UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant | ||||||

CHECK THE APPROPRIATE BOX: | |||

☐ | Preliminary Proxy Statement | ||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☑ | Definitive Proxy Statement | ||

☐ | Definitive Additional Materials | ||

☐ | Soliciting Material under §240.14a-12 | ||

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |||

☑ | No fee required | ||

☐ | Fee paid previously with preliminary materials | ||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||

We are Otis

We are the world’s leading company for elevator

and escalator manufacturing, installation and service.

You’ll find us in the world’s most iconic structures, as well as residential and commercial buildings,

transportation hubs and everywhere people are on the move.

Our Vision

We give people freedom to connect and thrive in a taller, faster, smarter world.

The Otis Absolutes

In realizing our vision, our colleagues are guided by our commitment to The Otis Absolutes:

Safety

We are in the safety business. The well-being of our

colleagues, our customers and the riding

public is paramount.

EVERYTHING DEPENDS ON MOVING

PEOPLE SAFELY.

Ethics

We strive to be a trusted company, and the employer

and supplier of choice. Doing business the ethical,

lawful and honest way is who we are, and our

reputation depends on it.

DOING BUSINESS THE RIGHT WAY – IT’S WHO

WE ARE.

Quality

We stand for delivering quality results in everything we

do – from engineering, manufacturing, installation and

service, to selling, marketing and financial reporting.

WE DELIVER QUALITY RESULTS IN

EVERYTHING WE DO.

In 2024, our fifth year as an independent company, Otis Worldwide Corporation (“Otis”) continued to demonstrate the strength of our Service-driven business model. Through focused execution of our long-term strategy, we delivered another year of strong financial performance. Guided by The Otis Absolutes of Safety, Ethics and Quality, we remain committed to serving our customers and passengers, and enabling people to connect in a taller, faster, smarter world.

Our reach is global, our people are local

| We maintain approximately 2.4 million customer units worldwide |  | We serve customers in more than 200 countries and territories | ||||||

| We have 72,000 colleagues, including 44,000 field professionals |  | We have over 1,400 branches and offices and a direct physical presence in more than 70 countries | ||||||

Executing on our strategy

We remain focused on achieving long-term, sustainable growth through execution of our strategic pillars, while optimizing our business to adapt to a changing market environment. Our disciplined capital allocation policy further complements our strategy. These efforts enable us to better serve our customers and passengers, while delivering long-term shareholder value.

STRATEGIC PILLARS | 2024 RESULTS | |||||||

Accelerate Service portfolio growth |  | • Grew Service portfolio 4.2%, marking our third year of growth at 4% or greater • Ended 2024 with approximately 1 million units connected globally(1) and grew units with Otis ONE subscriptions by 70% • Increased use of digital tools and a specialized Service organization to improve productivity, customer satisfaction and portfolio growth • Sustained growth in our repair business across all regions, marking a three-year CAGR in the low teens | ||||||

Deliver modernization value |  | • Grew modernization orders by 12% at constant currency(2) with all regions growing in both orders and sales, and modernization return on sales (ROS) surpassing New Equipment ROS • Increased modernization backlog by 13% at constant currency(2) • Deployed initiatives to accelerate orders through channel expansion, improved sales effectiveness and standardized packages | ||||||

Sustain New Equipment growth |  | • Gained ~400 basis points of New Equipment share since 2019(3) • Accelerated orders of our Gen3 and Gen360 products, up five points from prior year • New Equipment backlog down 4% at constant currency,(2) up low single digits excluding China • Continued to drive common platform products, factory transformation and material productivity to better serve our New Equipment customers while reducing costs | ||||||

Advance digitalization |  | • Expanded footprint of connected elevators with enhanced capabilities, including predictive insights for monitoring operational status, preventing shutdowns and eliminating unnecessary calls • Integrated artificial intelligence (AI) capabilities into existing product lines to deliver smarter, more efficient solutions, including deployment of AI-driven analytics tools and predictive maintenance features • Increased deployment of enterprise systems with a focus on sales, modernization capabilities, customer contact technologies and field and supply chain efficiencies • Deployed digital playbook for developing scalable and repeatable modernization process that supports customer needs and ensures safety | ||||||

Focus and empower our workforce |  | • Drove implementation of the UpLift operating model with clear roles and interdependencies, driving greater engagement, growth, and business performance • Improved total global voluntary attrition rates versus 2023 overall and among salaried colleagues • Achieved record high Success and Inclusion scores in colleague engagement survey amidst record participation rate • Honed impact of Employee Resource Groups (ERGs) by moving toward Business Resource Groups (BRGs) with more programming aligned with Otis’ business strategy • Continued to increase volunteerism and participation in science, technology, engineering and math (STEM) programming in our communities | ||||||

(1) | Includes units in warranty period. |

(2) |

(3) | Based on Otis internal estimates. |

1 // 103 | |||

Creating value in 2024 |

Financial highlights

Otis delivered solid financial results in 2024. Organic sales grew 1.4%, driven by our growing Service business, productivity initiatives and commodity deflation, enabling us to expand adjusted operating margins 50 basis points and grow adjusted earnings per share (“EPS”) by 8.2%. We increased our quarterly dividend by 14.7%, while generating $1.56 billion in operating cash flow (approximately $1.57 billion in adjusted free cash flow). We used our significant cash flow to return capital to our shareholders through approximately $1 billion in share repurchases and $600 million in dividends. Our modernization orders grew 18% and we ended the year with backlog up 13% at constant currency. Our maintenance portfolio grew above 4% for the third straight year to approximately 2.4 million units, positioning us for continued growth.(1)

Metrics | Percentage change from 2023 | ||||||

SALES | |||||||

GAAP | $14.3B | 1.4% organic sales growth(1) | |||||

BACKLOG / UNITS | |||||||

New Equipment backlog(1) | (4%) | (4%) | |||||

Modernization backlog(1) | 13% | 13% | |||||

Maintenance portfolio | 4.2% | 4.2% | |||||

CASH FLOW | |||||||

Operating cash flow | $1.56B | (3.9%) | |||||

Adjusted free cash flow(1) | $1.57B | 2.4% | |||||

DILUTED EARNINGS PER SHARE | |||||||

GAAP | $4.07 | 20.1% | |||||

Adjusted(1) | $3.83 | 8.2% |

(1) | As defined more fully in Appendix A on pages 99-102, Otis refers to non-GAAP sales as organic sales, non-GAAP backlog growth at constant currency as backlog growth, non-GAAP operating profit as adjusted operating profit, non-GAAP cash flow as adjusted free cash flow and non-GAAP diluted earnings per share as adjusted diluted EPS. Appendix A also provides a reconciliation of these non-GAAP financial measures to the corresponding GAAP financial measures. |

2 // 103 | |||

| TO OUR SHAREHOLDERS: As a Board, we were pleased with Otis’ performance in 2024. The company continued to enhance shareholder value with a clear vision and relentless focus on its long-term strategy, once again expanding its Service portfolio and driving growth in modernization, all while transforming itself from within as a more streamlined and customer-oriented company. We also were pleased to see Otis build on its strength and agility as a global Service business, and, in particular, the leadership team’s ability to capture market opportunities despite weakness in certain markets. Otis’ strong financial performance, including robust cash flow generation, also required a strong focus on its capital allocation strategy. In 2024, with the Board’s approval, the company returned more than $600 million in dividends and $1 billion in share repurchases to shareholders in addition to continuing bolt-on acquisitions. This year showed that Otis’ strategy – and the leadership team implementing it – are right on target. |

Otis also made great strides in 2024 with UpLift – a program designed to enhance customer centricity and leverage Otis’ global scale and drive efficiency across the organization. The Board oversaw each phase of UpLift implementation, receiving updates from management at every Board meeting over the course of the year, and approved new partnerships to unlock greater efficiencies and opportunities through simplified back-office operations. The Board has seen a leadership team energized by its own forward momentum, committed to building new capabilities and enhancing talent while staying true to The Otis Absolutes. We will continue to challenge management to move deliberately and with pace as we provide clear guidance and strong oversight on this visionary global initiative and transformation.

We continue to see great opportunities for Otis’ future and are committed to oversee and encourage management as it works to unlock the company’s potential. I would like to express my gratitude to you, our shareholders, for your trust and support. Your confidence in Otis propels us forward as we continue to innovate and lead in our industry. We are excited about the opportunities ahead and remain committed to delivering long-term value to our shareholders. I look forward to continued engagement with you in 2025 and respectfully request your support for the Board-recommended proposals contained in this Proxy Statement.

Yours truly,

JOHN H. WALKER

INDEPENDENT LEAD DIRECTOR

3 // 103 | |||

Meeting information

DATE AND TIME: May 15, 2025 9:00 a.m. Eastern time |  LOCATION: We will be holding our 2025 Annual Meeting of Shareholders (“Annual Meeting”) virtually via live webcast. To attend, vote or submit questions during the Annual Meeting, please see “How to attend” below. You will not be able to attend the meeting in person. For more information, see “Virtual Annual Meeting.” | ||||

Your vote is important. Please submit your proxy or voting instructions as soon as possible. | |||||

Agenda

1. | Election of the 11 director nominees listed in the Proxy Statement | ||||

2. | Advisory vote to approve executive compensation | ||||

3. | Appointment of PricewaterhouseCoopers LLP to serve as independent auditor for 2025 | ||||

4. | Shareholder proposal, if properly presented at the meeting | ||||

5. | Other business, if properly presented | ||||

Who may vote:

If you owned shares of Otis common stock at the close of business on March 17, 2025, you are entitled to receive this Notice of the 2025 Annual Meeting and to vote at the meeting, either online or by proxy.

How to attend:

To attend the meeting, please go to www.virtualshareholdermeeting.com/OTIS2025. To participate by voting or submitting questions during the Annual Meeting, you will need to log in to www.virtualshareholdermeeting.com/OTIS2025 using the control number located on your Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”), proxy card or voting instruction form. You will not be able to attend the Annual Meeting in person.

Please review your 2025 Proxy Statement (“Proxy Statement”) and vote using one of the methods described on the following page.

By Order of the Board of Directors.

TOBY W. SMITH

SENIOR VICE PRESIDENT, CORPORATE SECRETARY

4 // 103 | |||

Notice of 2025 Annual Meeting of Shareholders |

How to Vote

|  |  | ||||

INTERNET Online during the Virtual Annual Meeting: Go to www.virtualshareholdermeeting.com/OTIS2025 and follow the instructions on the website. Online in advance of the Virtual Annual Meeting: Up until 11:59 p.m. Eastern time on May 14, 2025, go to www.proxyvote.com and follow the instructions on the website | TELEPHONE Up until 11:59 p.m. Eastern time on May 14, 2025, call 1-800-690-6903 | MAIL Sign, date and return your proxy card or voting instruction form in the enclosed postage-paid envelope | ||||

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 15, 2025. This Notice of the 2025 Annual Meeting and Proxy Statement and our 2024 Annual Report to Shareholders (“2024 Annual Report”) are available free of charge at www.proxyvote.com. References in either document to our website or any third-party website are for the convenience of readers, and information available at or through these websites is not a part of nor is it incorporated by reference in the Proxy Statement or 2024 Annual Report.

The Board of Directors (the “Board”) is soliciting proxies to be voted at our Annual Meeting on May 15, 2025, and at any postponed or reconvened meeting. We expect that the proxy materials or a Notice of Internet Availability will be mailed and made available to shareholders beginning on or about April 4, 2025. At the Annual Meeting, votes will be taken on the matters listed in this Notice of the 2025 Annual Meeting.

Virtual Annual Meeting

For our Annual Meeting, we have adopted a virtual meeting format. This format enables shareholders to participate regardless of geographic location, physical or resource constraints. It also safeguards the health and safety of our shareholders, colleagues and members of our Board. All that is required is an internet-connected device.

How will the Annual Meeting be held?

The Annual Meeting will be held solely via live webcast through an online virtual meeting platform that allows shareholders around the globe to listen to the entire meeting on their computer or other device and submit questions. Members of management, our Board and a representative of our independent auditor will be in virtual attendance. There will not be a physical meeting location.

How can shareholders attend and participate in the Annual Meeting?

Only shareholders of record and beneficial owners as of March 17, 2025, the record date, may attend or participate in the meeting by voting or submitting questions. To attend and participate, go to www.virtualshareholdermeeting.com/OTIS2025 and log in using the 16-digit control number included on your Notice of Internet Availability, proxy card or voting instruction form.

On the day of the Annual Meeting, May 15, 2025, shareholders may begin to log in to the online virtual meeting platform beginning at 8:45 a.m. Eastern time. The meeting will begin promptly at 9:00 a.m. Eastern time. Please allow ample time to log in.

How can shareholders receive technical assistance in connection with the Annual Meeting?

Beginning at 8:45 a.m. Eastern time on the day of the meeting, we will have technicians ready to assist you with any technical difficulties you may have when logging in or accessing the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the online virtual meeting platform log-in page.

5 // 103 | |||

Notice of 2025 Annual Meeting of Shareholders |

How can shareholders submit questions at the Annual Meeting?

Once logged in to the virtual meeting platform as instructed, shareholders may submit questions directly by following the instructions on the website. We will answer as many shareholder-submitted questions that are appropriate and pertinent to the meeting agenda as time permits. Substantially similar questions may be answered as a group.

YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON.

6 // 103 | |||

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Proxy voting roadmap

PROPOSAL 1 | ||||||||

Election of directors | ||||||||

BOARD RECOMMENDATION: | PAGE | |||||||

FOR | Each Director Nominee | |||||||

PROPOSAL 2 | ||||||||

Advisory vote to approve executive compensation | ||||||||

BOARD RECOMMENDATION: | PAGE | |||||||

FOR | ||||||||

PROPOSAL 3 | ||||||||

Appoint an independent auditor for 2025 | ||||||||

BOARD RECOMMENDATION: | PAGE | |||||||

FOR | ||||||||

PROPOSAL 4 | ||||||||

Shareholder proposal, if properly presented at the meeting | ||||||||

BOARD RECOMMENDATION: | PAGE | |||||||

AGAINST | ||||||||

8 // 103 | |||

Proxy Statement summary |

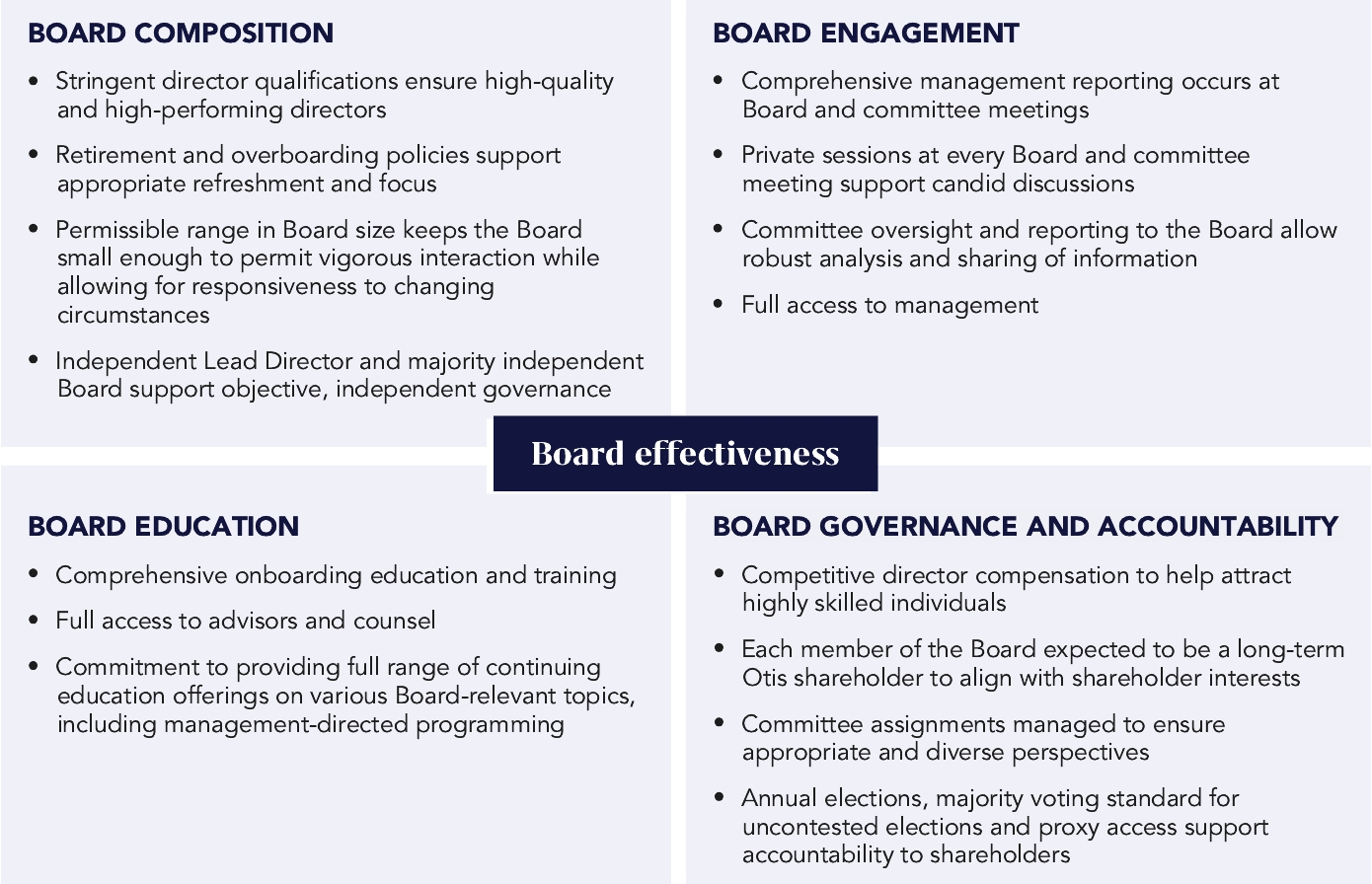

Otis is committed to strong corporate governance practices. Our governance structure reflects processes from across industries, which we believe provide the basis for effective board oversight. Our governance is dynamic, reflecting the Board’s continuous review of best practices and goal of maintaining optimum effectiveness. Below are Otis’ key corporate governance practices and where in this Proxy Statement and/or other publicly available documents you may find further information on these practices. Publicly available documents such as our Corporate Governance Guidelines (“CGG”), Certificate of Incorporation, Bylaws, Committee Charters and The Otis Absolutes are available on our website at www.otisinvestors.com/governance/governance-documents.

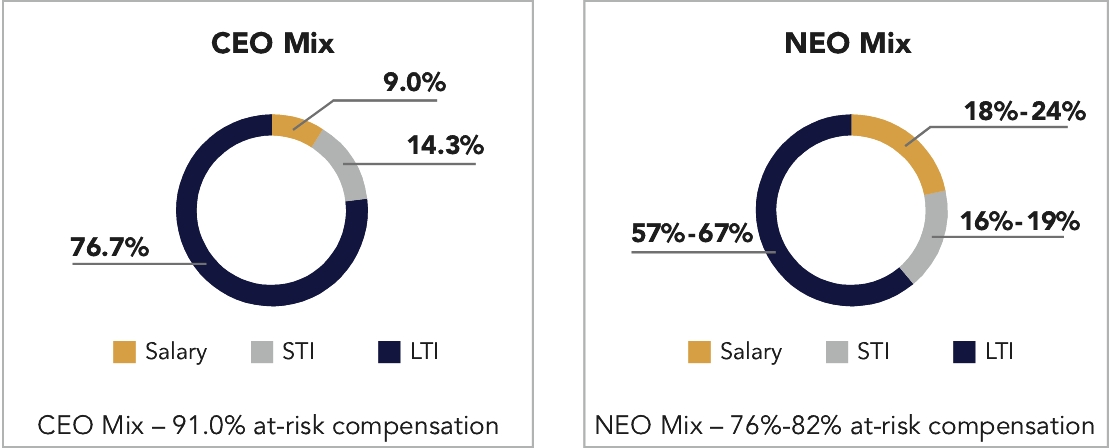

Board independence and composition 10 of 11 director nominees are independent All committees are composed of independent directors only Independent Lead Director has expansive authority and clearly defined responsibilities grounded in the fundamental principle of independent oversight CGG Private sessions excluding the Chief Executive Officer and management are typically held following each regularly scheduled Board and committee meeting; presided over by the Lead Director or committee chair CGG No classified Board. All directors are elected annually. Newly appointed directors of less than one year are subject to reelection at the Annual Meeting page 22 Bylaws and Certificate of Incorporation Overboarding is prohibited. All directors are restricted in the number of other public boards on which they may serve page 22 CGG Majority voting standard applies for uncontested elections. Resignation policy is in place if a director fails to receive the majority of votes cast CGG | Director engagement 5 Board meetings and 20 committee meetings in 2024 100% director attendance at Board and committee meetings in 2024 Robust onboarding and continuing education program for all directors CGG Annual self-evaluations completed by all directors page 24 CGG Extensive ESG program and active Board and committee oversight of ESG matters in place The Otis Absolutes, our code of ethics, applies to all colleagues globally as well as the Board page 17 The Otis Absolutes and CGG At-risk compensation makes up approximately 91% of our CEO’s target compensation opportunity and not less than 76% for other named executive officers (“NEOs”) Strong clawback provisions Careful consideration of risk page 58 | Shareholder rights Nomination of director candidates in Proxy materials available through the proxy access process; properly made shareholder nominations considered by the Nominations and Governance Committee Bylaws Request for a special meeting of shareholders can be made by shareholders holding at least 15% of outstanding shares of Otis common stock for at least one year Bylaws No dual class or cumulative voting structure – one vote per share Certificate of Incorporation No supermajority shareholder vote requirements or poison pill plan Bylaws and Certificate of Incorporation Robust stock ownership requirements for directors and executive officers CGG Prohibition on hedging and pledging of our common stock by directors and colleagues (including officers) page 58 | ||||

9 // 103 | |||

Proxy Statement summary |

The Board has nominated 11 individuals for election to the Otis Board upon recommendation of the Nominations and Governance Committee. These nominees are deeply experienced executives with the highest integrity and bring a highly diverse collection of backgrounds, experience, skills and perspectives. The nominees have led and advised companies as executive officers, chairs, founders, managing or lead partners and directors in a wide range of sectors, including asset management, automotive, consumer products, manufacturing, telecommunications, transportation and professional services. Each of the nominees is a current Otis director.

INDEPENDENT | |||||||||

| Thomas A. Bartlett, 66 Former President and Chief Executive Officer, American Tower Corporation Board Committees: Audit, Compensation Director since October 2023 |  | Jeffrey H. Black, 70 Former Senior Partner and Vice Chairman, Deloitte LLP Board committees: Audit (Chair) Director since April 2020 | ||||||

| Jill C. Brannon, 61 Executive Vice President, Chief Sales Officer, FedEx Corporation Board Committees: Audit, Nominations and Governance Director since October 2023 |  | Nelda J. Connors, 59 Founder and Chief Executive Officer, Pine Grove Holdings, LLC Board committees: Audit, Compensation Director since October 2022 | ||||||

| Kathy Hopinkah Hannan, 63 Former Global Lead Partner, National Managing Partner and Vice Chairman, KPMG, LLP Board committees: Audit, Nominations and Governance Director since April 2020 |  | Shailesh G. Jejurikar, 58 Chief Operating Officer, The Procter & Gamble Company Board committees: Compensation (Chair) Director since April 2020 | ||||||

| Christopher J. Kearney, 69 Former Chairman and Chief Executive Officer, SPX Corporation Board committees: None Director since April 2020 |  | Margaret M. V. Preston, 67 Managing Director, Cohen Klingenstein, LLC Board committees: Nominations and Governance (Chair) Director since April 2020 | ||||||

| Shelley Stewart, Jr., 71 Former Chief Procurement Officer, E. I. du Pont de Nemours and Company Board committees: Compensation, Nominations and Governance Director since April 2020 |  | John H. Walker, 67 Former Chairman and Chief Executive Officer, Global Brass and Copper Holdings, Inc. Board committees: Compensation Director since April 2020 | ||||||

NON-INDEPENDENT | |||||||||

| Judith F. Marks, 61 Chair, Chief Executive Officer and President, Otis Worldwide Corporation Director since April 2020 | ||||||||

10 // 103 | |||

Proposal 1: | |

Election of directors | |

• | We are seeking your support for the election of the 11 individuals whom the Board has nominated to serve as directors for a one-year term beginning on the date of the Annual Meeting. |

• | All the nominees are current directors of Otis. |

• | The Board believes that the nominees have the qualifications consistent with our position as a global leader in the elevator and escalator manufacture, installation and service industry with operations worldwide. |

THE BOARD RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE: | |||||||||

| Thomas A. Bartlett |  | Jeffrey H. Black | ||||||

| Jill C. Brannon |  | Nelda J. Connors | ||||||

| Kathy Hopinkah Hannan |  | Shailesh G. Jejurikar | ||||||

| Christopher J. Kearney |  | Judith F. Marks | ||||||

| Margaret M. V. Preston |  | Shelley Stewart, Jr. | ||||||

| John H. Walker | ||||||||

11 // 103 | |||

Corporate governance |

Otis’ CEO and President, Judith F. Marks, has served as the Chair of the Otis Board since February 2022. The decision to appoint Ms. Marks as Chair followed careful consideration by the Board after nearly two years of operating as a standalone public company. The Board considered several factors in reaching its decision to combine the roles of Chair and CEO under Ms. Marks, including that:

• | Ms. Marks has led Otis as President since 2017, was named CEO in 2019 and has served as a director since Otis became an independent publicly traded company in April 2020. |

• | Under Ms. Marks’ leadership, Otis has continued to deliver strong financial performance by driving near- and long-term strategic priorities, all while effectively guiding Otis through a global pandemic, substantial macroeconomic pressures and geopolitical uncertainty. |

• | Ms. Marks has proven to be an exceptional leader – setting a vision, creating an environment of success, removing obstacles and driving results – and the Board believes that she is the best candidate to lead the Board as its Chair. |

• | Combining the roles of Chair and CEO promotes decisive decision-making as Otis continues to execute on its long-term strategy and seeks to achieve sustainable growth and value creation for our customers, colleagues, communities and shareholders. |

• | The Board has a strong, independent Lead Director with responsibility to ensure leadership and oversight independent of company management, as described in more detail below. |

The Board continues to actively consider its leadership structure to ensure it aligns with the best interests of the company and its shareholders.

The independent Lead Director plays an important role in Otis’ corporate governance structure, ensuring that the Board fulfills its duty to provide the appropriate level of independent oversight of management and acting as the principal liaison between the independent directors and management. The Lead Director also acts in an advisory capacity to the Chair and CEO and to Otis management in matters concerning the interests of the organization and the Board as well as relationships between Otis management and the Board.

To promote strong and independent oversight of Board activities, Otis has delineated clear responsibilities for the independent Lead Director. For example, the Lead Director has final approval authority of all Board meeting schedules, agendas and materials, is authorized to call special meetings of the Board and committees, and leads robust private sessions – excluding the CEO and other Otis management – as part of every Board meeting. In addition, the Lead Director is responsible for providing annual and ongoing feedback to the Chair and CEO on various topics, including her performance, the functioning of the Board and any other issues or concerns that may arise.

The Corporate Governance Guidelines require the independent directors to select annually an independent member to serve as Lead Director whenever the Chair is not independent. Accordingly, the independent directors have selected John H. Walker to continue as Lead Director.

We are confident that all our directors understand their roles and are committed to acting in the best interest of Otis. In clearly defining the responsibilities of the Chair and CEO and Lead Director roles, respectively, we believe that we are striking the right balance to ensure effective leadership of the Board independent of Otis management. In continuing in the role of Lead Director, Mr. Walker is well positioned to provide a strong, independent perspective commensurate with his responsibilities.

12 // 103 | |||

Corporate governance |

The key responsibilities of the combined Chair and CEO and the Lead Director are incorporated into our Corporate Governance Guidelines and described below.

Chair and CEO | Lead Director | |||||||||||

• Develops meeting schedules and agendas • Ensures Board materials are appropriate, sufficient and high quality • Presides at all meetings of the full Board • Presides at annual and special shareholder meetings • Has authority to call special meetings of the Board • Fosters an open and inclusive environment at Board meetings • Identifies director candidates for the Board in consultation with the Nominations and Governance Committee and Lead Director • Assists the Nominations and Governance Committee with the screening and evaluation of director candidates • Assists the Nominations and Governance Committee with the selection of committee chairs | • Has final approval of meeting schedules, agendas and Board materials • Presides at private meetings of independent directors and at Board meetings when the Chair and CEO is not present • Has authority to call special meetings of the Board, committees and private sessions of the independent directors • Jointly leads, with the Chair of the Nominations and Governance Committee, the Board self-evaluation process and works with that committee to address issues that arise • Communicates the Board’s annual performance evaluation and provides ongoing feedback to the Chair and CEO • Serves as principal liaison between the independent directors and the Chair and CEO, as necessary • Assists the Chair and CEO and the Nominations and Governance Committee with the identification, screening and evaluation of director candidates • Assists the Nominations and Governance Committee with the selection of committee chairs • Authorizes retention of outside advisors who report directly to the Board • Meets, as representative of the Board, with representatives of significant stakeholder constituencies | |||||||||||

13 // 103 | |||

Corporate governance |

The Board is responsible for overseeing Otis’ business and activities. Board oversight is divided into several key areas, with oversight responsibility delegated in some instances to one or more of its committees. Key areas of Board oversight are set forth below. More information about committee oversight and responsibilities is set forth in the “Board committees” section starting on page 17.

STRATEGY | |||||

While management is responsible for executing Otis’ strategy, the Board actively engages with management to guide, inform and advise on that strategy to support and promote long-term shareholder value. Otis’ ESG initiatives are fully integrated into its business strategy. | |||||

• | The Board receives updates from management on the status of company performance, key strategic initiatives, global socioeconomic conditions, public policy issues relevant to Otis and its stakeholders, competitive trends, capital markets and other developments. | ||||

• | The Board has oversight responsibility over capital allocation policy, including financings, dividends, share repurchases, and significant investments and capital appropriations, including those related to mergers and acquisitions. | ||||

• | Throughout the year, the Board, through its committees, is briefed, discusses and gives guidance on strategies for issues falling under the oversight of those committees, including environmental, health and safety, sustainability, corporate social responsibility and governance matters. | ||||

• | The Board’s varied experiences and perspectives allow it to probe and test management’s assumptions and conclusions on strategies and their implementation. | ||||

• | Engagement by the entire Board is supported and promoted through discussions at private sessions of the independent members of the Board following every Board meeting led by the independent Lead Director and following every Board committee meeting led by its committee chair. | ||||

RISK MANAGEMENT | ||

Successful execution of a robust and innovative business strategy involves accepting a certain measure of risk. Otis identifies, assesses, monitors and manages risks through its comprehensive enterprise risk management (“ERM”) program that conforms to the Enterprise Risk Management – Integrated Framework established by the Committee of Sponsoring Organizations of the Treadway Commission. The Board works with management to develop appropriate risk tolerance and oversees and monitors the management of risks that could significantly affect the company’s operations, growth or reputation. Risk oversight is aligned with the Board’s oversight of Otis’ strategies and business plans. Thus, the Board regularly receives reports on the risks implicated by the company’s strategic decisions concurrent with the deliberations leading to those decisions. The Board annually participates in an update on the ERM program and is briefed on these risks periodically, either directly or through its committees. The Board, its committees and management work together on risk management as follows: | ||

BOARD OF DIRECTORS

The full Board has oversight responsibility for the following areas of risk and risk management:

• | Overall risk management program and structure, and risk tolerance levels |

• | Selection and retention of senior executive management |

• | Company culture and engagement |

• | Management succession planning and development |

• | Business objectives and major strategies |

• | Risks deemed significant |

Otis’ Board and its committees receive regular reports from the head of Internal Audit, General Counsel and other senior management regarding ERM, litigation and legal matters, compliance programs and risks, and other applicable risk-related policies, procedures and limits. We believe that our leadership structure supports our risk oversight function.

14 // 103 | |||

Corporate governance |

The Board delegates certain risk management responsibilities to committees. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks. Working with management, the Board supports discussions around escalating risks as business needs dictate.

Risk oversight delegated to committees includes:

AUDIT COMMITTEE • Enterprise Risk Management (ERM) • Financial statements and disclosures, reporting and controls • Legal, ethical and regulatory compliance • Financial (including policies related to investments, uses of cash and taxes) • Cybersecurity and privacy • Review of significant acquisitions and divestitures | COMPENSATION COMMITTEE • Executive incentive plan performance metrics and goals, including ESG factors • Compensation levels for senior leaders • Pay equity • CEO performance goals • Stock ownership requirements • Clawback policies | NOMINATIONS AND GOVERNANCE COMMITTEE • Director qualifications and nomination • Director independence • Assessment of Board effectiveness • Board refreshment • Corporate governance • Environment, health and safety • Corporate social responsibility and charitable giving • Sustainability and climate-related risks • Public policy issues • Shareholder engagement and proposals on various topics | ||||||

BOARD OVERSIGHT OF CYBERSECURITY | ||

The security of our products, services and corporate network is a key priority both for the growth of our business and our responsibilities as a leader in our industry. Otis has taken a risk-based approach to cybersecurity. We have implemented cybersecurity policies throughout our operations as part of our important digital transformation activities, including designing and incorporating cybersecurity into our products and services while they are being developed. | ||

Otis has established a three-level governance model for managing cybersecurity risks. Cybersecurity risks are overseen by the Audit Committee of the Board. Our Chief Digital Officer (“CDO”) and Chief Information Security Officer (“CISO”) regularly brief the Audit Committee and other members of the Board on the Otis Cybersecurity Program and cyber-threat landscape, including twice in 2024. Our Cybersecurity Program is directed by both our CDO and CISO, and we have established a Cyber Governance Council and Steering Committee made up of senior management, including our CEO. These committees are informed about and monitor the prevention, mitigation, detection, and remediation of cybersecurity incidents through their management of, and participation in, the cybersecurity risk management and strategy processes described above, including the operation of our incident response plan. | ||

Members of our Board also received briefings on risks associated with generative artificial intelligence, privacy management and our IT infrastructure. In addition, Audit Committee members periodically participate in simulated cyber incident tabletop exercises. Several members of our Board hold a CERT Certificate in Cybersecurity Oversight issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University. | ||

Our CDO and CISO collectively have over 25 years of prior work experience in various roles involving managing information security, developing cybersecurity strategy and implementing effective information and cybersecurity programs, as well as relevant degrees and certifications. These includes Certified Information Security Manager certification and National Association of corporate Directors (NACD) Cyber training. All Otis colleagues engaged in cybersecurity are required to have a baseline certification (such as Security+, CISSP or CISM), as well as an operational cyber certification (for example, incident response or forensics analysis). | ||

15 // 103 | |||

Corporate governance |

ESG PROGRAMS | ||

Otis’ business strategy – accelerate Service portfolio growth; deliver modernization value; sustain New Equipment growth; advance digitalization; and focus and empower our organization – is supported by our four ESG pillars. Together they drive value for all our stakeholders and the broader communities where we live and work. Underscoring the correlation between our business and ESG strategies, the Board and its committees engage in extensive review and oversight of ESG-related topics. | ||

Otis has developed an ESG Governance Model that supports its business strategy. ESG matters impact every corner of the business, and, accordingly, ESG governance is cross-functional, involving senior leaders and subject matter experts from Otis’ multiple functional and business areas. The ESG Council – composed of select Executive Officers and other senior executives of the company – works closely with an internal ESG Working Group comprising Otis subject matter experts on relevant topics. Both the ESG Council and ESG Working Group meet frequently, with the ESG Council reporting regularly to the CEO. | ||

ESG Risks | ||

A number of ESG risks are expressly considered in the ERM risk identification and assessment process, including ESG reporting in accordance with a complex and growing regulatory environment. ESG risks and corresponding mitigation actions that do not make the list of Top ERM Risks are managed by the ESG Council and ESG Working Group using a modified version of the ERM process. Otis also addresses impacts and opportunities related to climate change and other ESG topics through its ESG Council. | ||

ESG Governance Model

• Integrated, cross-functional initiative • ESG strategy aligned with Otis’ culture, values and business strategies and objectives • Objectives established in key areas, with continued discussion around longer-term approach • The ESG Council and ESG Working Group meet frequently, a demonstration of Otis’ commitment to developing and maintaining a successful ESG program. |  | Areas of oversight include, but are not limited to: • Community giving, volunteerism and community engagement • Corporate governance • Human capital management • Human rights • Ethics and compliance • Health and safety • Investor relations • Supply chain • Sustainability and climate-related risks and opportunities | ||||||

In 2024, the Nominations and Governance Committee received reports from management at every meeting on ESG topics. The Committee engaged in reviews of issues covering colleague health and safety; corporate social responsibility and giving; human capital management; shareholder engagement on ESG topics; and sustainability and climate-related risks and opportunities, and was briefed on our progress on the European Union’s Corporate Sustainability Reporting Directive (CSRD), including on our Double Materiality Assessment results and taxonomy analysis.

For more information about our ESG programs, please review our voluntary 2024 Sustainability Report, expected to be published later this year on our website at www.otisinvestors.com.

16 // 103 | |||

Corporate governance |

Otis’ code of ethics is called The Otis Absolutes. This code, which applies to all colleagues globally as well as the Board, is based on The Otis Absolutes of Safety, Ethics and Quality. These core values establish standards of conduct and ethical principles that guide every colleague and Board member across the globe in their day-to-day decisions. The Board, through its Audit Committee, receives reports from management, the Chief Compliance Officer (“CCO”) and Otis’ internal auditor on any significant issues regarding compliance with The Otis Absolutes.

While it is the responsibility of the Board as a whole to exercise its business judgment and to act in the best interests of Otis and its shareholders in overseeing Otis’ business and affairs, the Board delegates oversight of certain matters to its committees, which act on behalf of the Board and report back to the Board on its activities.

Actions reserved to the full Board include: | |||||

• Determine the appropriate size of the Board from time to time • Oversee the selection and evaluation of senior executive management • Review business objectives and major strategies | • Oversee significant risks • Evaluate the performance of the Chair and CEO • Review succession planning and management development | ||||

Our Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominations and Governance Committee. Each committee is composed exclusively of independent directors. Each standing committee has the authority to retain independent advisors to assist in the fulfillment of its responsibilities, to approve the fees paid to those advisors and to terminate their engagements.

All committee charters, which are reviewed annually by the respective committee, are available on our website at: www.otisinvestors.com/governance/governance-documents.

17 // 103 | |||

Corporate governance |

AUDIT COMMITTEE | MEETINGS IN 2024: 8 | ||||

MEMBERS: Jeffrey H. Black, Chair Thomas A. Bartlett Jill C. Brannon Nelda J. Connors Kathy Hopinkah Hannan All members of the Audit Committee are independent. ADDITIONAL INDEPENDENCE REQUIREMENTS: All members of the Audit Committee satisfy the heightened independence requirements under the relevant rules of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and New York Stock Exchange (“NYSE”), both of which require that the Board consider the source of the member’s compensation. FINANCIAL EXPERTISE AND AUDIT COMMITTEE FINANCIAL EXPERTS: The Board has determined that each member of the Audit Committee meets the financial expertise requirements of the NYSE, and that Jeffrey H. Black, Thomas A. Bartlett, Nelda J. Connors and Kathy Hopinkah Hannan are “audit committee financial experts” under the relevant rules of the Exchange Act. | PRIMARY RESPONSIBILITIES: Financial statements and disclosure matters • Reviews and discusses with management and the independent auditor the content, preparation, integrity and independent auditor review of Otis’ financial statements filed with the Securities and Exchange Commission (“SEC”), including significant financial reporting issues and judgments, and the adequacy and effectiveness of Otis’ internal control over financial and ESG reporting and disclosures Independent auditor and internal audit • Selects the independent auditor, subject to shareholder ratification, and monitors its performance, audit and non-audit services and independence • Approves the annual Internal Audit plan, budget and staffing, and reviews significant findings and key trends Compliance • Oversees the implementation and effectiveness of Otis’ legal, ethics and regulatory compliance programs, including The Otis Absolutes • Oversees complaints and concerns submitted by Otis colleagues or external parties regarding accounting and internal accounting controls, auditing matters or business practices Enterprise risk management • Oversees the overall policies and practices for ERM • Reviews and oversees the evaluation and management of Otis’ major financial (including tax), operational, compliance, reputational, strategic and cybersecurity risks Significant financial actions • Oversees Otis’ policies and strategies with respect to financing, dividends, share repurchases, capital appropriations, derivative transactions, global tax matters and insurance and risk management • Reviews plans for and execution of significant acquisitions and divestitures | ||||

18 // 103 | |||

Corporate governance |

COMPENSATION COMMITTEE | MEETINGS IN 2024: 8 | ||||

MEMBERS: Shailesh G. Jejurikar, Chair Thomas A. Bartlett Nelda J. Connors Shelley Stewart, Jr. John H. Walker All members of the Compensation Committee are independent. ADDITIONAL INDEPENDENCE REQUIREMENTS: All members of the Compensation Committee satisfy the heightened independence requirements under the relevant rules of the Exchange Act and the NYSE, which require that the Board consider the source of the member’s compensation. | PRIMARY RESPONSIBILITIES: Compensation practices and policies • Oversees executive compensation programs, practices and policies, including evaluating performance against incentive plan performance goals • Annually reviews a risk assessment of compensation policies, plans and practices • Oversees aspects of Otis’ human capital management assigned by the Board, including pay equity CEO compensation • Reviews and approves annual goals and objectives relevant to CEO compensation, and leads an evaluation of the CEO’s performance against those goals and objectives • Determines and approves, subject to review by the other independent directors, the CEO’s compensation levels based on the evaluation of the CEO’s performance Executive compensation • Reviews and approves compensation peer group • Reviews and approves changes to compensation for NEOs and other key officers • Approves benefit arrangements and agreements for the CEO, other NEOs and key officers • Assists the Board in overseeing and managing risk related to compensation practices NO COMPENSATION COMMITTEE INTERLOCKS AND NO INSIDER PARTICIPATION: During the year ended December 31, 2024: • No member of the Compensation Committee was a current or former officer or employee of Otis or any of its subsidiaries • None of our executive officers served as a member of a board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of the Otis Board or its Compensation Committee | ||||

19 // 103 | |||

Corporate governance |

NOMINATIONS AND GOVERNANCE COMMITTEE | MEETINGS IN 2024: 4 | ||||

MEMBERS: Margaret M. V. Preston, Chair Jill C. Brannon Kathy Hopinkah Hannan Shelley Stewart, Jr. All members of the Nominations and Governance Committee are independent. | PRIMARY RESPONSIBILITIES: Board and committee composition • Recommends for Board approval the qualifications and criteria for service as a director • Identifies, evaluates and recommends director candidates, including ensuring a diverse Board • Submits to the Board recommendations for committee assignments • Reviews and makes recommendations to the Board regarding whether a director should continue service on the Board if there is a change in their principal employment or the number or type of outside boards on which the director serves Stakeholder impacts • Oversees, reviews and monitors Otis’ policies, programs and practices related to environment, health and safety, human capital management, and related matters • Oversees, reviews and monitors Otis’ corporate social responsibility and charitable giving programs • Oversees shareholder engagement and proposals Corporate governance • Reviews and recommends to the Board appropriate compensation for non-employee directors • Oversees the design and conduct of the annual self-evaluation of the performance of the Board and its committees • Develops, reviews and recommends to the Board updates to the Corporate Governance Guidelines • Establishes and monitors policies and practices on Board operations and Board service • Reviews and monitors the orientation of new Board members and the continuing education of all directors • Reviews and makes recommendations to the Board regarding shareholder rights and shareholder proposals | ||||

20 // 103 | |||

Corporate governance |

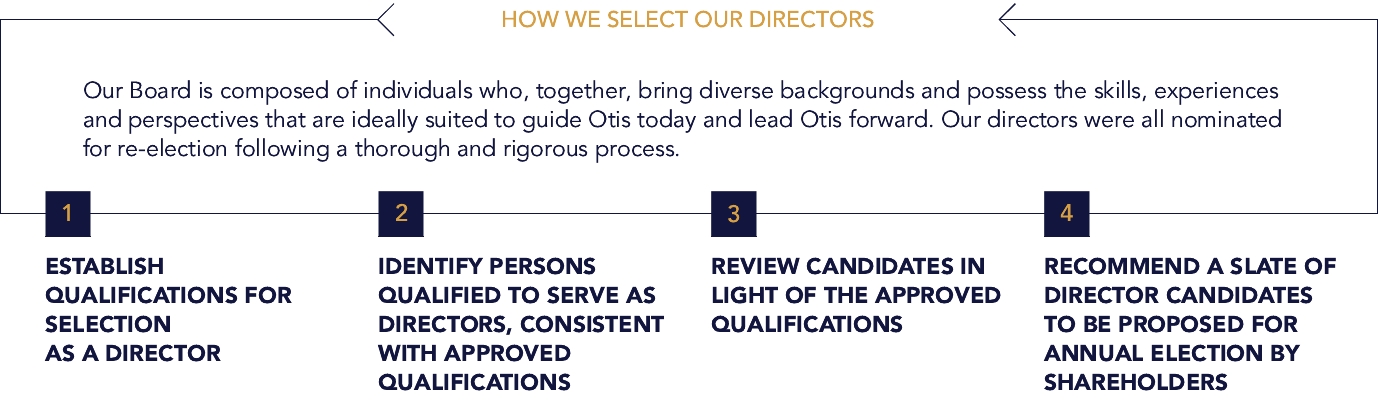

STEP 1 Establish qualifications for selection as a director | ||

The Board, on recommendation by the Nominations and Governance Committee, has established fundamental criteria that any prospective director must possess. Recognizing that Otis must continually adapt to ever-changing business, social, environmental and other global dynamics, the Board also considers which skills, attributes and experiences are necessary to support Otis in executing its current strategy as well as to guide the company in the future. The qualifications used by the Board in selecting the nominees for directors are described under “Criteria for Board membership” and “Director skills and attributes” on page 23. | ||

| ||

STEP 2 Identify persons qualified to serve as directors, consistent with approved qualifications | ||

The Chair, in consultation with the Nominations and Governance Committee and the Lead Director, is responsible for identifying candidates for the Board. The Board has delegated the screening and evaluation process for director candidates to the Nominations and Governance Committee, in consultation with the Chair and the Lead Director. The Nominations and Governance Committee also may engage search firms to assist in identifying and evaluating qualified candidates and to ensure that a large and diverse pool of potential candidates is being considered. | ||

| ||

21 // 103 | |||

Corporate governance |

STEP 3 Review candidates in light of the approved qualifications | |||||||

The Nominations and Governance Committee will consider candidates recommended by directors, management and shareholders who meet the qualifications Otis seeks in its directors. Each candidate is reviewed to ensure that they meet the criteria for Board membership established by the Board. While objectivity and independence of thought are critical attributes for any nominee, the Board also considers whether the candidate satisfies the independence and other requirements for service on the Board and its committees in accordance with the rules of the NYSE and SEC. Shareholder nominations. Shareholders may recommend nominees for consideration by advance notice or proxy access, pursuant to the procedures set forth in Otis’ Bylaws and subject to the universal proxy rules under Exchange Act Rule 14a-19. See “Frequently Asked Questions About the 2025 Annual Meeting – How do I submit proposals and nominations for the 2026 Annual Meeting?” on page 97 for more information on shareholder nominations of directors for the 2026 Annual Meeting. Any properly made shareholder nominations are considered by the Nominations and Governance Committee. Conflicts of interest. Directors must be loyal to and act in the best interests of Otis and promote shareholder value, thus avoiding conflicts of interest and any appearance thereof, as defined by applicable laws and as set forth in The Otis Absolutes. Candidates for Board membership must disclose all situations that could reasonably represent a conflict of interest. | |||||||

Additional considerations for renomination Change in principal responsibilities. If a director’s principal employment or principal responsibilities outside of Otis change substantially, the director must offer to resign from the Board. The Nominations and Governance Committee will recommend to the Board whether the resignation should be accepted. Service on other boards. A director may not serve on the boards of more than three other public companies in addition to the Otis Board. Additionally, the Nominations and Governance Committee will review the appropriateness of a director’s continuing Board service if a director joins the board of a public company or for-profit company where a relationship between Otis and such other entity may affect the independence of the director, require disclosure or conflict with other legal requirements. Retirement policy. Our Corporate Governance Guidelines require that directors will not stand for reelection and will retire from the Board as of the Annual Meeting of Shareholders following their attainment of age 75. The Board retains the authority to approve exceptions to this policy based on special circumstances. There are no fixed term limits for members of the Board. | |||||||

| ||||||

STEP 4 Recommend a slate of director candidates to be proposed for annual election by shareholders | ||||||

The individuals nominated for reelection to the Board at the Annual Meeting have served diligently, capably and vigorously in 2024. Each has been determined by the Nominations and Governance Committee and the Board to possess keen skills and attributes, and invaluable experiences necessary to strongly lead Otis into the future. | ||||||

22 // 103 | |||

Corporate governance |

The Board, on recommendation by the Nominations and Governance Committee, has established fundamental criteria that a prospective director must possess:

• | Objectivity and independence in making informed business decisions |

• | Broad, senior-level experience to be able to offer insight and practical wisdom and contribute to the wide scope of the Board |

• | The highest professional and personal ethics and values in accordance with The Otis Absolutes |

• | Loyalty to the interests of Otis |

• | A commitment to enhancing long-term shareholder value |

• | A capacity to devote the time required to successfully fulfill a director’s duties |

• | Alignment on the corporation’s goals in the areas of health and safety, environment and impact, people and communities, and governance and accountability to drive value for our colleagues, customers, communities and other stakeholders. |

All Board nominees meet the above criteria.

Recognizing that Otis and its strategy must continuously adapt to ever-changing global business and macroeconomic dynamics, the Board also considered which skills and attributes were necessary to support Otis in executing its current strategy and transformation agenda. As a result, the Board, on recommendation from the Nominations and Governance Committee, determined that it should be composed of individuals possessing one or more of the following skills and attributes, so that each crucial skill and attribute is adequately represented on the Board.

| Public company CEO Deep industry knowledge and governance experience through service as a CEO of a publicly traded company | ||||

| Enterprise transformation Executive leadership experience guiding organizations through rapid change – e.g., cultural, operational, digital – and driving innovative and optimized solutions to achieve strategic goals | ||||

| Corporate strategy Experience developing and implementing strategies to drive and enhance corporate culture, customer experience and sustained profitable growth, including capital allocation and mergers and acquisitions | ||||

| Leadership experience outside the United States Extensive leadership experience working outside the United States providing relevant business and cultural perspectives | ||||

| Risk management Experience in overseeing and understanding major risk exposures, including significant financial, operational, compliance, reputational, strategic, regulatory, ESG, geopolitical, trade and cybersecurity risks | ||||

| Audit Committee financial expert Experience as a public accountant, auditor, principal financial officer, controller or principal accounting officer in line with SEC definition of Audit Committee financial expert | ||||

23 // 103 | |||

Corporate governance |

A strong and effective Board is the foundation of Otis’ governance. The Board monitors and maintains its effectiveness through its interrelated Board governance practices. The Board’s self-evaluation process allows it to improve its practices and policies to increase effectiveness. Continuous improvement includes understanding and staying current on industry, global, financial and other trends impacting the business. Otis’ governance practices include robust onboarding and continuing education opportunities.

EVALUATION OF EFFECTIVENESS: BOARD SELF-EVALUATIONS | ||

• The Nominations and Governance Committee oversees the design and implementation of an annual self-evaluation to assess the performance and effectiveness of the Board, its committees and the contributions of directors | ||

• The Lead Director and the Nominations and Governance Committee Chair jointly lead the self-evaluation process, which includes individual interview sessions with directors | ||

• Through written feedback and individual follow-up interviews, the directors provide an evaluation of the performance of the Board and the committees on which they sit, their own performance and the performance of the other directors on the Board as a whole. A summary of results identifying themes or issues that emerge from the self-evaluations are discussed in Board and committee private sessions without management | ||

• Results from self-evaluations are used to enhance the Board and governance practices and policies, as well as inform the Board’s consideration of: ○ Board roles, including committee assignments and chair positions ○ Succession planning ○ Composition and refreshment objectives | ||

24 // 103 | |||

Corporate governance |

We encourage our Board members to visit Otis branches, service centers and other facilities. In 2024, certain Board members visited branches in Connecticut, New York City, Chicago and Vietnam and visited customer jobsites at each location. In addition, the Board endeavors to conduct at least one annual on-site visit to an Otis operating unit, factory or construction or customer site, giving directors a firsthand understanding of Otis’ operations and providing an opportunity for colleagues and directors to interact. In 2024, Board members visited the Otis Test Tower located in Bristol, Connecticut, where they participated in on-site tours and education related to Otis’ products, testing and related topics. All Board members also made a field visit to a customer jobsite in Austin, Texas, to learn more about Otis’ modernization business, a key driver of future growth.

Additionally, directors also receive daily news updates relevant to Otis and the broader elevator and escalator industry and participate in outside continuing education programs through organizations, including the NACD, Women Corporate Directors and others, on a variety of Board-relevant topics, including cybersecurity oversight.

As required by the Corporate Governance Guidelines, any new director will participate in an orientation program that will include:

• | Sessions familiarizing directors with the roles and responsibilities of the Board, including topics tailored to each director’s committee assignments |

• | Meetings with senior leaders to review the company’s strategy, the business, financial statements, significant financial, accounting and risk management issues, compliance programs and The Otis Absolutes, and the internal audit function and the independent auditor |

• | Attendance at a quarterly earnings call or other investor events |

• | Meetings with key executives, including regional and functional area leaders, and an assigned Board Director mentor |

25 // 103 | |||

CORPORATE GOVERNANCE |

The Board, on the recommendation of the Nominations and Governance Committee, has nominated for election the 11 individuals below. All are current directors of Otis.

Each nominee’s biography highlights the key skills and attributes on which the Board particularly relies, in addition to describing each director’s significant work experience and service.

INDEPENDENT DIRECTOR TENURE: Since October 2023 BOARD COMMITTEES: Audit, Compensation OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: ExlService Holdings, Inc. | THOMAS A. BARTLETT | 66 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • President and Chief Executive Officer, American Tower Corporation, 2020-2024 • Executive Vice President and Chief Financial Officer, American Tower Corporation, 2009-2020 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Director, Brightspeed (non-public) since 2024 • Executive Advisor, Apollo Global Management, Inc. (non-public) since 2024 • Member, Council on Foreign Relations, since 2024 • Advisor, Samaritans, since 2013 • Director, American Tower Corporation, 2020-2024 • Member, Business Roundtable, 2020-2024 • Board of Governors, National Association of Real Estate Investment Trust (NAREIT), 2020-2024 • Board of Governors, World Economic Forum’s Information and Communications Technologies (ICT), 2020-2024 • Director, Equinix, Inc., 2013-2020 • Board of Advisors, Rutgers Business School, since 2000 ACCREDITATION / TRAINING: • Certified Public Accountant • Rutgers University, MBA, 1981 | SKILLS AND ATTRIBUTES | ||||||||

| Public company CEO | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Leadership experience outside the U.S. | ||||||||

| Risk management | ||||||||

| Audit Committee financial expert | ||||||||

26 // 103 | |||

CORPORATE GOVERNANCE |

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Audit (Chair) OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Carter’s, Inc. | JEFFREY H. BLACK | 70 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Senior Partner and Vice Chairman, Deloitte LLP, 2002-2016; Member of Board of Directors, 2004-2011 • Partner-in-Charge of Metro New York audit practice, Arthur Andersen LLP, 1988-2002 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Director, Basin Holdings LLC (non-public), since 2018 • Director, Vantage Airport Group, LTD (non-public), since 2016 • Director, The University at Albany Bioscience Development Corp. (non-public), since 2015 • Treasurer and Director, The University at Albany Foundation, since 2009 • Board Chair, The Research Foundation for the State University of New York, 2012-2022 ACCREDITATION / TRAINING: • Certified Public Accountant • NACD Master Class in Cybersecurity, 2023 • CERT Certificate in Cybersecurity Oversight issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University, 2021 | SKILLS AND ATTRIBUTES: | ||||||||

| Risk management | ||||||||

| Audit Committee financial expert | ||||||||

INDEPENDENT DIRECTOR TENURE: Since October 2023 BOARD COMMITTEES: Audit, Nominations and Governance OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: None | JILL C. BRANNON | 61 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Executive Vice President, Chief Sales Officer, FedEx Corporation, since 2019 • Senior Vice President, FedEx Express – Europe, Middle East, India & Africa, 2015-2019 • Senior Vice President, International Sales, FedEx Services, 2006-2015 • FedEx Services – Roadway Package System (FedEx Ground) – Roadway Express, 1985-2006 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Director, Advisory Board, European Transport Solutions SARL, Luxembourg, since 2022 • Director, US-ASEAN Business Council, 2011-2015 • Director, International Children’s Heart Foundation, 2008-2010 | SKILLS AND ATTRIBUTES: | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Leadership experience outside the U.S. | ||||||||

27 // 103 | |||

CORPORATE GOVERNANCE |

INDEPENDENT DIRECTOR TENURE: Since October 2022 BOARD COMMITTEES: Audit, Compensation OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Carnival Corporation and Carnival plc ConocoPhillips Company Zebra Technologies Corporation | NELDA J. CONNORS | 59 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Founder, Chair and Chief Executive Officer, Pine Grove Holdings, LLC, since 2011 • President and Chief Executive Officer, Atkore International Inc. (formerly the Electrical and Metal Products division of Tyco International), 2008-2011 • Vice President, Eaton Corporation plc, 2002-2008 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Annual Rotating Member, Otis Inclusion Advisory Group, 2024 • Director, Arsenal AIC Holdings, Inc. (non-public), since 2023 • Operating Partner, Red Arts Capital (non-public), since 2023 • Advisor, Vibracoustic SE (non-public), since 2018 • Director, Baker Hughes Company, 2020-2024 • Director, Boston Scientific Corporation, 2009-2024 • Advisor, Nissan North America Inc., 2020-2023 • Director, BorgWarner Inc., 2020-2022 • Advisor, Queen’s Gambit Growth Capital, 2020-2022 • Director, EnerSys Corporation, 2017-2021 • Director, CNH Industrial N.V., 2020 • Director, Delphi Technologies PLC, 2017-2020 • Director, Echo Global Logistics, Inc., 2013-2021 • Director, Federal Reserve Bank of Chicago, 2011-2017 ACCREDITATION / TRAINING: • University of Dayton, MS in Mechanical Engineering, 1990 | SKILLS AND ATTRIBUTES: | ||||||||

| Corporate strategy | ||||||||

| Leadership experience outside the U.S. | ||||||||

| Risk management | ||||||||

| Audit Committee financial expert | ||||||||

28 // 103 | |||

CORPORATE GOVERNANCE |

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Audit, Nominations and Governance OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Annaly Capital Management, Inc. Ginkgo Bioworks | KATHY HOPINKAH HANNAN | 63 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Global Lead Partner, Senior Advisor for Board Leadership Center and National Leader Total Impact Strategy, KPMG LLP, 2015-2018 • National Managing Partner of Diversity and Corporate Responsibility, KPMG LLP, 2009-2015 • Midwest Area Managing Partner, Tax Services, KPMG LLP, 2004-2009 • Vice Chairman, Human Resources, KPMG LLP, 2000-2004 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Trustee, Tribal Abatement Fund Trust, since 2022 • Trustee, The Conference Board, since 2022 • Director, Carpenter Technology Corporation, 2022-2023 • Annual Rotating Member, Otis Inclusion Advisory Group, 2022 • Board Chair, Smithsonian National Museum of the American Indian, 2021-2022 • Director, Blue Trail Software (non-public), 2018-2022 • Board Chair and National President, Girl Scouts of the United States of America, 2014-2020 • President George W. Bush’s National Advisory Council on Indian Education, 2004-2008 ACCREDITATION / TRAINING: • Certified Public Accountant • NACD Master Class in Cybersecurity, 2023 • CERT Certificate in Cybersecurity Oversight issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University, 2021 • NACD Directorship Certification by the National Association of Corporate Directors, 2021 • Harvard Business School Online, Sustainable Business Strategy Course, 2021 • Benedictine University, Ph.D. in Leadership and Ethics Studies, 2016 | SKILLS AND ATTRIBUTES: | ||||||||

| Corporate strategy | ||||||||

| Risk management | ||||||||

| Audit Committee Financial Expert | ||||||||

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Compensation (Chair) OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: None | SHAILESH G. JEJURIKAR | 58 | BIRTHPLACE INDIA | ||||||||

EXPERIENCE: • Chief Operating Officer, The Procter & Gamble Company, since 2021 • Chief Executive Officer, Fabric & Home Care, The Procter & Gamble Company, 2019-2021 • Executive Sponsor, Corporate Sustainability, The Procter & Gamble Company, 2016-2021 • President, Global Fabric Care & Home Care Sector, The Procter & Gamble Company, 2018-2019 • President, Global Fabric Care, The Procter & Gamble Company, 2015-2018 • President, Fabric Care, North America and Corporate New Business, The Procter & Gamble Company, 2014-2015 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Chairperson, Cincinnati Center City Development Corporation, since 2022 • Vice Chairman, ACI-American Cleaning Institute, 2016-2017 ACCREDITATION / TRAINING: • CERT Certificate in Cybersecurity Oversight issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University, 2021 | SKILLS AND ATTRIBUTES: | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Leadership experience outside the U.S. | ||||||||

| Risk management | ||||||||

29 // 103 | |||

CORPORATE GOVERNANCE |

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: None OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Nucor Corporation | CHRISTOPHER J. KEARNEY | 69 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Managing Partner, Eagle Marsh Holdings, LLC, since 2017 • Executive Chair, Otis Worldwide Corporation, 2020-2022 • Non-Executive Chairman, SPX FLOW, Inc., 2016-2017 • Chairman, President and Chief Executive Officer, SPX FLOW, Inc., October-December 2015 • Chairman, President and Chief Executive Officer, SPX Corporation, 2007-2015 • President and Chief Executive Officer, SPX Corporation, 2004-2007 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Lead Director, Nucor Corporation, since 2022 • Director, United Technologies Corporation, 2018-2020 • Director, SPX Corporation, 2015-2016 • Director, Polypore International, Inc., 2012-2015 ACCREDITATION / TRAINING: • DePaul University, College of Law, JD, 1981 | SKILLS AND ATTRIBUTES: | ||||||||

| Public company CEO | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Risk management | ||||||||

NON-INDEPENDENT DIRECTOR AND CHAIR, CHIEF EXECUTIVE OFFICER AND PRESIDENT TENURE: Since April 2020 BOARD COMMITTEES: None OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Caterpillar, Inc. | JUDITH F. MARKS | 61 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Chair (since 2022), Chief Executive Officer and President (since 2020), Otis Worldwide Corporation • President (since 2017) and Chief Executive Officer (since 2019), Otis Elevator Company • Chief Executive Officer, Siemens USA and Dresser Rand, a Siemens business, 2016-2017 • Executive Vice President, New Equipment Solutions, Dresser Rand, 2015-2016 • President and Chief Executive Officer, Siemens Government Technologies, 2011-2015 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Member, Business Roundtable, since 2021 ○ Member of the Board of Directors, since 2023 ○ Chair of the Trade & International Committee, since 2023 ○ Co-Chair of the China Working Group, since 2023 ○ Member of the Tax Committee, 2022 • Board Member, AdvanceCT, since 2021 • Member, U.S.-India CEO Forum, 2022-2024 • Director, Hubbell Incorporated, 2016-2020 | SKILLS AND ATTRIBUTES: | ||||||||

| Public company CEO | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Risk management | ||||||||

30 // 103 | |||

CORPORATE GOVERNANCE |

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Nominations and Governance (Chair) OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: McCormick & Company | MARGARET M. V. PRESTON | 67 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Managing Director, Cohen Klingenstein, LLC, since 2021 • Managing Director, North Region Leader, U.S. Wealth Management, TD Bank, N.A., 2014-2019 • Managing Director and Regional Executive for U.S. Trust, Bank of America Private Wealth Management, 2006-2014 • Executive Vice President, Wealth Management and Investments, PNC Bank (formerly Mercantile-Safe Deposit & Trust Co.), 2002-2006 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Annual Rotating Member, Otis Inclusion Advisory Group, 2025 • Board Member, United Way of New York City Women’s Leadership Council, 2006-2020 • Board Member, Lincoln Center, Women’s Leadership Council, 2014-2019 ACCREDITATION / TRAINING: • NACD Directorship Certification by the National Association of Corporate Directors, 2023 • University of Pennsylvania, The Wharton School, Executive Leadership Program, 2013 • Harvard University, Graduate School of Business Administration, MBA, 1983 | SKILLS AND ATTRIBUTES: | ||||||||

| Corporate strategy | ||||||||

| Leadership experience outside the U.S. | ||||||||

| Risk management | ||||||||

| Audit Committee Financial Expert | ||||||||

INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Compensation, Nominations and Governance OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: Kontoor Brands, Inc. Clean Harbors, Inc. | SHELLEY STEWART, JR. | 71 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Managing Partner, Bottom Line Advisory LLC, since 2018 • Vice President, Sourcing and Logistics, and Chief Procurement Officer, E. I. du Pont de Nemours and Company, 2012-2018 • Senior Vice President, Operational Excellence, Chief Procurement Officer, Tyco International plc, 2005-2012 • Vice President, Supply Chain Management, Tyco International plc, 2003-2005 • Senior Vice President, Supply Chain, Invensys Ltd, 2001-2003 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Board Chair, The Executive Leadership Council, since 2025 • Annual Rotating Member, Otis Inclusion Advisory Group, 2023 • Advisory Board, Ariel Alternatives, LLC, since 2021 • Chairman, Billion Dollar Roundtable Inc., since 2019 • Board of Trustees, Howard University, since 2018 • Board of Governors, University of New Haven, since 2018 • Chair, Board of Visitors, Howard University School of Business, since 2015 • Director, Cleco Corporation, 2010-2016 | SKILLS AND ATTRIBUTES: | ||||||||

| Enterprise transformation | ||||||||

| Risk management | ||||||||

31 // 103 | |||

CORPORATE GOVERNANCE |

LEAD DIRECTOR INDEPENDENT DIRECTOR TENURE: Since April 2020 BOARD COMMITTEES: Compensation OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: None | JOHN H. WALKER | 67 | BIRTHPLACE UNITED STATES | ||||||||

EXPERIENCE: • Non-Executive Chair, O-I Glass, 2021-2024 • Non-Executive Chairman, Nucor Corporation, 2020-2022 • Non-Executive Chairman, Global Brass and Copper Holdings, Inc., 2014-2019 • Executive Chairman, Global Brass and Copper Holdings, Inc., 2013-2014 • Chief Executive Officer, Global Brass and Copper Holdings, Inc., 2007-2014 • President and Chief Executive Officer, The Boler Company, 2003-2006 • Chief Executive Officer, Weirton Steel Corporation, 2001-2003 OTHER LEADERSHIP EXPERIENCE AND SERVICE: • Director, O-I Glass, Inc., 2019-2024 • Director, Nucor Corporation, 2008-2023 • Director, United Continental Holdings, Inc., 2002-2016 • Director, Delphi Corporation, 2005-2009 | SKILLS AND ATTRIBUTES: | ||||||||

| Public company CEO | ||||||||

| Enterprise transformation | ||||||||

| Corporate strategy | ||||||||

| Risk management | ||||||||

32 // 103 | |||

CORPORATE GOVERNANCE |

We are proud of the breadth, depth and diversity of skills and expertise that our Board possesses. No one skill is more important than the other, and the strength of our Board and committees comes from its collective perspectives. The chart below and the biographical information for each director nominee above illustrate the diverse set of key skills, attributes and areas of expertise represented on our Board. The absence of a “•” for a particular skill or attribute does not mean the director is unable to contribute to the decision-making process in that area.

Thomas A. Bartlett | Jeffrey H. Black | Jill C. Brannon | Nelda J. Connors | Kathy Hopinkah Hannan | Shailesh G. Jejurikar | Christopher J. Kearney | Judith F. Marks | Margaret M. V. Preston | Shelley Stewart, Jr. | John H. Walker | |||

| Public company CEO | • | • | • | • | ||||||||

| Enterprise transformation | • | • | • | • | • | • | • | |||||

| Corporate strategy | • | • | • | • | • | • | • | • | • | |||

| Leadership experience outside the U.S. | • | • | • | • | • | |||||||

| Risk management | • | • | • | • | • | • | • | • | • | • | ||

| Audit Committee financial expert | • | • | • | • | • | |||||||

Gender Identity | Male | Male | Female | Female | Female | Male | Male | Female | Female | Male | Male | ||

African American or Black | • | • | |||||||||||

Alaskan Native or Native American | • | ||||||||||||

Asian | • | ||||||||||||

White | • | • | • | • | • | • | • | ||||||

Born Outside the U.S. | • | ||||||||||||

33 // 103 | |||

CORPORATE GOVERNANCE |

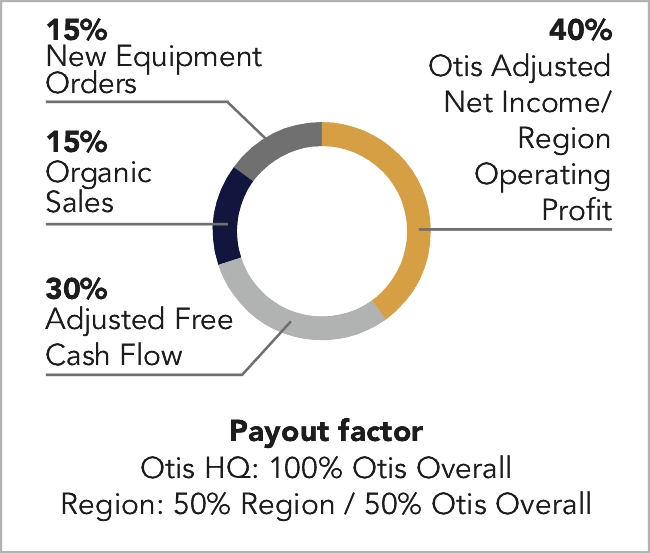

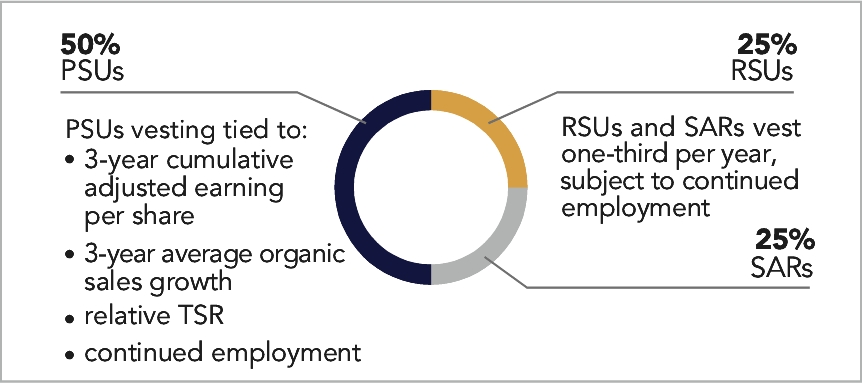

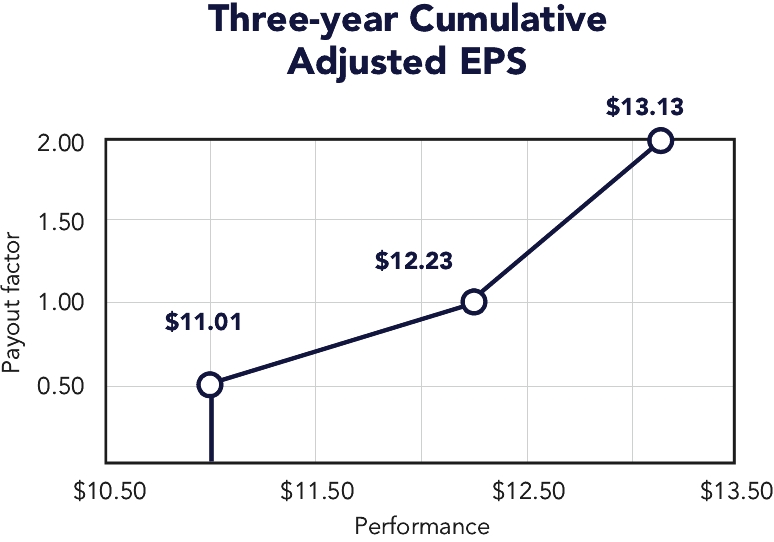

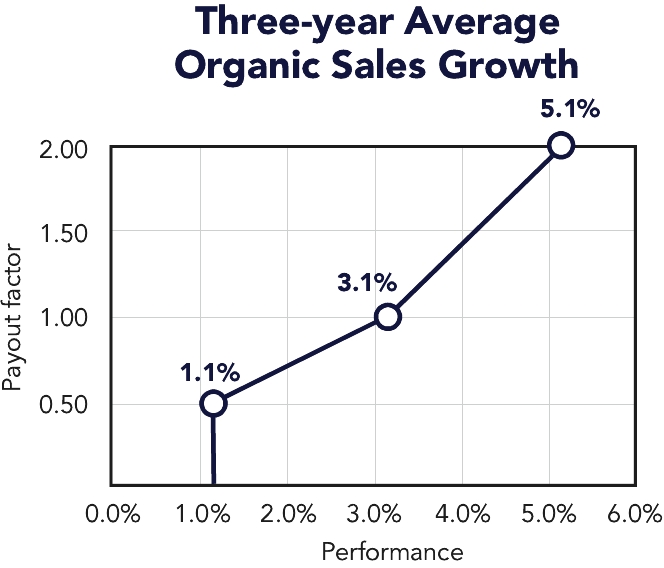

Objectivity and independence of thought are critical attributes for all our Board members, enabling our Board as a whole to respect and consider the broad range of viewpoints offered by our diverse directors. To further ensure that our directors are guided by independent thought and interest, the Board, under the Corporate Governance Guidelines, requires that a substantial majority of directors be independent in accordance with applicable law and the listing standards of the NYSE.