Goldman Sachs Interval Fund Annual Report September 30, 2025 Real Estate Diversified Income Fund

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23499

Goldman Sachs Real Estate Diversified Income Fund

(Exact name of registrant as specified in charter)

200 West Street,

New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 |

Stephen H. Bier, Esq. William J. Bielefeld, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2025

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders is filed herewith.

Goldman Sachs Interval Fund Annual Report September 30, 2025 Real Estate Diversified Income Fund

Goldman Sachs Real Estate Diversified Income Fund

| Table of Contents | Page | |||

| 3 | ||||

| 7 | ||||

| 11 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 24 | ||||

| 35 | ||||

| Statement Regarding Basis for Approval of Management Agreement |

36 | |||

| 40 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||||

PORTFOLIO RESULTS

Goldman Sachs Real Estate Diversified Income Fund

|

Investment Objective

The Fund seeks to produce income and achieve capital appreciation with low to moderate volatility and low to moderate correlation to the broader equity markets.

|

Portfolio Management Discussion and Analysis

Below, the portfolio management team of the Goldman Sachs Real Estate Diversified Income Fund (the “Fund”) discusses the Fund’s performance and positioning for the 12-month period ended September 30, 2025 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Class I, Class L, Class W, and Class P Shares generated average annual total returns, without sales charges, of (3.15)%, (3.88)%, (2.98)%, (3.39)%, (3.21)% and (2.86)%, respectively. |

| As of September 30, 2025, the Fund’s net asset value (“NAV”) for Class A, Class C, Class I, Class L, Class W, and Class P Shares was $7.50, $7.50, $7.96, $7.51, $7.66 and $7.97, respectively. |

| Q | What distributions did the Fund make during the Reporting Period? |

| A | The Fund’s Class A Shares declared dividends totaling $0.60 per unit. The Fund’s Class C Shares declared dividends totaling $0.54 per unit. The Fund’s Class I Shares declared dividends totaling $0.62 per unit. The Fund’s Class L Shares declared dividends totaling $0.58 per unit. The Fund’s Class W Shares declared dividends totaling $0.60 per unit. The Fund’s Class P Shares declared dividends totaling $0.62 per unit. |

| Q | What economic and market factors most influenced the U.S. real estate securities market as a whole during the Reporting Period? |

| A | For the Reporting Period overall, the U.S. real estate market underperformed the broader U.S. equity market and modestly lagged the U.S. fixed income market. The U.S. real estate market was slowly recovering from pressures resulting from capital constraints, increased supply valuation resets and limited transaction volume. |

| More specifically, relatively higher interest rates were one of the most significant headwinds for U.S. real estate. The Federal Reserve (“Fed”) maintained restrictive monetary policy through much of the Reporting Period, with the targeted federal funds rate holding near 4.25%-4.50% until signs of inflation moderated late in the third quarter of 2025. |

| Elevated borrowing costs weighed heavily on commercial real estate in particular, as refinancing risks and tighter credit availability constrained both acquisitions and development. The elevated interest rate backdrop dampened capital markets activity across all sub-sectors as well. |

| Asset repricing persisted across commercial property types, particularly in multi-family and office, as a result of elevated new supply and/or weakening demand, which further eroded values. Notably, the national office vacancy rate reached 20.1%, the highest on record, with effective rents also down year-over-year during the Reporting Period. The Green Street Commercial Property Price Index was down approximately 10% year-over-year as of September 2025, with cumulative declines exceeding 20% from the 2022 peak. The Green Street Commercial Property Price Index is a real-time index that measures the value of institutional-quality commercial real estate in the U.S. and Europe. |

| Limited transaction volume characterized much of the Reporting Period, as buyers and sellers struggled to bridge valuation gaps. Institutional investors largely remained on the sidelines awaiting greater price transparency and signs of rate stability. Altus Group, which provides the global commercial real estate industry with asset intelligence, reported a 7% year-over-year decline in the number of U.S. properties transacted during the second quarter of 2025 alone, with multi-family and retail volumes down approximately 10%. This lack of liquidity slowed capital recycling and delayed portfolio reposition efforts for many market participants. |

| For the Reporting Period overall, health care was the best performing property type, with strong net operating income growth. Health care benefitted as well from strong occupancy rates and an aging population driving increased demand. Self-storage was among the weakest performing property type during the Reporting Period. Demand for self-storage is highly correlated to single-family home sales, which declined materially with the persistence of higher mortgage rates. |

| 3 |

PORTFOLIO RESULTS

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The public securities sleeve of the Fund, which accounted for approximately 24% of the Fund’s net assets at the end of the Reporting Period, detracted from the Fund’s performance. Private equity investments, which accounted for approximately 76% of the Fund’s net assets at the end of the Reporting Period, started to recover from a period of quarterly declines in the last few years, and contributed positively, albeit modestly, to the Fund’s performance. |

| Preferred real estate investment trust (“REIT”) stocks overall performed roughly in line with the broader REIT market during the Reporting Period, reacting similarly to the optimism facing interest rate cuts. |

| Q | What were some of the Fund’s best-performing individual holdings during the Reporting Period? |

| A | The top individual contributors to the Fund’s performance during the Reporting Period were primarily in the private equity space—Wheelock Street Real Estate Long Term Value Fund L.P. (“Wheelock Street LTVF”) and Ares Industrial Real Estate Fund, LP (“Ares Industrial”). Wheelock Street LTVF is an open-ended real estate fund that invests in diversified property types throughout the U.S., including affordable housing, industrial, manufacturing, logistics, senior housing and hotels. Its strong performance was driven by growth in the affordable housing and health care property markets. Ares Industrial is an industrial-focused real estate fund that seeks to invest in high-quality bulk and last-mile distribution facilities in key logistics markets. The industrial sub-sector benefited from net operating income growth, as operators were able to mark rents to market amid resilient tenant demand. |

| Another top positive contributor—in the public equity space—was AvalonBay Communities, Inc. (“AvalonBay Communities”). AvalonBay Communities is an apartment REIT with a coastal focus. The company tends to concentrate more in first ring suburbs of major metropolitan areas versus downtown areas. (A first ring suburb, also known as an inner suburb, is a densely populated community that is located near the center of a metropolitan area.) During the Reporting Period, AvalonBay Communities performed well, benefitting from its high quality portfolio of multi-family properties concentrated in supply-constrained, high-demand coastal markets, which experienced strong rental growth and favorable demographic trends. Despite broader sector headwinds—particularly in the multi-family space—AvalonBay Communities’ robust balance sheet and operational efficiency enabled it to deliver superior operating results relative to its peers. We continued to favor AvalonBay Communities over other U.S. apartment REITs given its mix |

| of both high quality urban and suburban assets and given its development pipeline that will, in our view, drive incremental growth as new projects come online. |

| Q | Which positions detracted significantly from the Fund’s performance during the Reporting Period? |

| A | The positions that detracted most from the Fund’s performance during the Reporting Period were also primarily in the private space—Brookfield Real Estate Finance Fund V, LP (“BREF V”) and Clarion Ventures 4, LP (“CV4”). BREF V is a 2017 vintage, closed-end real estate credit fund. CV4 is a private equity fund that seeks long-term investment outperformance primarily through partnering in buyouts of lower-middle market companies. |

| Also detracting significantly during the Reporting Period was a position in Americold Realty Trust, Inc. (“Americold Realty”), a publicly-listed industrial REIT. Americold Realty is a global leader in temperature-controlled warehousing. Its stock declined during the Reporting Period due to weaker consumer sentiment and macroeconomic headwinds. Food inventories remained below historical levels, as consumers pulled back after a period of elevated food inflation— impacting, in turn, occupancy and throughput across the cold storage supply chain. (Throughput is the amount of material or items passing through a system or process.) Also, the REIT’s management projected a below-seasonal second half of 2025, reflecting ongoing softness in demand, which further weighed on its stock. Despite these near-term challenges, Americold Realty remained, in our view at the end of the Reporting Period, a critical component of the food distribution infrastructure. Should macro conditions normalize, we expect the company to return to growth, which we believe may well support its future performance. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Fund did not use any derivatives or similar instruments. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | During the Reporting Period, in the Fund’s private sleeve, we added to the Fund’s position in Wheelock Street LTVF, mentioned earlier. Conversely, we exited the Fund’s position in CBRE U.S. Core Partners, LP, an open-ended commercial real estate investment vehicle that owns a diversified portfolio of industrial, residential, office, retail and self-storage assets across the U.S. We elected to fully redeem the Fund’s position for liquidity management purposes and to free up capital to pursue what we viewed as better risk-adjusted investment opportunities. We also exited the Fund’s position in Carlyle Property Investors, LP, an open-ended, diversified U.S. core |

| 4 |

PORTFOLIO RESULTS

| plus real estate fund. We sold the position as we sought to take advantage of a secondary market sale opportunity to generate liquidity and recycled the capital into what we believed to be more attractive valuations in public securities. |

| In the Fund’s public equity sleeve, our confidence in the lab office sub-sector was somewhat diminished, with vacancy remaining elevated, and thus we exited the Fund’s position in Alexandria Real Estate Equities, Inc. On the other hand, the retail real estate environment remained strong, in our view, with limited supply, benefiting owners of prime space, such as Simon Property Group, which we added to the Fund’s portfolio. We also remained positive on the data center sub-sector, as the artificial intelligence build-out persists, leading, in turn, to limited availability of space in the core markets. We believe this allows incumbent owners, like Equinix, Inc., to have significant pricing power, and so we increased the Fund’s position in this REIT during the Reporting Period. |

| Q | Were there any changes made in the Fund’s investment strategy during the Reporting Period? |

| A | There were no significant changes made in the Fund’s investment strategy during the Reporting Period. Investment activity was muted, as relatively higher interest rates prevailed for most of the Reporting Period, and valuations, specifically in private funds, continued to adjust. We continued to focus on maintaining a robust level of liquidity within the Fund and on pursuing opportunities in demand-driven property types at attractive valuations. |

| Overall, during the Reporting Period, we modestly increased exposure to private equity funds and decreased exposure to listed, or public, equity REITs, as we viewed the forward opportunity set to be more compelling in private markets. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | How was the Fund positioned at the end of the Reporting Period? |

| A | At the end of the Reporting Period, the Fund was invested with approximately 72% of its total net assets in private equity, approximately 21% of its total net assets in public equity, approximately 4% of its total net assets in public credit, approximately 3% of its total net assets in private credit, and approximately 0.5% of its total net assets in cash and cash equivalents. |

| Approximately 93% of Fund assets was invested in equities representing property types that we believe benefit from strong demographic tailwinds or revenues protected by long-term lease obligations. Approximately 6.5% of Fund assets |

| was invested in credit instruments diversified across property types and focused on seeking relatively consistent and reliable streams of cash flows and low loan-to-value ratios. (Loan-to-value (“LTV”) ratio equals the loan amount divided by the purchase price or appraised property value. The LTV ratio is one way lenders and financial institutions can assess lending risk before approving a mortgage. Generally, loans that have high LTV ratios are considered more risky and as a result carry higher interest rates—and vice versa.) |

| Within the Fund’s equity sleeve, approximately 33% of assets was invested in industrial, 19% in multi-family, 8% in student housing, 5% in health care, 4% in office, 3% in lab office, 3% in single family rental, 3% in self-storage, 3% in towers, 2.5% in lodging, 2% in data centers, 2% in manufactured housing, and the remainder across the agency, retail, medical office buildings, residential and mixed use sub-sectors. |

| Q | How did the Fund use leverage during the Reporting Period? |

| A | The lines of credit established by the Fund under our management are bilateral, fully committed, revolving credit facilities. The Fund used leverage intermittently during the Reporting Period as a short-term cash flow management tool. More specifically, the credit agreements maintained by the Fund were typically utilized during quarterly repurchase periods and to dynamically allocate between private and public securities when other sources of capital were not immediately available. Using leverage in this way enables quick market entry to ensure those opportunities were not otherwise missed. The Fund did not maintain a balance on any credit facility on a recurring basis or for any material length of time. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, we believed that while performance across the real estate securities market has been challenged in recent years—largely due to relatively higher interest rates, declining valuations and limited transaction volume, the market appeared to have reached an inflection point with a rebound on the horizon. |

| In the fourth quarter of 2024, when the Reporting Period began, the NCREIF Fund Index - Open End Diversified Core Equity (“NFI-ODCE”), an index of core private real estate funds, began to show signs of bottoming, as it posted its first positive return quarter following several quarters of valuation declines. It then posted two consecutive quarters of positive performance in the first half of 2025. It had declined nearly 30% from its peak during the last three years. There have only been two periods in history, prior to 2024, wherein the NFI-ODCE had two or more consecutive quarters of negative returns. After those past two occurrences, the |

| 5 |

PORTFOLIO RESULTS

| NFI-ODCE returned 7.1% annually in the following three years and 9.4% annually during the following five years. This most recent drawdown in private markets, we believe, has the potential to continue this trend and see strong positive performance. Public markets demonstrated durable cash flows and disciplined balance sheets but were still trading with significant valuation upside relative to broader equity markets. |

| By the end of September 2025, we were increasingly convicted in our optimism about the opportunity set for the Fund, believing the U.S. real estate market offered a compelling investment proposition across both private and public markets, supported by healthy fundamentals, potentially declining interest rates and attractive valuations. |

| *Healthy Fundamentals - High development costs and constrained financing during the last two years have slowed new supply—while demand has remained relatively healthy—creating what we see as a favorable backdrop for higher rents and net operating income growth. Construction starts in the multi-family and industrial sub-sectors were down more than 60% each from their peak at the end of the Reporting Period. This slowing new supply pipeline, we believe, strengthens the position of existing assets and should translate to rent growth going forward. Leasing demand also remains robust, with the impact from tariffs less adverse than the market initially predicted. |

| *Declining Interest Rates - Interest rates were lowered, by 25 basis points, in September 2025 for the first time since December 2024. (A basis point is 1/100th of a percentage point.) While the long-term end of the U.S. Treasury yield curve, or spectrum of maturities, had not yet moved significantly, a moderating interest rate environment could, in our view, shift from a headwind to a tailwind, supporting property values, reducing financing costs and creating more market liquidity. |

| *Attractive Valuations - Private market cap rates widened across property types during the Reporting Period, translating to peak-to-trough valuation declines of more than 20% in some property types from 2022 highs, creating, in our view, a compelling entry point. (Cap rates, or capitalization rates, are a real estate metric that estimates the annual rate of return on a property, calculated by dividing its net operating income by its current market value.) Relative to broader equity markets at the end of September 2025, public REITs were trading with implied EV/EBITDA multiples at 3.5x below their long-term averages; a reversion to these averages would translate to a greater than 25% price return. (EV is enterprise value. EBITDA is earnings before interest, taxes, depreciation, and amortization.) |

| Overall, we believed that as real estate valuations appear to be turning a corner, income and diversification qualities, alongside improving fundamentals, position the sector as a compelling long-term investment opportunity, particularly in a world of macroeconomic uncertainty. In our view, it remains crucial to recognize that not all real estate assets will perform equally, making a strong case for active management. |

| We believed the Fund was well positioned at the end of the Reporting Period to benefit from our constructive view ahead through its holistic investment approach. The Fund is managed by collaborative efforts of the Goldman Sachs private and public real estate teams within the External Investing Group and Fundamental Equity business units. The teams make allocation decisions between public, private, equity and credit exposures, with a focus on sub-sectors driven by persistent and accelerating growth themes. As evidenced by its allocations, mentioned earlier, the teams were more constructive on private markets than public markets at the end of the Reporting Period. At the property level, the Fund seeks to maintain balance, offering diversified exposure to core and non-core property types, regularly seeking new investment opportunities to capture what we believe are the best risk-adjusted returns to its investors. |

| As we move forward, we intend to maintain our active and integrated approach that aims to balance the need for attractive income and capital appreciation, with low to moderate volatility relative to equity and public real estate markets, by investing primarily in income-producing real estate equity and debt securities. Through this actively managed interval Fund, we will continue seeking to provide access to both private and public real estate diversified across property types, geography and asset class (equity and debt). |

| Sector, sub-sector and property type designations throughout this shareholder report are defined by Goldman Sachs Asset Management. |

| 6 |

Real Estate Diversified Income Fund

as of September 30, 2025

| TOP TEN HOLDINGS AS OF 9/30/251 |

| Holding |

% of Net Assets |

Asset Class | ||||

| Oaktree Real Estate Income Fund LP |

12.8% | Private REIT & Private Investment Funds | ||||

| RealTerm Logistics Income Fund |

7.8 | Private REIT & Private Investment Funds | ||||

| Wheelock Street Real Estate Long Term Value Fund |

7.6 | Private REIT & Private Investment Funds | ||||

| TA Realty Core Property Fund, LP |

7.1 | Private REIT & Private Investment Funds | ||||

| Greystar Student Housing Growth and Income Fund |

6.9 | Private REIT & Private Investment Funds | ||||

| Ares Industrial Real Estate Fund, LP |

6.4 | Private REIT & Private Investment Funds | ||||

| Harrison Street Core Property Fund, LP |

5.5 | Private REIT & Private Investment Funds | ||||

| Prologis Targeted U.S. Logistics Holdings II, LP |

3.2 | Private REIT & Private Investment Funds | ||||

| Manulife U.S. Real Estate Fund LP |

3.0 | Private REIT & Private Investment Funds | ||||

| Bain Capital Real Estate Fund I-B, LP |

2.7 | Private REIT & Private Investment Funds | ||||

| 1 | The top 10 holdings may not be representative of the Fund’s future investments. |

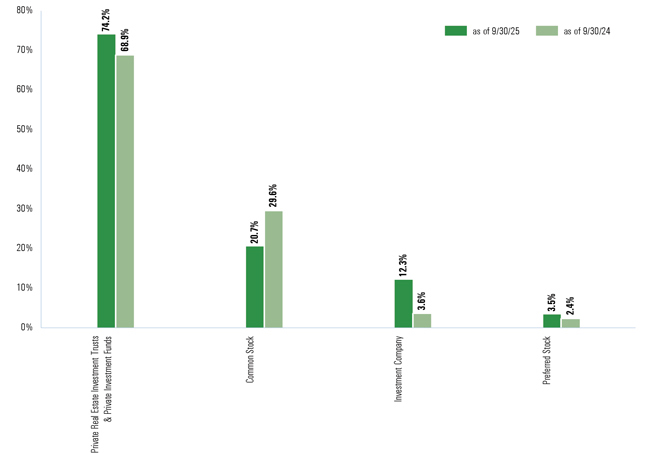

| ASSET CLASS ALLOCATION2 |

Percentage of Net Assets

| 2 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall allocations may differ from percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. |

| 7 |

ASSET CLASS ALLOCATION

| For more information about the Fund, please refer to am.gs.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 8 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

Performance Summary

September 30, 2025

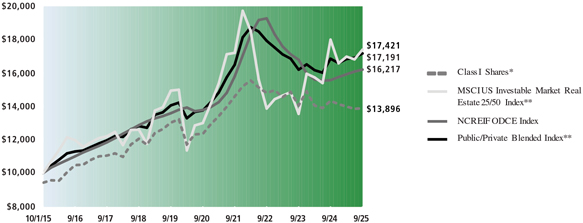

The following graph shows the value, as of September 30, 2025, of a $10,000 investment made on October 1, 2015 in Class I Shares at NAV. For comparative purposes, the performance of a private/public blended index (70% NCREIF ODCE Index & 30% MSCI US Investable Market Real Estate 25/50 Index, with dividends reinvested) (“Public/Private Blended Index”), is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at am.gs.com to obtain the most recent month-end returns.

| Real Estate Diversified Income Fund’s 10 Year Performance |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from October 1, 2015 through September 30, 2025.

| Average Annual Total Returns through September 30, 2025 ***, **** | One Year | Five Years | Ten Years | Since Inception | ||||||||||||||

| Class A |

||||||||||||||||||

| Excluding sales charges |

(3.15)% | 2.38% | 3.96% | — | ||||||||||||||

| Including sales charges |

(9.18)% | 1.18% | 3.34% | — | ||||||||||||||

| Class C |

||||||||||||||||||

| Excluding contingent deferred sales charges |

(3.88)% | 1.61% | 3.17% | — | ||||||||||||||

| Including contingent deferred sales charges |

(4.84)% | 1.61% | 3.17% | — | ||||||||||||||

| Class I |

(2.98)% | 2.64% | 4.04% | — | ||||||||||||||

| Class L (Commenced on July 10, 2017) |

||||||||||||||||||

| Excluding sales charges |

(3.39)% | 2.12% | — | 2.65% | ||||||||||||||

| Including sales charges |

(7.48)%** | 1.23% | — | 2.12% | ||||||||||||||

| Class W |

(3.21)% | 2.37% | 3.88% | — | ||||||||||||||

| Class P (Commenced on June 29, 2021) |

(2.86)% | — | — | 0.07% | ||||||||||||||

| * | Previously, the chart showed the performance of the Fund’s Class A Shares. Performance for Class I Shares is now shown because Class I Shares has more assets than any other share class with 10 years of performance. |

| ** | The MSCI US Investable Market Real Estate 25/50 Index was incepted on September 1, 2016 and therefore no performance information is available prior to this date. For the period between October 1, 2015 and September 1, 2016, the returns of the MSCI US REIT Index is used as a component of the performance calculation shown for the Public/Private Blended Index. |

| *** | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.75% for Class A, 4.25% for Class L, and the assumed contingent deferred sales charge of 1% for Class A and C Shares, if repurchased within 18 months and 12 months of purchase, respectively. Because Class P, Class I and Class W Shares do not involve sales charge, such a charge is not applied to their Average Annual Total Returns. |

| 9 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| **** | After the close of business on May 15, 2020, the Resource Real Estate Diversified Income Fund (the “Predecessor Fund”) was reorganized into the Fund. The Fund has assumed the historical performance of the Predecessor Fund, which was managed by another investment adviser. Therefore, the performance information reported above for the Fund is the combined performance of the Fund and the Predecessor Fund. The performance information shown in this report for periods through May 15, 2020 reflects the performance of the Predecessor Fund. As a result, the Fund’s performance may differ substantially from what is shown for periods through May 15, 2020. |

| For more information about the Fund, please refer to am.gs.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 10 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Description

|

Value

|

|||||

| Private Real Estate Investment Trusts & Private Investment Funds – 74.2%(a) |

| |||||

| Ares Industrial Real Estate Fund, LP | $ | 18,406,839 | ||||

| Ares US Real Estate Fund IX, LP | 5,249,236 | |||||

| Bain Capital Real Estate Fund I-B, LP | 7,807,719 | |||||

| Brookfield Premier Real Estate Partners, LP | 1,280,560 | |||||

| Brookfield Real Estate Finance Fund V, LP | 2,806,079 | |||||

| Clarion Partners Debt Investment Fund, LP | 1,850,920 | |||||

| Clarion Ventures 4, LP | 2,462,171 | |||||

| Greystar Student Housing Growth and Income Fund | 20,048,101 | |||||

| Harrison Street Core Property Fund, LP | 15,912,846 | |||||

| Heitman Core Real Estate Debt Income Trust, LP | 2,978,941 | |||||

| Manulife U.S. Real Estate Fund LP | 8,681,348 | |||||

| Nuveen U.S. Core-Plus Real Estate Debt Fund, LP | 5,741,731 | |||||

| Oaktree Real Estate Income Fund LP | 37,214,364 | |||||

| Prologis Targeted U.S. Logistics Holdings II, LP | 9,400,960 | |||||

| RealTerm Logistics Income Fund | 22,462,176 | |||||

| Sculptor Real Estate Credit Fund, LP | 10,286 | |||||

| Sentinel Real Estate Fund | 6,480,288 | |||||

| TA Realty Core Property Fund, LP | 20,697,813 | |||||

| The Trumbull Property Fund, LP | 3,493,614 | |||||

| Wheelock Street Real Estate Long Term Value Fund | 22,147,437 | |||||

|

|

||||||

| TOTAL PRIVATE REAL ESTATE INVESTMENT | ||||||

| TRUSTS & PRIVATE INVESTMENT FUNDS | ||||||

| (Cost $241,706,338) | 215,133,429 | |||||

|

|

||||||

| Shares | ||||||||

| Common Stocks – 20.7% |

| |||||||

| Hotel & Resort REITs – 0.8% |

| |||||||

| 24,405 | Ryman Hospitality Properties, Inc. REIT | 2,186,444 | ||||||

|

|

||||||||

| Industrial REITs – 2.5% |

| |||||||

| 191,857 | Americold Realty Trust, Inc. REIT | 2,348,329 | ||||||

| 43,396 | Prologis, Inc. REIT | 4,969,710 | ||||||

|

|

|

|||||||

| 7,318,039 | ||||||||

|

|

||||||||

| Mortgage Real Estate Investment Trusts (REITs) – 0.7% |

| |||||||

| 196,649 | Ladder Capital Corp. REIT | 2,145,441 | ||||||

|

|

||||||||

| Residential REITs – 6.7% |

| |||||||

| 131,310 | American Homes 4 Rent, Class A REIT | 4,366,057 | ||||||

| 23,352 | AvalonBay Communities, Inc. REIT | 4,510,906 | ||||||

| 101,767 | Equity LifeStyle Properties, Inc. REIT | 6,177,257 | ||||||

| 145,630 | Invitation Homes, Inc. REIT | 4,271,328 | ||||||

|

|

|

|||||||

| 19,325,548 | ||||||||

|

|

||||||||

| Retail REITs – 1.6% |

| |||||||

| 24,270 | Simon Property Group, Inc. REIT | 4,554,751 | ||||||

|

|

||||||||

| Specialized REITs – 8.4% |

| |||||||

| 21,646 | American Tower Corp. REIT | 4,162,959 | ||||||

| 8,295 | Equinix, Inc. REIT | 6,496,976 | ||||||

| Shares

|

Description

|

Value

|

||||||||

| Common Stocks – (continued) |

| |||||||||

| Specialized REITs – (continued) |

| |||||||||

| 20,878 | Extra Space Storage, Inc. REIT | $ | 2,942,545 | |||||||

| 10,907 | Public Storage REIT | 3,150,487 | ||||||||

| 19,517 | SBA Communications Corp. REIT | 3,773,612 | ||||||||

| 117,018 | VICI Properties, Inc. REIT | 3,815,957 | ||||||||

|

|

|

|||||||||

| 24,342,536 | ||||||||||

|

|

||||||||||

| TOTAL COMMON STOCKS |

| |||||||||

| (Cost $59,964,732) |

59,872,759 | |||||||||

|

|

||||||||||

| Shares | Description | Dividend Rate | Value | |||||||||

| Preferred Stocks – 3.5% |

|

|||||||||||

| Hotel & Resort REITs – 0.6% |

|

|||||||||||

| 88,458 |

Pebblebrook Hotel Trust, Series E | 6.38 | % | 1,787,736 | ||||||||

|

|

||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) – 2.9% |

| |||||||||||

| 77,545 |

MFA Financial, Inc., Series C | 9.61 | % | 1,850,999 | ||||||||

| 71,214 |

PennyMac Mortgage Investment Trust, Series B | 8.00 | 1,766,107 | |||||||||

| 73,559 |

Two Harbors Investment Corp., Series B | 7.63 | 1,699,949 | |||||||||

| 128,562 |

Two Harbors Investment Corp., Series A | 8.13 | 3,085,488 | |||||||||

|

|

|

|||||||||||

| 8,402,543 | ||||||||||||

|

|

||||||||||||

| TOTAL PREFERRED STOCKS |

|

|||||||||||

| (Cost $10,621,820) |

|

10,190,279 | ||||||||||

|

|

||||||||||||

| Shares | Dividend Rate | Value | ||||||

| Investment Company – 12.3%(b) |

| |||||||

| Goldman Sachs Financial Square Government |

| |||||||

| Fund - Institutional Shares |

| |||||||

| 35,521,303 | 4.042% | 35,521,303 | ||||||

| (Cost $35,521,303) |

||||||||

|

|

||||||||

| TOTAL INVESTMENTS – 110.7% |

||||||||

| (Cost $347,814,193) |

$ | 320,717,770 | ||||||

|

|

||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS – (10.7)% |

(30,945,709 | ) | ||||||

|

|

||||||||

| NET ASSETS – 100.0% |

$ | 289,772,061 | ||||||

|

|

||||||||

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets.

| The accompanying notes are an integral part of these consolidated financial statements. | 11 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Schedule of Investments (continued)

September 30, 2025 |

| (a) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on sale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered and the registration statement is effective. Disposal of these securities may involve time consuming negotiations and prompt sale at an acceptable price may be difficult. Total market value of restricted securities amounts to $215,133,429, which represents approximately 74.2% of net assets as of September 30, 2025. See additional details below: |

| Security | Date(s) of Purchase |

Cost | ||||||

| Ares Industrial Real Estate Fund, LP |

12/21/22-01/19/23 | $19,403,487 | ||||||

| Ares US Real Estate Fund IX, LP |

09/19/19-09/12/24 | 5,797,671 | ||||||

| Bain Capital Real Estate Fund I-B, LP |

12/18/19-07/21/25 | 6,334,300 | ||||||

| Brookfield Premier Real Estate |

||||||||

| Partners, LP |

10/01/19-12/20/21 | 1,432,283 | ||||||

| Brookfield Real Estate Finance |

||||||||

| Fund V, LP |

10/03/19-09/19/25 | 7,826,730 | ||||||

| Clarion Partners Debt Investment |

||||||||

| Fund, LP |

02/14/17-08/01/22 | 1,198,890 | ||||||

| Clarion Ventures 4, LP |

07/01/16-07/10/19 | 6,923,743 | ||||||

| Greystar Student Housing Growth and |

||||||||

| Income Fund |

01/04/22-10/24/23 | 20,921,737 | ||||||

| Harrison Street Core Property Fund, LP |

09/15/21-10/26/23 | 18,051,478 | ||||||

| Heitman Core Real Estate Debt Income |

||||||||

| Trust, LP |

07/27/17-01/26/23 | 3,993,052 | ||||||

| Manulife U.S. Real Estate Fund LP |

04/08/22-01/24/25 | 13,129,786 | ||||||

| Nuveen U.S. Core-Plus Real Estate |

||||||||

| Debt Fund, LP |

10/01/19-10/31/23 | 8,515,779 | ||||||

| Oaktree Real Estate Income Fund LP |

10/07/21-12/27/23 | 41,194,702 | ||||||

| Prologis Targeted U.S. Logistics |

||||||||

| Holdings II, LP |

01/03/20-06/20/23 | 7,938,955 | ||||||

| RealTerm Logistics Income Fund |

04/18/22-11/06/23 | 25,532,304 | ||||||

| Sculptor Real Estate Credit Fund, LP |

01/21/20-08/25/25 | 868,930 | ||||||

| Sentinel Real Estate Fund |

05/04/22-01/16/24 | 7,471,340 | ||||||

| TA Realty Core Property Fund, LP |

01/04/22-11/07/23 | 21,074,973 | ||||||

| The Trumbull Property Fund, LP |

01/04/16-10/01/18 | 4,260,209 | ||||||

| Wheelock Street Real Estate |

||||||||

| Long Term Value Fund |

04/23/24-09/10/24 | 19,835,989 | ||||||

| Total |

$241,706,338 | |||||||

| (b) | Represents an affiliated issuer. |

| Investment Abbreviations: | ||

| LP |

—Limited Partnership | |

| REIT |

—Real Estate Investment Trust | |

| 12 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| ADDITIONAL INVESTMENT INFORMATION |

Additional information on investments in Private Real Estate Investment Trusts & Private Investment Funds:

| Security | Value | Redemption Frequency |

Redemption Notice (Days) |

Unfunded September 30, 2025 | ||||||||||||

| Ares Industrial Real Estate Fund, LP |

$ | 18,406,839 | Quarterly | 90 | $ | – | ||||||||||

| Ares US Real Estate Fund IX, LP |

5,249,236 | N/R | N/R | 846,045 | ||||||||||||

| Bain Capital Real Estate Fund I-B, LP |

7,807,719 | N/R | N/R | 2,063,827 | ||||||||||||

| Brookfield Premier Real Estate Partners, LP |

1,280,560 | Quarterly | 90 | – | ||||||||||||

| Brookfield Real Estate Finance Fund V, LP |

2,806,079 | N/R | N/R | 7,799,045 | ||||||||||||

| Clarion Partners Debt Investment Fund, LP |

1,850,920 | N/R | N/R | 4,652,799 | ||||||||||||

| Clarion Ventures 4, LP |

2,462,171 | N/R | N/R | 963,242 | ||||||||||||

| Greystar Student Housing Growth and Income Fund |

20,048,101 | Quarterly | 90 | – | ||||||||||||

| Harrison Street Core Property Fund, LP |

15,912,846 | Quarterly | 45 | – | ||||||||||||

| Heitman Core Real Estate Debt Income Trust, LP |

2,978,941 | Quarterly | 90 | – | ||||||||||||

| Manulife U.S. Real Estate Fund LP |

8,681,348 | Quarterly | 60 | – | ||||||||||||

| Nuveen U.S. Core-Plus Real Estate Debt Fund, LP |

5,741,731 | Quarterly | 45 | – | ||||||||||||

| Oaktree Real Estate Income Fund LP |

37,214,364 | N/R | N/R | – | ||||||||||||

| Prologis Targeted U.S. Logistics Holdings II, LP |

9,400,960 | Quarterly | 90 | – | ||||||||||||

| RealTerm Logistics Income Fund |

22,462,176 | Quarterly | 90 | – | ||||||||||||

| Sculptor Real Estate Credit Fund, LP |

10,286 | N/R | N/R | – | ||||||||||||

| Sentinel Real Estate Fund |

6,480,288 | Quarterly | 90 | – | ||||||||||||

| TA Realty Core Property Fund, LP |

20,697,813 | Quarterly | 45 | – | ||||||||||||

| The Trumbull Property Fund, LP |

3,493,614 | Quarterly | 60 | – | ||||||||||||

| Wheelock Street Real Estate Long Term Value Fund |

22,147,437 | Annually | 90 | 5,164,011 | ||||||||||||

N/R - Not Redeemable

| The accompanying notes are an integral part of these consolidated financial statements. | 13 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Real Estate Diversified Income Fund(a) |

||||||||

| Assets: | ||||||||

| Investments in unaffiliated issuers, at value (cost $312,292,890) |

$ | 285,196,467 | ||||||

| Investments in affiliated issuers, at value (cost $35,521,303) |

35,521,303 | |||||||

| Cash |

1,841,427 | |||||||

| Receivables: |

||||||||

| Dividends |

1,523,768 | |||||||

| Fund shares sold |

156,329 | |||||||

| Other assets |

260,059 | |||||||

|

| ||||||||

| Total assets |

324,499,353 | |||||||

|

| ||||||||

| Liabilities: | ||||||||

| Payables: |

||||||||

| Drawdowns from line of credit |

34,000,000 | |||||||

| Management fees |

149,448 | |||||||

| Distribution and Service fees and Transfer Agency fees |

27,479 | |||||||

| Interest on borrowings |

23,131 | |||||||

| Accrued expenses |

527,234 | |||||||

|

| ||||||||

| Total liabilities |

34,727,292 | |||||||

|

| ||||||||

| Commitments and contingencies |

||||||||

| Net Assets: | ||||||||

| Paid-in capital | 315,973,448 | |||||||

| Total distributable loss | (26,201,387 | ) | ||||||

|

| ||||||||

| NET ASSETS |

$ | 289,772,061 | ||||||

| Net Assets: |

||||||||

| Class A |

$ | 48,056,696 | ||||||

| Class C |

8,589,218 | |||||||

| Class I |

70,686,077 | |||||||

| Class L |

2,993,125 | |||||||

| Class W |

14,616,730 | |||||||

| Class P |

144,830,215 | |||||||

| Total Net Assets |

$ | 289,772,061 | ||||||

| Shares Outstanding $0.001 par value (unlimited number of shares authorized): |

||||||||

| Class A |

6,409,126 | |||||||

| Class C |

1,145,482 | |||||||

| Class I |

8,878,803 | |||||||

| Class L |

398,749 | |||||||

| Class W |

1,908,012 | |||||||

| Class P |

18,177,583 | |||||||

| Net asset value, offering and repurchase price per share:(b) |

||||||||

| Class A |

$ | 7.50 | ||||||

| Class C |

7.50 | |||||||

| Class I |

7.96 | |||||||

| Class L |

7.51 | |||||||

| Class W |

7.66 | |||||||

| Class P |

7.97 | |||||||

| (a) | Statement of Assets and Liabilities for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| (b) | Maximum public offering price per share for Class A is $7.96 and Class L is $7.84. Upon repurchase, Class C Shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value (“NAV”) or the original purchase price of the shares. |

| 14 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Real Estate Diversified Income Fund(a) |

||||||||

| Investment income: | ||||||||

| Dividends — unaffiliated issuers |

$ | 9,575,341 | ||||||

| Dividends — affiliated issuers |

243,942 | |||||||

|

| ||||||||

| Total Investment Income |

9,819,283 | |||||||

|

| ||||||||

| Expenses: | ||||||||

| Management fees |

4,188,393 | |||||||

| Professional fees |

572,928 | |||||||

| Transfer Agency fees |

469,098 | |||||||

| Interest on borrowing |

422,213 | |||||||

| Printing and mailing costs |

321,931 | |||||||

| Distribution and/or Service (12b-1) fees(b) |

289,340 | |||||||

| Custody, accounting and administrative services |

289,113 | |||||||

| Registration fees |

79,395 | |||||||

| Shareholder Service fees(b) |

43,798 | |||||||

| Trustee fees |

25,275 | |||||||

| Other |

83,865 | |||||||

|

| ||||||||

| Total expenses |

6,785,349 | |||||||

|

| ||||||||

| Less — expense reductions |

(170,829 | ) | ||||||

|

| ||||||||

| Net expenses |

6,614,520 | |||||||

|

| ||||||||

| NET INVESTMENT INCOME |

3,204,763 | |||||||

|

| ||||||||

| Realized and Unrealized gain (loss): | ||||||||

| Net realized gain (loss) from: |

||||||||

| Investments — unaffiliated issuers |

(11,444,304 | ) | ||||||

| Net change in unrealized gain (loss) on: |

||||||||

| Investments — unaffiliated issuers |

(2,893,617 | ) | ||||||

|

| ||||||||

| Net realized and unrealized loss |

(14,337,921 | ) | ||||||

|

| ||||||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | (11,133,158 | ) | |||||

|

| ||||||||

(a) Statement of Operations for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated.

(b) Class specific Distribution and/or Service and Shareholder Service fees were as follows:

| Distribution and/or Service (12b-1) Fees | Shareholder Service Fees | |||||||||||||||

| Class A | Class C | Class L | Class W | Class C | Class L | |||||||||||

| $132,267 |

$106,803 | $8,197 | $42,073 | $35,601 | $8,197 | |||||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | 15 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Real Estate Diversified Income Fund(a) | ||||||||||||

| For the Fiscal Year Ended September 30, 2025 |

For the Fiscal Year Ended September 30, 2024 |

|||||||||||

| From operations: | ||||||||||||

| Net investment income |

$ | 3,204,763 | $ | 4,256,376 | ||||||||

| Net realized loss |

(11,444,304 | ) | (9,494,048 | ) | ||||||||

| Net change in unrealized gain (loss) |

(2,893,617 | ) | 13,461,813 | |||||||||

|

| ||||||||||||

| Net increase (decrease) in net assets resulting from operations |

(11,133,158 | ) | 8,224,141 | |||||||||

|

| ||||||||||||

| Distributions to shareholders: | ||||||||||||

| From distributable earnings: |

||||||||||||

| Class A Shares |

(130,798 | ) | (114,477 | ) | ||||||||

| Class C Shares |

(27,640 | ) | (41,719 | ) | ||||||||

| Class I Shares |

(195,131 | ) | (172,534 | ) | ||||||||

| Class L Shares |

(7,675 | ) | (7,078 | ) | ||||||||

| Class W Shares |

(39,620 | ) | (40,771 | ) | ||||||||

| Class P Shares |

(391,513 | ) | (360,104 | ) | ||||||||

| From return of capital: |

||||||||||||

| Class A Shares |

(3,906,284 | ) | (4,353,499 | ) | ||||||||

| Class C Shares |

(825,460 | ) | (1,586,568 | ) | ||||||||

| Class I Shares |

(5,827,577 | ) | (6,561,415 | ) | ||||||||

| Class L Shares |

(229,204 | ) | (269,175 | ) | ||||||||

| Class W Shares |

(1,183,286 | ) | (1,550,521 | ) | ||||||||

| Class P Shares |

(11,692,527 | ) | (13,694,601 | ) | ||||||||

|

| ||||||||||||

| Total distributions to shareholders |

(24,456,715 | ) | (28,752,462 | ) | ||||||||

|

| ||||||||||||

| From share transactions: | ||||||||||||

| Proceeds from sales of shares |

25,196,848 | 32,578,542 | ||||||||||

| Reinvestment of distributions |

10,433,149 | 14,309,375 | ||||||||||

| Cost of shares repurchased |

(103,629,632 | ) | (119,383,121 | ) | ||||||||

|

| ||||||||||||

| Net decrease in net assets resulting from share transactions |

(67,999,635 | ) | (72,495,204 | ) | ||||||||

|

| ||||||||||||

| TOTAL DECREASE |

(103,589,508 | ) | (93,023,525 | ) | ||||||||

|

| ||||||||||||

| Net Assets: | ||||||||||||

| Beginning of year |

$ | 393,361,569 | $ | 486,385,094 | ||||||||

|

| ||||||||||||

| End of year |

$ | 289,772,061 | $ | 393,361,569 | ||||||||

|

| ||||||||||||

| (a) | The Statements of Changes in Net Assets for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated. |

| 16 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Increase (Decrease) in cash – Cash flows provided by operating activities: |

||||||||||

| Net decrease in net assets from operations |

$ | (11,133,158 | ) | |||||||

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by (used in) operating activities: |

||||||||||

| Payments for purchases of investments |

(67,403,141 | ) | ||||||||

| Proceeds from sales of investments |

146,152,706 | |||||||||

| Net (payments for purchase) proceeds from sales of short-term investment securities |

(21,326,182 | ) | ||||||||

| (Increase) Decrease in assets: |

||||||||||

| Receivable for dividends |

474,712 | |||||||||

| Reimbursement from investment adviser |

48,166 | |||||||||

| Other assets |

(59 | ) | ||||||||

| Increase (Decrease) in liabilities: |

||||||||||

| Distribution and Service fees and Transfer Agency fees |

(13,170 | ) | ||||||||

| Interest on borrowings |

23,131 | |||||||||

| Management fees |

(54,458 | ) | ||||||||

| Accrued expenses |

215,147 | |||||||||

| Net realized (gain) loss on: |

||||||||||

| Investments |

11,444,304 | |||||||||

| Net change in unrealized (gain) loss on: |

||||||||||

| Investments |

2,893,617 | |||||||||

|

|

||||||||||

| Net cash provided by operating activities |

61,321,615 | |||||||||

|

|

||||||||||

| Cash flows used in financing activities: | ||||||||||

| Proceeds from sale of shares |

25,533,083 | |||||||||

| Cost of shares repurchased |

(103,629,632 | ) | ||||||||

| Decrease in payable to custodian |

(1,360,073 | ) | ||||||||

| Distributions paid |

(14,023,566 | ) | ||||||||

| Drawdowns from line of credit |

44,000,000 | |||||||||

| Repayment of line of credit |

(10,000,000 | ) | ||||||||

|

|

||||||||||

| Net cash used in financing activities |

(59,480,188 | ) | ||||||||

|

|

||||||||||

|

|

||||||||||

| NET INCREASE IN CASH |

$ | 1,841,427 | ||||||||

|

|

||||||||||

| Cash (restricted and unrestricted): | ||||||||||

| Beginning of year |

$ | — | ||||||||

|

|

||||||||||

| End of year |

$ | 1,841,427 | ||||||||

|

|

||||||||||

| Supplemental disclosure: |

||||||||||

| Cash paid for interest and related fees |

422,213 | |||||||||

| Reinvestment of distributions |

10,433,149 | |||||||||

|

|

||||||||||

(a) Statement of Cash Flows for the Fund is consolidated and includes the balances of wholly owned subsidiaries DIF Investments LLC, DIF Investments II LLC, and DIF Investments III LLC. Accordingly, all interfund balances and transactions have been eliminated.

| The accompanying notes are an integral part of these consolidated financial statements. | 17 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class A Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 8.36 | $ | 8.79 | $ | 9.91 | $ | 10.45 | $ | 9.38 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(a) |

0.06 | 0.08 | 0.14 | 0.21 | 0.20 | |||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.32 | ) | 0.09 | (0.61 | ) | (0.04 | ) | 1.47 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.26 | ) | 0.17 | (0.47 | ) | 0.17 | 1.67 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.01 | ) | (0.01 | ) | – | (0.19 | ) | (0.34 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.15 | ) | (0.11 | ) | (0.26 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.59 | ) | (0.59 | ) | (0.50 | ) | (0.41 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.60 | ) | (0.60 | ) | (0.65 | ) | (0.71 | ) | (0.60 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of year |

$ | 7.50 | $ | 8.36 | $ | 8.79 | $ | 9.91 | $ | 10.45 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(b)(c) |

(3.15 | )% | 1.97 | % | (5.05 | )% | 1.43 | % | 18.24 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of year (in 000’s) |

$ | 48,057 | $ | 61,073 | $ | 69,953 | $ | 80,263 | $ | 83,054 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

2.13 | % | 2.09 | % | 2.17 | % | 2.05 | % | 2.10 | % | ||||||||||||||||||||||||

| Ratio of net investment income to average net assets |

0.81 | % | 0.89 | % | 1.42 | % | 1.97 | % | 2.02 | % | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

1.99 | % | 1.99 | % | 1.99 | % | 1.98 | % | 1.99 | % | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

2.18 | % | 2.13 | % | 2.22 | % | 2.06 | % | 2.34 | % | ||||||||||||||||||||||||

| Portfolio turnover rate(d) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 18 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year |

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class C Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 8.36 | $ | 8.79 | $ | 9.91 | $ | 10.45 | $ | 9.38 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(a) |

– | (b) | 0.01 | 0.06 | 0.12 | 0.13 | ||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.32 | ) | 0.10 | (0.60 | ) | (0.03 | ) | 1.46 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.32 | ) | 0.11 | (0.54 | ) | 0.09 | 1.59 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.08 | ) | (0.06 | ) | – | (0.16 | ) | (0.26 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.16 | ) | (0.11 | ) | (0.26 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.46 | ) | (0.48 | ) | (0.42 | ) | (0.36 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.54 | ) | (0.54 | ) | (0.58 | ) | (0.63 | ) | (0.52 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of year |

$ | 7.50 | $ | 8.36 | $ | 8.79 | $ | 9.91 | $ | 10.45 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(c)(d) |

(3.88 | )% | 1.23 | % | (5.77 | )% | 0.67 | % | 17.37 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of year (in 000’s) |

$ | 8,589 | $ | 19,906 | $ | 37,064 | $ | 54,094 | $ | 69,360 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

2.87 | % | 2.83 | % | 2.91 | % | 2.81 | % | 2.84 | % | ||||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets |

(0.01 | )% | 0.07 | % | 0.63 | % | 1.18 | % | 1.27 | % | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

2.74 | % | 2.74 | % | 2.73 | % | 2.74 | % | 2.74 | % | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

2.92 | % | 2.87 | % | 2.95 | % | 2.82 | % | 3.09 | % | ||||||||||||||||||||||||

| Portfolio turnover rate(e) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Amount is less than $0.005 per share. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these consolidated financial statements. | 19 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year |

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class I Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 8.84 | $ | 9.26 | $ | 10.40 | $ | 10.93 | $ | 9.78 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(a) |

0.09 | 0.10 | 0.17 | 0.26 | 0.24 | |||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.35 | ) | 0.10 | (0.64 | ) | (0.05 | ) | 1.54 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.26 | ) | 0.20 | (0.47 | ) | 0.21 | 1.78 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.02 | ) | (0.02 | ) | – | (0.19 | ) | (0.37 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.16 | ) | (0.11 | ) | (0.26 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.60 | ) | (0.60 | ) | (0.51 | ) | (0.44 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.62 | ) | (0.62 | ) | (0.67 | ) | (0.74 | ) | (0.63 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of year |

$ | 7.96 | $ | 8.84 | $ | 9.26 | $ | 10.40 | $ | 10.93 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(b)(c) |

(2.98 | )% | 2.22 | % | (4.77 | )% | 1.70 | % | 18.59 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of year (in 000’s) |

$ | 70,686 | $ | 93,750 | $ | 114,738 | $ | 145,519 | $ | 98,018 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

1.87 | % | 1.84 | % | 1.92 | % | 1.76 | % | 1.84 | % | ||||||||||||||||||||||||

| Ratio of net investment income to average net assets |

1.06 | % | 1.13 | % | 1.66 | % | 2.31 | % | 2.33 | % | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

1.74 | % | 1.74 | % | 1.74 | % | 1.70 | % | 1.74 | % | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

1.93 | % | 1.88 | % | 1.96 | % | 1.77 | % | 2.12 | % | ||||||||||||||||||||||||

| Portfolio turnover rate(d) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 20 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year |

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class L Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 8.37 | $ | 8.80 | $ | 9.92 | $ | 10.46 | $ | 9.39 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(a) |

0.04 | 0.05 | 0.11 | 0.18 | 0.18 | |||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.32 | ) | 0.10 | (0.61 | ) | (0.04 | ) | 1.46 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.28 | ) | 0.15 | (0.50 | ) | 0.14 | 1.64 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.02 | ) | (0.02 | ) | – | (0.18 | ) | (0.31 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.15 | ) | (0.11 | ) | (0.26 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.56 | ) | (0.56 | ) | (0.47 | ) | (0.39 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.58 | ) | (0.58 | ) | (0.62 | ) | (0.68 | ) | (0.57 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of year |

$ | 7.51 | $ | 8.37 | $ | 8.80 | $ | 9.92 | $ | 10.46 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(b)(c) |

(3.39 | )% | 1.72 | % | (5.28 | )% | 1.17 | % | 17.93 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of year (in 000’s) |

$ | 2,993 | $ | 3,793 | $ | 4,569 | $ | 5,323 | $ | 5,919 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

2.38 | % | 2.34 | % | 2.42 | % | 2.30 | % | 2.34 | % | ||||||||||||||||||||||||

| Ratio of net investment income to average net assets |

0.55 | % | 0.62 | % | 1.15 | % | 1.70 | % | 1.76 | % | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

2.24 | % | 2.24 | % | 2.24 | % | 2.23 | % | 2.24 | % | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

2.43 | % | 2.38 | % | 2.46 | % | 2.31 | % | 2.59 | % | ||||||||||||||||||||||||

| Portfolio turnover rate(d) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these consolidated financial statements. | 21 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year |

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class W Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 8.53 | $ | 8.96 | $ | 10.08 | $ | 10.62 | $ | 9.52 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(a) |

0.07 | 0.08 | 0.14 | 0.21 | 0.21 | |||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.34 | ) | 0.09 | (0.61 | ) | (0.04 | ) | 1.49 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.27 | ) | 0.17 | (0.47 | ) | 0.17 | 1.70 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.03 | ) | (0.03 | ) | – | (0.18 | ) | (0.34 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.16 | ) | (0.11 | ) | (0.26 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.57 | ) | (0.57 | ) | (0.49 | ) | (0.42 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.60 | ) | (0.60 | ) | (0.65 | ) | (0.71 | ) | (0.60 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of year |

$ | 7.66 | $ | 8.53 | $ | 8.96 | $ | 10.08 | $ | 10.62 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(b)(c) |

(3.21 | )% | 1.93 | % | (4.96 | )% | 1.40 | % | 18.28 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of year (in 000’s) |

$ | 14,617 | $ | 20,742 | $ | 29,307 | $ | 39,873 | $ | 40,617 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

2.13 | % | 2.08 | % | 2.16 | % | 2.04 | % | 2.10 | % | ||||||||||||||||||||||||

| Ratio of net investment income to average net assets |

0.80 | % | 0.88 | % | 1.42 | % | 1.98 | % | 2.02 | % | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

1.99 | % | 1.99 | % | 1.98 | % | 1.98 | % | 1.99 | % | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

2.18 | % | 2.12 | % | 2.20 | % | 2.05 | % | 2.33 | % | ||||||||||||||||||||||||

| Portfolio turnover rate(d) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the year and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 22 | The accompanying notes are an integral part of these consolidated financial statements. |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| Consolidated Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Period |

| Real Estate Diversified Income Fund | ||||||||||||||||||||||||||||||||||

| Class P Shares | ||||||||||||||||||||||||||||||||||

| Year Ended September 30, | Period Ended September 30, | |||||||||||||||||||||||||||||||||

| 2025 | 2024 | 2023 | 2022 | |||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 8.84 | $ | 9.26 | $ | 10.41 | $ | 10.93 | $ | 10.63 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net investment income(b) |

0.09 | 0.10 | 0.17 | 0.28 | 0.05 | |||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.34 | ) | 0.10 | (0.65 | ) | (0.06 | ) | 0.41 | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total from investment operations |

(0.25 | ) | 0.20 | (0.48 | ) | 0.22 | 0.46 | |||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(0.03 | ) | (0.02 | ) | – | (0.18 | ) | (0.09 | ) | |||||||||||||||||||||||||

| Distributions to shareholders from net realized gains |

– | – | (0.16 | ) | (0.11 | ) | (0.07 | ) | ||||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

(0.59 | ) | (0.60 | ) | (0.51 | ) | (0.45 | ) | – | |||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total distributions |

(0.62 | ) | (0.62 | ) | (0.67 | ) | (0.74 | ) | (0.16 | ) | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 7.97 | $ | 8.84 | $ | 9.26 | $ | 10.41 | $ | 10.93 | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Total Return(c)(d) |

(2.86 | )% | 2.22 | % | (4.87 | )% | 1.79 | % | 4.31 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000’s) |

$ | 144,830 | $ | 194,097 | $ | 230,754 | $ | 253,957 | $ | 54,212 | ||||||||||||||||||||||||

| Ratio of net expense to average net assets after interest expenses |

1.87 | % | 1.84 | % | 1.92 | % | 1.70 | % | 1.81 | %(e) | ||||||||||||||||||||||||

| Ratio of net investment income to average net assets |

1.05 | % | 1.12 | % | 1.67 | % | 2.49 | % | 1.81 | %(e) | ||||||||||||||||||||||||

| Ratio of net expense to average net assets before interest expenses |

1.74 | % | 1.74 | % | 1.74 | % | 1.63 | % | 1.74 | %(e) | ||||||||||||||||||||||||

| Ratio of total expense to average net assets after interest expenses |

1.93 | % | 1.88 | % | 1.97 | % | 1.71 | % | 2.61 | %(e) | ||||||||||||||||||||||||

| Portfolio turnover rate(f) |

15 | % | 17 | % | 46 | % | 56 | % | 73 | % | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

| (a) | Commenced operations on June 29, 2021. |

| (b) | Calculated based on the average shares outstanding methodology. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete repurchase of the investment at the NAV at the end of the period and no sales or repurchase charges (if any). Total returns would be reduced if a sales or repurchase charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the repurchase of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Annualized. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these consolidated financial statements. | 23 |

GOLDMAN SACHS REAL ESTATE DIVERSIFIED INCOME FUND

| 1. ORGANIZATION |