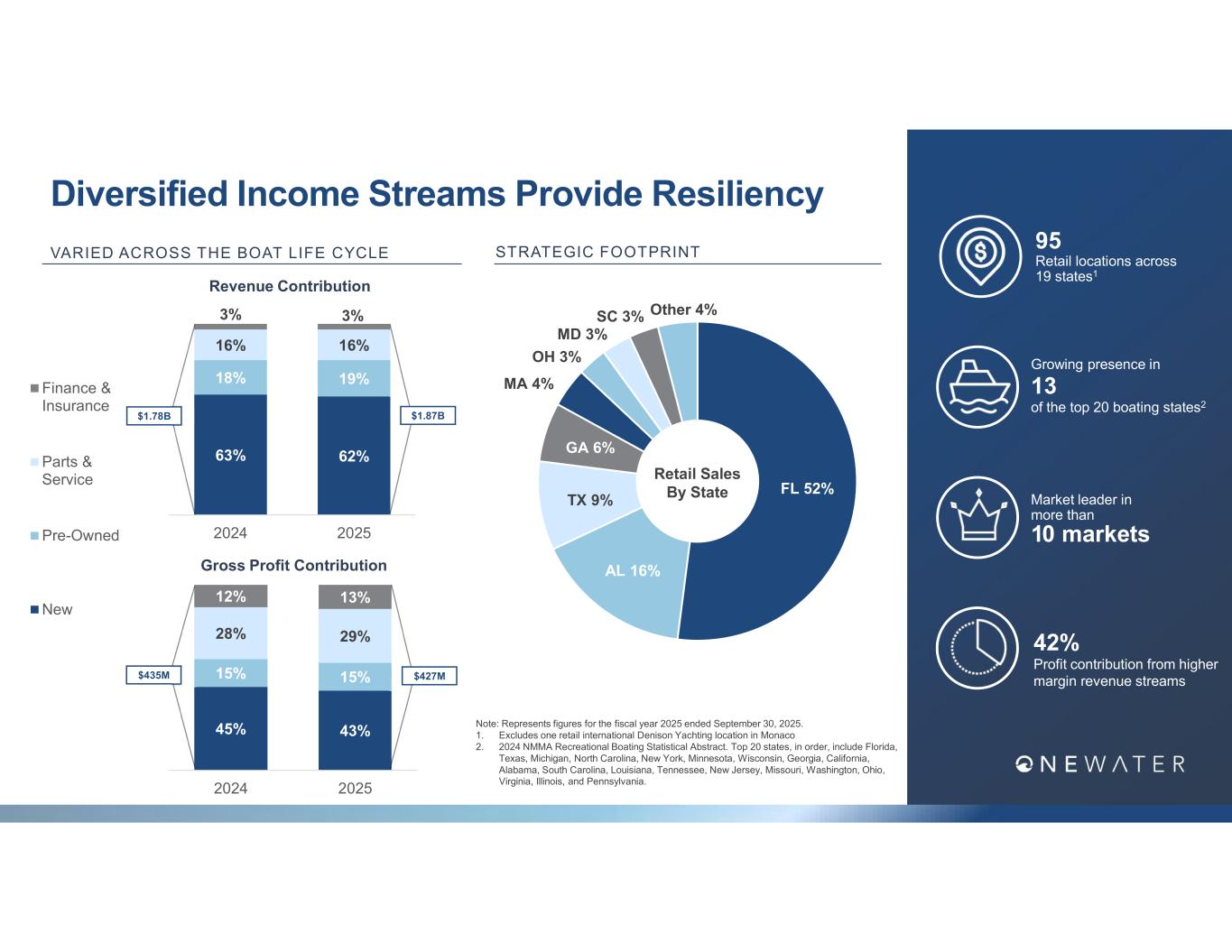

63% 62% 18% 19% 16% 16% 3% 3% 2024 2025 Finance & Insurance Parts & Service Pre-Owned New Diversified Income Streams Provide Resiliency Note: Represents figures for the fiscal year 2025 ended September 30, 2025. 1. Excludes one retail international Denison Yachting location in Monaco 2. 2024 NMMA Recreational Boating Statistical Abstract. Top 20 states, in order, include Florida, Texas, Michigan, North Carolina, New York, Minnesota, Wisconsin, Georgia, California, Alabama, South Carolina, Louisiana, Tennessee, New Jersey, Missouri, Washington, Ohio, Virginia, Illinois, and Pennsylvania. 13 of the top 20 boating states2 Market leader in more than 10 markets 95 Retail locations across 19 states1 42% Profit contribution from higher margin revenue streams FL 52% AL 16% TX 9% GA 6% MA 4% OH 3% MD 3% SC 3% Other 4% Retail Sales By State Growing presence in VARIED ACROSS THE BOAT LIFE CYCLE STRATEGIC FOOTPRINT Revenue Contribution 45% 43% 15% 15% 28% 29% 12% 13% 2024 2025 Gross Profit Contribution $1.78B $1.87B $435M $427M

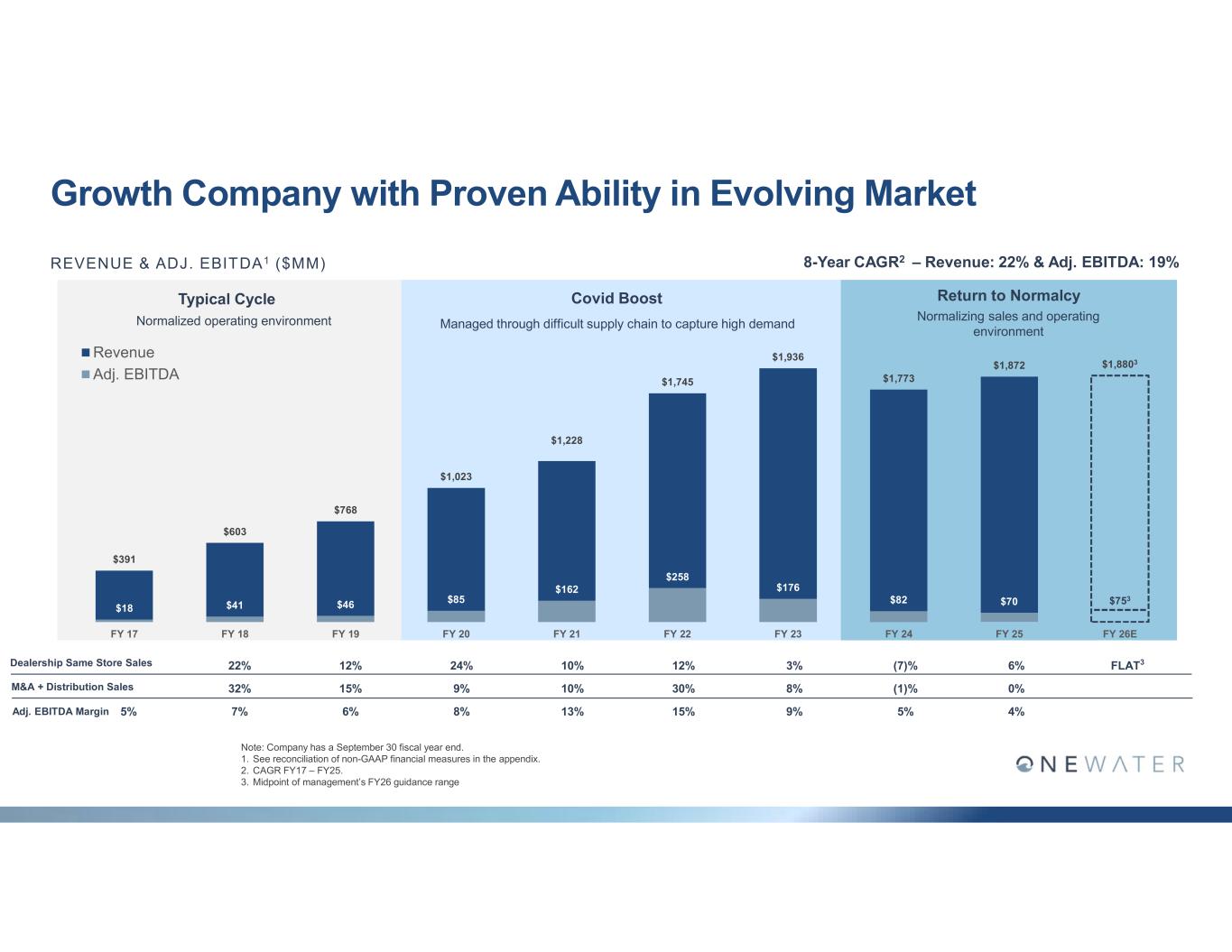

Growth Company with Proven Ability in Evolving Market REVENUE & ADJ. EBITDA1 ($MM) Note: Company has a September 30 fiscal year end. 1. See reconciliation of non-GAAP financial measures in the appendix. 2. CAGR FY17 – FY25. 3. Midpoint of management’s FY26 guidance range FLAT36%(7)%3%12%10%24%12%22% 0%(1)%8%30%10%9%15%32% 4%5%9%15%13%8%6%7%5% Adj. EBITDA Margin $391 $603 $768 $1,023 $1,228 $1,745 $1,936 $1,773 $1,872 $1,8803 $18 $41 $46 $85 $162 $258 $176 $82 $70 $753 FY 17 FY 18 FY 19 FY 20 FY 21 FY 22 FY 23 FY 24 FY 25 FY 26E Revenue Adj. EBITDA Typical Cycle Covid Boost Return to Normalcy Normalized operating environment Managed through difficult supply chain to capture high demand Normalizing sales and operating environment 8-Year CAGR2 – Revenue: 22% & Adj. EBITDA: 19% Dealership Same Store Sales M&A + Distribution Sales

Mid-Cycle Opportunity 264 146 133 155 179 201 202 219 177 145 100 150 200 250 300 N e w B o a t V o lu m e (T ho us an ds ) ~182K Avg. New Units Sold2 REVENUE GROSS MARGIN EXPENSES (SG&A as a % of Revenue) ADJUSTED EBITDA4 NEW BOATS SOLD1 WHAT DOES MID-CYCLE LOOK LIKE3 Significant upside potential from industry trough as market volumes return to historical averages FY25 FY26E Mid-Cycle ~$2.2B$1.83B - $1.93B~$1.87B 22.8% 24% - 25% 18.3% 16.5% - 17.5% $125M - $135M$70M $65M - $85M ADJUSTED EPS4 $0.25 - $0.75$0.44 $2.00 - $2.50 25% Growth to Reach Average

Appendix

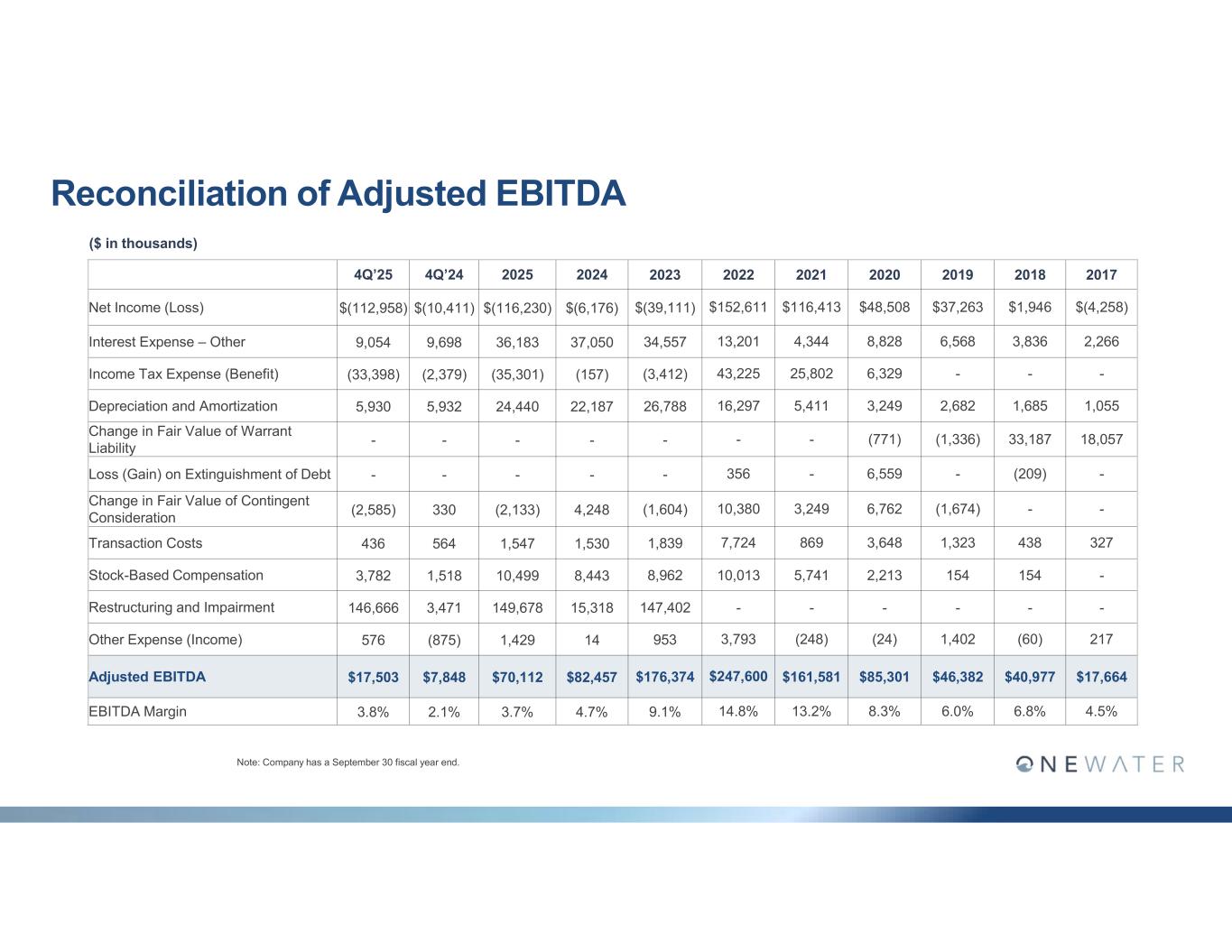

Reconciliation of Adjusted EBITDA ($ in thousands) 2017201820192020202120222023202420254Q’244Q’25 $(4,258)$1,946$37,263$48,508$116,413$152,611$(39,111)$(6,176)$(116,230)$(10,411)$(112,958)Net Income (Loss) 2,2663,8366,5688,8284,34413,20134,557 37,05036,1839,6989,054Interest Expense – Other ---6,32925,80243,225(3,412)(157)(35,301)(2,379)(33,398)Income Tax Expense (Benefit) 1,0551,6852,6823,2495,41116,29726,788 22,18724,4405,9325,930Depreciation and Amortization 18,05733,187(1,336)(771)------- Change in Fair Value of Warrant Liability -(209)-6,559-356-----Loss (Gain) on Extinguishment of Debt --(1,674)6,7623,24910,380(1,604)4,248(2,133)330(2,585) Change in Fair Value of Contingent Consideration 3274381,3233,6488697,7241,839 1,5301,547564436Transaction Costs -154 154 2,213 5,741 10,013 8,962 8,44310,4991,5183,782Stock-Based Compensation ------147,402 15,318149,6783,471146,666Restructuring and Impairment 217(60)1,402(24)(248)3,793953 141,429(875)576Other Expense (Income) $17,664 $40,977 $46,382 $85,301 $161,581 $247,600$176,374 $82,457$70,112$7,848$17,503Adjusted EBITDA 4.5%6.8%6.0%8.3%13.2%14.8%9.1%4.7%3.7%2.1%3.8%EBITDA Margin Note: Company has a September 30 fiscal year end.

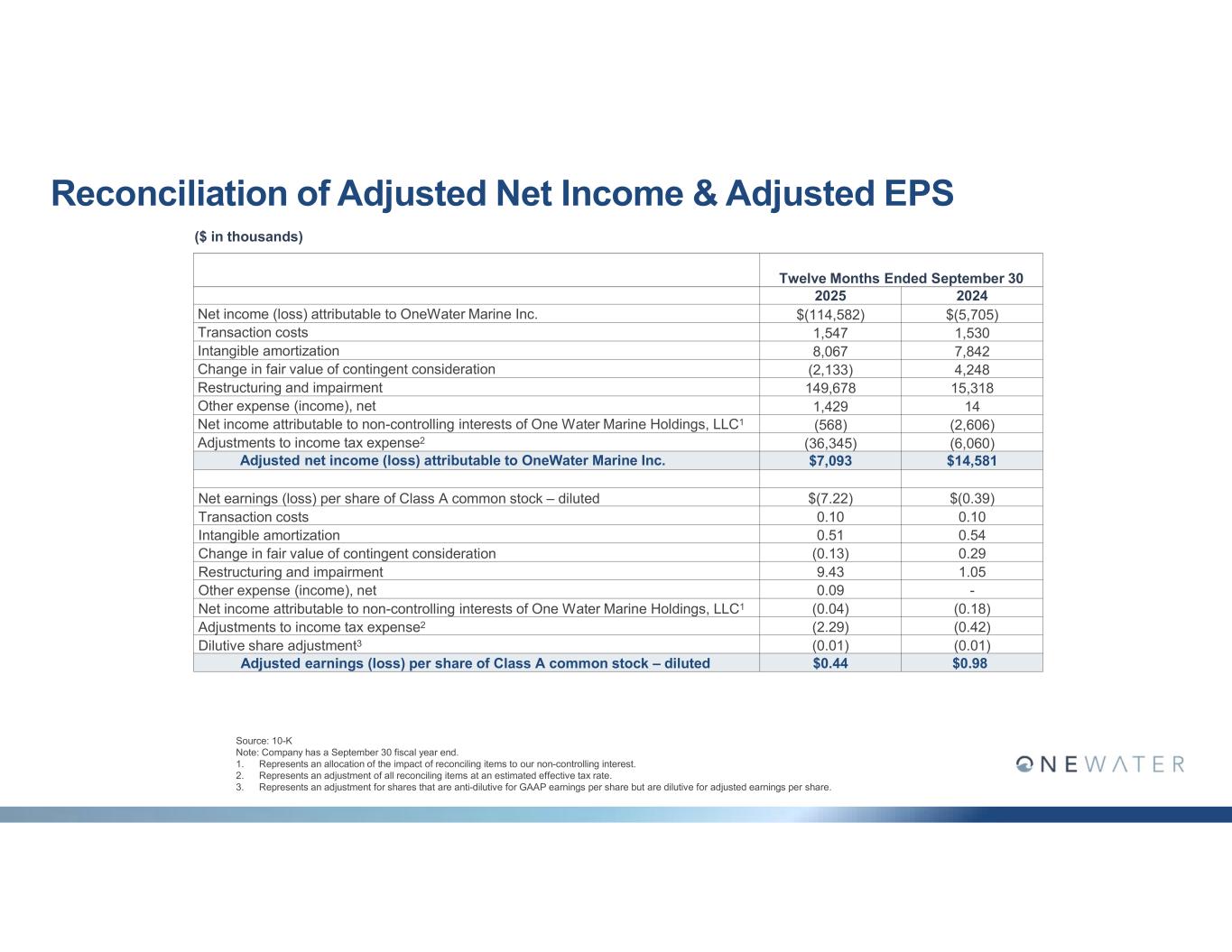

Reconciliation of Adjusted Net Income & Adjusted EPS ($ in thousands) Twelve Months Ended September 30 20242025 $(5,705)$(114,582)Net income (loss) attributable to OneWater Marine Inc. 1,5301,547Transaction costs 7,8428,067Intangible amortization 4,248(2,133)Change in fair value of contingent consideration 15,318149,678Restructuring and impairment 141,429Other expense (income), net (2,606)(568)Net income attributable to non-controlling interests of One Water Marine Holdings, LLC1 (6,060)(36,345)Adjustments to income tax expense2 $14,581$7,093Adjusted net income (loss) attributable to OneWater Marine Inc. $(0.39)$(7.22)Net earnings (loss) per share of Class A common stock – diluted 0.100.10Transaction costs 0.540.51Intangible amortization 0.29(0.13)Change in fair value of contingent consideration 1.059.43Restructuring and impairment -0.09Other expense (income), net (0.18)(0.04)Net income attributable to non-controlling interests of One Water Marine Holdings, LLC1 (0.42)(2.29)Adjustments to income tax expense2 (0.01)(0.01)Dilutive share adjustment3 $0.98$0.44Adjusted earnings (loss) per share of Class A common stock – diluted Source: 10-K Note: Company has a September 30 fiscal year end. 1. Represents an allocation of the impact of reconciling items to our non-controlling interest. 2. Represents an adjustment of all reconciling items at an estimated effective tax rate. 3. Represents an adjustment for shares that are anti-dilutive for GAAP earnings per share but are dilutive for adjusted earnings per share.