|

|

|

Nuveen Interval Fund

| Fund Name | Class A1 | Class A2 | Class I | |||||||||

| Nuveen Enhanced High Yield Municipal Bond Fund |

NHYEX | NHYAX | NMSSX | |||||||||

Annual

Report

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23445 |

Nuveen Enhanced High Yield Municipal Bond Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Vice President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 257-8787

Date of fiscal year end: March 31

Date of reporting period: March 31, 2025

| Item 1. | Reports to Stockholders. |

|

|

|

Nuveen Interval Fund

| Fund Name | Class A1 | Class A2 | Class I | |||||||||

| Nuveen Enhanced High Yield Municipal Bond Fund |

NHYEX | NHYAX | NMSSX | |||||||||

Annual

Report

Table

of Contents

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| Fund Performance, Expense Ratios, Leverage and Holdings Summaries |

8 | |||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 49 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

2

Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion.

3

Fund Performance

Nuveen Enhanced High Yield Municipal Bond Fund

Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, is the investment adviser for the Nuveen Enhanced High Yield Municipal Bond Fund (HYIF).

The portfolio managers for HYIF are Daniel Close, CFA, Steven Hlavin, and Stephen Candido, CFA.

Below is a discussion of the Fund’s performance and the factors that contributed and detracted during the 12-month reporting period ended March 31, 2025. For more information on the Fund’s investment objectives and policies, please refer to the Shareholder Update section at the end of the report.

Nuveen Enhanced High Yield Municipal Bond Fund (HYIF)

What factors affected markets during the reporting period?

| • | Municipal bond yields rose over the reporting period, except for short maturities, whose yields fell. However, the path was not a straight line given uncertainties about the Federal Reserve’s plan for monetary easing, U.S. fiscal policy under the Trump administration and the impact to the economy and inflation. |

| • | Credit fundamentals remained strong, with default activity at low levels. Although supply increased during the reporting period, demand for municipal debt remained solid. |

What key strategies were used to manage the Fund during the reporting period?

| • | The Fund’s trading activity remained focused on pursuing its investment objectives. There were no material changes to the Fund’s positioning. |

| • | The portfolio management team actively worked to invest in new issues offering high tax-exempt income and attractive spreads and in secondary market opportunities where pricing dislocations presented attractive relative value. |

How did the Fund perform and what factors affected relative performance?

For the 12-month reporting period ended March 31, 2025, the Class I Shares of the Nuveen Enhanced High Yield Municipal Bond Fund returned 8.11%. The Fund outperformed the S&P Municipal Yield Index, which returned 3.78%.

Top contributors to relative performance

| • | Overweight to the incremental tax sector. |

| • | Overweight to non-rated bonds and an underweight to BBB-rated and A-rated bonds. |

Top detractors from relative performance

| • | Overweights to durations of zero to two years and durations of 12 years and longer. |

| • | Overweight to certain transportation sector bonds and an underweight to the hospital sector. |

4

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of March 31, 2025. The Fund’s distribution levels may vary over time based on the Fund’s investment activity and portfolio investments value changes.

During the current reporting period, the Fund’s distributions to common shareholders were as shown in the accompanying table.

| Monthly Distributions (Ex-Dividend Date) | Class A1 | Class A2 | Class I | |||||||||

| April 2024 |

$0.0325 | $0.0340 | $0.0370 | |||||||||

| May 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| June 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| July 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| August 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| September 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| October 2024 |

0.0325 | 0.0340 | 0.0370 | |||||||||

| November 2024 |

0.0320 | 0.0340 | 0.0370 | |||||||||

| December 2024 |

0.0320 | 0.0340 | 0.0370 | |||||||||

| January 2025 |

0.0320 | 0.0340 | 0.0370 | |||||||||

| February 2025 |

0.0320 | 0.0340 | 0.0370 | |||||||||

| March 2025 |

0.0320 | 0.0340 | 0.0370 | |||||||||

| Total Distributions from Net Investment Income |

$0.3875 | $0.4080 | $0.4440 | |||||||||

| Total Distributions from Long Term Capital Gains |

0.0067 | 0.0067 | 0.0067 | |||||||||

| Total Distributions |

0.3942 | 0.4147 | 0.4507 | |||||||||

| Class A1 | Class A2 | Class I | ||||||||||

| Distribution Rate on NAV* |

5.02% | 5.33% | 5.80% | |||||||||

| *Distribution | rate represents the latest declared distribution, annualized, divided by the Fund’s current net asset value (NAV) as of the end of the reporting period. |

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to the Notes to Financial Statements for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, per share amounts of the Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for the Fund as of its most recent tax year end is presented in the Notes to Financial Statements of this report.

REPURCHASE OFFER

In order to provide liquidity to common shareholders, the Fund has adopted a fundamental investment policy, which may only be changed by a majority vote of shareholders, to make quarterly offers to repurchase between 5% and 25% of its outstanding Common Shares at NAV, reduced by any applicable repurchase fee. Subject to approval of the Board, for each quarterly repurchase offer, the Fund currently expects to offer to repurchase 7.5% of the outstanding Common Shares at NAV. The Fund does not currently expect to charge a repurchase fee.

Refer to the Notes to Financial Statements for further details on the Fund’s repurchase offer.

6

S&P Municipal Yield Index: An index that is structured so that 70% of the index consists of bonds that are either not rated or are rated below investment grade, 20% are rated BBB/Baa, and 10% are rated single A. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

7

Fund Performance, Expense Ratios, Leverage and Holdings Summaries

The Fund Performance, Leverage, Expense Ratios and Holdings Summaries for the Fund are shown within this section of the report.

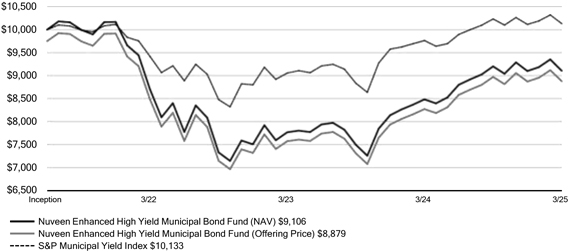

Fund Performance

Performance data shown represents past performance and does not predict or guarantee future results. Investment returns and principal value will fluctuate so that when shares are repurchased, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown.

Total returns for a period of less than one year are not annualized (i.e. cumulative returns). Since inception returns are shown for share classes that have less than 10-years of performance. Returns at NAV would be lower if the sales charge were included. Returns assume reinvestment of dividends and capital gains. For performance, current to the most recent month-end visit nuveen.com or call (800) 257-8787.

Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. Income is generally exempt from regular federal income taxes. Some income may be subject to state and local income taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Returns may reflect fee waivers and/or expense reimbursements by the investment adviser during the periods presented. If any such waivers and/or reimbursements had not been in place, returns would have been reduced. See Notes to Financial Statements for more information.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees, and assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for Class A1 Shares at NAV only.

Impact of Leverage

One important factor impacting the returns of the Fund’s common shares relative to its comparative benchmarks was the Fund’s use of leverage through its issuance of preferred shares and investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When the Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term interest rates. While fund leverage expenses are higher than prior year lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

Leverage Ratios

The Fund’s Effective Leverage and Regulatory Leverage Ratios are set forth below. “Effective Leverage” is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. “Regulatory Leverage” consists of preferred shares or borrowings of a Fund. Regulatory Leverage is a part of a Fund’s capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. A Fund, however, may from time to time borrow for temporary purposes, typically on a transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such temporary borrowings are excluded from the calculation of a Fund’s Effective Leverage and Regulatory Leverage ratios.

8

Expense Ratios

The expense ratios shown are as of the Fund’s most recent prospectus. The expense ratios shown reflect total operating expenses (before fee waivers and/or expense reimbursements, if any). The expense ratios include management fees and other fees and expenses. Refer to the Financial Highlights later in this report for the Fund’s expense ratios as of the end of the reporting period.

Holdings Summaries

The Holdings Summaries data relates to the securities held in the Fund’s portfolio of investments as of the end of this reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change. Refer to the Fund’s Portfolio of Investments for individual security information.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

9

| Nuveen Enhanced High Yield Municipal Bond Fund (continued) Fund Performance, Expense Ratios, Leverage and Holdings Summaries March 31, 2025 |

Fund Performance and Expense Ratios*

| Total Returns as of March 31, 2025** |

||||||||||||||||||||

| Average Annual | Expense Ratios*** | |||||||||||||||||||

| Inception Date |

1-Year | Since Inception |

Gross | Net | ||||||||||||||||

| Class A1 at NAV | 6/30/21 | 7.32% | (2.47)% | 3.87% | 3.76% | |||||||||||||||

| Class A1 at maximum Offering Price | 6/30/21 | 4.64% | (3.12)% | — | — | |||||||||||||||

| S&P Municipal Yield Index | — | 3.78% | 0.35% | — | — | |||||||||||||||

| Class A2 | 7/29/22 | 7.60% | 3.59% | 3.62% | 3.51% | |||||||||||||||

| Class I | 6/30/21 | 8.11% | (1.75)% | 3.12% | 3.01% | |||||||||||||||

| * | For purposes of Fund performance, relative results are measured against the S&P Municipal Yield Index. |

| ** | Class A1 Shares have a maximum 2.50% sales charge (Offering Price). Class A1 Share purchases of $100,000 or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC) of 1.50% if repur- chased before the first day of the month in which the one-year anniversary of the purchase falls. Class A2 and Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors. |

| *** | The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse Fund expenses through July 31, 2026 so that total annual Fund operating expenses (excluding distribution and/or service fees that may be applicable to a particular class of shares, issuance and dividend costs of preferred shares that may be issued by the Fund, interest expense, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities, litigation expenses and extraordinary expenses) do not exceed 1.05% of the average daily managed assets of any class of Fund shares. This expense limitation may be terminated or modified prior to that date only with the approval of the Board of Trustees of the Fund. |

Growth of an Assumed $10,000 Investment as of March 31, 2025 - Class A1

The graphs do not reflect the deduction of taxes, such as state and local income taxes or capital gains taxes that a shareholder may pay on Fund distributions or the redemptions of Fund shares.

10

Leverage and Holdings

Leverage

| Effective Leverage | 28.61% | |||

| Regulatory Leverage | 27.63% |

Fund Allocation

(% of net assets)

| Municipal Bonds | 140.6% | |||

| Variable Rate Senior Loan Interests | 0.0% | |||

| Other Assets & Liabilities, Net | 1.8% | |||

| Borrowings | (2.5)% | |||

| Floating Rate Obligations | (1.9)% | |||

| MFP Shares, Net | (38.0)% | |||

| Net Assets |

100% |

Bond Credit Quality

(% of total investments)

| AA | 1.0 | % | ||

| A | 1.3 | % | ||

| BBB | 2.6 | % | ||

| BB or Lower | 13.9 | % | ||

| N/R (not rated) | 81.2 | % | ||

| Total |

100 | % |

Portfolio Composition

(% of total investments)

| Tax Obligation/Limited | 39.0 | % | ||

| Education and Civic Organizations | 16.9 | % | ||

| Transportation | 11.3 | % | ||

| Long-Term Care | 9.2 | % | ||

| Consumer Staples | 6.0 | % | ||

| Industrials | 6.0 | % | ||

| Housing/Multifamily | 5.0 | % | ||

| Other | 6.6 | % | ||

| Variable Rate Senior Loan Interests | 0.0 | % | ||

| Total |

100 | % |

States and Territories1

(% of total municipal bonds)

| Colorado | 16.5 | % | ||

| Wisconsin | 14.8 | % | ||

| Florida | 13.1 | % | ||

| Texas | 8.0 | % | ||

| California | 7.5 | % | ||

| New York | 6.3 | % | ||

| Utah | 4.0 | % | ||

| Ohio | 3.7 | % | ||

| Illinois | 2.2 | % | ||

| Arkansas | 2.1 | % | ||

| Pennsylvania | 2.0 | % | ||

| District of Columbia | 1.7 | % | ||

| Alabama | 1.6 | % | ||

| Arizona | 1.6 | % | ||

| Missouri | 1.6 | % | ||

| Other | 13.3 | % | ||

| Total |

100 | % |

| 1 | See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above. |

11

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below include the interest and related expenses from inverse floaters that are reflected in the financial statements later within this report, when applicable.

The examples are based on an investment of $10,000 invested at the beginning and held for the entire reporting period. The examples are also based on the Fund’s actual expenses, which may vary from the expense rates shown in the Fund’s prospectus.

What were the Fund’s costs for the last year? (based on a hypothetical $10,000 investment)

| Cost of a $10,000 investment |

Cost paid as a percentage of $10,000 investment |

|||||||

| Class A1 Shares |

$389 | 3.75% | ||||||

| Class A2 Shares |

$364 | 3.51% | ||||||

| Class I Shares |

$312 | 3.00% | ||||||

12

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Nuveen Enhanced High Yield Municipal Bond Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Nuveen Enhanced High Yield Municipal Bond Fund (the “Fund”) as of March 31, 2025, the related statements of operations and cash flows for the year ended March 31, 2025, the statement of changes in net assets for each of the two years in the period ended March 31, 2025, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2025, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period ended March 31, 2025 and the financial highlights for each of the periods indicated therein in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2025 by correspondence with the custodian, agent banks and brokers; when replies were not received from agent banks or brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Chicago, Illinois

May 28, 2025

We have served as the auditor of one or more investment companies in Nuveen Funds since 2002.

13

Portfolio of Investments March 31, 2025

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| LONG-TERM INVESTMENTS - 140.6% | ||||||||||||||||||

| MUNICIPAL BONDS - 140.6% (100.0% of Total Investments) | ||||||||||||||||||

| ALABAMA - 2.3% | ||||||||||||||||||

| $ | 4,000,000 | Hoover Industrial Development Board, Alabama, Environmental Improvement Revenue Bonds, United States Steel Corporation Proejcet, Series 2019, (AMT) | 5.750% | 10/01/49 | $ | 4,167,039 | ||||||||||||

| 650,000 | (a) | Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024, (UB) | 5.250 | 10/01/49 | 670,707 | |||||||||||||

| 425,000 | (a) | Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024, (UB) | 5.500 | 10/01/53 | 444,684 | |||||||||||||

| 250,000 | MidCity Improvement District, Alabama, Special Assessment Revenue Bonds, Series 2022 | 4.750 | 11/01/49 | 214,624 | ||||||||||||||

| 500,000 | MidCity Improvement District, Alabama, Special Assessment Revenue Bonds, Series 2024 | 6.500 | 11/01/44 | 478,332 | ||||||||||||||

| 550,000 | MidCity Improvement District, Alabama, Special Assessment Revenue Bonds, Series 2024 | 6.750 | 11/01/53 | 520,749 | ||||||||||||||

| 4,850,000 | Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024A, (AMT) | 5.000 | 06/01/54 | 4,800,263 | ||||||||||||||

| 2,220,000 | (b) | Montgomery Medical Clinic Board, Alabama, Health Care Facility Revenue Bonds, Jackson Hospital & Clinic, Series 2015 | 5.000 | 03/01/36 | 1,393,050 | |||||||||||||

| 3,790,000 | (c) | Tuscaloosa County Industrial Development Authority, Alabama, Gulf Opportunity Zone Bonds, Hunt Refining Project, Refunding Series 2019A |

5.250 | 05/01/44 | 3,830,243 | |||||||||||||

|

|

|

|||||||||||||||||

| TOTAL ALABAMA | 16,519,691 | |||||||||||||||||

|

|

||||||||||||||||||

| ARIZONA - 2.2% | ||||||||||||||||||

| 2,000,000 | (c) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Heritage Academy - Gateway and Laveen Pojects, Series 2021B | 5.000 | 07/01/51 | 1,784,003 | |||||||||||||

| 1,800,000 | (c) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Heritage Academy - Gateway and Laveen Pojects, Taxable Series 2021A | 5.000 | 07/01/51 | 1,605,603 | |||||||||||||

| 2,000,000 | (c) | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Leman Academy of Excellence - Parker Colorado Campus Project, Series 2019A | 5.000 | 07/01/49 | 1,878,590 | |||||||||||||

| 2,500,000 | (c) | Arizona Industrial Development Authority, Arizona, Hotel Revenue Bonds, Provident Group ? Falcon Properties LLC, Project, Senior Series 2022A-1 | 4.000 | 12/01/41 | 1,948,899 | |||||||||||||

| 110,000 | (c) | Arizona Industrial Development Authority, Arizona, Hotel Revenue Bonds, Provident Group ? Falcon Properties LLC, Project, Senior Series 2022A-1 | 4.150 | 12/01/57 | 75,198 | |||||||||||||

| 100,000 | (c) | Arizona Industrial Development Authority, Arizona, Hotel Revenue Bonds, Provident Group ? Falcon Properties LLC, Project, Subordinate Series 2022B | 5.750 | 12/15/57 | 74,701 | |||||||||||||

| 150,000 | Estrella Mountain Ranch Community Facilities District, Goodyear, Arizona, Special Assessment Revenue Bonds, Montecito Assessment District 3, Series 2021 | 3.750 | 07/01/46 | 108,834 | ||||||||||||||

| 3,100,000 | (c) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Sun Valley Academy, Series 2024A | 6.625 | 07/01/59 | 3,195,287 | |||||||||||||

| 1,000,000 | (c) | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Sun Valley Academy, Series 2024A | 6.750 | 07/01/63 | 1,034,539 | |||||||||||||

| 1,655,000 | Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Villa Montessori, Inc Project, Series 2023A | 5.500 | 07/01/53 | 1,637,833 | ||||||||||||||

| 250,000 | (d) | Sierra Vista Industrial Development Authority, Arizona, Economic Development Revenue Bonds, Convertible Capital Appreciation Revenue Bonds, Series 2021A | 0.000 | 10/01/56 | 204,098 | |||||||||||||

| 500,000 | Sierra Vista Industrial Development Authority, Arizona, Economic Development Revenue Bonds, Convertible Capital Appreciation Revenue Bonds, Series 2022A | 7.000 | 10/01/56 | 495,774 | ||||||||||||||

| 500,000 | (c) | Sierra Vista Industrial Development Authority, Arizona, Education Facility Revenue Bonds, American Leadership Academy Project, Series 2024 | 5.000 | 06/15/64 | 465,583 | |||||||||||||

| 14 | See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| ARIZONA (continued) | ||||||||||||||||||

| $ | 1,000,000 | (c) | Tempe Industrial Development Authority, Arizona, Revenue Bonds, Mirabella at ASU Project, Series 2017A | 6.125% | 10/01/47 | $ | 652,128 | |||||||||||

| 1,400,000 | (c) | Tempe Industrial Development Authority, Arizona, Revenue Bonds, Mirabella at ASU Project, Series 2017A |

6.125 | 10/01/52 | 888,177 | |||||||||||||

|

|

|

|||||||||||||||||

| TOTAL ARIZONA | 16,049,247 | |||||||||||||||||

|

|

||||||||||||||||||

| ARKANSAS - 3.0% | ||||||||||||||||||

| 4,000,000 | (c) | Arkansas Development Finance Authority, Arkansas, Environmental Improvement Revenue Bonds, United States Steel Corporation, Green Series 2022, (AMT) | 5.450 | 09/01/52 | 4,098,581 | |||||||||||||

| 1,000,000 | Arkansas Development Finance Authority, Arkansas, Environmental Improvement Revenue Bonds, United States Steel Corporation, Green Series 2023, (AMT) | 5.700 | 05/01/53 | 1,039,267 | ||||||||||||||

| 4,500,000 | (c) | Arkansas Development Finance Authority, Charter School Revenue Bonds, Academy of Math and Science - Little Rock Project Series 2024A | 7.000 | 07/01/59 | 4,241,682 | |||||||||||||

| 9,750,000 | (c) | Arkansas Development Finance Authority, Industrial Development Revenue Bonds, Big River Steel Project, Series 2019, (AMT) | 4.500 | 09/01/49 | 9,294,629 | |||||||||||||

| 3,000,000 | (c) | Arkansas Development Finance Authority, Industrial Development Revenue Bonds, Big River Steel Project, Series 2020A, (AMT) |

4.750 | 09/01/49 | 2,895,838 | |||||||||||||

|

|

|

|||||||||||||||||

| TOTAL ARKANSAS | 21,569,997 | |||||||||||||||||

|

|

||||||||||||||||||

| CALIFORNIA - 10.6% | ||||||||||||||||||

| 2,000,000 | (c) | California Community Housing Agency, California, Essential Housing Revenue Bonds, Creekwood, Series 2021A | 4.000 | 02/01/56 | 1,291,158 | |||||||||||||

| 4,725,000 | (c) | California Community Housing Agency, California, Essential Housing Revenue Bonds, Serenity at Larkspur Apartments, Series 2020A | 5.000 | 02/01/50 | 3,468,385 | |||||||||||||

| 12,300,000 | (c) | California Community Housing Agency, Workforce Housing Revenue Bonds, Annadel Apartments, Series 2019A | 5.000 | 04/01/49 | 10,482,845 | |||||||||||||

| 250,000 | (c) | California Enterprise Development Authority, Charter School Revenue Bonds, Norton Science & Language Academy Project, Series 2021 | 4.000 | 07/01/61 | 191,177 | |||||||||||||

| 9,450,000 | (c) | California Infrastructure and Economic Development Bank, Revenue Bonds, Brightline West Passenger Rail Project, Green Bond Series 2025A, (AMT), (Mandatory Put 1/01/35) | 9.500 | 01/01/65 | 9,450,096 | |||||||||||||

| 550,000 | (c) | California Municipal Finance Authority, Revenue Bonds, American Musical and Dramatic Academy Inc. AMDA Inc Project, Taxable Series 2023B | 9.500 | 07/01/30 | 569,958 | |||||||||||||

| 1,400,000 | California Municipal Finance Authority, Revenue Bonds, American Musical and Dramatic Academy Inc., Series 2023A | 7.250 | 07/01/53 | 1,413,076 | ||||||||||||||

| 5,770,000 | California Public Finance Authority, Senior Living Revenue Bonds, The James, Senior Series 2024A | 6.500 | 06/01/54 | 5,552,901 | ||||||||||||||

| 6,000,000 | California Public Finance Authority, Senior Living Revenue Bonds, The James, Senior Series 2024A | 6.375 | 06/01/59 | 5,621,061 | ||||||||||||||

| 1,750,000 | (c) | California School Finance Authority, California, Charter School Revenue Bonds, Alta Public Schools - Obligated Group, Series 2024 | 5.875 | 06/01/54 | 1,647,283 | |||||||||||||

| 1,925,000 | (c) | California School Finance Authority, California, Charter School Revenue Bonds, Alta Public Schools - Obligated Group, Series 2024 | 6.000 | 06/01/64 | 1,800,345 | |||||||||||||

| 250,000 | (c) | California School Finance Authority, California, Charter School Revenue Bonds, Girls Athletic Leadership School Los Angeles Project, Series 2021A | 4.000 | 06/01/51 | 187,209 | |||||||||||||

| 1,360,000 | (c) | California School Finance Authority, California, Charter School Revenue Bonds, Hayward Twin Oaks Montessori Charter School Project, Series 2024A | 6.000 | 06/15/54 | 1,299,107 | |||||||||||||

| 2,765,000 | (c) | California School Finance Authority, California, Charter School Revenue Bonds, Hayward Twin Oaks Montessori Charter School Project, Series 2024A | 6.125 | 06/15/64 | 2,638,761 | |||||||||||||

| 5,000,000 | (c) | California School Finance Authority, Charter School Lease Revenue Bonds, Pathways to College Project, Series 2023A | 7.500 | 06/15/63 | 5,132,879 | |||||||||||||

| See Notes to Financial Statements | 15 |

Portfolio of Investments March 31, 2025 (continued)

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| CALIFORNIA (continued) | ||||||||||||||||||

| $ | 1,380,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Arts in Action Charter Schools - Obligated Group, Series 2020A | 5.000% | 06/01/30 | $ | 1,359,201 | |||||||||||

| 500,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Arts in Action Charter Schools - Obligated Group, Series 2020A | 5.000 | 06/01/59 | 422,296 | |||||||||||||

| 250,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Citizens of the World Charter, Series 2022A | 6.250 | 04/01/52 | 252,991 | |||||||||||||

| 100,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Partnerships to Uplift Communities Project, Refunding Social Series 2023 | 5.500 | 08/01/47 | 103,601 | |||||||||||||

| 250,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Russell Westbrook Why Not? Academy ? Obligated Group, Series 2021A | 4.000 | 06/01/51 | 193,842 | |||||||||||||

| 500,000 | (c) | California School Finance Authority, Charter School Revenue Bonds, Scholarship Prep Public Schools ? Obligated Group, Series 2023A | 6.000 | 06/01/63 | 503,143 | |||||||||||||

| 245,000 | California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2021C | 4.000 | 09/02/51 | 201,759 | ||||||||||||||

| 500,000 | (c) | CMFA Special Finance Agency I, California, Essential Housing Revenue Bonds, The Mix at Center City, Subordinate Series 2021B | 8.000 | 04/01/56 | 370,405 | |||||||||||||

| 250,000 | (c) | CMFA Special Finance Agency, California, Essential Housing Revenue Bonds, Latitude 33, Senior Series 2021A-2 | 4.000 | 12/01/45 | 199,795 | |||||||||||||

| 290,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, 1818 Platinum Triangle-Anaheim, Mezzanine Lien Series 2021B | 4.000 | 04/01/57 | 209,673 | |||||||||||||

| 325,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, 1818 Platinum Triangle-Anaheim, Social Bond Series 2021A-2 | 3.250 | 04/01/57 | 236,930 | |||||||||||||

| 250,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Acacia on Santa Rosa Creek, Mezzanine Lien Series 2021B | 4.000 | 10/01/46 | 197,381 | |||||||||||||

| 305,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Acacia on Santa Rosa Creek, Senior Lien Series 2021A | 4.000 | 10/01/56 | 249,188 | |||||||||||||

| 3,000,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Center City Anaheim, Series 2020A | 5.000 | 01/01/54 | 2,525,603 | |||||||||||||

| 630,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Millennium South Bay-Hawthorne, Mezzanine Lien Series 2021B | 4.000 | 07/01/58 | 348,266 | |||||||||||||

| 250,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Monterrey Station Apartments, Series 2021B | 4.000 | 07/01/58 | 169,927 | |||||||||||||

| 250,000 | (c) | CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Westgate Phase 1-Pasadena Apartments, Mezzanine Lien Series 2021B | 4.000 | 06/01/57 | 76,729 | |||||||||||||

| 5,000,000 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Capital Appreciation Series 2021B-2 | 0.000 | 06/01/66 | 538,461 | ||||||||||||||

| 20,000,000 | Inland Empire Tobacco Securitization Authority, California, Tobacco Settlement Asset-Backed Bonds, Series 2007C-1.Turbo Capital Appreciation | 0.000 | 06/01/36 | 9,326,212 | ||||||||||||||

| 1,000,000 | Kaweah Delta Health Care District, California, Revenue Bonds, Series 2015B | 5.000 | 06/01/40 | 955,029 | ||||||||||||||

| 4,100,000 | Oroville, California, Revenue Bonds, Oroville Hospital Series 2019 | 5.250 | 04/01/54 | 3,193,552 | ||||||||||||||

| 35,000 | Palomar Health System, California, Revenue Bonds, Refunding Series 2017 | 5.000 | 11/01/42 | 27,446 | ||||||||||||||

| 16 | See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| CALIFORNIA (continued) | ||||||||||||||||||

| $ | 15,000,000 | Tobacco Securitization Authority of Southern California, Tobacco Settlement Asset-Backed Bonds, San Diego County Tobacco Asset Securitization Corporation, First Subordinate CABs, Series 2006B |

0.000% | 06/01/46 | $ | 3,702,560 | ||||||||||||

|

|

|

|||||||||||||||||

| TOTAL CALIFORNIA | 76,110,231 | |||||||||||||||||

|

|

||||||||||||||||||

| COLORADO - 23.2% | ||||||||||||||||||

| 2,725,000 | (c) | Aerotropolis Regional Transportation Authority, Colorado, Special Revenue Bonds, Series 2024 | 5.750 | 12/01/54 | 2,812,991 | |||||||||||||

| 3,025,000 | Arista Metropolitan District, Broomfield County, Colorado, General Obligation Limited Tax Bonds, Refunding and Improvement Series 2023B | 8.250 | 12/15/39 | 3,111,449 | ||||||||||||||

| 2,500,000 | Aurora Highlands Community Authority Board, Adams County, Colorado, Special Tax Revenue Bonds, Refunding & Improvement Series 2021A | 5.750 | 12/01/51 | 2,334,614 | ||||||||||||||

| 1,200,000 | Baseline Metropolitan District 1, In the City and County of Broomfield, Colorado, Special Revenue Bonds, Subordinate Series 2024B | 6.750 | 12/15/54 | 1,199,093 | ||||||||||||||

| 4,775,000 | (c) | Bella Mesa Metropolitan District, Castle Rock, Colorado, Limited Tax General Obligation Bonds, Subordinate Series 2024B | 8.000 | 12/15/54 | 4,783,712 | |||||||||||||

| 500,000 | Berthoud-Heritage Metropolitan District 10, Larimer County, Colorado, Limited Tax General Obligation Bonds, Senior Series 2022A | 4.750 | 12/01/52 | 423,307 | ||||||||||||||

| 1,750,000 | Bradley Heights Metropolitan District 2, Colorado Springs, El Paso County, Colorado, General Obligation Limited Tax Bonds, Series 2021A-3 | 4.750 | 12/01/51 | 1,349,253 | ||||||||||||||

| 500,000 | Broadway Station Metropolitan District 2, Denver City and County, Colorado, General Obligation Limited Tax Bonds, Convertible to Unlimited Series 2019A | 5.000 | 12/01/35 | 446,345 | ||||||||||||||

| 1,475,000 | Broadway Station Metropolitan District 2, Denver City and County, Colorado, General Obligation Limited Tax Bonds, Convertible to Unlimited Series 2019A | 5.125 | 12/01/48 | 1,200,791 | ||||||||||||||

| 4,675,000 | Broadway Station Metropolitan District 3, Denver City and County, Colorado, General Obligation Limited Tax Bonds, Convertible to Unlimited Series 2019A | 5.000 | 12/01/49 | 3,645,645 | ||||||||||||||

| 7,872,000 | Broadway Station Metropolitan District 3, Denver County, Colorado, Tax Increment Supported Revenue Bonds, Series 2023A | 7.000 | 12/15/32 | 7,592,849 | ||||||||||||||

| 446,000 | Buffalo Ridge Metropolitan District (In the City of Commerce City), Adams County, Colorado, General Obligation Refunding and Improvement Bonds, Series 2018B | 7.375 | 12/15/47 | 447,234 | ||||||||||||||

| 1,000,000 | Centerra Metropolitan District 1, Loveland, Colorado, Special Revenue Bonds, Refunding & Improvement Series 2020A | 5.000 | 12/01/51 | 914,307 | ||||||||||||||

| 500,000 | Centerra Metropolitan District 1, Loveland, Colorado, Special Revenue Improvement Bonds, Series 2022 | 6.500 | 12/01/53 | 510,094 | ||||||||||||||

| 1,000,000 | Chambers Highpoint Metropolitan District No. 2, Colorado, Limited Tax General Obligation and Special Revenue Bonds, Series 2021 | 5.000 | 12/01/51 | 808,525 | ||||||||||||||

| 140,000 | (c) | Cherry Hills City Metropolitan District, Arapahoe County, Colorado, General Obligation Limited Tax Bonds, Subordinate Series 2020B-3 | 8.000 | 12/15/47 | 129,140 | |||||||||||||

| 500,000 | Citadel on Colfax Business Improvement District, Aurora, Colorado, Special Revenue and Tax Supported Bonds, Senior Series 2020A | 5.350 | 12/01/50 | 471,302 | ||||||||||||||

| 2,000,000 | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Community Leadership Academy, Inc. Second Campus Project, Series 2013 | 7.450 | 08/01/48 | 2,005,945 | ||||||||||||||

| 1,170,000 | (c) | Colorado Educational and Cultural Facilities Authority, Revenue Bonds, Rocky Mountain Classical Academy Project, Refunding Series 2019 | 5.000 | 10/01/59 | 1,084,219 | |||||||||||||

| 3,100,000 | (b) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, American Baptist Homes of the Midwest Obligated Group, Series 2013 | 8.000 | 08/01/43 | 1,977,299 | |||||||||||||

| 117,278 | (b) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Ralston Creek at Arvada Project, Series 2017A | 5.250 | 11/01/32 | 1,759 | |||||||||||||

| See Notes to Financial Statements | 17 |

Portfolio of Investments March 31, 2025 (continued)

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| COLORADO (continued) | ||||||||||||||||||

| $ | 349,229 | (b) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Ralston Creek at Arvada Project, Series 2017A | 5.500% | 11/01/37 | $ | 5,239 | |||||||||||

| 651,547 | (b) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Ralston Creek at Arvada Project, Series 2017A | 5.750 | 11/01/47 | 10,099 | |||||||||||||

| 435,233 | (b) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Ralston Creek at Arvada Project, Series 2017A | 6.000 | 11/01/52 | 6,572 | |||||||||||||

| 500,000 | (b),(c) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sunny Vista Living Center Project, Refunding & Improvement Series 2015A | 5.500 | 12/01/30 | 390,529 | |||||||||||||

| 500,000 | (b),(c) | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sunny Vista Living Center Project, Refunding & Improvement Series 2015A | 6.250 | 12/01/50 | 321,982 | |||||||||||||

| 500,000 | Copperleaf Metropolitan District 6, Arapahoe County, Colorado, Limited Tax, General Obligation Bonds, Subordinate Series 2022B | 6.000 | 12/15/41 | 497,602 | ||||||||||||||

| 2,000,000 | Crossroads Metropolitan District 1, El Paso County, Colorado, Limited Tax General Obligation and Special Revenue Bonds, Series 2022 | 6.500 | 12/01/51 | 1,986,347 | ||||||||||||||

| 1,400,000 | Dawson Trails Metropolitan District 1, Colorado, In The Town of Castle Rock, Limited Tax General Obligation Capital Appreciation Turbo Bonds, Series 2024 | 0.000 | 12/01/31 | 815,687 | ||||||||||||||

| 2,000,000 | DC Metropolitan District, Denver County, Colorado, Limited Tax General Obligation Bonds, Convertible to Unlimited Tax Series 2024A | 5.875 | 12/01/54 | 1,924,676 | ||||||||||||||

| 1,250,000 | DC Metropolitan District, Denver County, Colorado, Limited Tax General Obligation Bonds, Convertible to Unlimited Tax Series 2024B | 8.000 | 12/15/54 | 1,241,015 | ||||||||||||||

| 600,000 | (c) | Falcon Area Water and Wastewater Authority (El Paso County, Colorado), Tap Fee Revenue Bonds, Series 2022A | 6.750 | 12/01/34 | 581,028 | |||||||||||||

| 500,000 | (c) | Glen Metropolitan District 3, El Paso County, Colorado, General Obligation Limited Tax Bonds, Series 2021 | 4.250 | 12/01/51 | 396,371 | |||||||||||||

| 1,277,000 | Grand Avenue Metropolitan District, In the City of Aurora, Arapahoe County, Colorado, Limited Tax General Obligation Bonds, Series 2023 | 8.125 | 12/01/52 | 1,277,168 | ||||||||||||||

| 5,000,000 | Green Valley Ranch East Metropolitan District 6, Adams County, Colorado, Limited Tax General Obligation Bonds, Series 2020A-3 | 5.875 | 12/01/50 | 4,995,462 | ||||||||||||||

| 1,185,000 | Haymeadow Metropolitan District 1, Eagle County, Colorado, General Obligation Bonds, Limited Tax Subordinate Series 2025B | 8.375 | 12/15/49 | 1,176,990 | ||||||||||||||

| 1,000,000 | Haymeadow Metropolitan District 1, Eagle County, Colorado, General Obligation Bonds, Subordinate Limited Tax Series 2025A | 6.125 | 12/01/54 | 1,003,230 | ||||||||||||||

| 1,335,000 | Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 1, Series 2024A-1 | 6.000 | 12/01/43 | 1,358,817 | ||||||||||||||

| 585,000 | (c) | Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 2, Series 2024 | 5.500 | 12/01/44 | 571,159 | |||||||||||||

| 1,000,000 | (c) | Kremmling Memorial Hospital District, Colorado, Certificates of Participation, Series 2024 | 6.625 | 12/01/56 | 965,278 | |||||||||||||

| 2,000,000 | Lakota Pointe Metropolitan District 1, Winter Park, Colorado, Limited Tax General Obligation Bonds, Series 2025A | 6.000 | 12/01/55 | 2,010,673 | ||||||||||||||

| 1,185,000 | Lakota Pointe Metropolitan District 1, Winter Park, Colorado, Limited Tax General Obligation Bonds, Subordinate Series 2025B | 8.250 | 12/15/55 | 1,190,993 | ||||||||||||||

| 1,000,000 | (c) | Ledge Rock Center Commercial Metropolitan District (In the Town of Johnstown, Weld County, Colorado), Limited Tax General Obligation Bonds, Series 2022 | 7.375 | 11/01/52 | 1,007,839 | |||||||||||||

| 500,000 | Ledge Rock Center Residential Metropolitan District 1, Weld County, Colorado, Limited Tax General Obligation Bonds, Series 2024A | 6.375 | 12/01/54 | 504,029 | ||||||||||||||

| 1,000,000 | Legato Community Authority, Colorado, Commerce City Colorado Limited Tax Supported Revenue Bonds District 12 3 & 7 Convertible Capital Appreciation Series 2021A-2 | 5.000 | 12/01/51 | 752,948 | ||||||||||||||

| 18 | See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| COLORADO (continued) | ||||||||||||||||||

| $ | 535,000 | Lochbuie Station Metropolitan District, Colorado, General Obligation Limited Tax Bonds, Subordinate General Obligation Limited Tax Bonds, Series 2020B | 6.250% | 12/15/44 | $ | 529,858 | ||||||||||||

| 500,000 | (c) | Mineral Business Improvement District, Arapahoe County, Colorado, General Obligation and Special Revenue Bonds, Limited Tax Series 2024A | 5.750 | 12/01/54 | 505,449 | |||||||||||||

| 1,000,000 | Mirabelle Metropolitan District 2, Douglas County, Colorado, Limited Tax General Obligation Bonds, Subordinate Series 2025B | 6.125 | 12/15/49 | 1,001,759 | ||||||||||||||

| 500,000 | Mountain Brook Metropolitan District, Longmont, Boulder County, Colorado, Limited Tax General Obligation Bonds, Series 2021 | 4.750 | 12/01/51 | 402,464 | ||||||||||||||

| 1,000,000 | Mulberry Metropolitan District 2, Fort Collins, Colorado, Limited Tax General Obligation Bonds, Series 2022A | 7.000 | 12/01/52 | 1,023,342 | ||||||||||||||

| 500,000 | North Pine Vistas Metropolitan District 3, Castle Pines, Douglas County, Colorado, Limited Tax General Obligation Bonds, Subordinate Series 2021B - AGM Insured | 4.625 | 12/15/51 | 415,523 | ||||||||||||||

| 2,000,000 | North Range Metropolitan District 3, Adams County, Colorado, Limited Tax General Obligation Bonds, Series 2020A-3 | 5.250 | 12/01/50 | 2,001,751 | ||||||||||||||

| 2,175,000 | (c) | Old Towne Metropolitan District, Douglas County, Colorado, General Obligation Bonds, Refunding and Improvement Limited Tax Series 2024 | 6.000 | 12/01/53 | 2,063,174 | |||||||||||||

| 2,500,000 | (c) | Orchard Park Place South Metropolitan District, Adams County, Colorado, General Obligation Bonds, Limited Tax Series 2024 | 6.000 | 12/01/54 | 2,444,886 | |||||||||||||

| 1,500,000 | Painted Prairie Public Improvement Authority, Aurora, Colorado, Special Revenue Bonds, Series 2019 | 5.000 | 12/01/49 | 1,342,907 | ||||||||||||||

| 2,005,000 | (c),(d) | Palisade Metropolitan District 2, Broomfield County, Colorado, General Obligation Limited Tax Bonds, Refunding Subordinate Convertible Capital Appreciation Series 2024B | 0.000 | 12/15/54 | 1,829,895 | |||||||||||||

| 1,215,000 | (c) | Palisade Metropolitan District 2, Broomfield County, Colorado, General Obligation Limited Tax Bonds, Second Subordinate Series 2024C | 8.000 | 12/15/37 | 1,210,048 | |||||||||||||

| 1,000,000 | Peak Metropolitan District 3, Colorado Springs, El Paso County, Colorado, Limited Tax General Obligation Bonds, Series 2022A-1 | 7.500 | 12/01/52 | 1,007,235 | ||||||||||||||

| 500,000 | Pinery Commercial Metropolitan District 2, Douglas County, Colorado, Special Revenue Bonds, Series 2025 | 5.750 | 12/01/54 | 501,169 | ||||||||||||||

| 2,486,000 | Pioneer Community Authority Board (Weld County, Colorado), Special Revenue Bonds, Series 2022 | 6.500 | 12/01/34 | 2,382,984 | ||||||||||||||

| 500,000 | (c) | Prairie Song Metropolitan District 4, Windsor, Colorado, Limited Tax General Obligation Bonds, Series 2021 | 6.000 | 12/01/51 | 454,895 | |||||||||||||

| 1,310,000 | (c) | Pueblo Urban Renewal Authority, Colorado, Tax Increment Capital Appreciation Revenue Bonds, EVRAZ Project, Series 2021A and Tax Increment Revenue Capital Appreciation Bonds, Series 2021B | 0.000 | 12/01/25 | 1,265,021 | |||||||||||||

| 6,015,000 | (c) | Pueblo Urban Renewal Authority, Colorado, Tax Increment Revenue Bonds, EVRAZ Project, Series 2021A | 4.750 | 12/01/45 | 5,188,207 | |||||||||||||

| 1,100,000 | (c) | Reagan Ranch Metropolitan District 1, Colorado Springs, Colorado, General Obligation Bonds, Limited Tax & Special Revenue, Series 2025 | 6.125 | 12/01/54 | 1,065,299 | |||||||||||||

| 1,000,000 | Reagan Ranch Metropolitan District 1, Colorado Springs, Colorado, General Obligation Bonds, Limited Tax Series 2021-3 | 5.375 | 12/01/51 | 867,424 | ||||||||||||||

| 1,000,000 | Red Barn Metropolitan District, Mead, Colorado, Weld County, Colorado, General Obligation Bond, Limited Tax Convertible to Unlimited Tax, Refunding and Improvement, Series 2025A | 5.500 | 12/01/55 | 976,023 | ||||||||||||||

| 1,000,000 | Redtail Ridge Metropolitan District, City of Louisville, Boulder County, Colorado, General Obligation Limited Tax Capital Appreciation Turbo Bonds, Series 2025 | 0.000 | 12/01/32 | 588,312 | ||||||||||||||

| 1,070,000 | (c) | Ridge at Johnstown Metropolitan District 8, Larimer County, Colorado, Special Assessment Revenue Bonds, Special Improvement District 1, Series 2024 | 5.875 | 12/01/44 | 1,021,235 | |||||||||||||

| 657,000 | Ritoro Metropolitan District In the Town of Elizabeth, Elbert County, Colorado, Limited Tax General Obligation Bonds, Subordinate Refunding Series 2025B | 6.250 | 12/15/57 | 648,206 | ||||||||||||||

| 1,250,000 | Riverwalk Metropolitan District 2, Glendale, Arapahoe County, Colorado, Special Revenue Bonds, Series 2022A | 5.000 | 12/01/42 | 1,125,970 | ||||||||||||||

| See Notes to Financial Statements | 19 |

Portfolio of Investments March 31, 2025 (continued)

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| COLORADO (continued) | ||||||||||||||||||

| $ | 1,370,000 | RM Mead Metropolitan District, Weld County, Colorado, Limited Tax General Obligation Bonds, Series 2020A | 5.250% | 12/01/50 | $ | 1,311,987 | ||||||||||||

| 500,000 | RRC Metropolitan District 2, Jefferson County, Colorado, Limited Tax General Obligation Bonds, Series 2021 | 5.250 | 12/01/51 | 432,053 | ||||||||||||||

| 750,000 | Sagebrush Farm Metropolitan District 1, Aurora, Adams County, Colorado, General Obligation Limited Tax Bonds, Series 2022A | 6.375 | 12/01/42 | 786,142 | ||||||||||||||

| 2,545,000 | Sagebrush Farm Metropolitan District 1, Aurora, Adams County, Colorado, General Obligation Limited Tax Bonds, Subordinate Series 2024 | 8.000 | 12/15/54 | 2,551,468 | ||||||||||||||

| 1,000,000 | (c) | Saint Vrain Lakes Metropolitan District 4, Weld County, Colorado, General Obligation Bonds, Firestone Subordinate Limited Tax Series 2024B | 8.750 | 09/20/54 | 993,858 | |||||||||||||

| 500,000 | Senac South Metropolitan District No. 1, Aurora, Colorado, General Obligation Bonds, Limited Tax Series 2021A(3) | 5.250 | 12/01/51 | 445,503 | ||||||||||||||

| 500,000 | Siena Lake Metropolitan District, Gypsum, Colorado, General Obligation Limited Tax Bonds, Series 2021 | 4.000 | 12/01/51 | 367,562 | ||||||||||||||

| 1,500,000 | (c) | Sky Ranch Community Authority Board (Arapahoe County, Colorado), Limited Tax Supported District No. 3 Senior Bonds (Tax-Exempt Fixed Rate), Series 2022A and Subordinate Bonds (Tax-Exempt Fixed Rate), Series 2022B(3) | 5.750 | 12/01/52 | 1,430,431 | |||||||||||||

| 500,000 | (c),(d) | St. Vrain Lakes Metropolitan District 4, Weld County, Colorado, General Obligation Bonds, Firestone Convertible Capital Appreciation Limited Tax Series 2024A | 0.000 | 09/20/54 | 339,060 | |||||||||||||

| 675,000 | St. Vrain Lakes Metropolitan District No. 2, Weld County, Colorado, Limited Tax General Obligation Bonds, Refunding and Improvement Series 2024B | 6.375 | 11/15/54 | 693,987 | ||||||||||||||

| 600,000 | Sterling Ranch Community Authority Board, Douglas County, Colorado, Limited Tax Supported and Special Revenue Bonds, Special District 4, Series 2024A | 6.500 | 12/01/54 | 616,432 | ||||||||||||||

| 975,000 | Sterling Ranch Community Authority Board, Douglas County, Colorado, Limited Tax Supported and Special Revenue Bonds, Special District 4, Series 2024B | 8.750 | 12/15/54 | 982,996 | ||||||||||||||

| 648,000 | (c) | Sunset Parks Metropolitan District, Weld County, Colorado, General Obligation Bonds, Limited Tax Subordinate Series 2024B | 7.625 | 12/15/54 | 641,831 | |||||||||||||

| 500,000 | (c) | Third Creek Metropolitan District 1, Commerce City, Colorado, Limited Tax General Obligation Bonds, Series 2022A-1 | 4.750 | 12/01/51 | 394,888 | |||||||||||||

| 500,000 | Trails at Crowfoot Metropolitan District 3, Parker, Colorado, Limited Tax General Obligation Bonds, Refunding Series 2024B | 6.875 | 12/15/52 | 494,669 | ||||||||||||||

| 1,000,000 | Transport Metropolitan District 3, In the City of Aurora, Adams County, Colorado, General Obligation Limited Bonds, Series 2021A-1 | 4.125 | 12/01/31 | 909,473 | ||||||||||||||

| 5,700,000 | Transport Metropolitan District 3, In the City of Aurora, Adams County, Colorado, General Obligation Limited Bonds, Series 2021A-1 | 5.000 | 12/01/41 | 4,858,185 | ||||||||||||||

| 7,960,000 | Transport Metropolitan District 3, In the City of Aurora, Adams County, Colorado, General Obligation Limited Bonds, Series 2021A-1 | 5.000 | 12/01/51 | 6,187,412 | ||||||||||||||

| 3,000,000 | (c) | Tree Farm Metropolitan District, Eagle County, Colorado, General Obligation Limited Tax Bonds, Series 2021 | 4.750 | 12/01/50 | 2,588,595 | |||||||||||||

| 3,000,000 | (c) | USAFA Visitor?s Center Business Improvement District, Colorado Springs, Colorado, Special Revenue Bonds, Series 2022A, | 5.000 | 12/01/52 | 2,656,636 | |||||||||||||

| 500,000 | (d) | Verve Metropolitan District 1, Jefferson County and the City and County of Broomfield, Colorado, General Obligation Bonds, Convertible Capital Appreciation Improvement Series 2024A | 0.000 | 12/01/54 | 360,724 | |||||||||||||

| 2,250,000 | Verve Metropolitan District 1, Jefferson County and the City and County of Broomfield, Colorado, General Obligation Bonds, Refunding and Improvement Limited Tax Series 2021 | 5.000 | 12/01/41 | 1,986,855 | ||||||||||||||

| 500,000 | Villages at Johnstown Metropolitan District 7, Johnstown, Colorado, Limited Tax General Obligation Bonds, Series 2022A(3) | 6.250 | 12/01/52 | 505,027 | ||||||||||||||

| 500,000 | West Globeville Metropolitan District 1, Denver, Colorado, General Obligation Limited Tax Bonds, Series 2022 | 6.750 | 12/01/52 | 477,797 | ||||||||||||||

| 3,000,000 | (c) | West Globeville Metropolitan District 1, Denver, Colorado, General Obligation Limited Tax Bonds, Series 2024A-2 | 8.000 | 12/01/54 | 1,746,183 | |||||||||||||

| 20 | See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| COLORADO (continued) | ||||||||||||||||||

| $ | 1,625,000 | Westerly Metropolitan District 4, Weld County, Colorado, General Obligation Limited Tax Bonds, Series 2021A-1 | 5.000% | 12/01/50 | $ | 1,569,926 | ||||||||||||

| 2,500,000 | Westgate Metropolitan District, Colorado Springs, El Paso County, Colorado, General Obligation Limited Tax Bonds, Series 2022 | 5.125 | 12/01/51 | 2,099,142 | ||||||||||||||

| 500,000 | (c) | Westwood Metropolitan District, Thornton, Adams County, Colorado, Limited Tax General Obligation Bonds, Senior Series 2021A | 4.000 | 12/01/51 | 376,727 | |||||||||||||

| 1,146,000 | (c) | Willow Springs Ranch Metropolitan District, Monument, El Paso County, Colorado, Limited Tax General Obligation Bonds, Subordinate Series 2024B | 6.500 | 10/15/54 | 1,134,951 | |||||||||||||

| 5,000,000 | (c),(d) | Windler Public Improvement Authority, Aurora, Colorado, Limited Tax Supported Revenue Bonds, Convertible Capital Appreciation Series 2021A-2 | 0.000 | 12/01/41 | 3,513,586 | |||||||||||||

| 24,250,000 | (c) | Windler Public Improvement Authority, Aurora, Colorado, Limited Tax Supported Revenue Bonds, Convertible Capital Appreciation Series 2021A-2 | 4.625 | 12/01/51 | 15,456,058 | |||||||||||||

| 2,250,000 | (c) | Windler Public Improvement Authority, Aurora, Colorado, Limited Tax Supported Revenue Bonds, Series 2021A-1 | 4.000 | 12/01/36 | 2,003,541 | |||||||||||||

| 3,000,000 | (c) | Windler Public Improvement Authority, Aurora, Colorado, Limited Tax Supported Revenue Bonds, Series 2021A-1 | 4.000 | 12/01/41 | 2,475,784 | |||||||||||||

| 11,750,000 | (c) | Windler Public Improvement Authority, Aurora, Colorado, Limited Tax Supported Revenue Bonds, Series 2021A-1 | 4.125 | 12/01/51 | 8,998,343 | |||||||||||||

|

|

|

|||||||||||||||||

| TOTAL COLORADO | 166,492,454 | |||||||||||||||||

|

|

||||||||||||||||||

| CONNECTICUT - 1.1% | ||||||||||||||||||

| 3,550,000 | Connecticut Development Authority, Airport Facilities Revenue Bonds, Learjet Inc., Series 2004, (AMT) | 7.950 | 04/01/26 | 3,550,895 | ||||||||||||||

| 4,000,000 | (c) | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Mary Wade Home Issue, Series 2019A-1 | 5.000 | 10/01/54 | 3,084,141 | |||||||||||||

| 1,500,000 | (e) | Stamford Housing Authority, Connecticut, Revenue Bonds, Mozaic Concierge Living Project, Series 2025A | 6.250 | 10/01/60 | 1,511,182 | |||||||||||||

| 100,000 | (c) | Steel Point Infrastructure Improvement District, Connecticut, Special Obligation Revenue Bonds, Steelpointe Harbor Project, Series 2024 | 6.000 | 04/01/52 | 106,211 | |||||||||||||

|

|

|

|||||||||||||||||

| TOTAL CONNECTICUT | 8,252,429 | |||||||||||||||||

|

|

||||||||||||||||||

| DELAWARE - 0.1% | ||||||||||||||||||

| 1,100,000 | Delaware Economic Development Authority, Revenue Bonds, ASPIRA of Delaware Charter Operations, Inc. Project, Series 2016A | 5.000 | 06/01/51 | 1,035,071 | ||||||||||||||

|

|

|

|||||||||||||||||

| TOTAL DELAWARE | 1,035,071 | |||||||||||||||||

|

|

||||||||||||||||||

| DISTRICT OF COLUMBIA - 2.4% | ||||||||||||||||||

| 300,000 | District of Columbia Revenue Bonds, Rocketship Education DC Public Charter School Inc., Obligated Group -Issue 3, Series 2024A | 5.750 | 06/01/54 | 304,992 | ||||||||||||||

| 64,000,000 | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2006A | 0.000 | 06/15/46 | 16,277,446 | ||||||||||||||

| 3,335,000 | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2006C | 0.000 | 06/15/55 | 337,421 | ||||||||||||||

|

|

|

|||||||||||||||||

| TOTAL DISTRICT OF COLUMBIA | 16,919,859 | |||||||||||||||||

|

|

||||||||||||||||||

| FLORIDA - 18.4% | ||||||||||||||||||

| 250,000 | (c) | Alachua County Health Facilities Authority, Florida, Health Facilities Revenue Bonds, Terraces at Bonita Springs Project, Refunding Series 2022A | 5.000 | 11/15/61 | 184,300 | |||||||||||||

| 200,000 | Avenir Community Development District, Palm Beach Gardens, Florida, Special Assessment Bonds, Area 3 - Master Infrastructure Project, Series 2023 | 5.625 | 05/01/54 | 202,430 | ||||||||||||||

| 250,000 | (c) | Babcock Ranch Community Independent Special District, Charlotte County, Florida, Special Assessment Bonds, 2024 Project Series 2024 | 5.250 | 05/01/55 | 243,530 | |||||||||||||

| 2,500,000 | (c) | Capital Trust Agency, Florida, Educational Facilities Revenue Bonds, LLT Academy South Bay Project, Series 2020A | 6.000 | 06/15/55 | 2,525,827 | |||||||||||||

| See Notes to Financial Statements | 21 |

Portfolio of Investments March 31, 2025 (continued)

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| FLORIDA (continued) | ||||||||||||||||||

| $ | 15,020,000 | (c) | Capital Trust Agency, Florida, Revenue Bonds, Educational Growth Fund, LLC, Charter School Portfolio Projects, Subordinate Series 2021B | 0.000% | 07/01/61 | $ | 1,014,227 | |||||||||||

| 1,345,000 | (c) | Capital Trust Agency, Florida, Revenue Bonds, Viera Charter School Project, Series 2019A | 5.000 | 10/15/54 | 1,279,152 | |||||||||||||

| 250,000 | (c) | Capital Trust Agency, Florida, Senior Living Facilities Revenue Bonds, Elim Senior Housing, Inc. Project, Series 2017 | 5.375 | 08/01/32 | 236,667 | |||||||||||||

| 175,000 | (c) | Capital Trust Agency, Florida, Senior Living Facilities Revenue Bonds, Elim Senior Housing, Inc. Project, Series 2017 | 5.625 | 08/01/37 | 161,908 | |||||||||||||

| 1,000,000 | (c) | Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, Babcock Neighborhood School Inc Project, Series 2024 | 6.000 | 08/15/63 | 961,562 | |||||||||||||

| 500,000 | (c) | Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, Imagine School at West Pasco Project, Series 2023A | 6.500 | 12/15/53 | 501,308 | |||||||||||||

| 4,100,000 | (c) | Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, Imagine School at West Pasco Project, Series 2023A | 6.500 | 12/15/58 | 4,100,425 | |||||||||||||

| 1,750,000 | (c) | Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, IPS Enterprises, Inc. Projects, Refunding Series 2023A | 6.250 | 06/15/53 | 1,806,511 | |||||||||||||

| 2,600,000 | (c) | Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, IPS Enterprises, Inc. Projects, Refunding Series 2023A | 6.375 | 06/15/58 | 2,692,579 | |||||||||||||

| 1,890,000 | (b) | Celebration Pointe Community Development District 1, Alachua County, Florida, Special Assessment Revenue Bonds, Series 2021 | 4.000 | 05/01/53 | 1,495,878 | |||||||||||||

| 250,000 | (c) | Curiosity Creek Community Development District, Manatee County, Florida, Capital Improvement Revenue Bonds, Assessment Area 1, Series 2024 | 5.700 | 05/01/55 | 244,876 | |||||||||||||

| 500,000 | Edgewater West Community Development District, Osceola County, Florida, Special Assessment Revenue Bonds, Assessment Area One Series 2024 | 5.500 | 05/01/54 | 477,231 | ||||||||||||||

| 1,200,000 | (c) | Everlands Community Development District, Florida, Special Assessment Revenue Bonds, Assessment Area 2 Series 2024 | 5.500 | 06/15/54 | 1,174,688 | |||||||||||||

| 1,000,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Creative Inspiration Journey School of St. Cloud, Series 2021A | 5.000 | 06/15/51 | 884,833 | |||||||||||||

| 4,600,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Creative Inspiration Journey School of St. Cloud, Series 2021A | 5.000 | 06/15/56 | 3,985,832 | |||||||||||||

| 1,420,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Discovery High School Project, Series 2020A | 5.000 | 06/01/40 | 1,138,868 | |||||||||||||

| 100,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Dreamers Academy Project, Series 2022A | 6.000 | 01/15/57 | 92,986 | |||||||||||||

| 625,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Global Outreach Charter Academy, Series 2021A | 4.000 | 06/30/36 | 530,811 | |||||||||||||

| 765,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Global Outreach Charter Academy, Series 2021A | 4.000 | 06/30/41 | 596,100 | |||||||||||||

| 1,000,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Pepin Academies of Pasco County Inc., Series 2020A | 5.000 | 01/01/50 | 846,269 | |||||||||||||

| 500,000 | (c) | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Southwest Charter Foundation Inc Projects, Series 2017A | 6.125 | 06/15/47 | 501,285 | |||||||||||||

| 1,400,000 | (c) | Florida Development Finance Corporation, Florida, Solid Waste Disposal Revenue Bonds, Waste Pro USA, Inc. Project, Series 2023, (AMT), (Mandatory Put 7/01/26) | 6.125 | 07/01/32 | 1,426,255 | |||||||||||||

| 31,400,000 | (c) | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024, (AMT), (Mandatory Put 7/15/28) | 12.000 | 07/15/32 | 33,313,645 | |||||||||||||

| 1,800,000 | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024, (AMT) | 5.000 | 07/01/41 | 1,751,627 | ||||||||||||||

| 2,300,000 | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024 - AGM Insured, (AMT) | 5.250 | 07/01/47 | 2,348,515 | ||||||||||||||

| 22 | See Notes to Financial Statements |

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| FLORIDA (continued) | ||||||||||||||||||

| $ | 2,465,000 | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024 - AGM Insured, (AMT) | 5.250% | 07/01/53 | $ | 2,512,001 | ||||||||||||

| 1,500,000 | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024, (AMT) | 5.500 | 07/01/53 | 1,515,693 | ||||||||||||||

| 4,000,000 | (c) | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Series 2024A, (AMT), (Mandatory Put 7/15/28) | 10.000 | 07/15/59 | 4,120,327 | |||||||||||||

| 12,000,000 | (c) | Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A, (AMT), (Mandatory Put 8/13/25) | 8.250 | 07/01/57 | 12,461,914 | |||||||||||||

| 3,040,000 | (c) | Florida Development Finance Corporation, Student Housing Revenue Bonds, SPP - Tampa I - LLC The Henry Project, Series 2024B | 6.500 | 06/01/59 | 3,084,655 | |||||||||||||

| 1,975,000 | Florida Housing Finance Corporation, Multifamily Mortgage Revenue Bonds, Brookside Square Apartments, Series 2015J, (Mandatory Put 6/01/32) | 5.000 | 06/01/57 | 1,858,224 | ||||||||||||||

| 250,000 | Hobe-Saint Lucie Conservancy District, Florida, Special Assessment Revenue Bonds, Improvement Unit 1A, Series 2024 | 5.875 | 05/01/55 | 254,382 | ||||||||||||||

| 730,000 | (c) | Kelly Park Community Development District, Florida, Special Assessment Revenue Bonds, Assessment Area One Project Series 2023 | 6.250 | 11/01/53 | 750,914 | |||||||||||||

| 1,210,000 | Lake County, Florida Retirement Facility Revenue Bonds, Lakeside at Waterman Village Project, Series 2020A | 5.750 | 08/15/50 | 1,188,953 | ||||||||||||||

| 1,000,000 | Lake County, Florida Retirement Facility Revenue Bonds, Lakeside at Waterman Village Project, Series 2020A | 5.750 | 08/15/55 | 969,906 | ||||||||||||||

| 1,405,000 | Lakewood Ranch Stewardship District, Florida, Special Assessment Revenue Bonds, Taylor Ranch Project, Series 2023 | 6.300 | 05/01/54 | 1,472,207 | ||||||||||||||

| 2,850,000 | (c) | Lee County Industrial Development Authority, Florida, Charter School Revenue Bonds, Lee County Community Charter Schools, Series 2024A | 6.250 | 06/15/42 | 2,882,837 | |||||||||||||

| 405,000 | (c) | LTC Ranch Residential Community Development District, Port Saint Lucie, Florida, Special Assessment Bonds, Assessment Area 4 Project, Refunding Series 2024AA4 | 5.650 | 05/01/54 | 396,687 | |||||||||||||

| 870,000 | (c) | Magnolia Island Community Development District, Pasco County, Florida, Capital Improvement Revenue Bonds, Assessment Area 1, series 2025 | 5.750 | 05/01/55 | 863,166 | |||||||||||||

| 85,000 | (c) | Mandarin Grove Community Development District, Manatee County, Florida, Special Assessment Revenue Bonds, 2022 Project Series 2022 | 6.625 | 05/01/53 | 98,137 | |||||||||||||

| 3,000,000 | (c) | Miami-Dade County Housing Finance Authority, Florida, Multifamily Mortgage Revenue Bonds, Wynwood Works, Series 2023B, (Mandatory Put 6/01/26) | 5.780 | 06/01/27 | 3,010,894 | |||||||||||||

| 1,000,000 | (c) | Miami-Dade County Industrial Development Authority, Florida, Industrial Development Revenue Bonds, CFC-MB I, LLC Collins Park Housing Project Series 2023 | 6.250 | 01/01/59 | 996,373 | |||||||||||||

| 415,000 | (c) | Middleton Community Development District A, Florida, Special Assessment Revenue Bonds, Series 2022 | 6.200 | 05/01/53 | 435,198 | |||||||||||||

| 120,000 | (c) | Mirada Community Development District, Florida, Capital Improvement Bonds, Assessment Area 3 Series 2024 | 6.000 | 05/01/55 | 120,366 | |||||||||||||

| 70,000 | (c) | North Powerline Road Community Development District, Polk County, Florida, Special Assessment Revenue Bonds, Series 2022 | 5.625 | 05/01/52 | 71,613 | |||||||||||||

| 1,000,000 | (c) | Ocean and Highway Port Authority, Florida, Port Facilities Revenue Bonds, Worldwide Terminals Fernandina, LLC Project, Series 2019, (AMT) | 5.500 | 12/01/49 | 807,644 | |||||||||||||

| 1,500,000 | (c) | Palm Beach County, Florida, Revenue Bonds, Provident Group - LU Properties LLC Lynn University Housing Project, Series 2021A | 5.000 | 06/01/57 | 1,355,017 | |||||||||||||

| 2,560,000 | Palm Beach County, Florida, Revenue Bonds, Provident Group - LU Properties LLC Lynn University Housing Project, Series 2024A | 6.125 | 06/01/54 | 2,555,509 | ||||||||||||||

| 2,240,000 | Palm Beach County, Florida, Revenue Bonds, Provident Group - LU Properties LLC Lynn University Housing Project, Series 2024A | 6.250 | 06/01/59 | 2,251,370 | ||||||||||||||

| See Notes to Financial Statements | 23 |

Portfolio of Investments March 31, 2025 (continued)

Enhanced High Yield Municipal Bond

| PRINCIPAL | DESCRIPTION | RATE | MATURITY | VALUE | ||||||||||||||

|

|

|

|||||||||||||||||

| FLORIDA (continued) | ||||||||||||||||||

| $ | 1,725,000 | (c) | Parrish Lakes Community Development District, Manatee County, Florida, Capital Improvement Revenue Bonds, Assessment Area 2, Series 2023A | 5.625% | 05/01/53 | $ | 1,737,287 | |||||||||||

| 240,000 | (c) | Parrish Lakes Community Development District, Manatee County, Florida, Capital Improvement Revenue Bonds, Assessment Area 3, Series 2024 | 5.800 | 05/01/54 | 235,151 | |||||||||||||

| 1,125,000 | (c) | Peace Creek Village Community Development District, Winter Haven, Florida, Special Assessment Revenue Bonds, Series 2025 | 5.850 | 05/01/55 | 1,110,022 | |||||||||||||

| 710,000 | Pine Island Community Development District, Florida, Special Assessment Bonds, Bella Collina, Series 2004 | 5.750 | 05/01/35 | 713,139 | ||||||||||||||

| 1,500,000 | (c) | Pioneer Ranch Community Development District, Marion County, Florida, Special Assessment Bonds, Series 2024 | 5.300 | 05/01/55 | 1,417,126 | |||||||||||||

| 1,000,000 | (c) | Rye Ranch Community Development District, Florida, Special Assessment Revenue Bonds, Pod B - Assessment Area 1 Series 2023 | 6.000 | 11/01/53 | 1,024,838 | |||||||||||||

| 1,000,000 | (c) | Saltleaf Community Development District, Florida, Capital Improvement Revenue Bonds, Series 2024 | 6.000 | 05/01/56 | 1,006,536 | |||||||||||||

| 500,000 | (c) | Sawyers Landing Community Development District, Florida, Special Assessment Revenue Bonds, Series 2021 | 4.250 | 05/01/53 | 423,478 | |||||||||||||

| 415,000 | Seminole County Industrial Development Authority, Florida, Retirement Facility Revenue Bonds, Legacy Pointe At UCF Project, Series 2019A | 5.000 | 11/15/29 | 417,712 | ||||||||||||||

| 3,980,000 | Seminole County Industrial Development Authority, Florida, Retirement Facility Revenue Bonds, Legacy Pointe At UCF Project, Series 2019A | 5.500 | 11/15/49 | 3,884,206 | ||||||||||||||

| 1,500,000 | Seminole County Industrial Development Authority, Florida, Retirement Facility Revenue Bonds, Legacy Pointe At UCF Project, Series 2019A | 5.750 | 11/15/54 | 1,493,206 | ||||||||||||||

| 465,000 | (c) | Three Rivers Community Development District, Florida, Special Assessment Revenue Bonds, South Assessment Area Series 2021B | 4.625 | 05/01/36 | 448,379 | |||||||||||||

| 2,000,000 | Tradition Community Development District 1, Port Saint Lucie, Florida, Irrigation System Revenue Bonds, Existing System Series 2017 | 4.500 | 10/01/47 | 1,833,196 | ||||||||||||||

| 880,000 | (e) | Tradition Community Development District 9, Port Saint Lucie, Florida, Special Assessment Bonds, Series 2025 | 5.650 | 05/01/56 | 867,897 | |||||||||||||

| 2,000,000 | (c) | Venice, Florida, Retirement Community Revenue Improvement Bonds, Village On The Isle Project, Fixed Rate Series 2024A | 5.625 | 01/01/60 | 2,008,725 | |||||||||||||

| 225,000 | (c) | Village Community Development District 15, Florida, Special Assessment Revenue Bonds, Series 2023 | 5.250 | 05/01/54 | 229,725 | |||||||||||||

| 665,000 | West Villages Improvement District, Florida, Special Assessment Revenue Bonds, Unit of Development 7 Villages F-3 and G-1B Series 2023 | 6.250 | 05/01/54 | 698,479 | ||||||||||||||

|

|

|

|||||||||||||||||