Jefferies Healthcare Services Conference Supplemental Information September 30, 2025

Enhabit Home Health & Hospice 2 Disclaimer Forward looking statements This presentation contains historical information, as well as forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that involve known and unknown risks and relate to, among other things, future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, our future financial performance, our projected business results, or our projected capital expenditures. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, the reader can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Any forward-looking statement speaks only as of the date of this presentation, and the Company undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, our ability to execute on our strategic plans; regulatory and other developments impacting the markets for our services; changes in reimbursement rates; general economic conditions; changes in the episodic versus non-episodic mix of our payers, the case mix of our patients, and payment methodologies; our ability to attract and retain key management personnel and healthcare professionals; potential disruptions or breaches of our or our vendors’, payers’, and other contract counterparties’ information systems; the outcome of litigation; quality performance and ratings; our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures; our ability to successfully integrate technology in our operations; and our ability to control costs, particularly labor and employee benefit costs. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this presentation are described in reports filed with the SEC, including our annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which are available on the Company's website at http://investors.ehab.com. Note regarding presentation of non-GAAP financial measures This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Exchange Act, including Adjusted EBITDA, Adjusted EBITDA margin, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Adjusted earnings per share, and Adjusted free cash flow. For 2025, the Company has modified its methodology of calculating Adjusted free cash flow to exclude the impact of unusual or nonrecurring items on cash income taxes and changes in working capital. The change was made to conform to the Adjusted free cash flow measure with the current definition used by management and the Board of Directors to manage cash flow and evaluate performance. Prior periods presented herein have been recast to conform with the new methodology. The Company believes the non-GAAP financial measures are useful to investors because they facilitate evaluation of core business operating results over multiple periods unaffected by differences in unusual or nonrecurring items. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented at the end of this presentation. Our Form 8-K, filed with the SEC as of the date of this presentation, provides further explanation and disclosure regarding Enhabit’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Additionally, our Form 10-Q for the three months and six ended June 30, 2025, provides further information regarding "unusual or nonrecurring items that are not typical of ongoing operations," a reconciliation item in our Adjusted EBITDA calculation.

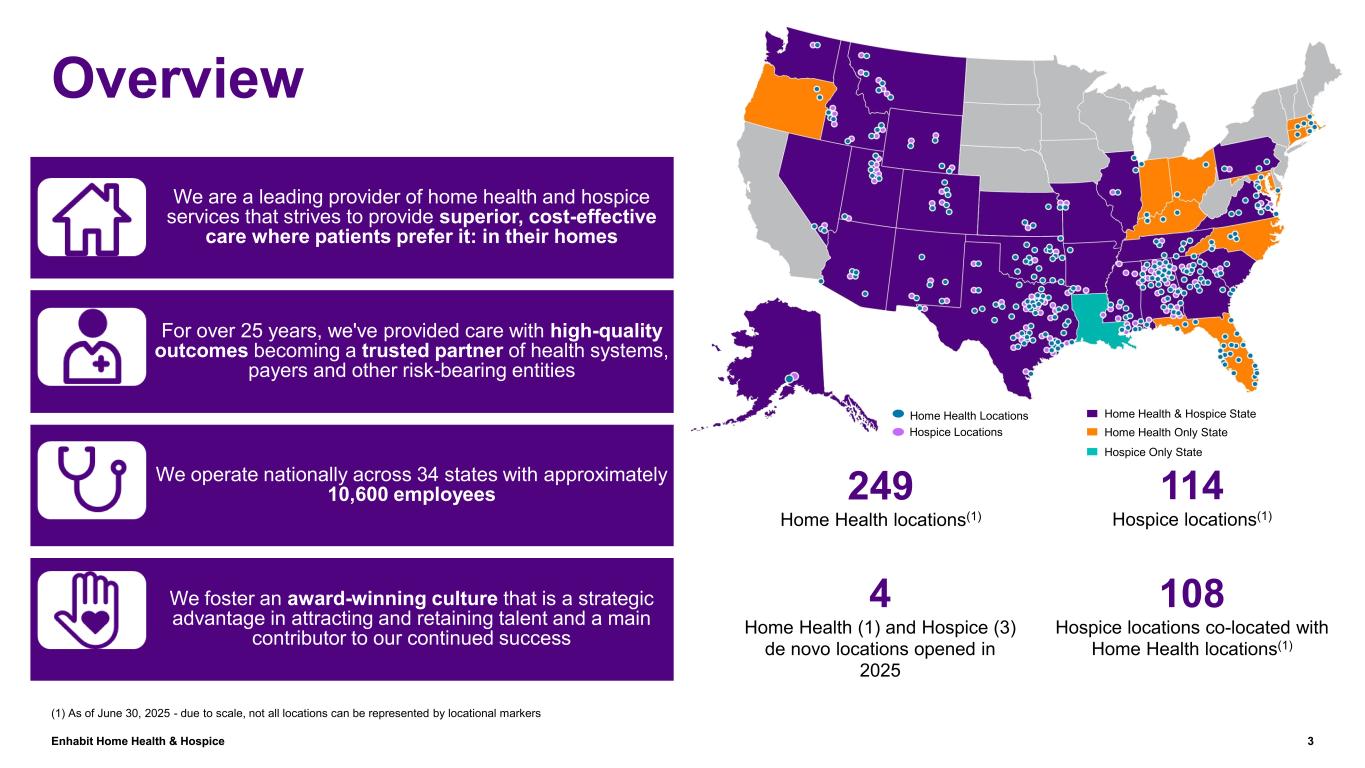

Enhabit Home Health & Hospice 3 Overview 108 Hospice locations co-located with Home Health locations(1) Home Health Locations Hospice Locations Home Health & Hospice State Home Health Only State (1) As of June 30, 2025 - due to scale, not all locations can be represented by locational markers 114 Hospice locations(1) 249 Home Health locations(1) We are a leading provider of home health and hospice services that strives to provide superior, cost-effective care where patients prefer it: in their homes For over 25 years, we've provided care with high-quality outcomes becoming a trusted partner of health systems, payers and other risk-bearing entities We operate nationally across 34 states with approximately 10,600 employees We foster an award-winning culture that is a strategic advantage in attracting and retaining talent and a main contributor to our continued success 4 Home Health (1) and Hospice (3) de novo locations opened in 2025 Hospice Only State

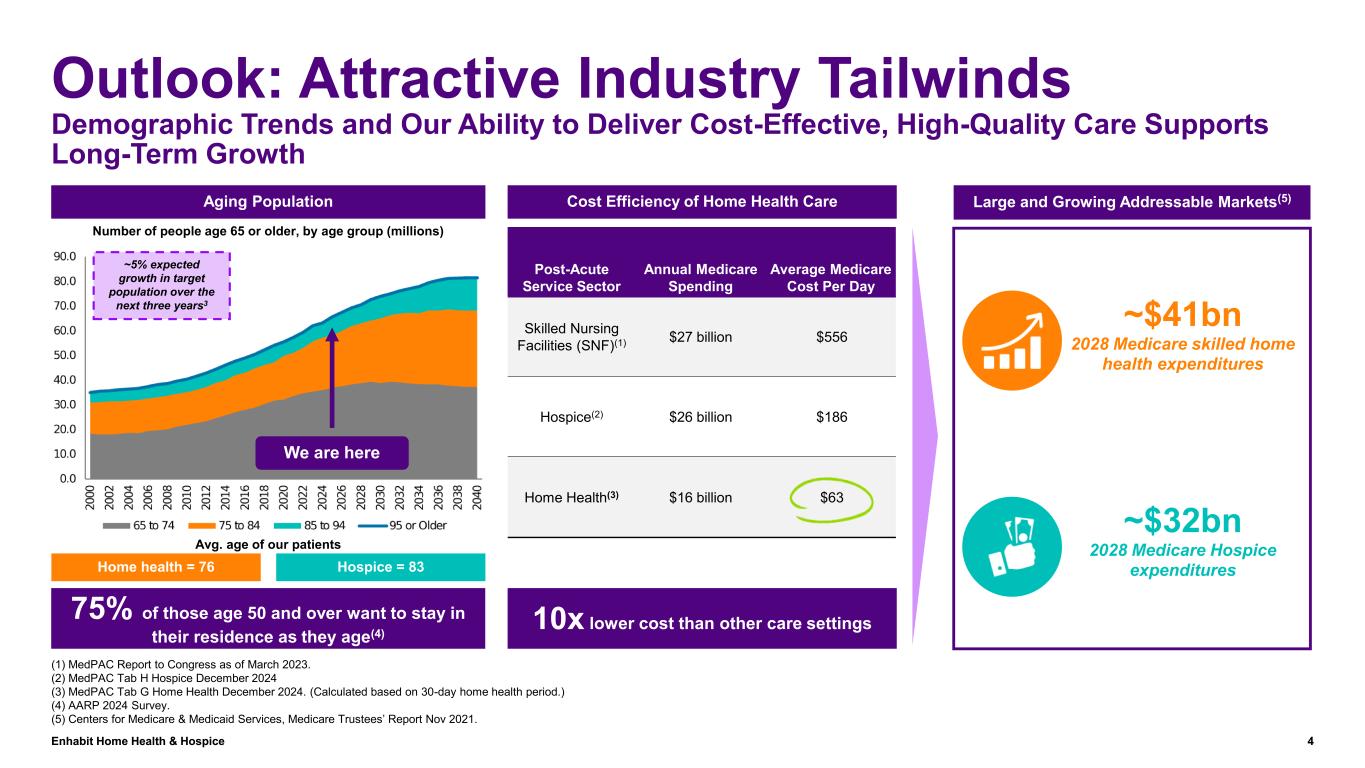

Enhabit Home Health & Hospice 4 (1) MedPAC Report to Congress as of March 2023. (2) MedPAC Tab H Hospice December 2024 (3) MedPAC Tab G Home Health December 2024. (Calculated based on 30-day home health period.) (4) AARP 2024 Survey. (5) Centers for Medicare & Medicaid Services, Medicare Trustees’ Report Nov 2021. Aging Population Cost Efficiency of Home Health Care Large and Growing Addressable Markets(5) Large and Growing Addressable Markets4 ~$41bn 2028 Medicare skilled home health expenditures ~$32bn 2028 Medicare Hospice expenditures 75% of those age 50 and over want to stay in their residence as they age(4) 10x lower cost than other care settings Post-Acute Service Sector Annual Medicare Spending Average Medicare Cost Per Day Skilled Nursing Facilities (SNF)(1) $27 billion $556 Hospice(2) $26 billion $186 Home Health(3) $16 billion $63 Home health = 76 Hospice = 83 Number of people age 65 or older, by age group (millions) ~5% expected growth in target population over the next three years3 We are here Avg. age of our patients Outlook: Attractive Industry Tailwinds Demographic Trends and Our Ability to Deliver Cost-Effective, High-Quality Care Supports Long-Term Growth

Advocacy: Response to the Proposed Medicare Cuts to Home Health Regulatory • Submitted comment letter in response to the CMS CY 2026 Home Health proposed rule. • The National Alliance for Care at Home (the Alliance), also submitted a comment letter - focused on the flawed methodology to calculate the permanent and temporary adjustments. Legislative • Reps. Kevin Hern (R-OK-1) and Terri Sewell (D-AL-7) introduced bipartisan legislation, HR 5142, the Home Health Stabilization Act on September 4th. Legislation would pause any permanent or temporary cuts for CYs 2026 and 2027. • Alliance’s Advocacy Week in DC September 8-10. More than 230 advocates met with over 275 Congressional offices. 10 Enhabit leaders had 46 meetings across Capitol Hill advocating against the proposed cuts. Grassroots • Enhabit hosted Rep. Hern at our Tulsa branch this past spring, the 5th ranking Republican and member of the House Ways and Means and Committee. • Enhabit employees have sent over 1,000 messages to their members of Congress in opposition to the cuts. • Select Enhabit clinicians are submitting op-eds to strategic media markets. 5

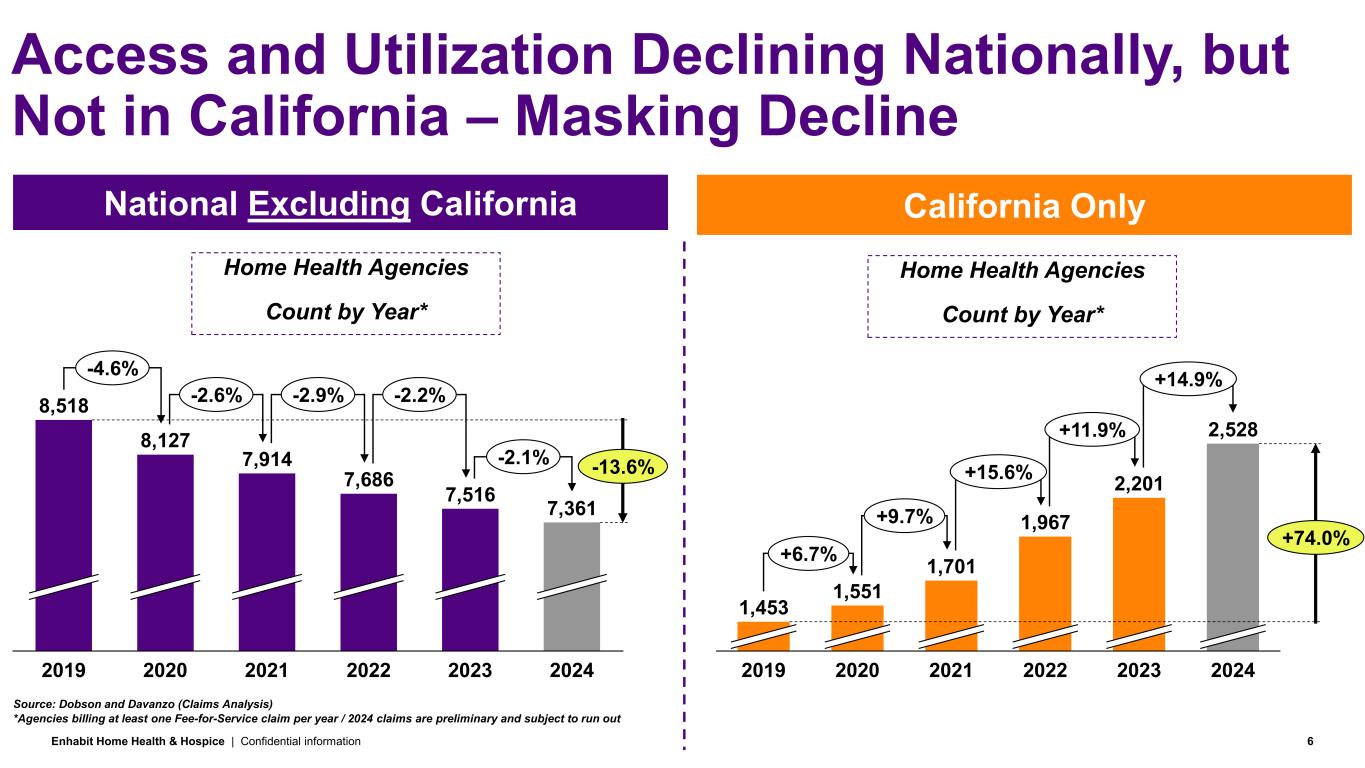

Enhabit Home Health & Hospice | Confidential information 6 Access and Utilization Declining Nationally, but Not in California – Masking Decline National Excluding California 7,516 7,361 202420232022202120202019 8,518 8,127 7,914 7,686 -13.6% -4.6% -2.6% -2.9% -2.2% -2.1% Source: Dobson and Davanzo (Claims Analysis) California Only 2,201 2,528 202420232022202120202019 1,453 1,551 1,701 1,967 +74.0% +6.7% +9.7% +15.6% +11.9% +14.9% Home Health Agencies Count by Year* Home Health Agencies Count by Year* *Agencies billing at least one Fee-for-Service claim per year / 2024 claims are preliminary and subject to run out

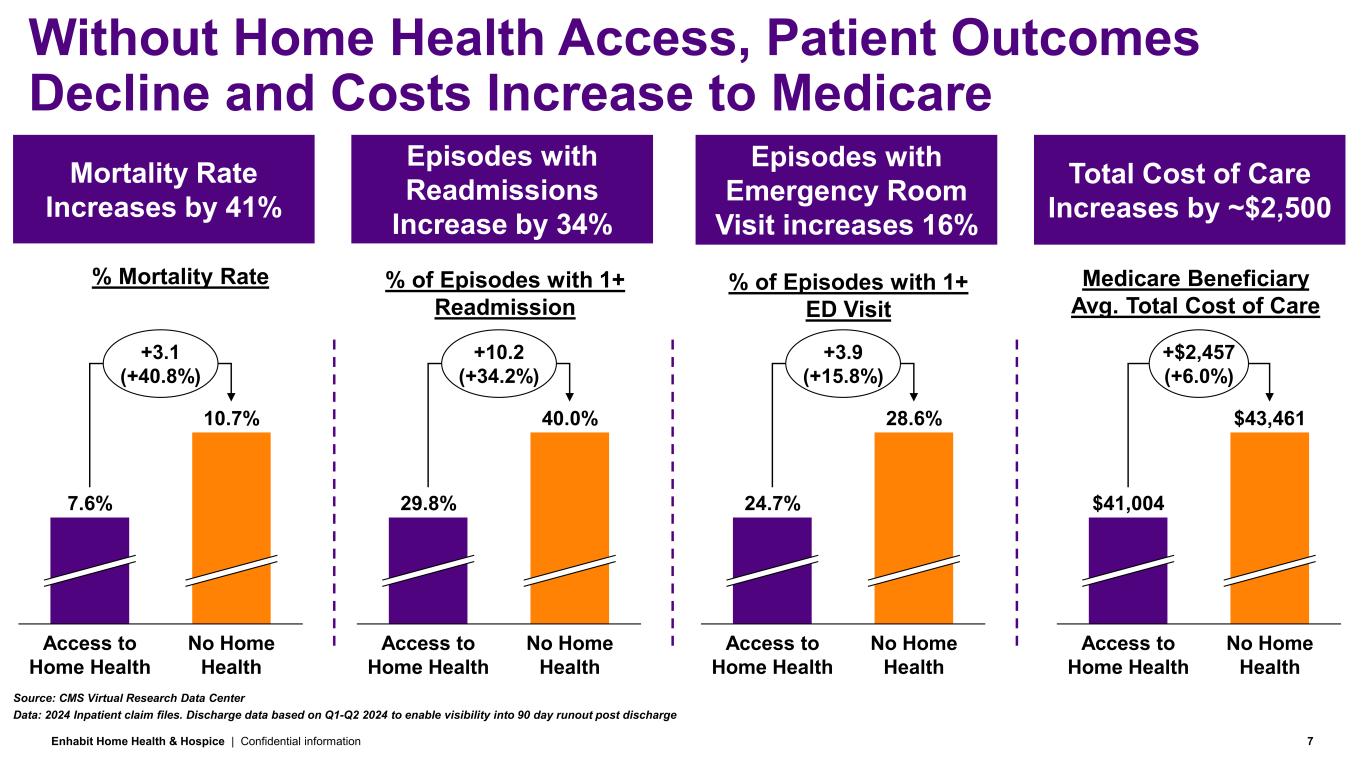

Enhabit Home Health & Hospice | Confidential information 7 Without Home Health Access, Patient Outcomes Decline and Costs Increase to Medicare Mortality Rate Increases by 41% Source: CMS Virtual Research Data Center Access to Home Health No Home Health 7.6% 10.7% +3.1 (+40.8%) Episodes with Readmissions Increase by 34% Access to Home Health No Home Health 29.8% 40.0% +10.2 (+34.2%) Episodes with Emergency Room Visit increases 16% Access to Home Health No Home Health 24.7% 28.6% +3.9 (+15.8%) Total Cost of Care Increases by ~$2,500 Access to Home Health No Home Health $41,004 $43,461 +$2,457 (+6.0%) Data: 2024 Inpatient claim files. Discharge data based on Q1-Q2 2024 to enable visibility into 90 day runout post discharge % of Episodes with 1+ Readmission % Mortality Rate % of Episodes with 1+ ED Visit Medicare Beneficiary Avg. Total Cost of Care

Enhabit Home Health & Hospice 8 2025 Priorities for Success • Home health momentum delivered 2nd quarter of sequential growth in net service revenue and Adjusted EBITDA, while continuing to stabilize Medicare ADC. • Hospice consistent growth with 6th straight quarter of sequential ADC growth; double digit growth to prior year. • Home health successfully re- negotiated a national payer agreement resulting in a low double digit % rate increase. • De novo growth with 3 new de novo sites in Q2, bringing year to date total to 4 and on track to deliver goal of 10 in 2025. • Consistent de-levering with 5th straight quarter of debt prepayments, totaling $45M since Q1 '24, lowering interest expense by $3.2M over the same period. • Home health census ◦ Payer mix • Hospice average daily census • Open de novo locations in strategic markets • Optimize de novo locations opened in 2023 and 2024 • Continue de- leveraging the balance sheet • G&A expense management • Home health and Hospice cost per patient day • Home health revenue per patient day • Value-based performance • Patient and family experience • Home health hospital readmission rates • Hospice visits in the last days of life • Engagement • Retention • Business development direct selling headcount • Leadership development Strategy Execution Q2 2025 Highlights Growth Financial Health Quality People Reconciliations to GAAP provided in Appendix of this presentation

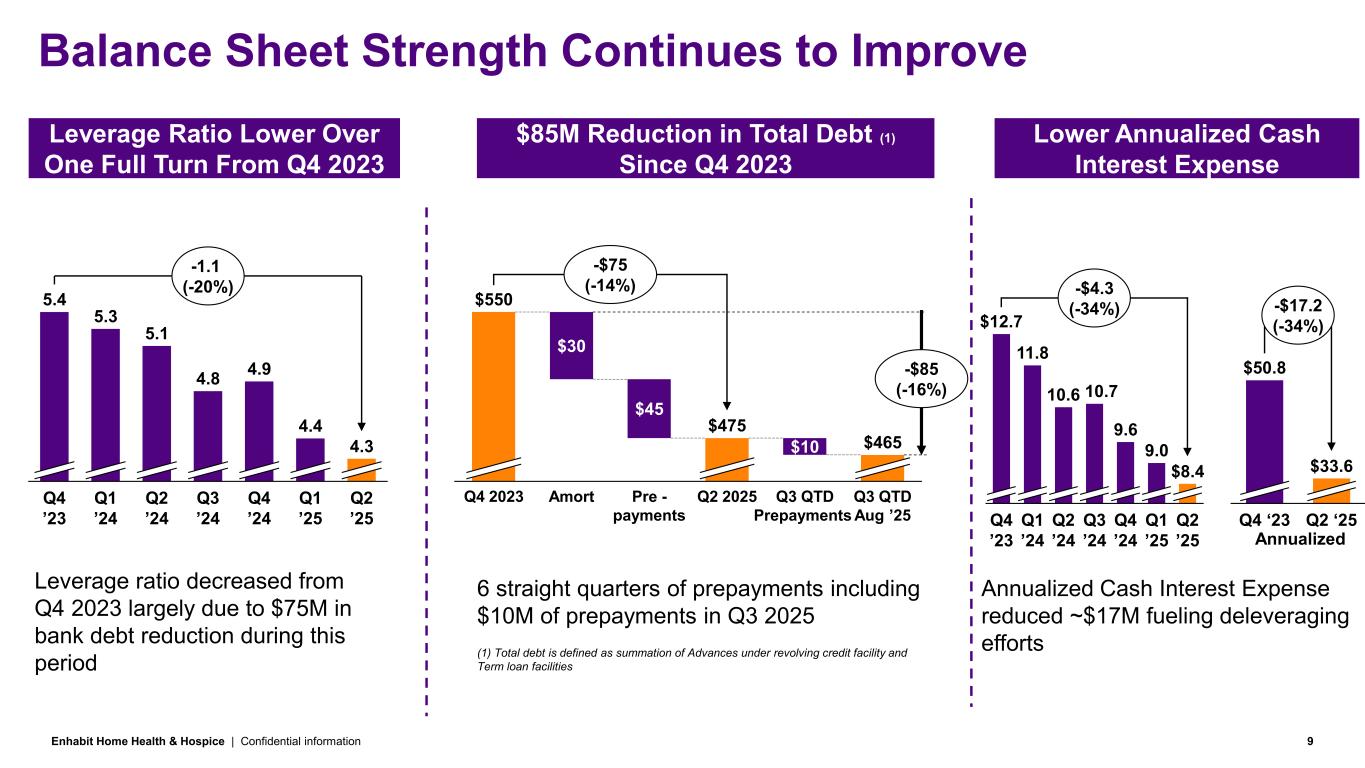

Enhabit Home Health & Hospice | Confidential information 9 Balance Sheet Strength Continues to Improve Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 Q2 ’25 5.4 5.3 5.1 4.8 4.9 4.4 4.3 Q4 ’23 -1.1 (-20%) Leverage ratio decreased from Q4 2023 largely due to $75M in bank debt reduction during this period Leverage Ratio Lower Over One Full Turn From Q4 2023 $85M Reduction in Total Debt (1) Since Q4 2023 $30 $45 $10 Q4 2023 Amort Pre - payments Q2 2025 $550 $475 Q3 QTD Prepayments Q3 QTD Aug ’25 $465 -$85 (-16%) -$75 (-14%) 6 straight quarters of prepayments including $10M of prepayments in Q3 2025 (1) Total debt is defined as summation of Advances under revolving credit facility and Term loan facilities Lower Annualized Cash Interest Expense Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 Q2 ’25 $12.7 11.8 10.6 10.7 9.6 9.0 $8.4 Q4 ’23 -$4.3 (-34%) Annualized Cash Interest Expense reduced ~$17M fueling deleveraging efforts Q4 ‘23 Q2 ‘25 $50.8 $33.6 -$17.2 (-34%) Annualized

Enhabit Home Health & Hospice | Confidential information 10 Appendix

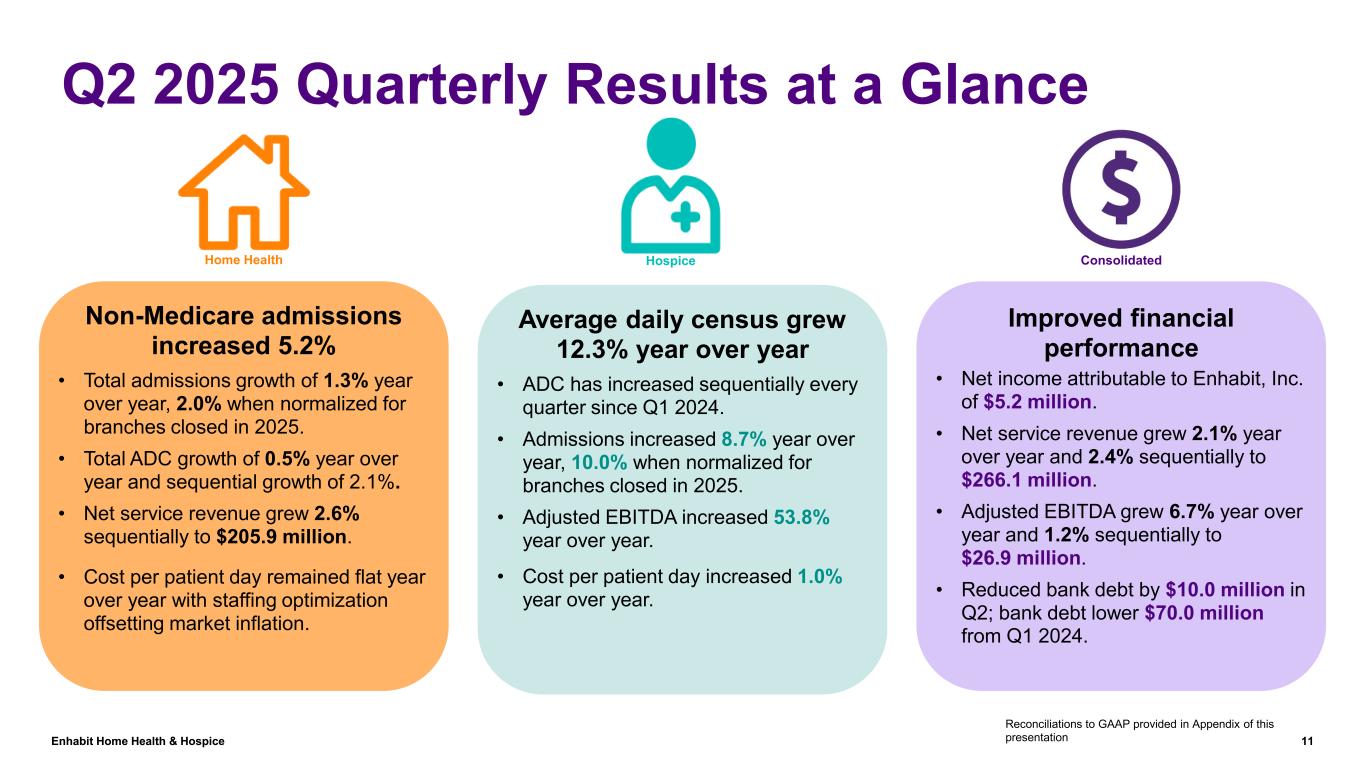

Enhabit Home Health & Hospice 11 Improved financial performance • Net income attributable to Enhabit, Inc. of $5.2 million. • Net service revenue grew 2.1% year over year and 2.4% sequentially to $266.1 million. • Adjusted EBITDA grew 6.7% year over year and 1.2% sequentially to $26.9 million. • Reduced bank debt by $10.0 million in Q2; bank debt lower $70.0 million from Q1 2024. Reconciliations to GAAP provided in Appendix of this presentation Q2 2025 Quarterly Results at a Glance Non-Medicare admissions increased 5.2% • Total admissions growth of 1.3% year over year, 2.0% when normalized for branches closed in 2025. • Total ADC growth of 0.5% year over year and sequential growth of 2.1%. • Net service revenue grew 2.6% sequentially to $205.9 million. • Cost per patient day remained flat year over year with staffing optimization offsetting market inflation. Average daily census grew 12.3% year over year • ADC has increased sequentially every quarter since Q1 2024. • Admissions increased 8.7% year over year, 10.0% when normalized for branches closed in 2025. • Adjusted EBITDA increased 53.8% year over year. • Cost per patient day increased 1.0% year over year. Home Health Hospice Consolidated

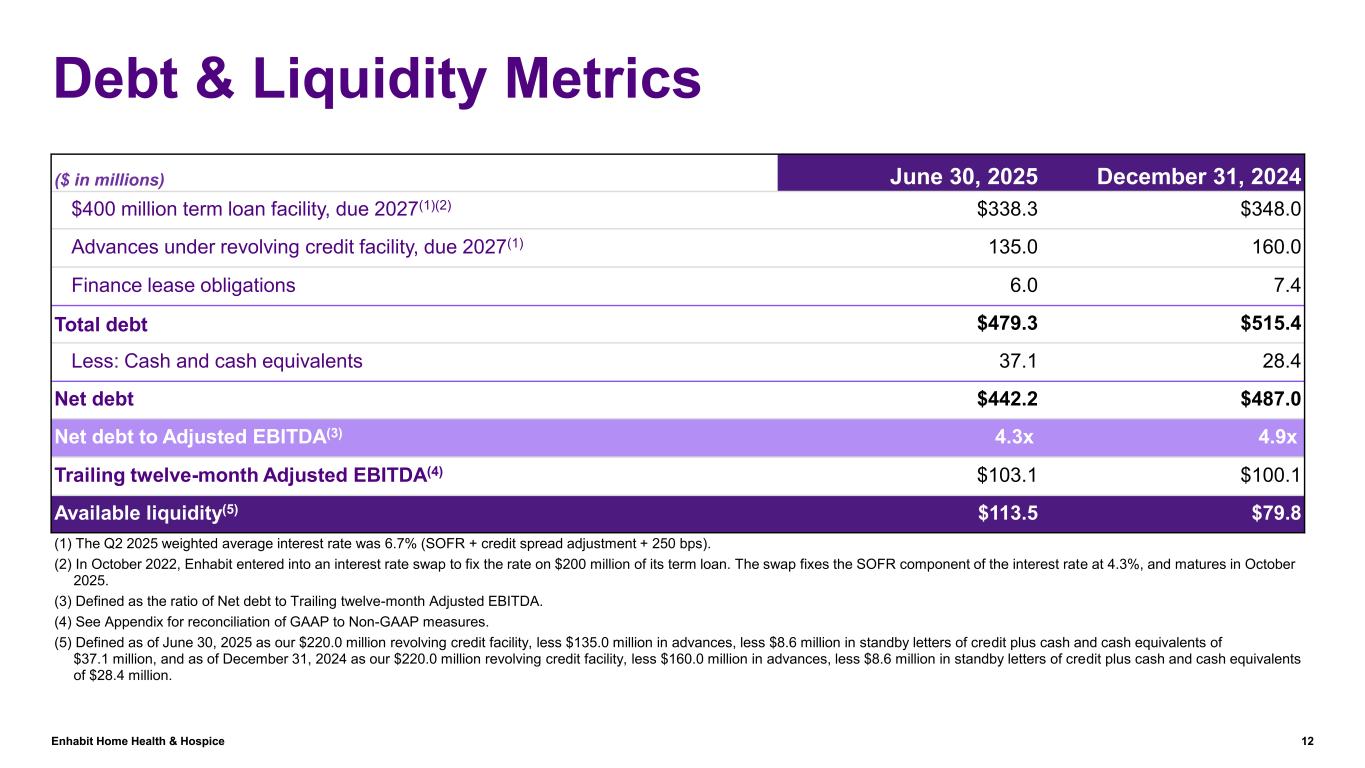

Enhabit Home Health & Hospice 12 Debt & Liquidity Metrics ($ in millions) June 30, 2025 December 31, 2024 $400 million term loan facility, due 2027(1)(2) $338.3 $348.0 Advances under revolving credit facility, due 2027(1) 135.0 160.0 Finance lease obligations 6.0 7.4 Total debt $479.3 $515.4 Less: Cash and cash equivalents 37.1 28.4 Net debt $442.2 $487.0 Net debt to Adjusted EBITDA(3) 4.3x 4.9x Trailing twelve-month Adjusted EBITDA(4) $103.1 $100.1 Available liquidity(5) $113.5 $79.8 (1) The Q2 2025 weighted average interest rate was 6.7% (SOFR + credit spread adjustment + 250 bps). (2) In October 2022, Enhabit entered into an interest rate swap to fix the rate on $200 million of its term loan. The swap fixes the SOFR component of the interest rate at 4.3%, and matures in October 2025. (3) Defined as the ratio of Net debt to Trailing twelve-month Adjusted EBITDA. (4) See Appendix for reconciliation of GAAP to Non-GAAP measures. (5) Defined as of June 30, 2025 as our $220.0 million revolving credit facility, less $135.0 million in advances, less $8.6 million in standby letters of credit plus cash and cash equivalents of $37.1 million, and as of December 31, 2024 as our $220.0 million revolving credit facility, less $160.0 million in advances, less $8.6 million in standby letters of credit plus cash and cash equivalents of $28.4 million.

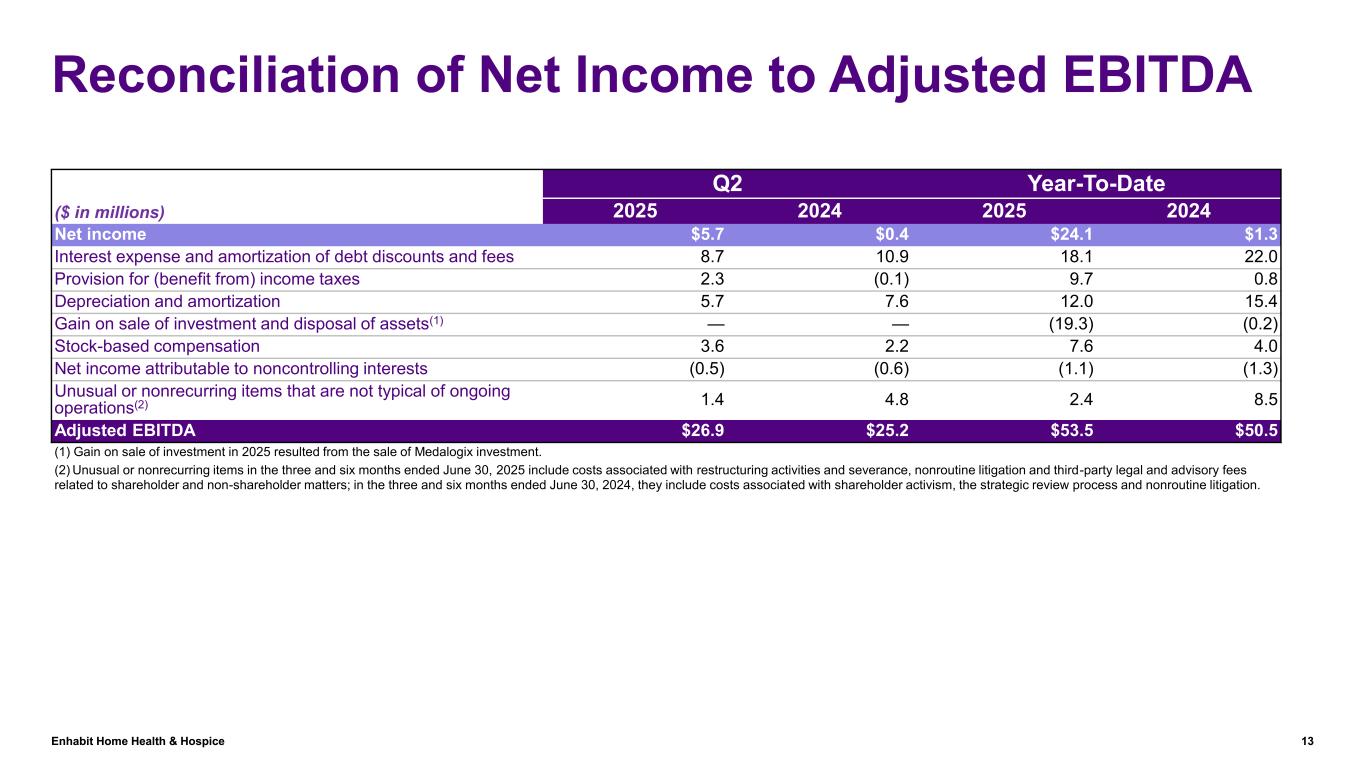

Enhabit Home Health & Hospice 13 Reconciliation of Net Income to Adjusted EBITDA ($ in millions) Q2 Year-To-Date 2025 2024 2025 2024 Net income $5.7 $0.4 $24.1 $1.3 Interest expense and amortization of debt discounts and fees 8.7 10.9 18.1 22.0 Provision for (benefit from) income taxes 2.3 (0.1) 9.7 0.8 Depreciation and amortization 5.7 7.6 12.0 15.4 Gain on sale of investment and disposal of assets(1) — — (19.3) (0.2) Stock-based compensation 3.6 2.2 7.6 4.0 Net income attributable to noncontrolling interests (0.5) (0.6) (1.1) (1.3) Unusual or nonrecurring items that are not typical of ongoing operations(2) 1.4 4.8 2.4 8.5 Adjusted EBITDA $26.9 $25.2 $53.5 $50.5 (1) Gain on sale of investment in 2025 resulted from the sale of Medalogix investment. (2) Unusual or nonrecurring items in the three and six months ended June 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation and third-party legal and advisory fees related to shareholder and non-shareholder matters; in the three and six months ended June 30, 2024, they include costs associated with shareholder activism, the strategic review process and nonroutine litigation.

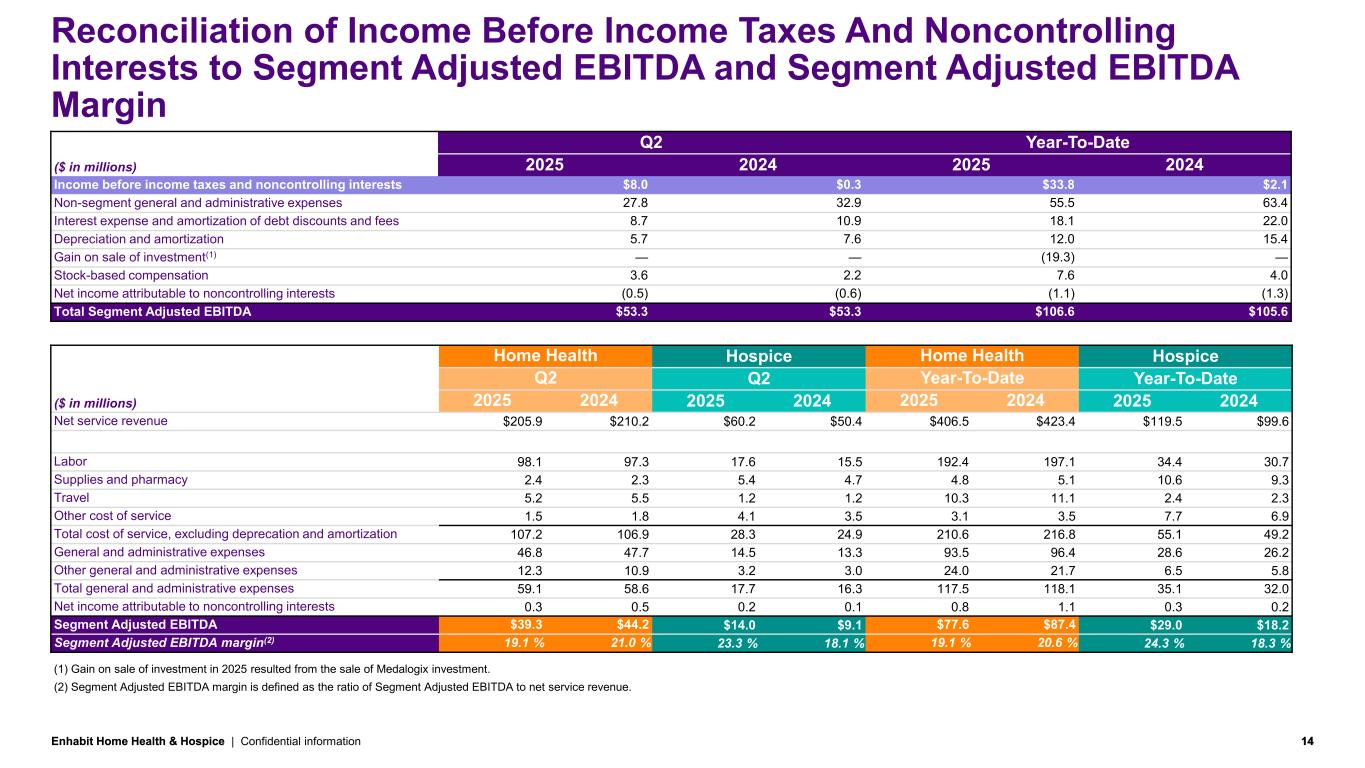

Enhabit Home Health & Hospice | Confidential information 14 Q2 Year-To-Date ($ in millions) 2025 2024 2025 2024 Income before income taxes and noncontrolling interests $8.0 $0.3 $33.8 $2.1 Non-segment general and administrative expenses 27.8 32.9 55.5 63.4 Interest expense and amortization of debt discounts and fees 8.7 10.9 18.1 22.0 Depreciation and amortization 5.7 7.6 12.0 15.4 Gain on sale of investment(1) — — (19.3) — Stock-based compensation 3.6 2.2 7.6 4.0 Net income attributable to noncontrolling interests (0.5) (0.6) (1.1) (1.3) Total Segment Adjusted EBITDA $53.3 $53.3 $106.6 $105.6 Home Health Hospice Home Health Hospice Q2 Q2 Year-To-Date Year-To-Date ($ in millions) 2025 2024 2025 2024 2025 2024 2025 2024 Net service revenue $205.9 $210.2 $60.2 $50.4 $406.5 $423.4 $119.5 $99.6 Labor 98.1 97.3 17.6 15.5 192.4 197.1 34.4 30.7 Supplies and pharmacy 2.4 2.3 5.4 4.7 4.8 5.1 10.6 9.3 Travel 5.2 5.5 1.2 1.2 10.3 11.1 2.4 2.3 Other cost of service 1.5 1.8 4.1 3.5 3.1 3.5 7.7 6.9 Total cost of service, excluding deprecation and amortization 107.2 106.9 28.3 24.9 210.6 216.8 55.1 49.2 General and administrative expenses 46.8 47.7 14.5 13.3 93.5 96.4 28.6 26.2 Other general and administrative expenses 12.3 10.9 3.2 3.0 24.0 21.7 6.5 5.8 Total general and administrative expenses 59.1 58.6 17.7 16.3 117.5 118.1 35.1 32.0 Net income attributable to noncontrolling interests 0.3 0.5 0.2 0.1 0.8 1.1 0.3 0.2 Segment Adjusted EBITDA $39.3 $44.2 $14.0 $9.1 $77.6 $87.4 $29.0 $18.2 Segment Adjusted EBITDA margin(2) 19.1 % 21.0 % 23.3 % 18.1 % 19.1 % 20.6 % 24.3 % 18.3 % (1) Gain on sale of investment in 2025 resulted from the sale of Medalogix investment. (2) Segment Adjusted EBITDA margin is defined as the ratio of Segment Adjusted EBITDA to net service revenue. Reconciliation of Income Before Income Taxes And Noncontrolling Interests to Segment Adjusted EBITDA and Segment Adjusted EBITDA Margin

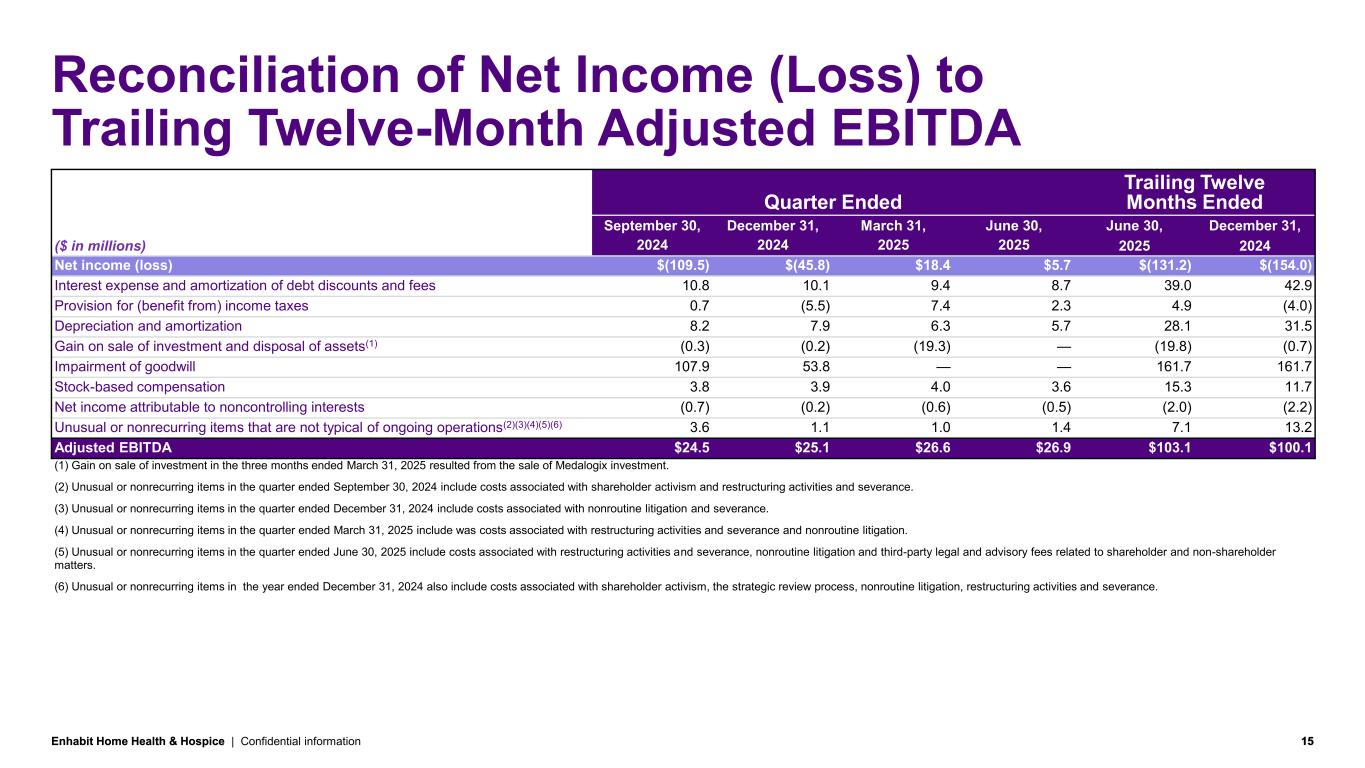

Enhabit Home Health & Hospice | Confidential information 15 Reconciliation of Net Income (Loss) to Trailing Twelve-Month Adjusted EBITDA ($ in millions) Quarter Ended Trailing Twelve Months Ended September 30, December 31, March 31, June 30, June 30, December 31, 2024 2024 2025 2025 2025 2024 Net income (loss) $(109.5) $(45.8) $18.4 $5.7 $(131.2) $(154.0) Interest expense and amortization of debt discounts and fees 10.8 10.1 9.4 8.7 39.0 42.9 Provision for (benefit from) income taxes 0.7 (5.5) 7.4 2.3 4.9 (4.0) Depreciation and amortization 8.2 7.9 6.3 5.7 28.1 31.5 Gain on sale of investment and disposal of assets(1) (0.3) (0.2) (19.3) — (19.8) (0.7) Impairment of goodwill 107.9 53.8 — — 161.7 161.7 Stock-based compensation 3.8 3.9 4.0 3.6 15.3 11.7 Net income attributable to noncontrolling interests (0.7) (0.2) (0.6) (0.5) (2.0) (2.2) Unusual or nonrecurring items that are not typical of ongoing operations(2)(3)(4)(5)(6) 3.6 1.1 1.0 1.4 7.1 13.2 Adjusted EBITDA $24.5 $25.1 $26.6 $26.9 $103.1 $100.1 (1) Gain on sale of investment in the three months ended March 31, 2025 resulted from the sale of Medalogix investment. (2) Unusual or nonrecurring items in the quarter ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance. (3) Unusual or nonrecurring items in the quarter ended December 31, 2024 include costs associated with nonroutine litigation and severance. (4) Unusual or nonrecurring items in the quarter ended March 31, 2025 include was costs associated with restructuring activities and severance and nonroutine litigation. (5) Unusual or nonrecurring items in the quarter ended June 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation and third-party legal and advisory fees related to shareholder and non-shareholder matters. (6) Unusual or nonrecurring items in the year ended December 31, 2024 also include costs associated with shareholder activism, the strategic review process, nonroutine litigation, restructuring activities and severance.

Jefferies Healthcare Services Conference Supplemental Information September 30, 2025