| Copyright © 2024 Harmony Biosciences. All rights reserved. Q2 2025 Financial Results & Business Update August 5, 2025 .2 |

| Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our full year 2024 net product revenue, expectations for the growth and value of WAKIX, plans to submit an sNDA for pitolisant in idiopathic hypersomnia; our future results of operations and financial position, business strategy, products, prospective products, product approvals, the plans and objectives of management for future operations and future results of anticipated products. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our commercialization efforts and strategy for WAKIX; the rate and degree of market acceptance and clinical utility of pitolisant in additional indications, if approved, and any other product candidates we may develop or acquire, if approved; our research and development plans, including our plans to explore the therapeutic potential of pitolisant in additional indications; our ongoing and planned clinical trials; our ability to expand the scope of our license agreements with Bioprojet Société Civile de Recherche (“Bioprojet”); the availability of favorable insurance coverage and reimbursement for WAKIX; the timing of, and our ability to obtain, regulatory approvals for pitolisant for other indications as well as any other product candidates; our estimates regarding expenses, future revenue, capital requirements and additional financing needs; our ability to identify, acquire and integrate additional products or product candidates with significant commercial potential that are consistent with our commercial objectives; our commercialization, marketing and manufacturing capabilities and strategy; significant competition in our industry; our intellectual property position; loss or retirement of key members of management; failure to successfully execute our growth strategy, including any delays in our planned future growth; our failure to maintain effective internal controls; the impact of government laws and regulations; volatility and fluctuations in the price of our common stock; the significant costs and required management time as a result of operating as a public company; the fact that the price of Harmony's common stock may be volatile and fluctuate substantially; statements related to our intended share repurchases and repurchase timeframe and the significant costs and required management time as a result of operating as a public company. These and other important factors discussed under the caption "Risk Factors" in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the "SEC") on February 25, 2025, and our other filings with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management's estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. 2 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. |

| 4+ YEARS OF PROFITABILITY WAKIX ® APPROACHING BLOCKBUSTER STATUS 4 ONGOING PHASE 3 REGISTRATIONAL TRIALS; UP TO 6 BY YEAR-END SELF-FUNDING ACROSS THE ENTERPRISE $672M ON BALANCE SHEET UNIQUE COMPANY PROFILE |

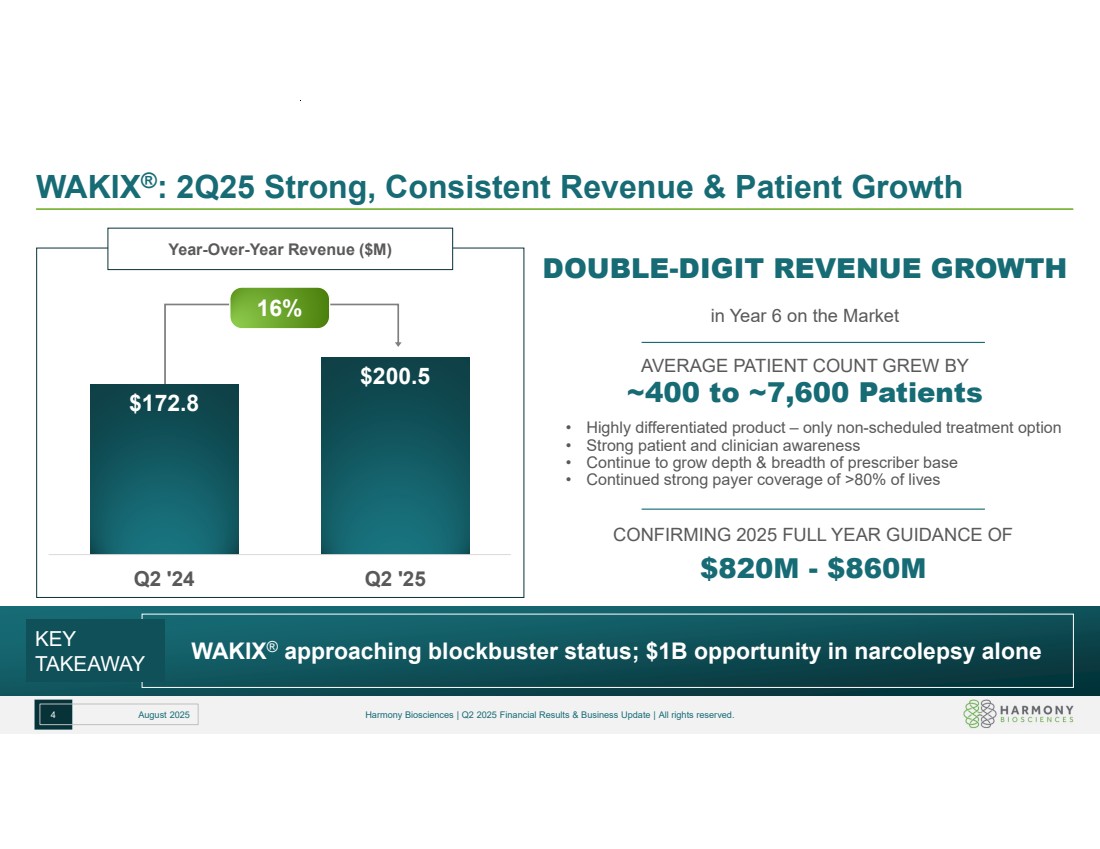

| WAKIX®: 2Q25 Strong, Consistent Revenue & Patient Growth 4 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. 16% $172.8 $200.5 Q2 '24 Q2 '25 Year-Over-Year Revenue ($M) DOUBLE-DIGIT REVENUE GROWTH in Year 6 on the Market AVERAGE PATIENT COUNT GREW BY ~400 to ~7,600 Patients • Highly differentiated product – only non-scheduled treatment option • Strong patient and clinician awareness • Continue to grow depth & breadth of prescriber base • Continued strong payer coverage of >80% of lives CONFIRMING 2025 FULL YEAR GUIDANCE OF $820M - $860M WAKIX® approaching blockbuster status; $1B opportunity in narcolepsy alone KEY TAKEAWAY |

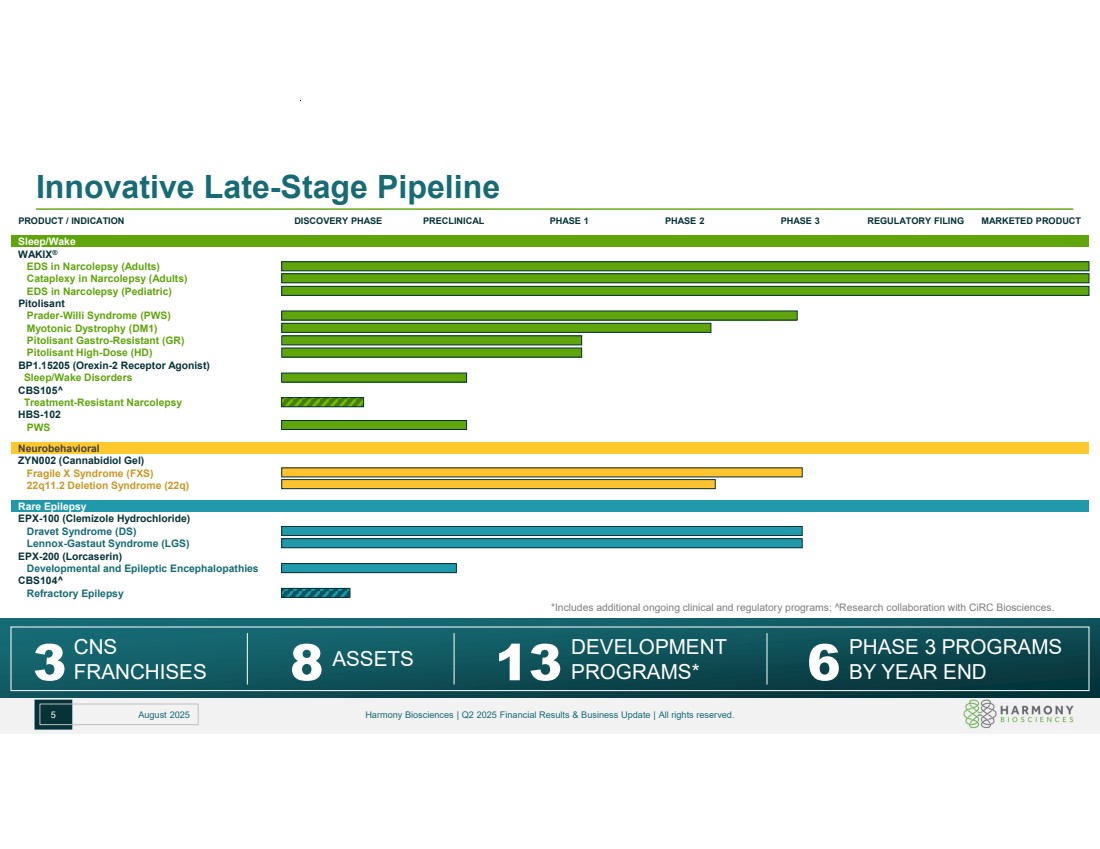

| Innovative Late-Stage Pipeline 5 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. PRODUCT / INDICATION DISCOVERY PHASE PRECLINICAL PHASE 1 PHASE 2 PHASE 3 REGULATORY FILING MARKETED PRODUCT Sleep/Wake WAKIX® EDS in Narcolepsy (Adults) Cataplexy in Narcolepsy (Adults) EDS in Narcolepsy (Pediatric) Pitolisant Prader-Willi Syndrome (PWS) Myotonic Dystrophy (DM1) Pitolisant Gastro-Resistant (GR) Pitolisant High-Dose (HD) BP1.15205 (Orexin-2 Receptor Agonist) Sleep/Wake Disorders CBS105 Treatment-Resistant Narcolepsy HBS-102 PWS Neurobehavioral ZYN002 (Cannabidiol Gel) Fragile X Syndrome (FXS) 22q11.2 Deletion Syndrome (22q) Rare Epilepsy EPX-100 (Clemizole Hydrochloride) Dravet Syndrome (DS) Lennox-Gastaut Syndrome (LGS) EPX-200 (Lorcaserin) Developmental and Epileptic Encephalopathies CBS104 Refractory Epilepsy 3 CNS FRANCHISES 13 DEVELOPMENT 8 PROGRAMS* ASSETS 6PHASE 3 PROGRAMS BY YEAR END *Includes additional ongoing clinical and regulatory programs; Research collaboration with CiRC Biosciences. |

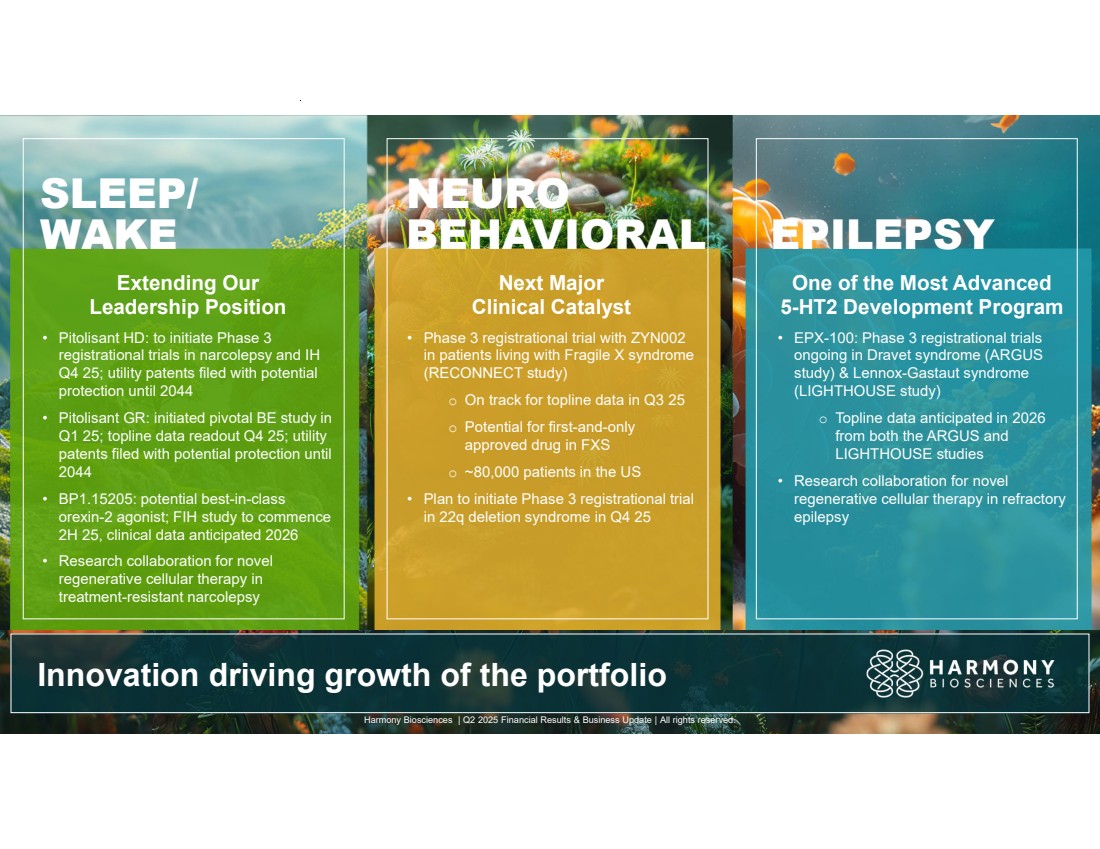

| Extending Our Leadership Position • Pitolisant HD: to initiate Phase 3 registrational trials in narcolepsy and IH Q4 25; utility patents filed with potential protection until 2044 • Pitolisant GR: initiated pivotal BE study in Q1 25; topline data readout Q4 25; utility patents filed with potential protection until 2044 • BP1.15205: potential best-in-class orexin-2 agonist; FIH study to commence 2H 25, clinical data anticipated 2026 • Research collaboration for novel regenerative cellular therapy in treatment-resistant narcolepsy Next Major Clinical Catalyst • Phase 3 registrational trial with ZYN002 in patients living with Fragile X syndrome (RECONNECT study) o On track for topline data in Q3 25 o Potential for first-and-only approved drug in FXS o ~80,000 patients in the US • Plan to initiate Phase 3 registrational trial in 22q deletion syndrome in Q4 25 One of the Most Advanced 5-HT2 Development Program • EPX-100: Phase 3 registrational trials ongoing in Dravet syndrome (ARGUS study) & Lennox-Gastaut syndrome (LIGHTHOUSE study) o Topline data anticipated in 2026 from both the ARGUS and LIGHTHOUSE studies • Research collaboration for novel regenerative cellular therapy in refractory epilepsy Innovation driving growth of the portfolio SLEEP/ WAKE NEURO BEHAVIORAL EPILEPSY Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. |

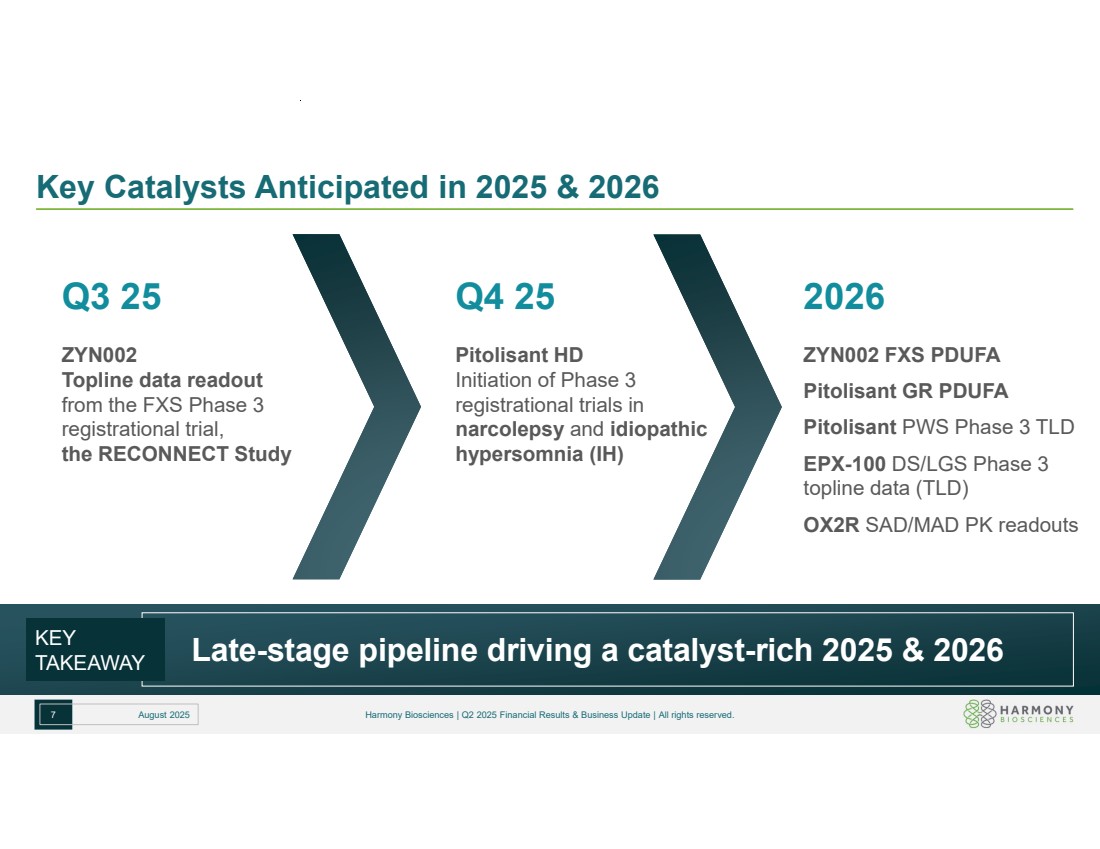

| Key Catalysts Anticipated in 2025 & 2026 7 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. Q3 25 ZYN002 Topline data readout from the FXS Phase 3 registrational trial, the RECONNECT Study Q4 25 Pitolisant HD Initiation of Phase 3 registrational trials in narcolepsy and idiopathic hypersomnia (IH) Late-stage pipeline driving a catalyst-rich 2025 & 2026 KEY TAKEAWAY 2026 ZYN002 FXS PDUFA Pitolisant GR PDUFA Pitolisant PWS Phase 3 TLD EPX-100 DS/LGS Phase 3 topline data (TLD) OX2R SAD/MAD PK readouts |

| ZYN002: Potential for First Approved Treatment in Fragile X Syndrome 8 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. ZYN002: INNOVATIVE PRODUCT PROFILE 100% synthetic, pharmaceutically manufactured cannabidiol (CBD), devoid of THC, in a patent-protected, permeation-enhanced gel formulation LEAD PROGRAM IN FRAGILE X SYNDROME (FXS) Phase 3 RECONNECT Study designed to replicate the positive findings from the prespecified analysis of primary endpoint in Phase 2/3 CONNECT Study in patients with complete methylation • FXS: The most common known inherited cause of intellectual impairment and autism spectrum disorders MARKET OPPORTUNITY ~80,000 patients in the US with FXS; worldwide rights VERY HIGH UNMET NEED No approved products for FXS Potential to be first approved treatment for patients with FXS Q325 Topline Data Readout from Phase 3 Registrational Trial, RECONNECT Study |

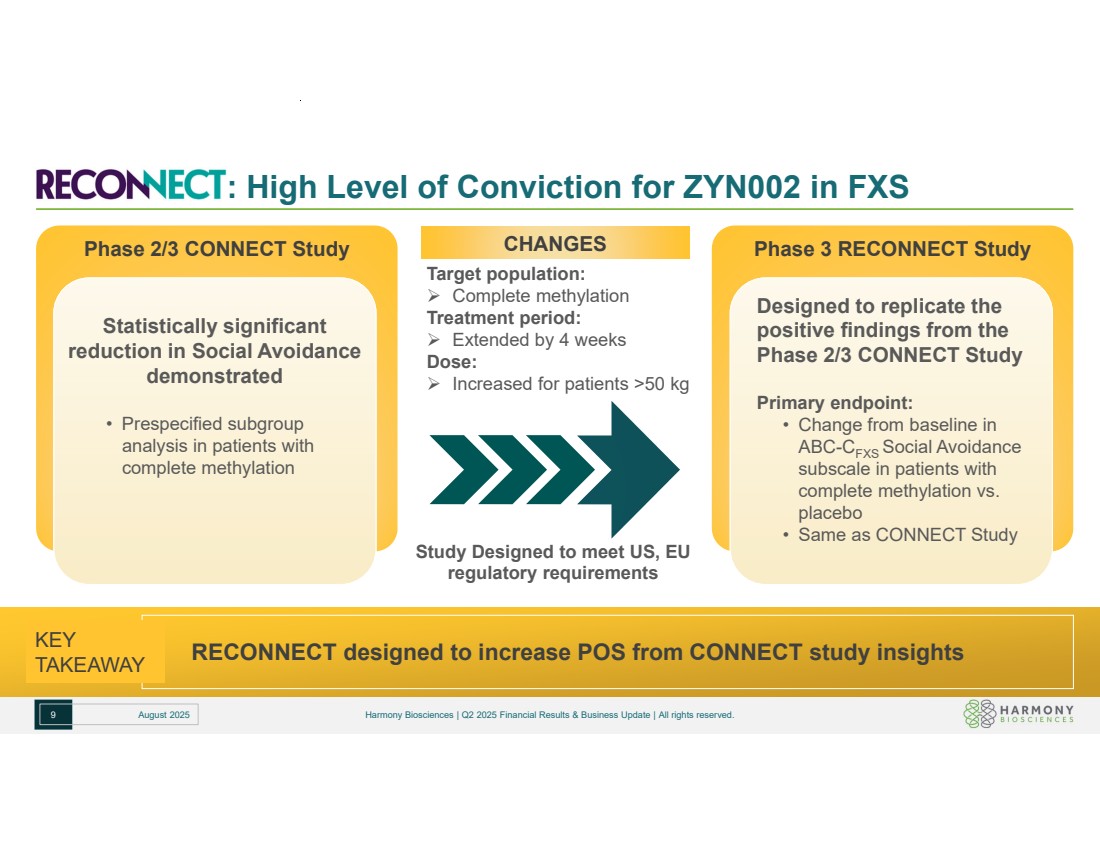

| : High Level of Conviction for ZYN002 in FXS 9 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. RECONNECT designed to increase POS from CONNECT study insights KEY TAKEAWAY Phase 2/3 CONNECT Study Statistically significant reduction in Social Avoidance demonstrated • Prespecified subgroup analysis in patients with complete methylation Phase 3 RECONNECT Study Designed to replicate the positive findings from the Phase 2/3 CONNECT Study Primary endpoint: • Change from baseline in ABC-CFXS Social Avoidance subscale in patients with complete methylation vs. placebo • Same as CONNECT Study Target population: Complete methylation Treatment period: Extended by 4 weeks Dose: Increased for patients >50 kg Study Designed to meet US, EU regulatory requirements CHANGES |

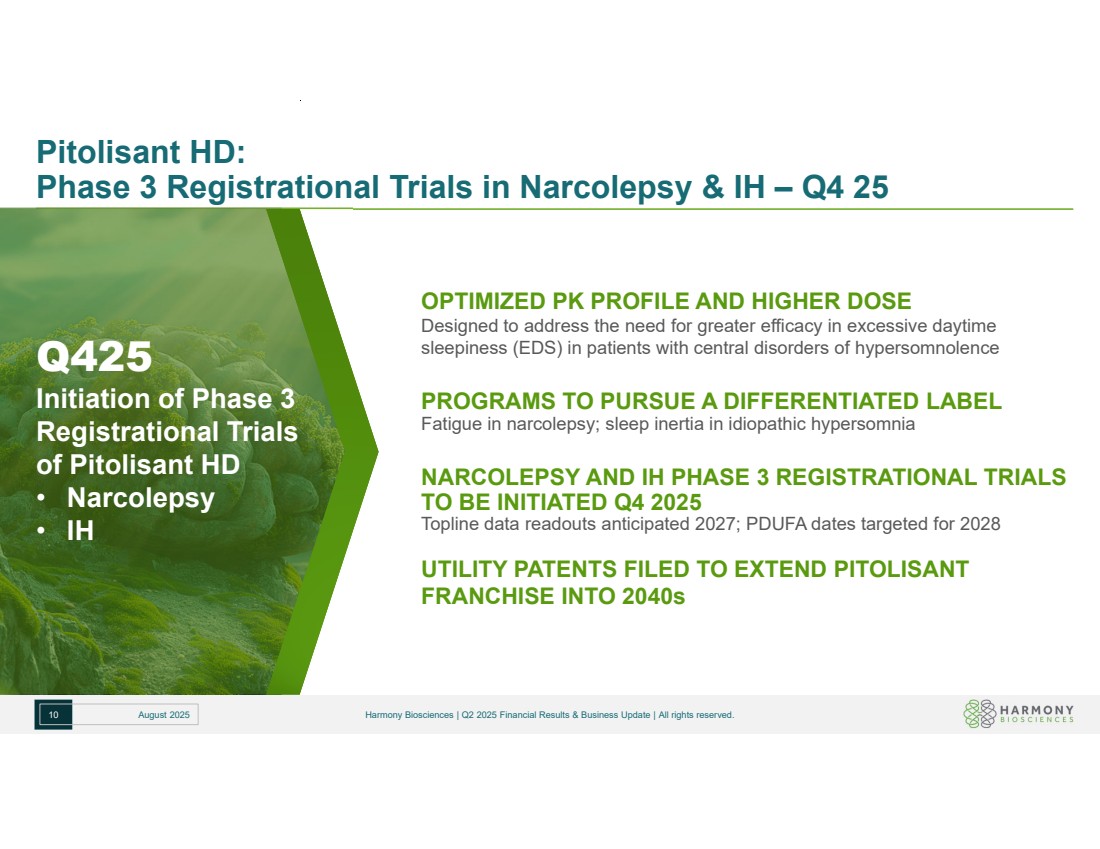

| Pitolisant HD: Phase 3 Registrational Trials in Narcolepsy & IH – Q4 25 10 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. Q425 Initiation of Phase 3 Registrational Trials of Pitolisant HD • Narcolepsy • IH OPTIMIZED PK PROFILE AND HIGHER DOSE Designed to address the need for greater efficacy in excessive daytime sleepiness (EDS) in patients with central disorders of hypersomnolence PROGRAMS TO PURSUE A DIFFERENTIATED LABEL Fatigue in narcolepsy; sleep inertia in idiopathic hypersomnia NARCOLEPSY AND IH PHASE 3 REGISTRATIONAL TRIALS TO BE INITIATED Q4 2025 Topline data readouts anticipated 2027; PDUFA dates targeted for 2028 UTILITY PATENTS FILED TO EXTEND PITOLISANT FRANCHISE INTO 2040s |

| EPX-100: One of Most Advanced 5-HT2 (Serotonin) Agonist Programs in DEEs 11 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. 2026 Anticipate Topline Data from Ongoing Global Phase 3 Trials • DS • LGS ESTABLISHED 5-HT2 (SEROTONIN) AGONIST MECHANISM OF ACTION MoA validated via the zebrafish model PHASE 3 STUDIES IN DS AND LGS Recruitment ongoing for Phase 3 registrational trial in patients with Dravet syndrome (ARGUS study) and Lennox-Gastaut syndrome (LIGHTHOUSE study) • Anticipate topline data in 2026 SAFETY: POTENTIAL TO OFFER A VERY UNIQUE RISK/BENEFIT PROPOSITION No additional laboratory or special safety monitoring BID DOSING REGIMEN Convenient for patients and caregivers |

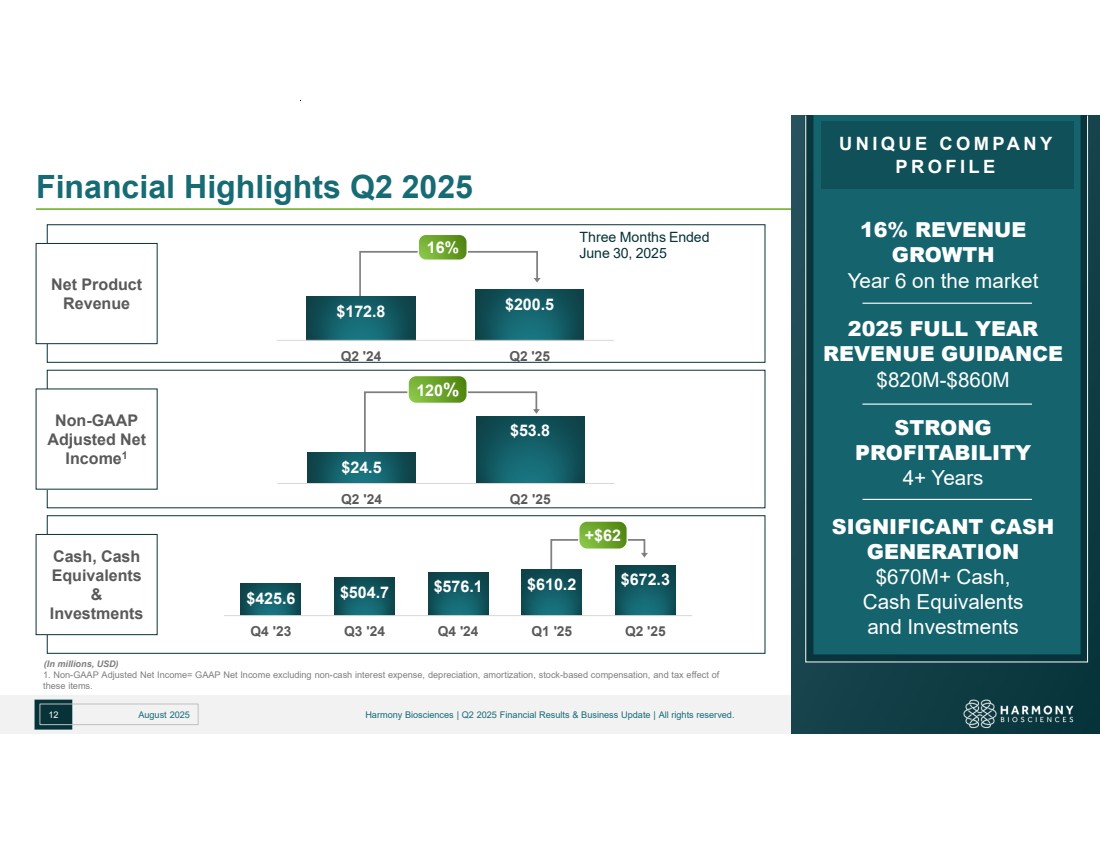

| Financial Highlights Q2 2025 12 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. 1. Non-GAAP Adjusted Net Income= GAAP Net Income excluding non-cash interest expense, depreciation, amortization, stock-based compensation, and tax effect of these items. Three Months Ended June 30, 2025 (In millions, USD) $172.8 $200.5 Q2 '24 Q2 '25 Net Product Revenue Non-GAAP Adjusted Net Income1 Cash, Cash Equivalents & Investments 120 % $24.5 $53.8 Q2 '24 Q2 '25 16% $425.6 $504.7 $576.1 $610.2 $672.3 Q4 '23 Q3 '24 Q4 '24 Q1 '25 Q2 '25 +$62 UNIQUE COMPANY PROFILE 16% REVENUE GROWTH Year 6 on the market 2025 FULL YEAR REVENUE GUIDANCE $820M-$860M STRONG PROFITABILITY 4+ Years SIGNIFICANT CASH GENERATION $670M+ Cash, Cash Equivalents and Investments |

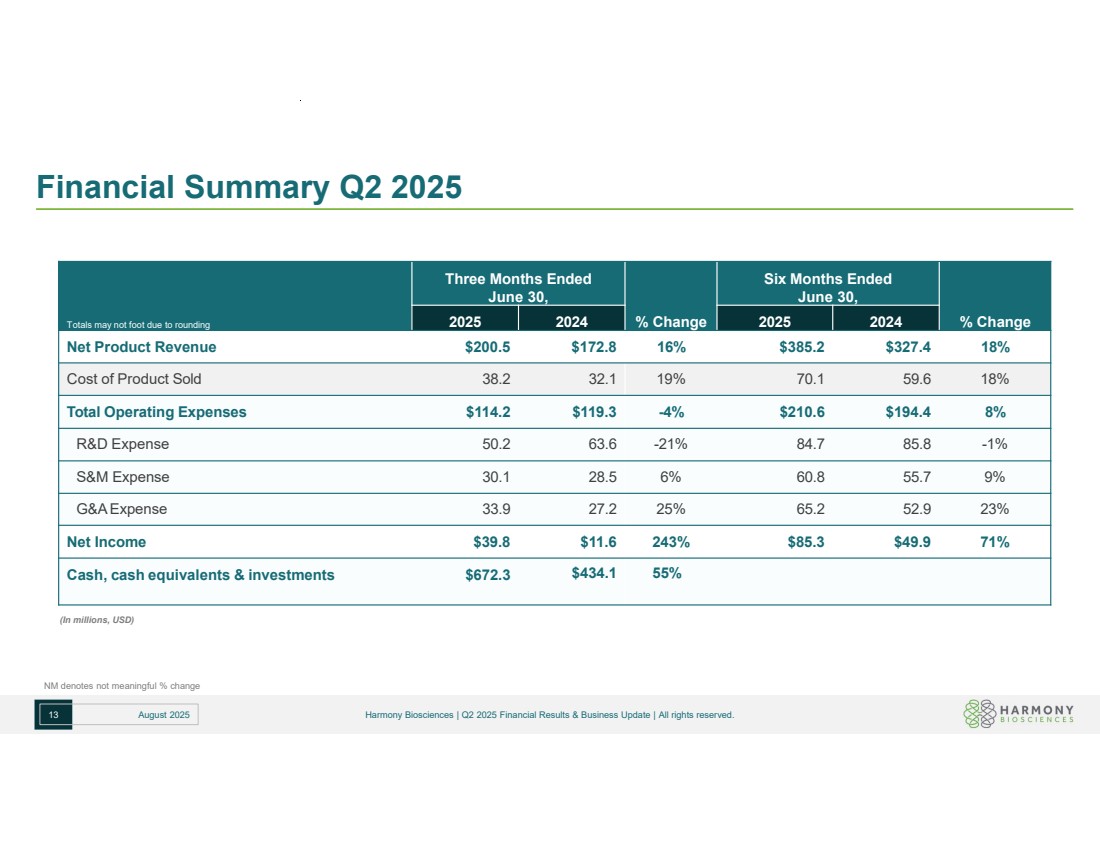

| Financial Summary Q2 2025 13 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. % Change Six Months Ended June 30, % Change Three Months Ended June 30, Totals may not foot due to rounding 2025 2024 2025 2024 Net Product Revenue $200.5 $172.8 16% $385.2 $327.4 18% Cost of Product Sold 38.2 32.1 19% 70.1 59.6 18% Total Operating Expenses $114.2 $119.3 -4% $210.6 $194.4 8% R&D Expense 50.2 63.6 -21% 84.7 85.8 -1% S&M Expense 30.1 28.5 6% 60.8 55.7 9% G&A Expense 33.9 27.2 25% 65.2 52.9 23% Net Income $39.8 $11.6 243% $85.3 $49.9 71% Cash, cash equivalents & investments $672.3 $434.1 55% NM denotes not meaningful % change (In millions, USD) |

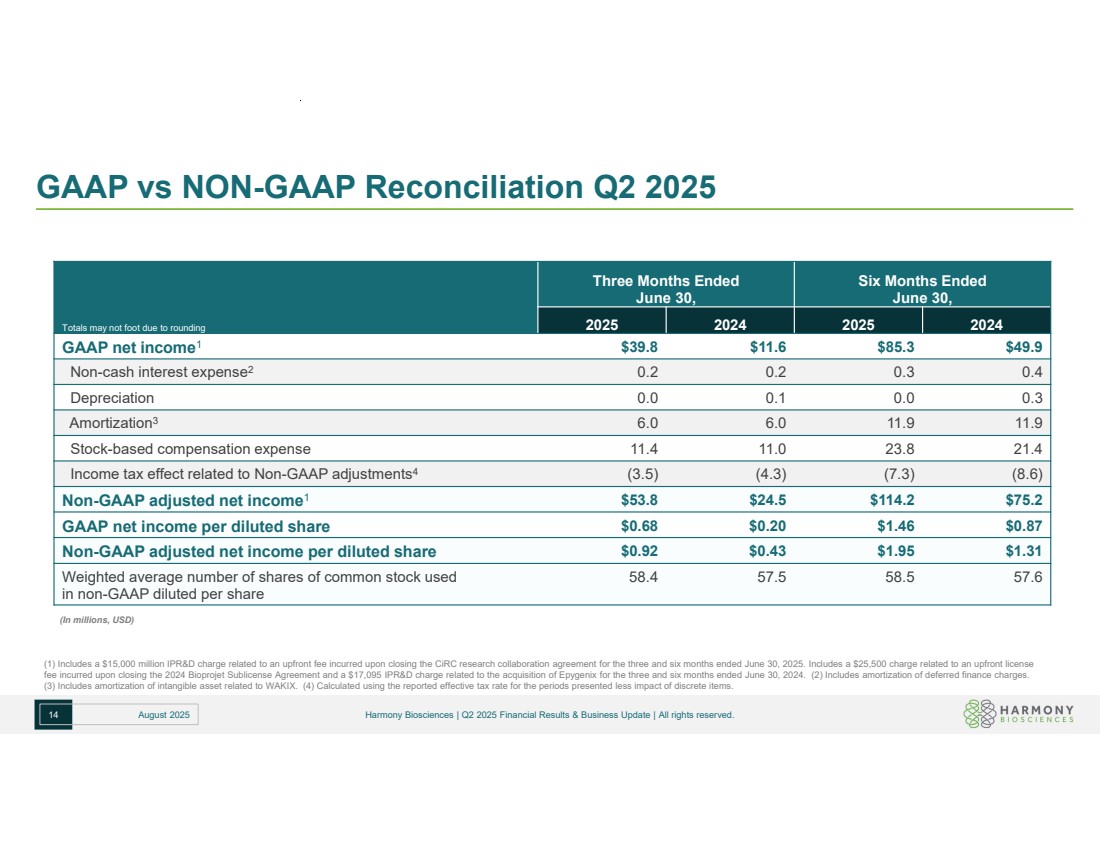

| GAAP vs NON-GAAP Reconciliation Q2 2025 14 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. (1) Includes a $15,000 million IPR&D charge related to an upfront fee incurred upon closing the CiRC research collaboration agreement for the three and six months ended June 30, 2025. Includes a $25,500 charge related to an upfront license fee incurred upon closing the 2024 Bioprojet Sublicense Agreement and a $17,095 IPR&D charge related to the acquisition of Epygenix for the three and six months ended June 30, 2024. (2) Includes amortization of deferred finance charges. (3) Includes amortization of intangible asset related to WAKIX. (4) Calculated using the reported effective tax rate for the periods presented less impact of discrete items. (In millions, USD) Six Months Ended June 30, Three Months Ended June 30, Totals may not foot due to rounding 2025 2024 2025 2024 GAAP net income1 $39.8 $11.6 $85.3 $49.9 Non-cash interest expense 0.2 0.2 0.3 0.4 2 Depreciation 0.0 0.1 0.0 0.3 Amortization 6.0 6.0 11.9 11.9 3 Stock-based compensation expense 11.4 11.0 23.8 21.4 Income tax effect related to Non-GAAP adjustments (3.5) (4.3) (7.3) (8.6) 4 Non-GAAP adjusted net income1 $53.8 $24.5 $114.2 $75.2 GAAP net income per diluted share $0.68 $0.20 $1.46 $0.87 Non-GAAP adjusted net income per diluted share $0.92 $0.43 $1.95 $1.31 Weighted average number of shares of common stock used 58.4 57.5 58.5 57.6 in non-GAAP diluted per share |

| 15 August 2025 Harmony Biosciences | Q2 2025 Financial Results & Business Update | All rights reserved. Commitment to patients Addressing unmet medical needs Delivering meaningful treatment options Helping patients thrive DELIVER ON PROMISE TO PATIENTS Innovative Catalyst-rich pipeline Profitable biotech company Meaningful investment opportunity DELIVER STONG VALUE TO SHAREHOLDERS |

|