.2 Transaction & Company Overview November 2025

DISCLAIMERS The information contained in this presentation has been prepared by Damora Therapeutics, Inc. and its affiliates (“Damora” or the “Company”) and contains information pertaining to the business and operations of the Company. The information contained in this presentation: (a) is provided as at the date hereof, is subject to change without notice, and is based on publicly available information, internally developed data as well as third party information from other sources; (b) does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in the Company; (c) is not to be considered as a recommendation by the Company that any person make an investment in the Company; (d) is for information purposes only and shall not constitute an offer to buy, sell, issue or subscribe for, or the solicitation of an offer to buy, sell or issue, or subscribe for any securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful. Where any opinion or belief is expressed in this presentation, it is based on certain assumptions and limitations and is an expression of present opinion or belief only. This presentation should not be construed as legal, financial or tax advice to any individual, as each individual’s circumstances are different. This document is for informational purposes only and should not be considered a solicitation or recommendation to purchase, sell or hold a security. Forward-Looking Statements and Other Information Certain information set forth in this presentation contains “forward-looking statements” within the meaning of applicable United States securities legislation. Except for statements of historical fact, certain information contained herein constitutes forward- looking statements which include but are not limited to statements regarding: our business strategy, including our ability to develop best-in-class therapeutics to address the full mutant CALR-driven myeloproliferative neoplasm disease spectrum that meaningfully improve both efficacy and convenience compared to INCA033989; the efficacy, safety profile, dosing regime, convenience, and tolerability of DMR-001; Damora’s ongoing and future clinical development activities, including the expected timing of Phase 1 clinical proof-of-concept data for DMR-001, including the initiation of the first Phase 3 trial after proof-of-concept data, and plans for and timing of investigational new drug applications for DMR-002 and DMR-003; estimated market sizes, potential growth opportunities, potential value creation and sample transactions; the length of time that the Company believes its existing cash resources will fund its operations, including expectations of cash runway extending into 2029; and management’s assessment of future plans and operations which are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Forward-looking statements can often be identified by the use of words such as “may”, “will”, “could”, “would”, “anticipate”, “believe”, “expect”, “intend”, “potential”, “estimate”, “scheduled”, “plans”, “planned”, “forecasts”, “goals” and similar expressions or the negatives thereof. Forward-looking statements are neither historical facts nor assurances of future performance. Forward-looking statements are based on a number of factors and assumptions made by management and considered reasonable at the time such information is provided, and forward- looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements, including uncertainties and risks arising from regulatory feedback, including potential disagreement by regulatory authorities with our clinical trial design, interpretation of data and our ongoing or planned clinical trials for our product candidates; the expected or potential impact of macroeconomic conditions, including inflationary pressures, rising interest rates, general economic slowdown or a recession, changes in tariff/trade and monetary policy, volatile market conditions, financial institution instability, as well as geopolitical instability, including the ongoing military conflicts between Ukraine and Russia, conflicts in the Middle East, and geopolitical tensions between the United States and other countries, including China, on our operations; the implementation of changes in law, tariffs, sanctions, export or import controls, and other government measures that could impact our business operations, including restricting international trade by the United States, China or other countries and the BIOSECURE Act or similar act if passed into law; the impacts of adverse events or disappointing results in clinical trials of third parties, including our competitors developing product candidates that target similar mechanisms of action and/or indications as our product candidates; and those uncertainties and factors described under the heading “Risk Factors,” “Risk Factor Summary” and “Note about Forward-Looking Statements” in the Company’s most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that the Company has filed or will file with the SEC, as well as discussions of potential risks, uncertainties, and other filings by the Company from time to time, as well as risk factors associated with companies that operate in the biopharma industry, including those associated with the uncertainties of drug development. All of the forward-looking statements made in this presentation are qualified by these cautionary statements and other cautionary statements or other factors contained herein. Although management believes that the expectations conveyed by forward-looking statements herein are reasonable based on information available on the date such forward-looking statements are made, there can be no assurance that forward looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The forward-looking statements contained herein are presented for the purposes of assisting readers in understanding the Company’s plan, objectives and goals and may not be appropriate for other purposes. The reader is cautioned not to place undue reliance on forward-looking statements. Market and Industry Data Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications and other data obtained from third-party sources as well as our own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third party sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. Statements as to our market and competitive position data are based on market data currently available to us, as well as management’s internal analyses and assumptions regarding the Company, which involve certain assumptions and estimates. These internal analyses have not been verified by any independent sources and there can be no assurance that the assumptions or estimates are accurate. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors. As a result, we cannot guarantee the accuracy or completeness of such information contained in this presentation. 2 2

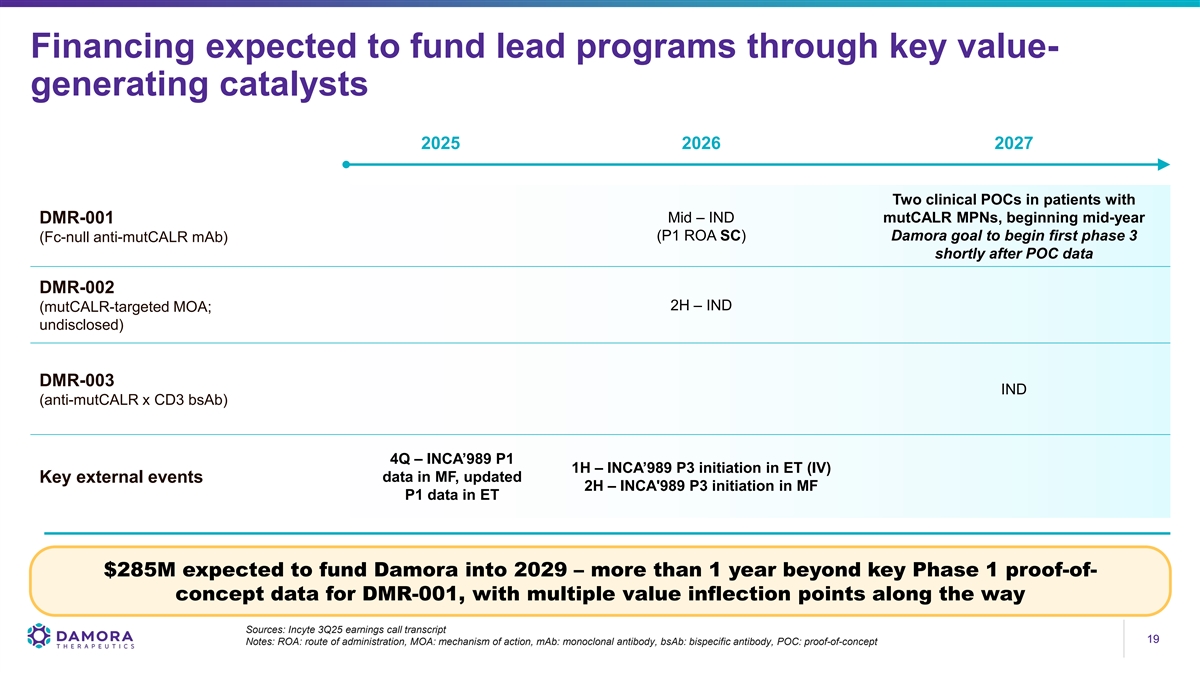

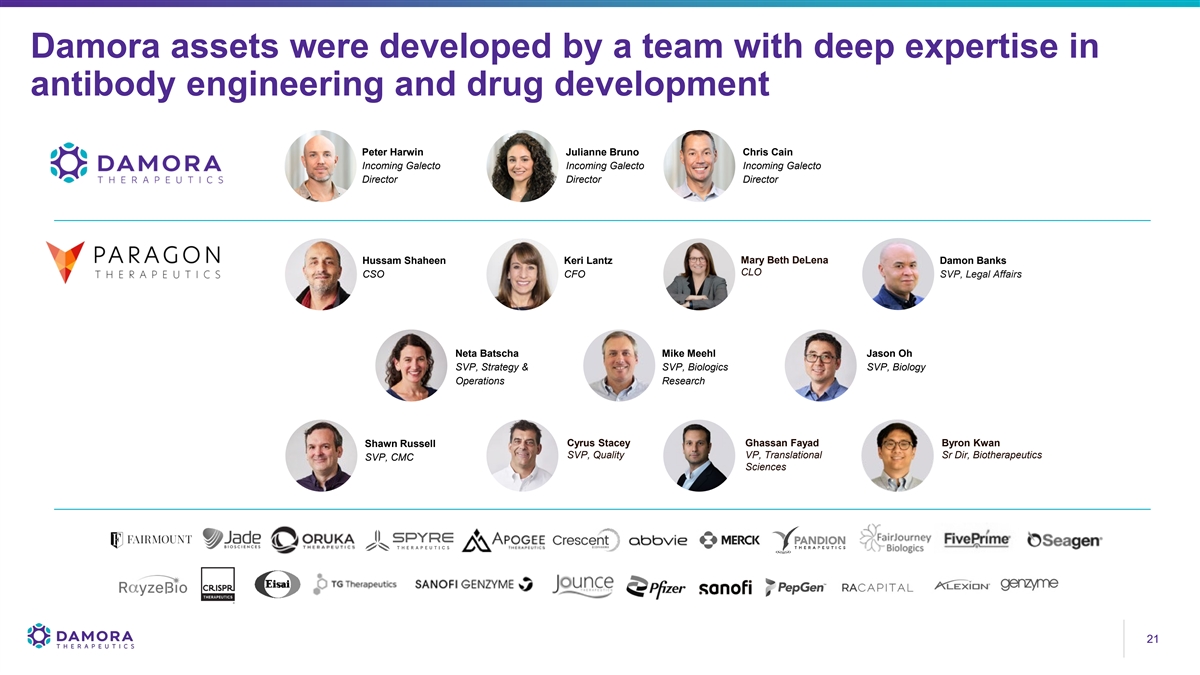

Transaction highlights Structure: The acquisition of Damora was structured as a stock-for-stock transaction whereby all of Damora’s outstanding equity interests were exchanged for a combination of shares of Galecto common stock and a newly created non-voting Series C convertible preferred stock. Financing: Concurrent with the acquisition of Damora, Galecto closed a $285 million private placement with a group of institutional accredited investors led by Fairmount and joined by a robust syndicate of dedicated biotechnology investors as well as additional undisclosed institutional investors. Management and BOD: Continuing leadership includes Hans Schambye, Matthew Kronmiller, Lori Firmani, and Garrett Winslow. Peter Harwin, Managing Member, Fairmount, Julie Bruno, Growth Partner, Fairmount, and Chris Cain, Director of Research, Fairmount, join Hans Schambye, Carl Goldfischer, Amit Munshi, and Jayson Dallas as directors. Primary use of proceeds: The proceeds from the private placement are expected to be primarily used to advance the Damora pipeline and deliver the following anticipated milestones: POC data for DMR-001 and DMR-002 and IND for DMR-003, and to fund business operations. Proceeds are expected to provide cash runway into 2029. 3 3

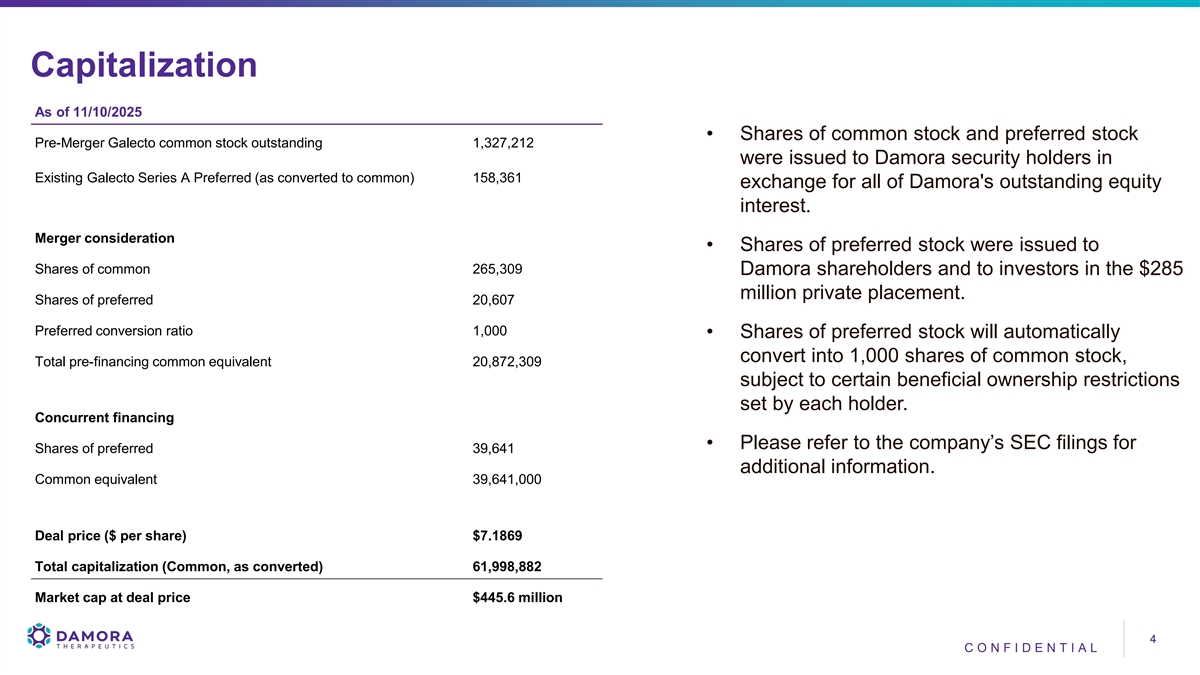

Capitalization As of 11/10/2025 • Shares of common stock and preferred stock Pre-Merger Galecto common stock outstanding 1,327,212 were issued to Damora security holders in Existing Galecto Series A Preferred (as converted to common) 158,361 exchange for all of Damora's outstanding equity interest. Merger consideration • Shares of preferred stock were issued to Shares of common 265,309 Damora shareholders and to investors in the $285 million private placement. Shares of preferred 20,607 Preferred conversion ratio 1,000 • Shares of preferred stock will automatically convert into 1,000 shares of common stock, Total pre-financing common equivalent 20,872,309 subject to certain beneficial ownership restrictions set by each holder. Concurrent financing • Please refer to the company’s SEC filings for Shares of preferred 39,641 additional information. Common equivalent 39,641,000 Deal price ($ per share) $7.1869 Total capitalization (Common, as converted) 61,998,882 Market cap at deal price $445.6 million 4 4 CO NF I DE NT I A L

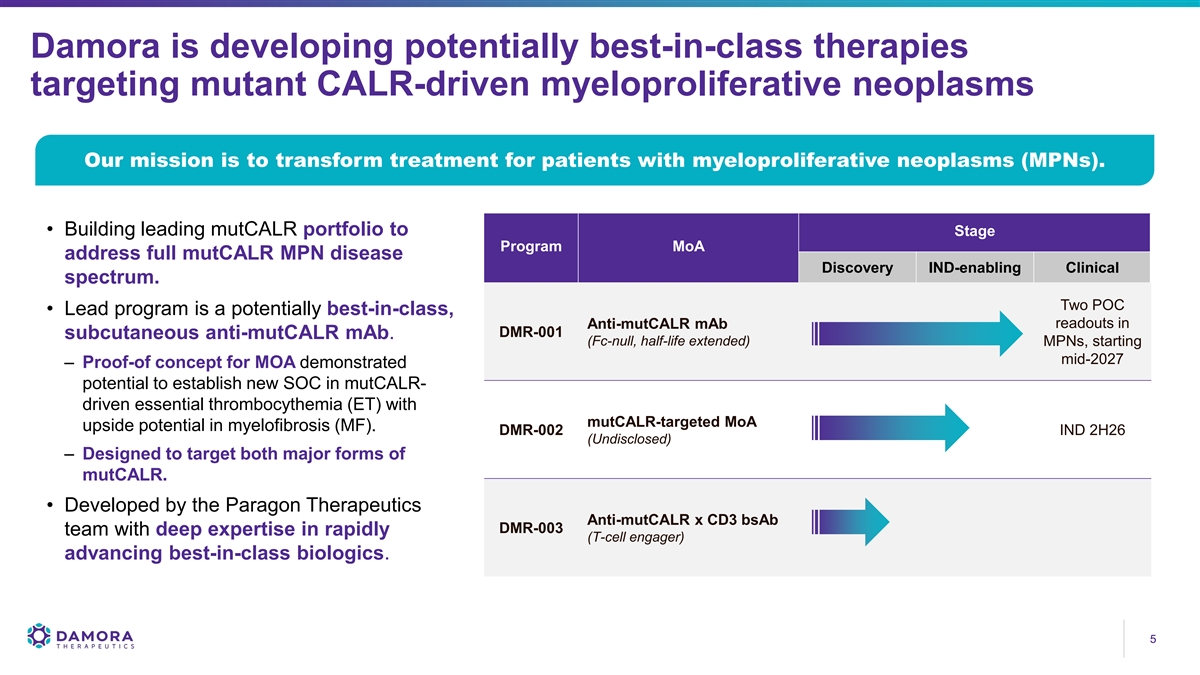

Damora is developing potentially best-in-class therapies targeting mutant CALR-driven myeloproliferative neoplasms Our mission is to transform treatment for patients with myeloproliferative neoplasms (MPNs). • Building leading mutCALR portfolio to Stage Program MoA address full mutCALR MPN disease Discovery IND-enabling Clinical spectrum. Two POC • Lead program is a potentially best-in-class, Anti-mutCALR mAb readouts in DMR-001 subcutaneous anti-mutCALR mAb. (Fc-null, half-life extended) MPNs, starting mid-2027 – Proof-of concept for MOA demonstrated potential to establish new SOC in mutCALR- driven essential thrombocythemia (ET) with mutCALR-targeted MoA upside potential in myelofibrosis (MF). DMR-002 IND 2H26 (Undisclosed) – Designed to target both major forms of mutCALR. • Developed by the Paragon Therapeutics Anti-mutCALR x CD3 bsAb DMR-003 team with deep expertise in rapidly (T-cell engager) advancing best-in-class biologics. 5 5

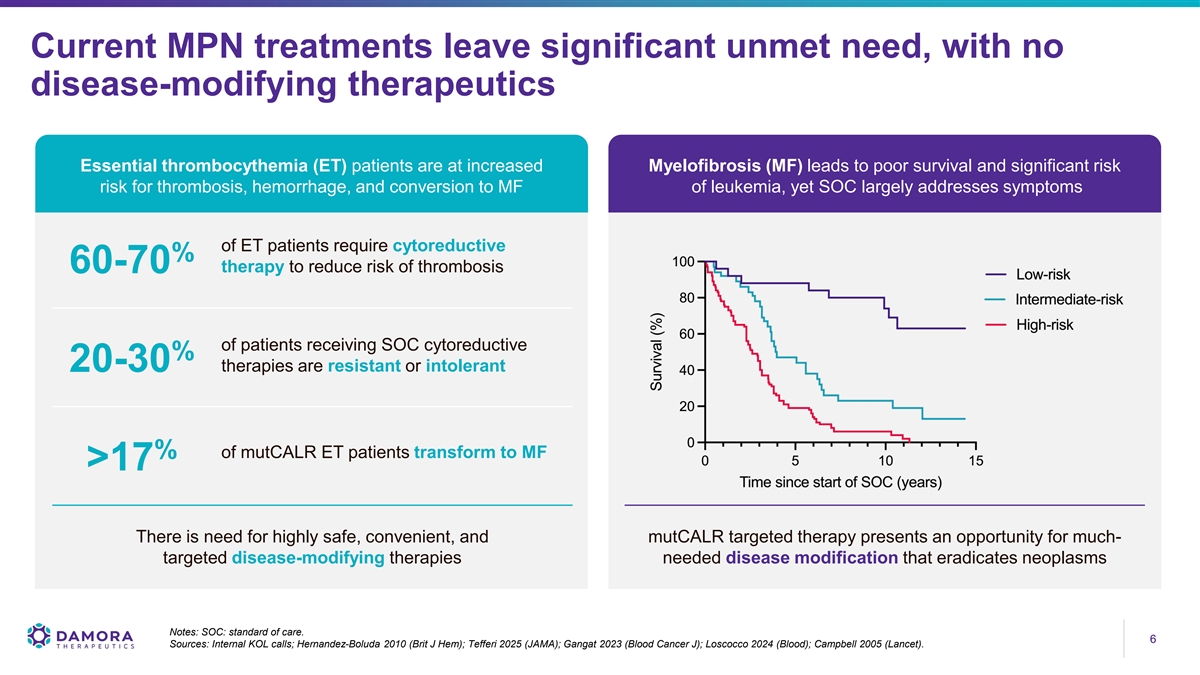

Current MPN treatments leave significant unmet need, with no disease-modifying therapeutics Essential thrombocythemia (ET) patients are at increased Myelofibrosis (MF) leads to poor survival and significant risk risk for thrombosis, hemorrhage, and conversion to MF of leukemia, yet SOC largely addresses symptoms of ET patients require cytoreductive % therapy to reduce risk of thrombosis 60-70 of patients receiving SOC cytoreductive % therapies are resistant or intolerant 20-30 % of mutCALR ET patients transform to MF >17 There is need for highly safe, convenient, and mutCALR targeted therapy presents an opportunity for much- targeted disease-modifying therapies needed disease modification that eradicates neoplasms Notes: SOC: standard of care. 6 6 Sources: Internal KOL calls; Hernandez-Boluda 2010 (Brit J Hem); Tefferi 2025 (JAMA); Gangat 2023 (Blood Cancer J); Loscocco 2024 (Blood); Campbell 2005 (Lancet).

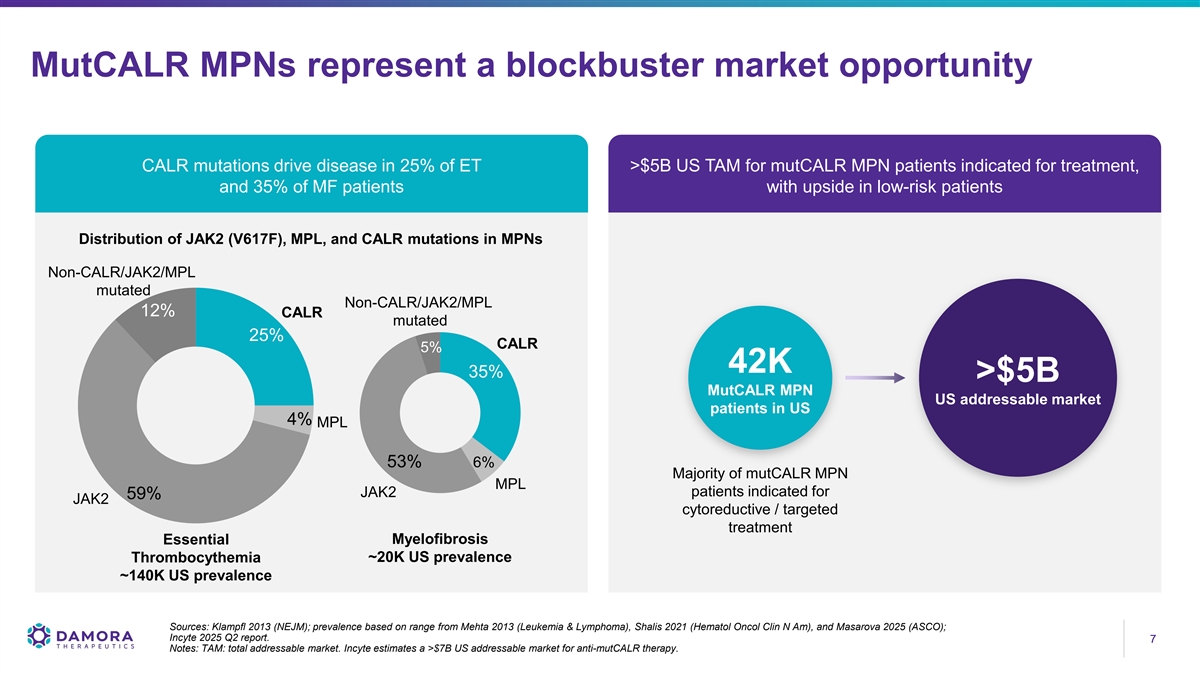

MutCALR MPNs represent a blockbuster market opportunity CALR mutations drive disease in 25% of ET >$5B US TAM for mutCALR MPN patients indicated for treatment, and 35% of MF patients with upside in low-risk patients Distribution of JAK2 (V617F), MPL, and CALR mutations in MPNs Non-CALR/JAK2/MPL mutated Non-CALR/JAK2/MPL 12% CALR mutated 25% CALR 5% 42K 35% >$5B MutCALR MPN US addressable market patients in US 4% MPL 53% 6% Majority of mutCALR MPN MPL patients indicated for JAK2 59% JAK2 cytoreductive / targeted treatment Myelofibrosis Essential Thrombocythemia ~20K US prevalence ~140K US prevalence Sources: Klampfl 2013 (NEJM); prevalence based on range from Mehta 2013 (Leukemia & Lymphoma), Shalis 2021 (Hematol Oncol Clin N Am), and Masarova 2025 (ASCO); Incyte 2025 Q2 report. 7 7 Notes: TAM: total addressable market. Incyte estimates a >$7B US addressable market for anti-mutCALR therapy.

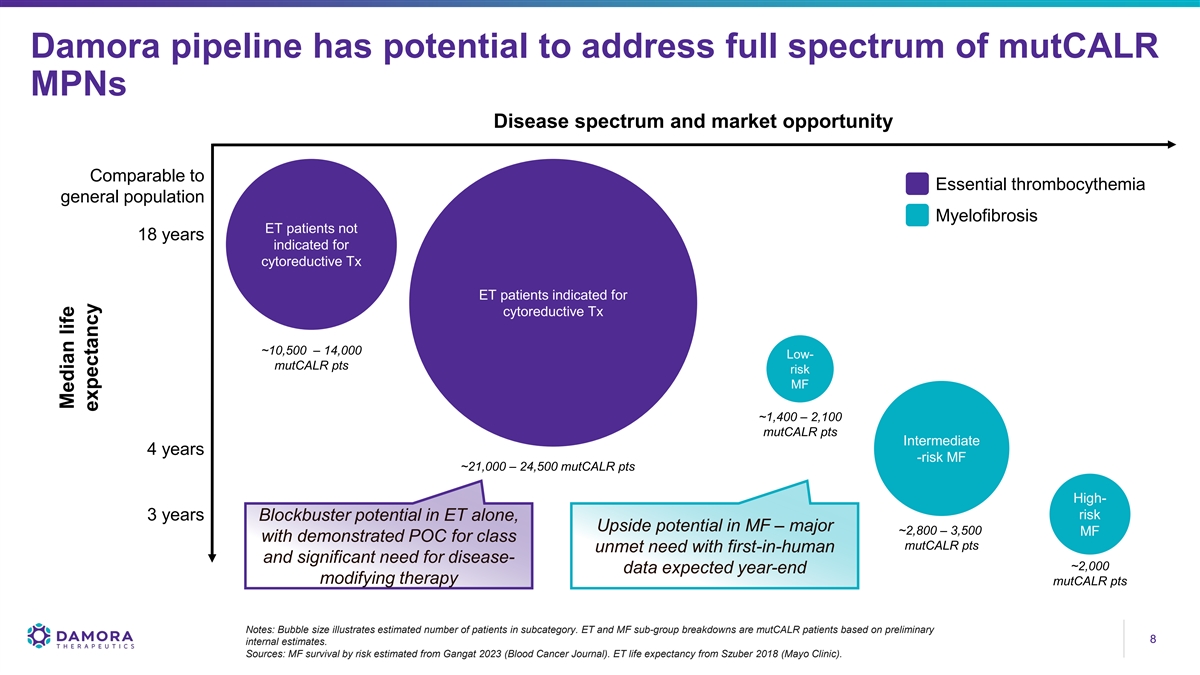

Damora pipeline has potential to address full spectrum of mutCALR MPNs Disease spectrum and market opportunity Comparable to Essential thrombocythemia general population Myelofibrosis ET patients not 18 years indicated for cytoreductive Tx ET patients indicated for cytoreductive Tx ~10,500 – 14,000 Low- mutCALR pts risk MF ~1,400 – 2,100 mutCALR pts Intermediate 4 years -risk MF ~21,000 – 24,500 mutCALR pts High- risk 3 years Blockbuster potential in ET alone, Upside potential in MF – major ~2,800 – 3,500 MF with demonstrated POC for class mutCALR pts unmet need with first-in-human and significant need for disease- ~2,000 data expected year-end modifying therapy mutCALR pts Notes: Bubble size illustrates estimated number of patients in subcategory. ET and MF sub-group breakdowns are mutCALR patients based on preliminary 8 8 internal estimates. Sources: MF survival by risk estimated from Gangat 2023 (Blood Cancer Journal). ET life expectancy from Szuber 2018 (Mayo Clinic). Median life expectancy

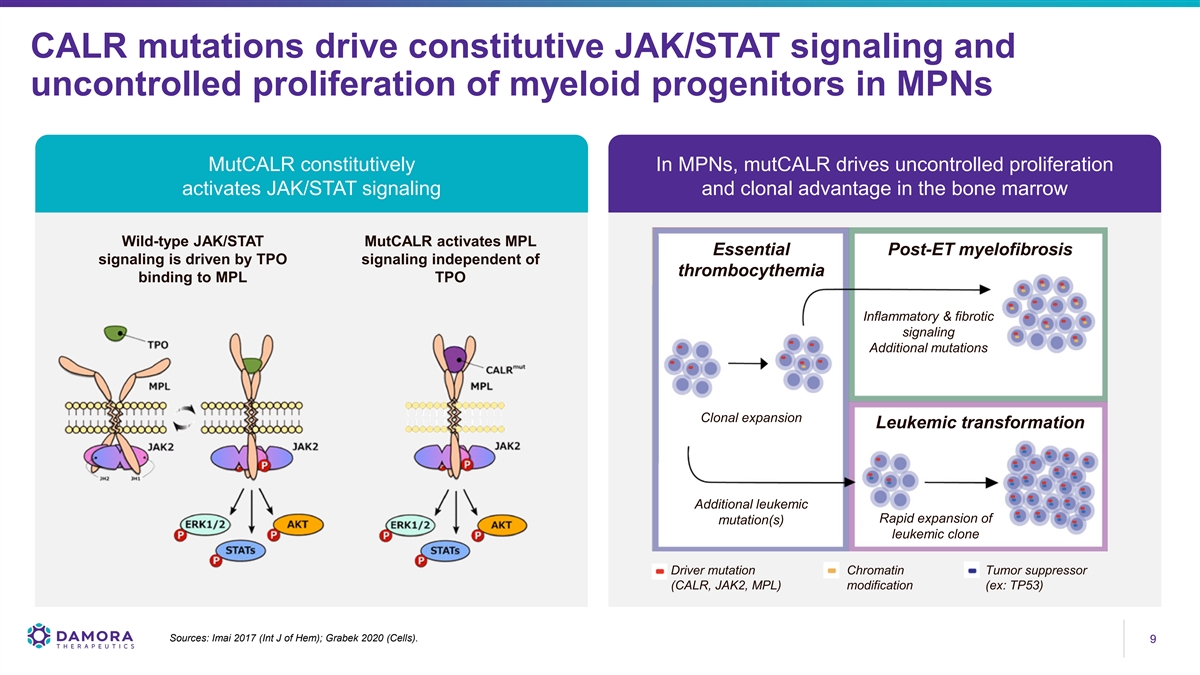

CALR mutations drive constitutive JAK/STAT signaling and uncontrolled proliferation of myeloid progenitors in MPNs MutCALR constitutively In MPNs, mutCALR drives uncontrolled proliferation activates JAK/STAT signaling and clonal advantage in the bone marrow Wild-type JAK/STAT MutCALR activates MPL Essential Post-ET myelofibrosis signaling is driven by TPO signaling independent of thrombocythemia binding to MPL TPO Inflammatory & fibrotic signaling Additional mutations Clonal expansion Leukemic transformation Additional leukemic Rapid expansion of mutation(s) leukemic clone Driver mutation Chromatin Tumor suppressor (CALR, JAK2, MPL) modification (ex: TP53) Sources: Imai 2017 (Int J of Hem); Grabek 2020 (Cells). 9 9

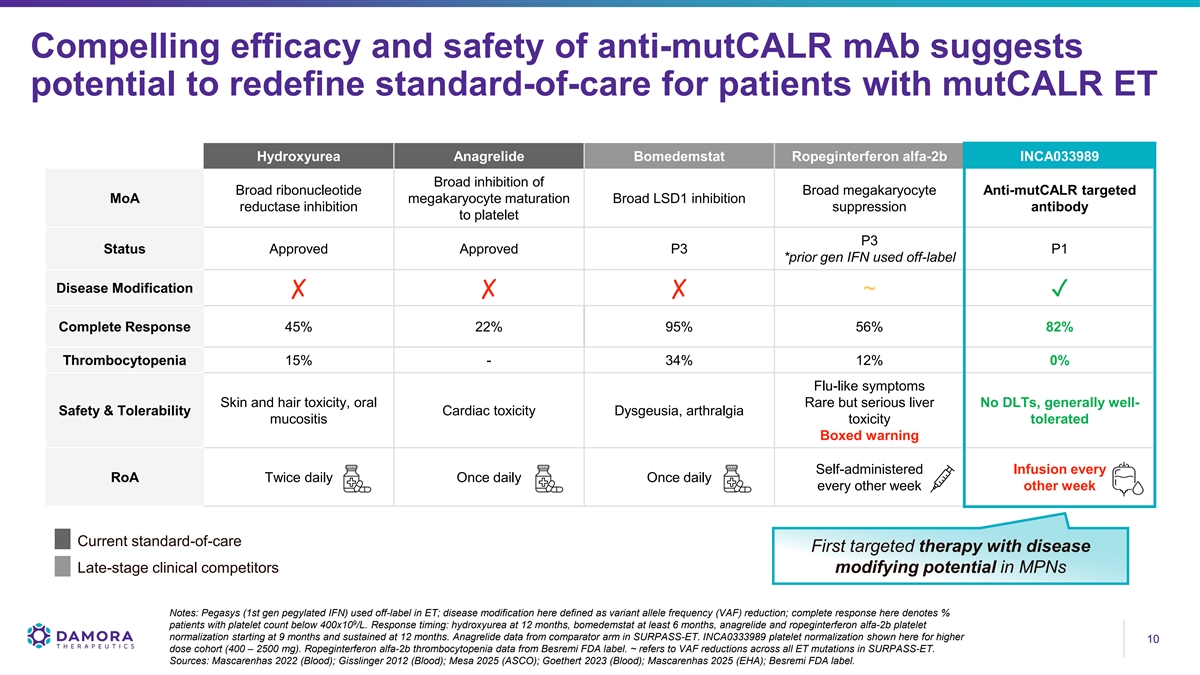

Compelling efficacy and safety of anti-mutCALR mAb suggests potential to redefine standard-of-care for patients with mutCALR ET Hydroxyurea Anagrelide Bomedemstat Ropeginterferon alfa-2b INCA033989 Broad inhibition of Broad ribonucleotide Broad megakaryocyte Anti-mutCALR targeted MoA megakaryocyte maturation Broad LSD1 inhibition reductase inhibition suppression antibody to platelet P3 Status Approved Approved P3 P1 *prior gen IFN used off-label Disease Modification ✗✗✗ ~✓ Complete Response 45% 22% 95% 56% 82% Thrombocytopenia 15% - 34% 12% 0% Flu-like symptoms Skin and hair toxicity, oral Rare but serious liver No DLTs, generally well- Safety & Tolerability Cardiac toxicity Dysgeusia, arthralgia mucositis toxicity tolerated Boxed warning Self-administered Infusion every RoA Twice daily Once daily Once daily every other week other week Current standard-of-care First targeted therapy with disease Late-stage clinical competitors modifying potential in MPNs Notes: Pegasys (1st gen pegylated IFN) used off-label in ET; disease modification here defined as variant allele frequency (VAF) reduction; complete response here denotes % 9 patients with platelet count below 400x10 /L. Response timing: hydroxyurea at 12 months, bomedemstat at least 6 months, anagrelide and ropeginterferon alfa-2b platelet normalization starting at 9 months and sustained at 12 months. Anagrelide data from comparator arm in SURPASS-ET. INCA0333989 platelet normalization shown here for higher 10 10 dose cohort (400 – 2500 mg). Ropeginterferon alfa-2b thrombocytopenia data from Besremi FDA label. ~ refers to VAF reductions across all ET mutations in SURPASS-ET. Sources: Mascarenhas 2022 (Blood); Gisslinger 2012 (Blood); Mesa 2025 (ASCO); Goethert 2023 (Blood); Mascarenhas 2025 (EHA); Besremi FDA label.

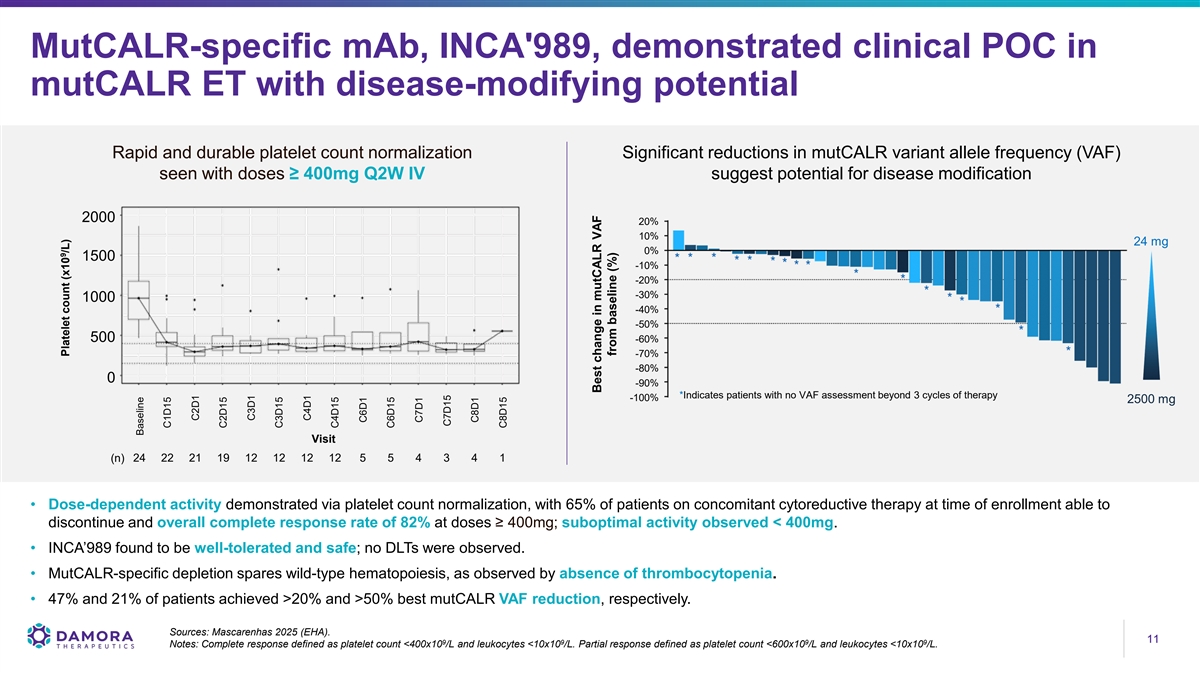

MutCALR-specific mAb, INCA'989, demonstrated clinical POC in mutCALR ET with disease-modifying potential Rapid and durable platelet count normalization Significant reductions in mutCALR variant allele frequency (VAF) seen with doses ≥ 400mg Q2W IV suggest potential for disease modification 2000 20% 10% 24 mg 0% 1500 -10% -20% -30% 1000 -40% -50% 500 -60% -70% -80% 0 -90% *Indicates patients with no VAF assessment beyond 3 cycles of therapy -100% 2500 mg Visit 24 22 21 19 12 12 12 12 5 5 4 3 4 1 (n) • Dose-dependent activity demonstrated via platelet count normalization, with 65% of patients on concomitant cytoreductive therapy at time of enrollment able to discontinue and overall complete response rate of 82% at doses ≥ 400mg; suboptimal activity observed < 400mg. • INCA’989 found to be well-tolerated and safe; no DLTs were observed. • MutCALR-specific depletion spares wild-type hematopoiesis, as observed by absence of thrombocytopenia. • 47% and 21% of patients achieved >20% and >50% best mutCALR VAF reduction, respectively. Sources: Mascarenhas 2025 (EHA). 11 11 9 9 9 9 Notes: Complete response defined as platelet count <400x10 /L and leukocytes <10x10 /L. Partial response defined as platelet count <600x10 /L and leukocytes <10x10 /L. 9 Platelet count (x10 /L) Baseline C1D15 C2D1 C2D15 C3D1 C3D15 C4D1 C4D15 C6D1 C6D15 C7D1 C7D15 C8D1 C8D15 Best change in mutCALR VAF from baseline (%)

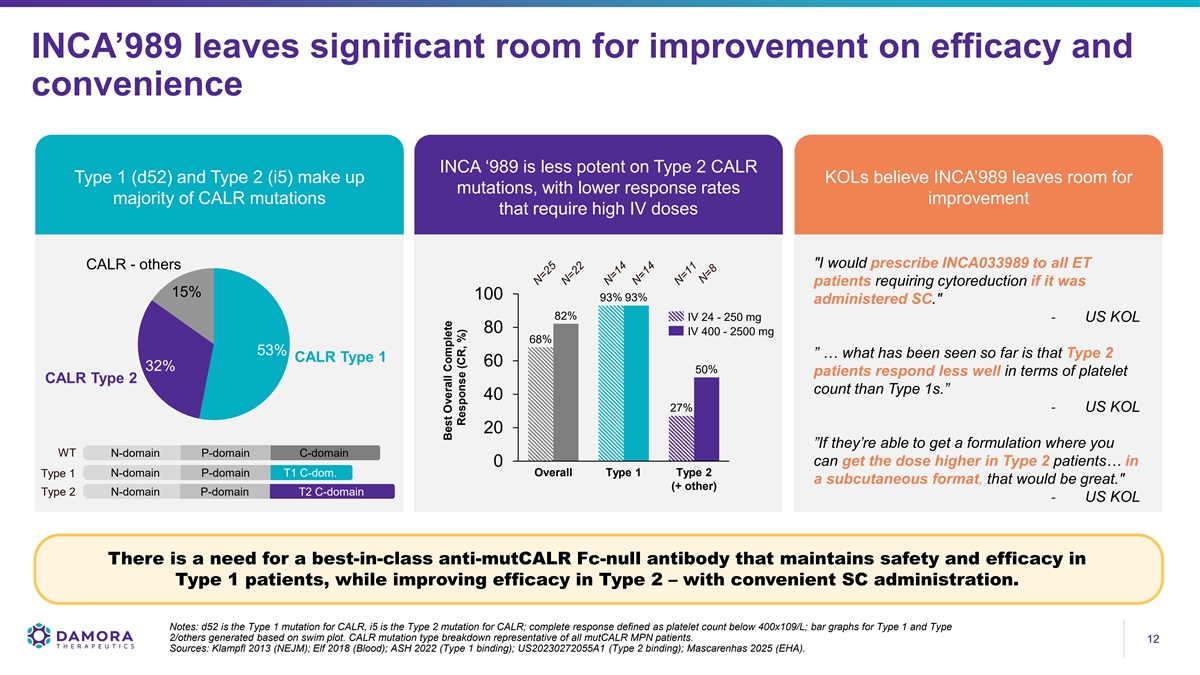

INCA’989 leaves significant room for improvement on efficacy and convenience INCA ‘989 is less potent on Type 2 CALR Type 1 (d52) and Type 2 (i5) make up KOLs believe INCA’989 leaves room for mutations, with lower response rates majority of CALR mutations improvement that require high IV doses I would prescribe INCA033989 to all ET CALR - others patients requiring cytoreduction if it was 15% 100 93% 93% administered SC. 82% IV 24 - 250 mg - US KOL 80 IV 400 - 2500 mg 68% 53% ” … what has been seen so far is that Type 2 CALR Type 1 60 32% 50% patients respond less well in terms of platelet CALR Type 2 count than Type 1s.” 40 27% - US KOL 20 ”If they’re able to get a formulation where you WT N-domain P-domain C-domain can get the dose higher in Type 2 patients… in 0 Overall Type 1 Type 2 Type 1 N-domain P-domain T1 C-dom. a subcutaneous format, that would be great. (+ other) Type 2 N-domain P-domain T2 C-domain - US KOL There is a need for a best-in-class anti-mutCALR Fc-null antibody that maintains safety and efficacy in Type 1 patients, while improving efficacy in Type 2 – with convenient SC administration. Notes: d52 is the Type 1 mutation for CALR, i5 is the Type 2 mutation for CALR; complete response defined as platelet count below 400x109/L; bar graphs for Type 1 and Type 2/others generated based on swim plot. CALR mutation type breakdown representative of all mutCALR MPN patients. 12 12 Sources: Klampfl 2013 (NEJM); Elf 2018 (Blood); ASH 2022 (Type 1 binding); US20230272055A1 (Type 2 binding); Mascarenhas 2025 (EHA). Best Overall Complete Response (CR, %)

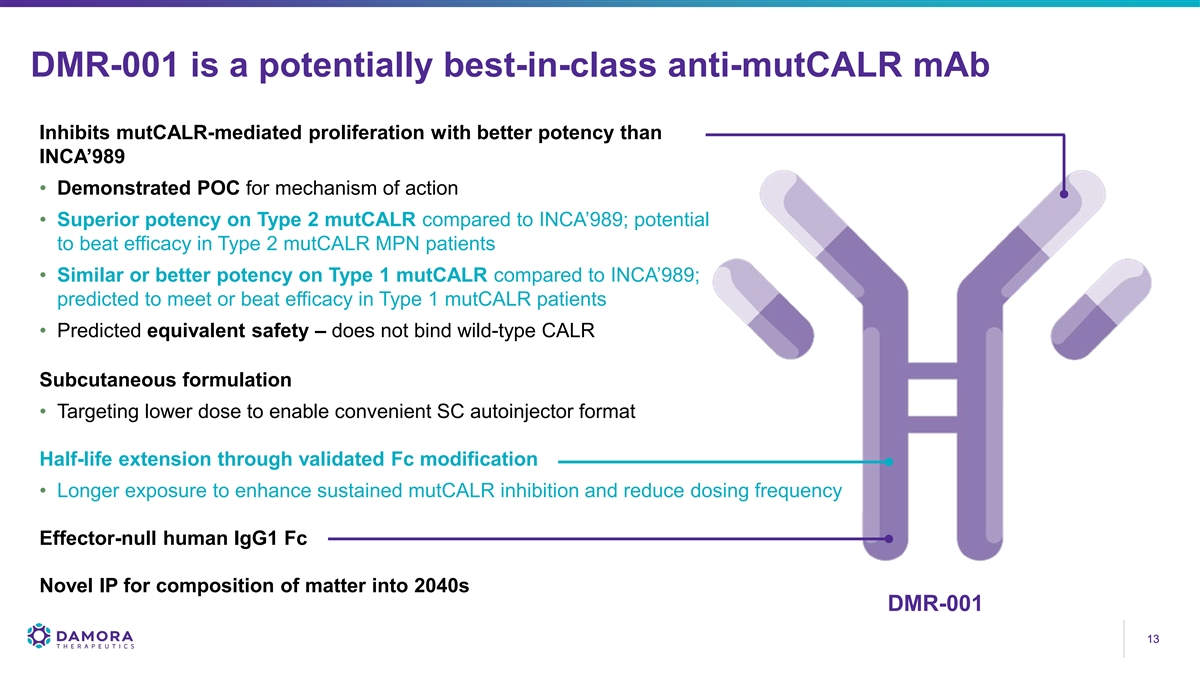

DMR-001 is a potentially best-in-class anti-mutCALR mAb Inhibits mutCALR-mediated proliferation with better potency than INCA’989 • Demonstrated POC for mechanism of action • Superior potency on Type 2 mutCALR compared to INCA’989; potential to beat efficacy in Type 2 mutCALR MPN patients • Similar or better potency on Type 1 mutCALR compared to INCA’989; predicted to meet or beat efficacy in Type 1 mutCALR patients • Predicted equivalent safety – does not bind wild-type CALR Subcutaneous formulation • Targeting lower dose to enable convenient SC autoinjector format Half-life extension through validated Fc modification • Longer exposure to enhance sustained mutCALR inhibition and reduce dosing frequency Effector-null human IgG1 Fc Novel IP for composition of matter into 2040s DMR-001 13 13

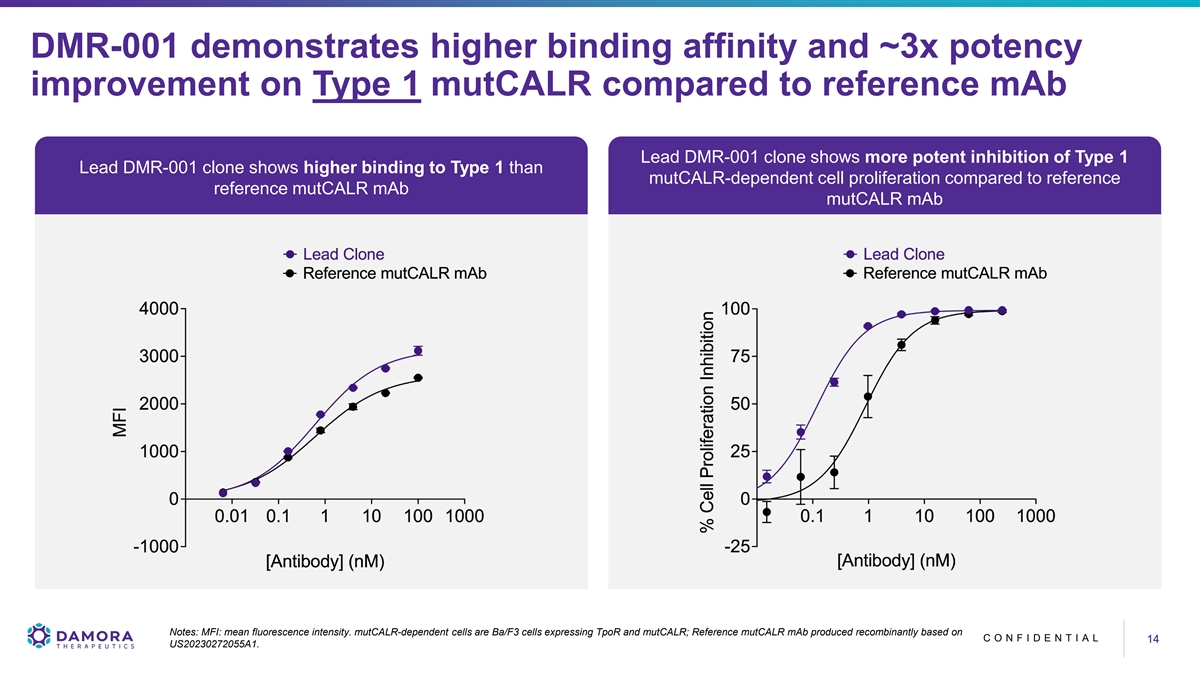

DMR-001 demonstrates higher binding affinity and ~3x potency improvement on Type 1 mutCALR compared to reference mAb Lead DMR-001 clone shows more potent inhibition of Type 1 Lead DMR-001 clone shows higher binding to Type 1 than mutCALR-dependent cell proliferation compared to reference reference mutCALR mAb mutCALR mAb Notes: MFI: mean fluorescence intensity. mutCALR-dependent cells are Ba/F3 cells expressing TpoR and mutCALR; Reference mutCALR mAb produced recombinantly based on C O N F I D E N T I A L 14 14 US20230272055A1.

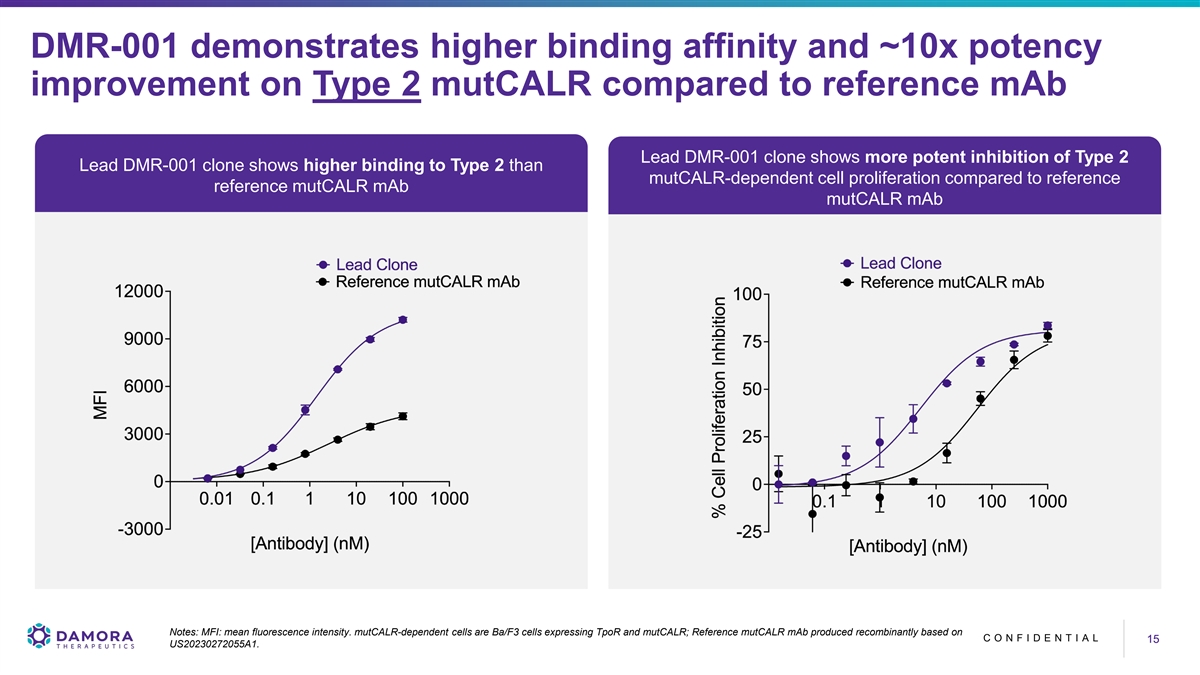

DMR-001 demonstrates higher binding affinity and ~10x potency improvement on Type 2 mutCALR compared to reference mAb Lead DMR-001 clone shows more potent inhibition of Type 2 Lead DMR-001 clone shows higher binding to Type 2 than mutCALR-dependent cell proliferation compared to reference reference mutCALR mAb mutCALR mAb Notes: MFI: mean fluorescence intensity. mutCALR-dependent cells are Ba/F3 cells expressing TpoR and mutCALR; Reference mutCALR mAb produced recombinantly based on C O N F I D E N T I A L 15 15 US20230272055A1.

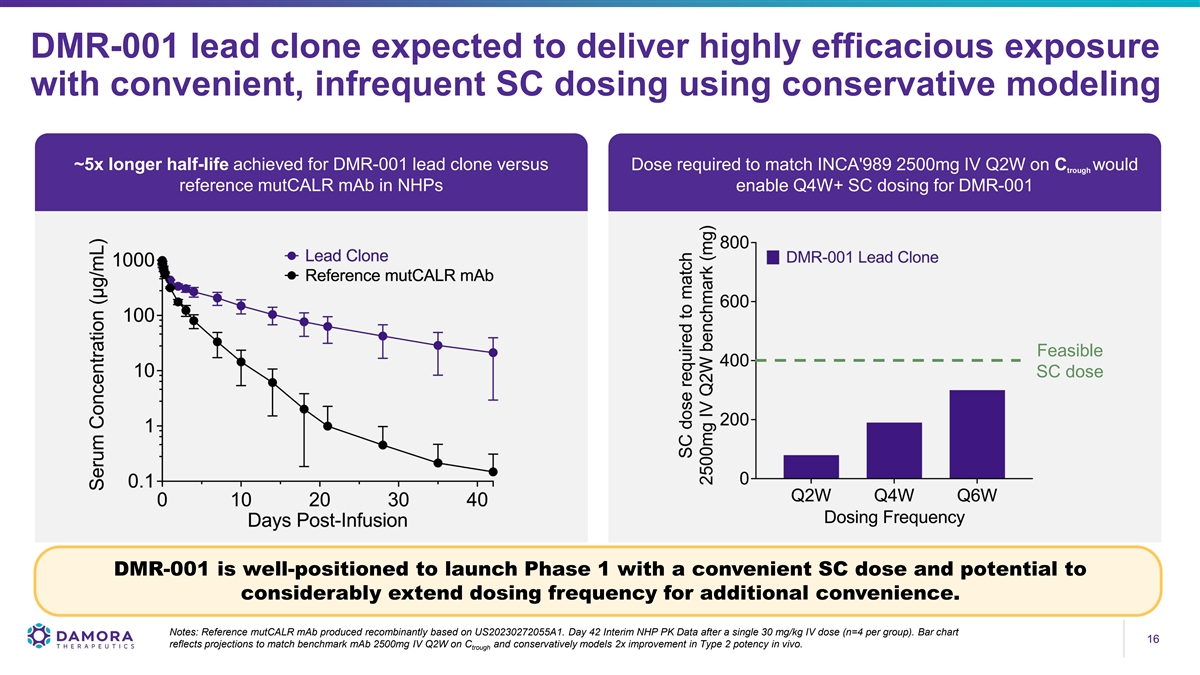

DMR-001 lead clone expected to deliver highly efficacious exposure with convenient, infrequent SC dosing using conservative modeling ~5x longer half-life achieved for DMR-001 lead clone versus Dose required to match INCA'989 2500mg IV Q2W on C would trough reference mutCALR mAb in NHPs enable Q4W+ SC dosing for DMR-001 Feasible SC dose DMR-001 is well-positioned to launch Phase 1 with a convenient SC dose and potential to considerably extend dosing frequency for additional convenience. Notes: Reference mutCALR mAb produced recombinantly based on US20230272055A1. Day 42 Interim NHP PK Data after a single 30 mg/kg IV dose (n=4 per group). Bar chart 16 16 reflects projections to match benchmark mAb 2500mg IV Q2W on C and conservatively models 2x improvement in Type 2 potency in vivo. trough

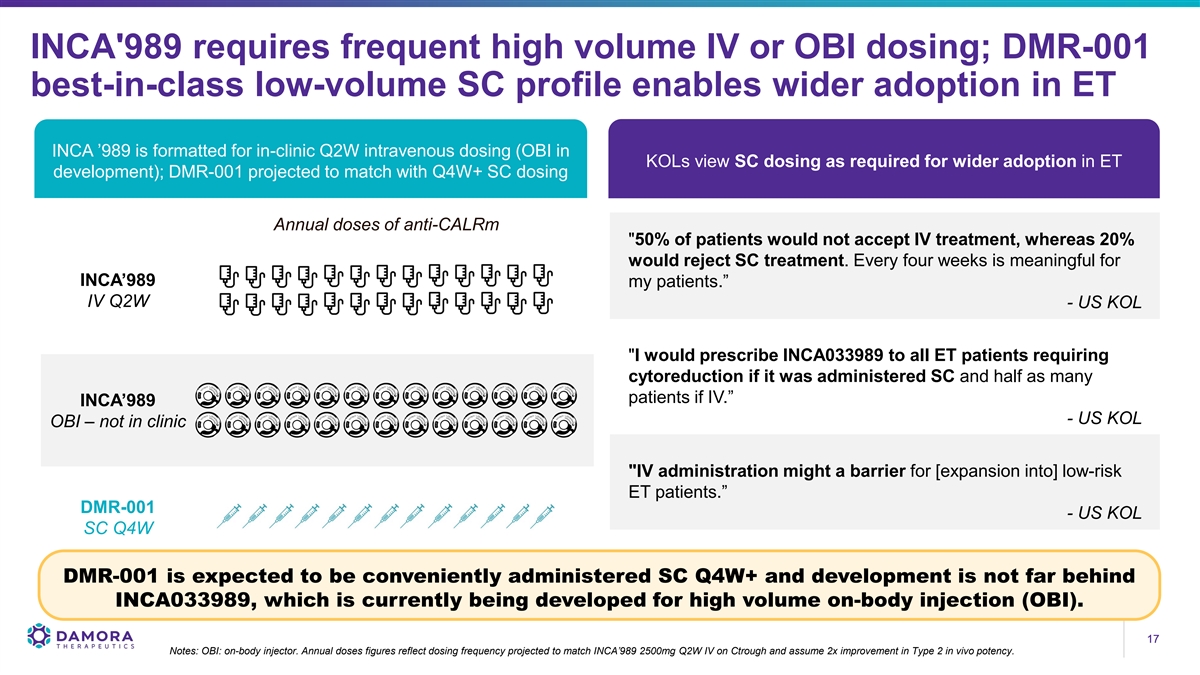

INCA'989 requires frequent high volume IV or OBI dosing; DMR-001 best-in-class low-volume SC profile enables wider adoption in ET INCA ’989 is formatted for in-clinic Q2W intravenous dosing (OBI in KOLs view SC dosing as required for wider adoption in ET development); DMR-001 projected to match with Q4W+ SC dosing Annual doses of anti-CALRm 50% of patients would not accept IV treatment, whereas 20% would reject SC treatment. Every four weeks is meaningful for INCA’989 my patients.” IV Q2W - US KOL I would prescribe INCA033989 to all ET patients requiring cytoreduction if it was administered SC and half as many patients if IV.” INCA’989 - US KOL OBI – not in clinic IV administration might a barrier for [expansion into] low-risk ET patients.” DMR-001 - US KOL SC Q4W DMR-001 is expected to be conveniently administered SC Q4W+ and development is not far behind INCA033989, which is currently being developed for high volume on-body injection (OBI). 17 17 Notes: OBI: on-body injector. Annual doses figures reflect dosing frequency projected to match INCA’989 2500mg Q2W IV on Ctrough and assume 2x improvement in Type 2 in vivo potency.

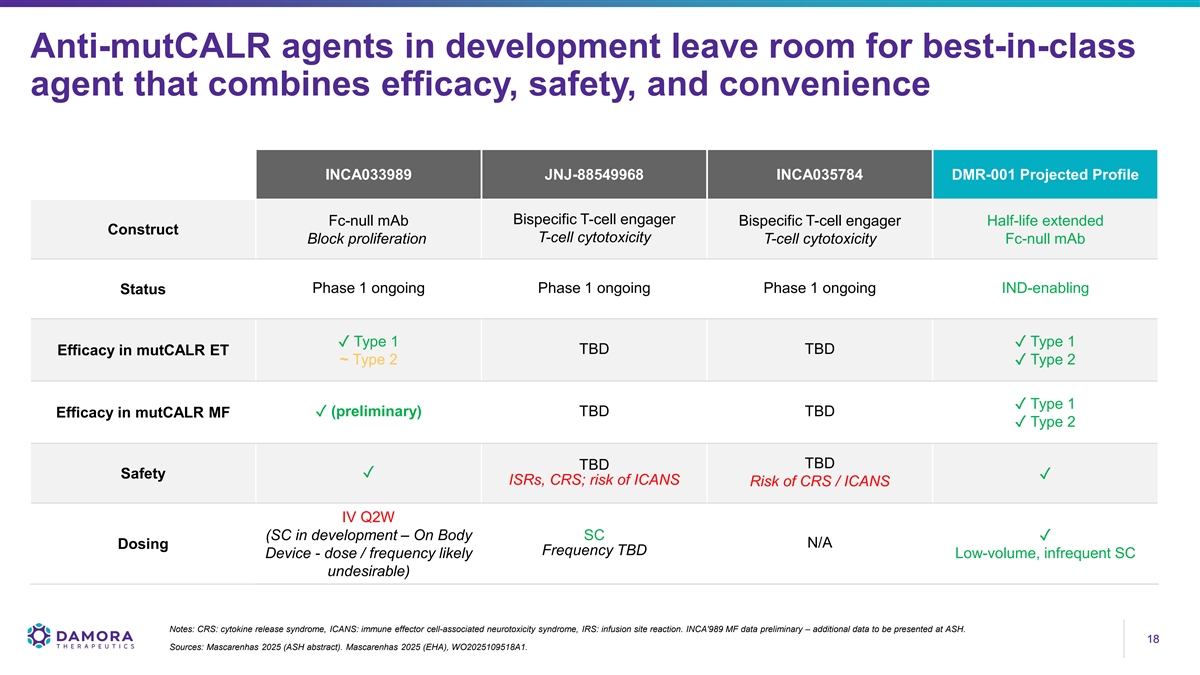

Anti-mutCALR agents in development leave room for best-in-class agent that combines efficacy, safety, and convenience INCA033989 JNJ-88549968 INCA035784 DMR-001 Projected Profile Bispecific T-cell engager Fc-null mAb Bispecific T-cell engager Half-life extended Construct T-cell cytotoxicity Block proliferation T-cell cytotoxicity Fc-null mAb Phase 1 ongoing Phase 1 ongoing Phase 1 ongoing IND-enabling Status ✓ Type 1✓ Type 1 TBD TBD Efficacy in mutCALR ET ~ Type 2✓ Type 2 ✓ Type 1 ✓ (preliminary) TBD TBD Efficacy in mutCALR MF ✓ Type 2 TBD TBD ✓ Safety✓ ISRs, CRS; risk of ICANS Risk of CRS / ICANS IV Q2W (SC in development – On Body SC✓ N/A Dosing Frequency TBD Device - dose / frequency likely Low-volume, infrequent SC undesirable) Notes: CRS: cytokine release syndrome, ICANS: immune effector cell-associated neurotoxicity syndrome, IRS: infusion site reaction. INCA'989 MF data preliminary – additional data to be presented at ASH. 18 18 Sources: Mascarenhas 2025 (ASH abstract). Mascarenhas 2025 (EHA), WO2025109518A1.

Financing expected to fund lead programs through key value- generating catalysts 2025 2026 2027 Two clinical POCs in patients with Mid – IND mutCALR MPNs, beginning mid-year DMR-001 (P1 ROA SC) Damora goal to begin first phase 3 (Fc-null anti-mutCALR mAb) shortly after POC data DMR-002 2H – IND (mutCALR-targeted MOA; undisclosed) DMR-003 IND (anti-mutCALR x CD3 bsAb) 4Q – INCA’989 P1 1H – INCA’989 P3 initiation in ET (IV) Key external events data in MF, updated 2H – INCA'989 P3 initiation in MF P1 data in ET $285M expected to fund Damora into 2029 – more than 1 year beyond key Phase 1 proof-of- concept data for DMR-001, with multiple value inflection points along the way Sources: Incyte 3Q25 earnings call transcript 19 19 Notes: ROA: route of administration, MOA: mechanism of action, mAb: monoclonal antibody, bsAb: bispecific antibody, POC: proof-of-concept

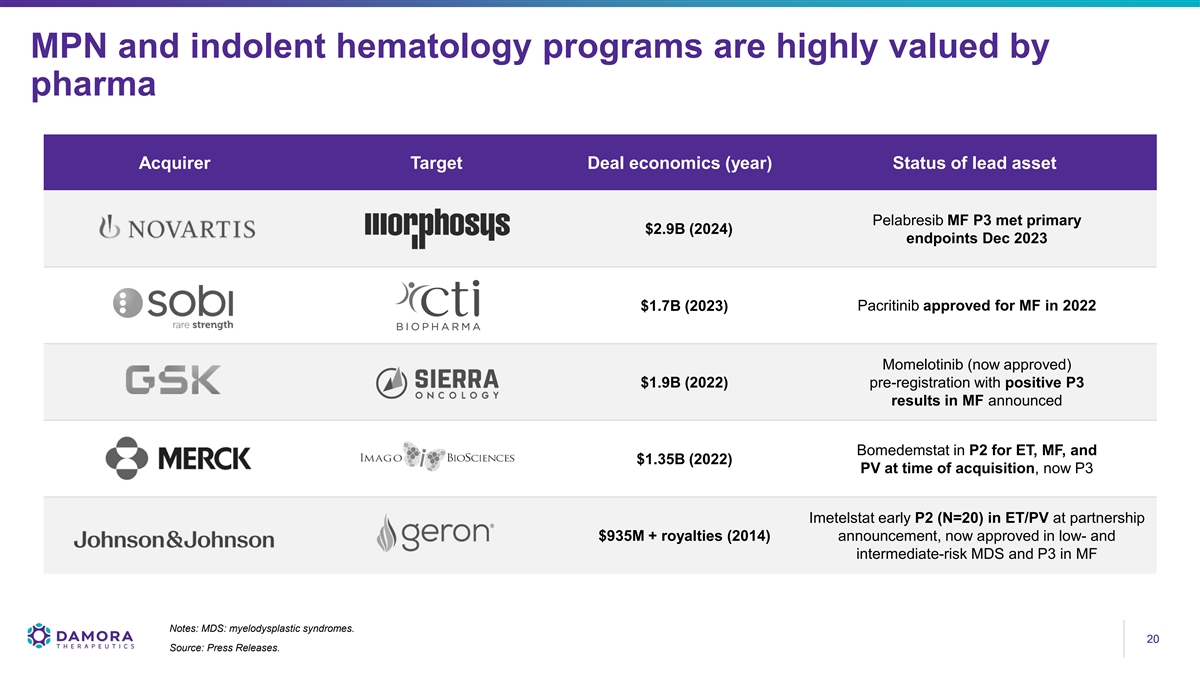

MPN and indolent hematology programs are highly valued by pharma Acquirer Target Deal economics (year) Status of lead asset Pelabresib MF P3 met primary $2.9B (2024) endpoints Dec 2023 $1.7B (2023) Pacritinib approved for MF in 2022 Momelotinib (now approved) $1.9B (2022) pre-registration with positive P3 results in MF announced Bomedemstat in P2 for ET, MF, and $1.35B (2022) PV at time of acquisition, now P3 Imetelstat early P2 (N=20) in ET/PV at partnership $935M + royalties (2014) announcement, now approved in low- and intermediate-risk MDS and P3 in MF Notes: MDS: myelodysplastic syndromes. 20 20 Source: Press Releases.

Damora assets were developed by a team with deep expertise in antibody engineering and drug development Peter Harwin Julianne Bruno Chris Cain Incoming Galecto Incoming Galecto Incoming Galecto Director Director Director Hussam Shaheen Keri Lantz Mary Beth DeLena Damon Banks CLO CSO CFO SVP, Legal Affairs Neta Batscha Mike Meehl Jason Oh SVP, Strategy & SVP, Biologics SVP, Biology Operations Research Cyrus Stacey Ghassan Fayad Byron Kwan Shawn Russell SVP, Quality VP, Translational Sr Dir, Biotherapeutics SVP, CMC Sciences 21 21

Thank you