Exhibit T3A-26

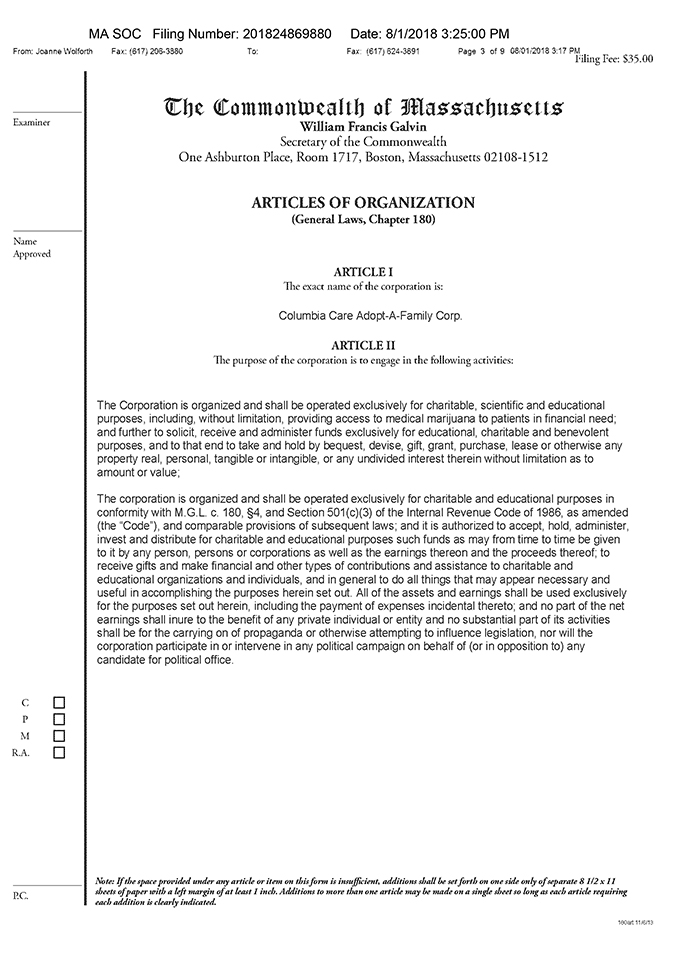

The Commonwealth of Massachuseus William Francis Galvin Secretary of the Commonwealth One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512 ARTICLES OF ORGANIZATION (General Laws, Chapter 180) ARTICLE I The exact name of the corporation is: Columbia Care Adopt-A-Family Corp. ARTICLE II The purpose of the corporation is to engage in the following activities: The Corporation is organized and shall be operated exclusively for charitable, scientific and educational purposes, including, without limitation, providing access to medical marijuana to patients in financial need; and further to solicit, receive and administer funds exclusively for educational, charitable and benevolent purposes, and to that end to take and hold by bequest, devise, gift, grant, purchase, lease or otherwise any property real, personal, tangible or intangible, or any undivided interest therein without limitation as to amount or value; The corporation is organized and shall be operated exclusively for charitable and educational purposes in conformity with M.G.L. c. 180, §4, and Section 501(c)(3) of the Internal Revenue Code of 1986, as amended (the “Code”), and comparable provisions of subsequent laws; and it is authorized to accept, hold, administer, invest and distribute for charitable and educational purposes such funds as may from time to time be given to it by any person, persons or corporations as well as the earnings thereon and the proceeds thereof; to receive gifts and make financial and other types of contributions and assistance to charitable and educational organizations and individuals, and in general to do all things that may appear necessary and useful in accomplishing the purposes herein set out. All of the assets and earnings shall be used exclusively for the purposes set out herein, including the payment of expenses incidental thereto; and no part of the net earnings shall inure to the benefit of any private individual or entity and no substantial part of its activities shall be for the carrying on of propaganda or otherwise attempting to influence legislation, nor will the corporation participate in or intervene in any political campaign on behalf of (or in opposition to) any candidate for political office. Note: the space provided under any article or item on this form is insuufficient, additions shall be set fortb on one side only of separate 81/2 x 11 sheets of paper with a left margin of at least 1 inch. Additions to more than one article may be made on a single sheet so long as each article requiring each addition is clearly indicated.