787 Seventh Avenue

New York, NY 10019-6099

Tel: 212 728 8000

Fax: 212 728 8111

|

|

||||

| 787 Seventh Avenue New York, NY 10019-6099 Tel: 212 728 8000 Fax: 212 728 8111 |

May 24, 2024

David L. Orlic, Esq.

Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549

| Re: |

BlackRock California Municipal Income Trust BlackRock Capital Allocation Term Trust BlackRock ESG Capital Allocation Term Trust BlackRock Health Sciences Term Trust BlackRock Innovation and Growth Term Trust BlackRock MuniHoldings New York Quality Fund, Inc. BlackRock MuniYield New York Quality Fund, Inc. BlackRock MuniYield Pennsylvania Quality Fund BlackRock New York Municipal Income Trust BlackRock Science and Technology Term Trust Violations of the Proxy Rules under the Securities Exchange Act of 1934 (the “Exchange Act”) – May 20, 2024 Saba Webinar |

Ladies and Gentlemen:

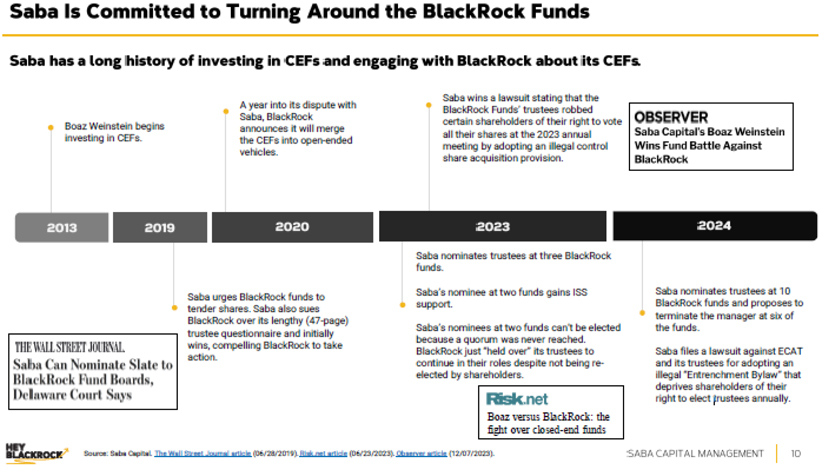

On behalf of our clients BlackRock California Municipal Income Trust (“BFZ”), BlackRock Capital Allocation Term Trust (“BCAT”), BlackRock ESG Capital Allocation Term Trust (“ECAT”), BlackRock Health Sciences Term Trust (“BMEZ”), BlackRock Innovation and Growth Term Trust (“BIGZ”), BlackRock MuniHoldings New York Quality Fund, Inc. (“MHN”), BlackRock MuniYield New York Quality Fund, Inc. (“MYN”), BlackRock MuniYield Pennsylvania Quality Fund (“MPA”), BlackRock New York Municipal Income Trust (“BNY”) and BlackRock Science and Technology Term Trust (“BSTZ,” and collectively with BFZ, BCAT, ECAT, BMEZ, BIGZ, MHN, MYN, MPA and BNY, the “Funds”), we respectfully bring to the attention of the staff (the “Staff”) of the Division of Investment Management of the Securities and Exchange Commission (the “Commission”) material violations of Rule 14a-9 under the Exchange Act made in a webinar led by Mr. Boaz Weinstein, Founder and Chief Investment Officer of Saba Capital Management, L.P. (“Saba Capital,” and with its affiliates, “Saba”), on Monday, May 20, 2024 (the “Saba Webinar”), and a presentation for the Saba Webinar filed by Saba with the Commission on Schedule 14A on form type DFAN 14A on May 20, 2024 (the “Presentation”). Each of Saba Capital and Mr. Weinstein, the Managing Member of the general partner of Saba Capital, is a “participant in a solicitation” (as defined in Rule 14a-101 under the Exchange Act) with respect to each Fund.

BRUSSELS CHICAGO DALLAS FRANKFURT HOUSTON LONDON LOS ANGELES MILAN

MUNICH NEW YORK PALO ALTO PARIS ROME SAN FRANCISCO WASHINGTON

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

As described below, certain statements made and information presented by Mr. Weinstein during the Saba Webinar and in the Presentation, which have since been made publicly available on Saba Capital’s website “heyblackrock.com” (the “Website”), violate Rule 14a-9. Additionally, as detailed in our letters dated May 13, 2024 and May 15, 2024, Saba Capital and Mr. Weinstein have made numerous other public statements on X.com, on the Website, and on live television that violate Rule 14a-9. We respectfully request that the Staff take action to protect the Funds’ shareholders from the negative impact of such violations and false, misleading, unsubstantiated, incomplete and inaccurate information put forth by Mr. Weinstein as detailed below and in our letters dated May 13, 2024 and May 15, 2024.

Below, we set out in italicized typeface (certain text bolded for emphasis) examples of relevant statements made and information presented by Mr. Weinstein during the Saba Webinar and/or included in the Presentation that violate Rule 14a-9. We have also included explanations of how such statements and information violate Rule 14a-9.

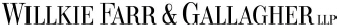

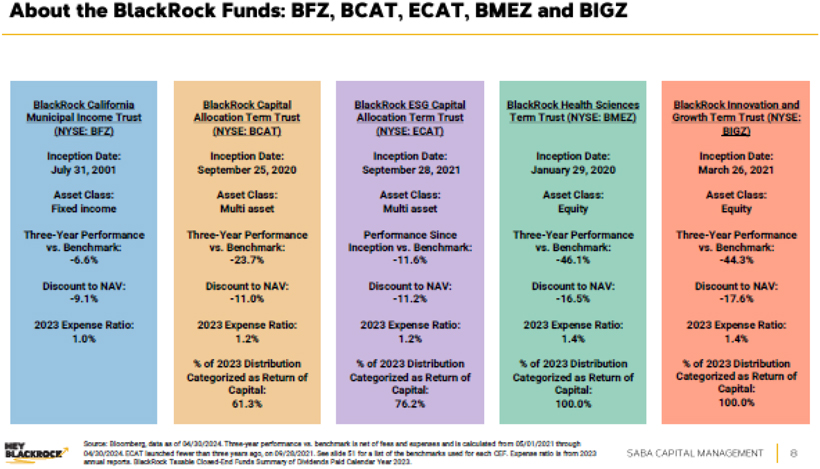

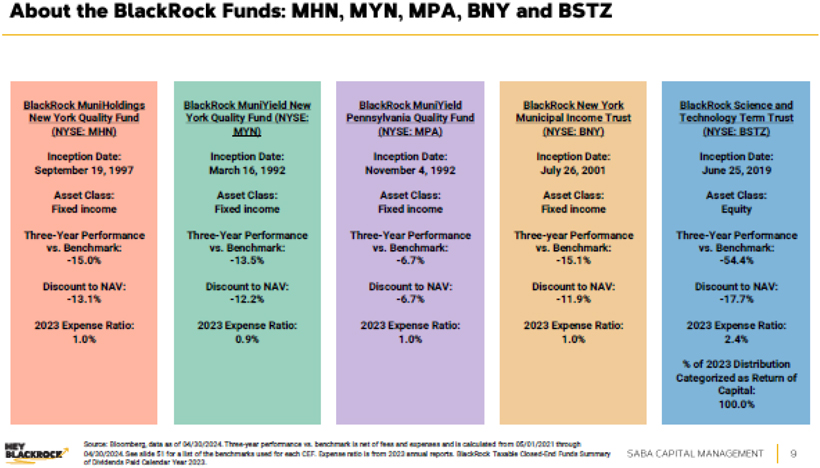

| 1. | Saba Materially Misstated BSTZ’s Expense Ratio (see Exhibit A) |

In the Saba Webinar and in the Presentation, Saba included purported expense ratios of each of the Funds, and noted in the Presentation that the source of the expense ratios was the Funds’ 2023 annual shareholder reports. However, the purported expense ratios are incorrect and do not correspond with the expense ratios present in the 2023 annual shareholder reports. Saba’s purported expense ratio for BSTZ is 2.39%, which is materially misleading, as BSTZ’s expense ratio is actually 1.34% (as reported in BSTZ’s 2023 annual shareholder report).

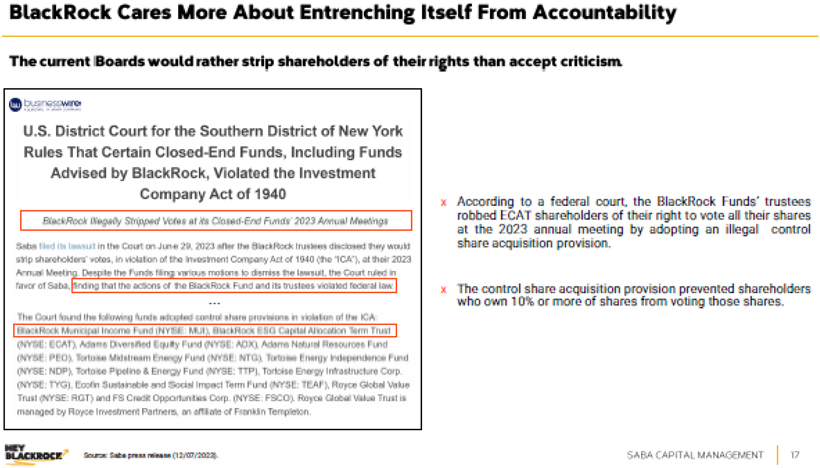

| 2. | “BlackRock Cares More About Entrenching Itself From Accountability” (see Exhibit B) |

“The current Boards would rather strip shareholders of their rights than accept criticism.” (see Exhibit B)

These statements are false, as well as misleading as they impugn BlackRock’s and each Fund board member’s “character, integrity [and] personal reputation” and “make[] charges concerning improper, illegal or immoral conduct or associations, without factual foundation.”1

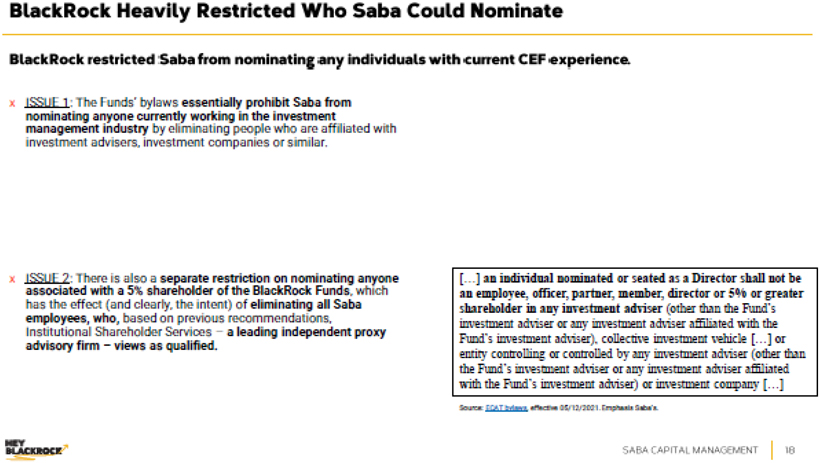

| 3. | “BlackRock Heavily Restricted Who Saba Could Nominate” (see Exhibit C) |

“BlackRock restricted Saba from nominating any individuals with current CEF experience.” (see Exhibit C)

“The Funds’ bylaws essentially prohibit Saba from nominating anyone currently working in the investment management industry by eliminating people who are affiliated with investment advisers, investment companies or similar.” (see Exhibit C)

“There is also a separate restriction on nominating anyone associated with a 5% shareholder of the BlackRock Funds, which has the effect (and clearly, the intent) of eliminating all Saba employees...” (see Exhibit C)

“First, BlackRock limited who we could put on a board. They can’t work for a financial institution, they can’t have been paid by Saba, though of course they’re paying their board members.”

These statements are again false and extremely misleading. Saba quotes provisions from ECAT’s bylaws that are designed to prevent conflicts of interest between nominees for the boards and the Funds.

1 See Note (b) to Rule 14a-9.

2

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Further, the claim that it is the “intent” of the Funds’ bylaws to “eliminat[e] all Saba employees” for nomination to the Funds’ boards is unsubstantiated, as well as misleading, as it impugns each Fund board member’s “character, integrity [and] personal reputation” and “makes charges concerning improper, illegal or immoral conduct or associations, without factual foundation.”2

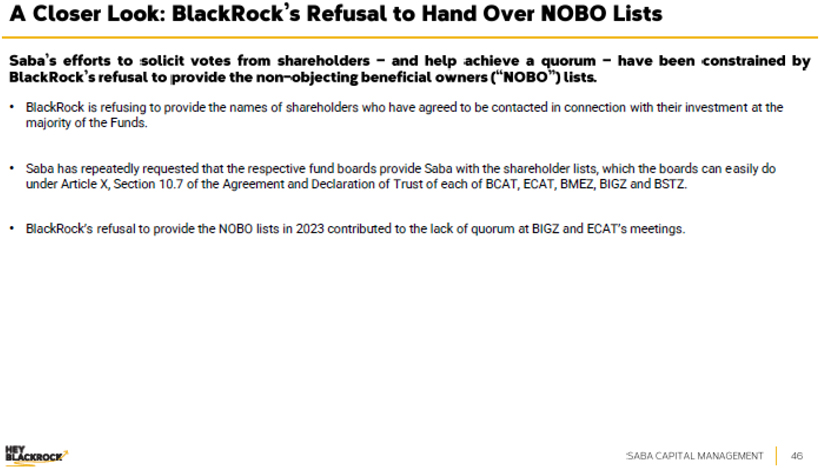

| 4. | “And also along the way, once in a while, we have a campaign that gets to the stage where we get sent the list of all of the shareholders that asked to be contacted, the non-objecting beneficial owners, NOBO. So you fill out your account at Schwab or Fidelity or what have you, and you’re asked, do you want to be contacted? Do you want to be contacted if it’s contested? Because if it’s uncontested, there’s no point. But if it’s contested, do you want to be contacted yes or no? And we had this campaign with BlackRock last year and last year just, and I think this year though, I think they’re still trying to figure out what has more PR damage for them to give us the list or not. Last year, they would not give us the list of names and addresses of people that said, please contact me – both sides – if there is a contested election because presumably in a contested election, you want to hear from both sides. That’s the whole point. And we were unable to get that list because BlackRock withheld it from us.” |

“Saba’s efforts to solicit votes from shareholders – and help achieve a quorum – have been constrained by BlackRock’s refusal to provide the non-objecting beneficial owners (“NOBO”) lists.” (see Exhibit D)

“BlackRock is refusing to provide the names of shareholders who have agreed to be contacted in connection with their investment at the majority of the Funds.” (see Exhibit D)

These statements are false, and in certain respects, incorrect as a matter of law. Rules 14b-1(b)(3)(i) and 14b-2(b)(4)(ii) and (iii) under the Exchange Act provide that a “broker or dealer” or “bank” is required to provide non-objecting beneficial owner information to “the registrant”, i.e., the Funds. Further, the Funds have provided or are in the process of providing, in a timely manner, Saba and Mr. Weinstein with all shareholder records required to be provided under the Funds’ governing documents and/or applicable law in response to proper requests from Saba and/or Mr. Weinstein.

| 5. | “Two of these funds have a different governance than the other eight and the two of those funds, I wonder if anyone can guess which two funds have better governance, which two funds do not trap shareholders in quite the same way. There’s some bad governance, but it’s bad. What we have found, and we’ve studied it, literally studied it, is that the worse the governance is, the harder it is, the more entrapped a shareholder is where they have no hope of us or someone else, the bigger the discount. So the two funds with the better governance are BFZ and MPA. They’re the only two trading at smaller discounts because investors actually think there’s a higher likelihood that we’ll win because some of the tactics used in the worst governance funds, the other eight are not possible in these.” |

Mr. Weinstein claims that BFZ and MPA have “better governance” than the other Funds, which is why BFZ and MPA trade at a smaller discount to net asset value than the other Funds. These claims are not only unsubstantiated, but false. For example, BFZ and BNY have the same governance structures.

| 6. | “This entire fight is about greed. And this time it’s not the hedge fund manager that’s greedy, it’s the asset manager that is taking advantage of the most vulnerable investors. It’s one thing |

2 Id.

3

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

| to have IPO-ed with the best of intentions, but to basically violate federal law and run elections in a way that could not possibly produce a different board is unconscionable.” |

“Instead, they’re trying to, I’ll use a technical term, screw the investor by not letting the investors vote, carry the election. I’m not saying we need to win the election. I’m saying run a fair election. It is outrageous. Aren’t you embarrassed?”

“You shouldn’t run an election where no one can unseat your directors. . . We have a right to elect directors.”

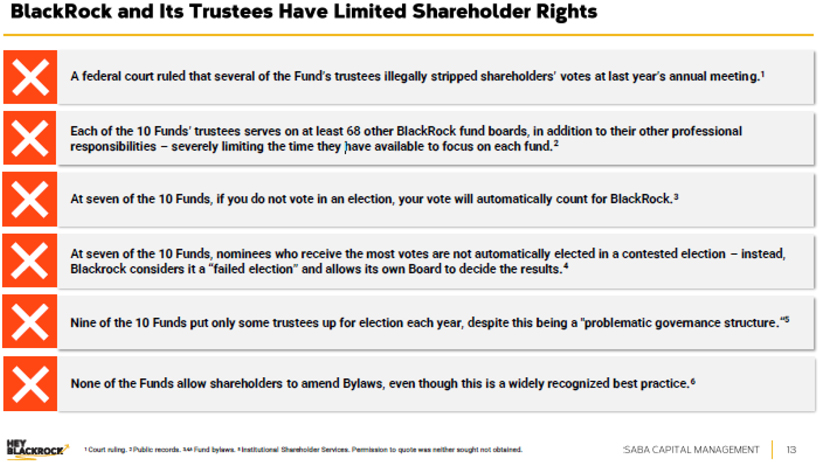

“At seven of the 10 Funds, nominees who receive the most votes are not automatically elected in a contested election – instead, Blackrock considers it a ‘failed election’ and allows its own Board to decide the results.” (see Exhibit E)

“Saba files a lawsuit against ECAT and its trustees for adopting an illegal ‘Entrenchment Bylaw’ that deprives shareholders of their right to elect trustees annually.” (see Exhibit E)

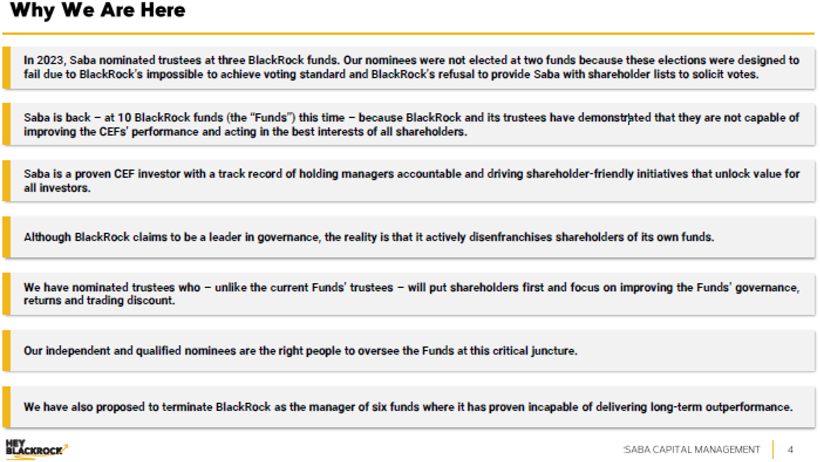

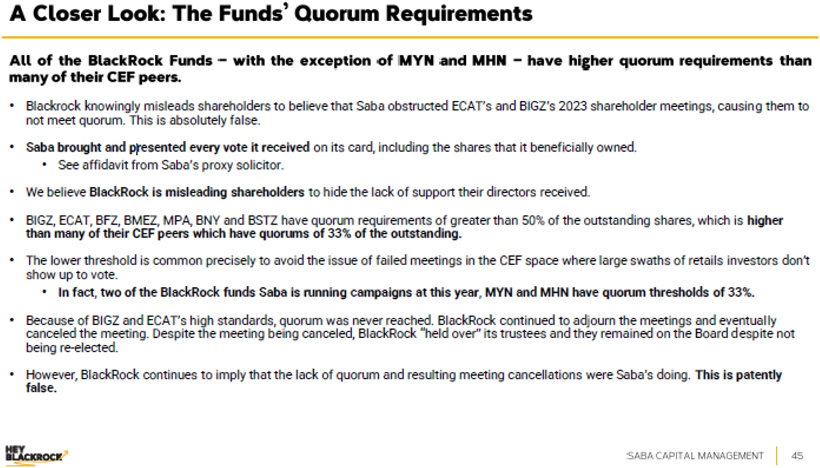

“In 2023, Saba nominated trustees at three BlackRock funds. Our nominees were not elected at two funds because these elections were designed to fail due to BlackRock’s impossible to achieve voting standard and BlackRock’s refusal to provide Saba with shareholder lists to solicit votes.” (see Exhibit F)

These statements are false, as well as misleading as they impugn BlackRock’s and each Fund board member’s “character, integrity [and] personal reputation” and “make[] charges concerning improper, illegal or immoral conduct or associations, without factual foundation.”3 In these statements, Saba and Mr. Weinstein are referring to a provision in certain of the Funds’ bylaws that requires a majority of outstanding shares to elect trustees in a contested election. This vote standard does not prevent investors from voting or deprive them of their right to elect directors or trustees annually, as Saba and Mr. Weinstein allege, nor does it “basically violate federal law” or make it impossible to produce a different board. Additionally, this vote standard does not in any way result in a Fund “allow[ing] its own Board to decide the results.” Rather, this vote standard is utilized throughout the closed-end fund industry and does not violate federal law.

| 7. | “but I am firmly invested and focused on these funds….And the problem is as a 10 trillion institution, BlackRock is not because once they place these funds, it’s onto the next product and they’ve effectively locked in all the fees that they can because unlike ETFs and mutual funds, they don’t grow and or shrink. And so they don’t have to be at the top of their game.” |

“The incumbent trustees have failed in their fiduciary duties, overseeing poor performance and limiting shareholder’s rights.”

“You would start to feel like that wasn’t quite the amazing investment you thought and the term ‘shell game’ and ‘Ponzi,’ which is not appropriate in my mind when we talk about these things, but there is this idea of like the investor being fooled by return of their capital, and is . . . something that will definitely trick shareholders.”

“But here instead, you’re like, how do I do the minimum to get enough to siphon enough votes to trick some shareholders into thinking that they’re now going to make 20% a year?”

“They’re willing to literally shred shareholder rights. At the same time, out of the other side of their mouth, they launch all sorts of ESG products that purport to invest in only good

3 Id.

4

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

governance funds. And Blackrock has made the calling balls and strikes on these very matters trivial, because they actually say how ESG, how the G part ought to be implemented. How should we protect shareholders with respect to electing a board and so on and so forth, which I’ll get into, and you’ll see that they actually are violating their own words. They are treating these funds, which are shares in the New York Stock Exchange, that have a board that have, you’re entitled to be treated not like a second class citizen. They are abusing them through the tactics, which are not only enshrined into the documents, but even things that they’ve done in addition to that, and even the things they’ve said, which are an attempt at confusing the reality.”

“Someone at BlackRock who wrote this quote, they should be excoriated for trying to pull the wool over their shareholders’ eyes.”

“So they use the word ‘simply,’ and they write it in forked-tongue doublespeak. . .”

“What is clearly true is how disgusting it is to give the importance, the honor, of serving on a board, the responsibility, to do good, to people that are going to spend five minutes per seat, with a rubber stamp. . . . So this board should be fired—leave aside Saba, okay—it should be fired because it can’t possibly be [inaudible] its duties. . . That’s like, drop the mic, they should all be fired.”

“After they experienced it last year and did the things they did to entrench themselves, we didn’t think they would do it again.”

“We have nominated trustees who – unlike the current Funds’ trustees – will put shareholders first and focus on improving the Funds’ governance, returns and trading discount.” (see Exhibit F)

“Saba is back – at 10 BlackRock funds (the “Funds”) this time – because BlackRock and its trustees have demonstrated that they are not capable of improving the CEFs’ performance and acting in the best interests of all shareholders.” (see Exhibit F)

“If BlackRock put aside its greed and self-interest and offered shareholders in these 10 Funds an exit at NAV as Saba is advocating for, shareholders would immediately make approximately $1.4 billion.” (see Exhibit G)

These statements are false, as well as misleading as they impugn BlackRock’s, the Funds’ and each Fund board member’s “character, integrity [and] personal reputation” and “make[] charges concerning improper, illegal or immoral conduct or associations, without factual foundation.”4

| 8. | “BlackRock limited who we could put on a board. They can’t work for a financial institution, they can’t have been paid by Saba, though of course they’re paying their board members…”” |

This statement is false. BlackRock does not pay the independent directors and trustees of the Funds – they are compensated by the Funds.

4 Id.

5

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

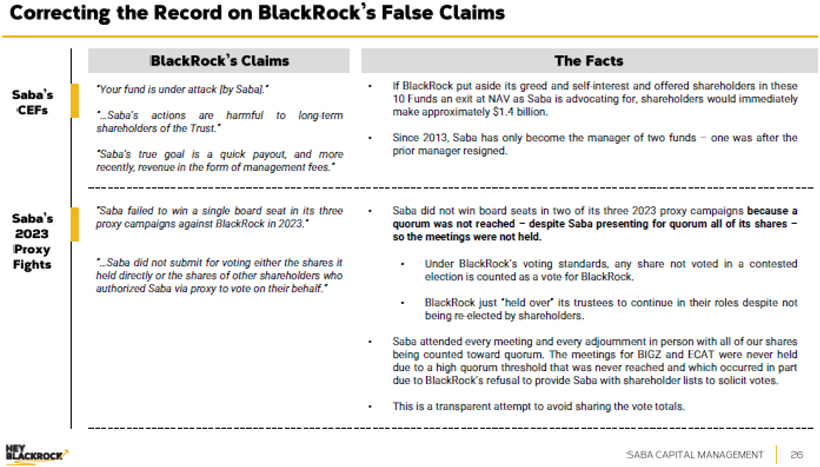

| 9. | “Saba did not win board seats in two of its three 2023 proxy campaigns because a quorum was not reached – despite Saba presenting for quorum all of its shares – so the meetings were not held.” (see Exhibit G) |

“Saba attended every meeting and every adjournment in person with all of our shares being counted toward quorum... This is a transparent attempt to avoid sharing the vote totals.” (see Exhibit G)

“Blackrock knowingly misleads shareholders to believe that Saba obstructed ECAT’s and BIGZ’s 2023 shareholder meetings, causing them to not meet quorum. This is absolutely false.” (see Exhibit H)

“Saba brought and presented every vote it received on its card, including the shares that it beneficially owned.” (see Exhibit H)

These statements are false. Saba and its representatives did not present any votes for which it was appointed as proxy it received on at the annual shareholder meetings for ECAT and BIGZ held on August 7, 2023, as certified by the inspector of election for ECAT’s and BIGZ’s 2023 annual meetings of shareholders and as disclosed, along with the voting totals, in each of ECAT’s and BIGZ’s 2023 annual shareholder reports.

* * * * *

The Funds respectfully request that the Staff require Mr. Weinstein and Saba to: (1) publicly take corrective action, including retracting all violating statements from the Saba Webinar, the Presentation and on the Website; (2) fully comply with Rule 14a-9 under the Exchange Act with respect to its solicitation activities for the Funds’ upcoming annual meetings; and (3) cease making such violations of Rule 14a-9 in the future.

The Funds thank the Staff for their attention to this matter. Please direct any questions that you may have with respect to the foregoing or any requests for supplemental information to Elliot J. Gluck at (212) 728-8138.

Very truly yours,

/s/ Elliot Gluck

Elliot Gluck

6

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit A

7

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

8

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit B

9

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit C

10

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit D

11

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit E

12

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit F

13

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit G

14

Securities and Exchange Commission

Division of Investment Management

May 24, 2024

Exhibit H

15