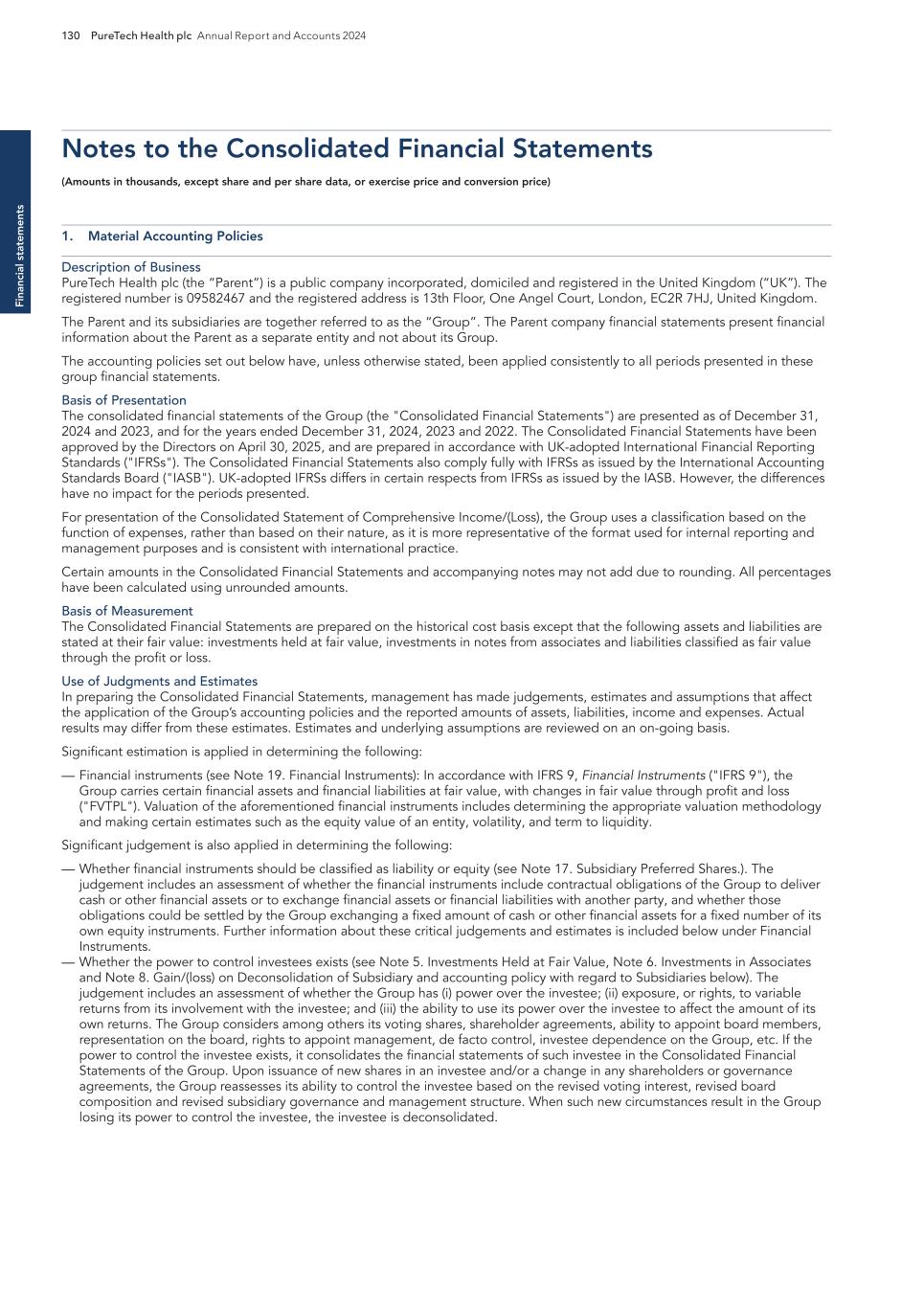

PURETECH HEALTH PLC – ANNUAL REPORT AND ACCOUNTS 2024 Exhibit 15.1

BOSTON MA Headquarters PRTC Nasdaq and LSE Relations with Stakeholders 91 Directors’ Report 93 Report of the Nomination Committee 98 Report of the Audit Committee 99 Directors’ Remuneration Report 102 Directors’ Remuneration Policy 106 Annual Report on Remuneration 110 Financial statements Independent Auditor’s Report to the Members of PureTech Health plc 121 Consolidated Statements of Comprehensive Income/(Loss) 126 Consolidated Statements of Financial Position 127 Consolidated Statements of Changes in Equity 128 Consolidated Statements of Cash Flows 129 Notes to the Consolidated Financial Statements 130 PureTech Health plc Statement of Financial Position 176 PureTech Health plc Statements of Changes in Equity 177 Notes to the Financial Statements 178 Additional information History and Development of the Company 181 Risk Factor Annex 182 Directors, Secretary and Advisors to PureTech Health plc 220 Overview Highlights of the Year 1 Letter from the Chair 2 Strategic report Letter from the Chief Executive Officer 4 2025 Strategy to Deliver Shareholder Value 6 Our Key Components of Value 8 Our R&D Approach 9 Our Hub-and-Spoke Model 10 Our Programs 11 ESG report Building and Maintaining a Sustainable Business 22 Governance Risk Management 60 Viability 65 Key Performance Indicators 67 Financial Review 68 Chair’s Overview 81 Board of Directors 82 Management Team 85 The Board 86

PureTech Health plc Annual Report and Accounts 2024 1 PureTech Health plc (“PureTech Health”, “PureTech” or “the Company”), together with its subsidiaries (the “Group”), is a clinical-stage biotherapeutics company dedicated to giving life to new classes of medicine that transform the lives of patients with devastating diseases. Our broad and deep portfolio is driven by a seasoned research and development team and an extensive network of leading scientists, clinicians, and industry experts. We advance our programs¹ both internally and through our Founded Entities² via an innovative hub-and-spoke model3. Our R&D engine has powered the development of multiple therapeutics and therapeutic candidates, including three that have received regulatory approvals from agencies such as the U.S. Food and Drug Administration and the European Medicines Agency. Each program is rooted in robust scientific validation and designed to address serious patient needs by leveraging key signals of human efficacy and validated pharmacology. This strategic focus underpins our track record of success in clinical development and positions us to continue translating breakthrough science into meaningful patient impact and long-term shareholder value. 1 Programs refers to the Company’s current and future therapeutic candidates and technologies, including those that are being developed internally by PureTech and those being advanced within PureTech’s Founded Entities. Wholly-Owned Programs are comprised of the Company’s current and future therapeutic candidates and technologies that are developed by the Company’s wholly-owned subsidiaries, whether they were announced as a Founded Entity or not, and will be advanced through with either the Company’s funding or non-dilutive sources of financing. As of December 31 ,2024, Wholly-Owned Programs were developed by the wholly-owned subsidiaries including PureTech LYT, Inc., PureTech LYT 100, Inc. and Gallop Oncology, Inc. and included primarily the programs deupirfenidone (LYT-100) and LYT-200. 2 As of the date of this report, Founded Entities represent companies founded by PureTech in which PureTech maintains ownership of an equity interest and/or, in certain cases, is eligible to receive sublicense income, milestone payments and royalties on product sales. References in the Strategic Report, ESG Report, Governance section, and Additional Information section to Founded Entities include PureTech’s ownership interests in Gallop Oncology, Inc., Seaport Therapeutics, Inc., Vedanta Biosciences, Inc., Vor Bio, Inc., Entrega, Inc., Sonde Health, Inc., for all dates prior to July 2, 2024, Akili Interactive Labs, Inc., for all dates prior to March 18, 2024, Karuna Therapeutics, Inc., for all dates prior to October 30, 2023, Gelesis, Inc., for all dates prior to December 21, 2023, Follica, Incorporated, and for all dates prior to December 18, 2019, resTORbio. 3 See page 10 for further details 4 PureTech level cash, cash equivalents and short-term investments excludes cash and cash equivalents at non-wholly owned subsidiary of $0.5m. PureTech level cash, cash equivalents and short-term investments is a non-IFRS measure. For more information in relation to the PureTech level cash, cash equivalents and short-term investments and Consolidated cash, cash equivalents and short-term investments measures used in this Annual Report, please see page 69 of the Financial Review. The balance shown for each year may include short-term investments for any positions that Puretech holds as of each year end. 5 Funding figure includes private convertible notes and public offerings. Funding figure excludes future milestone considerations received in conjunction with partnerships and collaborations. 6 Number represents figure for the relevant fiscal year only and is not cumulative. H ig hlig hts 2024 $397.5m5,6 Amount of Funding Secured for Founded Entities $367.3m4 Consolidated Cash, Cash Equivalents and Short-term Investments as of Year End Includes cash held at the PureTech level and at Controlled Founded Entities $366.8m4 PureTech Level Cash, Cash Equivalents and Short-term Investments as of Year End Highlights of the Year – 2024 2023: $578.4m 2022: $1.28b 2021: $731.9m 2020: $247.8m 2019: $666.8m 2018: $274.0m 2023: $327.1m 2022: $350.1m 2021: $465.7m 2020: $403.9m 2019: $162.4m 2018: $250.9m 2023: $326.0m 2022: $339.5m 2021: $418.9m 2020: $349.4m 2019: $120.6m 2018: $177.7m

2 PureTech Health plc Annual Report and Accounts 2024 A standout achievement was the U.S. FDA approval of KarXT—now marketed by Bristol Myers Squibb (BMS) as Cobenfy™—for the treatment of schizophrenia in adults. Invented and initially developed at PureTech, Cobenfy represents the first drug with a novel mechanism of action for schizophrenia in over 50 years, underscoring our scientific invention and leadership. Complementing this historic approval was a major financial milestone: the acquisition of Karuna Therapeutics, our Founded Entity that shepherded Cobenfy through late-stage development, by BMS for $14 billion. Through the monetization of our equity holdings—including proceeds from the BMS acquisition and a strategic royalty agreement—PureTech has generated approximately $1.1 billion in cash from the $18.5 million it initially invested in the program. Together, these achievements highlight the power of our proven hub-and-spoke model (see page 10) to advance science, build value, and deliver meaningful outcomes. Expanding on this success, we launched Seaport Therapeutics—our latest Founded Entity. Seaport builds on our leadership in neuroscience, a field where we reignited broader investment interest through the success of Karuna. Several key team members from Karuna are now involved at Seaport, leveraging their expertise to advance a promising pipeline of neuropsychiatric medicines. With over $325 million raised across two oversubscribed Series A and Series B financings, Seaport is now advancing multiple drugs developed at PureTech using the Glyph platform that PureTech validated and advanced. 2024 was a landmark year for PureTech— one defined by breakthrough achievements that created long-term value for both patients and shareholders. These accomplishments reflect not only the power of our innovation engine but also the dedication, discipline, and excellence of the PureTech team. From bold scientific bets to smart capital decisions, this year demonstrated what’s possible when vision meets execution. We reached major milestones throughout the year, including the third FDA approval for a therapeutic invented at PureTech, transformative financings for Seaport Therapeutics (a PureTech Founded Entity), and unprecedented clinical results for deupirfenidone (LYT-100), an asset fully owned by PureTech. These achievements, supported by a strong year-end balance sheet of $367 million1, underscore the strength of our capital-efficient and disciplined approach. A Year of Successes for PureTech Innovation These achievements highlight the power of our proven hub-and-spoke model to advance science, build value, and deliver meaningful outcomes. Raju Kucherlapati, Ph.D. Chair of the Board of Directors Le tt er fr o m th e C ha ir Letter from the Chair

PureTech Health plc Annual Report and Accounts 2024 3 The Board has been a steadfast partner throughout this journey—providing strategic oversight, financial discipline, and an unwavering commitment to our long-term mission. As part of this commitment, I traveled to the UK in 2024 to meet directly with several shareholders, reflecting the Board’s active engagement and dedication to maintaining strong, direct relationships with our investor base. I am proud to serve alongside such a thoughtful and forward-looking group. Their counsel has been instrumental in navigating complexity and driving results. On behalf of the Board, I extend my deepest gratitude to our shareholders for their continued support. Your confidence empowers us to pursue life-changing therapies and deliver on our vision. To the entire PureTech team—thank you. Your scientific excellence, operational rigor, and relentless drive have made this year possible. Looking ahead, we remain grounded in the disciplined approach that has long defined PureTech—prioritizing capital efficiency, thoughtful resource allocation, and strategic agility and flexibility. The momentum we have built in 2024 has positioned us for a future of continued impact, and we remain steadfast in our mission to deliver novel medicines that transform patient outcomes. Raju Kucherlapati, Ph.D. Board Chair April 30, 2025 Perhaps the most defining moment of 2024 came in December with the announcement of positive results from ELEVATE IPF, our global Phase 2b trial of deupirfenidone in idiopathic pulmonary fibrosis (IPF). The trial met its primary and key secondary endpoints, demonstrating the potential of deupirfenidone to stabilize lung function decline and meaningfully improve patient outcomes—an advance that could redefine the standard of care for IPF. These results again prove the strength of our scientific platform and our team’s ability to translate bold ideas into patient-impacting innovation. Advancing deupirfenidone into Phase 3 is now a strategic priority for PureTech, which we aim to accomplish with financial partners. Recognizing the significant cash realizations made from our success with Karuna, we also were able to return significant levels of cash to our shareholders during the year against a challenging macroeconomic backdrop. We returned $100 million through a Tender Offer and completed a $50 million share buyback program, which was initiated in 2022. Notably, we accomplished these returns without raising capital from public equity markets for seven consecutive years—all while driving significant patient progress, advancing our pipeline, and maintaining a very strong balance sheet. These actions reflect our confidence in PureTech’s intrinsic value and our commitment to delivering returns for shareholders. At the same time, the Board recognizes that there remains a disconnect between the value of PureTech’s assets and our share price. We are working closely with the CEO and management team to explore all strategic options to address this gap— including recent take-private discussions—with the goal of unlocking value in a manner that is in the best interest of all shareholders. Letter fro m the C hair Note: Certain third-party trademarks are included here; PureTech does not claim any rights to any third-party trademarks. COBENFY™ (xanomeline and trospium chloride) is indicated for the treatment of schizophrenia in adults. For Important Safety Information, see U.S. Full Prescribing Information, including Patient Information on COBENFY.com. Following the acquisition of Karuna, KarXT is now under the stewardship of Bristol Myers Squibb and will be marketed as Cobenfy. 1 This amount represents PureTech level cash, cash equivalents and short-term investments and excludes cash and cash equivalents at non-wholly owned subsidiary of $0.5m. PureTech level cash, cash equivalents and short-term investments is a non-IFRS measure. For more information in relation to the PureTech level cash, cash equivalents and short- term investments and Consolidated cash, cash equivalents and short-term investments measures used in this Annual Report, please see page 69 of the Financial Review. Letter from the Chair continued

4 PureTech Health plc Annual Report and Accounts 2024 Le tt er fr o m th e C hi ef E xe cu ti ve O ffi ce r lung function decline over 26 weeks. To our knowledge, this is an achievement unmatched by any other investigational IPF therapeutic to date. Notably, this higher dose also showed an effect size that was 50% greater than that seen in our trial with pirfenidone (80.9% vs. 54.1%, respectively), further underscoring its potential for superior efficacy. Importantly, deupirfenidone was generally well- tolerated at this higher dose, overcoming the tolerability limitations that constrain current standard-of-care therapies and limit their effectiveness. Furthermore, I’m pleased that we continue to see strong preliminary data from our ongoing open label extension (OLE) trial. As of March 14, 2025, 140 patients have continued in the OLE, with 85 patients having received at least 52 weeks of treatment with deupirfenidone. Preliminary data from those receiving deupirfenidone 825 mg TID indicate that the significant slowing of lung function decline observed in Part A of the trial has been sustained through 52 weeks of treatment, supporting the durability of the treatment effect with this dose and its potential to stabilize lung function decline over time. Detailed OLE results will be presented at an upcoming scientific forum. These results suggest the potential for deupirfenidone to offer improved efficacy without compromising safety and position it as a potential new standard-of-care, not only in IPF, but also potentially in other underserved fibrotic lung diseases. We intend to discuss these results with the FDA before the end of the third quarter of 2025 to align on a potential registrational pathway, with the goal of initiating a Phase 3 trial by the end of the year. We anticipate providing further guidance later this year following the finalization of the trial design and FDA interactions. We will also be presenting details from the Phase 2b ELEVATE IPF trial at the American Thoracic Society International Conference in May 2025. We are committed to advancing deupirfenidone while maintaining capital efficiency, in line with our proven strategy. Subject to feedback from the FDA with respect to trial design, as well as historical data from other Phase 3 IPF studies, we don’t believe our current cash balance would be sufficient to fully fund a Phase 3 trial. We have therefore initiated discussions to explore a range of funding mechanisms—including a potential spin-out of the program into a new Founded Entity and accessing external equity financing, similar to our approach with Karuna and Seaport; project or royalty- based financing; and strategic partnerships—which may be used in combination, to support the program’s continued development as we don’t intend to fully fund a Phase 3 trial on our own. We will, however, continue to fund the program in the interim to maintain development momentum. While deupirfenidone represents our next wave of innovation, we also saw the full potential of our model realized through the FDA approval of Cobenfy™, formerly KarXT, which became the first new mechanism approved for schizophrenia in over 50 years. Invented at PureTech and advanced by our Founded Entity Karuna Therapeutics, Cobenfy’s approval by the FDA in 2024, following Karuna’s acquisition by BMS for approximately $14 billion, marked the culmination of years of scientific, clinical, and strategic execution. Through our equity and royalty interest in Karuna, we not only delivered shareholder returns, but also reinforced the self- 2024 was a defining year for PureTech— one in which the programs we cultivated through our R&D engine came to fruition in ways that delivered meaningful impact for patients and showcased the strength of our innovation engine. We saw the full arc of our strategy on display: from unprecedented clinical results with our wholly-owned program that could reshape the standard of care in a major disease area, to the FDA approval of a first-in-class therapy for schizophrenia that began with our team, to the launch and successful financing of a new Founded Entity in neuropsychiatry. These moments weren’t isolated wins—they were outcomes of a deliberate and disciplined model that translates scientifically validated biology into therapies for areas of high unmet need. Among the most significant milestones of the year was the progress of our wholly- owned program, deupirfenidone (LYT-100), which delivered transformative results in our Phase 2b ELEVATE IPF trial. This randomized, double-blind, placebo- and active-controlled study evaluated two dose levels of deupirfenidone in patients with idiopathic pulmonary fibrosis (IPF), a progressive and fatal lung disease. The trial met its primary and key secondary endpoints, with the higher dose demonstrating the potential to stabilize Delivering on Our Strategy We remain deeply focused on executing a strategy that maximizes value for our shareholders while advancing our mission to improve patients’ lives. Bharatt Chowrira, Ph.D., J.D. Chief Executive Officer and Member of the Board of Directors Letter from the Chief Executive Officer

PureTech Health plc Annual Report and Accounts 2024 5 We remain deeply focused on executing a strategy that maximizes value for our shareholders while advancing our mission to improve patients’ lives, and we will carefully consider any opportunity that arises to create value for our shareholders. Our balance sheet remains strong, with $367 million as of December 31, 2024,1 and we are committed to maintaining financial discipline by allocating capital efficiently to high-impact programs while actively pursuing external funding opportunities. This measured approach allows us to protect our balance sheet while preserving flexibility in a volatile market environment. Our model has always emphasized capital efficiency, and we remain confident in our ability to build value through disciplined execution and strategic agility. I want to thank each member of the PureTech team for their contributions to our work and culture—what we’ve accomplished together is rare and meaningful. I’m also grateful to our Board of Directors for their steadfast guidance and partnership. Finally, to our broader community of collaborators—patients, advocates, clinicians, partners—and to our shareholders, thank you. Your trust and support have been essential to our journey, especially over the past year as I stepped into the role of CEO. We’re deeply grateful for the belief you’ve placed in our vision, our model, and our team. It is a privilege to pursue this mission with you, and we are committed to delivering value to all of our stakeholders. We are proud of what we have achieved together—and we are energized by the impact our science continues to make in the world. Bharatt Chowrira, Ph.D., J.D. Chief Executive Officer and Director April 30, 2025 progression tends to be less than one month and whose overall survival averages 1.7-2.4 months with standard-of-care therapy. We’re also pleased to share topline results from the head and neck cancer study, which showed a favorable safety profile in all cohorts, disease control, and initial efficacy signals, including one CR lasting more than two years. Additional details from both studies are available on pages 14-15. Our Founded Entity Vedanta Biosciences initiated its pivotal Phase 3 program for VE303 in recurrent C. difficile infection, and Vor Bio continued to make clinical progress with trem-cel (VOR33), a promising shielded transplant platform for patients with AML. Taken together, these milestones reflect a robust innovation engine that spans the biotech lifecycle from discovery through commercialization and delivers impact across multiple therapeutic areas. Our hub-and-spoke model has enabled us to achieve this with scientific rigor, executional discipline, and capital efficiency. Despite the strength of our innovation engine and the significant milestones we have achieved, our market capitalization has not reflected the underlying value of the business for some time. This persistent disconnect has remained despite meaningful efforts over the past several years—including the return of $150 million to shareholders via share buybacks and a Tender Offer, attaining a dual listing on Nasdaq, engaging in significant investor outreach and capital market activities, and making strategic shifts in our model—all while delivering meaningful scientific, clinical, and financial milestones that we believe demonstrate the inherent strength of our business. In response, we have been evaluating a range of potential pathways to better align our market value with the strength of our underlying assets and long-term potential. These efforts are grounded in a clear objective: to address structural challenges and deliver value to shareholders in a way that reflects both the maturity of our business and the opportunity ahead. funded cycle that fuels our broader pipeline. Another example of our flexible funding model in motion is Seaport Therapeutics, launched in 2024 to develop neuropsychiatric candidates based on the Glyph platform validated and advanced by PureTech. The rapid growth of Seaport—including more than $325 million raised across its Series A and B rounds in just six months— demonstrates continued external conviction in our R&D engine and our ability to build high-quality companies around transformational programs. Several other programs had important developments this year. Our newest Founded Entity, Gallop Oncology, is advancing LYT-200 for the potential treatment of hematological malignancies and solid tumors. LYT-200, which targets galectin-9, received FDA Fast Track designation for both acute myeloid leukemia (AML) and head and neck cancers, was granted Orphan Drug Designation for AML, and delivered encouraging data across its two clinical trials. The ongoing Phase 1b trial in AML and high-risk myelodysplastic syndromes (MDS) has shown clinical activity and disease stabilization in heavily pretreated patients, both as a monotherapy and in combination with venetoclax/ hypomethylating agents (HMA), along with a favorable safety profile. Data were presented at the American Society for Hematology in 2024, and – since then – the trial has continued to demonstrate robust efficacy and safety. As of April 28, 2025, treatment with LYT-200 has resulted in one complete response (CR), three partial responses (PRs) and more than 50% of patients treated experienced stable disease. When administered in combination with venetoclax/HMA, results as of April 28, 2025, demonstrate that LYT-200 may enhance the efficacy of standard-of-care therapies, resulting in 6 CRs, 1 morphological leukemia-free state, and 50% of patients experiencing stable disease. The average time on combination therapy was four months as of the data cutoff, which is meaningful in a patient population whose time to Letter from the Chief Executive Officer continued Letter fro m the C hief E xecutive O fficer Note: Certain third-party trademarks are included here; PureTech does not claim any rights to any third-party trademarks. COBENFY™ (xanomeline and trospium chloride) is indicated for the treatment of schizophrenia in adults. For Important Safety Information, see U.S. Full Prescribing Information, including Patient Information on COBENFY.com. Following the acquisition of Karuna, KarXT is now under the stewardship of Bristol Myers Squibb and will be marketed as Cobenfy. 1 This amount represents PureTech level cash, cash equivalents and short-term investments and excludes cash and cash equivalents at non-wholly owned subsidiary of $0.5m. PureTech level cash, cash equivalents and short-term investments is a non-IFRS measure. For more information in relation to the PureTech level cash, cash equivalents and short- term investments and Consolidated cash, cash equivalents and short-term investments measures used in this Annual Report, please see page 69 of the Financial Review.

6 PureTech Health plc Annual Report and Accounts 2024 PureTech is at an important strategic juncture. Our priority in 2025 is to address the persistent value disconnect and deliver shareholder returns through potential strategic initiatives and disciplined capital allocation. Our hub-and-spoke model (see page 10) enables us to derive meaningful economics from our Founded Entities—via equity holdings, milestones, and royalties—while supporting the continued development of our programs. This model has allowed us to self-fund our operations for more than seven years without raising capital from public equity markets, preserving shareholder value and ownership. It has also enabled us to return $150 million to shareholders, while continuing to fuel a highly productive and validated R&D engine – one that consistently generates innovative programs with the potential for significant patient impact. At the core of this track record is our ongoing commitment to scientific rigor, high ethical and quality standards, efficient execution, and disciplined capital allocation. Addressing the Value Disconnect Strategy PureTech’s core mission has always been - and continues to be - to deliver transformative treatments to patients with serious diseases and to translate that patient impact into meaningful value for shareholders. Over the past decade, we have achieved significant scientific, clinical, and financial milestones, underpinned by our capital- efficient hub-and-spoke model. However, despite this progress, our market capitalization has not consistently reflected the intrinsic value of our business. We have taken a number of actions in light of this disconnect over time—including share buybacks, a Tender Offer, attaining a dual listing on Nasdaq, engaging in significant investor outreach and capital market activities, and strategic shifts in our R&D model. We continue to believe there is an opportunity to better align our valuation with the underlying strength of our platform, pipeline, and track record of execution. This has been recognized by external parties – as highlighted by the possible cash offer that was recently made public – and the Board actively engages with such approaches as appropriate. At the same time, we remain focused on executing our business plan, advancing our pipeline, and generating future monetization opportunities. Value impact We remain committed to delivering value in a way that reflects both the maturity of our business, the strength of our assets and financial position, and the opportunity ahead. We will carefully consider any opportunity that arises to create value for our shareholders. We will also continue to operate with capital discipline and strategic focus— deploying resources toward our highest-impact programs and protecting our balance sheet, especially against the current macroeconomic backdrop. Our model allows for ongoing progress across multiple fronts, and our Board remains actively engaged in assessing how best to maximize long-term shareholder value. Wholly-Owned Programs Strategy In December 2024, we announced robust Phase 2b data from our Wholly-Owned Program, deupirfenidone (LYT-100), in idiopathic pulmonary fibrosis (IPF). See pages 11-13. These data have been met with enthusiasm from key stakeholders, including key opinion leaders, based on both their clinical strength and the potential to meaningfully improve the standard of care. Strong safety and efficacy data support meaningful differentiation from current therapies and underscore the potential for significant patient impact of this program. We are targeting a meeting with the FDA before the end of Q3 2025 to align on a potential registrational pathway, with the goal of initiating a Phase 3 trial by the end of the year. We anticipate providing further guidance later this year following the finalization of the trial design and FDA interactions. As we advance toward this next phase, we are actively exploring a variety of strategic funding mechanisms—including a potential spin-out of the program into a new Founded Entity and accessing external equity financing, similar to our approach with Karuna and Seaport; project or royalty-based financing and strategic partnerships—which may be used in combination—to support continued development in a capital-efficient manner. We do not intend to fully fund the Phase 3 trial independently; moreover, we don’t believe our current cash reserves would be sufficient to fully fund a Phase 3 trial. We will, however, continue to fund the program in the interim to maintain development momentum. We are also pursuing continued publication and presentation of the deupirfenidone Phase 2b trial data to support external engagement with potential investors, partners, and collaborators. In parallel, we are continuing to support the development of LYT-200 through our Founded Entity, Gallop Oncology, which is currently led by PureTech’s Entrepreneur-In-Residence, Luba Greenwood, J.D. We anticipate additional clinical data in Q3 2025 and are targeting to secure external funding later this year. PureTech is actively pursuing third-party financing to support Gallop’s next phase of growth and will continue to fund the program in the interim to maintain development momentum. Value impact Our R&D approach is designed to efficiently progress the most promising programs in a disciplined and efficient manner. We apply rigorous internal de-risking, set a high threshold for advancement, and explore multiple paths to value creation—including partnerships and external funding opportunities—to reduce risk and optimize capital deployment. Our goal is to deliver high-impact therapies while maximizing shareholder value through thoughtful, and disciplined program execution and capital deployment. 2025 Strategy to Deliver Shareholder Value 20 25 S tr at eg y to D el iv er S ha re ho ld er V al ue

PureTech Health plc Annual Report and Accounts 2024 7 Founded Entities Strategy Consistent with our hub-and-spoke model, we plan to conduct additional sourcing activities and may launch new Founded Entities to house select programs – balancing risk, cost, and potential reward. Initial expenditures associated with any innovation and sourcing activities would be relatively low. In some cases, we may participate in financing rounds to preserve or enhance our ownership position, when we believe it will generate long-term value. Value impact Our Founded Entities offer multiple advantages: — Enabling the advancement of therapeutic candidates through capital-intensive development — Reducing PureTech’s financial exposure — Creating future monetization opportunities — Driving shareholder returns while avoiding dilution at the PureTech level — Providing a diversified portfolio that reduces binary risk and offers multiple shots on goal This structure also attracts specialized management teams and external capital, allowing PureTech to maintain upside potential with reduced operational burden. See page 16 for our Karuna Therapeutics case study. Shareholder Returns Strategy The Board is committed to maximizing value for our shareholders, and – in 2024 alone – PureTech returned $100 million to shareholders through a Tender Offer. The Board may evaluate additional capital return opportunities —particularly in connection with monetization events—and will consider such actions as part of its broader strategy to maximize shareholder value. Value impact While our primary focus remains on building long-term value through scientific and operational execution, we recognize the importance of capital discipline and direct returns to shareholders when appropriate. Our strong balance sheet, capital-efficient model, and potential monetization events provide us with multiple tools to deliver value—both in the near term and over time. 2025 Strateg y to D eliver Shareho ld er Value

8 PureTech Health plc Annual Report and Accounts 2024 O ur K ey C o m p o ne nt s of V al ue Our Key Components of Value Maximizing stakeholder value Note: Certain third-party trademarks are included here; PureTech does not claim any rights to any third-party trademarks. COBENFY™ (xanomeline and trospium chloride) is indicated for the treatment of schizophrenia in adults. For Important Safety Information, see U.S. Full Prescribing Information, including Patient Information on COBENFY.com. Following the acquisition of Karuna, KarXT is now under the stewardship of Bristol Myers Squibb and will be marketed as Cobenfy. 1 As of December 31, 2024. PureTech level cash, cash equivalents and short-term investments excludes cash and cash equivalents at non-wholly owned subsidiary of $0.5m. PureTech level cash, cash equivalents and short-term investments is a non-IFRS measure. 2 This percentage includes number of successful trials out of all trials run for all therapeutic candidates advanced through at least Phase 1 by PureTech or its Founded Entities from 2009 onward. $366.8M 2024YE1 1. Strong Balance Sheet Deupirfenidone (LYT-100) for IPF (entering Phase 3 clinical development) LYT-200 for AML (poised to enter mid-stage clinical development) 2. Wholly-Owned Programs e.g., Seaport, Vedanta 3. Founded Entity Equity Value e.g., Cobenfy™, Seaport progress 4. Royalties, milestone and sublicense income $150M returned to date via Tender Offer & share buyback (additional capital returns possible) 5. Capital Returns 3 FDA approvals and a strong track record of clinical success (>80% of clinical trials successful2) 6. People/R&D Engine

Conduct rigorous, early de-risking Change the lives of patients with devastating diseases Develop solution driven by validated pharmacology Identify significant patient need PureTech Health plc Annual Report and Accounts 2024 9 O ur Innovative R& D A p p ro ach Our Innovative R&D Approach Accelerating Momentum & Delivering Results Key milestones in recent years Deupirfenidone ELEVATE IPF Study PureTech completed successful Phase 2b trial of deupirfenidone in IPF Vedanta Biosciences PureTech’s Founded Entity Vedanta Biosciences iniated Phase 3 trial of VE303 Seaport Therapeutics PureTech launched Founded Entity Seaport Therapeutics; >$325m raised in 2024 Cobenfy™ (formerly KarXT) BMS/Karuna received FDA Approval for Cobenfy™ Gallop Oncology PureTech’s LYT-200 granted Orphan Drug and Fast Track Designations Royalty Pharma PureTech and Royalty Pharma entered into Cobenfy (KarXT) royalty transaction for up to $500 million Karuna Therapeutics and Bristol Myers Squibb PureTech’s Founded Entity Karuna Therapeutics acquired by Bristol Myers Squibb for $14 billion

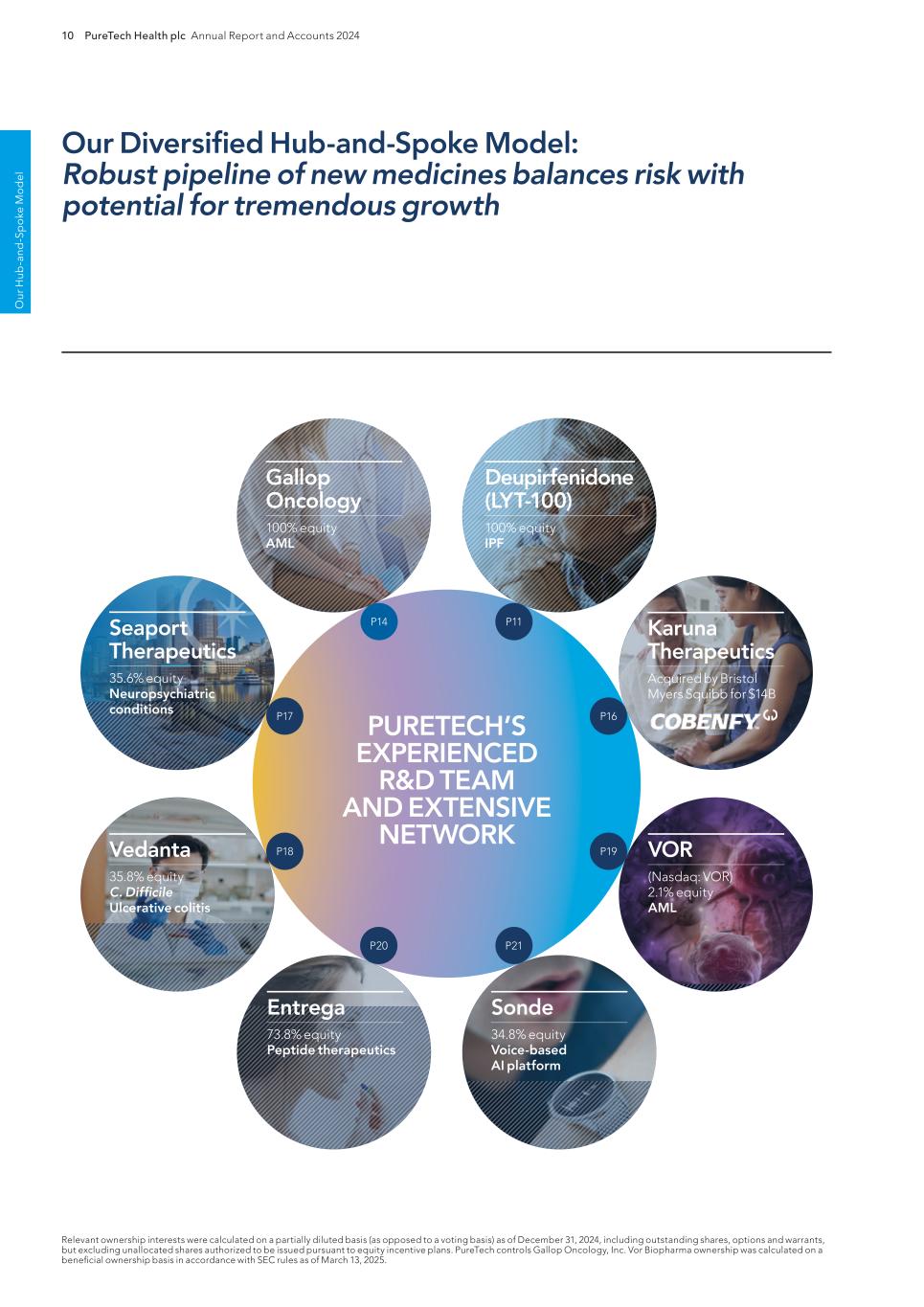

10 PureTech Health plc Annual Report and Accounts 2024 O ur H ub -a nd -S p o ke M o d el Relevant ownership interests were calculated on a partially diluted basis (as opposed to a voting basis) as of December 31, 2024, including outstanding shares, options and warrants, but excluding unallocated shares authorized to be issued pursuant to equity incentive plans. PureTech controls Gallop Oncology, Inc. Vor Biopharma ownership was calculated on a beneficial ownership basis in accordance with SEC rules as of March 13, 2025. Our Diversified Hub-and-Spoke Model: Robust pipeline of new medicines balances risk with potential for tremendous growth Gallop Oncology 100% equity AML Deupirfenidone (LYT-100) 100% equity IPF Seaport Therapeutics 35.6% equity Neuropsychiatric conditions Vedanta 35.8% equity C. Difficile Ulcerative colitis Entrega 73.8% equity Peptide therapeutics VOR (Nasdaq: VOR) 2.1% equity AML Karuna Therapeutics Acquired by Bristol Myers Squibb for $14B Sonde 34.8% equity Voice-based AI platform PURETECH’S EXPERIENCED R&D TEAM AND EXTENSIVE NETWORK P16 P11P14 P17 P18 P20 P21 P19

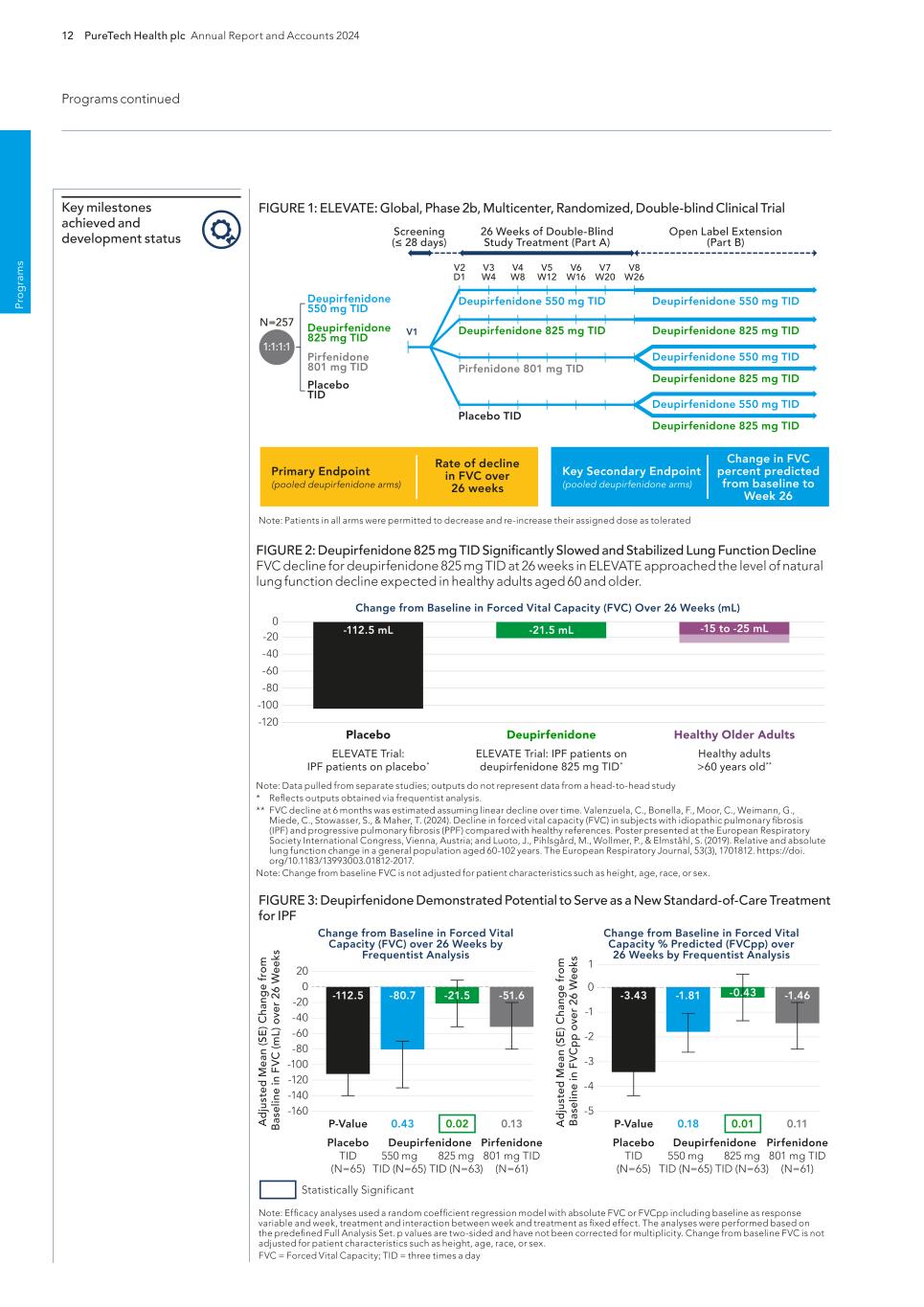

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 11 — We acquired deupirfenidone in July 2019 based on insights gained internally and via unpublished findings through our network of collaborators. Deupirfenidone was originally developed by Auspex Pharmaceuticals, Inc. (Auspex), where our Chief Executive Officer, Bharatt Chowrira, Ph.D., J.D., served as Chief Operating Officer. Auspex (now a wholly owned subsidiary of Teva Pharmaceuticals) pioneered deuteration technology and successfully developed deutetrabenazine (Austedo®), the first deuterated drug to ever receive FDA approval.4 — Deupirfenidone is a deuterated form of pirfenidone, one of the two FDA-approved SOC treatments. The strategic replacement of three hydrogen atoms with deuterium at the site of metabolism has been shown to enhance the beneficial pharmacology and clinically-validated efficacy of pirfenidone while maintaining a favorable tolerability profile. This enhancement allows greater levels of drug exposure to be achieved with deupirfenidone compared to the highest approved dose of pirfenidone, without sacrificing tolerability. Program discovery process by the PureTech team Deupirfenidone (LYT-100) Programs — In December 2024, we announced positive topline results from the ELEVATE IPF Phase 2b clinical trial evaluating deupirfenidone in patients with IPF. – ELEVATE IPF was a global, randomized, double-blind, active- and placebo-controlled, dose-ranging trial that evaluated deupirfenidone at two dose levels (550 mg and 825 mg) three times a day (TID) over 26 weeks in patients with IPF. (Figure 1). – The trial achieved its primary endpoint based on the prespecified Bayesian analysis, with a 98.5% posterior probability. This means there is a 98.5% probability that the pooled deupirfenidone arms were superior to placebo in slowing the rate of lung function decline in people with IPF at 26 weeks, as measured by forced vital capacity (FVC), a measurement of the maximum amount of air a person can forcefully exhale from their lungs. • Deupirfenidone 825 mg TID demonstrated the potential to stabilize lung function decline. Patients treated with deupirfenidone 825 mg TID experienced an FVC decline of -21.5 mL over 26 weeks, which is comparable to the expected natural lung function decline in healthy adults aged 60 and older. (Figure 2). • The deupirfenidone arms, 550mg TID and 825mg TID, exhibited dose-dependent efficacy with an FVC reduction from baseline of -80.7mL and -21.5mL, respectively. The placebo and pirfenidone arms responded as reported in previous studies with an FVC reduction from baseline of -112.5mL and -51.6mL, respectively. The performance of these control arms and the dose-dependent response of the deupirfenidone arms suggests that the efficacy of deupirfenidone was not likely a chance observation. (Figure 3). – The deupirfenidone 825 mg TID arm had an effect size, compared to placebo, that was 50% greater than that seen with pirfenidone (80.9% vs. 54.1%, respectively). Additionally, preliminary pharmacokinetic results indicate that deupirfenidone 825 mg TID achieved ~50% higher exposure than pirfenidone 801 mg TID, corresponding with the greater efficacy results demonstrated with deupirfenidone 825 mg TID. – Deupirfenidone was generally well-tolerated with a favorable adverse event profile at both doses studied. (Figure 4). Key milestones achieved and development status PureTech Ownership 100% equity Deupirfenidone (LYT-100) is being developed at PureTech as a potential new standard of care (SOC) for the treatment of idiopathic pulmonary fibrosis (IPF), a progressive and fatal lung disease estimated to affect over 230,000 people across the U.S. and EU51. Only about 25% of IPF patients have ever been treated with either FDA-approved therapeutic (pirfenidone and nintedanib)2, yet combined sales of these medications in 2022 were more than $4 billion3, representing a significant market opportunity in IPF and other fibrotic lung diseases. Despite achieving blockbuster status, the current SOC treatments only modestly slow lung function decline, as their effectiveness is limited by poor tolerability at higher doses. This results in suboptimal efficacy, reduced patient uptake, and poor adherence—all due to a tolerability ceiling that prevents dosing levels that could significantly improve patient outcomes. Our studies have shown that deupirfenidone may overcome these limitations and – to our knowledge – is the only investigational therapeutic for IPF that has demonstrated the potential to stabilize lung function decline over at least 26 weeks while maintaining safety and tolerability. Beyond IPF, deupirfenidone could also address multiple underserved fibrotic diseases, including progressive fibrosing interstitial lung diseases (ILDs) and other fibrotic conditions.

Pr o g ra m s 12 PureTech Health plc Annual Report and Accounts 2024 Programs continued Key milestones achieved and development status FIGURE 1: ELEVATE: Global, Phase 2b, Multicenter, Randomized, Double-blind Clinical Trial FIGURE 3: Deupirfenidone Demonstrated Potential to Serve as a New Standard-of-Care Treatment for IPF FIGURE 2: Deupirfenidone 825 mg TID Significantly Slowed and Stabilized Lung Function Decline FVC decline for deupirfenidone 825 mg TID at 26 weeks in ELEVATE approached the level of natural lung function decline expected in healthy adults aged 60 and older. Note: Patients in all arms were permitted to decrease and re-increase their assigned dose as tolerated Note: Data pulled from separate studies; outputs do not represent data from a head-to-head study * Reflects outputs obtained via frequentist analysis. ** FVC decline at 6 months was estimated assuming linear decline over time. Valenzuela, C., Bonella, F., Moor, C., Weimann, G., Miede, C., Stowasser, S., & Maher, T. (2024). Decline in forced vital capacity (FVC) in subjects with idiopathic pulmonary fibrosis (IPF) and progressive pulmonary fibrosis (PPF) compared with healthy references. Poster presented at the European Respiratory Society International Congress, Vienna, Austria; and Luoto, J., Pihlsgård, M., Wollmer, P., & Elmståhl, S. (2019). Relative and absolute lung function change in a general population aged 60-102 years. The European Respiratory Journal, 53(3), 1701812. https://doi. org/10.1183/13993003.01812-2017. Note: Change from baseline FVC is not adjusted for patient characteristics such as height, age, race, or sex. Note: Efficacy analyses used a random coefficient regression model with absolute FVC or FVCpp including baseline as response variable and week, treatment and interaction between week and treatment as fixed effect. The analyses were performed based on the predefined Full Analysis Set. p values are two-sided and have not been corrected for multiplicity. Change from baseline FVC is not adjusted for patient characteristics such as height, age, race, or sex. FVC = Forced Vital Capacity; TID = three times a day

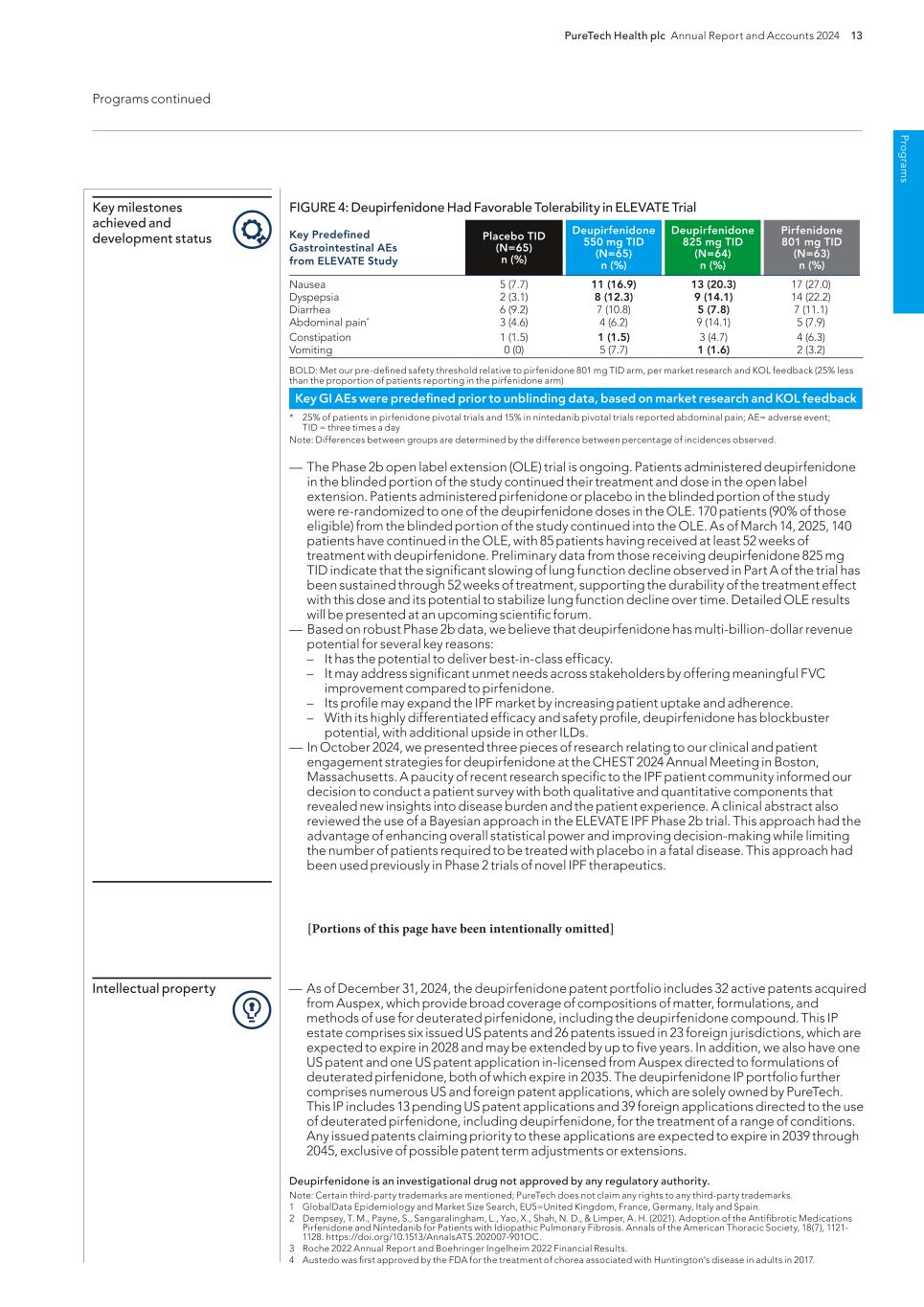

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 13 Programs continued — As of December 31, 2024, the deupirfenidone patent portfolio includes 32 active patents acquired from Auspex, which provide broad coverage of compositions of matter, formulations, and methods of use for deuterated pirfenidone, including the deupirfenidone compound. This IP estate comprises six issued US patents and 26 patents issued in 23 foreign jurisdictions, which are expected to expire in 2028 and may be extended by up to five years. In addition, we also have one US patent and one US patent application in-licensed from Auspex directed to formulations of deuterated pirfenidone, both of which expire in 2035. The deupirfenidone IP portfolio further comprises numerous US and foreign patent applications, which are solely owned by PureTech. This IP includes 13 pending US patent applications and 39 foreign applications directed to the use of deuterated pirfenidone, including deupirfenidone, for the treatment of a range of conditions. Any issued patents claiming priority to these applications are expected to expire in 2039 through 2045, exclusive of possible patent term adjustments or extensions. Intellectual property Deupirfenidone is an investigational drug not approved by any regulatory authority. Note: Certain third-party trademarks are mentioned; PureTech does not claim any rights to any third-party trademarks. 1 GlobalData Epidemiology and Market Size Search, EU5=United Kingdom, France, Germany, Italy and Spain. 2 Dempsey, T. M., Payne, S., Sangaralingham, L., Yao, X., Shah, N. D., & Limper, A. H. (2021). Adoption of the Antifibrotic Medications Pirfenidone and Nintedanib for Patients with Idiopathic Pulmonary Fibrosis. Annals of the American Thoracic Society, 18(7), 1121- 1128. https://doi.org/10.1513/AnnalsATS.202007-901OC. 3 Roche 2022 Annual Report and Boehringer Ingelheim 2022 Financial Results. 4 Austedo was first approved by the FDA for the treatment of chorea associated with Huntington’s disease in adults in 2017. FIGURE 4: Deupirfenidone Had Favorable Tolerability in ELEVATE Trial BOLD: Met our pre-defined safety threshold relative to pirfenidone 801 mg TID arm, per market research and KOL feedback (25% less than the proportion of patients reporting in the pirfenidone arm) * 25% of patients in pirfenidone pivotal trials and 15% in nintedanib pivotal trials reported abdominal pain; AE= adverse event; TID = three times a day Note: Differences between groups are determined by the difference between percentage of incidences observed. — The Phase 2b open label extension (OLE) trial is ongoing. Patients administered deupirfenidone in the blinded portion of the study continued their treatment and dose in the open label extension. Patients administered pirfenidone or placebo in the blinded portion of the study were re-randomized to one of the deupirfenidone doses in the OLE. 170 patients (90% of those eligible) from the blinded portion of the study continued into the OLE. As of March 14, 2025, 140 patients have continued in the OLE, with 85 patients having received at least 52 weeks of treatment with deupirfenidone. Preliminary data from those receiving deupirfenidone 825 mg TID indicate that the significant slowing of lung function decline observed in Part A of the trial has been sustained through 52 weeks of treatment, supporting the durability of the treatment effect with this dose and its potential to stabilize lung function decline over time. Detailed OLE results will be presented at an upcoming scientific forum. — Based on robust Phase 2b data, we believe that deupirfenidone has multi-billion-dollar revenue potential for several key reasons: – It has the potential to deliver best-in-class efficacy. – It may address significant unmet needs across stakeholders by offering meaningful FVC improvement compared to pirfenidone. – Its profile may expand the IPF market by increasing patient uptake and adherence. – With its highly differentiated efficacy and safety profile, deupirfenidone has blockbuster potential, with additional upside in other ILDs. — In October 2024, we presented three pieces of research relating to our clinical and patient engagement strategies for deupirfenidone at the CHEST 2024 Annual Meeting in Boston, Massachusetts. A paucity of recent research specific to the IPF patient community informed our decision to conduct a patient survey with both qualitative and quantitative components that revealed new insights into disease burden and the patient experience. A clinical abstract also reviewed the use of a Bayesian approach in the ELEVATE IPF Phase 2b trial. This approach had the advantage of enhancing overall statistical power and improving decision-making while limiting the number of patients required to be treated with placebo in a fatal disease. This approach had been used previously in Phase 2 trials of novel IPF therapeutics. Key milestones achieved and development status Key GI AEs were predefined prior to unblinding data, based on market research and KOL feedback Key Predefined Gastrointestinal AEs from ELEVATE Study Placebo TID (N=65) n (%) Deupirfenidone 550 mg TID (N=65) n (%) Deupirfenidone 825 mg TID (N=64) n (%) Pirfenidone 801 mg TID (N=63) n (%) Nausea 5 (7.7) 11 (16.9) 13 (20.3) 17 (27.0) Dyspepsia 2 (3.1) 8 (12.3) 9 (14.1) 14 (22.2) Diarrhea 6 (9.2) 7 (10.8) 5 (7.8) 7 (11.1) Abdominal pain* 3 (4.6) 4 (6.2) 9 (14.1) 5 (7.9) Constipation 1 (1.5) 1 (1.5) 3 (4.7) 4 (6.3) Vomiting 0 (0) 5 (7.7) 1 (1.6) 2 (3.2) [Portions of this page have been intentionally omitted]

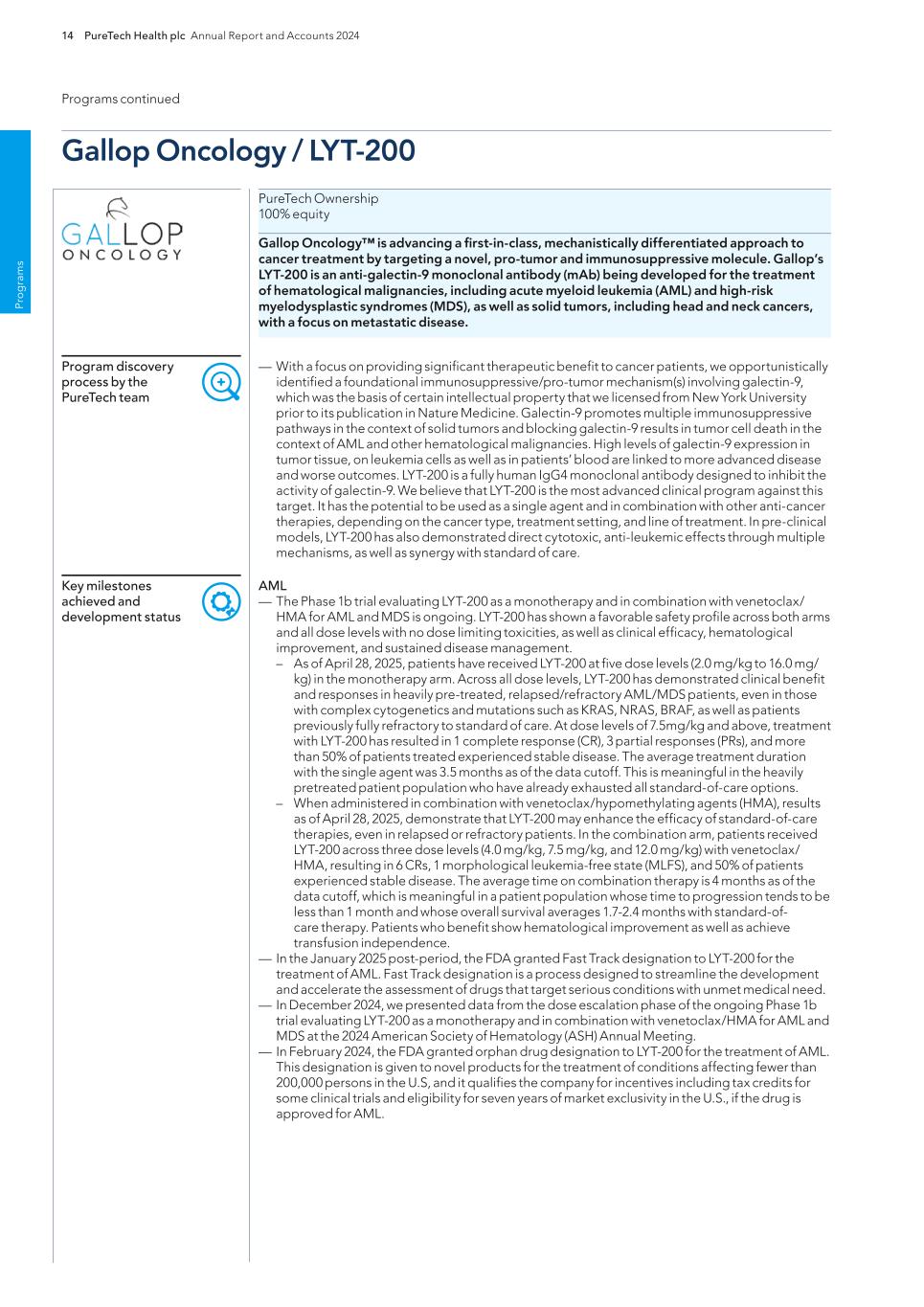

Pr o g ra m s 14 PureTech Health plc Annual Report and Accounts 2024 AML — The Phase 1b trial evaluating LYT-200 as a monotherapy and in combination with venetoclax/ HMA for AML and MDS is ongoing. LYT-200 has shown a favorable safety profile across both arms and all dose levels with no dose limiting toxicities, as well as clinical efficacy, hematological improvement, and sustained disease management. – As of April 28, 2025, patients have received LYT-200 at five dose levels (2.0 mg/kg to 16.0 mg/ kg) in the monotherapy arm. Across all dose levels, LYT-200 has demonstrated clinical benefit and responses in heavily pre-treated, relapsed/refractory AML/MDS patients, even in those with complex cytogenetics and mutations such as KRAS, NRAS, BRAF, as well as patients previously fully refractory to standard of care. At dose levels of 7.5mg/kg and above, treatment with LYT-200 has resulted in 1 complete response (CR), 3 partial responses (PRs), and more than 50% of patients treated experienced stable disease. The average treatment duration with the single agent was 3.5 months as of the data cutoff. This is meaningful in the heavily pretreated patient population who have already exhausted all standard-of-care options. – When administered in combination with venetoclax/hypomethylating agents (HMA), results as of April 28, 2025, demonstrate that LYT-200 may enhance the efficacy of standard-of-care therapies, even in relapsed or refractory patients. In the combination arm, patients received LYT-200 across three dose levels (4.0 mg/kg, 7.5 mg/kg, and 12.0 mg/kg) with venetoclax/ HMA, resulting in 6 CRs, 1 morphological leukemia-free state (MLFS), and 50% of patients experienced stable disease. The average time on combination therapy is 4 months as of the data cutoff, which is meaningful in a patient population whose time to progression tends to be less than 1 month and whose overall survival averages 1.7-2.4 months with standard-of- care therapy. Patients who benefit show hematological improvement as well as achieve transfusion independence. — In the January 2025 post-period, the FDA granted Fast Track designation to LYT-200 for the treatment of AML. Fast Track designation is a process designed to streamline the development and accelerate the assessment of drugs that target serious conditions with unmet medical need. — In December 2024, we presented data from the dose escalation phase of the ongoing Phase 1b trial evaluating LYT-200 as a monotherapy and in combination with venetoclax/HMA for AML and MDS at the 2024 American Society of Hematology (ASH) Annual Meeting. — In February 2024, the FDA granted orphan drug designation to LYT-200 for the treatment of AML. This designation is given to novel products for the treatment of conditions affecting fewer than 200,000 persons in the U.S, and it qualifies the company for incentives including tax credits for some clinical trials and eligibility for seven years of market exclusivity in the U.S., if the drug is approved for AML. Key milestones achieved and development status — With a focus on providing significant therapeutic benefit to cancer patients, we opportunistically identified a foundational immunosuppressive/pro-tumor mechanism(s) involving galectin-9, which was the basis of certain intellectual property that we licensed from New York University prior to its publication in Nature Medicine. Galectin-9 promotes multiple immunosuppressive pathways in the context of solid tumors and blocking galectin-9 results in tumor cell death in the context of AML and other hematological malignancies. High levels of galectin-9 expression in tumor tissue, on leukemia cells as well as in patients’ blood are linked to more advanced disease and worse outcomes. LYT-200 is a fully human IgG4 monoclonal antibody designed to inhibit the activity of galectin-9. We believe that LYT-200 is the most advanced clinical program against this target. It has the potential to be used as a single agent and in combination with other anti-cancer therapies, depending on the cancer type, treatment setting, and line of treatment. In pre-clinical models, LYT-200 has also demonstrated direct cytotoxic, anti-leukemic effects through multiple mechanisms, as well as synergy with standard of care. Program discovery process by the PureTech team Programs continued Gallop Oncology / LYT-200 PureTech Ownership 100% equity Gallop Oncology™ is advancing a first-in-class, mechanistically differentiated approach to cancer treatment by targeting a novel, pro-tumor and immunosuppressive molecule. Gallop’s LYT-200 is an anti-galectin-9 monoclonal antibody (mAb) being developed for the treatment of hematological malignancies, including acute myeloid leukemia (AML) and high-risk myelodysplastic syndromes (MDS), as well as solid tumors, including head and neck cancers, with a focus on metastatic disease.

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 15 Locally advanced/metastatic solid tumors — The Phase 1b trial evaluating LYT-200 as a monotherapy and in combination with tislelizumab for the treatment of locally advanced/metastatic, relapsed/refractory solid tumors, including head and neck cancers, has successfully completed. LYT-200 demonstrated a favorable safety profile in all cohorts and showed disease control and initial efficacy signals. The LYT-200 solid tumor study enrolled 44 relapsed/refractory solid tumor patients across 13 sites in the United States. – The single agent (SA) cohorts dosed LYT-200 between 0.2 – 16 mg/kg every two weeks (Q2W) or 10 mg/kg every week (QW). The combination cohorts dosed LYT-200 at 6.3mg/kg QW and 16mg/kg QW with an anti-PD-1 antibody, tislelizumab. The SA cohorts enrolled 20 all-comer patients, while the combination cohorts enrolled 24 patients, including 19 with head and neck cancer and five with urothelial cancer. The median number of prior lines of treatment was four in the single agent cohorts and three in the combination cohorts. There were no dose limiting toxicities in this study. There were no LYT-200 related serious adverse events in the SA cohorts. Eight patients (40%) experienced grade 3 or higher adverse events, none of which were related to LYT-200. In combination with tislelizumab, three patients (12.5%) experienced an immune mediated adverse reaction (IMAR), all of which were related to tislelizumab (grade 2 hypothyroidism, grade 1 hyperthyroidism, and grade 3 cholangitis). There was one LYT-200- related grade 3 serious adverse event, an asymptomatic elevation of the protein troponin, that occurred with 16 mg/kg QW LYT-200 plus tislelizumab, led to treatment discontinuation, but resolved fully on steroid treatment. 14 patients (58.3%) experienced grade 3 or higher adverse events of which one (the elevated troponin) was related to LYT-200. In the SA cohorts, three patients (16% of evaluable patients) achieved stable disease. Disease control has been noted from dose levels of 6.3 mg/kg and above. – In the combination cohorts, two urothelial cancer patients (out of 4 evaluable patients) treated with 6.3 mg/kg QW LYT-200 plus tislelizumab had stable disease. In head and neck patients treated with 6.3 mg/kg QW LYT-200 plus tislelizumab, one patient experienced a complete response lasting more than 2 years; two patients had a partial response; and two patients had stable disease, resulting in an overall response rate of 33% and a disease control rate of 50%. At 16 mg/kg plus tislelizumab, three patients (out of seven evaluable) had stable disease, giving a disease control rate of 43%. For patients achieving a response as per RECIST 1.1 criteria, the six-month progression-free survival (PFS) is 67%, and the 12-month PFS is 33%. — In March 2024, the FDA granted Fast Track designation for LYT-200 in combination with anti-PD1 therapy for the treatment of recurrent/metastatic head and neck cancers. Fast Track designation is a process designed to streamline the development and accelerate the assessment of drugs that target serious conditions with unmet need. Key milestones achieved and development status — The intellectual property portfolio for LYT-200 provides broad intellectual property coverage for antibody-based immunotherapy technologies. As of December 31, 2024, there are 16 families of intellectual property within this patent portfolio, including eight (8) families of patent filings that are co-owned with and/or exclusively licensed from New York University which cover antibodies that target galectin-9, including LYT-200, and methods of using these antibodies in various immuno-oncology technologies and other therapeutic methods. In addition, the intellectual property portfolio includes seven (7) families of company-owned patent applications covering the use of anti-galectin-9 antibodies in the diagnosis and treatment of various cancers, including solid tumors and hematological cancers, and one family of patent applications co-owned with BeiGene directed to combination therapies for the treatment of solid tumors. This intellectual property portfolio comprises four (4) issued U.S. patents which are expected to expire in 2038, 14 pending U.S. patent applications, which if issued, are expected to expire 2037 through 2045, one (1) international PCT application, 82 pending foreign applications and 20 issued patents in foreign jurisdictions. Intellectual property Programs continued LYT-200 is an investigational drug not approved by any regulatory authority. [Portions of this page have been intentionally omitted]

Pr o g ra m s 16 PureTech Health plc Annual Report and Accounts 2024 Note: Certain third-party trademarks are included here; PureTech does not claim any rights to any third-party trademarks. COBENFY™ (xanomeline and trospium chloride) is indicated for the treatment of schizophrenia in adults. For Important Safety Information, see U.S. Full Prescribing Information, including Patient Information on COBENFY.com. Following the acquisition of Karuna, KarXT is now under the stewardship of Bristol Myers Squibb and will be marketed as Cobenfy. 1 As of 22 March 2023, PureTech has sold its right to receive a 3 percent royalty from Karuna to Royalty Pharma on net sales up to $2 billion annually, after which threshold PureTech will receive 67 percent of the royalty payments and Royalty Pharma will receive 33 percent. Additionally, under its license agreement with Karuna, PureTech retains the right to also receive certain sublicense income. The acquisition of Karuna by Bristol Meyers Squibb (NYSE: BMY), had no impact on our rights or obligations under the Exclusive Patent License Agreement with Karuna, which remains in full force and effect. — In March 2024, Bristol Myers Squibb (NYSE: BMY) announced the completion of its acquisition of Karuna for $330.00 per share, for a total equity value of approximately $14 billion. With the acquisition’s completion, Karuna is now a wholly owned subsidiary of BMS. Through monetization of equity holdings in Karuna, including gross proceeds from the BMS acquisition and a strategic royalty agreement, PureTech has generated approximately $1.1 billion to date from an initial allocation of $18.5 million in Karuna’s founding. — In September 2024, BMS announced that Cobenfy (formerly known as KarXT) had received U.S. Food and Drug Administration approval for the treatment of schizophrenia in adults. The FDA approval triggered two separate milestone payments to PureTech totaling $29 million under agreements with Royalty Pharma and PureTech’s Founded Entity, Karuna Therapeutics (now BMS). Under these agreements, PureTech is also entitled to potential future payments related to additional milestones as well as approximately 2% royalties on net annual sales over $2 billion. Key milestones achieved and development status — We and our collaborators, including leading schizophrenia experts, were excited about efficacy data generated in schizophrenia and Alzheimer’s disease by Eli Lilly with xanomeline, which had notable efficacy stemming from its activation of muscarinic receptors (M1 and M4) but had been held back by gastrointestinal tolerability issues. To overcome this, we invented KarXT, an oral M1/ M4-preferring muscarinic agonist, by combining xanomeline (a muscarinic agonist) with trospium (a peripherally acting muscarinic antagonist that doesn’t cross the blood brain barrier). This enabled the beneficial effects of M1/M4 activation in the brain without the peripheral side effects. We conducted key human tolerability proof-of-concept studies with KarXT that allowed Karuna, and subsequently BMS to advance it further in schizophrenia patients. In September 2024, Cobenfy (formerly known as KarXT) received U.S. FDA approval for the treatment of schizophrenia in adults. Program discovery process by the PureTech team — Phase 3 trials, ADEPT-2 and ADEPT-3, are ongoing and continue to evaluate Cobenfy for the treatment of psychosis in Alzheimer’s disease. Programs continued Karuna Therapeutics A wholly owned subsidiary of Bristol Myers Squibb PureTech Ownership PureTech is entitled to milestone payments, royalties and up to $400 million in milestone payments under its agreement with Royalty Pharma. Karuna Therapeutics is a wholly owned subsidiary of Bristol Myers Squibb (BMS) driven to create and deliver transformative medicines for people living with psychiatric and neurological conditions. Cobenfy (formerly known as KarXT), is the first new drug with a novel mechanism to treat schizophrenia in more than 50 years. Cobenfy was invented and initially developed by PureTech. Consistent with its unique model of drug development, PureTech advanced Cobenfy by founding Karuna Therapeutics, which progressed Cobenfy through Phase 3 development before being acquired by BMS for $14 billion in March 2024. [Portions of this page have been intentionally omitted]

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 17 — In April 2024, we launched Seaport Therapeutics with a $100 million oversubscribed Series A financing round to advance novel neuropsychiatric medicines. Daphne Zohar was appointed as a Founder, Chief Executive Officer and a member of the Board, and Steven M. Paul, M.D., as a Founder and Chair of the Board of Directors. — In October 2024, Seaport raised a total of $226 million in its oversubscribed Series B financing round. This financing brought the total capital raised by Seaport to $326 million since the company’s launch in April 2024. — In May 2024, Seaport presented two posters detailing the results from multiple clinical trials of SPT-300 at the Society of Biological Psychiatry (SOBP) Annual Meeting in Austin, TX. Together, these data summarize some of the evidence supporting the core mechanisms of SPT-300 as Seaport advances to later-stage clinical studies. – The first poster provided data from the first-in-human, multi-part Phase 1 trial of SPT-300 from which topline results were first reported in December 2022. Overall, the Phase 1 trial was well tolerated and evaluated oral bioavailability, safety, tolerability, pharmacokinetics and GABAA target engagement. – The second poster provided details from the Phase 2a trial of SPT-300 in the Trier Social Stress Test (TSST), a validated clinical model of anxiety in healthy volunteers. Topline results from the trial, demonstrating SPT-300 substantially reduced salivary cortisol at all post-TSST timepoints compared to placebo, meeting the study’s primary endpoint and demonstrating regulation of the hypothalamic-pituitary-adrenal axis reactivity to acute stress, were first reported in November 2023. — In December 2024, Seaport presented additional data from its first-in-human, multi-part Phase 1 study of SPT-300 in healthy volunteers at the American College of Neuropsychopharmacology (ACNP) Annual Meeting, held in Phoenix, Arizona. New data presented at the conference include further safety analyses and pharmacokinetic and pharmacodynamic data. In the Phase 1 study, increases in EEG beta frequency power and reduction in saccadic eye velocity were observed at approximately 4 hours post-dose. Somnolence peaked in this same timeframe and diminished by 6 to 8 hours post-dose, consistent with both pharmacodynamic markers and blood levels of allopregnanolone. Based on these results, SPT-300 is suitable for chronic dosing and oral administration at night in a planned Phase 2b placebo-controlled study in major depressive disorder with or without anxious distress. Key milestones achieved and development status — With intersecting interests in enabling promising neuropsychiatric drugs to reach their full potential and the emerging science around the lymphatic system, we identified a breakthrough technology being developed at Monash University that had the potential to selectively transport therapeutic molecules through the lymphatic system. — Through the Glyph platform, drugs are absorbed like dietary fats through the intestinal lymphatic system and transported into circulation. The Glyph technology has the potential to be widely applied to many therapeutic molecules that have high first-pass metabolism leading to low bioavailability and/or side effects, including hepatotoxicity. We prioritized areas of high unmet patient need where the broad application of treatment options with validated efficacy was untapped due to these issues. The Glyph platform was advanced initially at PureTech and now exclusively licensed and assigned to Seaport and has been applied to efficiently generate multiple therapeutic candidates within Seaport’s pipeline. Program discovery process by the PureTech team Programs continued Seaport Therapeutics PureTech Ownership 35.6% equity, milestone and sublicense payments, and 3-5% royalties Seaport Therapeutics is a clinical-stage biopharmaceutical company advancing the development of novel neuropsychiatric medicines in areas of high unmet patient needs. The company has a proven strategy of advancing clinically validated mechanisms previously held back by limitations that are overcome with its proprietary Glyph™ technology platform. All the therapeutic candidates in its pipeline of first and best-in-class medicines are based on the Glyph platform. Seaport is led by an experienced team that invented and advanced important neuropsychiatric medicines and are guided by an extensive network of renowned scientists, clinicians and key opinion leaders. Seaport’s clinical-stage pipeline includes its most advanced therapeutic candidate, SPT- 300, an oral prodrug of allopregnanolone, which is being advanced for the treatment of major depressive disorder (MDD) with or without anxious distress; SPT-320, a novel oral prodrug of agomelatine, which is being advanced for the treatment of generalized anxiety disorder (GAD); and SPT-348, a prodrug of a non-hallucinogenic neuroplastogen, which is in development for the treatment of mood and other neuropsychiatric disorders. [Portions of this page have been intentionally omitted]

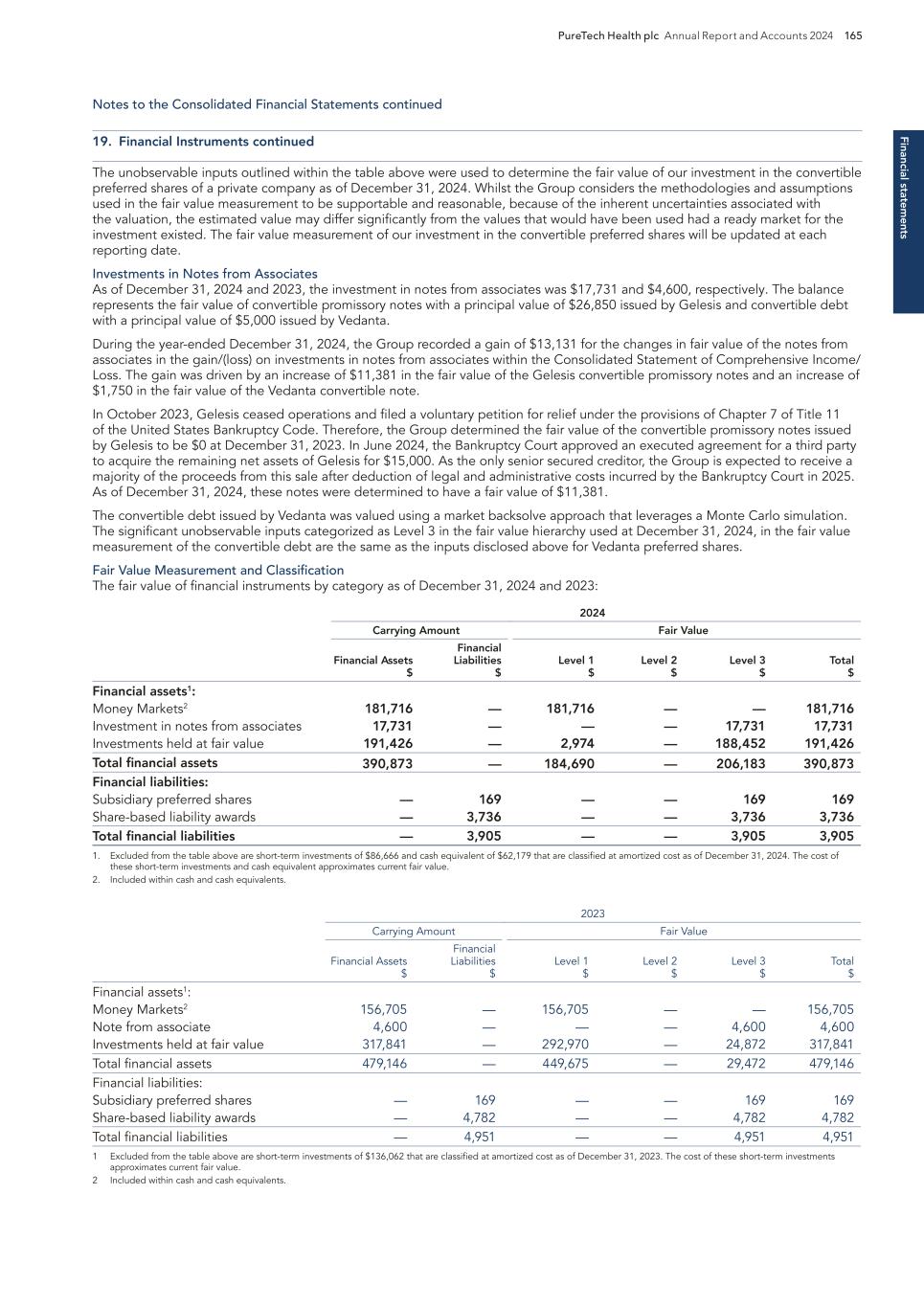

Pr o g ra m s 18 PureTech Health plc Annual Report and Accounts 2024 — In April 2024, Vedanta was awarded $3.9 million from the global nonprofit CARB-X to ready its preclinical candidate VE707 for a first-in-human clinical study to examine its ability to reduce colonization and prevent subsequent infections caused by multi-drug-resistant organisms. The funding was triggered by Vedanta’s completion of certain milestones for VE707, which were supported by previous CARB-X awards totaling $5.7 million. — In May 2024, Vedanta enrolled the first patient in the pivotal Phase 3 RESTORATiVE303 study of VE303 for the prevention of recurrent C. difficile infection. This study is intended to form the basis for a Biologics License Application to be filed with the U.S. Food and Drug Administration. — In July 2024, Vedanta announced it had expanded its leadership team, including appointing a Head of Commercial in alignment with having initiated the pivotal clinical phase. — In October 2024, Vedanta shared additional analyses from the CONSORTIUM trial at Infectious Diseases Week (IDWeek) 2024. The analyses characterized the benefit of VE303 on antibiotic resistant gene levels in patient microbiomes. Antibiotic resistance can lead to the development of hard-to-treat infections throughout the body, and as VE303 administration appears to correlate with reduced prevalence of organisms carrying these resistance genes, the result describes an additional dimension of VE303’s therapeutic profile. — In the January 2025 post-period, Vedanta published additional results from the VE303 Phase 2 CONSORTIUM clinical trial in Nature Medicine, providing a new level of profiling of the multiple mechanisms by which VE303 may decrease the odds of rCDI. The CONSORTIUM trial showed that the higher dose of VE303 studied was well tolerated and reduced the odds of CDI recurrence by more than 80% compared with placebo. Clinical results from the trial were previously published in the Journal of the American Medical Association (JAMA). Key milestones achieved and development status — We engaged with leading world-renowned experts in immunology and identified and in- licensed intellectual property to pioneer the concept of therapeutically defined consortia of microbes that could modulate the immune system or treat bacterial infections. Program discovery process by the PureTech team Programs continued Vedanta Biosciences PureTech Ownership 35.8% equity Vedanta Biosciences is a clinical-stage biopharmaceutical company developing medicines for the treatment of gastrointestinal diseases. The company’s lead assets are potential first- in-class oral therapies – VE303, in a Phase 3 registrational trial for prevention of recurrent C. difficile infection (rCDI), and VE202, in a Phase 2 trial for treatment of ulcerative colitis. Vedanta’s pipeline has been built using the company’s industry-leading product engine for the development of therapies based on defined consortia of bacteria grown from pure clonal cell banks. The product engine, supported by broad foundational intellectual property, includes one of the largest libraries of bacteria isolated from the human microbiome, vast clinical datasets, proprietary capabilities in consortium design, and end-to-end CGMP manufacturing capabilities at commercial launch scale. [Portions of this page have been intentionally omitted]

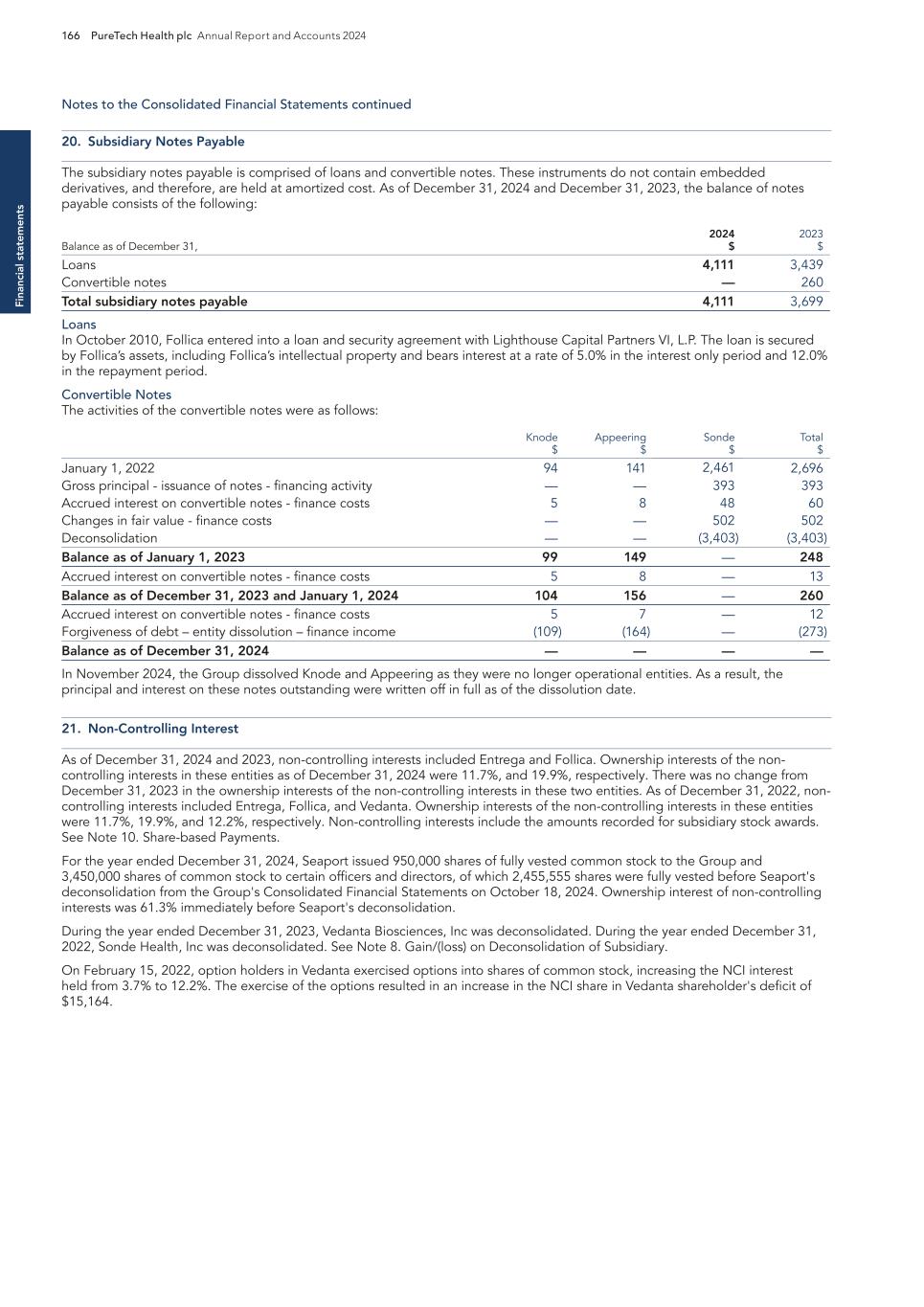

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 19 — In 2024, Vor expanded its ongoing Phase 1/2 VBP101 study to include patients diagnosed with myelodysplastic syndrome (MDS) in addition to its original trial population of patients with AML. During the trial, patients received trem-cel, a shielded stem cell transplant lacking CD33 manufactured by Vor, followed by Mylotarg™, a CD33-directed Antibody Drug Conjugate (ADC) therapy. Preliminary data suggest improved relapse-free survival compared to published groups of AML patients at high risk of relapse post-transplant. Trem-cel + MylotargTM also continued to show engraftment, shielding, and a broadened therapeutic window. Vor received supportive feedback from the FDA regarding a registrational clinical trial design. — In 2024, Vor dosed the first patient in VBP301, its Phase 1/2, multicenter, open-label, first-in- human study of VCAR33ALLO in patients with relapsed or refractory AML after standard-of-care transplant or a trem-cel transplant and received both Fast Track designation and Orphan Drug designation from the FDA. Patients treated with the lowest dose of VCAR33ALLO , a CAR-T cell therapy manufactured by Vor from lymphocytes collected from the patient’s original transplant donor, demonstrated promising biomarker data. — In September 2024, Vor disclosed a new preclinical asset, VADC45, an ADC that targets the CD45 protein. CD45 is a well-validated target for a wide variety of blood cancers with clinical proof of concept. Initial data suggest VADC45 has large potential opportunities across oncology, gene therapy, and autoimmune disorders. Key milestones achieved and development status — We were interested in approaches to treat hematological malignancies that currently have poor response rates or poor adverse event profiles despite recent advances in cell therapies and targeted therapies. We worked with Vor Bio Scientific Advisory Board Chair, Siddhartha Mukherjee, M.D., Ph.D., on key intellectual property, which Vor Bio exclusively in-licensed from Columbia University, and on advancing this concept through critical proof-of- concept experiments Program discovery process by the PureTech team Programs continued Vor PureTech Ownership 2.1% equity Vor Bio is a clinical-stage cell and genome engineering company that aims to change the standard of care for patients with blood cancers by engineering hematopoietic stem cells to enable targeted therapies post-transplant. [Portions of this page have been intentionally omitted]

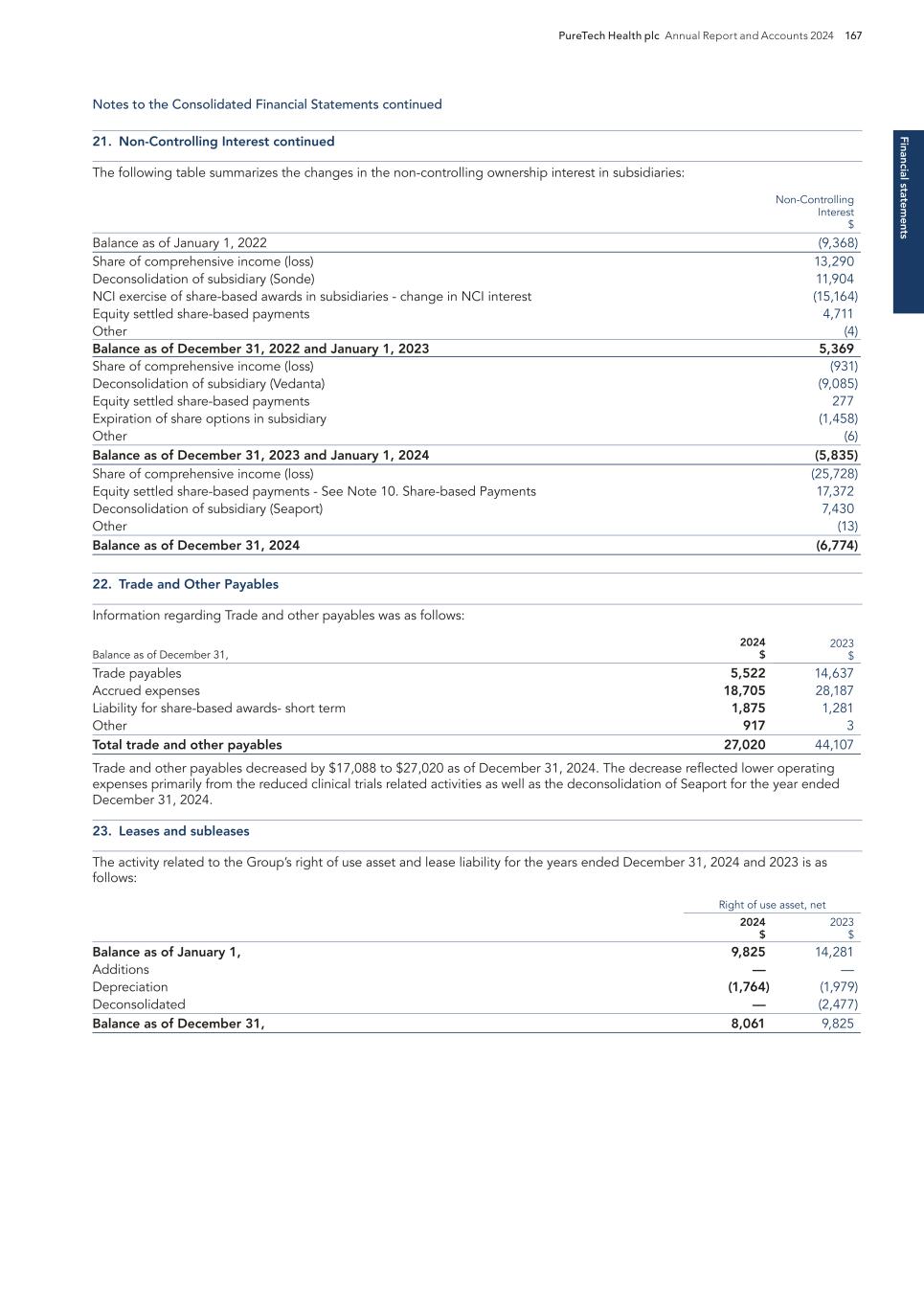

Pr o g ra m s 20 PureTech Health plc Annual Report and Accounts 2024 Programs continued — We were interested in enabling the oral administration of biologics, which has been a long- standing problem in drug development. We engaged with leading experts in drug administration, including Robert Langer, Sc.D., screened over 100 technologies, and the initial platform was licensed from Samir Mitragotri, Ph.D., when he was Professor of Chemical Engineering at UC Santa Barbara (currently Hiller Professor of Bioengineering and Hansjorg Wyss Professor of Biologically Inspired Engineering at Harvard University). We later enhanced this platform with intellectual property developed by our team. Program discovery by the PureTech team Entrega PureTech Ownership 73.8% equity Entrega is unlocking key areas of medicine by enabling oral administration of biologics, vaccines and other drugs that are otherwise not efficiently absorbed when taken orally. The vast majority of biologic drugs, including peptides, proteins and other macromolecules, are currently administered by injection, which can present challenges for healthcare administration and compliance with treatment regimes. For this growing class of therapies, including newly developed treatments for diabetes and weight loss, oral administration may be the ideal route of administration. Entrega’s technology platform is an innovative approach to oral administration, which uses a proprietary, customizable hydrogel dosage form to control local fluid microenvironments in the GI tract to both enhance absorption and reduce the variability of drug exposure. Peptide therapeutics (e.g., the emerging GLP-1 agonist class) are ideally suited to benefit from Entrega’s approach and our platform has demonstrated increased oral peptide availability of two- to three-fold over standard permeation enhancer formulations. [Portions of this page have been intentionally omitted]

Pro g ram s PureTech Health plc Annual Report and Accounts 2024 21 Programs continued — In the February 2025 post-period, Sonde began design and implementation of validation studies with three organizations within the Department of the Air Force (DAF). Two organizations will be studying the impact of shift work on soldiers’ performance beginning in March and the third organization will study the impact of fatigue on soldiers operating in the field beginning in June. — In the February 2025 post-period, Sonde successfully completed a large-scale trial with one of the top oil and gas conglomerates in the world. Over 4,000 workers used Sonde’s Mental Fitness tracking app and insight dashboard over 5 weeks at 60 different sites. Sonde was able to effectively identify at-risk workers, enabling proactive intervention by flagging individuals with high sensitivity and deliver significant positive predictive value for a healthy population, ensuring most workers who needed support were identified. — In the January 2025 post-period, Sonde successfully integrated its voice-based health monitoring technology into Qualcomm’s Snapdragon® S7+ Gen 1 Sound Platform. Building on its longtime partnership with Qualcomm, Sonde optimized its technology to operate within the strict power and processing constraints of audio earbud and headset devices while maintaining its industry- leading accuracy. — In August 2024, Sonde announced that it has been selected by AFWERX, the innovation arm of the Department of the Air Force (DAF), for a Small Business Innovation Research (SBIR) Phase II contract in the amount of $1,215,606 focused on Sonde Mental Fitness. This contract builds on work completed through a Phase 1 contract awarded in January 2024 that identified multiple use cases for employing Sonde Mental Fitness vocal biomarker tracking to promote mental health engagement and resource utilization and to enhance operational decision-making. The customization and integration work planned for this SBIR Phase II effort will enable use and validation of Sonde’s mental fitness tracking technology in DAF settings. — In July 2024, Sonde launched Sonde Cognitive Fitness, which analyses eight vocal characteristics from 30-second voice interactions to provide cognitive effort tracking and insight, helping people manage their mental well-being and productivity effectively. Key milestones achieved and development status — We identified vocal features as a leading non-invasive source of health data, particularly given the evolving technology landscape where voice interactions with devices are rapidly increasing. We developed novel intellectual property around this concept and helped advance the technology from an academic concept to a commercially focused technology. Program discovery by the PureTech team Sonde PureTech Ownership 34.8% equity Sonde Health is the global leader in voice AI health tracking and data insights. Sonde’s vocal biomarker platform serves apps and devices spanning consumer wellness to population health. Leveraging a best-in-class voice data set and clinical research with over 1.2 million samples from 85,000+ individuals on four continents, Sonde uses advanced audio signal processing, speech science, and machine learning to sense and analyze subtle vocal changes due to changes in a person’s physiology to provide key insights into health and well-being. [Portions of this page have been intentionally omitted]

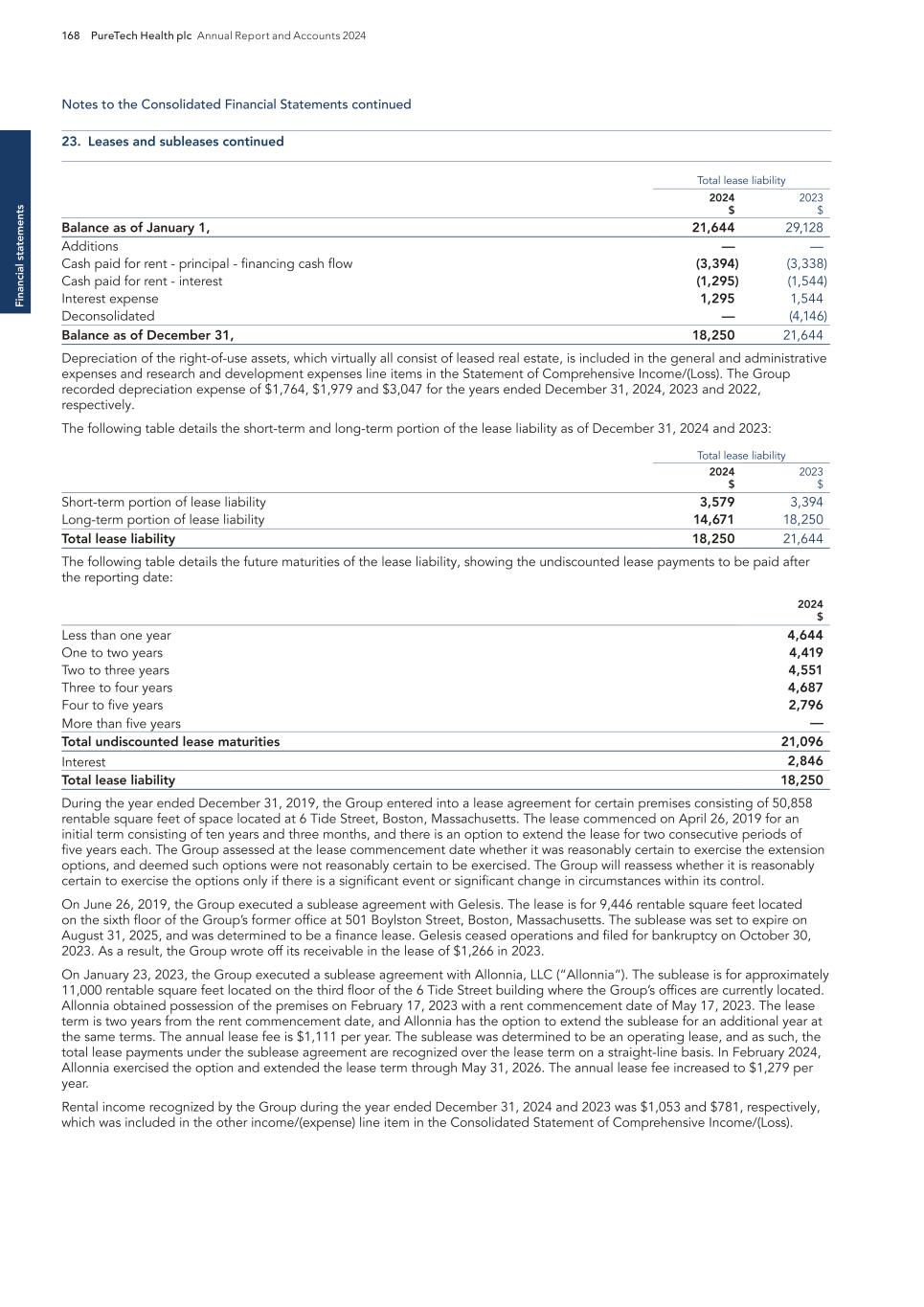

E SG re p o rt 22 PureTech Health plc Annual Report and Accounts 2024 [Pages 22 to 29 have been intentionally omitted]

E SG rep o rt E SG rep o rt PureTech Health plc Annual Report and Accounts 2024 23

24 PureTech Health plc Annual Report and Accounts 2024 E SG re p o rt

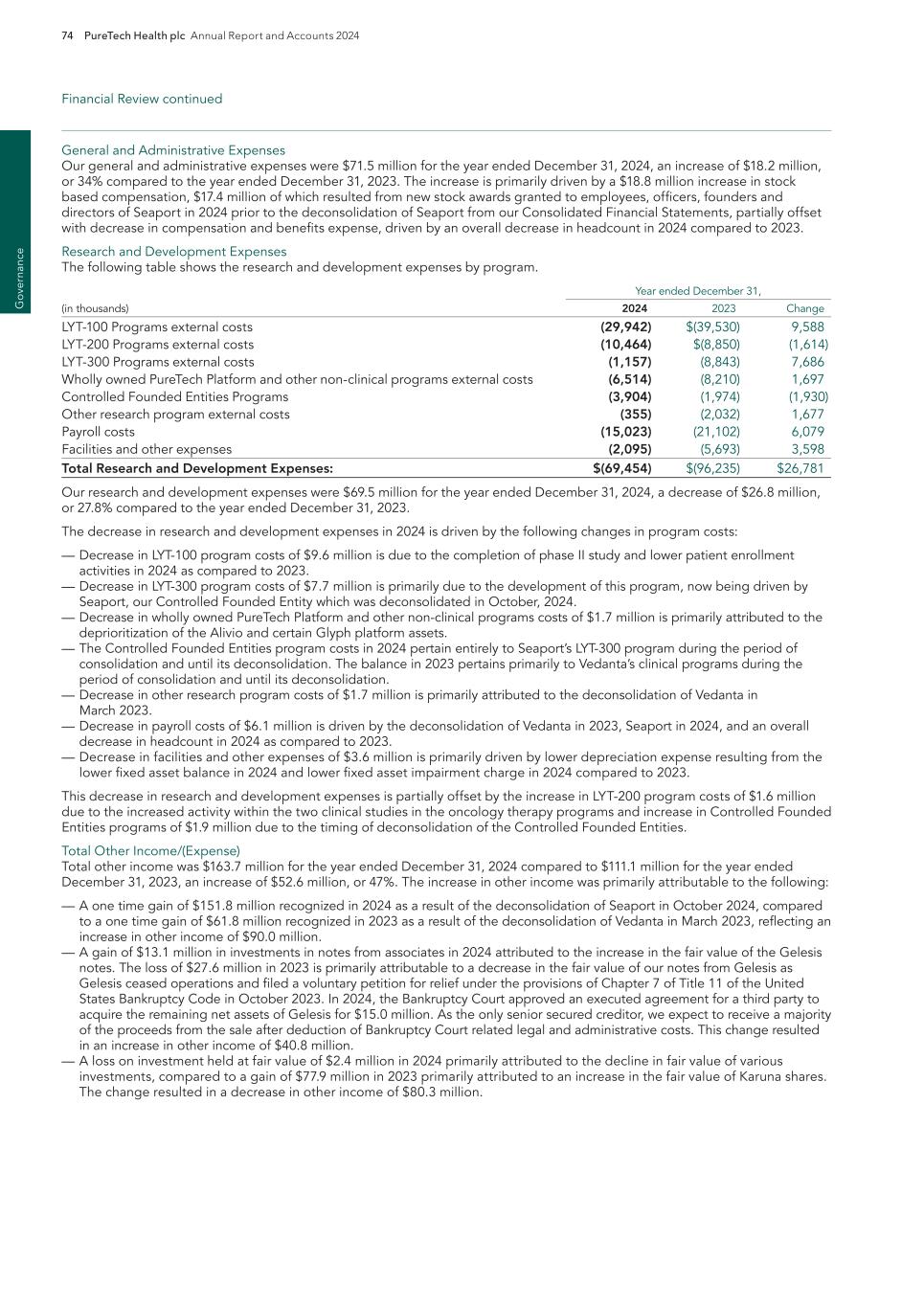

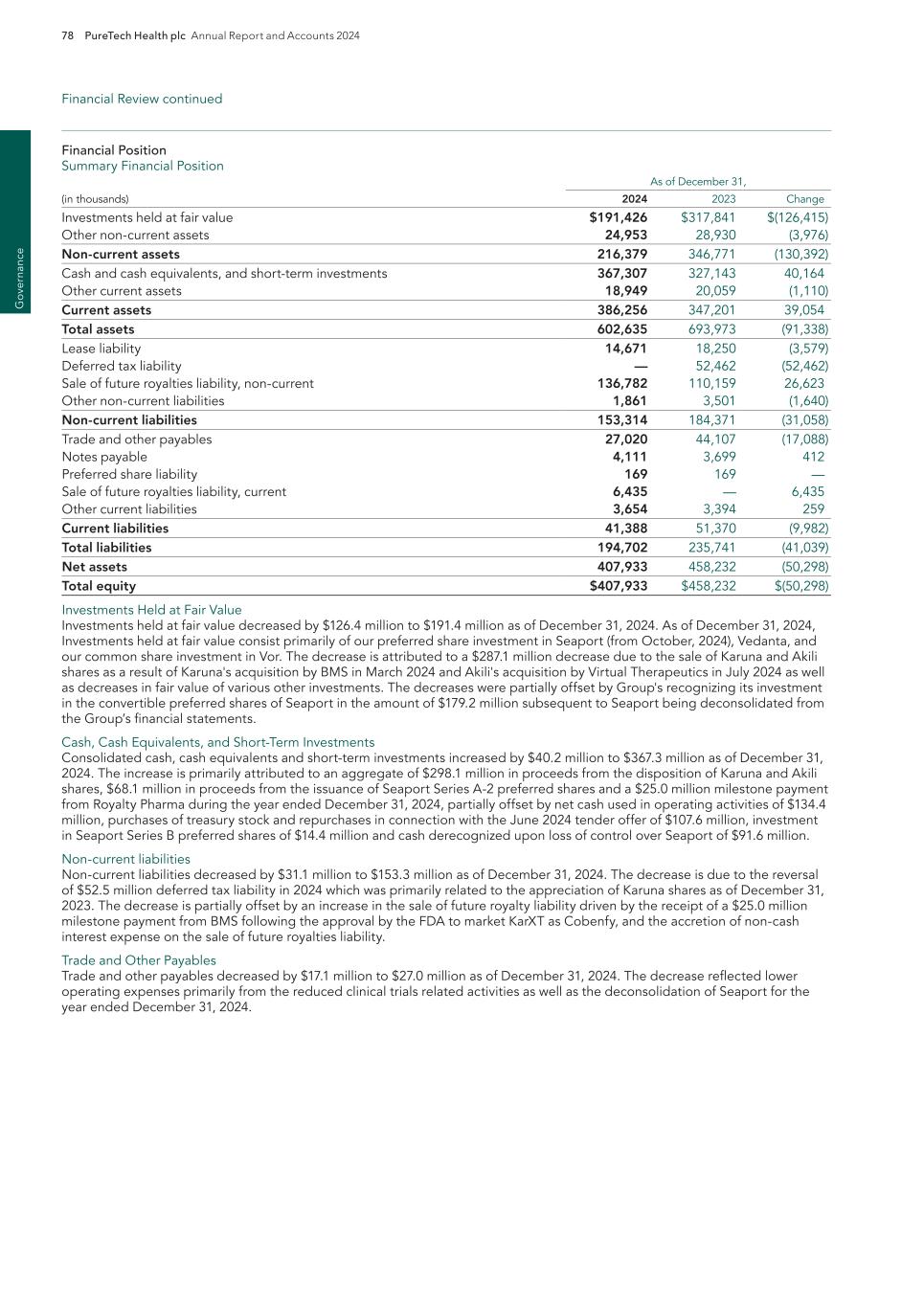

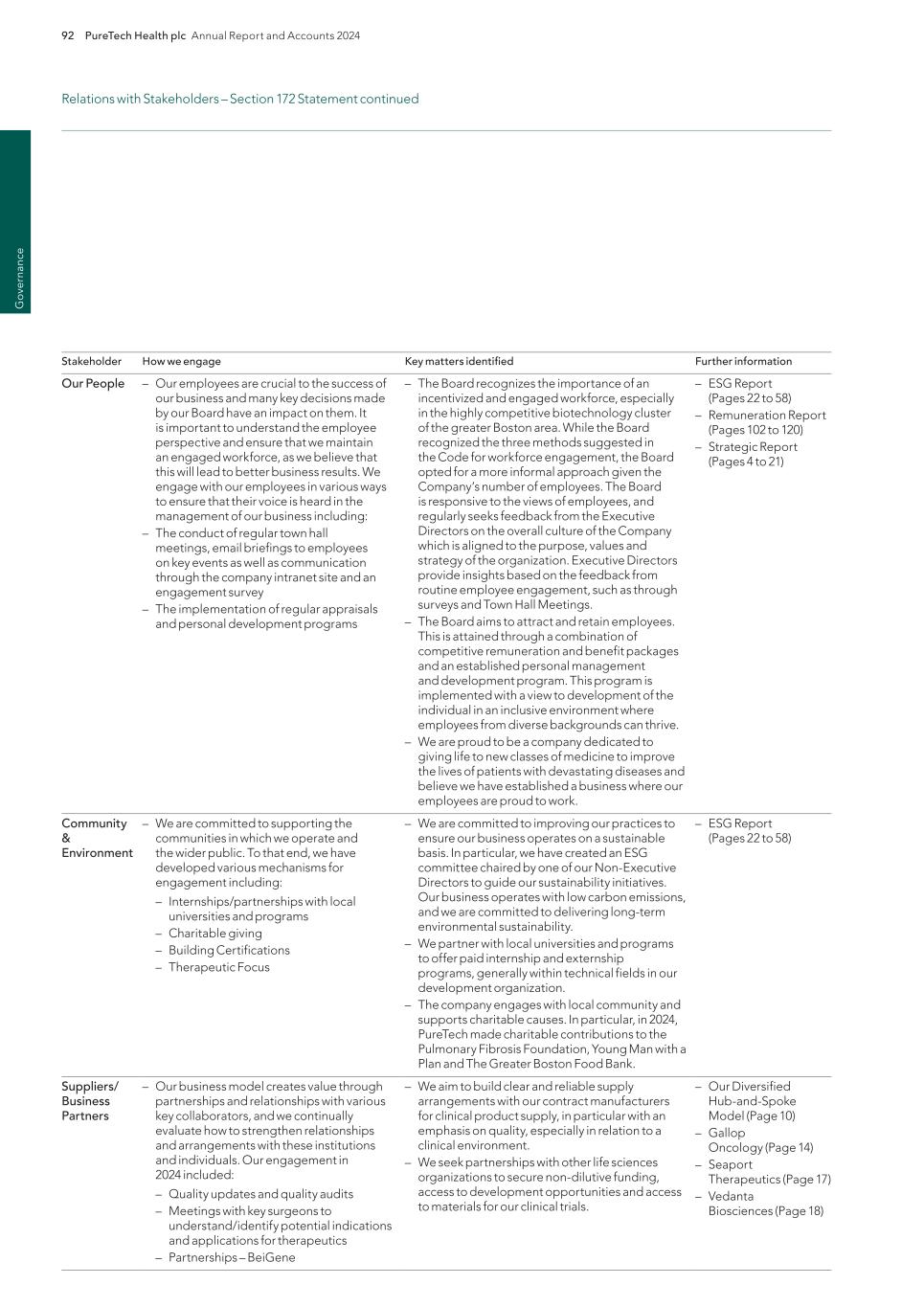

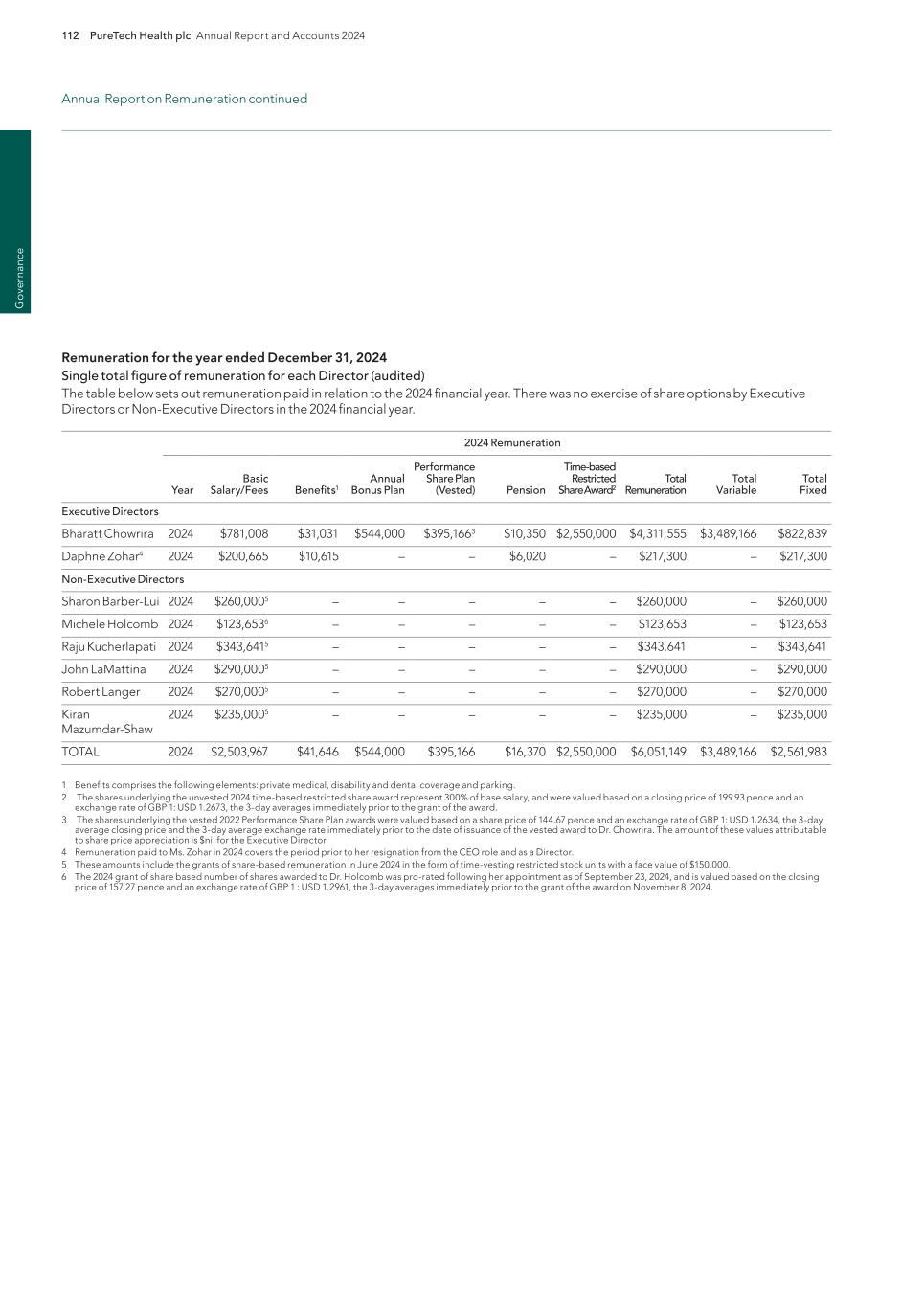

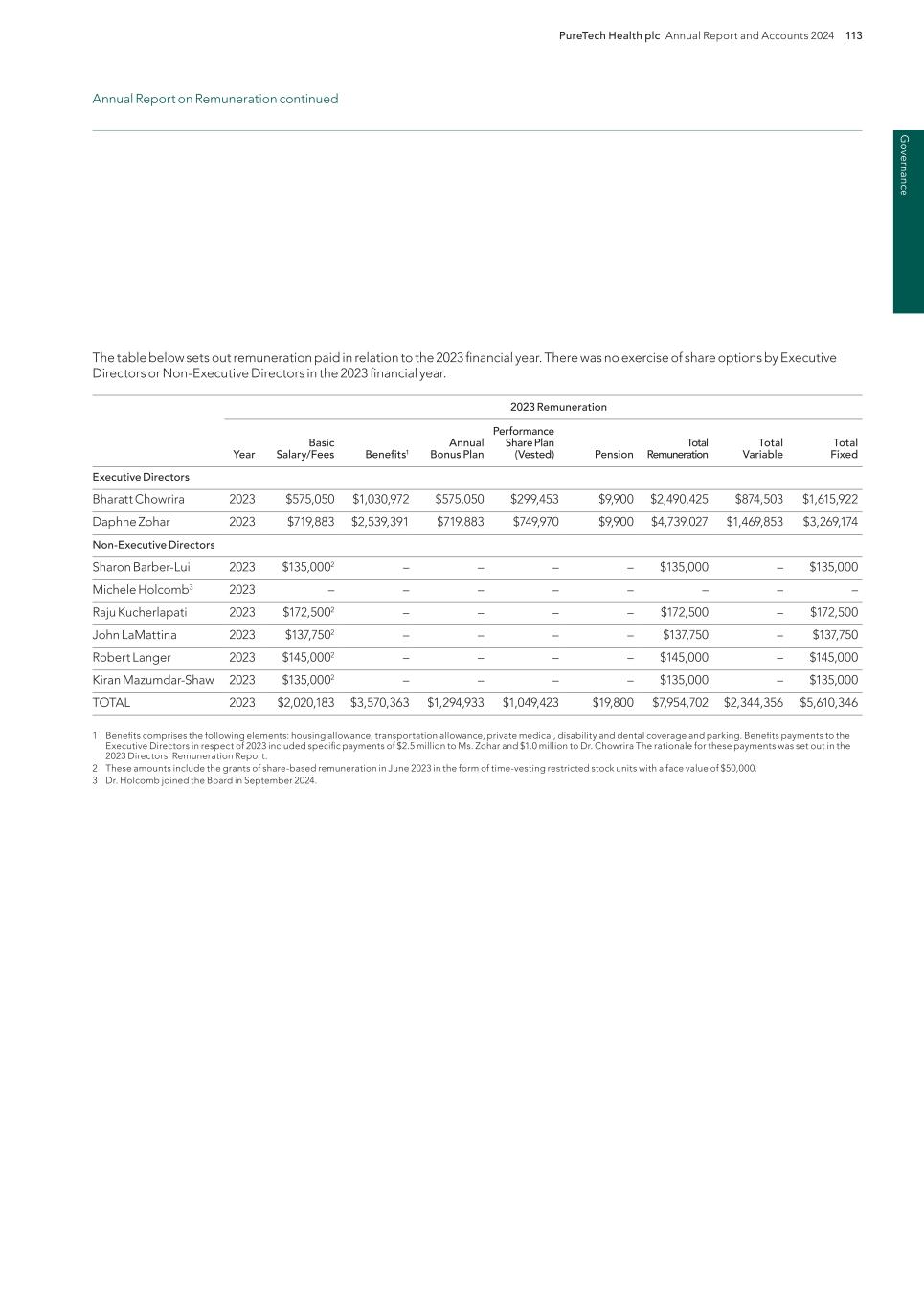

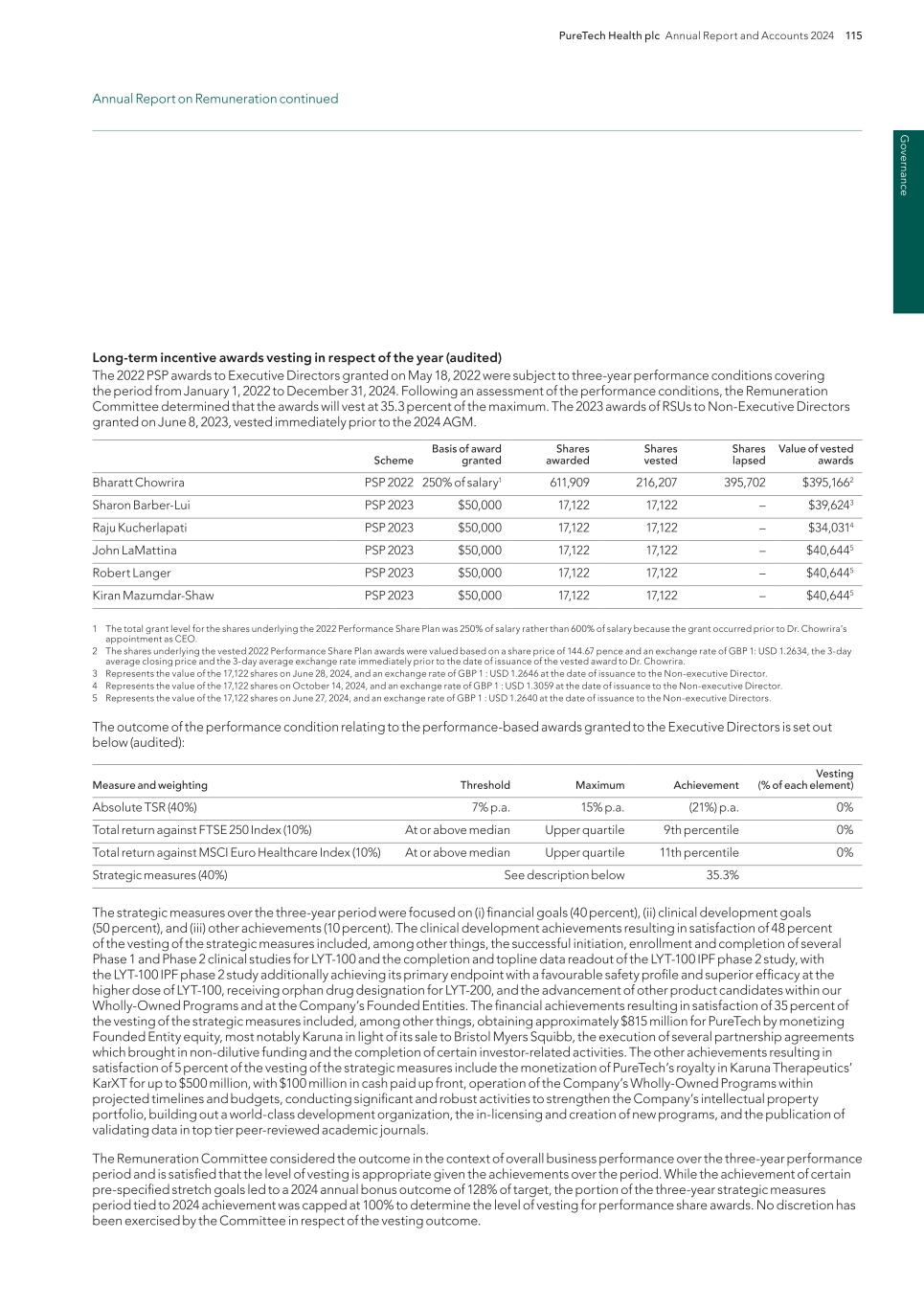

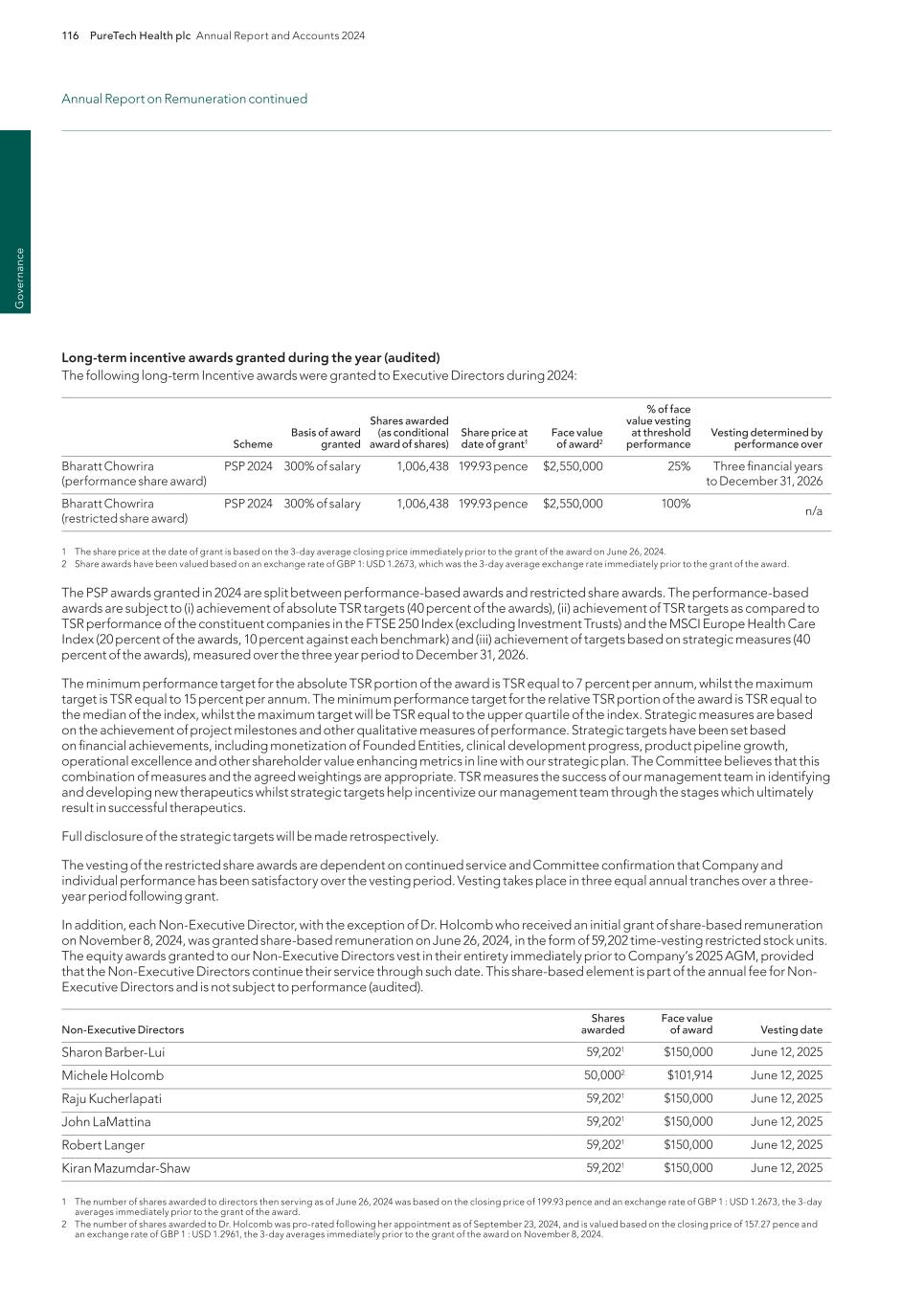

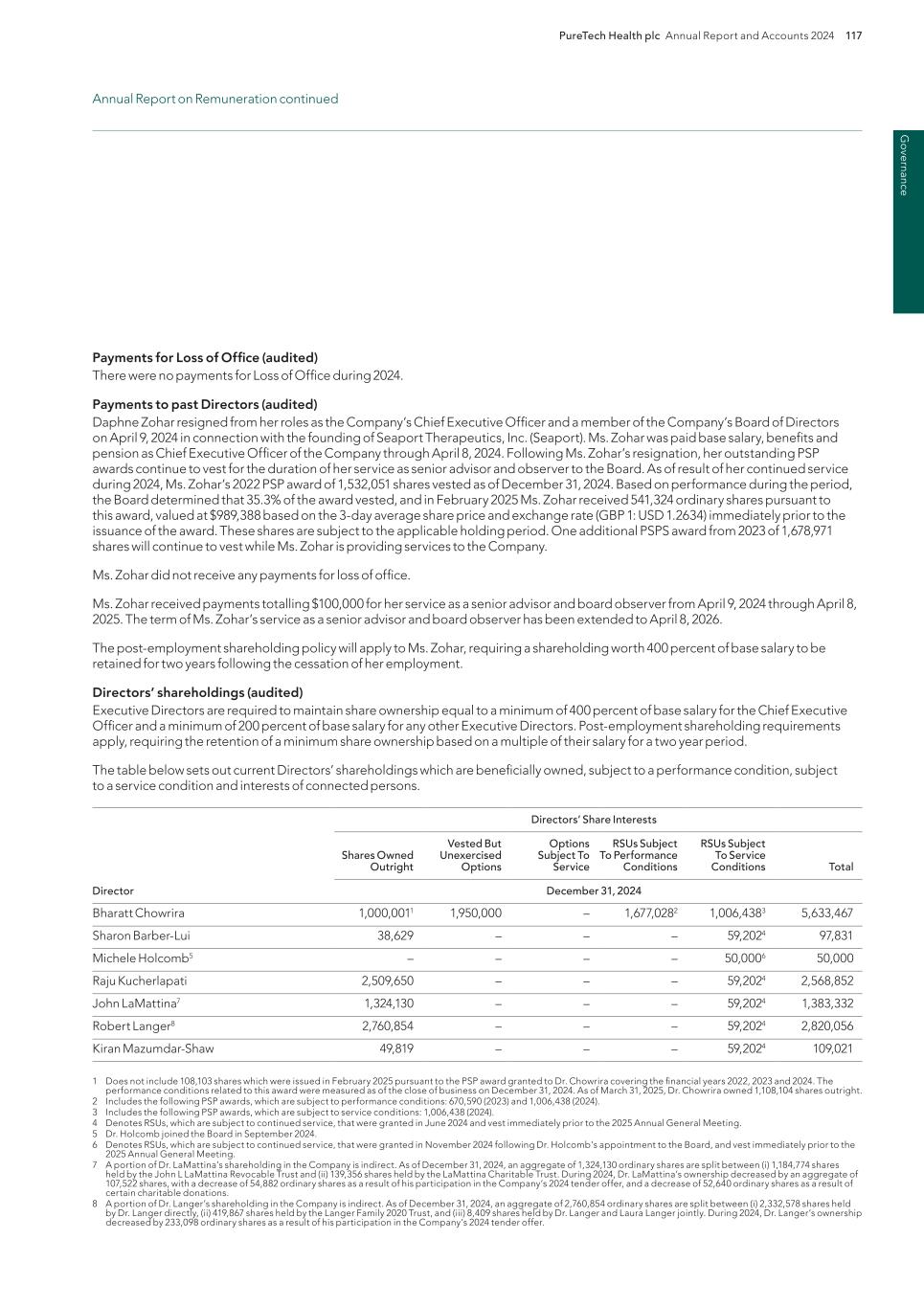

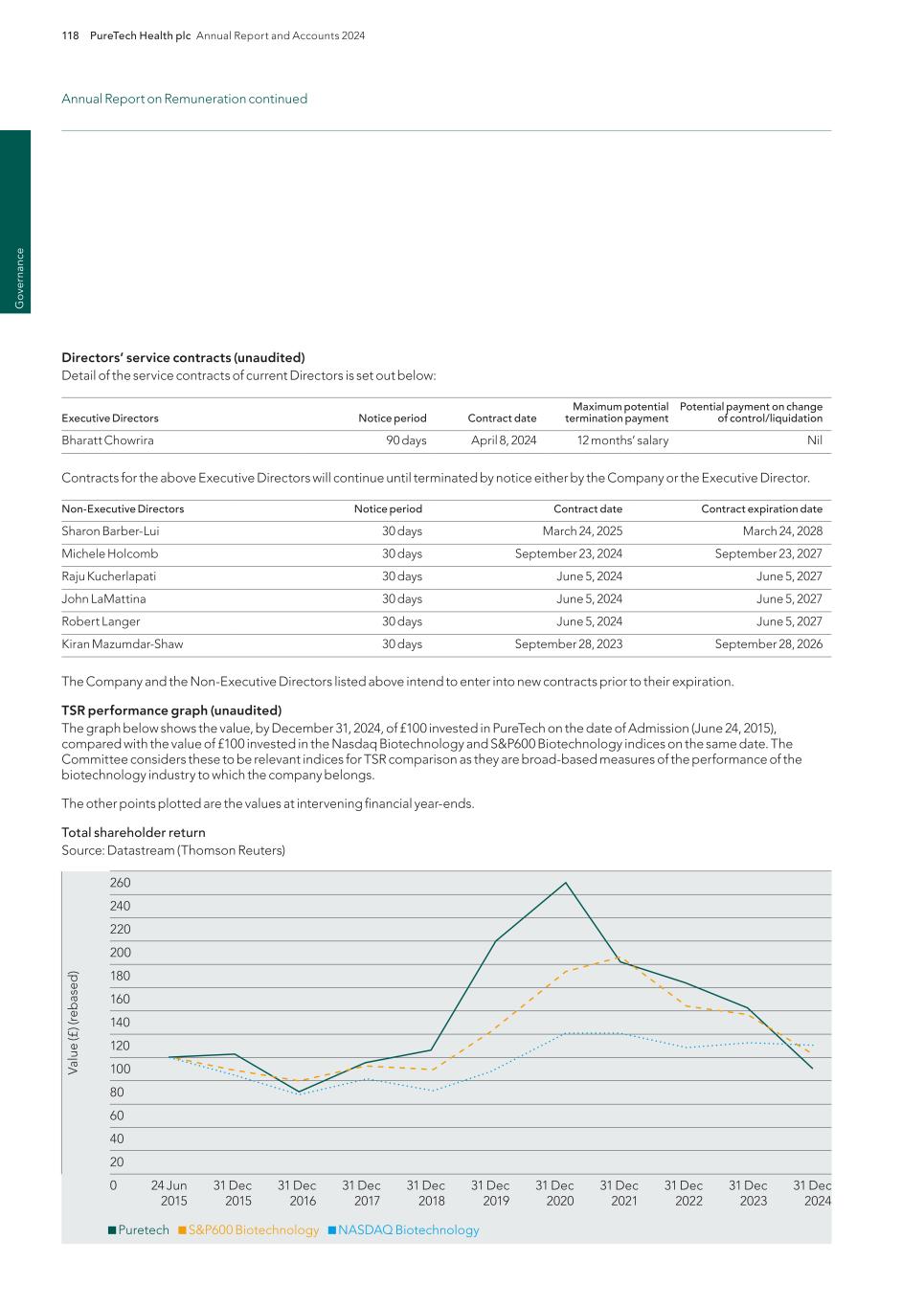

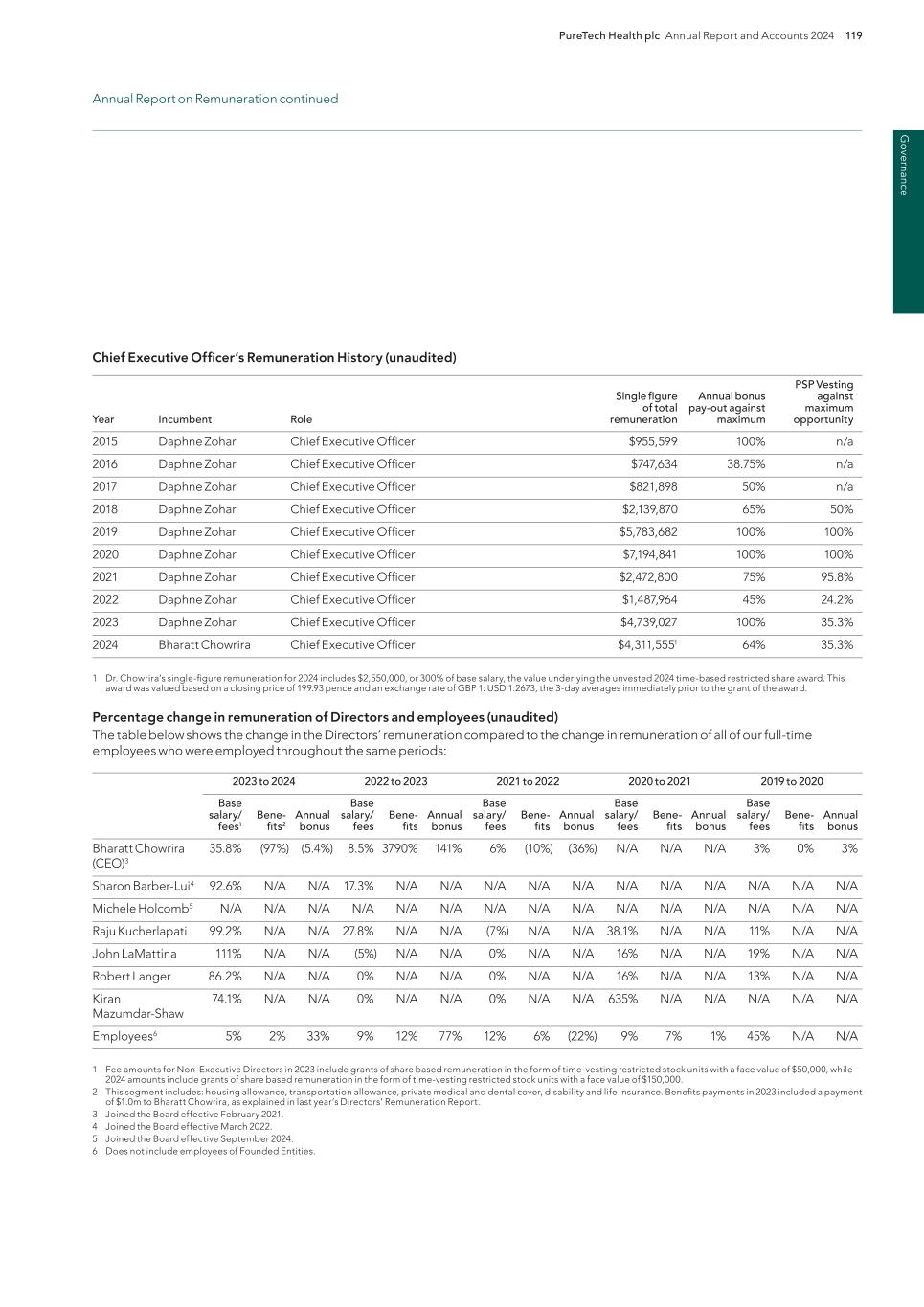

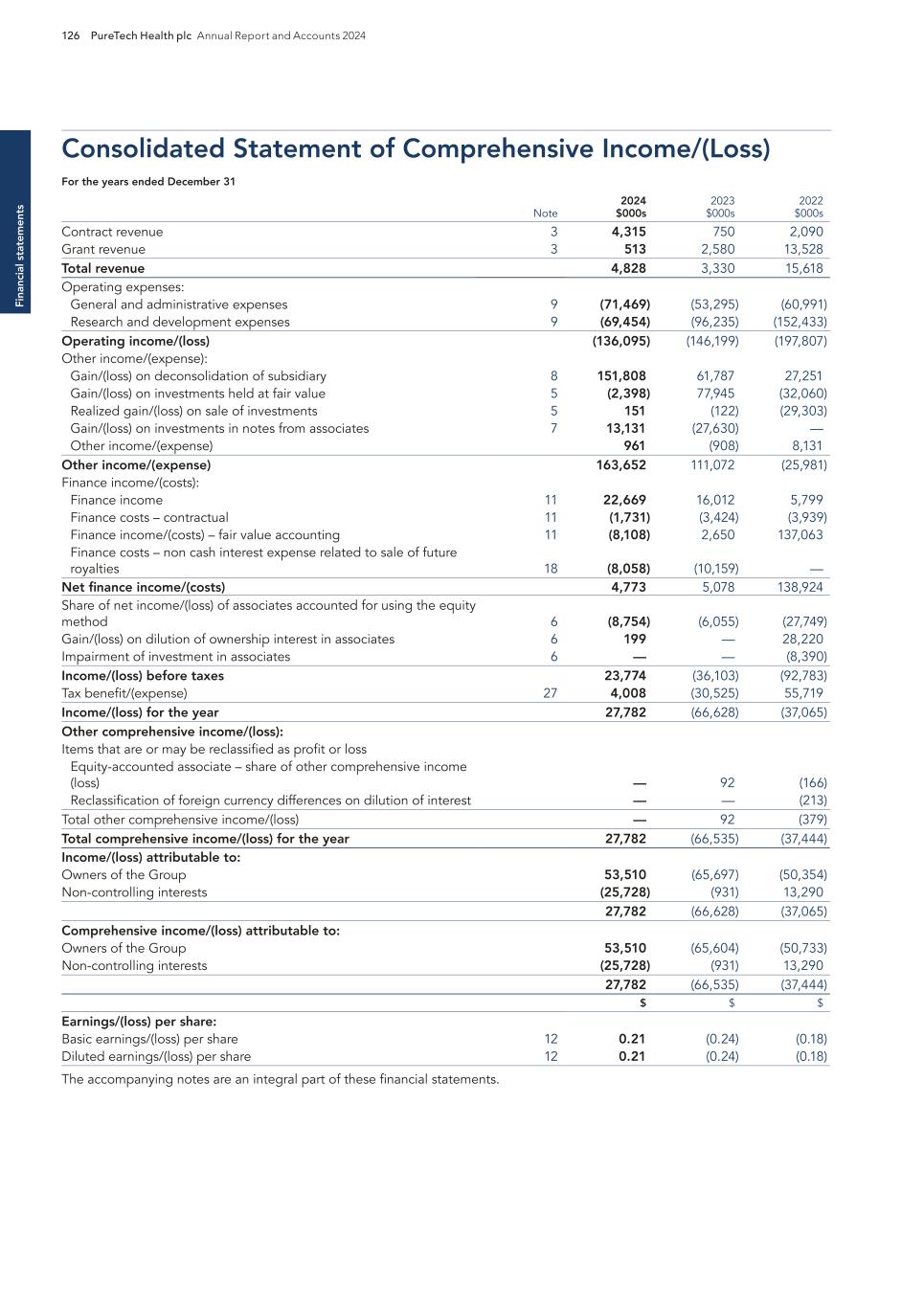

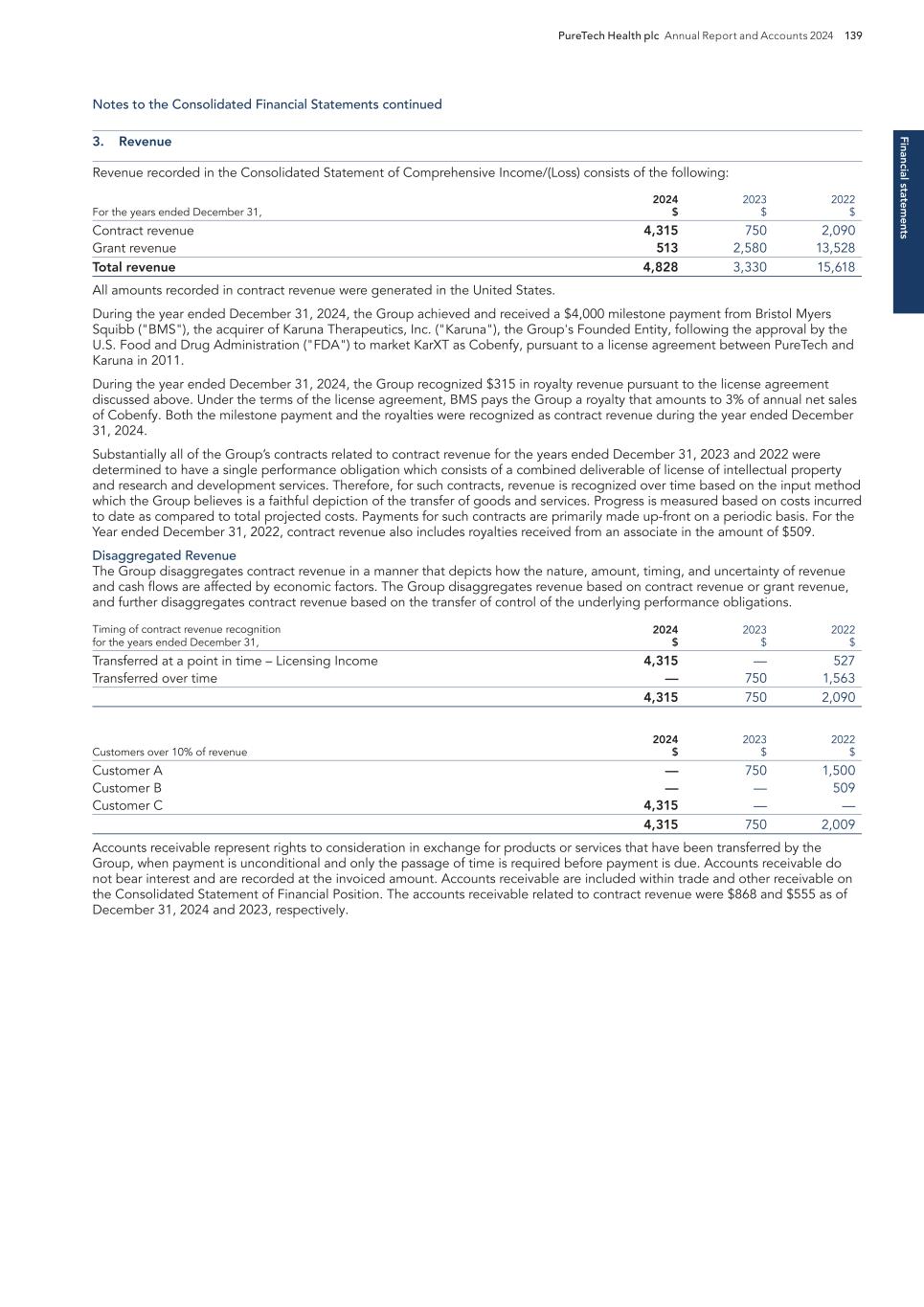

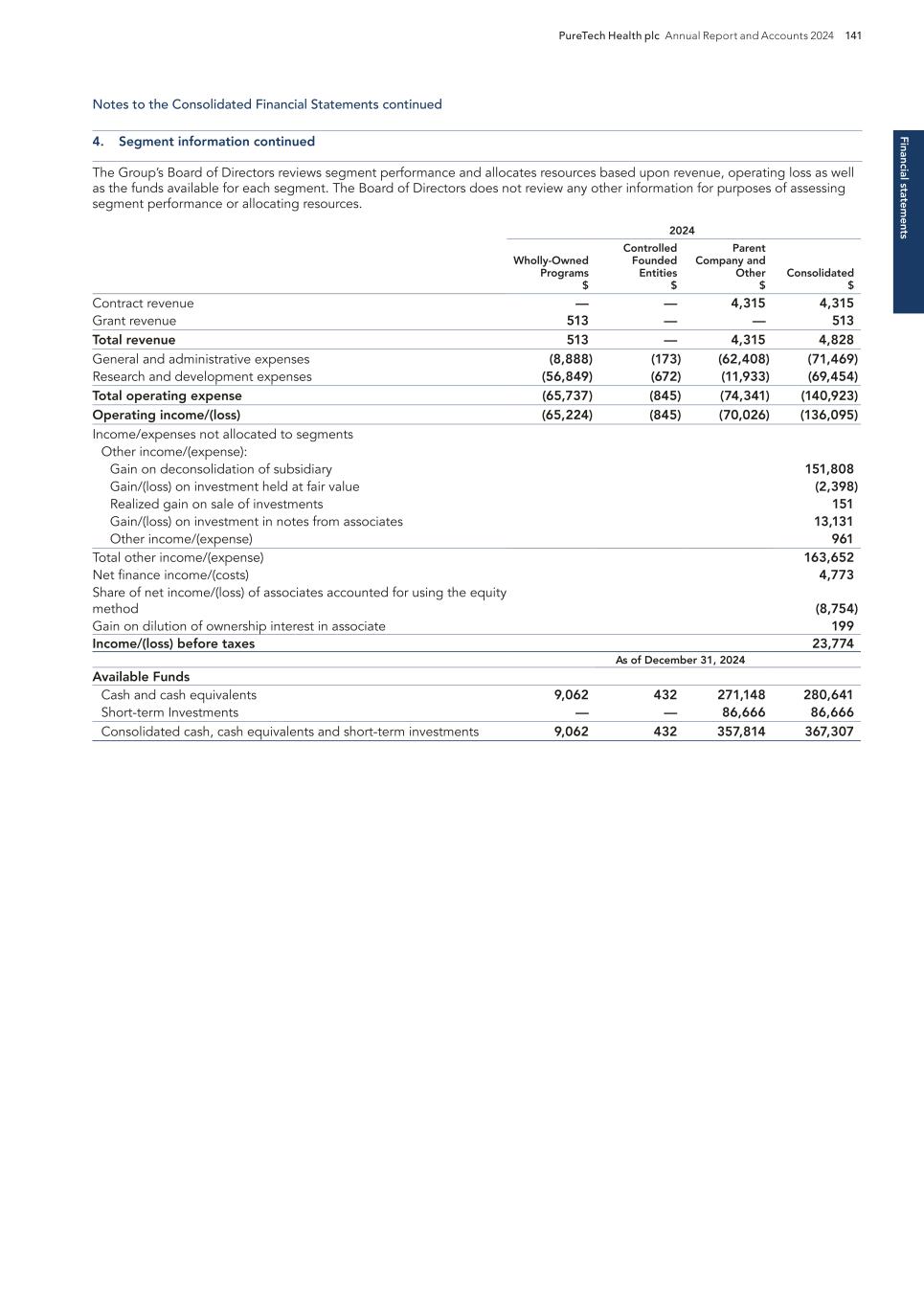

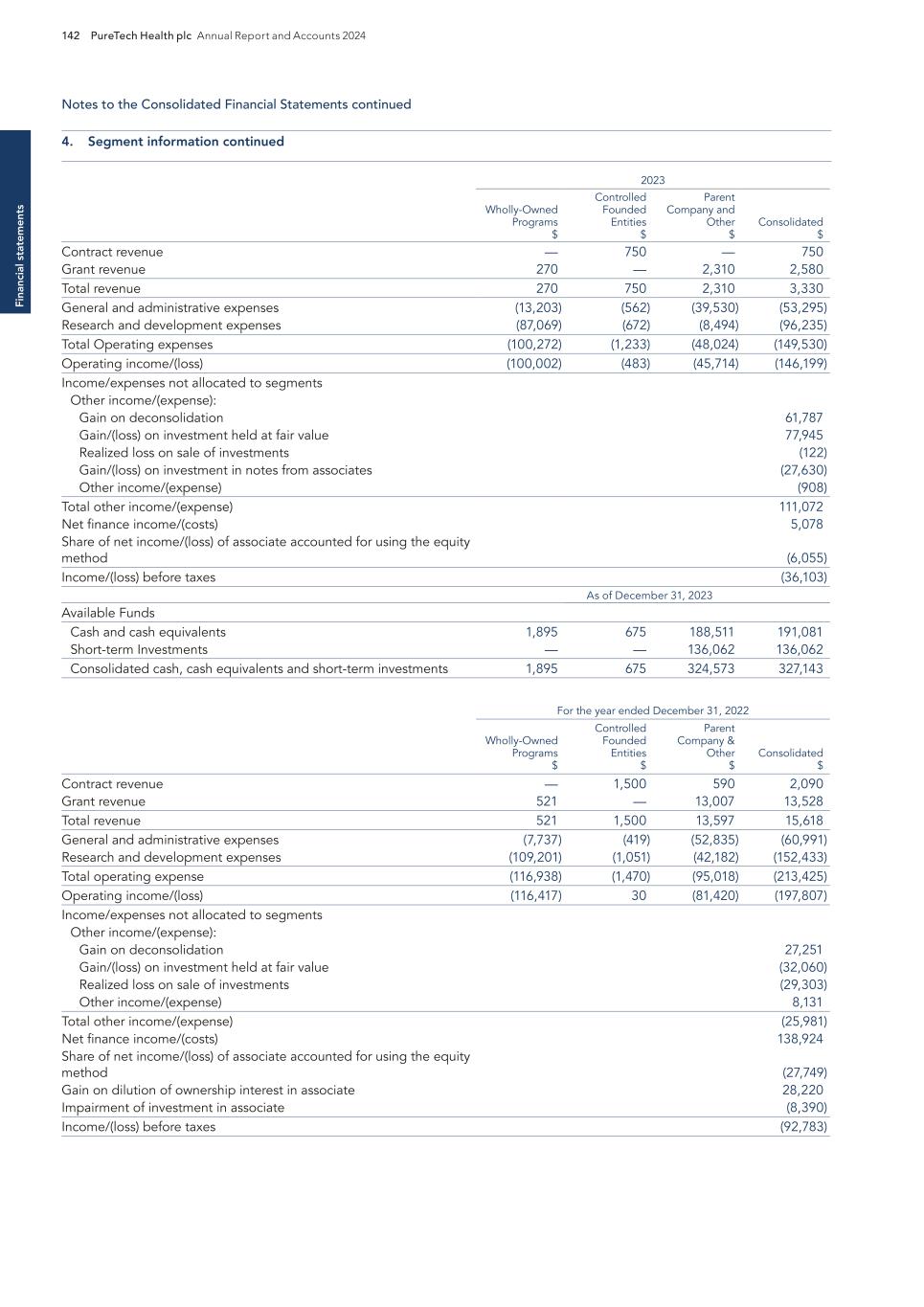

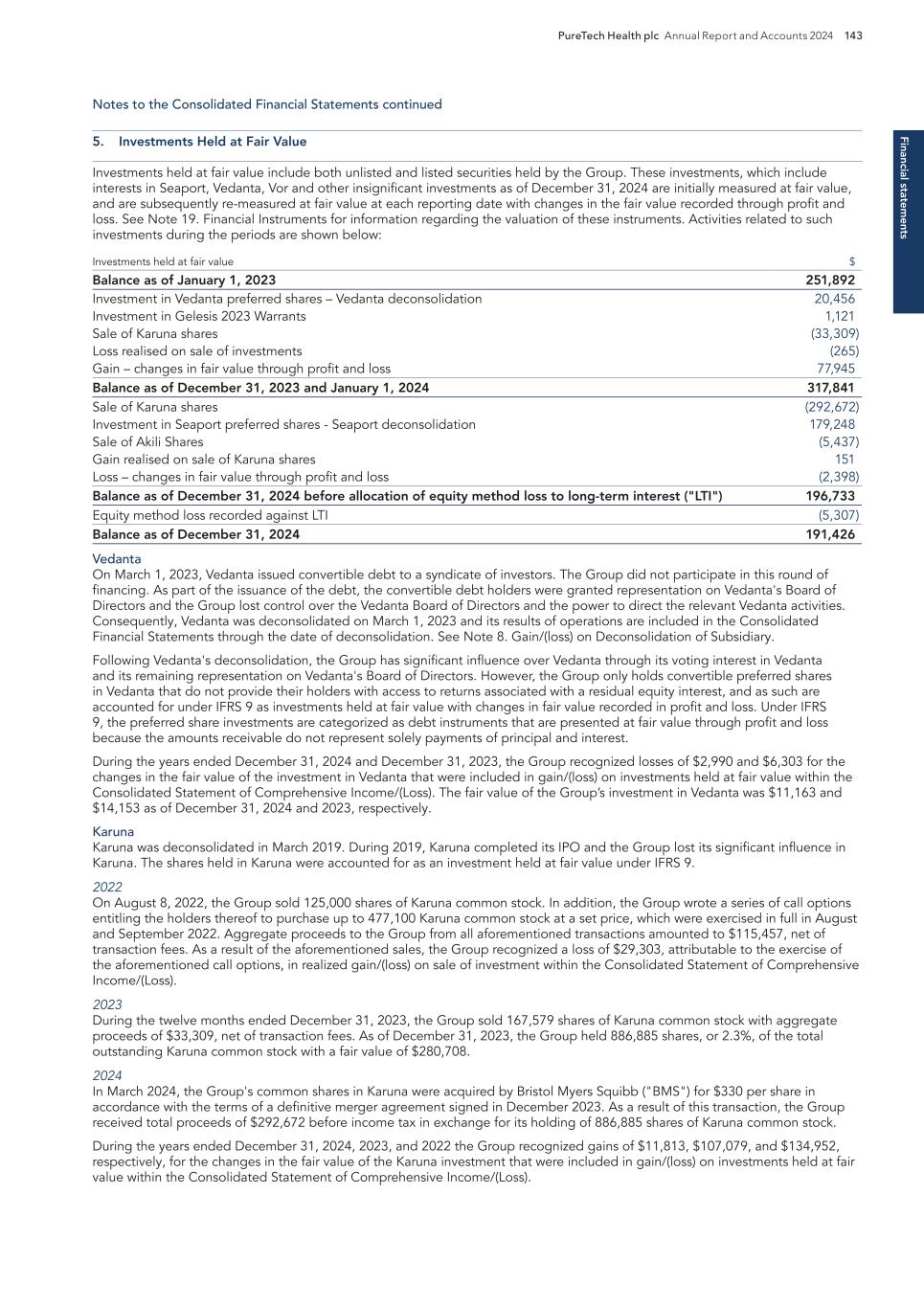

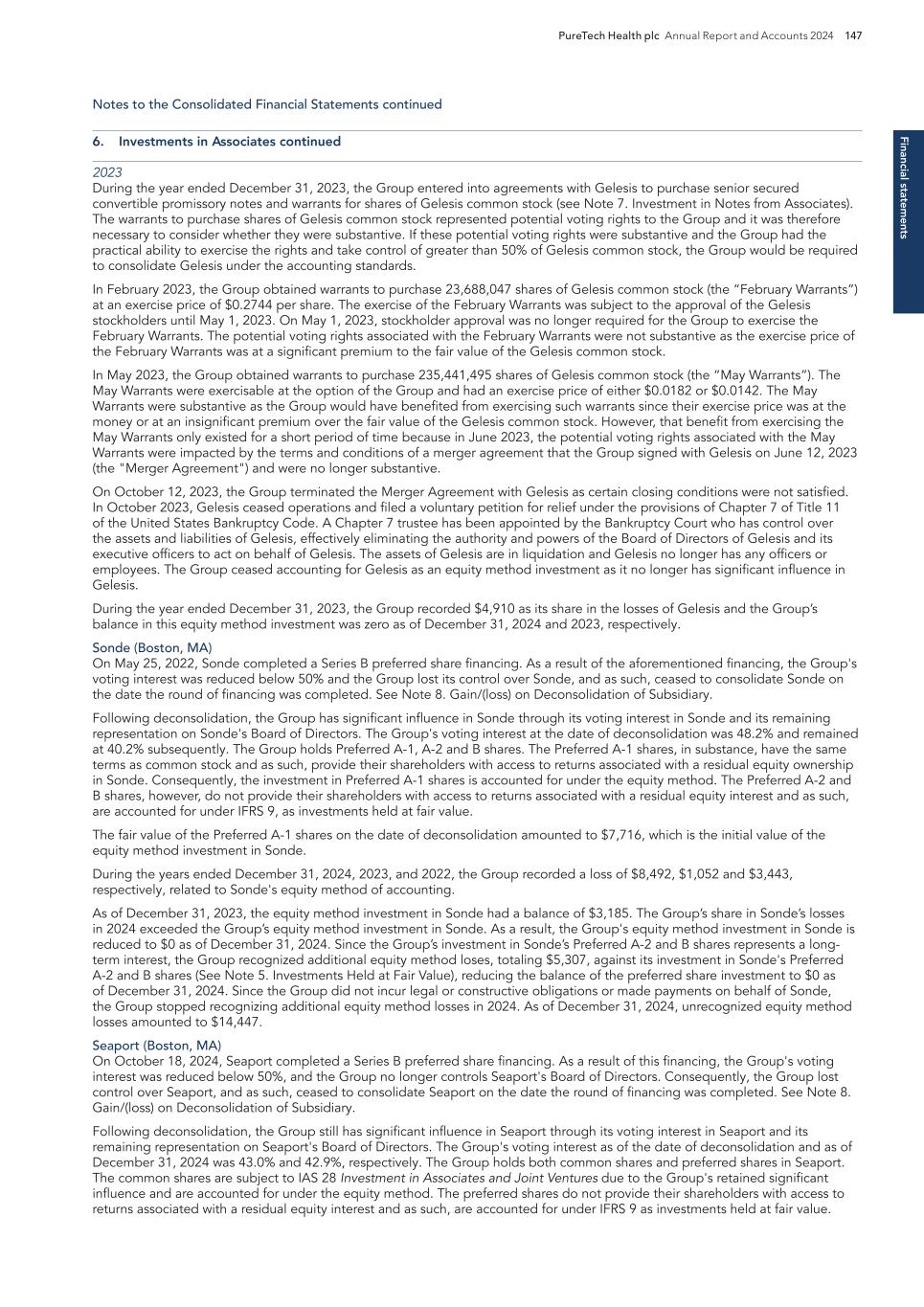

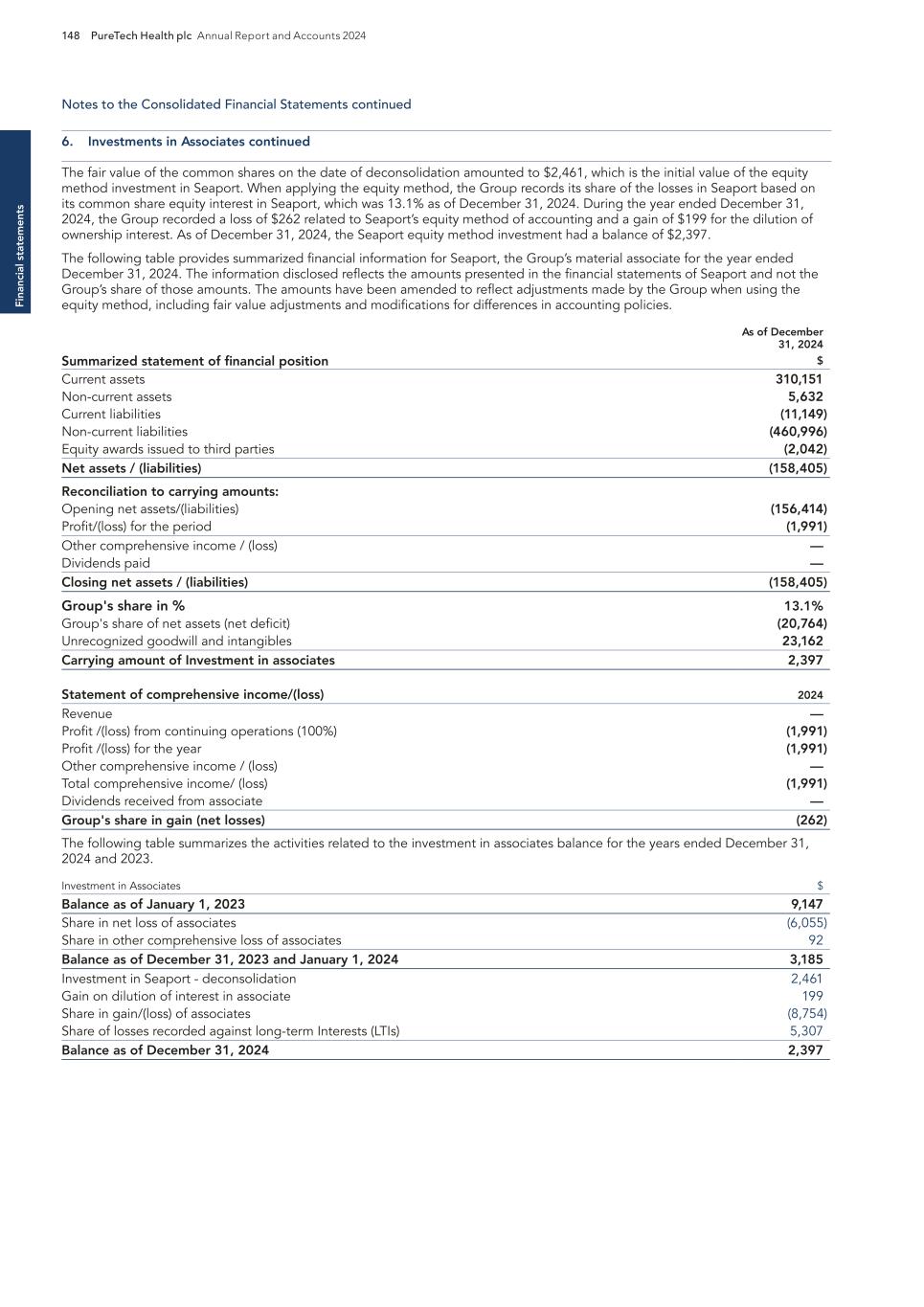

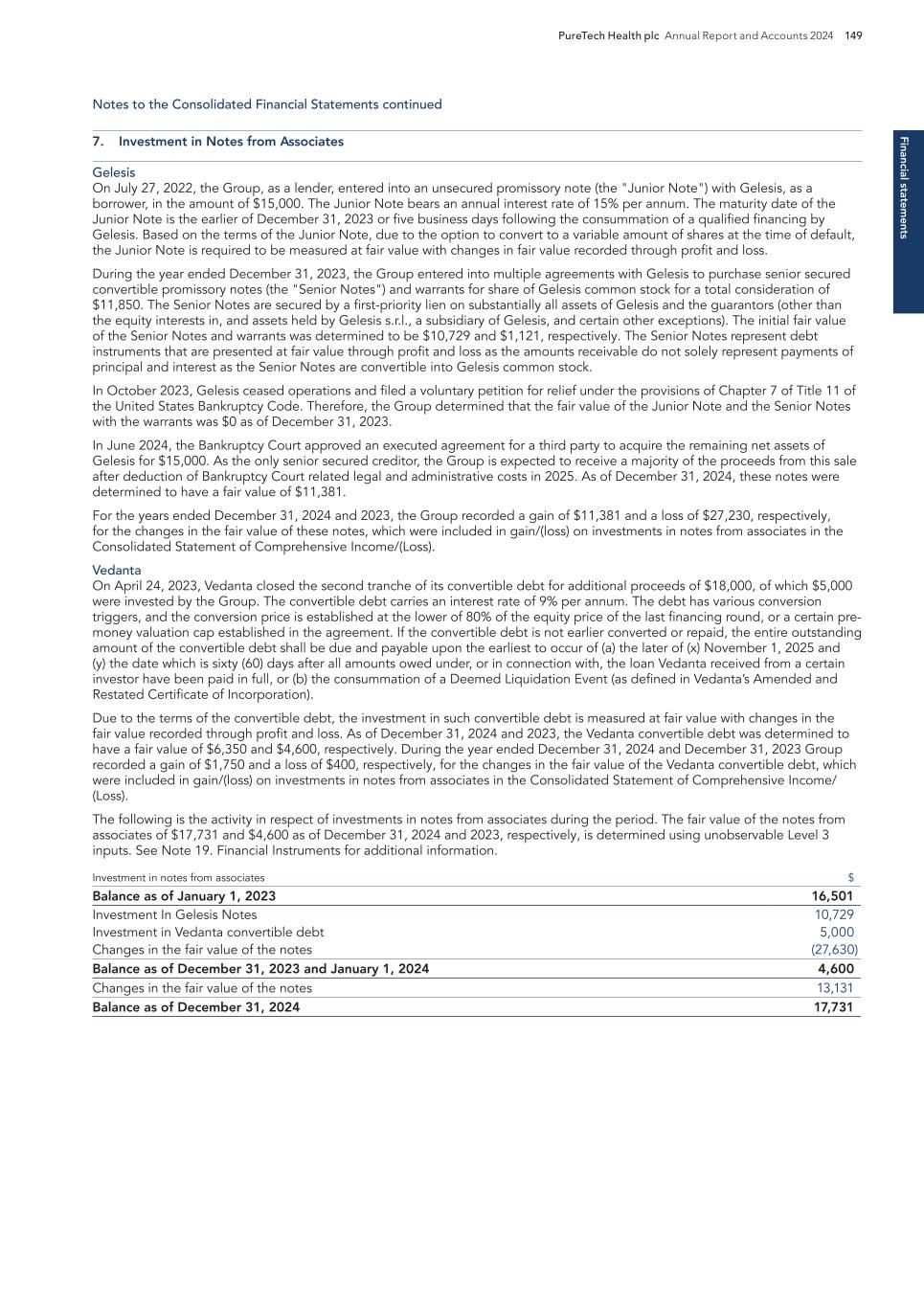

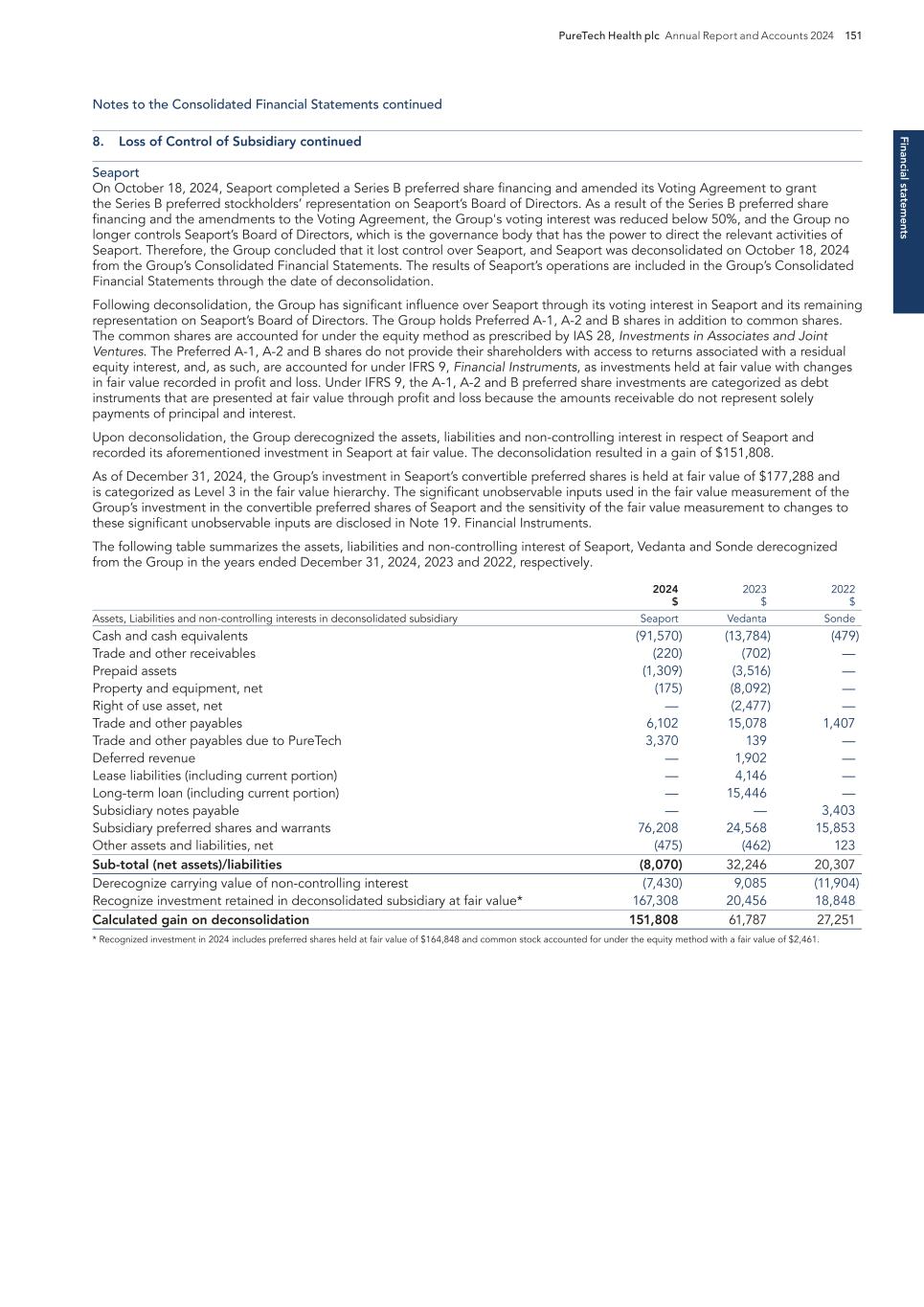

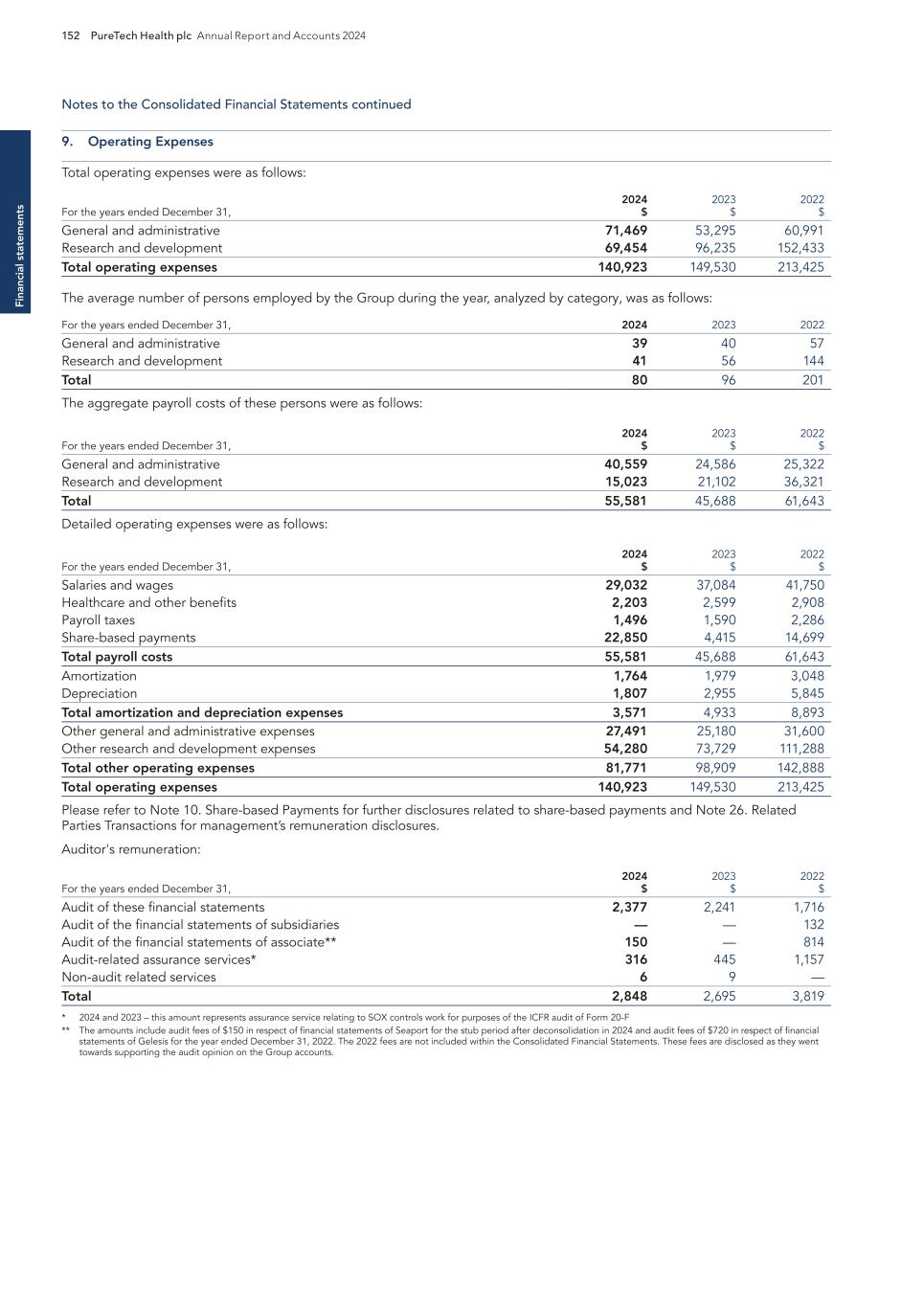

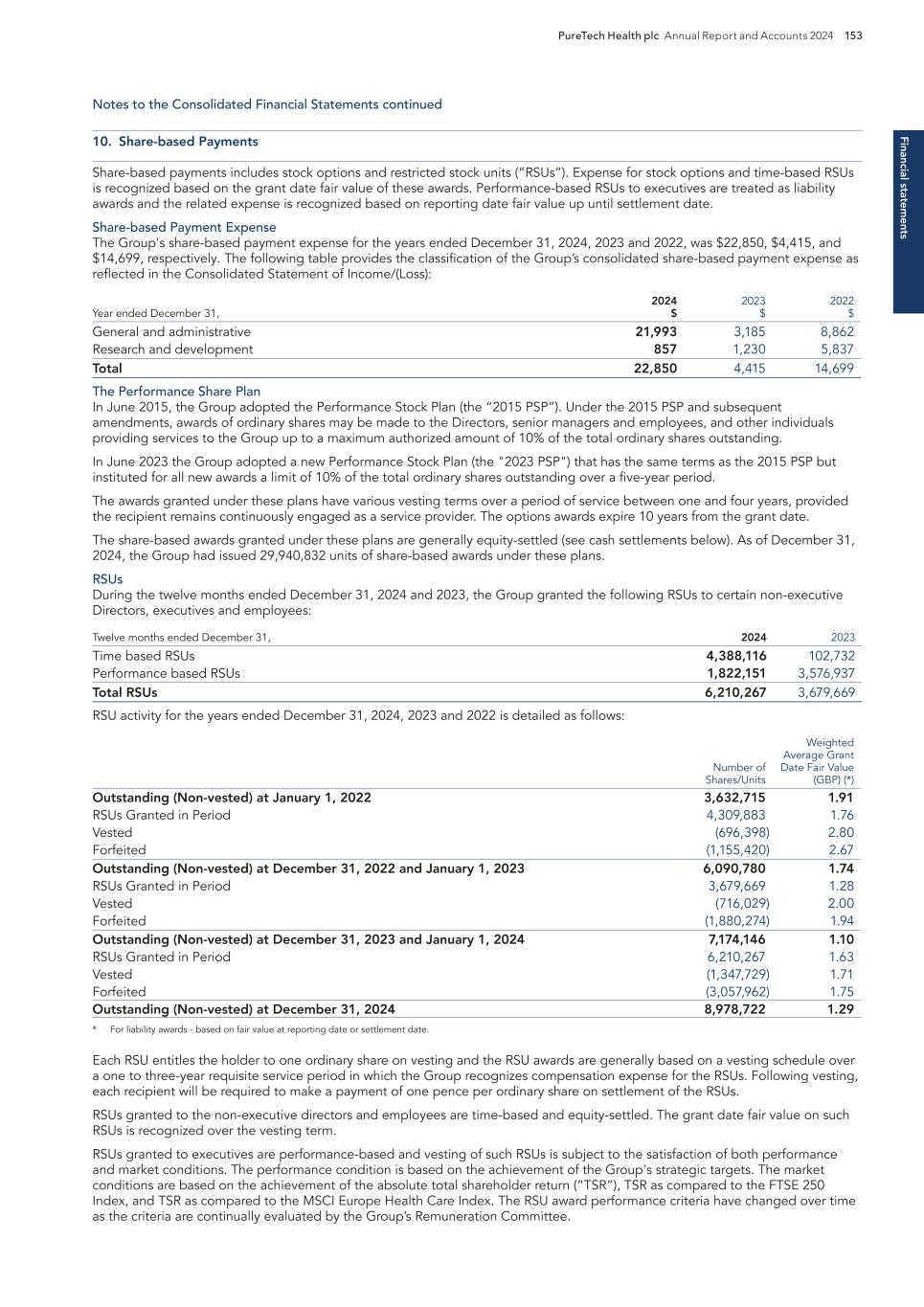

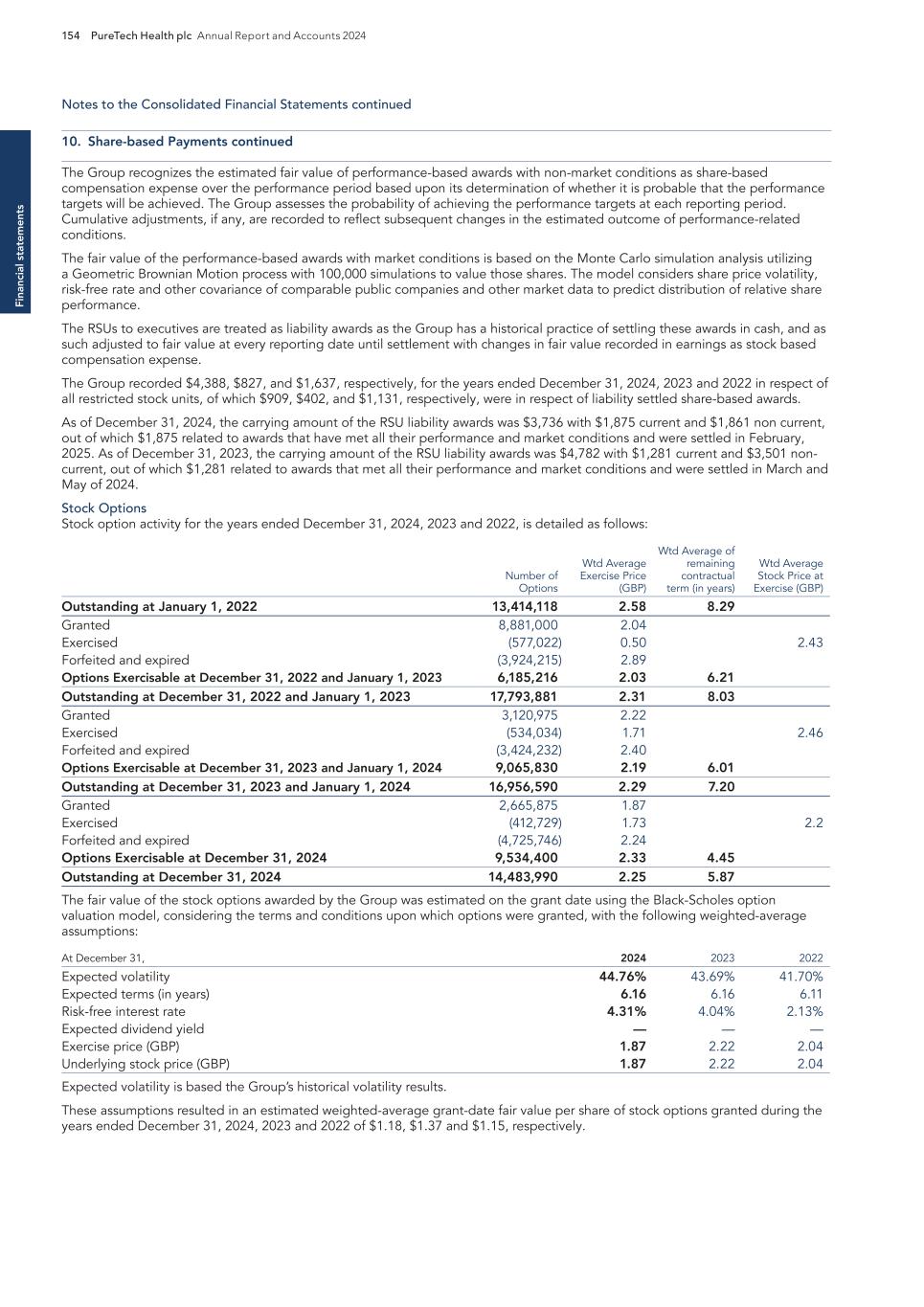

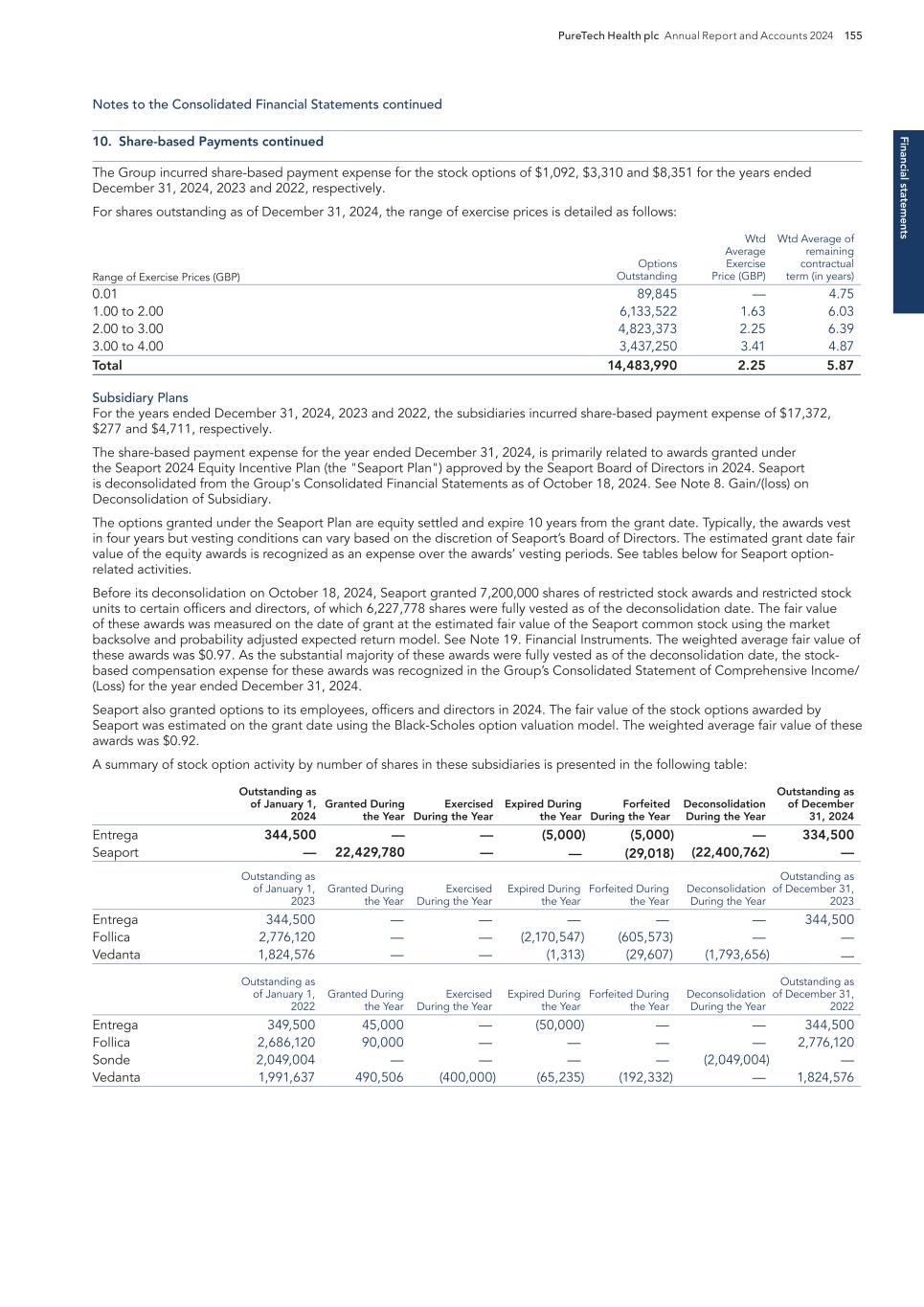

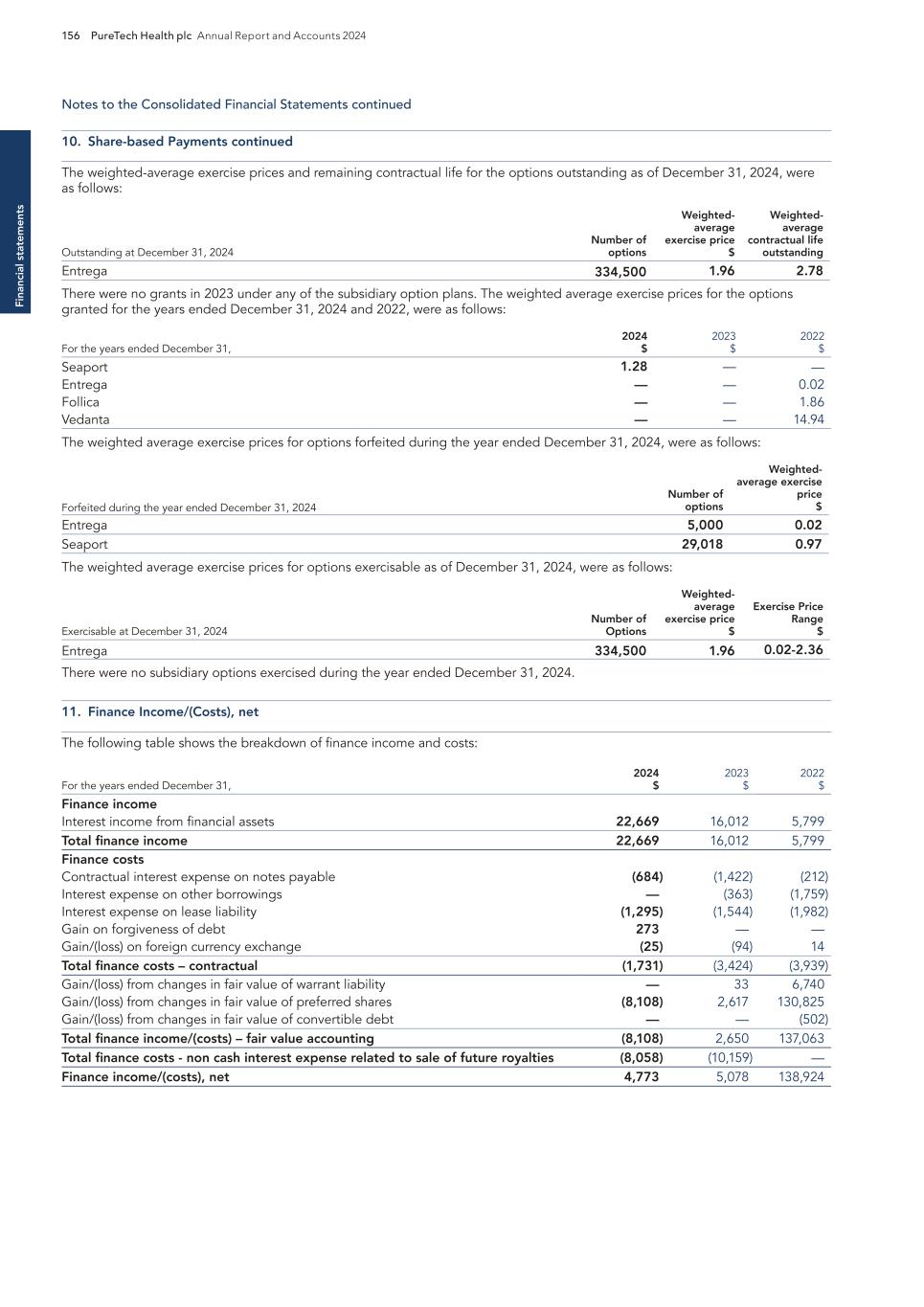

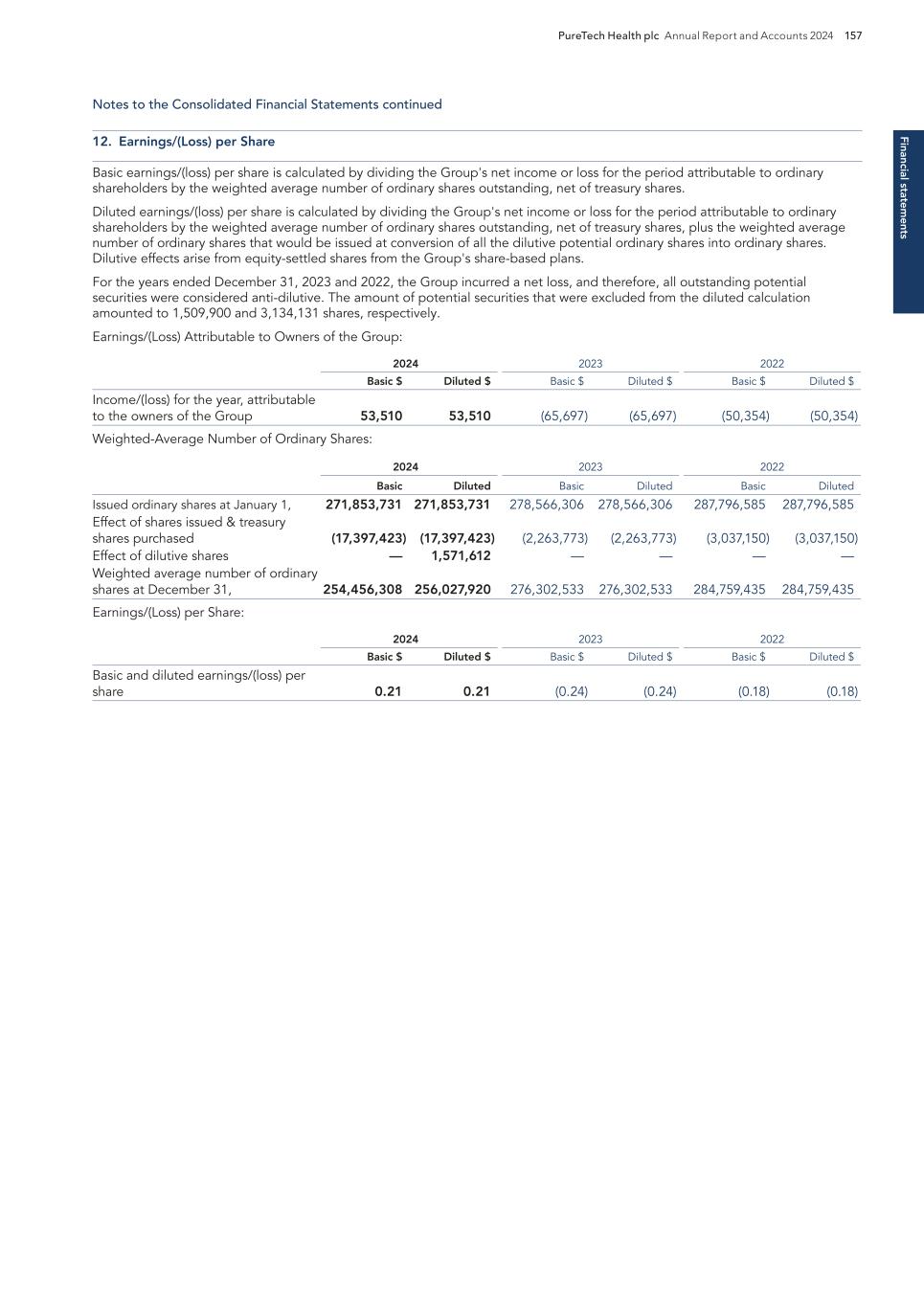

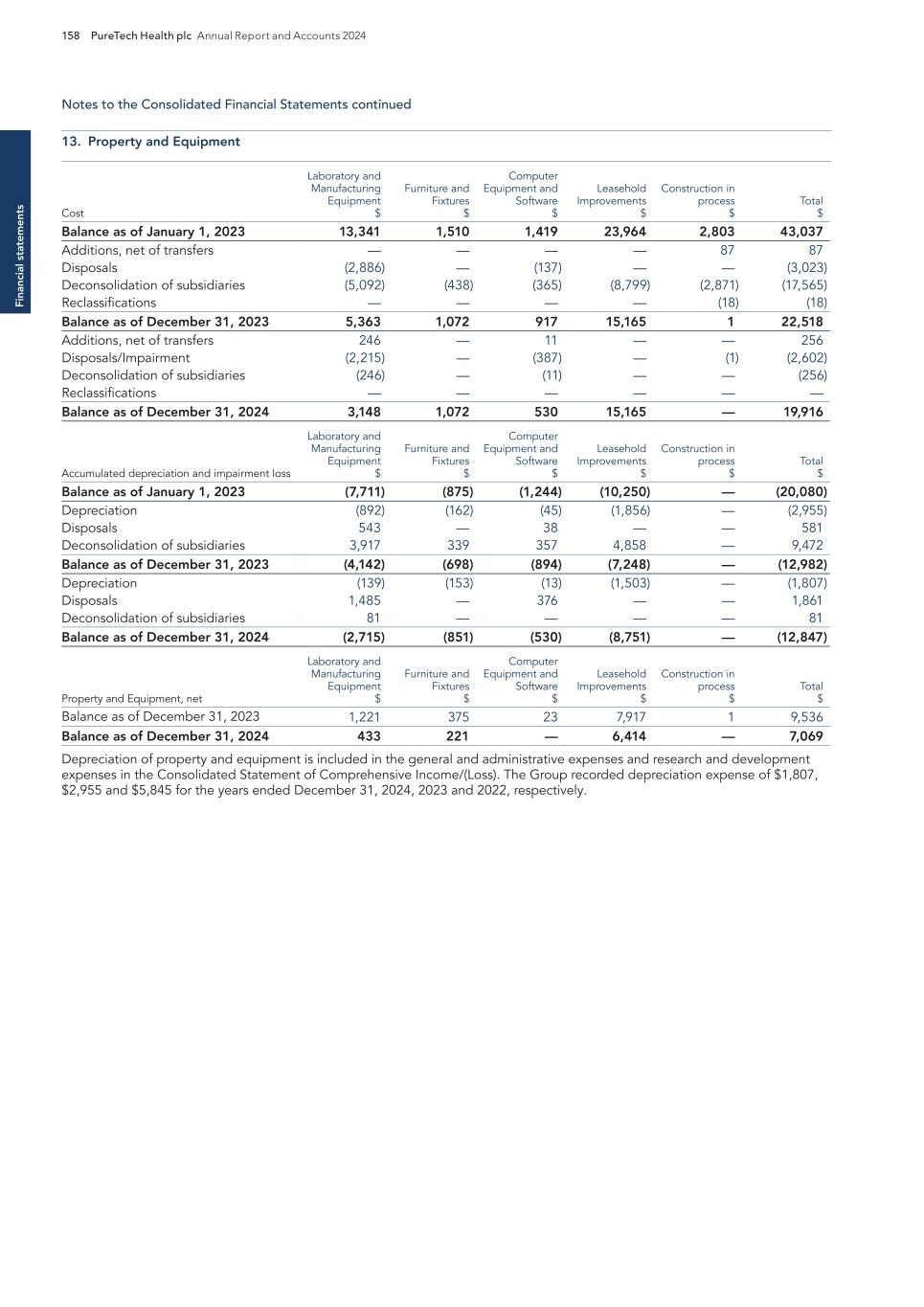

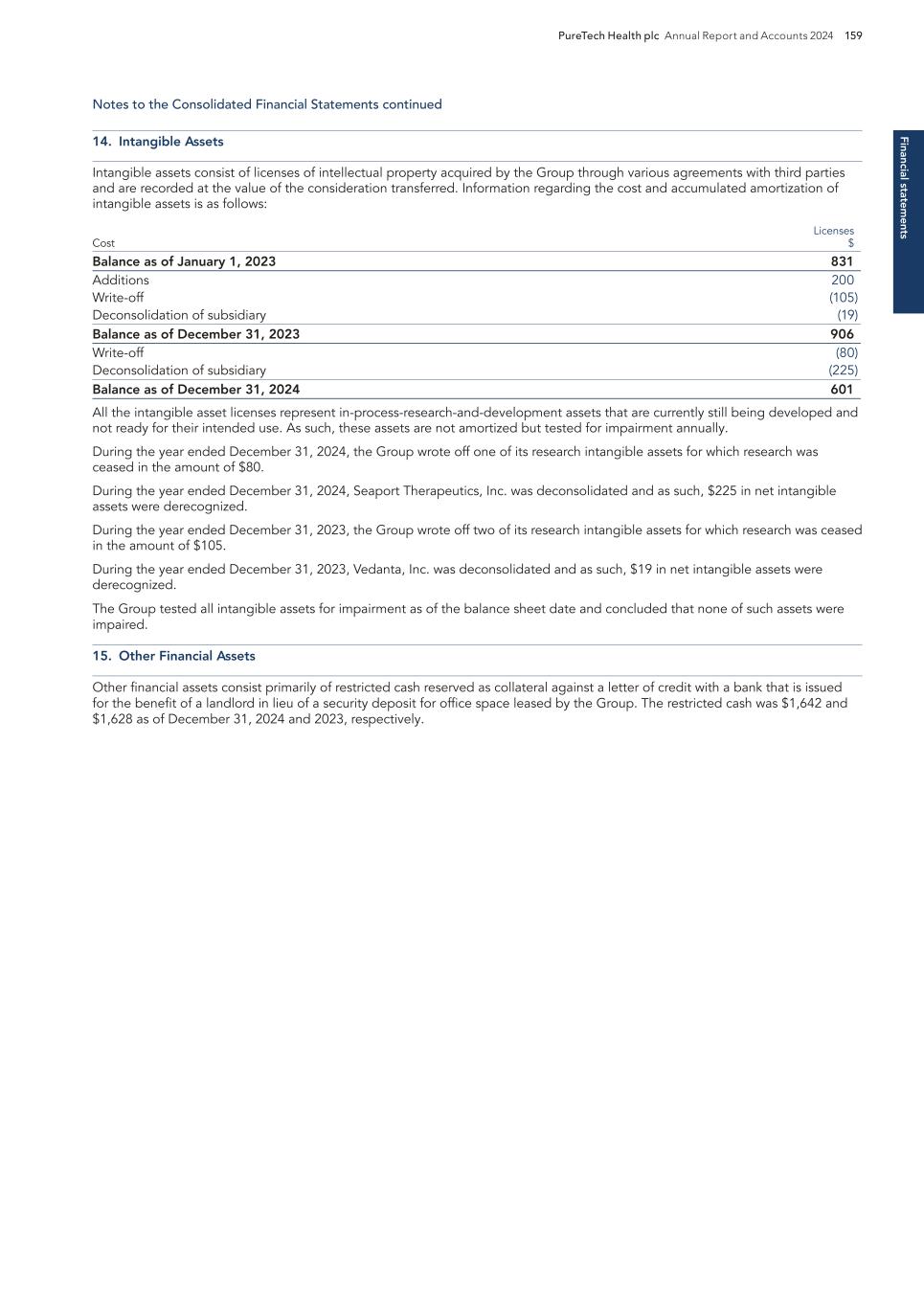

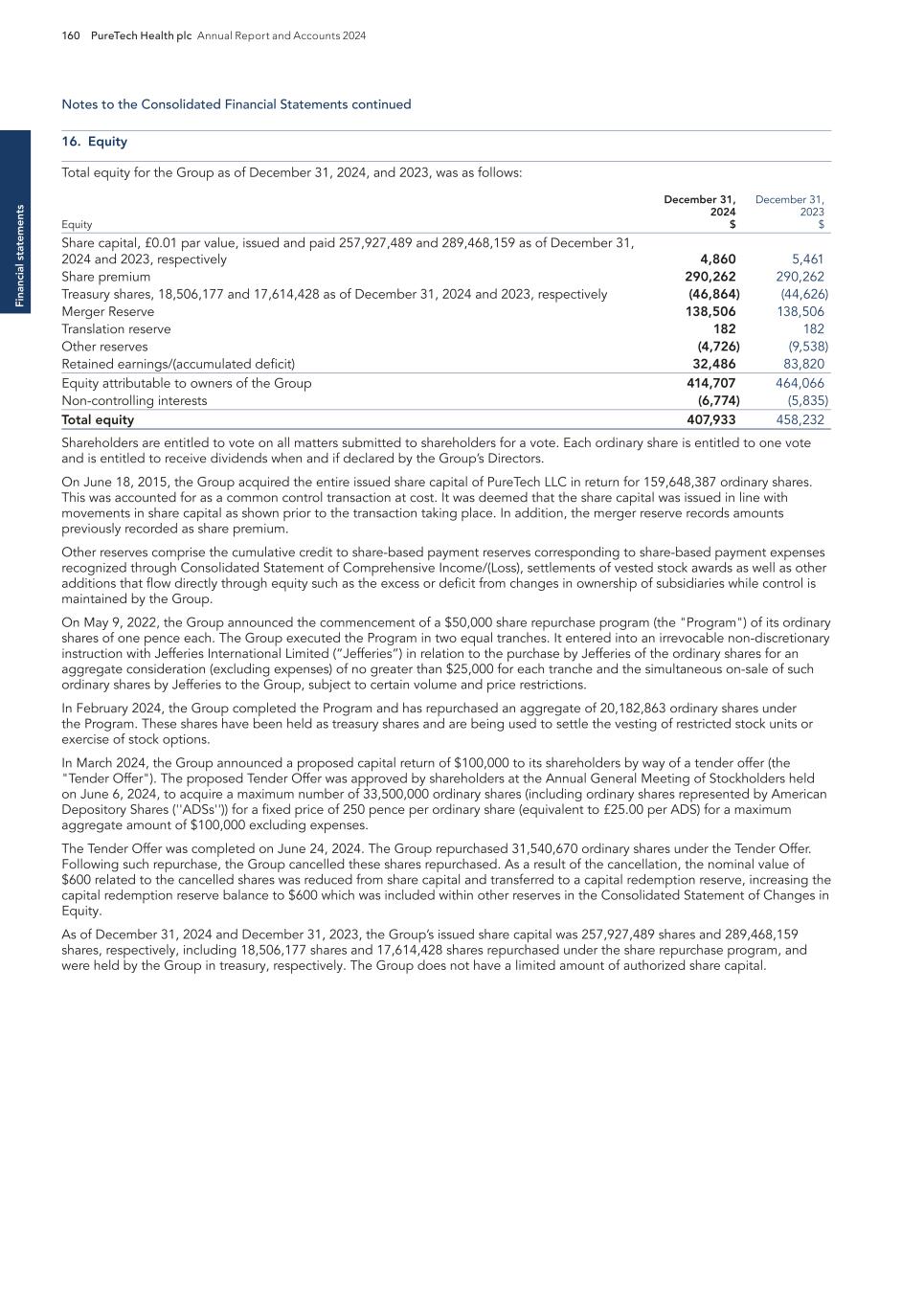

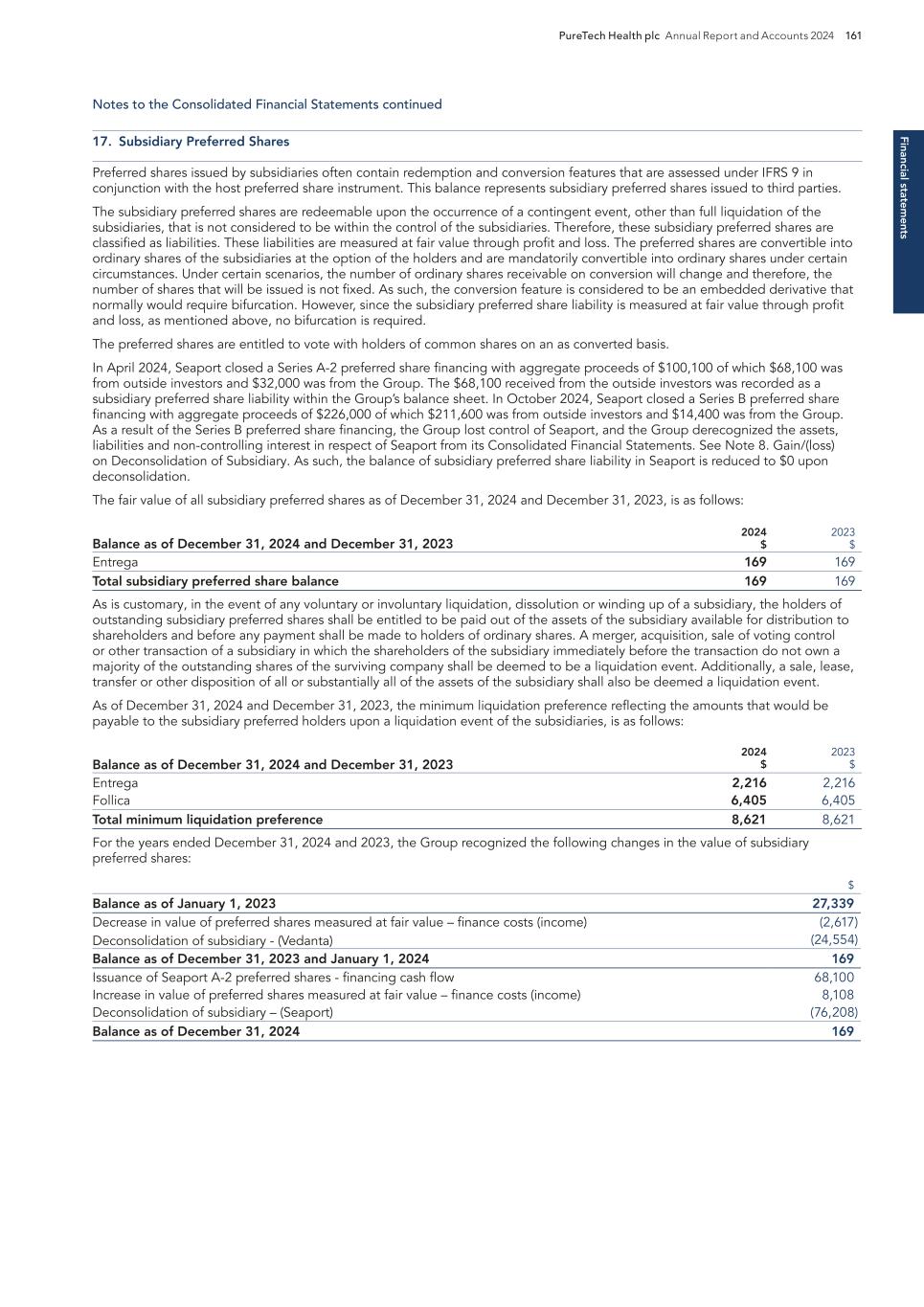

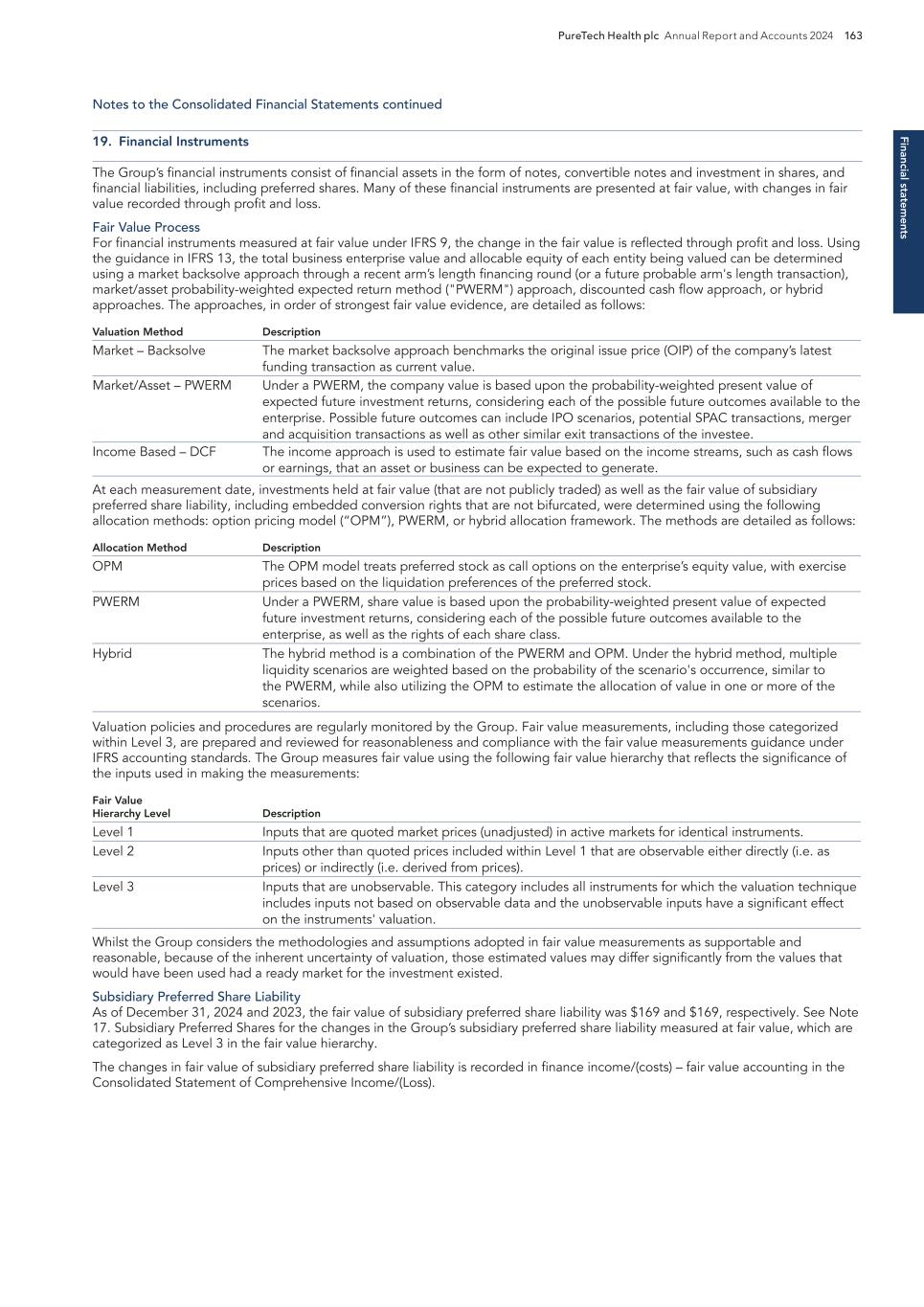

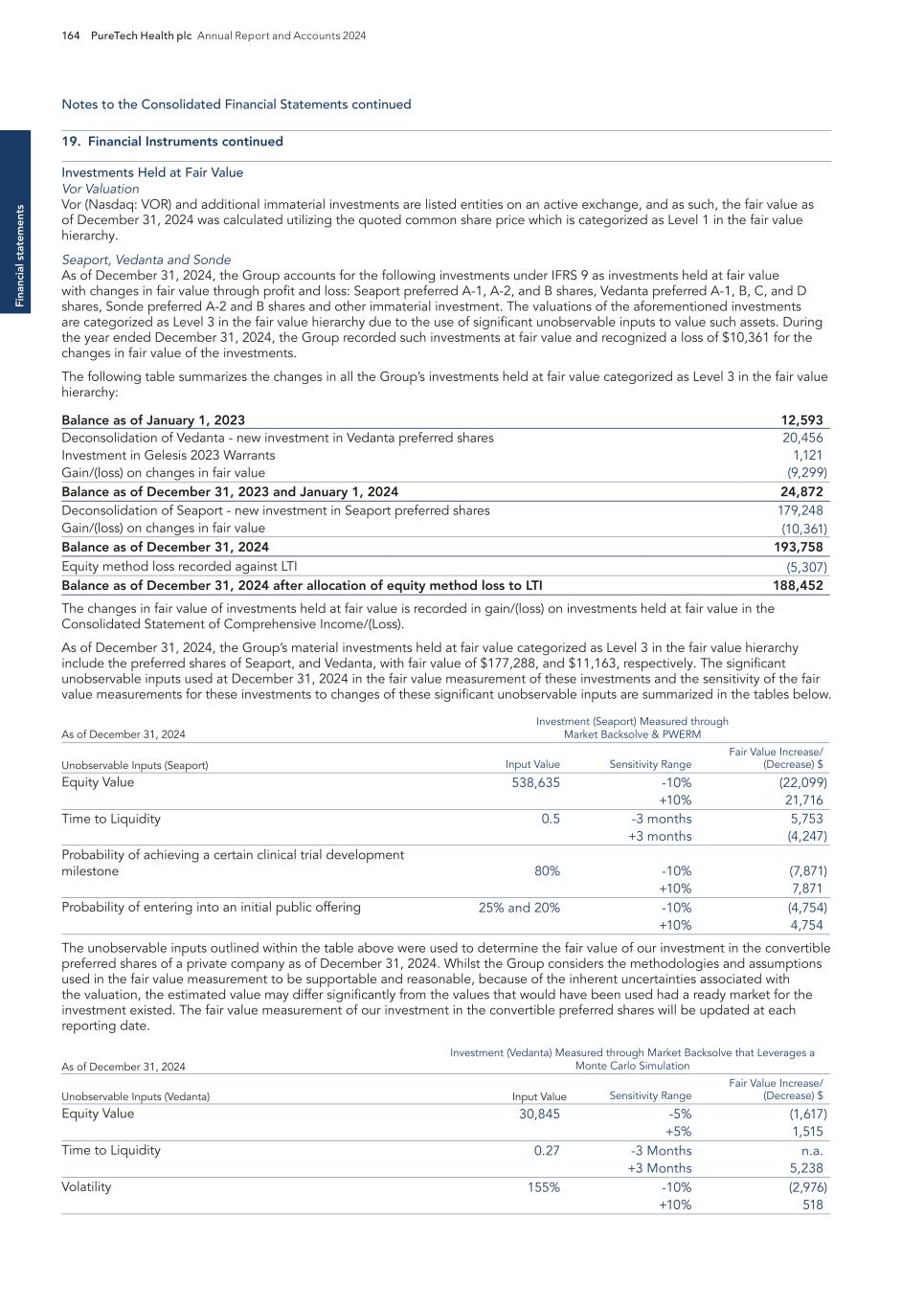

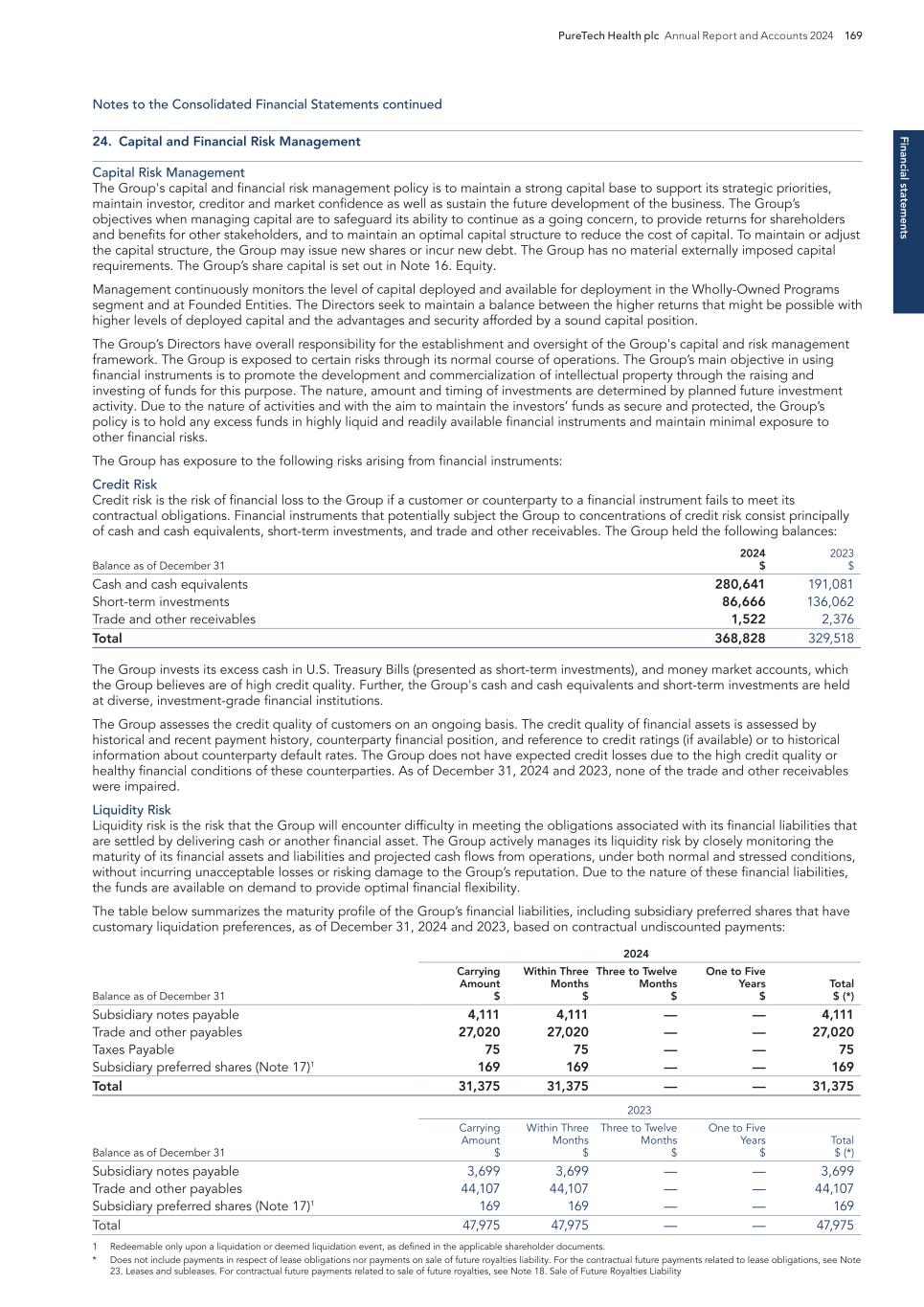

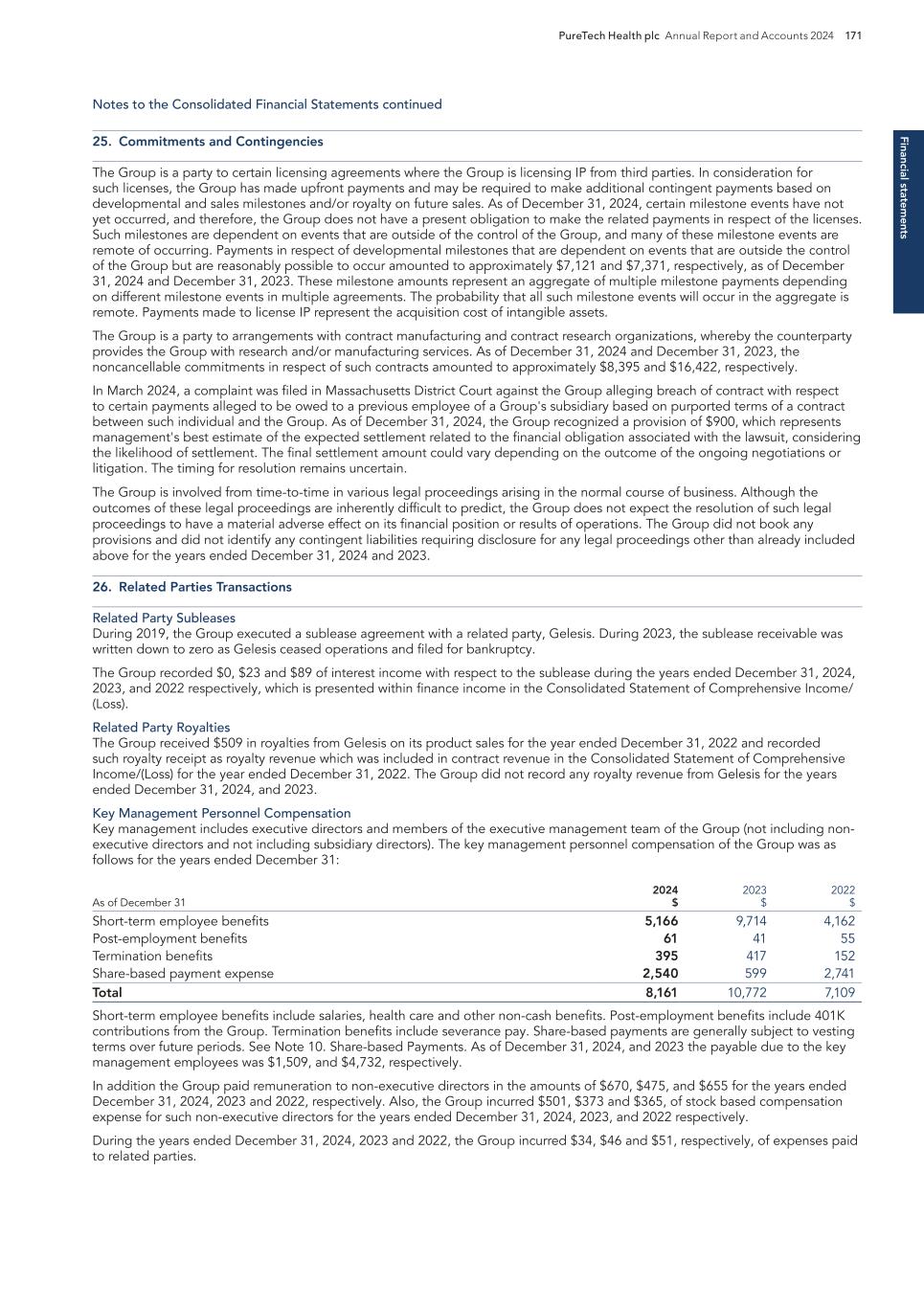

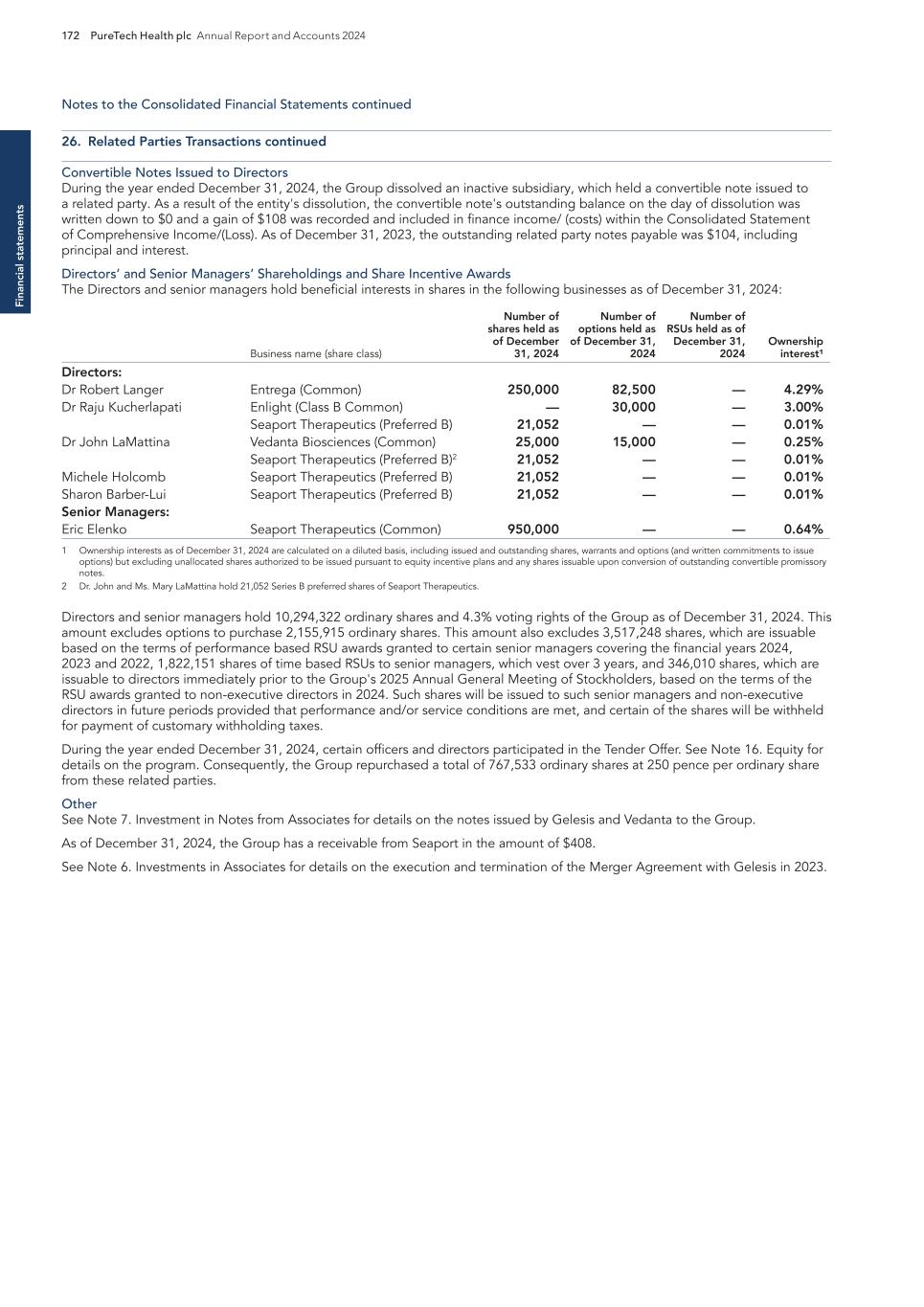

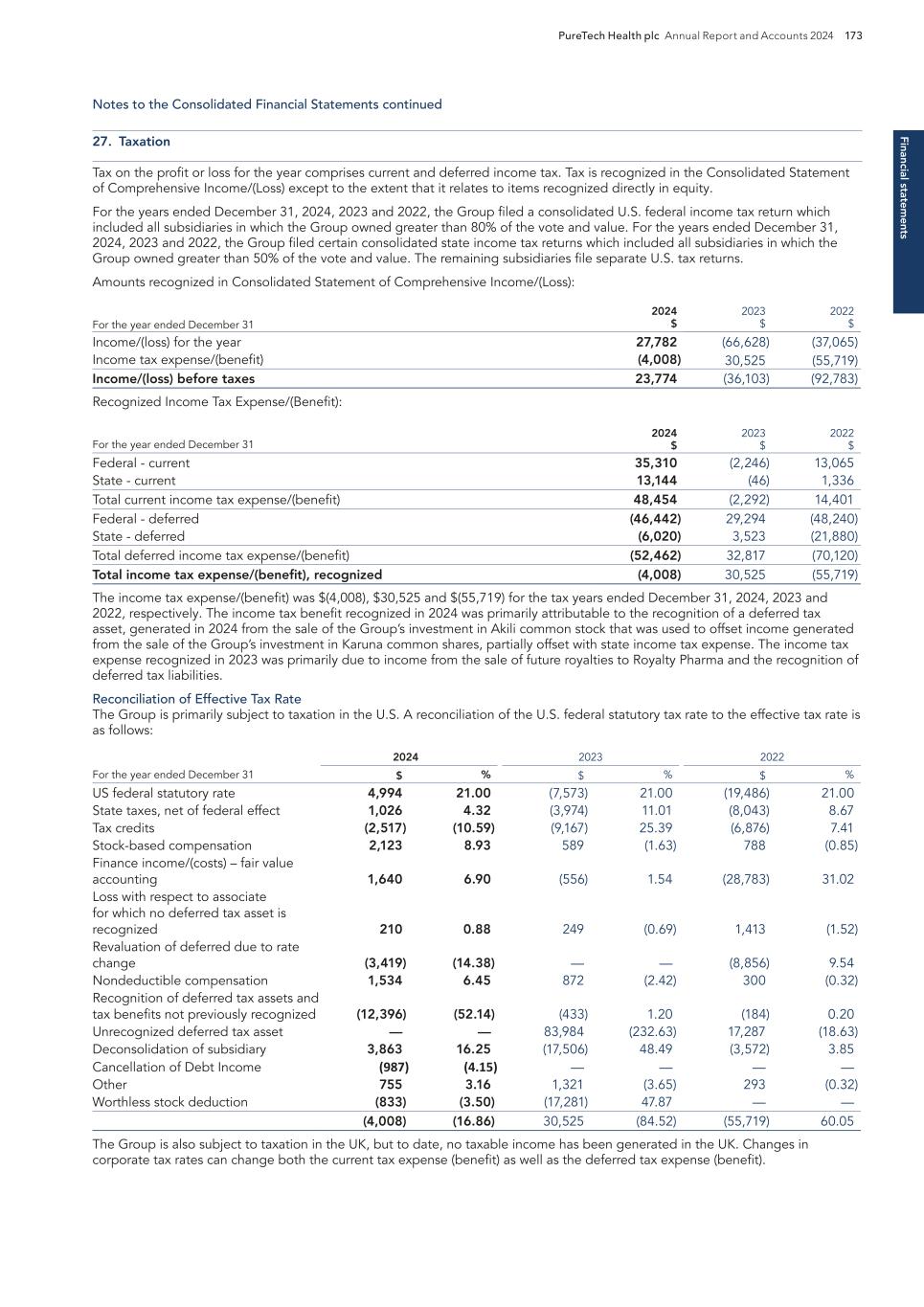

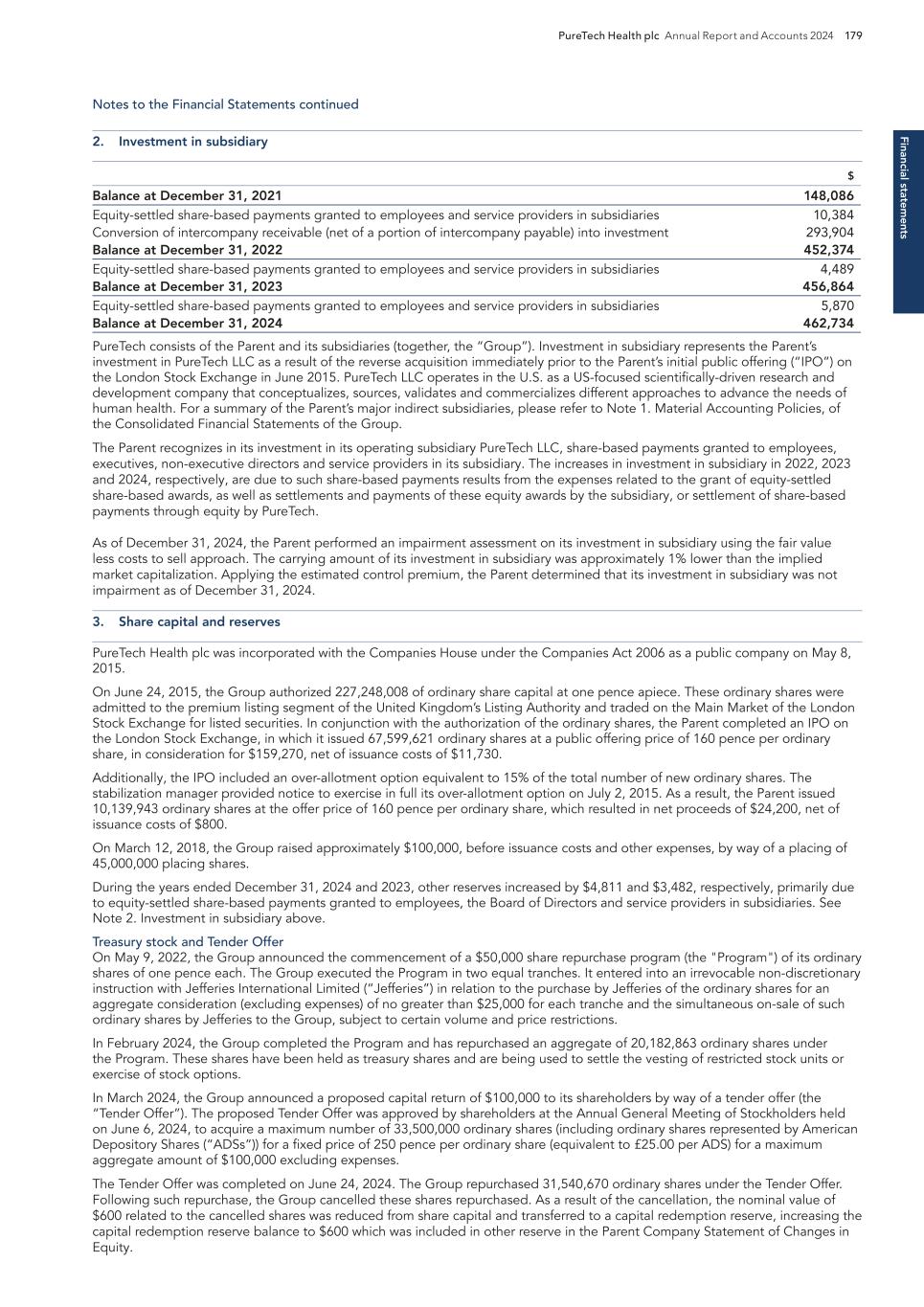

PureTech Health plc Annual Report and Accounts 2024 25 E SG rep o rt