DRAFT Investor Presentation December 2025 Strictly Privat e and Confidential

For purposes of this presentation, MRQ = Most Recent Quarter, LTM = Last Twelve Months, and YTD = Year to Date. Disclaimers This presentation contains, and future oral and written statements of GBank Financial Holdings Inc. (the “Company,” “we,” “us” or “our”) and its management may contain, forward-looking statements. Forward- looking statements are neither historical facts nor guarantees or assurances of future performance. Instead, they are based only on our current expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements involve risks and uncertainties and can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,” “targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and other financial items; (ii) statements of plans, objectives, and expectations of the Company or our management or board of directors; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are based on the Company’s current expectations and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those contemplated by the forward- looking statements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and our assessment of that impact; (2) the impact of the COVID-19 pandemic on our business, including the impact of actions taken by governmental and regulatory authorities in response to such pandemic, such as the CARES Act and the programs established thereunder, and our participation in such programs; (3) volatility and disruption in national and international financial markets; (4) government intervention in the U.S. financial system, whether through changes in the discount rate or money supply or otherwise; (5) changes in the level of non- performing assets and charge-offs; (6) changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (7) adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (8) inflation, deflation, changes in market interest rates, developments in the securities market, and monetary fluctuations; (9) the timely development and acceptance of new products and services and perceived overall value of these products and services by customers; (10) changes in consumer spending, borrowings, and savings habits; (11) technological changes and the ability to develop and maintain secure and reliable electronic systems; (12) the ability to increase market share and control expenses; (13) changes in the competitive environment among banks, bank holding companies, and other financial service providers; (14) the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) with which we and our subsidiaries must comply; (15) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Financial Accounting Standards Board, and other accounting standard setters; (16) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; (17) the loss of key executives or employees; (18) the economic impact of past and any future terrorist threats and attacks and any acts of war or threats thereof; (19) unexpected results of acquisitions; and (20) our success at managing the risks involved in the foregoing items. These and other risks and uncertainties detailed in the Company's periodic reports filed with the Securities and Exchange Commission, including its Form 10-Q for the quarter ended September 30, 2025, and its last earnings press release could cause actual results to differ materially from those expressed or implied in any forward-looking statements. Any forward-looking statement made by the Company in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. This presentation has been prepared by the Company solely for informational purposes and is being furnished on a confidential basis to a limited number of institutional accredited investors, as defined in Rule 501(a)(1),(3),(7) or (9) of Regulation D promulgated under the Securities Act, and qualified institutional buyers, as defined in Rule 144A under the Securities Act. This presentation does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of the Company. This presentation does not purport to contain all of the information that you should consider before investing in securities of the Company and should not be construed as investment, legal, regulatory or tax advice. Each potential investor should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of the Company and should consult its own legal counsel and financial, accounting, regulatory and tax advisors to determine the consequences of such an investment prior to making an investment decision and should not rely on any information set forth in this presentation. The information in this presentation may not be reproduced or redistributed, passed on or divulged, directly or indirectly, to any other person. The Company reserves the right to request the return of this presentation at any time. The receipt of this presentation does not create, nor is it intended to create, a binding and enforceable contract or commitment between the Company and any other party, and this presentation may not be relied upon by any party as the basis for a contract or commitment to purchase the securities of the Company. Any purchase and sale of the securities of the Company will be governed solely by a purchase agreement, and the information contained herein will be superseded in its entirety by such purchase agreement. In the event that any information contained in this presentation is inconsistent with or contrary to any of the terms and conditions of the purchase agreement, the purchase agreement shall control. Each potential investor should review the purchase agreement prior to making an investment decision. The securities of the Company mentioned in this presentation will not be registered for resale and will be subject to significant restrictions and limitations on transferability and liquidity. Investment in the securities of the Company involves a high degree of risk. Only potential investors who can bear the risk of an unregistered illiquid investment should consider investment in the securities of the Company. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information. This presentation contains certain pro forma and projected information, including projected pro forma information that reflects the Company’s current expectations and assumptions. This pro forma information does not purport to present the results that the Company will ultimately realize. This presentation includes certain measures that are not calculated under U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures should be considered only as supplemental to, and not superior to, financial measures prepared in accordance with GAAP. SECURITIES NOT REGISTERED. The securities mentioned in this document have not been registered under the Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold absent registration or exemption from registration under applicable law. Such securities have not been approved or disapproved by the Securities and Exchange Commission, any state securities commission or any regulatory authority, including the Board of Governors of the Federal Reserve System, nor have any of the foregoing authorities passed upon or endorsed the merits of any proposed offering of these securities or the accuracy or adequacy of this document. Any representation to the contrary is a criminal offense. SECURITIES NOT INSURED. The securities mentioned in this presentation are not savings or deposit accounts and are not insured by the Federal Deposit Insurance Corporation or by any other government agency.

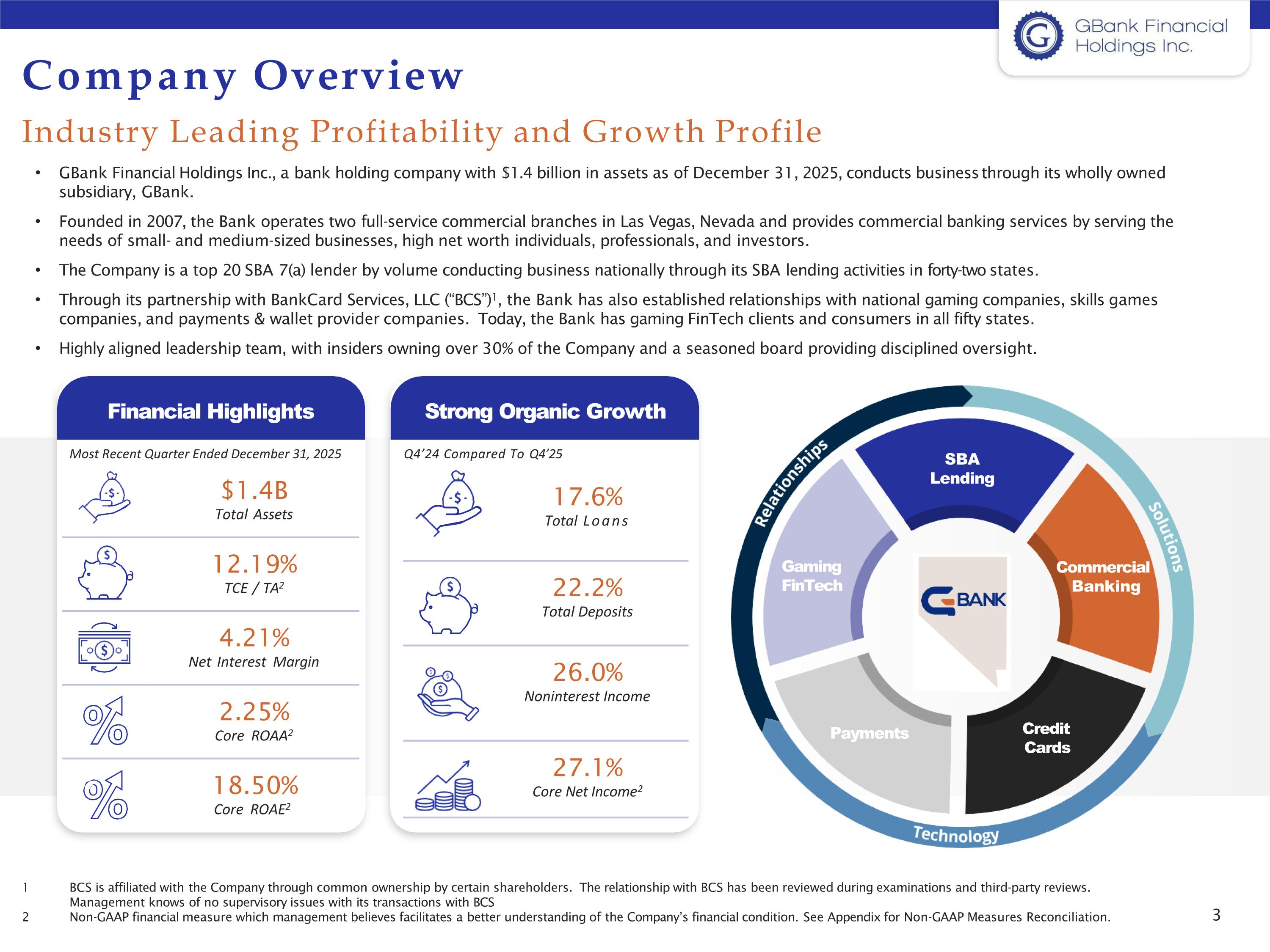

Commercial Banking Credit Cards Payments Gaming FinTech SBA Lending $1.4B Total Assets 12.19% TCE / TA2 4.21% Net Interest Margin 2.25% Core ROAA2 18.50% Core ROAE2 Financial Highlights Strong Organic Growth Company Overview 1 BCS is affiliated with the Company through common ownership by certain shareholders. The relationship with BCS has been reviewed during examinations and third-party reviews. Management knows of no supervisory issues with its transactions with BCS GBank Financial Holdings Inc., a bank holding company with $1.4 billion in assets as of December 31, 2025, conducts business through its wholly owned subsidiary, GBank. Founded in 2007, the Bank operates two full-service commercial branches in Las Vegas, Nevada and provides commercial banking services by serving the needs of small- and medium-sized businesses, high net worth individuals, professionals, and investors. The Company is a top 20 SBA 7(a) lender by volume conducting business nationally through its SBA lending activities in forty-two states. Through its partnership with BankCard Services, LLC (“BCS”)1, the Bank has also established relationships with national gaming companies, skills games companies, and payments & wallet provider companies. Today, the Bank has gaming FinTech clients and consumers in all fifty states. Highly aligned leadership team, with insiders owning over 30% of the Company and a seasoned board providing disciplined oversight. Industry Leading Profitability and Growth Profile Most Recent Quarter Ended December 31, 2025 Q4’24 Compared To Q4’25 2 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP Measures Reconciliation. 17.6% Total Loans 22.2% Total Deposits 26.0% Noninterest Income 27.1% Core Net Income2

Investment Highlights GBank’s unique product offerings, community focus and strong leadership create a compelling investment opportunity Consistent Industry Leading Profitability GBFH has consistently demonstrated best-in-class profitability with annual core return on average assets1 between 1.51% and 2.04% since 2020 throughout various challenging operating environments. Leading National SBA Business & Regional Commercial Banking Franchise GBFH is a top originator of SBA 7(a) credits and the leading originator of hotel SBA loans in the country, which generates significant earnings power. GBank was the #11 ranked originator with over $550 million in 7(a) credits originated in 2025. Gaming Fintech Presents a Significant Growth Opportunity for Core Deposits and Fee Income GBFH has partnered with BankCard Services and positioned itself as a market leader in the Gaming FinTech space, creating a strong potential for future growth and providing an attractive source of low-cost deposits. The GBank Visa Signature card targets prime and super-prime consumers offering cash rewards on gaming transactions and has entered into several marketing & referral agreements. Annual transaction volume increased from $73.8 million to $420.5 million from 2024 to 2025. The program was intentionally paused to fully build fraud-prevention, verification and onboarding systems. With the enhanced infrastructure now live, the business is positioned to scale charge volume and earnings in 2026. Experienced Management Team & Board of Directors GBFH is led by a seasoned and experienced management team with a deep understanding of the Las Vegas market, gaming industry, technology and the SBA market. Insiders own over 30% of the Company, ensuring management’s interests are closely aligned with key stakeholders. Customer-Centric Approach Focused on delivering exceptional customer service and tailored financial solutions, GBFH has built a loyal customer base. 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP Measures Reconciliation.

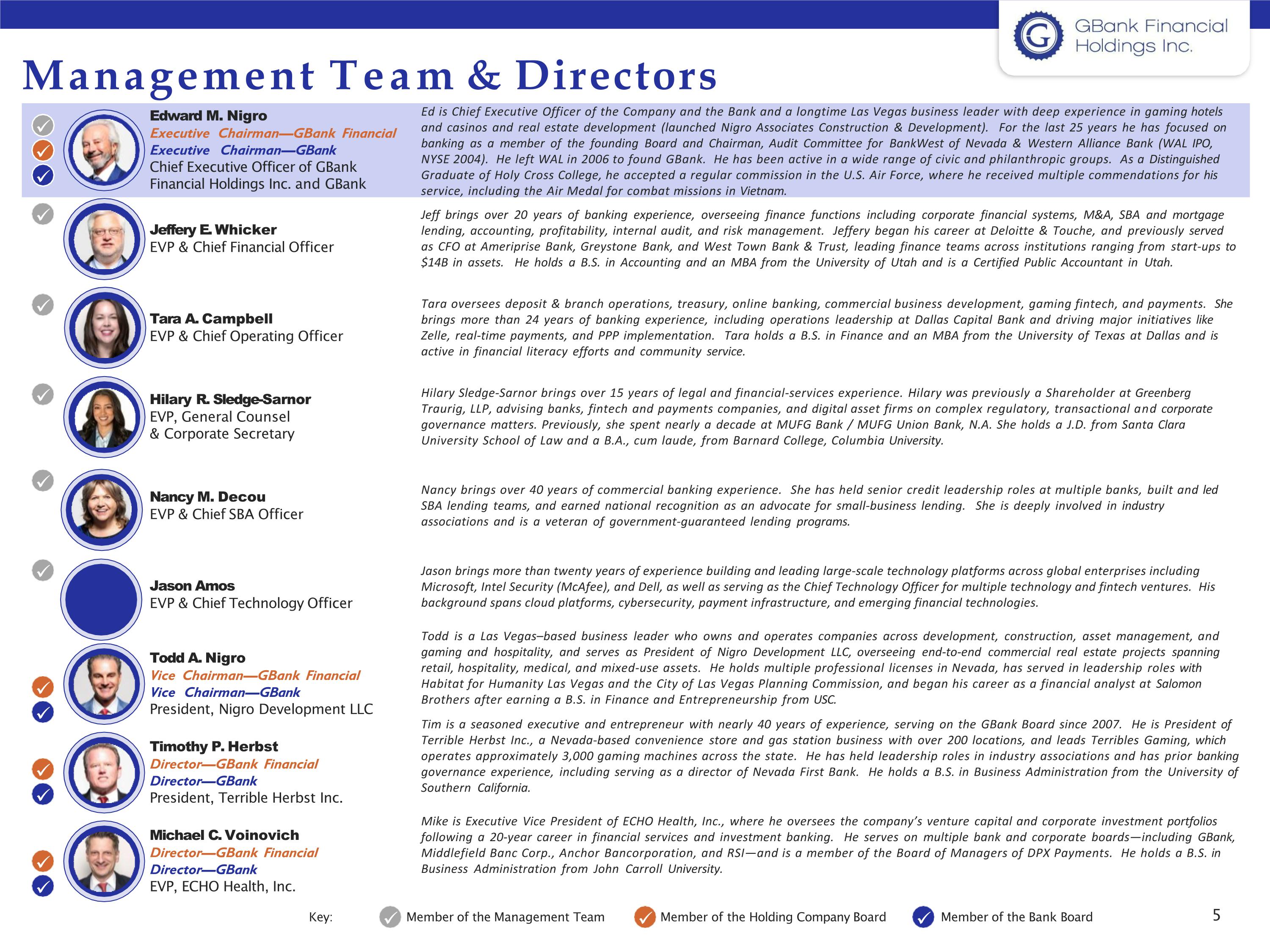

Management Team & Directors Ed is Chief Executive Officer of the Company and the Bank and a longtime Las Vegas business leader with deep experience in gaming hotels and casinos and real estate development (launched Nigro Associates Construction & Development). For the last 25 years he has focused on banking as a member of the founding Board and Chairman, Audit Committee for BankWest of Nevada & Western Alliance Bank (WAL IPO, NYSE 2004). He left WAL in 2006 to found GBank. He has been active in a wide range of civic and philanthropic groups. As a Distinguished Graduate of Holy Cross College, he accepted a regular commission in the U.S. Air Force, where he received multiple commendations for his service, including the Air Medal for combat missions in Vietnam. Edward M. Nigro Executive Chairman—GBank Financial Executive Chairman—GBank Chief Executive Officer of GBank Financial Holdings Inc. and GBank Jeff brings over 20 years of banking experience, overseeing finance functions including corporate financial systems, M&A, SBA and mortgage lending, accounting, profitability, internal audit, and risk management. Jeffery began his career at Deloitte & Touche, and previously served as CFO at Ameriprise Bank, Greystone Bank, and West Town Bank & Trust, leading finance teams across institutions ranging from start-ups to $14B in assets. He holds a B.S. in Accounting and an MBA from the University of Utah and is a Certified Public Accountant in Utah. Jeffery E. Whicker EVP & Chief Financial Officer Tara oversees deposit & branch operations, treasury, online banking, commercial business development, gaming fintech, and payments. She brings more than 24 years of banking experience, including operations leadership at Dallas Capital Bank and driving major initiatives like Zelle, real-time payments, and PPP implementation. Tara holds a B.S. in Finance and an MBA from the University of Texas at Dallas and is active in financial literacy efforts and community service. Tara A. Campbell EVP & Chief Operating Officer Jason brings more than twenty years of experience building and leading large-scale technology platforms across global enterprises including Microsoft, Intel Security (McAfee), and Dell, as well as serving as the Chief Technology Officer for multiple technology and fintech ventures. His background spans cloud platforms, cybersecurity, payment infrastructure, and emerging financial technologies. Todd is a Las Vegas–based business leader who owns and operates companies across development, construction, asset management, and gaming and hospitality, and serves as President of Nigro Development LLC, overseeing end-to-end commercial real estate projects spanning retail, hospitality, medical, and mixed-use assets. He holds multiple professional licenses in Nevada, has served in leadership roles with Habitat for Humanity Las Vegas and the City of Las Vegas Planning Commission, and began his career as a financial analyst at Salomon Brothers after earning a B.S. in Finance and Entrepreneurship from USC. Tim is a seasoned executive and entrepreneur with nearly 40 years of experience, serving on the GBank Board since 2007. He is President of Terrible Herbst Inc., a Nevada-based convenience store and gas station business with over 200 locations, and leads Terribles Gaming, which operates approximately 3,000 gaming machines across the state. He has held leadership roles in industry associations and has prior banking governance experience, including serving as a director of Nevada First Bank. He holds a B.S. in Business Administration from the University of Southern California. Mike is Executive Vice President of ECHO Health, Inc., where he oversees the company’s venture capital and corporate investment portfolios following a 20-year career in financial services and investment banking. He serves on multiple bank and corporate boards—including GBank, Middlefield Banc Corp., Anchor Bancorporation, and RSI—and is a member of the Board of Managers of DPX Payments. He holds a B.S. in Business Administration from John Carroll University. Michael C. Voinovich Director—GBank Financial Director—GBank EVP, ECHO Health, Inc. Hilary Sledge-Sarnor brings over 15 years of legal and financial-services experience. Hilary was previously a Shareholder at Greenberg Traurig, LLP, advising banks, fintech and payments companies, and digital asset firms on complex regulatory, transactional and corporate governance matters. Previously, she spent nearly a decade at MUFG Bank / MUFG Union Bank, N.A. She holds a J.D. from Santa Clara University School of Law and a B.A., cum laude, from Barnard College, Columbia University. Hilary R. Sledge-Sarnor EVP, General Counsel & Corporate Secretary Nancy brings over 40 years of commercial banking experience. She has held senior credit leadership roles at multiple banks, built and led SBA lending teams, and earned national recognition as an advocate for small-business lending. She is deeply involved in industry associations and is a veteran of government-guaranteed lending programs. Nancy M. Decou EVP & Chief SBA Officer Jason Amos EVP & Chief Technology Officer Todd A. Nigro Vice Chairman—GBank Financial Vice Chairman—GBank President, Nigro Development LLC Timothy P. Herbst Director—GBank Financial Director—GBank President, Terrible Herbst Inc. Key: Member of the Management Team Member of the Holding Company Board Member of the Bank Board

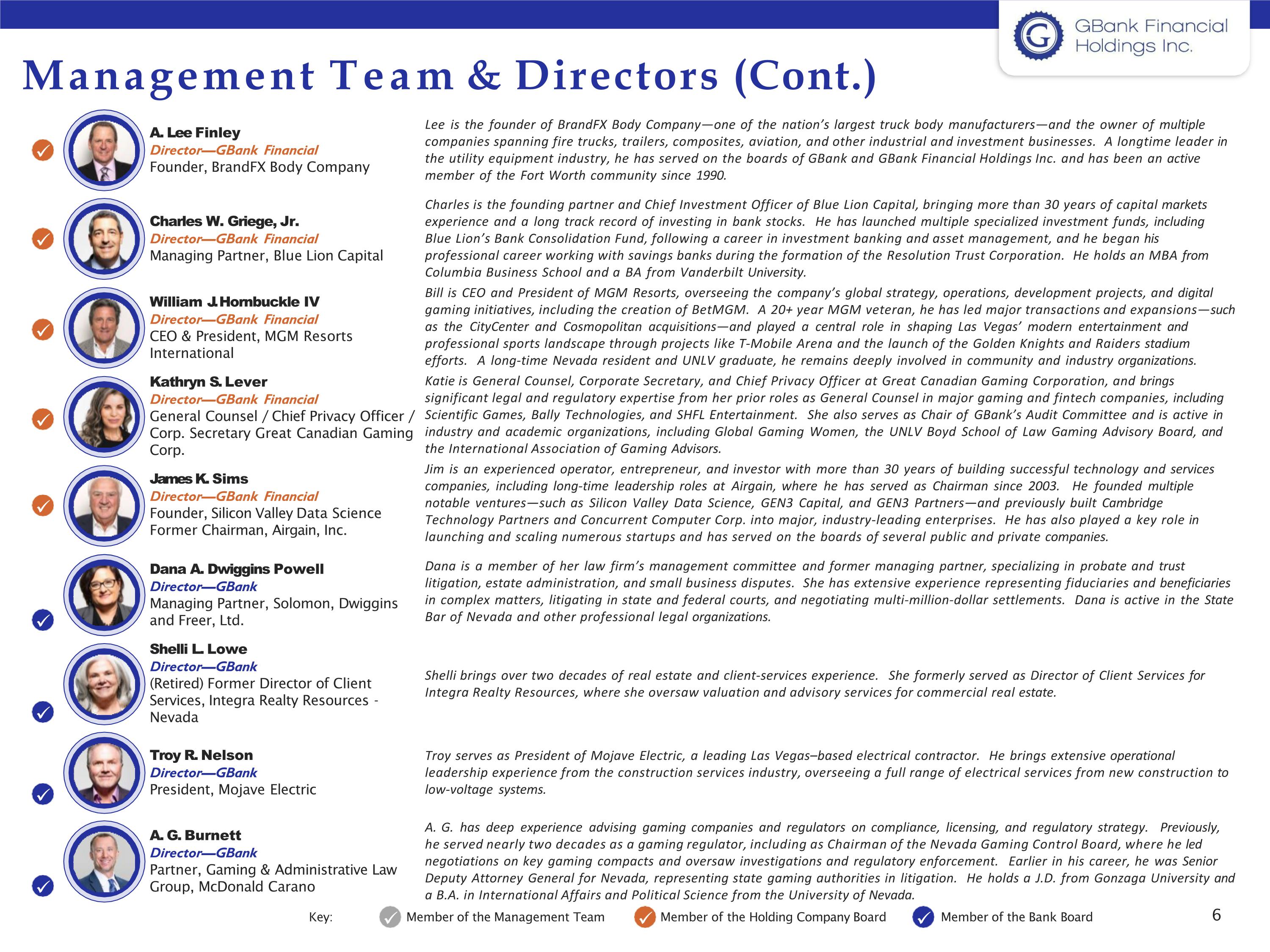

Management Team & Directors (Cont.) A. G. has deep experience advising gaming companies and regulators on compliance, licensing, and regulatory strategy. Previously, he served nearly two decades as a gaming regulator, including as Chairman of the Nevada Gaming Control Board, where he led negotiations on key gaming compacts and oversaw investigations and regulatory enforcement. Earlier in his career, he was Senior Deputy Attorney General for Nevada, representing state gaming authorities in litigation. He holds a J.D. from Gonzaga University and a B.A. in International Affairs and Political Science from the University of Nevada. Shelli brings over two decades of real estate and client-services experience. She formerly served as Director of Client Services for Integra Realty Resources, where she oversaw valuation and advisory services for commercial real estate. Troy serves as President of Mojave Electric, a leading Las Vegas–based electrical contractor. He brings extensive operational leadership experience from the construction services industry, overseeing a full range of electrical services from new construction to low-voltage systems. Lee is the founder of BrandFX Body Company—one of the nation’s largest truck body manufacturers—and the owner of multiple companies spanning fire trucks, trailers, composites, aviation, and other industrial and investment businesses. A longtime leader in the utility equipment industry, he has served on the boards of GBank and GBank Financial Holdings Inc. and has been an active member of the Fort Worth community since 1990. Charles is the founding partner and Chief Investment Officer of Blue Lion Capital, bringing more than 30 years of capital markets experience and a long track record of investing in bank stocks. He has launched multiple specialized investment funds, including Blue Lion’s Bank Consolidation Fund, following a career in investment banking and asset management, and he began his professional career working with savings banks during the formation of the Resolution Trust Corporation. He holds an MBA from Columbia Business School and a BA from Vanderbilt University. Bill is CEO and President of MGM Resorts, overseeing the company’s global strategy, operations, development projects, and digital gaming initiatives, including the creation of BetMGM. A 20+ year MGM veteran, he has led major transactions and expansions—such as the CityCenter and Cosmopolitan acquisitions—and played a central role in shaping Las Vegas’ modern entertainment and professional sports landscape through projects like T-Mobile Arena and the launch of the Golden Knights and Raiders stadium efforts. A long-time Nevada resident and UNLV graduate, he remains deeply involved in community and industry organizations. Katie is General Counsel, Corporate Secretary, and Chief Privacy Officer at Great Canadian Gaming Corporation, and brings significant legal and regulatory expertise from her prior roles as General Counsel in major gaming and fintech companies, including Scientific Games, Bally Technologies, and SHFL Entertainment. She also serves as Chair of GBank’s Audit Committee and is active in industry and academic organizations, including Global Gaming Women, the UNLV Boyd School of Law Gaming Advisory Board, and the International Association of Gaming Advisors. Jim is an experienced operator, entrepreneur, and investor with more than 30 years of building successful technology and services companies, including long-time leadership roles at Airgain, where he has served as Chairman since 2003. He founded multiple notable ventures—such as Silicon Valley Data Science, GEN3 Capital, and GEN3 Partners—and previously built Cambridge Technology Partners and Concurrent Computer Corp. into major, industry-leading enterprises. He has also played a key role in launching and scaling numerous startups and has served on the boards of several public and private companies. Dana is a member of her law firm’s management committee and former managing partner, specializing in probate and trust litigation, estate administration, and small business disputes. She has extensive experience representing fiduciaries and beneficiaries in complex matters, litigating in state and federal courts, and negotiating multi-million-dollar settlements. Dana is active in the State Bar of Nevada and other professional legal organizations. A. G. Burnett Director—GBank Partner, Gaming & Administrative Law Group, McDonald Carano Dana A. Dwiggins Powell Director—GBank Managing Partner, Solomon, Dwiggins and Freer, Ltd. Shelli L. Lowe Director—GBank (Retired) Former Director of Client Services, Integra Realty Resources - Nevada Troy R. Nelson Director—GBank President, Mojave Electric A. Lee Finley Director—GBank Financial Founder, BrandFX Body Company William J. Hornbuckle IV Director—GBank Financial CEO & President, MGM Resorts International Kathryn S. Lever Director—GBank Financial General Counsel / Chief Privacy Officer / Corp. Secretary Great Canadian Gaming Corp. James K. Sims Director—GBank Financial Founder, Silicon Valley Data Science Former Chairman, Airgain, Inc. Charles W. Griege, Jr. Director—GBank Financial Managing Partner, Blue Lion Capital Key: Member of the Management Team Member of the Holding Company Board Member of the Bank Board

Insider Ownership Insider Position December 31, 2025 Shares (%) A. Lee Finley Independent Director 1,655,900 11.70 Edward M. Nigro CEO & Executive Chairman 1,201,128 8.49 Charles William Griege Jr. Independent Director 457,890 3.24 Todd A. Nigro Secretary & Vice Chairman 344,130 2.43 Timothy P. Herbst Independent Director 341,917 2.42 William Joseph Hornbuckle IV Independent Director 327,520 2.31 Nancy M. DeCou Independent Director 102,171 0.72 James K. Sims Independent Director 93,836 0.66 Michael C. Voinovich Independent Director 81,969 0.58 Kathryn S. Lever Independent Director 44,898 0.32 Jeffery E. Whicker EVP & CFO 13,450 0.10 Tara A. Campbell EVP & COO at GBank 5,633 0.04 Scot M. Levine EVP & Chief Risk Officer at Gbank 5,500 0.04 Total Insiders and Directors 4,675,942 33.04 Significant Insider Ownership Underscores Commitment and Confidence Source: S&P Capital IQ Pro

Recent Developments Meaningful Leadership Additions Hilary Sledge-Sarnor, Executive Vice President, General Counsel, and Corporate Secretary – seasoned payments/legal executive with deep pooled-account architecture expertise. Jason Amos, Executive Vice President, Chief Technology Officer – experienced technology leader with deep experience in building secure, scalable technology platforms Olga Bencini, technology consultant – compliance-certified technology leader focused on scaling payments and real-time infrastructure. Reorganization and New Leadership over the credit card development. These hires strengthen regulatory, legal and technology foundations for fintech-scale growth. Infrastructure Now Built for Multi-Year Expansion Improvements across SBA, credit card and gaming operations have largely been completed and the Company is well-positioned to scale across multiple revenue streams. Early operational refinements have strengthened focus, aligned priorities and supported timely improvements across the Bank. SBA Profitability Improved Changed the SBA broker-compensation model to reward profitability over volume, reversing margin pressure. Targeting gain-on-sale margins of 4%, reinforcing the SBA platform’s role as a stable, recurring driver of profitability. Credit Card Platform Built for Scale Growth was intentionally paused to fully build fraud-prevention, verification and onboarding systems. With the enhanced infrastructure now live, the business is positioned to scale charge volume and earnings as we enter 2026. Slot Program Nearing Commercial BoltBetz with Distill Taverns received final approval from the gaming commission and is live in Distilled Taverns. Terribles to launch in the second quarter bringing total slot machines under the program close to 3,000. Nevada regulators have approved the first-of-its-kind funding structure that keeps casino liquidity fully banked and insured, removing cash friction and enabling real-time digital funding. Initial rollout at Terrible’s Gaming and Distill Taverns will serve as scalable pilot programs and, once fully integrated, are expected to contribute a significant level of deposit growth. Path to Incremental Earnings Power Additional opportunities to include further integration with Konami as well as other casino management systems.

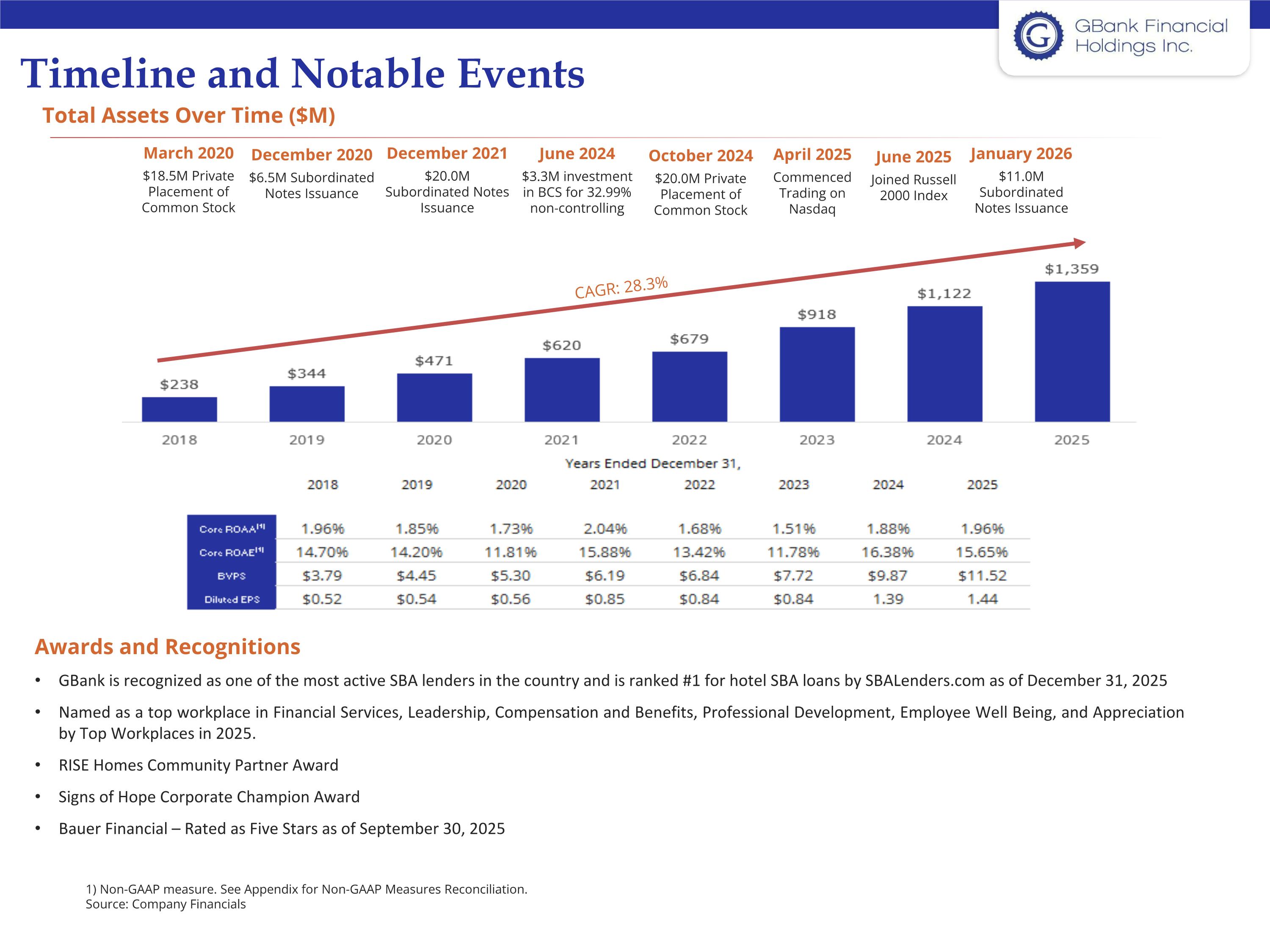

Timeline and Notable Events 1) Non-GAAP measure. See Appendix for Non-GAAP Measures Reconciliation. Source: Company Financials Total Assets Over Time ($M) March 2020 $18.5M Private Placement of Common Stock December 2020 $6.5M Subordinated Notes Issuance December 2021 $20.0M Subordinated Notes Issuance April 2025 Commenced Trading on Nasdaq June 2024 $3.3M investment in BCS for 32.99% non-controlling October 2024 $20.0M Private Placement of Common Stock June 2025 Joined Russell 2000 Index January 2026 $11.0M Subordinated Notes Issuance CAGR: 28.3% Awards and Recognitions GBank is recognized as one of the most active SBA lenders in the country and is ranked #1 for hotel SBA loans by SBALenders.com as of December 31, 2025 Named as a top workplace in Financial Services, Leadership, Compensation and Benefits, Professional Development, Employee Well Being, and Appreciation by Top Workplaces in 2025. RISE Homes Community Partner Award Signs of Hope Corporate Champion Award Bauer Financial – Rated as Five Stars as of September 30, 2025

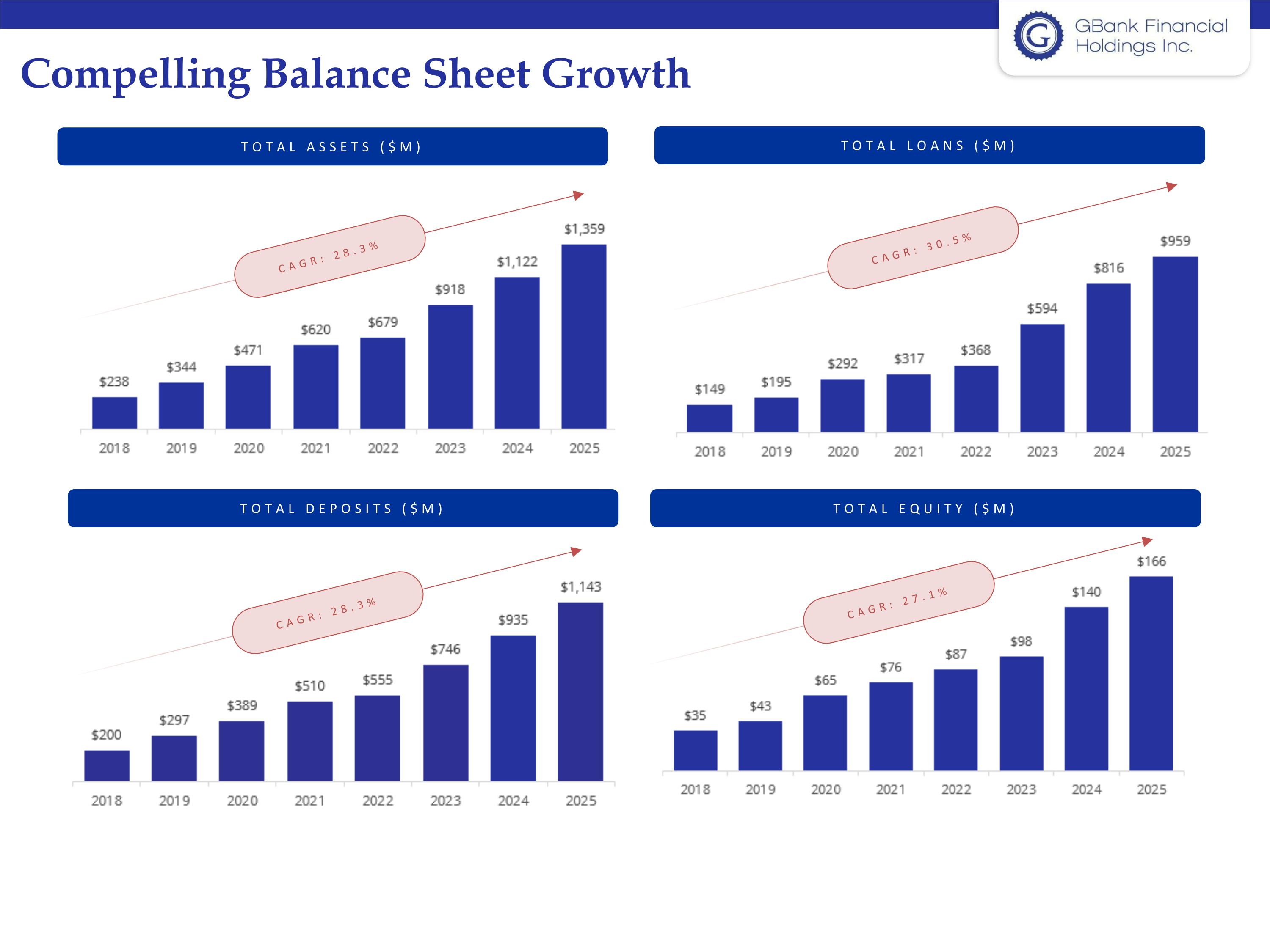

Compelling Balance Sheet Growth TOTAL ASSETS ($M) TOTAL LOANS ($M) TOTAL DEPOSITS ($M) TOTAL EQUITY ($M) CAGR: 28.3% CAGR: 30.5% CAGR: 28.3% CAGR: 27.1%

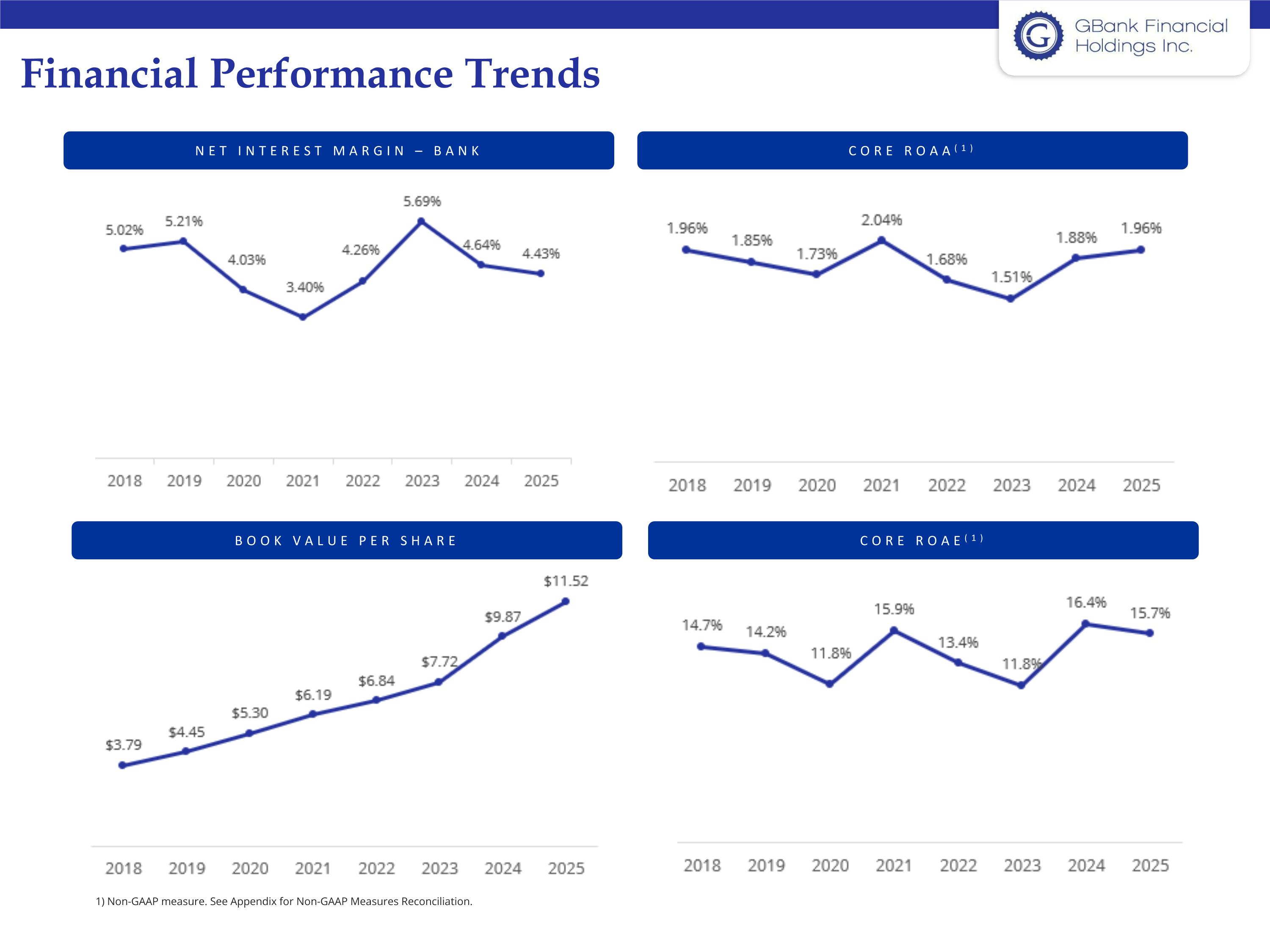

Financial Performance Trends 1) Non-GAAP measure. See Appendix for Non-GAAP Measures Reconciliation. NET INTEREST MARGIN – BANK CORE ROAA(1) BOOK VALUE PER SHARE CORE ROAE(1)

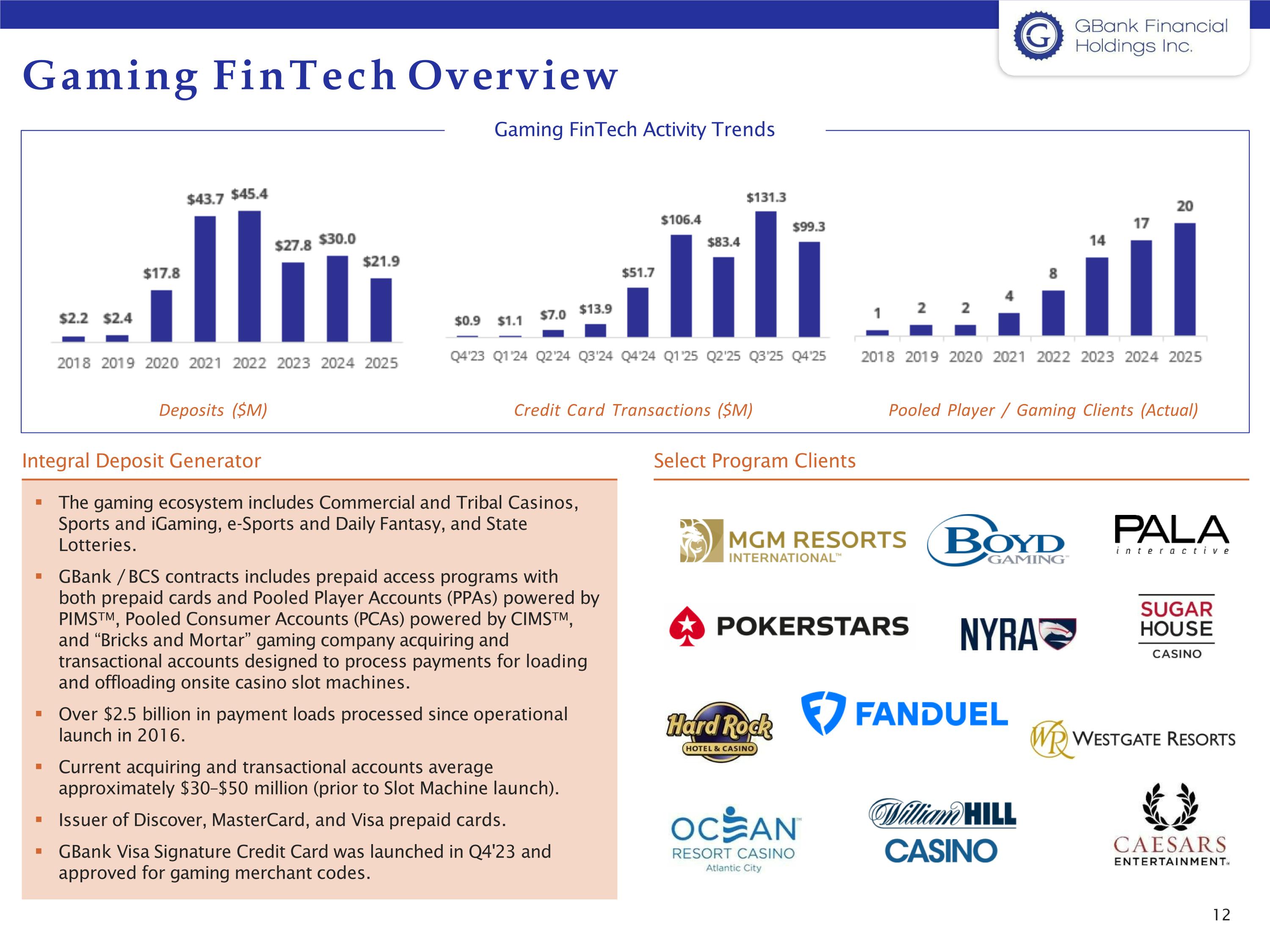

Gaming FinTech Overview Gaming FinTech Activity Trends Deposits ($M) Credit Card Transactions ($M) Pooled Player / Gaming Clients (Actual) The gaming ecosystem includes Commercial and Tribal Casinos, Sports and iGaming, e-Sports and Daily Fantasy, and State Lotteries. GBank / BCS contracts includes prepaid access programs with both prepaid cards and Pooled Player Accounts (PPAs) powered by PIMSTM, Pooled Consumer Accounts (PCAs) powered by CIMSTM, and “Bricks and Mortar” gaming company acquiring and transactional accounts designed to process payments for loading and offloading onsite casino slot machines. Over $2.5 billion in payment loads processed since operational launch in 2016. Current acquiring and transactional accounts average approximately $30–$50 million (prior to Slot Machine launch). Issuer of Discover, MasterCard, and Visa prepaid cards. GBank Visa Signature Credit Card was launched in Q4'23 and approved for gaming merchant codes. Integral Deposit Generator Select Program Clients

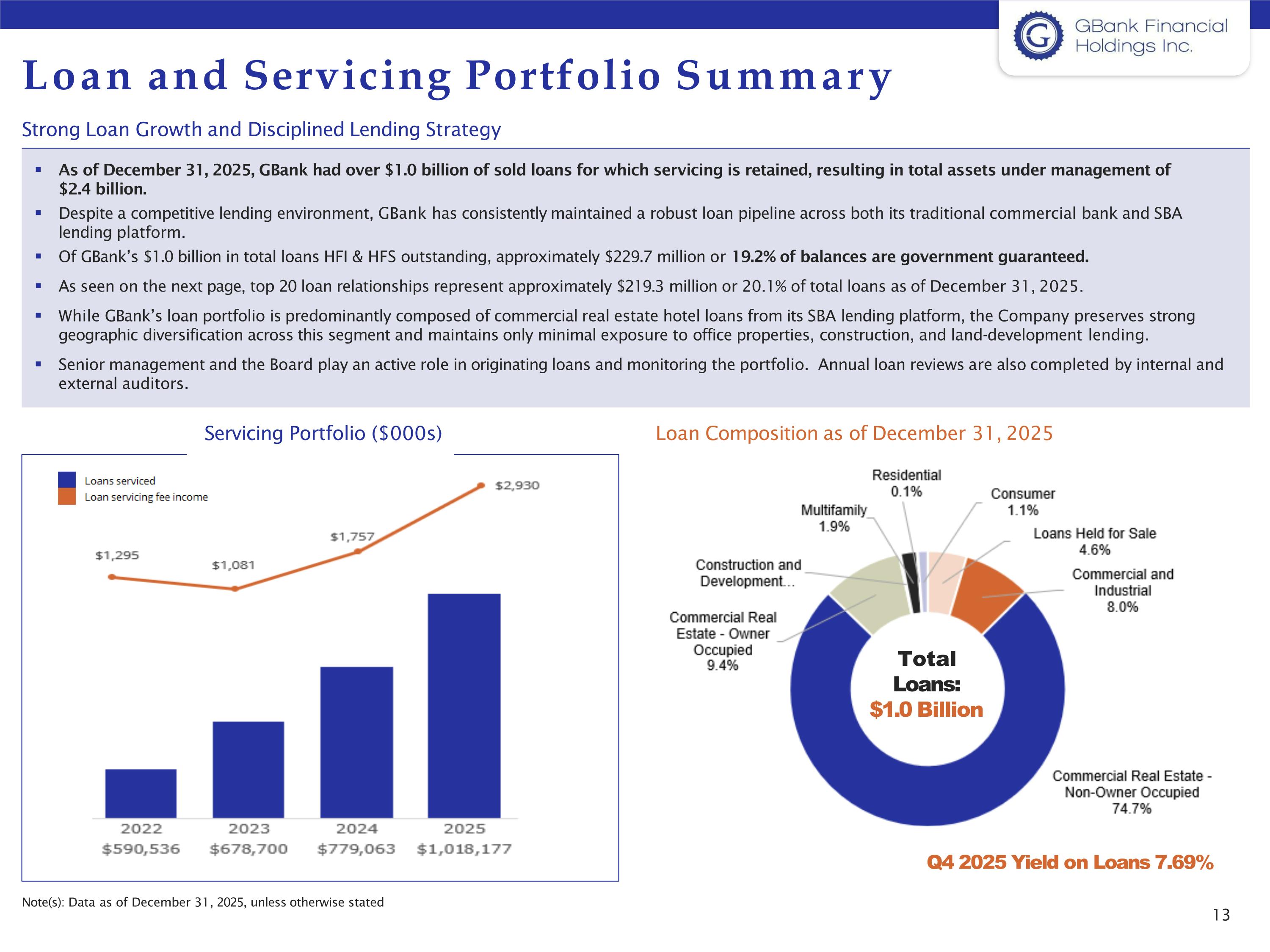

13 1,295 1,081 Loan and Servicing Portfolio Summary Note(s): Data as of December 31, 2025, unless otherwise stated Strong Loan Growth and Disciplined Lending Strategy As of December 31, 2025, GBank had over $1.0 billion of sold loans for which servicing is retained, resulting in total assets under management of $2.4 billion. Despite a competitive lending environment, GBank has consistently maintained a robust loan pipeline across both its traditional commercial bank and SBA lending platform. Of GBank’s $1.0 billion in total loans HFI & HFS outstanding, approximately $229.7 million or 19.2% of balances are government guaranteed. As seen on the next page, top 20 loan relationships represent approximately $219.3 million or 20.1% of total loans as of December 31, 2025. While GBank’s loan portfolio is predominantly composed of commercial real estate hotel loans from its SBA lending platform, the Company preserves strong geographic diversification across this segment and maintains only minimal exposure to office properties, construction, and land-development lending. Senior management and the Board play an active role in originating loans and monitoring the portfolio. Annual loan reviews are also completed by internal and external auditors. Servicing Portfolio ($000s) Loan Composition as of December 31, 2025 Q4 2025 Yield on Loans 7.69% Total Loans: $1.0 Billion

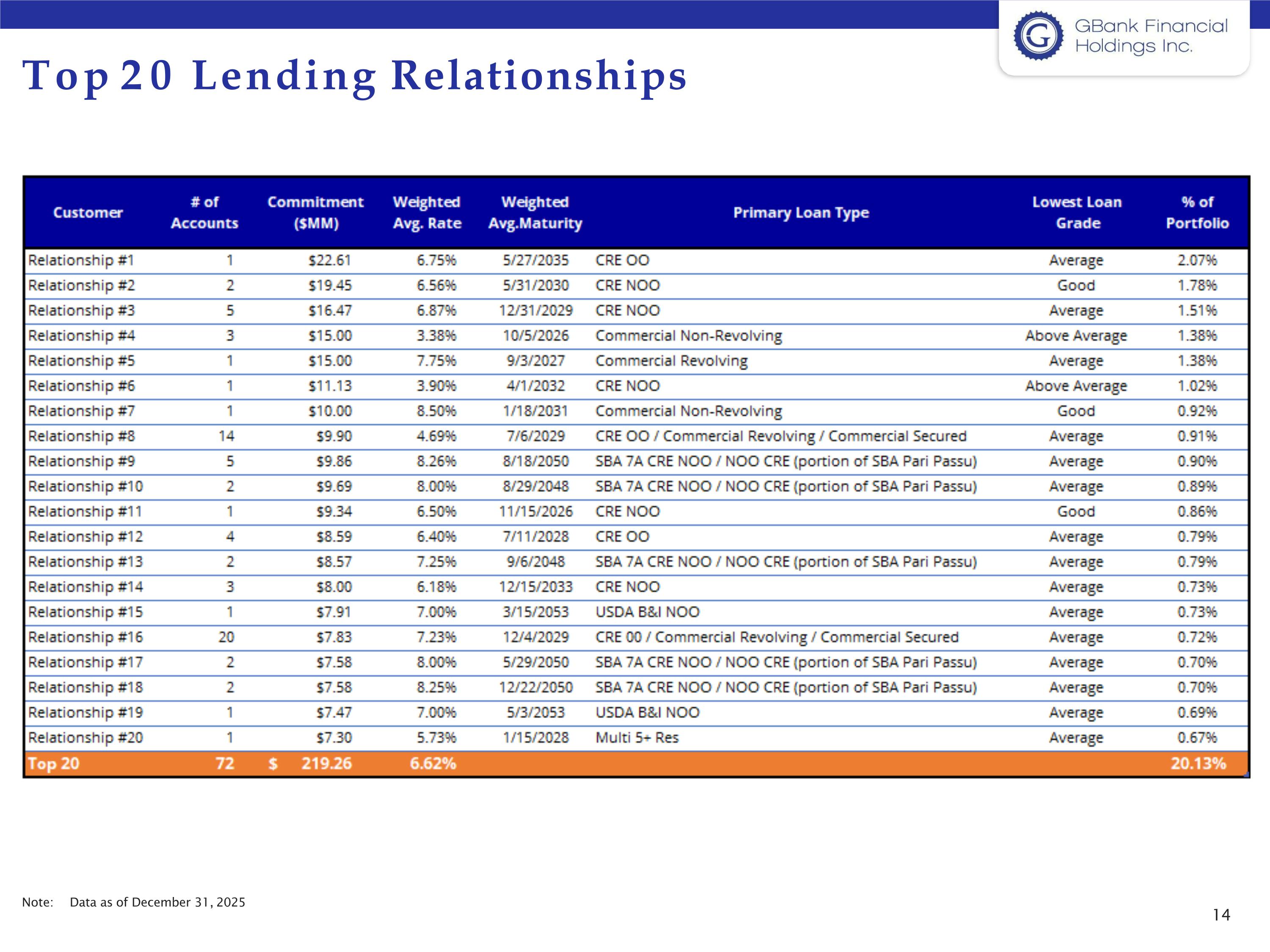

14 Top 20 Lending Relationships Note: Data as of December 31, 2025

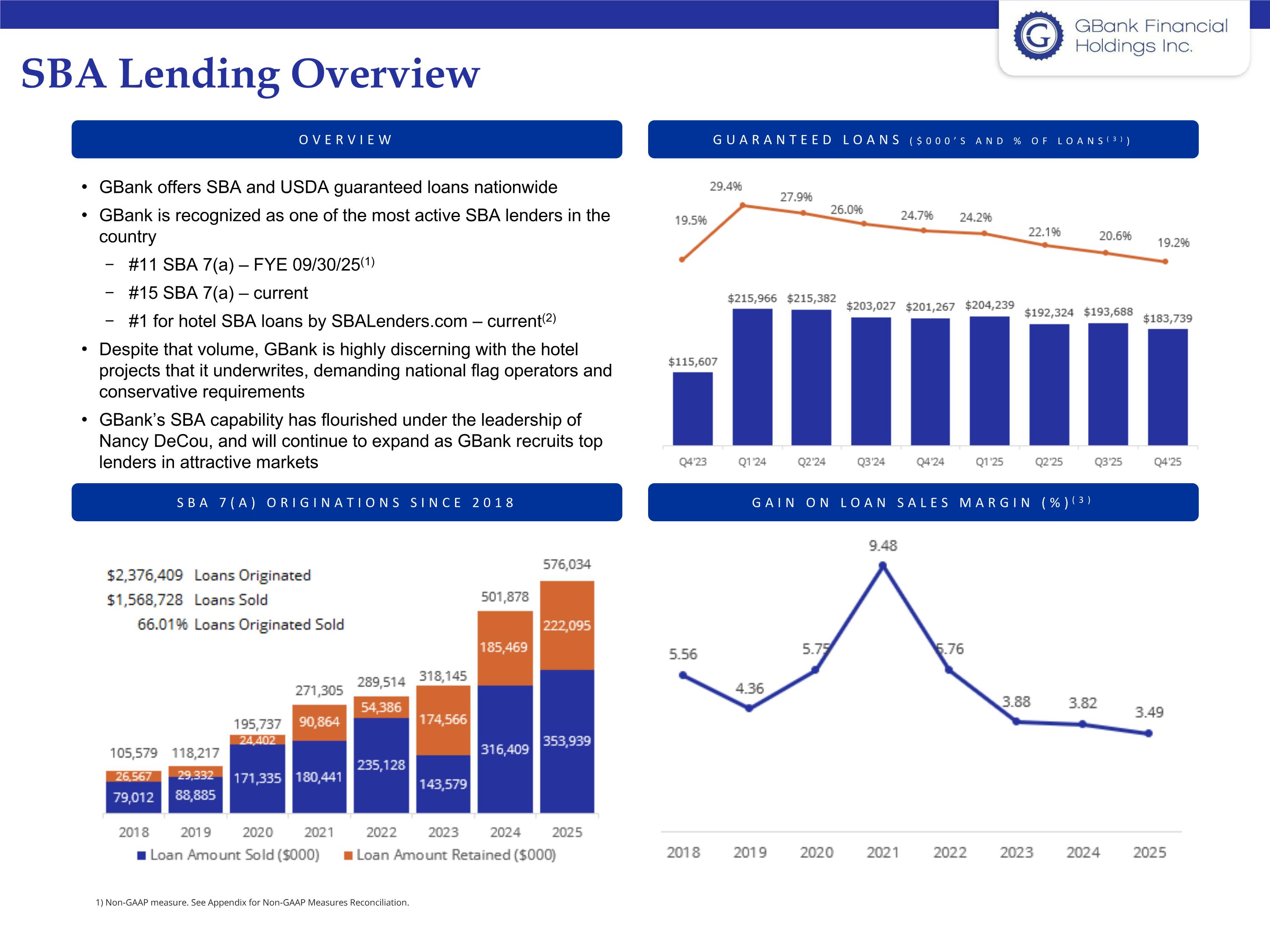

SBA Lending Overview 1) Non-GAAP measure. See Appendix for Non-GAAP Measures Reconciliation. OVERVIEW GAIN ON LOAN SALES MARGIN (%)(3) GBank offers SBA and USDA guaranteed loans nationwide GBank is recognized as one of the most active SBA lenders in the country #11 SBA 7(a) – FYE 09/30/25(1) #15 SBA 7(a) – current #1 for hotel SBA loans by SBALenders.com – current(2) Despite that volume, GBank is highly discerning with the hotel projects that it underwrites, demanding national flag operators and conservative requirements GBank’s SBA capability has flourished under the leadership of Nancy DeCou, and will continue to expand as GBank recruits top lenders in attractive markets SBA 7(A) ORIGINATIONS SINCE 2018 GUARANTEED LOANS ($000’S AND % OF LOANS(3))

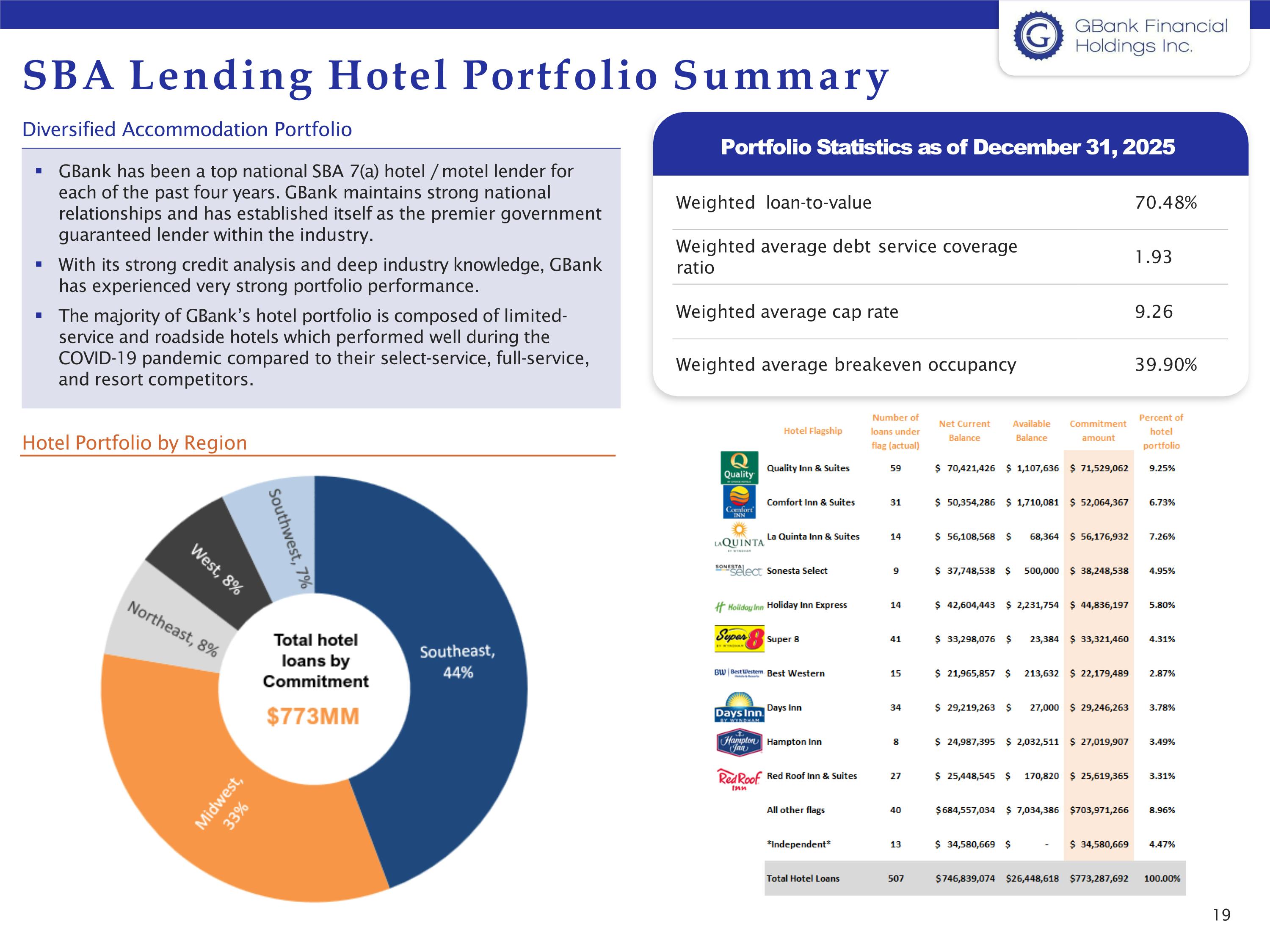

19 SBA Lending Hotel Portfolio Summary GBank has been a top national SBA 7(a) hotel / motel lender for each of the past four years. GBank maintains strong national relationships and has established itself as the premier government guaranteed lender within the industry. With its strong credit analysis and deep industry knowledge, GBank has experienced very strong portfolio performance. The majority of GBank’s hotel portfolio is composed of limited- service and roadside hotels which performed well during the COVID-19 pandemic compared to their select-service, full-service, and resort competitors. Diversified Accommodation Portfolio Hotel Portfolio by Region Weighted loan-to-value 70.48% Weighted average debt service coverage ratio 1.93 Weighted average cap rate 9.26 Weighted average breakeven occupancy 39.90% Portfolio Statistics as of December 31, 2025

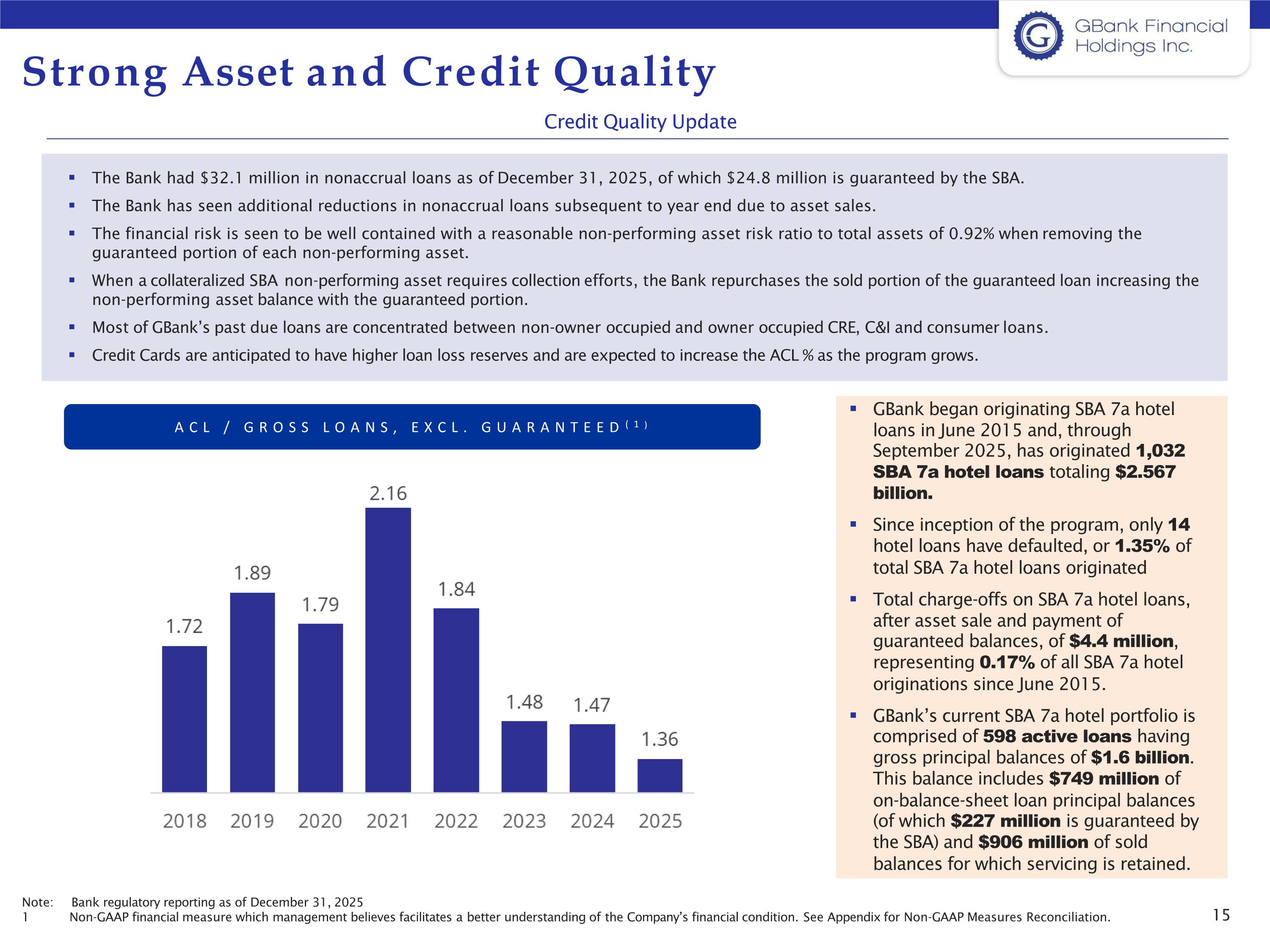

15 In $000s unless otherwise stated As of December 31, As of Quarter End, 2020 2021 2022 2023 2024 Q1’25 Q2'25 Q3'25 Q4'25 Strong Asset and Credit Quality Note: Bank regulatory reporting as of December 31, 2025 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP Measures Reconciliation. The Bank had $32.1 million in nonaccrual loans as of December 31, 2025, of which $24.8 million is guaranteed by the SBA. The Bank has seen additional reductions in nonaccrual loans subsequent to year end due to asset sales. The financial risk is seen to be well contained with a reasonable non-performing asset risk ratio to total assets of 0.92% when removing the guaranteed portion of each non-performing asset. When a collateralized SBA non-performing asset requires collection efforts, the Bank repurchases the sold portion of the guaranteed loan increasing the non-performing asset balance with the guaranteed portion. Most of GBank’s past due loans are concentrated between non-owner occupied and owner occupied CRE, C&I and consumer loans. Credit Cards are anticipated to have higher loan loss reserves and are expected to increase the ACL % as the program grows. Credit Quality Update GBank began originating SBA 7a hotel loans in June 2015 and, through September 2025, has originated 1,032 SBA 7a hotel loans totaling $2.567 billion. Since inception of the program, only 14 hotel loans have defaulted, or 1.35% of total SBA 7a hotel loans originated Total charge-offs on SBA 7a hotel loans, after asset sale and payment of guaranteed balances, of $4.4 million, representing 0.17% of all SBA 7a hotel originations since June 2015. GBank’s current SBA 7a hotel portfolio is comprised of 598 active loans having gross principal balances of $1.6 billion. This balance includes $749 million of on-balance-sheet loan principal balances (of which $227 million is guaranteed by the SBA) and $906 million of sold balances for which servicing is retained. ACL / GROSS LOANS, EXCL. GUARANTEED(1)

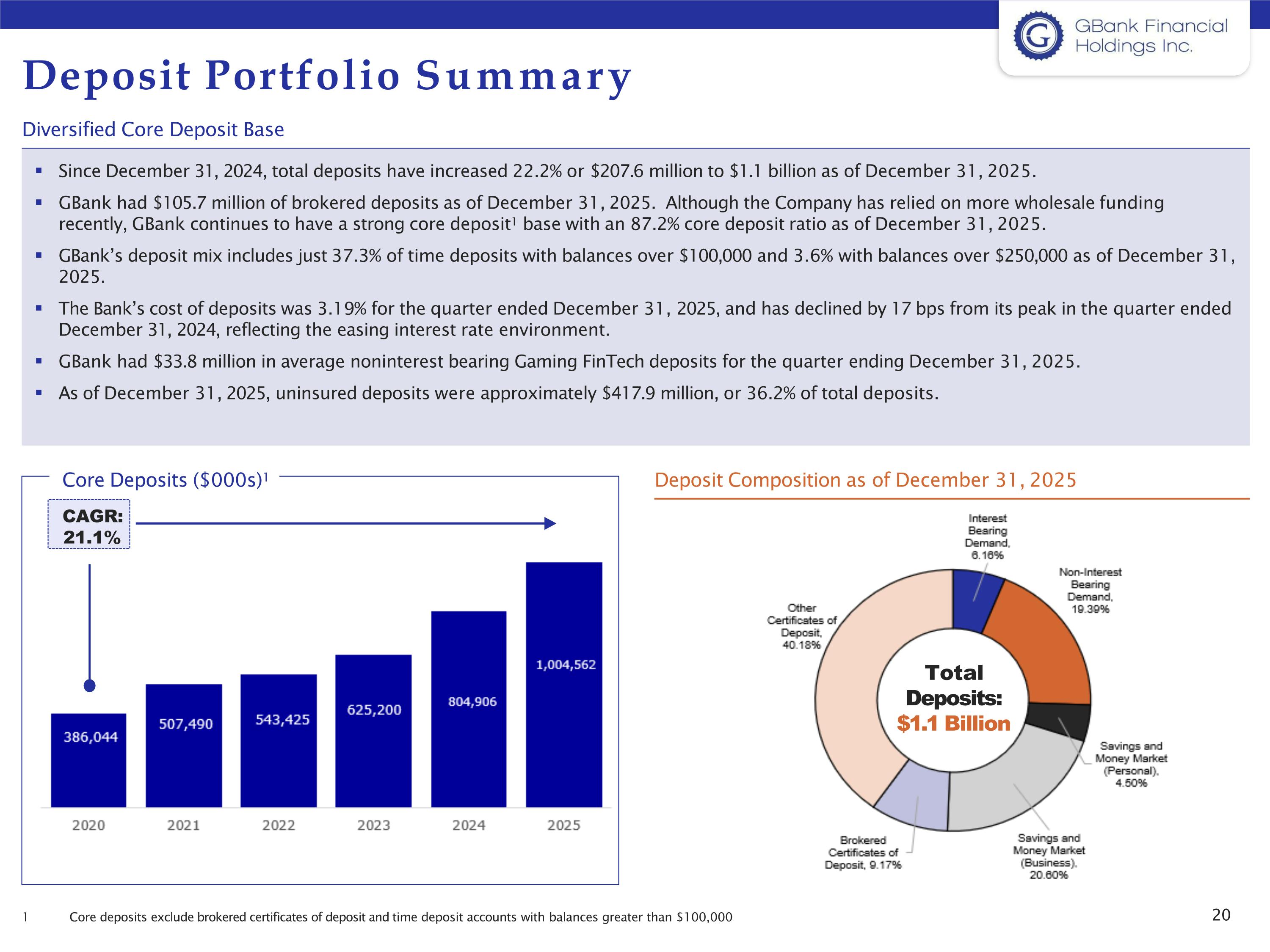

20 Deposit Portfolio Summary 1 Core deposits exclude brokered certificates of deposit and time deposit accounts with balances greater than $100,000 Diversified Core Deposit Base Since December 31, 2024, total deposits have increased 22.2% or $207.6 million to $1.1 billion as of December 31, 2025. GBank had $105.7 million of brokered deposits as of December 31, 2025. Although the Company has relied on more wholesale funding recently, GBank continues to have a strong core deposit1 base with an 87.2% core deposit ratio as of December 31, 2025. GBank’s deposit mix includes just 37.3% of time deposits with balances over $100,000 and 3.6% with balances over $250,000 as of December 31, 2025. The Bank’s cost of deposits was 3.19% for the quarter ended December 31, 2025, and has declined by 17 bps from its peak in the quarter ended December 31, 2024, reflecting the easing interest rate environment. GBank had $33.8 million in average noninterest bearing Gaming FinTech deposits for the quarter ending December 31, 2025. As of December 31, 2025, uninsured deposits were approximately $417.9 million, or 36.2% of total deposits. Deposit Composition as of December 31, 2025 Core Deposits ($000s)1 21.1% CAGR: Total Deposits: $1.1 Billion

Experienced and invested board and management (33% ownership) Commercial banking and national SBA lines High growth FinTech and payment opportunities Strong credit culture and pristine asset quality Robust capital and liquidity positions Investment Highlights Outstanding profitability and financial performance 19

DRAFT S E C T I O N A Appendix

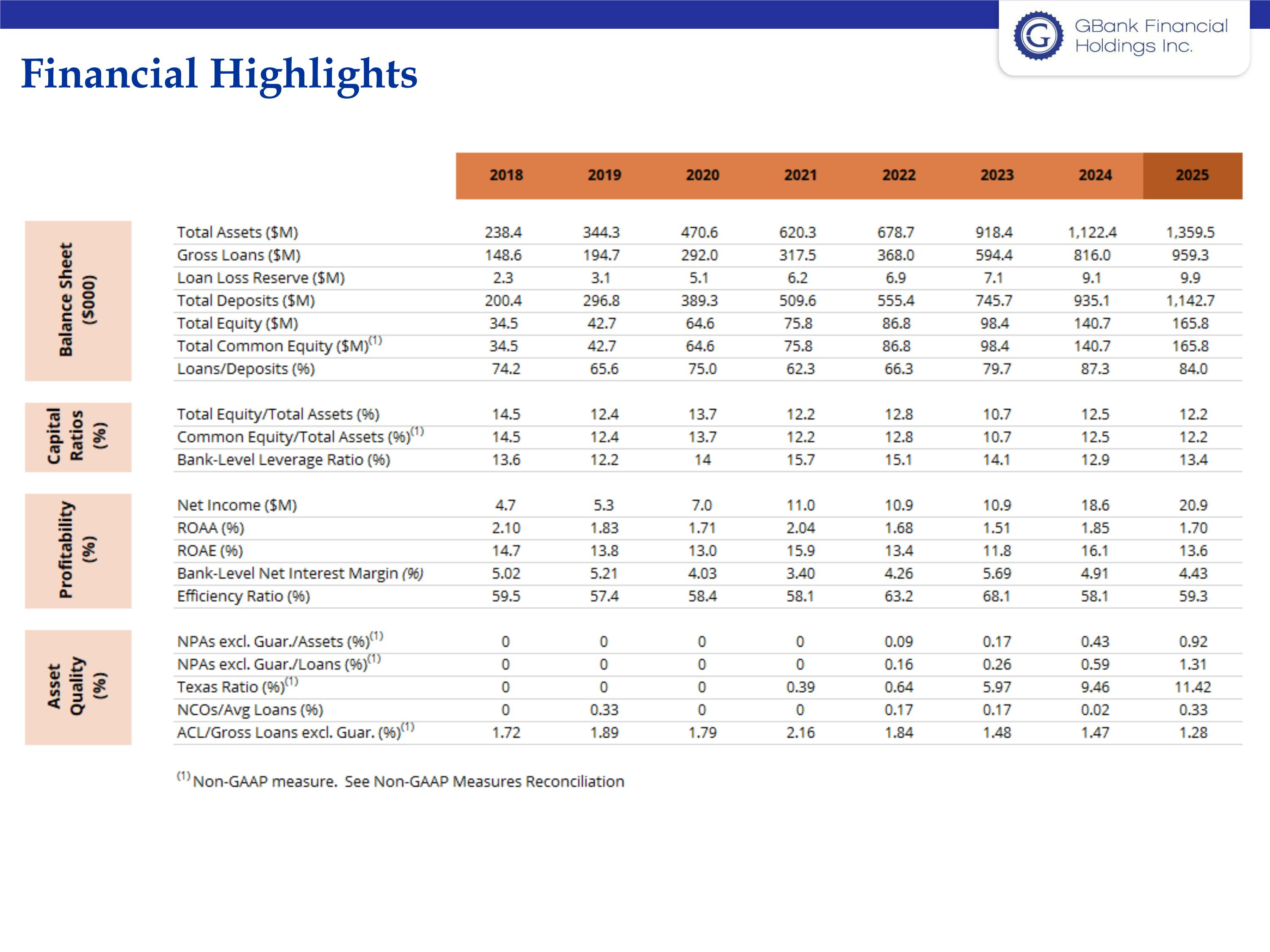

Financial Highlights

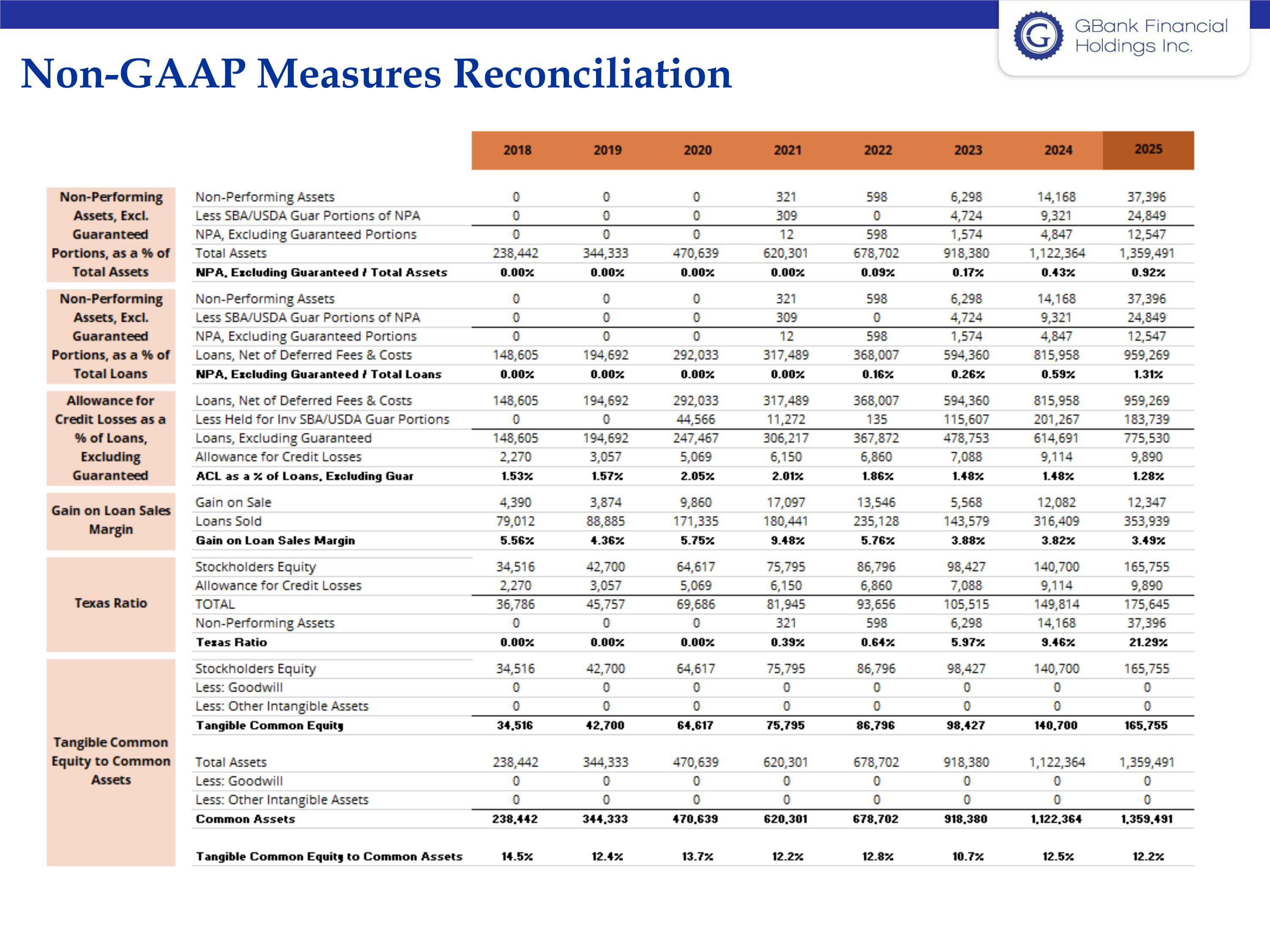

Non-GAAP Measures Reconciliation

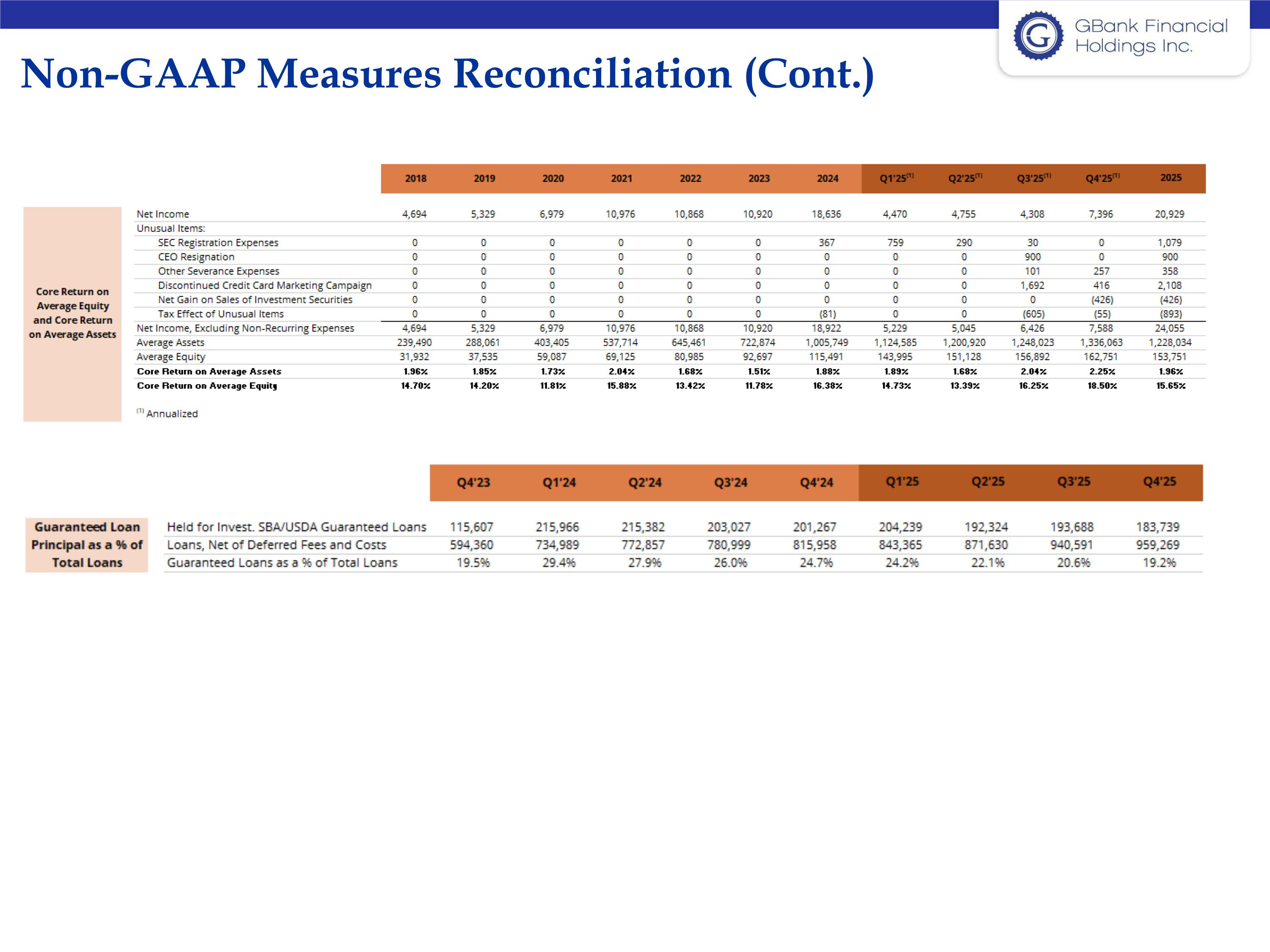

Non-GAAP Measures Reconciliation (Cont.)

DRAFT Thank You! NASDAQCM:GBFH