Financial Statements Seaport Therapeutics, Inc. For the period October 18, 2024 through December 31, 2024 With Report from Independent Auditors

F-1 Seaport Therapeutics, Inc. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Audited Consolidated Financial Statements for the Period of October 18, 2024 through December 31, 2024 Report from Independent Auditors F-2 Consolidated Balance Sheet F-4 Consolidated Statement of Operations and Comprehensive Loss F-5 Consolidated Statement of Changes in Convertible Preferred Stock and Stockholders' Deficit F-6 Consolidated Statement of Cash Flows F-7 Notes to Consolidated Financial Statements F-8

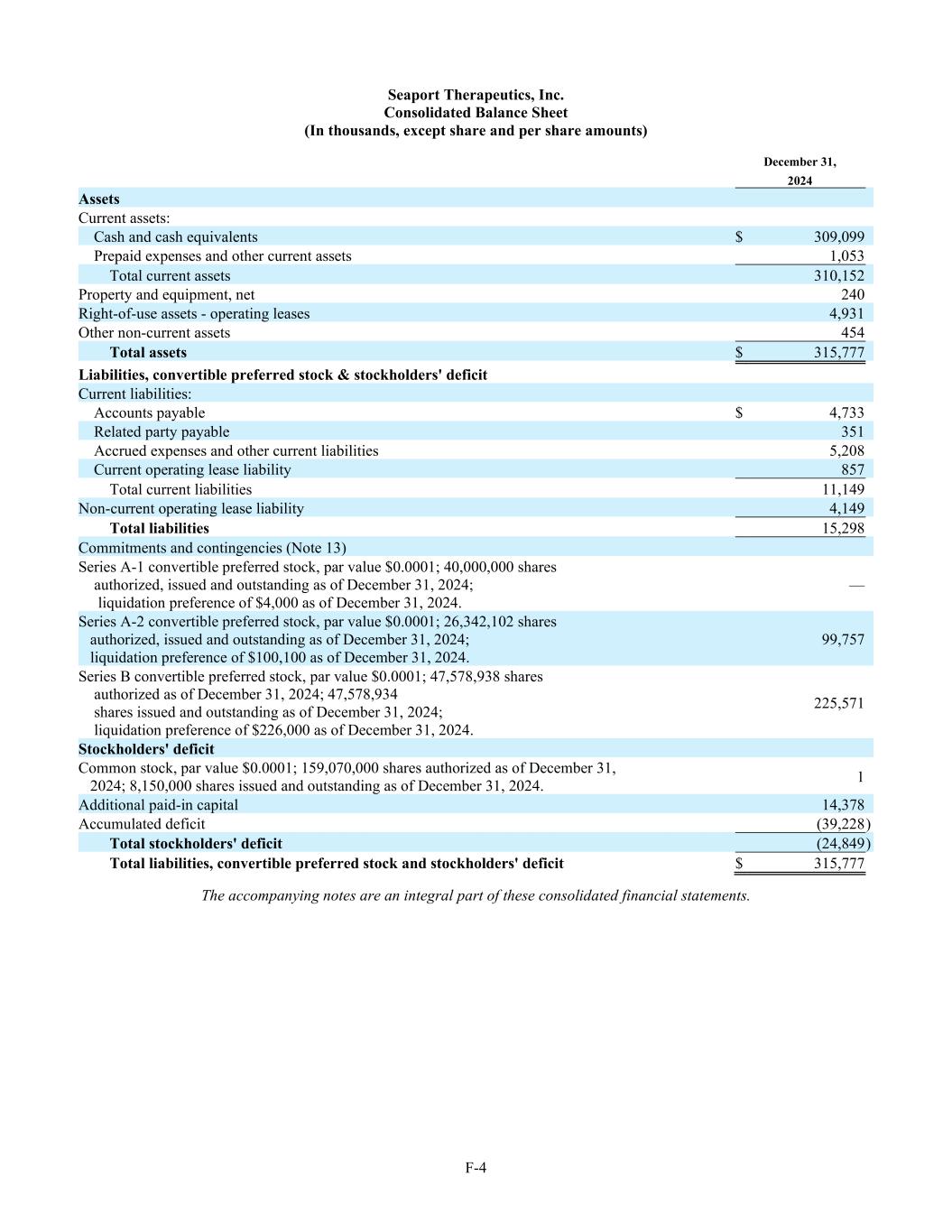

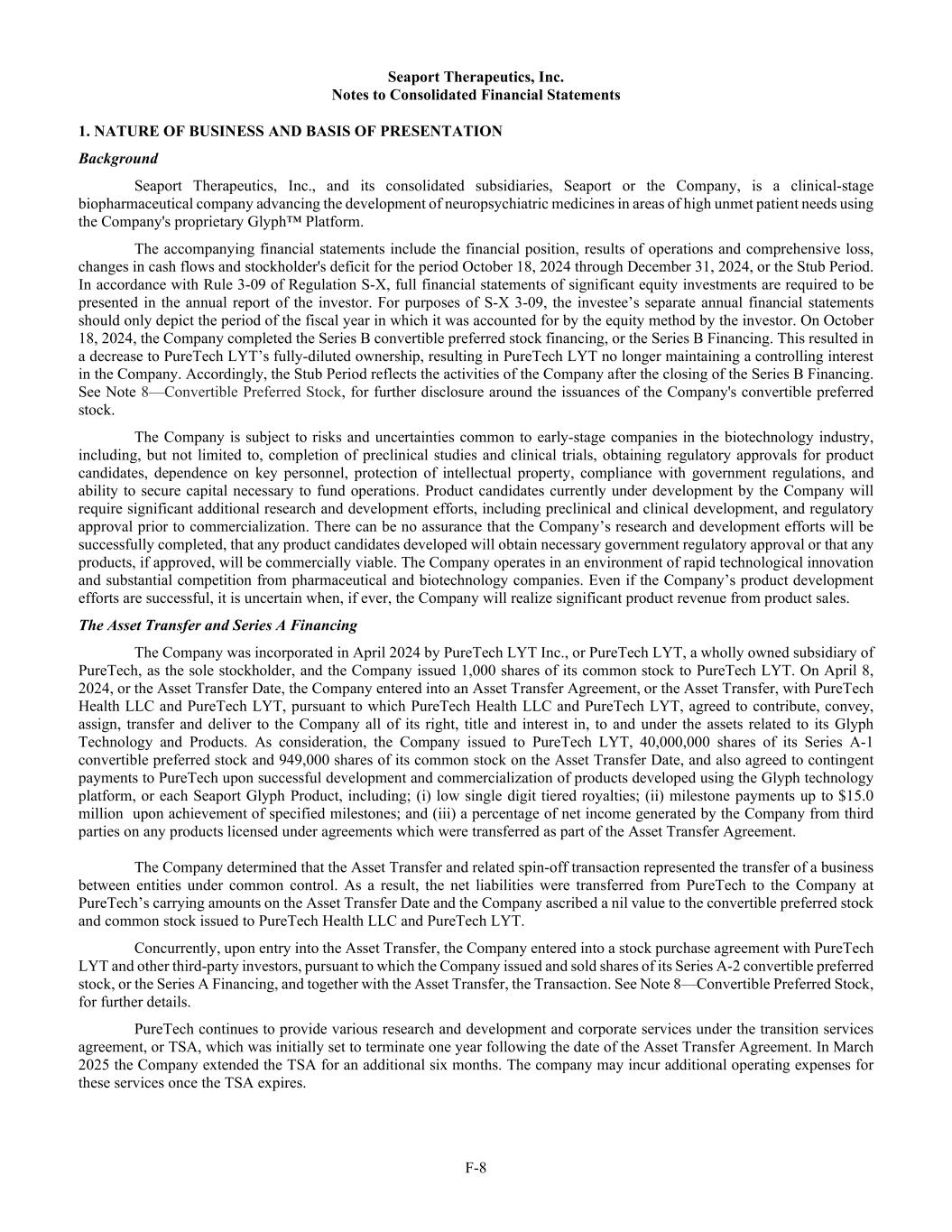

F-4 Seaport Therapeutics, Inc. Consolidated Balance Sheet (In thousands, except share and per share amounts) December 31, 2024 Assets Current assets: Cash and cash equivalents $ 309,099 Prepaid expenses and other current assets 1,053 Total current assets 310,152 Property and equipment, net 240 Right-of-use assets - operating leases 4,931 Other non-current assets 454 Total assets $ 315,777 Liabilities, convertible preferred stock & stockholders' deficit Current liabilities: Accounts payable $ 4,733 Related party payable 351 Accrued expenses and other current liabilities 5,208 Current operating lease liability 857 Total current liabilities 11,149 Non-current operating lease liability 4,149 Total liabilities 15,298 Commitments and contingencies (Note 13) Series A-1 convertible preferred stock, par value $0.0001; 40,000,000 shares authorized, issued and outstanding as of December 31, 2024; liquidation preference of $4,000 as of December 31, 2024. — Series A-2 convertible preferred stock, par value $0.0001; 26,342,102 shares authorized, issued and outstanding as of December 31, 2024; liquidation preference of $100,100 as of December 31, 2024. 99,757 Series B convertible preferred stock, par value $0.0001; 47,578,938 shares authorized as of December 31, 2024; 47,578,934 shares issued and outstanding as of December 31, 2024; liquidation preference of $226,000 as of December 31, 2024. 225,571 Stockholders' deficit Common stock, par value $0.0001; 159,070,000 shares authorized as of December 31, 2024; 8,150,000 shares issued and outstanding as of December 31, 2024. 1 Additional paid-in capital 14,378 Accumulated deficit (39,228 ) Total stockholders' deficit (24,849 ) Total liabilities, convertible preferred stock and stockholders' deficit $ 315,777 The accompanying notes are an integral part of these consolidated financial statements.

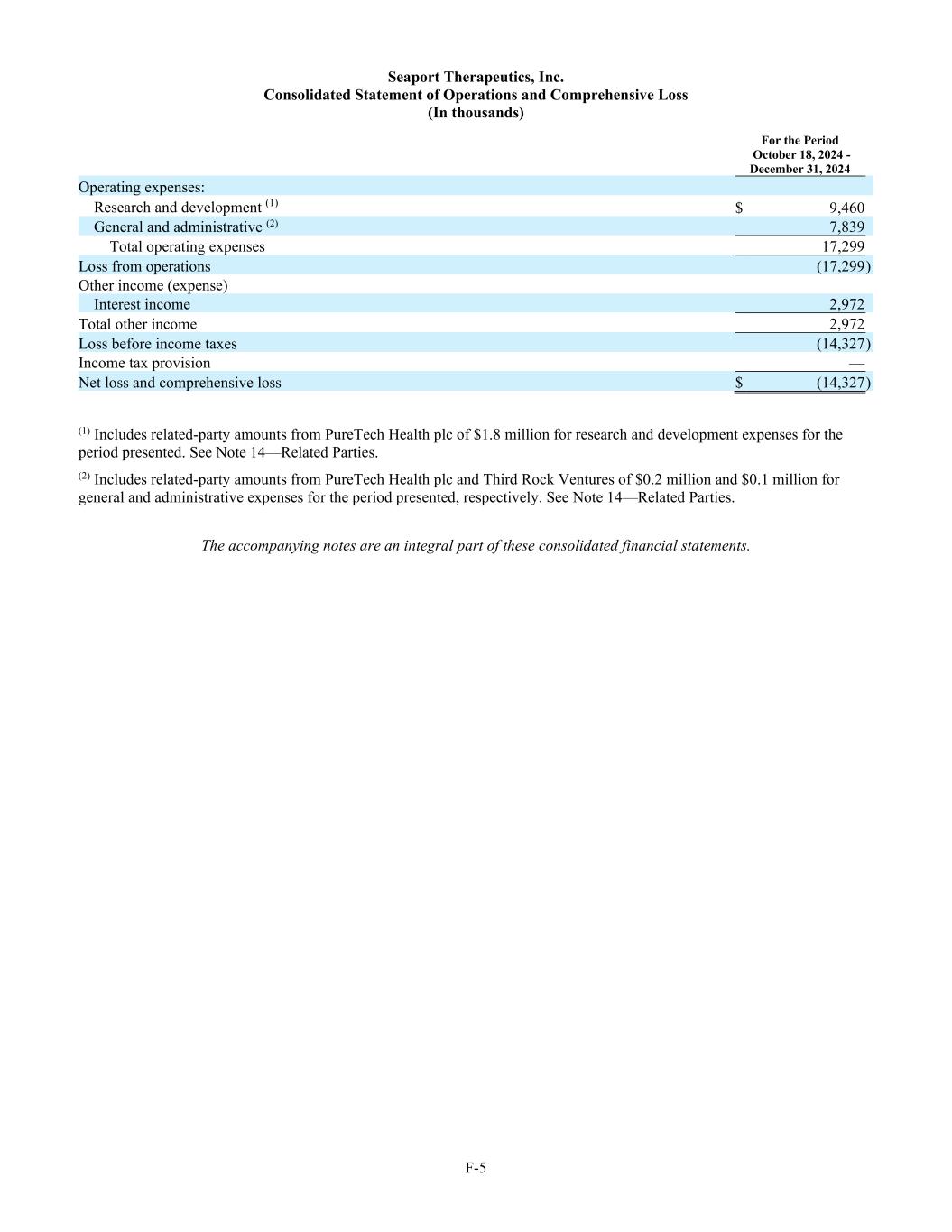

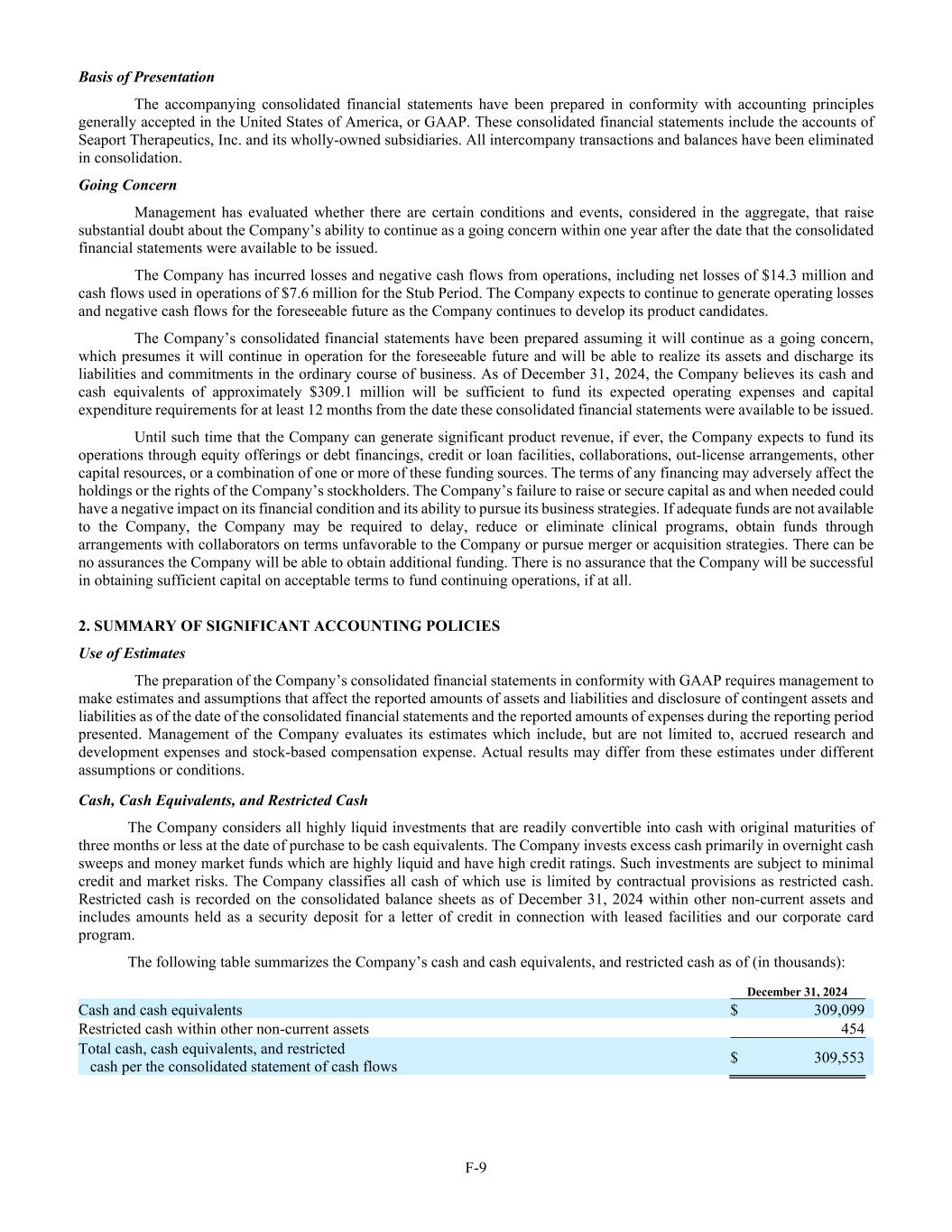

F-5 Seaport Therapeutics, Inc. Consolidated Statement of Operations and Comprehensive Loss (In thousands) For the Period October 18, 2024 - December 31, 2024 Operating expenses: Research and development (1) $ 9,460 General and administrative (2) 7,839 Total operating expenses 17,299 Loss from operations (17,299 ) Other income (expense) Interest income 2,972 Total other income 2,972 Loss before income taxes (14,327 ) Income tax provision — Net loss and comprehensive loss $ (14,327 ) (1) Includes related-party amounts from PureTech Health plc of $1.8 million for research and development expenses for the period presented. See Note 14—Related Parties. (2) Includes related-party amounts from PureTech Health plc and Third Rock Ventures of $0.2 million and $0.1 million for general and administrative expenses for the period presented, respectively. See Note 14—Related Parties. The accompanying notes are an integral part of these consolidated financial statements.

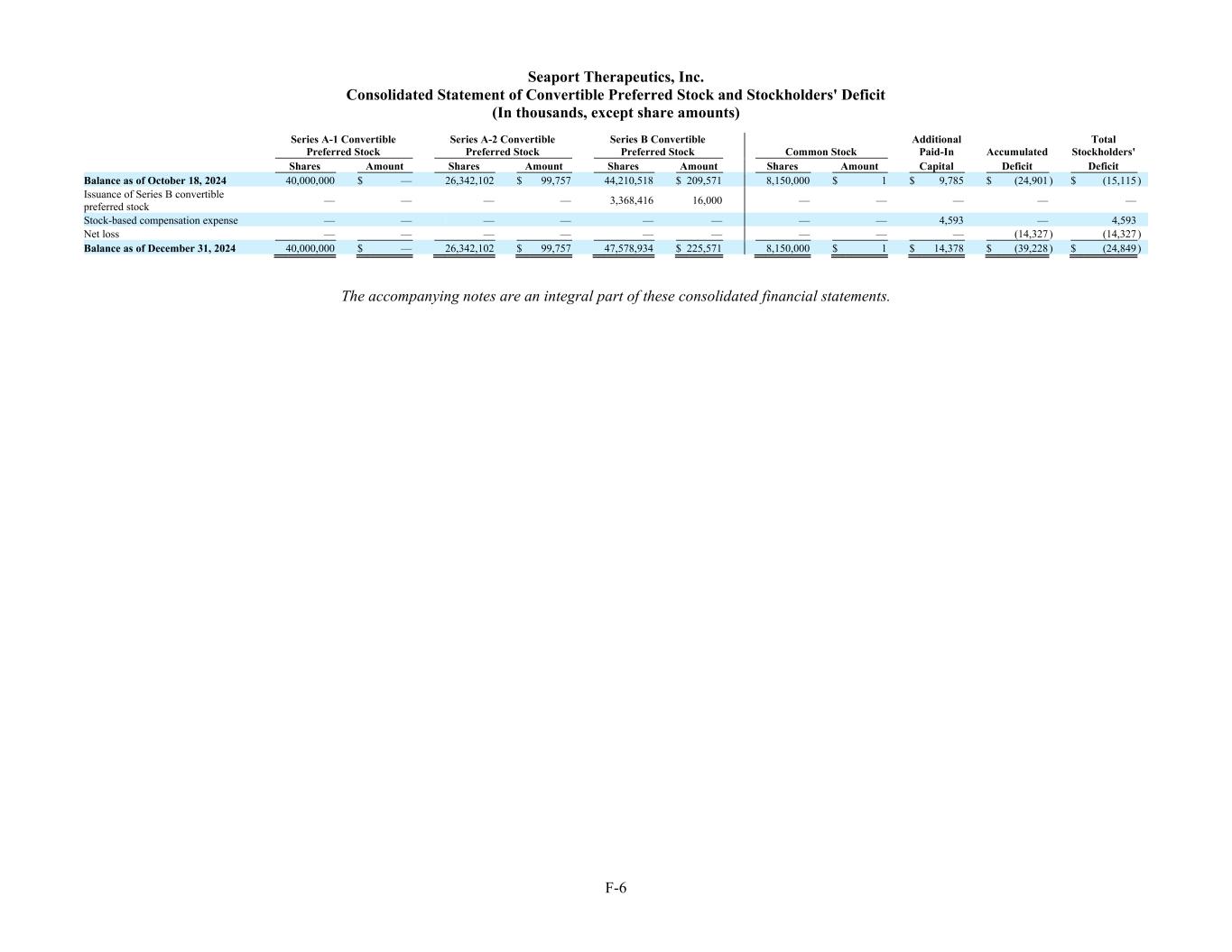

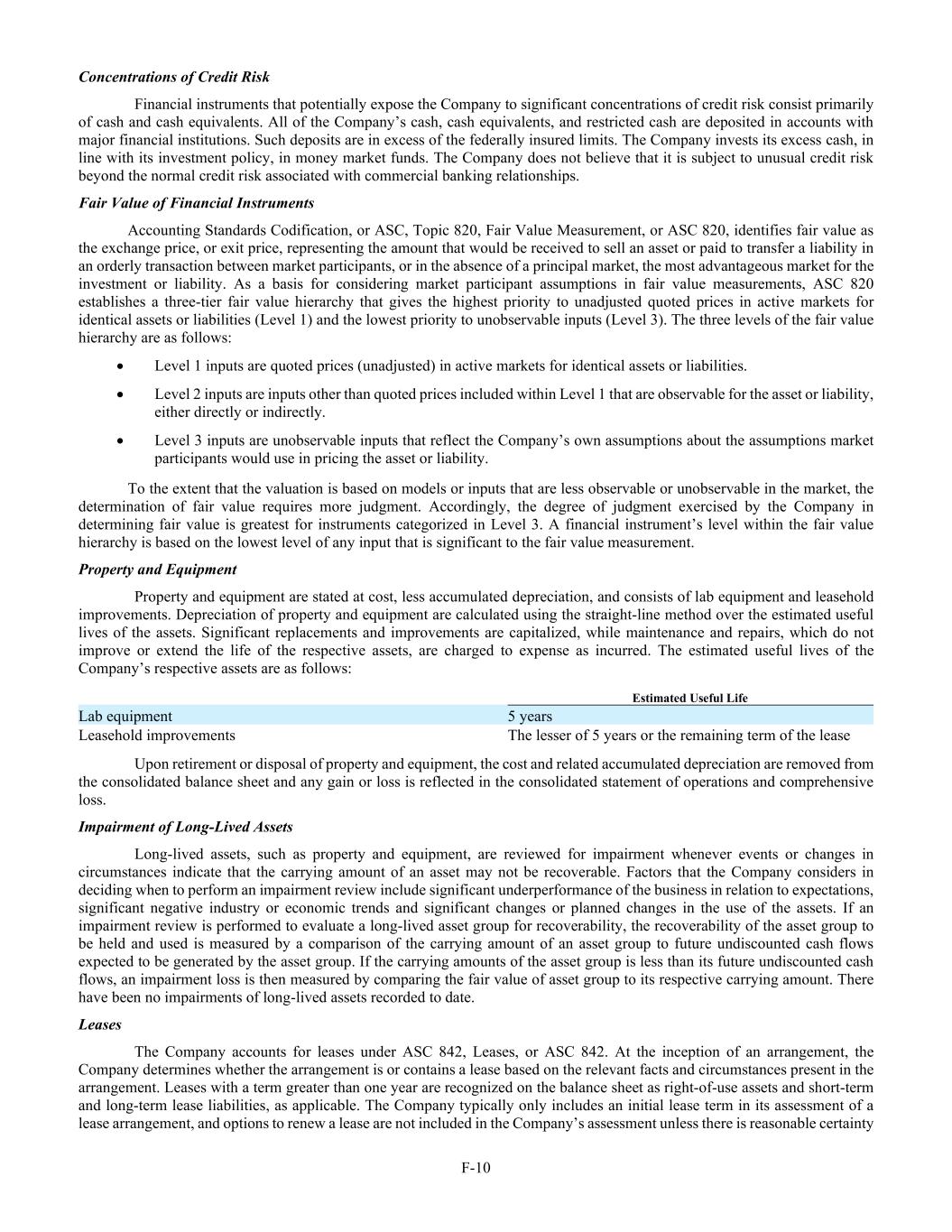

F-6 Seaport Therapeutics, Inc. Consolidated Statement of Convertible Preferred Stock and Stockholders' Deficit (In thousands, except share amounts) Series A-1 Convertible Preferred Stock Series A-2 Convertible Preferred Stock Series B Convertible Preferred Stock Common Stock Additional Paid-In Accumulated Total Stockholders' Shares Amount Shares Amount Shares Amount Shares Amount Capital Deficit Deficit Balance as of October 18, 2024 40,000,000 $ — 26,342,102 $ 99,757 44,210,518 $ 209,571 8,150,000 $ 1 $ 9,785 $ (24,901 ) $ (15,115 ) Issuance of Series B convertible preferred stock — — — — 3,368,416 16,000 — — — — — Stock-based compensation expense — — — — — — — — 4,593 — 4,593 Net loss — — — — — — — — — (14,327 ) (14,327 ) Balance as of December 31, 2024 40,000,000 $ — 26,342,102 $ 99,757 47,578,934 $ 225,571 8,150,000 $ 1 $ 14,378 $ (39,228 ) $ (24,849 ) The accompanying notes are an integral part of these consolidated financial statements.

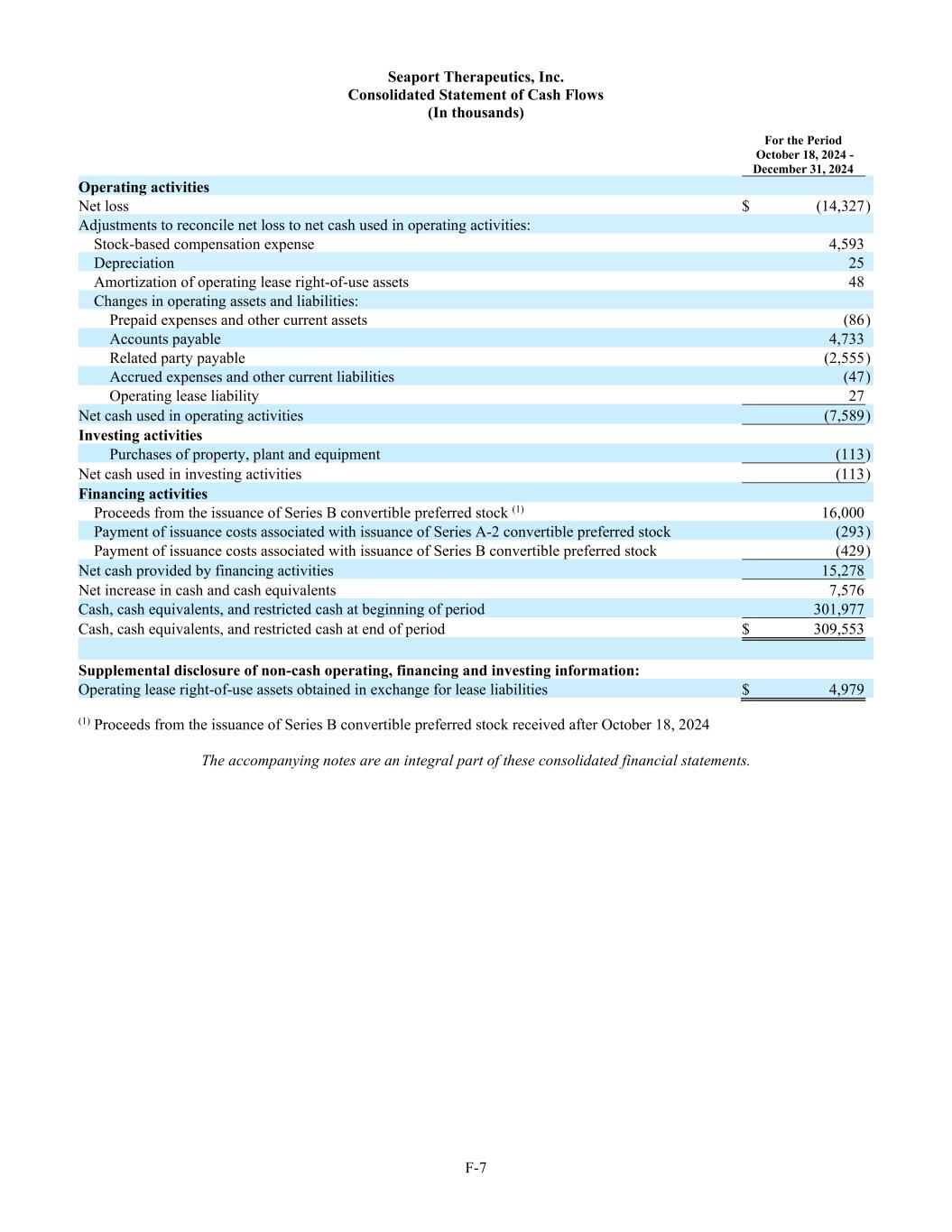

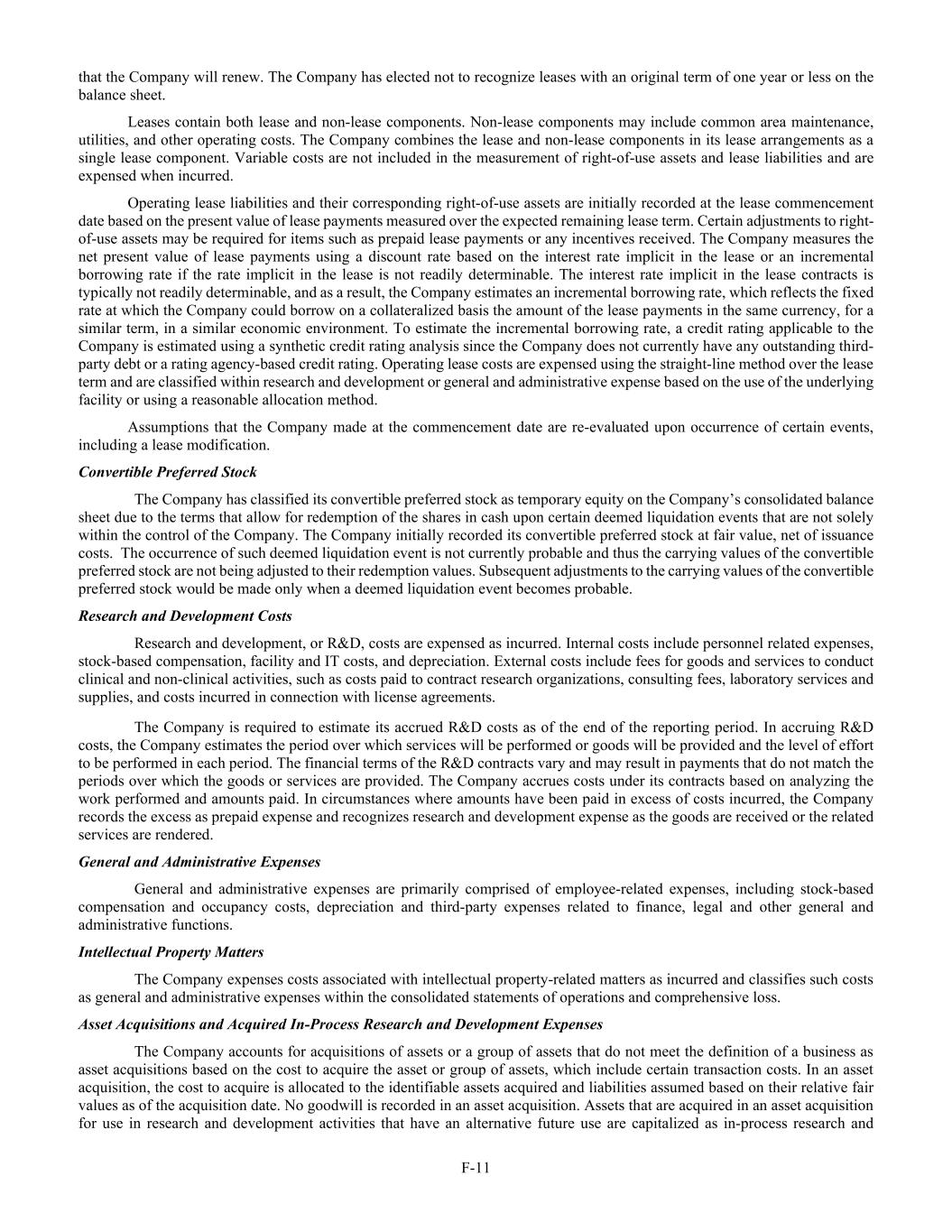

F-7 Seaport Therapeutics, Inc. Consolidated Statement of Cash Flows (In thousands) For the Period October 18, 2024 - December 31, 2024 Operating activities Net loss $ (14,327 ) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation expense 4,593 Depreciation 25 Amortization of operating lease right-of-use assets 48 Changes in operating assets and liabilities: Prepaid expenses and other current assets (86 ) Accounts payable 4,733 Related party payable (2,555 ) Accrued expenses and other current liabilities (47 ) Operating lease liability 27 Net cash used in operating activities (7,589 ) Investing activities Purchases of property, plant and equipment (113 ) Net cash used in investing activities (113 ) Financing activities Proceeds from the issuance of Series B convertible preferred stock (1) 16,000 Payment of issuance costs associated with issuance of Series A-2 convertible preferred stock (293 ) Payment of issuance costs associated with issuance of Series B convertible preferred stock (429 ) Net cash provided by financing activities 15,278 Net increase in cash and cash equivalents 7,576 Cash, cash equivalents, and restricted cash at beginning of period 301,977 Cash, cash equivalents, and restricted cash at end of period $ 309,553 Supplemental disclosure of non-cash operating, financing and investing information: Operating lease right-of-use assets obtained in exchange for lease liabilities $ 4,979 (1) Proceeds from the issuance of Series B convertible preferred stock received after October 18, 2024 The accompanying notes are an integral part of these consolidated financial statements.

F-8 Seaport Therapeutics, Inc. Notes to Consolidated Financial Statements 1. NATURE OF BUSINESS AND BASIS OF PRESENTATION Background Seaport Therapeutics, Inc., and its consolidated subsidiaries, Seaport or the Company, is a clinical-stage biopharmaceutical company advancing the development of neuropsychiatric medicines in areas of high unmet patient needs using the Company's proprietary Glyph™ Platform. The accompanying financial statements include the financial position, results of operations and comprehensive loss, changes in cash flows and stockholder's deficit for the period October 18, 2024 through December 31, 2024, or the Stub Period. In accordance with Rule 3-09 of Regulation S-X, full financial statements of significant equity investments are required to be presented in the annual report of the investor. For purposes of S-X 3-09, the investee’s separate annual financial statements should only depict the period of the fiscal year in which it was accounted for by the equity method by the investor. On October 18, 2024, the Company completed the Series B convertible preferred stock financing, or the Series B Financing. This resulted in a decrease to PureTech LYT’s fully-diluted ownership, resulting in PureTech LYT no longer maintaining a controlling interest in the Company. Accordingly, the Stub Period reflects the activities of the Company after the closing of the Series B Financing. See Note 8—Convertible Preferred Stock, for further disclosure around the issuances of the Company's convertible preferred stock. The Company is subject to risks and uncertainties common to early-stage companies in the biotechnology industry, including, but not limited to, completion of preclinical studies and clinical trials, obtaining regulatory approvals for product candidates, dependence on key personnel, protection of intellectual property, compliance with government regulations, and ability to secure capital necessary to fund operations. Product candidates currently under development by the Company will require significant additional research and development efforts, including preclinical and clinical development, and regulatory approval prior to commercialization. There can be no assurance that the Company’s research and development efforts will be successfully completed, that any product candidates developed will obtain necessary government regulatory approval or that any products, if approved, will be commercially viable. The Company operates in an environment of rapid technological innovation and substantial competition from pharmaceutical and biotechnology companies. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will realize significant product revenue from product sales. The Asset Transfer and Series A Financing The Company was incorporated in April 2024 by PureTech LYT Inc., or PureTech LYT, a wholly owned subsidiary of PureTech, as the sole stockholder, and the Company issued 1,000 shares of its common stock to PureTech LYT. On April 8, 2024, or the Asset Transfer Date, the Company entered into an Asset Transfer Agreement, or the Asset Transfer, with PureTech Health LLC and PureTech LYT, pursuant to which PureTech Health LLC and PureTech LYT, agreed to contribute, convey, assign, transfer and deliver to the Company all of its right, title and interest in, to and under the assets related to its Glyph Technology and Products. As consideration, the Company issued to PureTech LYT, 40,000,000 shares of its Series A-1 convertible preferred stock and 949,000 shares of its common stock on the Asset Transfer Date, and also agreed to contingent payments to PureTech upon successful development and commercialization of products developed using the Glyph technology platform, or each Seaport Glyph Product, including; (i) low single digit tiered royalties; (ii) milestone payments up to $15.0 million upon achievement of specified milestones; and (iii) a percentage of net income generated by the Company from third parties on any products licensed under agreements which were transferred as part of the Asset Transfer Agreement. The Company determined that the Asset Transfer and related spin-off transaction represented the transfer of a business between entities under common control. As a result, the net liabilities were transferred from PureTech to the Company at PureTech’s carrying amounts on the Asset Transfer Date and the Company ascribed a nil value to the convertible preferred stock and common stock issued to PureTech Health LLC and PureTech LYT. Concurrently, upon entry into the Asset Transfer, the Company entered into a stock purchase agreement with PureTech LYT and other third-party investors, pursuant to which the Company issued and sold shares of its Series A-2 convertible preferred stock, or the Series A Financing, and together with the Asset Transfer, the Transaction. See Note 8—Convertible Preferred Stock, for further details. PureTech continues to provide various research and development and corporate services under the transition services agreement, or TSA, which was initially set to terminate one year following the date of the Asset Transfer Agreement. In March 2025 the Company extended the TSA for an additional six months. The company may incur additional operating expenses for these services once the TSA expires.

F-9 Basis of Presentation The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP. These consolidated financial statements include the accounts of Seaport Therapeutics, Inc. and its wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. Going Concern Management has evaluated whether there are certain conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the consolidated financial statements were available to be issued. The Company has incurred losses and negative cash flows from operations, including net losses of $14.3 million and cash flows used in operations of $7.6 million for the Stub Period. The Company expects to continue to generate operating losses and negative cash flows for the foreseeable future as the Company continues to develop its product candidates. The Company’s consolidated financial statements have been prepared assuming it will continue as a going concern, which presumes it will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities and commitments in the ordinary course of business. As of December 31, 2024, the Company believes its cash and cash equivalents of approximately $309.1 million will be sufficient to fund its expected operating expenses and capital expenditure requirements for at least 12 months from the date these consolidated financial statements were available to be issued. Until such time that the Company can generate significant product revenue, if ever, the Company expects to fund its operations through equity offerings or debt financings, credit or loan facilities, collaborations, out-license arrangements, other capital resources, or a combination of one or more of these funding sources. The terms of any financing may adversely affect the holdings or the rights of the Company’s stockholders. The Company’s failure to raise or secure capital as and when needed could have a negative impact on its financial condition and its ability to pursue its business strategies. If adequate funds are not available to the Company, the Company may be required to delay, reduce or eliminate clinical programs, obtain funds through arrangements with collaborators on terms unfavorable to the Company or pursue merger or acquisition strategies. There can be no assurances the Company will be able to obtain additional funding. There is no assurance that the Company will be successful in obtaining sufficient capital on acceptable terms to fund continuing operations, if at all. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Use of Estimates The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of expenses during the reporting period presented. Management of the Company evaluates its estimates which include, but are not limited to, accrued research and development expenses and stock-based compensation expense. Actual results may differ from these estimates under different assumptions or conditions. Cash, Cash Equivalents, and Restricted Cash The Company considers all highly liquid investments that are readily convertible into cash with original maturities of three months or less at the date of purchase to be cash equivalents. The Company invests excess cash primarily in overnight cash sweeps and money market funds which are highly liquid and have high credit ratings. Such investments are subject to minimal credit and market risks. The Company classifies all cash of which use is limited by contractual provisions as restricted cash. Restricted cash is recorded on the consolidated balance sheets as of December 31, 2024 within other non-current assets and includes amounts held as a security deposit for a letter of credit in connection with leased facilities and our corporate card program. The following table summarizes the Company’s cash and cash equivalents, and restricted cash as of (in thousands): December 31, 2024 Cash and cash equivalents $ 309,099 Restricted cash within other non-current assets 454 Total cash, cash equivalents, and restricted cash per the consolidated statement of cash flows $ 309,553

F-10 Concentrations of Credit Risk Financial instruments that potentially expose the Company to significant concentrations of credit risk consist primarily of cash and cash equivalents. All of the Company’s cash, cash equivalents, and restricted cash are deposited in accounts with major financial institutions. Such deposits are in excess of the federally insured limits. The Company invests its excess cash, in line with its investment policy, in money market funds. The Company does not believe that it is subject to unusual credit risk beyond the normal credit risk associated with commercial banking relationships. Fair Value of Financial Instruments Accounting Standards Codification, or ASC, Topic 820, Fair Value Measurement, or ASC 820, identifies fair value as the exchange price, or exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants, or in the absence of a principal market, the most advantageous market for the investment or liability. As a basis for considering market participant assumptions in fair value measurements, ASC 820 establishes a three-tier fair value hierarchy that gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are as follows: • Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. • Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. • Level 3 inputs are unobservable inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability. To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for instruments categorized in Level 3. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Property and Equipment Property and equipment are stated at cost, less accumulated depreciation, and consists of lab equipment and leasehold improvements. Depreciation of property and equipment are calculated using the straight-line method over the estimated useful lives of the assets. Significant replacements and improvements are capitalized, while maintenance and repairs, which do not improve or extend the life of the respective assets, are charged to expense as incurred. The estimated useful lives of the Company’s respective assets are as follows: Estimated Useful Life Lab equipment 5 years Leasehold improvements The lesser of 5 years or the remaining term of the lease Upon retirement or disposal of property and equipment, the cost and related accumulated depreciation are removed from the consolidated balance sheet and any gain or loss is reflected in the consolidated statement of operations and comprehensive loss. Impairment of Long-Lived Assets Long-lived assets, such as property and equipment, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Factors that the Company considers in deciding when to perform an impairment review include significant underperformance of the business in relation to expectations, significant negative industry or economic trends and significant changes or planned changes in the use of the assets. If an impairment review is performed to evaluate a long-lived asset group for recoverability, the recoverability of the asset group to be held and used is measured by a comparison of the carrying amount of an asset group to future undiscounted cash flows expected to be generated by the asset group. If the carrying amounts of the asset group is less than its future undiscounted cash flows, an impairment loss is then measured by comparing the fair value of asset group to its respective carrying amount. There have been no impairments of long-lived assets recorded to date. Leases The Company accounts for leases under ASC 842, Leases, or ASC 842. At the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the relevant facts and circumstances present in the arrangement. Leases with a term greater than one year are recognized on the balance sheet as right-of-use assets and short-term and long-term lease liabilities, as applicable. The Company typically only includes an initial lease term in its assessment of a lease arrangement, and options to renew a lease are not included in the Company’s assessment unless there is reasonable certainty

F-11 that the Company will renew. The Company has elected not to recognize leases with an original term of one year or less on the balance sheet. Leases contain both lease and non-lease components. Non-lease components may include common area maintenance, utilities, and other operating costs. The Company combines the lease and non-lease components in its lease arrangements as a single lease component. Variable costs are not included in the measurement of right-of-use assets and lease liabilities and are expensed when incurred. Operating lease liabilities and their corresponding right-of-use assets are initially recorded at the lease commencement date based on the present value of lease payments measured over the expected remaining lease term. Certain adjustments to right- of-use assets may be required for items such as prepaid lease payments or any incentives received. The Company measures the net present value of lease payments using a discount rate based on the interest rate implicit in the lease or an incremental borrowing rate if the rate implicit in the lease is not readily determinable. The interest rate implicit in the lease contracts is typically not readily determinable, and as a result, the Company estimates an incremental borrowing rate, which reflects the fixed rate at which the Company could borrow on a collateralized basis the amount of the lease payments in the same currency, for a similar term, in a similar economic environment. To estimate the incremental borrowing rate, a credit rating applicable to the Company is estimated using a synthetic credit rating analysis since the Company does not currently have any outstanding third- party debt or a rating agency-based credit rating. Operating lease costs are expensed using the straight-line method over the lease term and are classified within research and development or general and administrative expense based on the use of the underlying facility or using a reasonable allocation method. Assumptions that the Company made at the commencement date are re-evaluated upon occurrence of certain events, including a lease modification. Convertible Preferred Stock The Company has classified its convertible preferred stock as temporary equity on the Company’s consolidated balance sheet due to the terms that allow for redemption of the shares in cash upon certain deemed liquidation events that are not solely within the control of the Company. The Company initially recorded its convertible preferred stock at fair value, net of issuance costs. The occurrence of such deemed liquidation event is not currently probable and thus the carrying values of the convertible preferred stock are not being adjusted to their redemption values. Subsequent adjustments to the carrying values of the convertible preferred stock would be made only when a deemed liquidation event becomes probable. Research and Development Costs Research and development, or R&D, costs are expensed as incurred. Internal costs include personnel related expenses, stock-based compensation, facility and IT costs, and depreciation. External costs include fees for goods and services to conduct clinical and non-clinical activities, such as costs paid to contract research organizations, consulting fees, laboratory services and supplies, and costs incurred in connection with license agreements. The Company is required to estimate its accrued R&D costs as of the end of the reporting period. In accruing R&D costs, the Company estimates the period over which services will be performed or goods will be provided and the level of effort to be performed in each period. The financial terms of the R&D contracts vary and may result in payments that do not match the periods over which the goods or services are provided. The Company accrues costs under its contracts based on analyzing the work performed and amounts paid. In circumstances where amounts have been paid in excess of costs incurred, the Company records the excess as prepaid expense and recognizes research and development expense as the goods are received or the related services are rendered. General and Administrative Expenses General and administrative expenses are primarily comprised of employee-related expenses, including stock-based compensation and occupancy costs, depreciation and third-party expenses related to finance, legal and other general and administrative functions. Intellectual Property Matters The Company expenses costs associated with intellectual property-related matters as incurred and classifies such costs as general and administrative expenses within the consolidated statements of operations and comprehensive loss. Asset Acquisitions and Acquired In-Process Research and Development Expenses The Company accounts for acquisitions of assets or a group of assets that do not meet the definition of a business as asset acquisitions based on the cost to acquire the asset or group of assets, which include certain transaction costs. In an asset acquisition, the cost to acquire is allocated to the identifiable assets acquired and liabilities assumed based on their relative fair values as of the acquisition date. No goodwill is recorded in an asset acquisition. Assets that are acquired in an asset acquisition for use in research and development activities that have an alternative future use are capitalized as in-process research and

F-12 development, or IPR&D. Acquired IPR&D that has no alternative future use as of the acquisition date is recognized as research and development expense as of the acquisition date. The Company will recognize additional research and development expenses in the future if and when the Company becomes obligated to make contingent milestone payments under the terms of the agreements by which it acquired the IPR&D assets. Contingent consideration in asset acquisitions is measured and recognized when payment becomes probable and reasonably estimable. Subsequent changes in the accrued amount of contingent consideration are measured and recognized at the end of each reporting period and upon settlement as an adjustment to the cost basis of the acquired asset or group of assets, or, if related to IPR&D with no alternative future use, charged to expense. The Company did not recognize any IPR&D expense during the Stub Period. Stock-Based Compensation Employees of the Company participate in the Company’s stock-based compensation plan. Stock-based compensation expense of the Company relates to equity awards issued by the Company to its employees and non-employees under its 2024 Equity Incentive Plan, or the 2024 Plan, including stock options and restricted stock awards with both service and performance- based vesting conditions. Stock-based compensation expense is measured at estimated fair value on the grant date and is recognized as compensation expense over the requisite service period, which is the vesting period during which an employee provides service in exchange for the award. Compensation expense for awards to non-employees is recognized in the same manner as if the Company had paid cash in exchange for the goods or services, which is generally over the vesting period of the award. Forfeitures are accounted for as they occur. Stock-based compensation expense for service-only based awards is recognized on a straight-line basis. Stock-based compensation expense for awards with both performance and service-based vesting conditions is recognized over the requisite service period using an accelerated attribution method, once the performance conditions are considered probable of being achieved, using management’s best estimates. The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option pricing model, which requires inputs based on certain subjective assumptions, including the expected stock price volatility, the expected term of the award, the risk-free interest rate, and expected dividends. The fair value of each restricted stock award granted is measured on the date of grant at the estimated fair value of the common stock. Because there has not historically been a public market for the Company’s common stock, the estimated fair value of common stock was determined by the Company’s Board of Directors as of the date of each option grant, with inputs from management, considering third-party valuations of its common stock as well as the Company’s Board of Directors’ assessment of additional objective and subjective factors that it believed were relevant. These third-party valuations were performed in accordance with the guidance outlined in the American Institute of Certified Public Accountants’ Accounting and Valuation Guide, Valuation of Privately Held Company Equity Securities Issued as Compensation. The Company estimates its expected stock price volatility based on the historical volatility of publicly traded peer companies. The expected term of the Company’s stock options has been determined utilizing the “simplified” method. The risk- free interest rate is determined by reference to the U.S. Treasury yield curve in effect at the time of grant for time periods approximately equal to the expected term of the award. There is no expected dividend yield since the Company has never paid cash dividends on common stock and does not expect to pay any cash dividends in the foreseeable future. The Company classifies stock-based compensation expense in the consolidated statements of operations and comprehensive loss in the same manner in which the award recipients’ payroll costs are classified or in which the award recipients’ service payments are classified. See Note 10—Stock-Based Compensation, for more information. Income Taxes The Company recognizes income taxes under the asset and liability method. Deferred income taxes are recognized for differences between the financial reporting and tax basis of assets and liabilities at enacted statutory tax rates in effect for the years in which the differences are expected to reverse. The effect on deferred taxes of a change in tax rates are recognized in income in the period that includes the enactment date. In evaluating the Company’s ability to recover its deferred tax assets, the Company considers all available positive and negative evidence including its past operating results, the existence of cumulative losses in the most recent fiscal years, changes in the business in which the Company operates and its forecast of future taxable income. In determining future taxable income, the Company is responsible for assumptions utilized, including the amount of pre- tax operating income, the reversal of temporary differences and the implementation of feasible and prudent tax planning strategies. These assumptions require significant judgment about the forecasts of future taxable income and are consistent with the plans and estimates that the Company is using to manage the underlying business. The Company accounts for uncertain tax positions using a more-likely-than-not threshold for recognizing and resolving uncertain tax positions. The evaluation of uncertain tax positions is based on factors including, but not limited to, changes in tax law, the measurement of tax positions taken or expected to be taken in tax returns, the effective settlement of matters subject to audit, new audit activity and changes in facts or circumstances related to a tax position. The Company also accrues for potential

F-13 interest and penalties related to unrecognized tax benefits in income tax expense. As of December 31, 2024, the Company had no tax reserves accrued for uncertain tax positions. Comprehensive Loss Comprehensive loss is comprised of net loss and other comprehensive loss. The Company has no components of other comprehensive loss. Therefore, net loss equals comprehensive loss for the period presented. Recently Issued Accounting Standards Updates From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board, or FASB, or other standard-setting bodies that are adopted by Seaport as of the specified effective date. Unless otherwise discussed, Seaport believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption. In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurements of Credit Losses on Financial Instruments, or ASU 2016-13, which requires the measurement and recognition of expected credit losses for financial assets held at amortized cost. ASU 2016-13 replaces the existing incurred loss impairment model with an expected loss model. It also eliminates the concept of other-than temporary impairment and requires credit losses related to available-for-sale debt securities to be recorded through an allowance for credit losses rather than as a reduction in the amortized cost basis of the securities. These changes will result in the earlier recognition of credit losses, if any. In May 2019, the FASB issued ASU No. 2019-05, Financial Instruments—Credit Losses (Topic 326): Targeted Transition Relief, or ASU 2019-05, which provides additional implementation guidance on the previously issued ASU 2016-13. For the Company, both ASU 2016-13 and ASU 2019-05 were effective for fiscal years beginning after December 15, 2022. The Company adopted the standard effective January 1, 2023 on a modified-retrospective basis which did not have a material impact on the Company’s consolidated financial statements. In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, or ASU 2023-09. This amended guidance applies to all entities and broadly aims to enhance the transparency and decision usefulness of income tax disclosures. For public entities, the amendments in this update are effective for fiscal years beginning after December 15, 2024 and for entities other than public entities, the amendments in this update are effective for fiscal years beginning after December 15, 2025. Early adoption is permitted for any annual periods for which financial statements have not been issued or made available for issuance. Seaport is currently analyzing the impact that ASU 2023-09 may have on the consolidated financial statements for fiscal years beginning after December 15, 2024. In November 2024, the FASB issued ASU 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, or ASU 2024-03, which is intended to provide more detailed information about specified categories of expenses (purchases of inventory, employee compensation, depreciation and amortization) included in certain expense captions presented on the statement of operations. The guidance in ASU 2024-03 is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027. Early adoption is permitted. The amendments may be applied either (1) prospectively to financial statements issued for periods after the effective date of ASU 2024-03 or (2) retrospectively to all prior periods presented in the financial statements. Seaport is currently evaluating the impact that the adoption of ASU 2024-03 may have on its consolidated financial statements and disclosures for fiscal years beginning after December 15, 2026. 3. PREPAID EXPENSES AND OTHER CURRENT ASSETS Prepaid expenses and other current assets consisted of the following (in thousands): December 31, 2024 Prepaid research and development $ 389 Prepaid employee compensation and benefits 271 Prepaid, other 393 Total prepaid expenses and other current assets $ 1,053

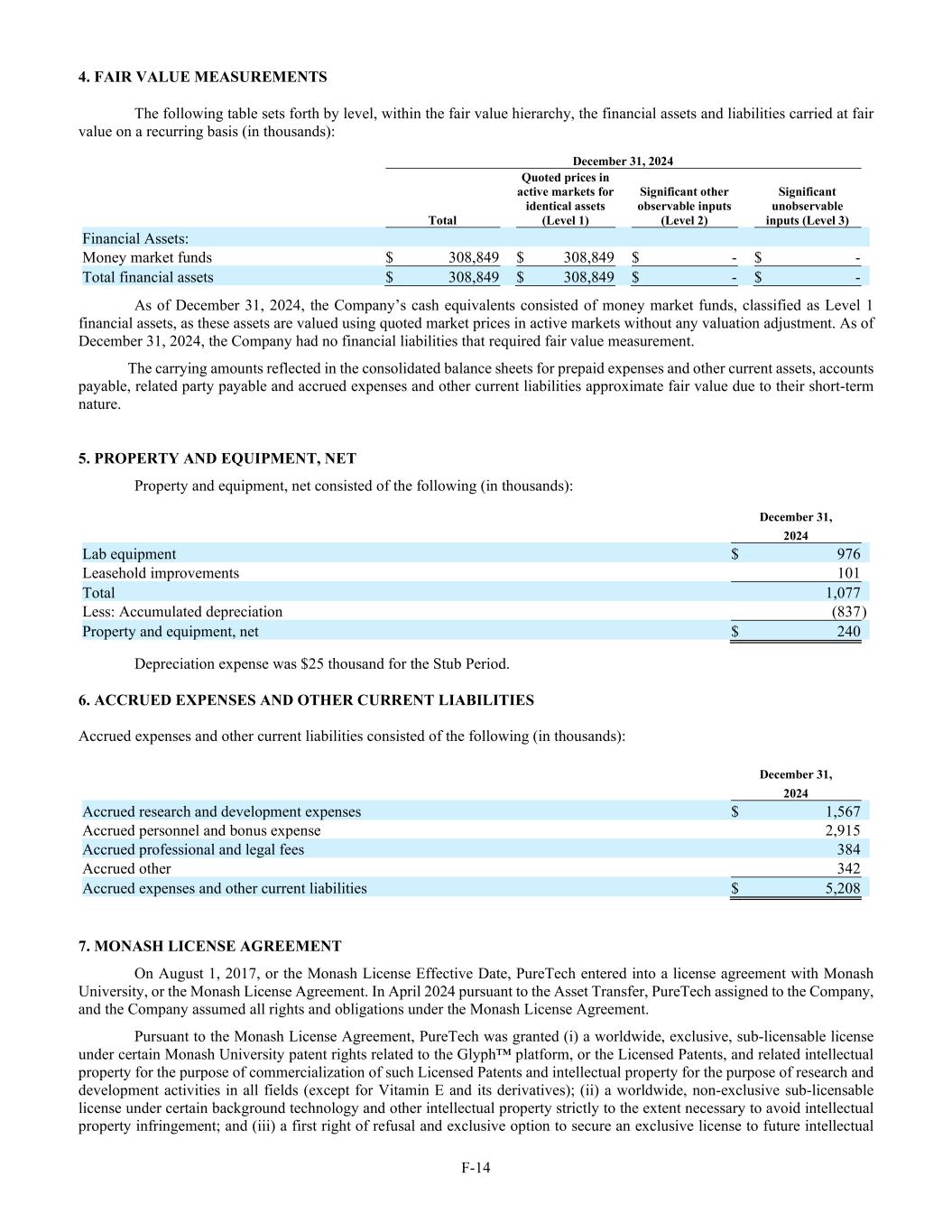

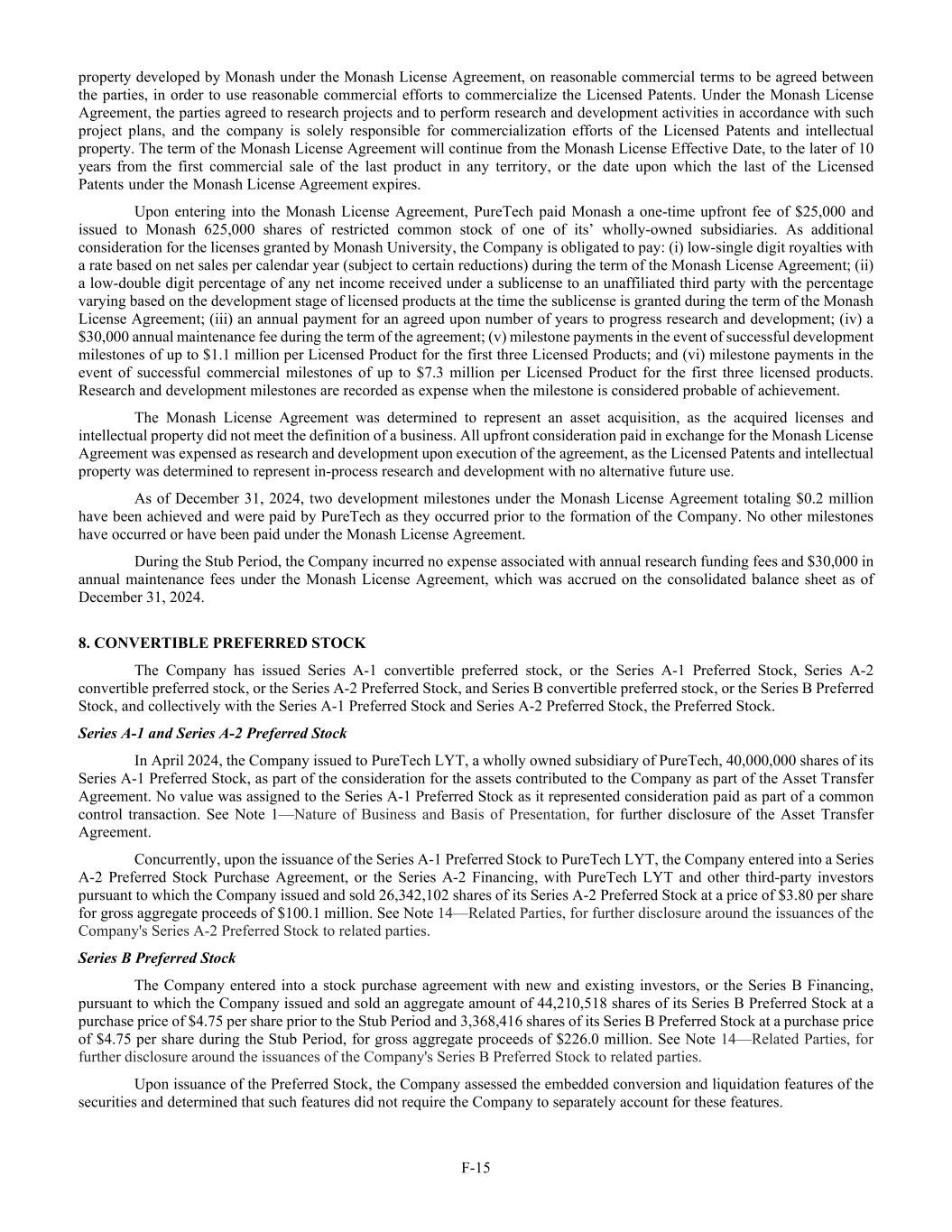

F-14 4. FAIR VALUE MEASUREMENTS The following table sets forth by level, within the fair value hierarchy, the financial assets and liabilities carried at fair value on a recurring basis (in thousands): December 31, 2024 Total Quoted prices in active markets for identical assets (Level 1) Significant other observable inputs (Level 2) Significant unobservable inputs (Level 3) Financial Assets: Money market funds $ 308,849 $ 308,849 $ - $ - Total financial assets $ 308,849 $ 308,849 $ - $ - As of December 31, 2024, the Company’s cash equivalents consisted of money market funds, classified as Level 1 financial assets, as these assets are valued using quoted market prices in active markets without any valuation adjustment. As of December 31, 2024, the Company had no financial liabilities that required fair value measurement. The carrying amounts reflected in the consolidated balance sheets for prepaid expenses and other current assets, accounts payable, related party payable and accrued expenses and other current liabilities approximate fair value due to their short-term nature. 5. PROPERTY AND EQUIPMENT, NET Property and equipment, net consisted of the following (in thousands): December 31, 2024 Lab equipment $ 976 Leasehold improvements 101 Total 1,077 Less: Accumulated depreciation (837 ) Property and equipment, net $ 240 Depreciation expense was $25 thousand for the Stub Period. 6. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES Accrued expenses and other current liabilities consisted of the following (in thousands): December 31, 2024 Accrued research and development expenses $ 1,567 Accrued personnel and bonus expense 2,915 Accrued professional and legal fees 384 Accrued other 342 Accrued expenses and other current liabilities $ 5,208 7. MONASH LICENSE AGREEMENT On August 1, 2017, or the Monash License Effective Date, PureTech entered into a license agreement with Monash University, or the Monash License Agreement. In April 2024 pursuant to the Asset Transfer, PureTech assigned to the Company, and the Company assumed all rights and obligations under the Monash License Agreement. Pursuant to the Monash License Agreement, PureTech was granted (i) a worldwide, exclusive, sub-licensable license under certain Monash University patent rights related to the Glyph™ platform, or the Licensed Patents, and related intellectual property for the purpose of commercialization of such Licensed Patents and intellectual property for the purpose of research and development activities in all fields (except for Vitamin E and its derivatives); (ii) a worldwide, non-exclusive sub-licensable license under certain background technology and other intellectual property strictly to the extent necessary to avoid intellectual property infringement; and (iii) a first right of refusal and exclusive option to secure an exclusive license to future intellectual

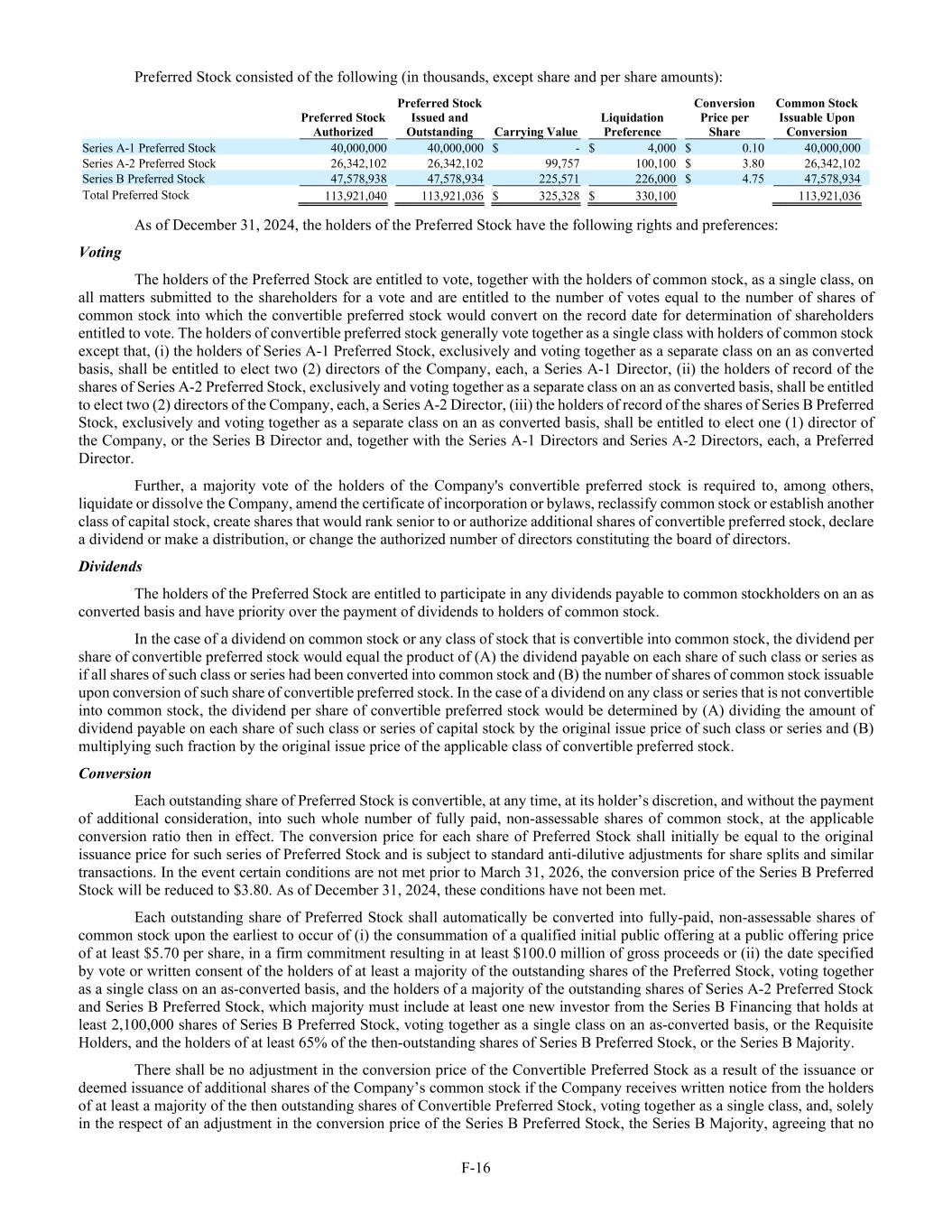

F-15 property developed by Monash under the Monash License Agreement, on reasonable commercial terms to be agreed between the parties, in order to use reasonable commercial efforts to commercialize the Licensed Patents. Under the Monash License Agreement, the parties agreed to research projects and to perform research and development activities in accordance with such project plans, and the company is solely responsible for commercialization efforts of the Licensed Patents and intellectual property. The term of the Monash License Agreement will continue from the Monash License Effective Date, to the later of 10 years from the first commercial sale of the last product in any territory, or the date upon which the last of the Licensed Patents under the Monash License Agreement expires. Upon entering into the Monash License Agreement, PureTech paid Monash a one-time upfront fee of $25,000 and issued to Monash 625,000 shares of restricted common stock of one of its’ wholly-owned subsidiaries. As additional consideration for the licenses granted by Monash University, the Company is obligated to pay: (i) low-single digit royalties with a rate based on net sales per calendar year (subject to certain reductions) during the term of the Monash License Agreement; (ii) a low-double digit percentage of any net income received under a sublicense to an unaffiliated third party with the percentage varying based on the development stage of licensed products at the time the sublicense is granted during the term of the Monash License Agreement; (iii) an annual payment for an agreed upon number of years to progress research and development; (iv) a $30,000 annual maintenance fee during the term of the agreement; (v) milestone payments in the event of successful development milestones of up to $1.1 million per Licensed Product for the first three Licensed Products; and (vi) milestone payments in the event of successful commercial milestones of up to $7.3 million per Licensed Product for the first three licensed products. Research and development milestones are recorded as expense when the milestone is considered probable of achievement. The Monash License Agreement was determined to represent an asset acquisition, as the acquired licenses and intellectual property did not meet the definition of a business. All upfront consideration paid in exchange for the Monash License Agreement was expensed as research and development upon execution of the agreement, as the Licensed Patents and intellectual property was determined to represent in-process research and development with no alternative future use. As of December 31, 2024, two development milestones under the Monash License Agreement totaling $0.2 million have been achieved and were paid by PureTech as they occurred prior to the formation of the Company. No other milestones have occurred or have been paid under the Monash License Agreement. During the Stub Period, the Company incurred no expense associated with annual research funding fees and $30,000 in annual maintenance fees under the Monash License Agreement, which was accrued on the consolidated balance sheet as of December 31, 2024. 8. CONVERTIBLE PREFERRED STOCK The Company has issued Series A-1 convertible preferred stock, or the Series A-1 Preferred Stock, Series A-2 convertible preferred stock, or the Series A-2 Preferred Stock, and Series B convertible preferred stock, or the Series B Preferred Stock, and collectively with the Series A-1 Preferred Stock and Series A-2 Preferred Stock, the Preferred Stock. Series A-1 and Series A-2 Preferred Stock In April 2024, the Company issued to PureTech LYT, a wholly owned subsidiary of PureTech, 40,000,000 shares of its Series A-1 Preferred Stock, as part of the consideration for the assets contributed to the Company as part of the Asset Transfer Agreement. No value was assigned to the Series A-1 Preferred Stock as it represented consideration paid as part of a common control transaction. See Note 1—Nature of Business and Basis of Presentation, for further disclosure of the Asset Transfer Agreement. Concurrently, upon the issuance of the Series A-1 Preferred Stock to PureTech LYT, the Company entered into a Series A-2 Preferred Stock Purchase Agreement, or the Series A-2 Financing, with PureTech LYT and other third-party investors pursuant to which the Company issued and sold 26,342,102 shares of its Series A-2 Preferred Stock at a price of $3.80 per share for gross aggregate proceeds of $100.1 million. See Note 14—Related Parties, for further disclosure around the issuances of the Company's Series A-2 Preferred Stock to related parties. Series B Preferred Stock The Company entered into a stock purchase agreement with new and existing investors, or the Series B Financing, pursuant to which the Company issued and sold an aggregate amount of 44,210,518 shares of its Series B Preferred Stock at a purchase price of $4.75 per share prior to the Stub Period and 3,368,416 shares of its Series B Preferred Stock at a purchase price of $4.75 per share during the Stub Period, for gross aggregate proceeds of $226.0 million. See Note 14—Related Parties, for further disclosure around the issuances of the Company's Series B Preferred Stock to related parties. Upon issuance of the Preferred Stock, the Company assessed the embedded conversion and liquidation features of the securities and determined that such features did not require the Company to separately account for these features.

F-16 Preferred Stock consisted of the following (in thousands, except share and per share amounts): Preferred Stock Authorized Preferred Stock Issued and Outstanding Carrying Value Liquidation Preference Conversion Price per Share Common Stock Issuable Upon Conversion Series A-1 Preferred Stock 40,000,000 40,000,000 $ - $ 4,000 $ 0.10 40,000,000 Series A-2 Preferred Stock 26,342,102 26,342,102 99,757 100,100 $ 3.80 26,342,102 Series B Preferred Stock 47,578,938 47,578,934 225,571 226,000 $ 4.75 47,578,934 Total Preferred Stock 113,921,040 113,921,036 $ 325,328 $ 330,100 113,921,036 As of December 31, 2024, the holders of the Preferred Stock have the following rights and preferences: Voting The holders of the Preferred Stock are entitled to vote, together with the holders of common stock, as a single class, on all matters submitted to the shareholders for a vote and are entitled to the number of votes equal to the number of shares of common stock into which the convertible preferred stock would convert on the record date for determination of shareholders entitled to vote. The holders of convertible preferred stock generally vote together as a single class with holders of common stock except that, (i) the holders of Series A-1 Preferred Stock, exclusively and voting together as a separate class on an as converted basis, shall be entitled to elect two (2) directors of the Company, each, a Series A-1 Director, (ii) the holders of record of the shares of Series A-2 Preferred Stock, exclusively and voting together as a separate class on an as converted basis, shall be entitled to elect two (2) directors of the Company, each, a Series A-2 Director, (iii) the holders of record of the shares of Series B Preferred Stock, exclusively and voting together as a separate class on an as converted basis, shall be entitled to elect one (1) director of the Company, or the Series B Director and, together with the Series A-1 Directors and Series A-2 Directors, each, a Preferred Director. Further, a majority vote of the holders of the Company's convertible preferred stock is required to, among others, liquidate or dissolve the Company, amend the certificate of incorporation or bylaws, reclassify common stock or establish another class of capital stock, create shares that would rank senior to or authorize additional shares of convertible preferred stock, declare a dividend or make a distribution, or change the authorized number of directors constituting the board of directors. Dividends The holders of the Preferred Stock are entitled to participate in any dividends payable to common stockholders on an as converted basis and have priority over the payment of dividends to holders of common stock. In the case of a dividend on common stock or any class of stock that is convertible into common stock, the dividend per share of convertible preferred stock would equal the product of (A) the dividend payable on each share of such class or series as if all shares of such class or series had been converted into common stock and (B) the number of shares of common stock issuable upon conversion of such share of convertible preferred stock. In the case of a dividend on any class or series that is not convertible into common stock, the dividend per share of convertible preferred stock would be determined by (A) dividing the amount of dividend payable on each share of such class or series of capital stock by the original issue price of such class or series and (B) multiplying such fraction by the original issue price of the applicable class of convertible preferred stock. Conversion Each outstanding share of Preferred Stock is convertible, at any time, at its holder’s discretion, and without the payment of additional consideration, into such whole number of fully paid, non-assessable shares of common stock, at the applicable conversion ratio then in effect. The conversion price for each share of Preferred Stock shall initially be equal to the original issuance price for such series of Preferred Stock and is subject to standard anti-dilutive adjustments for share splits and similar transactions. In the event certain conditions are not met prior to March 31, 2026, the conversion price of the Series B Preferred Stock will be reduced to $3.80. As of December 31, 2024, these conditions have not been met. Each outstanding share of Preferred Stock shall automatically be converted into fully-paid, non-assessable shares of common stock upon the earliest to occur of (i) the consummation of a qualified initial public offering at a public offering price of at least $5.70 per share, in a firm commitment resulting in at least $100.0 million of gross proceeds or (ii) the date specified by vote or written consent of the holders of at least a majority of the outstanding shares of the Preferred Stock, voting together as a single class on an as-converted basis, and the holders of a majority of the outstanding shares of Series A-2 Preferred Stock and Series B Preferred Stock, which majority must include at least one new investor from the Series B Financing that holds at least 2,100,000 shares of Series B Preferred Stock, voting together as a single class on an as-converted basis, or the Requisite Holders, and the holders of at least 65% of the then-outstanding shares of Series B Preferred Stock, or the Series B Majority. There shall be no adjustment in the conversion price of the Convertible Preferred Stock as a result of the issuance or deemed issuance of additional shares of the Company’s common stock if the Company receives written notice from the holders of at least a majority of the then outstanding shares of Convertible Preferred Stock, voting together as a single class, and, solely in the respect of an adjustment in the conversion price of the Series B Preferred Stock, the Series B Majority, agreeing that no

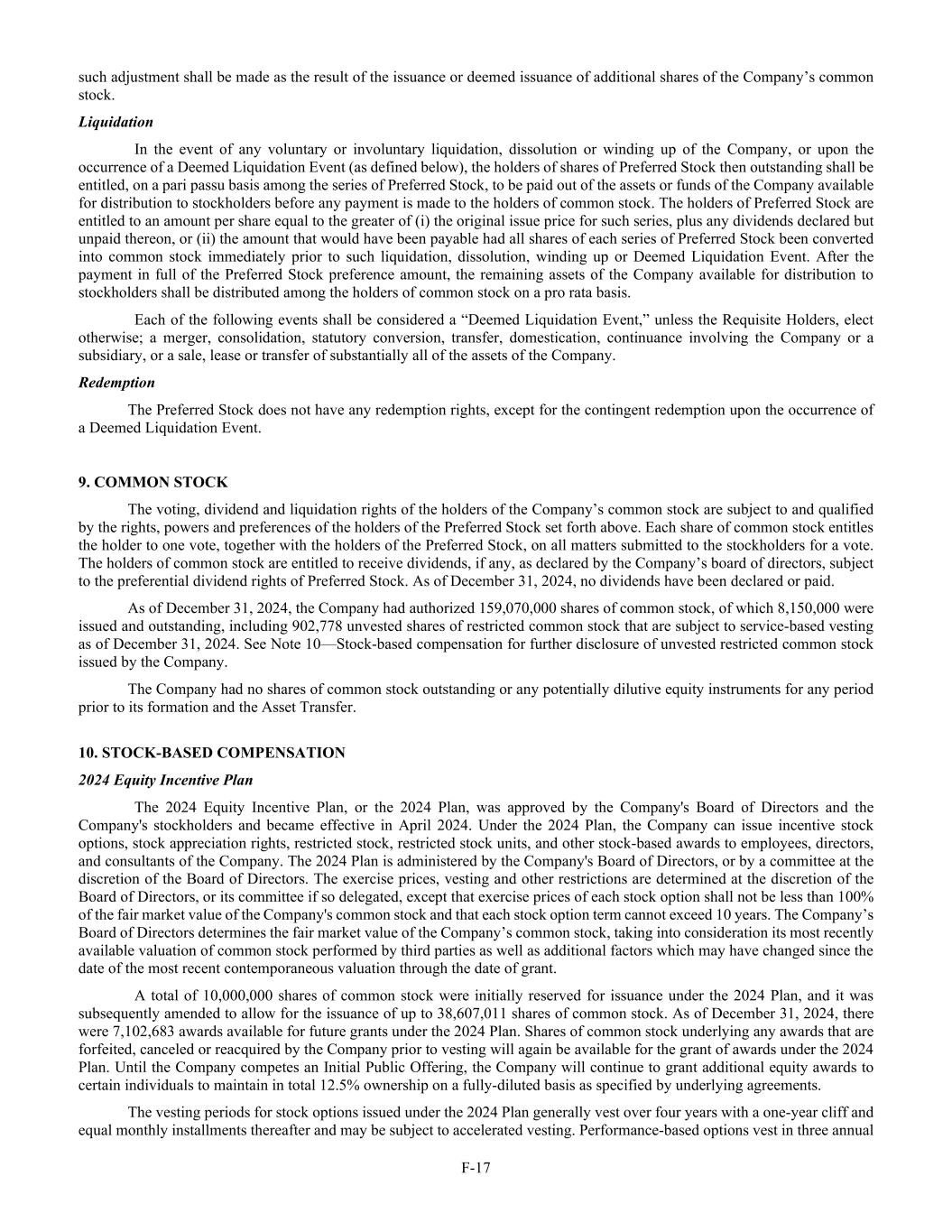

F-17 such adjustment shall be made as the result of the issuance or deemed issuance of additional shares of the Company’s common stock. Liquidation In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, or upon the occurrence of a Deemed Liquidation Event (as defined below), the holders of shares of Preferred Stock then outstanding shall be entitled, on a pari passu basis among the series of Preferred Stock, to be paid out of the assets or funds of the Company available for distribution to stockholders before any payment is made to the holders of common stock. The holders of Preferred Stock are entitled to an amount per share equal to the greater of (i) the original issue price for such series, plus any dividends declared but unpaid thereon, or (ii) the amount that would have been payable had all shares of each series of Preferred Stock been converted into common stock immediately prior to such liquidation, dissolution, winding up or Deemed Liquidation Event. After the payment in full of the Preferred Stock preference amount, the remaining assets of the Company available for distribution to stockholders shall be distributed among the holders of common stock on a pro rata basis. Each of the following events shall be considered a “Deemed Liquidation Event,” unless the Requisite Holders, elect otherwise; a merger, consolidation, statutory conversion, transfer, domestication, continuance involving the Company or a subsidiary, or a sale, lease or transfer of substantially all of the assets of the Company. Redemption The Preferred Stock does not have any redemption rights, except for the contingent redemption upon the occurrence of a Deemed Liquidation Event. 9. COMMON STOCK The voting, dividend and liquidation rights of the holders of the Company’s common stock are subject to and qualified by the rights, powers and preferences of the holders of the Preferred Stock set forth above. Each share of common stock entitles the holder to one vote, together with the holders of the Preferred Stock, on all matters submitted to the stockholders for a vote. The holders of common stock are entitled to receive dividends, if any, as declared by the Company’s board of directors, subject to the preferential dividend rights of Preferred Stock. As of December 31, 2024, no dividends have been declared or paid. As of December 31, 2024, the Company had authorized 159,070,000 shares of common stock, of which 8,150,000 were issued and outstanding, including 902,778 unvested shares of restricted common stock that are subject to service-based vesting as of December 31, 2024. See Note 10—Stock-based compensation for further disclosure of unvested restricted common stock issued by the Company. The Company had no shares of common stock outstanding or any potentially dilutive equity instruments for any period prior to its formation and the Asset Transfer. 10. STOCK-BASED COMPENSATION 2024 Equity Incentive Plan The 2024 Equity Incentive Plan, or the 2024 Plan, was approved by the Company's Board of Directors and the Company's stockholders and became effective in April 2024. Under the 2024 Plan, the Company can issue incentive stock options, stock appreciation rights, restricted stock, restricted stock units, and other stock-based awards to employees, directors, and consultants of the Company. The 2024 Plan is administered by the Company's Board of Directors, or by a committee at the discretion of the Board of Directors. The exercise prices, vesting and other restrictions are determined at the discretion of the Board of Directors, or its committee if so delegated, except that exercise prices of each stock option shall not be less than 100% of the fair market value of the Company's common stock and that each stock option term cannot exceed 10 years. The Company’s Board of Directors determines the fair market value of the Company’s common stock, taking into consideration its most recently available valuation of common stock performed by third parties as well as additional factors which may have changed since the date of the most recent contemporaneous valuation through the date of grant. A total of 10,000,000 shares of common stock were initially reserved for issuance under the 2024 Plan, and it was subsequently amended to allow for the issuance of up to 38,607,011 shares of common stock. As of December 31, 2024, there were 7,102,683 awards available for future grants under the 2024 Plan. Shares of common stock underlying any awards that are forfeited, canceled or reacquired by the Company prior to vesting will again be available for the grant of awards under the 2024 Plan. Until the Company competes an Initial Public Offering, the Company will continue to grant additional equity awards to certain individuals to maintain in total 12.5% ownership on a fully-diluted basis as specified by underlying agreements. The vesting periods for stock options issued under the 2024 Plan generally vest over four years with a one-year cliff and equal monthly installments thereafter and may be subject to accelerated vesting. Performance-based options vest in three annual

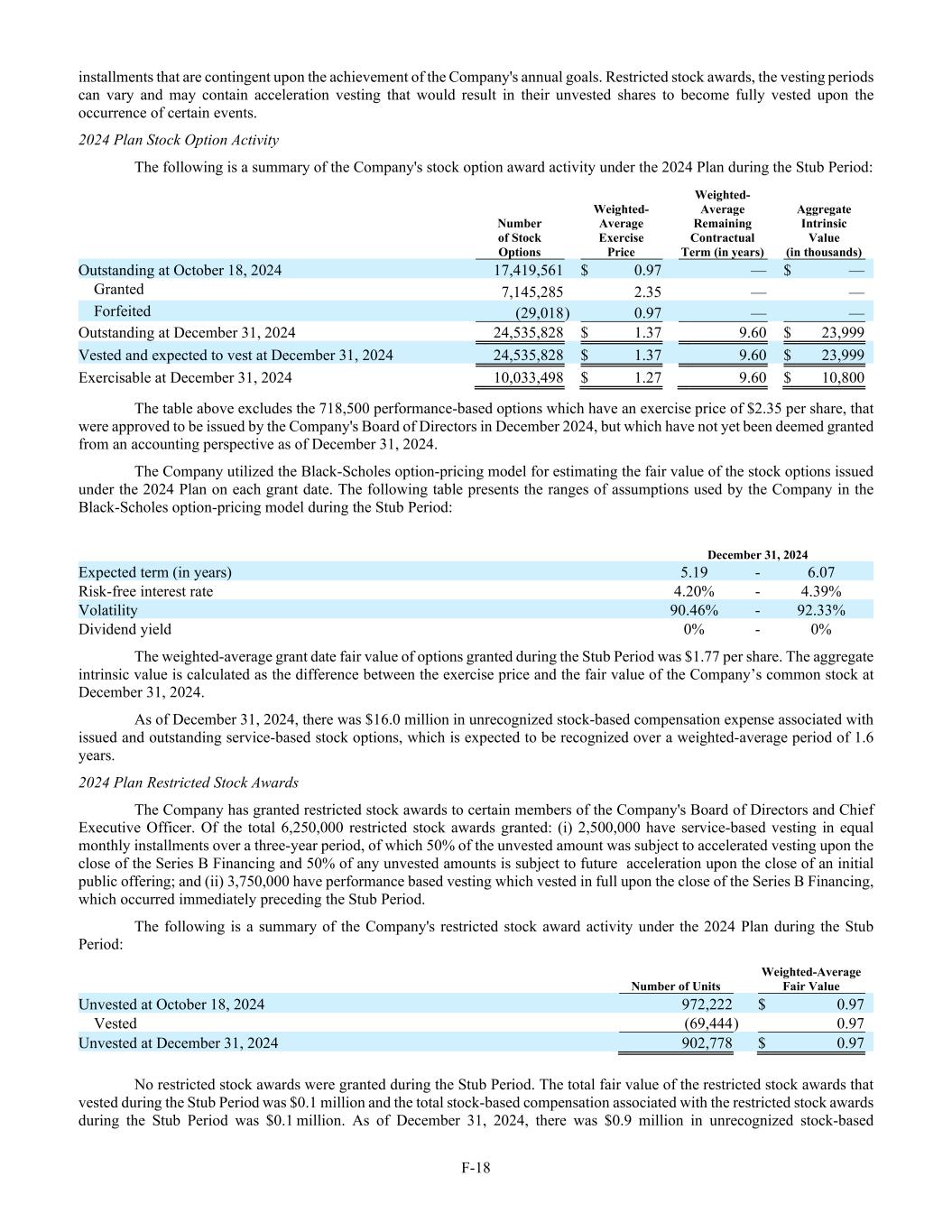

F-18 installments that are contingent upon the achievement of the Company's annual goals. Restricted stock awards, the vesting periods can vary and may contain acceleration vesting that would result in their unvested shares to become fully vested upon the occurrence of certain events. 2024 Plan Stock Option Activity The following is a summary of the Company's stock option award activity under the 2024 Plan during the Stub Period: Number of Stock Options Weighted- Average Exercise Price Weighted- Average Remaining Contractual Term (in years) Aggregate Intrinsic Value (in thousands) Outstanding at October 18, 2024 17,419,561 $ 0.97 — $ — Granted 7,145,285 2.35 — — Forfeited (29,018 ) 0.97 — — Outstanding at December 31, 2024 24,535,828 $ 1.37 9.60 $ 23,999 Vested and expected to vest at December 31, 2024 24,535,828 $ 1.37 9.60 $ 23,999 Exercisable at December 31, 2024 10,033,498 $ 1.27 9.60 $ 10,800 The table above excludes the 718,500 performance-based options which have an exercise price of $2.35 per share, that were approved to be issued by the Company's Board of Directors in December 2024, but which have not yet been deemed granted from an accounting perspective as of December 31, 2024. The Company utilized the Black-Scholes option-pricing model for estimating the fair value of the stock options issued under the 2024 Plan on each grant date. The following table presents the ranges of assumptions used by the Company in the Black-Scholes option-pricing model during the Stub Period: December 31, 2024 Expected term (in years) 5.19 - 6.07 Risk-free interest rate 4.20% - 4.39% Volatility 90.46% - 92.33% Dividend yield 0% - 0% The weighted-average grant date fair value of options granted during the Stub Period was $1.77 per share. The aggregate intrinsic value is calculated as the difference between the exercise price and the fair value of the Company’s common stock at December 31, 2024. As of December 31, 2024, there was $16.0 million in unrecognized stock-based compensation expense associated with issued and outstanding service-based stock options, which is expected to be recognized over a weighted-average period of 1.6 years. 2024 Plan Restricted Stock Awards The Company has granted restricted stock awards to certain members of the Company's Board of Directors and Chief Executive Officer. Of the total 6,250,000 restricted stock awards granted: (i) 2,500,000 have service-based vesting in equal monthly installments over a three-year period, of which 50% of the unvested amount was subject to accelerated vesting upon the close of the Series B Financing and 50% of any unvested amounts is subject to future acceleration upon the close of an initial public offering; and (ii) 3,750,000 have performance based vesting which vested in full upon the close of the Series B Financing, which occurred immediately preceding the Stub Period. The following is a summary of the Company's restricted stock award activity under the 2024 Plan during the Stub Period: Number of Units Weighted-Average Fair Value Unvested at October 18, 2024 972,222 $ 0.97 Vested (69,444 ) 0.97 Unvested at December 31, 2024 902,778 $ 0.97 No restricted stock awards were granted during the Stub Period. The total fair value of the restricted stock awards that vested during the Stub Period was $0.1 million and the total stock-based compensation associated with the restricted stock awards during the Stub Period was $0.1 million. As of December 31, 2024, there was $0.9 million in unrecognized stock-based

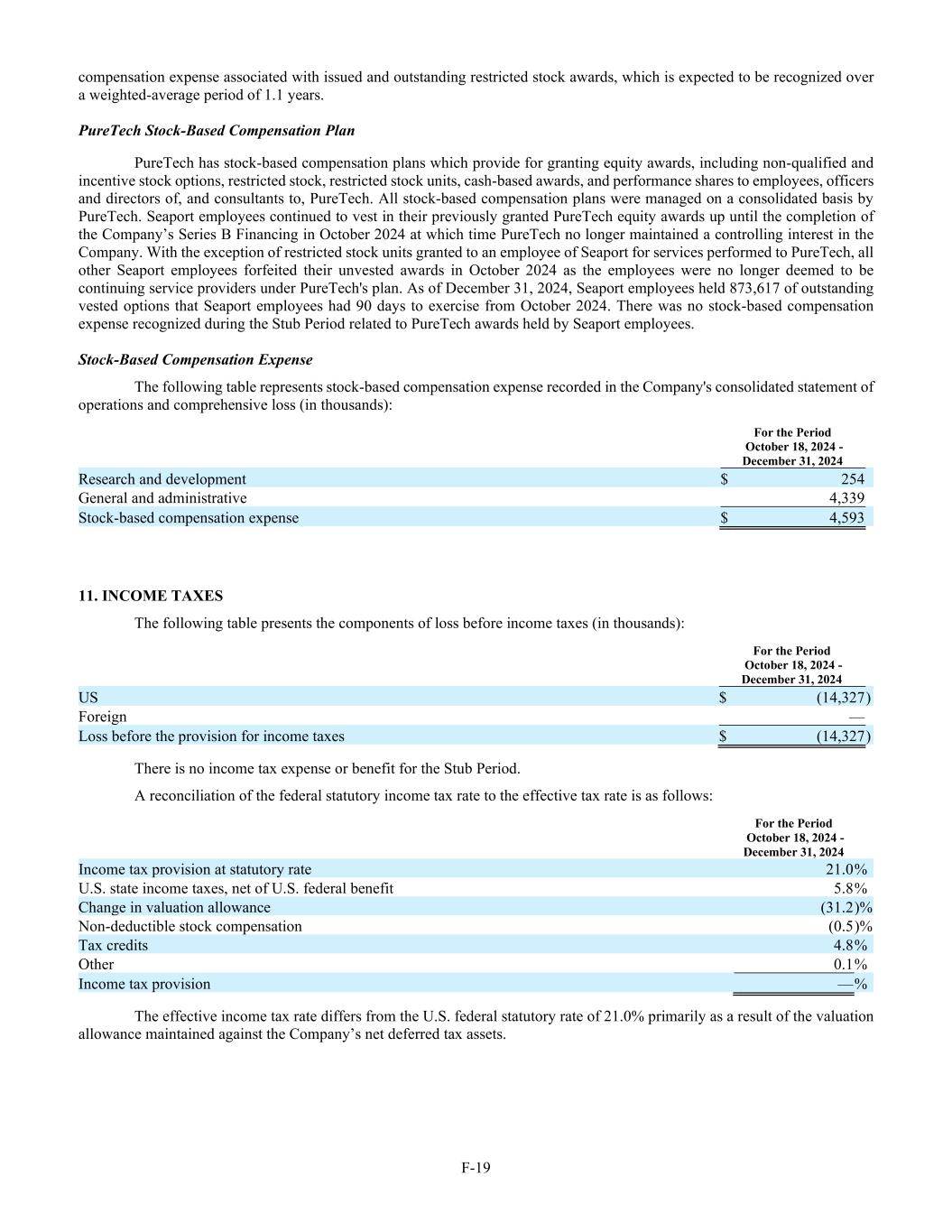

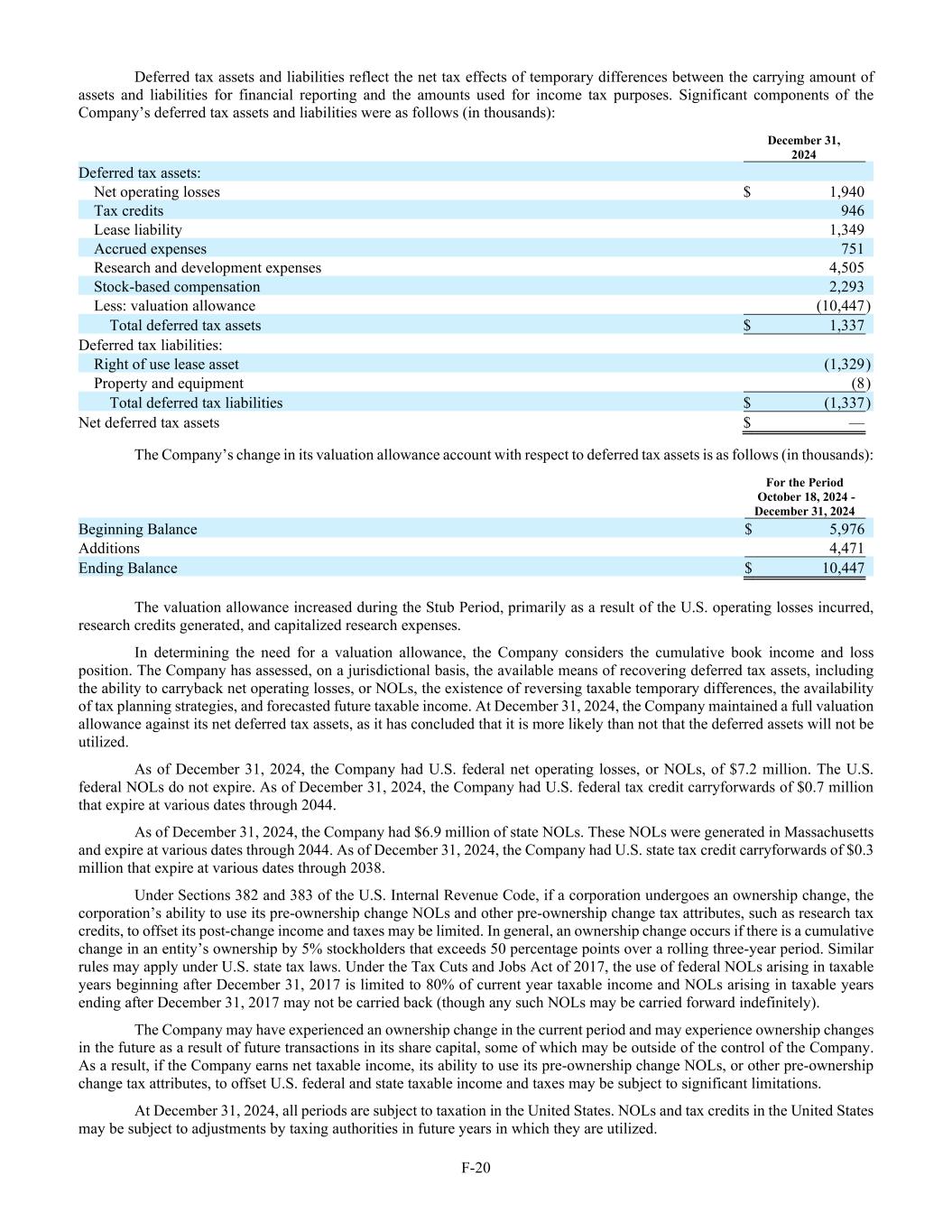

F-19 compensation expense associated with issued and outstanding restricted stock awards, which is expected to be recognized over a weighted-average period of 1.1 years. PureTech Stock-Based Compensation Plan PureTech has stock-based compensation plans which provide for granting equity awards, including non-qualified and incentive stock options, restricted stock, restricted stock units, cash-based awards, and performance shares to employees, officers and directors of, and consultants to, PureTech. All stock-based compensation plans were managed on a consolidated basis by PureTech. Seaport employees continued to vest in their previously granted PureTech equity awards up until the completion of the Company’s Series B Financing in October 2024 at which time PureTech no longer maintained a controlling interest in the Company. With the exception of restricted stock units granted to an employee of Seaport for services performed to PureTech, all other Seaport employees forfeited their unvested awards in October 2024 as the employees were no longer deemed to be continuing service providers under PureTech's plan. As of December 31, 2024, Seaport employees held 873,617 of outstanding vested options that Seaport employees had 90 days to exercise from October 2024. There was no stock-based compensation expense recognized during the Stub Period related to PureTech awards held by Seaport employees. Stock-Based Compensation Expense The following table represents stock-based compensation expense recorded in the Company's consolidated statement of operations and comprehensive loss (in thousands): For the Period October 18, 2024 - December 31, 2024 Research and development $ 254 General and administrative 4,339 Stock-based compensation expense $ 4,593 11. INCOME TAXES The following table presents the components of loss before income taxes (in thousands): For the Period October 18, 2024 - December 31, 2024 US $ (14,327 ) Foreign — Loss before the provision for income taxes $ (14,327 ) There is no income tax expense or benefit for the Stub Period. A reconciliation of the federal statutory income tax rate to the effective tax rate is as follows: For the Period October 18, 2024 - December 31, 2024 Income tax provision at statutory rate 21.0 % U.S. state income taxes, net of U.S. federal benefit 5.8 % Change in valuation allowance (31.2 )% Non-deductible stock compensation (0.5 )% Tax credits 4.8 % Other 0.1 % Income tax provision — % The effective income tax rate differs from the U.S. federal statutory rate of 21.0% primarily as a result of the valuation allowance maintained against the Company’s net deferred tax assets.

F-20 Deferred tax assets and liabilities reflect the net tax effects of temporary differences between the carrying amount of assets and liabilities for financial reporting and the amounts used for income tax purposes. Significant components of the Company’s deferred tax assets and liabilities were as follows (in thousands): December 31, 2024 Deferred tax assets: Net operating losses $ 1,940 Tax credits 946 Lease liability 1,349 Accrued expenses 751 Research and development expenses 4,505 Stock-based compensation 2,293 Less: valuation allowance (10,447 ) Total deferred tax assets $ 1,337 Deferred tax liabilities: Right of use lease asset (1,329 ) Property and equipment (8 ) Total deferred tax liabilities $ (1,337 ) Net deferred tax assets $ — The Company’s change in its valuation allowance account with respect to deferred tax assets is as follows (in thousands): For the Period October 18, 2024 - December 31, 2024 Beginning Balance $ 5,976 Additions 4,471 Ending Balance $ 10,447 The valuation allowance increased during the Stub Period, primarily as a result of the U.S. operating losses incurred, research credits generated, and capitalized research expenses. In determining the need for a valuation allowance, the Company considers the cumulative book income and loss position. The Company has assessed, on a jurisdictional basis, the available means of recovering deferred tax assets, including the ability to carryback net operating losses, or NOLs, the existence of reversing taxable temporary differences, the availability of tax planning strategies, and forecasted future taxable income. At December 31, 2024, the Company maintained a full valuation allowance against its net deferred tax assets, as it has concluded that it is more likely than not that the deferred assets will not be utilized. As of December 31, 2024, the Company had U.S. federal net operating losses, or NOLs, of $7.2 million. The U.S. federal NOLs do not expire. As of December 31, 2024, the Company had U.S. federal tax credit carryforwards of $0.7 million that expire at various dates through 2044. As of December 31, 2024, the Company had $6.9 million of state NOLs. These NOLs were generated in Massachusetts and expire at various dates through 2044. As of December 31, 2024, the Company had U.S. state tax credit carryforwards of $0.3 million that expire at various dates through 2038. Under Sections 382 and 383 of the U.S. Internal Revenue Code, if a corporation undergoes an ownership change, the corporation’s ability to use its pre-ownership change NOLs and other pre-ownership change tax attributes, such as research tax credits, to offset its post-change income and taxes may be limited. In general, an ownership change occurs if there is a cumulative change in an entity’s ownership by 5% stockholders that exceeds 50 percentage points over a rolling three-year period. Similar rules may apply under U.S. state tax laws. Under the Tax Cuts and Jobs Act of 2017, the use of federal NOLs arising in taxable years beginning after December 31, 2017 is limited to 80% of current year taxable income and NOLs arising in taxable years ending after December 31, 2017 may not be carried back (though any such NOLs may be carried forward indefinitely). The Company may have experienced an ownership change in the current period and may experience ownership changes in the future as a result of future transactions in its share capital, some of which may be outside of the control of the Company. As a result, if the Company earns net taxable income, its ability to use its pre-ownership change NOLs, or other pre-ownership change tax attributes, to offset U.S. federal and state taxable income and taxes may be subject to significant limitations. At December 31, 2024, all periods are subject to taxation in the United States. NOLs and tax credits in the United States may be subject to adjustments by taxing authorities in future years in which they are utilized.

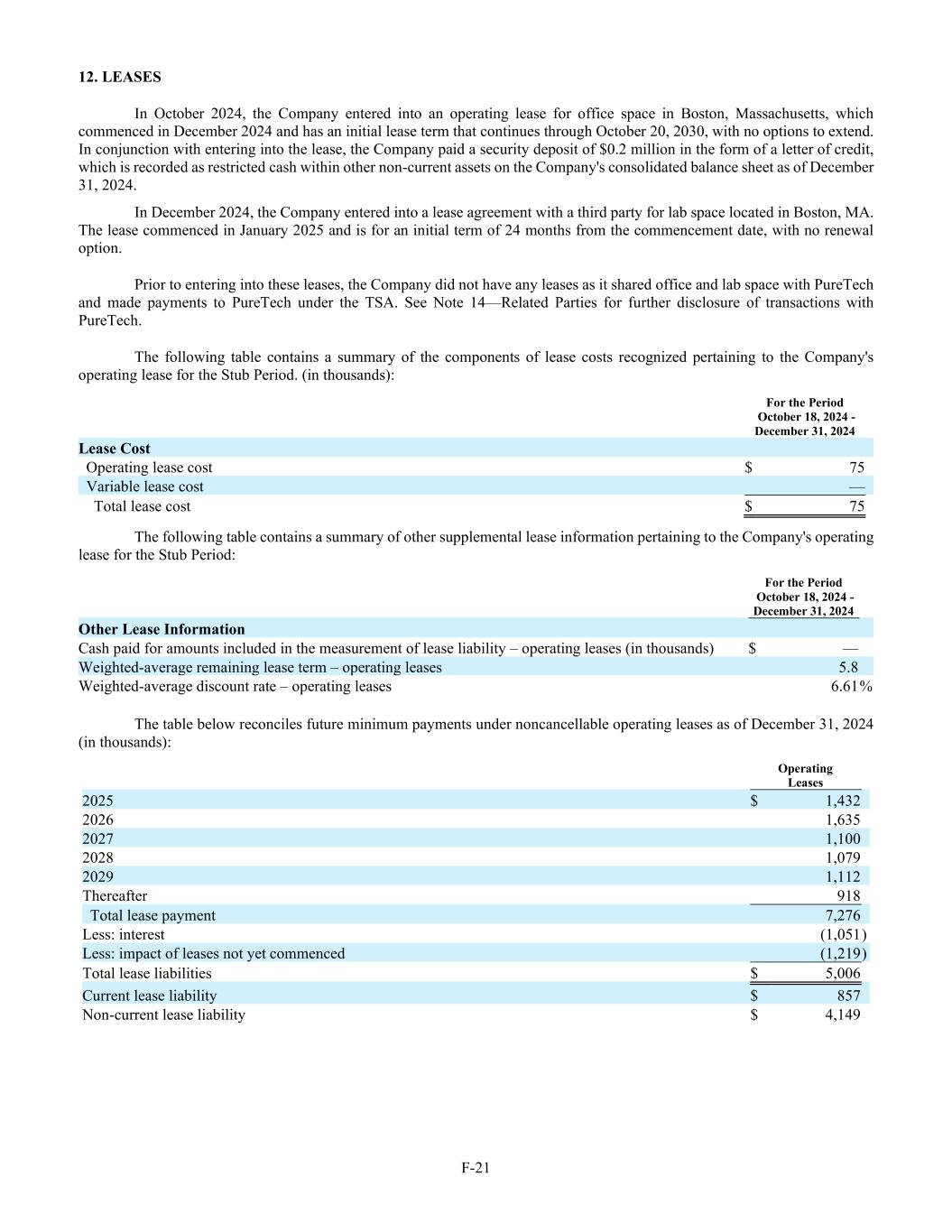

F-21 12. LEASES In October 2024, the Company entered into an operating lease for office space in Boston, Massachusetts, which commenced in December 2024 and has an initial lease term that continues through October 20, 2030, with no options to extend. In conjunction with entering into the lease, the Company paid a security deposit of $0.2 million in the form of a letter of credit, which is recorded as restricted cash within other non-current assets on the Company's consolidated balance sheet as of December 31, 2024. In December 2024, the Company entered into a lease agreement with a third party for lab space located in Boston, MA. The lease commenced in January 2025 and is for an initial term of 24 months from the commencement date, with no renewal option. Prior to entering into these leases, the Company did not have any leases as it shared office and lab space with PureTech and made payments to PureTech under the TSA. See Note 14—Related Parties for further disclosure of transactions with PureTech. The following table contains a summary of the components of lease costs recognized pertaining to the Company's operating lease for the Stub Period. (in thousands): For the Period October 18, 2024 - December 31, 2024 Lease Cost Operating lease cost $ 75 Variable lease cost — Total lease cost $ 75 The following table contains a summary of other supplemental lease information pertaining to the Company's operating lease for the Stub Period: For the Period October 18, 2024 - December 31, 2024 Other Lease Information Cash paid for amounts included in the measurement of lease liability – operating leases (in thousands) $ — Weighted-average remaining lease term – operating leases 5.8 Weighted-average discount rate – operating leases 6.61 % The table below reconciles future minimum payments under noncancellable operating leases as of December 31, 2024 (in thousands): Operating Leases 2025 $ 1,432 2026 1,635 2027 1,100 2028 1,079 2029 1,112 Thereafter 918 Total lease payment 7,276 Less: interest (1,051 ) Less: impact of leases not yet commenced (1,219 ) Total lease liabilities $ 5,006 Current lease liability $ 857 Non-current lease liability $ 4,149

F-22 13. COMMITMENTS AND CONTINGENCIES Legal Matters The Company, from time to time, may be involved with lawsuits arising in the ordinary course of business. The Company is not involved in any pending legal proceedings that it believes could have a material adverse effect on its financial condition, results of operations or cash flows. Contracts The Company enters into contracts in the normal course of business with various third parties for preclinical research studies, clinical trials, testing, manufacturing, and other services. These contracts generally provide for termination upon notice and are cancellable without significant penalty or payment, and do not contain any minimum purchase commitments. Guarantees and Indemnification In the ordinary course of business, the Company may provide indemnification of varying scope and terms to vendors, lessors, business partners and other parties with respect to certain matters including, but not limited to, losses arising out of breach of such agreements or from intellectual property infringement claims made by third parties. In addition, the Company has entered into indemnification agreements with all board of directors that will require the Company, among other things, to indemnify them against certain liabilities that may arise by reason of their status or service as directors. The maximum potential amount of future payments the Company could be required to make under these indemnification agreements is, in many cases, unlimited. To date, the Company has not incurred any material costs as a result of such indemnifications. The Company is not aware of any claims under indemnification arrangements that could have a material effect on its financial position, results of operations or cash flows, and it has not accrued any liabilities related to such obligations in its consolidated financial statements as of December 31, 2024. 401(k) Plan The Company participates in the PureTech defined-contribution plan under Section 401(k) of the Internal Revenue Code of 1986, or the 401(k) Plan. The 401(k) Plan covers all employees who meet defined minimum age and service requirements and allows participants to defer a portion of their annual compensation on a pre-tax basis. The Company will make a contribution of 3% of each employee's annual compensation up to annual safe harbor limits. The Company has accrued $0.1 million in 401(k) contribution liabilities as of December 31, 2024. Leases See Note 12—Leases, for information related to the Company’s lease obligations. 14. RELATED PARTIES As disclosed in Note 1—Nature of Business and Basis of Presentation, the Company entered into the Asset Transfer Agreement with PureTech. In connection with entering into the Asset Transfer Agreement, the Company entered into the TSA to reimburse PureTech for work performed by certain third-parties to advance the Company's programs and activities. During the Stub Period, the Company incurred $2.0 million of expenses from PureTech under the TSA, of which $1.8 million related to research and development expenses and $0.2 million related to general and administrative expenses, and $0.1 million from Third Rock Ventures related to general and administrative expenses. In April 2024, as part of its Series A-2 Financing, the Company issued and sold 8,421,052 shares of its Series A-2 Preferred Stock to PureTech LYT, at a purchase price of $3.80 per share for gross aggregate proceeds of $32.0 million. Subsequent to the Series A-2 financing, PureTech LYT remained the controlling investor of the Company. In October 2024, as part of its Series B Financing, the Company issued and sold an aggregate 3,031,578 and 494,734 shares of its Series B Preferred Stock to PureTech LYT and to certain of the Company’s management and board of directors, respectively, at a purchase price of $4.75 per share, for gross aggregate proceeds of $14.4 million and $2.3 million, respectively. Subsequent to the Series B Financing, PureTech LYT was no longer a controlling investor of the Company. 15. SUBSEQUENT EVENTS The Company has evaluated subsequent events through March 31, 2025, the date these consolidated financial statements were available to be issued. There were no subsequent events that require adjustments to or disclosure in the financial statements.