Please wait

JOHANNESBURG, 20 February 2026: Sibanye Stillwater Limited (Sibanye-Stillwater or the Group) (JSE: SSW and NYSE: SBSW) is pleased to report operating and financial results for the six months ended 31 December 2025, and condensed consolidated financial statements for the year ended 31 December 2025.

SALIENT FEATURES FOR THE SIX MONTHS AND YEAR ENDED 31 DECEMBER 2025 •Continued safety improvement with Group SIFR and TRIFR at lowest recorded levels

•Revenue for 2025 increased by 14% year-on-year to R129.7 billion (US$7.3 billion)

•281% increase in HEPS to 244 SA cents (14 US cents), lower basic loss per share of 183 SA cents (10 US cents) mainly due to impairments

•Normalised earnings1 for H2 2025 377% higher than for H1 2025, comprising 83% of full year normalised earnings

•Dividend of R3.7 billion (US$213 million) or R1.31 per share (32.68 US cents per ADR) declared, consistent with dividend policy and representing a 2.1%2 yield

•Group adjusted EBITDA1 of R37.8 billion (US$2.1 billion) increased by 189% year-on-year

•Balance sheet leverage lower y-on-y – net debt : adjusted EBITDA1 of 0.59x at 31 Dec 2025 and ample liquidity and flexibility

•Solid operational performance with all operations achieving annual guidance

•Favourable precious metals tailwinds drive improved profitability

•Renewable energy leader in SA mining – R93.2m savings and 316,440 tCO₂ avoided emissions3

–From 2028, the 765MW portfolio expected to deliver >R1bn annual cost savings and reduce emissions3 by 2.63m tCO₂e annually

•Staged start up of Keliber lithium project approved – completion of high capital construction phase and commencement of mining in Q1 2026

1 See "Non-IFRS measures" for more information on the metrics presented by Sibanye-Stillwater 2 Based on the closing share price of R63.76 at 17 February 2026

3 Conversion factor used of 1.08 tCO2e/MWh

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US dollar | | | | | | SA rand |

| Year ended | Six months ended | | | | | | Six months ended | Year ended |

| Dec 2024 | Dec 2025 | Dec 2024 | Jun 2025 | Dec 2025 | | KEY STATISTICS | | Dec 2025 | Jun 2025 | Dec 2024 | Dec 2025 | Dec 2024 |

| | | | | | GROUP | | | | | | |

| (398) | (288) | (8) | (194) | (94) | US$m | Basic earnings | Rm | (1,580) | (3,591) | 38 | (5,171) | (7,297) |

| 99 | 387 | 85 | 292 | 94 | US$m | Headline earnings | Rm | 1,540 | 5,372 | 1,543 | 6,912 | 1,817 |

| 715 | 2,115 | 360 | 818 | 1,297 | US$m | Adjusted EBITDA1,10 | Rm | 22,727 | 15,073 | 6,440 | 37,800 | 13,088 |

| (311) | (264) | | 61 | (211) | (53) | | US$m | (Loss)/profit for the period | Rm | (833) | | (3,906) | 1,291 | (4,739) | | (5,710) |

| 18.32 | | 17.88 | 17.92 | | 18.39 | | 17.38 | R/US$ | Average exchange rate using daily closing rate | | | | | | |

| | | | | | | | | | | | | | |

| TABLE OF CONTENTS | Page | | Stock data for the six months ended 31 December 2025 |

| | | | |

| | | Number of shares in issue | |

| | | - at 31 December 2025 | 2,830,567,264 |

| | | - weighted average | 2,830,567,264 |

| | | Free Float | 99 | % |

| | | Bloomberg/Reuters | SSWSJ/SSWJ.J |

| | | | |

Notes to the condensed consolidated financial statements | | | JSE Limited - (SSW) | |

| | | Price range per ordinary share (High/Low) | R32.64 to R64.70 |

| | | Average daily volume | 21,571,894 |

| | | | |

| | | NYSE - (SBSW); one ADR represents four ordinary shares | |

| | | Price range per ADR (High/Low) | US$7.27 to US$15.70 |

| | | Average daily volume | 7,601,834 |

| | | | |

| | | | |

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US dollar | | | | | | SA rand |

| Year ended | Six months ended | | | | | | Six months ended | Year ended |

| Dec 2024 | Dec 2025 | Dec 2024 | Jun 2025 | Dec 2025 | | KEY STATISTICS | | Dec 2025 | Jun 2025 | Dec 2024 | Dec 2025 | Dec 2024 |

| | | | | SOUTHERN AFRICA (SA) OPERATIONS | | | | | |

| | | | | | SA PGM operations | | | | | | |

| 1,738,946 | | 1,724,778 | | 910,486 | | 804,252 | | 920,526 | | oz | 4E PGM production2,3 | kg | 28,632 | | 25,015 | | 28,319 | | 53,647 | | 54,087 | |

| 1,322 | | 1,740 | | 1,333 | | 1,429 | | 2,009 | | US$/4Eoz | Average basket price | R/4Eoz | 34,914 | | 26,283 | | 23,892 | | 31,110 | | 24,213 | |

| 407 | | 933 | | 152 | | 260 | | 673 | | US$m | Adjusted EBITDA10 | Rm | 11,904 | | 4,778 | | 2,633 | | 16,682 | | 7,399 | |

| 1,198 | | 1,353 | | 1,245 | | 1,299 | | 1,407 | | US$/4Eoz | All-in sustaining cost4,10 | R/4Eoz | 24,457 | | 23,892 | | 22,317 | | 24,193 | | 21,948 | |

| | | | | | SA gold operations | | | | | | |

| 704,583 | | 632,341 | | 360,474 | | 300,191 | | 332,149 | | oz | Gold produced | kg | 10,331 | | 9,337 | | 11,212 | | 19,668 | | 21,915 | |

| 2,378 | | 3,379 | | 2,560 | | 3,049 | | 3,706 | | US$/oz | Average gold price | R/kg | 2,070,774 | | 1,802,580 | | 1,474,973 | | 1,942,194 | | 1,400,468 | |

| 323 | | 700 | | 206 | | 260 | | 440 | | US$m | Adjusted EBITDA10 | Rm | 7,696 | | 4,809 | | 3,631 | | 12,505 | | 5,832 | |

| 2,126 | | 2,509 | | 2,175 | | 2,430 | | 2,589 | | US$/oz | All-in sustaining cost4,10 | R/kg | 1,446,794 | | 1,436,817 | | 1,253,083 | | 1,442,063 | | 1,251,810 | |

| | | | | INTERNATIONAL OPERATIONS | | | | | |

| | | | | | US PGM underground operations | | | | | | |

| 425,842 | | 284,069 | | 187,703 | | 141,124 | | 142,945 | | oz | 2E PGM production2,5 | kg | 4,446 | | 4,389 | | 5,838 | | 8,836 | | 13,245 | |

| 988 | | 1,195 | | 1,001 | | 985 | | 1,380 | | US$/2Eoz | Average basket price | R/2Eoz | 23,978 | | 18,114 | | 17,942 | | 21,367 | | 18,097 | |

| (9) | | 249 | | (36) | | 151 | | 98 | | US$m | Adjusted EBITDA10 | Rm | 1,669 | | 2,775 | | (599) | | 4,444 | | (111) | |

| 1,206 | | 1,203 | | 1,182 | | 1,207 | | 1,198 | | US$/2Eoz | All-in sustaining cost4,6,10 | R/2Eoz | 20,819 | | 22,200 | | 21,185 | | 21,516 | | 22,096 | |

| | | | | | Recycling7 | | | | | | |

| 32 | | 228 | | 24 | | 147 | | 81 | | US$m | Adjusted EBITDA10 | Rm | 1,371 | | 2,707 | | 441 | | 4,078 | | 594 | |

| | | | | | Sandouville nickel refinery | | | | | | |

| (41) | | (33) | | (26) | | (17) | | (16) | | US$m | Adjusted EBITDA10 | Rm | (280) | | (310) | | (443) | | (590) | | (723) | |

| | | | | | Century zinc retreatment operation | | | | | | |

| 82 | | 101 | | 40 | | 51 | | 49 | | ktZn | Payable zinc production8 | ktZn | 49 | | 51 | | 40 | | 101 | | 82 | |

| 2,678 | | 2,717 | | 2,898 | | 2,626 | | 2,812 | | US$/tZn | Average equivalent zinc concentrate price9 | R/tZn | 48,878 | | 48,294 | | 51,931 | | 48,584 | | 49,046 | |

| 34 | | 88 | | 53 | | 36 | | 52 | | US$m | Adjusted EBITDA10 | Rm | 925 | | 657 | | 992 | | 1,582 | | 641 | |

| 2,317 | | 1,921 | | 2,413 | | 1,762 | | 2,094 | | US$/tZn | All-in sustaining cost4,10 | R/tZn | 36,399 | | 32,411 | | 43,244 | | 34,356 | | 42,446 | |

1The Group reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) based on the formula included in the facility agreements for compliance with the debt covenant formula. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS Accounting Standards and should be considered in addition to and not as a substitute for any other measure of financial performance and liquidity. For a reconciliation of profit/(loss) before royalties and tax to adjusted EBITDA, see note 12.1 of the condensed consolidated financial statements

2The Platinum Group Metals (PGM) production in the SA operations is principally platinum, palladium, rhodium and gold, referred to as 4E (3PGM+Au) and measured at the concentrator, and the US underground operations is principally platinum and palladium, referred to as 2E (2PGM)

3The SA PGM production excludes the production associated with the PoC from third parties. For a reconciliation of the production and third party PoC, refer to the "Reconciliation of operating cost excluding third party PoC for Total SA PGM operations and Marikana" sections

4See "Salient features and cost benchmarks" sections for the definition of All-in sustaining cost (AISC). The SA PGM All-in sustaining cost excludes the production and costs associated with the purchase of concentrate (PoC) from third parties

5The US PGM operations’ underground production is converted to metric tonnes and kilograms, and financial performance is translated to SA rand (rand)

6The US PGM operations’ All-in sustaining cost for the six months and year ended 31 December 2024 were adjusted to include the Section 45X Advance Manufacturing Production Credits. For the six months ended 31 December 2024, R699 million (US$39 million) was recognised and for the year ended 31December 2024 R1,255 (US$71 million) was recognised related to mining costs. During the six months ended 30 June 2025 the US PGM operations recognised R2,466 million (US$139 million) which relates to mining costs incurred for the years ended 31 December 2024 and 31 December 2023

7Recycling includes Reldan Pennsylvania (PA) site, Metallix North Carolina (NC) site and Columbus recycling site. The acquisition of the PA site was concluded on 15 March 2024 and the acquisition of NC site was concluded on 4 September 2025. The year ended 31 December 2024 only includes the results of the PA site since acquisition and the year ended December 2025, includes the NC site results since acquisition

8Payable zinc production is the payable quantity of zinc metal produced after applying smelter content deductions

9Average equivalent zinc concentrate price is the total zinc sales revenue recognised at the price expected to be received excluding the fair value adjustments divided by the payable zinc metal sold

10Adjusted EBITDA and AISC are not measures of performance under IFRS and should not be considered in isolation or as substitutes for measures of financial performance prepared in accordance with IFRS. See "Non-IFRS measures" for more information on the metrics presented by Sibanye-Stillwater. The Adjusted EBITDA amount in US$m for the six months ended 31 December 2025 is calculated using the Adjusted EBITDA amount in US$m for the year ended 31 December 2025 less the Adjusted EBITDA amount in US$m for the six months ended 30 June 2025 Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 2

STATEMENT BY RICHARD STEWART, CHIEF EXECUTIVE OFFICER OF SIBANYE-STILLWATER Sibanye-Stillwater ended 2025 in a position of strengthened financial and operational performance, with positive momentum continuing during 2026. During the second half of the year, the Group successfully navigated its leadership transition. This included the presentation of a refreshed strategy, structured to look beyond short‑term turbulence and emphasise long‑term value creation, driven by structural demand for metals critical to global economic and energy transitions.

This was achieved against an exceptionally volatile global backdrop, marked by geopolitical tension, shifting supply chains and accompanying record swings in commodity prices. Global competition for critical minerals intensified, driving many commodity prices sharply higher during 2025. Gold reached an all‑time high spot price of US$5,595/oz in late January 2026, while platinum, palladium and rhodium all recorded substantial gains amid heightened global uncertainty and constrained supply dynamics. Lithium prices rebounded sharply in the fourth quarter, driven by regulatory restrictions on higher cost local supply and restocking in China and persistent supply‑side tightness, though some moderation emerged into early 2026. Heading into 2026, commodity markets will remain a defining feature of the operating context.

The resolution of overhanging matters for the Group during the fourth quarter, including the Appian court case and settling South African gold wage agreements, as well as some key operational decisions including shortening the Kloof life of mine, the commencement of phased startup of the Keliber lithium project and focus on internal organic growth projects, has set a clear, simplified and stable operating platform for 2026. These actions however, combined with volatile commodity prices, have resulted in a complex set of financial results for 2025.

Looking through the volatility of 2025, the business fundamentals are pleasing. All Group operations other than the SA gold operations delivered on or exceeded market guidance and costs were well managed across the Group, with some commendable cost performances. Improved operational delivery, combined with the higher commodity price tailwinds, underpinned materially improved fundamental financial performance and pleasingly a return to dividend payments.

With sustained higher commodity prices, disciplined capital allocation and improving operational stability, we expect continued improvement in earnings and balance‑sheet resilience, providing a solid foundation as the Group enters 2026.

Safety

Safety remained the Group’s leading priority throughout 2025, with significant progress across leading and lagging indicators. The Total Recordable Injury Frequency Rate (TRIFR) improved by 13% to 3.78, marking the first time the Group achieved a year‑end rate below the milestone target of 4. Serious Injury Frequency Rate (SIFR) and Lost Time Injury Frequency Rate (LTIFR) also reached their best levels since 2013, improving to 2.19 and 3.36 respectively.

Despite these improvements, six fatalities tragically occurred during 2025, with three occurring in the second half of 2025. On behalf of the Board and management our sincere condolences go the families and friends of Mr. Xavier, Ms. Jozana, Ms. Matsolo, Mr. Hanson, Mr. Ramaila and Mr. Klaas. Eliminating fatal incidents remains our utmost priority and a drive on our Fatal Elimination Program in 2026 will focus on safety behaviours through compliance, management routines and critically, implementing safe behaviour through our culture of care.

Operational update

The proactive repositioning of our operations over the past few years, has resulted in greater operational stability and consistency with performance improved across most operations, where our operating teams have demonstrated strong operational resilience, effective cost control, and significant financial leverage to commodity prices in 2025. In particular the SA PGM and gold operations delivered substantial earnings uplift while the US PGM operations returned to profitability following strategic restructuring and the benefit of US Section 45X Advanced Manufacturing Production credits.

The SA PGM operations delivered a steady performance, producing 1,797,928 4E ounces including attributable volumes and purchased concentrate, in line with guidance. This was despite a decline in surface production of 29%, largely due to heavy rainfall and the transition between tailings storage facilities. AISC (excluding PoC and Mimosa) rose 10% to R24,193/4Eoz (US$1,353/4Eoz), mainly due to sharply higher royalty payments linked to rising PGM prices, and increased sustaining capital. The increasing PGM prices during H2 2025, drove a 125% increase in adjusted EBITDA to R16.7 billion (US$933 million).

The SA gold operations faced operational challenges during 2025, most notably the Kloof operations, where seismicity and infrastructure constraints resulted in the cessation of certain mining areas for safety reasons and an associated material underperformance relative to the operational plan. Revised mine planning and the exclusion of high grade isolated high‑risk mining areas, reflect the Group’s commitment to safe, sustainable mining practices. As a result, gold production from the SA gold operations (including DRDGOLD) declined 10% year‑on‑year to 19,668kg (632,341oz). The SA gold operations remain highly operationally geared: the 39% increase in the rand gold price year-on-year, more than offset the 14% decline in gold sold, underpinning a 114% increase in adjusted EBITDA to R12.5 billion (US$700 million).

Significant improvements and advancements have been made across all our international operations. The benefits of the 2024 restructuring programme were evident in the performance of the US PGM operations which exceeded guidance for 2025, delivering 284,069 2Eoz, and AISC of US$1,203/2Eoz (R21,516/2Eoz), meaningfully below plan. The Recycling business, strengthened by the Metallix acquisition, continued to demonstrate enhanced scale, flexibility and margin resilience, contributed a significant adjusted EBITDA of US$228 million (R4.1 billion) for the year.

The Keliber lithium project advanced substantially during the year, with €299m in capital expenditure incurred, and it has been extremely pleasing to witness the nearing completion of the Group's first greenfield project. The construction phase is approaching completion and the first mining blast was taken in February 2026. A staged startup has been adopted to mitigate risks associated with evolving lithium‑market conditions while maintaining strategic optionality.

Finally, the Century zinc operation in Australia delivered a strong recovery, with production rising 22% to 101kt and AISC improving by 17% to US$1,921/tZn (R34,356/tZn). Adjusted EBITDA rose to US$88 million (US$1.6 billion) due to improved production stability, zinc price support, and reduced treatment charges.

Financial update

Despite the complex financial accounting matters, driven primarily by impairments, the Appian settlement, fair value losses, and higher share‑based payment expenses, the Group's core operational financial performance reflected a significant and pleasing turnaround. Group revenue rose 16% to R129.7 billion (US$7.3 billion), while adjusted EBITDA increased to R37.8 billion (US$2.1 billion) for 2025, a 189%

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 3

year‑on‑year improvement. Notwithstanding the payment of the Appian legal settlement of US$215 million (R3.6 billion) in December 2025 funded from internal resources, and an increase in the Keliber debt facility, net debt decreased to R22.1 billion (from R23.4 billion in 2024). As a result of the significant increase in Group profitability, net debt:adjusted EBITDA declined to 0.59x at the end of 2025, well below our comfort level of 1 times net debt: adjusted EBITDA.

Most pleasing was the significant increase in operational cash flow throughout the Group. Notional free cash flow (NFCF) for the Group increased by R12.4 billion year-on-year. Year-on-year operational NFCF improved across the SA PGM operations (+R5.7 billion), the SA gold operations (+R4.8 billion), the US PGM operations and recycling (+R3.4 billion) and the Century retreatment operation (+R966 million). European operations NFCF year-on-year was negative at R6.6 billion but improved from negative R7.4 billion due to lower Keliber capex and the transition of Sandouville to care and maintenance.

On the basis of significantly improved normalised earnings1 of R10.6 billion (US$591 million) for 2025, the Board declared a full year dividend of R3.7 billion (US$213 million) or R1.31 per share (32.68 US cents per ADR), representing 35% of normalised earnings, the higher end of the Group’s dividend policy.

1 Normalised earnings is not a measure of performance under IFRS Accounting Standards. As a result it should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS Accounting Standards. See note 10 of the condensed consolidated financial statements for the definition and reconciliation of normalised earnings

Strategic update

Strategic progress continued across multiple fronts. In the United States, preliminary antidumping duties of 132.83% have been announced on Russian palladium imports, in response to the antidumping and countervailing duty petitions filed by Sibanye-Stillwater together with the United Steelworkers Union in July 2025.

Significant progress has been made on several fronts in our sustainability strategy, but extremely pleasing is the solidifying of our position as the largest contracted private renewable energy off-taker in the SA mining industry, with 765MW of renewable energy having been secured. This not only contributes to an anticipated 41% decline in our greenhouse gas emissions by 2028, but is also expected to provide a more than R1 billion saving per annum on energy costs.

A refreshed strategy was presented to the market on 29 January 2026 in which the Group will focus on creating a high-performing, future-focused metals business. The priorities to unlock unrealised value include:

•Simplification of operating model and asset portfolio to enhance accountability, agility and management focus

•Performance excellence through holistic improvement to drive higher margins

•Growth focused on value creation that is anchored in returns and unlocking organic value as a priority

•Capital allocation through a disciplined framework prioritising returns and securing sustainability

Delivering on our strategy will ensure resilience for the Group in navigating through multi-metal pricing cycles and a rapidly changing macro environment.

Conclusion

Looking ahead, Sibanye-Stillwater enters 2026 with positive momentum, supported by strong commodity‑price leverage, improved operational stability, a stable balance sheet and advancing high‑quality organic growth opportunities. While volatility is expected to persist, disciplined execution of the Group’s strategic pillars of safe operational excellence, capital discipline, portfolio simplification and cultural renewal will remain the core enablers of long‑term value creation.

OPERATING GUIDANCE FOR 2026*

| | | | | | | | | | | | | | |

2026 Annual guidance | Production | All-in sustaining cost | Total capital |

SA operations | SA PGM operations (4E PGMs) | 1.65 - 1.75Moz3,4 | R26,500 - 27,500/4Eoz (US$1,453 - 1,508/4Eoz)² | R8bn (US$439m)² (incl. R1.79bn (US$98m) for project capital) |

SA gold operations (excl. DRDGOLD) | 13,700 - 14,700kg (440 - 473koz) | R1,620k - 1,730k/kg (US$2,855 - 3,049/oz)² | R2.8bn (US$154m)² |

International operations | US PGM operations (2E mined) | 280 - 300koz | US$1,520 - 1,580/2Eoz¹ Including Section 45X: US$1,360 - 1,420/2Eoz | US$125m - US$135m (incl. US$6m growth) (R2.3bn - R2.5bn incl. R109m growth)² |

Recycling (Columbus, PA and NC) (PGM autocats, industrial and e-waste precious metals bearing waste) | 400 - 420koz (gold equivalent ounces)5 | n/a | US$12.2m (R223m)² |

Keliber lithium project | 15k - 20k tonnes of spodumene concentrate | n/a | €180m - €190m6 (R3.7bn – R3.9bn))² (incl. €90m (R1.8bn) for project capital) |

Century zinc operations | 86.3k - 98.3k tonnes (payable) | A$3,400 – 3,800/t (R42,160 – 47,120/t)² (US$2,311 - 2,583/t)² | A$5 - A$5.5m (US$3,4m – US$3.7m, R62m - R68.2m)² |

Source: Company forecasts, Note: Guidance does not take into account the impact of unplanned events

* As at 20 February 2026

1.US PGM AISC are impacted by tax and royalties paid based on PGM prices, current guidance was based on spot 2E PGM prices of US$1,180/oz; By product credit assumptions of Rh US$4,800/oz and gold US$2,500/oz

2.Estimates are converted at an exchange rate of R18.24/US$, R20.43/€ and R12.40/A$

3.SA PGM operations production guidance includes third party PoC and 50% attributable production from Mimosa

4.SA PGM operations AISC excludes the purchase cost of third party PoC and Mimosa costs and capital (equity accounted)

5.Gold equivalent ounce production calculated using the following metal pricing: Au US$2,506/oz, Ag US$38/oz, Pt US$1,150/oz, Pd US$1,050, Ir US$4,000/oz, Rh US$4,800/oz, Ru US$500/oz and Cu US$4.4/lb

6.2026 guided capital includes construction phase start-up capital, sustaining cost and capitalised cost. The current production profile includes the Syväjärvi and Rapasaari open pit mining areas

RICHARD STEWART

CHIEF EXECUTIVE OFFICER

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 4

SIBANYE-STILLWATER GROUP SAFETY AND OPERATING REVIEW SAFETY

Safety has been a core value for the Group and is our first priority. It is therefore pleasing to note that several of our operations continue to record improving trends in leading safety indicators and achieve globally leading injury rates, confirming ongoing progress in risk reduction. However, unacceptable risks remain in certain areas, and we continue to experience tragic incidents despite our efforts. Our commitment to ensuring a safe work environment and zero harm is unwavering.

For the first time, the Group recorded a year-end Total Recordable Injury Frequency Rate (TRIFR) below the milestone target of 4, achieving a rate of 3.78 in 2025 and improving 13% year-on-year. The Serious and Lost Time Injury Frequency Rates (SIFR and LTIFR) were also the best average numbers recorded since inception in 2013, improving by 1% to 2.19 and 13% to 3.36 respectively, when compared to 2024. In addition, there has been a consistent decline in high potential incidents (HPIs), 44% lower in 2025 than 2024 with HPI's declining from an average 52 per month in 2022, when this was first monitored to 10 per month in 2025. The Group fatal injury frequency rate (FIFR) (per million hours worked) improved from 0.051 in 2024, to 0.037 for 2025.

Notwithstanding the progress being made, in addition to the five colleagues already mourned, during Q4 2025, a tragic incident on 5 November 2025 resulted in the passing of a colleague, Mr Nkosana Klaas, a winch operator at Marikana East 3 shaft, from a fall of ground incident. This incident is being investigated with relevant stakeholders to understand the root causes and specify risk mitigation measures for implementation. The Board and management of Sibanye-Stillwater extend their sincere condolences to the loved ones, families and friends of our deceased colleagues, and support has been provided to the families of the deceased.

We remain committed to advancing our safe behaviour programme for the South African (SA) operations. This initiative is strategically structured across two tiers to ensure cultural transformation at both leadership and supervisory levels effectively drives and reinforces positive safety behaviours throughout the organisation. The consistent and improved reporting of near-miss incidents in recent years has significantly improved risk awareness, operational transparency, and employee confidence in the reporting process. This reflects positively on our proactive risk management and the establishment of a culture rooted in trust and transparency.

We continue to promote a bottom-up safety culture, empowering all employees to halt unsafe work. As at end of 2025, 85% of unsafe work stoppages were executed by frontline employees. This represents an improvement on the 81% stoppages achieved by 2024 year-end.

OPERATING REVIEW

Southern Africa (SA) operations

SA PGM operations

The SA PGM operations delivered consistent operational performance for 2025 with PGM production of 1,797,928 4Eoz (including attributable production from Mimosa and third-party purchase of concentrate (PoC)), within annual guidance of 1.75 to 1.85 million 4Eoz and consistent year-on-year.

Since 2020, the first full year after the acquisition of Lonmin in June 2019, PGM production from the SA PGM operations has been stable at between 1.73 and 1.83 million 4Eoz. Annual production and cost guidance has consistently been met, enabling continued improvement in cost and competitive positioning relative to peers, evident in an ongoing shift from the fourth quartile of the PGM industry cost curves, towards the second quartile.

PGM production (excluding PoC) of 1,724,778 4Eoz was consistent with 2024 despite a significant decline in surface production. Underground mining production increased by 2% (30,569 4Eoz) to 1,616,545 4Eoz in 2025, primarily as a result of improved production from the Rustenburg mechanised mining operations, particularly the Bathopele shaft, and more stable production compared with 2024, which was impacted by production disruptions at the Siphumelele shaft (affected by the shaft infrastructure incident) and Kroondal operation (illegal strike action). Underground production from the Marikana operations declined due to safety related stoppages (particularly at the high production Saffy shaft which produced 15% (31,040 4Eoz) less year-on-year), partially offset by the ramp up at the K4 shaft where production increased by 28,944 4Eoz to 99,605 4Eoz. Surface production declined by 29% to 108,233 4Eoz due to the impact of high rainfall in H1 2025, and declining production from the end of life of Rustenburg Waterval West TSF and Marikana ETD1 transitioning to ETD2 tailings storage facility (TSF) in November 2025. A comprehensive assessment on potential for long life production from surface sources at Rustenburg is underway. Third party PoC of 73,150 4Eoz for 2025 was 24% lower than for 2024, in line with third party contractual agreements.

AISC (excluding third party PoC and Mimosa) for 2025 of R24,193/4Eoz (US$1,353/4Eoz) was within annual guidance of R23,500 to R24,500/4Eoz (US$1288 to US$1,343/4Eoz), but was 10% higher than for 2024, primarily due to higher royalties which increased by 261% to R765 million (US$43 million) as a result of increased revenue and profitability from increasing PGM prices, and a 12% increase in sustaining capital year-on-year to R2.9 billion (US$160 million). An inventory increase of R2.5 billion (US$152 million) for 2025 was the result of an increase of 43,318 4Eoz in saleable metal at the Rustenburg operation, mainly due to the timing of sales and build up in saleable metal inventory as a result of the Kroondal PoC contract with Valterra converting to a toll agreement on 1 September 2024, increase in the weighted average cost of metal in process and the reversal during 2025 of the previously recognised provision for net realisable value of inventory (R851 million) following higher metal prices during 2025. By-product credits of R11.7 billion (US$655 million) for 2025 partially offset these increases, reducing AISC by R6,969/4Eoz (US$390/4Eoz), consistent with the reduction of by-product credits of R6,817/4Eoz (US$372/4Eoz) for 2024.

Chrome credits comprised 41% of total by-product credits for 2025 (decreasing from 52% for 2024) due to lower chrome production, sales and prices, offset by higher ruthenium prices and increased iridium volumes sold. AISC (including PoC) for 2025 increased by 11% to R24,312/4Eoz (US$1,360/4Eoz) due to a 6% increase in PoC purchase cost as a result of higher PGM prices.

Total capital expenditure for 2025 of R5.9 billion (US$329 million) was lower than guidance of R6.5 billion (US$356 million). Project capital decreased by 16% to R675 million (US$38 million), due to the completion of expenditure for a reflux classifier plant at Rustenburg during 2024, and a 10% decline in project capital at K4 project to R590 million (US$33 million) in line with the ramp-up plan. Project capital of R675 million (US$38 million) was below guidance of R1.4 billion (US$78 million) primarily due to the withdrawal from the planned purchase of a third party processing plant and deferred spending on the Marikana K4 and Siphumelele projects. Ore reserve development (ORD) capital was 5% lower year-on-year, however sustaining capital increased by 12% to R2.9 billion (US$160 million) primarily for replacement and upgrades of essential equipment at the mining operations and infrastructure upgrades at the Precious Metals Refinery (PMR).

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 5

The sharp rally in PGM prices from May 2025 resulted in the average 4E PGM basket price increasing by 28% to R31,110/4Eoz (US$1,740/4Eoz) year-on-year and underpinned by the stable operational performance, drove a 125% increase in adjusted EBITDA to R16.7 billion (US$933 million) for 2025 relative to the previous year, illustrating the significant leverage of the SA PGM operations to increasing prices. The 4E PGM basket price has increased further during 2026 averaging R47,262/4Eoz (US$2,916/4Eoz) year-to-date (YTD), 35% higher than the H2 2025 average basket price. Despite a general correction in metal prices at the end January 2026, the basket price has stabilised at about R44,424/4Eoz (US$2,778/4Eoz), and with fundamental drivers remaining supportive, suggests potential for further earnings and cash flow gains during 2026.

Attributable production from Mimosa decreased by 5% year-on-year to 117,019 4Eoz primarily due to concentrator downtime due to power outages, which affected recoveries. AISC increased by 11% to US$1,280/4Eoz (R22,894/4Eoz) primarily due to lower production.

SA gold operations

Despite significant operational challenges which persisted throughout the year at Kloof, and short term production constraints affecting Driefontein and Beatrix, these mature operations continue to deliver significant value for the Group and all its stakeholders well beyond the life of mine (LOM) planned at the end of 2012. Buoyed by the continued increase in the gold price, the SA gold operations delivered materially better financial results for 2025.

The SA gold operations are highly leveraged to the gold price and generated significantly higher earnings and cash flow for 2025 despite lower gold production for 2025. The average gold price received by the SA gold operations (including DRDGOLD) increased by 39% to R1,942,194/kg (42% to US$3,379/oz) which resulted in adjusted EBITDA for the SA gold operations (including DRDGOLD) increasing by 114% to R12.5 billion (US$700 million) year-on-year. The SA gold operations contributed 33% to 2025 Group adjusted EBITDA, 61% higher than the previous highest annual adjusted EBITDA of R7.8 billion (US$472 million) for 2020. The outlook for the gold price for 2026 remains positive, supported by global economic and socio-political uncertainty and fractured international relations. The spot gold price has increased by approximately 9% to R2.5 million/kg (US$4,900/oz) for 2026 YTD, approximately 21% higher than the average for H2 2025. Should the gold price maintain current levels or higher during 2026, earnings and cashflow from the SA gold operations are likely to increase significantly.

Gold production from the SA gold operations (excluding DRDGOLD) of 15,066kg (484,383oz) was within revised guidance of 15,000 to 16,000kg (480 to 514koz) for the year, but 11% lower than for 2024. Guidance was revised in Q2 2025 following significant operational disruptions at the Kloof operation compounded by elevated seismicity in high grade Isolated Blocks of Ground (IBGs) areas, necessitating the withdrawal and relocation of crews to the Driefontein operation and the removal of these IBGs from the production plans due to safety concerns. Due to these constraints, production from Kloof, declined by 31% (1,518kg/48,805oz) year-on-year to 3,374kg (108,477oz). The removal of higher grade IBGs due to increased seismicity exceeding safety risk tolerance levels and ongoing production constraints resulted in a rebasing of the LOM plans and a significant reduction in reserves. The safety of our employees and colleagues is our first and overarching priority, and the increased safety risk associated with increased seismicity in the high grade IBGs, prompted a difficult decision which has led to the Kloof LOM reducing to one year from eight years previously.

Gold production from the Driefontein operation increased by 3% to 7,216kg (232,000oz) year-on-year as operational delivery recovered in H2 2025 following the fire in the 5 shaft pump station and safety related stoppage experienced in H1 2025. Gold production at Beatrix decreased by 5% year-on-year to 3,582kg (115,164oz) mainly due to throughput constraints experienced at the Beatrix plant.

Gold production (including DRDGOLD) in 2025 decreased by 10% to 19,668kg (632,341oz) year-on-year, primarily due to a 8% decline in DRDGOLD production.

AISC for the SA gold operations (excluding DRDGOLD) for 2025 increased by 17% to R1,576,859/kg (US$2,743/oz), due to a 16% decrease in gold sold year-on-year to 14,442kg (464,321oz), ORD capital expenditure which increased by 3% to R2.9 billion (US$164 million) and sustaining capital expenditure which increased by 12% to R776 million (US$43 million). Despite lower production, ORD has focussed on strategic development of secondary reefs to sustain production and maintain flexibility at Kloof and Driefontein whilst sustaining capital has focussed on maintaining sustainable mining infrastructure. Similarly for 2025, AISC for the SA gold operations (including DRDGOLD) increased by 15% to R1,442,063/kg (US$2,509/oz).

Total capital expenditure from the SA gold operations (excluding DRDGOLD) decreased by 4% to R3.7 billion (US$208 million). Project capital expenditure decreased from R354 million (US$19 million) for 2024 to R13 million (US$1 million) for 2025 mainly due to the Burnstone project being placed on care and maintenance during H1 2024. Capital expenditure at DRDGOLD remained elevated due to expenditure on the Far West Gold Recoveries (FWGR) facility but decreased by 12% to R3.0 billion (US$166 million) primarily due to a 15% decrease in project capital expenditure as detailed below.

In December 2025, a three-year wage agreement was concluded with the representative unions at the SA gold operations. The agreement is effective for three years from 1 July 2025 to 30 June 2028, which should allow increased management focus on operational delivery.

Production from DRDGOLD declined by 8% for 2025 to 4,602kg (147,958oz) primarily driven by a 12% decline in yield reflecting a transition to lower grade material from the Driefontein tailings storage facilities (TSFs). Operating costs were well controlled with lower electricity costs from the commissioning of the renewable energy project which was commissioned in November 2024. AISC of R1,076,310/kg (US$1,872/oz) was 14% higher year-on-year, primarily due to less gold sold and a 26% increase in sustaining capital expenditure. Project capital expenditure decreased by 15% to R2.7 billion (US$149 million) due to the completion of the renewable energy project. Adjusted EBITDA from DRDGOLD of R4.4 billion (US$248 million) for 2025 increased by 75% to R4.4 billion (US$248 million) year-on-year, due to the 40% increase in the rand gold price received to R1,967,881/kg (US$3,423/oz).

International operations

US PGM operations

The US PGM operations delivered a successful operational and financial performance in 2025 post the restructuring undertaken from Q4 2024 in which the Stillwater West mine was put on care and maintenance. Stable production, lower operating cost and capital expenditure year-on-year, the recognition of Section 45X credits and improved 2E PGM basket prices contributed towards a turnaround in the performance for 2025 and significant reduction in losses compared to 2024. The improved profitability in 2025 sets a solid platform to further optimise operations and set up the US PGM business for long term success.

In accordance with the restructuring plan mined 2E PGM production for 2025 of 284,069 2Eoz was 33% lower year-on-year, exceeding the upper end of guidance of 270,000 2Eoz for the year. 2E PGM sold for 2025 of 283,622 2Eoz was in line with production.

The average 2E PGM basket price for 2025 increased by 21% to US$1,195/2Eoz (R21,367/2Eoz), with PGM prices rallying sharply during H2 2025. Improved PGM basket pricing and total Section 45X credit benefits of US$185 million (R3.3 billion) resulted in adjusted EBITDA for 2025

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 6

of US$249 million (R4.4 billion). Even without the Section 45X credit benefit, the US PGM operations contributed positively to the Group with adjusted EBITDA (excluding Section 45X credits) of US$64 million (R1.2 billion), a significant change in the financial performance compared to the US$9 million (R111 million) adjusted EBITDA loss for 2024.

Total operating cost for 2025 was well controlled declining by 30% to US$289 million (R5.2 billion) as planned and consistent with the reduced production profile. Operating cost includes the benefit of Section 45X credit legislation, with Section 45X credits of US$46 million (R801 million) recognised for 2025, and US$139 million (R2.5 billion) recognised during 2025 related to the combined 2023 and 2024 financial years.

AISC of US$1,203/2Eoz (R21,516/2Eoz) (including Section 45X credits) for 2025 was well below annual guidance of US$1,320/2Eoz. AISC (excluding Section 45X credits recognised for 2025) would have been US$162/2Eoz (R2,820/2Eoz) higher at US$1,365/2Eoz.

Total capital expenditure of US$96 million (R1.7 billion) was below guidance of US$100 million (R1.8 billion) and 38% lower year-on-year in line with the Q4 2024 restructuring plan. Project capital expenditure decreased by 52% to US$8 million (R135 million) for 2025. Sustaining capital expenditure increased in H2 2025 due to the delivery of new mining and support fleet to replace less efficient fleet as part of the strategic mechanisation initiatives.

The improvement in the PGM basket price and profitable performance in H2 2025 has eased near term pressure on the US PGM operations but has not diminished the focus to set up the US PGM business for the long term and establish a pathway to reduce costs to a sustainable AISC of US$1,000/2Eoz (in 2024 real terms, excluding Section 45X credits). We expect to provide further detail on the pathway to AISC of US$1,000/2Eoz at an investor day planned to be held in 2026.

Recycling

The US Recycling operations comprise Reldan Pennsylvania (PA), Metallix North Carolina (NC) acquired on 4 September 2025, and Columbus autocat recycling sites (Columbus), now operating under a unified leadership structure with integration of NC progressing well and synergies being realised across logistics, technology, technical capability and the expanding autocat value proposition. Going forward, all three sites will be reported as the US Recycling segment.

The combined Recycling operations recorded adjusted EBITDA of US$228 million (R4.1 billion) for 2025, contributing 11% to the Group adjusted EBITDA (including Section 45X credits).

PGM recycling operation (Columbus site)

Total PGM ounces fed for 2025 of 308,617 3Eoz were 2% lower year-on-year. Unfed inventory on hand has normalised to 52 tonnes at year end from the 147 tonnes at the end of H1 2025 .

The average 3E PGM basket price increased by 9% year-on-year to US$1,383/3Eoz (R24,728/3Eoz), primarily driven by higher rhodium prices. This increase was lower than the 21% rise in the 2E basket price achieved in the underground operations, reflecting the typical 2–3 month pricing lag in Recycling, where prices are fixed with customers at the time of delivery. Adjusted EBITDA increased by 857% to US$163 million (R2.9 billion) largely driven by the recognition of Section 45X credits.

Pennsylvania site (PA) (previously Reldan recycling)

Favourable metal pricing, strong manufacturing-sector demand, effective integration into the Sibanye-Stillwater Group and early benefits from the integration of the NC facility, enhancing the efficient processing of precious metal-bearing industrial waste, enabled PA to increase its profit and cash contribution to the Group.

For 2025 the PA site sold 138,977 oz gold, 2,031,547 oz silver, 17,697 oz platinum, 24,103 oz palladium and 3.1 million lbs of copper and processed 8.9 million lbs of industrial scrap. PA site's 2025 adjusted EBITDA was US$65 million (R1.2 billion), up from the US$15 million (R268 million) in 2024 which only included 10 months of Reldan since acquisition.

North Carolina site (NC) (previously Metallix recycling)

The acquisition of Metallix was concluded on 4 September 2025 and is expected to enhance the Group's recycling footprint adding processing capacity, logistics capability and technical skills. For the four months ended 31 December 2025, NC contributed revenue of US$93 million (R1,658 million).

The integration of NC into the Sibanye-Stillwater Group is underway. At acquisition, an accounting fair value adjustment of US$28 million (R501 million) was recognised to inventory on hand. This adjustment was subsequently expensed through cost of sales as the related inventory was sold, resulting in the NC site recording an adjusted EBITDA loss of US$10 million (R181 million) for the four months up to 31 December 2025.

European operations

Keliber lithium project

The Keliber lithium project is an advanced, fully integrated lithium development project located in Finland.

Construction activities at the Keliber lithium project progressed according to plan during 2025 with completion of the construction phase planned during Q1 2026.

Project capital expenditure for H2 2025 was €148 million (R2.7 billion), including capitalised interest of €8 million (R225 million) and other capitalised expenditure outside the project’s initial forecast scope (such as exploration). Full‑year 2025 capital expenditure totalled €299 million (R5.8 billion), consistent with the 2025 annual guidance of €300 million (R5.9 billion). At the end of December 2025, total project capital expenditure for the construction phase amounted to €693 million (R14.1 billion) (excluding capitalised interest and exploration) and in line with the revised capital forecast of €783 million (R15.9 billion) in 2024 real terms.

As communicated in January 2026, following a detailed multidisciplinary assessment of various project start up scenarios during H2 2025, Sibanye-Stillwater and its partner, Finnish Minerals Group, agreed that a staged startup for the Keliber lithium project was the most responsible approach.

Despite encouraging improvements in lithium prices during the fourth quarter of 2025 and into early 2026, the longevity of these price levels is yet to be confirmed. Staged commissioning of the mine, concentrator, and refinery reduces ramp-up risk by prioritising operational readiness in the mining and concentrating stages before determining the appropriate timing for refinery commissioning. This approach also preserves financing flexibility by enabling the deferral of capital expenditure and refinery ramp-up costs, depending on

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 7

lithium market developments and broader market conditions. The first stage of the project start up began during Q1 2026, with the first blast at the Syväjärvi open pit mining area on 11 February 2026.

* Amounts are translated at the average rate of R20.17/€ for 2025 and project expenditure to date, R20.08/€ for H2 2025 and R19.80/€ for the 2025 guidance

Sandouville nickel refinery

The Sandouville nickel refinery received the last nickel matte in January 2025 and subsequently ramped down production. Various cleaning and closure activities were undertaken during the year and the site was placed on care and maintenance as of January 2026.

An adjusted EBITDA loss of US$33 million (R590 million) was incurred for 2025 compared to a loss of US$41 million (R723 million) in 2024. Financial losses are expected to reduce in 2026 with estimated care and maintenance costs of US$12 million (R215 million) for 2026.

The GalliCam pre-feasibility study (PFS) to assess the potential conversion of the Sandouville plant to produce pCAM continued in 2025. GalliCam pre-feasibility costs of US$9 million (R161 million) were expensed in 2025 against guidance of US$11 million (R195 million) for 2025. The study will continue into 2026, with a decision on progressing the project to be evaluated by the end of H1 2026.

Australian operations

Century tailings retreatment operation

The Century zinc retreatment operation delivered a strong operational and financial performance, exceeding metal production guidance and AISC cost guidance for 2025. Production in 2025 was stable, having returned to normal levels when compared to 2024, which was impacted by a heavy wet season and damaged pipeline infrastructure from a regional bushfire in Q4 2024. Numerous wet-season resilience measures implemented in recent years, including the satellite slurry-winning pontoons, expanded dewatering infrastructure, enhanced debris removal systems and water diversion bunds, collectively reduced operational disruption and improved production consistency.

Production from the Century operations increased by 22% to 101 kilotonnes (kt) of payable zinc metal for 2025, compared to 82 kt in 2024. All-in sustaining costs (AISC) for 2025 were 17% lower to US$1,921/tZn (R34,356/tZn), compared to US$2,317/tZn and (R42,446/tZn) in 2024 due to increased production, disciplined cost control and a more predictable maintenance profile.

Adjusted EBITDA for the Century operations for 2025 was US$88 million (R1.6 billion), 160% higher compared to US$34 million (R641 million) in 2024, having benefitted considerably from improved production, higher zinc metal prices and lower treatment charges in 2025. The average equivalent zinc price increased by 1% to US$2,717/tZn (R48,584/tZn) in 2025 from US$2,678/tZn (R49,046/tZn) in 2024.

Total capital expenditure for 2025 decreased by 39% to US$6 million (R114 million) compared to US$10 million (R192 million) in 2024, due to once off infrastructure expenditure in 2024 post the bushfire recovery, and the five yearly scheduled maintenance overhaul for the Century transhipment vessel, the Wunma. Sustaining capital expenditure during 2025 focused on maintaining asset integrity, strengthening operational resilience and ensuring the long-term reliability of critical infrastructure. Project capital expenditure in 2025 of US$3 million (R55 million) was due to spend and capitalisation of costs relating to the phosphate feasibility study that commenced in 2025.

We expect the strong operational performance in 2025 to continue in 2026, positioning the Century operations well to benefit from an environment of supportive zinc metal pricing and low treatment charges.

Options to leverage the existing infrastructure (processing plant, pipeline, camp and port facilities) and extend the life of the assets beyond the current zinc retreatment operations continue to be actively explored. This includes opportunities to potentially utilise the Century infrastructure to access the extensive, largely undeveloped phosphate resources in the region. A feasibility study (AACE Class 2 Estimate) is expected to be completed during H1 2026.

Mt Lyell copper project

The Mt Lyell feasibility study (AACE Class 2 Estimate) was completed at the end of 2025. The work undertaken during the year allowed the declaration of a 1,053Mlb copper Mineral Reserve at 31 December 2025. Progression of any further study work and a final investment decision to be evaluated in accordance with the Group's capital allocation framework and subject to final board approval.

Project capital amounted to US$4 million (R66 million) in 2025 due to spend and capitalisation of the Mt Lyell feasibility study costs.

* Amounts are translated at the average rate R11.52/A$ and R17.88/US$ for 2025

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 8

FINANCIAL REVIEW OF THE SIBANYE-STILLWATER GROUP Group financial performance

The financial review commentary compares the H2 2025 reporting period to H2 2024 reporting period for income statement items and 31 December 2025 to 30 June 2025 for statement of financial position items.

Group revenue for H2 2025 increased by 32% to R74,910 million mainly due to higher commodity prices received at all operations except the Century operations, partially offset by lower sales volumes at the SA gold, US PGM and Century operations. Group cost of sales, before amortisation and depreciation increased by 4% to R50,165 million mainly due to the inclusion of costs from the NC recycling site (Metallix), partially offset by lower cost of sales at the Sandouville nickel refinery and lower sales volumes. The increase in net impairments recognised, higher share-based payment expenses, lower other income received, higher other costs, net loss on financial instruments, higher transaction costs and higher royalties and taxes together with the higher cost of sales resulted in a 165% decrease in the Group loss for H2 2025 of R833 million. Group adjusted EBITDA for H2 2025 increased by 253% or R16,287 million to R22,727 million.

Revenue

Group revenue for H2 2025 increased by 32% or R17,985 million to R74,910 million. Group revenue benefited from increased commodity prices and the inclusion of the NC recycling site, which is consolidated with the PA recycling site (Reldan), partially offset by lower sales volumes at SA gold, US PGM and Century operations and Sandouville which ramped down and ceased production. Consequently, the impact of both higher commodity prices and higher volumes resulted in higher revenue at the SA PGM operations of R11,366 million while higher gold prices resulted higher revenue at the SA gold operations of R4,304 million. The higher commodity prices combined with NC recycling revenue also resulted in higher revenue for PA recycling of R4,300 million.

Cost of sales, before amortisation and depreciation

Group cost of sales before amortisation and depreciation for H2 2025 increased by 4% or R1,828 million to R50,165 million. This was mainly due to the inclusion of costs from the NC recycling site which resulted in a net increase in costs at the combined recycling operations of R3,715 million and for the SA PGM operations, mainly due to higher volumes sold. Notably, cost of sales before amortisation and depreciation at the US PGM underground operations decreased by R2,508 million or 53%,due to a 32% decrease in volumes sold by the US PGM operations as they were repositioned for a lower cost structure. Section 45X advanced manufacturing production credits recognised for H2 2025 were R441 million (US$26 million). Additionally, cost of sales before amortisation and depreciation at the Sandouville nickel refinery decreased by R1,450 million or 99%, due to the termination of nickel production and preparation towards placing Sandouville in care and maintenance.

Loss for the period

Loss for H2 2025 increased by 165% from a profit of R1,291 million to a loss of R833 million, due to higher net impairments raised (Keliber and Kloof, discussed later in this section), higher share-based payment expenses of R1,385 million (a function of the higher share price), higher transaction costs (which included the Appian legal settlement of R3,565 million - see note 13 of the condensed consolidated financial statements), movement in net loss on financial instruments of R7,340 million (mainly due to higher fair value losses recognised relating to the Burnstone debt and other BEE related liabilities), lower other income of R434 million, higher other costs of R179 million and higher royalties and taxes of R626 million and R2,522 million (due to increased profitability). The decrease in other income was mainly due to no onerous supply contract provision utilisation/change in estimate for the Sandouville nickel refinery. The loss for H2 2025 was partially offset by the profit from the share of results of equity accounted investees of R693 million, mainly related to a higher profit from Mimosa.

Adjusted EBITDA

Adjusted EBITDA includes other cash costs, care and maintenance costs; lease payments and corporate social investment costs (see note 19 of the condensed consolidated financial statements for a reconciliation of profit before royalties, carbon tax and tax to adjusted EBITDA). Care and maintenance costs for H2 2025 were R1,099 million.

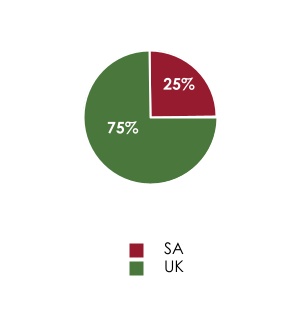

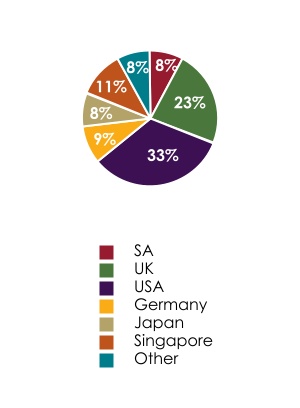

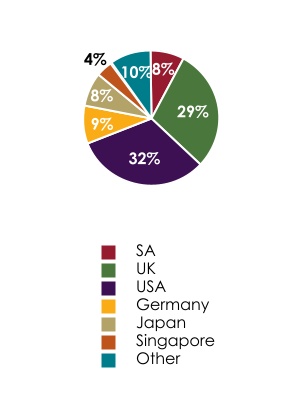

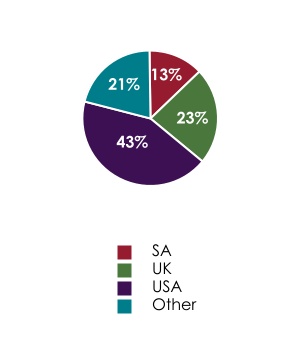

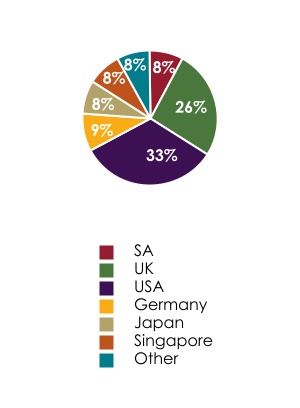

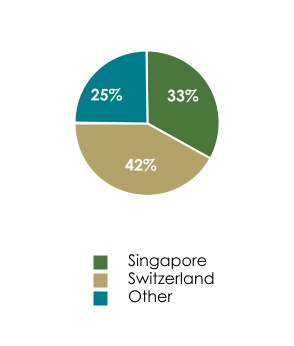

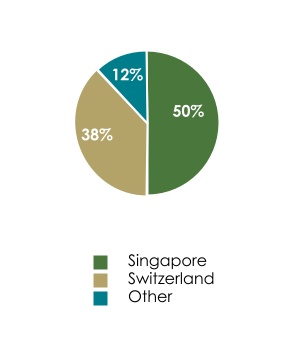

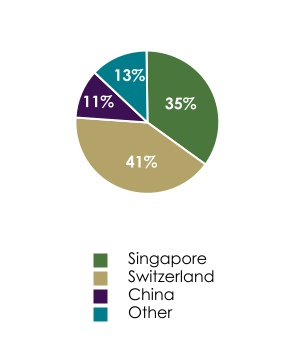

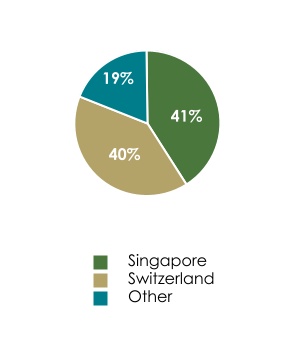

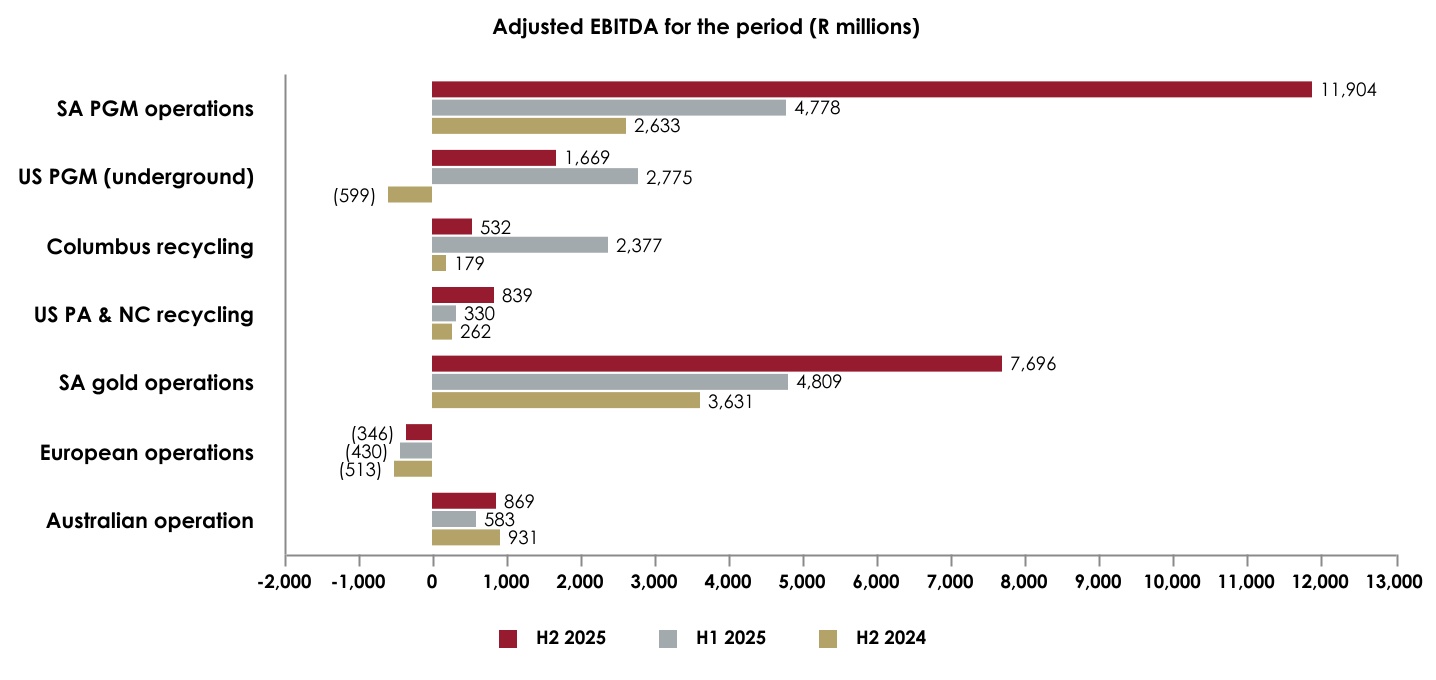

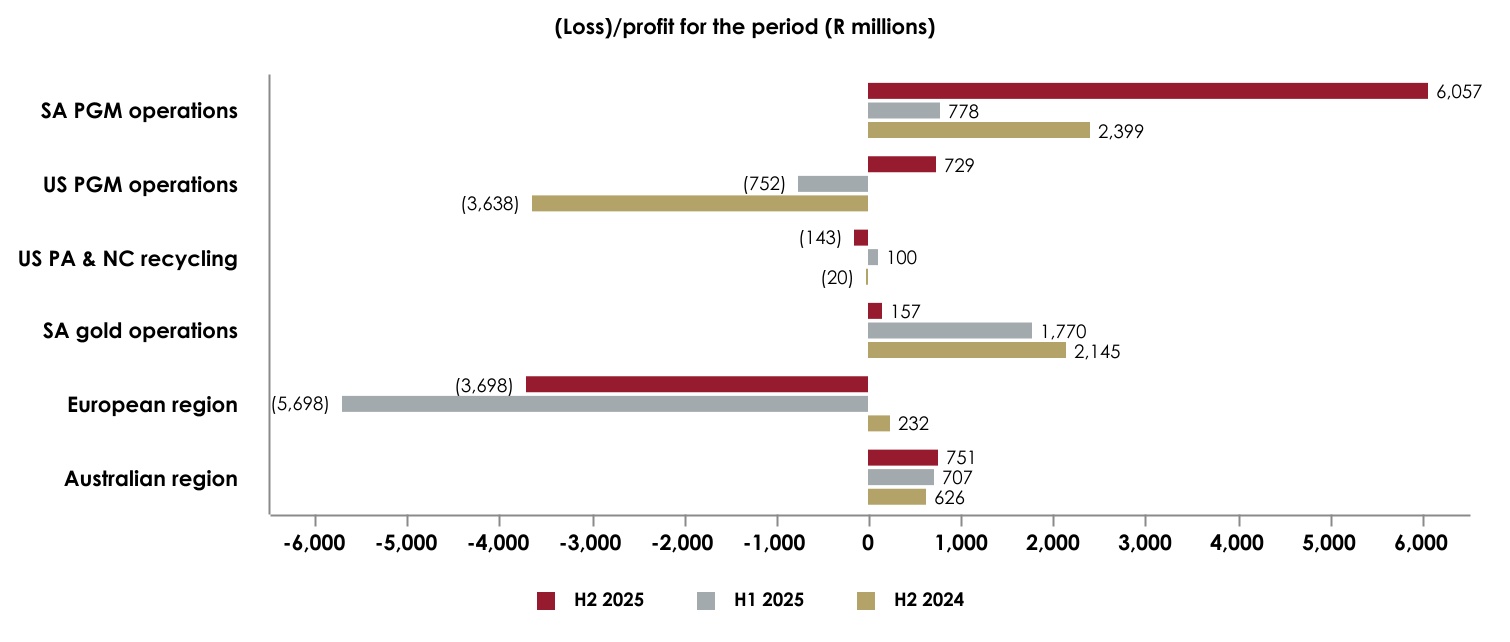

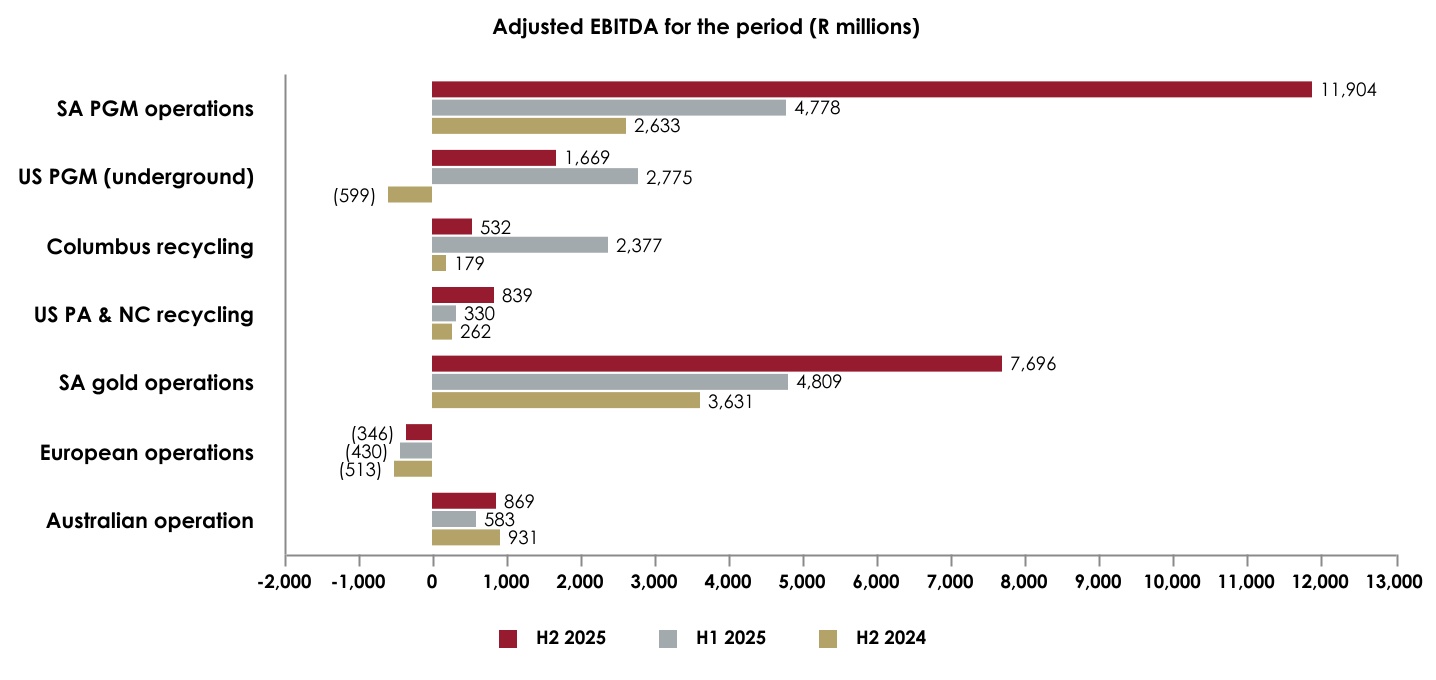

The (Loss)/profit and Adjusted EBITDA are shown in the graphs below:

The (Loss)/profit in the graph above includes the impairment losses recognised/reversed during the H2 2025 period, which are discussed under the impairments section further below.

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 9

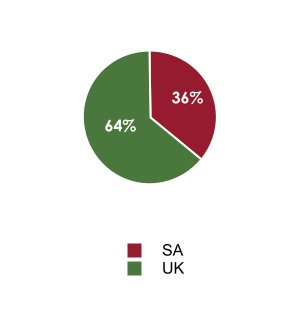

Adjusted EBITDA is shown in the graph below:

Interest Income

Interest IncomeInterest income increased by R293 million to R882 million mainly due to Section 45X interest accrued at the US PGM and Columbus recycling operations of R142 million and R127 million, respectively and R21 million higher interest received on average cash balances.

Finance expense

Finance expense increased by R168 million to R2,447 million mainly due to a R387 million increase in the unwinding of the finance costs on the deferred revenue transactions. See note 4 of the condensed consolidated financial statements for further detail of finance expenses.

Loss on financial instruments

The loss on financial instruments of R3,403 million for H2 2025 compared with the gain of R3,937 million for H2 2024, represents a period-on-period net loss of R7,340 million. The net loss for H2 2025 is mainly attributable to a change in estimated cash flows/fair value loss on the Burnstone project debt of R1,805 million after increased long-term gold prices and fair value losses on hedge contracts for gold of R958 million, attributable to the record high gold prices during 2025. Also included in the loss for H2 2025 was fair value adjustment on the PA recycling metal borrowing of R461 million, fair value losses on the (Rustenburg and Marikana operations BEE cash-settled) share-based payment obligations (and the Marikana dividend obligation) of R289 million, fair value losses on hedge contracts for zinc of R66 million, partially offset by reduced cash flows of the Keliber dividend obligation of R290 million and other investments of R20 million. See note 5 of the condensed consolidated financial statements for a breakdown of the loss on financial instruments.

Impairments

At 31 December 2025, the Group recognised net impairments of R4,341 million due to:

•a further decrease in the long-term forecasted lithium hydroxide price compared to 30 June 2025 and a decision to proceed with a phased start-up profile resulting in a decrease in the recoverable amount as at 31 December 2025, and resulted in an impairment of property, plant and equipment amounting to R2,460 million at Keliber

•a decrease in the life of mine as a result of logistical constraints, seismicity and safety concerns to access higher grade areas, that resulted in a decrease in the recoverable amount at 31 December 2025 and resulted in an impairment of property, plant and equipment amounting to R3,779 million at Kloof

•an higher gold price outlook and sustained operational improvements at the Beatrix and Driefontein operations translated to an increase in the expected future net cash flows and recoverable amounts at Beatrix, Driefontein and Burnstone that resulted in an increase in their carrying values of of property, plant and equipment, and led to a reversal in previously recognised impairment losses amounting to R1,923 million

See note 7 of the condensed consolidated financial statements for additional information on impairments.

Mining and income tax

Mining and income tax of R2,843 million for H2 2025 increased by R2,522 million compared with the R321 million for H2 2024. Current tax increased by R1,202 million to R2,109 million in H2 2025 from R907 million in H2 2024, mainly due to higher current tax at the SA PGM Marikana (R308 million) and Rustenburg operations (R1,009 million). The deferred taxation expense increased from R586 million income in H2 2024 to an expense of R734 million in H2 2025, representing a net movement of R1,320 million. The increase in deferred taxation expense in H2 2025 mainly related to deferred tax on property, plant and equipment at DRDGOLD Limited and Western Platinum Proprietary Limited, due to redeeming capital for tax purposes, as a result of higher profitability. The capital for Western Platinum Proprietary Limited incorporate the project capital expenditure from the K4 project.

Cash and liquidity

The Group’s cash balance (excluding cash of Burnstone1) decreased by 18% from R20,966 million at 30 June 2025 to R17,129 million at 31 December 2025. The Appian settlement of R3,607 million was paid on 9 December 2025 from existing cash resources. Group liquidity was R40,057 million (30 June 2025: R46,932 million), comprising R17,129 million of cash and cash equivalents (30 June 2025: R20,966 million) and R22,928 million of undrawn facilities (30 June 2025: R25,966 million). The outstanding Rand RCF was settled subsequent to 31 December 2025.

1.The Burnstone debt is securitised and therefore has no recourse to Sibanye-Stillwater and as such Sibanye-Stillwater reports Gross debt, Net debt and Cash excluding the amounts that belong to Burnstone

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 10

Borrowings and net debt

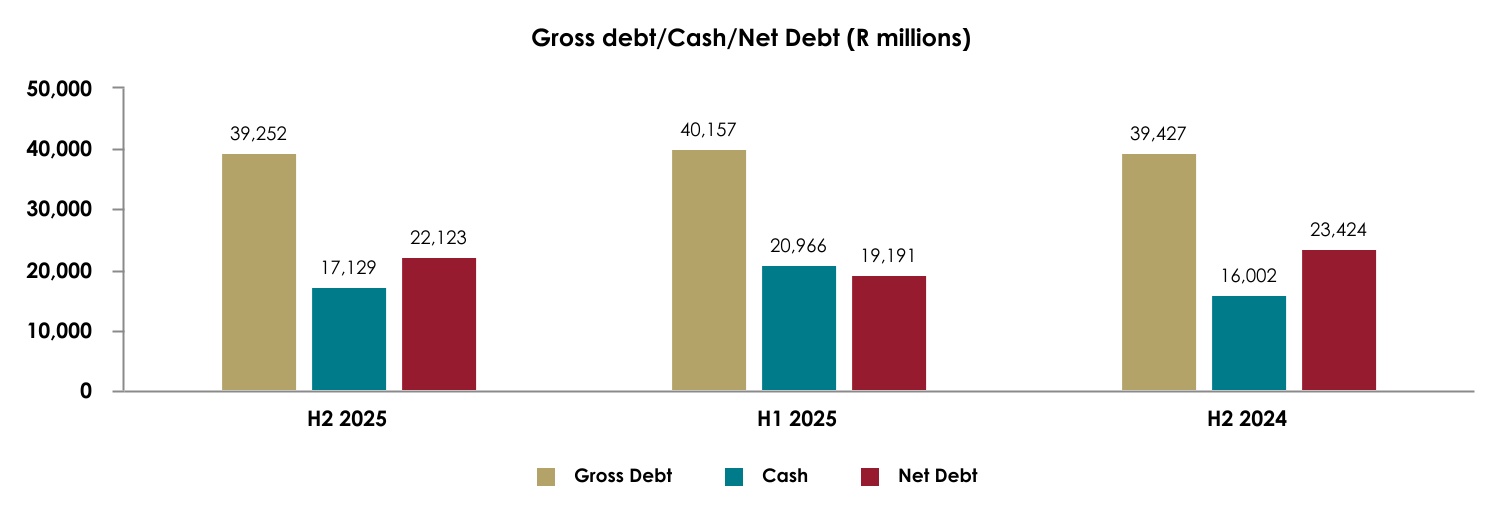

Gross debt1 decreased by 2% from R40,157 million at 30 June 2025 to R39,252 million at 31 December 2025. Burnstone debt amounted to R4,005 million (30 June 2025: R2,254 million). The decrease in gross debt was mainly due to a net decrease of R2,797 million on US dollar denominated debt due to a 7% stronger rand since 30 June 2025, a decrease in the Rand RCF of R500 million, partially offset by a drawdown on the Keliber financing facility of R1,374 million. Net debt was R22,123 million at 31 December 2025 (30 June 2025: R19,191 million) and increased by R2,932 million due to the Appian settlement of R3,607 million from existing cash resources and a partial repayment on the Rand RCF loan. Refer to note 12 of the condensed consolidated financial statements for a roll forward of the gross debt for the six months ended 31 December 2025.

1.The Burnstone debt is securitised and therefore has no recourse to Sibanye-Stillwater and as such Sibanye-Stillwater reports Gross debt, Net debt and Cash excluding the amounts that relates to Burnstone

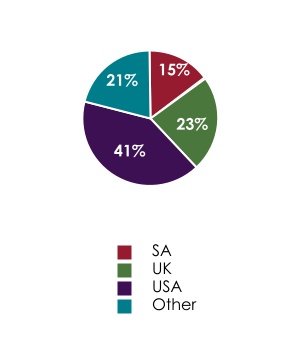

The graph below illustrates the Group's gross debt/cash/net debt for H2 2025, H1 2025 and H2 2024:

Cash flow analysis

Notional free cash flow

Sibanye-Stillwater defines notional free cash flow as adjusted EBITDA, less non cash revenue relating to streaming transactions and deferred prepayments, non cash government grants and accrued taxes and royalties, and includes other non-routine cash items such as legal dispute settlements and realised hedges.

The following table shows the calculation of notional free cash flow:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Figures in million - SA rand | | Six months ended | Year ended |

| | Dec 2025 | June 2025 | Dec 2024 | Dec 2025 | Dec 2024 |

| Adjusted EBITDA | | 22,727 | 15,073 | 6,440 | 37,800 | 13,088 |

| Adjusted for non-cash items: | | | | | | |

| Deferred revenue released - Streaming | | (473) | (659) | (286) | (1,132) | (455) |

| Deferred revenue released - Prepays | | (467) | (1,201) | (406) | (1,668) | (406) |

| Section 45X grant not yet received | | (832) | (5,053) | — | (5,885) | — |

| Tax and royalties (accrued) | | (3,035) | (527) | (1,209) | (3,562) | (1,961) |

| Other non-routine cash items: | | | | | | |

| Legal settlement payment to Appian | | (3,565) | — | (115) | (3,565) | (115) |

| Early settlement payment on onerous contract | | (29) | (16) | (665) | (45) | (665) |

| Realised hedges | | (1,274) | (333) | (247) | (1,607) | (314) |

| | 13,052 | 7,284 | 3,512 | 20,336 | 9,172 |

| Property. plant and equipment additions | | (10,769) | (9,538) | (10,422) | (20,307) | (21,569) |

| Notional free cash flow | | 2,283 | (2,254) | (6,910) | 29 | (12,397) |

Notional free cash flow, defined and reconciled above, is not a measure of performance under IFRS Accounting Standards. As a result, it should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS Accounting Standards

For a reconciliation between notional free cash flow and net cash from operating activities, see pages 63 and 64.

The following table shows the notional free cash flow per operating segment:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Figures in million - SA rand | | Six months ended | Year ended |

| | Dec 2025 | June 2025 | Dec 2024 | Dec 2025 | Dec 2024 |

US PGM operations | | 232 | (1,063) | (1,952) | (831) | (3,375) |

US PA & NC recycling operations | | 739 | 273 | 151 | 1,012 | 133 |

| SA PGM operations | | 5,405 | 441 | (1,331) | 5,846 | 136 |

| SA gold operations | | 2,146 | 1,078 | 164 | 3,224 | (1,608) |

| European operations | | (3,242) | (3,330) | (4,354) | (6,572) | (7,449) |

| Australian operation | | 587 | 409 | 628 | 996 | 30 |

| | 5,867 | (2,192) | (6,694) | 3,675 | (12,133) |

| Group corporate | | (3,584) | (62) | (216) | (3,646) | (264) |

| Notional free cash flow | | 2,283 | (2,254) | (6,910) | 29 | (12,397) |

Notional free cash flow, reconciled above, is not a measure of performance under IFRS Accounting Standards. As a result, it should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS Accounting Standards

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 11

The US PGM operations notional free cash flow for H2 2025 of R232 million compared to negative notional free cash flow for H2 2024 of R1,952 million. The increase in notional free cash flow for H2 2025 was mainly due an increase in adjusted EBITDA due to lower cost of sales of R1,917 million, lower revenue of R274 million mainly due to 32% lower 2E sales volumes in line with the restructured US PGM production profile and lower cash additions to property, plant and equipment of R208 million.

The US PA & NC recycling operations generated notional free cash flow of R739 million compared to notional free cash flow for H2 2024 of R151 million, mainly due to the addition of the NC recycling site (Metallix), partially offset by higher cash additions to property, plant and equipment of R39 million.

The SA PGM operations generated notional free cash flow of R5,405 million compared to negative notional free cash flow for H2 2024 of R1,331 million, due to 8% higher sales volumes and 46% higher 3E PGM basket price received during H2 2025 which resulted in R11,366 million higher revenue, partially offset by higher cost of sales of R2,224 million and higher taxes and royalties accrued of R2,653 million due to higher profitability.

The SA gold operations generated notional free cash flow of R2,146 million compared to notional free cash flow of R164 million in H2 2024, mainly due to the 40% higher gold price received during H2 2025 which resulted in R4,304 million higher revenue, partially offset by 8% lower volumes and the losses realised on the gold hedge contracts of R566 million and higher cash additions to property, plant and equipment of R938 million.

The European operations incurred negative notional free cash flow of R3,242 million compared to negative notional free cash flow for H2 2024 of R4,354 million, mainly attributable to capital expenditure on the Keliber lithium project of R2,735 million (H2 2024: R3,533 million), a decrease in the Sandouville adjusted EBITDA loss to R280 million in H2 2025 (H2 2024: R443 million) due to being placed on care and maintenance during H2 2025 and the settlement of a key contract of R665 million paid during H2 2024.

The Century operation generated notional free cash flow of R587 million compared to notional free cash flow for H2 2024 of R628 million, mainly due to the impact of lower sales recognised due to shipping constraints and a 6% lower zinc concentrate price.

DIVIDENDS

The Sibanye-Stillwater board of directors has declared and approved a cash dividend of 131 SA cents per ordinary share (US 8.17 cents* per share or US 32.68 cents* per ADR) or approximately R3,697 million (US$231 million*) in respect of the six months ended 31 December 2025 (Final dividend). The Board applied the solvency and liquidity test and reasonably concluded that the Company and Group is and will be solvent and liquid as required by the Companies Act in South Africa, before and immediately after completing the proposed distribution.

The Group’s dividend policy is to return between 25% to 35% of normalised earnings to shareholders and after due consideration of future requirements the dividend may be increased beyond these levels. The Board, consistently considers normalised earnings in determining what value will be distributed to shareholders. The Board believes normalised earnings provides useful information to investors regarding the extent to which results of operations may affect shareholder returns. Normalised earnings is defined as earnings attributable to the owners of Sibanye-Stillwater excluding gains and losses on financial instruments and foreign exchange differences, impairments and related compensation, gain/loss on disposal of property, plant and equipment, occupational healthcare expenses, restructuring costs, transactions costs, share-based payment expenses on B-BBEE transactions, gains on acquisitions, net other business development costs, share of results of equity-accounted investees, all after tax and the impact of non-controlling interest, and changes in the estimated deferred tax rate.

The total dividend declared of 131 SA cents (Final dividend: 131 SA cents and Interim dividend: 0 SA cents) equates to 35% of normalised earnings for the year ended 31 December 2025.

The final dividend will be subject to Dividends Withholding Tax. In accordance with paragraph 7.23 of the JSE Listings Requirements the following additional information is disclosed:

•The dividend has been declared out of income reserves

•The local Dividends Withholding Tax rate is 20% (twenty per centum)

•The gross local dividend amount is 131.0000 SA cents per ordinary share for shareholders exempt from the Dividends Tax

•The net local dividend amount is 104.8000 SA cents (80% of 131 SA cents) per ordinary share for shareholders liable to pay the Dividends Withholding Tax

•Sibanye-Stillwater currently has 2,830,567,264 ordinary shares in issue

•Sibanye-Stillwater’s income tax reference number is 9723 182 169

Shareholders are advised of the following dates in respect of the final dividend:

Final dividend: 131 SA cents per share

Declaration date: Friday, 20 February 2026

Last date to trade cum dividend: Tuesday, 17 March 2026

Shares commence trading ex-dividend: Wednesday, 18 March 2026

Record date: Friday, 20 March 2026

Payment of dividend: Monday, 23 March 2026

Please note that share certificates may not be dematerialised or rematerialised between Wednesday, 18 March 2026 and Friday, 20 March 2026 both dates inclusive.

To holders of American Depositary Receipts (ADRs):

•Each ADR represents 4 ordinary shares;

•ADRs trade ex-dividend on the New York Stock Exchange (NYSE): Thursday, 19 March 2026;

•Record Friday, 20 March 2026;

•Approximate date of currency conversion: Monday, 23 March 2026; and

•Approximate payment date of dividend: Monday, 6 April 2026

Assuming an exchange rate of R16.0348/US$1*, the dividend payable on an ADR is equivalent to 26.14 United States cents for Shareholders liable to pay dividend withholding tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

* Based on an exchange rate of R16.0348/US$ at 17 February 2025 from Equity RT. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion

MINERAL RESOURCES AND MINERAL RESERVES

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 12

On 17 February 2025, Sibanye-Stillwater reported an update of its Mineral Resources and Mineral Reserves as at 31 December 2025, the salient points of which are summarised below.

•4E PGM Mineral Resources of 138.2Moz (-4.5%) and Mineral Reserves of 29.4Moz (+4.7%) at our SA PGM operations

–The inclusion of the Marikana E4 mechanised UG2 project Mineral Reserves added +2.9Moz to Mineral Reserves following the completion of a feasibility study

•2E PGM Mineral Resources of 57.5Moz (+2.8%) and Mineral Reserves of 19.4Moz (+2.1%) at our US PGM operations

•Gold Mineral Resources of 25.2Moz (-31.7%) and Mineral Reserves of 9.4Moz (-6.3%) at our SA gold operations (including DRDGOLD) and development projects (including Burnstone)

–At the Kloof operation, production constraints, including geotechnical considerations which led to the removal of isolated blocks of ground, have impacted the economic viability of the operation, leading to a writedown of the majority of the Mineral Reserves (-1.4Moz)

•Uranium Oxide (U3O8) Mineral Resources of 33.1Mlb (-44.1%) and Mineral Reserves of 25.2Mlb at our SA gold operations

–The maiden uranium Mineral Reserve is based on the completion of the Cooke TSF feasibility study

–The reduction in Mineral Resources is informed by the conversion to Mineral Reserves

•Lithium Mineral Resources of 263kt lithium carbonate equivalent (LCE) (-38.0%) and Mineral Reserves of 248kt (unchanged)

–The change in Mineral Resource is informed by the disposal of our interest in Ioneer Ltd (-201kt) and an updated Mineral Resource estimate at the Keliber lithium project (+40kt) in Finland following successful exploration

•Zinc Mineral Resources of 568kt (unchanged year-on-year) and Mineral Reserves of 308kt (-44.2%)

–Informed by the ongoing depletion of the tailings Mineral Reserve at the Century operation, which now has ~18 months of reserve life left

•Copper Mineral Resources of 5,006kt (-37.3%) and Mineral Reserves of 478kt

–At the Mt Lyell copper project in Tasmania, Australia, the completion of the feasibility study has resulted in a maiden Mineral Reserve under Sibanye-Stillwater. This also informed a reduction in Mineral Resources at Mt Lyell

–At the Altar project in Argentina, a reduction in project ownership (40% to 20%) following a further earn-in by Aldebaran Resources, has resulted in an attributable Mineral Resource reduction (-2,478kt)

Sibanye-Stillwater is preparing, and will file with the United States Securities and Exchange Commission (SEC), updated technical report summaries as required by Subpart 1300 of Regulation S-K with its 2025 annual report on Form 20-F.

CHANGE IN BOARD OF DIRECTORS

Changes to the Board of Sibanye Stillwater Limited during the six-month period ended 31 December 2025 include Dr Lindiwe Mthimunye who has been appointed as an Independent Non-Executive Director of the Company on 26 August 2025. In addition, Mr Neal Froneman has retired as Chief Executive Officer (CEO) and executive director of the Group, effective 30 September 2025 and Dr Richard Stewart has assumed the role of CEO of the Group effective 1 October 2025.

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2025 13

SALIENT FEATURES AND COST BENCHMARKS – SIX MONTHS US and SA PGM operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | US PGM operations | Total SA PGM operations2 | Rustenburg including Kroondal10 | Marikana2 | Plat Mile | Mimosa |

| | | Under- ground1 | Total | Under-

ground | Surface | Under-

ground | Surface | Under-

ground | Surface | Surface | Attribu-table |

| Production | | | | | | | | | | | | |

| Tonnes milled/treated | kt | Dec 2025 | 395 | | 19,185 | | 9,858 | | 9,327 | | 5,861 | | 2,614 | | 3,262 | | 1,746 | | 4,967 | | 735 | |

| | Jun 2025 | 365 | | 17,311 | | 8,702 | | 8,609 | | 5,139 | | 2,591 | | 2,840 | | 1,569 | | 4,449 | | 723 | |

| | Dec 2024 | 510 | | 18,035 | | 9,244 | | 8,790 | | 5,304 | | 2,630 | | 3,207 | | 1,984 | | 4,176 | | 734 | |

| Plant head grade | g/t | Dec 2025 | 12.36 | | 2.12 | | 3.23 | | 0.94 | | 2.95 | | 1.17 | | 3.69 | | 1.22 | | 0.72 | | 3.38 | |

| | Jun 2025 | 13.32 | | 2.04 | | 3.18 | | 0.89 | | 2.87 | | 1.03 | | 3.70 | | 1.16 | | 0.72 | | 3.39 | |

| | Dec 2024 | 12.65 | | 2.16 | | 3.30 | | 0.96 | | 2.94 | | 1.05 | | 3.87 | | 1.11 | | 0.83 | | 3.39 | |

| Plant recoveries | % | Dec 2025 | 91.02 | | 70.73 | | 84.63 | | 19.20 | | 84.93 | | 25.15 | | 86.90 | | 17.74 | | 15.00 | | 72.60 | |

| | Jun 2025 | 90.68 | | 70.84 | | 84.32 | | 21.96 | | 84.10 | | 31.42 | | 86.51 | | 20.65 | | 14.63 | | 74.98 | |

| | Dec 2024 | 90.42 | | 72.70 | | 85.13 | | 27.86 | | 85.06 | | 38.19 | | 87.17 | | 26.46 | | 20.58 | | 76.25 | |

| Yield | g/t | Dec 2025 | 11.25 | | 1.49 | | 2.73 | | 0.18 | | 2.51 | | 0.29 | | 3.21 | | 0.22 | | 0.11 | | 2.45 | |

| | Jun 2025 | 12.08 | | 1.45 | | 2.68 | | 0.20 | | 2.41 | | 0.32 | | 3.20 | | 0.24 | | 0.11 | | 2.54 | |

| | Dec 2024 | 11.44 | | 1.57 | | 2.81 | | 0.27 | | 2.50 | | 0.40 | | 3.37 | | 0.29 | | 0.17 | | 2.58 | |

PGM production3 | 4Eoz - 2Eoz | Dec 2025 | 142,945 | | 920,526 | | 866,395 | | 54,131 | | 472,090 | | 24,736 | | 336,340 | | 12,154 | | 17,241 | | 57,965 | |

| | Jun 2025 | 141,124 | | 804,252 | | 750,150 | | 54,102 | | 398,791 | | 26,956 | | 292,305 | | 12,084 | | 15,062 | | 59,054 | |

| | Dec 2024 | 187,703 | | 910,486 | | 834,912 | | 75,574 | | 426,120 | | 33,906 | | 347,821 | | 18,735 | | 22,933 | | 60,971 | |

PGM sold4 | 4Eoz - 2Eoz | Dec 2025 | 150,516 | | 930,549 | | | | 426,568 | | 24,105 | | 392,690 | 17,241 | | 69,945 | |

| | Jun 2025 | 133,106 | | 797,039 | | | | 375,792 | | 26,863 | | 340,367 | 15,062 | | 38,955 | |

| | Dec 2024 | 220,456 | | 858,355 | | | | 325,369 | | 41,846 | | 408,858 | 22,933 | | 59,349 | |

Price and costs5 | | | | | | | | | | | |