Fourth Quarter and Full Year 2025 Supplemental Financial Information

Table of Contents 2 03 Corporate Overview 04 Quarterly Highlights 05 Consolidated Statements of Operations 06 Funds from Operations and Adjusted Funds from Operations 07 EBITDAre and Adjusted EBITDAre 08 Net Operating Income 09 Consolidated Balance Sheets 10 Debt, Capitalization, and Financial Ratios 12 Investment Activity 13 Portfolio Information 17 Lease Expiration Schedule 18 Non-GAAP Measures and Definitions 21 Forward-Looking and Cautionary Statements

Management Team Mark Manheimer Chief Executive Officer and President Daniel Donlan Chief Financial Officer and Treasurer Sofia Chernylo Senior Vice President, Chief Accounting Officer Jeff Fuge Senior Vice President of Acquisitions Chad Shafer Senior Vice President of Real Estate and Underwriting 3 Corporate Overview Corporate Profile NETSTREIT Corp. (NYSE: NTST) is an internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e- commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country in order to generate consistent cash flows and dividends for its investors. Board of Directors Lori Wittman - Chair Michael Christodolou Heidi Everett Mark Manheimer Todd Minnis Matthew Troxell Robin Zeigler Corporate Headquarters 2021 McKinney Avenue Suite 1150 Dallas, Texas, 75201 Phone: (972) 597 - 4825 Website: www.netstreit.com Transfer Agent Computershare PO Box 43007 Providence, RI 09240-3007 Phone: (800) 736 - 3001 Website: www.computershare.com

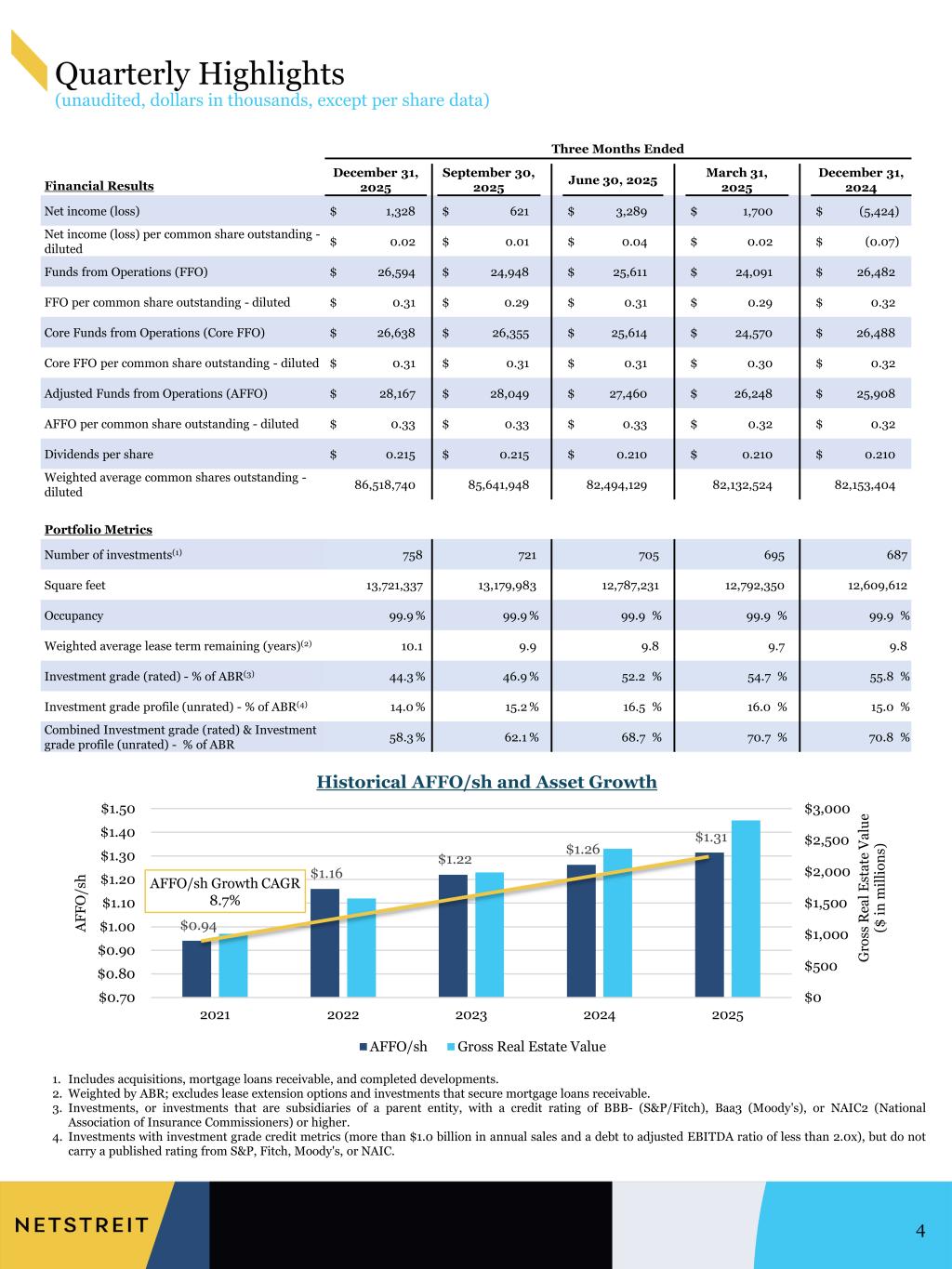

Quarterly Highlights (unaudited, dollars in thousands, except per share data) 4 1. Includes acquisitions, mortgage loans receivable, and completed developments. 2. Weighted by ABR; excludes lease extension options and investments that secure mortgage loans receivable. 3. Investments, or investments that are subsidiaries of a parent entity, with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody's), or NAIC2 (National Association of Insurance Commissioners) or higher. 4. Investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC. Three Months Ended Financial Results December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 Net income (loss) $ 1,328 $ 621 $ 3,289 $ 1,700 $ (5,424) Net income (loss) per common share outstanding - diluted $ 0.02 $ 0.01 $ 0.04 $ 0.02 $ (0.07) Funds from Operations (FFO) $ 26,594 $ 24,948 $ 25,611 $ 24,091 $ 26,482 FFO per common share outstanding - diluted $ 0.31 $ 0.29 $ 0.31 $ 0.29 $ 0.32 Core Funds from Operations (Core FFO) $ 26,638 $ 26,355 $ 25,614 $ 24,570 $ 26,488 Core FFO per common share outstanding - diluted $ 0.31 $ 0.31 $ 0.31 $ 0.30 $ 0.32 Adjusted Funds from Operations (AFFO) $ 28,167 $ 28,049 $ 27,460 $ 26,248 $ 25,908 AFFO per common share outstanding - diluted $ 0.33 $ 0.33 $ 0.33 $ 0.32 $ 0.32 Dividends per share $ 0.215 $ 0.215 $ 0.210 $ 0.210 $ 0.210 Weighted average common shares outstanding - diluted 86,518,740 85,641,948 82,494,129 82,132,524 82,153,404 Portfolio Metrics Number of investments(1) 758 721 705 695 687 Square feet 13,721,337 13,179,983 12,787,231 12,792,350 12,609,612 Occupancy 99.9 % 99.9 % 99.9 % 99.9 % 99.9 % Weighted average lease term remaining (years)(2) 10.1 9.9 9.8 9.7 9.8 Investment grade (rated) - % of ABR(3) 44.3 % 46.9 % 52.2 % 54.7 % 55.8 % Investment grade profile (unrated) - % of ABR(4) 14.0 % 15.2 % 16.5 % 16.0 % 15.0 % Combined Investment grade (rated) & Investment grade profile (unrated) - % of ABR 58.3 % 62.1 % 68.7 % 70.7 % 70.8 % $0.94 $1.16 $1.22 $1.26 $1.31 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $0.70 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 $1.50 2021 2022 2023 2024 2025 G ro ss R ea l E st at e V al ue ($ in m ill io ns ) A FF O /s h Historical AFFO/sh and Asset Growth AFFO/sh Gross Real Estate Value AFFO/sh Growth CAGR 8.7%

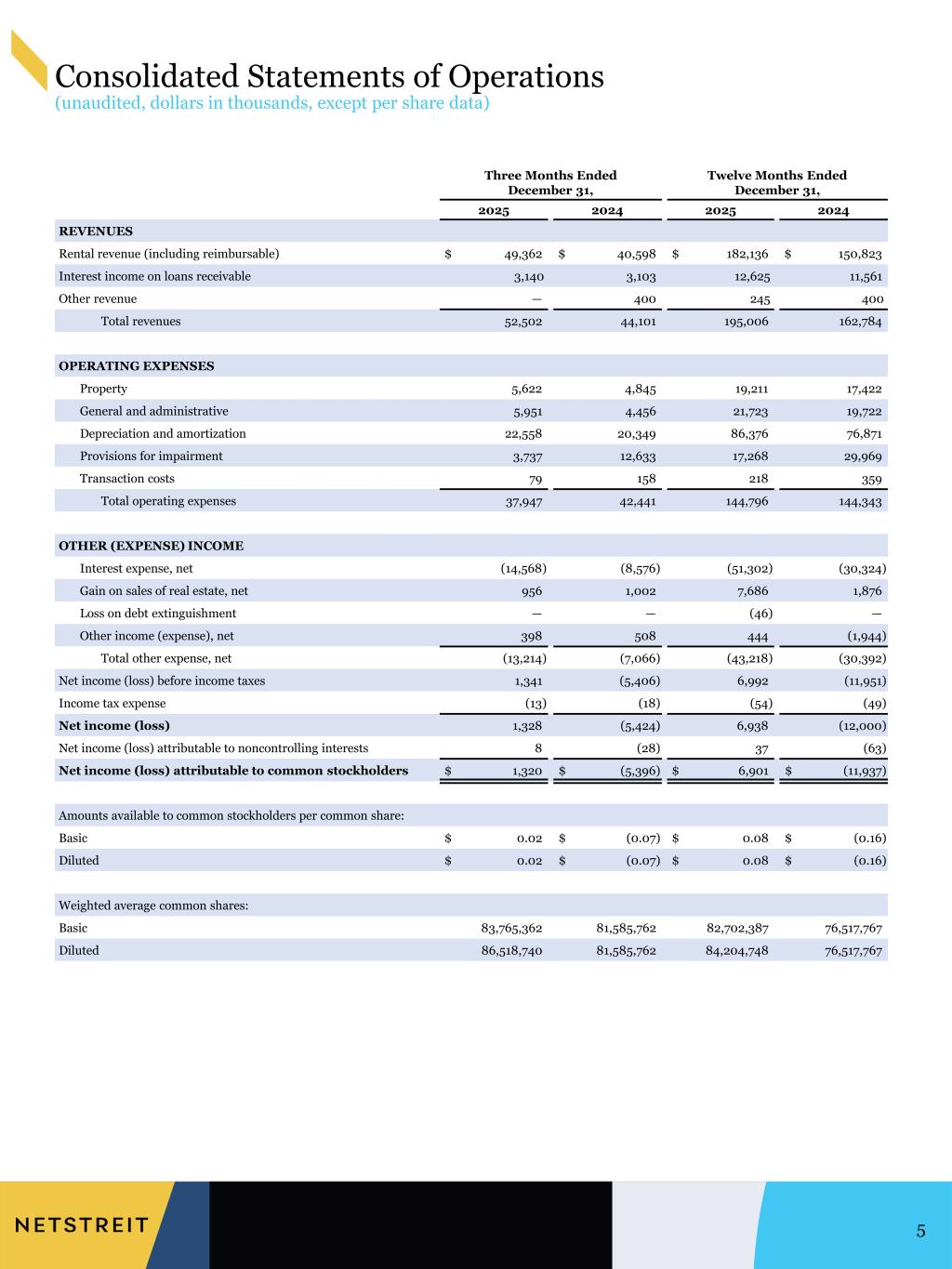

5 Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 REVENUES Rental revenue (including reimbursable) $ 49,362 $ 40,598 $ 182,136 $ 150,823 Interest income on loans receivable 3,140 3,103 12,625 11,561 Other revenue — 400 245 400 Total revenues 52,502 44,101 195,006 162,784 OPERATING EXPENSES Property 5,622 4,845 19,211 17,422 General and administrative 5,951 4,456 21,723 19,722 Depreciation and amortization 22,558 20,349 86,376 76,871 Provisions for impairment 3,737 12,633 17,268 29,969 Transaction costs 79 158 218 359 Total operating expenses 37,947 42,441 144,796 144,343 OTHER (EXPENSE) INCOME Interest expense, net (14,568) (8,576) (51,302) (30,324) Gain on sales of real estate, net 956 1,002 7,686 1,876 Loss on debt extinguishment — — (46) — Other income (expense), net 398 508 444 (1,944) Total other expense, net (13,214) (7,066) (43,218) (30,392) Net income (loss) before income taxes 1,341 (5,406) 6,992 (11,951) Income tax expense (13) (18) (54) (49) Net income (loss) 1,328 (5,424) 6,938 (12,000) Net income (loss) attributable to noncontrolling interests 8 (28) 37 (63) Net income (loss) attributable to common stockholders $ 1,320 $ (5,396) $ 6,901 $ (11,937) Amounts available to common stockholders per common share: Basic $ 0.02 $ (0.07) $ 0.08 $ (0.16) Diluted $ 0.02 $ (0.07) $ 0.08 $ (0.16) Weighted average common shares: Basic 83,765,362 81,585,762 82,702,387 76,517,767 Diluted 86,518,740 81,585,762 84,204,748 76,517,767 Consolidated Statements of Operations (unaudited, dollars in thousands, except per share data)

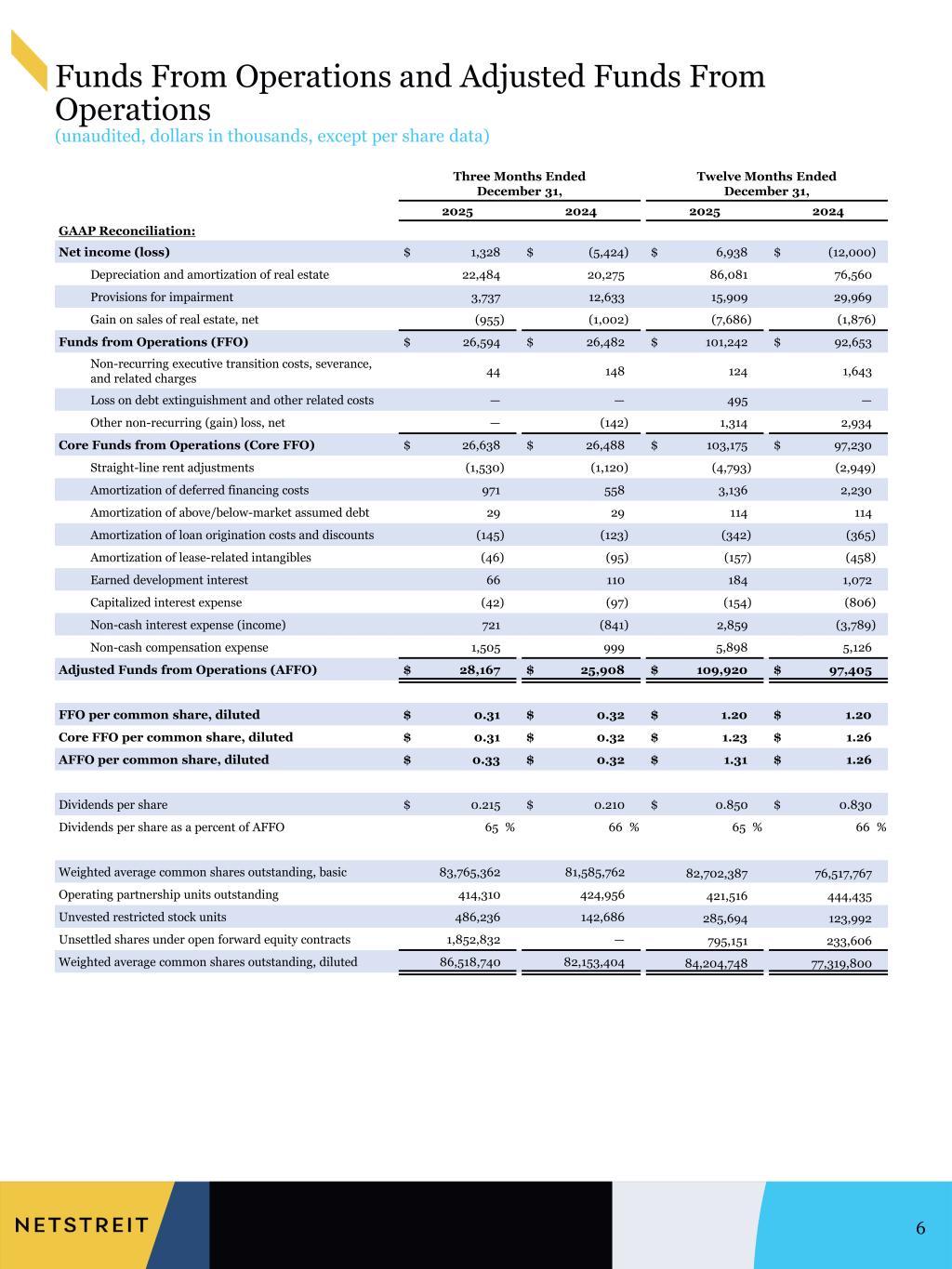

Funds From Operations and Adjusted Funds From Operations (unaudited, dollars in thousands, except per share data) 6 Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 GAAP Reconciliation: Net income (loss) $ 1,328 $ (5,424) $ 6,938 $ (12,000) Depreciation and amortization of real estate 22,484 20,275 86,081 76,560 Provisions for impairment 3,737 12,633 15,909 29,969 Gain on sales of real estate, net (955) (1,002) (7,686) (1,876) Funds from Operations (FFO) $ 26,594 $ 26,482 $ 101,242 $ 92,653 Non-recurring executive transition costs, severance, and related charges 44 148 124 1,643 Loss on debt extinguishment and other related costs — — 495 — Other non-recurring (gain) loss, net — (142) 1,314 2,934 Core Funds from Operations (Core FFO) $ 26,638 $ 26,488 $ 103,175 $ 97,230 Straight-line rent adjustments (1,530) (1,120) (4,793) (2,949) Amortization of deferred financing costs 971 558 3,136 2,230 Amortization of above/below-market assumed debt 29 29 114 114 Amortization of loan origination costs and discounts (145) (123) (342) (365) Amortization of lease-related intangibles (46) (95) (157) (458) Earned development interest 66 110 184 1,072 Capitalized interest expense (42) (97) (154) (806) Non-cash interest expense (income) 721 (841) 2,859 (3,789) Non-cash compensation expense 1,505 999 5,898 5,126 Adjusted Funds from Operations (AFFO) $ 28,167 $ 25,908 $ 109,920 $ 97,405 FFO per common share, diluted $ 0.31 $ 0.32 $ 1.20 $ 1.20 Core FFO per common share, diluted $ 0.31 $ 0.32 $ 1.23 $ 1.26 AFFO per common share, diluted $ 0.33 $ 0.32 $ 1.31 $ 1.26 Dividends per share $ 0.215 $ 0.210 $ 0.850 $ 0.830 Dividends per share as a percent of AFFO 65 % 66 % 65 % 66 % Weighted average common shares outstanding, basic 83,765,362 81,585,762 82,702,387 76,517,767 Operating partnership units outstanding 414,310 424,956 421,516 444,435 Unvested restricted stock units 486,236 142,686 285,694 123,992 Unsettled shares under open forward equity contracts 1,852,832 — 795,151 233,606 Weighted average common shares outstanding, diluted 86,518,740 82,153,404 84,204,748 77,319,800

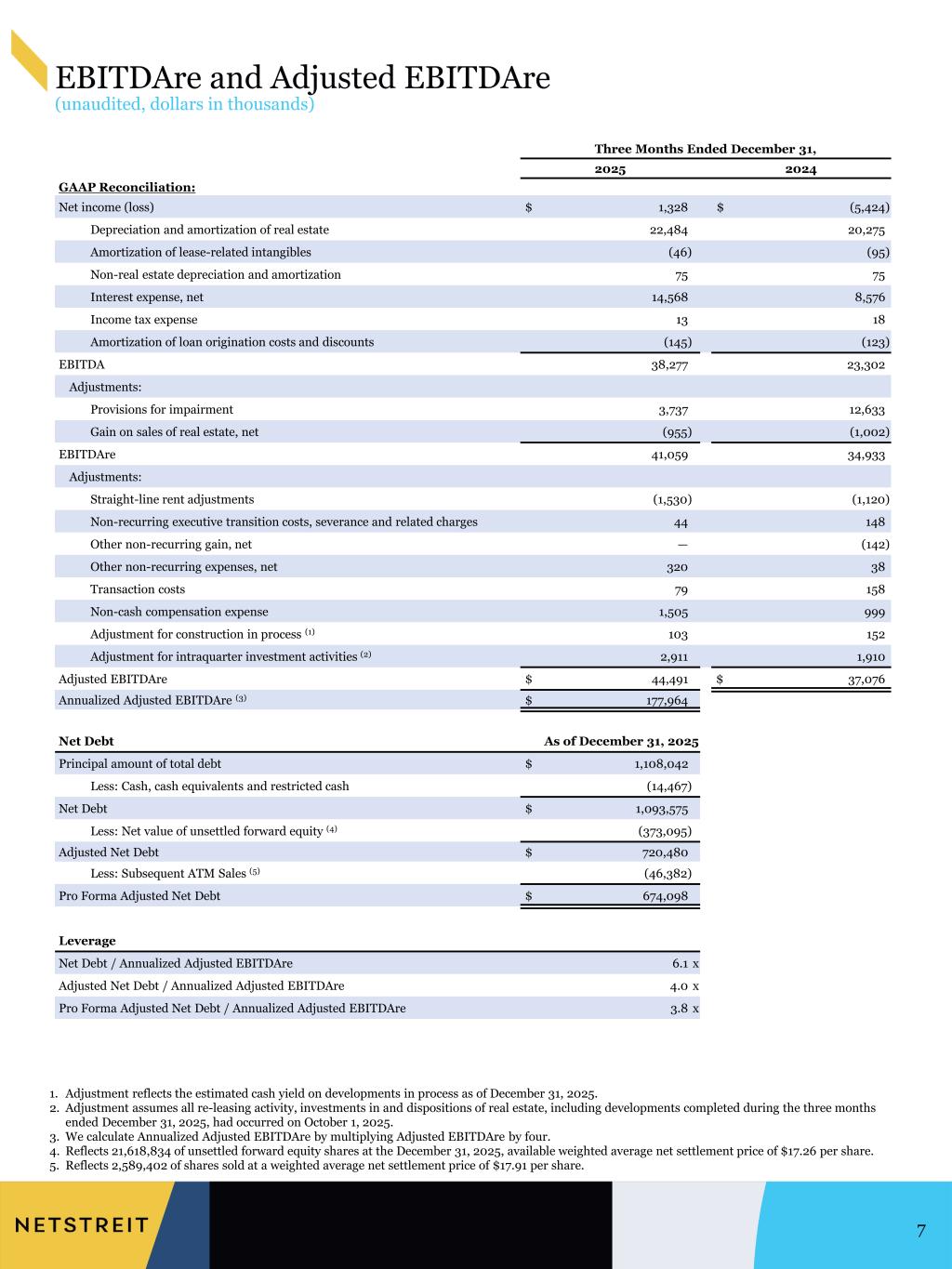

EBITDAre and Adjusted EBITDAre (unaudited, dollars in thousands) 7 Three Months Ended December 31, 2025 2024 GAAP Reconciliation: Net income (loss) $ 1,328 $ (5,424) Depreciation and amortization of real estate 22,484 20,275 Amortization of lease-related intangibles (46) (95) Non-real estate depreciation and amortization 75 75 Interest expense, net 14,568 8,576 Income tax expense 13 18 Amortization of loan origination costs and discounts (145) (123) EBITDA 38,277 23,302 Adjustments: Provisions for impairment 3,737 12,633 Gain on sales of real estate, net (955) (1,002) EBITDAre 41,059 34,933 Adjustments: Straight-line rent adjustments (1,530) (1,120) Non-recurring executive transition costs, severance and related charges 44 148 Other non-recurring gain, net — (142) Other non-recurring expenses, net 320 38 Transaction costs 79 158 Non-cash compensation expense 1,505 999 Adjustment for construction in process (1) 103 152 Adjustment for intraquarter investment activities (2) 2,911 1,910 Adjusted EBITDAre $ 44,491 $ 37,076 Annualized Adjusted EBITDAre (3) $ 177,964 Net Debt As of December 31, 2025 Principal amount of total debt $ 1,108,042 Less: Cash, cash equivalents and restricted cash (14,467) Net Debt $ 1,093,575 Less: Net value of unsettled forward equity (4) (373,095) Adjusted Net Debt $ 720,480 Less: Subsequent ATM Sales (5) (46,382) Pro Forma Adjusted Net Debt $ 674,098 Leverage Net Debt / Annualized Adjusted EBITDAre 6.1 x Adjusted Net Debt / Annualized Adjusted EBITDAre 4.0 x Pro Forma Adjusted Net Debt / Annualized Adjusted EBITDAre 3.8 x 1. Adjustment reflects the estimated cash yield on developments in process as of December 31, 2025. 2. Adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including developments completed during the three months ended December 31, 2025, had occurred on October 1, 2025. 3. We calculate Annualized Adjusted EBITDAre by multiplying Adjusted EBITDAre by four. 4. Reflects 21,618,834 of unsettled forward equity shares at the December 31, 2025, available weighted average net settlement price of $17.26 per share. 5. Reflects 2,589,402 of shares sold at a weighted average net settlement price of $17.91 per share.

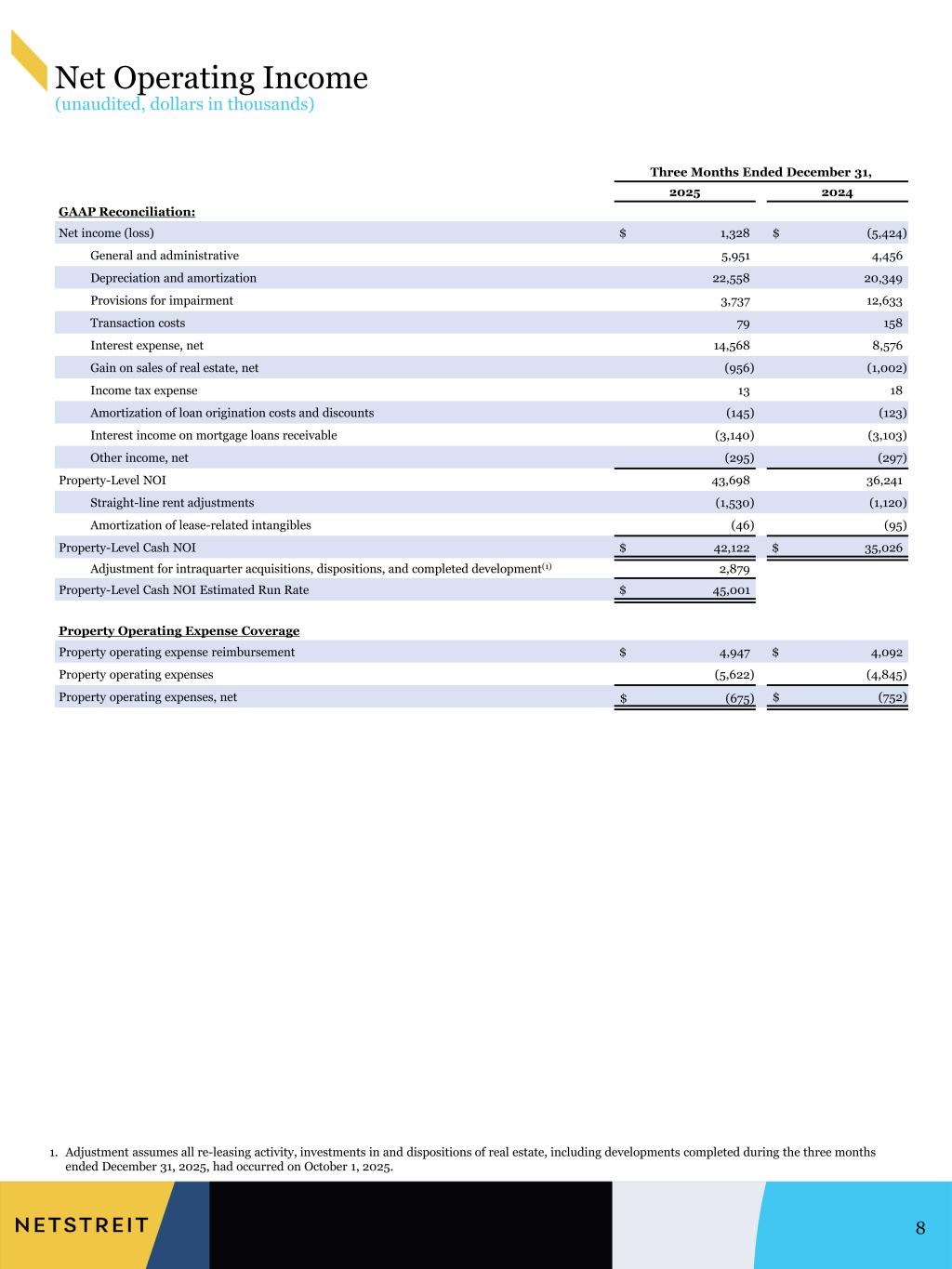

Net Operating Income (unaudited, dollars in thousands) 8 Three Months Ended December 31, 2025 2024 GAAP Reconciliation: Net income (loss) $ 1,328 $ (5,424) General and administrative 5,951 4,456 Depreciation and amortization 22,558 20,349 Provisions for impairment 3,737 12,633 Transaction costs 79 158 Interest expense, net 14,568 8,576 Gain on sales of real estate, net (956) (1,002) Income tax expense 13 18 Amortization of loan origination costs and discounts (145) (123) Interest income on mortgage loans receivable (3,140) (3,103) Other income, net (295) (297) Property-Level NOI 43,698 36,241 Straight-line rent adjustments (1,530) (1,120) Amortization of lease-related intangibles (46) (95) Property-Level Cash NOI $ 42,122 $ 35,026 Adjustment for intraquarter acquisitions, dispositions, and completed development(1) 2,879 Property-Level Cash NOI Estimated Run Rate $ 45,001 Property Operating Expense Coverage Property operating expense reimbursement $ 4,947 $ 4,092 Property operating expenses (5,622) (4,845) Property operating expenses, net $ (675) $ (752) 1. Adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including developments completed during the three months ended December 31, 2025, had occurred on October 1, 2025.

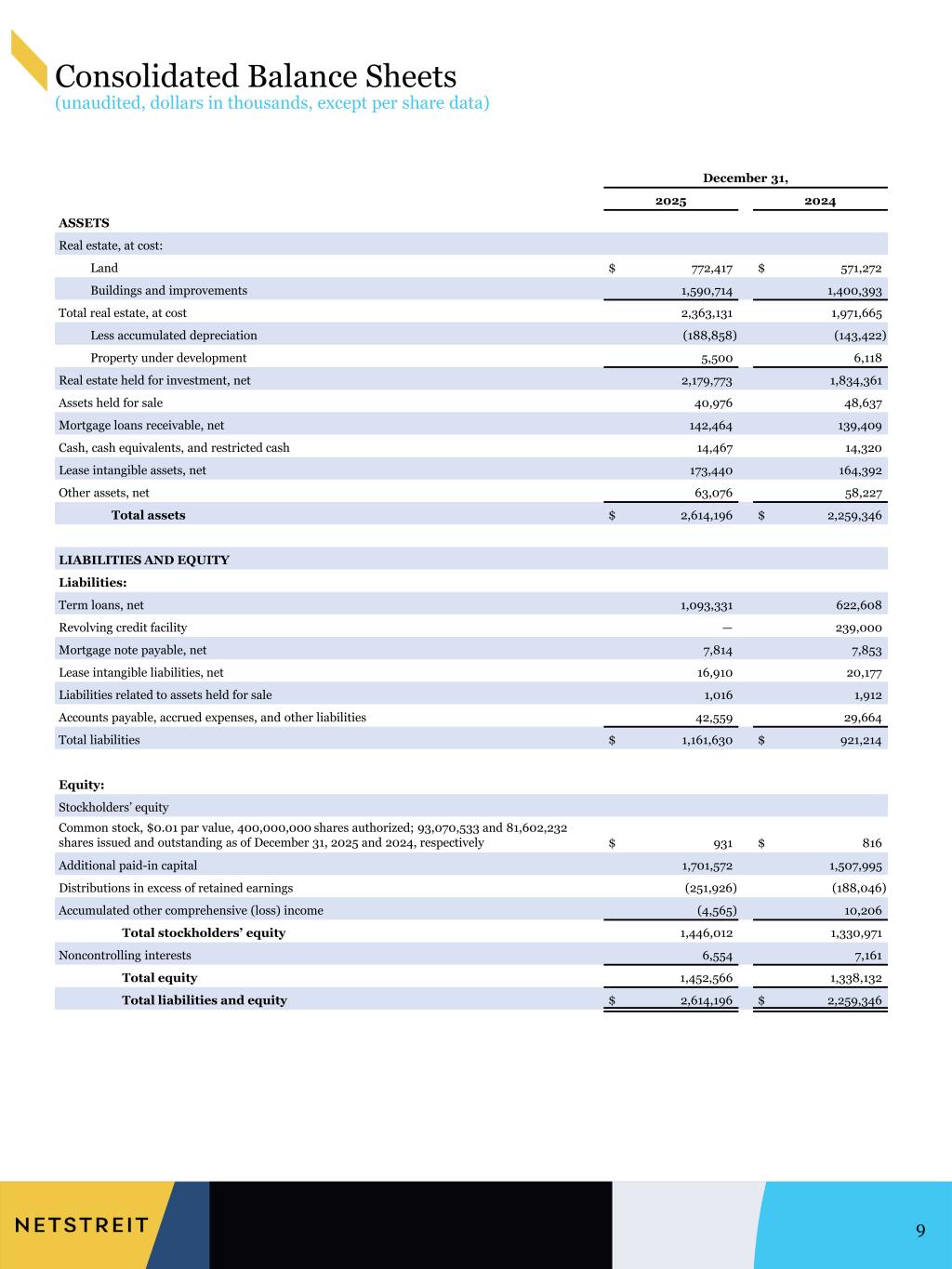

Consolidated Balance Sheets (unaudited, dollars in thousands, except per share data) 9 December 31, 2025 2024 ASSETS Real estate, at cost: Land $ 772,417 $ 571,272 Buildings and improvements 1,590,714 1,400,393 Total real estate, at cost 2,363,131 1,971,665 Less accumulated depreciation (188,858) (143,422) Property under development 5,500 6,118 Real estate held for investment, net 2,179,773 1,834,361 Assets held for sale 40,976 48,637 Mortgage loans receivable, net 142,464 139,409 Cash, cash equivalents, and restricted cash 14,467 14,320 Lease intangible assets, net 173,440 164,392 Other assets, net 63,076 58,227 Total assets $ 2,614,196 $ 2,259,346 LIABILITIES AND EQUITY Liabilities: Term loans, net 1,093,331 622,608 Revolving credit facility — 239,000 Mortgage note payable, net 7,814 7,853 Lease intangible liabilities, net 16,910 20,177 Liabilities related to assets held for sale 1,016 1,912 Accounts payable, accrued expenses, and other liabilities 42,559 29,664 Total liabilities $ 1,161,630 $ 921,214 Equity: Stockholders’ equity Common stock, $0.01 par value, 400,000,000 shares authorized; 93,070,533 and 81,602,232 shares issued and outstanding as of December 31, 2025 and 2024, respectively $ 931 $ 816 Additional paid-in capital 1,701,572 1,507,995 Distributions in excess of retained earnings (251,926) (188,046) Accumulated other comprehensive (loss) income (4,565) 10,206 Total stockholders’ equity 1,446,012 1,330,971 Noncontrolling interests 6,554 7,161 Total equity 1,452,566 1,338,132 Total liabilities and equity $ 2,614,196 $ 2,259,346

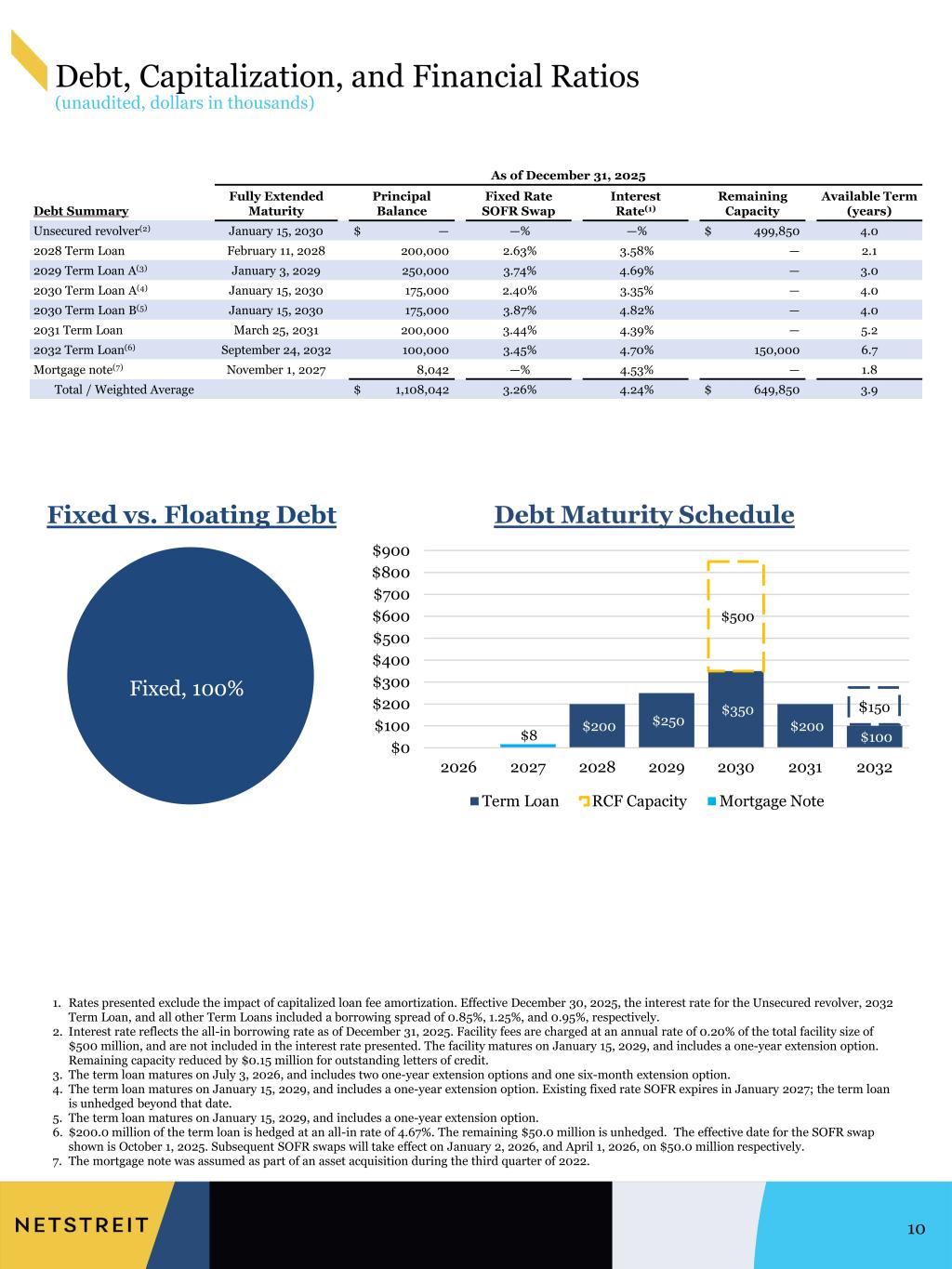

Debt, Capitalization, and Financial Ratios (unaudited, dollars in thousands) 10 As of December 31, 2025 Debt Summary Fully Extended Maturity Principal Balance Fixed Rate SOFR Swap Interest Rate(1) Remaining Capacity Available Term (years) Unsecured revolver(2) January 15, 2030 $ — —% —% $ 499,850 4.0 2028 Term Loan February 11, 2028 200,000 2.63% 3.58% — 2.1 2029 Term Loan A(3) January 3, 2029 250,000 3.74% 4.69% — 3.0 2030 Term Loan A(4) January 15, 2030 175,000 2.40% 3.35% — 4.0 2030 Term Loan B(5) January 15, 2030 175,000 3.87% 4.82% — 4.0 2031 Term Loan March 25, 2031 200,000 3.44% 4.39% — 5.2 2032 Term Loan(6) September 24, 2032 100,000 3.45% 4.70% 150,000 6.7 Mortgage note(7) November 1, 2027 8,042 —% 4.53% — 1.8 Total / Weighted Average $ 1,108,042 3.26% 4.24% $ 649,850 3.9 1. Rates presented exclude the impact of capitalized loan fee amortization. Effective December 30, 2025, the interest rate for the Unsecured revolver, 2032 Term Loan, and all other Term Loans included a borrowing spread of 0.85%, 1.25%, and 0.95%, respectively. 2. Interest rate reflects the all-in borrowing rate as of December 31, 2025. Facility fees are charged at an annual rate of 0.20% of the total facility size of $500 million, and are not included in the interest rate presented. The facility matures on January 15, 2029, and includes a one-year extension option. Remaining capacity reduced by $0.15 million for outstanding letters of credit. 3. The term loan matures on July 3, 2026, and includes two one-year extension options and one six-month extension option. 4. The term loan matures on January 15, 2029, and includes a one-year extension option. Existing fixed rate SOFR expires in January 2027; the term loan is unhedged beyond that date. 5. The term loan matures on January 15, 2029, and includes a one-year extension option. 6. $200.0 million of the term loan is hedged at an all-in rate of 4.67%. The remaining $50.0 million is unhedged. The effective date for the SOFR swap shown is October 1, 2025. Subsequent SOFR swaps will take effect on January 2, 2026, and April 1, 2026, on $50.0 million respectively. 7. The mortgage note was assumed as part of an asset acquisition during the third quarter of 2022. Fixed vs. Floating Debt Fixed, 100% $200 $250 $350 $500 $200 $100 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2026 2027 2028 2029 2030 2031 2032 Debt Maturity Schedule Term Loan RCF Capacity Mortgage Note $8 $150

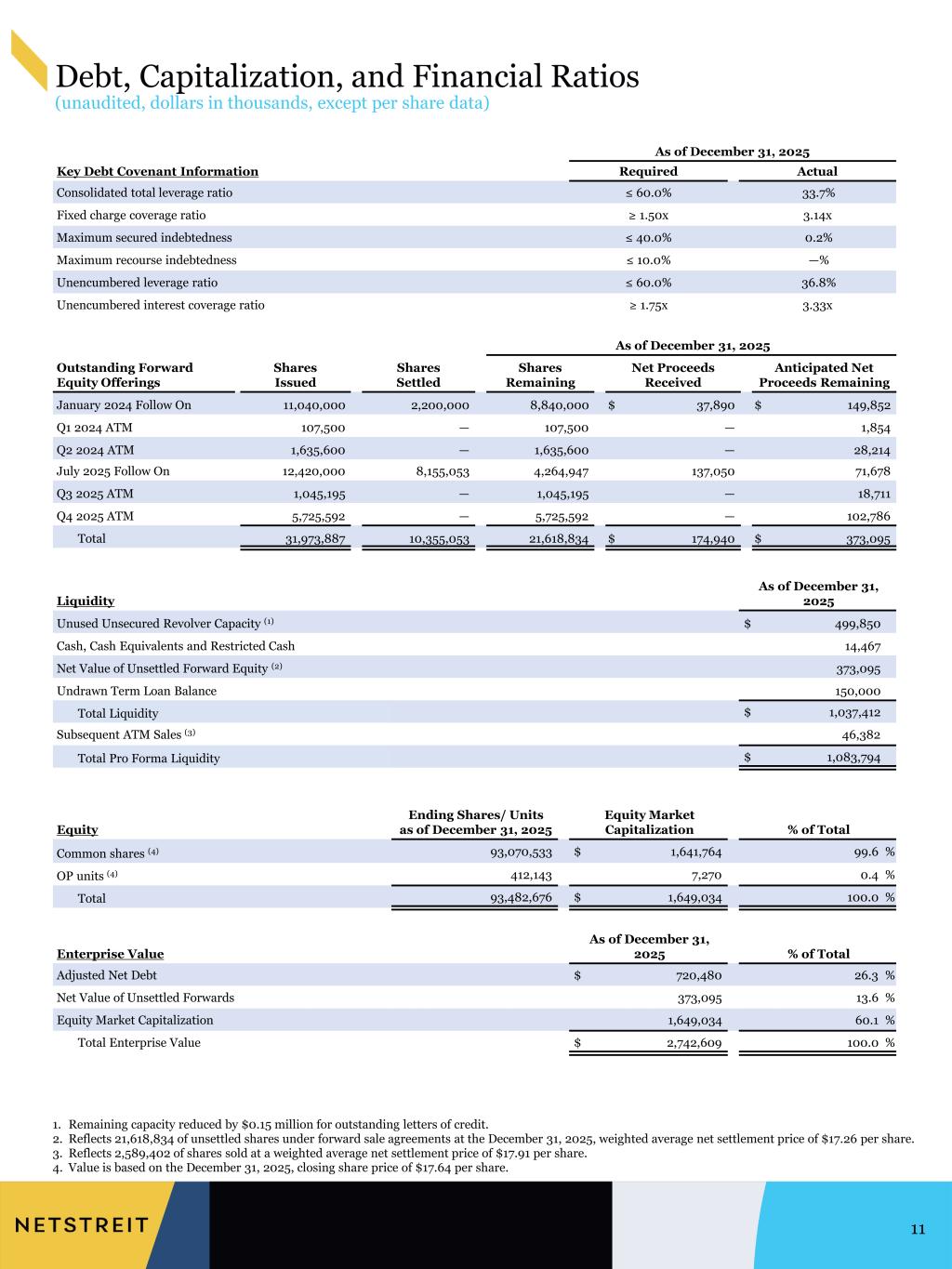

1. Remaining capacity reduced by $0.15 million for outstanding letters of credit. 2. Reflects 21,618,834 of unsettled shares under forward sale agreements at the December 31, 2025, weighted average net settlement price of $17.26 per share. 3. Reflects 2,589,402 of shares sold at a weighted average net settlement price of $17.91 per share. 4. Value is based on the December 31, 2025, closing share price of $17.64 per share. Debt, Capitalization, and Financial Ratios (unaudited, dollars in thousands, except per share data) 11 As of December 31, 2025 Key Debt Covenant Information Required Actual Consolidated total leverage ratio ≤ 60.0% 33.7% Fixed charge coverage ratio ≥ 1.50x 3.14x Maximum secured indebtedness ≤ 40.0% 0.2% Maximum recourse indebtedness ≤ 10.0% —% Unencumbered leverage ratio ≤ 60.0% 36.8% Unencumbered interest coverage ratio ≥ 1.75x 3.33x Liquidity As of December 31, 2025 Unused Unsecured Revolver Capacity (1) $ 499,850 Cash, Cash Equivalents and Restricted Cash 14,467 Net Value of Unsettled Forward Equity (2) 373,095 Undrawn Term Loan Balance 150,000 Total Liquidity $ 1,037,412 Subsequent ATM Sales (3) 46,382 Total Pro Forma Liquidity $ 1,083,794 Equity Ending Shares/ Units as of December 31, 2025 Equity Market Capitalization % of Total Common shares (4) 93,070,533 $ 1,641,764 99.6 % OP units (4) 412,143 7,270 0.4 % Total 93,482,676 $ 1,649,034 100.0 % Enterprise Value As of December 31, 2025 % of Total Adjusted Net Debt $ 720,480 26.3 % Net Value of Unsettled Forwards 373,095 13.6 % Equity Market Capitalization 1,649,034 60.1 % Total Enterprise Value $ 2,742,609 100.0 % As of December 31, 2025 Outstanding Forward Equity Offerings Shares Issued Shares Settled Shares Remaining Net Proceeds Received Anticipated Net Proceeds Remaining January 2024 Follow On 11,040,000 2,200,000 8,840,000 $ 37,890 $ 149,852 Q1 2024 ATM 107,500 — 107,500 — 1,854 Q2 2024 ATM 1,635,600 — 1,635,600 — 28,214 July 2025 Follow On 12,420,000 8,155,053 4,264,947 137,050 71,678 Q3 2025 ATM 1,045,195 — 1,045,195 — 18,711 Q4 2025 ATM 5,725,592 — 5,725,592 — 102,786 Total 31,973,887 10,355,053 21,618,834 $ 174,940 $ 373,095

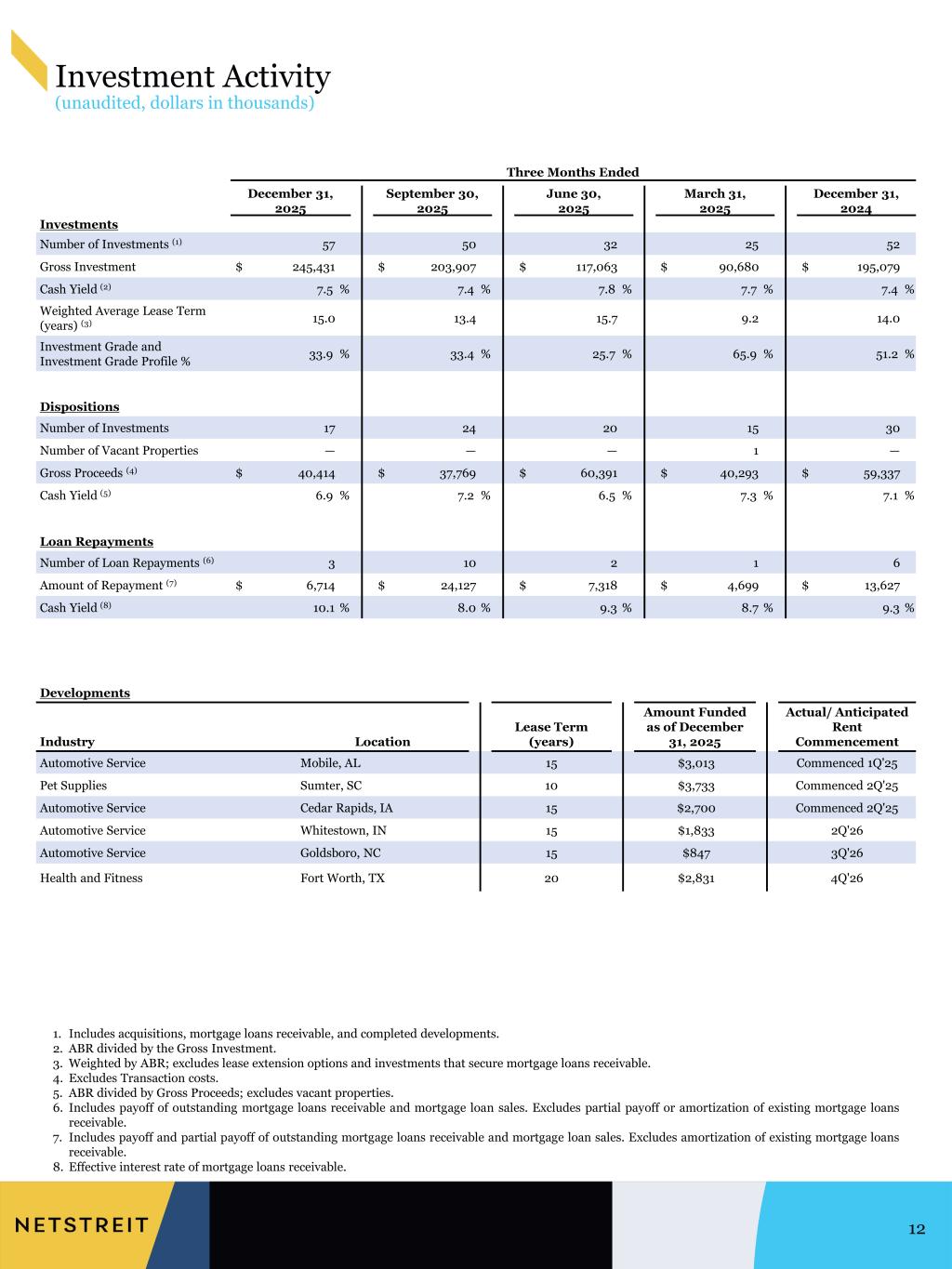

1. Includes acquisitions, mortgage loans receivable, and completed developments. 2. ABR divided by the Gross Investment. 3. Weighted by ABR; excludes lease extension options and investments that secure mortgage loans receivable. 4. Excludes Transaction costs. 5. ABR divided by Gross Proceeds; excludes vacant properties. 6. Includes payoff of outstanding mortgage loans receivable and mortgage loan sales. Excludes partial payoff or amortization of existing mortgage loans receivable. 7. Includes payoff and partial payoff of outstanding mortgage loans receivable and mortgage loan sales. Excludes amortization of existing mortgage loans receivable. 8. Effective interest rate of mortgage loans receivable. Investment Activity (unaudited, dollars in thousands) 12 Three Months Ended December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 Investments Number of Investments (1) 57 50 32 25 52 Gross Investment $ 245,431 $ 203,907 $ 117,063 $ 90,680 $ 195,079 Cash Yield (2) 7.5 % 7.4 % 7.8 % 7.7 % 7.4 % Weighted Average Lease Term (years) (3) 15.0 13.4 15.7 9.2 14.0 Investment Grade and Investment Grade Profile % 33.9 % 33.4 % 25.7 % 65.9 % 51.2 % Dispositions Number of Investments 17 24 20 15 30 Number of Vacant Properties — — — 1 — Gross Proceeds (4) $ 40,414 $ 37,769 $ 60,391 $ 40,293 $ 59,337 Cash Yield (5) 6.9 % 7.2 % 6.5 % 7.3 % 7.1 % Loan Repayments Number of Loan Repayments (6) 3 10 2 1 6 Amount of Repayment (7) $ 6,714 $ 24,127 $ 7,318 $ 4,699 $ 13,627 Cash Yield (8) 10.1 % 8.0 % 9.3 % 8.7 % 9.3 % Developments Industry Location Lease Term (years) Amount Funded as of December 31, 2025 Actual/ Anticipated Rent Commencement Automotive Service Mobile, AL 15 $3,013 Commenced 1Q'25 Pet Supplies Sumter, SC 10 $3,733 Commenced 2Q'25 Automotive Service Cedar Rapids, IA 15 $2,700 Commenced 2Q'25 Automotive Service Whitestown, IN 15 $1,833 2Q'26 Automotive Service Goldsboro, NC 15 $847 3Q'26 Health and Fitness Fort Worth, TX 20 $2,831 4Q'26

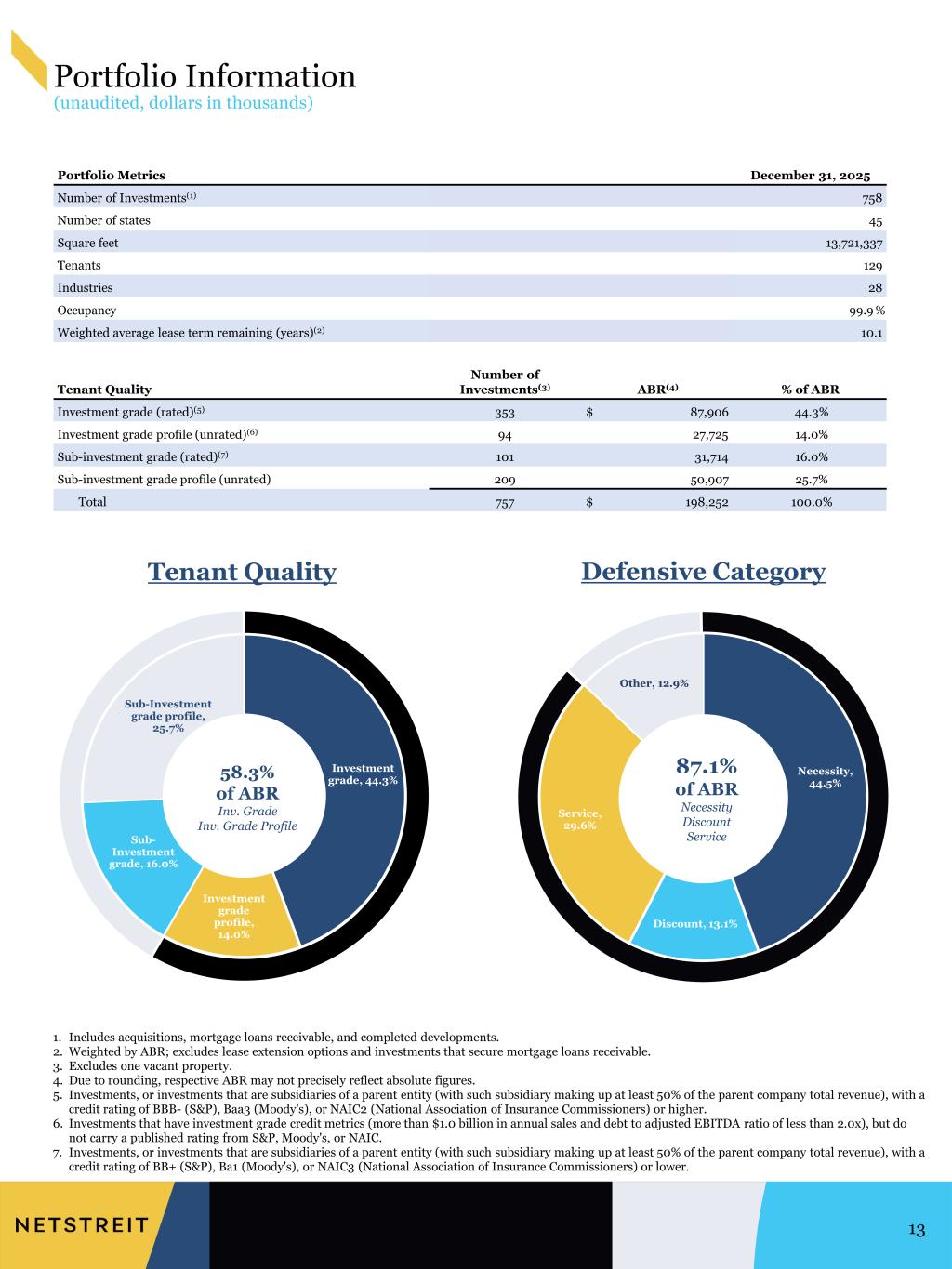

Tenant Quality Portfolio Information (unaudited, dollars in thousands) 13 1. Includes acquisitions, mortgage loans receivable, and completed developments. 2. Weighted by ABR; excludes lease extension options and investments that secure mortgage loans receivable. 3. Excludes one vacant property. 4. Due to rounding, respective ABR may not precisely reflect absolute figures. 5. Investments, or investments that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BBB- (S&P), Baa3 (Moody's), or NAIC2 (National Association of Insurance Commissioners) or higher. 6. Investments that have investment grade credit metrics (more than $1.0 billion in annual sales and debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, or NAIC. 7. Investments, or investments that are subsidiaries of a parent entity (with such subsidiary making up at least 50% of the parent company total revenue), with a credit rating of BB+ (S&P), Ba1 (Moody's), or NAIC3 (National Association of Insurance Commissioners) or lower. Portfolio Metrics December 31, 2025 Number of Investments(1) 758 Number of states 45 Square feet 13,721,337 Tenants 129 Industries 28 Occupancy 99.9 % Weighted average lease term remaining (years)(2) 10.1 Tenant Quality Number of Investments(3) ABR(4) % of ABR Investment grade (rated)(5) 353 $ 87,906 44.3% Investment grade profile (unrated)(6) 94 27,725 14.0% Sub-investment grade (rated)(7) 101 31,714 16.0% Sub-investment grade profile (unrated) 209 50,907 25.7% Total 757 $ 198,252 100.0% Necessity, 44.5% Discount, 13.1% Service, 29.6% Other, 12.9% Defensive Category Investment grade, 44.3% Investment grade profile, 14.0% Sub- Investment grade, 16.0% Sub-Investment grade profile, 25.7% 58.3% of ABR Inv. Grade Inv. Grade Profile 87.1% of ABR Necessity Discount Service

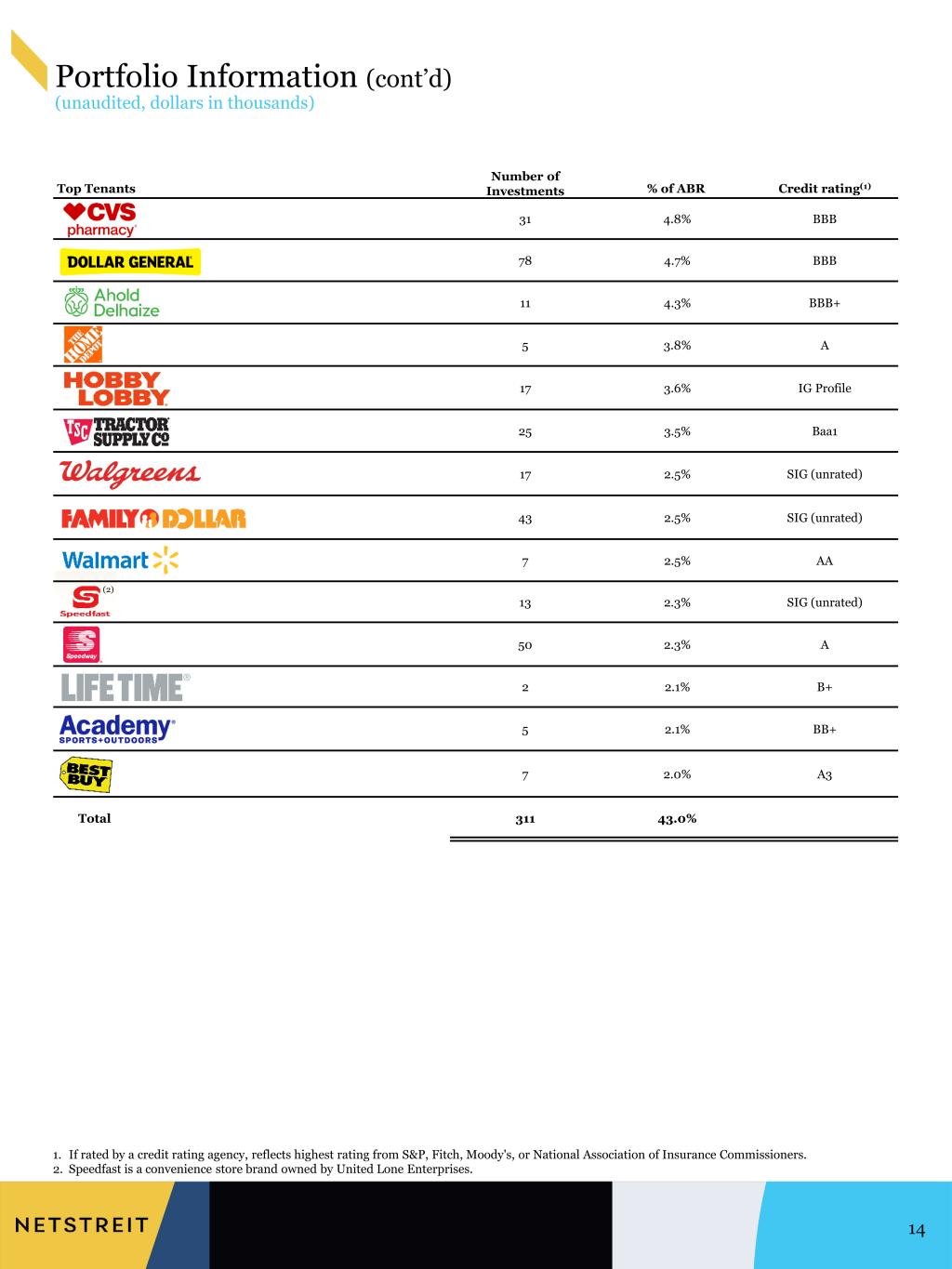

Portfolio Information (cont’d) (unaudited, dollars in thousands) 14 1. If rated by a credit rating agency, reflects highest rating from S&P, Fitch, Moody's, or National Association of Insurance Commissioners. 2. Speedfast is a convenience store brand owned by United Lone Enterprises. Top Tenants Number of Investments % of ABR Credit rating(1) CVS 31 4.8% BBB Dollar General 78 4.7% BBB Ahold Delhaize – Food Lion / Stop & Shop 11 4.3% BBB+ Home Depot 5 3.8% A Hobby Lobby 17 3.6% IG Profile Tractor Supply 25 3.5% Baa1 Walgreens 17 2.5% SIG (unrated) Family Dollar 43 2.5% SIG (unrated) Sam's / Walmart 7 2.5% AA r 13 2.3% SIG (unrated) Speedway 50 2.3% A 2 2.1% B+ Academy Sports 5 2.1% BB+ Best Buy 7 2.0% A3 Total 311 43.0% (2)

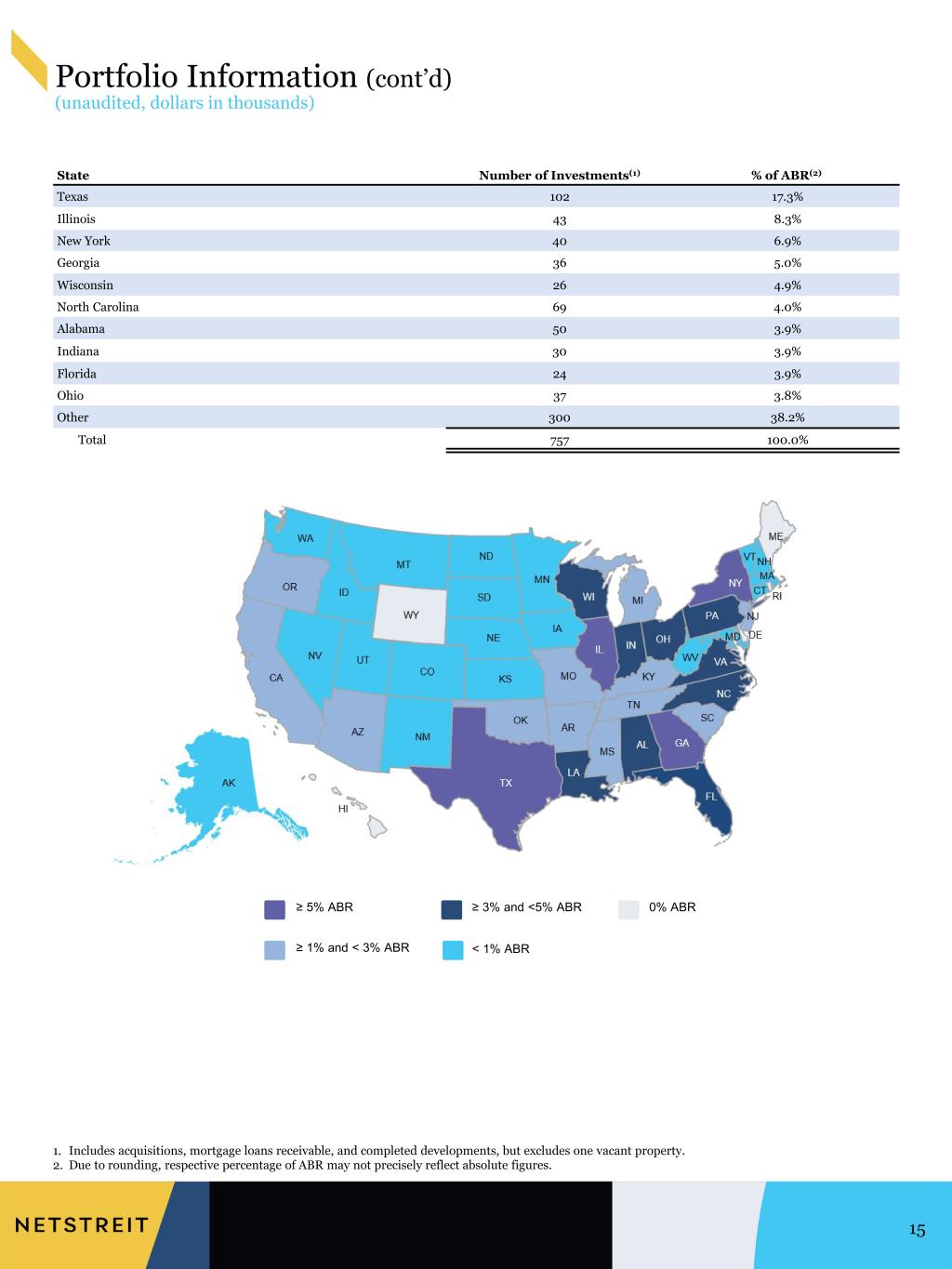

Portfolio Information (cont’d) (unaudited, dollars in thousands) 15 State Number of Investments(1) % of ABR(2) Texas 102 17.3% Illinois 43 8.3% New York 40 6.9% Georgia 36 5.0% Wisconsin 26 4.9% North Carolina 69 4.0% Alabama 50 3.9% Indiana 30 3.9% Florida 24 3.9% Ohio 37 3.8% Other 300 38.2% Total 757 100.0% 1. Includes acquisitions, mortgage loans receivable, and completed developments, but excludes one vacant property. 2. Due to rounding, respective percentage of ABR may not precisely reflect absolute figures. ≥ 5% ABR ≥ 1% and < 3% ABR ≥ 3% and <5% ABR < 1% ABR 0% ABR

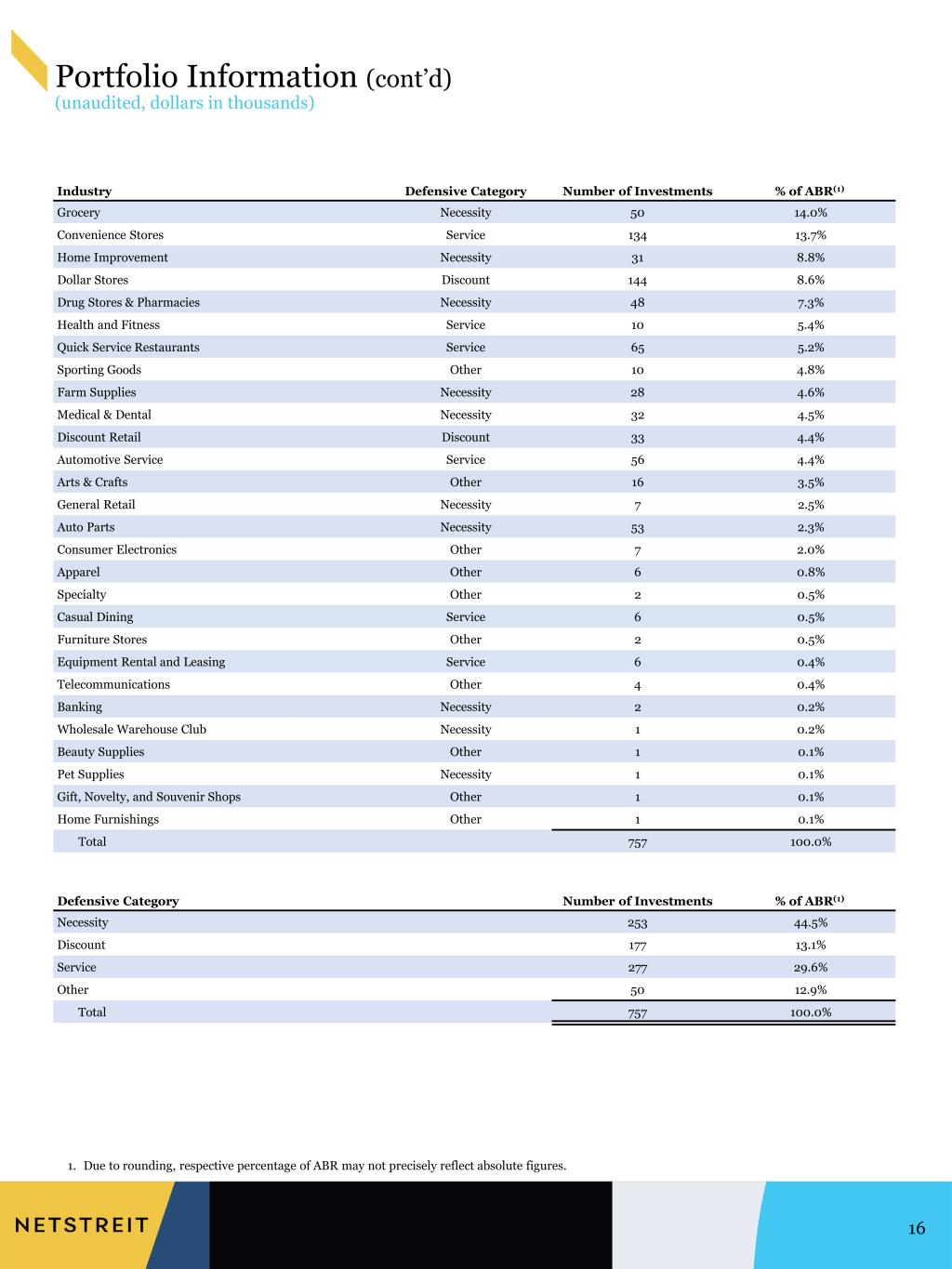

Portfolio Information (cont’d) (unaudited, dollars in thousands) 16 Industry Defensive Category Number of Investments % of ABR(1) Grocery Necessity 50 14.0% Convenience Stores Service 134 13.7% Home Improvement Necessity 31 8.8% Dollar Stores Discount 144 8.6% Drug Stores & Pharmacies Necessity 48 7.3% Health and Fitness Service 10 5.4% Quick Service Restaurants Service 65 5.2% Sporting Goods Other 10 4.8% Farm Supplies Necessity 28 4.6% Medical & Dental Necessity 32 4.5% Discount Retail Discount 33 4.4% Automotive Service Service 56 4.4% Arts & Crafts Other 16 3.5% General Retail Necessity 7 2.5% Auto Parts Necessity 53 2.3% Consumer Electronics Other 7 2.0% Apparel Other 6 0.8% Specialty Other 2 0.5% Casual Dining Service 6 0.5% Furniture Stores Other 2 0.5% Equipment Rental and Leasing Service 6 0.4% Telecommunications Other 4 0.4% Banking Necessity 2 0.2% Wholesale Warehouse Club Necessity 1 0.2% Beauty Supplies Other 1 0.1% Pet Supplies Necessity 1 0.1% Gift, Novelty, and Souvenir Shops Other 1 0.1% Home Furnishings Other 1 0.1% Total 757 100.0% Defensive Category Number of Investments % of ABR(1) Necessity 253 44.5% Discount 177 13.1% Service 277 29.6% Other 50 12.9% Total 757 100.0% 1. Due to rounding, respective percentage of ABR may not precisely reflect absolute figures.

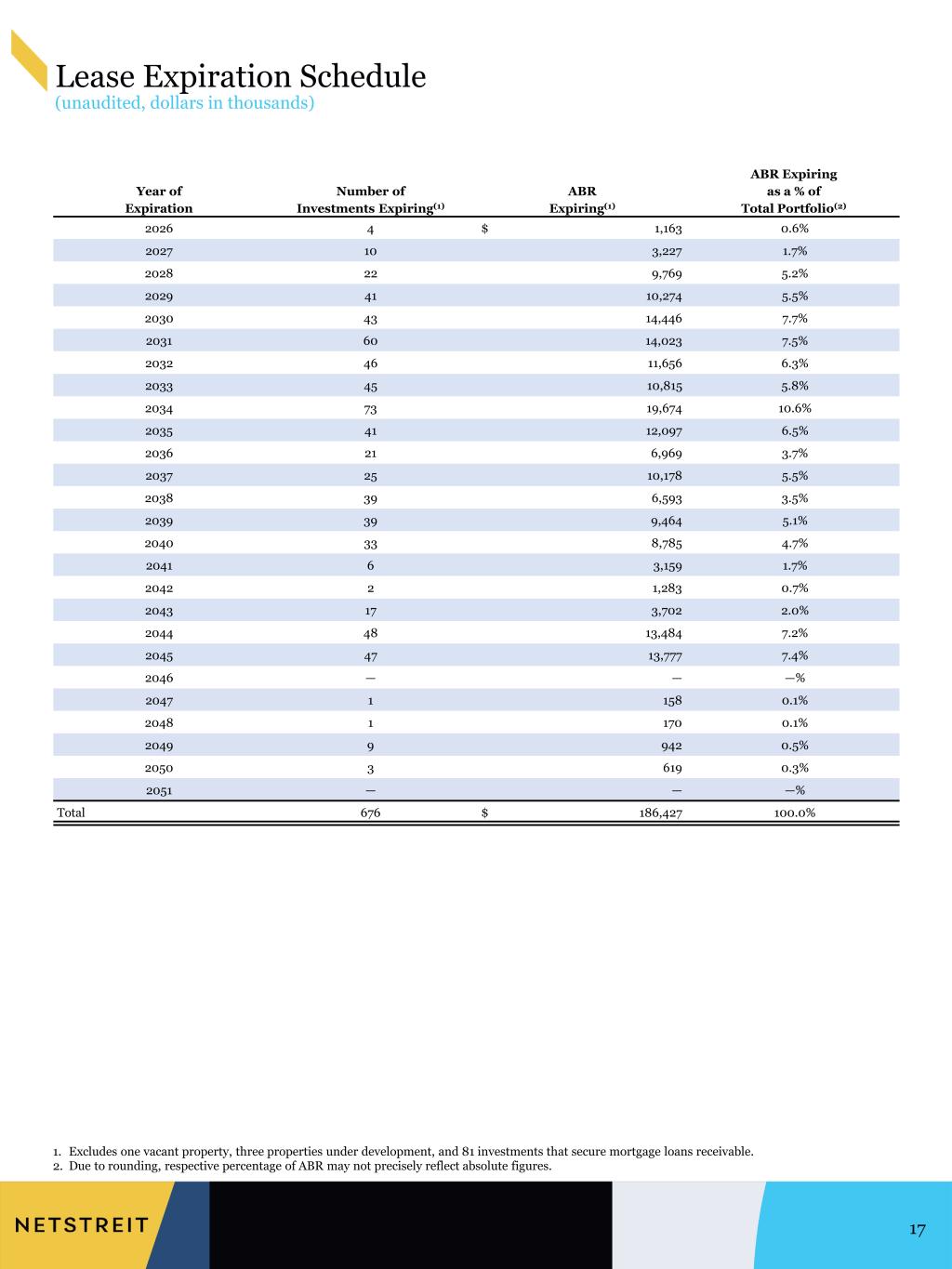

Lease Expiration Schedule (unaudited, dollars in thousands) 17 ABR Expiring Year of Number of ABR as a % of Expiration Investments Expiring(1) Expiring(1) Total Portfolio(2) 2026 4 $ 1,163 0.6% 2027 10 3,227 1.7% 2028 22 9,769 5.2% 2029 41 10,274 5.5% 2030 43 14,446 7.7% 2031 60 14,023 7.5% 2032 46 11,656 6.3% 2033 45 10,815 5.8% 2034 73 19,674 10.6% 2035 41 12,097 6.5% 2036 21 6,969 3.7% 2037 25 10,178 5.5% 2038 39 6,593 3.5% 2039 39 9,464 5.1% 2040 33 8,785 4.7% 2041 6 3,159 1.7% 2042 2 1,283 0.7% 2043 17 3,702 2.0% 2044 48 13,484 7.2% 2045 47 13,777 7.4% 2046 — — —% 2047 1 158 0.1% 2048 1 170 0.1% 2049 9 942 0.5% 2050 3 619 0.3% 2051 — — —% Total 676 $ 186,427 100.0% 1. Excludes one vacant property, three properties under development, and 81 investments that secure mortgage loans receivable. 2. Due to rounding, respective percentage of ABR may not precisely reflect absolute figures.

Non-GAAP Measures and Definitions 18 FFO, Core FFO, and AFFO The National Association of Real Estate Investment Trusts (“NAREIT”), an industry trade group, has promulgated a widely accepted non-GAAP financial measure of operating performance known as FFO. Our FFO is net income in accordance with GAAP, excluding gains (or losses) resulting from dispositions of properties, plus depreciation and amortization and impairment charges on depreciable real property. Core FFO is a non-GAAP financial measure defined as FFO adjusted to remove the effect of unusual and non-recurring items that are not expected to impact our operating performance or operations on an ongoing basis. These include non-recurring executive transition costs, severance and related charges, other non- recurring losses (gains), and debt related transaction costs. AFFO is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non- cash revenues and expenses, such as straight-line rent, amortization of above- and below-market lease- related intangibles, amortization of lease incentives, capitalized interest expense and earned development interest, non-cash interest expense, non-cash compensation expense, amortization of deferred financing costs, amortization of above/below-market assumed debt, and amortization of loan origination costs. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance. We further consider FFO, Core FFO, and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO, and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO, and AFFO to be alternatives to net income as a reliable measure of our operating performance nor should you consider FFO, Core FFO, and AFFO to be alternatives to cash flows from operating, investing, or financing activities (as defined by GAAP) as measures of liquidity. FFO, Core FFO, and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including debt service obligations, capital improvements, and distributions to stockholders. FFO, Core FFO, and AFFO do not represent cash flows from operating, investing, or financing activities as defined by GAAP. Further, FFO, Core FFO, and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO, and AFFO.

Non-GAAP Measures and Definitions (cont’d) 19 EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre We compute EBITDA as earnings before interest expense, income tax expense, and depreciation and amortization. In 2017, NAREIT issued a white paper recommending that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and impairment charges on depreciable real property. Adjusted EBITDAre is a non-GAAP financial measure defined as EBITDAre further adjusted to exclude straight-line rent, non-cash compensation expense, non-recurring executive transition costs, severance and related charges, debt related transaction costs, transaction costs, other non-recurring loss (gain), net, other non-recurring expenses (income) including lease termination fees, as well as adjustments for construction in process and for intraquarter activities. Annualized Adjusted EBITDAre is Adjusted EBITDAre multiplied by four. We present EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre as measures of our operating performance and not as measures of liquidity. EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs. Net Debt, Adjusted Net Debt, and Pro Forma Adjusted Net Debt We calculate Net Debt as the principal amount of our total debt outstanding, excluding deferred financing costs, net discounts, and debt issuance costs, less cash, cash equivalents, and restricted cash available for future investment. We then adjust Net Debt by the net value of unsettled forward equity as of period end to derive Adjusted Net Debt. Further, we adjust Adjusted Net Debt by the value of any unsettled forward equity and at-the-market sales occurring subsequent to the period to derive Pro Forma Adjusted Net Debt. We believe excluding cash, cash equivalents, and restricted cash available for future investment from the principal amount of our total debt outstanding, together with the exclusion of the net value of unsettled forward equity as of period end and the net value of unsettled forward equity and at-the-market sales subsequent to the period, all of which could be used to repay debt, provides a useful estimate of the net contractual amount of borrowed capital to be repaid. We believe these adjustments are additional beneficial disclosures to investors and analysts. Enterprise Value We calculate Enterprise Value as the sum of our Adjusted Net Debt, market value of unsettled forwards, and equity market capitalization as of period end.

Non-GAAP Measures and Definitions (cont’d) 20 Property-Level NOI, Property-Level Cash NOI, and Property-Level Cash NOI - Estimated Run Rate Property-Level NOI, Property-Level Cash NOI, and Property-Level Cash NOI - Estimated Run Rate are non- GAAP financial measures which we use to assess our operating results. We compute Property-Level NOI as net income (computed in accordance with GAAP), excluding general and administrative expenses, interest expense, net, income tax expense, amortization of loan origination costs and discounts, transaction costs, depreciation and amortization, gains (or losses) on sales of depreciable property, real estate impairment losses, interest income on mortgage loans receivable, debt related transaction costs, and other expense (income), net, including lease termination fees. We further adjust Property-Level NOI for non-cash revenue components of straight-line rent and amortization of lease-intangibles to derive Property-Level Cash NOI. We further adjust Property-Level Cash NOI for intraquarter acquisitions, dispositions, and completed development to derive Property-Level Cash NOI - Estimated Run Rate. We believe Property-Level NOI, Property-Level Cash NOI, and Property-Level Cash NOI - Estimated Run Rate provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis. Property-Level NOI, Property-Level Cash NOI, and Property-Level Cash NOI - Estimated Run Rate are not measurements of financial performance under GAAP and may not be comparable to similarly titled measures of other companies. You should not consider our measures as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Other Definitions ABR is annualized base rent for all leases that commenced and annualized cash interest for all executed mortgage loans as of December 31, 2025. Cash Yield is the annualized base rent contractually due from acquired properties and completed developments, and interest income from mortgage loans receivable, divided by the gross investment amount, gross proceeds in the case of dispositions, or loan repayment amount. Defensive Category is considered by us to represent tenants that focus on necessity goods and essential services in the retail sector, including discount stores, grocers, drug stores and pharmacies, home improvement, automotive service and quick-service restaurants, which we refer to as defensive retail industries. The defensive sub-categories as we define them are as follows: (1) Necessity, which are retailers that are considered essential by consumers and include sectors such as drug stores, grocers and home improvement, (2) Discount, which are retailers that offer a low price point and consist of off-price and dollar stores, (3) Service, which consist of retailers that provide services rather than goods, including, tire and auto services and quick service restaurants, and (4) Other, which are retailers that are not considered defensive in terms of being considered necessity, discount or service, as defined by us. Investments are lease agreements in place at owned properties, properties that have leases associated with mortgage loans receivable, developments where rent commenced, interest earning developments, or in the case of master lease arrangements each property under the master lease is counted as a separate lease. Occupancy is expressed as a percentage, and it is the number of leased investments divided by the total number of investments owned, excluding properties under development. OP Units means operating partnership units not held by NETSTREIT. Weighted Average Lease Term is weighted by the annualized base rent, excluding lease extension options and investments associated with mortgage loans receivable.

Forward-Looking and Cautionary Statements 21 This supplemental report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities, including estimated development costs, and trends in our business, including trends in the market for single-tenant, retail commercial real estate. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this supplemental report may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on February 24, 2025 and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this supplemental report. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from macroeconomic conditions, including inflation, interest rates and instability in the banking system. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.