Please wait

Letter to Shareholders: Q3 2025

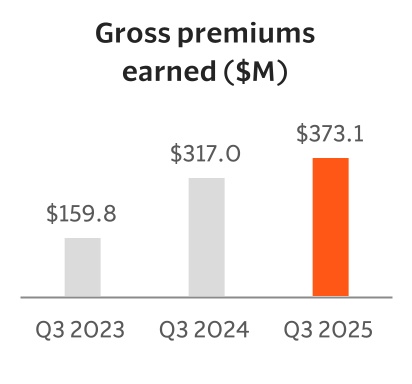

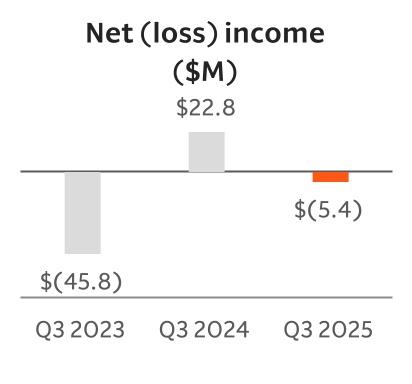

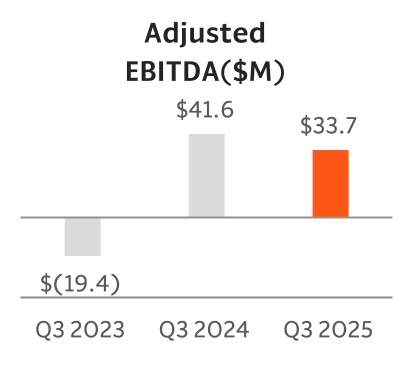

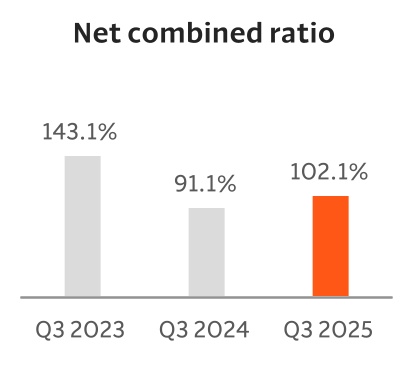

Key quarterly metrics

Dear Shareholders

Dear Root Shareholders,

In the third quarter, we set another record for policies-in-force and revenue, while continuing to generate exceptional loss ratio performance. Specifically:

•Total revenue grew 27% year-over-year, driven by net earned premium growth of 29%

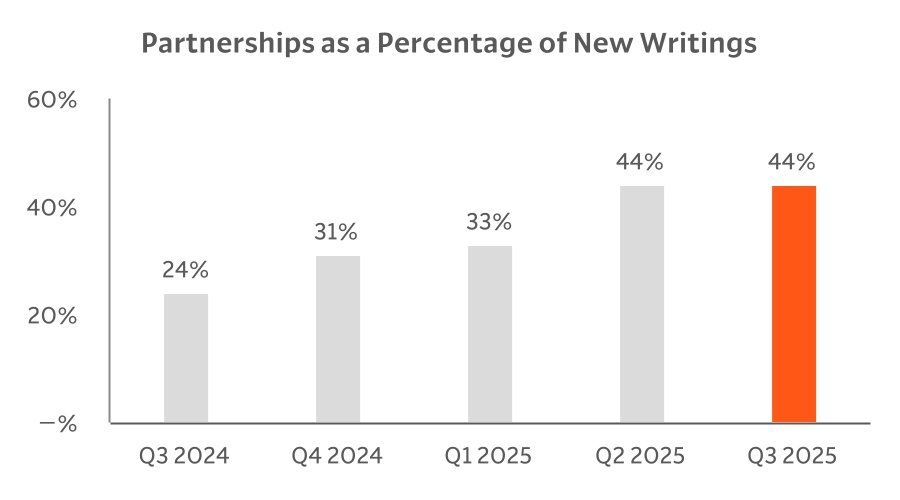

•Independent agent new writings more than tripled year-over-year, highlighting the ongoing diversification of our Partnership channel

•Gross loss ratio of 59% demonstrated the power of our pricing and underwriting technology and continues to trend below our long-term target of 60-65%

These results were driven by a structural, durable competitive advantage of combining a core technology company with a full stack insurance carrier. This advantage has built a formidable business model that provides a foundation for better prices and experiences for our customers, more efficient and scalable operations, and ultimately the path for continued growth and profit for our shareholders.

2

2

Letter to Shareholders: Q3 2025

This advantage was evident in the quarter as we grew new writings sequentially across all channels. This was driven by the deployment of our latest pricing model discussed last quarter, which increased estimated customer LTVs (Lifetime Values) by over 20% on average. As a technology company, our ability to rapidly gather new data and deploy new algorithms creates a virtuous cycle that allows us to continually improve our product. With the continued proliferation of AI and machine learning, our data science DNA places us right where the future is headed.

And we believe this is just the beginning.

Our business model extends to customers no matter how they shop for insurance, and today Root is only available through a small fraction of distribution channels. A proof point from the third quarter of this growth opportunity was the continued scaling of independent agents, where we tripled our new writings year-over-year while only active with less than 10% of independent agents nationally. This channel alone represents more than $100 billion in premium and we continue to efficiently add independent agents to our platform. As we continue to invest in our Partnership initiatives and embedded technology, we have a firm belief that we will increase scale across independent agents, automotive partners, and financial services partners by creating seamless experiences and offering great prices.

Our goal remains unchanged—to build the largest, most profitable personal lines insurance carrier in the United States. Our confidence in executing against this vision strengthens with each quarter of marked progress. We could not be more excited.

Growth

Through our technology, we have built a product that delivers excellent customer experiences at prices customers love. This obsession with the customer and focus on offering great prices is the foundation of our continued growth. We believe we are in the very early stages of growth and are focused on three primary levers to continue to expand our business:

Letter to Shareholders: Q3 2025

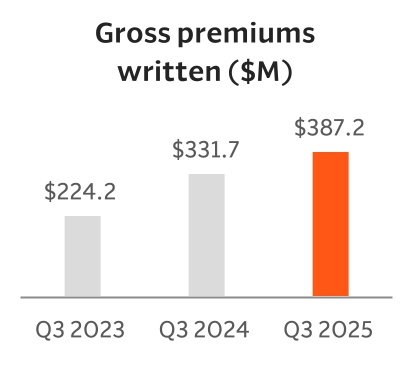

For the third quarter, gross premiums written increased 17% and gross premiums earned increased 18% year-over-year, while our gross loss ratio and LAE ratio moderated 1 percentage point year-over-year to 66%. On a sequential basis, despite an increasingly competitive environment, we are seeing growth accelerate both in our Direct and Partnership channels.

Our Partnership channel is consistently growing and once again more than doubled new writings year-over-year. This channel allows us to leverage our technology advantage to create seamless and integrated insurance purchasing experiences in the moments that make the most sense for customers. We continue to deepen our integration with existing partners while also expanding our roster of new partners across the automotive, financial services, and independent agent verticals. As we highlighted last quarter, independent agents are an exciting area of new growth and are now meaningfully contributing to our trajectory. In the third quarter, independent agents accounted for roughly 50% of overall Partnership new writings, reflecting a 3x year-over-year increase as we rapidly make new independent agent appointments and integrate with additional comparative raters that our independent agents use to compare prices.

In our Direct channel, new writings increased sequentially by high single digits as we continued to deploy our latest pricing model and enhance our real-time bidding algorithms. Our machine continues to detect prevailing trends in the competitive marketplace and dynamically deploys our marketing investment to optimize growth at our target unit economics. As we continue to advance segmentation, it will open up new pockets of growth as we provide more attractive prices for the best drivers.

We continued to make progress on state expansion. In the third quarter, we launched in the state of Washington, increasing our geographic footprint to 36 states that comprise nearly 80% of the U.S. population. While we still have several state filings pending, and the timelines for approval vary state by state, we are excited by this milestone and the continued progress towards our goal to be fully national.

Letter to Shareholders: Q3 2025

Pricing and Underwriting

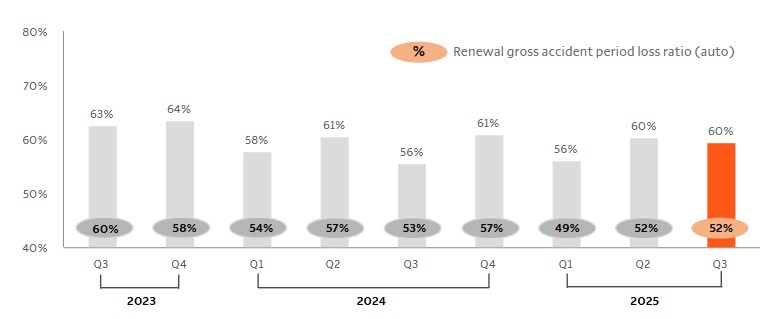

Accurately matching price to risk is a key pillar of Root’s strategy. For the third quarter, our strong underwriting performance continued with a gross loss ratio of 59%.

As a technology company, we are able to innovate quickly, rapidly iterating on our pricing models and constantly reinforcing a structural competitive advantage. Machine learning and data science techniques enable an environment of constant experimentation to fine tune our prices and drive targeted growth in our business. This creates a flywheel effect where new features provide better data, which helps us give our customers more tailored products at a better price.

Last quarter, we released an updated pricing model, significantly improving our accuracy through better risk segmentation and increasing estimated customer lifetime values by over 20% on average. In the third quarter, we launched the newest version of our UBI (Usage-Based Insurance) model that has upgraded feature models, new interaction terms, and improved feature transformations to increase predictive power. We estimate that this UBI model is roughly 10% more predictive than its predecessor and is one of the most meaningful variables in our broader pricing engine.

We look forward to building on our strong foundation by launching and expanding features for our customers such as continuous telematics for ongoing policyholder engagement, connected car experiences to take advantage of existing driving data, and third-party telematics utilization. We expect that this will enable us to increasingly offer telematics at the point of sale without the required test drive period. Ultimately, we’re on a mission to make insurance fair and transparent.

Beyond telematics, we have built a superior data platform that is capable of ingesting multiple data sources to continuously optimize our pricing engine. By using a high quantity of differentiated data and continuously retraining our models, we are able to write profitable business at great prices for customers regardless of telematics preference.

Letter to Shareholders: Q3 2025

Gross accident period loss ratio

Financials

Our third quarter results were driven by growth across both distribution channels, targeted customer acquisition investment, strong loss ratio performance, and continued investments into our technology. For the quarter, we recorded a net loss of $5 million, a decrease in net income of $28 million year-over-year. We also delivered operating income of $0.3 million and adjusted EBITDA of $34 million, a $34 million and $8 million decrease year-over-year, respectively. As we previously communicated, our net loss in the quarter was primarily driven by $17 million of non-cash expense related to our outstanding warrant structure with Carvana, of which $15.5 million reflects a cumulative expense catch-up. This expense reflects the success of our partnership, as the vesting of warrants is dependent on achieving policy origination milestones. Even with this charge, we have generated $35 million of net income on a year-to-date basis.

Our capital position remains strong with unencumbered capital of $309 million at the end of the third quarter. Given our excellent underwriting performance, we continue to be in a position of excess capital across our insurance subsidiaries. This allows us to continually optimize our operating structure and dynamically deploy growth capital to the best opportunities.

We have proof points that our approach is unique and our foundation for profitable growth is enduring. We are continuing to invest in our business, technology, and growth, which may impact our near-term net income profitability. However, we believe these near-term investments will enable meaningful future growth, unlock long-term operational synergies, and create enduring shareholder value.

Letter to Shareholders: Q3 2025

Looking Forward

At our core, Root is a technology company. This identity impacts every element of our business—from who we hire to how we make decisions. Our focus on technology, innovation, and rapid experimentation, taken together with our relentless pursuit to deliver delightful customer experiences is what makes Root special.

As we close out 2025 with exceptional underwriting performance, a healthy capital position and a strong culture, we are now in a position of strength to drive accelerating growth at our target unit economics. Put simply, we are optimistic that our superior technology will continue to drive growth despite an increasingly competitive environment. We believe this moat will continue to widen as we further invest in our platform and create even better customer experiences.

Stay tuned and watch us work.

Thank you to our team members for their hard work, to our customers for their trust, and to our shareholders for their support.

Alex Timm

Co-Founder & CEO

Letter to Shareholders: Q3 2025

Non-GAAP financial measures

This letter and statements made during our earnings webcast may include information relating to Direct Contribution and Adjusted EBITDA, which are "non-GAAP financial measures" and are defined below. These non-GAAP financial measures have not been calculated in accordance with generally accepted accounting principles in the United States, or GAAP, and should be considered in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results.

In addition, Direct Contribution and Adjusted EBITDA should not be construed as indicators of our operating performance, liquidity, or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that they fail to address. We caution investors that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Therefore, its use can make it difficult to compare our current results with our results from other reporting periods and with the results of other companies.

Our management uses these non-GAAP financial measures, in conjunction with GAAP financial measures, as an integral part of managing our business and to, among other things: (1) monitor and evaluate the performance of our business operations and financial performance, (2) facilitate internal comparisons of the historical operating performance of our business operations, (3) facilitate external comparisons of the results of our overall business to the historical operating performance of other companies that may have different capital structures and debt levels, (4) review and assess the performance of our management team, including when determining incentive compensation, (5) analyze and evaluate financial and strategic planning decisions regarding future operating investments, and (6) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments.

For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP financial measures,” “Reconciliation of Total Revenue to Direct Contribution” and “Reconciliation of Net (Loss) Income to Adjusted EBITDA” below and in Root’s Quarterly Report on Form 10-Q at http://ir.joinroot.com or the SEC’s website at www.sec.gov.

Letter to Shareholders: Q3 2025

Defined Terms & Glossary

We utilize the following definitions for terms used in this letter.

Direct Contribution

We define direct contribution, a non-GAAP financial measure, as gross profit excluding net investment income, acquisition costs, which include report costs and refunds related to these expenses and commission expenses related to our partnership channel, and fixed expenses, which include certain warrant compensation expense related to policies originating through the integrated automobile insurance solution for Carvana’s online buying platform, overhead allocated based on headcount, or Overhead, and salaries, health benefits, bonuses, employee retirement plan-related expenses and employee share-based compensation expense, or Personnel Costs, licenses, professional fees and other expenses. Further impacts related to reinsurance are excluded, these consist of ceded premiums earned, ceded loss and LAE, and net ceding commission and other. Net ceding commission and other is comprised of ceding commission received in connection with reinsurance ceded, partially offset by amortization of excess ceding commission, and other impacts of reinsurance ceded which are included in other insurance expense. After these adjustments, the resulting calculation is inclusive of only those gross variable costs of revenue incurred on the successful acquisition of business. We view direct contribution as an important metric because we believe it measures profitability of our total policy portfolio prior to the impact of reinsurance.

Adjusted EBITDA

We define adjusted EBITDA, a non-GAAP financial measure, as net (loss) income excluding interest expense, income tax expense, depreciation and amortization, share-based compensation, loss on extinguishment of debt, warrant compensation expense, restructuring charges, legal fees and other items that do not reflect our ongoing operating performance. After these adjustments, the resulting calculation represents expenses directly attributable to our operating performance. We use adjusted EBITDA as an internal performance measure in the management of our operations because we believe it provides management and other users of our financial information useful insight into our results of operations and underlying business performance. Adjusted EBITDA should not be viewed as a substitute for net (loss) income calculated in accordance with GAAP, and other companies may define adjusted EBITDA differently.

Encumbered Capital

We define encumbered capital as cash and cash equivalents held within our regulated insurance entities.

Unencumbered Capital

We define unencumbered capital as unrestricted cash and cash equivalents held outside of our regulated insurance entities. This amount includes borrowed funds that are subject to certain minimum liquidity covenants.

Distribution Channels

•Direct: seamless experiences driven by performance marketing and organic traffic connecting consumers directly to the product.

Letter to Shareholders: Q3 2025

◦Digital. Our direct digital channel is designed to drive volume by efficiently capturing high-intent customers. We accomplish this by meeting our customers within platforms they use extensively such as Google or select marketplace platforms where consumers are actively shopping for insurance. We deploy dynamic data science models to optimize advertising, targeting and bidding strategies across our digital platforms, aligning customer acquisition cost to expected lifetime value of the potential customer.

◦Referral. We encourage our existing customers to spread our value proposition. Our referral channel compensates existing customers who refer new customers who subsequently complete a test drive. This channel facilitates community-based growth to those who value our fair and transparent approach to insurance. This is our lowest cost acquisition channel and an important aspect of our ongoing distribution and brand strategy.

◦Channel Media. We build consideration and drive intent through household-level targeted media channels including direct mail and social media. We utilize these media channels to drive awareness when launching in new markets and to actively target customers in active states.

•Partnership: a wide array of integrations, spanning early-stage marketing partnerships through fully embedded user experiences.

◦Embedded. We build upon or within the mobile and web customer experiences of distribution partners to reach a captive customer base with an embedded solution. With varying levels of connectivity, including our proprietary and fully-integrated application which removes the need for the customer to ever visit a Root website to purchase and bind a policy. While these partnerships take time to onboard and launch, over the long term, we believe our flexible technology stack and investment in our platform seeks to optimize a seamless bind experience, creating a differentiated customer experience in this channel. We expect increased penetration of this channel over time as we seek to grow embedded relationships with other automotive and financial service technology companies with relevant customer bases.

◦Agency. We continue to invest in a product to bring the speed and ease of our technology to the independent agency channel. This channel provides access to a larger demographic of customers and we believe it has staying power. We developed an efficient quote and bind process through our agent platform that enables simplified distribution from agents to their customers. The technology driven approach makes this an appealing platform for agents and an efficient acquisition channel for us.

Letter to Shareholders: Q3 2025

About Root, Inc.

Founded in 2015 and based in Columbus, Ohio, Root, Inc. (NASDAQ: ROOT) is the parent company of Root Insurance Company. Root is revolutionizing insurance through data science and technology to provide consumers a personalized, easy, and fair experience. The Root app has roughly 16 million app downloads and has collected 34 billion miles of driving data to inform their insurance offerings.

For further information on Root, please visit root.com.

Root Insurance Company and Root Property & Casualty Insurance Company are headquartered in Columbus, Ohio, with renters insurance available through Root Insurance Company in Arkansas, Georgia, Kentucky, Missouri, Nevada, New Mexico, Ohio, Tennessee, and Utah. Root, Inc. is active in 36 markets for auto insurance: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, and Wisconsin. Business is underwritten by Root Insurance Company, Root Property & Casualty Insurance Company and/or Root Florida Insurance Company depending on the market. In Texas, we also write business as a Managing General Agent, underwritten by Redpoint County Mutual Insurance Company. Carvana Insurance built with Root is available only in the states where Root writes insurance.

Letter to Shareholders: Q3 2025

Forward-looking statements

This letter contains—and statements made during the above-referenced webcast will contain— forward-looking statements relating to, among other things, the future performance of Root and its consolidated subsidiaries that are based on Root’s current expectations, forecasts, and assumptions, and involve risks and uncertainties. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “path,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These include, but are not limited to, statements regarding:

•our ability to retain existing customers, acquire new customers and expand our customer reach;

•our expectations regarding our future financial performance, including total revenue, gross profit, net (loss) income, direct contribution, adjusted EBITDA, net loss and loss adjustment expense, or LAE, ratio, net expense ratio, net combined ratio, gross loss ratio, marketing costs and costs of customer acquisition, gross LAE ratio, gross expense ratio, gross combined ratio, operating expenses, quota share levels, changes in unencumbered cash balances and expansion of our new and renewal premium base;

•our ability to realize profits, acquire customers, retain customers, contract with additional partners to utilize the products, or achieve other benefits from our embedded insurance offering;

•our ability to expand our distribution channels through additional partnership relationships, digital media, independent agents and referrals;

•our ability to drive a significant long-term competitive advantage through our partnership with Carvana Group, LLC, or Carvana, and other partnerships, such as our partnerships with Hyundai Capital America and Experian®;

•our ability to develop products for embedded insurance and other partners;

•the impact of supply chain disruptions, increasing inflation, a potential increase in tariffs or the implementation of new tariffs, a recession and/or disruptions to properly functioning financial and capital markets and interest rates on our business and financial condition;

•our ability to realize profits and extend our capital runway;

•our goal to be licensed in all states in the United States, or U.S., and the timing of obtaining additional licenses and launching in new states;

•the accuracy and efficiency of our telematics and behavioral data, and our ability to gather and leverage existing and additional data;

Letter to Shareholders: Q3 2025

•our ability to materially improve retention rates and our ability to realize benefits from retaining customers;

•our ability to underwrite risks accurately and charge profitable rates;

•our ability to maintain our business model and improve our capital and marketing efficiency;

•our ability to drive improved conversion and decrease the cost of customer acquisition;

•our ability to maintain and enhance our brand and reputation;

•our ability to effectively manage the growth of our business;

•our ability to raise additional capital efficiently or at all;

•our ability to improve our product offerings, introduce new products and expand into additional insurance lines;

•our ability to cross sell our products and attain greater value from each customer;

•our ability to compete effectively with existing competitors and new market entrants in our industry;

•future performance of the markets in which we operate;

•our ability to operate a “capital-efficient” business and obtain and maintain desirable levels of reinsurance;

•the effect of further reductions in the utilization of reinsurance, which would result in retention of more premium and losses and could cause our capital requirements to increase;

•our ability to realize economies of scale;

•our ability to attract, motivate and retain key personnel, or hire personnel, and to offer competitive compensation and benefits;

•our ability to deliver a vertically integrated customer experience;

•our ability to develop products that utilize telematics to drive better customer satisfaction and retention;

•our ability to protect our intellectual property and any costs associated therewith;

•our ability to develop an autonomous claims experience;

•our ability to take rate action early and react to changing environments;

•our ability to meet risk-based capital requirements;

Letter to Shareholders: Q3 2025

•our ability to realize benefits from our Texas county mutual fronting arrangement;

•our ability to expand domestically;

•our ability to comply with laws and regulations that currently apply or become applicable to our business;

•the impact of litigation or other losses;

•changes in laws or regulations, or changes in the interpretation of laws or regulations by a regulatory authority, specific to the use of artificial intelligence, telematics data and the consent to use telematics data, connected card data, and other sources of data, or relating to taxation including changes in tax regulations or guidance promulgated pursuant to the new legislation implemented in the One Big Beautiful Bill Act;

•the impact of moratoriums, mandates and similar regulations or requests related to the federal government shutdown that negatively impact our ability to charge or increase premiums or result in increased premium write-offs;

•our ability to defend against cybersecurity threats and prevent, or recover from, a security incident or other significant disruption of our technology systems or those of our partners and third-party service providers;

•the effect of interest rates on our available cash and our ability to maintain compliance with our term loan;

•our ability to maintain proper and effective internal control over financial reporting; and

•the growth rates of the markets in which we compete.

Root’s actual results could differ materially from those predicted or implied by such forward-looking statements, and reported results should not be considered as an indication of future performance.

Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Root’s business, operating results, and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Root’s 2024 Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, and other filings with the SEC at http://ir.joinroot.com or the SEC’s website at www.sec.gov.

Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Root on the date hereof. We assume no obligation to update such statements.

Letter to Shareholders: Q3 2025

Financial statements

| | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED |

| As of |

| September 30, | | December 31, |

| 2025 | | 2024 |

| (in millions, except par value ) |

| Assets | | | |

| Investments: | | | |

| Fixed maturities available-for-sale, at fair value (amortized cost: $354.3 and $294.3 at September 30, 2025 and December 31, 2024, respectively) | $ | 357.8 | | | $ | 292.0 | |

| Short-term investments (amortized cost: zero and $14.8 at September 30, 2025 and December 31, 2024, respectively) | — | | | 14.8 | |

| Other investments | 4.4 | | | 4.4 | |

| Total investments | 362.2 | | | 311.2 | |

| Cash and cash equivalents | 653.3 | | | 599.3 | |

| Restricted cash | 1.1 | | | 1.0 | |

| Premiums receivable, net of allowance of $8.0 and $9.8 at September 30, 2025 and December 31, 2024, respectively | 352.5 | | | 305.3 | |

| Reinsurance recoverable and receivable, net of allowance of $0.1 at September 30, 2025 and December 31, 2024 | 142.3 | | | 150.6 | |

| Prepaid reinsurance premiums | 11.7 | | | 25.1 | |

| Other assets | 119.3 | | | 103.2 | |

| Total assets | $ | 1,642.4 | | | $ | 1,495.7 | |

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Equity | | | |

| Liabilities: | | | |

| Loss and loss adjustment expense reserves | $ | 462.9 | | | $ | 413.2 | |

| Unearned premiums | 409.3 | | | 353.9 | |

| Long-term debt | 200.4 | | | 200.1 | |

| Reinsurance premiums payable | 12.0 | | | 32.8 | |

| Accounts payable and accrued expenses | 58.6 | | | 71.1 | |

| Other liabilities | 122.2 | | | 108.9 | |

| Total liabilities | 1,265.4 | | | 1,180.0 | |

| Commitments and Contingencies | | | |

| Redeemable convertible preferred stock, $0.0001 par value, 100.0 shares authorized, 14.1 shares issued and outstanding at September 30, 2025 and December 31, 2024 (redemption value of $126.5) | 112.0 | | | 112.0 | |

| Stockholders’ equity: | | | |

Class A common stock, $0.0001 par value, 1,000.0 shares authorized, 13.7 and 11.1 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively | — | | | — | |

Class B convertible common stock, $0.0001 par value, 269.0 shares authorized, 1.8 and 4.0 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively | — | | | — | |

| | | |

| Additional paid-in capital | 1,908.4 | | | 1,887.9 | |

| Accumulated other comprehensive income (loss) | 3.5 | | | (2.3) | |

| Accumulated loss | (1,646.9) | | | (1,681.9) | |

| Total stockholders’ equity | 265.0 | | | 203.7 | |

| Total liabilities, redeemable convertible preferred stock and stockholders’ equity | $ | 1,642.4 | | | $ | 1,495.7 | |

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME - UNAUDITED |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2025 | | 2024 | | 2025 | | 2024 |

| (in millions, except per share data) |

| Revenues: | | | | | | | |

| Net premiums earned | $ | 360.1 | | | $ | 279.3 | | | $ | 1,034.4 | | | $ | 771.2 | |

| Net investment income | 7.0 | | | 8.0 | | | 25.1 | | | 27.2 | |

| | | | | | | |

| Fee income | 19.8 | | | 17.1 | | | 58.2 | | | 48.4 | |

| Other income | 0.9 | | | 1.3 | | | 2.4 | | | 3.0 | |

| Total revenues | 387.8 | | | 305.7 | | | 1,120.1 | | | 849.8 | |

| Operating expenses: | | | | | | | |

| Loss and loss adjustment expenses | 239.4 | | | 184.5 | | | 678.3 | | | 541.2 | |

| Sales and marketing | 40.6 | | | 34.0 | | | 129.2 | | | 98.6 | |

| Other insurance expense | 67.0 | | | 22.4 | | | 151.6 | | | 75.1 | |

| Technology and development | 14.7 | | | 12.9 | | | 39.8 | | | 38.6 | |

| General and administrative | 25.8 | | | 17.5 | | | 69.9 | | | 52.7 | |

| Total operating expenses | 387.5 | | | 271.3 | | | 1,068.8 | | | 806.2 | |

| Operating income | 0.3 | | | 34.4 | | | 51.3 | | | 43.6 | |

| Interest expense | (5.3) | | | (11.6) | | | (15.9) | | | (34.8) | |

| | | | | | | |

| (Loss) income before income tax expense | (5.0) | | | 22.8 | | | 35.4 | | | 8.8 | |

| Income tax expense | (0.4) | | | — | | | (0.4) | | | — | |

| Net (loss) income | (5.4) | | | 22.8 | | | 35.0 | | | 8.8 | |

| Net income attributable to participating securities | — | | | (1.1) | | | (1.8) | | | (0.5) | |

| Net (loss) income attributable to common shareholders | (5.4) | | | 21.7 | | | 33.2 | | | 8.3 | |

| Other comprehensive income: | | | | | | | |

| Net (loss) income | (5.4) | | | 22.8 | | | 35.0 | | | 8.8 | |

| Changes in net unrealized gains on investments | 1.2 | | | 5.5 | | | 5.8 | | | 4.6 | |

| Comprehensive (loss) income | $ | (4.2) | | | $ | 28.3 | | | $ | 40.8 | | | $ | 13.4 | |

| (Loss) earnings per common share: (both Class A and B) | | | | | | | |

| Basic | $ | (0.35) | | | $ | 1.45 | | | $ | 2.17 | | | $ | 0.56 | |

| Diluted | $ | (0.35) | | | $ | 1.35 | | | $ | 2.05 | | | $ | 0.52 | |

| Weighted-average common shares outstanding: (both Class A and B) | | | | | | | |

| Basic | 15.4 | | | 15.0 | | | 15.3 | | | 14.8 | |

| Diluted | 15.4 | | | 16.9 | | | 17.1 | | | 16.8 | |

Letter to Shareholders: Q3 2025

| | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED |

| Nine Months Ended September 30, |

| 2025 | | 2024 |

| (in millions) |

| Cash flows from operating activities: | | | |

| Net income | $ | 35.0 | | | $ | 8.8 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Share-based compensation | 26.4 | | | 12.7 | |

| Warrant compensation expense | 17.2 | | | 3.8 | |

| Depreciation and amortization | 8.7 | | | 12.1 | |

| Bad debt expense | 27.1 | | | 22.7 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Premiums receivable | (74.3) | | | (84.3) | |

| Reinsurance recoverable and receivable | 8.3 | | | (35.3) | |

| Prepaid reinsurance premiums | 13.4 | | | 10.4 | |

| Other assets | (10.3) | | | (23.1) | |

| Losses and loss adjustment expenses reserves | 49.7 | | | 108.2 | |

| Unearned premiums | 55.4 | | | 70.7 | |

| Reinsurance premiums payable | (20.8) | | | (8.2) | |

| Accounts payable and accrued expenses | (12.7) | | | (1.9) | |

| Other liabilities | 13.3 | | | 29.9 | |

| Net cash provided by operating activities | 136.4 | | | 126.5 | |

| Cash flows from investing activities: | | | |

| Purchases of investments | (103.2) | | | (147.7) | |

| Proceeds from maturities, calls and pay downs of investments | 53.6 | | | 40.5 | |

| Sales of investments | 0.3 | | | 0.5 | |

| Capitalization of internally developed software | (9.9) | | | (7.0) | |

| Purchases of fixed assets | — | | | (0.4) | |

| | | |

| Net cash used in investing activities | (59.2) | | | (114.1) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from exercise of stock options and restricted stock units | 0.3 | | | — | |

| | | |

| Taxes paid related to net share settlement of equity awards | (23.4) | | | (13.3) | |

| Payment of preferred stock and related warrants issuance costs | — | | | (3.0) | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (23.1) | | | (16.3) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 54.1 | | | (3.9) | |

| Cash, cash equivalents and restricted cash at beginning of period | 600.3 | | | 679.7 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 654.4 | | | $ | 675.8 | |

Letter to Shareholders: Q3 2025

Supplemental financial information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | | | |

| KEY PERFORMANCE INDICATORS - UNAUDITED | | | | |

| Three Months Ended | | |

| September 30, | | June 30, | | March 31, | | December 31, | | September 30, | | | | September 30, | | | | | | | | | | |

| 2025 | | 2025 | | 2025 | | 2024 | | 2024 | | | | 2023 | | | | | | | | | | |

| (dollars in millions, except Premiums per Policy) | | |

| Policies in force | 466,320 | | | 455,493 | | | 453,800 | | | 414,862 | | | 407,313 | | | | | 259,522 | | | | | | | | | | | |

| Premiums per policy | $ | 1,581 | | | $ | 1,616 | | | $ | 1,614 | | | $ | 1,584 | | | $ | 1,558 | | | | | $ | 1,398 | | | | | | | | | | | |

| Premiums in force | $ | 1,474.5 | | | $ | 1,472.2 | | | $ | 1,464.9 | | | $ | 1,314.3 | | | $ | 1,269.2 | | | | | $ | 725.6 | | | | | | | | | | | |

| Gross premiums written | $ | 387.2 | | | $ | 346.2 | | | $ | 410.8 | | | $ | 330.5 | | | $ | 331.7 | | | | | $ | 224.2 | | | | | | | | | | | |

| Gross premiums earned | $ | 373.1 | | | $ | 371.3 | | | $ | 344.4 | | | $ | 331.0 | | | $ | 317.0 | | | | | $ | 159.8 | | | | | | | | | | | |

| Gross profit | $ | 81.4 | | | $ | 101.7 | | | $ | 107.1 | | | $ | 103.6 | | | $ | 98.8 | | | | | $ | 11.2 | | | | | | | | | | | |

| Net (loss) income | $ | (5.4) | | | $ | 22.0 | | | $ | 18.4 | | | $ | 22.1 | | | $ | 22.8 | | | | | $ | (45.8) | | | | | | | | | | | |

| Direct contribution | $ | 127.4 | | | $ | 125.8 | | | $ | 127.1 | | | $ | 115.8 | | | $ | 110.5 | | | | | $ | 37.0 | | | | | | | | | | | |

| Adjusted EBITDA | $ | 33.7 | | | $ | 37.6 | | | $ | 31.9 | | | $ | 43.1 | | | $ | 41.6 | | | | | $ | (19.4) | | | | | | | | | | | |

| Net loss and LAE ratio | 66.5 | % | | 66.1 | % | | 64.0 | % | | 64.0 | % | | 66.1 | % | | | | 85.8 | % | | | | | | | | | | |

| Net expense ratio | 35.6 | % | | 29.1 | % | | 31.6 | % | | 27.5 | % | | 25.0 | % | | | | 57.3 | % | | | | | | | | | | |

| Net combined ratio | 102.1 | % | | 95.2 | % | | 95.6 | % | | 91.5 | % | | 91.1 | % | | | | 143.1 | % | | | | | | | | | | |

| Gross loss ratio | 58.5 | % | | 58.0 | % | | 56.1 | % | | 56.8 | % | | 57.1 | % | | | | 65.6 | % | | | | | | | | | | |

| Gross LAE ratio | 7.5 | % | | 7.3 | % | | 6.7 | % | | 6.9 | % | | 8.3 | % | | | | 9.6 | % | | | | | | | | | | |

| Gross expense ratio | 35.3 | % | | 29.0 | % | | 31.2 | % | | 26.9 | % | | 23.8 | % | | | | 43.5 | % | | | | | | | | | | |

| Gross combined ratio | 101.3 | % | | 94.3 | % | | 94.0 | % | | 90.6 | % | | 89.2 | % | | | | 118.7 | % | | | | | | | | | | |

| Gross accident period loss ratio | 59.5 | % | | 60.3 | % | | 56.2 | % | | 60.9 | % | | 55.5 | % | | | | 62.6 | % | | | | | | | | | | |

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | | | |

| KEY PERFORMANCE INDICATORS - UNAUDITED | | | | |

| Nine Months Ended September 30, |

| 2025 | | 2024 | | | | 2023 | | | | | | | | | | |

| (dollars in millions, except Premiums per Policy) | | |

| Policies in force | 466,320 | | | 407,313 | | | | | 259,522 | | | | | | | | | | | |

| Premiums per policy | $ | 1,581 | | | $ | 1,558 | | | | | $ | 1,398 | | | | | | | | | | | |

| Premiums in force | $ | 1,474.5 | | | $ | 1,269.2 | | | | | $ | 725.6 | | | | | | | | | | | |

| Gross premiums written | $ | 1,144.2 | | | $ | 970.6 | | | | | $ | 503.9 | | | | | | | | | | | |

| Gross premiums earned | $ | 1,088.8 | | | $ | 900.0 | | | | | $ | 421.4 | | | | | | | | | | | |

| Gross profit | $ | 290.2 | | | $ | 233.5 | | | | | $ | 29.4 | | | | | | | | | | | |

| Net income (loss) | $ | 35.0 | | | $ | 8.8 | | | | | $ | (123.4) | | | | | | | | | | | |

| Direct contribution | $ | 380.3 | | | $ | 278.2 | | | | | $ | 84.9 | | | | | | | | | | | |

| Adjusted EBITDA | $ | 103.2 | | | $ | 68.8 | | | | | $ | (42.6) | | | | | | | | | | | |

| Net loss and LAE ratio | 65.6 | % | | 70.2 | % | | | | 93.2 | % | | | | | | | | | | |

| Net expense ratio | 32.1 | % | | 28.1 | % | | | | 56.9 | % | | | | | | | | | | |

| Net combined ratio | 97.7 | % | | 98.3 | % | | | | 150.1 | % | | | | | | | | | | |

| Gross loss ratio | 57.6 | % | | 59.7 | % | | | | 67.4 | % | | | | | | | | | | |

| Gross LAE ratio | 7.2 | % | | 9.2 | % | | | | 10.2 | % | | | | | | | | | | |

| Gross expense ratio | 31.8 | % | | 27.2 | % | | | | 42.3 | % | | | | | | | | | | |

| Gross combined ratio | 96.6 | % | | 96.1 | % | | | | 119.9 | % | | | | | | | | | | |

| Gross accident period loss ratio | 58.7 | % | | 57.9 | % | | | | 64.2 | % | | | | | | | | | | |

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF TOTAL REVENUE TO DIRECT CONTRIBUTION - UNAUDITED | | |

| Three Months Ended |

| September 30, | | June 30, | | March 31, | | December 31 | | September 30, | | September 30, | | | | | | | | |

| 2025 | | 2025 | | 2025 | | 2024 | | 2024 | | 2023 | | | | | | | | |

| (dollars in millions) |

| Total revenue | $ | 387.8 | | | $ | 382.9 | | | $ | 349.4 | | | $ | 326.7 | | | $ | 305.7 | | | $ | 115.3 | | | | | | | | | |

| Loss and loss adjustment expenses | (239.4) | | | (233.3) | | | (205.6) | | | (191.8) | | | (184.5) | | | (85.8) | | | | | | | | | |

| Other insurance expense | (67.0) | | | (47.9) | | | (36.7) | | | (31.3) | | | (22.4) | | | (18.3) | | | | | | | | | |

| Gross profit | 81.4 | | | 101.7 | | | 107.1 | | | 103.6 | | | 98.8 | | | 11.2 | | | | | | | | | |

| Net investment income | (7.0) | | | (9.4) | | | (8.7) | | | (8.7) | | | (8.0) | | | (9.0) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Adjustments from other insurance expense(1) | 50.1 | | | 29.5 | | | 22.2 | | | 15.5 | | | 11.6 | | | 21.7 | | | | | | | | | |

| Ceded premiums earned | 13.0 | | | 18.3 | | | 23.1 | | | 31.3 | | | 37.7 | | | 59.8 | | | | | | | | | |

| Ceded loss and loss adjustment expenses | (7.0) | | | (9.2) | | | (10.4) | | | (19.2) | | | (22.8) | | | (34.4) | | | | | | | | | |

Net ceding commission and other(2) | (3.1) | | | (5.1) | | | (6.2) | | | (6.7) | | | (6.8) | | | (12.3) | | | | | | | | | |

| Direct contribution | $ | 127.4 | | | $ | 125.8 | | | $ | 127.1 | | | $ | 115.8 | | | $ | 110.5 | | | $ | 37.0 | | | | | | | | | |

______________

(1) Adjustments from other insurance expense consists of acquisition costs, including report costs and refunds related to these expenses and commission expenses related to our partnership channel of $28.5 million, $25.0 million, $19.7 million, $11.8 million, $8.2 million and $14.8 million for Q3 2025, Q2 2025, Q1 2025, Q4 2024, Q3 2024 and Q3 2023, respectively. Adjustments from other insurance expense also consists of fixed expenses, including certain warrant compensation expense related to policies originating through the integrated automobile insurance solution for Carvana’s online buying platform, Personnel costs, Overhead, licenses, professional fees and other of $21.6 million, $4.6 million, $2.5 million, $3.7 million, $3.4 million and $6.9 million for Q3 2025, Q2 2025, Q1 2025, Q4 2024, Q3 2024 and Q3 2023, respectively

(2) Net ceding commission and other is comprised of ceding commissions received in connection with reinsurance ceded, partially offset by amortization of excess ceding commission and other impacts of reinsurance ceded.

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF TOTAL REVENUE TO DIRECT CONTRIBUTION - UNAUDITED | | |

| Nine Months Ended September 30, | | |

| 2025 | | 2024 | | 2023 | | | | | | |

| (dollars in millions) |

| Total revenue | $ | 1,120.1 | | | $ | 849.8 | | | $ | 260.2 | | | | | | | |

| Loss and loss adjustment expenses | (678.3) | | | (541.2) | | | (208.6) | | | | | | | |

Other insurance expense | (151.6) | | | (75.1) | | | (22.2) | | | | | | | |

Gross profit | 290.2 | | | 233.5 | | | 29.4 | | | | | | | |

| Net investment income | (25.1) | | | (27.2) | | | (22.5) | | | | | | | |

| | | | | | | | | | | |

Adjustments from other insurance expense(1) | 101.8 | | | 51.0 | | | 49.6 | | | | | | | |

| Ceded premiums earned | 54.4 | | | 128.8 | | | 197.5 | | | | | | | |

| Ceded loss and loss adjustment expenses | (26.6) | | | (78.5) | | | (118.3) | | | | | | | |

Net ceding commission and other(2) | (14.4) | | | (29.4) | | | (50.8) | | | | | | | |

| Direct contribution | $ | 380.3 | | | $ | 278.2 | | | $ | 84.9 | | | | | | | |

______________

1) Adjustments from other insurance expense consists of acquisition costs, including report costs and refunds related to these expenses and commission expenses related to our partnership channel of $73.2 million, $37.9 million and $30.3 million for the nine months ended September 30, 2025, 2024 and 2023, respectively. Adjustments from other insurance expense also consists of fixed expenses, including certain warrant compensation expense related to policies originating through the integrated automobile insurance solution for Carvana’s online buying platform, Personnel costs, Overhead, licenses, professional fees and other of $28.7 million, $13.1 million and $19.3 million for the nine months ended September 30, 2025, 2024 and 2023, respectively.

(2) Net ceding commission and other is comprised of ceding commissions received in connection with reinsurance ceded, partially offset by amortization of excess ceding commission and other impacts of reinsurance ceded.

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF NET (LOSS)/INCOME TO ADJUSTED EBITDA - UNAUDITED | | |

| Three Months Ended |

| September 30, | | June 30, | | March 31, | | December 31, | | September 30, | | | | September 30, | | | | | | | | |

| 2025 | | 2025 | | 2025 | | 2024 | | 2024 | | | | 2023 | | | | | | | | |

| (dollars in millions) |

Net (loss) income | $ | (5.4) | | | $ | 22.0 | | | $ | 18.4 | | | $ | 22.1 | | | $ | 22.8 | | | | | $ | (45.8) | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | 5.1 | | | 5.2 | | | 5.1 | | | 7.1 | | | 10.9 | | | | | 11.1 | | | | | | | | | |

| Income tax expense | 0.4 | | | — | | | — | | | — | | | — | | | | | — | | | | | | | | | |

| Depreciation and amortization | 4.7 | | | 1.9 | | | 2.0 | | | 2.6 | | | 5.2 | | | | | 2.7 | | | | | | | | | |

| Share-based compensation | 11.6 | | | 8.4 | | | 6.4 | | | 5.8 | | | 4.3 | | | | | 4.7 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Loss on extinguishment of debt | — | | | — | | | — | | | 5.4 | | | — | | | | | — | | | | | | | | | |

| Warrant compensation expense | 17.2 | | | — | | | — | | | — | | | — | | | | | 5.0 | | | | | | | | | |

Restructuring charges(1) | — | | | 0.1 | | | — | | | 0.1 | | | — | | | | | 1.9 | | | | | | | | | |

Other(2) | 0.1 | | | — | | | — | | | — | | | (1.6) | | | | | 1.0 | | | | | | | | | |

| Adjusted EBITDA | $ | 33.7 | | | $ | 37.6 | | | $ | 31.9 | | | $ | 43.1 | | | $ | 41.6 | | | | | $ | (19.4) | | | | | | | | | |

______________

(1) Restructuring costs consist of employee costs, real estate exit costs, and other. This includes zero, $0.1 million, zero, $0.2 million, zero and zero of depreciation and amortization for Q3 2025, Q2 2025, Q1 2025, Q4 2024, Q3 2024 and Q3 2023, respectively.

(2) Other primarily reflects legal costs and other items that do not reflect our ongoing operating performance. This includes legal and other fees related to the 2022 misappropriation of funds by a former senior marketing employee of $0.1 million, zero, zero, zero, $(1.6) million and $1.0 million in Q3 2025, Q2 2025, Q1 2025, Q4 2024, Q3 2024 and Q3 2023, respectively.

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | |

| | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| RECONCILIATION OF NET INCOME/(LOSS) TO ADJUSTED EBITDA - UNAUDITED |

| Nine Months Ended September 30, |

| 2025 | | 2024 | | 2023 |

| (dollars in millions) |

Net income (loss) | $ | 35.0 | | | $ | 8.8 | | | $ | (123.4) | |

| Adjustments: | | | | | |

| Interest expense | 15.4 | | | 32.6 | | | 32.2 | |

| Income tax expense | 0.4 | | | — | | | — | |

| Depreciation and amortization | 8.6 | | | 11.9 | | | 8.0 | |

| Share-based compensation | 26.4 | | | 12.7 | | | 12.0 | |

| Warrant compensation expense | 17.2 | | | 3.8 | | | 13.3 | |

Restructuring charges(1) | 0.1 | | | 0.1 | | | 9.4 | |

Other(2) | 0.1 | | | (1.1) | | | 5.9 | |

| Adjusted EBITDA | $ | 103.2 | | | $ | 68.8 | | | $ | (42.6) | |

______________(1) Restructuring costs consist of employee costs, real estate exit costs and other. This includes $0.4 million of share-based compensation for the nine months ended September 30, 2023. This also includes $0.1 million, $0.2 million and $0.2 million of depreciation and amortization for the nine months ended September 30, 2025, 2024 and 2023, respectively.

(2) Other primarily reflects legal costs and other items that do not reflect our ongoing operating performance. This includes legal and other fees related to the 2022 misappropriation of funds by a former senior marketing employee of $0.1 million, $0.5 million and $3.4 million for the nine months ended September 30, 2025, 2024 and 2023, respectively.

Letter to Shareholders: Q3 2025

| | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| WRITTEN AND EARNED PREMIUM - UNAUDITED |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2025 | | 2024 | | 2025 | | 2024 |

| (dollars in millions) |

| Gross premiums written | $ | 387.2 | | | $ | 331.7 | | | $ | 1,144.2 | | | $ | 970.6 | |

| Ceded premiums written | (10.0) | | | (27.1) | | | (41.0) | | | (118.4) | |

| Net premiums written | 377.2 | | | 304.6 | | | 1,103.2 | | | 852.2 | |

| | | | | | | |

| | | | | | | |

| Gross premiums earned | 373.1 | | | 317.0 | | | 1,088.8 | | | 900.0 | |

| Ceded premiums earned | (13.0) | | | (37.7) | | | (54.4) | | | (128.8) | |

| Net premiums earned | $ | 360.1 | | | $ | 279.3 | | | $ | 1,034.4 | | | $ | 771.2 | |

2

2