1 January 15, 2026 Claritev J.P. Morgan 44th Annual Healthcare Conference NYSE: CTEV

2 Presenters President & CEO Travis Dalton CFO Doug Garis

3 Disclaimers Forward-Looking Statements This presentation includes statements that express our management’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “forecasts,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this presentation, including, but not limited to, statements relating to the anticipated benefits of our transformation and expansion plans; our potential for growth; the anticipated expansion of our international initiatives; and the long-term prospects of the Company. Such forward-looking statements are based on available current market and management’s expectations, beliefs and forecasts concerning future events impacting the business. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that these forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These factors include: loss of our clients, particularly our largest clients; the ability to achieve the goals of our strategic plans and recognize the anticipated strategic, operational, growth and efficiency benefits when expected; our ability to enter new lines of business and broaden the scope of our services; the loss of key members of our management team or inability to maintain sufficient qualified personnel; our ability to continue to attract, motivate and retain a large number of skilled employees, and adapt to the effects of inflationary pressure on wages; trends in the U.S. healthcare system, including recent trends of unknown duration of reduced healthcare utilization and increased patient financial responsibility for services; effects of competition; effects of pricing pressure; the inability of our clients to pay for our services; changes in our industry and in industry standards and technology; adverse outcomes related to litigation or governmental proceedings; interruptions or security breaches of our information technology systems and other cybersecurity attacks; our ability to maintain the licenses or right of use for the software we use; our ability to protect proprietary information, processes and applications; our inability to expand our network infrastructure; inability to preserve or increase our existing market share or the size of our preferred provider organization networks; decreases in discounts from providers; pressure to limit access to preferred provider networks; changes in our regulatory environment, including healthcare law and regulations; the expansion of privacy and security laws; heightened enforcement activity by government agencies; our ability to obtain additional financing; our ability to pay interest and principal on our notes and other indebtedness; lowering or withdrawal of our credit ratings; changes in accounting principles or the incurrence of impairment charges; the possibility that we may be adversely affected by other political, economic, business, and/or competitive factors; other factors disclosed in our Securities and Exchange Commission filings; and other factors beyond our control. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. There can be no assurance that future developments affecting our business will be those that we have anticipated. Forward-looking statements speak only as of the date made. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Non-GAAP Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), this presentation contains certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. A non-GAAP financial measure is generally defined as a numerical measure of a company’s financial or operating performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP. EBITDA and Adjusted EBITDA, are supplemental measures of Claritev’s performance that are not required by or presented in accordance with GAAP. These measures are not measurements of our financial or operating performance under GAAP, have limitations as analytical tools and should not be considered in isolation or as an alternative to net income (loss), cash flows or any other measures of performance prepared in accordance with GAAP. EBITDA represents net income (loss) before interest expense, interest income, income tax provision (benefit), depreciation and amortization of intangible assets, and non-income taxes. Adjusted EBITDA is EBITDA as further adjusted by certain items as described in the table below. In addition, in evaluating EBITDA and Adjusted EBITDA you should be aware that in the future, we may incur expenses similar to the adjustments in the presentation of EBITDA and Adjusted EBITDA. The presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. The calculations of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Based on our industry and debt financing experience, we believe that EBITDA and Adjusted EBITDA are customarily used by investors, analysts and other interested parties to provide useful information regarding a company’s ability to service and/or incur indebtedness. We also believe that Adjusted EBITDA is useful to investors and analysts in assessing our operating performance during the periods these charges were incurred on a consistent basis with the periods during which these charges were not incurred. Both EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider either in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of the limitations are: • EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; • EBITDA and Adjusted EBITDA do not reflect interest expense, or the cash requirements necessary to service interest or principal payments on our debt; • EBITDA and Adjusted EBITDA do not reflect our tax expense or the cash requirements to pay our taxes; and • Although depreciation and amortization are non-cash charges, the tangible assets being depreciated will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. • Claritev's presentation of Adjusted EBITDA should not be construed as an inference that our future results and financial position will be unaffected by unusual items.

4 01 Claritev Vision 02 Products and Offerings Agenda 03 Financial Overview

5 Claritev Vision

6 Our purpose is simple. We work to help make healthcare transparent and affordable for all.

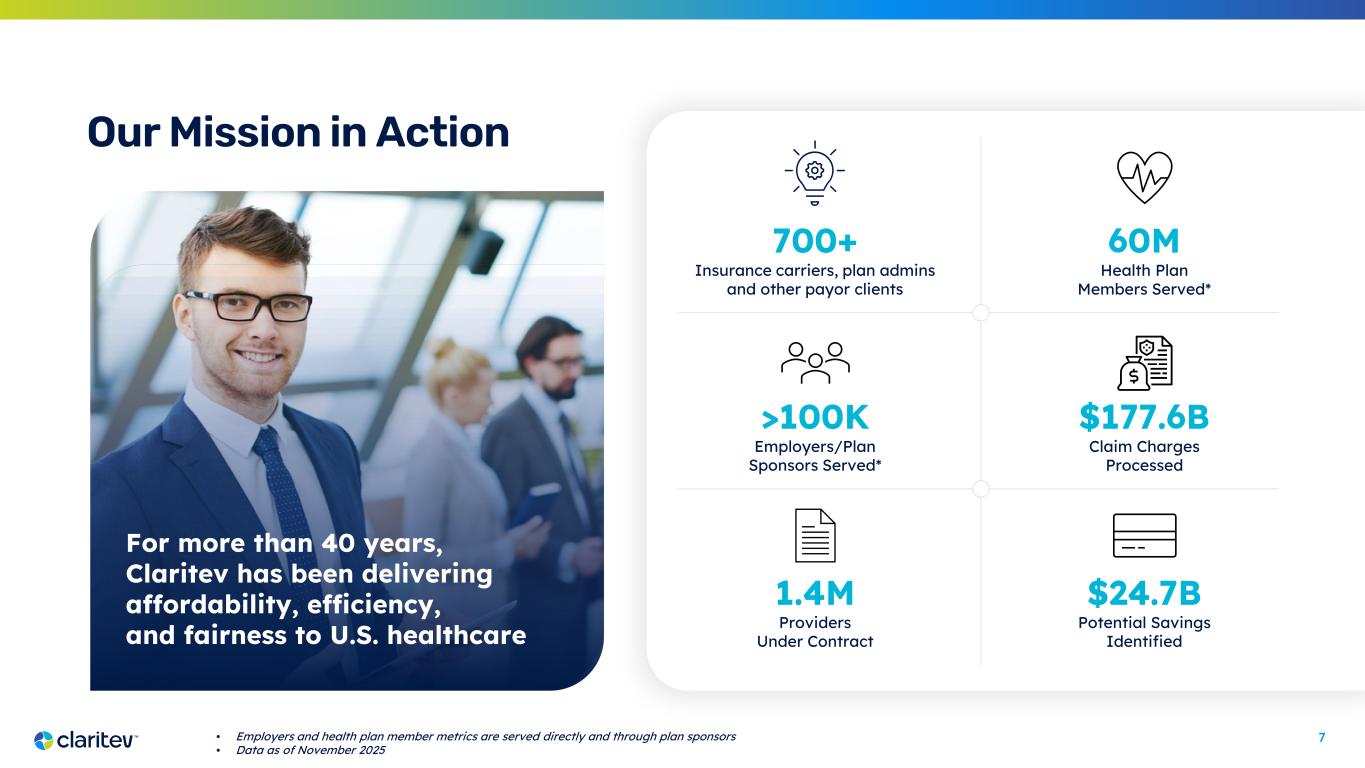

7 Our Mission in Action $24.7B Potential Savings Identified 60M Health Plan Members Served* >100K Employers/Plan Sponsors Served* 1.4M Providers Under Contract 700+ Insurance carriers, plan admins and other payor clients $177.6B Claim Charges Processed For more than 40 years, Claritev has been delivering affordability, efficiency, and fairness to U.S. healthcare • Employers and health plan member metrics are served directly and through plan sponsors • Data as of November 2025

8 Our Journey THE FOUNDATION and THE VISION Clarity | Alignment | Focus, Fit for Growth, Horizons THE TURN Launch Brand, New Products, Business Models, Markets THE WAY UP Focus and Disciplined Execution, Sales Aggression, Growth THE WAY FORWARD Sustained Growth, Independence, Culture, Product, Acquisitions REALIZE THE VISION Impact Healthcare Continuum, Diversified Markets, Mission 2024 2025 2026 2027 2028-2030

9 Market Challenges Escalating Healthcare Costs and Inflation Employer Costs Rising, Shifting to Employees Complexity of Regulatory Compliance Consumer Demand for Transparency & Personalization Fragmentation, Waste & Inefficiencies in Care Coordination 8.5% Medical Inflation 8-10% Healthcare cost increase for Employers $1T Healthcare waste Sources: PWC Medical Cost Trend Report, WTW Employer Survey, Aon Employer Survey, JAMA, Peterson G. Peterson Foundation

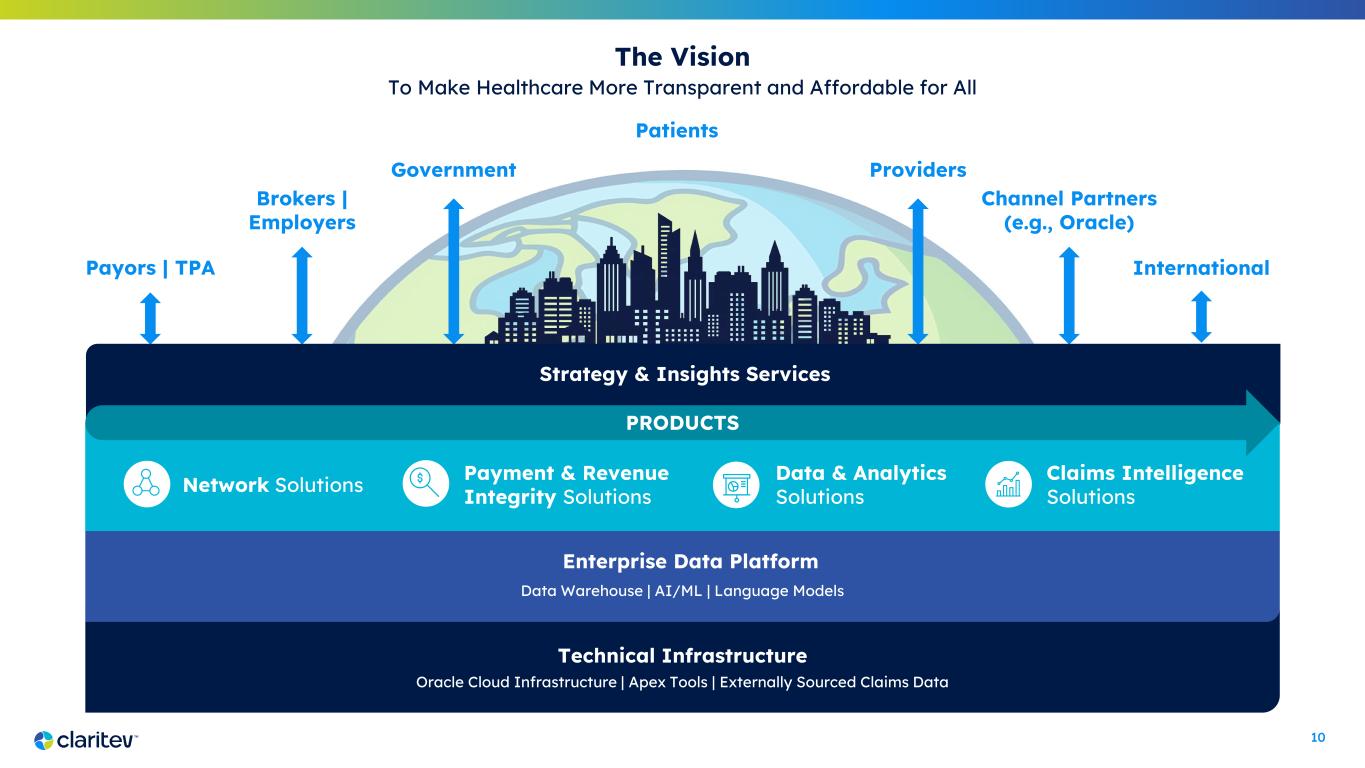

10 The Vision To Make Healthcare More Transparent and Affordable for All Patients Payors | TPA Brokers | Employers Government Channel Partners (e.g., Oracle) Providers International Enterprise Data Platform Data Warehouse | AI/ML | Language Models Technical Infrastructure Oracle Cloud Infrastructure | Apex Tools | Externally Sourced Claims Data Strategy & Insights Services PRODUCTS Network Solutions Payment & Revenue Integrity Solutions Data & Analytics Solutions Claims Intelligence Solutions

11 Where Our Transformation Leads Us World-Class Talent and Leadership with Growth Mindset Serving the Entire Healthcare Continuum Sustainable Growth Diversified Business Model and Product Suite Organic Product Capability Leading with Data, Analytics and Technology Capital Structure that Fits the Business Process Rigor, Discipline, and Predictability CLARITY ALIGNMENT FOCUS RESULTS Driving Our Transformation

12 Products and Offerings

13 Build and manage custom healthcare provider networks with access to 1.4M credentialed providers Data-driven reimbursement solutions for out-of-network claims & support for NSA compliance Identify, correct and prevent improper billing to optimize accuracy and reduce waste and abuse in the healthcare system that lowers cost of care Deliver actionable, digestible insights to improve plan and network design and lower healthcare costs by identifying and better serving high risk patients that improve outcomes Integrated health plan solutions including reference- based pricing and exclusive network access that enable employers to reduce medical cost and increase employee satisfaction Network Solutions Key Solutions • Complementary networks • Primary networks • Government networks • Property & casualty and other Claims Intelligence Solutions Key Solutions • Data iSight & other out- of-network analytics • Surprise bill services Payment & Revenue Integrity Solutions Key Solutions • Clinical negotiation • Clinical review / advanced code editing • Other pre-pay and post- pay payment & revenue integrity solutions Data & Analytics Solutions Key Solutions • BenInsights • Payor solutions (e.g. PlanOptix) • Provider solutions (e.g. CompleteVue) • Risk, analytics, insights & other Vistara Key Solutions • Health plan solutions and services • Balance bill protection Claritev Offerings Integrated platform providing exceptional products and services to customers

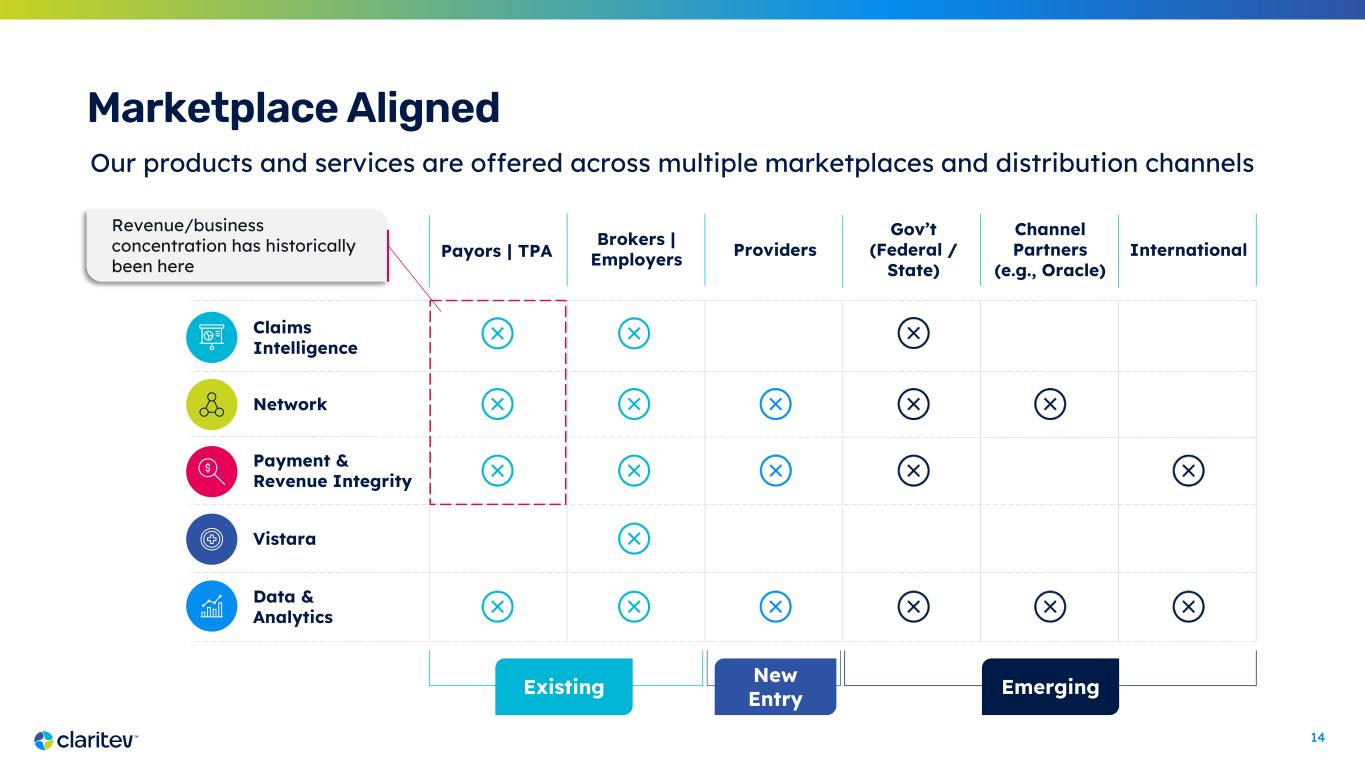

14 Marketplace Aligned Our products and services are offered across multiple marketplaces and distribution channels Claims Intelligence Payment & Revenue Integrity Network Vistara Data & Analytics Existing New Entry Emerging Revenue/business concentration has historically been here Payors | TPA Brokers | Employers Providers Gov’t (Federal / State) Channel Partners (e.g., Oracle) International

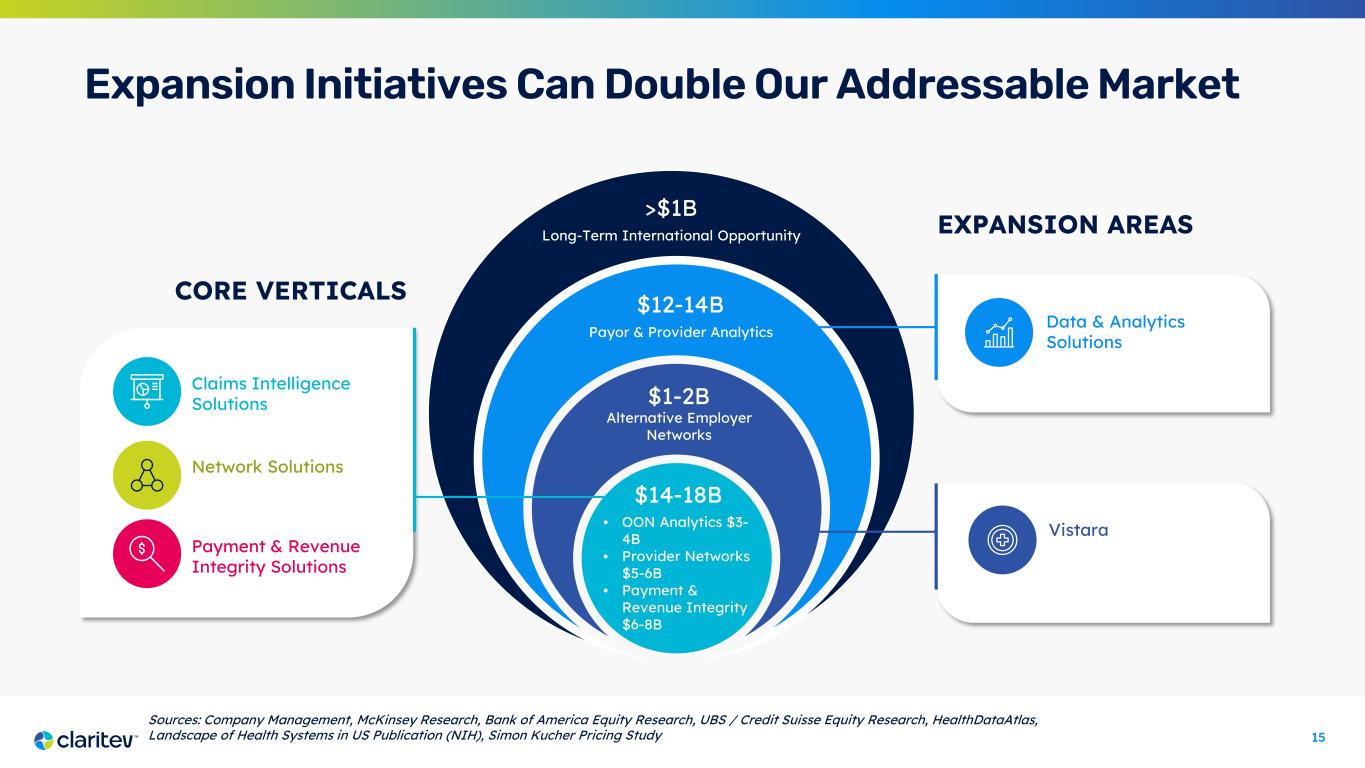

15 Vistara Expansion Initiatives Can Double Our Addressable Market $14-18B CORE VERTICALS EXPANSION AREAS • OON Analytics $3- 4B • Provider Networks $5-6B • Payment & Revenue Integrity $6-8B Alternative Employer Networks Payor & Provider Analytics Data & Analytics Solutions Network Solutions Claims Intelligence Solutions Payment & Revenue Integrity Solutions Sources: Company Management, McKinsey Research, Bank of America Equity Research, UBS / Credit Suisse Equity Research, HealthDataAtlas, Landscape of Health Systems in US Publication (NIH), Simon Kucher Pricing Study $1-2B $12-14B Long-Term International Opportunity >$1B

16 Multi-Pronged Approach to Accelerate Growth 04 03 02 01 Grow the Core Tailored focus and proactive engagement with existing clients Penetrate New Market Verticals Entry into Provider and International Accelerate Product Innovation Pursue big swings and ideas to solve global healthcare problems Advance Growth Areas – Vistara | Data & Analytics Scale growth via channel partnerships and broker engagements Our Growth Vectors

17 Proprietary data & analytics 400k custom business rules derived from 700+ payors and over 40 years of experience and claims flow Extensive technology scale Managing 15+ petabytes of data and ingesting 500B+ records monthly High provider acceptance Our solutions minimize provider abrasion and achieves 90%+ acceptance across our solutions Depth of client relationships Difficult to replicate technical integrations and custom rules built into our platform allow us to quickly deploy new solutions Regulatory expertise Agility and flexibility to ensure compliance with complex regulatory changes at Federal and State levels Why Claritev Our Competitive Advantage $500M+ Invested in R&D in 5 yrs

18 Financial Overview

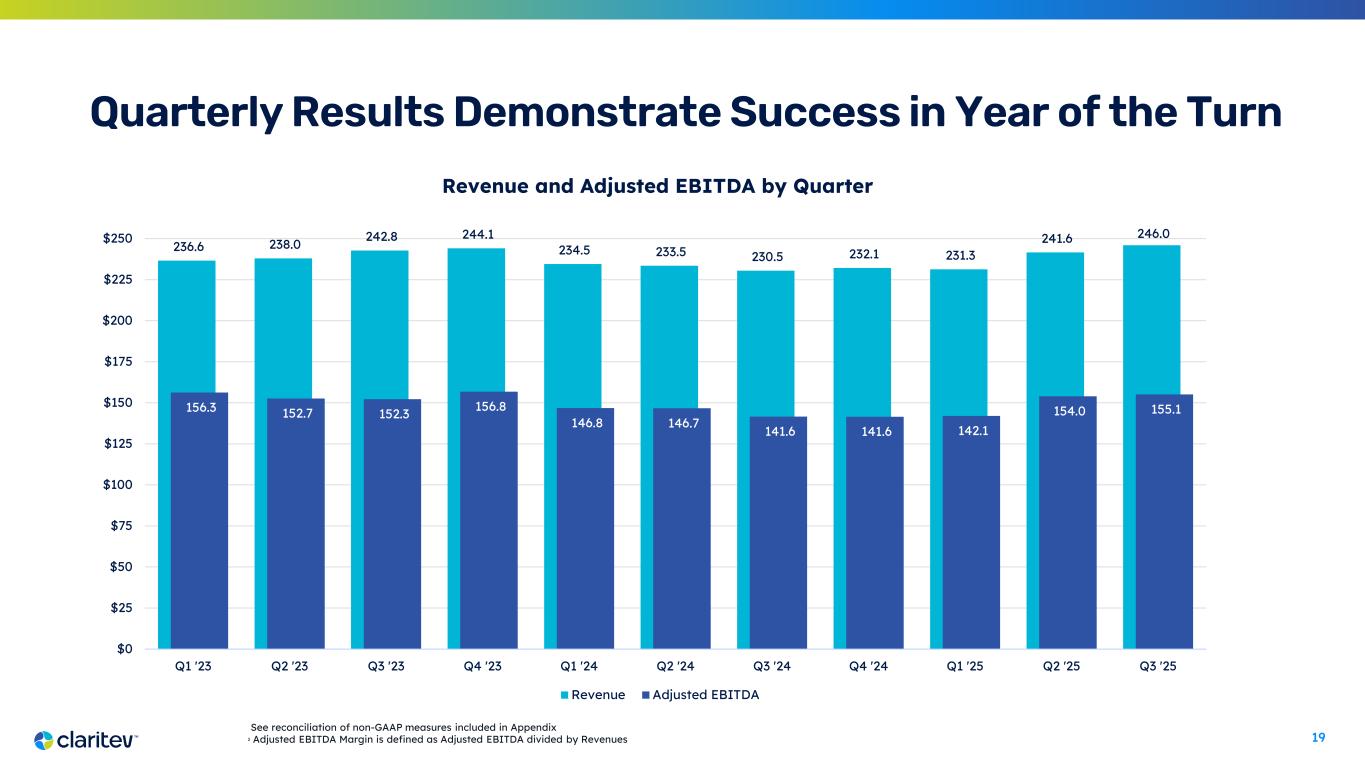

19 Quarterly Results Demonstrate Success in Year of the Turn Revenue and EBITDA by Quarter ($ in millions) 236.6 238.0 242.8 244.1 234.5 233.5 230.5 232.1 231.3 241.6 246.0 156.3 152.7 152.3 156.8 146.8 146.7 141.6 141.6 142.1 154.0 155.1 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Q2 '25 Q3 '25 Revenue Adjusted EBITDA Revenue and Adjusted EBITDA by Quarter See reconciliation of non-GAAP measures included in Appendix 2 Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenues

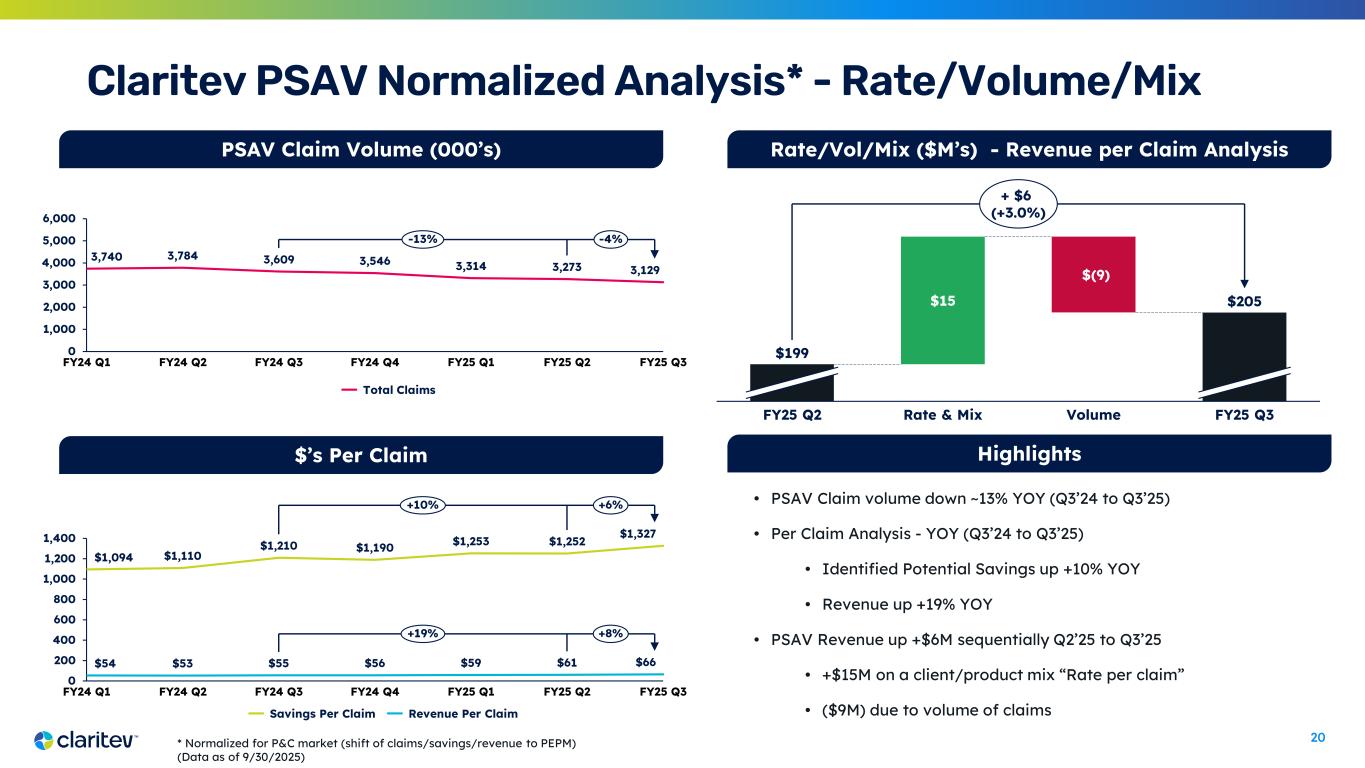

20 Claritev PSAV Normalized Analysis* - Rate/Volume/Mix Rate/Vol/Mix ($M’s) - Revenue per Claim Analysis $15 $(9) FY25 Q2 Rate & Mix Volume FY25 Q3 $199 $205 + $6 (+3.0%) 3,740 3,784 3,609 3,546 3,314 3,273 3,129 0 1,000 2,000 3,000 4,000 5,000 6,000 FY24 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY25 Q1 FY25 Q2 FY25 Q3 -13% -4% PSAV Claim Volume (000’s) $’s Per Claim $1,094 $1,110 $1,210 $1,190 $1,253 $1,252 $1,327 $54 $53 $55 $56 $59 $61 $66 0 200 400 600 800 1,000 1,200 1,400 FY24 Q1 FY24 Q2 FY24 Q3 FY24 Q4 FY25 Q1 FY25 Q2 FY25 Q3 +10% +19% +6% +8% Savings Per Claim Revenue Per Claim Total Claims Highlights • PSAV Claim volume down ~13% YOY (Q3’24 to Q3’25) • Per Claim Analysis - YOY (Q3’24 to Q3’25) • Identified Potential Savings up +10% YOY • Revenue up +19% YOY • PSAV Revenue up +$6M sequentially Q2’25 to Q3’25 • +$15M on a client/product mix “Rate per claim” • ($9M) due to volume of claims * Normalized for P&C market (shift of claims/savings/revenue to PEPM) (Data as of 9/30/2025)

21 Our primary use of capital is invest in our business, serve our clients, care for our associates, and maximize shareholder value. HIGHEST PRIORITYOrganic investments to fuel Vision 2030 Plan Debt paydown Value creating M&A Share buybacks HIGH PRIORITY HIGH PRIORITY LOW % OF CAPITAL ALLOCATION Strategic Investment Prioritization • Diversify & Accelerate • Expand solutions, verticals, channels to drive growth • De-lever and De-risk • Improve cash flow, provide operating flexibility Guiding Principles

22 Claritev has Been Re-Invigorated and is Positioned to Accelerate Growth 6 2 3 1 4 5 Recurring Revenue from a Durable, Proven and Highly Profitable1 Core Business Automated claims processing volume and integrated offering increases predictable revenue Multiple Avenues to Drive Growth from New Products and Market Verticals Steady secular performance in Core Business enabling execution of meaningful growth opportunities Operating Platform Built For Significant Scale Ability to leverage scale and data assets to provide new value-add services and insights at high margins Innovative Revamped Technology Platform and Partnerships Investment in technology infrastructure creates highly scalable platform Refreshed Leadership Driving a Clear Strategic Vision New team bringing operational discipline, strategic focus and a clear vision for long-term growth Essential Role in Healthcare Ecosystem Growth opportunity to double TAM and accelerate growth in analytics with untapped international opportunity 1 Based on historical Adjusted EBITDA margins

23 Thank you

24 Appendix

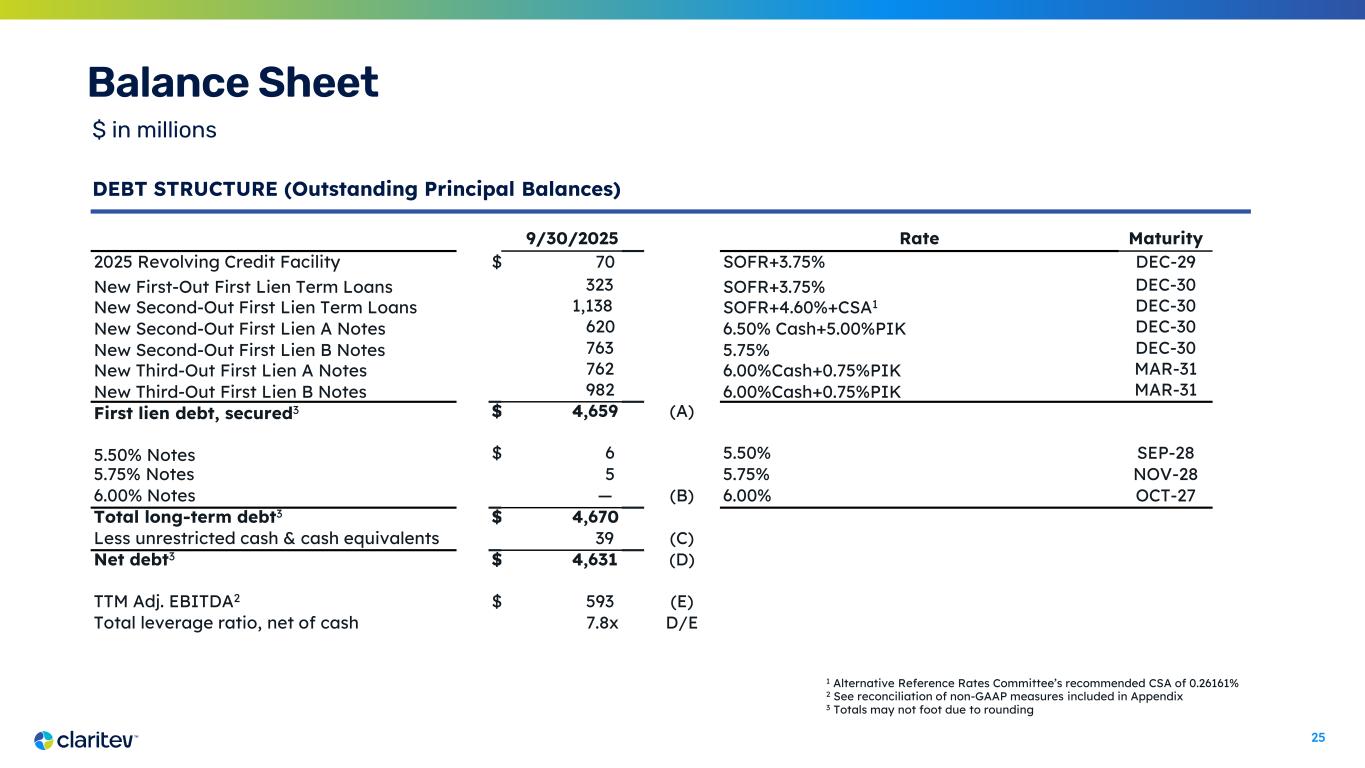

25 Balance Sheet $ in millions DEBT STRUCTURE (Outstanding Principal Balances) 9/30/2025 Rate Maturity 2025 Revolving Credit Facility $ 70 SOFR+3.75% DEC-29 New First-Out First Lien Term Loans 323 SOFR+3.75% DEC-30 New Second-Out First Lien Term Loans 1,138 SOFR+4.60%+CSA1 DEC-30 New Second-Out First Lien A Notes 620 6.50% Cash+5.00%PIK DEC-30 New Second-Out First Lien B Notes 763 5.75% DEC-30 New Third-Out First Lien A Notes 762 6.00%Cash+0.75%PIK MAR-31 New Third-Out First Lien B Notes 982 6.00%Cash+0.75%PIK MAR-31 First lien debt, secured3 $ 4,659 (A) 5.50% Notes $ 6 5.50% SEP-28 5.75% Notes 5 5.75% NOV-28 6.00% Notes — (B) 6.00% OCT-27 Total long-term debt3 $ 4,670 Less unrestricted cash & cash equivalents 39 (C) Net debt3 $ 4,631 (D) TTM Adj. EBITDA2 $ 593 (E) Total leverage ratio, net of cash 7.8x D/E 1 Alternative Reference Rates Committee’s recommended CSA of 0.26161% 2 See reconciliation of non-GAAP measures included in Appendix 3 Totals may not foot due to rounding

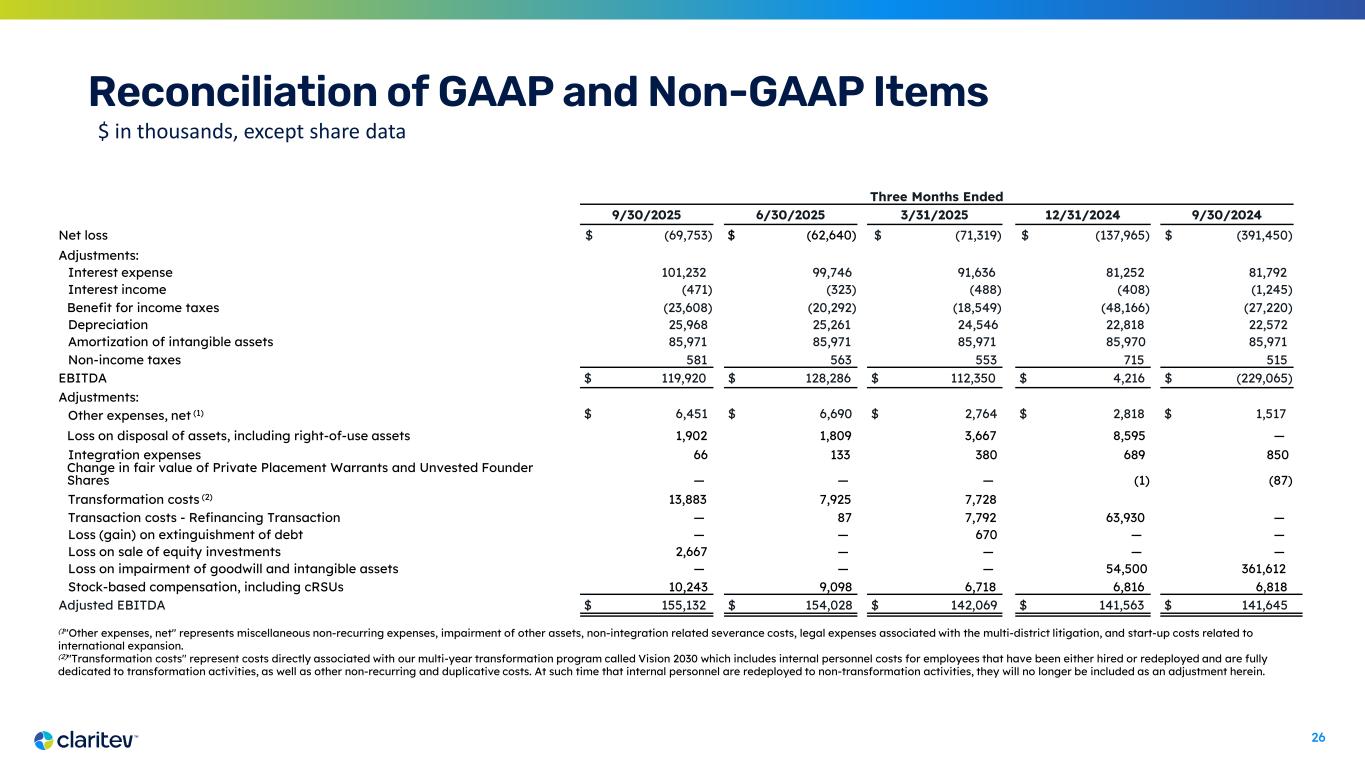

26 Reconciliation of GAAP and Non-GAAP Items $ in thousands, except share data (1"Other expenses, net" represents miscellaneous non-recurring expenses, impairment of other assets, non-integration related severance costs, legal expenses associated with the multi-district litigation, and start-up costs related to international expansion. (2)"Transformation costs" represent costs directly associated with our multi-year transformation program called Vision 2030 which includes internal personnel costs for employees that have been either hired or redeployed and are fully dedicated to transformation activities, as well as other non-recurring and duplicative costs. At such time that internal personnel are redeployed to non-transformation activities, they will no longer be included as an adjustment herein. Three Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Net loss $ (69,753) $ (62,640) $ (71,319) $ (137,965) $ (391,450) Adjustments: Interest expense 101,232 99,746 91,636 81,252 81,792 Interest income (471) (323) (488) (408) (1,245) Benefit for income taxes (23,608) (20,292) (18,549) (48,166) (27,220) Depreciation 25,968 25,261 24,546 22,818 22,572 Amortization of intangible assets 85,971 85,971 85,971 85,970 85,971 Non-income taxes 581 563 553 715 515 EBITDA $ 119,920 $ 128,286 $ 112,350 $ 4,216 $ (229,065) Adjustments: Other expenses, net (1) $ 6,451 $ 6,690 $ 2,764 $ 2,818 $ 1,517 Loss on disposal of assets, including right-of-use assets 1,902 1,809 3,667 8,595 — Integration expenses 66 133 380 689 850 Change in fair value of Private Placement Warrants and Unvested Founder Shares — — — (1) (87) Transformation costs (2) 13,883 7,925 7,728 Transaction costs - Refinancing Transaction — 87 7,792 63,930 — Loss (gain) on extinguishment of debt — — 670 — — Loss on sale of equity investments 2,667 — — — — Loss on impairment of goodwill and intangible assets — — — 54,500 361,612 Stock-based compensation, including cRSUs 10,243 9,098 6,718 6,816 6,818 Adjusted EBITDA $ 155,132 $ 154,028 $ 142,069 $ 141,563 $ 141,645

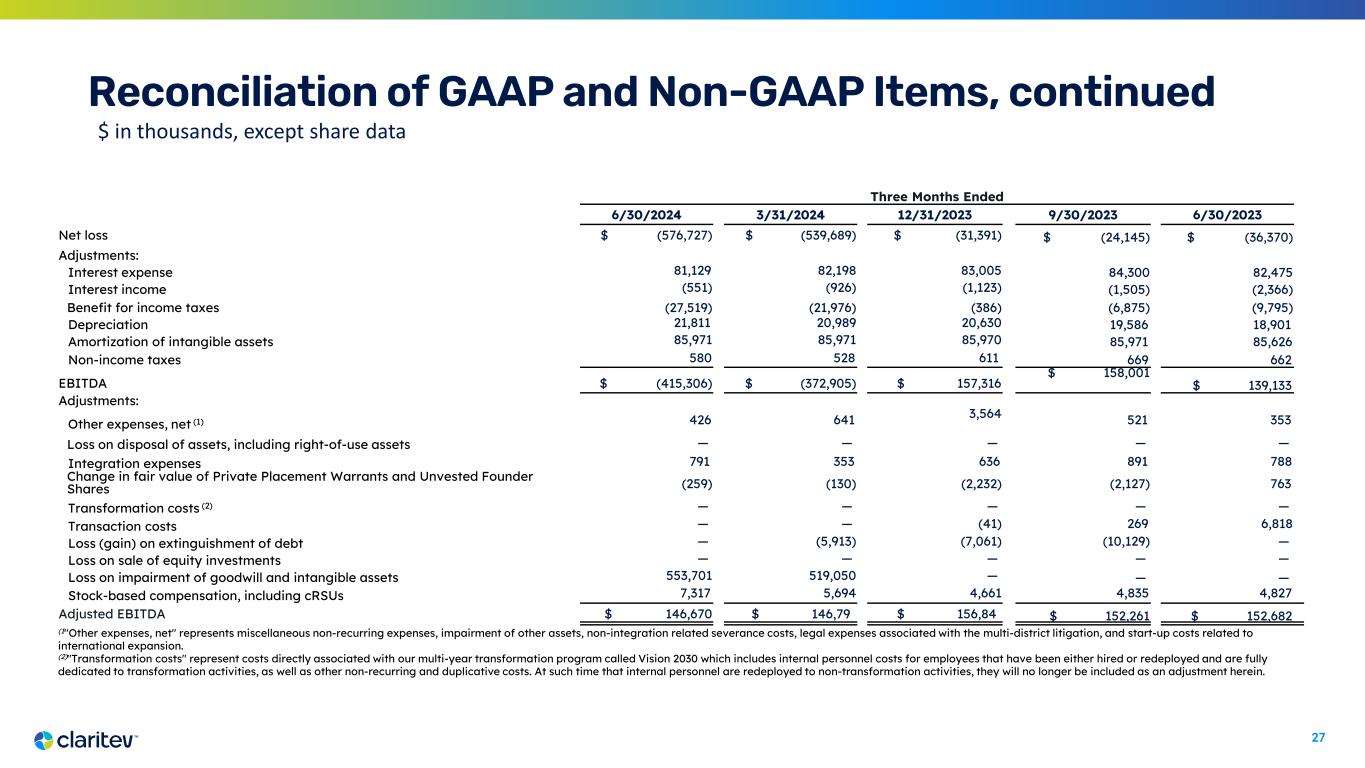

27 Reconciliation of GAAP and Non-GAAP Items, continued $ in thousands, except share data (1"Other expenses, net" represents miscellaneous non-recurring expenses, impairment of other assets, non-integration related severance costs, legal expenses associated with the multi-district litigation, and start-up costs related to international expansion. (2)"Transformation costs" represent costs directly associated with our multi-year transformation program called Vision 2030 which includes internal personnel costs for employees that have been either hired or redeployed and are fully dedicated to transformation activities, as well as other non-recurring and duplicative costs. At such time that internal personnel are redeployed to non-transformation activities, they will no longer be included as an adjustment herein. Three Months Ended 6/30/2024 3/31/2024 12/31/2023 9/30/2023 6/30/2023 Net loss $ (576,727) $ (539,689) $ (31,391) $ (24,145) $ (36,370) Adjustments: Interest expense 81,129 82,198 83,005 84,300 82,475 Interest income (551) (926) (1,123) (1,505) (2,366) Benefit for income taxes (27,519) (21,976) (386) (6,875) (9,795) Depreciation 21,811 20,989 20,630 19,586 18,901 Amortization of intangible assets 85,971 85,971 85,970 85,971 85,626 Non-income taxes 580 528 611 669 662 EBITDA $ (415,306) $ (372,905) $ 157,316 $ 158,001 $ 139,133 Adjustments: Other expenses, net (1) 426 641 3,564 521 353 Loss on disposal of assets, including right-of-use assets — — — — — Integration expenses 791 353 636 891 788 Change in fair value of Private Placement Warrants and Unvested Founder Shares (259) (130) (2,232) (2,127) 763 Transformation costs (2) — — — — — Transaction costs — — (41) 269 6,818 Loss (gain) on extinguishment of debt — (5,913) (7,061) (10,129) — Loss on sale of equity investments — — — — — Loss on impairment of goodwill and intangible assets 553,701 519,050 — — — Stock-based compensation, including cRSUs 7,317 5,694 4,661 4,835 4,827 Adjusted EBITDA $ 146,670 $ 146,79 $ 156,84 $ 152,261 $ 152,682

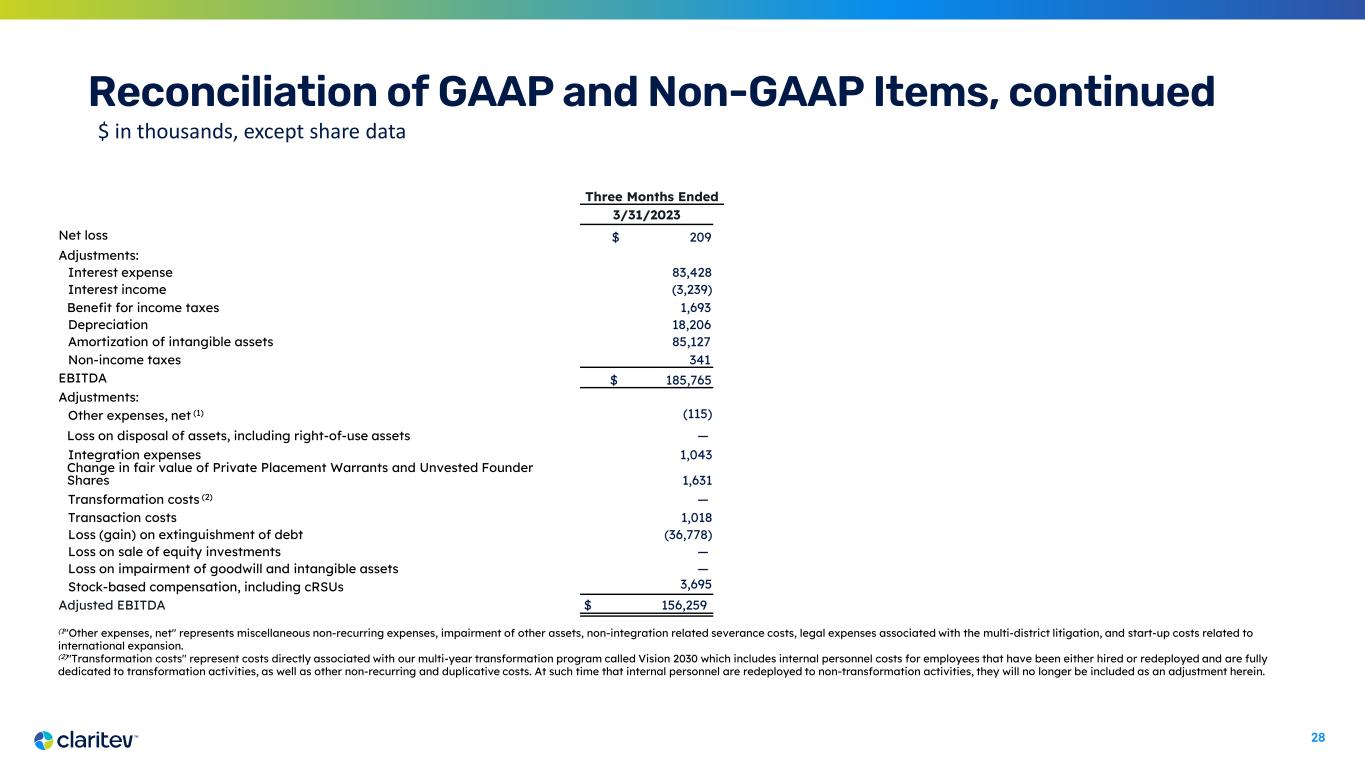

28 Reconciliation of GAAP and Non-GAAP Items, continued $ in thousands, except share data (1"Other expenses, net" represents miscellaneous non-recurring expenses, impairment of other assets, non-integration related severance costs, legal expenses associated with the multi-district litigation, and start-up costs related to international expansion. (2)"Transformation costs" represent costs directly associated with our multi-year transformation program called Vision 2030 which includes internal personnel costs for employees that have been either hired or redeployed and are fully dedicated to transformation activities, as well as other non-recurring and duplicative costs. At such time that internal personnel are redeployed to non-transformation activities, they will no longer be included as an adjustment herein. Three Months Ended 3/31/2023 Net loss $ 209 Adjustments: Interest expense 83,428 Interest income (3,239) Benefit for income taxes 1,693 Depreciation 18,206 Amortization of intangible assets 85,127 Non-income taxes 341 EBITDA $ 185,765 Adjustments: Other expenses, net (1) (115) Loss on disposal of assets, including right-of-use assets — Integration expenses 1,043 Change in fair value of Private Placement Warrants and Unvested Founder Shares 1,631 Transformation costs (2) — Transaction costs 1,018 Loss (gain) on extinguishment of debt (36,778) Loss on sale of equity investments — Loss on impairment of goodwill and intangible assets — Stock-based compensation, including cRSUs 3,695 Adjusted EBITDA $ 156,259