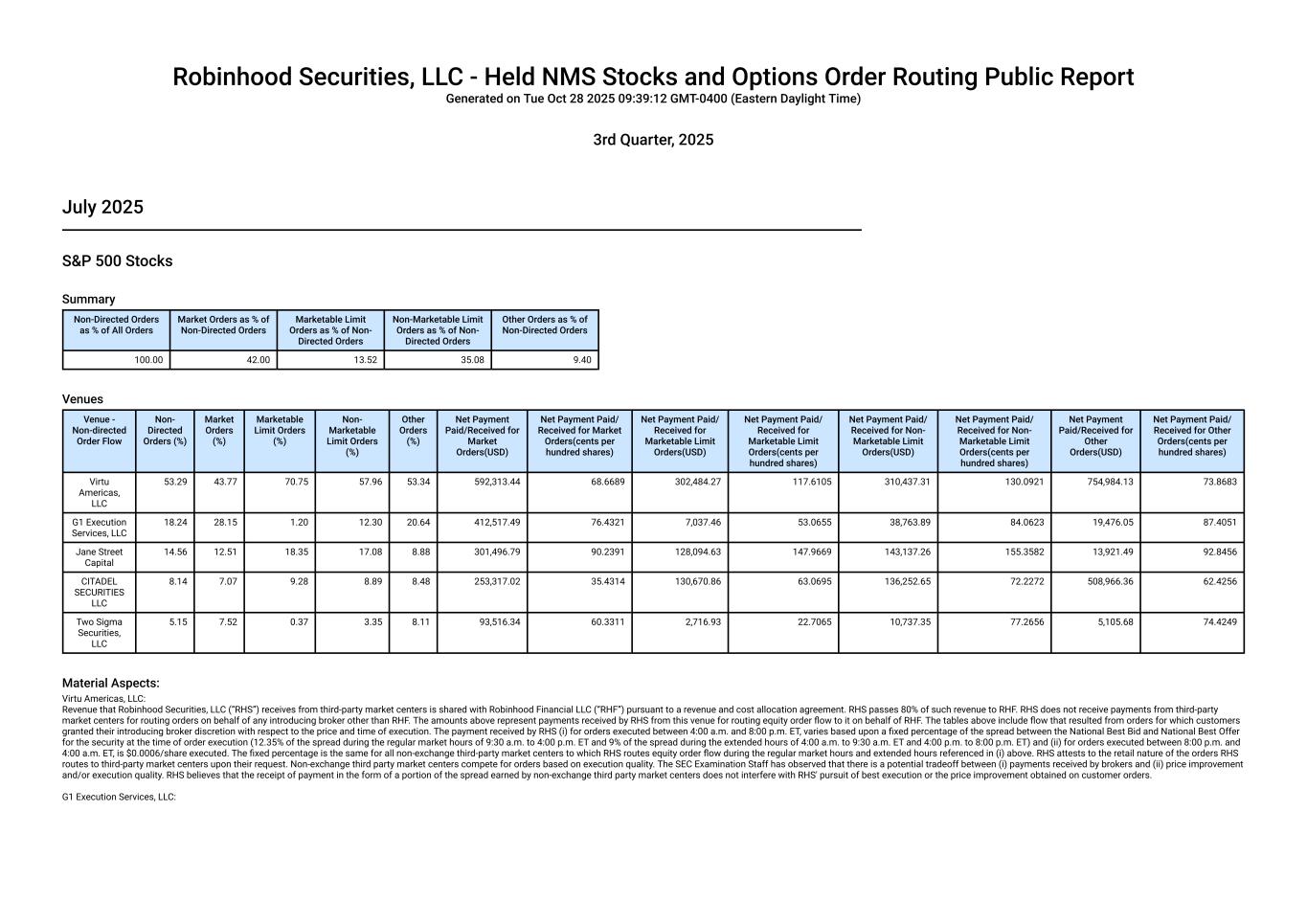

Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Tue Oct 28 2025 09:39:12 GMT-0400 (Eastern Daylight Time) 3rd Quarter, 2025 July 2025 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 42.00 13.52 35.08 9.40 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 53.29 43.77 70.75 57.96 53.34 592,313.44 68.6689 302,484.27 117.6105 310,437.31 130.0921 754,984.13 73.8683 G1 Execution Services, LLC 18.24 28.15 1.20 12.30 20.64 412,517.49 76.4321 7,037.46 53.0655 38,763.89 84.0623 19,476.05 87.4051 Jane Street Capital 14.56 12.51 18.35 17.08 8.88 301,496.79 90.2391 128,094.63 147.9669 143,137.26 155.3582 13,921.49 92.8456 CITADEL SECURITIES LLC 8.14 7.07 9.28 8.89 8.48 253,317.02 35.4314 130,670.86 63.0695 136,252.65 72.2272 508,966.36 62.4256 Two Sigma Securities, LLC 5.15 7.52 0.37 3.35 8.11 93,516.34 60.3311 2,716.93 22.7065 10,737.35 77.2656 5,105.68 74.4249 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC:

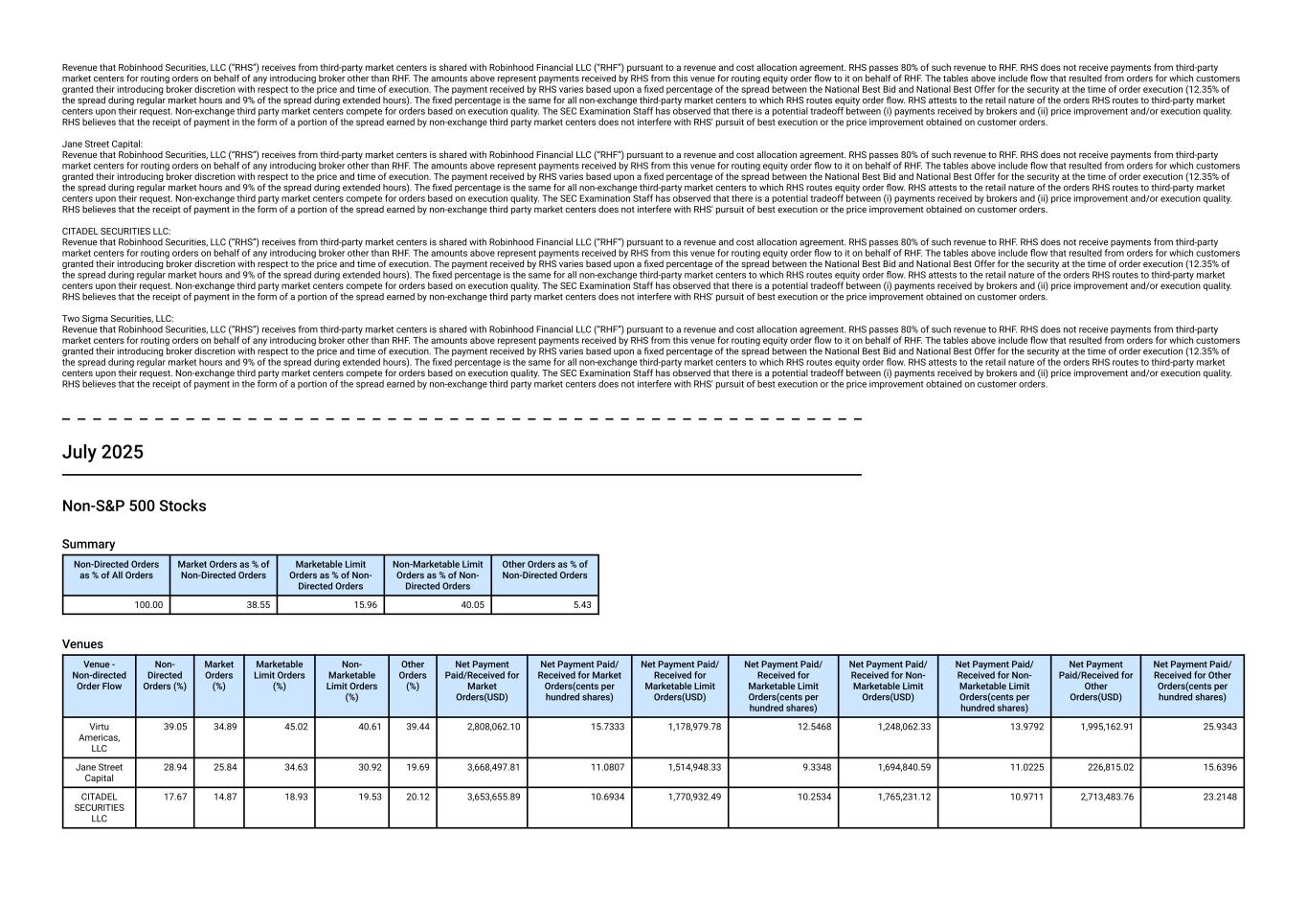

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. July 2025 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 38.55 15.96 40.05 5.43 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 39.05 34.89 45.02 40.61 39.44 2,808,062.10 15.7333 1,178,979.78 12.5468 1,248,062.33 13.9792 1,995,162.91 25.9343 Jane Street Capital 28.94 25.84 34.63 30.92 19.69 3,668,497.81 11.0807 1,514,948.33 9.3348 1,694,840.59 11.0225 226,815.02 15.6396 CITADEL SECURITIES LLC 17.67 14.87 18.93 19.53 20.12 3,653,655.89 10.6934 1,770,932.49 10.2534 1,765,231.12 10.9711 2,713,483.76 23.2148

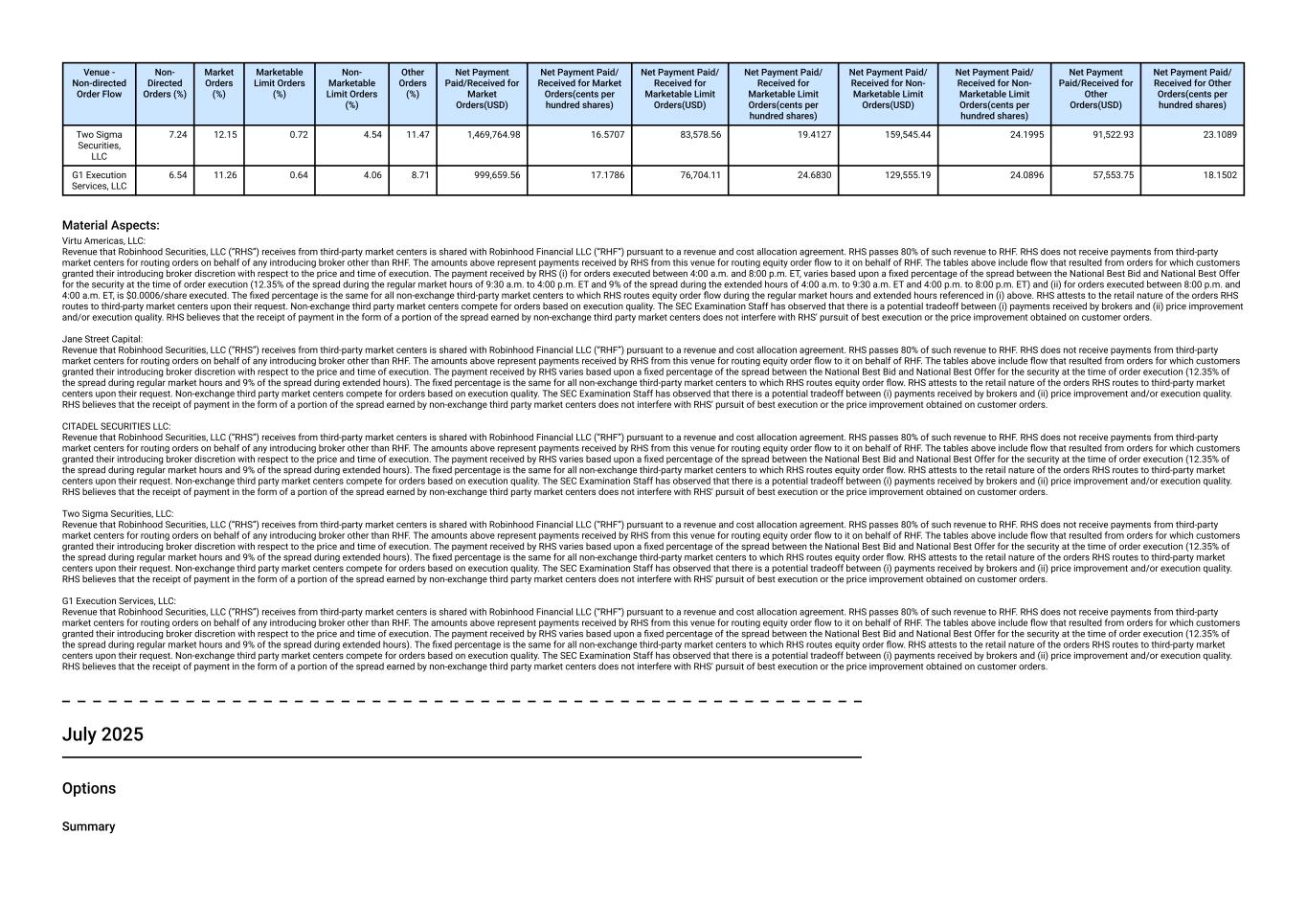

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Two Sigma Securities, LLC 7.24 12.15 0.72 4.54 11.47 1,469,764.98 16.5707 83,578.56 19.4127 159,545.44 24.1995 91,522.93 23.1089 G1 Execution Services, LLC 6.54 11.26 0.64 4.06 8.71 999,659.56 17.1786 76,704.11 24.6830 129,555.19 24.0896 57,553.75 18.1502 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. July 2025 Options Summary

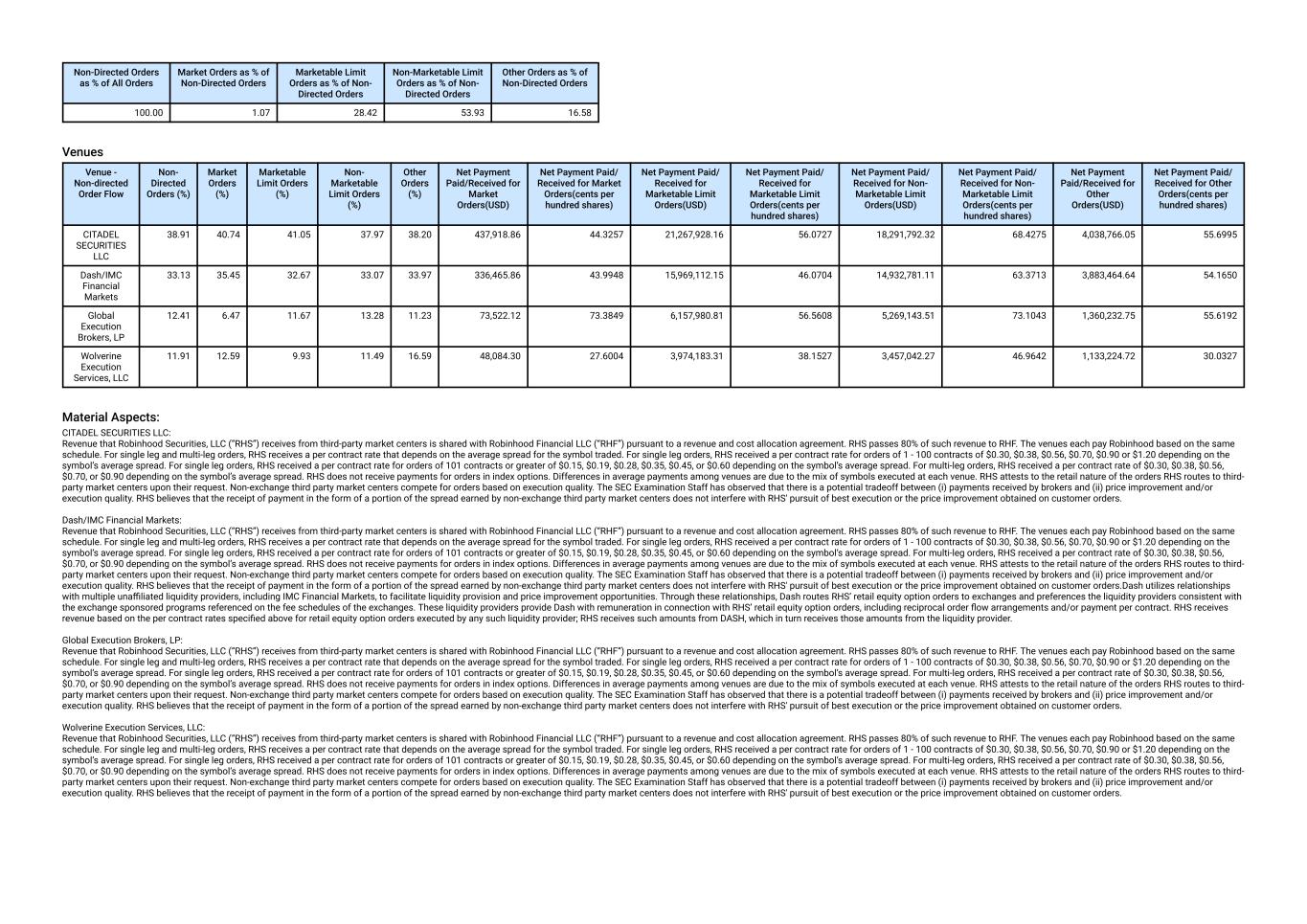

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 1.07 28.42 53.93 16.58 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.91 40.74 41.05 37.97 38.20 437,918.86 44.3257 21,267,928.16 56.0727 18,291,792.32 68.4275 4,038,766.05 55.6995 Dash/IMC Financial Markets 33.13 35.45 32.67 33.07 33.97 336,465.86 43.9948 15,969,112.15 46.0704 14,932,781.11 63.3713 3,883,464.64 54.1650 Global Execution Brokers, LP 12.41 6.47 11.67 13.28 11.23 73,522.12 73.3849 6,157,980.81 56.5608 5,269,143.51 73.1043 1,360,232.75 55.6192 Wolverine Execution Services, LLC 11.91 12.59 9.93 11.49 16.59 48,084.30 27.6004 3,974,183.31 38.1527 3,457,042.27 46.9642 1,133,224.72 30.0327 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

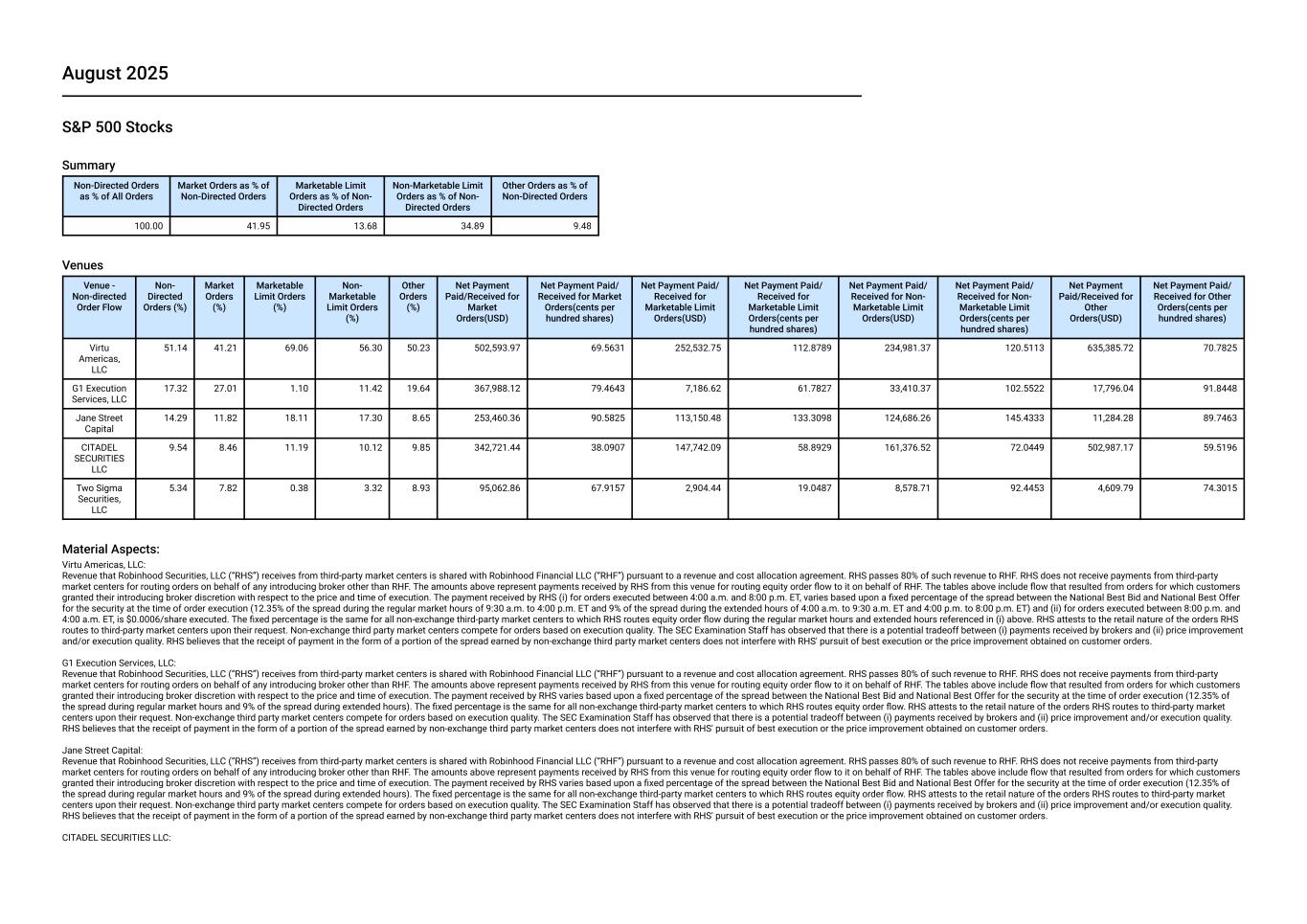

August 2025 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 41.95 13.68 34.89 9.48 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 51.14 41.21 69.06 56.30 50.23 502,593.97 69.5631 252,532.75 112.8789 234,981.37 120.5113 635,385.72 70.7825 G1 Execution Services, LLC 17.32 27.01 1.10 11.42 19.64 367,988.12 79.4643 7,186.62 61.7827 33,410.37 102.5522 17,796.04 91.8448 Jane Street Capital 14.29 11.82 18.11 17.30 8.65 253,460.36 90.5825 113,150.48 133.3098 124,686.26 145.4333 11,284.28 89.7463 CITADEL SECURITIES LLC 9.54 8.46 11.19 10.12 9.85 342,721.44 38.0907 147,742.09 58.8929 161,376.52 72.0449 502,987.17 59.5196 Two Sigma Securities, LLC 5.34 7.82 0.38 3.32 8.93 95,062.86 67.9157 2,904.44 19.0487 8,578.71 92.4453 4,609.79 74.3015 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC:

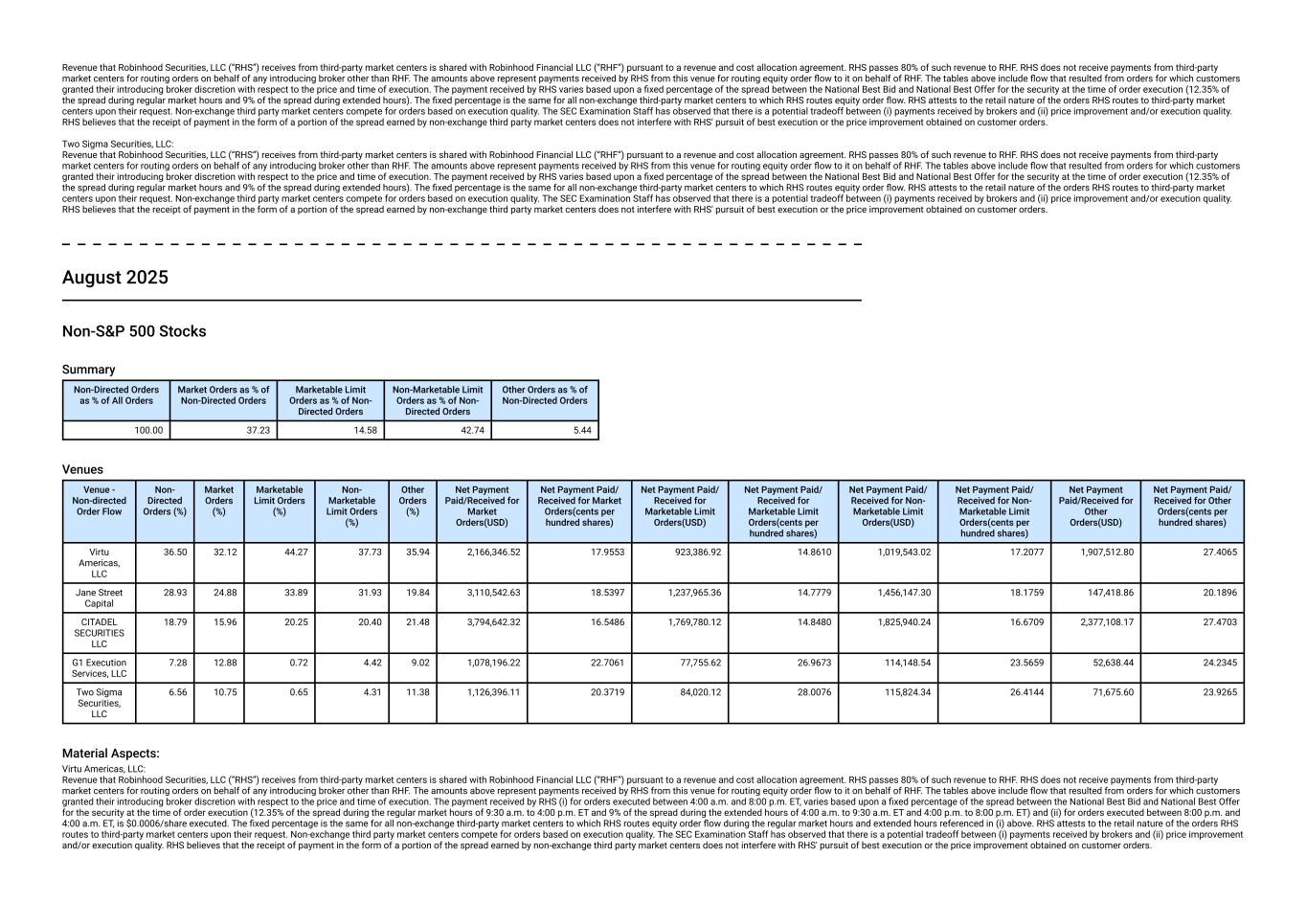

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. August 2025 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 37.23 14.58 42.74 5.44 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 36.50 32.12 44.27 37.73 35.94 2,166,346.52 17.9553 923,386.92 14.8610 1,019,543.02 17.2077 1,907,512.80 27.4065 Jane Street Capital 28.93 24.88 33.89 31.93 19.84 3,110,542.63 18.5397 1,237,965.36 14.7779 1,456,147.30 18.1759 147,418.86 20.1896 CITADEL SECURITIES LLC 18.79 15.96 20.25 20.40 21.48 3,794,642.32 16.5486 1,769,780.12 14.8480 1,825,940.24 16.6709 2,377,108.17 27.4703 G1 Execution Services, LLC 7.28 12.88 0.72 4.42 9.02 1,078,196.22 22.7061 77,755.62 26.9673 114,148.54 23.5659 52,638.44 24.2345 Two Sigma Securities, LLC 6.56 10.75 0.65 4.31 11.38 1,126,396.11 20.3719 84,020.12 28.0076 115,824.34 26.4144 71,675.60 23.9265 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

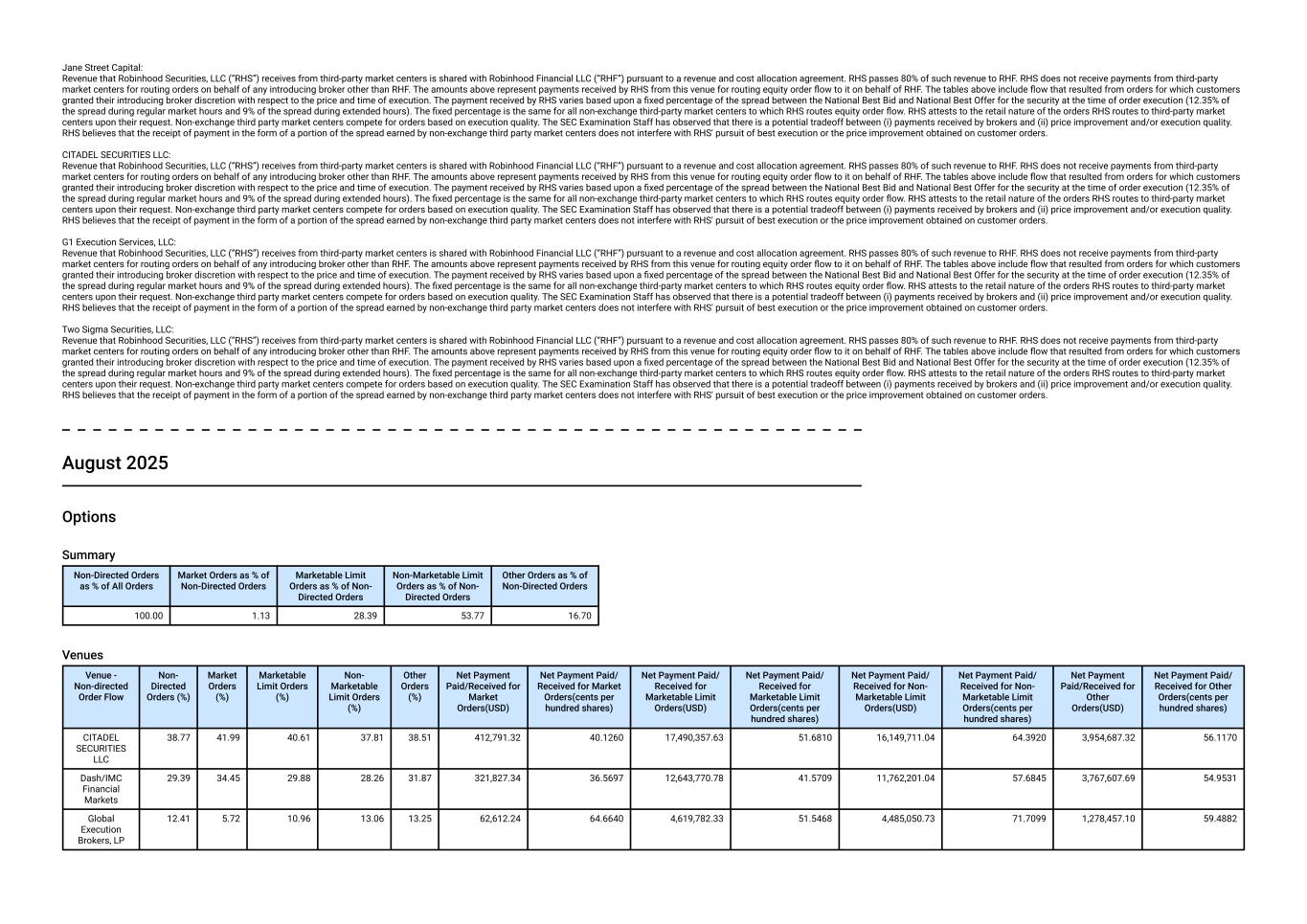

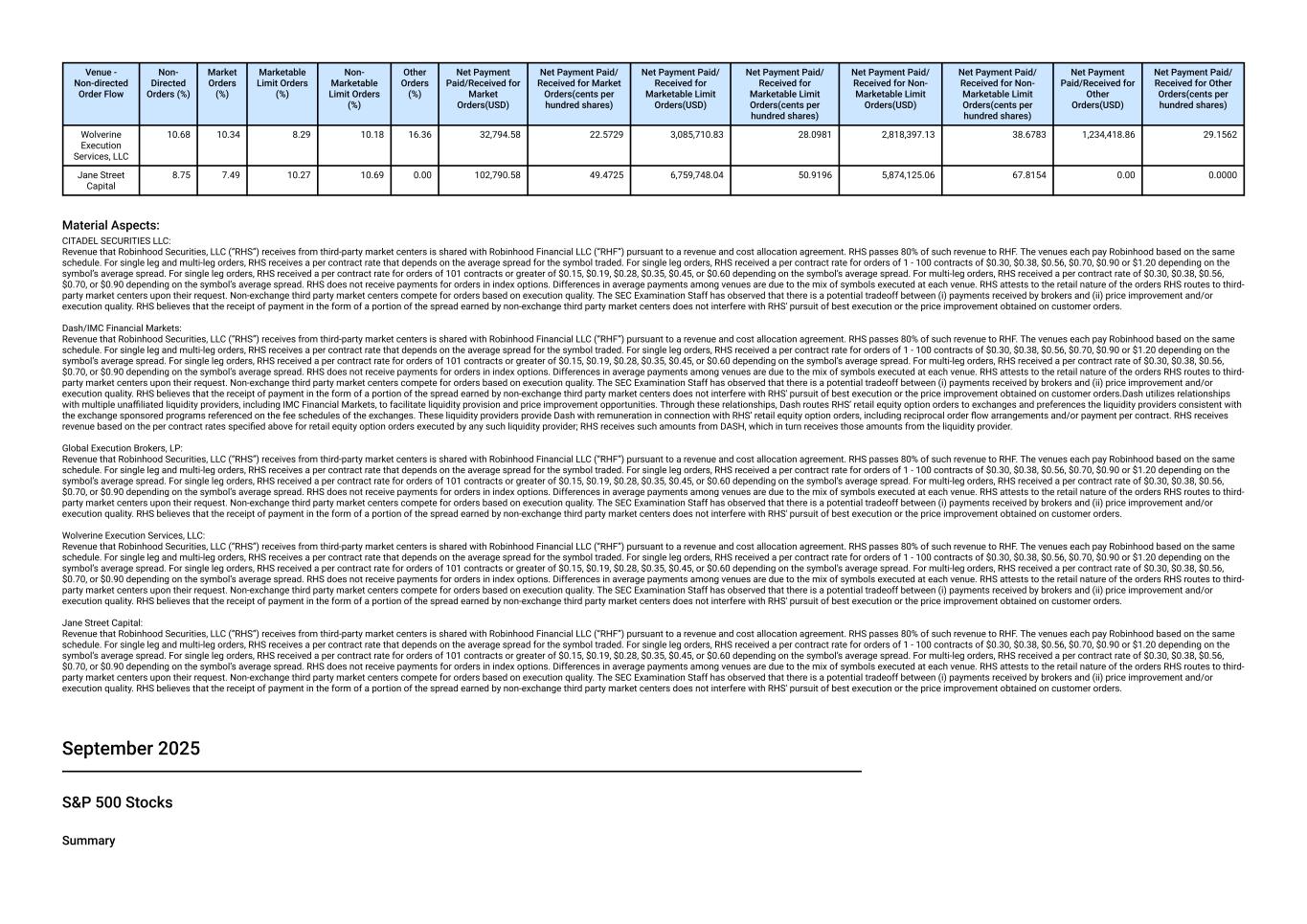

Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. August 2025 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 1.13 28.39 53.77 16.70 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.77 41.99 40.61 37.81 38.51 412,791.32 40.1260 17,490,357.63 51.6810 16,149,711.04 64.3920 3,954,687.32 56.1170 Dash/IMC Financial Markets 29.39 34.45 29.88 28.26 31.87 321,827.34 36.5697 12,643,770.78 41.5709 11,762,201.04 57.6845 3,767,607.69 54.9531 Global Execution Brokers, LP 12.41 5.72 10.96 13.06 13.25 62,612.24 64.6640 4,619,782.33 51.5468 4,485,050.73 71.7099 1,278,457.10 59.4882

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Wolverine Execution Services, LLC 10.68 10.34 8.29 10.18 16.36 32,794.58 22.5729 3,085,710.83 28.0981 2,818,397.13 38.6783 1,234,418.86 29.1562 Jane Street Capital 8.75 7.49 10.27 10.69 0.00 102,790.58 49.4725 6,759,748.04 50.9196 5,874,125.06 67.8154 0.00 0.0000 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.Dash utilizes relationships with multiple unaffiliated liquidity providers, including IMC Financial Markets, to facilitate liquidity provision and price improvement opportunities. Through these relationships, Dash routes RHS’ retail equity option orders to exchanges and preferences the liquidity providers consistent with the exchange sponsored programs referenced on the fee schedules of the exchanges. These liquidity providers provide Dash with remuneration in connection with RHS’ retail equity option orders, including reciprocal order flow arrangements and/or payment per contract. RHS receives revenue based on the per contract rates specified above for retail equity option orders executed by any such liquidity provider; RHS receives such amounts from DASH, which in turn receives those amounts from the liquidity provider. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg and multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. For single leg orders, RHS received a per contract rate for orders of 1 - 100 contracts of $0.30, $0.38, $0.56, $0.70, $0.90 or $1.20 depending on the symbol’s average spread. For single leg orders, RHS received a per contract rate for orders of 101 contracts or greater of $0.15, $0.19, $0.28, $0.35, $0.45, or $0.60 depending on the symbol’s average spread. For multi-leg orders, RHS received a per contract rate of $0.30, $0.38, $0.56, $0.70, or $0.90 depending on the symbol’s average spread. RHS does not receive payments for orders in index options. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third- party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. September 2025 S&P 500 Stocks Summary

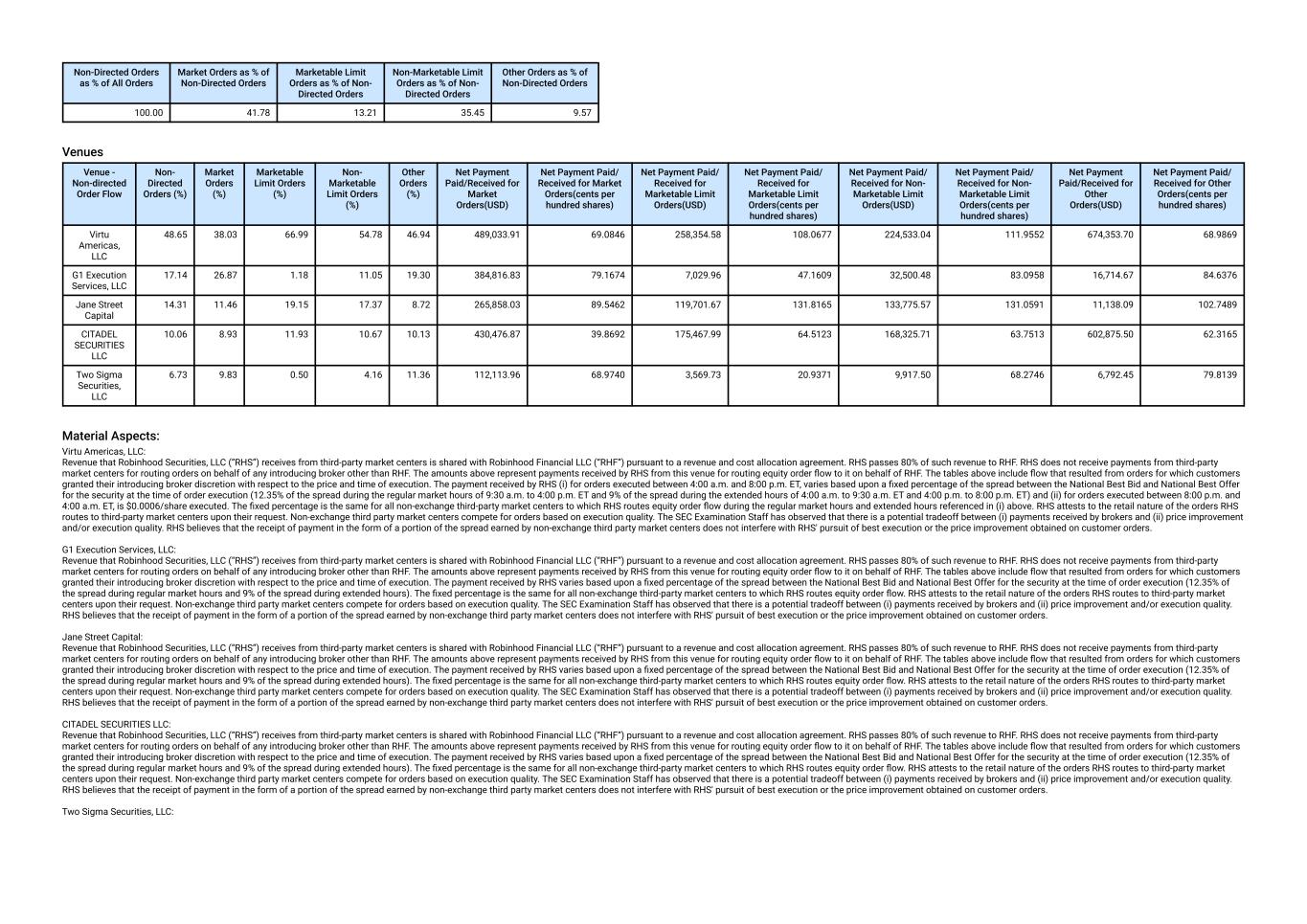

Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 41.78 13.21 35.45 9.57 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 48.65 38.03 66.99 54.78 46.94 489,033.91 69.0846 258,354.58 108.0677 224,533.04 111.9552 674,353.70 68.9869 G1 Execution Services, LLC 17.14 26.87 1.18 11.05 19.30 384,816.83 79.1674 7,029.96 47.1609 32,500.48 83.0958 16,714.67 84.6376 Jane Street Capital 14.31 11.46 19.15 17.37 8.72 265,858.03 89.5462 119,701.67 131.8165 133,775.57 131.0591 11,138.09 102.7489 CITADEL SECURITIES LLC 10.06 8.93 11.93 10.67 10.13 430,476.87 39.8692 175,467.99 64.5123 168,325.71 63.7513 602,875.50 62.3165 Two Sigma Securities, LLC 6.73 9.83 0.50 4.16 11.36 112,113.96 68.9740 3,569.73 20.9371 9,917.50 68.2746 6,792.45 79.8139 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Two Sigma Securities, LLC:

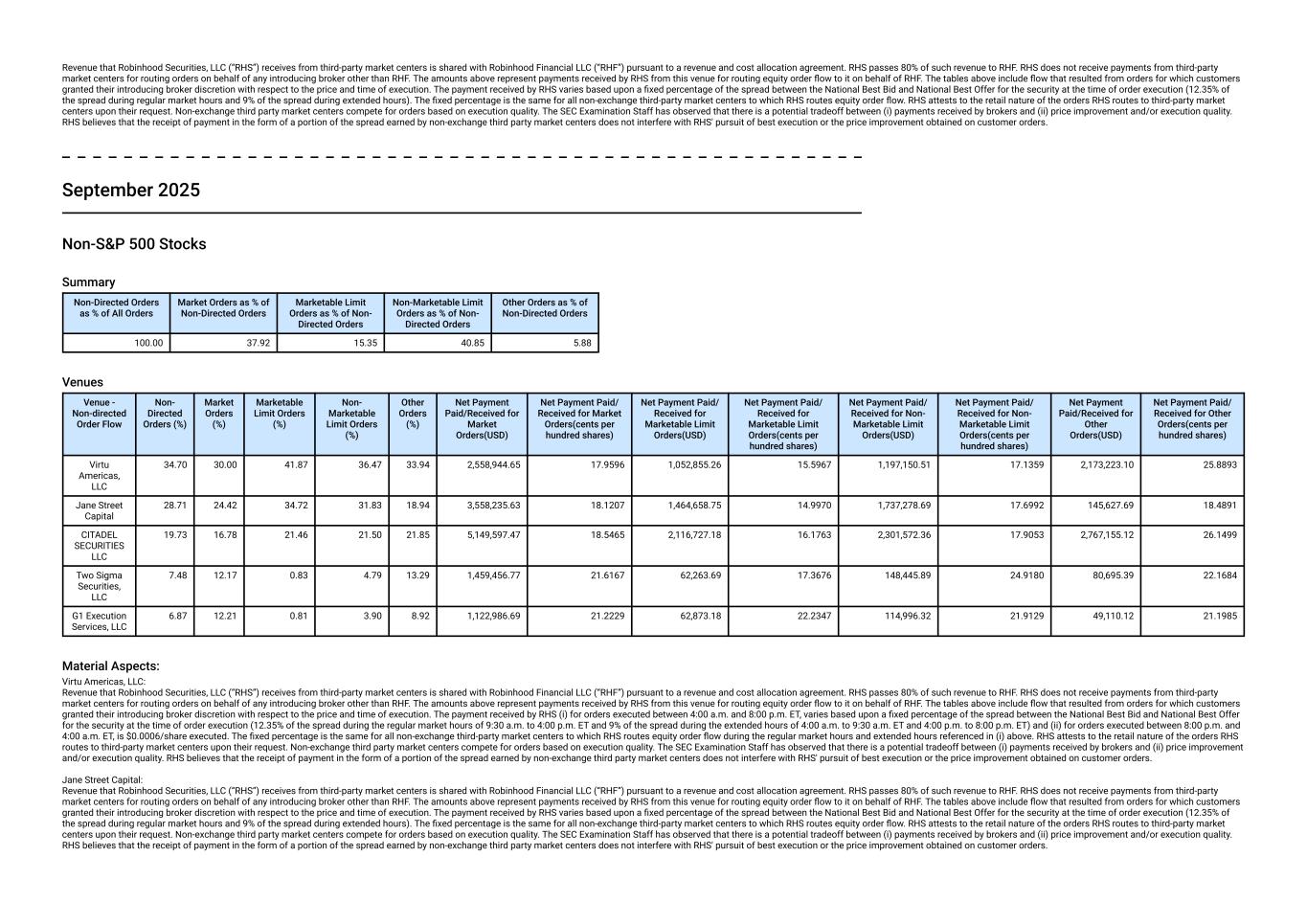

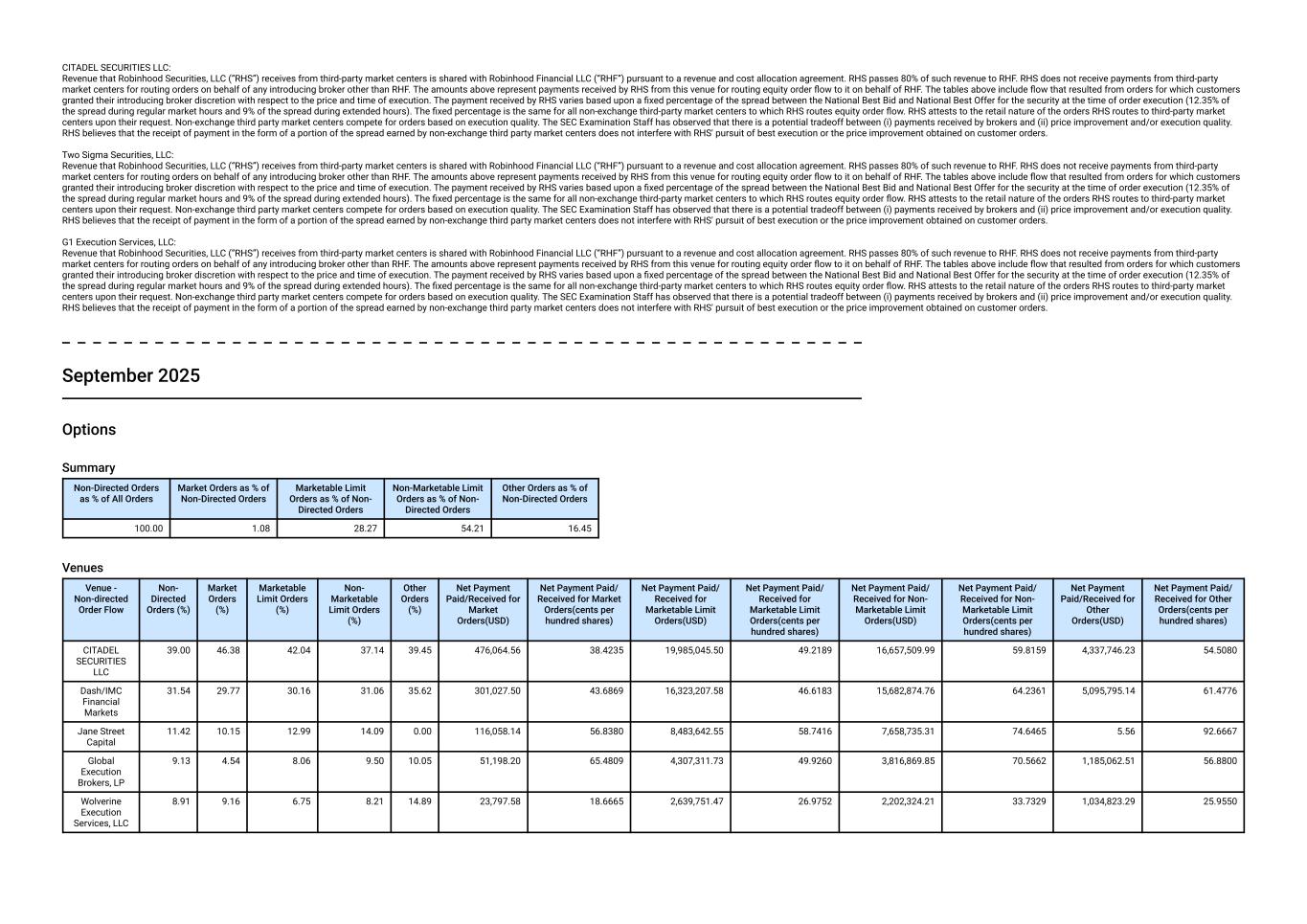

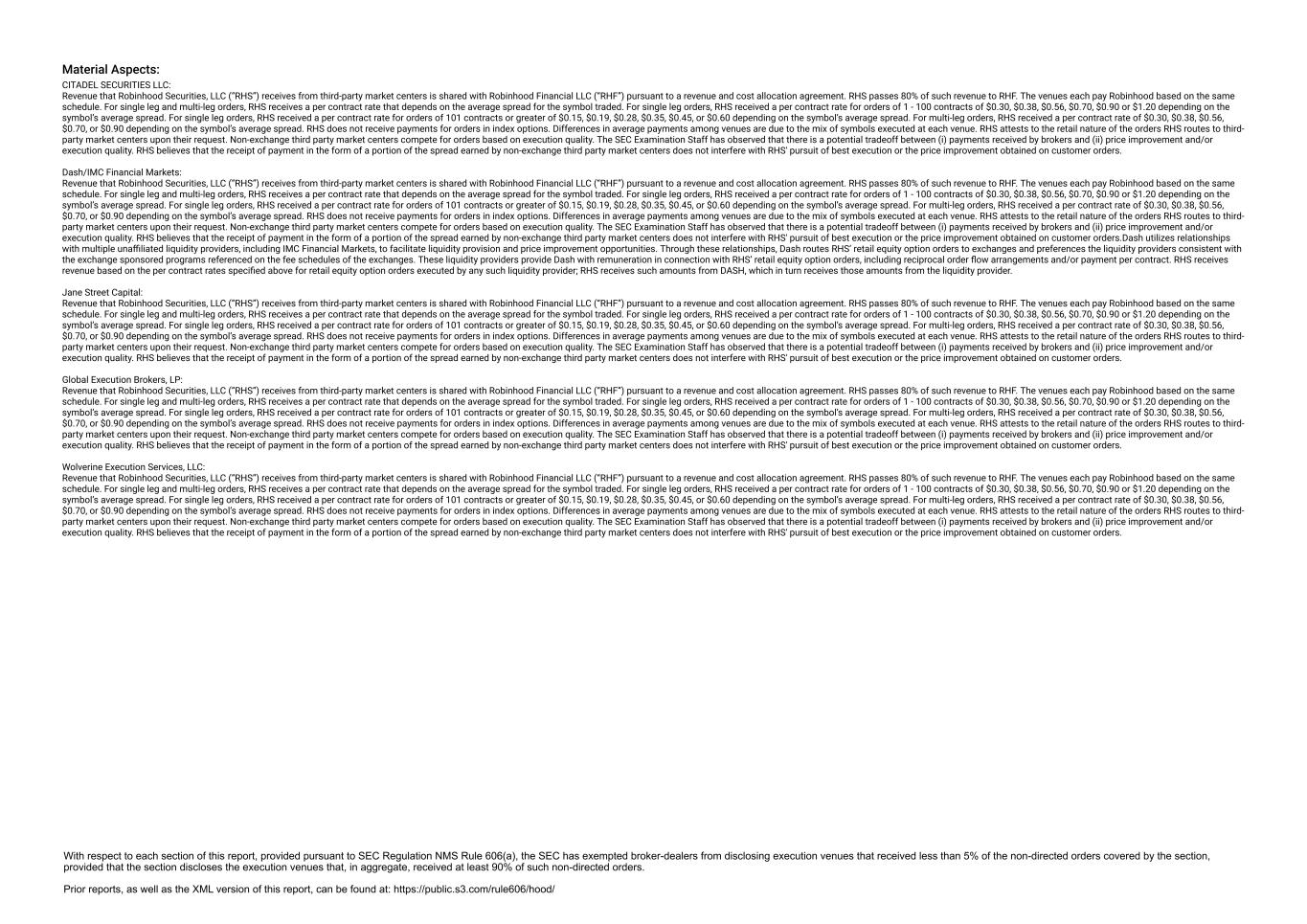

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. September 2025 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 37.92 15.35 40.85 5.88 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 34.70 30.00 41.87 36.47 33.94 2,558,944.65 17.9596 1,052,855.26 15.5967 1,197,150.51 17.1359 2,173,223.10 25.8893 Jane Street Capital 28.71 24.42 34.72 31.83 18.94 3,558,235.63 18.1207 1,464,658.75 14.9970 1,737,278.69 17.6992 145,627.69 18.4891 CITADEL SECURITIES LLC 19.73 16.78 21.46 21.50 21.85 5,149,597.47 18.5465 2,116,727.18 16.1763 2,301,572.36 17.9053 2,767,155.12 26.1499 Two Sigma Securities, LLC 7.48 12.17 0.83 4.79 13.29 1,459,456.77 21.6167 62,263.69 17.3676 148,445.89 24.9180 80,695.39 22.1684 G1 Execution Services, LLC 6.87 12.21 0.81 3.90 8.92 1,122,986.69 21.2229 62,873.18 22.2347 114,996.32 21.9129 49,110.12 21.1985 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS (i) for orders executed between 4:00 a.m. and 8:00 p.m. ET, varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during the regular market hours of 9:30 a.m. to 4:00 p.m. ET and 9% of the spread during the extended hours of 4:00 a.m. to 9:30 a.m. ET and 4:00 p.m. to 8:00 p.m. ET) and (ii) for orders executed between 8:00 p.m. and 4:00 a.m. ET, is $0.0006/share executed. The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow during the regular market hours and extended hours referenced in (i) above. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. RHS does not receive payments from third-party market centers for routing orders on behalf of any introducing broker other than RHF. The amounts above represent payments received by RHS from this venue for routing equity order flow to it on behalf of RHF. The tables above include flow that resulted from orders for which customers granted their introducing broker discretion with respect to the price and time of execution. The payment received by RHS varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.