Please wait

Exhibit 2.1

CERTAIN INFORMATION CONTAINED IN THIS SECURITIES SALE DEED HAS, PURSUANT TO ITEM 601(B)(2) OF REGULATION S-K, BEEN OMITTED BY MEANS OF REDACTING A PORTION OF THE TEXT AND REPLACING IT WITH [***] BECAUSE SUCH INFORMATION IS BOTH NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL.

EXECUTION VERSION

| | | | | |

|

Securities Sale Deed Project Eagle ____ Each party listed in Column 1 of the table in Part A of Schedule 1 (Vendors) Each party listed in Column 1 of the table in Part B of Schedule 1 (EST Holders) Each party named as a ‘Key Person’ in Schedule 1 and Schedule 2 (Key Persons) Horizon BidCo Pty Ltd (Purchaser) Hims, Inc. (Guarantor) Hims & Hers Health, Inc. (Purchaser Parent) ____ |

Securities Sale Deed

Project Eagle

Details 7

Date 7

Parties 7

Background 7

1. Defined terms & interpretation 9

1.1 Defined terms 9

1.2 Interpretation 37

1.3 Headings 39

1.4 Accounting and mathematical conventions 39

1.5 Deed 39

1.6 Conversion rate 39

1.7 EST and EST Holders 39

1.8 Accession by OV EST Holders 39

1.9 Target Shareholder approvals 39

2. Conditions 40

2.1 Conditions 40

2.2 Waiver of Conditions 41

2.3 Conduct of the parties 41

2.4 Obligation to notify 43

2.5 Failure of Condition 43

2.6 Effect of termination 44

3. Sale and purchase 44

3.1 Sale and purchase 44

3.2 Title and risk 44

3.3 Vendors' covenants 44

4. Purchase Price 44

4.1 Purchase Price for Sale Securities 44

4.2 Payment of Purchase Price 45

4.3 True-up following finalisation of the Adjustment Statement 47

4.4 Key Employee Vendors paid as an Other Vendor 48

4.5 Cleared funds or Purchaser Parent Shares 49

4.6 Vendor and EST Holder directions 52

4.7 Payment of UK Option Tax Liability 53

4.8 Certain US income tax matters 53

5. Obligations before Completion 54

5.1 Continuity of business 54

5.2 Prohibited actions 55

5.3 Other prohibited actions 55

5.4 Exceptions 57

5.5 Notification of occurrence of prohibited actions 57

5.6 Access to Business and Records and updates on Business developments 58

5.7 CoC Material Contracts 58

5.8 D&O Run Off Policy 58

5.9 Amounts owed to a Target Group Member 59

5.10 Bank Guarantee 60

5.11 Vendors’ Completion Certificate 60

5.12 Section 280G of the Code 61

5.13 Purchaser's obligations prior to Completion 61

5.14 Alterations to the capital structure 61

5.15 Pre-Completion Revolving Facility 62

6. Completion 62

6.1 Time and place 62

6.2 Obligations of the Vendors 62

6.3 Obligations of the Purchaser 65

6.4 Simultaneous actions at Completion 66

6.5 Payments to CCO Holders 66

6.6 Vendor cooperation 66

6.7 Additional obligations of the Purchaser Parent 67

7. Adjustment Statement 68

7.1 Preparation of draft Adjustment Statement 68

7.2 Basis of preparation 69

7.3 Access to information 69

7.4 Review of draft Adjustment Statement 69

7.5 Dispute Resolution Procedure 69

7.6 Costs 71

8. Earnout Statements 71

8.1 Preparation of draft Earnout Statements 71

8.2 Basis of preparation of the Pre-Completion Baseline Accounts and

each Relevant Earnout Statement 72

8.3 Review of a draft Pre-Completion Baseline Accounts and Relevant

Earnout Statement 72

8.4 Access to information 73

8.5 Dispute resolution procedure 73

8.6 Costs 74

9. Warranties by the Warrantors 74

9.1 Warranties 74

9.2 When Warranties given 74

9.3 Application of the Warranties 75

9.4 Indemnity for breach of Warranty 75

9.5 Reliance 75

9.6 Qualifications 75

9.7 Acknowledgments 76

9.8 Maximum aggregate liability for Claims 76

9.9 Financial limits on Claims 76

9.10 Time limits on Claims 76

9.11 Notice of potential Claim 77

9.12 Costs indemnity 77

9.13 Independent limitations 77

10. W&I Insurance Policy 77

10.1 On the date of this deed 77

10.2 Sole recourse 78

10.3 Fraud 79

11. Tax Indemnity and Tax Returns 79

11.1 Tax Indemnity 79

11.2 Notice of Tax Claims 80

11.3 Pre-Completion Returns 80

11.4 Post-Completion Returns 81

11.5 Section 338(g) elections 81

11.6 Assistance relating to Tax Returns 81

11.7 Section 280G of the Code. 81

12. Specific Indemnities 82

12.1 Specific Indemnities 82

13. Purchaser Warranties 83

13.1 Representations 83

13.2 When Purchaser Warranties given 83

13.3 Application of the Purchaser Warranties 83

13.4 Specific limitations on Purchaser Warranties 83

13.5 Guarantee 84

14. Default and termination 84

14.1 Failure by a party to Complete 84

14.2 Specific performance or termination 85

14.3 Insolvency of the Purchaser, Guarantor or Purchaser Parent 85

14.4 Effect of termination 85

14.5 Termination of Target Shareholders' Agreement 85

15. Period following Completion 86

15.1 Notifications to Governmental Authorities 86

15.2 Vendor Side Party access to Records 86

15.3 Release 86

16. Confidentiality and publicity 87

16.1 Confidentiality 87

16.2 Business Confidential Information 87

16.3 Announcements 88

16.4 Excluded Information 88

16.5 Confidentiality Agreement 88

17. GST 89

17.1 Interpretation 89

17.2 GST gross up 89

17.3 Reimbursements 89

17.4 Tax invoice 89

17.5 Adjustment event 89

18. Notices and other communications 89

18.1 Service of notices 89

18.2 Effective on receipt 90

19. Trustees 90

19.1 Application 90

19.2 Limited capacity 90

19.3 Limited rights to sue 90

19.4 Exceptions 91

19.5 Limitation on authority 91

20. Appointed Representative 91

20.1 Initial Appointed Representatives and Replacement 91

20.2 Authority 92

20.3 Multiple persons as Appointed Representative 92

20.4 Details of Appointed Representative 92

20.5 Validity of other powers and authority 93

21. Miscellaneous 93

21.1 Alterations 93

21.2 Approvals and consents 93

21.3 Assignment 93

21.4 Costs 94

21.5 Duty 94

21.6 Survival 94

21.7 Cumulative rights 94

21.8 Counterparts 94

21.9 Counterparts and electronic execution 94

21.10 No merger 94

21.11 Entire agreement 94

21.12 Further action 95

21.13 Severability 95

21.14 Waiver 95

21.15 Relationship 95

21.16 Indemnities and reimbursement obligations 95

21.17 Best endeavours or reasonable endeavours 95

21.18 Benefit 96

21.19 Payments affecting the Purchase Price 96

21.20 Vendor's CGT withholding declaration 96

21.21 Payment with withholding or deduction 97

21.22 Tax effect 97

21.23 Service of process 97

21.24 Governing law and jurisdiction 98

Schedule 1 – Parties (clause 1.1) 99

Schedule 2 – KEV CCO Holders 111

Schedule 3 – Details of the Target Group (clause 1.1) 112

Schedule 4 116

Schedule 5 – Warranties 117

Schedule 6 – Purchaser, Guarantor and Listed Entity Warranties 152

Schedule 7 – Adjustment Statement 155

Schedule 8 – Vendors' Completion Certificate (clause 5.10) 164

Schedule 9 – Earnout provisions 166

Schedule 10 – Intellectual Property Rights (Warranty 13) 170

Schedule 11 – Leased Properties and Lease Agreements (clause 1.1) 204

Schedule 12 205

Schedule 13 – Treatment of Options 206

Schedule 14 – Foreign public search records 210

Schedule 15 – Permitted Security Interests 214

Signing page 218

Exhibit A – Contracts (clause 1.1) 289

Exhibit B – Accession Deed (clause 1.7) 292

Exhibit C – Target Shareholders' Agreement (clause 1.1) 294

Exhibit D – 1V Warrant Novation Deed 295

Exhibit E – Investor Suitability Documentation 296

Exhibit F – Deed 297

1. Defined terms & interpretation

2. Operation of this deed

3. Material Adverse Change

4. Execution of Executive Services Agreements by Key Executives

5. Obligations before Completion

6. Completion

7. Additional obligations of Purchaser Parent

8. Warranties by the Warrantors

9. W&I Insurance Policy

10. Tax Indemnity and Tax Returns

11. Specific Indemnities

12. Restraint

13. RSUs

14. Guarantee

15. Blackbird

16. OneVentures

17. Miscellaneous

| | | | | |

Details Date | 19 February 2026 |

Parties

| | | | | | | | |

Name | Each party listed in Column 1 of the table in Part A of Schedule 1 of the address set out adjacent to that party's name in Column 2 of the table in Part A of Schedule 1 |

Short form name | Vendors |

Name | Each party listed in Column 1 of the table in Part B of Schedule 1 of the address set out adjacent to that party's name in Column 2 of the table in Part B of Schedule 1 |

Short form name | EST Holders |

Name | Each party named as a ‘Key Person’ in Schedule 1 and Schedule 2 of the address set out adjacent to that party's name |

Short form name | Key Persons |

Name | Horizon BidCo Pty Ltd ACN 694 778 375 |

Short form name | Purchaser |

Notice details | C/- MinterEllison, Governor Macquarie Tower, 1 Farrer Place, Sydney NSW 2000, Australia

Attention: Legal Email: [***] |

Name | Hims, Inc. |

Short form name | Guarantor |

Notice details | 2269 Chestnut Street, #523, San Francisco, California 94123, United States of America

Attention: Legal Email: [***] |

Name | Hims & Hers Health, Inc. |

Short form name | Purchaser Parent |

Notice details | 2269 Chestnut Street, #523, San Francisco, California 94123, United States of America

Attention: Legal Email: [***] |

| |

Background

AThe Sale Securities are owned by the Vendors. The Sale Shares held by the EST are held beneficially for the EST Holders.

BThe Vendors and the EST Holders have agreed to sell, and the Purchaser has agreed to purchase, the Sale Shares on the terms and conditions set out in this deed.

C1V has agreed to sell, and the Purchaser has agreed to purchase, the Warrants on the terms and conditions set out in this deed.

D The Guarantor has agreed to guarantee the Purchaser’s obligations on the terms and conditions set out in this deed.

Agreed terms

1.Defined terms & interpretation

1.1Defined terms

In this deed:

10-K means an Annual Report on Form 10-K of the Purchaser Parent.

1936 Tax Act means the Income Tax Assessment Act 1936 (Cth).

1953 Tax Act means the Taxation Administration Act 1953 (Cth).

1997 Tax Act means the Income Tax Assessment Act 1997 (Cth).

1V means 1V Venture Fund IV, LP (ILP1800054).

1V Warrant Deed means the warrant deed entered into between the Target and 1V on 2 March 2021 contained within Data Room Document 2.4.5 (as varied from time to time).

1V Warrant Novation Deed means the novation deed in respect of the 1V Warrant Deed to be entered into by the Purchaser, 1V and the Target, the form of which is annexed to this deed as Exhibit D.

1V Warrants means the warrants issued by the Target to 1V on the terms of the 1V Warrant Deed set out next to 1V’s name in Column 3 of the table in Schedule 1.

280G Waiver has the meaning given to that expression in clause 11.7(a).

Accounting Principles means the principles and policies set out in Part A of Schedule 7.

Accounting Standards means:

(a)the requirements of the Corporations Act about the preparation and contents of financial reports; and

(b)the accounting standards approved under the Corporations Act, being the Australian Accounting Standards and any authoritative interpretations issued by the Australian Accounting Standards Board.

Accounts means the audited consolidated financial statements of the Target Group as at the Accounts Date including:

(a)the consolidated statement of financial position of the Target Group as at the Accounts Date;

(b)the consolidated statement of profit and loss of the Target Group for the financial year ending on the Accounts Date; and

(c)the consolidated statement of cash flows for the financial year ending on the Accounts Date,

together with the notes to, and the reports of the directors in respect of, those financial statements (as contained within Data Room Document 3.1.7).

Accounts Date means 30 June 2025.

Actual Adjustment Amount means:

(a)Actual Working Capital; plus

(b)Actual Net Debt; less

(c)Estimated Working Capital; less

(d)Estimated Net Debt,

which may, for the avoidance of doubt, produce an amount that is a negative amount.

Actual Adjustment Payment Date means the date that is 20 Business Days after the date on which the Adjustment Statement and each of the Actual Net Debt, the Actual Working Capital and the Actual Adjustment Amount become final and binding on the Vendors and the Purchaser pursuant to this deed.

Actual Net Debt means the Net Debt as set out in the Adjustment Statement that is final and binding on the Vendors and the Purchaser pursuant to this deed.

Actual Working Capital means the Working Capital as set out in the Adjustment Statement that is final and binding on the Vendors and the Purchaser pursuant to this deed.

Adjustment Statement means the statement, in the form set out in Part B of Schedule 7 and prepared in accordance with the Accounting Principles, that is final and binding on the Vendors and the Purchaser pursuant to this deed.

Aggregate Earnout Amount means in relation to:

(a)a Key Employee Vendor, an amount equal to 60% of that Key Employee Vendor's Respective Proportion of the Completion Amount;

(b)a KEV EST Holder, an amount equal to 60% of the KEV EST Holder’s Respective Proportion of the Completion Amount;

(c)an OV EST Holder, an amount equal to 10% of the OV EST Holder’s Respective Proportion of the Completion Amount;

(d)an Other Vendor, an amount equal to 10% of that Other Vendor's Respective Proportion of the Completion Amount

(e)each KEV CCO Holder, an amount equal to 60% of that KEV CCO Holder’s Respective Proportion of the Completion Amount; and

(f)each OV CCO Holder, an amount equal to 10% of that OV CCO Holder’s Respective Proportion of the Completion Amount.

Aggregate CCO Exercise Price means the aggregate exercise price for all CCO Options.

Aggregate Upfront Payment Amount means the aggregate of all Upfront Payments.

Agreed Form means, in respect of a document, at any time:

(a)prior to the execution of this deed, the form of that document agreed in writing by the Appointed Representative and the Purchaser prior to the execution of this deed; and

(b)after the execution of this deed and prior to Completion, if any amendments are requested or required to be made prior to Completion to the Agreed Form of the document as described in paragraph (a) of this definition (whether to complete any blanks, to correct any matters or otherwise), the form of that document agreed in writing by the Appointed Representative and the Purchaser prior to Completion (each acting reasonably).

Allowed Delay has the meaning given to that expression in clause 6.7(c).

Appointed Representative means any person or persons from time to time nominated and acting as 'Appointed Representative' in accordance with clause 20.1, being as at the execution of this deed the Initial Appointed Representatives.

ASIC means the Australian Securities and Investments Commission.

Assets means all of the assets owned or used by a Target Group Member and/or used by the Target Group in connection with the Business.

Assignee has the meaning given to that expression in clause 21.3(c).

Associate has the meaning given to that expression by sections 10 to 17 of the Corporations Act.

ATO means the Australian Taxation Office.

Authorisations means all licences, approvals, consents, permits, registrations, approvals, certificates and other authorisations and Authorisation means any one of them.

Bank Guarantees means the following bank guarantees or other letters of credit:

(a)the bank guarantee given by Fill Function Pty Ltd in favour of Westpac Banking Corporation contained within Data Room Document 4.3.1; and

(b)the bank guarantee given by EUC Services Pty Ltd in favour of Westpac Banking Corporation contained within Data Room Document 4.3.2.

Base Horizon International EBITDA means that EBITDA amount determined in the Pre-Completion Baseline Accounts.

Base Horizon International Revenue means that Revenue amount determined in the Pre-Completion Baseline Accounts.

Blackbird SAFE Holder means:

(a)Blackbird FOF22 Pty Limited ACN 657 567 256 as trustee for Blackbird Ventures 2022 Follow-on Fund Trust; and

(b)Blackbird Purple Pty Limited ACN 637 190 599 as trustee for Blackbird Purple Trust.

Business means the businesses carried on by the Target Group in any jurisdiction as at the date of this deed and as at Completion.

Business Confidential Information has the meaning given to that expression in Part A of Schedule 5.

Business Day means:

(a)for receiving a notice under clause 18, a day that is not a Saturday, Sunday, public holiday or bank holiday in the place where the notice is received; and

(b)for all other purposes, a day that is not a Saturday, Sunday, public holiday or bank holiday in Sydney, Australia or San Francisco, California, United States of America.

Business Hours means from 9.00am to 5.00pm on a Business Day.

Business Intellectual Property means the:

(a)Owned Intellectual Property; and

(b)Licensed Intellectual Property.

Business Warranties means the Warranties other than the Title and Capacity Warranties and includes the Tax Warranties.

Business Warranty Indemnity means the indemnity in clause 9.4(b).

Cash means [***].

Cash-Backing has the meaning given in clause 5.10(a).

Cause means [***].

CCO Holders means a person who holds CCO Options in the Target whose Options will be cancelled for cash consideration by the Target on or prior to Completion, pursuant to the terms of an Equity Plan, the terms on which those Options are held and this deed.

CCO Loan has the meaning given in clause 5.14(f).

CCO Options means Options which are, in accordance with clause 5.14(f), cancelled for cash consideration by the Target on or prior to Completion, pursuant to the terms of an Equity Plan, the terms on which those Options are held and this deed.

Claim includes a claim, allegation, suit, notice, demand, action, proceeding, litigation, investigation, judgment, damage, loss, cost, expense or liability however arising, whether prospective, present, unascertained, immediate, future or contingent, whether based in law (including in contract or tort), in equity or under statute or this deed and whether involving a Third Party, a party to this deed or an Associate of a party to this deed.

Claim Notice means a written notice from the Purchaser to the Appointed Representative under clause 9.11 or clause 11.2, as the context requires.

Claims Election Date has the meaning agreed between the parties in writing.

CoC Material Contracts means those contracts listed in Part A of Exhibit A.

Code means the U.S. Internal Revenue Code of 1986, as amended.

Completion means completion of the sale and purchase of the Sale Securities contemplated by this deed and Complete has a corresponding meaning.

Completion Amount means the amount equal to:

(a)the Enterprise Value; plus

(b)the Estimated Adjustment Amount; plus

(c)the Aggregate CCO Exercise Price.

Completion Date means the date on which Completion occurs.

Conditions means the conditions precedent set out in clause 2.1 and Condition means any one of them.

Confidential Information means:

(a)all information of, or used by, the Target Group, including in relation to the Business and the Target Group Member's transactions, operations and affairs (whether or not in tangible form);

(b)all other information treated by the Target Group as confidential including information provided to the Target Group by any third party under an obligation of confidentiality;

(c)all notes, data, reports and other records (whether or not in tangible form) based on, incorporating or derived from information referred to in paragraphs (a) or (b) of this definition; and

(d)all copies (whether or not in tangible form) of the information, notes, reports and records referred to in paragraphs (a), (b) or (c) of this definition,

that is not Excluded Information.

Confidentiality Agreement means the confidentiality agreement, dated 23 October 2025 and amended on 29 December 2025, between the Purchaser and the Target.

Consequential Loss means [***].

Consolidated Group has the meaning given to that expression in section 703-5 of the Tax Act and includes a 'MEC Group' as defined in section 995-1 of the Tax Act.

Corporations Act means the Corporations Act 2001 (Cth).

Current Insurances has the meaning given to that expression in clause 5.1(d).

Court means the Supreme Court of New South Wales and the NSW Court of Appeal.

D&O Run Off Beneficiary has the meaning given to that expression in clause 5.8(a)(i).

D&O Run Off Policy means a policy of run off insurance cover in the name of the Target, for a period of at least 7 years commencing from Completion, in respect of directors’ and officers’ liability (including in connection with the Transaction).

D&O Run Off Policy Costs means all costs and expenses in connection with the D&O Run Off Policy, including the gross premium plus any premium taxes and fees and charges (including brokerage) in respect of the D&O Run Off Policy.

Data Room means the online data room, as at 5:00pm on 14 February 2026, titled 'Eucalyptus' hosted by Datasite and established by or on behalf of the Vendors in connection with the Transaction.

Debt means [***].

Deductible has the meaning given to that expression in clause 9.9(a)(ii).

Deferred Payment 1 means in respect of:

(a)an Other Vendor, an amount equal to 15% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 15% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 15% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payment 2 means in respect of:

(a)an Other Vendor, an amount equal to 15% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 15% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 15% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payment 3 means in respect of:

(a)an Other Vendor, an amount equal to 15% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 15% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 15% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payment 4 means in respect of:

(a)an Other Vendor, an amount equal to 15% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 15% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 15% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payment 5 means in respect of:

(a)an Other Vendor, an amount equal to 10% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 10% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 10% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payment 6 means in respect of:

(a)an Other Vendor, an amount equal to 10% of that Other Vendor’s Non-Earnout Amount;

(b)each OV EST Holder, an amount equal to 10% of the OV EST Holder’s Non-Earnout Amount; and

(c)each OV CCO Holder, an amount equal to 10% of that OV CCO Holder’s Non-Earnout Amount, less any remaining Exercise Price amounts payable in respect of the Options held by an OV CCO Holder that are cancelled by the Target (calculated in accordance with Schedule 13).

Deferred Payments means the Deferred Payment 1, the Deferred Payment 2, the Deferred Payment 3, the Deferred Payment 4, the Deferred Payment 5 and the Deferred Payment 6.

Disclosure Letter means a letter, dated the date of this deed, from the Vendors, addressed to the Purchaser, disclosing any further relevant facts, matters and circumstances that are or may be inconsistent with the Warranties.

Dispute Notice has the meaning given to that expression in clause 7.5(a).

Dispute Settlement Period has the meaning given to that expression in clause 7.5(c).

Disputed Matters has the meaning given to that expression in clause 7.5(a)(i).

Domain Names means each of the domain names set out in Part B of Schedule 10.

Due Diligence Material means the information contained in the Disclosure Letter and:

(d)information and documents contained in the Data Room; and

(a)written responses provided to written questions submitted by or on behalf of the Purchaser as part of the question and answer process facilitated through the Data Room, provided that such responses are included in the Data Room,

in each case, as at 5:00pm on Saturday, 14 February 2026 and a copy of which information, documents and responses is to be provided by the Appointed Representative to the Purchaser on the execution of this deed via a downloadable link or delivered on a USB key.

Duty means any stamp, transaction or registration duty, transfer taxes or similar charge which is imposed by any Governmental Authority and includes any associated interest, fine, penalty, charge or other amount which is imposed in respect of, or in connection with, any of the foregoing.

Earnout Dispute Notice has the meaning given to that expression in clause 8.5(a).

Earnout Dispute Response has the meaning given to that expression in clause 8.5(b).

Earnout Dispute Settlement Period has the meaning given to that expression in clause 8.5(c).

Earnout Disputed Matters has the meaning given to that expression in clause 8.5(a).

Earnout Group means:

(a)each Target Group Member (including all future Target Group Members through which the Target Group expands into new jurisdictions outside of the United States (unless agreed otherwise by the Purchaser and the Appointed Representative), other than any entity or assets acquired by the Purchaser Group from a third party);

(b)Hims and Hers UK, Ltd; and

(c)Hims & Hers Canada Inc.,

and Earnout Group Member means any one of them.

Earnout Objection Date has the meaning given to that expression in clause 8.3(a).

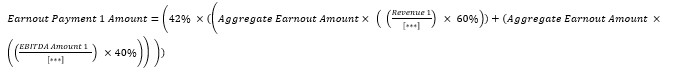

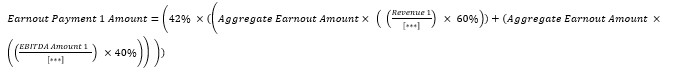

Earnout Payment 1 Amount means, in respect of a Vendor, an EST Holder or a CCO Holder, an amount set out in the First Earnout Statement that is final and binding (after following the disputes process provided for in this deed, if applicable) on the Vendors, the EST Holders, the CCO Holders and the Purchaser pursuant to this deed, which amount shall be calculated in accordance with the following formula and the Earnout Principles, provided that:

(a)the Earnout Payment 1 Cap is the Earnout Payment 1 Cap for that Vendor, EST Holder or CCO Holder (as applicable);

(b)notwithstanding the values of Revenue 1 and EBITDA Margin 1 below, in no circumstances will the Earnout Payment 1 Amount exceed such Earnout Payment 1 Cap; and

(c)in the case of a Key Employee Vendor, a KEV EST Holder or a KEV CCO Holder, the Earnout Payment 1 Amount may be reduced to nil in accordance with, or increased by reallocations to that Key Employee Vendor, KEV EST Holder or KEV CCO Holder (as applicable) under, clause 1.1 of Part A of Schedule 1:

(c)the Aggregate Earnout Amount is the Aggregate Earnout Amount for that Vendor, EST Holder or CCO Holder (as applicable);

(d)notwithstanding the values of Revenue 1 and EBITDA Amount 1 below, in no circumstances will the Earnout Payment 1 Amount exceed the Earnout Payment 1 Cap for that Vendor, EST Holder or CCO Holder (as applicable); and

(e)in the case of a Key Employee Vendor, a KEV EST Holder or a KEV CCO Holder, the Earnout Payment 1 Amount may be reduced to nil in accordance with, or increased by reallocations to that Key Employee Vendor, KEV EST Holder or KEV CCO Holder (as applicable) under, clause 1.1 of Part A of Schedule 1:

Earnout Payment 1 Cap means in relation to:

(a)a Key Employee Vendor, the amount equal to 42% of that Key Employee Vendor's Aggregate Earnout Amount;

(b)a KEV EST Holder, the amount equal to 42% of the KEV EST Holder’s Aggregate Earnout Amount;

(c)an OV EST Holder, the amount equal to 42% of the OV EST Holder’s Aggregate Earnout Amount;

(d)an Other Vendor, the amount equal to 42% of that Other Vendor's Aggregate Earnout Amount;

(e)a KEV CCO Holder, the amount equal to 42% of that KEV CCO Holder’s Aggregate Earnout Amount; and

(f)a OV CCO Holder, the amount equal to 42% of that OV CCO Holder’s Aggregate Earnout Amount.

Earnout Payment 1 Date means the date which is the later of:

(a)the date which is 30 Business Days after the date on which the Form 10-K for the financial year ended 31 December 2026 is publicly filed with the SEC; and

(b)the date which is 7 Business Days after the First Earnout Statement becomes final under clause 8,

and in any event by no later than 29 June 2031.

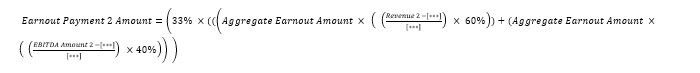

Earnout Payment 2 Amount means, in respect of a Vendor, an EST Holder or a CCO Holder, an amount set out in the Second Earnout Statement that is final and binding (after following the disputes process provided for in this deed, if applicable) on the Vendors, the EST Holders, the CCO Holders and the Purchaser pursuant to this deed, which amount shall be calculated in accordance with the following formula and the Earnout Principles, provided that:

(a)the Aggregate Earnout Amount is the Aggregate Earnout Amount for that Vendor, EST Holder, or CCO Holder (as applicable);

(b)subject to paragraph (c) of this definition, notwithstanding the values of Revenue 2 and EBITDA Amount 2 below, in no circumstances will the Earnout Payment 2 Amount exceed the Earnout Payment 2 Cap, in each case, for that Vendor, EST Holder, or CCO Holder (as applicable);

(c)if the (1) Earnout Payment Amount 1 was lower than the Earnout Payment 1 Cap and (2) value of:

(i)Revenue 2 exceeds US$[***], Earnout Payment Amount 1 shall be recalculated on the basis that Revenue 1 was increased by the excess of Revenue 2 over US$[***]; and/or

(ii)EBITDA Amount 2 exceeds US$[***], Earnout Payment Amount 1 shall be recalculated on the basis that EBITDA Amount 1 was increased by the excess of EBITDA Amount 2 over US$[***],

and the difference between (on the one hand) the Earnout Payment Amount 1 as so recalculated and (on the other hand) the Earnout Payment Amount 1 actually paid (if any) shall be added to Earnout Payment Amount 2; and

(d)in the case of a Key Employee Vendor, the KEV EST Holders and KEV CCO Holders, the Earnout Payment 2 Amount payable to the Key Employee Vendor, EST or KEV CCO Holder (as applicable) may be reduced to nil in accordance with, or increased by reallocations to that Key Employee Vendor, the EST or KEV CCO Holder under, clause 1.1 of Part A of Schedule 9:

Earnout Payment 2 Cap means in relation to:

(a)a Key Employee Vendor, the amount equal to 33% of that Key Employee Vendor's Aggregate Earnout Amount;

(b)a KEV EST Holder, an amount equal to 33% of the KEV EST Holder’s Aggregate Earnout Amount;

(c)a OV EST Holder, an amount equal to 33% of the OV EST Holder’s Aggregate Earnout Amount;

(d)an Other Vendor, the amount equal to 33% of that Other Vendor's Aggregate Earnout Amount;

(e)a KEV CCO Holder, the amount equal to 33% of that KEV CCO Holders’ Aggregate Earnout Amount; and

(f)a OV CCO Holder, the amount equal to 33% of that OV CCO Holders’ Aggregate Earnout Amount.

Earnout Payment 2 Date means the date which is the later of:

(a)the date which is 30 Business Days after the date on which the Form 10-K for the financial year ended 31 December 2027 is publicly filed with the SEC; and

(b)the date which is 7 Business Days after the Second Earnout Statement becomes final under clause 8,

and in any event by no later than 29 June 2031.

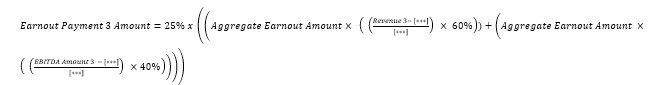

Earnout Payment 3 Amount means, in respect of a Vendor, EST Holder or CCO Holder, an amount set out in the Third Earnout Statement that is final and binding (after following the disputes process provided for in this deed, if applicable) on the Vendors, the EST Holders, the CCO Holders and the Purchaser pursuant to this deed, which amount shall be calculated in accordance with the following formula and the Earnout Principles, provided that:

(a)the Aggregate Earnout Amount is the Aggregate Earnout Amount for that Vendor, EST Holder, or CCO Holder;

(b)subject to paragraphs (c) and (d) of this definition, notwithstanding the values of Revenue 3 and EBITDA Amount 3 below, in no circumstances will the Earnout Payment 3 Amount exceed the Earnout Payment 3 Cap, in each case, for that Vendor, EST Holder, or CCO Holder;

(c)if the (1) Earnout Payment Amount 1 plus any amount paid pursuant to paragraph (c) of the definition of Earnout Payment Amount 2 was lower than the Earnout Payment 1 Cap and (2) value of:

(i)Revenue 3 exceeds US$[***], Earnout Payment Amount 1 shall be recalculated on the basis that Revenue 1 was increased by the excess of Revenue 3 over US$[***]; and/or

(ii)EBITDA Amount 3 exceeds US$[***], Earnout Payment Amount 1 shall be recalculated on the basis that EBITDA Amount 1 was increased by the excess of EBITDA Amount 3 over US$[***],

and the difference (if any) between:

(iii)(on the one hand) the Earnout Payment Amount 1 as so recalculated; and

(iv)(on the other hand) the Earnout Payment Amount 1 actually paid (if any) plus any amount paid pursuant to paragraph (c) of the definition of Earnout Payment Amount 2,

shall be added to Earnout Payment Amount 3;

(d)if the (1) Earnout Payment Amount 2 (before taking into account any amount paid pursuant to paragraph (c) of the definition of Earnout Payment Amount 2) was lower than the Earnout Payment 2 Cap and (2) value of:

(i)Revenue 3 exceeds US$[***], Earnout Payment Amount 2 shall be recalculated on the basis that Revenue 2 was increased by the excess of Revenue 3 over US$[***] less, if paragraph (c) of this definition applies and Revenue 2 as recalculated pursuant to that paragraph would exceed US$[***], the amount required to be added to the Revenue 2 as originally calculated to equal US$[***]; and/or

(ii)EBITDA Amount 3 exceeds US$[***], Earnout Payment Amount 2 shall be recalculated on the basis that EBITDA Amount 2 was increased by the excess of EBITDA Amount 3 over US$[***] less, if paragraph (c) of this definition applies and the EBITDA Amount 2 as recalculated pursuant to that paragraph would exceed US$[***], the amount required to be added to the EBITDA Amount 2 as originally calculated to equal US$[***],

and the difference (if any) between:

(iii)(on the one hand) the Earnout Payment Amount 2 (before taking into account any amount paid pursuant to paragraph (c) of the definition of Earnout Payment Amount 2) as so recalculated; and

(iv)(on the one hand) the Earnout Payment Amount 2 (before taking into account any amount paid pursuant to paragraph (c) of the definition of Earnout Payment Amount 2) actually paid (if any),

shall be added to Earnout Payment Amount 3; and

(e)in the case of a Key Employee Vendor, KEV EST Holder or KEV CCO Holder, the Earnout Payment 3 Amount may be reduced to nil in accordance with, or increased by reallocations to that Key Employee Vendor, KEV EST Holder or KEV CCO Holder under, clause 1.1 of Part A of Schedule 9:

Earnout Payment 3 Cap means in relation to:

(a)a Key Employee Vendor, the amount equal to 25% of that Key Employee's Aggregate Earnout Amount;

(b)a KEV EST Holder, the amount equal to 25% of the KEV EST Holder's Aggregate Earnout Amount;

(c)an OV EST Holder, the amount equal to 25% of the OV EST Holder's Aggregate Earnout Amount;

(d)an Other Vendor, the amount equal to 25% of that Other Vendor's Aggregate Earnout Amount;

(e)a KEV CCO Holder, the amount equal to 25% of that KEV CCO Holders’ Aggregate Earnout Amount; and

(f)a OV CCO Holder, the amount equal to 25% of that OV CCO Holders’ Aggregate Earnout Amount.

Earnout Payment 3 Date means the date which is the later of:

(a)the date which is 30 Business Days after the date on which the Purchaser's Form 10-K for the financial year ended 31 December 2028 is publicly filed with the SEC; and

(b)the date which is 7 Business Days after the Third Earnout Statement becomes final under clause 8,

and in any event by no later than 29 June 2031.

Earnout Payment Amounts or Earnout Payment means each of the Earnout Payment 1 Amount, the Earnout Payment 2 Amount and the Earnout Payment 3 Amount.

Earnout Payment Cap means each of the Earnout Payment 1 Cap, Earnout Payment 2 Cap, and Earnout Payment 3 Cap.

Earnout Payment Date means the Earnout Payment 1 Date, the Earnout Payment 2 Date or the Earnout Payment 3 Date.

Earnout Period means:

(a)in relation to the Earnout Payment 1 Amount, the First Earnout Period;

(b)in relation to the Earnout Payment 2 Amount, the Second Earnout Period; and

(c)in relation to the Earnout Payment 3 Amount, the Third Earnout Period.

Earnout Principles means the principles and policies set out in Part A of Schedule 9.

Earnout Remaining Disputed Matters has the meaning given to that expression in clause 8.5(d).

Earnout Statements means each of the First Earnout Statement, the Second Earnout Statement and the Third Earnout Statement, the form of which is set out in Part B of Schedule 9 and which is prepared in accordance with the Earnout Principles.

EBITDA means, in respect of a period, net income (loss) before stock-based compensation, depreciation and amortization, acquisition and transaction-related costs (which includes (i) consideration paid for employee and non-employee compensation with vesting requirements incurred directly as a result of acquisitions, inclusive of revaluation of earn-out consideration recorded in general and administrative expenses prior to 2024, and (ii) transaction professional services), change in fair value of liabilities, payroll tax expense related to stock-based compensation, impairment of long-lived assets, legal settlement expenses that are considered non-recurring, change in fair value of equity securities, income taxes, and interest income and expense, net.

EBITDA Amount means, in respect of an Earnout Period, the aggregated total EBITDA of the Earnout Group during that period, as calculated (and adjusted as required) in accordance with the Earnout Principles and set out in the Relevant Earn Out Statement.

EBITDA Amount 1 means [***].

EBITDA Amount 2 means [***].

EBITDA Amount 3 means [***].

Effective Time means immediately prior to Completion.

Election Notice means each election notice issued to Option holders in accordance with Step 4 of the steps advised in writing in the email from Gilbert + Tobin to MinterEllison dated 12 February 2026 at 1.17pm.

Employee means:

(a)an employee of a Target Group Member as at the date of this deed; and

(b)any person that becomes an employee of a Target Group Member between the period commencing on the execution of this deed and ending immediately prior to Completion, provided that such person does not become an employee of a Target Group Member as a result of any breach or non-observance by any Vendor of any of clause 5.1 or clause 5.2.

Employee Equity Settled Vendor has the meaning given in the definition of “Purchaser Parent Share Price”.

Employee Restricted Period has the meaning given in the definition of “Purchaser Parent Share Price”.

Enterprise Value means the amount of US$1,150,000,000.

Equity Election Notice has the meaning given to that expression in clause 4.5(c)(i)(B).

Equity Election Partial Cash Payment Obligation has the meaning given to that expression in clause 4.5(c)(i)(C).

Equity Election Value has the meaning given to that expression in clause 4.5(c)(i)(A).

Equity Plan means the employee share schemes of the Target titled:

(a)“Employee Option Plan” in respect of Australia, dated 28 October 2022, contained within Data Room Document 6.23.1.1.3.1;

(b)“EUC International Employee Option Plan” in respect of Germany, approved by the board of the Target on 27 April 2023 contained within Data Room Document 6.23.1.1.2.2;

(c)“EUC International Employee Option Plan” in respect of the United Kingdom, approved by the Board on 27 April 2022 contained within Data Room Document 6.23.1.1.1.2;

(d)“Employee option plan – Tax deferred” adopted by the board of the Target on 22 August 2023, and including as modified by any appendixes to such Plan in respect of offers made to persons in Australia contained within Data Room Document 6.23.1.2.5.2, Ireland contained within Data Room Document 6.23.1.2.1.2, Japan contained within Data Room Document 6.23.1.2.3.2 and Germany contained within Data Room Document 6.23.1.2.4.1; and

(e)“EUC International Employee Option Plan” in respect of the United Kingdom, approved by the board of the Target on 8 October 2025 contained within Data Room Document 6.23.1.2.2.1.

in each case, as amended or replaced from time to time before the date of this deed.

Equity Settled Vendor means each Vendor who is designated “Equity Settled Vendor” as listed in Column 7 of Part A of Schedule 1.

EST means Evolution Trustees Limited in its capacity as trustee of the EST Trust.

EST Trust means the Target’s employee share trust.

Estimated Adjustment Amount means:

(a)Estimated Working Capital; plus

(b)Estimated Net Debt; less

(c)Target Working Capital Amount

Estimated Cash has the meaning given to that expression in clause 5.11(a)(i)(B).

Estimated Debt has the meaning given to that expression in clause 5.11(a)(i)(C).

Estimated Net Debt means an amount (which may be a positive or negative number) equal to:

(a)the Estimated Cash; less

(b)the Estimated Debt,

in each case, as set out in the Vendors’ Completion Certificate delivered by the Vendors to the Purchaser in accordance with clause 5.11. For the avoidance of doubt, if Estimated Debt is greater than Estimated Cash, then Estimated Net Debt will be a negative number.

Estimated Working Capital has the meaning given to that expression in clause 5.11(a)(i)(A).

Evidence of Issuance has the meaning given to that expression in clause 4.5(c)(v).

Exchange Act means the Securities Exchange Act of 1934, as amended.

Excluded Cash means [***].

Excluded Claim means any Claim:

(a)under the Tax Indemnity;

(b)under a Specific Indemnity;

(c)relating to, or in connection with, any of clause 5, clause 7, clause 8, clause 15 or as otherwise agreed in writing between the parties;

(d)under the indemnity in clause 9.12 or any other indemnity Claims which the parties agree in writing should be Excluded Claims; or

(e)that is, or that is relating to or in connection with, a Fraud Claim.

Excluded Information means information which is in or becomes part of the public domain other than through breach of this deed or any obligation of confidence and on the basis that information is not taken to be in the public domain only because such information was known to any Vendor Party, the Target Group or any of their respective Representatives at any time prior to Completion.

Executive Services Agreement means, in respect of a Key Executive (other than [***]), the executive services agreement or offer letter, in the Agreed Form, entered into, or to be entered into (as the case may be) between the Key Executive and the EUC Services Pty Ltd or Fill Function UK Limited (as the case may be).

Exercise Price means the price specified in any offer giving rise to an Option that would be required to be paid by the holder of the Option upon exercise of the Option.

FATA means the Foreign Acquisitions and Takeovers Act 1975 (Cth).

Final Number of Purchaser Parent Shares has the meaning given to that expression in clause 4.5(c)(i)(C).

Final Objection Date has the meaning given to that expression in clause 7.4(a).

Final Purchaser Parent Share Price has the meaning given to that expression in clause 4.5(c)(i)(C).

Finance Party has the meaning given to that expression in clause 21.3(b).

Financial Databook means the unaudited databook setting out the Target Group’s consolidated monthly profit and loss and balance sheet, for the period from the Accounts Date to 30 November 2025, as contained within Data Room Document 20.1.1 and 20.2.

FIRB means the Foreign Investments Review Board.

First Earnout Period means the period commencing on 1 January 2026 and ending 31 December 2026.

First Earnout Statement means the Earnout Statement prepared in respect of the First Earnout Period and setting out the calculation of the Earnout Payment 1 Amount.

First Earnout Statement Preparation Date means [***].

Foreign Investment Condition means the Condition set out in clause 2.1(a).

Forward-looking Information means, in respect of a future matter or event (including without limitation a fiscal or economic matter or event), any:

(a)expression, representation or statement of intention, opinion, belief or expectation; or

(b)warranty, forecast, model, budget, business plan, projection or estimate,

given verbally or in writing in each case, only to the extent relating to the future matter or event.

Fraud Claim means any actual or potential Claim arising out of or in connection with, or in respect of which the facts, matters or circumstances connected to the Claim involve or concern, either:

(a)the fraud or misconduct of a Target Group Member, any Vendor Party or any of their respective Representatives; or

(b)any Target Group Member, any Vendor Party or any of their respective Representatives deliberately or recklessly including in, or omitting to include in, the Due Diligence Material any information that would render:

(i)any information contained in the Due Diligence Material misleading, false or deceptive in a material respect; or

(ii)any Warranty misleading, false or deceptive in a material respect.

Fundamental Warranty means the Warranties that comprise Warranty 3, but not including Warranty 3.10.

Fundamental Warranty Subject Claim means a Claim:

(a)by the Purchaser arising as a result of a breach of a Fundamental Warranty or otherwise as a result of a Fundamental Warranty being untrue, incorrect, inaccurate or misleading; and/or

(b)under the Business Warranty Indemnity as a result of, or in connection with, a Fundamental Warranty being untrue, incorrect, inaccurate or misleading.

Governmental Authority means any governmental, semi–governmental, municipal or statutory authority, instrumentality, organisation, body or delegate (including any Tax Authority, town planning or development authority, public utility, environmental, building, health, safety or other body or authority) in any part of the world and includes any having jurisdiction, authority or power over, or in respect of, a Target Group Member, the Business or the Leased Property.

GST has the meaning given to that expression by the GST Act.

GST Act means A New Tax System (Goods and Services Tax) Act 1999 (Cth).

Guarantee means any guarantee, letter of credit or suretyship or any other obligation to pay, purchase or provide funds for the payment or discharge of, to indemnify against the consequences of default in the payment of, or otherwise be responsible for, any indebtedness of, obligations of, liability of or the insolvency of, any other person.

Guaranteed Obligations has the meaning given to that term in clause 13.5(a) of this deed.

Independent Accountant means a partner of an internationally recognised accounting firm, which firm is independent of the Vendors, the Purchaser and the Target and which partner has at least 10 years' post-qualification experience as an accountant and has the requisite knowledge and expertise in determining completion adjustment disputes, who is appointed pursuant to clause 7.5(f) or clause 7.5(g) (as the case may be) as the 'Independent Accountant'.

Initial Appointed Representative means each of Tim Doyle and Nick Crocker.

Insolvency Event means:

(a)in relation to an entity:

(i)the entity is unable to pay its debts as and when they fall due or has stopped or suspended, or threatened to stop or suspend, payment of all or a class of its debts;

(ii)the entity goes, or proposes to go, into liquidation;

(iii)the entity:

(A)receives a deregistration notice under section 601AB of the Corporations Act or any communication from ASIC that might reasonably be expected to lead to such a notice; or

(B)applies for deregistration under section 601AA of the Corporations Act;

(iv)an order is made or an effective resolution is passed for the winding up or dissolution without winding up (otherwise than for the purposes of reconstruction or amalgamation) of the entity;

(v)a receiver, receiver and manager, judicial manager, liquidator, administrator or like official is appointed, or threatened or expected to be appointed, over the whole or a substantial part of the undertaking or property of the entity;

(vi)the holder of a Security Interest takes possession of the whole or substantial part of the undertaking or property of the entity;

(vii)a writ of execution is issued against the entity or any of the entity’s assets;

(viii)the entity proposes or takes any steps to implement a scheme or arrangement or other compromise with its creditors or any class of them; or

(ix)the entity is declared or taken under applicable law to be insolvent, or the entity’s board of directors resolve that it is, or is likely to become insolvent; and

(b)in relation to a natural person, the person is made bankrupt, declared bankrupt or files a petition for relief under bankruptcy laws.

Insurances has the meaning given to that expression in Warranty 14.3.

Intellectual Property Rights means any and all intellectual property and proprietary rights (whether registered or unregistered) rights, similar rights and forms of protection with comparable effect, including all legal rights, title or interest, irrespective of the country in which such rights were granted and regardless of whether they are or could be recorded in a public register, including applications and renewals for rights including all:

(a)business names and any and all goodwill associated with and symbolized by the foregoing;

(b)trade or service marks, trade names, logos, and related registrations and applications as well as business designations and geographical indications of origin and any and all goodwill associated with and symbolized by the foregoing;

(c)any right to have information (including Confidential Information) kept confidential; and

(d)all patents, patent applications, utility models, drawings, discoveries, inventions, disclosures, (whether patented or not) improvements, trade secrets, technical data, formulae, computer programs, data and data bases, domain names, Know How, logos, designs, design rights, copyright and similar industrial or intellectual property rights (including other ancillary copyrights, as well as all published and unpublished works of authorship whether or not copyrightable, and all corresponding rights;

(e)rights in or relating to applications, registrations, renewals, extensions, combinations, revisions, divisions, continuations, continuations-in-part and reissues of, and applications for, any of the rights referred to in clauses (a) through (e) above; and

(f)all causes of action and rights to sue or seek other remedies arising from or relating to the foregoing, including for any past or ongoing infringement, misuse or misappropriation.

Investor Suitability Documentation means the questionnaire in the form of Exhibit E to confirm that an Equity Settled Vendor satisfies the applicable exemption from registration of Purchaser Parent Shares.

Irrevocable Equity Election has the meaning given to that expression in clause 4.5(c)(i)(A).

Issuance Date has the meaning given to that expression in clause 4.5(c)(i)(C).

ISU means the Investment Security Unit, part of the UK Cabinet Office.

KEV CCO Holders means CCO Holders who are designated “Key Employee Vendors” as listed in Schedule 2.

KEV EST Holders means persons for whom the EST holds Sale Shares on trust that are designated “Key Employee Vendors” by the EST as listed in Part C of Schedule 1.

Key Executive means each of [***].

Key Contract means each contract listed in Part B of Exhibit A.

Key Employee Vendor means a Vendor that is designated in Column 6 of Part A of Schedule 1 as a 'Key Employee Vendor'.

Key Persons means, in respect of:

(a)a Key Employee Vendor, the person that is designated adjacent to the name of that Key Employee Vendor in Column 7 of Part A of Schedule 1;

(b)a KEV EST Holder, the person that is designated adjacent to the name of that KEV EST Holder in column 3 of Part B of Schedule 1; and

(c)a KEV CCO Holder, the person that is designated adjacent to the name of that KEV CCO Holder in column 3 of Schedule 2

and Key Person means any one of them.

Know How means the information or know how owned or used by the Business, its systems, technology and affairs (and whether written or unwritten) including:

(a)financial, technological, strategic or business information, concepts, plans, strategies or directions;

(b)research, development, operational, legal, marketing or accounting information;

(c)inventions, discoveries, improvements, processes, formulae, techniques, manuals, instructions, software, source and object codes for computer software, methods, specifications, works of authorship, data, databases, data collections, all other forms of technology (whether or not embodied in any tangible form and including all tangible embodiments of the foregoing), and other such items for which Intellectual Property Rights may be secured, including any documents or other tangible media containing any of the foregoing and technical and historical information relating to them; and

(d)customer and supplier information.

Knowledge Person has the meaning given to that expression in clause 1.2(t).

Lease Agreements means each of the lease or licence agreements set out in Schedule 11 and Lease Agreement means any one of them.

Leased Properties means each of the leasehold premises or the licensed premises (as applicable) the subject of the Lease Agreements and Leased Property means any one of them.

Liability means any liability or obligation (whether actual, contingent or prospective), including for any Loss of whatever description irrespective of when the acts, events or things giving rise to the liability or obligation occurred.

Licensed Intellectual Property means the material Intellectual Property Rights that are licensed to any Target Group Member.

Loss includes any loss, damage, cost, Claim, Tax, liability or expense.

Material Adverse Change means:

(a)other than with the consent of the Purchaser, the employment of a Key Executive with a Target Group Member ceases or terminates (in any manner), a Key Executive gives or receives notice of cessation or termination of that Key Executive’s employment with a Target Group Member or a Key Executive ceases to be able to perform, or otherwise becomes incapable of being able to perform, that Key Executive's duties or obligations in respect of that Key Executive’s employment with a Target Group Member;

(b)a material adverse effect on the business, operations, assets, liabilities, financial or trading position or profitability of the Target Group;

(c)the occurrence prior to Completion of any Insolvency Event in respect of a Target Group Member and / or any Material Vendor,

in each case, other than if the occurrence of those facts, matters or circumstances:

(d)was fairly disclosed in the Due Diligence Material or in the searches referred to in clause 9.6;

(e)was within the actual knowledge of a Purchaser Group Member prior to the date of this deed;

(f)which arise as a consequence of the Therapeutic Goods Administration’s investigations of the Target Group identified in the Disclosure Letter;

(g)arising from any changes in general economic, business or industry conditions (including changes to interest rates, foreign exchange rates, changes affecting financial, credit, foreign exchange or capital market conditions, changes in the price of services, commodity prices, prices or energy or raw materials, imposition of tariffs or other barriers to trade or financial markets or political conditions) other than where such matters have a materially disproportionate effect on the Target Group as compared to other participants in the industry in which the Target Group operates;

(h)arising from any actual or proposed change in law (whether through a legislative change or court decision), regulation, generally accepted accounting standards or generally accepted accounting principles or the interpretation of any such standards or principles, or policy of a Governmental Authority, in each case, announced after the date of this deed and prior to Completion;

(i)arising from actions taken by the Target Group or any Vendor which is expressly required or permitted by this deed and by any other document to which the parties are a party, the announcement of the Transaction or which was otherwise agreed to, or requested by, the Purchaser in writing, including prior to the date of this deed;

(j)which relates to or arise from any acts of terrorism, outbreak or escalation of war (whether or not declared) or hostilities (including any escalation or worsening thereof), sabotage, civil unrest, an act of God, storm, flood, fire, earthquake or explosion, cyclone, tidal wave, landslide or any other natural disaster; or

(k)any failure by the Target Group Members to meet any projections, budgets or estimates of revenue or earnings in the ordinary course of business.

Material Contracts means:

(a)those contracts listed in Part C of Exhibit A; and

(b)any contract, commitment or arrangement (or series of contracts, commitments or arrangement) to which a Target Group Member is a party and which:

(i)is reasonably likely over its term to generate aggregate revenue or incur aggregate expenses for that Target Group Member in excess of AU$[***] (exclusive of GST); or

(ii)has an initial term of 12 months or greater (and contracts, commitments or arrangements with no time period are presumed to have a form in excess of that period),

excluding all Lease Agreements and any contract of employment in respect of any Employee and Material Contract means any one of them.

Material Vendor means any Vendor that holds in excess of 2% of the Sale Shares (and any Vendor that is affiliate of such Vendor) as at the date of this deed, the Blackbird SAFE Holder and 1V.

Mighty Partners Loan Agreement means the 'Letter of Offer' between the Target (as 'borrower'), MP Loan SPV 1 Pty Ltd ACN 691 059 328 (as 'lender') and others dated 17 October 2025.

Necessary Approvals means, in respect of any contract, all approvals, amendments, consents, notifications or waivers required under, or in connection with, the terms of that contract in order to effect the Transaction without:

(a)breaching, or causing a breach of, the terms of the contract; or

(b)giving rise to, or permitting any party to the contract, any right under the relevant contract which will or may arise as a result of the consummation of the Transaction (or any part of the Transaction), including any right to terminate the contract, to limit or restrict any rights in respect of the contract and/or the right to require the payment, repayment or reimbursement of any applicable amounts under the contract.

Negative Response means either:

(a)the Secretary of State for the UK Cabinet Office:

(i)notifying the Purchaser or any person who has or is to have control of the Purchaser (within the meaning given to that term in Part XII of FSMA) (or any of their representatives or advisors) that it will not approve the Purchaser (or such person) acquiring, directly or indirectly, control over the Target; or

(ii)making a final order permitting the transaction contemplated by this deed subject to such remedies or requirements that are not acceptable to the Purchaser, acting reasonably; and

(b)the Treasurer of the Commonwealth of Australia (or his or her agent) provides notice to the Purchaser that it:

(i)objects; or

(ii)does not object but on conditions that are not acceptable to the Purchaser, acting reasonably,

in each case, under the FATA, to the acquisition of the Sale Securities by the Purchaser in the manner contemplated by this deed.

Net Debt means:

(a)Cash; less

(b)Debt,

which may, for the avoidance of doubt, produce an amount that is a negative amount if Debt is greater than Cash.

Nominated Account means the Australian bank account notified in writing by the Appointed Representative to the Purchaser (with such notice to specify all relevant details in respect of the bank account) in accordance with clause 4.5(b).

Non-Earnout Amount means, in relation to:

(a)an Other Vendor, the amount equal to 90% of that Other Vendor's Respective Proportion of the Completion Amount;

(b)an OV EST Holder, an amount equal to 90% of that OV EST Holder’s Respective Proportion of the Completion Amount; and

(c)an OV CCO Holder, an amount equal to 90% of that OV CCO Holder’s Respective Proportion of the Completion Amount.

Non-Exchanging SAFE means the Simple Agreement for Future Equity entered into between the Target and Blackbird HP Pty Limited ACN 621 829 534 as trustee for Blackbird Hostplus Trust, dated 28 October 2025.

Notice has the meaning given to that expression in clause 18.1.

NSIA Condition means the Condition set out in clause 2.1(e).

NSIA21 means the UK National Security and Investment Act 2021.

Old Street Leases means:

(a)the lease between Moorhead Holdings Limited (as landlord) and Fill Function (as tenant) in respect of 4th Floor, City Cloisters East, 196 Old Street, London EC1V 9FR; and

(b)the lease between Moorhead Holdings Limited (as landlord) and Fill Function (as tenant) in respect of 5th Floor, City Cloisters East, 196 Old Street, London EC1V 9FR.

Option Cancellation Amount means the amount of cash consideration payable by the Target for the cancellation of the Options pursuant to clause 4.2 funded by the CCO Loan.

Options means an option to acquire a fully paid ordinary share in the capital of the Target issued pursuant to an Equity Plan.

Options Tax Ruling means the tax ruling referred to in Step 3 of the steps advised in writing in the email from Gilbert + Tobin to MinterEllison dated 12 February 2026 at 1.17pm.

Other Vendor means a Vendor other than a Key Employee Vendor or the EST.

OV CCO Holders means CCO Holders which are not KEV CCO Holders.

OV EST Holders means persons for whom the EST holds Sale Shares on trust that are designated “Other Vendors” by the EST as specified in Part C of Schedule 1.

Owned Intellectual Property means:

(a)all Intellectual Property Rights and Know How that are owned, or purported by the Vendor in the Due Diligence Materials to be owned, by any Target Group Member; and

(b)the Registered Intellectual Property.

Permitted Security Interest means:

(a)any Security Interest registered by the Purchaser;

(b)the Security Interest registered on the PPS Register as at the date of this deed as listed in Schedule 15;

(c)any lien or charge that arises by the operation of law in the ordinary course of business;

(d)right of set-off included in a contract entered in the ordinary course of business that does not secure financial indebtedness;

(e)provided that, in the case of Permitted Security Interests arising after the date of this deed (i) the obligation secured arose in accordance with clause 5 of this deed and (ii) would not, were it to be given by a member of the Purchaser Group breach any covenants under the Purchaser Parent Credit Agreement:

(i)any retention of title arrangement under which title is retained by a supplier over goods supplied to any Target Group Member until payment for such goods is made, provided that such arrangement has been entered into in the ordinary and usual course of business on arm’s length terms;

(ii)a security interest contemplated by section 12(3)(a) of the PPSA provided that such security interest has been entered into in the ordinary and usual course of business and is not a security interest within the meaning of section 12(1) of the PPSA;

(iii)a security interest contemplated by section 12(3)(b) of the PPSA provided that such commercial consignment has been entered into in the ordinary and usual course of business and is not a security interest within the meaning of section 12(1) of the PPSA; and

(iv)a security interest contemplated by section 12(3)(c) of the PPSA provided that such PPS lease (as defined in section 13 of the PPSA and as amended by the Personal Property Securities Amendment (PPS Leases) Act 2017 (Cth)) has been entered into in the ordinary and usual course of business and is not a security interest within the meaning of section 12(1) of the PPSA.

Post-Completion Returns means each Tax Return of a Target Group Member for any Tax period:

(a)ending on or prior to Completion (other than a Pre-Completion Return);

(b)commencing before and ending after Completion; or

(c)commencing after Completion,

and Post-Completion Return means any one of them.

PPS Register means the Personal Property Securities register established under the PPSA.

PPSA means the Personal Property Securities Act 2009 (Cth).

Pre-Completion Baseline Accounts means the statement of financial performance for Hims and Hers UK, Ltd and Hims & Hers Canada Inc. for the period from 1 January 2026 to the Completion Date, prepared in accordance with clause 8.

Pre-Completion Returns means each Tax Return of a Target Group Member for any Tax period ending on or prior to Completion and where the due date for lodgement of the Tax Return is a date that is on or prior to Completion and Pre-Completion Return means any one of them.

Pre-Completion Revolving Facility means the facility referred to in clause 5.15.

Principal Exchange means the principal securities exchange or securities market on which Purchaser Parent Shares are then traded (which is the New York Stock Exchange as at the date of this deed).

Pro Rate Base Horizon International EBITDA means the amount calculated as the Base Horizon International EBITDA, divided by 365, multiplied by the number of days between the Completion Date and 31 December 2026.

Pro Rate Base Horizon International Revenue means the amount calculated as the Base Horizon International Revenue, divided by 365, multiplied by the number of days between the Completion Date and 31 December 2026.

Purchase Price means the amount equal to:

(a)the Completion Amount (which, for the avoidance of doubt, is equal to the aggregate of all Upfront Payments, Deferred Payments and Earnout Payments); plus

(b)the Actual Adjustment Amount,

subject to any other adjustments to the Purchase Price made under, and in accordance with, this deed.

Purchaser Deal Team means [***].

Purchaser Disclosure Letter means a letter, dated the date of this deed, from the Purchaser, addressed to the Warrantors, disclosing any further relevant facts, matters and circumstances that are or may be inconsistent with the Purchaser Warranties.

Purchaser Group means, at any given time:

(a)the Purchaser; and

(b)each Related Body Corporate of the Purchaser from time to time (including, after Completion, the Target Group and may include, for the avoidance of doubt, any person or entity not in existence as at the date of this deed and/or at Completion),

and Purchaser Group Member means any one of them.

Purchaser Group Information has the meaning given to that expression in clause 13.4(b).

Purchaser Parent Board means the board of directors of the Purchaser Parent as constituted from time to time.

Purchaser Parent Credit Agreement means the Revolving Credit and Guaranty Agreement, dated as of 18 February 2025, among the Purchaser Parent, JPMorgan Chase Bank, N.A. (as administrative agent and collateral agent), and JPMorgan Chase Bank, N.A., Morgan Stanley Senior Funding, Inc. and Goldman Sachs Bank USA (as joint lead arrangers and joint bookrunners) and various lenders.

Purchaser Parent Shares means shares of the Class A common stock, par value US$0.0001 per share, in the Purchaser Parent.

Purchaser Parent Share Issuance Conditions has the meaning given to that expression in clause 4.5(c).

Purchaser Parent Share Price means, in respect of a specified date, the average of the daily volume weighted average sales price of one (1) share of Purchaser Parent Shares on the

Principal Exchange, as such daily volume-weighted average sales price per share is reported as of 4:00pm, New York, New York, United States of America time on such date by Bloomberg, or if not available on Bloomberg, as reported by Morningstar, calculated to four decimal places and determined without regard to after-hours trading or any other trading outside the regular trading session trading hours, for each of the 10 consecutive Trading Days ending one Trading Day prior to the applicable date of issuance of such Purchaser Parent Shares (such period, the VWAP Measurement Period).

Purchaser Warranties means the warranties set out in Schedule 6 and Purchaser Warranty means any one of them.

Qualifying Claim has the meaning given to that expression in clause 9.9(a).

Records means all original and copy records, documents, books, files, reports, accounts, plans, correspondence, letters and papers of every description and other material regardless of their form or medium and whether coming into existence before, on or after the date of this deed, of the Target Group or the Vendors relating to the Business including certificates of registration, minute books, statutory books and registers, books of account, Tax Returns, title deeds and other documents of title, databases, supplier lists, customer lists, client lists, price lists, tender documents, computer programs and software and trading and financial records.

Registered Intellectual Property means all registered Intellectual Property Rights and all applications for registration of Intellectual Property Rights, including the patents, and patent applications, registered trade marks and trade mark applications, registered designs and design applications, registered copyrights and copyright applications (where applicable), registered business names and business name applications, and domain names and domain name applications set out in Schedule 10.

Related Body Corporate has the meaning given to that expression in the Corporations Act.

Relevant Earnout Statement has the meaning given to that expression in clause 8.1.

Relevant Party has the meaning given to that expression in clause 20.1(a).

Relevant Records has the meaning given to that expression in clause 15.2(a).

Relevant Third Party Claim has the meaning agreed between the parties in writing.

Relevant Trust means, in respect of each Vendor or EST Holder that has entered into this deed in its capacity as trustee of a trust, the trust set out following that party’s name in Column 1 of the tables in Schedule 1.

Relevant Warrantor has the meaning agreed between the parties in writing.

Representatives means, in respect of a person or entity, any director, officer, executive or employee of that person or entity and any contractor, agent, adviser or financier of that person or entity.

Resale Registration Statement has the meaning given to it in clause 4.5(c).

Respective Proportion means, in respect of:

(a)a Vendor, the proportion (expressed as a percentage) set out in Column 4 of the table in Part A of Schedule 1 adjacent to that Vendor's name in Column 1 of the table in Part A of Schedule 1 with the parties agreeing that the EST will have a 0% Respective Proportion;

(b)an EST Holder the proportion (expressed as a percentage) set out in Column 4 of the tables in Part B or Part C of Schedule 1 (as applicable) adjacent to that holder’s name in Column 1 of the table in Part B or Part C of Schedule 1 (as applicable);

(c)KEV CCO Holders, the proportion (expressed as a percentage) set out in Column 4 of the table in Schedule 2 adjacent to that holder’s name in Column 1 of the table in Schedule 2;

(d)all OV CCO Holders, 100% minus the aggregate Respective Proportions of all Vendors, EST Holders and KEV CCO Holders, and in respect of an individual OV CCO Holder, the proportion (expressed as a percentage) that the OV CCO Holder’s CCO Options bear to the total number of CCO Options held by all OV CCO Holders multiplied by 100% minus the aggregate Respective Proportions of all Vendors, EST Holders and KEV CCO Holders.

Response has the meaning given to that expression in clause 7.5(b).

Revenue means, in any relevant period, the aggregated total 'online revenue' (as defined in accordance with U.S. GAAP) of the Earnout Group during that period, as calculated (and adjusted as required) in accordance with the Earnout Principles and set out in the Relevant Earnout Statement).

Revenue 1 means [***].

Revenue 2 means [***].

Revenue 3 means [***]

RI President means the President from time to time of Resolution Institute ABN 69 008 651 232 or his or her nominee or delegate.

Rule 144 means Rule 144 promulgated under the Securities Act.

SAFE means the Simple Agreements for Future Equity entered into between the Target and:

(a)Blackbird FOF22 Pty Limited ACN 657 567 256 as trustee for Blackbird Ventures 2022 Follow-on Fund Trust, dated 30 September 2025; and

(b)Blackbird Purple Pty Limited ACN 637 190 599 as trustee for Blackbird Purple Trust, dated 18 November 2025.

Sale Securities means the Sale Shares and 1V Warrants.

Sale Shares means all of the shares in the capital of the Target, being the shares in the capital of the Target set out in Column 3 of the table in Schedule 1 and Sale Share means any one of them.

Scheduled Completion Date means:

(a)the first Business Day of the calendar month following the calendar month during which the last outstanding Condition (other than the Conditions in clause 2.1(b)) is satisfied or waived under clause 2.2 (as applicable), provided that if such day is less than five Business Days after the date on which such last outstanding Condition is satisfied or waived under clause 2.2 (as applicable), the Scheduled Completion Date will be the first Business Day of the calendar month following the next calendar month; or

(b)such other date as the Appointed Representative and the Purchaser may agree in writing (acting reasonably).

Scheduled Delayed Payment has the meaning given to that term in clause 4.5(c).

SEC means the U.S. Securities and Exchange Commission.

Second Earnout Period means the period commencing on 1 January 2027 and ending 31 December 2027.

Second Earnout Statement means the Earnout Statement prepared in respect of the Second Earnout Period and setting out the calculation of the Earnout Payment 2 Amount.

Second Earnout Statement Preparation Date means [***].

Securities has the meaning given to that expression in Warranty 3.6.

Securities Act means the U.S. Securities Act of 1933, as amended.

Security Interest means any security for the payment of money or performance of obligations, including a mortgage, lien, charge, pledge, trust, power, option, right to acquire, right of pre-emption, assignment by way of security, title retention, flawed deposit arrangement and any 'security interest' as defined in sections 12(1) or 12(2) of the PPSA or any agreement to create any of them or allow any of them to exist.

Settlement Date has the meaning given to that expression in clause 4.5(c)(i)(A).

Specific Indemnities means each of the indemnities agreed in writing between the parties and Specific Indemnity means any one of them.

Specific Indemnity Claim means a claim under the Specific Indemnity.