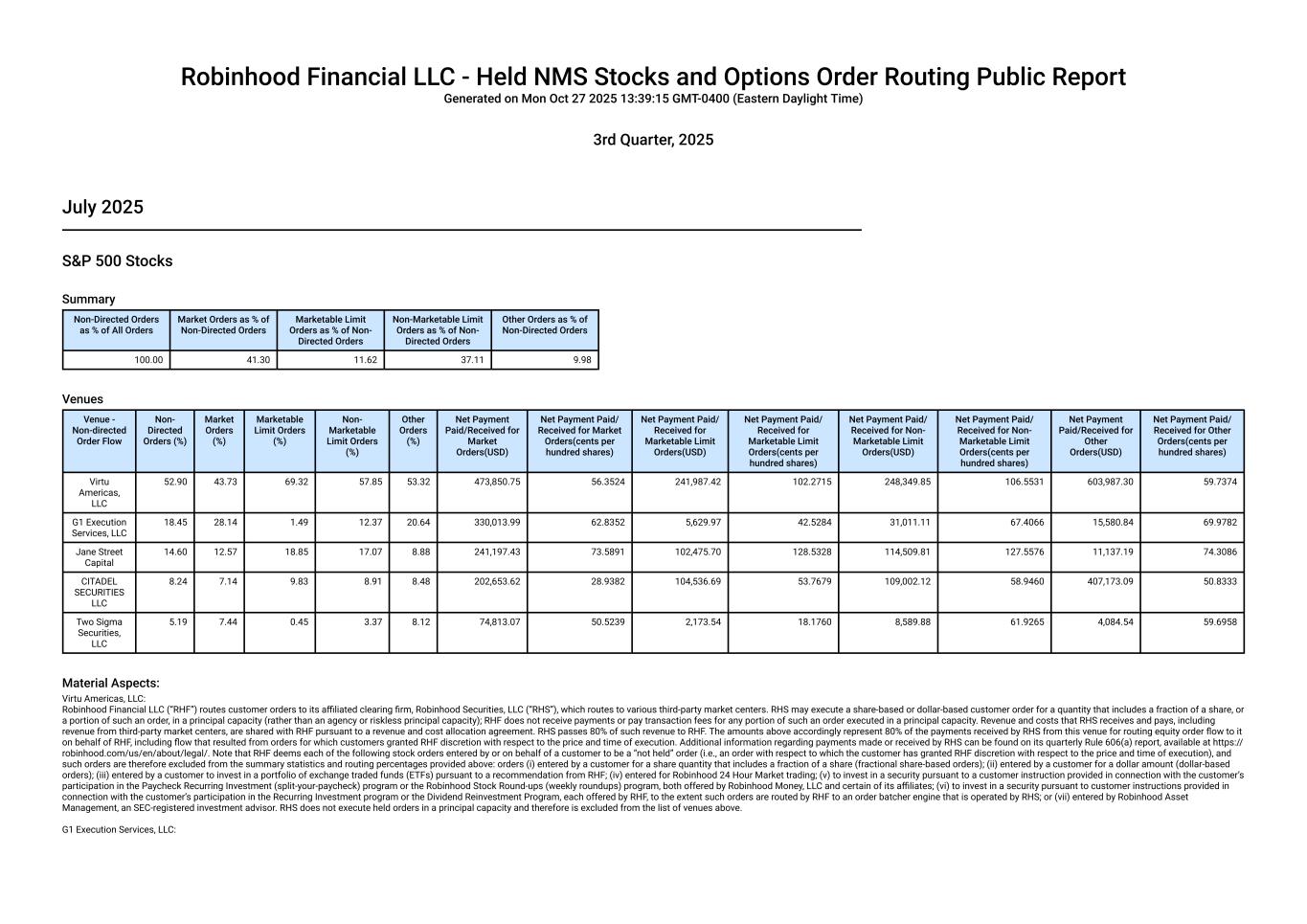

Robinhood Financial LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Mon Oct 27 2025 13:39:15 GMT-0400 (Eastern Daylight Time) 3rd Quarter, 2025 July 2025 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 41.30 11.62 37.11 9.98 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 52.90 43.73 69.32 57.85 53.32 473,850.75 56.3524 241,987.42 102.2715 248,349.85 106.5531 603,987.30 59.7374 G1 Execution Services, LLC 18.45 28.14 1.49 12.37 20.64 330,013.99 62.8352 5,629.97 42.5284 31,011.11 67.4066 15,580.84 69.9782 Jane Street Capital 14.60 12.57 18.85 17.07 8.88 241,197.43 73.5891 102,475.70 128.5328 114,509.81 127.5576 11,137.19 74.3086 CITADEL SECURITIES LLC 8.24 7.14 9.83 8.91 8.48 202,653.62 28.9382 104,536.69 53.7679 109,002.12 58.9460 407,173.09 50.8333 Two Sigma Securities, LLC 5.19 7.44 0.45 3.37 8.12 74,813.07 50.5239 2,173.54 18.1760 8,589.88 61.9265 4,084.54 59.6958 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC:

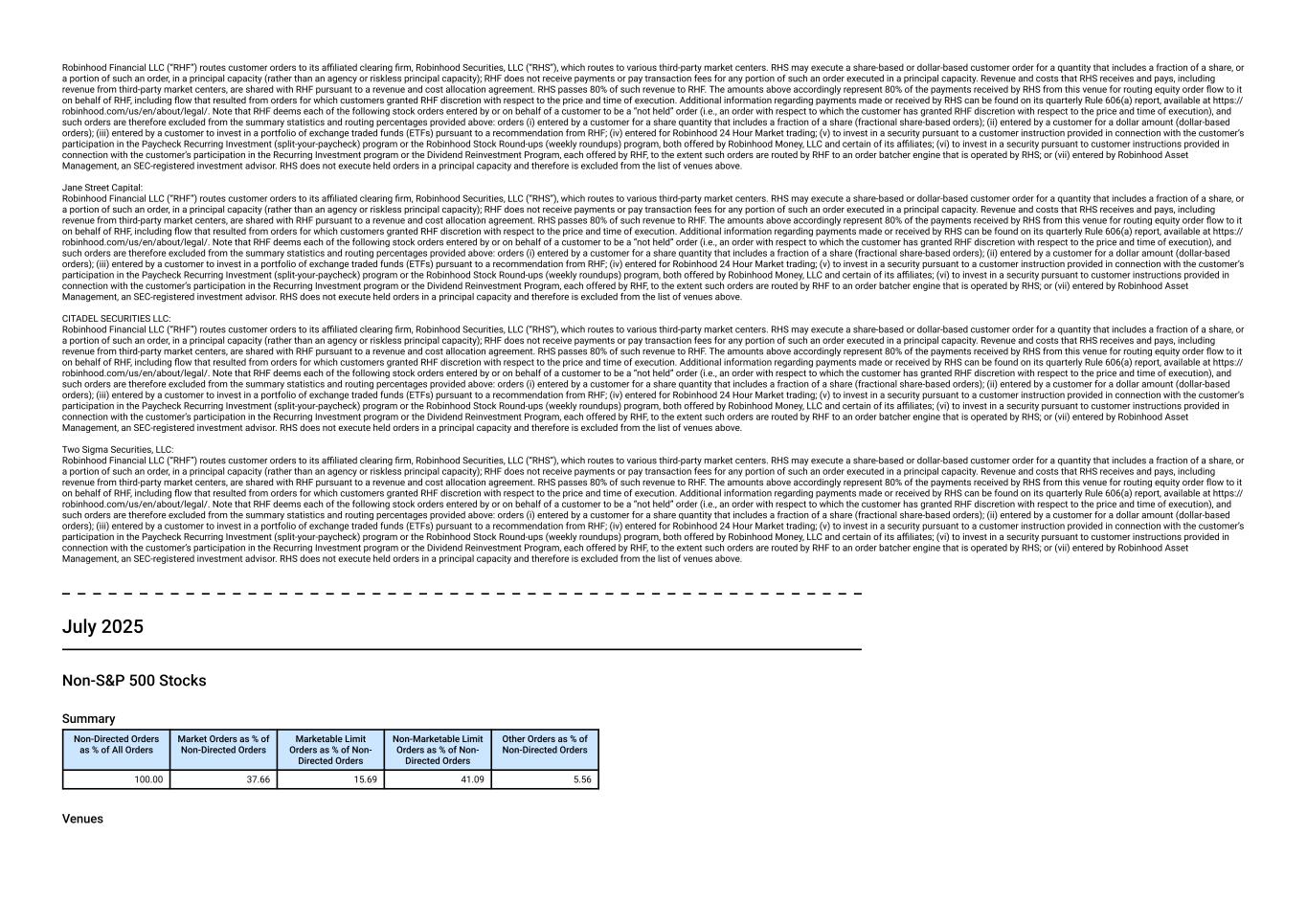

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. July 2025 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 37.66 15.69 41.09 5.56 Venues

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 38.88 34.67 44.28 40.59 39.43 2,246,449.68 12.7680 943,183.82 10.2181 998,449.86 11.2860 1,596,130.33 21.2644 Jane Street Capital 29.08 25.93 35.20 30.92 19.67 2,934,798.25 8.9638 1,211,958.66 7.5797 1,355,872.47 8.9040 181,452.02 14.1541 CITADEL SECURITIES LLC 17.79 15.02 19.05 19.54 20.16 2,922,924.71 8.6536 1,416,745.99 8.3312 1,412,184.90 8.8512 2,170,787.01 19.0084 Two Sigma Securities, LLC 7.20 12.17 0.75 4.54 11.46 1,175,811.98 13.4178 66,862.85 15.7765 127,636.35 19.5118 73,218.34 18.6272 G1 Execution Services, LLC 6.49 11.23 0.67 4.06 8.72 799,727.65 13.9654 61,363.29 19.8243 103,644.15 19.3837 46,043.00 14.5717 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC:

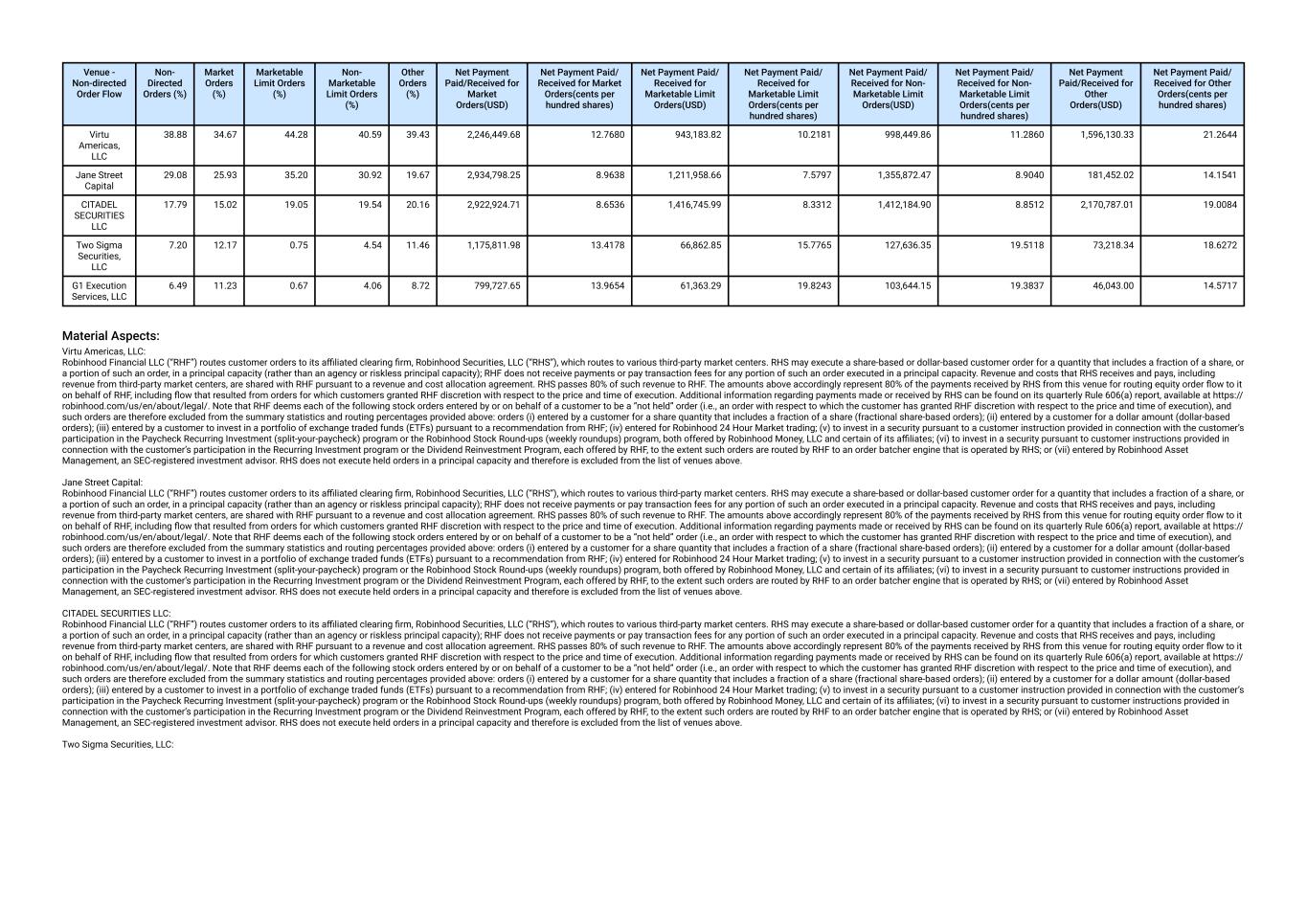

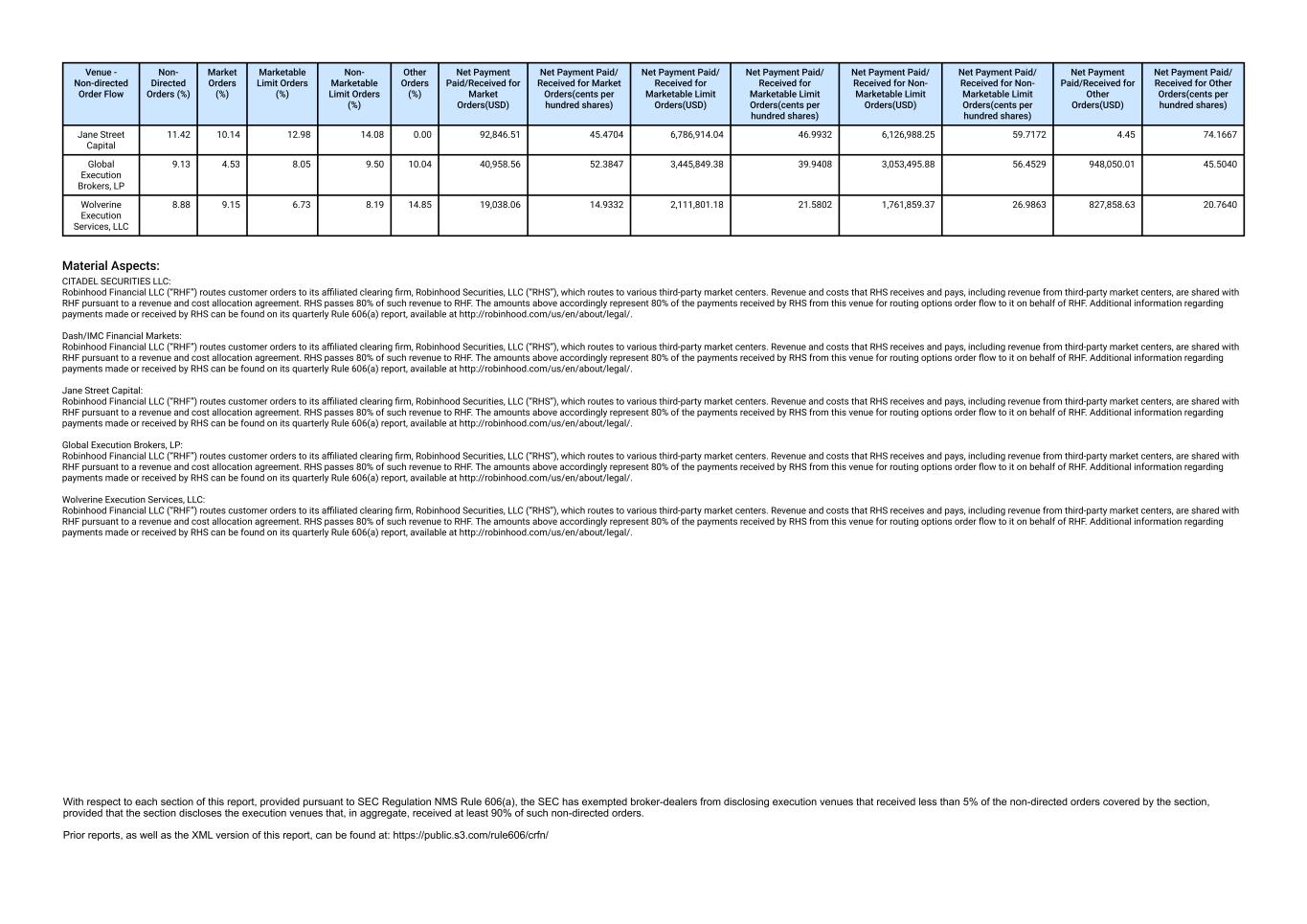

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. July 2025 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 1.07 28.44 53.94 16.56 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.92 40.76 41.06 37.97 38.24 350,335.09 35.4606 17,014,342.53 44.8582 14,633,433.86 54.7420 3,231,012.84 44.5596 Dash/IMC Financial Markets 33.15 35.47 32.69 33.09 34.01 269,172.69 35.1958 12,775,289.72 36.8563 11,946,224.89 50.6970 3,106,771.71 43.3320 Global Execution Brokers, LP 12.40 6.47 11.65 13.27 11.22 58,817.70 58.7079 4,926,384.65 45.2486 4,215,314.81 58.4835 1,088,186.20 44.4953 Wolverine Execution Services, LLC 11.88 12.57 9.91 11.47 16.53 38,467.44 22.0803 3,179,346.65 30.5222 2,765,633.82 37.5713 906,579.78 24.0261 Material Aspects: CITADEL SECURITIES LLC:

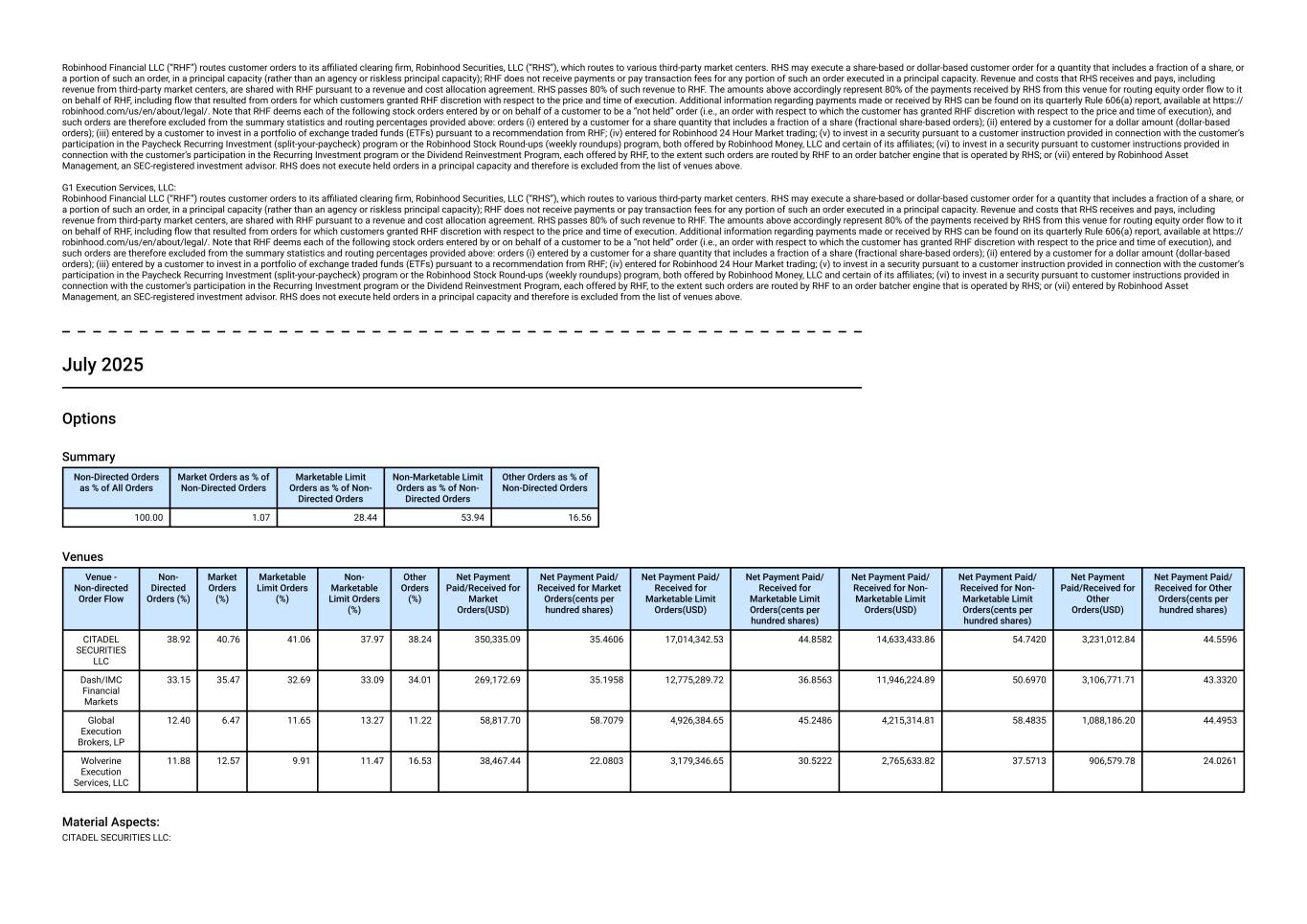

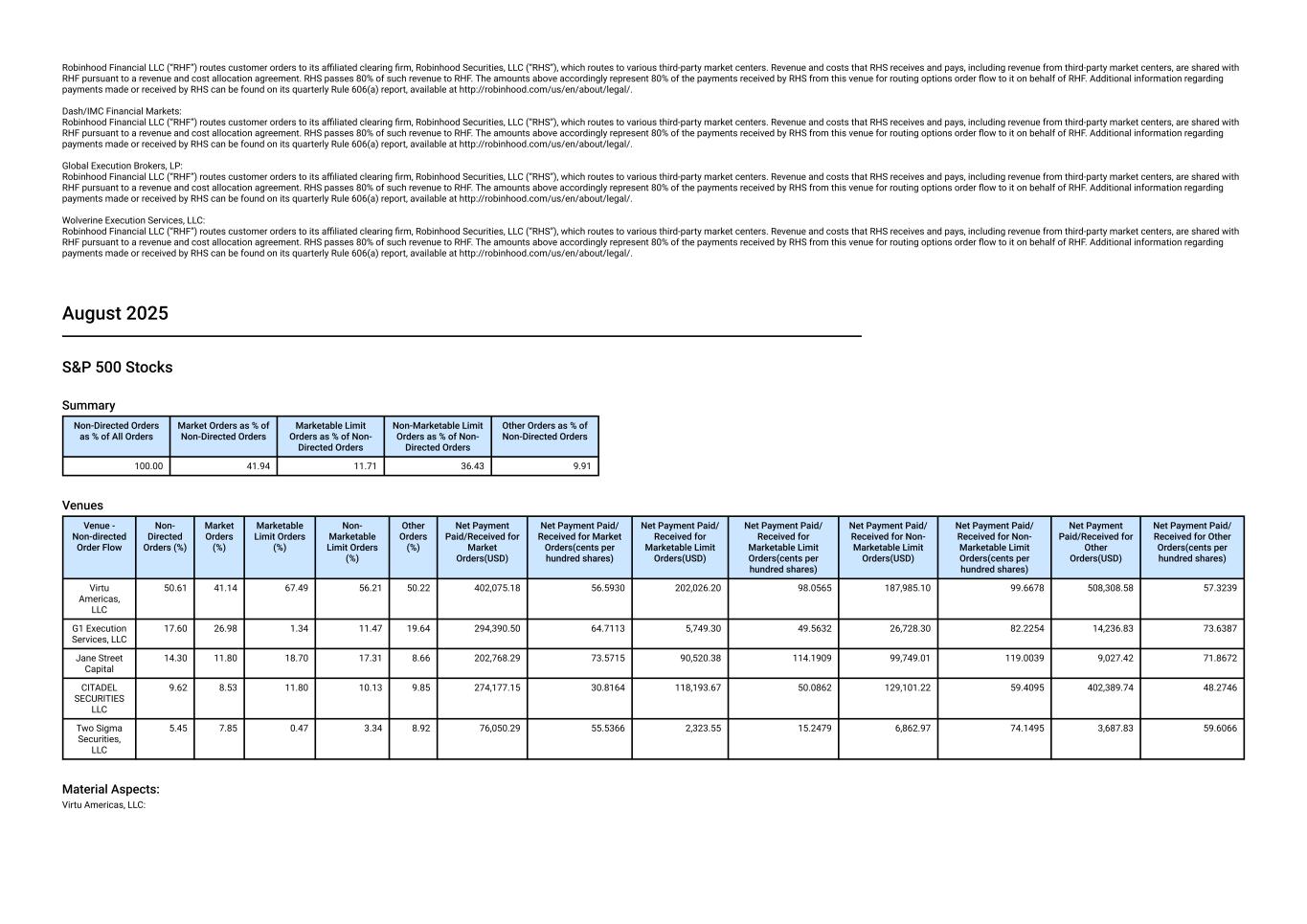

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. August 2025 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 41.94 11.71 36.43 9.91 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 50.61 41.14 67.49 56.21 50.22 402,075.18 56.5930 202,026.20 98.0565 187,985.10 99.6678 508,308.58 57.3239 G1 Execution Services, LLC 17.60 26.98 1.34 11.47 19.64 294,390.50 64.7113 5,749.30 49.5632 26,728.30 82.2254 14,236.83 73.6387 Jane Street Capital 14.30 11.80 18.70 17.31 8.66 202,768.29 73.5715 90,520.38 114.1909 99,749.01 119.0039 9,027.42 71.8672 CITADEL SECURITIES LLC 9.62 8.53 11.80 10.13 9.85 274,177.15 30.8164 118,193.67 50.0862 129,101.22 59.4095 402,389.74 48.2746 Two Sigma Securities, LLC 5.45 7.85 0.47 3.34 8.92 76,050.29 55.5366 2,323.55 15.2479 6,862.97 74.1495 3,687.83 59.6066 Material Aspects: Virtu Americas, LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. August 2025 Non-S&P 500 Stocks Summary

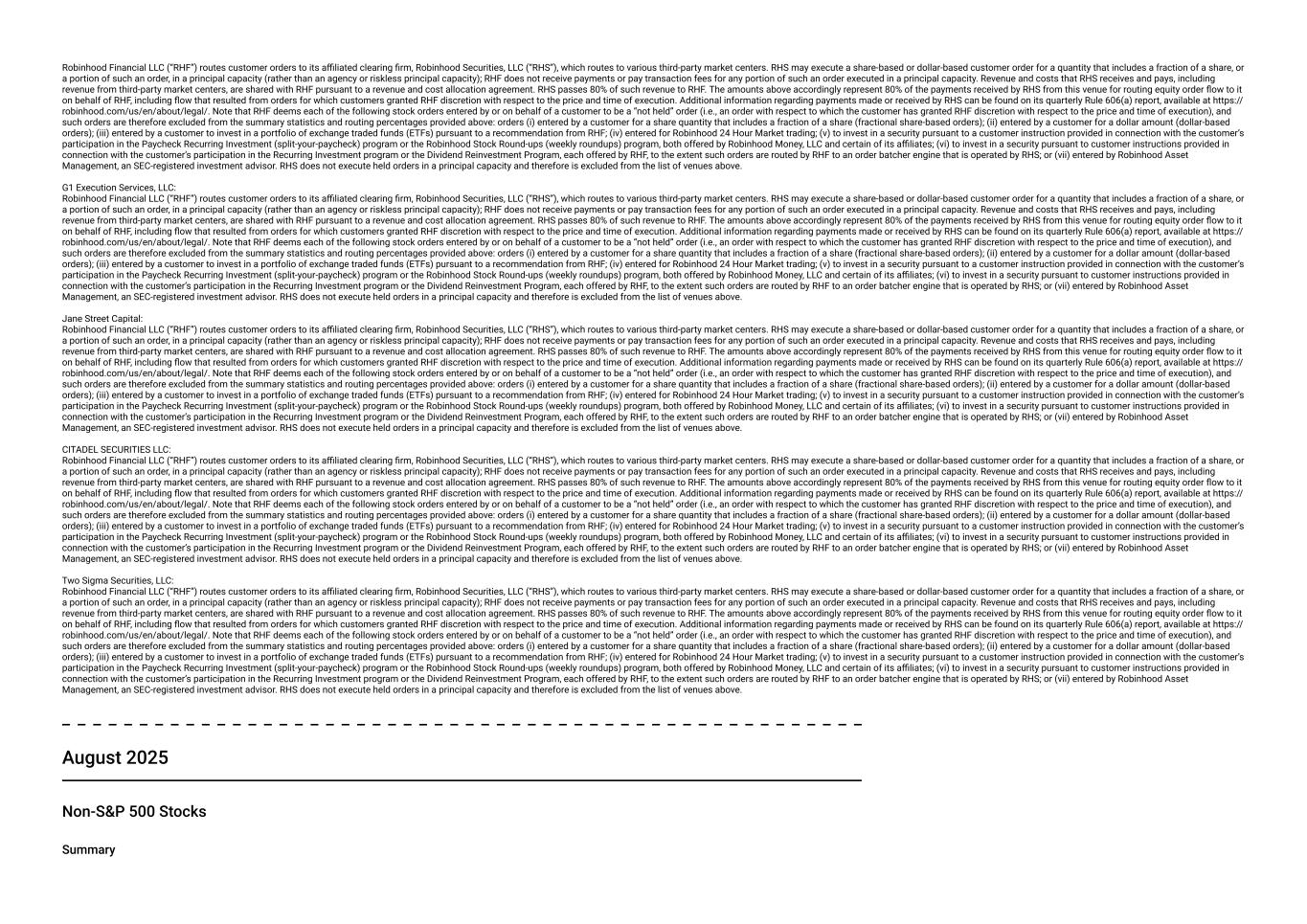

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 36.46 14.31 43.69 5.55 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 36.33 31.90 43.56 37.71 35.93 1,733,077.22 14.5428 738,709.54 12.0649 815,634.42 13.8944 1,526,010.24 22.2241 Jane Street Capital 29.02 24.83 34.36 31.93 19.83 2,488,434.10 15.0205 990,372.29 11.9972 1,164,917.84 14.6679 117,935.09 16.2167 CITADEL SECURITIES LLC 18.93 16.19 20.43 20.40 21.52 3,035,713.86 13.4073 1,415,824.10 12.0440 1,460,752.19 13.4485 1,901,686.54 22.2804 G1 Execution Services, LLC 7.25 12.91 0.75 4.43 9.02 862,556.98 18.3575 62,204.50 21.6350 91,318.83 18.9427 42,110.75 19.4161 Two Sigma Securities, LLC 6.53 10.74 0.68 4.31 11.37 901,116.89 16.5027 67,216.10 22.5305 92,659.47 21.2380 57,340.48 19.2605 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC:

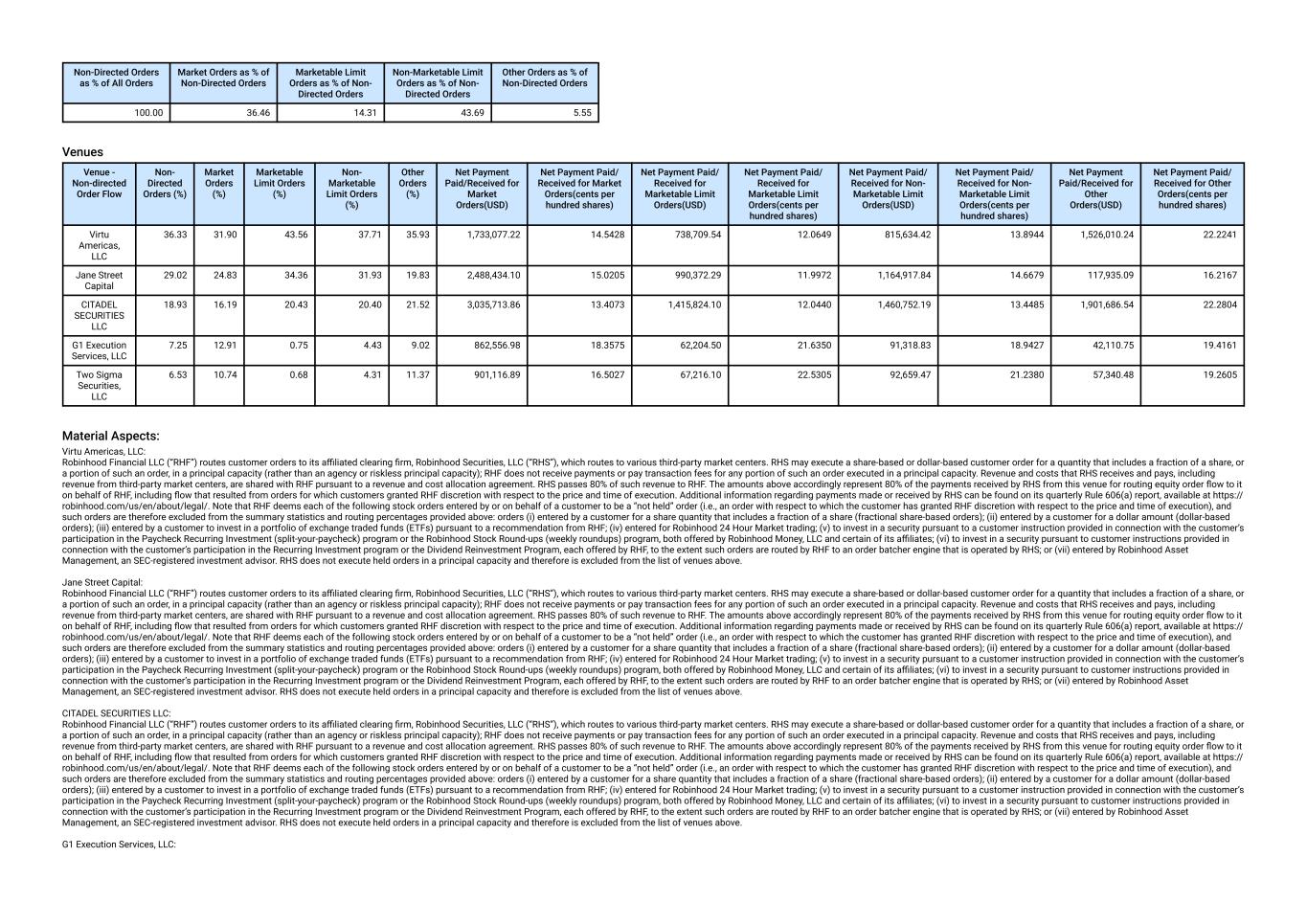

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to an order batcher engine that is operated by RHS; or (vii) entered by Robinhood Asset Management, an SEC-registered investment advisor. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. August 2025 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 1.14 28.40 53.77 16.69 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.78 42.01 40.62 37.81 38.52 330,233.06 32.1008 13,992,286.10 41.3448 12,919,768.83 51.5136 3,163,749.86 44.8936 Dash/IMC Financial Markets 29.42 34.47 29.90 28.28 31.90 257,461.87 29.2557 10,115,016.62 33.2567 9,409,760.83 46.1476 3,014,086.15 43.9625 Global Execution Brokers, LP 12.41 5.71 10.95 13.06 13.24 50,089.79 51.7312 3,695,825.86 41.2375 3,588,040.58 57.3680 1,022,765.68 47.5905 Wolverine Execution Services, LLC 10.66 10.32 8.27 10.16 16.34 26,235.66 18.0583 2,468,568.66 22.4785 2,254,717.70 30.9426 987,535.09 23.3250 Jane Street Capital 8.75 7.48 10.26 10.69 0.00 82,232.46 39.5780 5,407,798.43 40.7357 4,699,300.05 54.2523 0.00 0.0000 Material Aspects:

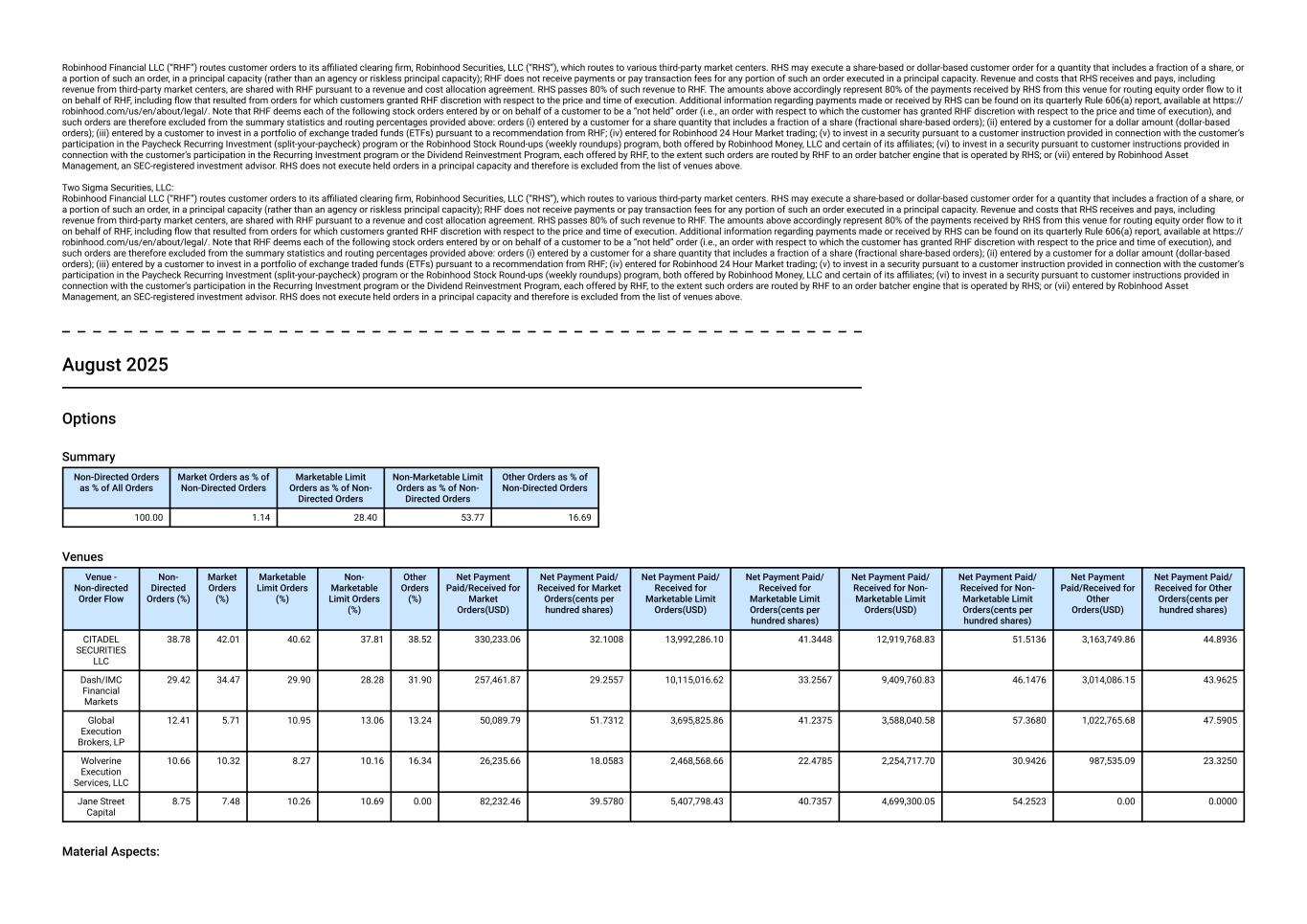

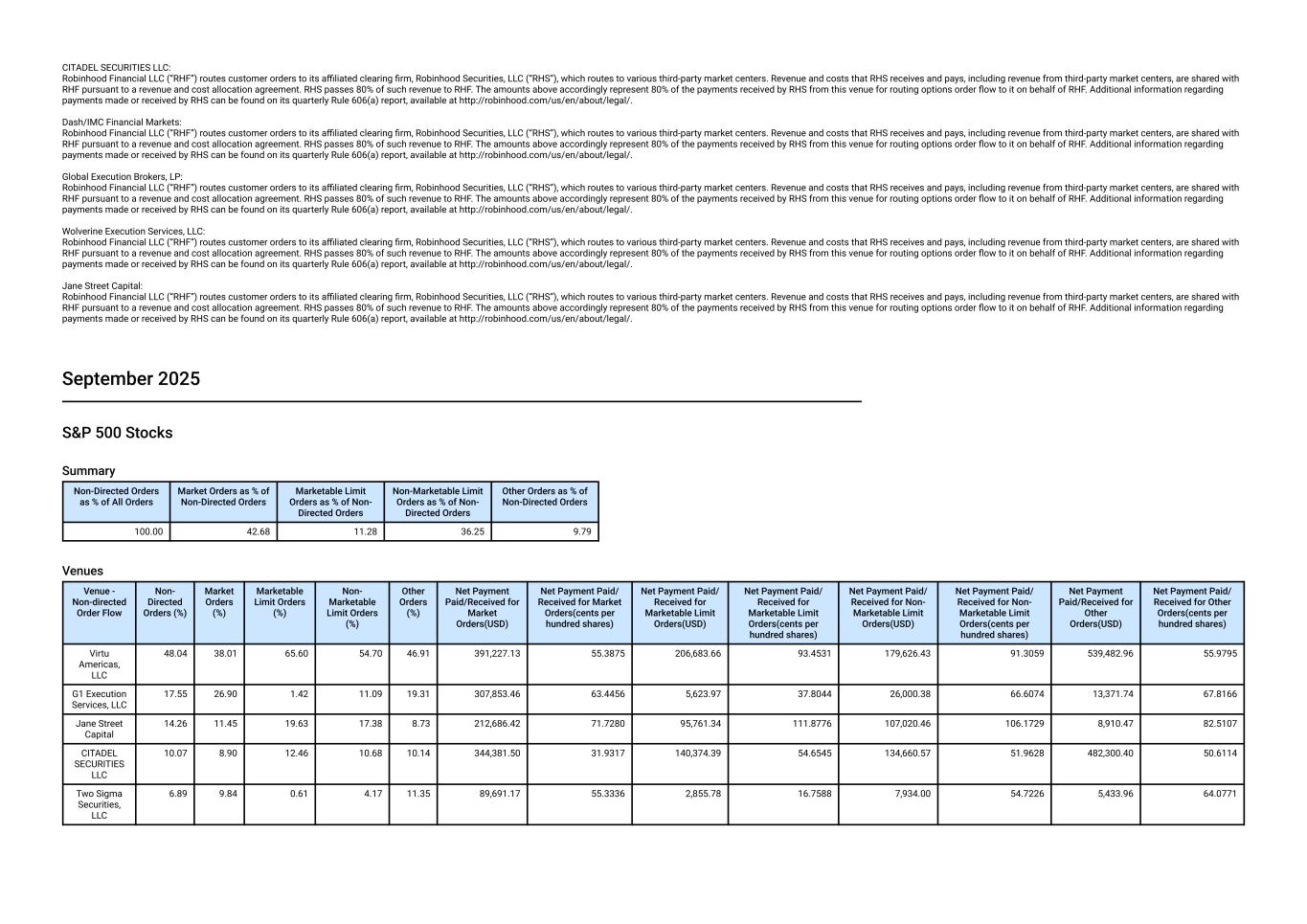

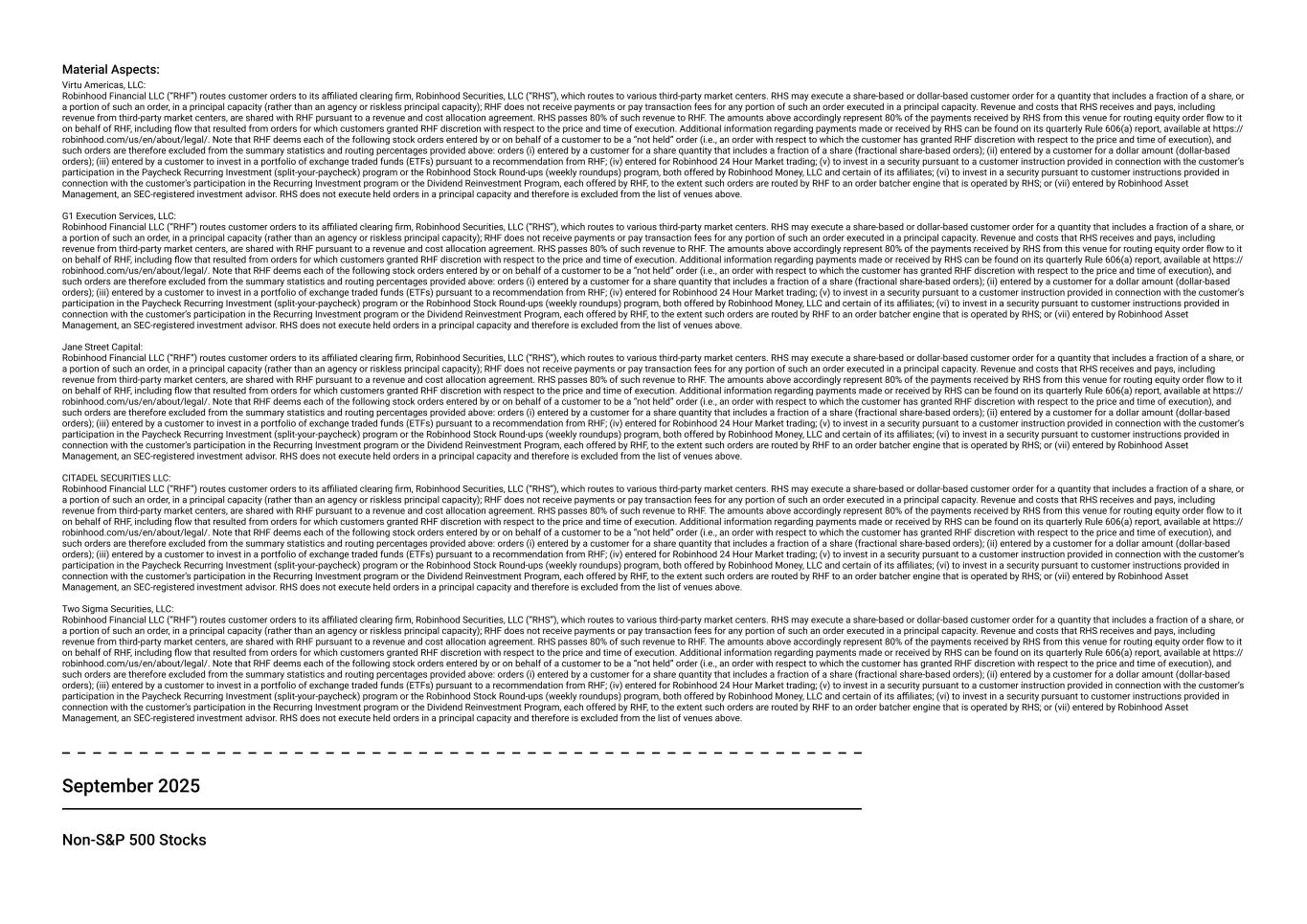

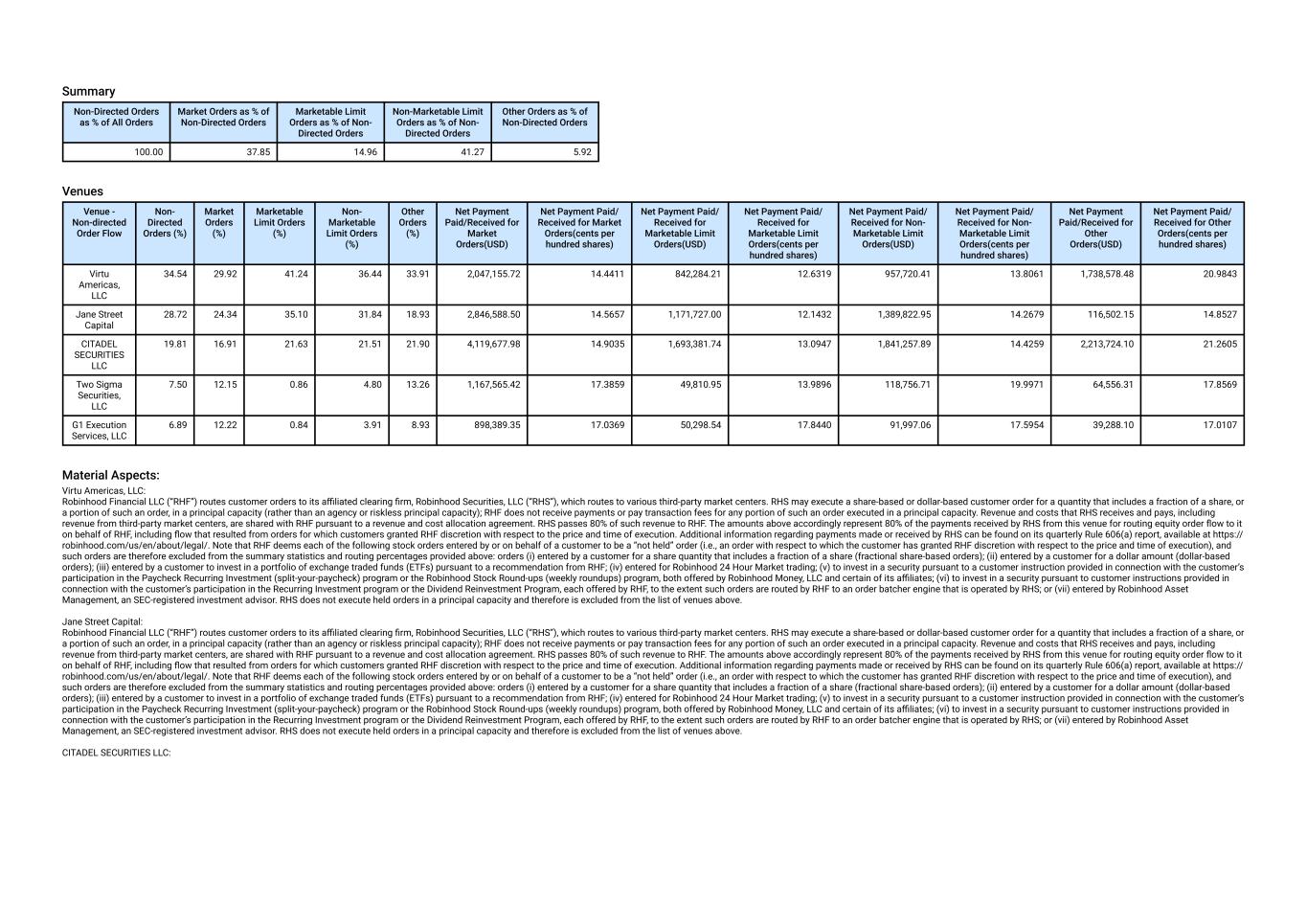

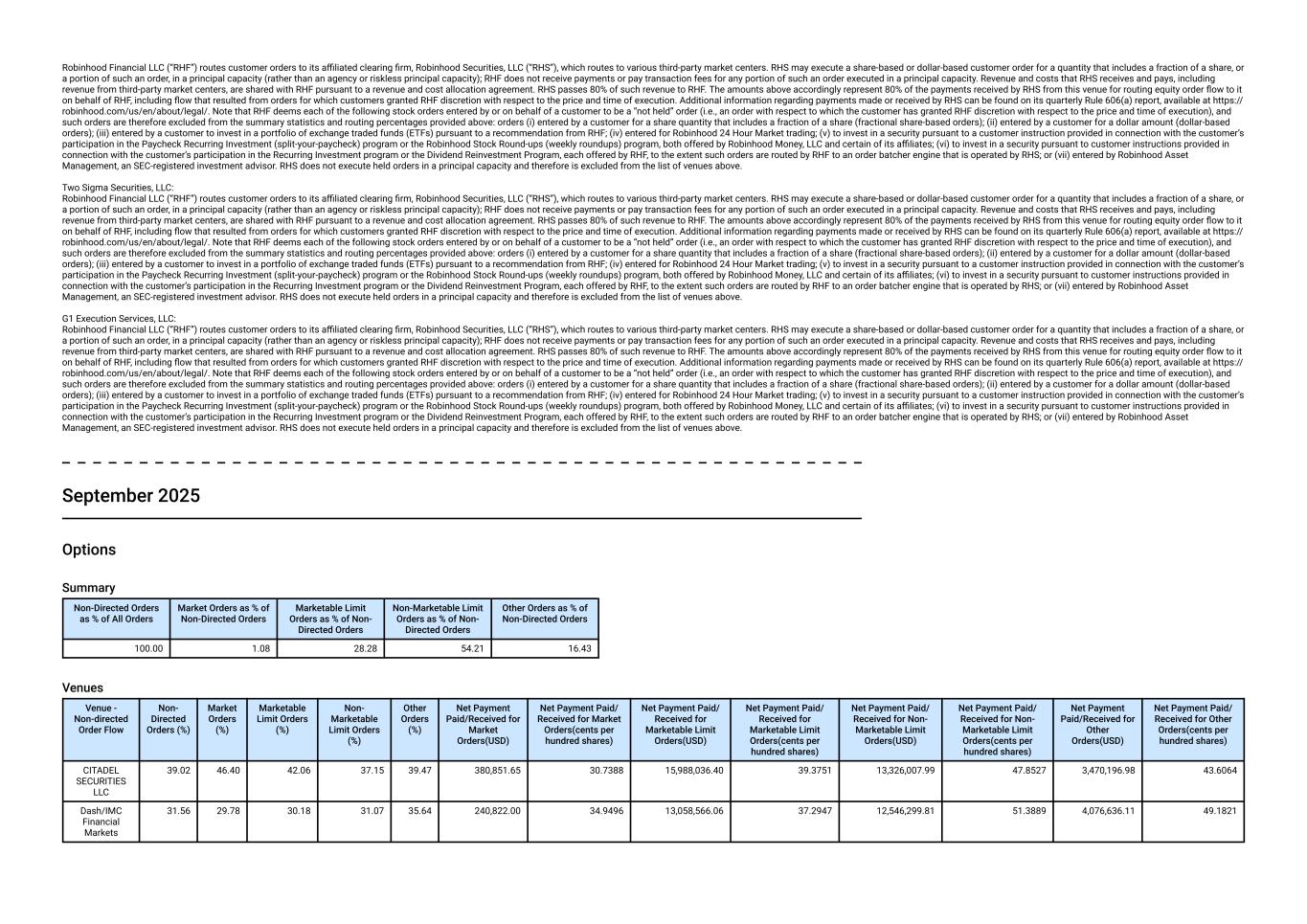

CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. September 2025 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 42.68 11.28 36.25 9.79 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 48.04 38.01 65.60 54.70 46.91 391,227.13 55.3875 206,683.66 93.4531 179,626.43 91.3059 539,482.96 55.9795 G1 Execution Services, LLC 17.55 26.90 1.42 11.09 19.31 307,853.46 63.4456 5,623.97 37.8044 26,000.38 66.6074 13,371.74 67.8166 Jane Street Capital 14.26 11.45 19.63 17.38 8.73 212,686.42 71.7280 95,761.34 111.8776 107,020.46 106.1729 8,910.47 82.5107 CITADEL SECURITIES LLC 10.07 8.90 12.46 10.68 10.14 344,381.50 31.9317 140,374.39 54.6545 134,660.57 51.9628 482,300.40 50.6114 Two Sigma Securities, LLC 6.89 9.84 0.61 4.17 11.35 89,691.17 55.3336 2,855.78 16.7588 7,934.00 54.7226 5,433.96 64.0771